Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

10 Current & Future Blockchain Applications

Most people associate blockchain technology with cryptocurrencies like Bitcoin.

In reality, blockchain technology is more than just cryptocurrency. The technology can be applied to solve a variety of real-world, non-finance-related problems.

In the article below, we’ll discuss 10 of the newest and most interesting blockchain applications, including the companies putting these applications into practice.

1. Stock Trading

Online platforms like Robinhood and E-Trade allow for instant buying and selling of stocks. However, settlement dates can still take anywhere from 2 to 5 business days.

This delay in settlement can cause liquidity problems for exchanges, as was evidenced when Robinhood halted trading of meme stock Gamestop during a short squeeze in January of 2021.

Settlement delays were part of the reason that Robinhood temporarily stopped trades on its platform in January 2021.

The trading halt affected so many people and was so controversial that it led to a class-action lawsuit and the SEC making changes to its settlement rules.

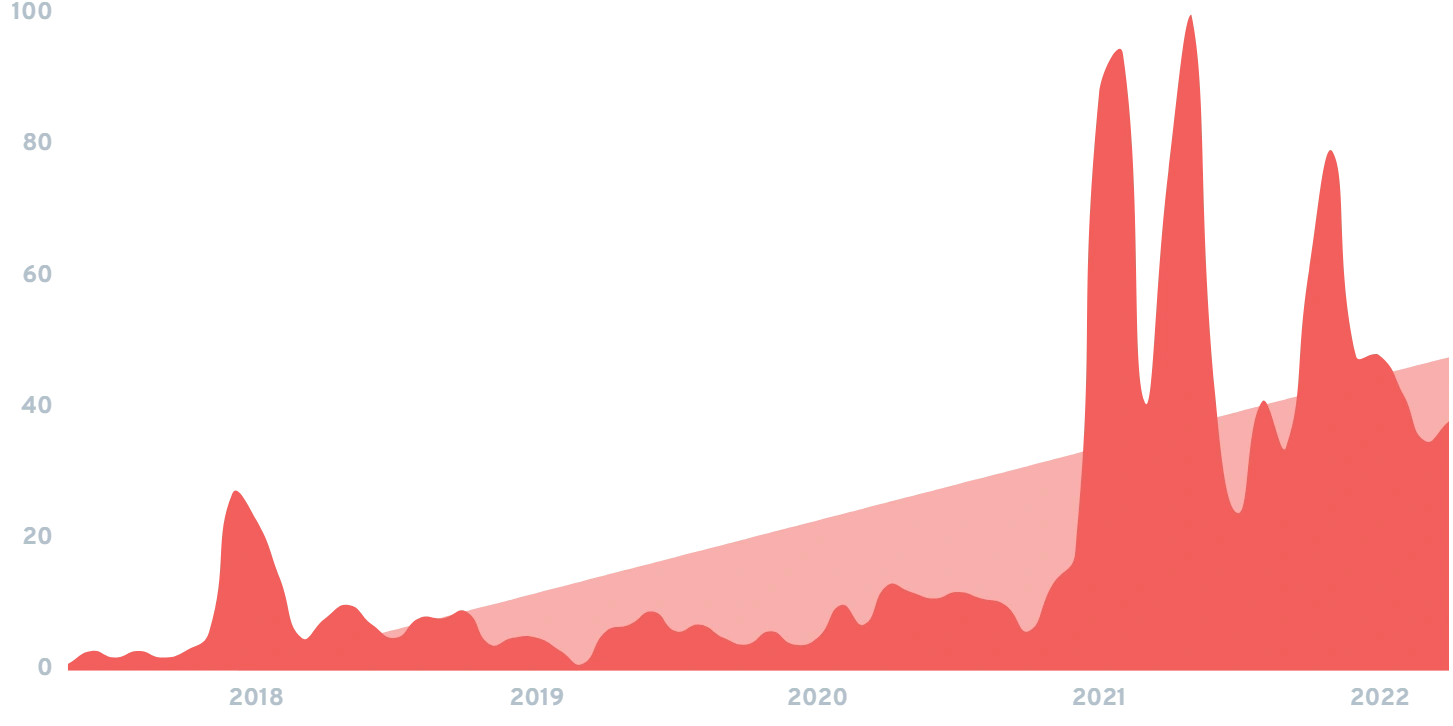

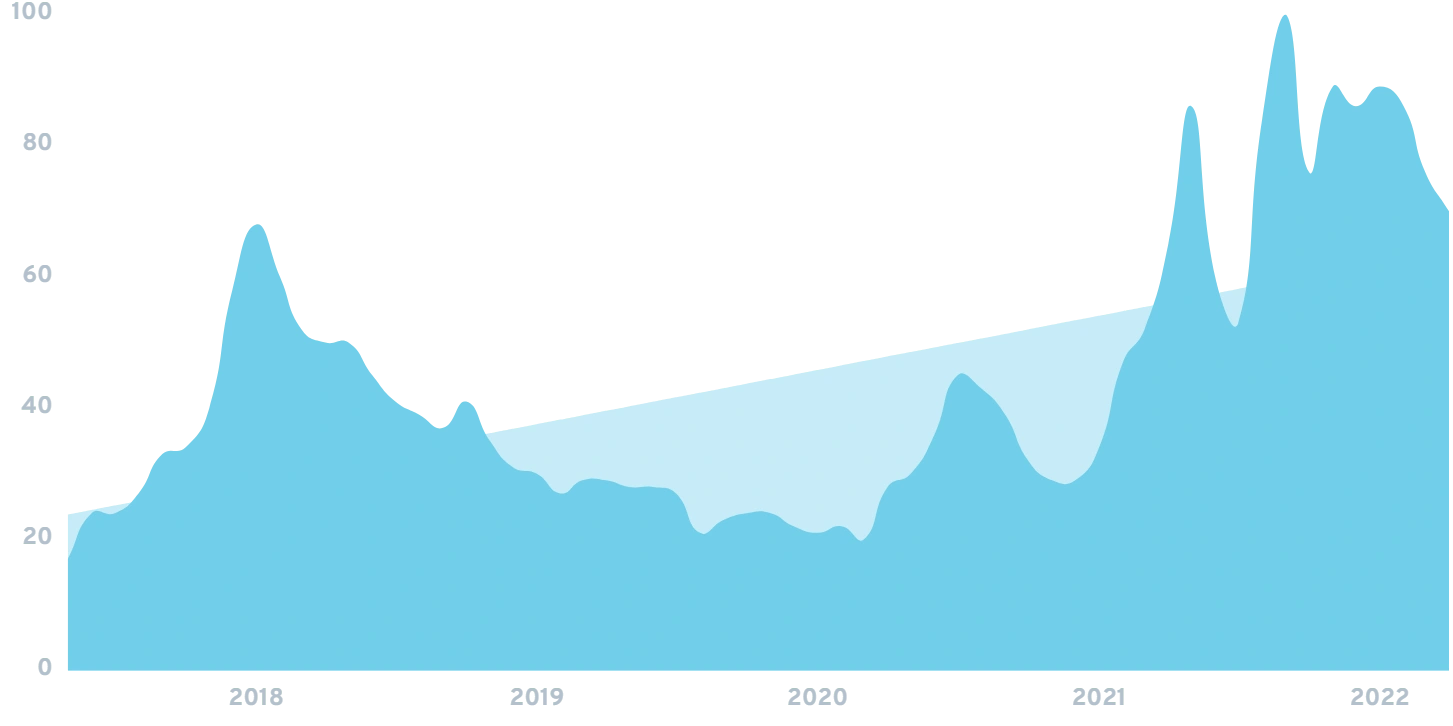

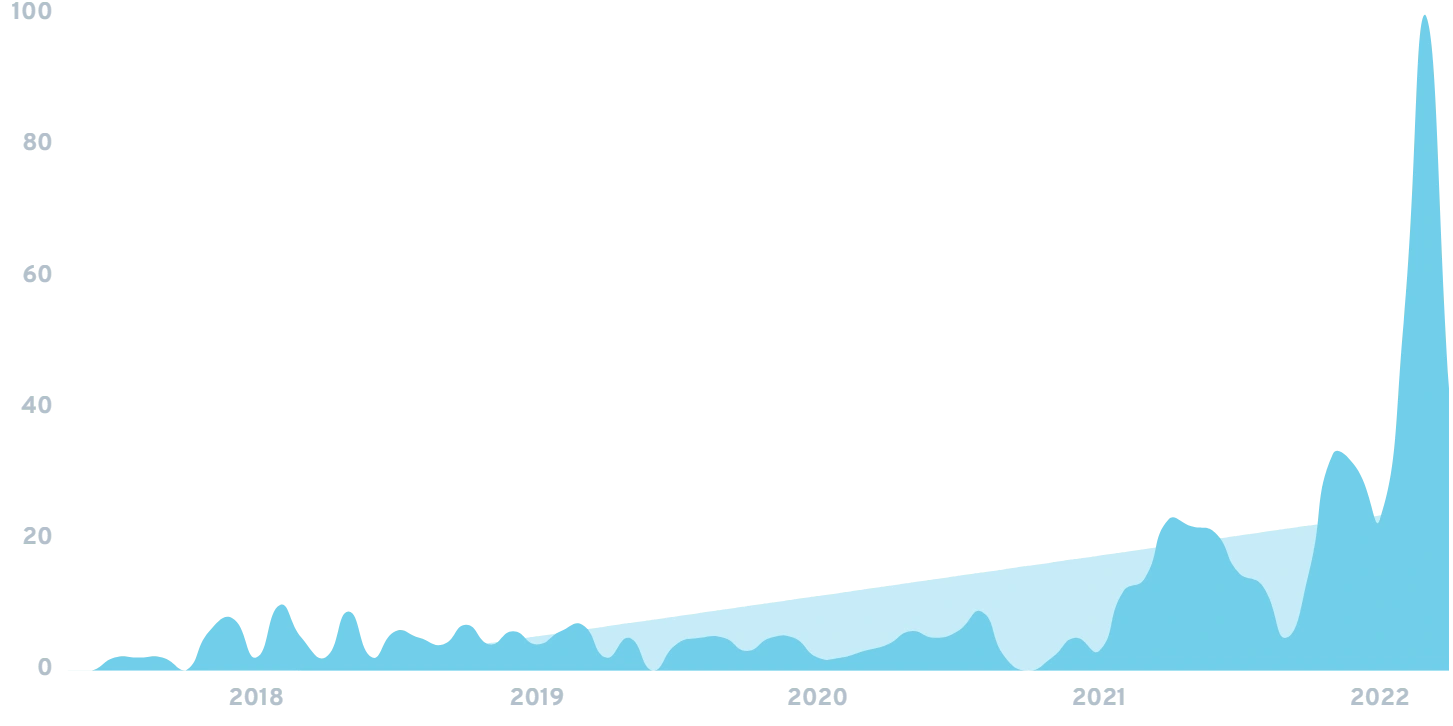

Searches for “Crypto stock trading” over a 5-year span.

Fast forward to today and financial institutions like Credit Suisse are working with companies like Instinet to radically increase settlement times. In fact, last year Credit Suisse announced it had successfully reduced settlement times to one business day by transacting on the fintech-oriented Paxos blockchain.

2. Healthcare Data Access

Obtaining medical records can be a tedious and bureaucratic process.

Further, in emergency situations, there may not be enough time to contact a patient’s primary physician (e.g. to identify their blood type or any prescription allergies they may have).

In addition, medical practitioners - many of which are small businesses - are under constant pressure to comply with an ever-changing regulatory landscape. This, in turn, can lead to several hassles, including excess paperwork, wasted man-hours, and a variety of unintentional healthcare law and privacy violations.

By moving patient records to a private, healthcare-specific blockchain, medical practitioners nationwide (and potentially worldwide) could obtain instant access to any given person’s medical records (thanks to the blockchain’s inherent cryptographic security).

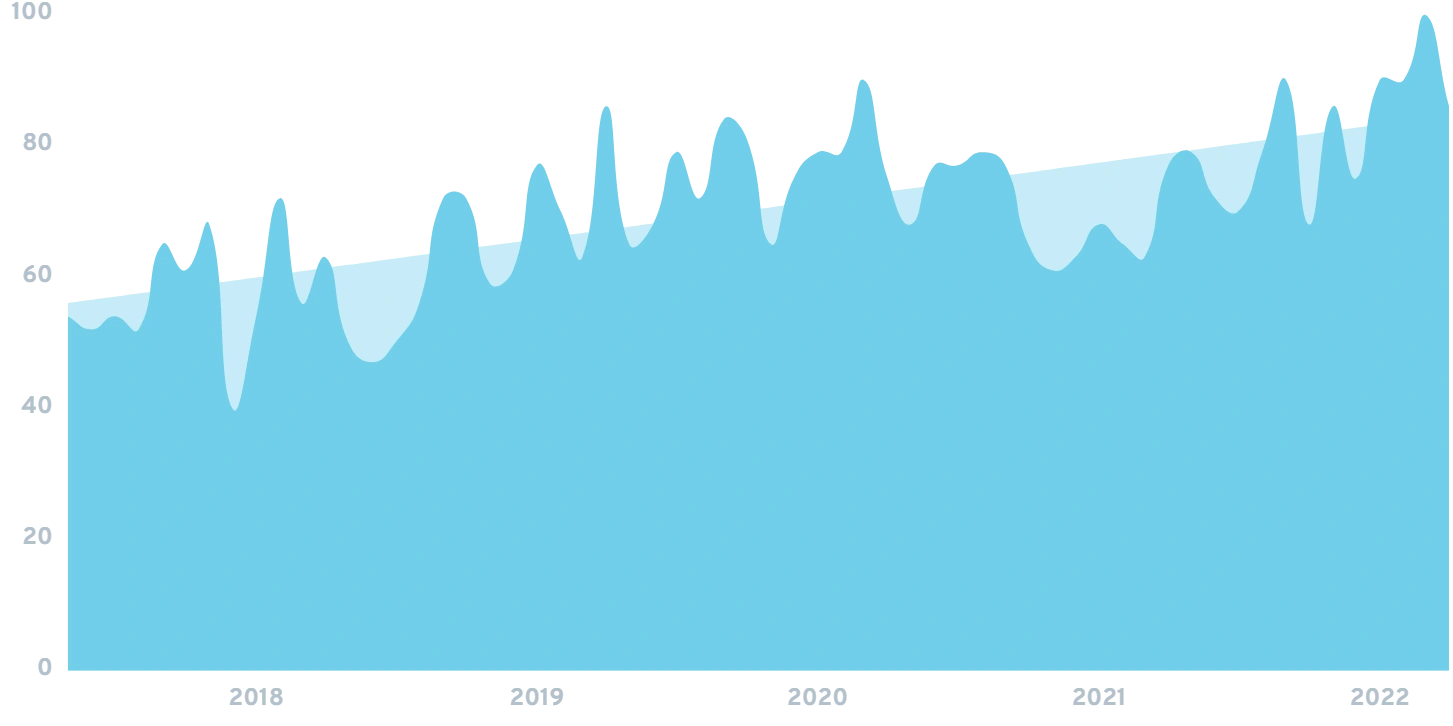

Google search volume for “HealthVerity” is up 63% since 2018.

As an example, HealthVerity is currently working with the government, big pharma, and the nation’s top healthcare providers to share data with “10x greater accuracy” while still remaining HIPAA-compliant.

3. Crowdfunding

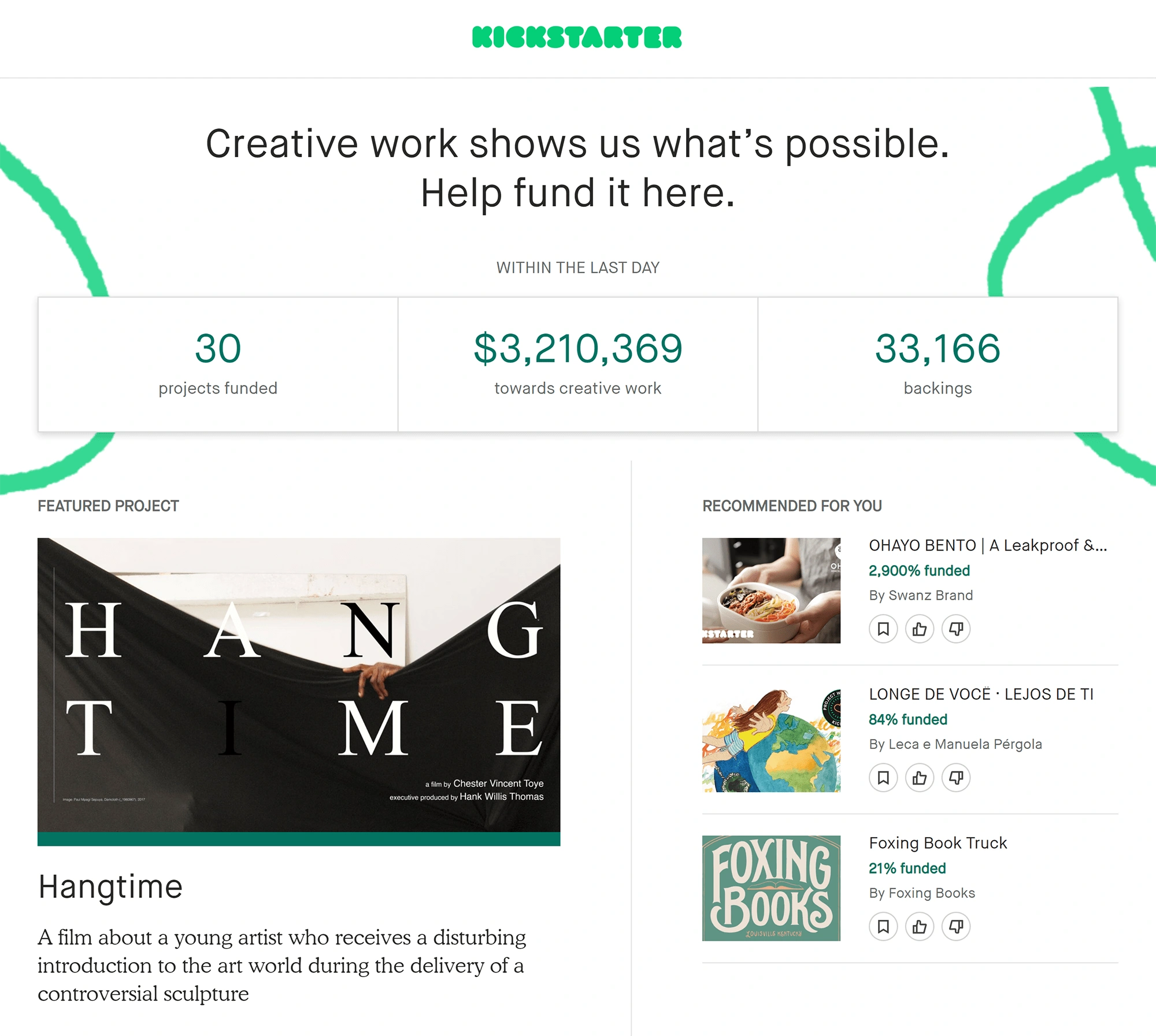

Over the past decade, crowdfunding websites like IndieGoGo and Kickstarter have grown to achieve tens of millions of dollars in annual revenue.

Designed to help startups (and even private citizens) raise money, crowdfunding websites charge an average of 5% (in addition to the standard 3% merchant processing fees).

In addition to losing 8% of donations right out of the gate, crowdfunding sites have come under fire for blocking donations to controversial causes in what some see as political overreach.

Moving crowdfunding to the blockchain, however, could solve both of these problems.

First, transaction fees on many blockchains can be as low as one penny (or even a fraction of a cent). Second, by relying on smart contracts to distribute funds to fundraisers, censorship would become virtually impossible.

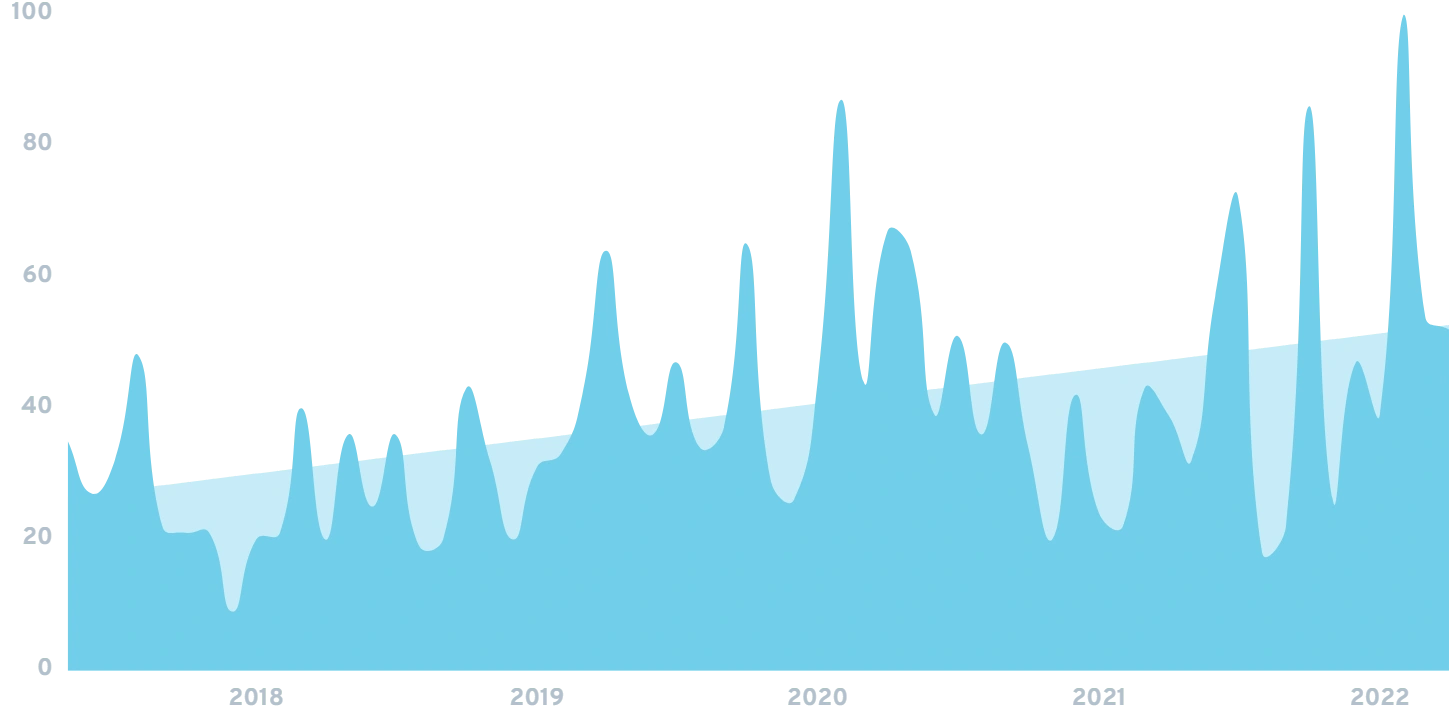

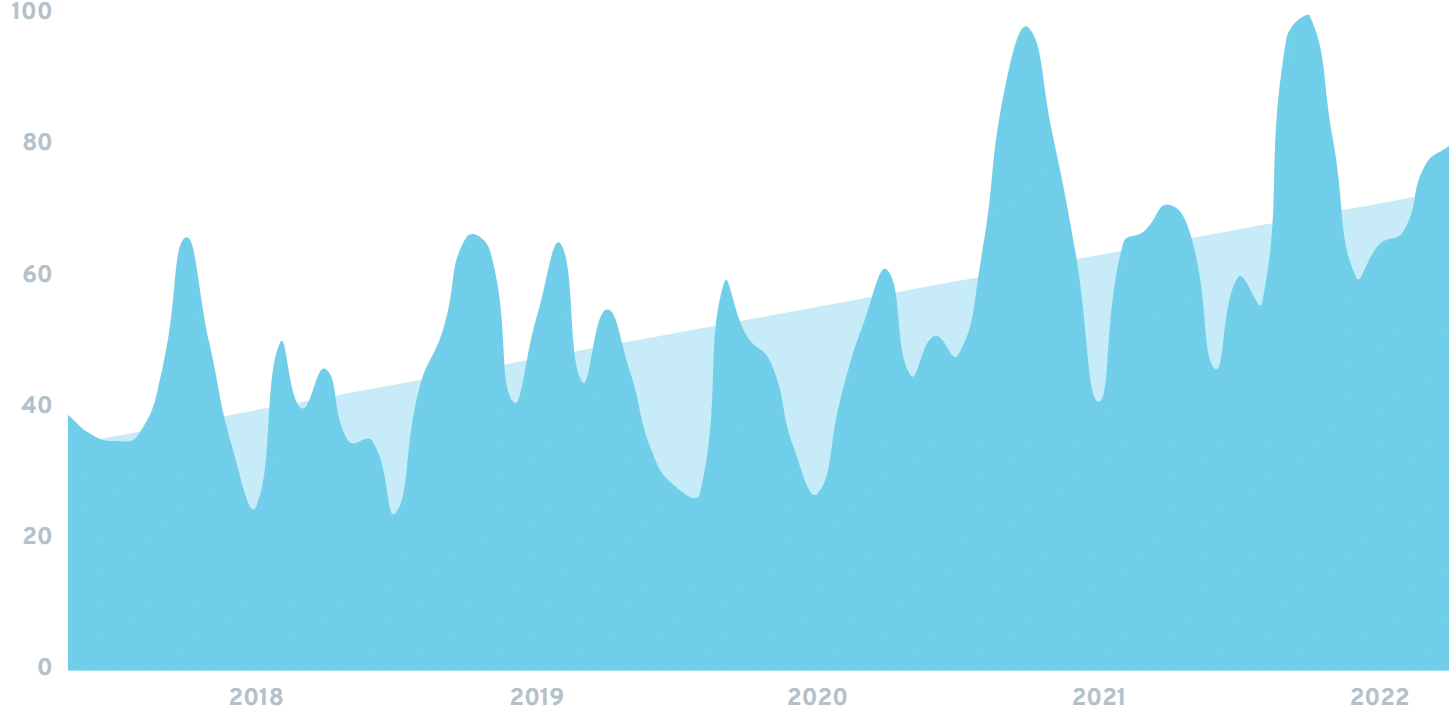

Google search interest in “smart contract” over time.

Instead, donors would send their donations (in the form of cryptocurrency tokens) from a decentralized wallet to a smart contract, which would then distribute the funds to fundraisers automatically.

As an example, PledgeCamp is working to compete with industry heavyweights like IndieGoGo while offering lower fees and additional user protections.

4. Wills and Inheritances

Similar to contesting the division of assets during a divorce, the legal fees involved in contesting a will, trust or estate can become extremely costly.

In many cases, this happens because instructions on how to distribute the deceased’s assets were not clearly defined in the will or trust (assuming one even exists).

In addition, there can be questions as to the legitimacy of the will itself. While more organized estates will work with an attorney to draft official documents, many wills are written by hand (or even spoken verbally) on a person’s deathbed at the last minute (quite literally known as “Deathbed Wills”).

With that said, the blockchain could solve both of these problems.

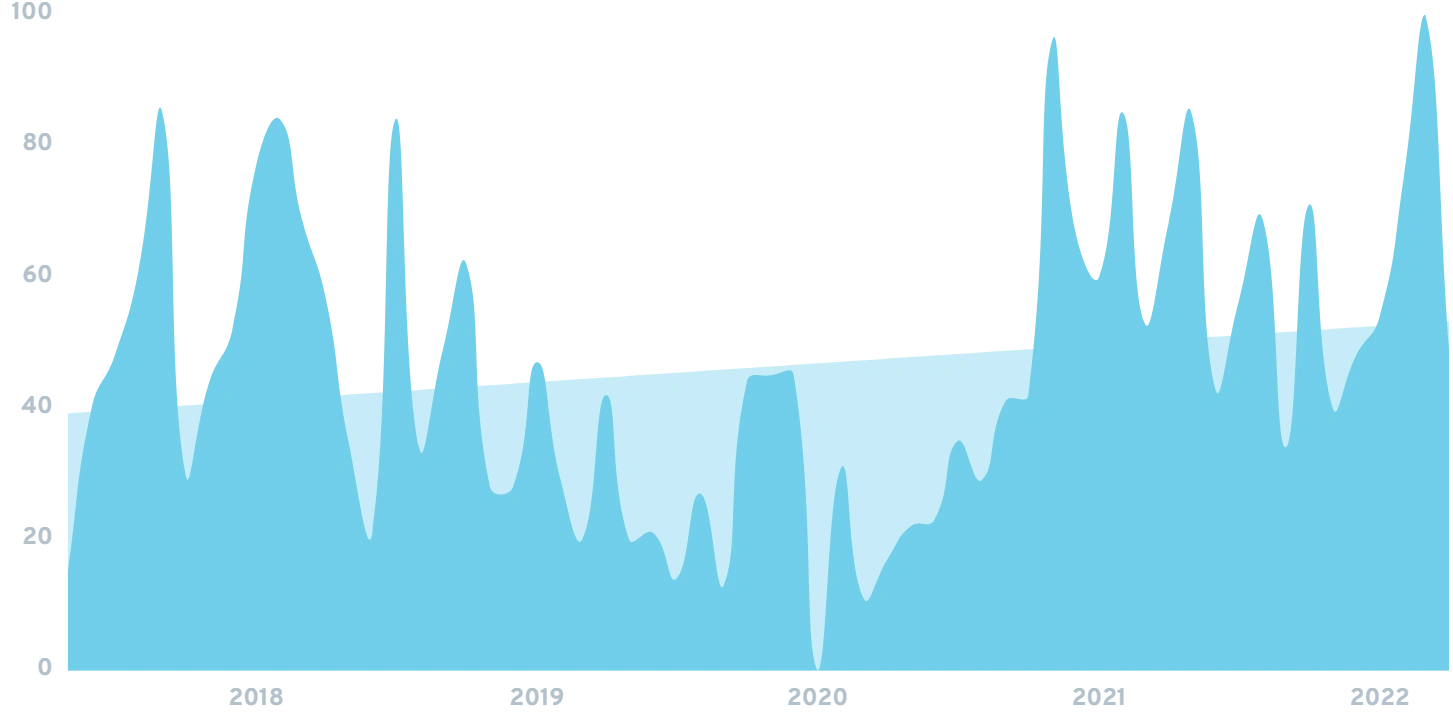

Searches for “wills & trusts” have increased by 77% over the last 5 years.

In addition to smart contracts, some blockchains rely on what are known as Oracles to verify real-world (i.e. non-blockchain-based) data.

As an example, an oracle could integrate with ESPN.com to determine the winner of a sports match on a given date. Then, based on that data, a smart contract could automatically execute an action (e.g. distributing funds to winners who had bet on said sports match).

Along the same lines, by using oracles to connect a smart contract with a mortician’s database, a nationwide obituary, or the Social Security database itself, a blockchain application could automatically distribute a deceased person’s financial assets (and even property deeds) without the need for lawyers or human interpretation whatsoever.

5. Voting

Despite advances in technology, the United States still largely relies on paper-based voting.

With that said, the distributed ledger technology that lies at the core of blockchain applications could help make the voting process more robust.

Search growth for the term “voting equity” is on a consistent uptick.

First, by using an oracle to connect a voting-centric smart contract with the Social Security database, the government could make it impossible for any person to submit more than one vote (by tying their vote to their social security number).

Second, because blockchain applications operate as distributed ledgers, the blockchain itself would provide a transparent and publicly visible record of every vote (a project Agora.vote is currently working on).

This, in turn, would allow authorities to rapidly disprove claims of fraud.

Third, because of its digital nature, moving voting to the blockchain would remove the need for manual ballot counting. Because of this, the results of critical elections (e.g. the Presidency) could be determined instantly upon the conclusion of voting.

6. Cloud Storage

As of the latest data, three companies (Microsoft, Google and Amazon) dominate 58% of the cloud storage industry (and the data stored on said clouds).

In addition to storing private citizens’ files, both government organizations (like the FBI and CIA) and major corporations depend on these three companies (Amazon Web Services in particular).

While cloud storage services are considered to be extremely secure, they represent a centralized point of failure. Should a malicious actor manage to hack a cloud storage service - including the possibility of an internal, employee-based hack - the consequences could be severe.

With that said, moving data to a decentralized version of the cloud could solve many of these issues.

Search growth for “blockchain cloud storage”.

First, by using a token-based system (as is common with most cryptocurrencies), participants across the globe could rent out their excess server space in return for financial rewards.

Second, because of the inherent cryptographic security protocols behind today’s blockchains - which are widely considered to be nearly impossible to hack - the security surrounding the storage of data would be on par (if not stronger) than what today’s top cloud storage companies have in place.

In fact, in an industry where blockchain applications come and go, cloud storage-focused Filecoin - which was founded in 2014 and has raised multiple rounds of funding - is one of the longest-standing blockchain applications.

7. Decentralized Credit Scoring

In the United States, it’s estimated that 1/3s of US citizens have a an error that negatively affects their credit score.

As a result, many people are unable to get loans or have to pay substantially higher interest rates than they would if the error was not in place.

One of the main problems behind credit scoring is the reliance upon three centralized credit reporting agencies (Experian, Equifax and TransUnion).

When a credit violation lands on someone’s report, fixing the mistake requires interacting with the business that submitted the violation and coordinating with all three agencies to get the violation removed.

By moving credit scoring to a decentralized blockchain, however, both businesses and consumers would be freed up from having to deal with the big three agencies.

Instead, credit scoring would take place on a dedicated blockchain application (which, once again, is a permanent and unhackable distributed ledger). From there, businesses would submit credit violations directly to the blockchain itself.

Similar to how the process works now, consumers would be able to view their score and credit report on the blockchain at any time (a project Bloom.co is currently working on now).

However, instead of having to coordinate between businesses and the big three, companies could remove mistakes directly from the blockchain.

This, in turn, would reduce the paperwork and bureaucracy involved in fixing credit reporting mistakes. In addition, it would unify the scoring process in a world where the big three assign different scores based on different (and unknown) criteria.

8. Charity Accountability

While donating to charity is generally seen as a good and altruistic thing to do, much controversy exists around how charities spend their donations.

In fact, how charities spend their funds is such a hot topic that entire organizations exist dedicated to analyzing and grading them on the efficiency and effectiveness of their spending.

By moving charitable giving and spending to the blockchain, however, much of the controversy could be resolved.

Interest in donating via cryptocurrencies is on the rise.

Because blockchain ledgers are inherently transparent, forcing charities to transact on the blockchain would allow auditors, the government, and private citizens to analyze an organization’s spending with dramatically more transparency than is currently possible.

Mainly because, instead of depending on internal reporting (which can be subject to both human error and corruption), all transactions between the charity’s cryptocurrency wallet and the wallets of the organizations they transact with would be recorded on the ledger and publicly visible.

As an example of an early mover in the space, BitGive is currently working with 31 non-profits in 29 countries to increase spending transparency using the Bitcoin network.

9. Auto Maintenance

As anyone who’s purchased a used car knows, getting a professional inspection is critical to analyzing a vehicle’s reliability.

Unfortunately, inspections tend to focus on the vehicle’s current performance versus its prior history. To address this, services like CarFox tap over a dozen sources in an attempt to keep accurate records regarding a vehicle’s accidents, previous repairs, etc.

With that said, investigative journalists have uncovered serious flaws in the CarFax reporting process. Mainly because keeping truly perfect records would require interfacing with every mechanic, mom-and-pop insurance company, and motor vehicle bureau in the country.

If implemented correctly, however, an NFT-focused blockchain application could solve the issue of imperfect record keeping.

Unlike cryptocurrency tokens - which are mutually interchangeable- non-fungible tokens have unique identifiers (similar to how every American has a unique Social Security number).

By connecting a vehicle’s VIN to an NFT - and requiring federally mandated records keeping - insurance companies, mechanics, parts dealers and motor vehicle bureaus could submit every repair, accident, and parts replacement to the blockchain.

In doing so, it would create a permanent, transparent record of a vehicle’s history through a single, unified database. As a result, it would become dramatically more difficult for sellers to hide fundamental flaws unsuspecting buyers may have no way of knowing about.

Along the same lines, attaching NFT identifiers to individual car parts would allow manufacturers to more easily communicate with owners affected by recalls (given they would know precisely which vehicles contained the affected parts and could rely on smart contracts to automatically notify owners).

10. Travel Efficiency

One well-cited survey showed that Americans hate flying (and in particular airports) more than they hate waiting at the DMV.

Between inefficient check-in processes, security hassles, etc., traveling itself tends to be the least enjoyable part of “traveling.”

Admittedly, services like TSA Pre✔️ and the U.S. Customs and Border Patrol’s Global Entry program attempt to streamline the boarding and customs processes.

Sadly, both services require an approximate $100 fee and what can be a time-consuming and bureaucratic application process (leading many travelers to avoid it altogether).

With that said, a blockchain application controlled by the government - and integrated with the airlines - could resolve many of these issues.

By connecting someone’s identity to an NFT-based smart contract application, both TSA and airlines could eliminate the process of verifying identity documents upon check-in (while at the same time eliminating the need for boarding passes).

Instead, a person’s blockchain wallet would act as their identification, payment method and boarding pass. All of which could be scannable using QR codes and biometric security verification.

In fact, by attaching NFT-identifiers to every piece of luggage, a robotic delivery system could eliminate luggage theft (by only releasing a piece of luggage once the recipient has scanned their wallet, thereby verifying they are the owner of said luggage).

Along the same lines, transforming airline miles and reward points into cryptocurrency tokens would allow both businesses and consumers to buy, sell and trade points/miles with dramatically more ease than is possible today.

With nearly 70% of consumers participating in one or more credit card rewards programs, Singapore Airlines has already begun working on a blockchain application designed to do just that (as part of their Kris + Lifestyle App).

Conclusion

Because blockchain-based smart contracts were invented in 2015, it would be easy to assume the technology should be further along than it is.

With that said, very few developers understood a smart contract’s ability to automatically execute tasks until 2020 (when demand for decentralized finance services led to an explosion in smart contract development).

Because of that, one could argue the world of blockchain applications is just two years old.

As more developers learn how to program smart contracts, and more venture capital pours into Web3 companies, one can expect to see a variety of new and exciting blockchain apps rolled out over the coming years.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more