Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top Trending Stocks (2024)

This is our list of the top trending stocks in the US right now.

Note that these are not flash-in-the-pan stocks (like overhyped IPOs or speculative bets). Instead, these stocks have long-term growth potential for the rest of 2024 and beyond.

How We Identify Trending Stocks: Our Methodology

Exploding Topics does not identify trending stocks the same way most other sites do. Instead of analyzing recent price activity, we scan millions of consumer behavior signals to identify trending stocks before the price rises or the stock is overbought.

Specifically, our proprietary algorithm monitors online conversations, retail interest, searches, and social media conversations across the internet. This unique approach helps us identify trending companies early on with the potential to generate positive alpha.

Top Trending Stocks In The US Right Now

| # | Stock | Search Growth |

| 1 | WULF (Terawulf Inc) | 99x+ |

| 2 | ACHR (Archer Aviation) | 99x+ |

| 3 | ENVX (Enovix Corp) | 8,600% |

| 4 | RIOT (Riot Platforms) | 7,300% |

| 5 | STLA (Stellantis NV) | 7,300% |

| 6 | HLN (Haleon) | 6,400% |

| 7 | LUMN (Lumen Technologies) | 5,600% |

| 8 | CLSK (CleanSpark Inc) | 4,900% |

| 9 | Sofi (Sofi Technologies) | 4,300% |

| 10 | NVDA (NVIDIA Corp) | 1,567% |

| 11 | BILI (Bilibili Inc) | 913% |

| 12 | SYM (Symbotic) | 778% |

| 13 | JOBY (Joby Aviation) | 760% |

| 14 | GPCR (Structure Therapeutics Inc) | 683% |

| 15 | S (SentinelOne Inc) | 608% |

| 16 | DNA (Ginkgo Bioworks Holdings Inc) | 527% |

| 17 | ALIT (Alight Inc.) | 390% |

| 18 | KVY (Klaviyo Inc) | 379% |

| 19 | CRWD (Crowdstrike Holdings Inc) | 317% |

| 20 | MRVL (Marvell Technology) | 254% |

| 21 | TSMC (Taiwan Semiconductor Manufacturing Company) | 223% |

| 22 | APP (Applovin Corp) | 211% |

| 23 | RELY (Remitly Global Inc.) | 203% |

| 24 | ZS (Zscaler Inc) | 174% |

| 25 | DDOG (Datadog Inc) | 159% |

| 26 | SPRU (Spruce Power Holding Corp) | 156% |

| 27 | SEMR (Semrush) | 150% |

| 28 | UPWK (Upwork Inc) | 145% |

| 29 | FVRR (Fiverr International Ltd) | 144% |

| 30 | AFRM (Affirm Holdings Inc) | 137% |

| 31 | DXCM (DexCom Inc) | 118% |

| 32 | DOCU (DocuSign) | 107% |

| 33 | SLDP (Solid Power Inc) | 100% |

| 34 | OKTA (Okta Inc) | 96% |

| 35 | NET (Cloudflare) | 88% |

| 36 | PAYO (Payoneer Global Inc) | 87% |

| 37 | DT (Dynatrace Inc) | 76% |

Let’s take a closer look at a handful of stocks that stood out the most.

1. Klaviyo Inc. (NYSE: KVYO)

5-year search growth: 379%

Search growth status: Exploding

Market cap: $6.62 billion

Current share price: $25.01

Description: Klaviyo is an email and SMS marketing platform used primarily by eCommerce companies. In 2024, over 135,000 companies use the platform to automate SMS and email marketing initiatives.

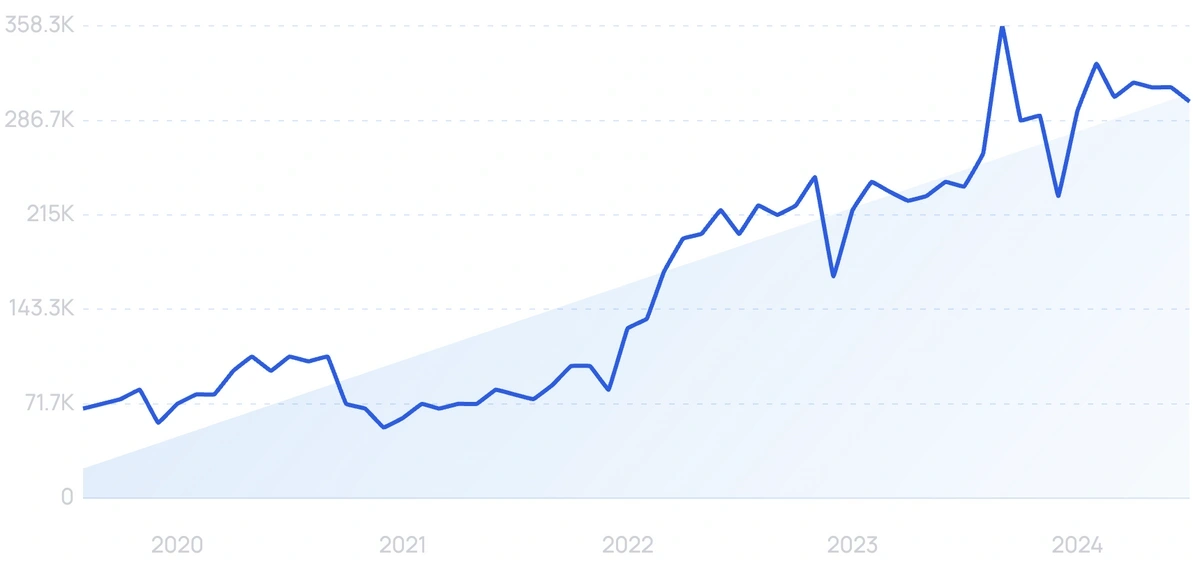

2. Nvidia Corp. (NASDAQ: NVDA)

5-year search growth: 1,567%

Search growth status: Exploding

Market cap: $2.98trillion

Current share price: $121.29

Description: Nvidia is a semiconductor design and manufacturing company specializing in the development of GPUs. Beyond GPUs, the company is a leading chip system provider for vehicles, robotics, AI, and more. In 2024, Nvidia holds a 95% market share in workstation graphics chips and an 80% market share in machine learning processors.

3. Okta Inc. (NASDAQ: OKTA)

5-year search growth: 96%

Search growth status: Exploding

Market cap: $15.80 billion

Current share price: $93.92

Description: Okta is a cloud-based IT management software company. They offer Identity-as-a-Service (IDaaS) to allow organizations to add authentication and authorization to applications. Some of Okta's biggest customers include Apple, CVS, and Chevron.

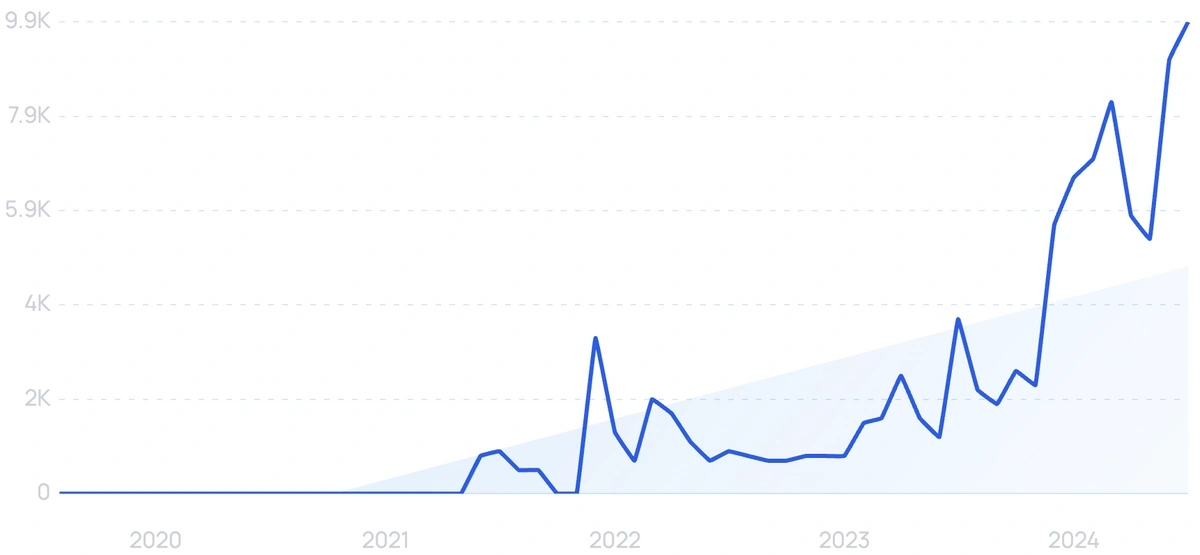

4. Joby Aviation Inc. (NYSE: JOBY)

5-year search growth: 760%

Search growth status: Exploding

Market cap: $4.94 billion

Current share price: $6.97

Description: Joby Aviation is an aviation company developing electric aircraft. The stock’s IPO was in 2020, but recent innovation and market growth have caused the stock to rise. Joby is a leader in the eVTOL space with contracts from NASA, Toyota, the Air Force, and Delta Airlines.

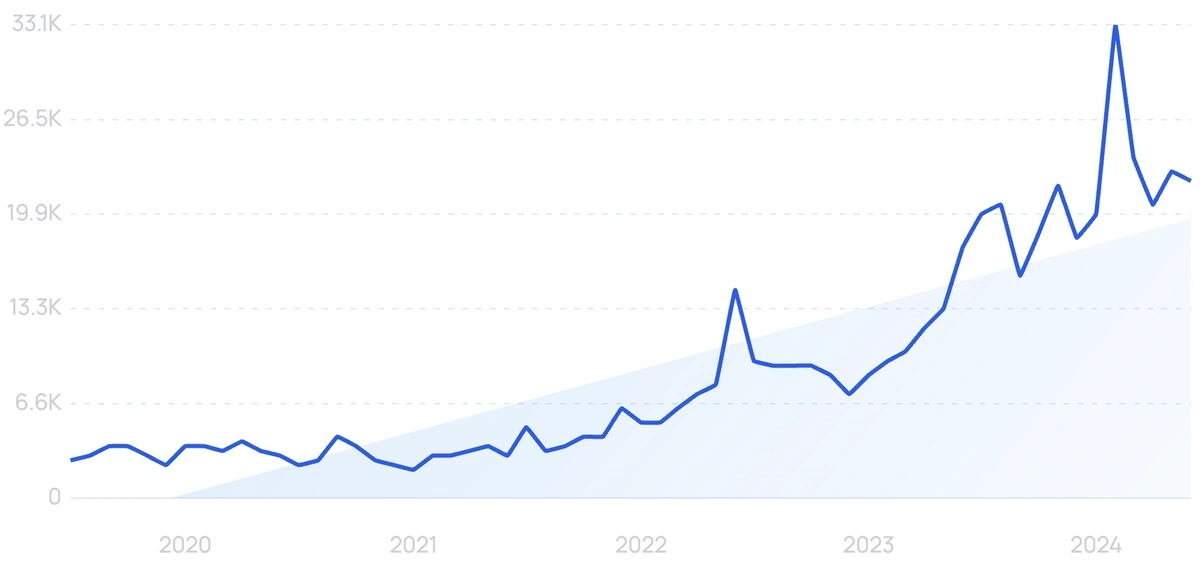

5. SoFi Technologies Inc (NASDAQ: SOFI)

5-year search growth: 4,300%

Search growth status: Regular

Market cap: $7.96 billion

Current share price: $7.53

Description: SoFi Technologies is an online bank and personal finance company. They offer digital personal finance products like student loan refinancing, mortgages, and personal loans. Traded as SOFI, the company looks to target millennials and Gen Z with its all-in-one platform.

6. Alight Inc. (NYSE: ALIT)

5-year search growth: 390%

Search growth status: Regular

Market cap: $4.00 billion

Current share price: $7.12

Description: Alight Inc. is a cloud-based human capital technology. The platform offers global payroll, talent, workforce, HR services, and much more. The company serves 4,300 clients and over 36 million people and dependents.

7. TeraWulf (NASDAQ: WULF)

5-year search growth: 99x+

Search growth status: Exploding

Market cap: $1.70 billion

Current share price: $5.35

Description: TeraWulf is a Bitcoin mining company that uses over 95% zero-carbon energy for all mining operations. The company implements vertically integrated mining operations to manage the entire process from energy generation to bitcoin mining. In 2023, TeraWulf increased revenue by 360% and raised total self-mined Bitcoin production by 550% (3,407 Bitcoins).

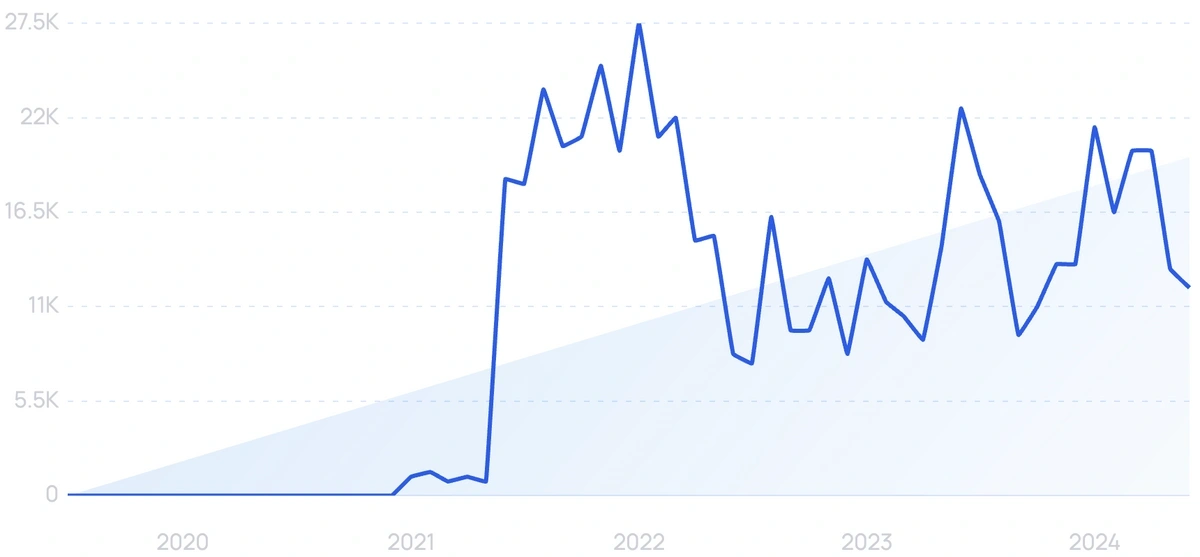

8. Symbotic Inc. (NASDAQ: SYM)

5-year search growth: 778%

Search growth status: Exploding

Market cap: $22.50 billion

Current share price: $38.49

Description: Symbotic is a robotics warehouse automation company. They use autonomous robotic systems to augment existing warehouse processes. In May 2022, Walmart announced the use of Symbotic’s systems in all 42 distribution centers in the US.

9. Bilibili Inc. (NASDAQ: BILI)

5-year search growth: 913%

Search growth status: Exploding

Market cap: $6.46 billion

Current share price: $15.59

Description: Bilibili is a Chinese online entertainment platform that targets the younger generation. The video platform offers live streaming, video sharing, and themed games. The company has over 326 million MAUs and 28.1 million paying customers.

10. Zscaler Inc (NASDAQ: ZS)

5-year search growth: 174%

Search growth status: Exploding

Market cap: $28.77 billion

Current share price: $190.37

Description: Zscaler is a cloud-based security company that protects against cyber threats and data breaches. In their most recent earnings report, Zscaler announced a new suite of generative AI security solutions to protect private enterprise data.

Conclusion

This concludes our detailed list of the top 37 trending stocks today.

Many of these top trending stocks are disrupting the tech industry (Cloudflare and Lumen Technologies). And many others (Fiverr and Upwork) are innovators advancing the gig economy.

This list will be updated regularly. So keep checking back for new stock ideas to add to your portfolio.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more