Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

CrunchBase vs. CB Insights: How to Choose the Best Market Intelligence Platform

When you want to get the most out of your investments, it’s smart to take advantage of market intelligence platforms like CrunchBase and CB Insights.

But if you’re having a hard time choosing one over the other, we can help.

This is a detailed breakdown of what both platforms offer, how they compare, and how they differ, with a heavy focus on what actual users say about them.

Let’s dive right in.

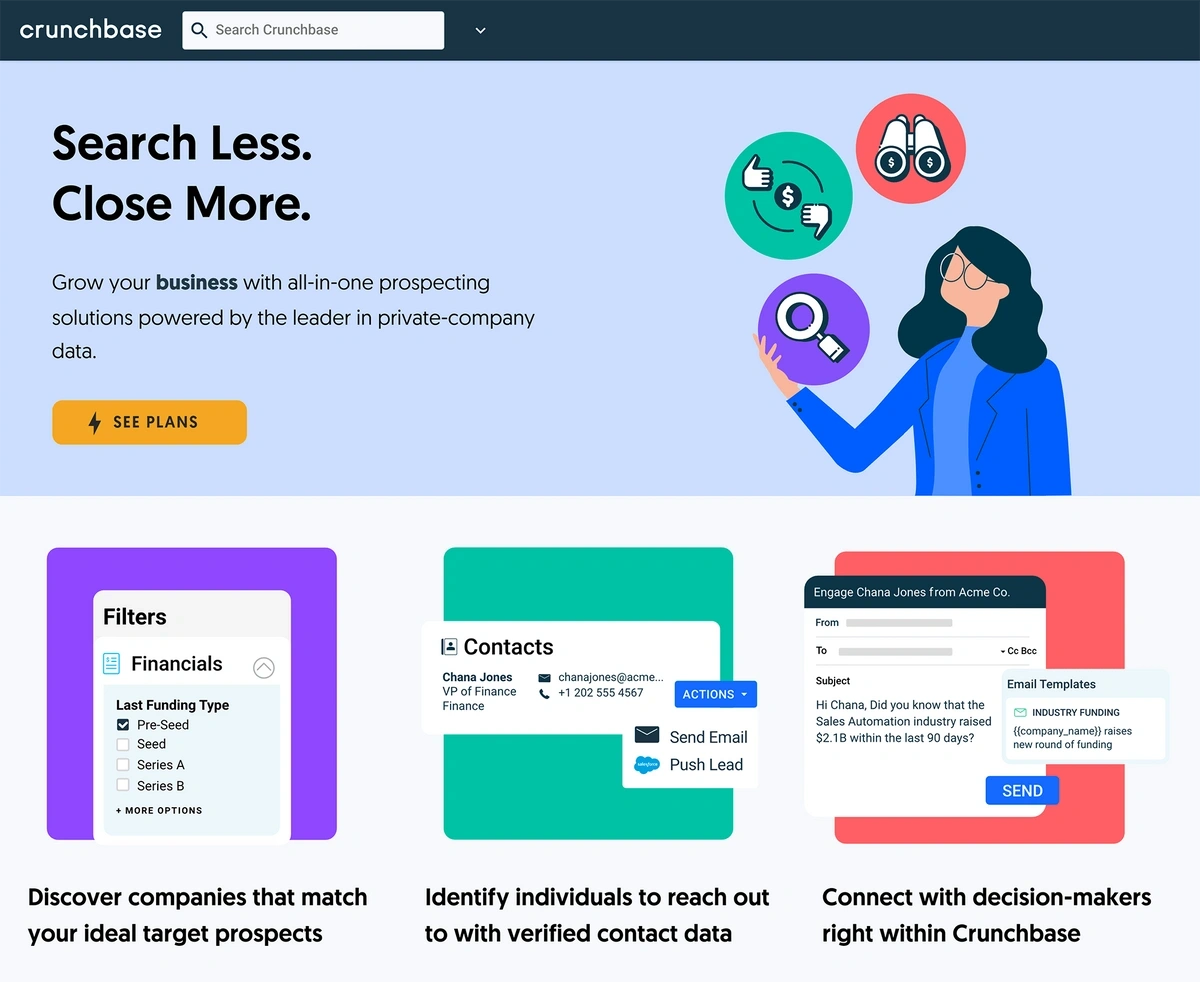

CrunchBase: Product Overview

CrunchBase is a popular option for investors due to its primary focus on startups and tech companies and its database of decision-maker contact information.

CrunchBase: Key Features

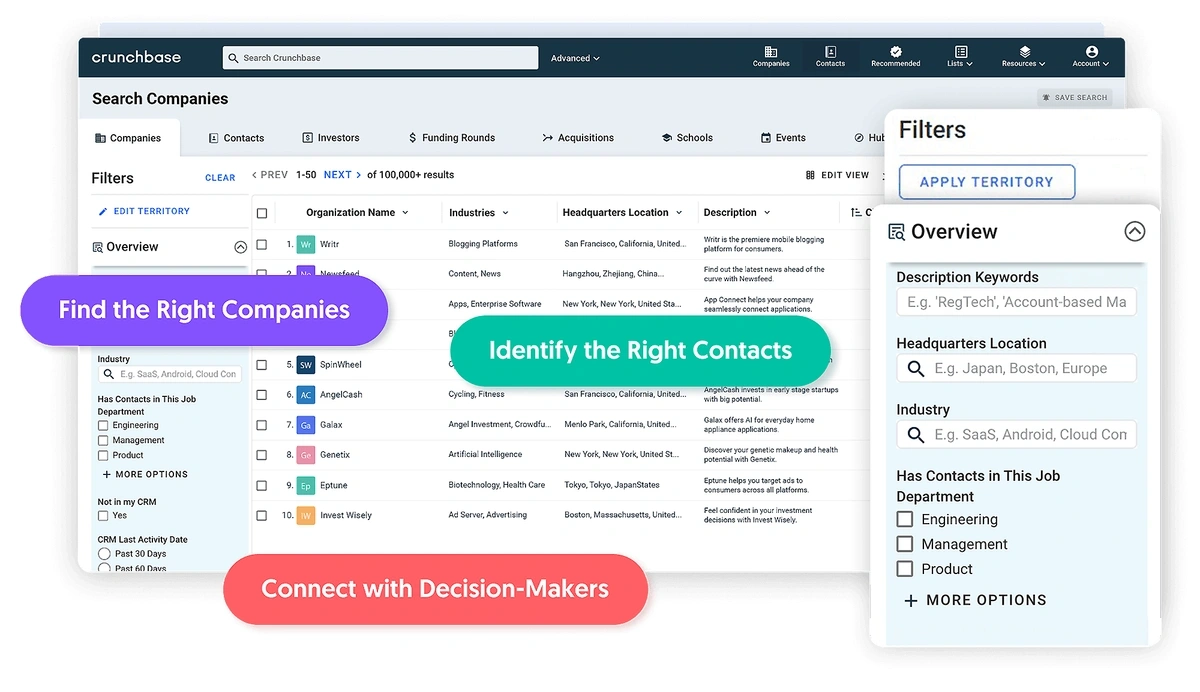

1. Advanced Search Capabilities

With CrunchBase, you can employ up to 38 search filters to drill down to the best companies that fit your ideal criteria. The interface is clean and easy to use, so you can check out detailed, at-a-glance data points like company size, funding stage, and revenue range.

2. Prospecting Tools

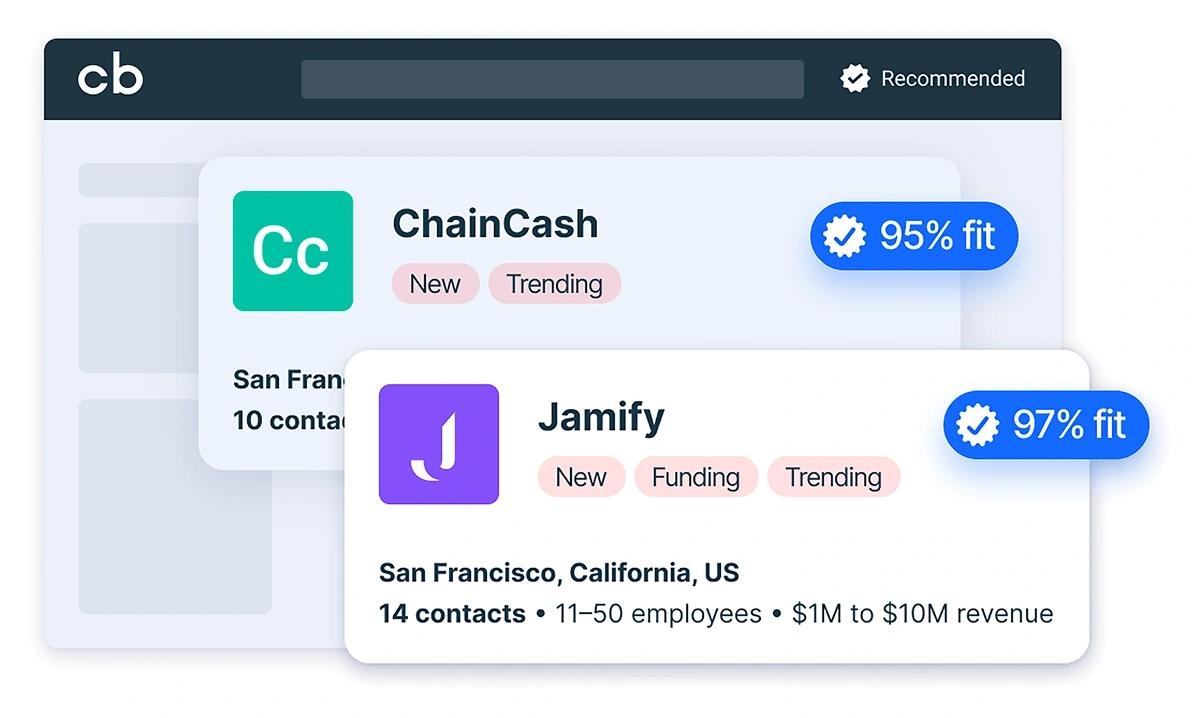

With CrunchBase’s built-in prospecting tools, you can find qualified contacts in your territory and connect with decision-makers. These tools also include prepared outreach templates, alerts on accounts you’re monitoring, and automatic recommendations of prospects that fit your ideal profile. Plus, CrunchBase can push contact information directly to your CRM.

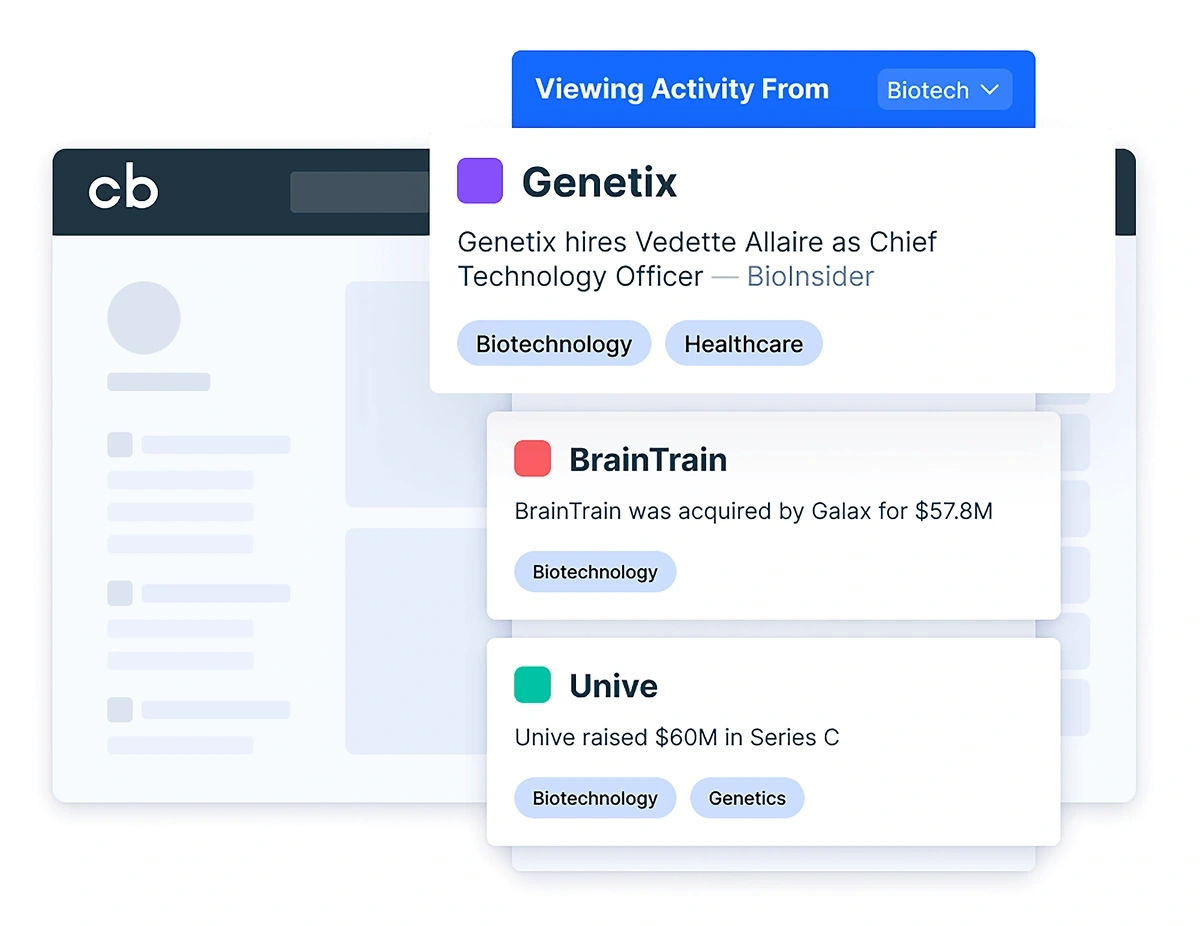

3. Insights and Analysis

While not up to par with the level of in-depth reporting and predictive analysis that CB Insights can offer, CrunchBase does have the ability to monitor industry trends and send you personalized insights, and similar company recommendations based on your activity.

You can also set up alerts that will help you stay on top of specific events or companies that you’d like to keep an eye on.

4. AI and Machine Learning Enrichment = Better Data

CrunchBase updates its database 24 hours a day. This is possible through a system that uses AI and machine learning algorithms combined with in-house data experts to find and validate 2,000+ news sources. CrunchBase is unique in that its community of contributors is active and regularly updates over 100,000 company profiles per month to keep the data as accurate and timely as possible.

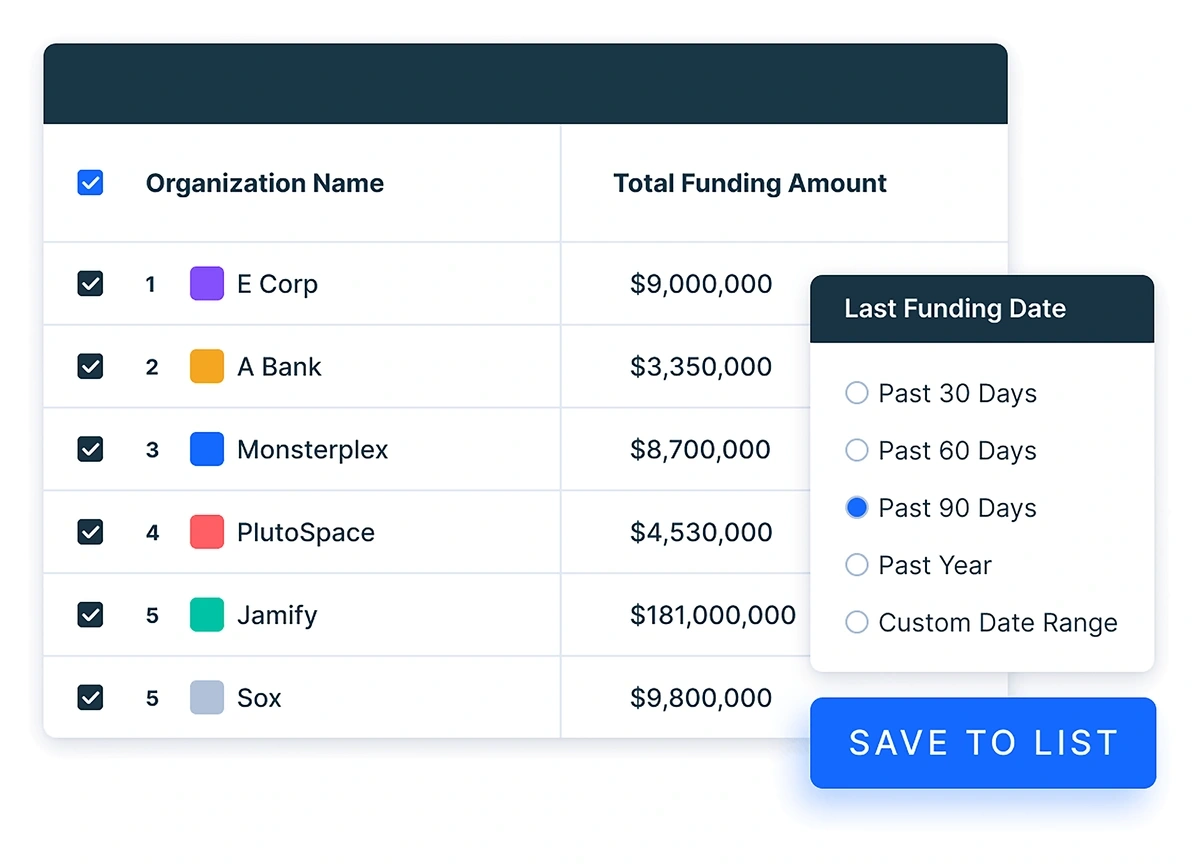

5. Track Your Portfolio

Tracking your portfolio is easy in CrunchBase using the interface or using the platform to export or import a CSV you’ve prepared. You can see details on the companies you’re investing in, get verified contact information, and sign up for real-time alerts so you don’t miss a thing.

CrunchBase: User Reviews

Scores

- G2 score: 4.5 out of 5 (based on 317 reviews)

- TrustRadius score: 7.9 out of 10 (based on 55 reviews)

3 Things Users Like About CrunchBase

1. A Good Source of Funding Data

- “Crunchbase is the best data source I've used for funding data, we have some of this data available in another tool but it is often incomplete and out of date. Crunchbase has been more accurate & up-to-date which helps our team have the best information available while prospecting for new accounts and attending our sales calls.”

- “Using the funding data in Crunchbase, our sales team is able to identify shared investors across our customer base. This enables our team to craft tailored messaging tied to social proof during our prospecting efforts and allows us to come prepared during calls with our prospective clients.”

- “Crunchbase is my one stop solution to provide data to my clients whenever we need funding/ investment related information. It is also easy to explain to other the description of various columns present in the data.”

2. Advanced Search Filters

- “Crunchbase has all of the specific data points that I need as a B2B Sales Leader selling to other VC-backed B2B startups. It has very good advanced filters to search for specific companies. It is much better priced compared to other tools on the market. You have the ability to bulk export.”

- “I really like the search engine and the filter. By the way I can scale my searches, companies etc. As a sales professional I really like the explore new companies, organization based on my filter. Crunchbase really helps me with that.”

3. Easy-to-use Interface

- “Crunchbase is a very user-friendly database. The logos available for every company helps in easy identification of the company we need to work upon. We can download the data in microseconds. The database does not take much of our time to get the data. It's a quick process once you are familiar with the tabs and information available.

- “Crunchbase is helping us identifying prospects thanks to its extensive database, it is easy to search depending on the industry, location, funding stage, and other criteria.”

- “I have been using Crunchbase for several months now and have found it to be an excellent resource for gaining insights into the startup ecosystem. The platform is easy to use and provides comprehensive data on companies, investors, funding rounds, and industry trends.”

2 Things Users Dislike About CrunchBase

1. Pricing and Value Proposition

- "Crunchbase is overpriced, especially for small businesses. The value proposition simply doesn't add up."

- “The data provided by Crunchbase, while extensive, is not as valuable as it's made out to be. I found that I could source most of the information provided by Crunchbase elsewhere, at a much more reasonable cost.”

- “The credit system is quite restrictive. With only 10 credits provided per month, it's hardly enough to conduct comprehensive research. Additional credits are offered, but at an extra cost, which further inflates the already high price of the service.”

2. Limitations in Search and Data Access

- "The limitations of search results, only providing you with 1000 results, can be a major problem as there may be additional results beyond the first 1000 that you cannot access."

- "The limit on the number of companies/ funding round one can download at one go is 1000 which should increase as one has to download data again and again in multiple batches due to this."

- "There is often a lack of depth when it comes to information, especially about smaller companies since Crunchbase relies heavily on information from articles and user generated content."

CrunchBase: Pricing Plans

CrunchBase offers a free plan where you can browse some of the featured company profiles. It’s pretty limited in what you’re able to see, but there’s also a Free Trial option where you can try any of the paid plans for 7 days free. All you need to do is to create an account and provide a credit card. Here’s a breakdown of the current cost of the paid plans:

- Starter

$29/ user/ month billed annually

Track and monitor the companies you care about

Best for individuals

Free trial available

- Pro

$49/ user/ month billed annually

Full suite of prospecting tools fueled by sales intelligence

Best for individuals and small teams

Free trial available

- Enterprise

Contact sales team for pricing

Custom billing

A custom solution that scales as teams do

Best for large teams

CB Insights: Product Overview

CB Insights offers market analysis and in-depth research reports to help you make more informed decisions about investing or making similar moves. The platform is more complex than what CrunchBase offers, but it offers a lot more than just at-a-glance company info.

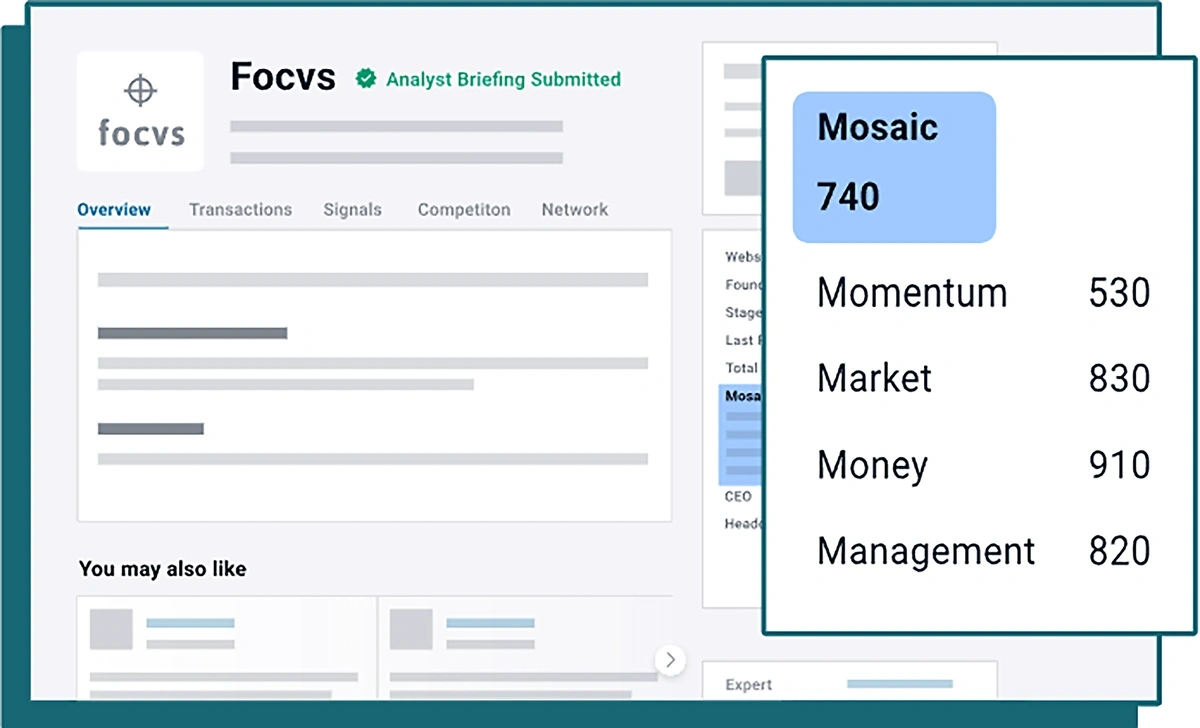

1. Proprietary Mosaic Score

One of CB Insight’s most impressive features, the Mosaic Score is a number assigned to a specific company based on the below key indicators:

- Momentum

- Market

- Money

- Management

You can use this information as a way to gauge a company’s future success like in the example below.

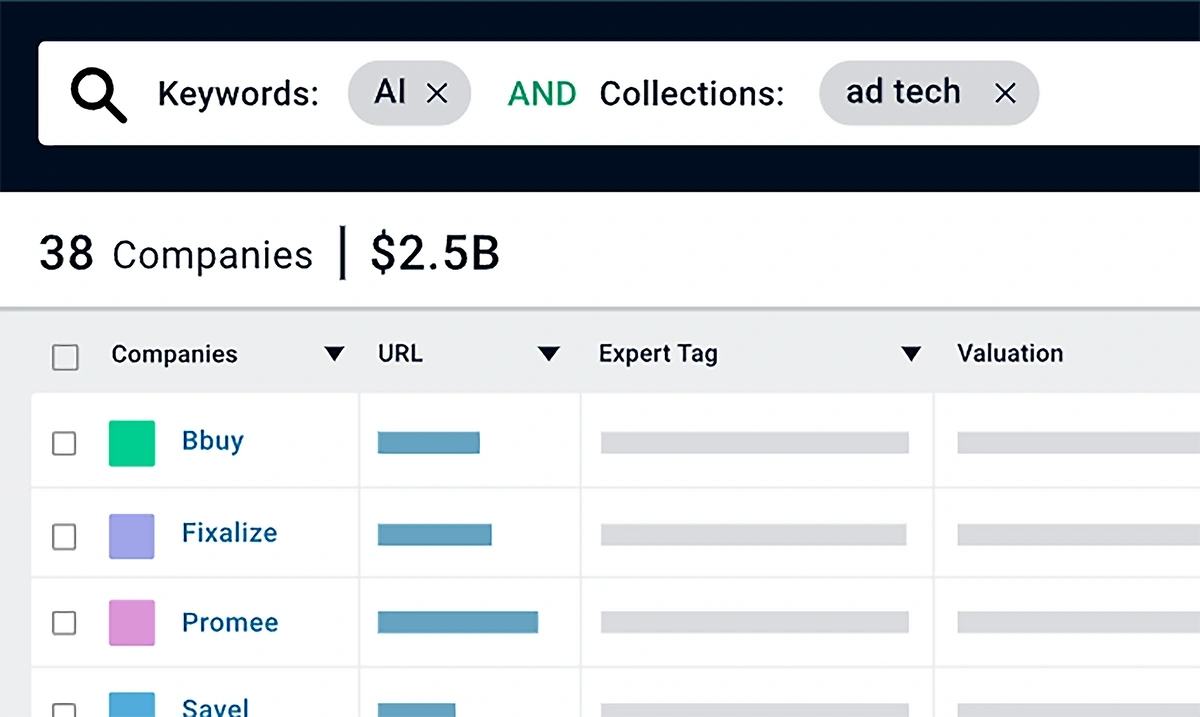

2. Tech Search Engine

Searching in CB Insights for tech companies is made easier with search filters so you can find specific industries, track the tech markets, anticipate where growth will happen, and predict what will happen next.

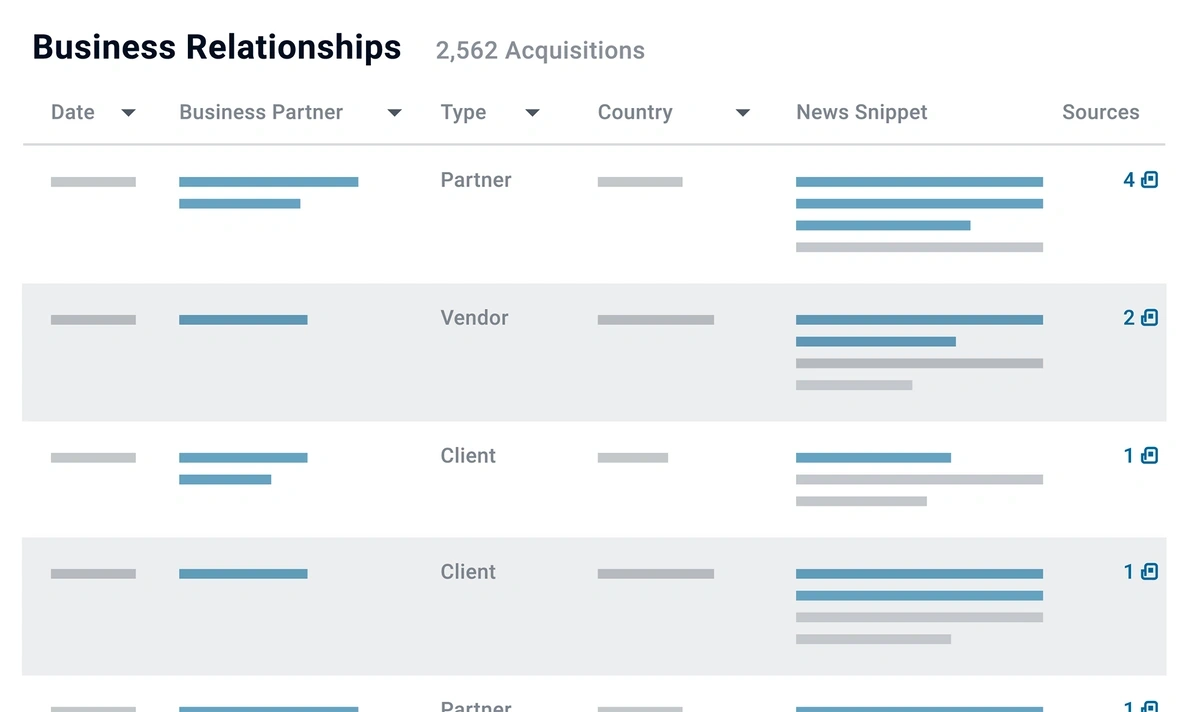

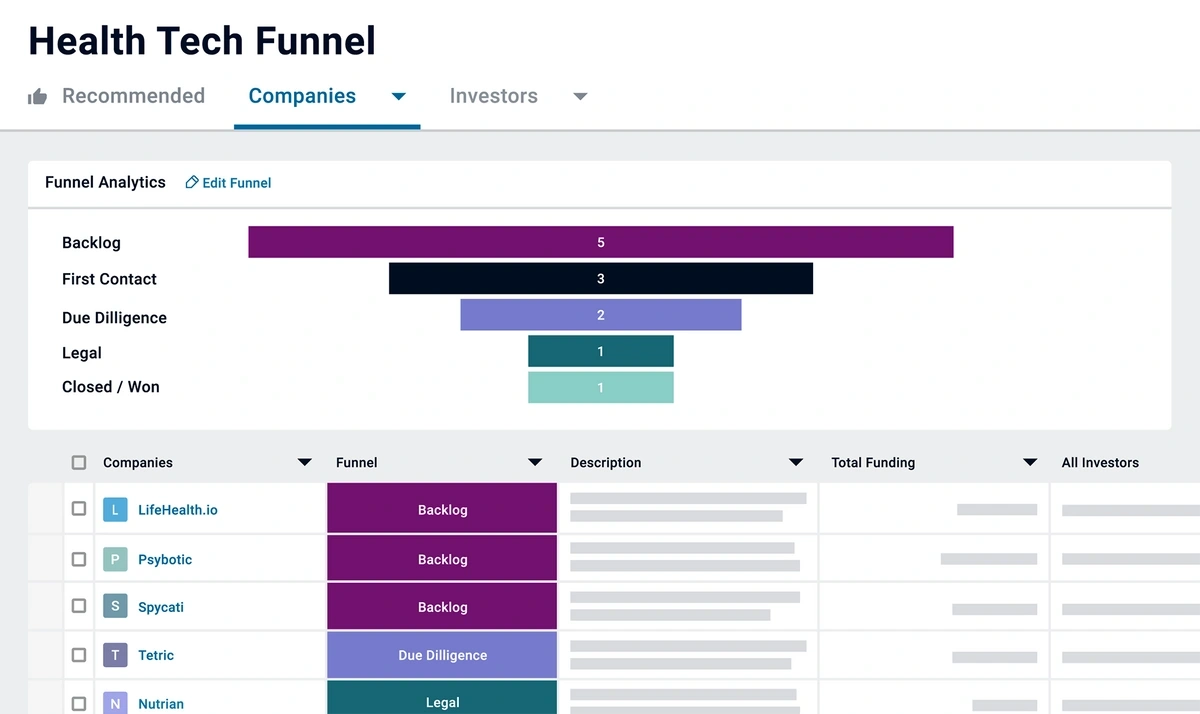

3. Anticipate Competitor Strategy

CB Insights has a wide range of market insights and in-depth analysis that you can refer to, but one of the more interesting use cases is to anticipate the strategy of your competitors. With Business Relationship data, you can discover your competitor’s partnerships, investments, acquisitions, and so on.

4. Cutting-Edge Research Reports

Through CB Insights, you can create highly detailed research reports that combine existing data and predictive analysis so that you can harness up-and-coming trends in your respective field.

Notably, these research reports are designed to be highly visual, clear, and concise, as opposed to reports that are just dozens of pages of long-winded text. The easier it is to read and visualize, the easier it is for you to arrive at your next decision.

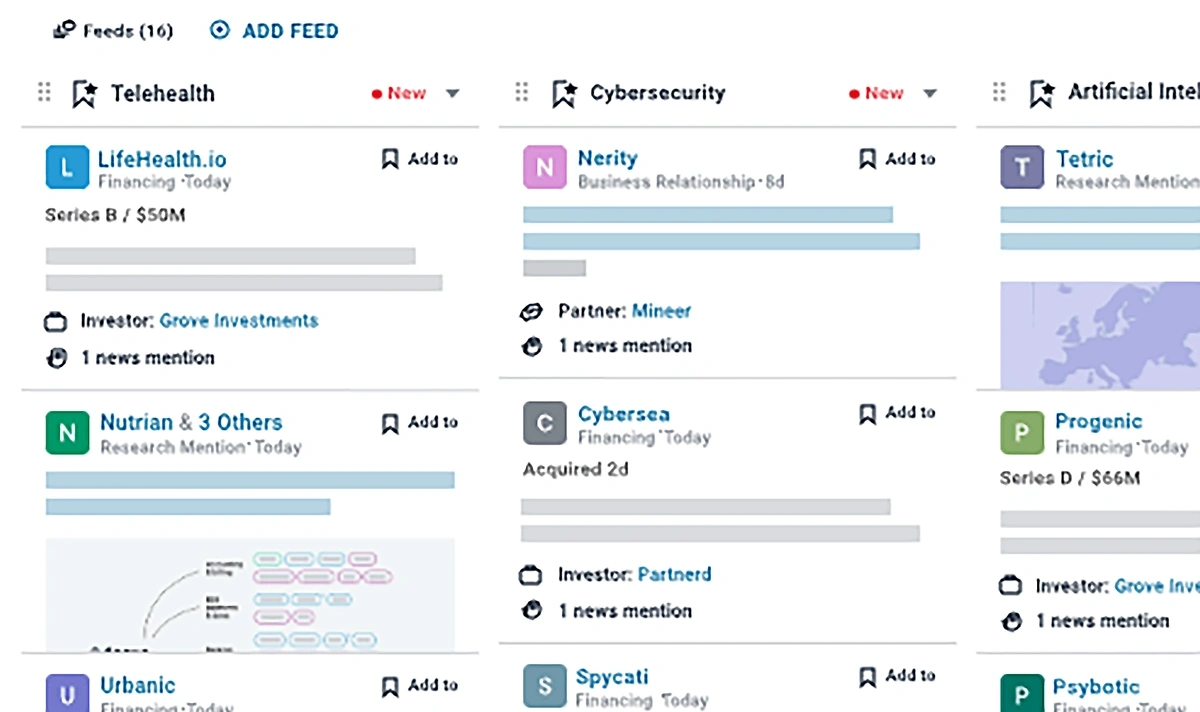

5. Collaboration Tools

CB Insights allows you to collaborate with your team directly in the platform where you’ll also be able to see real-time updates, predictions, alerts, and more. You can use these to strategically manage your initiatives with your team without missing out on the most recent developments.

When you’re ready to present the information to your team, you’re only two clicks away from preparing an extensive slide deck filled with funding data, investor information, and more.

CB Insights: User Reviews

Scores

- G2 score: 4.3 out of 5 (based on 14 reviews)

- TrustRadius score: 8.8 out of 10 (based on 16 reviews)

3 Things Users Like About CB Insights

1. Detailed, Up-to-Date Data on Investments and Market Trends

- "It helps us to uncover latest funding trends in emerging tech space."

- "They report on private companies as well which is extremely difficult info to access in such a timely manner on your own."

2. The Daily E-Newsletter

- "I like the daily emails they send out. It consolidates a lot of the info in a user-friendly manner."

- "Information being presented is always in a unique manner and their email lists are quite entertaining."

- "Their daily e-newsletter is chock full of intelligence presented in such a fun and entertaining way, it makes you want to pay for it too!"

3. Insight into Business and Investment Opportunities

- "CBInsights is part of our investment opportunity sourcing platform. We use the system to identify new companies and benchmark the traction of existing companies to their cohorts."

- "Great tool for business development. The funding round information is extremely helpful."

2 Things Users Dislike About CB Insights

1. Search Capabilities and User Interface

- "The initial search function could be a little more user friendly."

- "I have experienced that compared to its competitor database, there are limited "expert collections" - so every time I end up building a query to create my own collection of startups for a particular use case."

2. Pricing and Subscription Model

- "Price is too high. There should be cheaper options for subscription."

- "Very expensive service and can’t always find what I’m looking for."

- "Unless you have the paid version, you are really limited on your searches."

CB Insights: Pricing

Suited to larger companies with bigger budgets, the pricing for CB Insights isn’t easy to find as it isn’t shared on the site (you need to contact them for a customized quote). That being said, some users have shared that the platform starts at $60,000 per year with plans going up to as much as $265,000 for an all-inclusive “insider” package, which we weren’t able to confirm.

What we do know is that the users who have reviewed the platform note that it isn’t designed to be affordable, but generally feel like they’re getting value for their investment into the platform. We should also note that there is a 7-day free trial version of CB Insights that doesn’t require a credit card.

CrunchBase vs. CB Insights: A Detailed Comparison

Basically, here is how the two compare if you need to make a decision and you’re short on time.

CrunchBase is ideal for users who want quick at-a-glance info, a simple user interface, a lower price tag, and detailed information on funding and startups.

CB Insights is ideal for users who want more comprehensive information, predictive analytics, detailed research reports, and bigger budgets.

CrunchBase vs. CB Insights: Ideal Users

CrunchBase may be a better fit for the following:

- Angel Investors

Crunchbase is filled with opportunities for angel investors and key information on funding and founding members. CrunchBase also seems to be adding more functionality for prospecting and outreach, as well.

- Early-stage VCs

Keep up on which companies are being funded, what stages they’re at, and who to get in touch with. CrunchBase usually includes useful data like funding history, growth metrics, and market trends.

- Startup Founders and Entrepreneurs

Founders and entrepreneurs can leverage the tool similarly to investors by looking deeper into their potential investors, monitoring competitors, and keeping up-to-speed on trends in the market.

- Market Researchers

Making informed predictions starts with good data, and CrunchBase offers detailed information on a wealth of companies that can help market researchers create in-depth reports, and track important industry trends.

CB Insights may be a better fit for the following:

- Corporate Strategists and Innovation Teams

CB Insights provides trend analysis, market mapping, and predictive analytics which can guide corporate teams in understanding emerging technologies and sectors, helping them in making strategic decisions and staying ahead of competition.

- Venture Capitalists and Private Equity Firms

VCs and Private Equity firms can leverage CB Insights for deal sourcing, due diligence, and market mapping. The platform's predictive analytics can also help identify high-momentum startups, sectors, and technologies.

- Business Development Professionals

Business development professionals can use CB Insights to identify potential partnership opportunities, strategic alliances, and market expansion possibilities.

CrunchBase vs. CB Insights: Key Differentiators

Let’s talk about the four key areas in which the two platforms differ.

1. Focus and Depth

CrunchBase offers comprehensive data about companies and their histories and, again, the primary focus is on startup companies, as well as when and how they’ve been funded.

CB Insights is more about predictive analysis, and not so much at-a-glance company data but detailed insights into what is expected to happen in the market in the future.

2. User Interface

CrunchBase has been cited by many users as an easy-to-use platform that keeps its interface simple, even with its advanced search capabilities.

CB Insights, on the other hand, is generally seen as more complex than some people would like. Users specifically pointed out difficulties they had navigating the advanced search function of CB Insights.

3. Data Accuracy

Data accuracy is always a tricky metric to compare when it comes to two different platforms, especially if we have limited data on users who have tried both.

CrunchBase is regarded as pretty accurate, but some users have noted that they compare data elsewhere to double-check accuracy.

CB Insights offers more detailed reports that are built around current data and predictive analysis. That being said, users are pretty happy with the accuracy of the data.

4. Pricing

CrunchBase is the more affordable option of the two, while CB Insights costs more because it delves deeper into the company and industry information. CrunchBase does offer a free plan, but it’s pretty limited in scope.

| CrunchBase | CB Insights | |

| Key differentiators | Affordable, user-friendly UI, startup-focused data | In-depth reports, predictive analytics, expert collections |

| Target users | Angel investors, early-stage VCs, startup founders/ entrepreneurs, market researchers | Strategists and innovation teams, entrepreneurs, VC’s, market researchers |

| Market specialty | More focused on startups and tech companies | More focused on private company info |

| Ease of use | Known for its easy-to-use and intuitive interface | Complex user interface that some users had trouble with |

| Data accuracy | Typically pretty accurate | Very accurate |

| Pricing | $$ | $$$$ - by custom quote only |

Conclusion - CrunchBase vs. CB Insights

Please remember that every decision when it comes to choosing the right platform will depend on your business needs, so that’s what you must take into consideration before anything else.

CrunchBase stands out for its ability to provide detailed, company-specific data, especially with relation to funding and key points of contact. This thorough information allows the user to keep track of a company’s journey and position over time.

CB Insights shines in identifying market trends and predictive analysis based on current data. This makes it ideal for users who need a forward-reaching perspective and those who need to keep an eye out for potential emerging sectors or market disruptions.

While both of these platforms are great and serve their own purpose, there is one more option that might interest you if you’re keen to track important market trends.

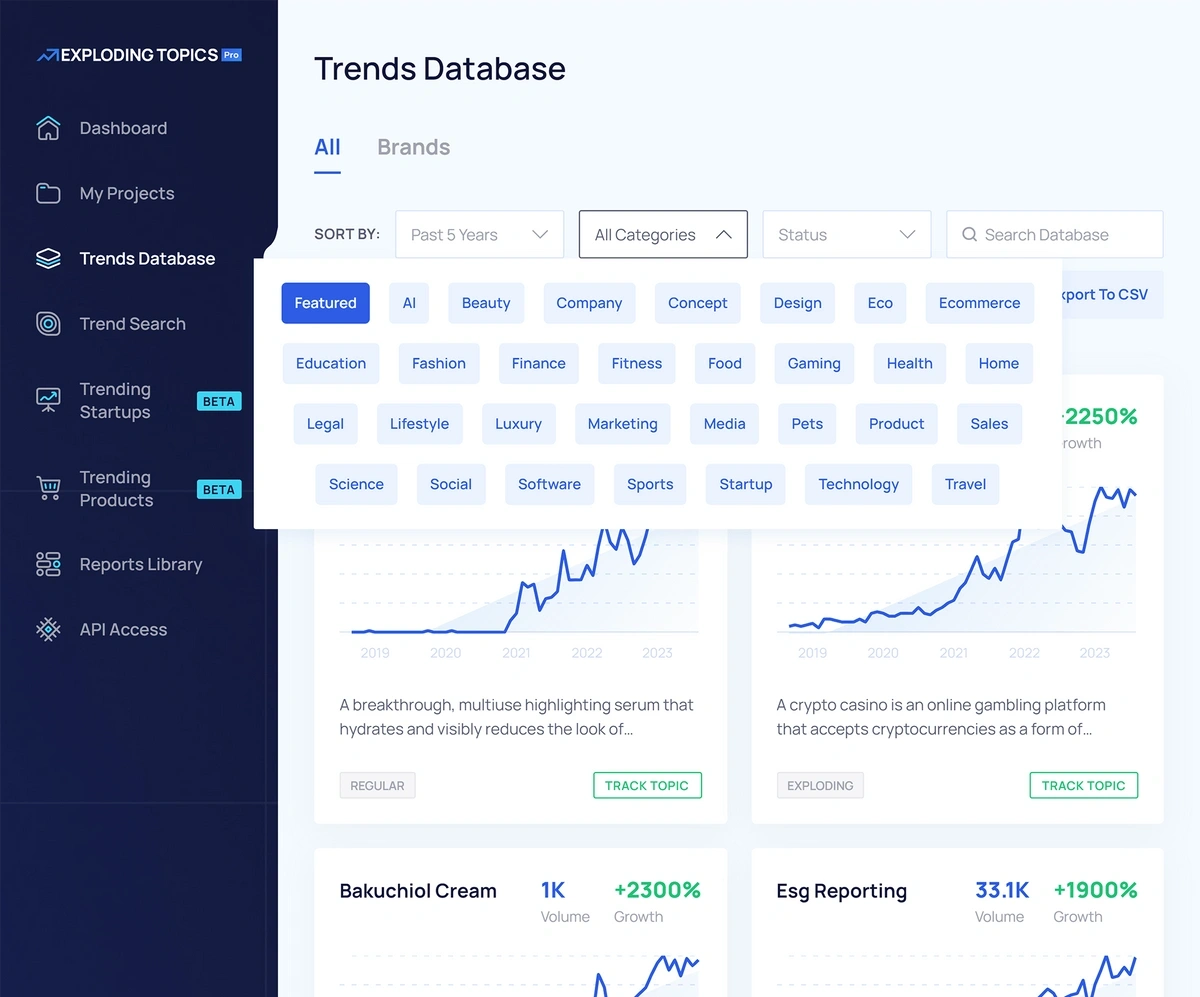

Here’s a Bonus Option For The Best, Most Up-to-Date Trend Information

Exploding Topics Pro is a platform designed to track trends that are emerging and just on the verge of taking off. In fact, the platform, thanks to AI-driven algorithms combined with human verification, can pick up on trends that are about to explode as many as six months before it happens.

The good news is that Exploding Topics Pro Investor is only $99 per month. That small investment allows you to:

- Stay on top of trends that are about to hit it big

- Set up alerts

- Monitor market changes

- Run a search in ET’s exclusive Trends Database

And you can implement Exploding Topics into your strategy whether you go with CrunchBase or CB Insights to have an even broader grasp of what’s coming in your industry.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more