Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

How to Use Alternative Data for Investment Decisions

Traditional data is now being complemented, and often eclipsed, by a powerful new player: alternative data (AD).

This emerging data source is changing how investing decisions are made, from initial deal sourcing to the final stages of exiting an investment.

Alternative data usually comes from unconventional sources: satellite images, cell tower data, and web search trends.

Instead of relying solely on official company or government data, investors are increasingly leaning on AD for bottom-up, real-time metrics that drive investment returns.

How Alternative Data is Used During The Investment Process

Initial Screening

AD plays a critical role in uncovering hidden opportunities in the initial stages of investing.

The key in this phase is early detection: by accessing relevant information before the broader market, investors are able to capitalize on this asymmetry and generate outsized returns.

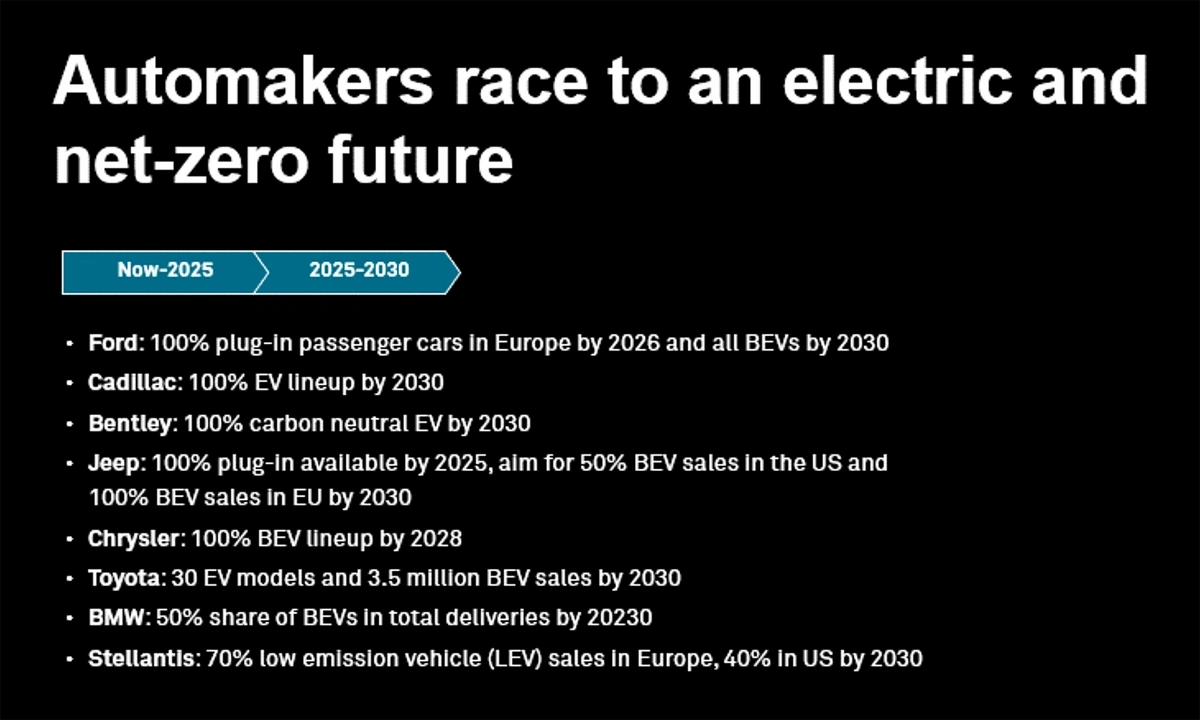

For instance, the market for electric vehicles (EVs) is among the most rapidly expanding sectors in the economy.

Source: S&P Global

The Neudata platform helps EV investors by reporting on monthly lithium battery deliveries (a key component of electric vehicles) across 50 markets.

If the data indicates a discrepancy between battery deliveries and automakers’ projections, investors can respond by buying or selling stock accordingly.

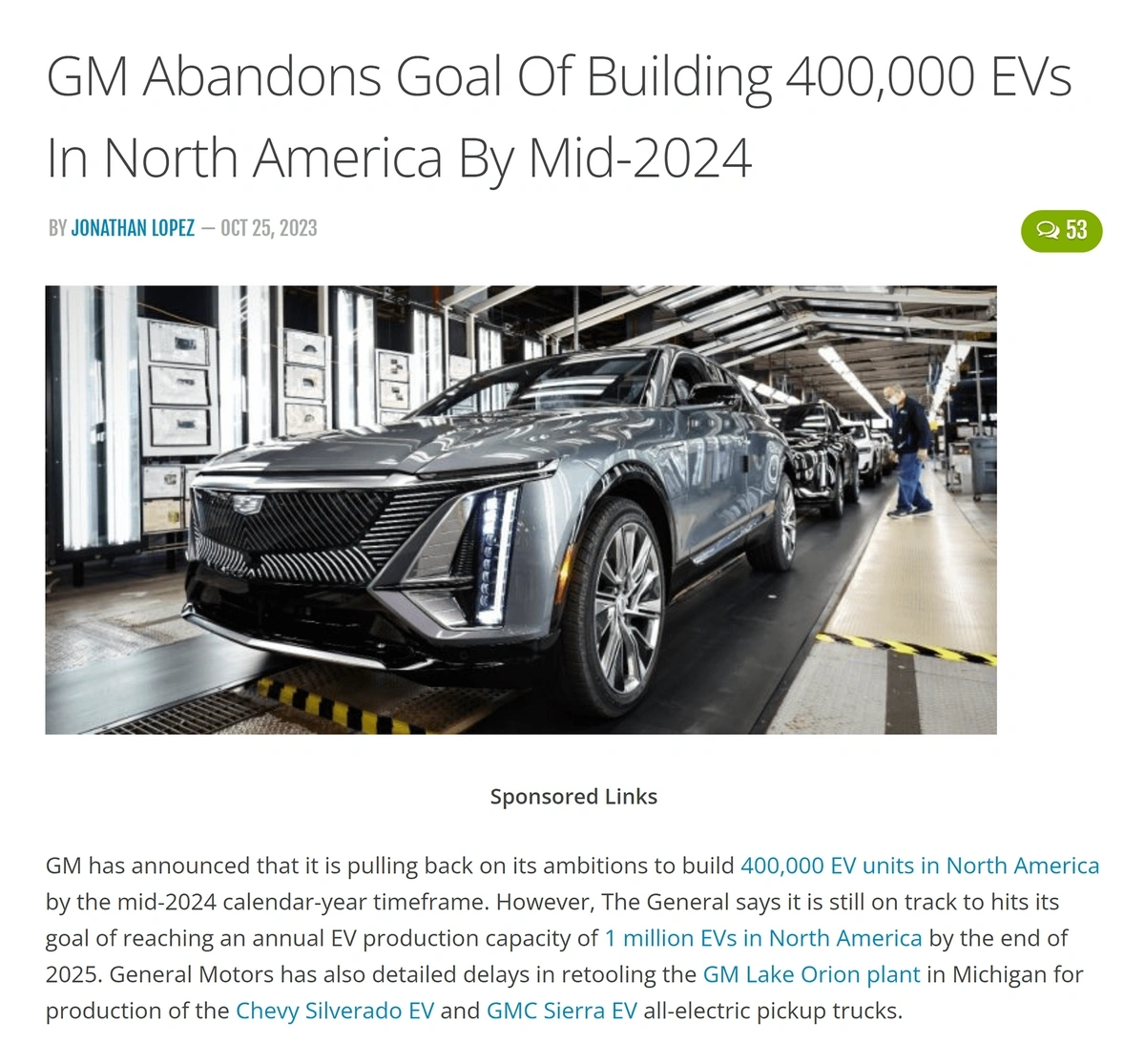

In the third quarter of 2023 alone, Ford and GM experienced a $20 billion drop in market cap, stemming from changes to their EV projections. Investors armed with alternative data could have seen it coming.

Source: GM Authority

Due Diligence and Monitoring

The principle of "strong opinions, weakly held" underscores the need for investors to be decisive yet adaptable, constantly reevaluating their theses in light of new information.

That’s where alternative data comes in.

When hedge fund SAC Capital Advisors was considering an investment in the company Vertex Pharmaceuticals, they turned to an unlikely source to validate their thesis: the U.S. government.

Through a Freedom of Information Act (FOIA) request, the hedge fund inquired the Food and Drug Administration (FDA) for any “adverse event reports” on Vertex’s new cystic fibrosis drug.

Source: Institutional Investor

The FDA was required to honor the request, and revealed that no adverse reports existed.

With their hunch confirmed, SAC went on to buy 13,000 shares of Vertex Pharmaceuticals in early 2013.

The hedge fund saw their investment pop 62% on a single day in April, when positive results from a separate safety test were announced.

The cost for confirming their investment thesis? A mere $72.50 paid for the FOIA request.

Exit Strategy Assessment

As investments mature, AD helps in determining the best exit strategy, be it to mitigate losses or maximize profits. Specifically, AD provides real-time intelligence that traditional quarterly reports simply can’t match.

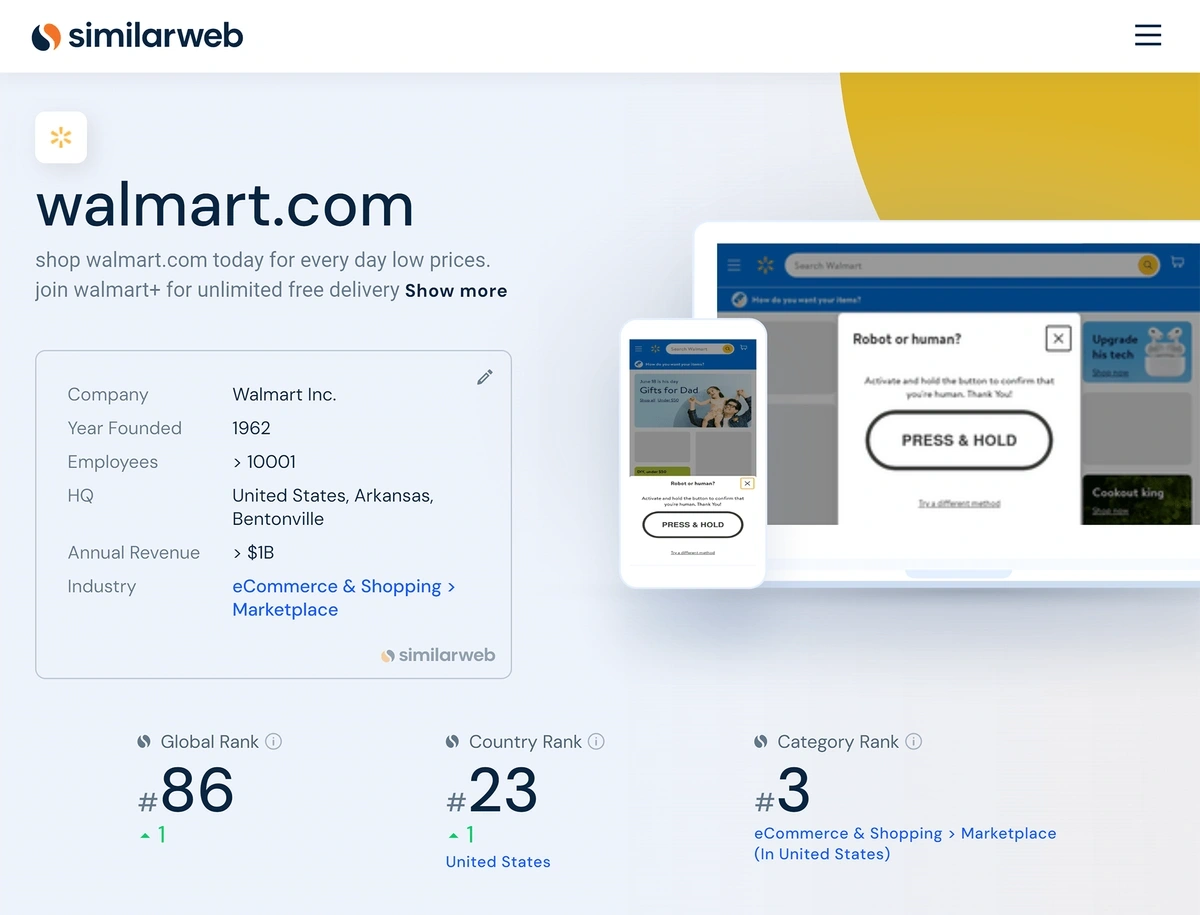

Consider the contrasting cases of Walmart and Sears in the context of digital transformation. Walmart, already a brick-and-mortar behemoth, successfully pivoted to e-commerce in 2010, heavily investing in online platforms and services.

This strategic shift led to $73 billion in e-commerce sales in 2022 and over 400 million monthly website visits. Conversely, Sears, despite being a household name with its iconic mail-order catalog, failed to adapt to the digital era.

Sears' bankruptcy filing in October 2018 marked the culmination of years of declining sales, highlighting its failure to keep pace with digital transformation in the retail industry.

Source: Ocrolus

In this situation, alternative data can be quite valuable. Tools like Similarweb empower investors to assess in real time whether a retail company is thriving like Walmart or floundering like Sears.

With detailed analytics on web traffic and user engagement, Similarweb provides a timely barometer for a company’s digital strategy effectiveness.

Should web visits show an upward trend, surpassing growth forecasts, the bullish stance on the investment is reinforced.

Conversely, if the data reveals a gap between projections and actual user engagement, it might signal it’s time to reconsider the investment.

Source: Similarweb

Alternative Data vs. Traditional Data

Defining the Old and the New

Traditional data, which includes financial statements, earnings reports, economic indicators, and regulatory filings, typically provides a historical perspective. It details past events and trends.

AD, on the other hand, taps into unconventional sources like social media sentiment and credit card receipts. It offers frequent snapshots with a forward-looking perspective.

Predictive Power

AD often has superior predictive capabilities compared to traditional data, providing insights into future market developments before they become apparent through traditional metrics.

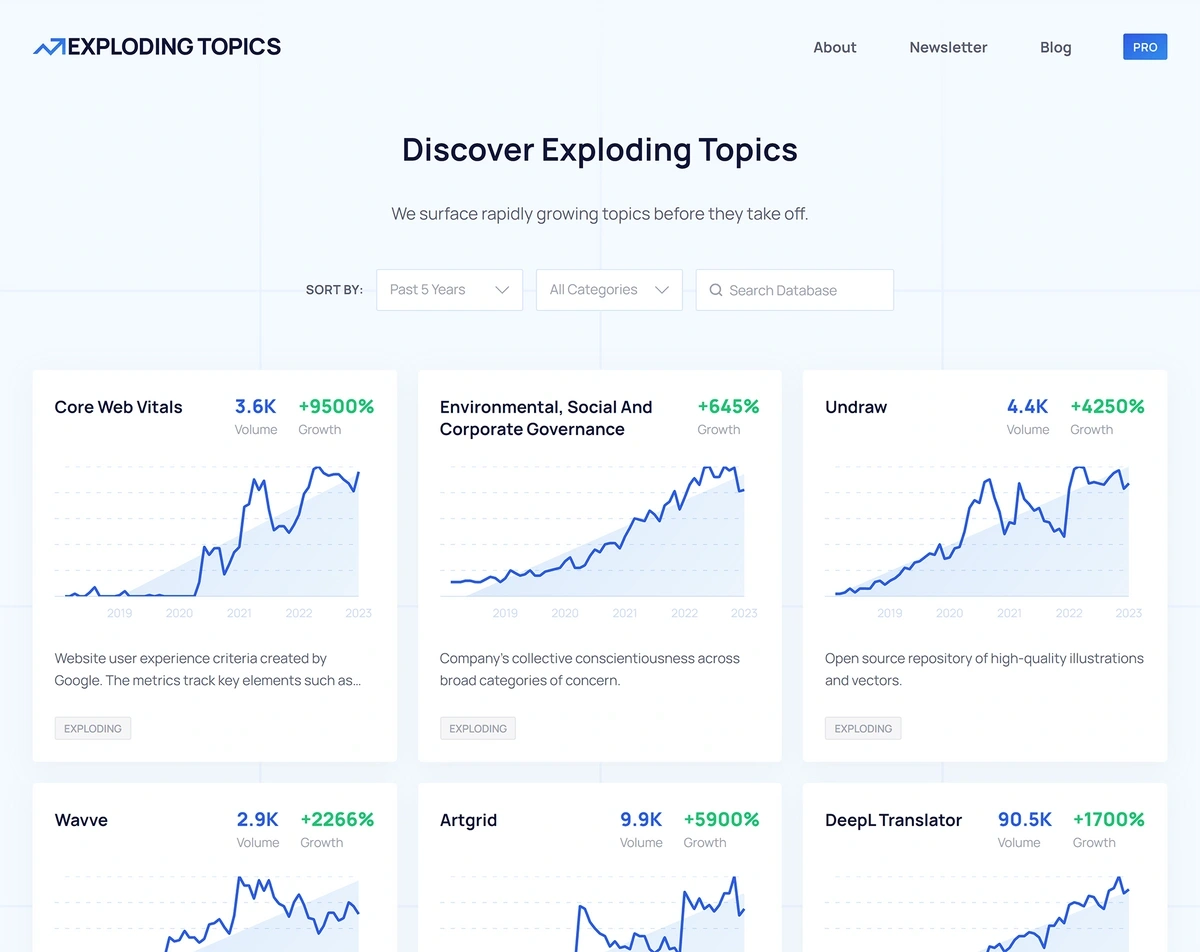

For example, Exploding Topics utilizes real-time web search analytics to identify nascent trends, providing investors with early signals of potential investment opportunities.

Source: Exploding Topics

Extent and Efficacy of Alternative Data Use

Single Data Point vs. Aggregate Analysis

While a single alternative data point, like foot traffic data, can provide valuable insight, it often gains more significance when integrated into a broader picture.

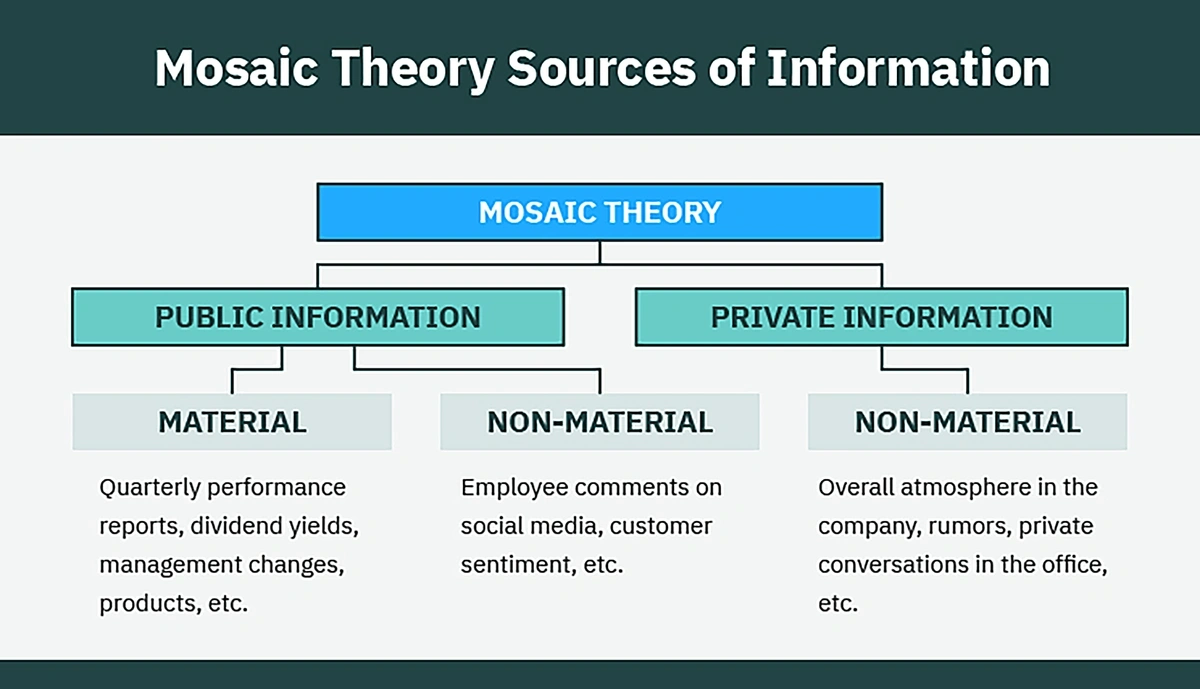

Hedge fund manager Steven Cohen's Mosaic Theory of Investing is a prime example of this approach.

Source: Tokenist

This theory advocates for finding investment opportunities using a diverse array of information sources. These range from traditional earnings reports and official government data to CEO interviews and focus group insights.

Incorporating alternative data into this mix enriches the overall picture. This comprehensive approach melds quantitative and qualitative factors, enabling investors to make well-rounded decisions.

However, there are times when AD may emerge as the primary source of intelligence. When a trend is undiscovered and still gaining momentum, there are often no research reports or established sources.

In this scenario, timing is crucial. The agility with which an investor conducts due diligence and executes based on alternative data could mean the difference between beating the market and underperforming it.

Limitations and Pitfalls

Despite its advantages, AD is most effective when used to avoid misconceptions and biases that can occur from analyzing traditional data.

Certain types of AD are vulnerable to false positives, and insights that denote correlation but not causation. For example, a flashy store opening may boost foot traffic by another store without actually increasing its sales.

AD is best used in conjunction with several other reliable sources of data, specifically in identifying short-term changes and confirming or disproving investment theses.

Conclusion

The growing influence of AD in the investment world cannot be overstated. It’s redefining the boundaries of market analysis and investment strategy.

Investors who adeptly blend AD with traditional metrics are poised to lead in the complex world of investing, making decisions that are both well-informed and forward-looking.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

... Read more