The Beginner’s Guide to DeFi

Decentralized Finance (aka DeFi) has exploded over the last two years.

And for good reason: relative to traditional banking (“TradFi”) this new technology has the potential to make managing money faster and more convenient. That said, most of the interest in DeFi comes from its potential to provide relatively high returns.

Those returns, however, come with plenty of risks.

And while some see DeFi as the future of finance, others consider it a threat to the global financial system.

In this article, we’ll break down all the angles so you can get a balanced look at this emerging space.

Intro to DeFi

In this chapter, we’ll discuss the emergence of NFTs, hard statistics that show just how fast the industry is growing, and explain why the concept of “fungibility” matters.

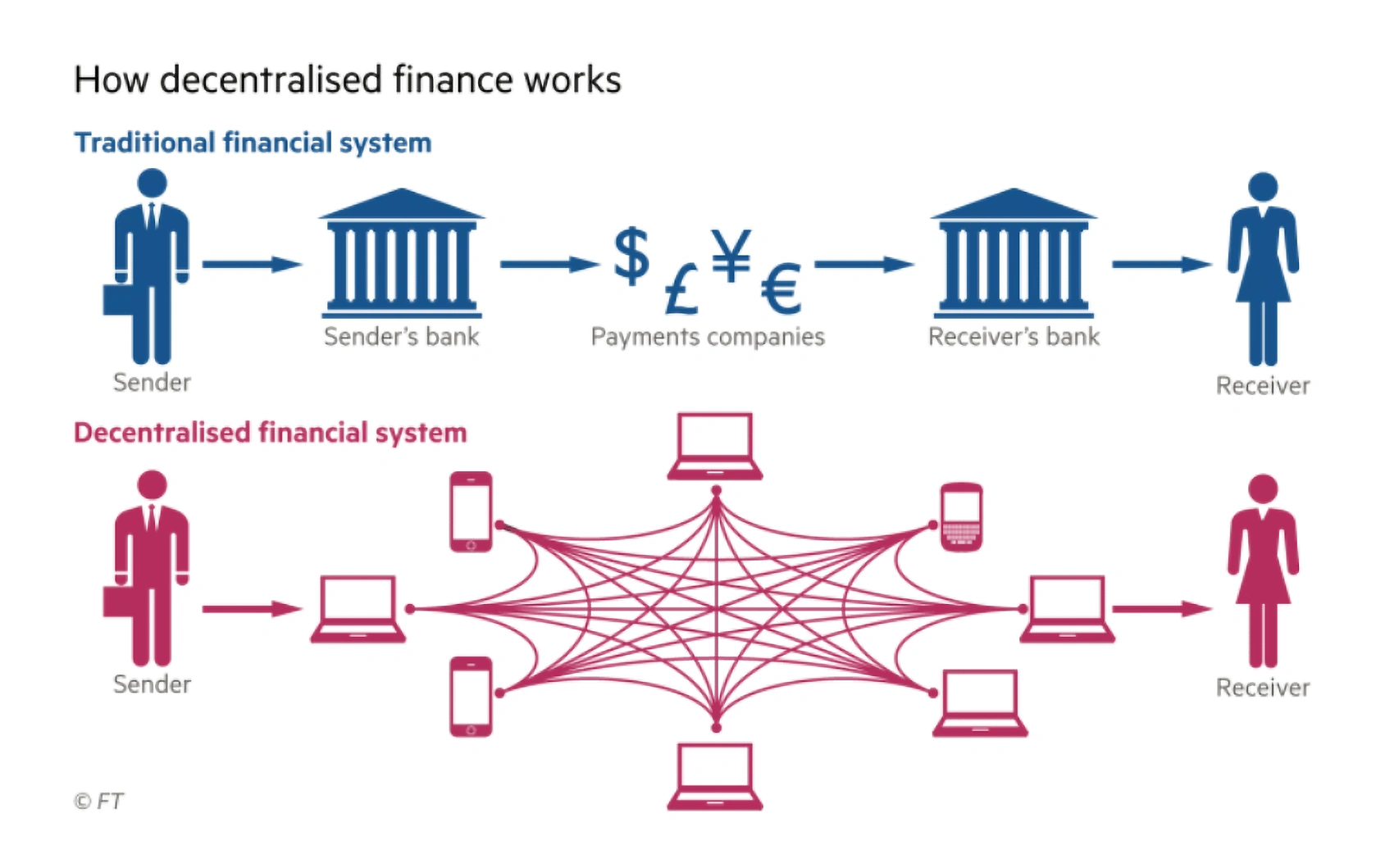

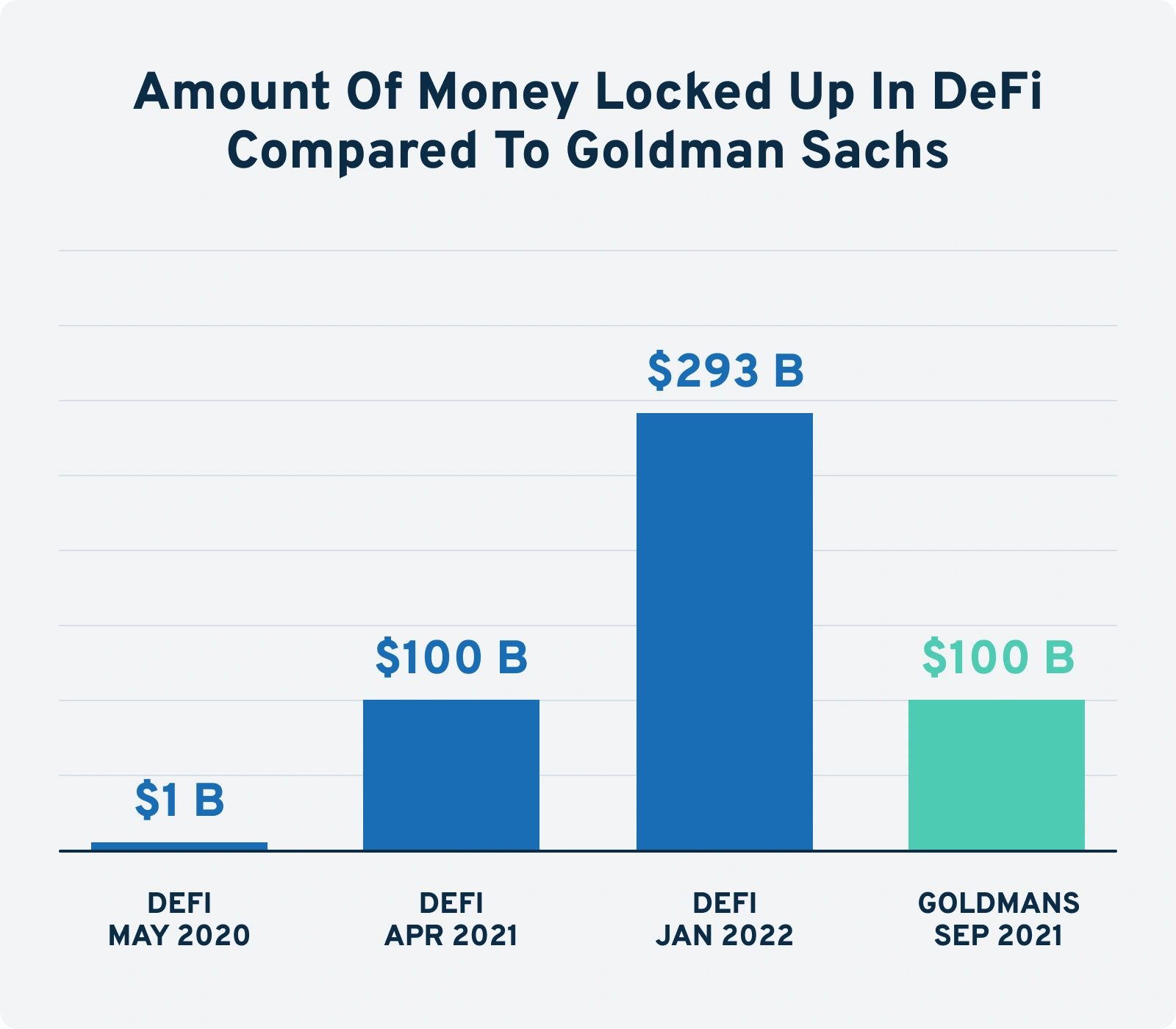

DeFi (short for “decentralized finance”) refers to financial services that don’t use intermediaries for transactions. Instead, DeFi applications typically use blockchain technology to facilitate transactions. The main appeal of DeFi is the fact that there are no centralized entities or intermediaries. Instead, users transact with one another directly via computer code. While this decentralized approach has its downsides, recent data shows that a growing number of people are saving, spending and investing using DeFi applications. To put DeFi’s growth in perspective, consider this: In September of 2021, Goldman Sachs announced that after five years of operations, they had reached $100 billion in deposits into their savings and banking branch (known as Marcus). DeFi, however, achieved that same level of growth in just eleven months. As of May 2020, there were one billion dollars locked up in various DeFi protocols (similar to a bank’s deposits). However, by April of 2021, that number exploded to $100 billion. Fast forward another eight months and the industry nearly tripled (to approximately $293 billion). As of this writing, that’s more than the deposits you’d find at Goldman Sachs, HSBC or Morgan Stanley. But the financial numbers only tell half the story. Because in 2021, MetaMask - one of the top technology providers in the DeFi space - onboarded 10 million new users (while growing 1,800%). To understand where it all started, however, we have to go back to cryptocurrency’s origin point: the invention of Bitcoin. While Bitcoin has grown to mean many things to many people, its original purpose was quite simple: create a digital version of cash. Focused on safety, simplicity, and the single-minded purpose of creating digital cash, Bitcoin’s founder chose to make the protocol what developers refer to as being Turing Incomplete (which, in plain English, means its functionality was limited on purpose). On the one hand, this decision was perfectly suited to Bitcoin’s function as a highly secure form of digital currency. On the other hand, the decision to be Turing Incomplete meant Bitcoin’s code was extremely limited in the complexity of transactions it could handle. Try to do too much all at once and the fees to process a transaction could become prohibitively expensive. Over time, however, it became clear blockchain technology could be used for much more than just paying your friends back for dinner. In particular, some cryptocurrency proponents believed they could duplicate every function of the worldwide financial system onto the blockchain (from yield-bearing savings accounts to complicated derivatives trading). To achieve this, however, programmers needed a protocol that was more scalable than Bitcoin. In particular, one that could handle highly complicated transactions without clogging the network or driving up usage fees. The solution? Queen to Bitcoin’s King, Ethereum is the #2 cryptocurrency in the world (as measured by market cap). Unlike Bitcoin, however, Ethereum had much loftier ambitions than just digital cash. Instead, Ethereum’s founders wanted to build a base layer operating system developers could use to launch decentralized applications on the blockchain (similar to how Apple’s iOS is the base layer operating system for iPhone apps). So, in 2015, Ethereum launched “Turing Complete” smart contracts. And in doing so, they opened the floodgates to what would become a hundred billion dollar technology.What Is DeFi?

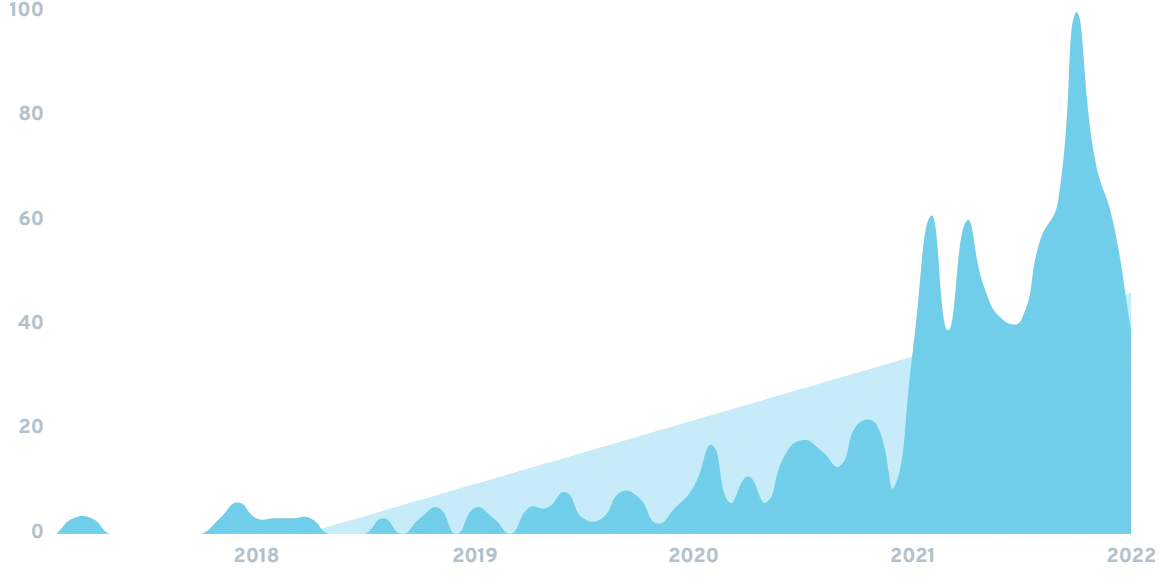

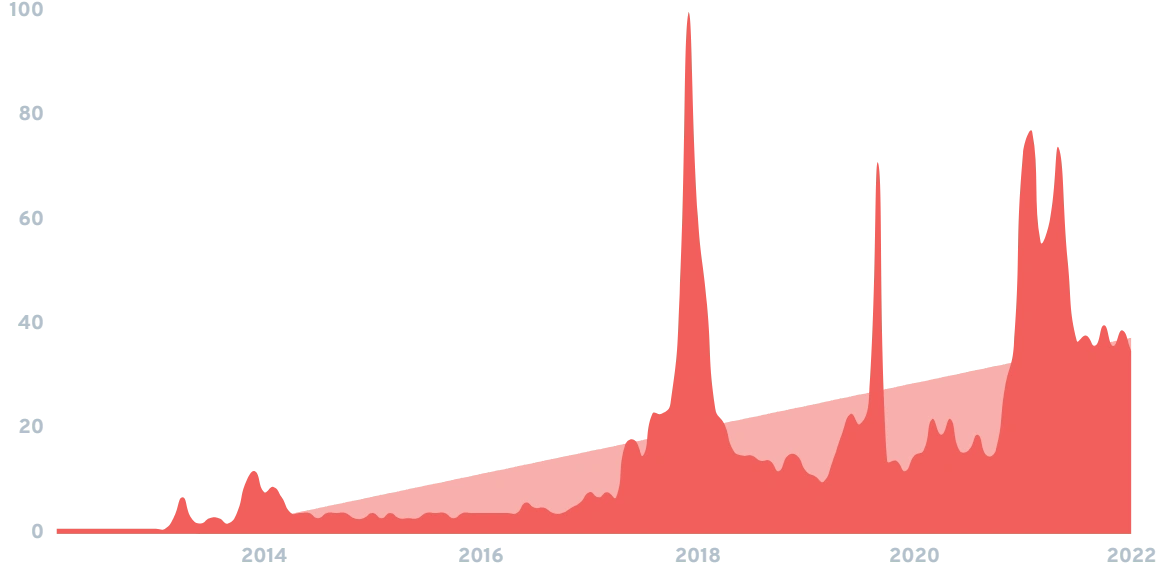

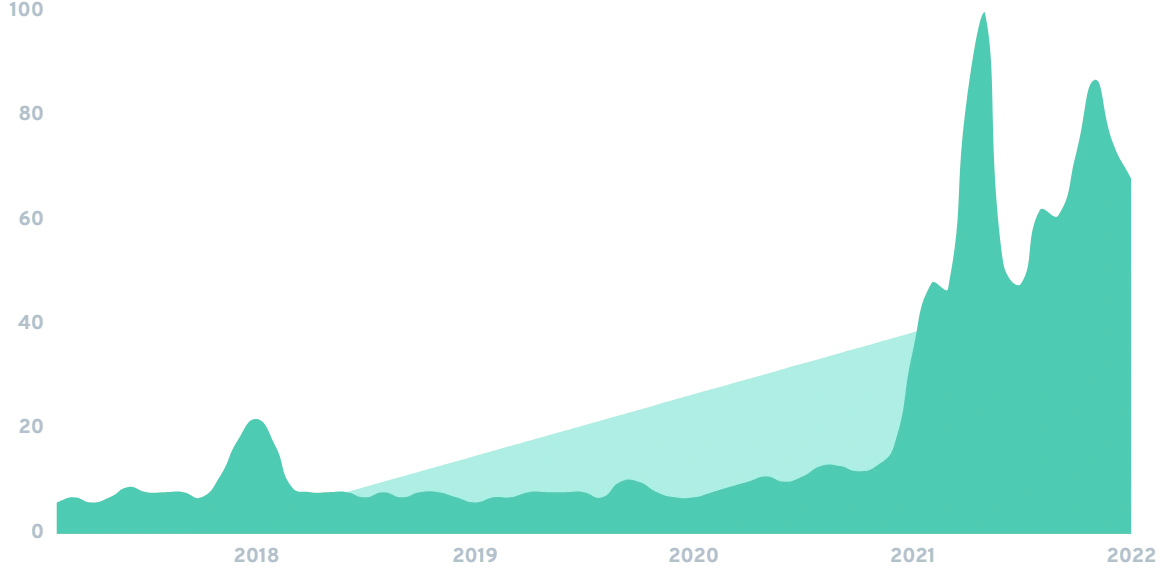

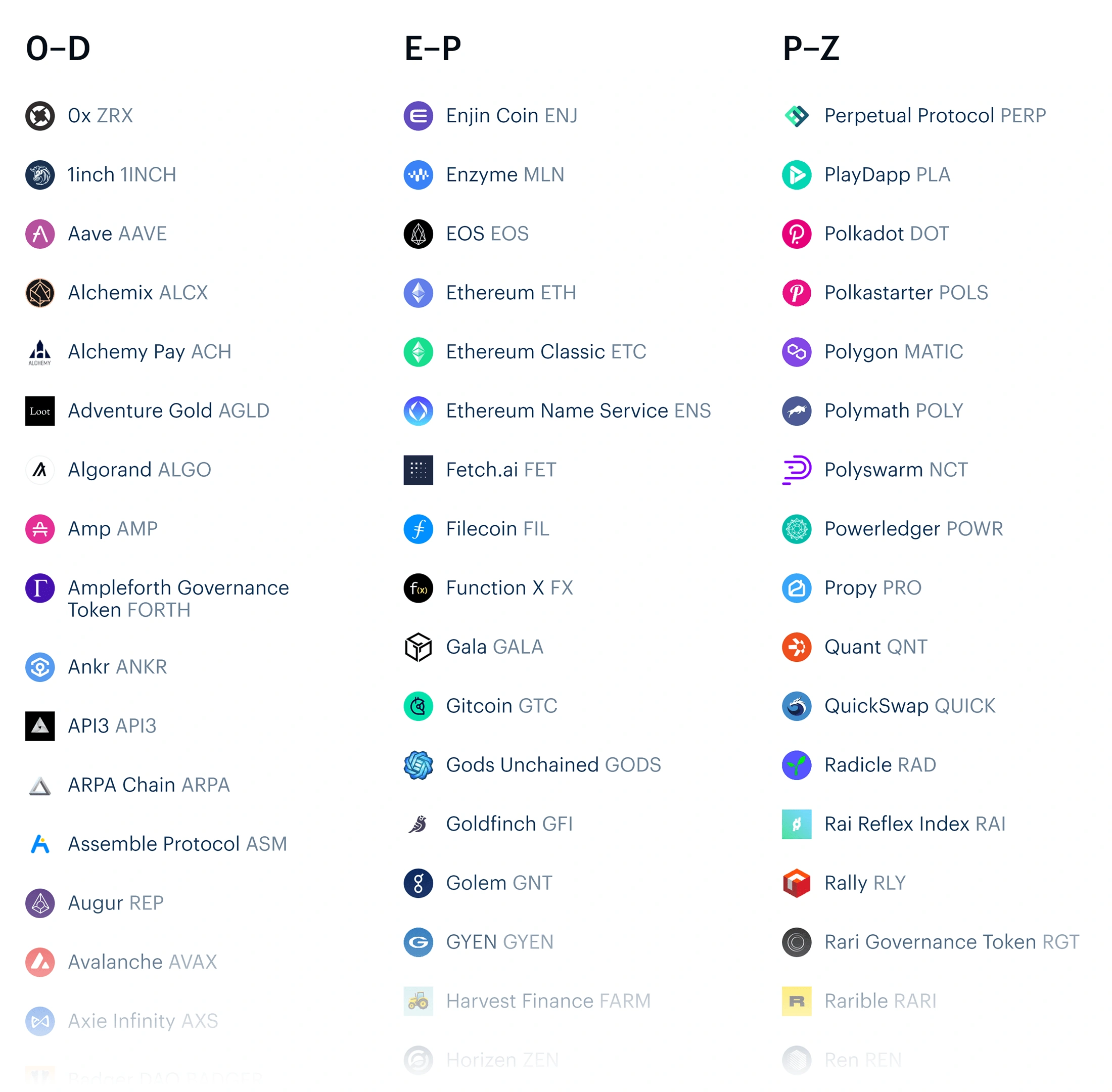

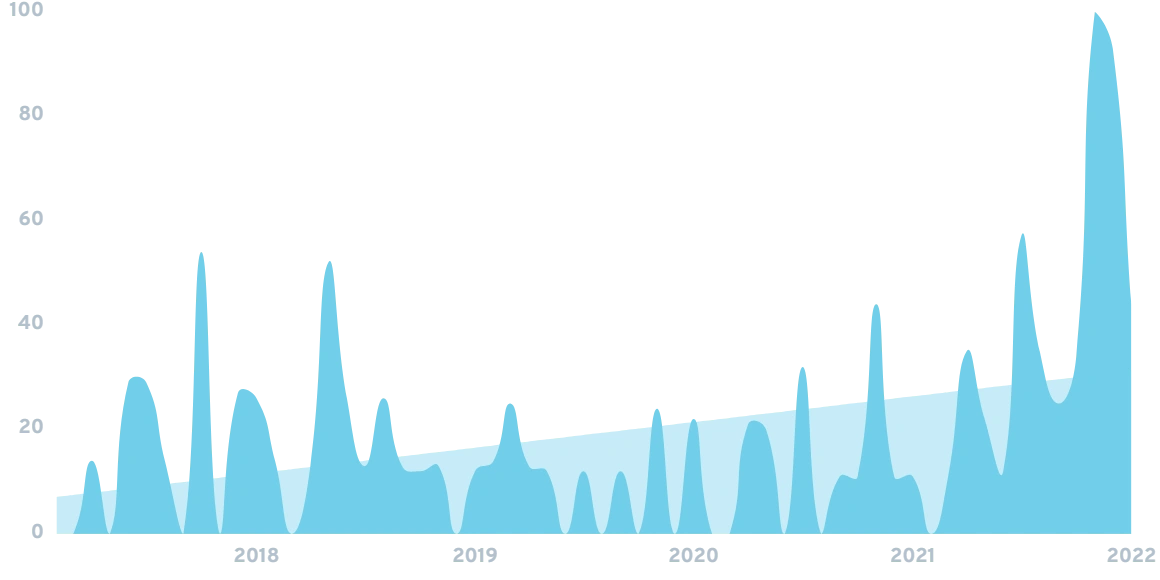

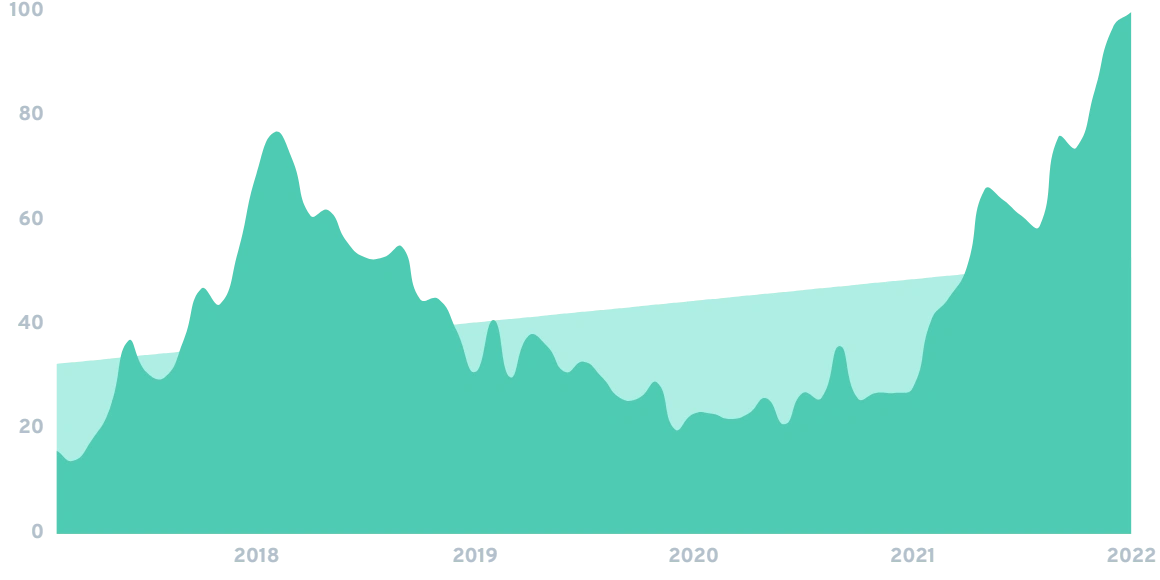

Searches for "Decentralized Finance" have grown to 3800% in the last five yearsRemoving the Middlemen

Source: Moralis AcademyThe Statistics Behind DeFi’s Rapid Growth

Searches for "MetaMask" exploded 99X+ times in just over one yearHow Bitcoin Birthed DeFi

Searches for "Bitcoin" over the last 10 yearsOvercoming Bitcoin’s Limitations

Ethereum Smart Contracts

Searches for "Ethereum" went up 4500% over the last decade

How DeFi Works

In this chapter, we’ll discuss the technology that lies at the core of decentralized finance.

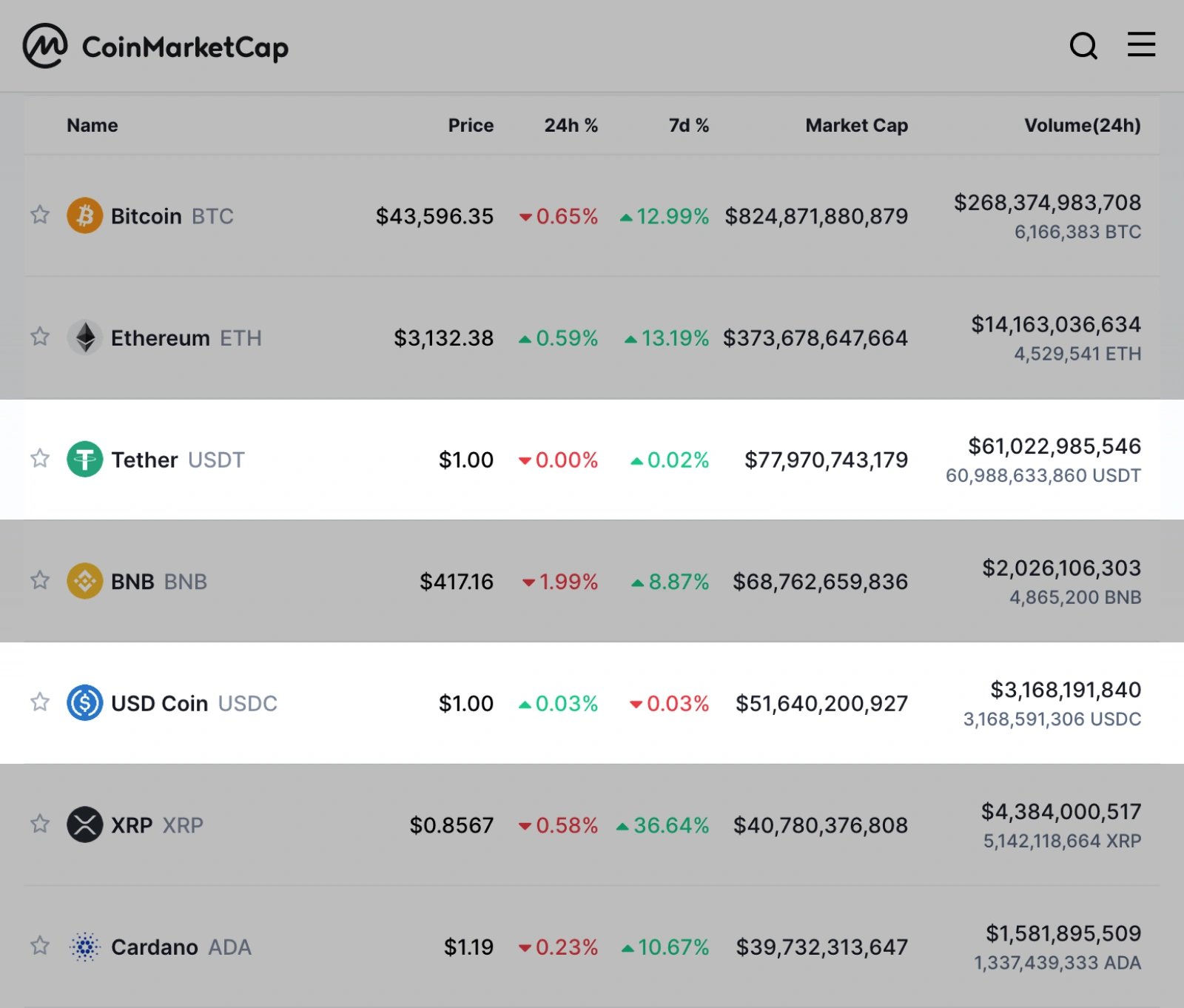

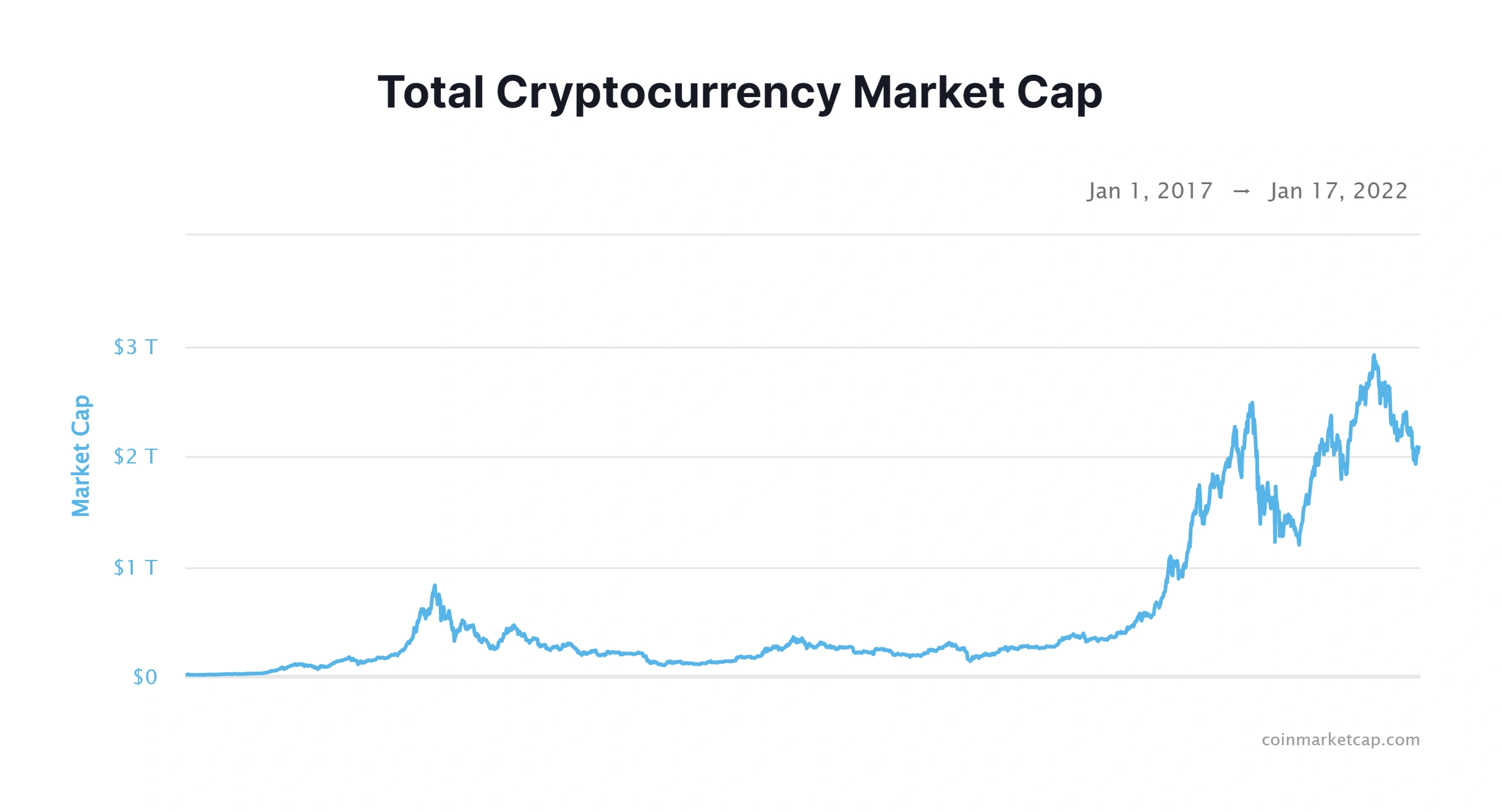

At the heart of most blockchain networks (like Bitcoin and Ethereum) are cryptocurrency tokens. While the concept of a token may remind you of a coin, cryptocurrencies are much more similar to the digital code that shows how much money you have in your online banking account. Mainly because, similar to the software your bank uses, cryptocurrencies themselves are nothing but a collection of binary computer code. Except for one big difference: While banking data is hosted on a centralized server (the bank’s), blockchain data is hosted on hundreds (if not thousands) of decentralized servers. This distinction was critical to the invention of DeFi. Prior to blockchain technology, organizing a mass-scale DeFi operation would have been extremely difficult (if not impossible) to pull off. Mainly because you’d have to convince large swaths of people to transact in some kind of monetary instrument besides your country’s currency. As you can imagine, this would be highly impractical. In fact, doing so would be like going back in time to when people used shells as a form of cash. On the flip side, blockchain technology - and cryptocurrencies in particular - have three characteristics that make them the perfect vehicle for decentralizing financial transactions. First, crypto is fully digital and accessible to almost anyone on the planet who has an internet connection. While some governments have outlawed crypto and/or restricted internet providers from allowing their citizens to access crypto-related websites, users can still swap cryptocurrencies directly using what are known as cold wallets. Second, the value of any given crypto token is mutually agreed upon by network participants (similar to how the value of a stock is determined by market participants). Third, cryptocurrency tokens can be transferred from one party to another safely, easily and quickly. Add these three characteristics together and you have the perfect recipe for decentralizing financial transactions. No banks, governments, or payment processors involved. With that said, cryptocurrencies as an asset class are highly volatile. To the point that some coins can lose 99% of their value in a matter of seconds. Further, moving money between crypto exchanges and traditional banking accounts can be a slow and arduous process. Not good if you’re trying to rapidly execute a trade. In short, what investors needed was some kind of coin that would offer them a stable store of value (like a digital dollar) when they didn’t want to be involved in a trade. So, in 2014, a company called Tether launched the crypto industry’s first digital dollar coin (symbol USDT). Fast forward to 2022 and the top five stablecoins have a combined market cap of more than $155 billion dollars. Depending on the day, it’s common to see USDT - and its competitor USDC - among the top five largest coins. Thanks to stablecoins, investors were able to swap their crypto tokens into a stable store of value without having to withdraw their funds to a bank. Similar to plugging the holes in a leaky bucket, this ability to keep funds circulating inside the cryptocurrency ecosystem was critical to increasing the market cap of crypto as a whole. And that rapidly growing market cap - which grew from the hundreds of billions into the trillions of dollars - laid the foundation for DeFi’s explosive growth. Similar to stock trading platforms like TD Ameritrade, cryptocurrencies have their own centralized exchanges (CEXs). Examples include companies like Binance (the worldwide industry leader), Coinbase (the US leader), and a host of others. And while DeFi purists hate the idea of centralization, most DeFi wouldn’t be possible without CEXs. Mainly because CEXs act as the onramp and offramp people use to buy crypto via their checking account, debit or credit card. CEXs are also how people convert and withdraw crypto back into spendable fiat currency. Meaning, to participate in DeFi, most people start off on a centralized exchange. From there, they buy the cryptocurrency they plan on transacting with and move it to a decentralized cryptocurrency wallet. Once a DeFi investor purchases their crypto on a CEX, the next step is to transfer it to a smart contract wallet (also known as a DeFi wallet). In most cases, these “wallets” exist as browser extensions (e.g. a Google Chrome extension). Further, similar to how you need to know someone’s account number before you can send them an ACH or wire transfer, the process of sending tokens to a wallet is very similar. The only difference is that your wallet’s “address” (account number) contains both letters and numbers (and is most likely upwards of 30 digits). Last, DeFi wallets are free, with the most popular options currently being MetaMask and Trust Wallet. Then, once you have the tokens in your DeFi wallet, you can deposit them into a smart contract and begin transacting. To understand the importance of smart contracts to DeFi, consider the company you do your banking with. Regardless of its size, odds are your bank has rules, regulations and laws they must abide by (and that you must abide by as their customer). Further, they have standard operating procedures regarding how deposits should be handled, how and when fees should be charged, etc. However, when you interact with a DeFi protocol, (for better or worse) there are no humans involved. Instead, DeFi protocols rely on what are known as Smart Contracts to replicate the work that’s normally done through a mix of computers and human intervention. On the one hand, the contract aspect is just what it sounds like: An agreement between the consumer using the DeFi protocol and the protocol itself. However, that’s where the similarities stop. Because with smart contracts, the contract itself contains the computer code required to process whatever transactions are expected to be processed as part of that protocol. Think of smart contracts like the code your bank uses to pay interest as part of having funds deposited in a savings account. Except instead of having a bank standing between you and your money, you can visit a DeFi website, connect your wallet, deposit funds and start receiving “interest” directly into your wallet. In short, smart contracts dictate what should happen with someone’s cryptocurrency tokens when they’re deposited into (or removed) from a protocol. And earning interest on deposits is just the tip of the iceberg. From automated token swaps to liquidating over-leveraged loans, today’s smart contracts can handle highly complicated transactions (including processing complex derivatives trading).Cryptocurrency Tokens

Searches for "Cryptocurrency" exploded 5900% over the last 5 yearsDeFi Pre-Crypto Was Near Impossible

The DeFi Trifecta

Decentralization Good, Volatility Bad

Searches for "Tether" went up 1033% over the last five yearsStablecoins

Stablecoins Laid the Foundation for DeFi

Converting Fiat Currency into Crypto

From Bank Accounts to DeFi Wallets

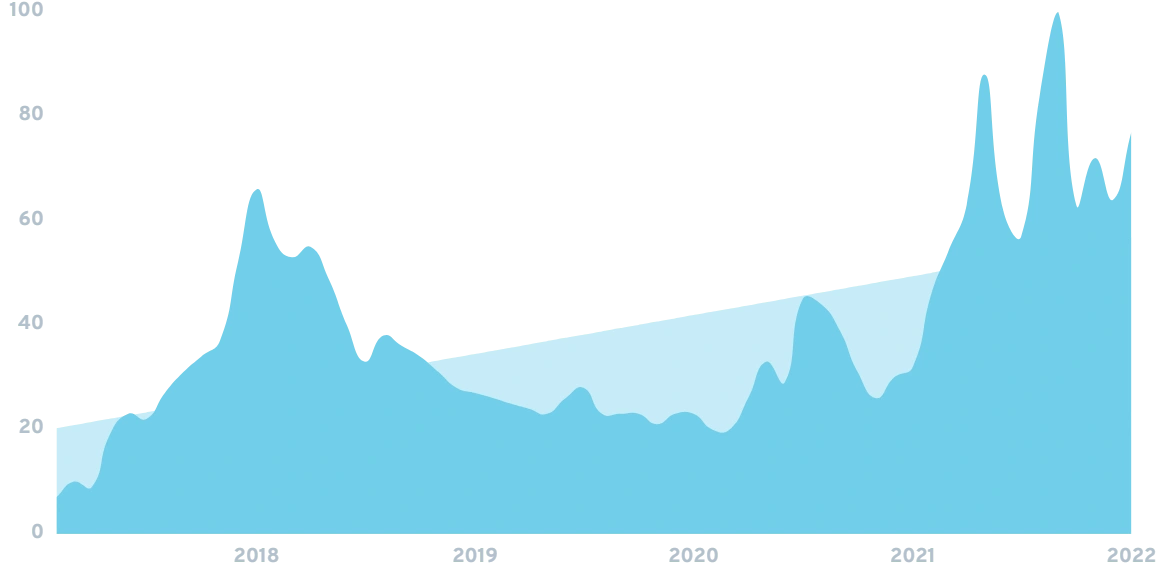

Searches for "DeFi Wallet" over the last five yearsBanking Without Humans

Smart Contracts

Searches for "Smart Contract" have gone up 1000% over the last five yearsYour Own Mini Bank

Understanding the Incentives that Make DeFi Work

In this chapter, we’ll discuss the financial incentives that attract investors while powering the world of decentralized finance.

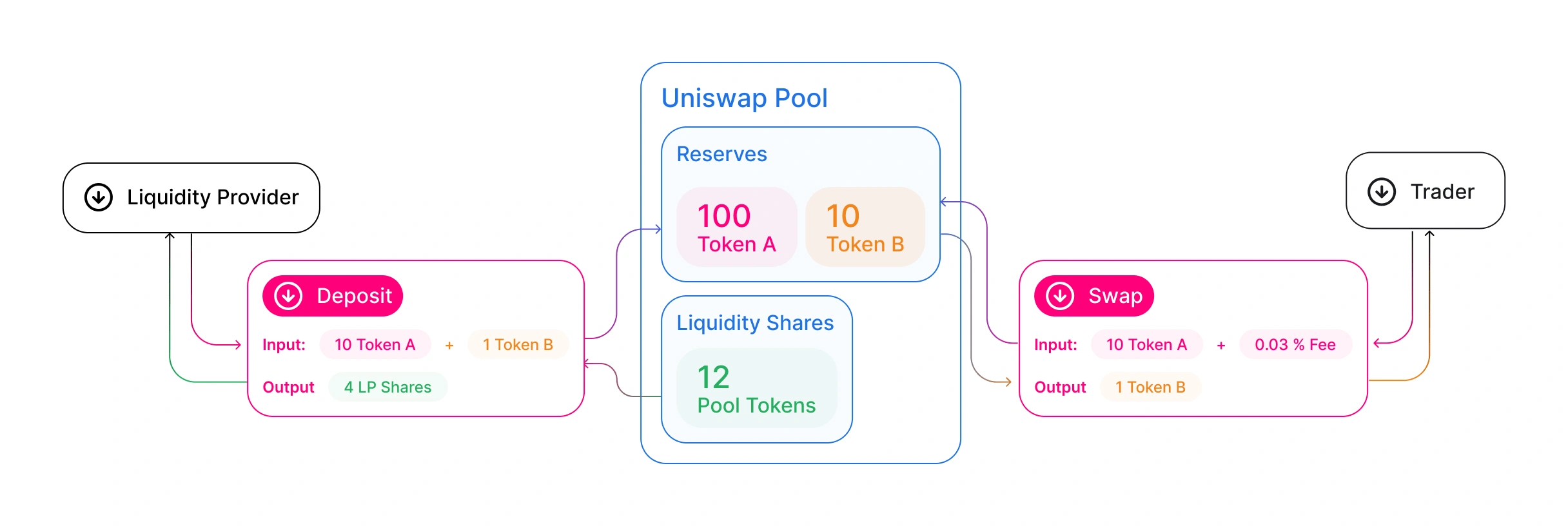

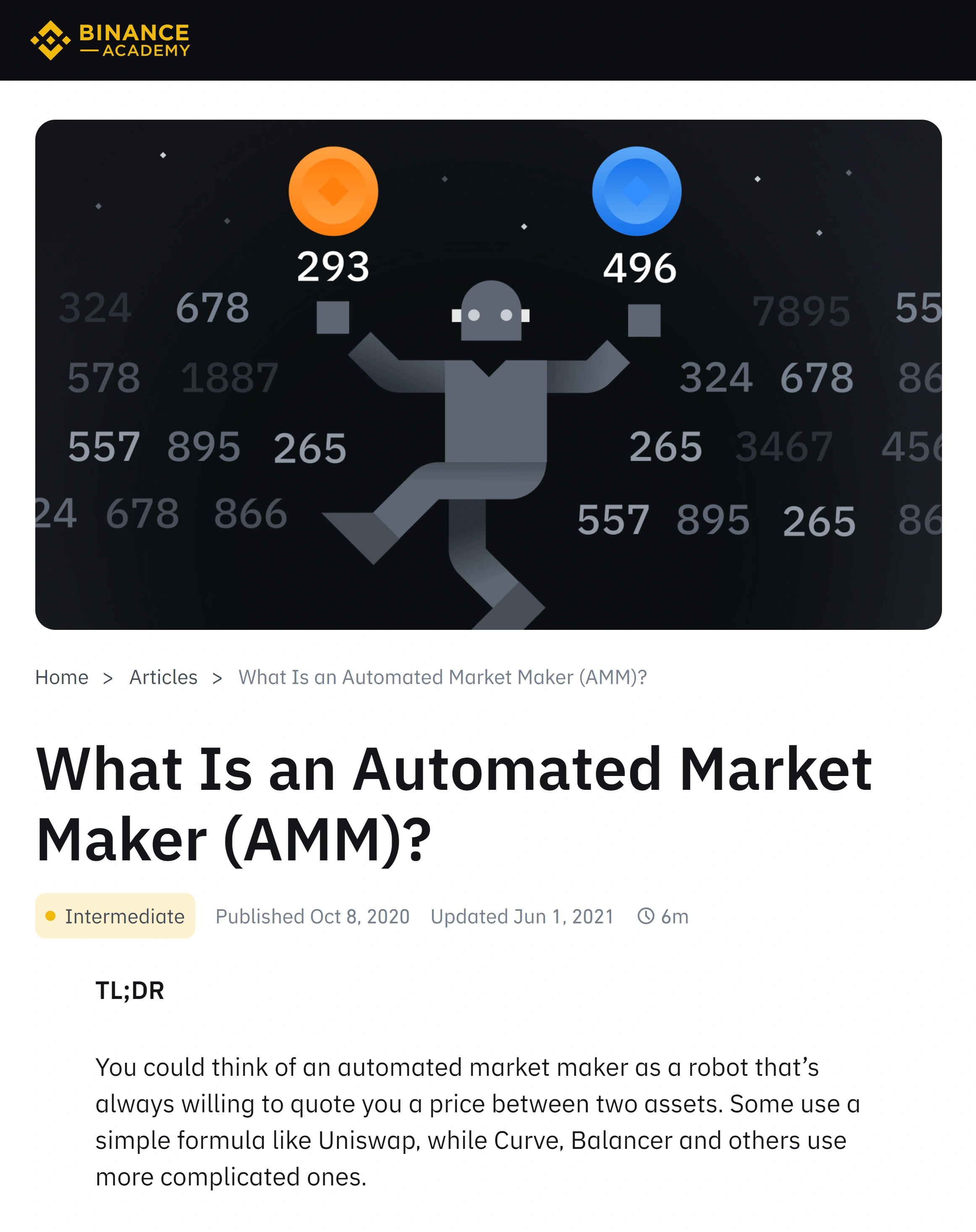

While the term “DeFi” covers a wide variety of cryptocurrency activities, most DeFi transactions are focused on two things: Staking and LP Farming. And similar to how smart contracts underpin the technological side of DeFi, staking lies at the core of where the financial returns come from. This is because blockchains need tokens to be readily available in order to operate properly. If you’ve ever maxed out your hard drive, you know it can make your computer unusably slow. On the flip side, if your hard drive has a ton of free space, your computer should operate just fine. Admittedly, blockchains don’t use the same type of memory your computer does (nor do they save data the same way). However, a very similar concept applies. While blockchain technology is highly complex, the short version is that staked tokens act as the processing power needed to write new blocks to the chain. Meaning, when you stake your tokens on a blockchain, you’re providing the processing power needed for that blockchain to continue operating. Because of that, most blockchains reward stakers with more tokens (as a financial incentive for them to continue providing this service). Further, staking rewards can be used as incentives to get new users involved in a project. In smaller (and therefore riskier) DeFi protocols, it's common to see double, triple, and even quadruple-digit interest rates in exchange for staking tokens. While these returns are exponentially higher than the APR one could get on a US savings account, they come with exponentially higher risk as well. Mainly because - even in crypto - you can’t print free money out of thin air. Meaning, regardless of how many tokens a protocol rewards stakers with, the dollar value behind those tokens is dependent on supply and demand. Because of that, paying out abnormally high staking rewards - without driving an equal or higher amount of token purchases - can dilute the value of the token. In some cases very rapidly. A second and more aggressive DeFi strategy involves what’s known as Liquidity Mining or LP Farming. Whether someone’s interested in stocks, commodities or crypto, all asset trading is dependent on liquidity. As an example, a pension fund can’t just go online and buy $100 million worth of Apple stock. Mainly because making that kind of purchase requires the person or company doing the selling to have $100 million worth of Apple stock in the first place. Instead, that pension fund would have to find an exchange that has enough liquidity to support a $100 million purchase. And when it comes to crypto, it's the same thing. For large, centralized exchanges (CEXs) to process billions of dollars in crypto transactions every day, they have to have billions of dollars worth of coins on their balance sheets. Further, on CEXs, almost every transaction that takes place is between one human and another. Even in the case of bots and automated trading, there are humans behind the bots providing them with instructions. In DeFi, however, everything is done through smart contracts. Meaning, there’s no buyer or seller on the other side of a transaction. Instead, DeFi users swap their tokens in and out of token pairs known as Liquidity Pools. In most cases, these pairs are made up of the blockchain’s native token - for example, Ethereum - and the protocol’s token (e.g. Token Z). Further, it’s these liquidity pairs that allow DeFi investors to “swap” from one token to another on a DEX. Because of that, it’s critical DEXs - many of which offer DeFi services - have enough liquidity available to support buying and selling (swapping). Without sufficient liquidity, the inability to swap between tokens at attractive prices would make the DEX unattractive to users. So where does the liquidity needed to swap come from? First and foremost, most decentralized exchanges (and CEXs) charge a small fee for every swap that takes place on their platform. While they use these fees for a variety of purposes, one of the most important is rewarding liquidity providers. Similar to how single staking allows blockchains to operate smoothly, creating token pairs and staking them provides the liquidity investors need to swap between tokens. It’s a circular system, where: Because of this, it's in DEX’s best interest to reward investors who stake their token pairs. With that said, LP farming carries additional risks that don’t exist as part of the single staking process. First, it should be noted that both the theory and the math behind impermanent loss (aka IL) are highly complicated. With that said, when an investor creates an LP pair, they submit an equal dollar value of two tokens to create the pair (e.g. $100 of Token A and $100 of Token B). Over time, however, it's likely the price of those tokens is going to fluctuate. When that happens, smart contracts have to adjust the ratio of tokens in your pair (per the x * y = k Automated Market Maker formula). As an example, if the price of Token A is going up, a smart contract will reduce your exposure to Token A (given it’s now worth more) to maintain the original 50/50 ratio. Further, if the price of Token B is going down, the contract will adjust the ratio to give you more of Token B (to offset the decrease). Because of this, price movement in either direction can affect the ratio of tokens in your pair. In general, however, this is only a bad thing if the price of one or both tokens is going down and the yield you’re earning from the LP pair would not offset that loss. With that said, it’s called “impermanent” for a reason: Until you break the pair (at which point the loss becomes permanent) you haven’t really “lost” anything. Instead, as long as your tokens are in the pair, they’re in limbo and still being adjusted by the smart contract (while earning you rewards). Further, if the price of both tokens returns to the same ratio as when you deposited them, you’ll still get the same number of tokens back when you break the pair. Last, in a situation where the price of both tokens is going up, the value of your LP pair will also go up. Admittedly, you won’t earn as much as you would have from holding onto each of the tokens separately (once again, because of IL). However, in most cases, the token rewards you get from LP farming should far outpace the difference in profit you would have received from holding each token separately. While some DeFi protocols offer abnormally high-interest rates / APRs, most of these projects cannot stimulate enough demand to offset the minting (creation) of new tokens. Because of that, unsuspecting investors can very quickly find themselves in a situation where the price of one or both tokens in their LP pair is rapidly crashing. When that happens, investors have two choices. Stay in the pair, which is rapidly losing value. Or break the pair, at which point what was an impermanent loss becomes a permanent one.Tokens, Blockchains and Profits

Staking Allows Blockchains to Function

Where DeFi Rewards Come From

Supply and Demand Reign Supreme

Taking Staking to the Next Level

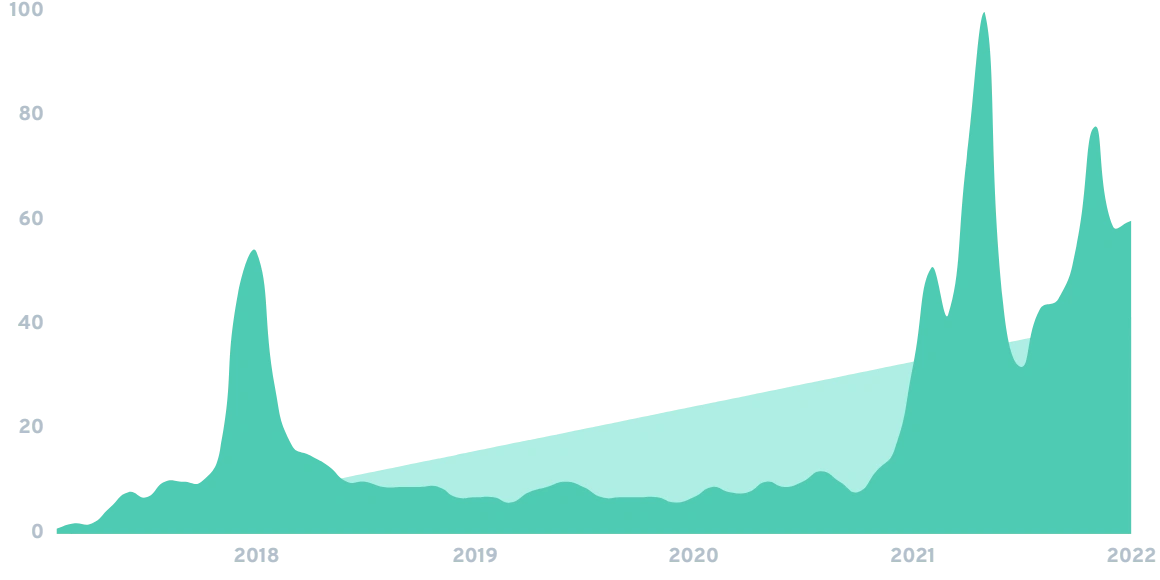

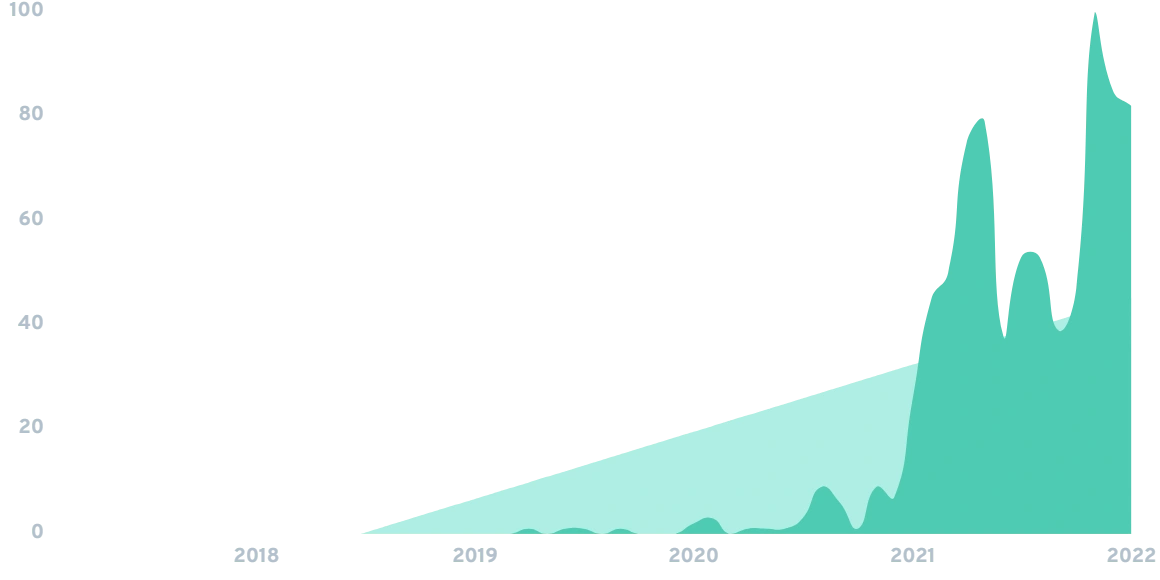

Searches for "Liquidity Mining" have gone up 99X+ times in the last two yearsHow Trades Happen in the World of DeFi

Swaps Instead of Trades

Incentivizing Liquidity Providers

Weighing the Risks of Impermanent Loss

The Intricacies of Impermanent Loss (IL)

The Dangers of High APR Farms

Defi Use Cases

In this chapter, we’ll discuss the most common ways consumers are using DeFi protocols to power their finances.

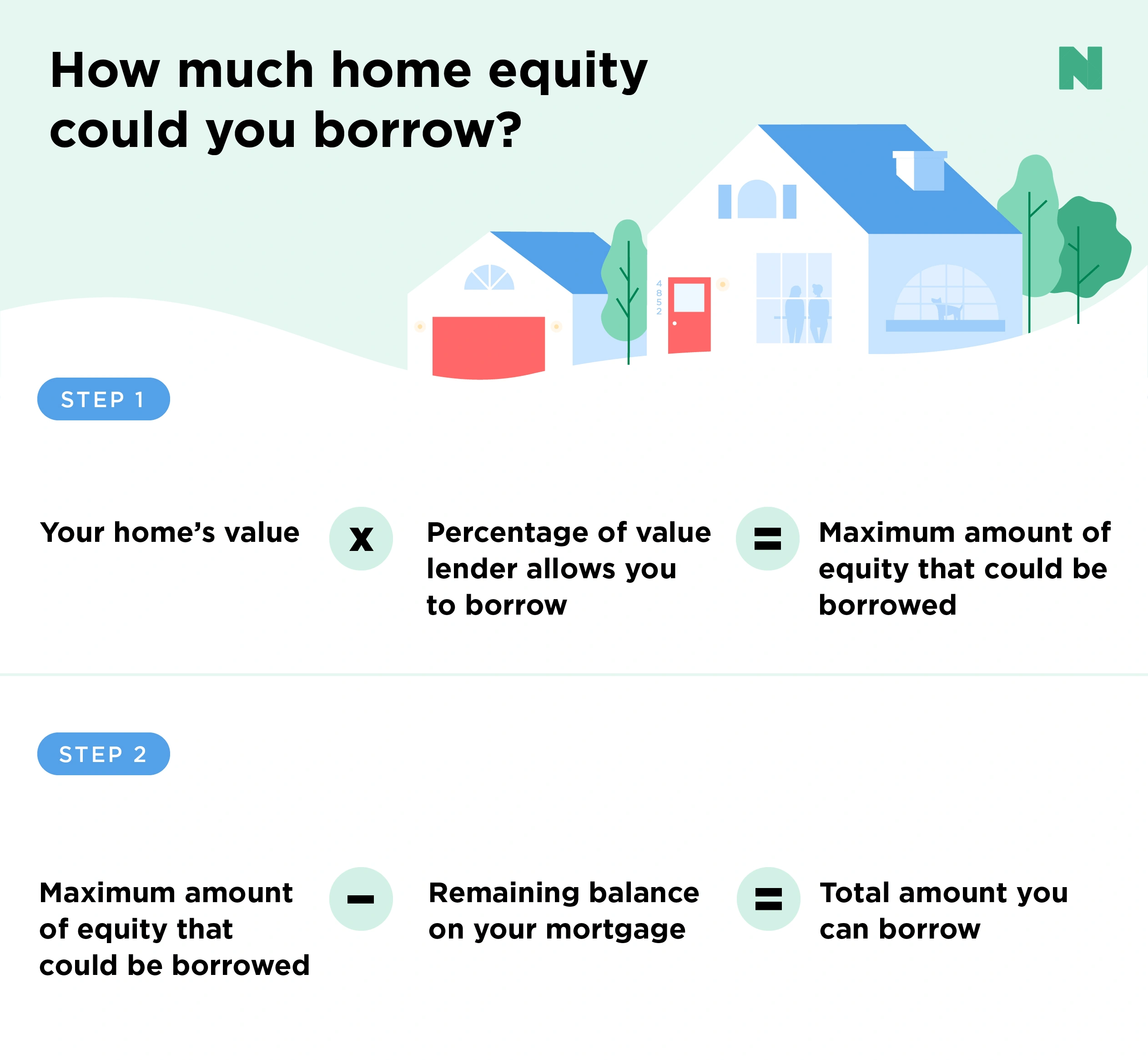

Whether someone is staking tokens or LP pairs, the goal in both situations is the same: Earn more tokens. Why? First, assuming an investor is earning tokens from legitimate projects, the value of those tokens should go up over time. Second, because LP farming rewards are based on the fees DEXs earn on swaps, a dramatic increase in trade volume can lead to a dramatic increase in the APR that protocol pays out to LP stakers. Because of this, the most successful DeFi investors are the ones who invest in LP pairs where a) the price of both tokens are likely to go up, and b) the trading volume between those pairs is likely to remain constant and/or increase. Admittedly, this is easier said than done. At the end of the day, however, the real reason investors try to amass tokens is so they can convert them back into spending cash. And with smart contracts handling everything except the deposit and withdrawal process, staking rewards - when approached properly - can in fact yield passive income (per the IRS definition at least). If you own a home (in the US at least), odds are you’re familiar with home equity loans. If not, the concept is quite simple: If you buy a home for $500,000 and it appreciates to $700,000, you now have $200,000 in “equity” built up in your home. Equity that - thanks to banking home equity loans - you can tap into without having to sell your house. It's a beautiful concept, and one of the hallmarks of American wealth creation via real estate. So what does this have to do with crypto? Well, prior to DeFi, there was no way to “tap into” the value of your crypto without selling it. Even if you had a million dollars in Bitcoin, unless you sold your Bitcoin, you couldn’t tap into that value. Smart contracts, however, fixed this. Similar to how auto loans are secured by whatever vehicle the borrower decides to purchase, DeFi loans are secured by the value of the borrower’s crypto. Except for one key difference: While auto and home loans are lent out at a 1-1 ratio ($30,000 loan to buy a $30,000 car), the highly volatile nature of crypto makes this much too dangerous for lenders. So, to offset the risk, lenders require borrowers to over-collateralize their loans. In most cases, this means you can borrow $0.50 to $0.75 for every $1 of crypto you deposit as collateral. When the market’s going up, this is a fair trade for both sides. Mainly because the investor gets to hold onto their crypto while tapping into cash flow they wouldn’t have had access to otherwise. Cash flow they can then invest into more crypto or spend in the real world. Further, because the borrower has to provide collateral to access the loan, they essentially behave as both lenders and borrowers at the same time. And just like in the traditional banking system, lenders get paid (while borrowers do the paying). Meaning, if the interest rate the investor gets on their collateral is higher than the interest rate they have to pay for whatever crypto they’re borrowing, the net difference is paid to the investor as profit (and vice versa). With that said, there is a downside to decentralized borrowing. Because if the market starts going down, lending protocols can end up in a situation where the value of the crypto they’ve lent out is worth more than the value of that person’s collateral (putting them at risk of a loss). So, while over-collateralization does reduce a lender’s risk, it does not eliminate that risk completely. Because of that, smart contracts are programmed to protect lenders. In particular, borrowers must agree to a price point at which their collateral will be sold off (liquidated) so that the lending protocol doesn’t lose money. Fortunately, borrowers have multiple options for avoiding liquidations (including paying back a portion of the loan or just depositing more collateral). While most of DeFi is focused on staking and rewards, decentralized exchanges serve a much larger role in the overarching cryptocurrency ecosystem. While most centralized exchanges (CEXs) require investors to submit identity verification documents (as part of the Know Your Customer and Anti-Money Laundering regulations), decentralized exchanges are not subject to the same regulations. Mainly because, unlike CEXs, DEXs are not companies. Instead, DEXs operate autonomously thanks to smart contracts. Because of that, investors can trade on DEXs without identifying themselves. In fact, the only thing required to trade on a DEX is a DeFi wallet (which itself is anonymous). Admittedly, some of the people who wish to remain anonymous are much more concerned with avoiding taxes than they are with privacy. Meaning, as long as the DEXs are not legally required to identify their users, it's likely they will continue to attract traders eager to avoid capital gains taxes. Last, while there are more than 15,000 cryptocurrencies in existence, most centralized exchanges have fewer than 200 tokens available for trading. Meaning, if you’re interested in buying or selling one of the 99% of tokens that aren’t listed on a CEX, your only option for buying or selling that token is via a decentralized exchange. So while some people use DEXs for privacy and tax evasion purposes, some people use them because they don’t have any other choice. There are a variety of reasons to transfer their tokens from one wallet to another. First, creating multiple wallets reduces the risk of loss should one of your wallets get hacked. Second, some blockchains require their own custom wallet because of the underlying technology being used on that particular chain. Because of this, DeFi investors who invest on multiple blockchains may have to send tokens from one DeFi wallet to another (both of which they own). Third, given CEXs act as the on-ramp for converting fiat (dollars, etc.) into crypto, investors who want to participate in DeFi must first buy tokens on a CEX before transferring those tokens to their DeFi wallet. Last, if you want to send crypto to a family member or friend, you can do so via your DeFi wallet in a matter of seconds.Compound Interest and Token Accumulation

DeFi as a Source of Passive Income

Crypto-Backed Lending

How a home equity loan worksOver-Collateralized Loans

The Upside of DeFi Borrowing

Get Paid for Lending Your Crypto

The Downsides of Borrowing

DeFi Loan Liquidations

Trading, Swapping and Investing

Anonymous Investing

Tax Evasion

Trading Micro Cap Tokens

Transferring Tokens Between Wallets

Obstacles to DeFi Adoption

In this chapter, we’ll discuss the various headwinds and obstacles that could prevent DeFi from being adopted on a mass scale.

While the US government has made it clear they have no intention to ban Bitcoin or crypto in general, regulators have their eyes on DeFi. There are multiple reasons for this. First, DeFi protocols that pay out interest in the form of token rewards operate very similarly to banks that pay out interest in the form of dollars. And as you probably know, banking regulations in the US are very strict. Because of that, some believe DeFi protocols should be regulated in the same way banks are. Doing this, however, isn’t as straightforward as it seems. Because DeFi protocols are not companies and do not have any executives or employees, there isn’t a legal entity for governments to regulate. Instead, many (but not all) of today’s top DeFi protocols operate as Decentralized Autonomous Organizations (aka DAOs). There are two core components to these organizations. First, a DAO is by definition decentralized. Meaning, there’s no CEO, President, executive team or employees whatsoever. Further, there’s no headquarters or office. In fact, while many DeFi protocols have multiple team members who work side by side, this does not make them employees. Instead, many of these men and women are technically volunteers (who are rewarded by the smart contract for their efforts). In other cases, the people working on a project will buy and hold onto the project’s tokens (usually in its very early days) in hopes of making massive financial gains when the project succeeds (a concept known as Token Gated Membership). Second, DAOs operate autonomously. Meaning, there are no meetings, employee manuals or standard operating procedures. Instead, the financial “service” the protocol provides is handled via the smart contract itself. This presents a variety of legal challenges. In particular, challenges related to what country the protocol should be regulated in, and who (if anybody) is responsible for interfacing with regulators. Because of this, the concept of how DAOs will be regulated has become a hot topic among lawmakers and attorneys looking to cash in on the action. A second and arguably larger threat to DeFi involves the regulation of stablecoins. In 2021, the US government opened multiple inquiries regarding the stability and legitimacy of stablecoins. Their fear? A 1920s style bank run. While stablecoins are designed to be pegged to the dollar, there are no regulations forcing stablecoin providers to have one dollar of backing for every stablecoin in existence. Because of that, some people worry that if one or more stablecoins lost their peg (and fell to $0.95 for example), it could spark a stablecoin bank run where crypto investors try to cash out their stablecoins all at once. This, in turn, would cause the peg to drop even further, resulting in even more investors losing their money. And because regulators are responsible for protecting both investors and the overarching financial system, many predict the government will finally crack down on stablecoin providers in 2022. In November of 2021, the US government passed a bipartisan infrastructure bill that could devastate DeFi. First, one of the bill’s provisions relates to crypto gains reporting, requiring crypto “brokers” to report each customer’s gains. The problem? Because DeFi is by definition anonymous, the protocols processing hundreds of billions in DeFi transactions have no idea who their customers are (making it technologically “unworkable” for them to comply with these laws). Another law revolves around a provision that expands Section 6050I of the tax code to include digital assets. 6050I requires any person or business who receives $10,000 in cash or its equivalent to file a report with the IRS, including the name, address, and social security number of the person they received the money from. While this wouldn’t affect investors, it would affect any DeFi protocol that receives $10,000 or more in cryptocurrency investment (tokens) from its users. Once again, with DeFi being anonymous, there isn’t a single DeFi provider that could comply with this law (as of today). Further, with many DeFi protocols operating as DAOs, it's unclear who the government would even try to hold accountable for such violations. On the one hand, the language in these provisions could spell disaster for DeFi. On the other, both the Treasury Department and a variety of lawmakers have signaled a willingness to clarify who will and will not be subject to these provisions before the bill goes into effect in 2024. With that said, government regulators aren’t the only threats to DeFi. Instead, many threats come from DeFi’s core technology itself: Smart Contracts. First, the computer programming language behind most DeFi contracts (known as Solidity) wasn’t invented until 2014. Further, because DeFi didn’t catch on until 2020, the idea of using smart contracts for DeFi purposes has only been around for two years. Because of that, smart contract security is nowhere near as advanced as the security protocols today’s banks are using. Meaning, for better or worse, there are billions of dollars in liquid crypto out there being protected by relatively flimsy security. The result? Hacks. And lots of them. In 2021 alone, it's estimated that hackers stole more than $10 billion in crypto from various DeFi protocols (and a handful of CEXs). (While the industry is only two years old, the 2021 total is a 100 fold increase from the approximate $100 million that was stolen in 2020.) And while the largest hack of 2021 targeted a CEX, notable DeFi hacks include Cream Finance losing $130 million while Badger DAO was hacked for $120 million. Another more subtle form of hack involves what’s called an exploit. While a hack involves stealing crypto tokens directly, an exploit involves taking advantage of a smart contract vulnerability. Think of it as stealing someone’s wallet, versus finding a wallet and taking the money before giving it to the police. Regardless of the ethics, both hacks and exploits have the same result: Massive losses for investors while the criminals escape with millions. As soon as you send your tokens from a CEX to a DeFi wallet, it's safe to assume you’re on your own. Meaning, if you get hacked or scammed, there’s no customer support you can call for help. Fortunately, the technology behind DeFi wallets is highly secure. Unfortunately, however, it's not the tech you need to be worried about. Instead, it's your own innocence and naivety. As most hackers know, it's dramatically easier to phish someone into giving up their banking password than it is to hack a bank. And when it comes to DeFi wallet security, the same rules apply. Because of that, DeFi investors need to be aware of phishing scams. Most of which involve scammers pretending to work for a DAO, DeFi protocol or wallet company. While there are a variety of ways someone could approach you pretending to work for one of these organizations, the scammer’s strategies are almost always the same. In particular, the scammer’s goal is to convince investors they need access to the investor’s wallet to help them with something (get free tokens, recover lost tokens, etc.). From there, unsuspecting investors (who need help or want the free tokens) provide access to their wallets. This is by far the biggest and most egregious mistake in DeFi. In short, you should never give anyone your wallet’s password or seed phrase. In fact, DeFi users should automatically assume anyone who even remotely hints at asking you for this information is a guaranteed scammer.Government Regulation

Applying Bank Regulations to DeFi

Regulating Invisible Organizations

Searches for "Decentralized autonomous organization" have gone up 4300% in the last five yearsThe World’s First Decentralized Workforce

The Code Does The Work

New Laws Must be Written

Preventing a Crypto Bank Run

Stablecoins Are Pegged, But Not Backed

The 2021 Infrastructure Bill

Felony Charges for DeFi Providers?

Crypto Advocates Have Time on Their Side

Smart Contract Flaws

Searches for "Solidity" over the last five yearsDeFi Hacks On The Rise

Exploits

No Customer Support in DeFi

The Real Vulnerability? You!

How DeFi Phishing Scams Work

Never Ever Share Access to Your Wallet

The Future of DeFi

In this chapter, we’ll discuss the future of decentralized finance.

In an industry that’s barely two years old, one could argue it's premature to predict what the future may hold for DeFi. With that said, a lot has happened over the past two years. In fact, in the “blink and you’ll miss it,” lightning speed world of crypto, two years is a long time. From the threat of government regulations to the failures of LP farming, both companies and DAOs are playing whack-a-mole to keep the industry moving forward. And because DeFi is nothing without investors, finding new and innovative ways to attract investors is a top priority. While most anyone can attract a flood of DeFi users with a high enough rewards incentive, convincing those users to stick around is something else entirely. See, the problem with incentivizing investors with rewards tokens is that as soon as the price of those rewards tokens starts to drop, it can set off a chain reaction of panic selling. And if too much panic selling takes place, it can kill a project before they even get off the ground. On top of that, the process of constantly minting (creating) new tokens to reward investors is a form of inflation. Similar to hyperinflation in a third-world country, constantly printing new money can very quickly drive a currency’s value into the ground. And with DeFi, the same rules apply. If a protocol can’t drive enough token purchases to offset the rewards they’re paying out, they can quickly drive the value of their token into the floor. To solve this problem, DeFi developers are testing a variety of new incentives structures. One example includes shifting from LP farming to what’s known as Protocol Owned Liquidity (a process that involves creating LP pairs, then exchanging them for new auto-compounding tokens). While this strategy was highly successful in early 2021, DeFi protocols that took this approach were some of the hardest hit during the winter 2021 / 2022 market correction (which is still taking place as of this writing). Another solution involved taking tokens out of the equation entirely and instead rewarding users who provide the technology needed to process transactions on the blockchain (known as Nodes). On the one hand, nodes are and always have been a critical part of blockchain functionality. On the other hand, many blockchains allow you to set up your own node without needing to go through any kind of middleman. Because of that, many see node farming as yet another kind of DeFi Ponzi scheme. While most people associate NFTs with digital art, behind each NFT is a cryptocurrency token (which is why NFTs must be purchased with crypto). Because of that, a handful of DeFi protocols allow users to “stake” their NFTs in exchange for reward tokens. In fact, while the concept is less than one year old, a variety of platforms are creating elaborate ecosystems where users can buy, sell, and upgrade their NFTs. NFTs they can then use to play blockchain games and even participate in the metaverse. Ironically, the most successful DeFi projects and DAOs are the ones that took a page out of the traditional finance playbook. In particular, they’re the ones that developed a workable (profitable) business model, enrolled customers into their vision, and delivered on their promises. More important, DeFi is one of the few sub-niches of crypto that solves real-world problems. From earning yield to leveraged borrowing, developers have taken serious steps to replicate many of the services offered by today’s top financial institutions. And in a world that’s filled with scams, Ponzi schemes and useless dog coins, having a token with real-world utility is highly attractive to both Average Joes and institutional investors. Further, DeFi’s explosive growth has led to a variety of new careers being invented. One area where that demand is obvious is the need for qualified smart contract developers. With one quick Google search, developers can easily find smart contract jobs paying hundreds of thousands of dollars per year. Another industry experiencing rapid growth is Smart Contract Audits. With hacks and exploits on the rise, both DAOs and DeFi companies are spending serious money to protect their protocols from hackers. While crypto has gone through multiple boom and bust cycles over the past decade, 2021 hit a little bit differently. There were a couple of reasons for this. First, 2021 was the first year the US government (finally) signaled they would not ban Bitcoin or crypto in general. Second, 2021 was also the first time major corporations began putting Bitcoin on their balance sheets. Last and most important, 2021 saw record-setting institutional investment into crypto as an asset class. Combine these three factors together and it's fair to say 2021 is the year crypto went mainstream.DeFi Struggles to Find Its Feet

Inflation Applies to Cryptocurrencies Too

Protocol Owned Liquidity

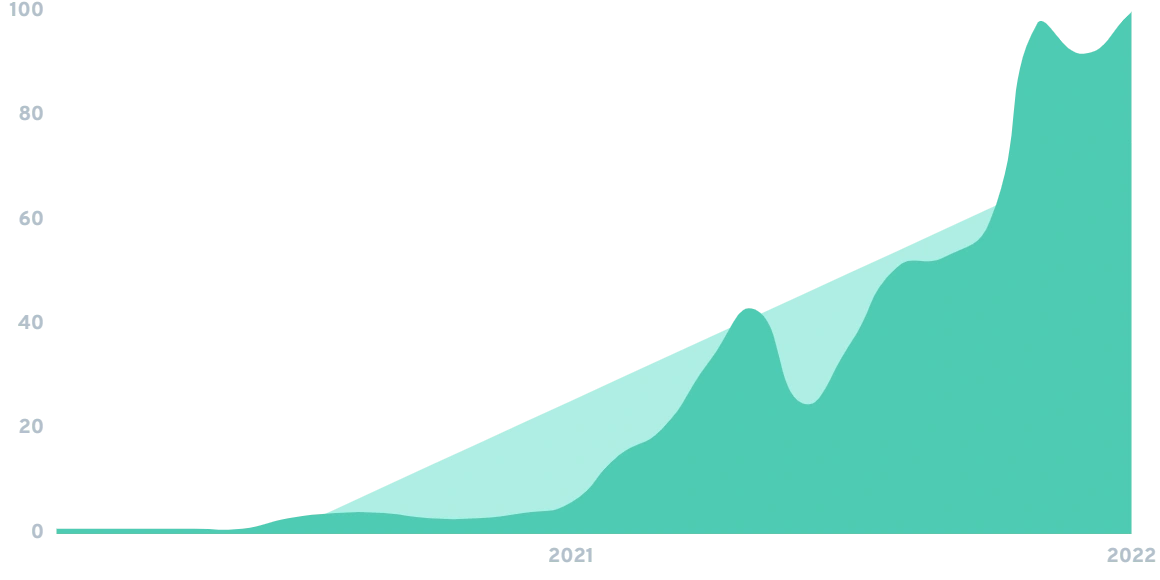

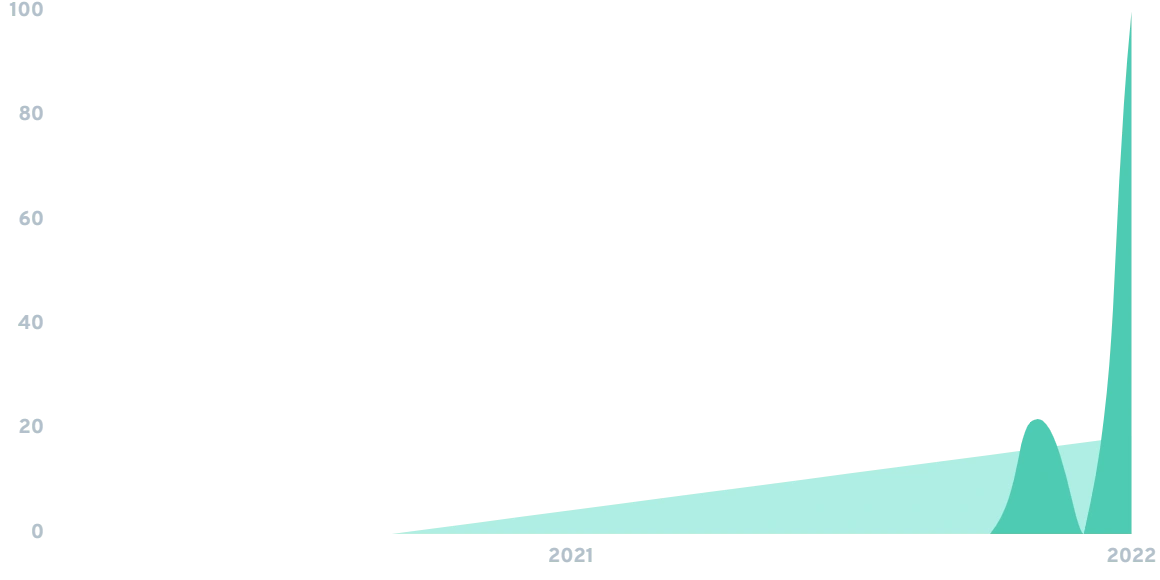

Searches for "Protocol owned liquidity" have started spiking near the end of 2021Master Node Farming

NFT Staking

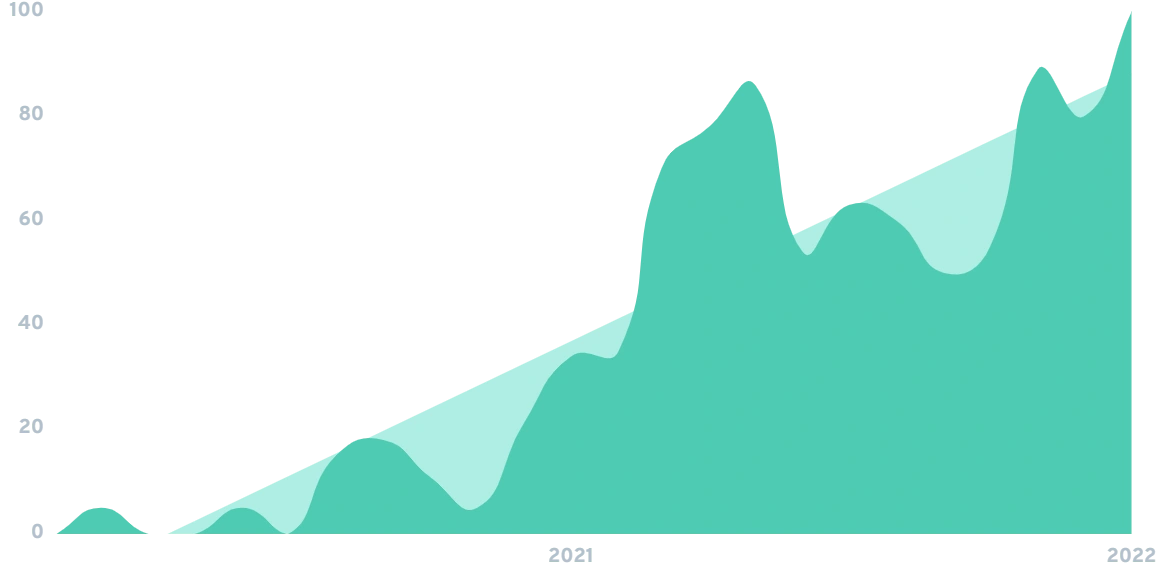

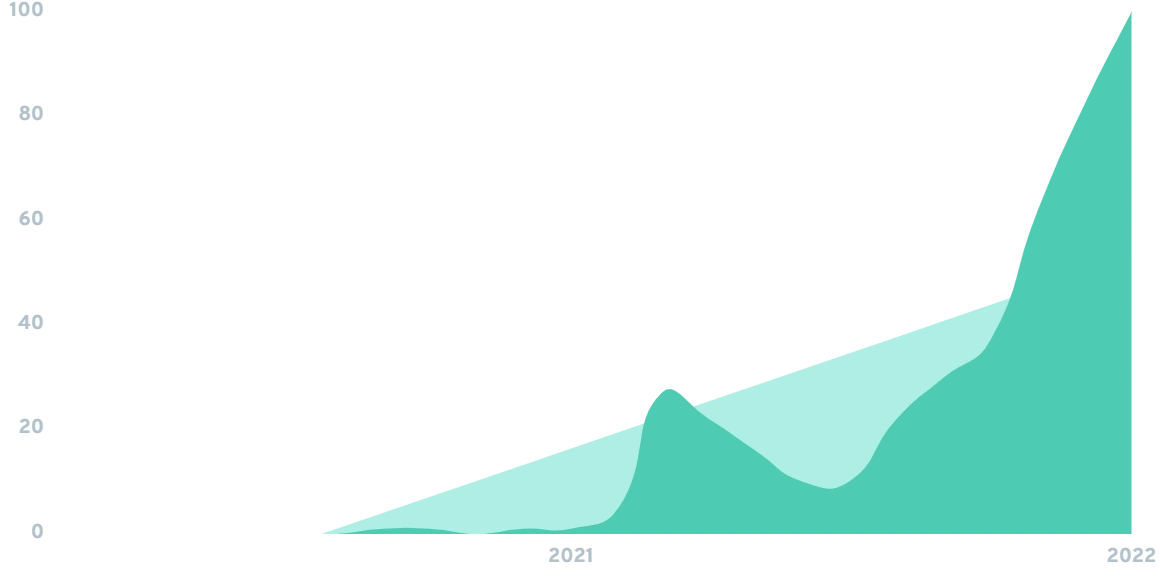

Searches for "Non-fungible token" have spiked 99X+ times in the last two yearsDeFi 1.0 is Still Kicking

Real-World Utility Wins

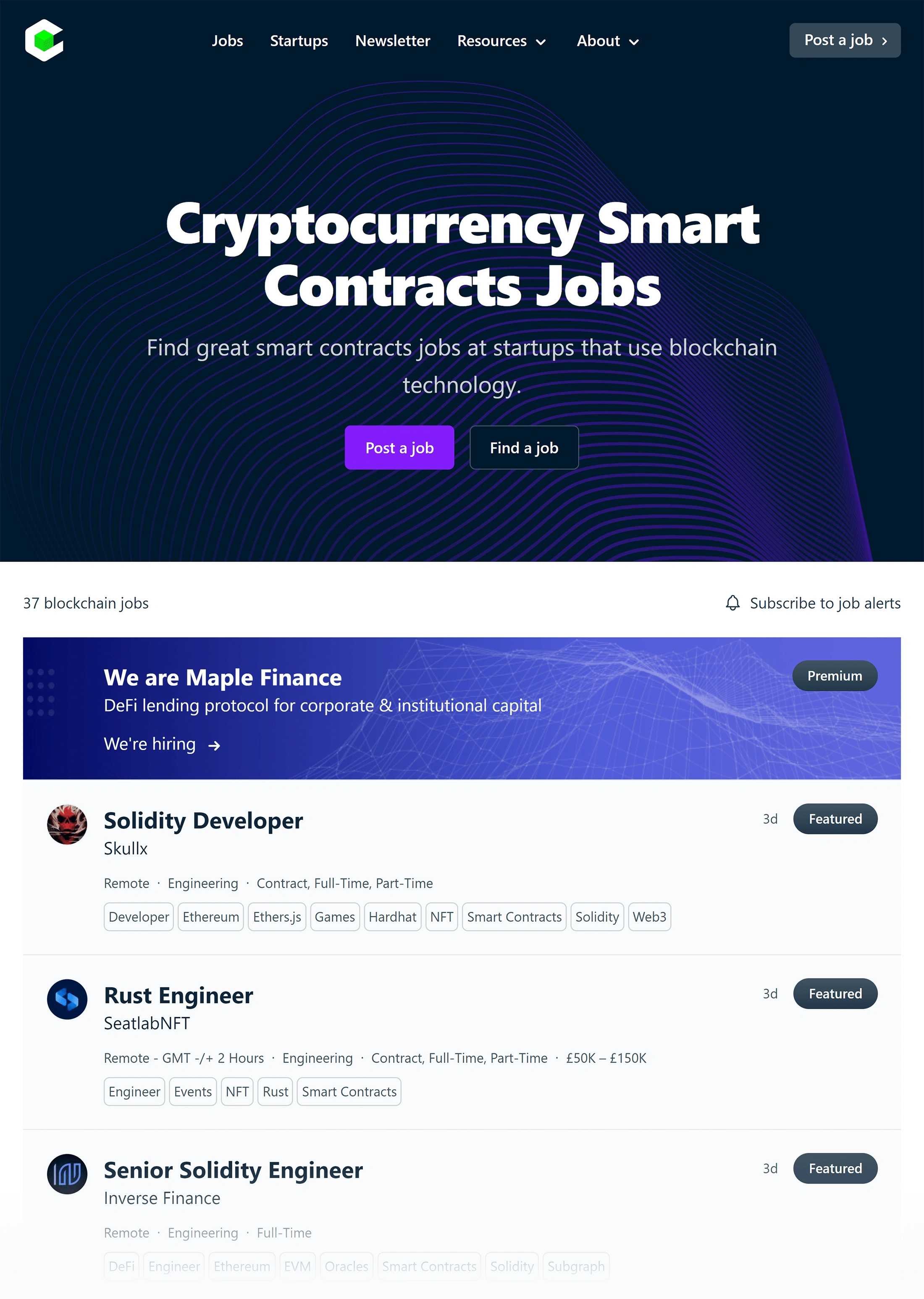

Increasing Demand for Smart Contract Developers

The Growth of DAOs

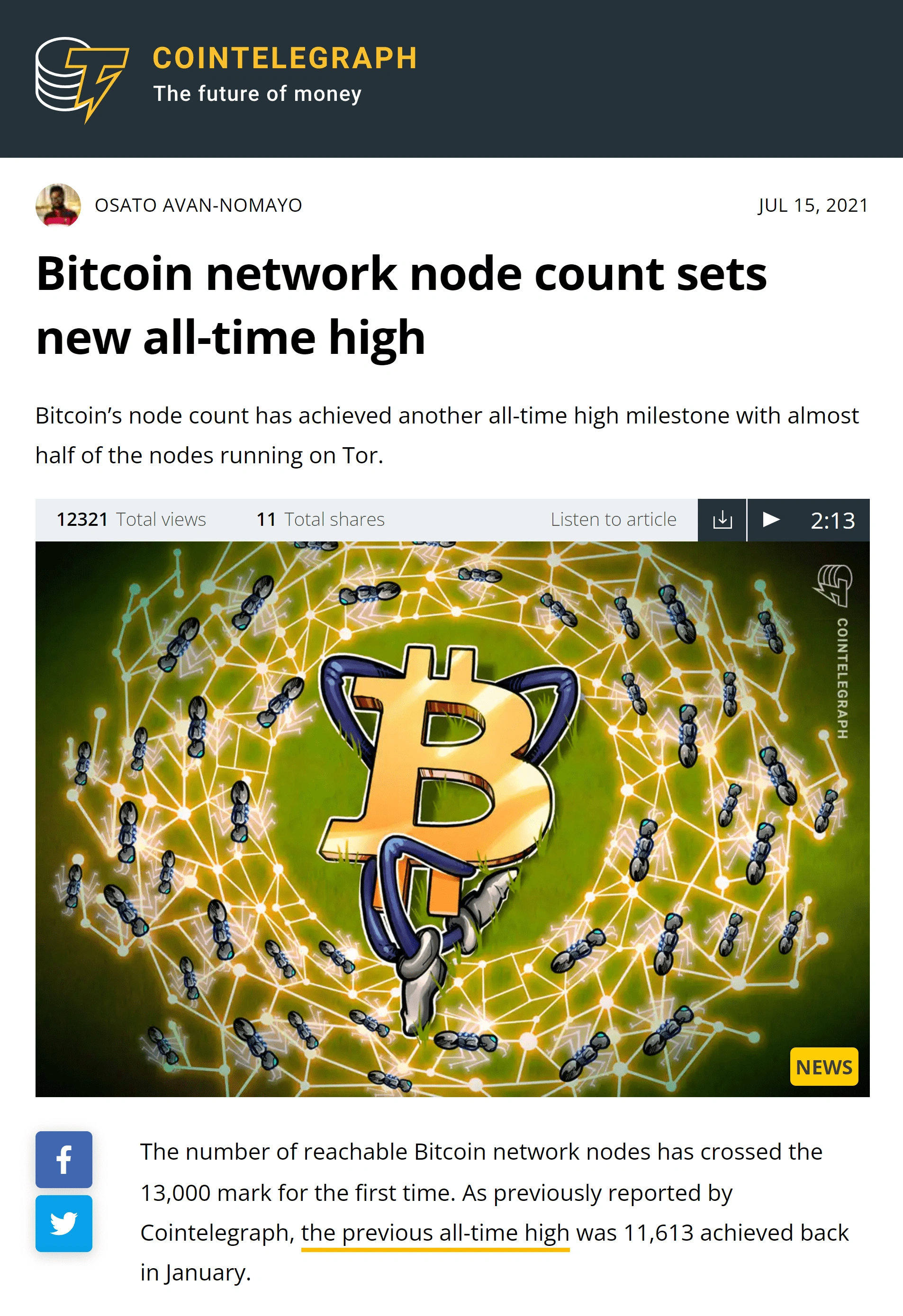

Crypto Finally Goes Mainstream

Conclusion

With threats and opportunities around every corner, it's hard to predict where DeFi will be one year from now (let alone in the “future”). Yes, the industry is likely to see stablecoin regulation in 2022. And it's critical lawmakers clarify the provisions in the Infrastructure Bill (for US investors at least). However, after a year of record-setting adoption numbers, it's hard to imagine DeFi disappearing anytime soon. Instead, it's safe to assume DAOs will continue pushing the limits of what’s possible in terms of what an “organization” looks like. In short, decentralized finance is an exciting space that’s worth following.