Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

6 Top Dealroom Alternatives & Competitors (2025)

Dealroom.co is a global database of startup companies. This tool is commonly used by venture capital (VC) and private equity (PE) businesses to find startups to invest in.

The Dealroom database contains data on over two million startups. You can use the platform to:

- Find new, up-and-coming startups

- Perform investment opportunity analysis

- Sort startups by data points like company valuation, headcount, and financials

- Discover new industry trends

Startups can also use Dealroom to find potential investors. The database contains information on 120,000 investors that startups can connect with.

The extensive startup database makes Dealroom a top choice for VCs in search of their next investment - but there are other options. This post will explore six Dealroom alternatives that might suit your needs better.

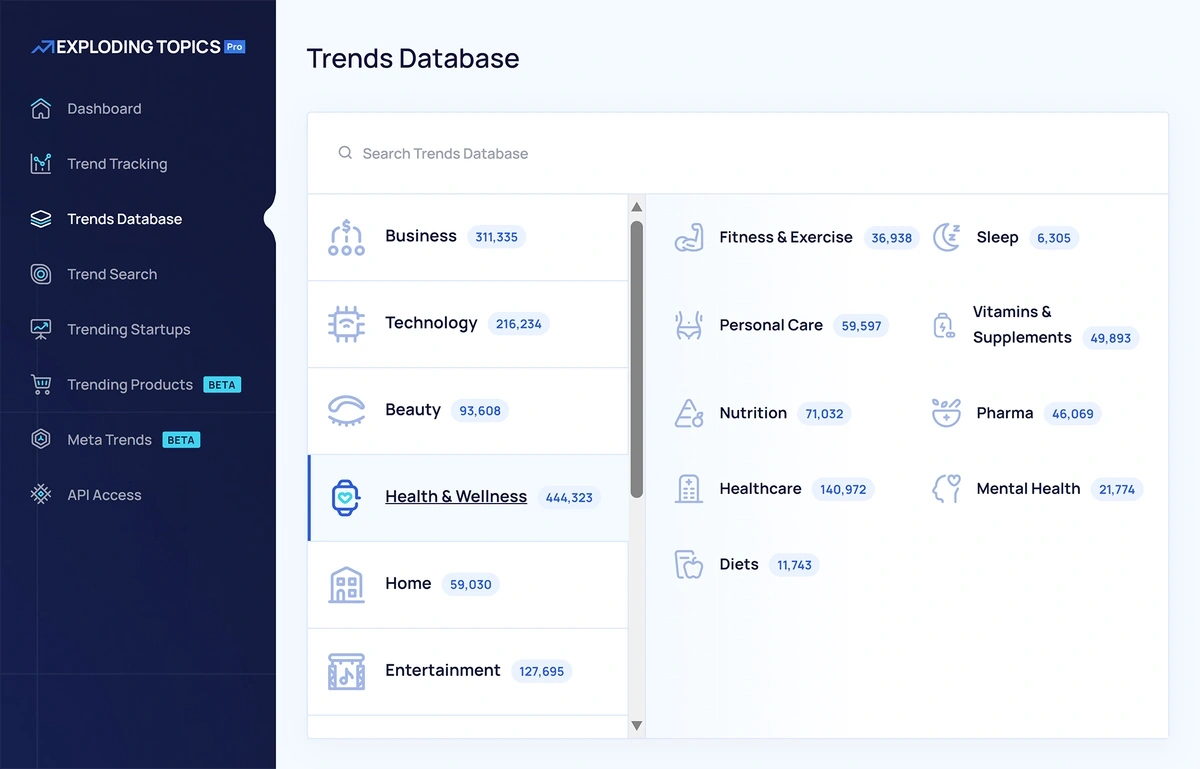

1. Exploding Topics

Exploding Topics is ideal for finding new and promising startups to invest in.

Our AI tracks growing companies based on search growth and consumer interest. This helps us identify under-the-radar startups with huge growth potential months or even years before they take off.

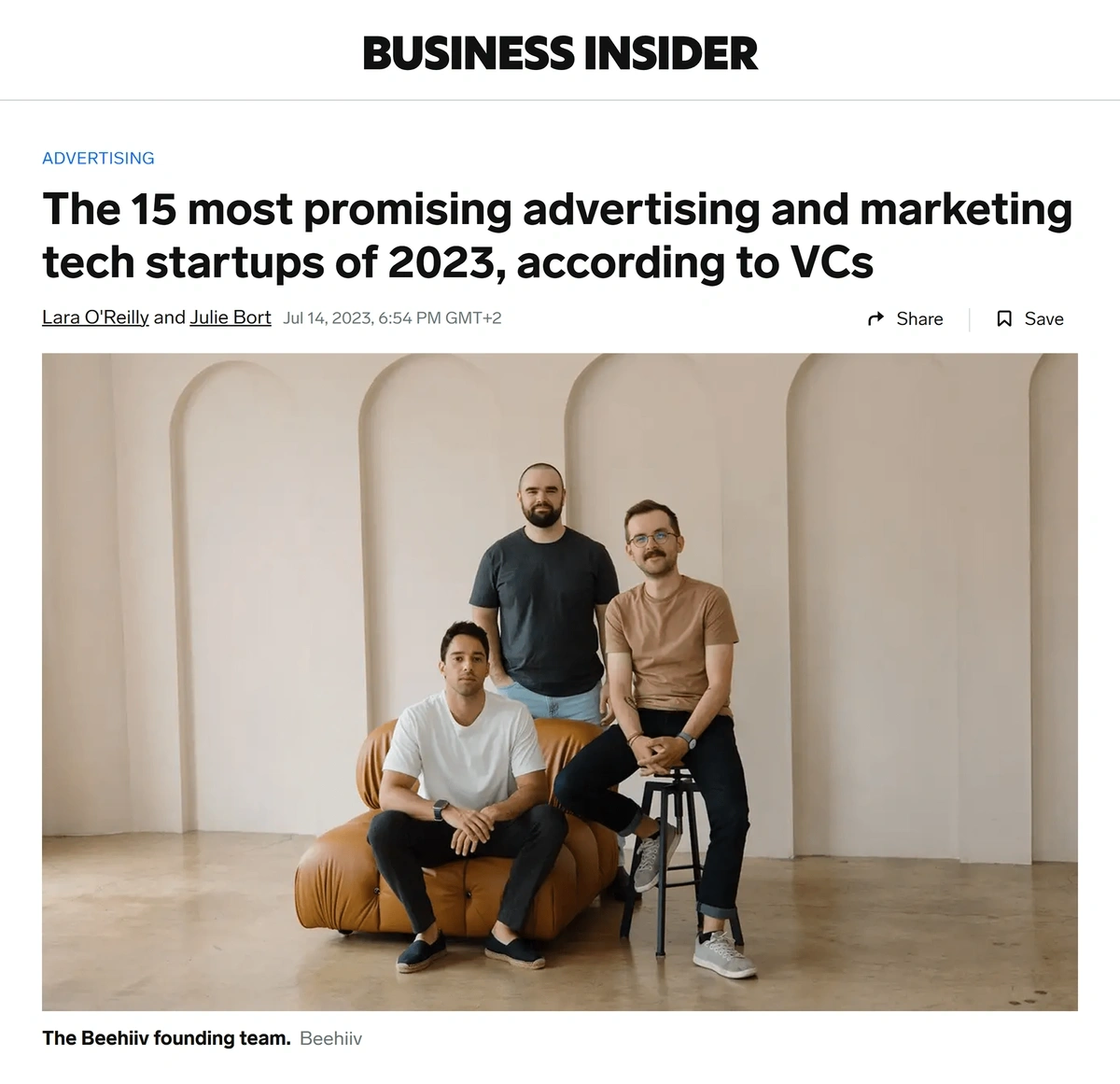

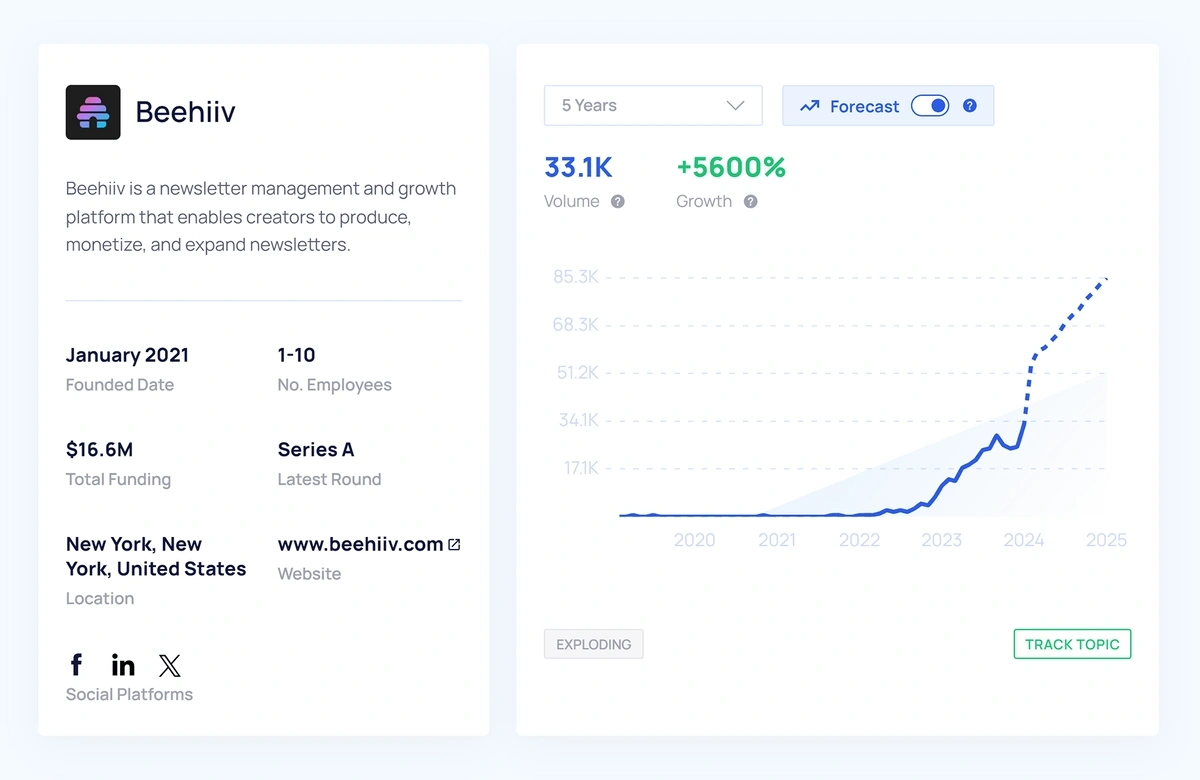

Beehiiv is an example of a startup that we found well before it hit the mainstream. This newsletter SaaS platform has been making waves in the online publishing and newsletter space recently, quickly becoming a top Substack competitor.

Take a moment to scroll through Twitter, and you’ll see countless creators publishing with this innovative tool. Even Business Insider recently named Beehiiv as one of the most promising advertising and marketing tech startups of 2023.

Because of this recent exposure, you would assume this is a brand-new company. But in fact, the company was founded in December 2020 and raised $12.5 million in Series A funding in June.

Exploding Topics Pro users were tipped off about Beehiiv’s potential in December of 2022, well before they became a household name in the publishing world.

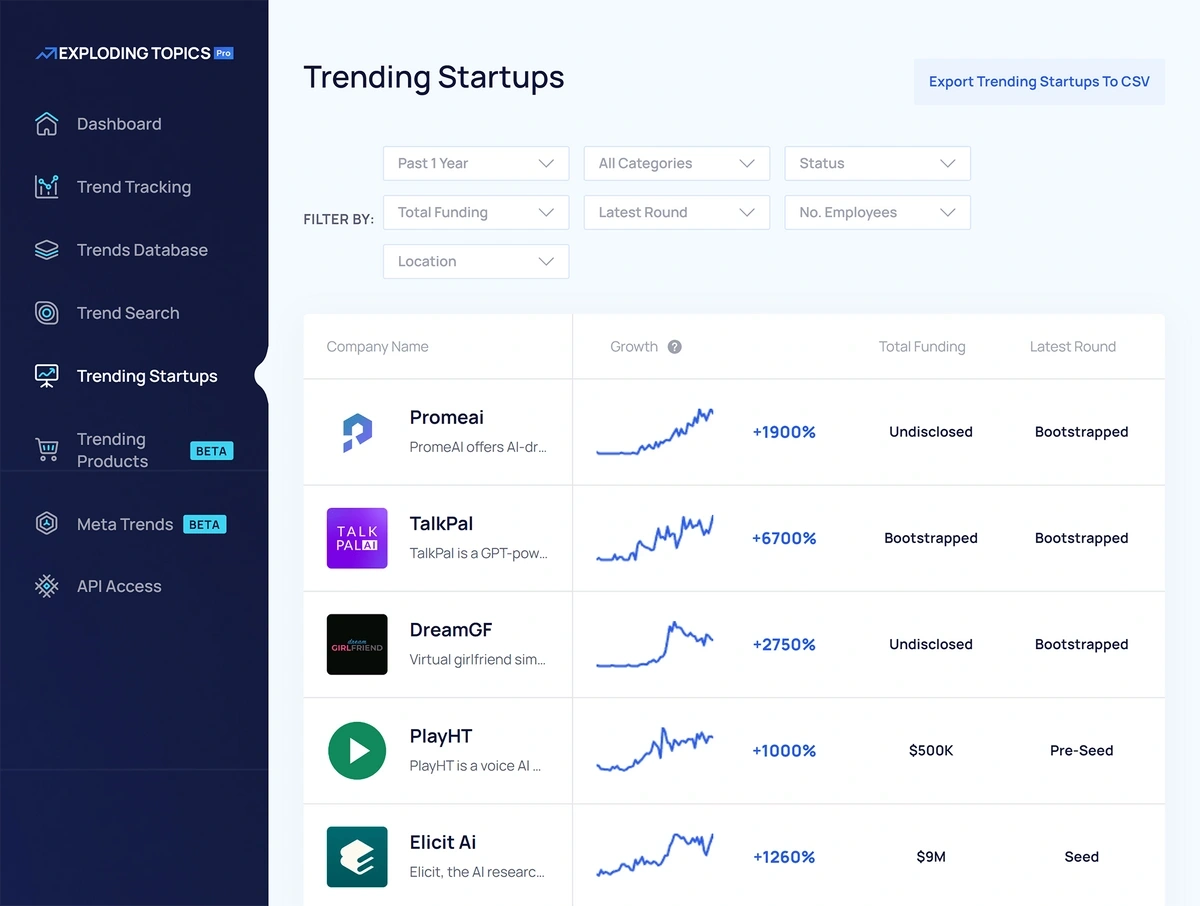

If you want to find more companies like Beehiiv before they take off, it’s super easy with an Exploding Topics Pro membership. You can use the Trending Startups database to sort companies by:

- Category

- Growth Status (regular, peaked, or exploding)

- Total Funding

- Latest Funding Round

- Founded Date

- Number of Employees

After adjusting your search filters, a new list of startups that fits your criteria will appear. From there, you can click on any startup and see more information about the company.

We also have dedicated features (like our trends database) to help you identify important industry trends and trending physical products.

This database of nearly 1M trends is available for all Exploding Topics Pro users, plus you can access:

- Weekly trends reports

- Instant trend alerts

- Meta trends

- Exploding Topics API

Dealroom vs. Exploding Topics: How They Stack Up

| Dealroom | Exploding Topics Pro | |

| Who Should Use It | Investors; Startup founders looking for investment capital | VCs looking for promising high-growth startups |

| Key Features | Thorough startup database, investor database, Bespoke research services | Trending startup database, in-depth company data, trend analysis |

| Starting price | Custom pricing | $39 per month billed annually |

| API availability | Yes | Yes |

2. PitchBook

Pitchbook is a market intelligence tool used to compile research, trends, and insights. The database contains hundreds of data points for public companies, private companies, startups, investors, and more.

You can use the Pitchbook platform to:

- Raise capital for a startup

- Find new investment opportunities

- Review past mergers and acquisition (M&A) deals to gauge company valuations

- Analyze public and private company financials

- Connect with industry professionals, C-level execs, fund managers, etc.

If you’re an investor, Pitchbook has some great features. But it’s not the easiest tool to start using. There is a steep learning curve, plus you’ll need to request a free trial and wait for approval from the Pitchbook team.

However, Pitchbook does make it easier to use the software wherever you go. They offer users various tools to access data, including:

- Desktop app

- Mobile app

- Chrome extension

- Excel plugin

Dealroom vs. PitchBook: How They Stack Up

| Dealroom | PitchBook | |

| Who Should Use It | Investors; Startup founders looking for investment capital | Investors, fund managers, M&A executives, and founders |

| Key Features | Thorough startup database, investor database, Bespoke research services | Investor database, company financials, deal history, founder and investor lists |

| Starting price | Custom pricing | Custom pricing |

| API availability | Yes | Yes |

3. Crunchbase

Crunchbase is a detailed startup and investor database with a number of prospecting, sales, and research features.

As an investor, researcher, or sales professional, you can use Crunchbase as an all-in-one prospecting tool. When using the platform, you can look up company details like:

- Funding rounds

- Total funding

- Company contacts

- Employee profiles

- Investors

- Company news

Crunchbase also allows you to do direct outreach from the platform. They even have a Chrome extension to enrich data and find prospects while researching on other platforms (like LinkedIn).

If you were hoping to use Dealroom as a sales tool, Crunchbase is an option to consider. Pricing is also more transparent, and creating an account for new users is much faster.

Dealroom vs. Crunchbase: How They Stack Up

| Dealroom | Crunchbase | |

| Who Should Use It | Investors; Startup founders looking for investment capital | Investors, fund managers, M&A executives, and founders |

| Key Features | Thorough startup database, investor database, Bespoke research services | Funding details, automatic updates, investor data, prospecting tools |

| Starting price | Custom pricing | $29 per month billed annually (free plan available) |

| API availability | Yes | Yes |

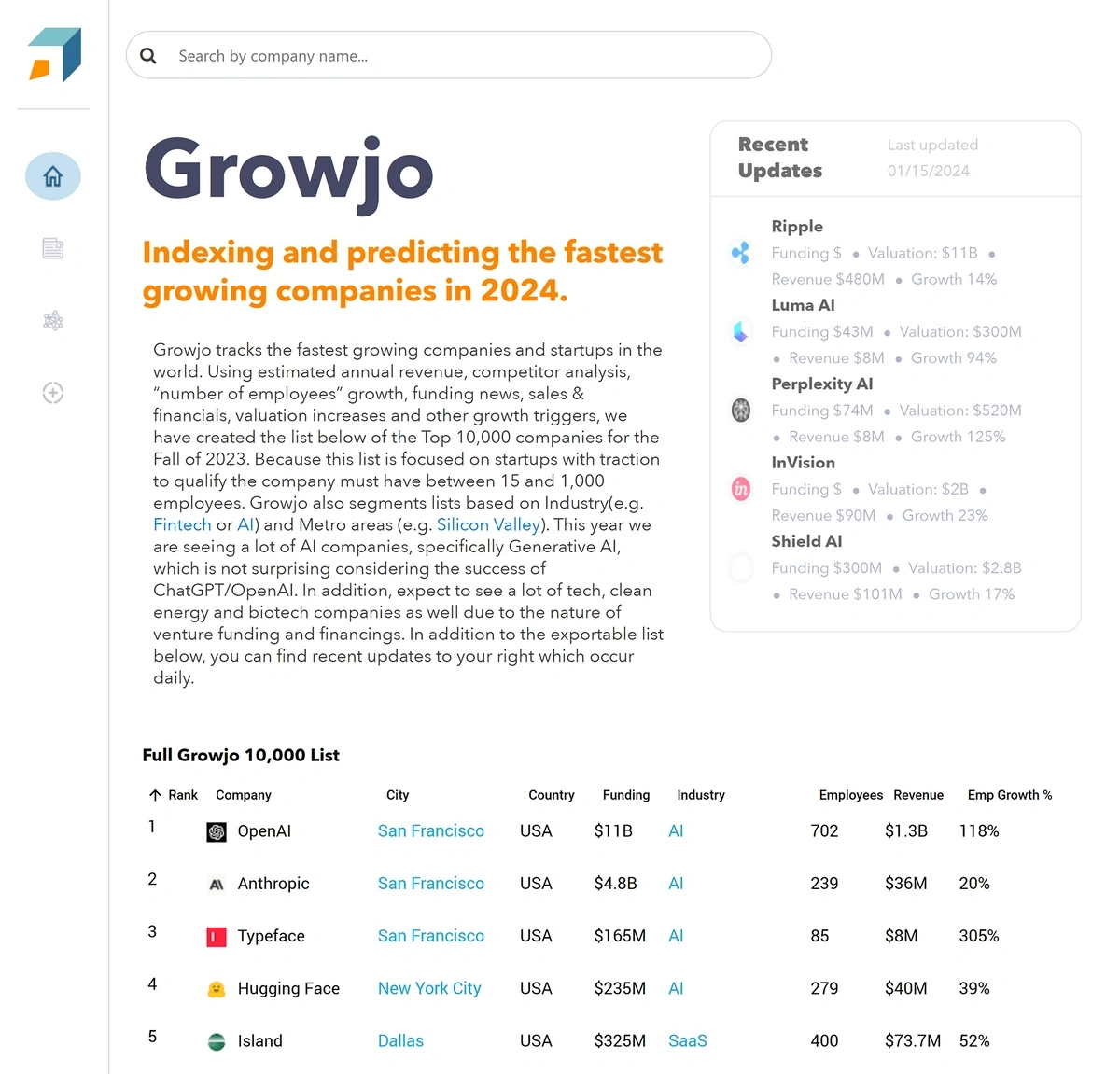

4. Growjo

Growjo is a startup database that tracks the fastest-growing companies in the world. It’s free to use and provides basic company information.

When using Growjo to find startups, you can access:

- Company name

- Company location

- Funding details

- Employee headcount

- Headcount growth

- Startup competitors

- Company news

- Growjo ranking

Growjo gets all data provided from user-generated content, blog posts, new outlets, and quarterly reports. The Growjo algorithm uses this data to calculate growth percentages and company revenue.

This is a basic tool with only one update per month. But it’s perfectly suitable for monitoring companies or looking for quick details. To get more in-depth startup information, there are better options out there.

Dealroom vs. Growjo: How They Stack Up

| Dealroom | Growjo | |

| Who Should Use It | Investors; Startup founders looking for investment capital | Founders, salespeople, investors, researchers |

| Key Features | Thorough startup database, investor database, Bespoke research services | Company revenue, headcount, funding, and valuation |

| Starting price | Custom pricing | Free |

| API availability | Yes | Yes |

5. Tracxn

Tracxn is a research and data intelligence platform that offers comprehensive data on over 10 million companies worldwide.

Tracxn analyzes startup maturity, profiles the management team, uncovers hidden market trends, and offers a look at the competitive arena that companies are operating in. You can also use this tool to:

- Look up startup funding rounds

- Source deals from a portfolio of top investors

- Generate company financials

- Track company news updates

Tracxn also offers data visualizations useful for reporting purposes for venture capital, private equity firms, and M&A teams. If you have the budget for it, Tracxn offers extensive features that make it a strong choice for VCs, PE firms, and M&A teams.

Dealroom vs. Tracxn: How They Stack Up

| Dealroom | Tracxn | |

| Who Should Use It | Investors; Startup founders looking for investment capital | Venture capital funds, PE funds, investment banks, M&A teams, business reporters, and publications |

| Key Features | Thorough startup database, investor database, Bespoke research services | Startup data, investment insights, competitive analysis, data visualization |

| Starting price | Custom pricing | $1,100 per month (billed annually) |

| API availability | Yes | Yes |

6. Harmonic AI

Harmonic AI is a startup database and discovery platform for early-stage VCs.

When using Harmonic, you can use the advanced filtering tools to find startups and analyze key data points like:

- Verified contact info for founders and key team members

- Startup funding history and capital velocity

- Real-time competitor and market insights

- Detailed company information (HQ location, team size, hiring trends, etc.)

Investors can benefit most from Harmonic's data. They're able to locate company and founder profiles to source potential deals. Harmonic has over 30 million companies and 100 million individual profiles in its database.

Dealroom vs. Harmonic AI: How They Stack Up

| Dealroom | Harmonic AI | |

| Who Should Use It | Investors; Startup founders looking for investment capital | Early-stage VC investors, private equity firms |

| Key Features | Thorough startup database, investor database, Bespoke research services | Company profiles, startup growth signals, list building, Scout AI chatbot |

| Starting price | Custom pricing | Custom pricing |

| API availability | Yes | Yes |

Conclusion

If you are an investor looking for a tool that makes it easier to find trending startups with high-growth potential, Exploding Topics is worth testing out.

You can identify industry trends and see companies that are gaining traction before anybody else. And over 73% of the startups in the Exploding Topics database won’t be found on other platforms like Dealroom.

All of the trends that we track are updated daily too. So you can get freshly updated metrics every morning to make informed business decisions.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Anthony is a Content Writer at Exploding Topics. Before joining the team, Anthony spent over four years managing content strat... Read more