Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

12 Top M&A Software Platforms (2024)

It is possible to find any acquire companies without a dedicated software platform. For example, by using something like Microsoft Excel.

But the process can get messy quickly.

Enter: dedicated M&A platforms.

Whether you’re in PE, VC or part of an internal mergers and acquisitions department, the M&A tools on this list can make the deal-making process easier.

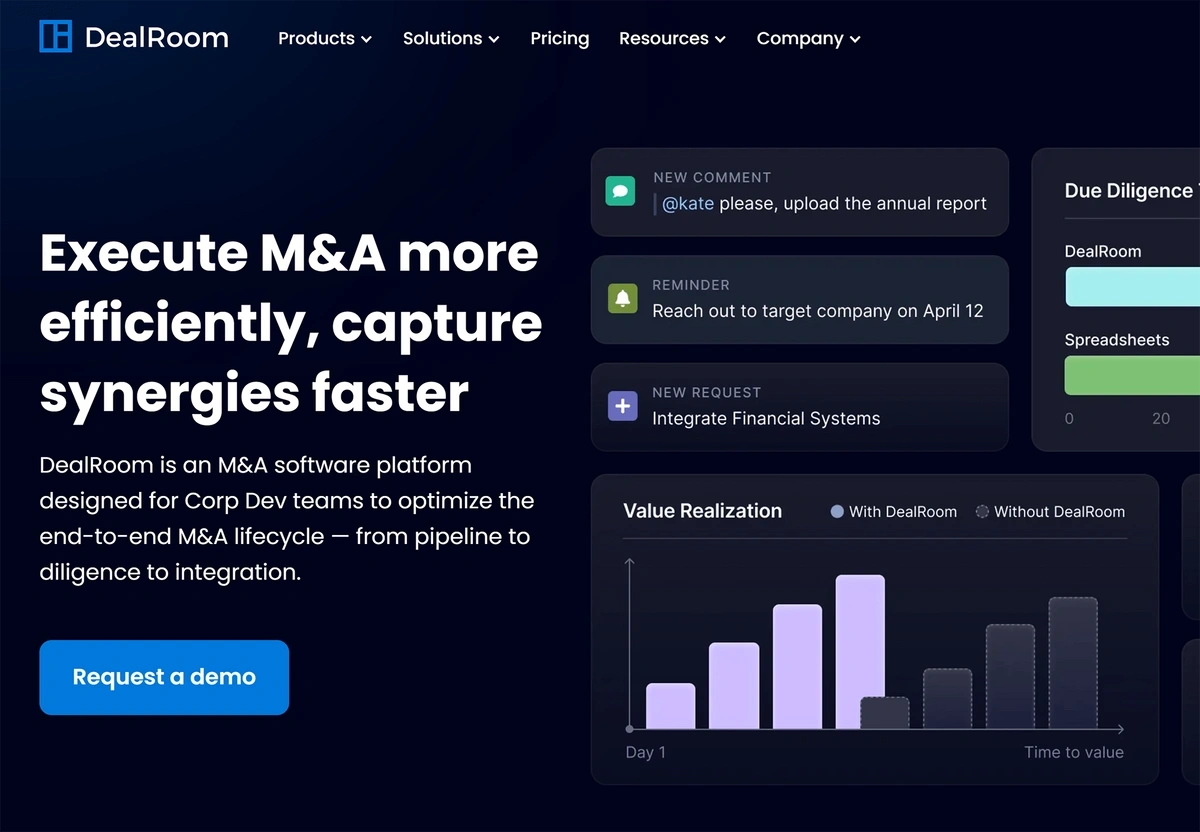

1. DealRoom

DealRoom is a comprehensive M&A project management platform.

You can use this software to manage the entire deal lifecycle, including:

- Pipeline management

- Due diligence activities

- Document exchange in a virtual data room (VDR)

- Post-merger integration work

DealRoom is useful when managing one acquisition—or many. Its customizable dashboards allow users to see and compare data points (such as deal values). That way, they can evaluate several opportunities at once.

Dealroom's pricing varies on how you plan to use the tool. Anyone using DealRoom to manage a single sale or merger will pay $1,495 per month.

To manage multiple deals or build your M&A pipeline, you’ll need DealRoom’s more full-featured plan, which starts at $11,995 per year.

DealRoom also offers customized plans for companies with a sizable pipeline or those that plan to close two or more mergers per year.

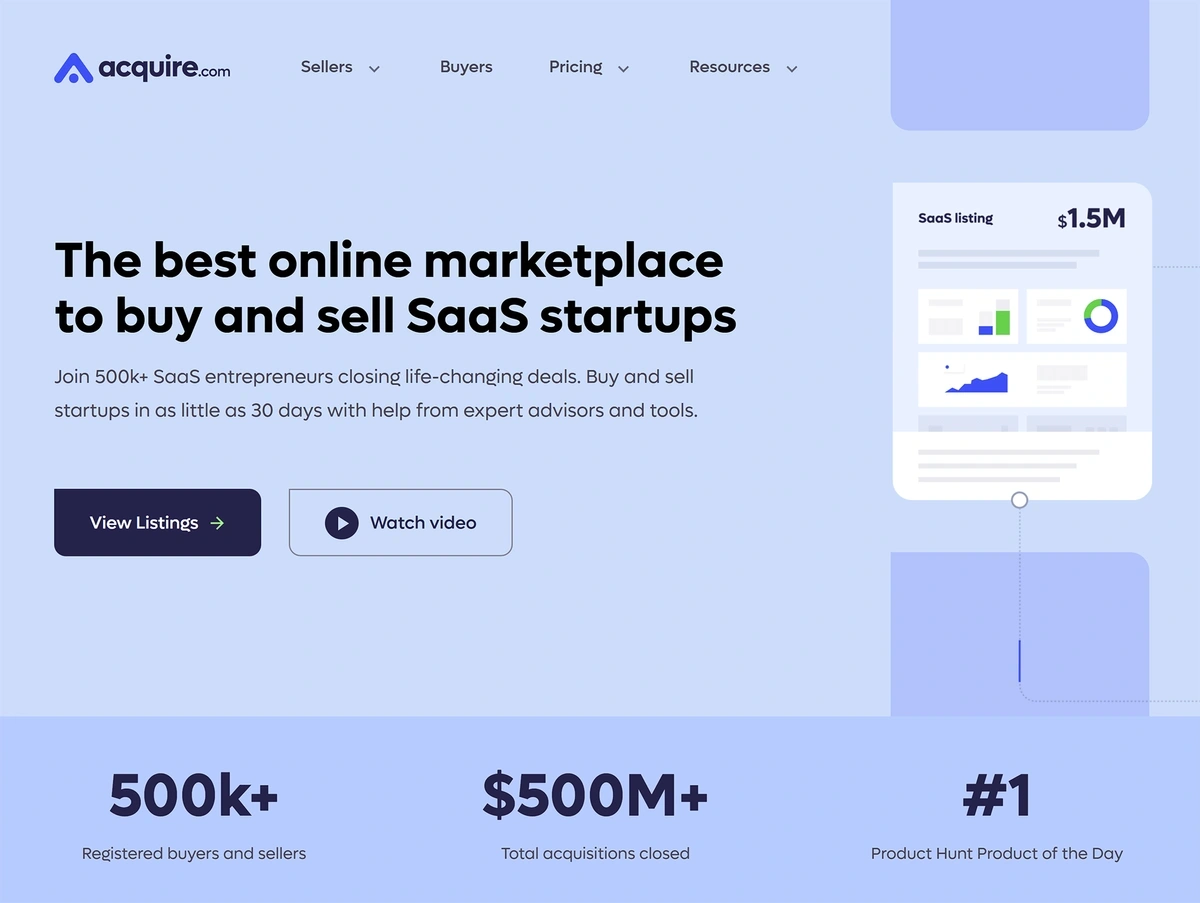

2. Acquire

Acquire is a marketplace-style acquisition platform.

Rather than building a pipeline and seeking out target companies (or acquirers) through multiple sources, you can log onto Acquire and find startups actively for sale.

While there are no guarantees on how long an Acquire transaction will take, the company says that it is possible to complete a sale in as little as 30 days when using their platform.

If you’re interested in using Acquire to find a startup, you can start browsing the platform’s listings for free. To access more of Acquire’s marketplace, you’ll need to select a paid plan. Options start at $390 per year.

If you want to sell your startup, you can list it for free in Acquire’s marketplace. When a sale goes through, you’ll pay Acquire a 4% commission.

3. iDeals

iDeals is a dedicated VDR (virtual data room) solution.

Regardless of how you are sourcing and managing mergers, you can use iDeals to securely exchange key documents with all stakeholders.

You can use iDeals during your:

- Due diligence process and legal reviews

- Pre-merger activities

- Post-merger integration

iDeals is both GDPR and HIPAA compliant, so it’s a good option for anyone working in an industry or company with strict privacy regulations (like finance and healthcare).

The platform is also a solid choice for any businesses that manage a real estate portfolio. Because iDeals includes tools to help manage real estate documentation, you can potentially keep using it even after your deal closes.

All iDeals plans include live training so you know how to best use the platform for your needs. Pricing is only available via a customized quote, so you’ll need to get in touch with the iDeals team to select a plan.

That said, virtual data rooms are already built into many M&A platforms, like DealRoom. If you’re already using an M&A tool, iDeals may be redundant.

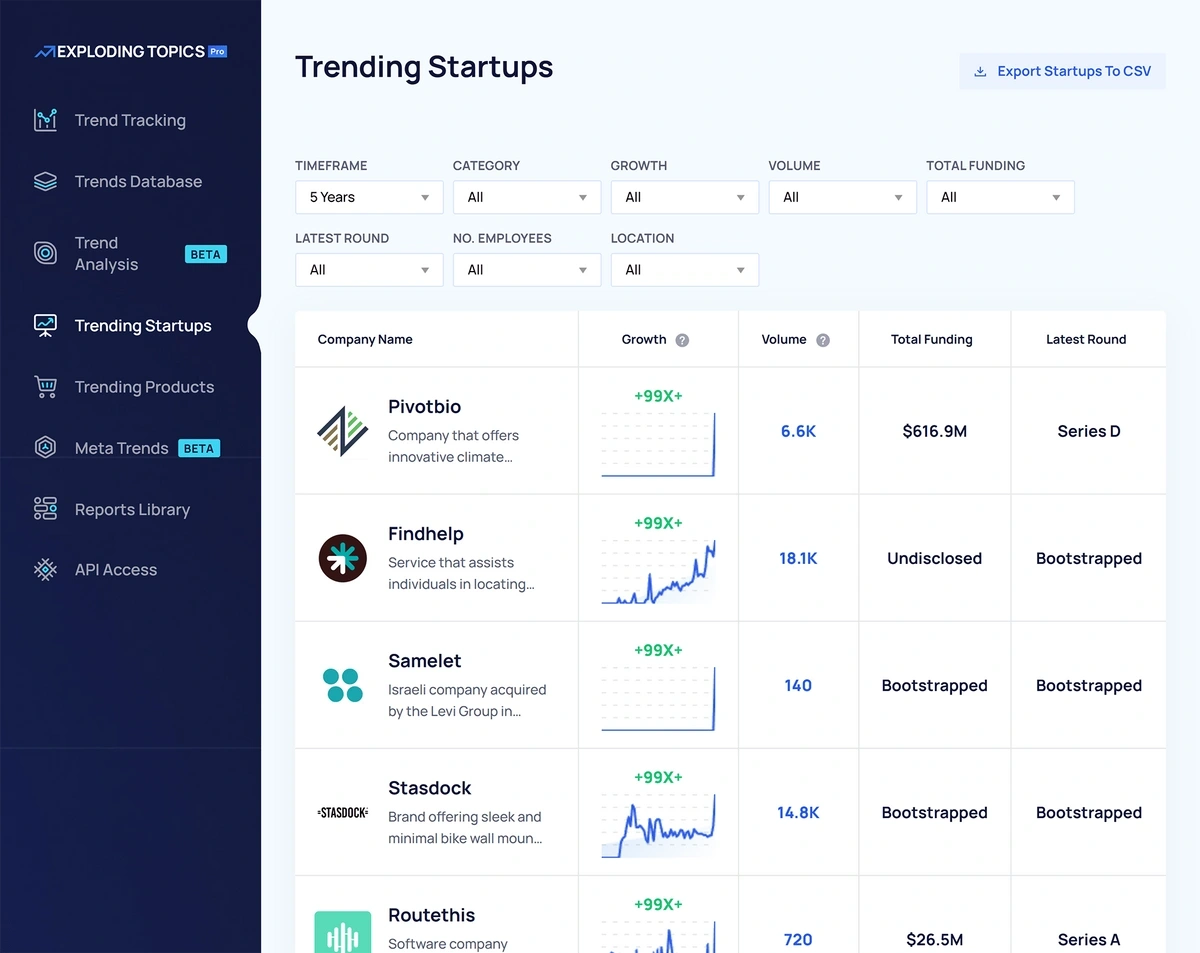

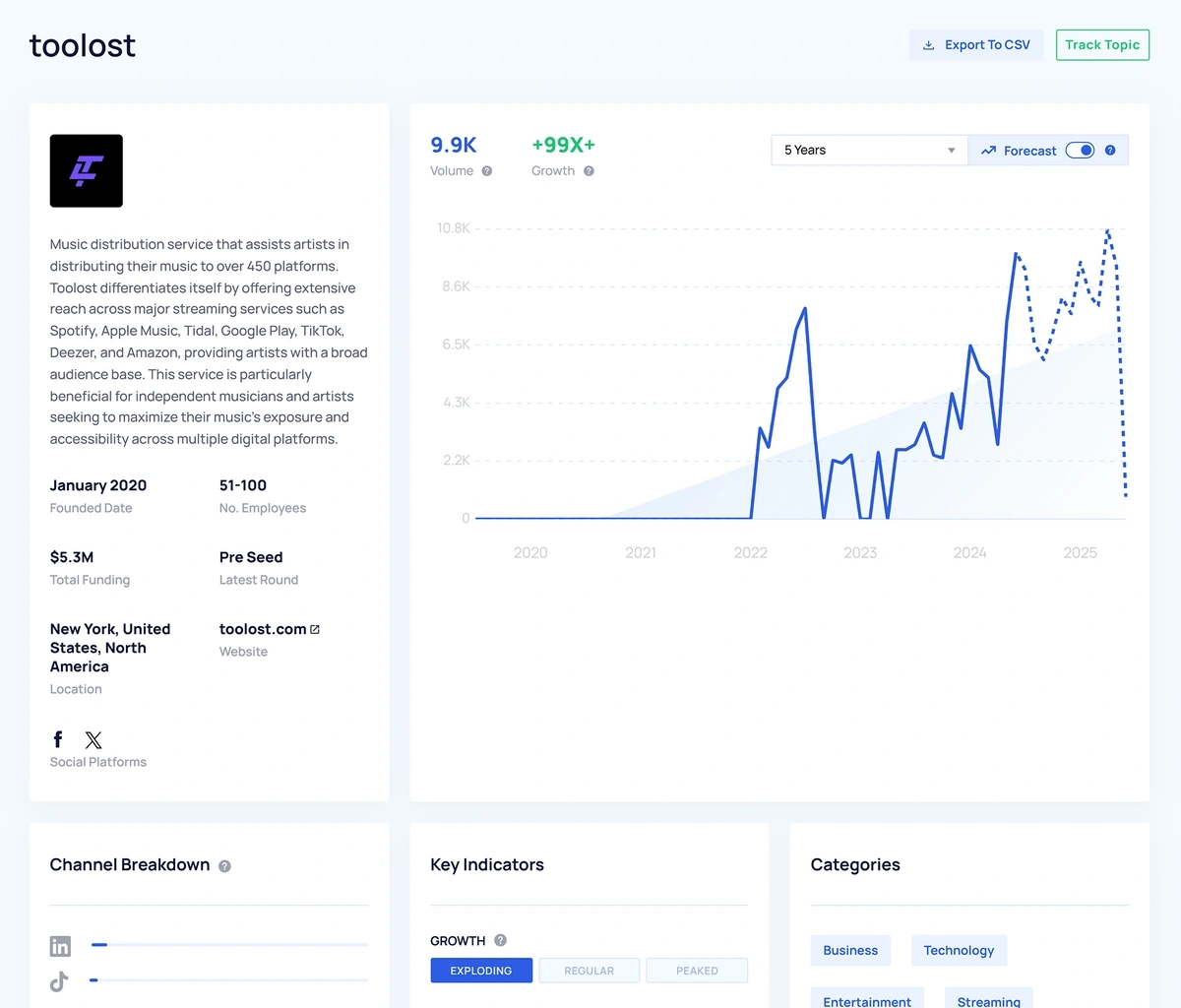

4. Exploding Topics

Exploding Topics is a research tool that can help you find industries to invest in, as well as valuable startups that are ripe for acquisition.

At our core, we’re a trend spotting platform, which means we continually listen to online conversations about the companies, products, and industries that are of interest to consumers.

This data has many uses, including helping acquirers build out a pipeline.

Like Acquire, Exploding Topics’ company data is very focused on startups. You can’t purchase a startup directly through our platform, though. Instead, you can:

- Research companies of interest

- Keep an eye on emerging startups’ popularity

- See which industries are getting the most notice among users and investors

- View a startup’s founding date and funding stage

- Get an idea of the number of employees at a startup of interest

- Search for new and recently funded startups in 25+ industries

When paired with an M&A deal management tool, you can use Exploding Topics data to help with decision making, including deciding:

- Which companies to add to your pipeline

- Where to invest your capital

- Which industries to enter through an acquisition or merger

You can start exploring Exploding Topics’ full startup database right now for $1. You’ll get fourteen days to explore the entire platform—and if you like it, you can keep your access active for as little as $39 per month (billed annually).

Plus, you’ll get access to more of our other trend tracking features that can help you with other investing, marketing, and business development activities.

5. Grata

Grata is designed primarily for finding new M&A targets.

While Acquire is focused on startups, though, Grata’s database provides details on 10 million middle market companies.

You can use the platform to search for specific companies, or browse multiple businesses within a target industry.

Each company listing on Grata includes verified executive contact information, so it’s easy to get in touch with decision makers at the companies you’d like to acquire.

It’s important to note, though, that the companies listed in Grata’s database didn’t create their profiles. Grata sources company information through public and private sources—so it’s not guaranteed that each company you find is actually open to a sale or merger.

Grata offers three plans and API access; you’ll need to get in touch with their team for a demo and a price quote.

6. Datasite

Datasite is a software company that can help you manage M&A transactions from start to finish—and it also includes regulatory technology to make ongoing compliance easier.

With Datasite’s archive functionality, you can:

- Log snapshots of project progress throughout the entire M&A lifecycle

- Access a complete audit of your M&A project at any time

- Index and search every document related to the purchase or sale of a company

- Generate comfort letters to indicate your legitimacy as a buyer

- Prove data integrity

- Maintain a chain of custody

- Copy data from archived projects to new ones

If you’re in a highly-regulated industry, or you just want to make sure that you can answer any and all questions about a merger or acquisition, Datasite may be a useful tool.

You’ll also be able to use Datasite’s other features to:

- Conduct company research

- Build a pipeline

- Undergo due diligence

- Prepare for a merger or transition

Datasite is only available through a custom demo and quoting process—whether you’re on the buy-side or the sell-side of the table.

7. Ansarada

Ansarada can be useful on the buy-side or sell-side, but we think it’s an interesting choice for anyone working to grow, and ultimately sell, a startup.

This is because Ansarada includes tools to help you:

- Raise venture capital

- Maintain investment compliance

- Share documents with board members and shareholders

- Prepare reports that demonstrate environmental, social, and governance (ESG) data

- Create board packs and agendas

- Manage board and committee meetings remotely

- Prepare for and undergo a merger or acquisition

- Complete integration after the deal process is complete

Andarada’s compliance tools make it suitable for use in regulated industries like finance and healthcare. It’s also useful for tech companies, consumer packaged goods (CPG) brands, and more.

Access to all Ansarada features starts at $399 per month, or $240 per month when billed annually. The price varies based on your data storage needs as well as how long you plan to use the tool.

If you’re primarily interested in Ansarada’s board management features, you can access just that toolset by paying $60 per user every month (billed annually).

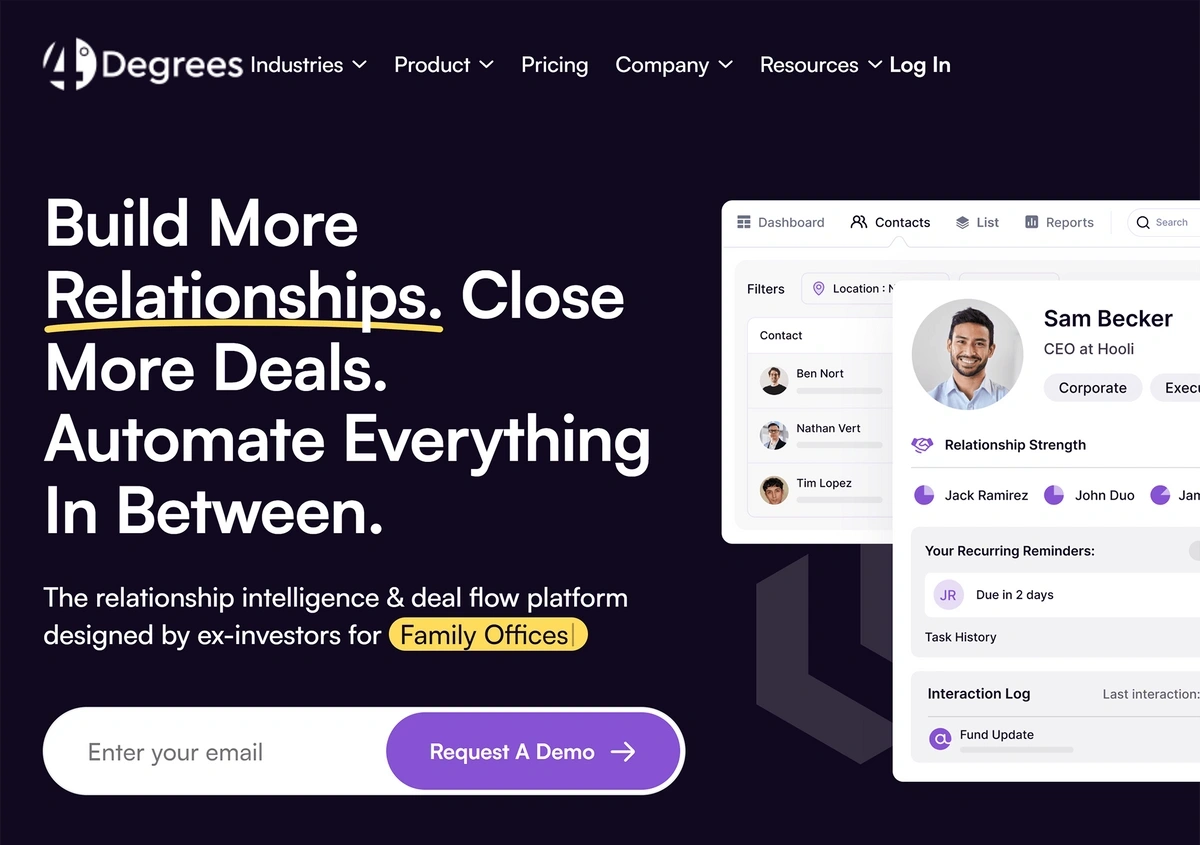

8. 4Degrees

4Degrees is a CRM for mergers, acquisitions, and investments.

If you're actively seeking out M&A opportunities, you can use 4Degrees to keep track of all your relevant connections.

The platform will show you, at a glance, details like:

- Key contacts at companies

- An estimate of your relationship strength

- Contact warmth

- When you last engaged with the contact

It'll even remind you when you need to reach out to a connection in order to keep them warm and open to M&A deals.

Plus, 4Degrees provides you with a feed of updates regarding your contacts and their companies. You'll be able to see:

- When a company you're interested in is acquired by someone else

- When contacts change employers or roles within a company

- When you're in the same city as some of your connections, so you can meet with them in person

While you can't manage the entire deal flow through 4Degrees, the platform is a nice complement to other research tools like iDeals and Exploding Topics.

4Degrees doesn't publish its pricing publicly, so you'll need to get in touch with the company to get a quote based on user seats.

9. SS&C Intralinks

SS&C Intralinks is a suite of tools for M&A teams.

The platform is similar to DealRoom, and offers users access to:

- A virtual data room

- Deal flow CRM tools

- AI-powered due diligence software

- Secure portals for post-merger activities

As with DealRoom, SS&C Intralinks is useful whether you're managing one merger or several. You can customize the Intralinks platform and its dashboards as needed to collaborate with your team and acquisition targets.

SS&C Intralinks also provides automatic audit trails, so you can easily make sure you're compliant with all necessary measures and regulations during the M&A process.

Because the platform is very customizable, you must request a custom quote and demo in order to sign up for SS&C Intralinks.

10. Venue

Venue is a virtual data room tool offered by Donnelley Financial Advisors.

As a data room, the platform offers many of the features you'd expect from similar services like iDeals. You'll be able to:

- Securely organize and exchange documents

- Analyze document contents

- Track deal flow

- Comply with audits

One thing that makes Venue stand out, though, is the access you get to the Donnelley Financial Advisors team. They offer around-the-clock support to Venue users, making the platform an appealing choice for companies entering into a merger for the first time.

If you're interested in Venue, you'll need to contact Donnelley to set up a 15-minute demo and discuss pricing options.

11. Sourcescrub

Sourcescrub is a deal discovery platform for privately traded companies.

The platform includes a database of 190,000 sources at 15 million companies—and will show you how those sources connect to each other.

This makes it easy for users to find a contact in their network and start a chain of introductions back to their primary target. In addition to information about these sources' companies and roles, you'll be able to see information like:

- Company growth intent

- Key corporate milestones

- The trade shows your targets plan to attend

You can also sync your CRM data with Sourcescrub to build out a network of connections even further.

The platform is suitable for both buy- and sell-side users. There are three subscription tiers available, but you'll need to contact Sourcescrub to find out specific prices.

12. FirmRoom

FirmRoom is another virtual data room.

It's designed for quick startup—the company says you can get FirmRoom running in as little as two minutes.

As a result, it's a simple and straightforward tool, without some of the additional features offered by other VDRs like Venue. FirmRoom users get access to tools for:

- Secure data uploads

- User permissions

- Document analytics

- In-app document and spreadsheet viewing

- Onboarding support

If you need a simple VDR solution, and aren't interested in going through the custom quoting process required by iDeals, FirmRoom may be a good choice.

Plan options start at $695 per month. If you opt for quarterly or annual billing, you can save an additional 20% on your FirmRoom subscription.

Conclusion

Getting access to the M&A tools on this list will make the process easier and far more organized, especially when dealing with compliance matters.

A good M&A platform is worth the purchase cost, too. Whether you need a complete end-to-end solution like DealRoom, or want to use Exploding Topics or Grata to conduct research, making the investment into reputable M&A software will ultimately help you maximize the return on your efforts.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more