Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

10 Best Industries to Invest In (2024)

We’ve put together a list of industries that have seen significant growth over the past several years and show promising signs for the future.

Specifically, here are a few things that we looked at when evaluating these industries:

- Compounding annual growth rate history and forecasts

- Recent venture capital investments in the space

- Search volume trends for keywords related to the industry

While this list isn't designed to predict the future, the data will give you some ideas of industries you can research further and potentially incorporate into your investment strategy.

1. Green Hydrogen

In recent years, climate tech leaders have been increasing their focus on hydrogen.

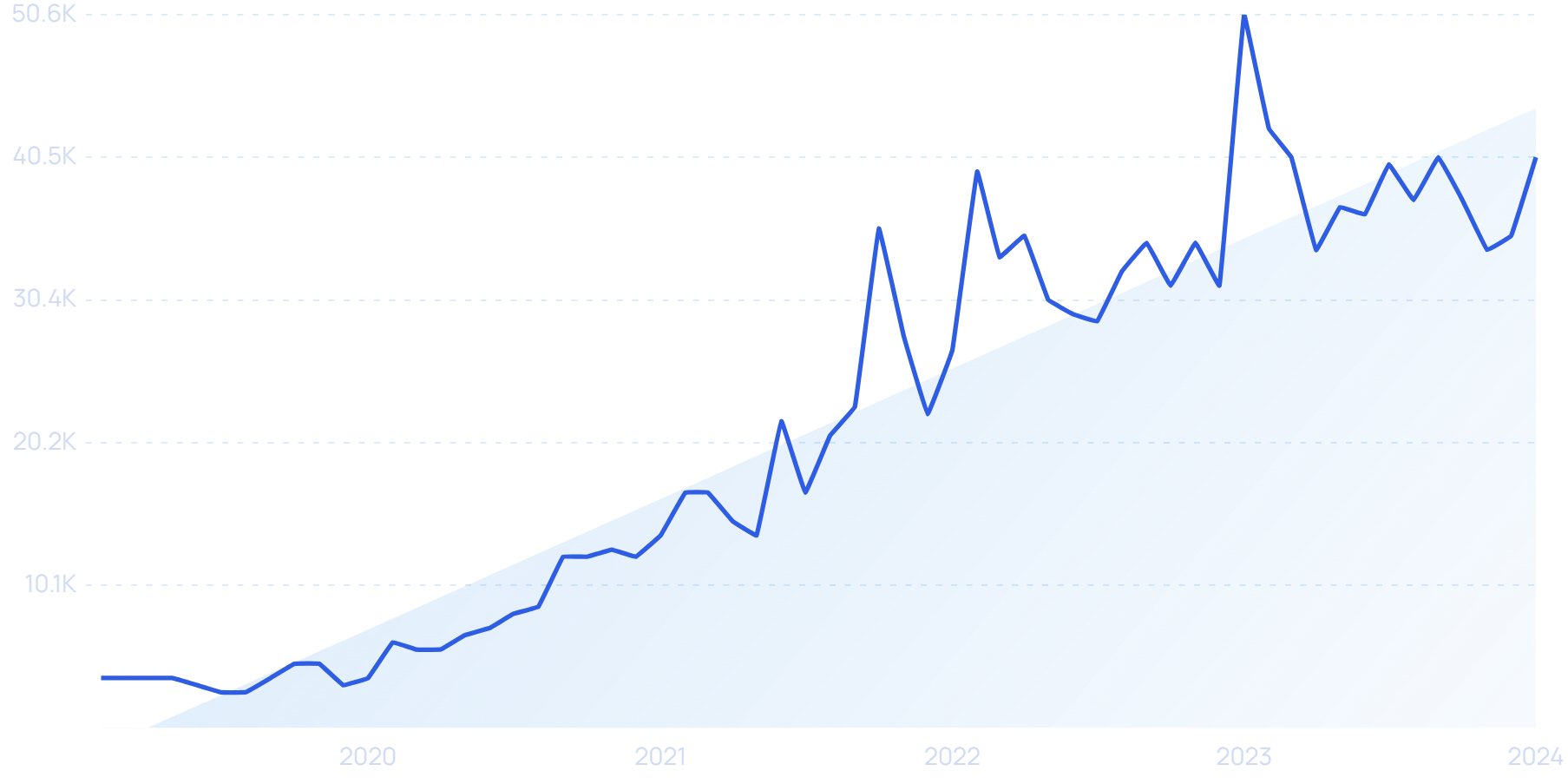

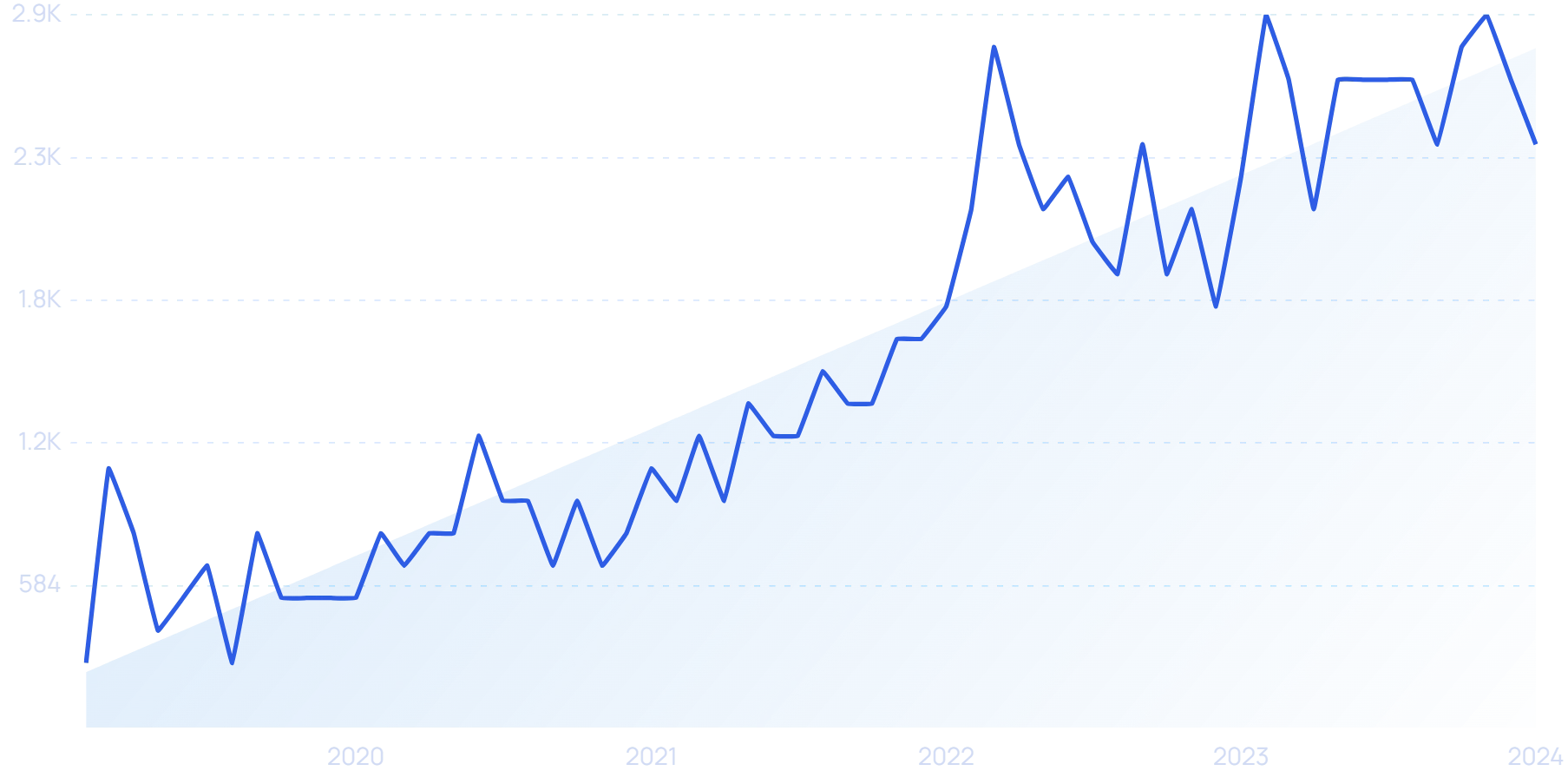

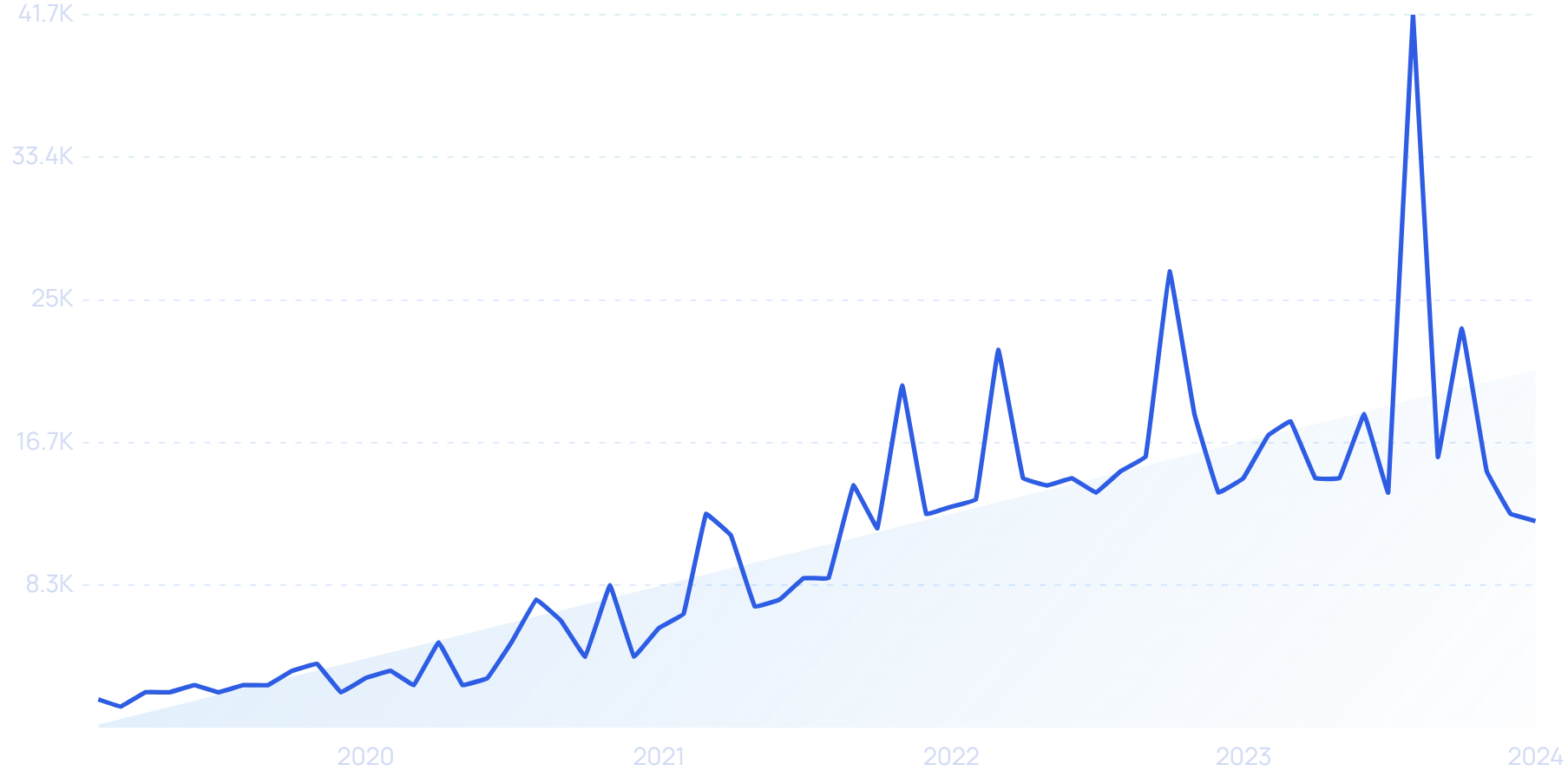

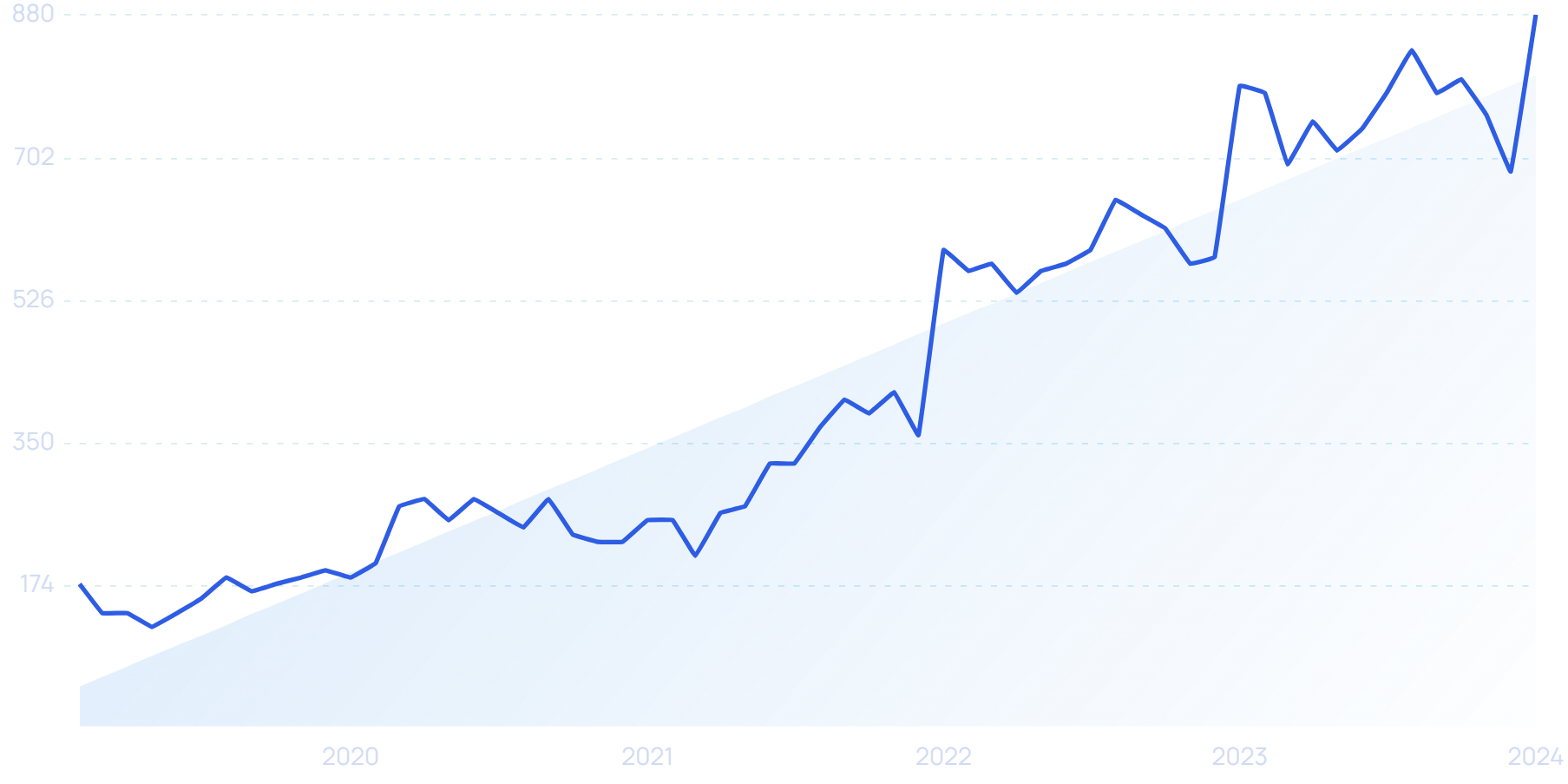

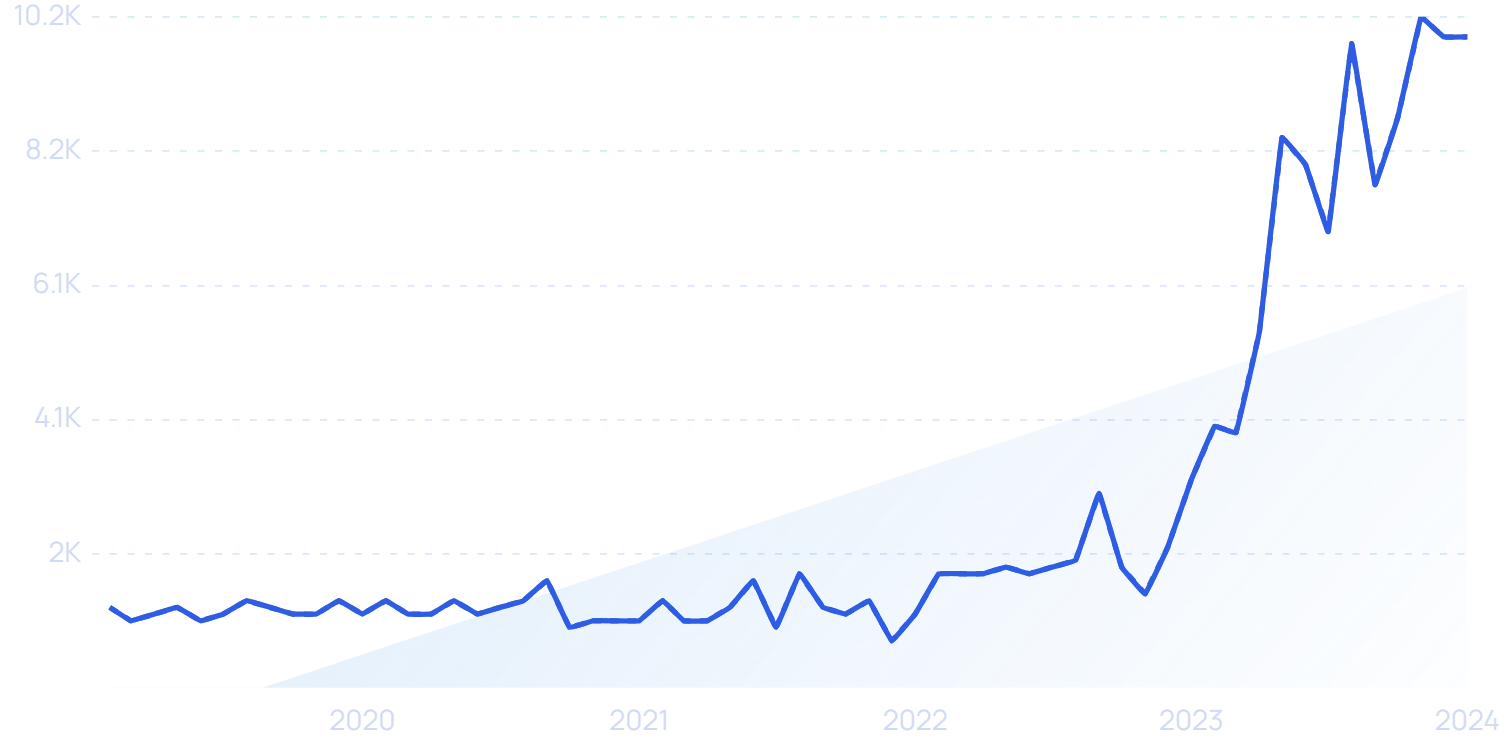

Search interest in “green hydrogen” is up more than 1,500% in the past five years.

That’s mainly due to its ability to be a totally clean form of energy. Only heat and electricity are released when hydrogen and oxygen combine in a fuel cell. There’s no CO2.

But hydrogen doesn’t freely exist in nature, so new technologies are needed in order to produce it in an environmentally friendly manner.

Currently, “gray hydrogen” is the most commonly produced form of hydrogen. It’s derived from natural gas and releases greenhouse gasses during processing.

There’s also “blue hydrogen,” which uses the same process but also utilizes carbon capture and storage technology.

But the ideal form of hydrogen is “green hydrogen.”

Green hydrogen is created when clean electricity is used to power electrolysis—a reaction that splits water into hydrogen and oxygen.

Search interest in “alkaline water electrolysis,” a key method for hydrogen production, has increased nearly 400% in the past five years.

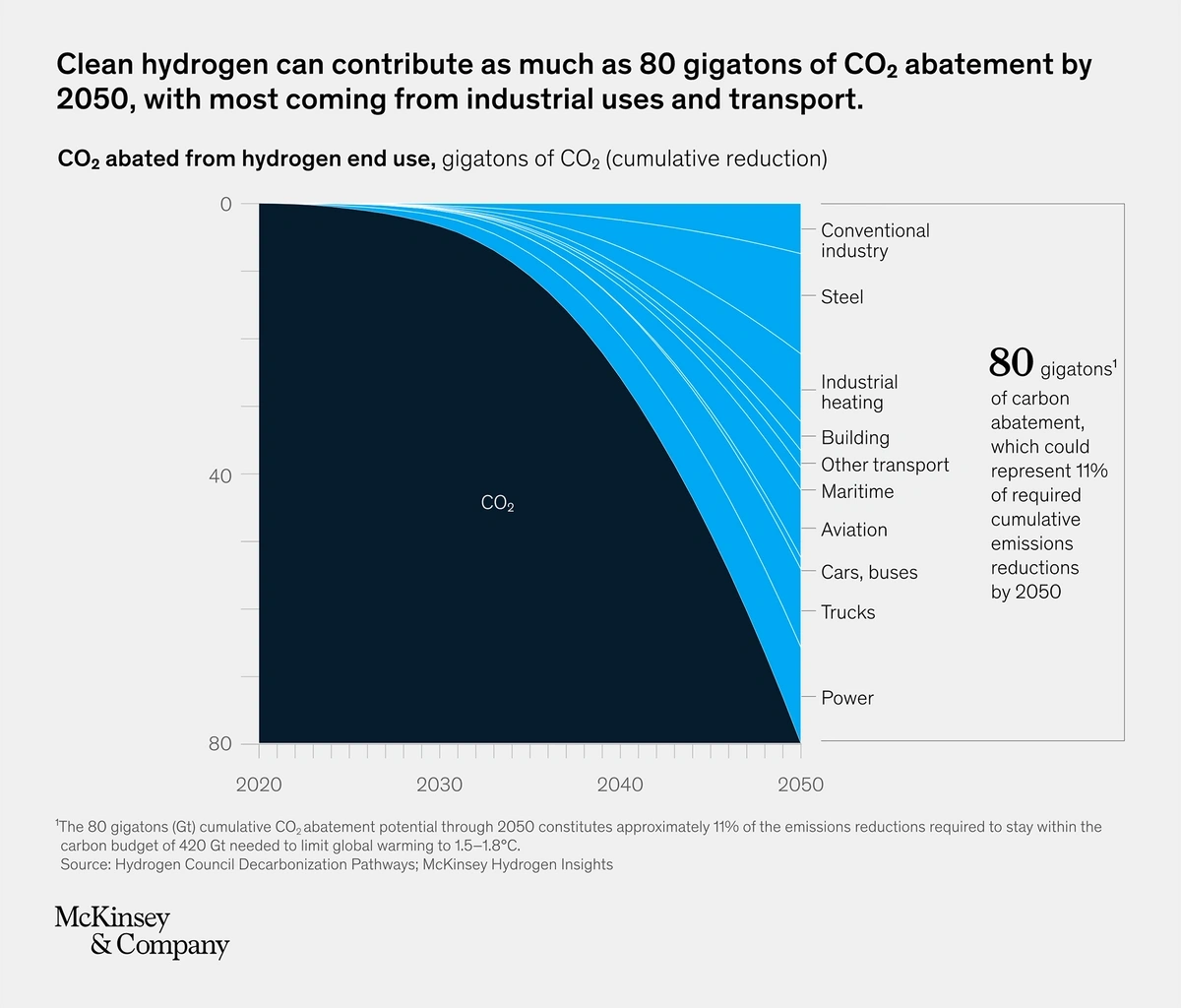

McKinsey reports that the use of green hydrogen has the potential to cut global emissions by one-fifth by the year 2050.

Green hydrogen is most impactful in the industrial and transportation sectors.

The United States government is pushing the private sector to scale up green hydrogen operations.

In October 2023, President Biden announced a $7 billion program that aims to establish seven hydrogen hubs throughout the country.

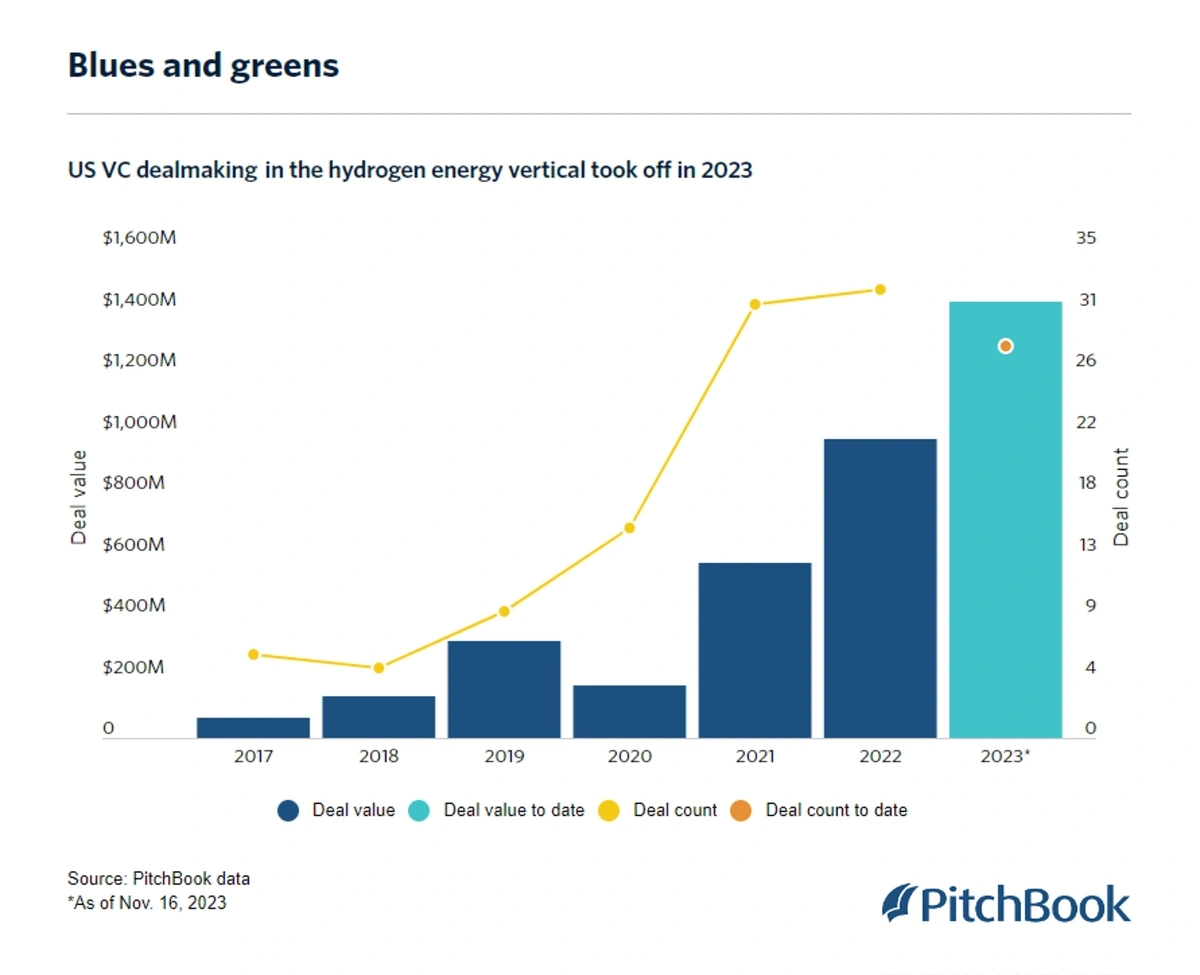

VC investment in hydrogen companies has also reached all-time highs.

In 2023, U.S.-based hydrogen companies closed 28 VC deals worth a total of $1.4 billion. Total investment in 2022 was just $973.8 million.

VC investment in hydrogen energy is growing.

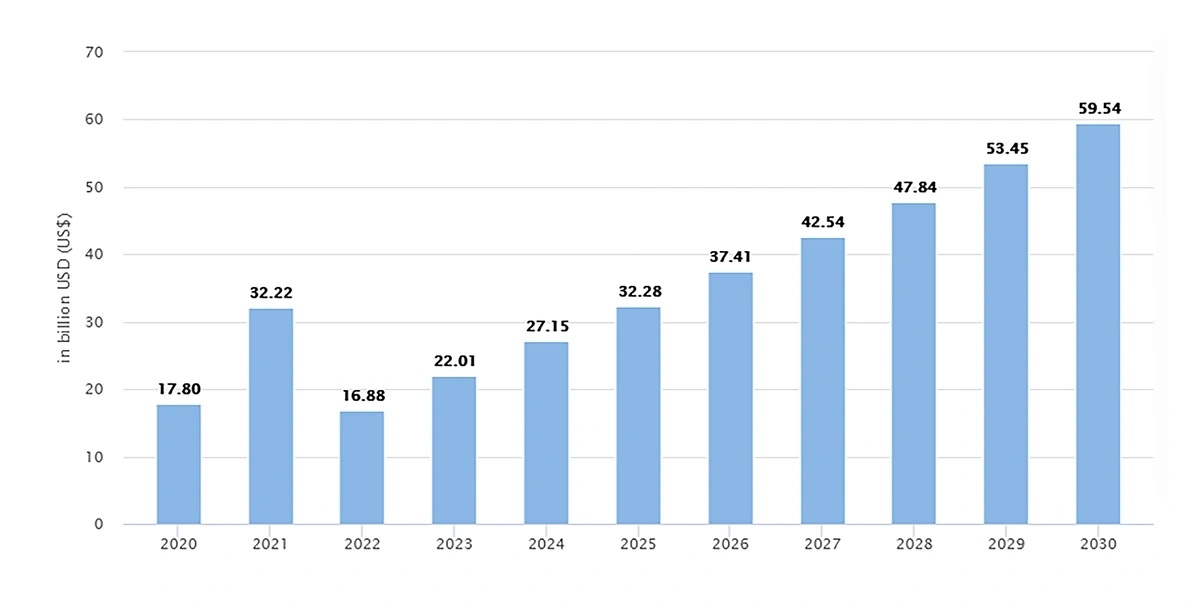

Reports predict the green hydrogen market to grow at a CAGR of nearly 40% through 2030 to land at $60.56 billion.

In 2023, more than 1,300 patents related to green hydrogen tech were issued, a signal that the market is set to expand in the coming years.

Trending Topics to Explore

- Lhyfe: A European-based company building production sites for green and renewable hydrogen.

- GTI Energy: A company focused on energy transition solutions, including research, development, and production of low-carbon and renewable hydrogen.

- Advent Technologies: Manufacturer of ht-pem (high-temperature proton exchange membrane) fuel cells, which are critical to the de-carbonization of heavy-duty vehicles.

2. Pet Care

Consumer spending on pet care-related products has skyrocketed over the past several years, making it an interesting category for investors.

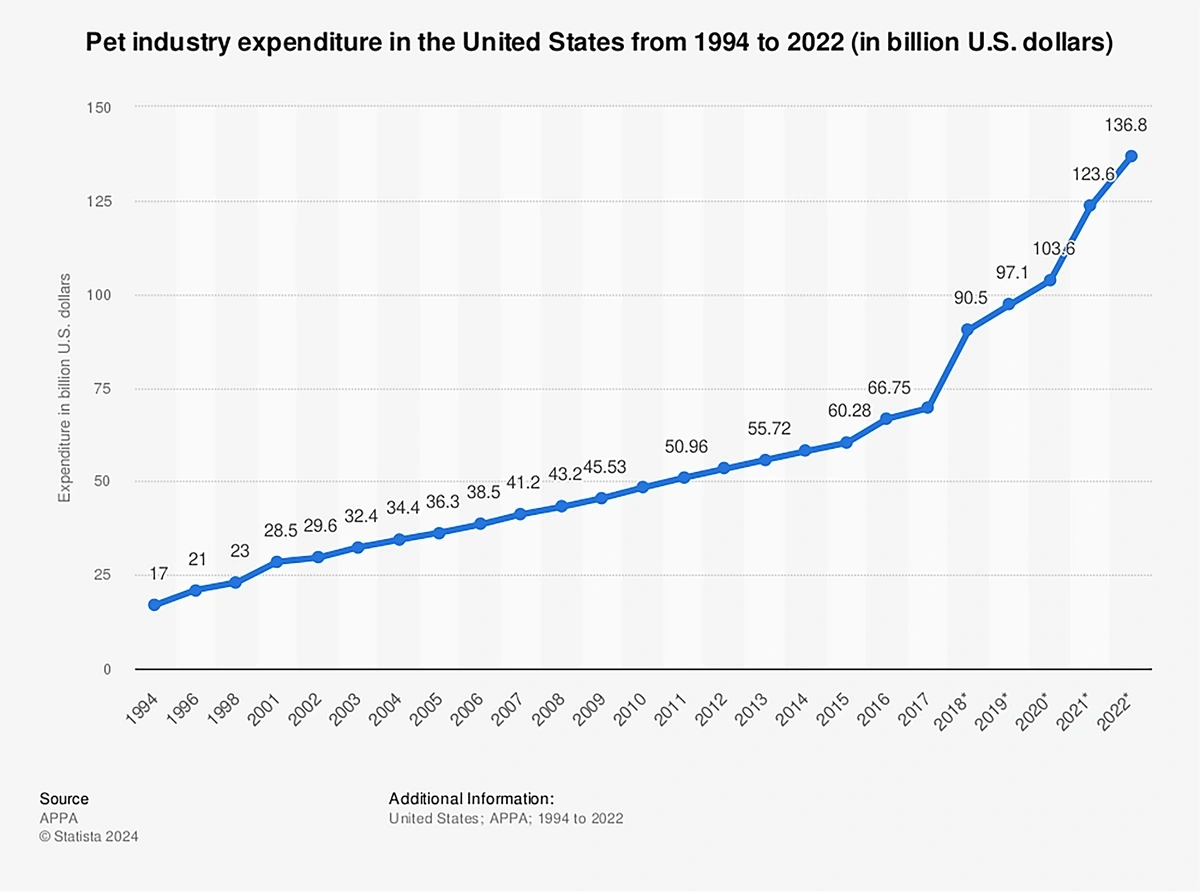

In fact, between 2013 and 2021 pet expenditures increased nearly 80%.

In 2022, total consumer expenditures on pets surpassed $136 billion.

During the pandemic, nearly 1 in 5 households in the U.S. adopted a dog or cat. That’s 23 million households.

More than 90% of dogs and 87% of cats are still in their homes today.

In total, 66% of American households had one or more pets in 2023.

And those households are spending big to keep their pets happy. Annual expenditures in 2022 in the U.S. topped $21.4 billion on nonmedical pet products and another $28.4 billion on dog food.

Consumer spending on pet care is growing rapidly.

A few rising niches in the pet industry include pet supplements, insurance, luxury toys, and premium food.

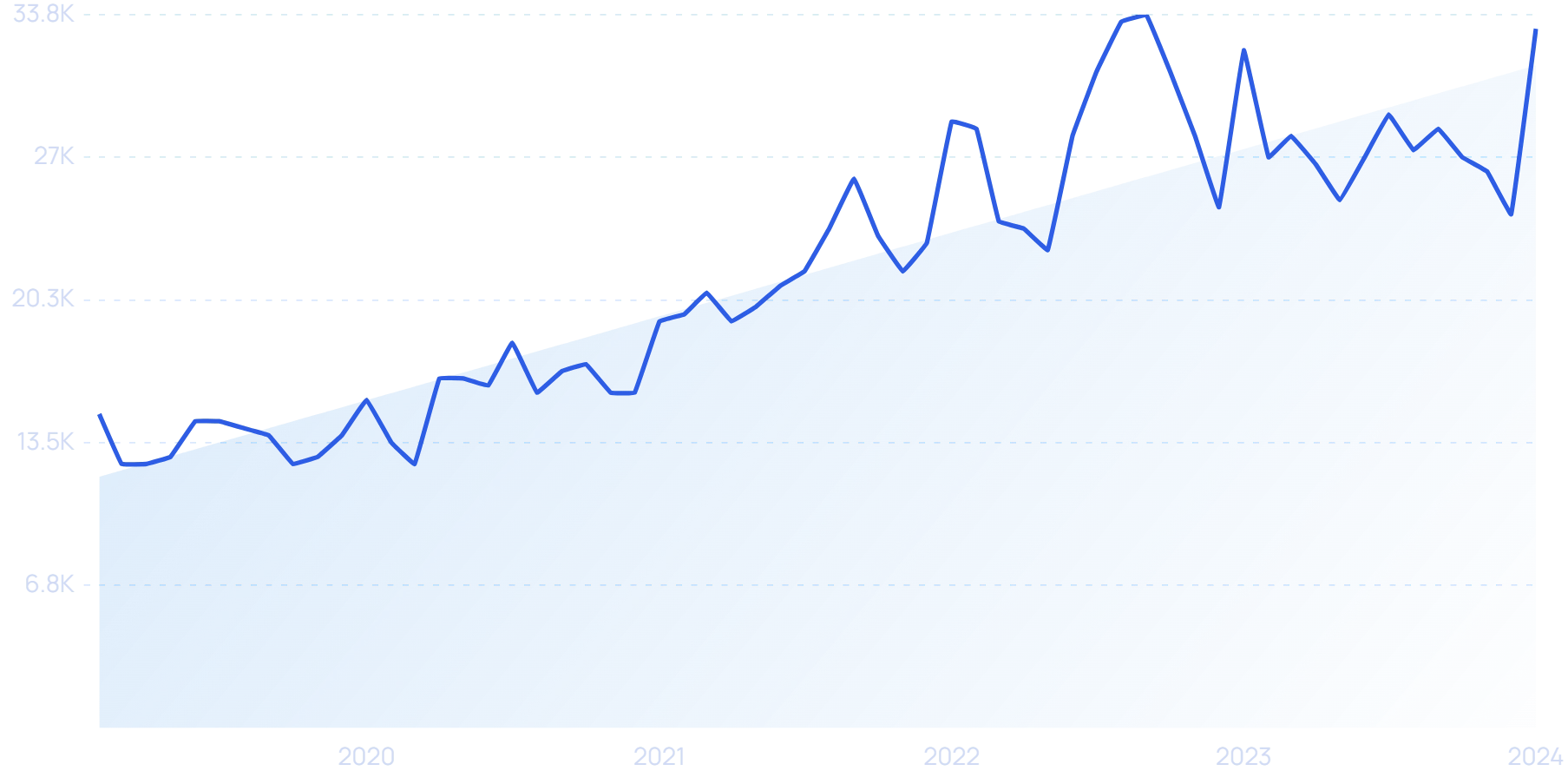

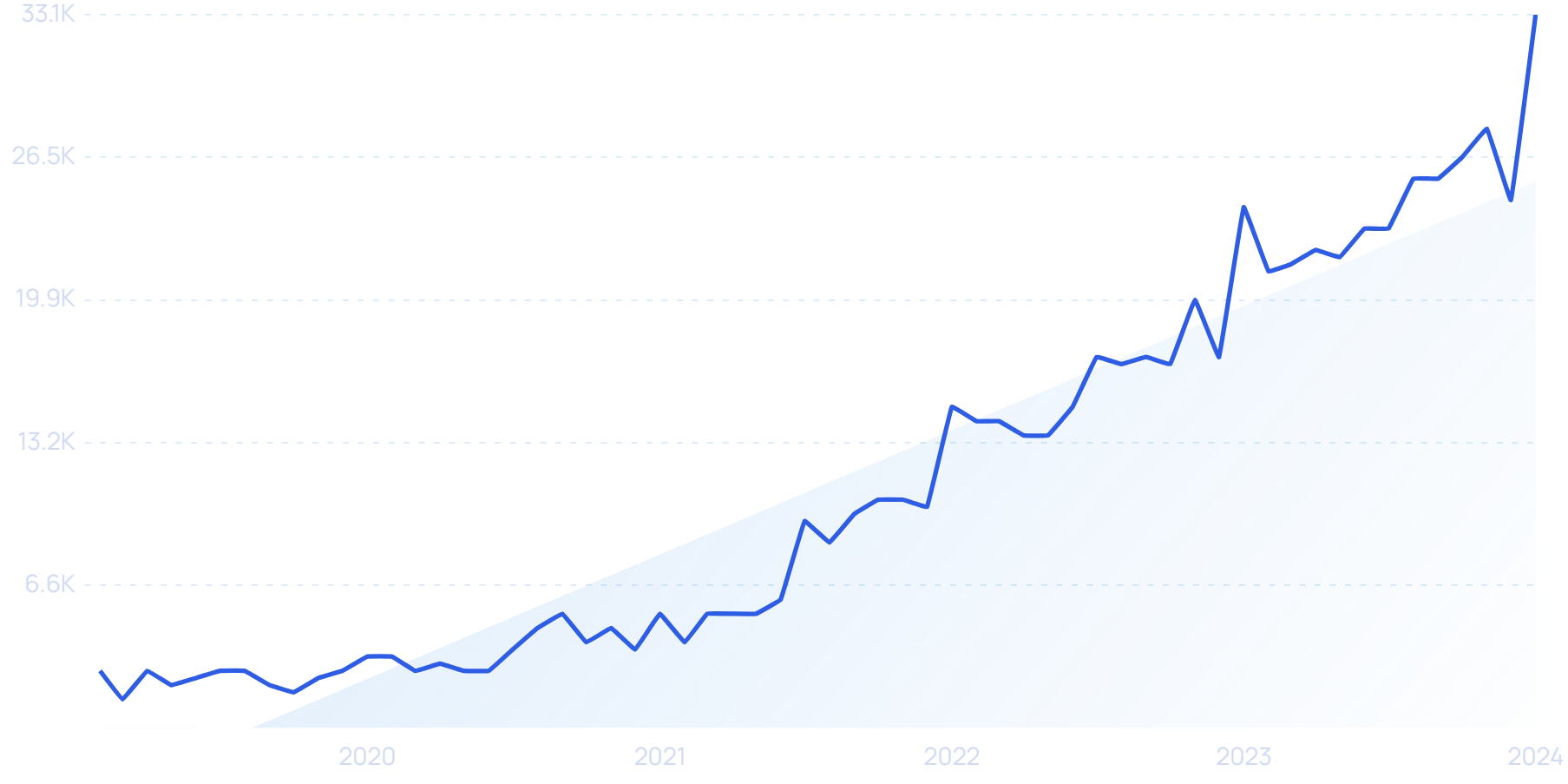

For example, Google Search volume for “dog probiotics” is seeing growth.

Search volume for “dog probiotics” is up more than 100% in recent years.

Pet tech is a rapidly expanding area of this market as well.

For example, owners can program automatic feeders to provide specific amounts of food for pets at certain times of the day.

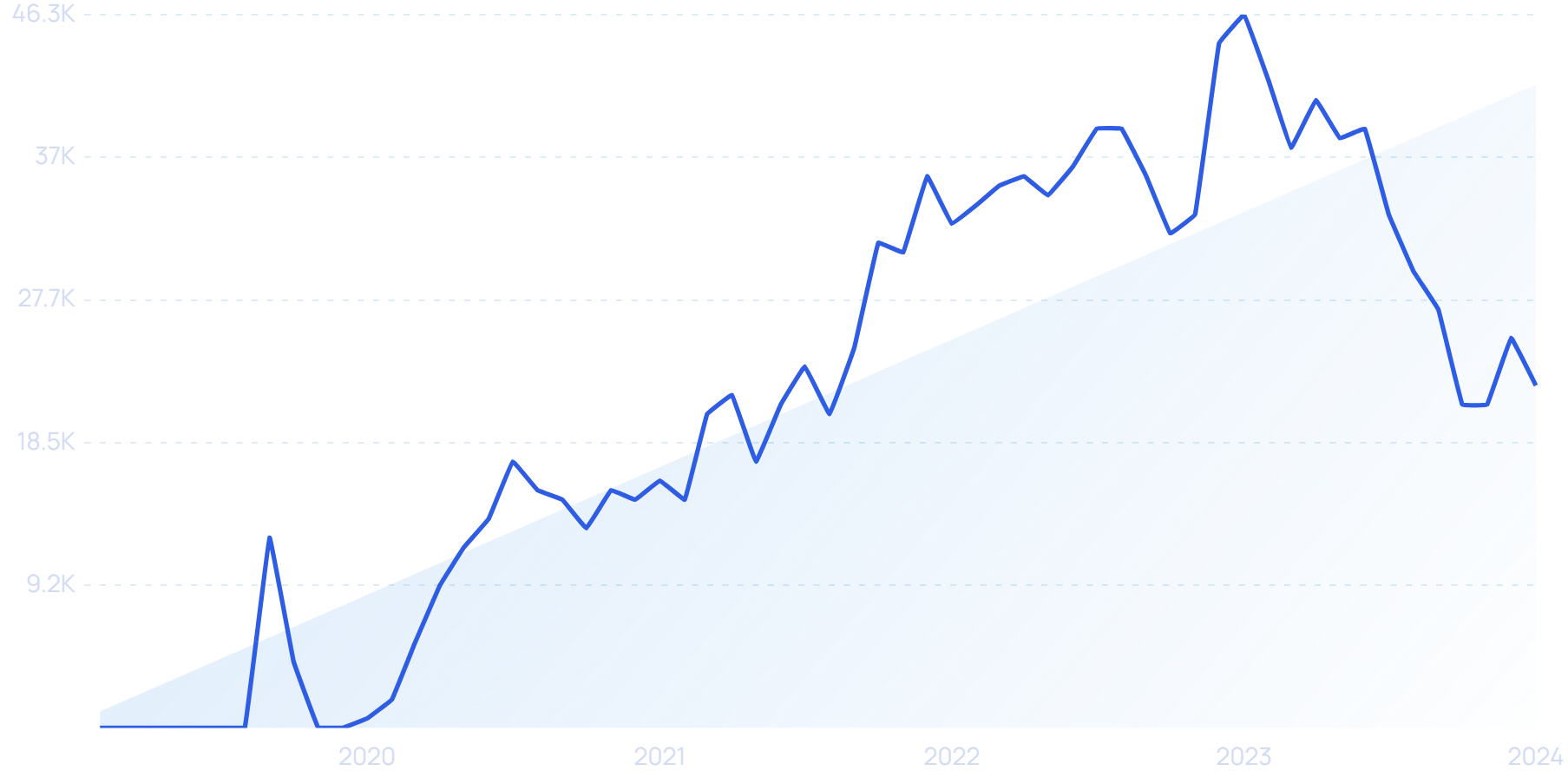

Search volume for “automatic dog feeder” has grown nearly 5,000% in recent years.

Several companies have already capitalized on these new pet care trends with great success.

For example, Halo Collar created a smart dog collar that enables GPS fencing wherever they go. The company’s revenue in 2020 totaled $3 million and revenue had grown to $50 million by 2022.

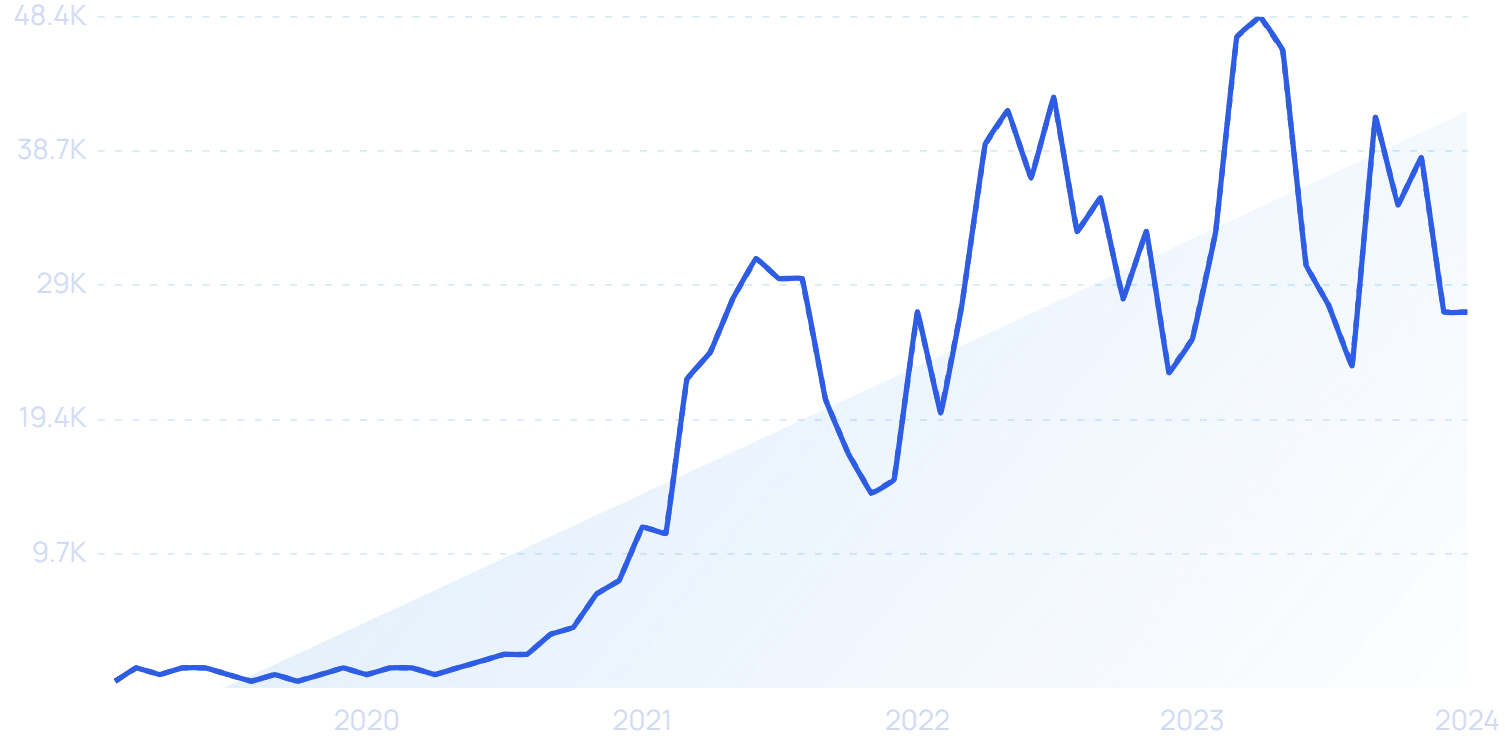

Google Search volume for the brand continues to steadily trend upward.

Search volume for “Halo Collar” has climbed more than 1,700% since 2020.

Venture capitalists are also betting on the pet industry.

In September 2023, Butternut Box set a new record for the largest pet tech VC funding round by raising $351 million.

Trending Topics to Explore

- Badlands Ranch: A pet food company started by actress Katherine Heigl. Their food is air dried in order to retain nutrients.

- Vetster: A company providing pet telehealth services.

- Furbo: A pet tech company that builds interactive cameras for dogs and cats.

3. Cybersecurity

The number of cyber attacks reached all-time highs in 2023.

In the second quarter of the year, organizations faced an average of 1,258 potential attacks per week.

The number of data breaches increased at least 20% between 2022 and 2023.

Ransomware was especially prevalent, posting a 70% increase between 2022 and 2023.

With these drastic increases in mind, Cybersecurity Ventures predicts cybercrime costs across the globe could grow to $10.5 trillion by 2025.

Likewise, the cybersecurity market is growing.

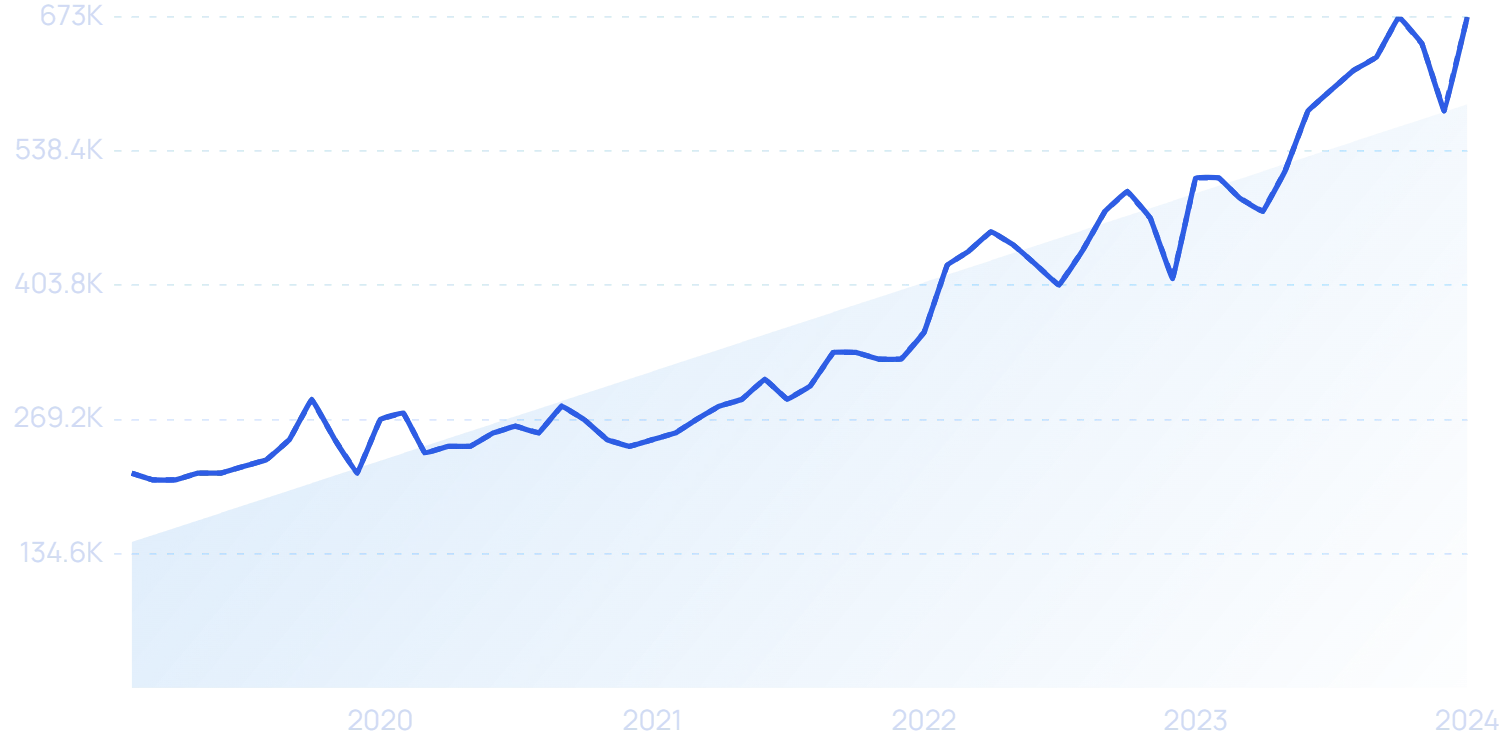

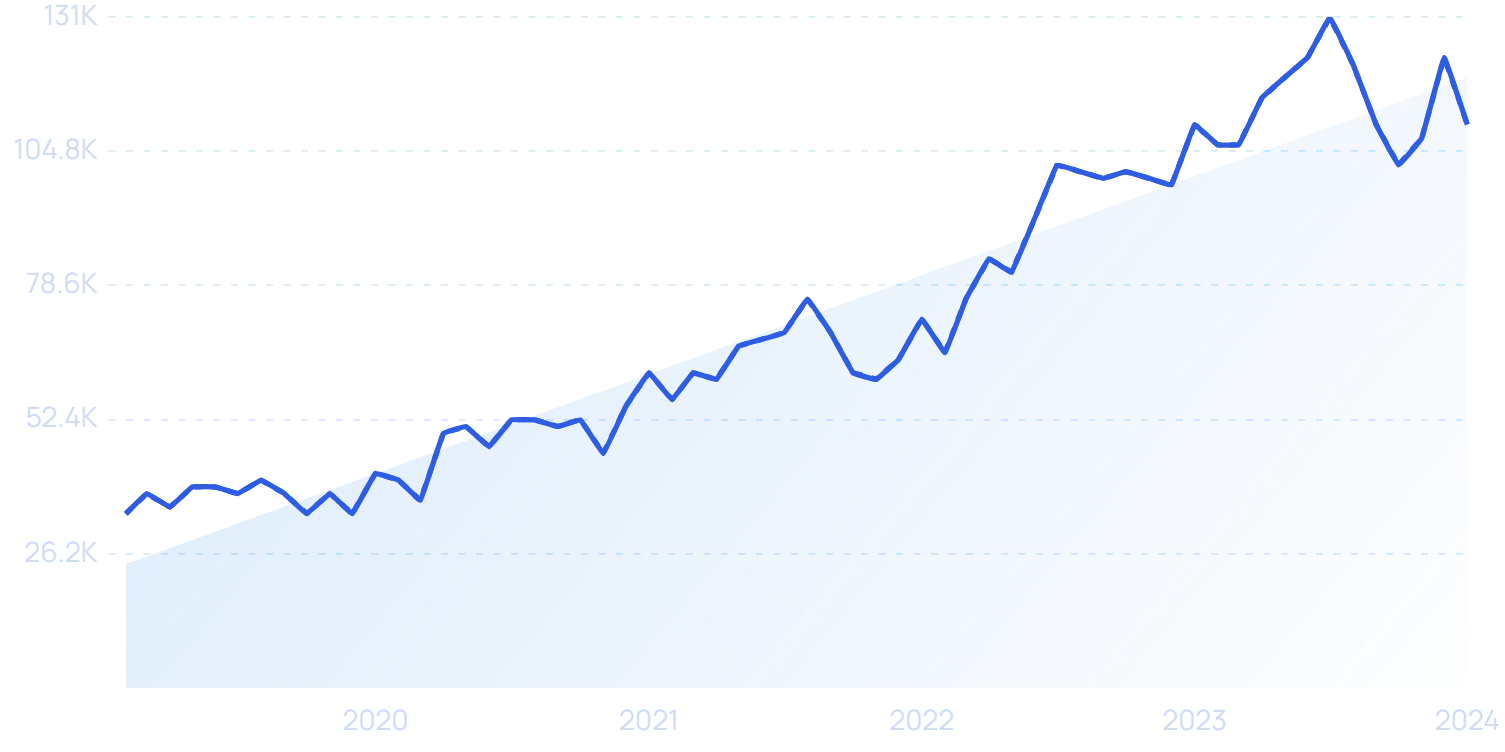

Search interest in “cybersecurity” is up nearly 200% in the past five years.

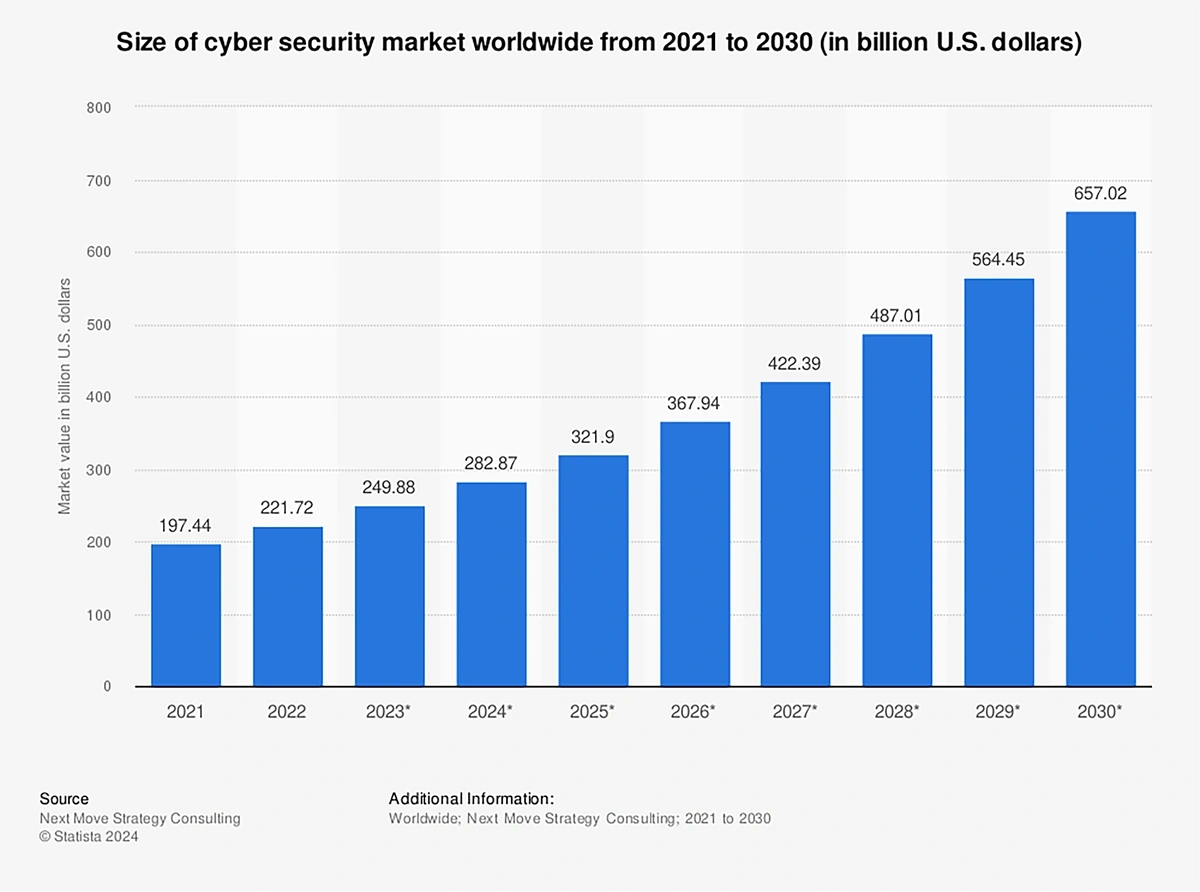

Valued at nearly $250 billion in 2023, the market is set to surpass $657 billion by 2030.

The global cybersecurity market is growing rapidly.

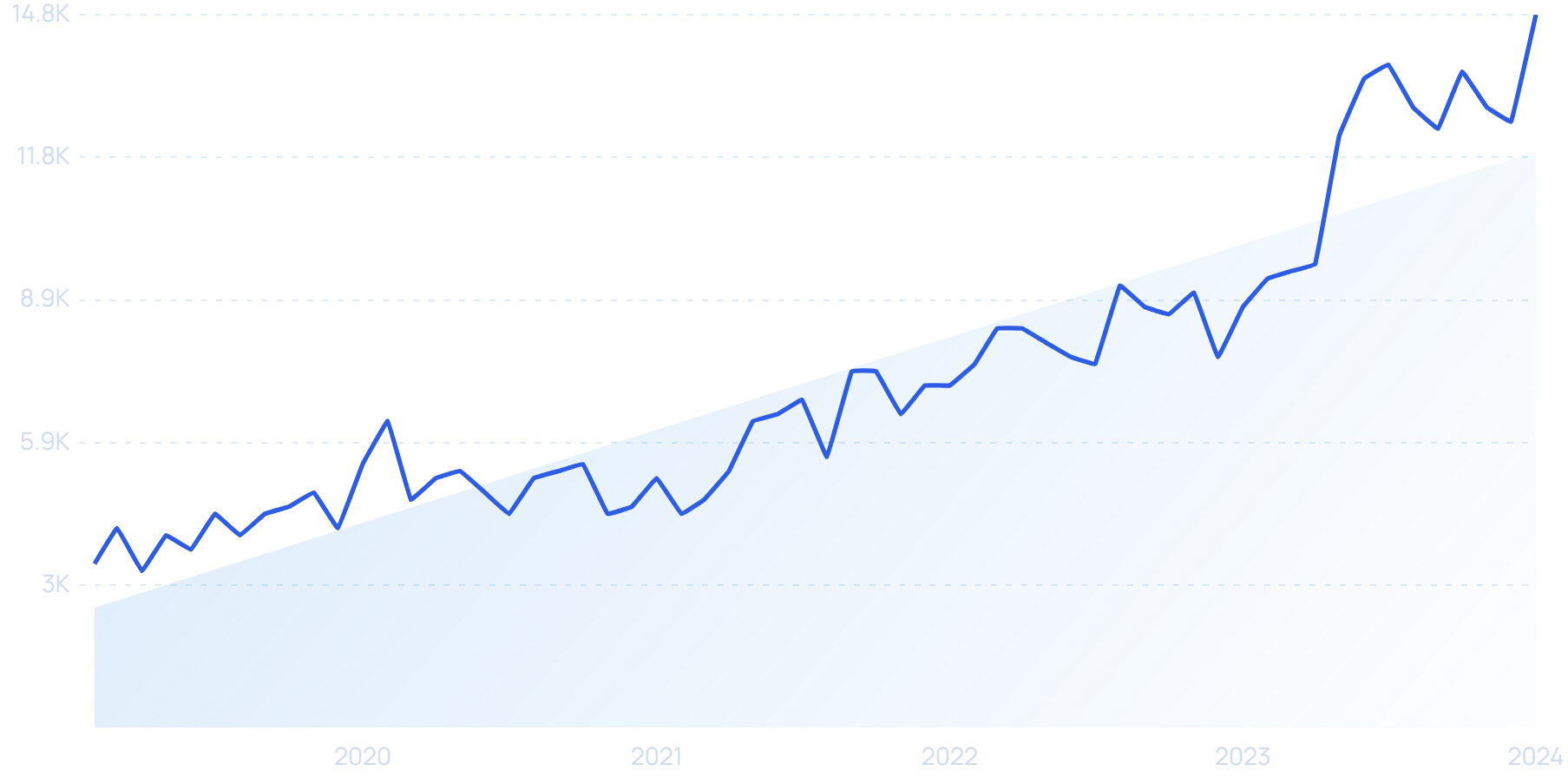

Keywords like "cybersecurity training" and "cybersecurity jobs" have also experienced search volume growth, suggesting this is a top pain point for organizations.

Search volume for “cybersecurity training” is up nearly 250% in recent years.

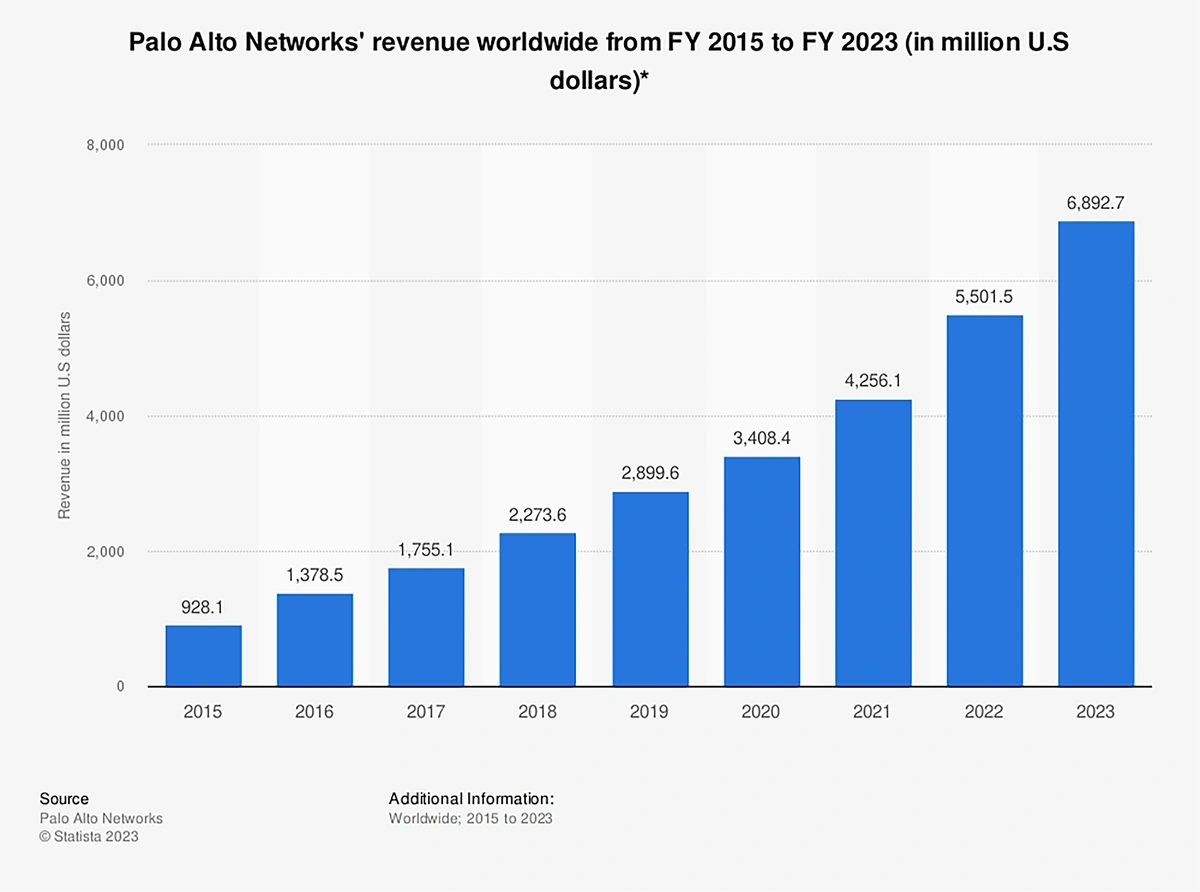

Revenue growth trends from industry giants also suggest that organizations are continuing to emphasize cybersecurity.

Revenue for leading cybersecurity provider Palo Alto Networks grew 25% year-over-year in fiscal year 2023 and landed at a total of $6.89 billion.

That’s compared to $5.5 billion in 2022 and $4.25 billion in 2021.

Palo Alto Networks is rapidly increasing revenue.

Trending Topics to Explore

- SentinelOne: A cybersecurity firm based in California that specializes in autonomous AI endpoint security.

- OneTrust: A security provider that offers a trust platform to ensure data privacy and compliance with regulations.

- Hoxhunt: An enterprise security company providing a Human Risk Management Platform to train users to avoid phishing and other threats.

4. FemTech

Since the term was coined in 2016, the femtech market—products, wearables, services, and other technology solutions that specifically address the healthcare needs of women—has been growing.

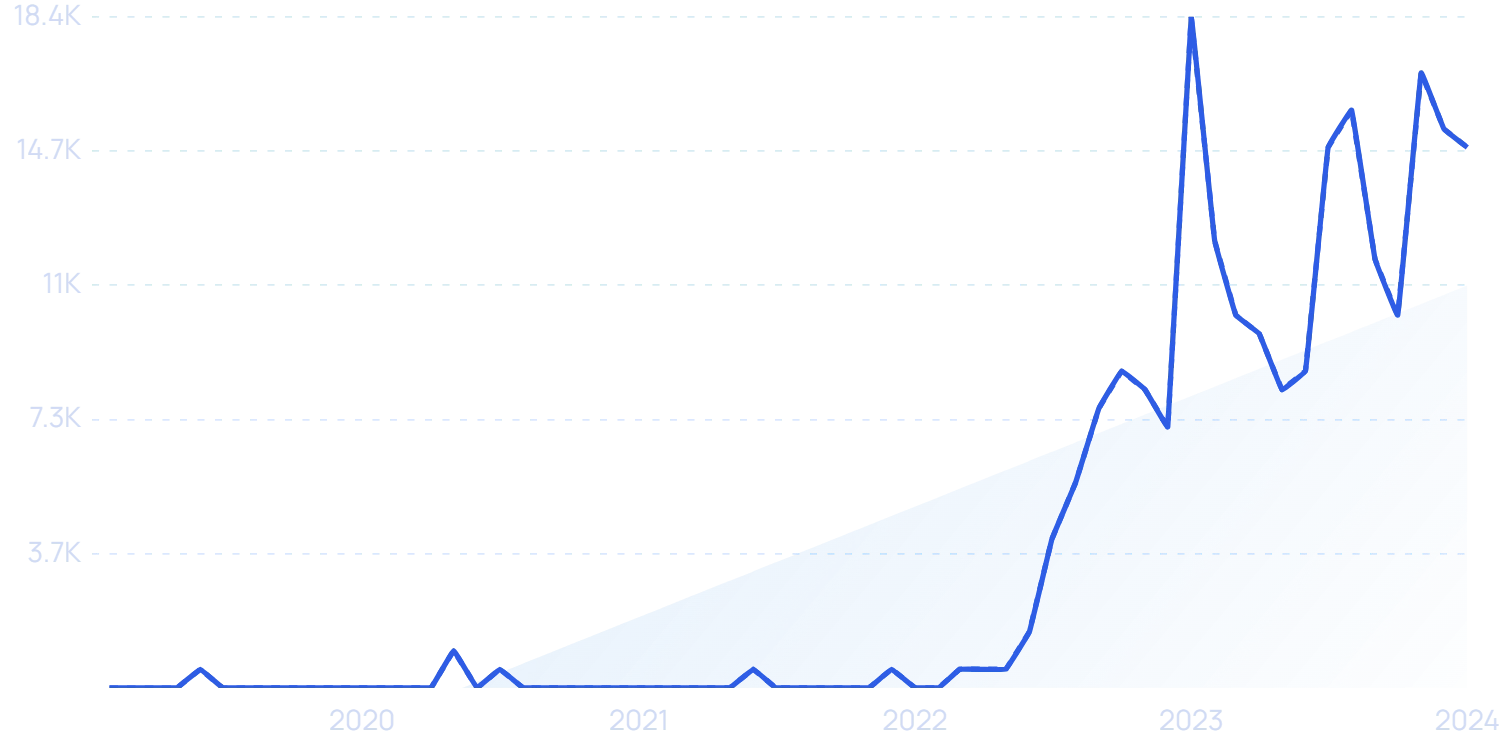

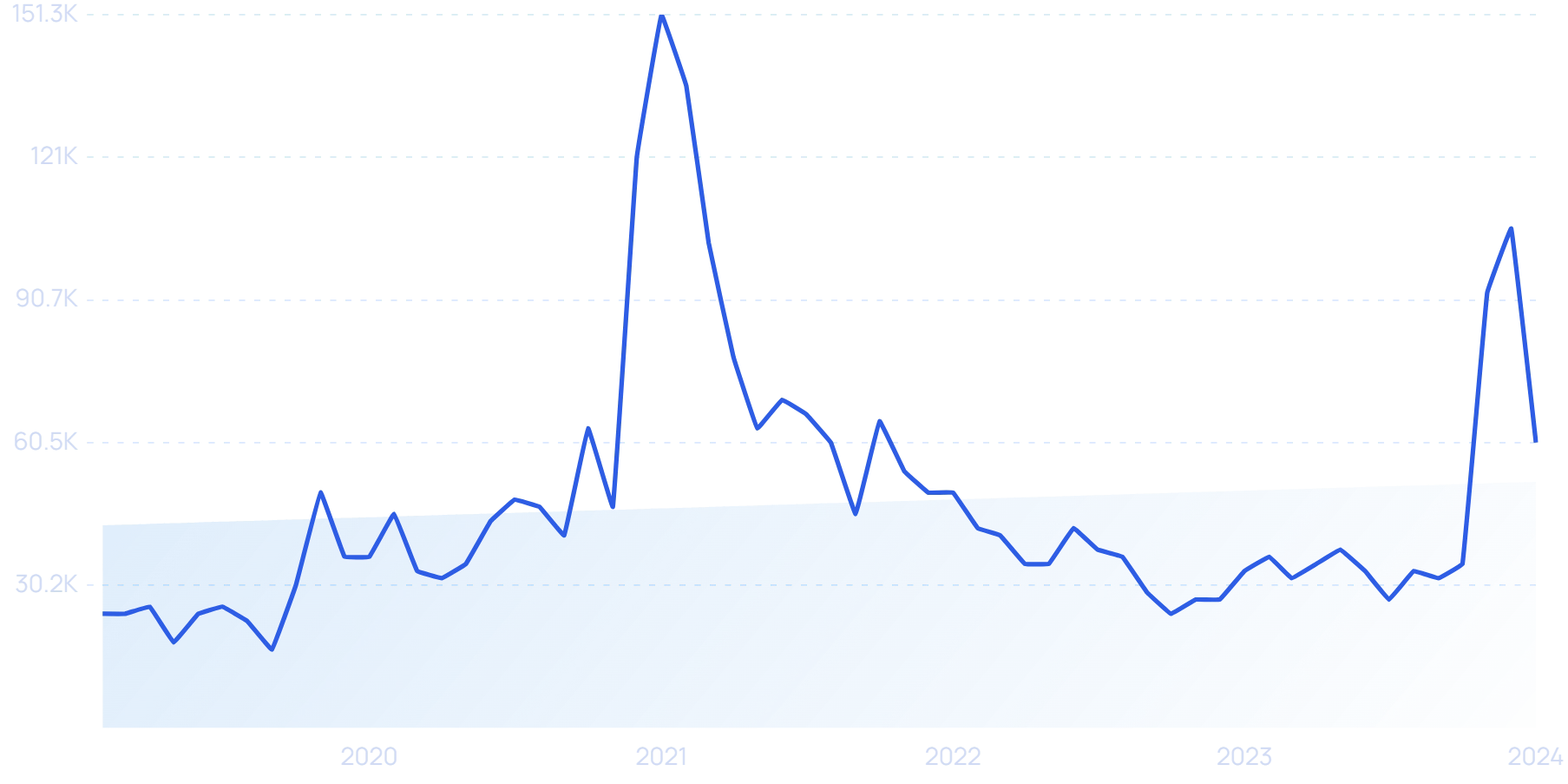

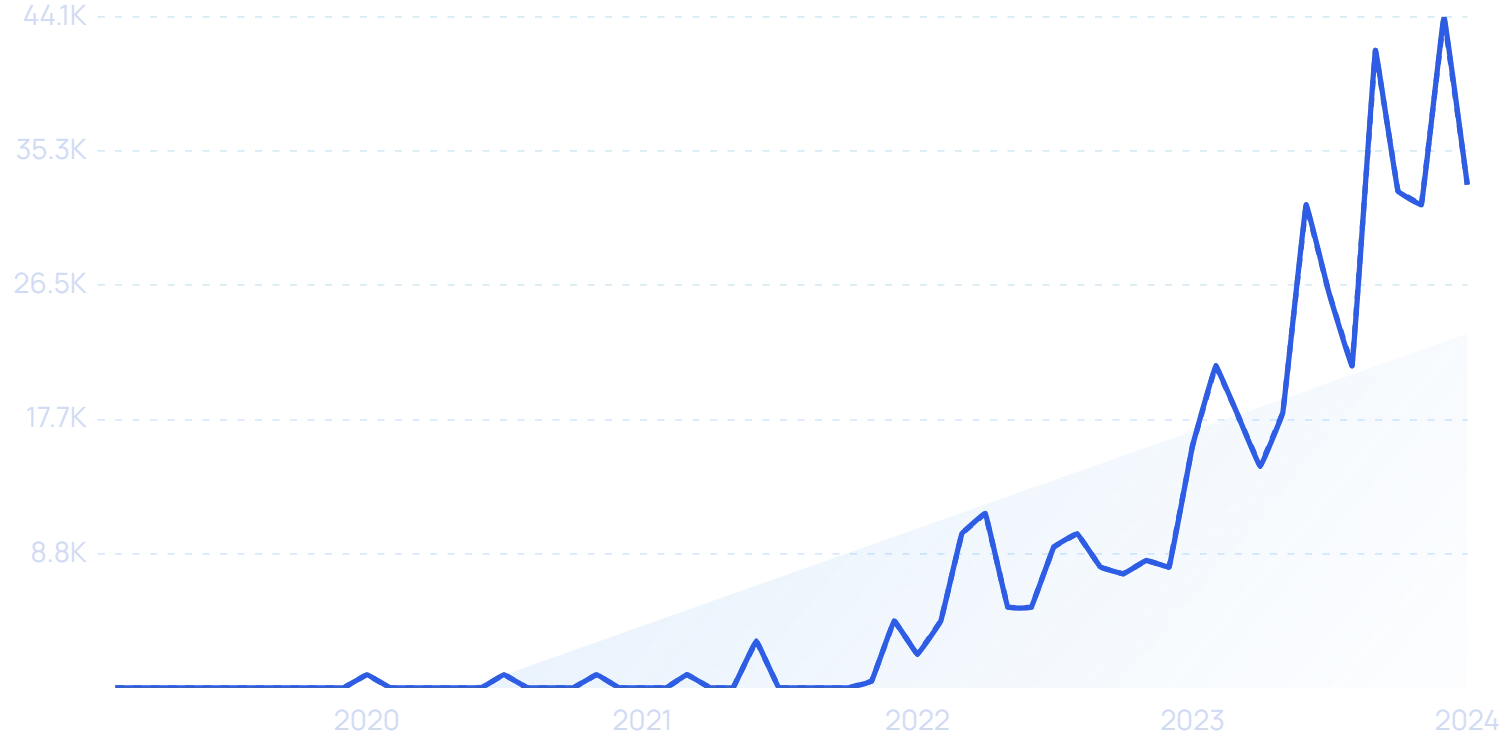

Search interest in “femtech” is up 700% since 2020.

The market is currently valued at $7.48 billion and is predicted to climb as high as $14.67 billion in the next five years.

In addition, the number of femtech startups is surging.

There’s been a 1,000% increase in the number of femtech organizations since 2012.

The maternal health segment is the largest with 162 companies globally.

There are also 151 companies focused on menstrual health and 136 focused on fertility.

Search volume for femtech products and services continues to climb.

For example, Google Search volume for “wearable breast pumps” shows steady growth.

Search interest in “wearable breast pump” has jumped more than 1,000% since 2020.

Market analysts suggest the market for wearable breast pumps could reach more than $1 billion by 2032.

And, there’s been plenty of VC money pouring into this segment.

Annabella, a breast pump tech company, raised $8.5 million in seed funding in early 2024.

Pain relief devices designed to be worn during menstruation is also a growing segment.

Search interest in “period pain relief” is growing.

One femtech company called Myoovi has developed a wearable TENS device that sends small electrical pulses into the body, which interrupt the body’s pain signals. The device is discrete and can be worn under clothing.

Search volume for “Myoovi” has grown nearly 9,000% in recent years.

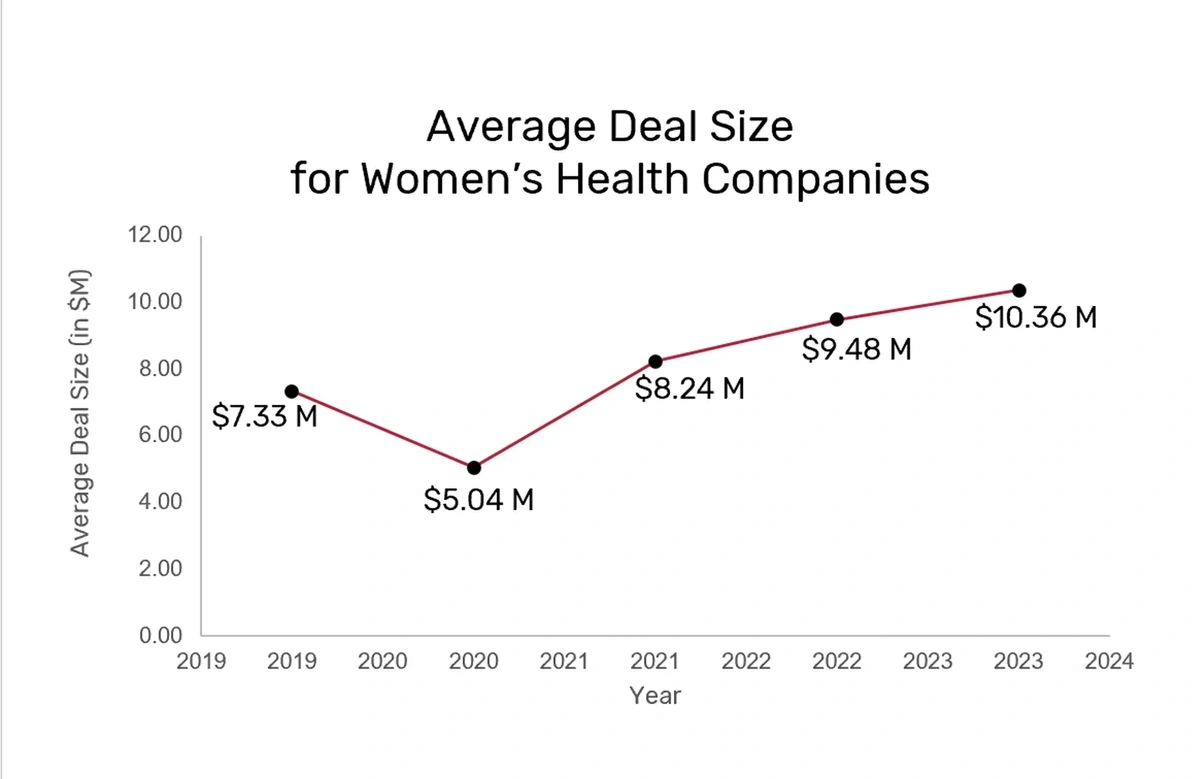

Overall, investment in women’s health companies has grown 350% over the past three years.

In 2023, total VC funding in femtech reached $1.14 billion across 120 deals.

In the same year, the average deal size increased to an all-time high of $10.36 million.

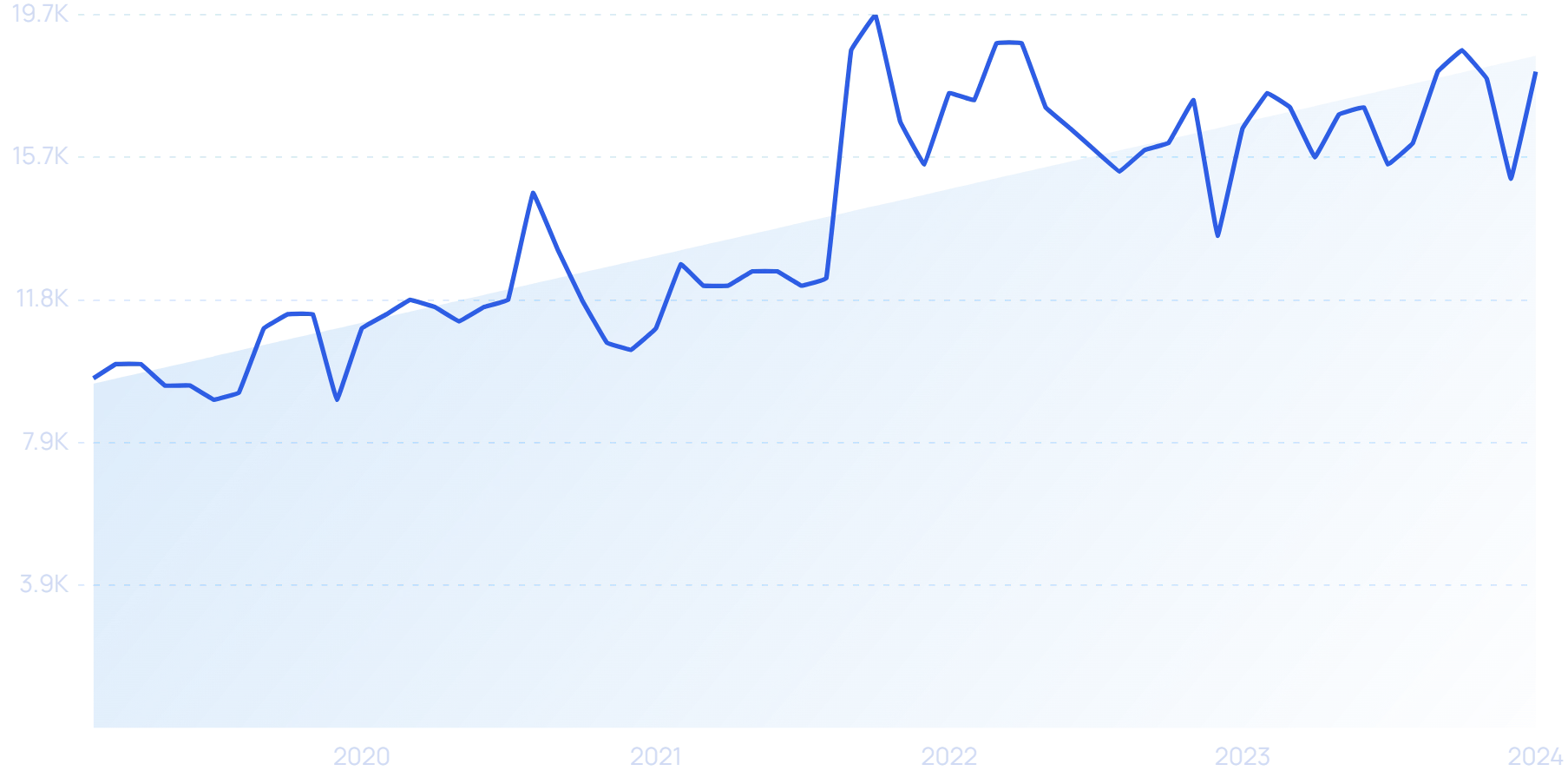

The average deal size for femtech companies has been growing since 2020.

Trending Topics to Explore

- Midi Health: A virtual platform offering healthcare to women going through perimenopause and menopause.

- Evvy: A precision healthcare company that provides kits for at-home testing of vaginal microbiome and delivers a comprehensive report with personalized insights.

- Oura: Tech company that sells a wearable ring that tracks a woman’s cycle by monitoring her temperature and syncing with Natural Cycles, the first FDA-approved birth control app.

5. Gene Therapy

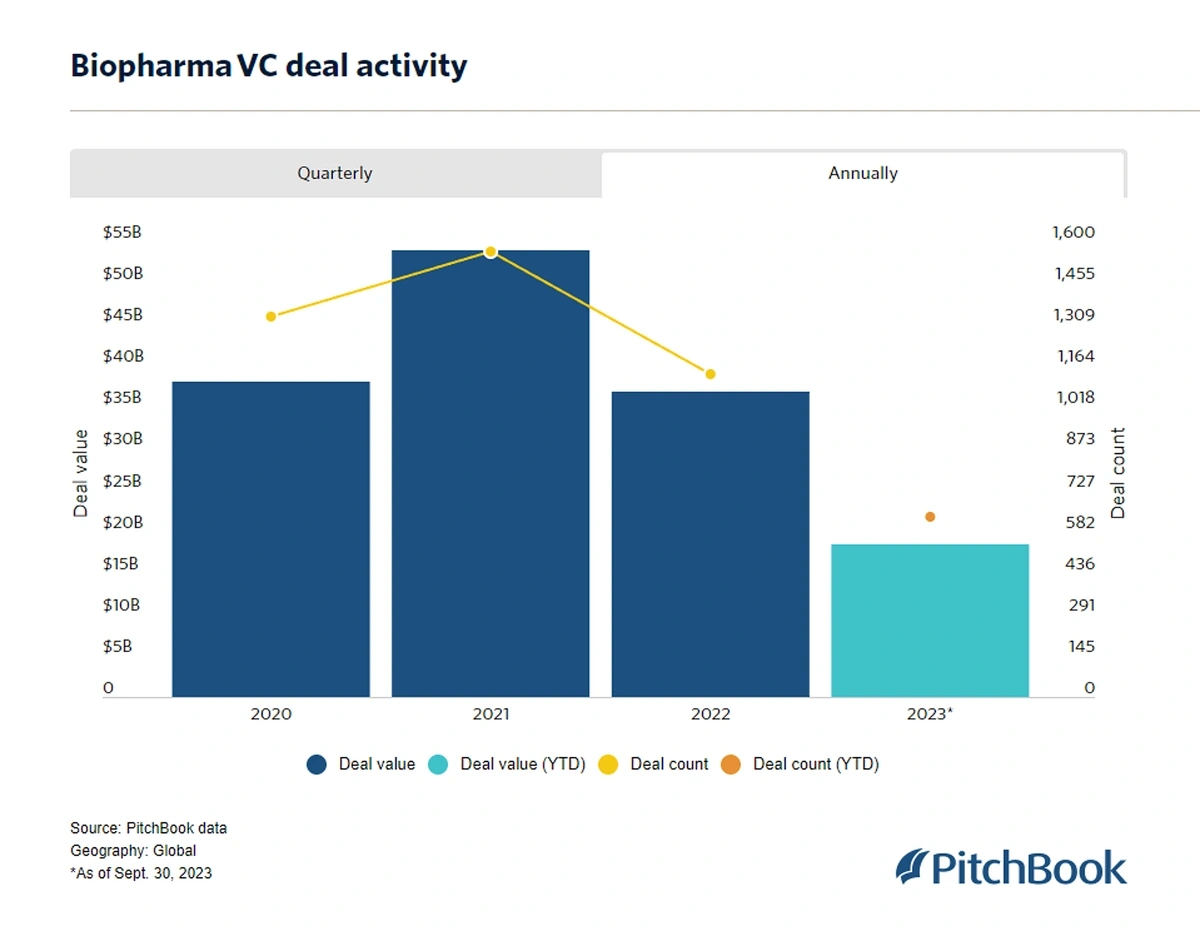

Despite the cooling of the biopharma market in recent years, there were 634 VC deals in the sector through the first three quarters of 2023. Total funding amounted to $18.5 billion.

Biopharma investors are looking for fewer but larger deals.

Industry experts say growth in the sector is undergoing a strategic shift: investors are looking for fewer deals of larger value.

That’s where the cell and gene therapy segment comes into play.

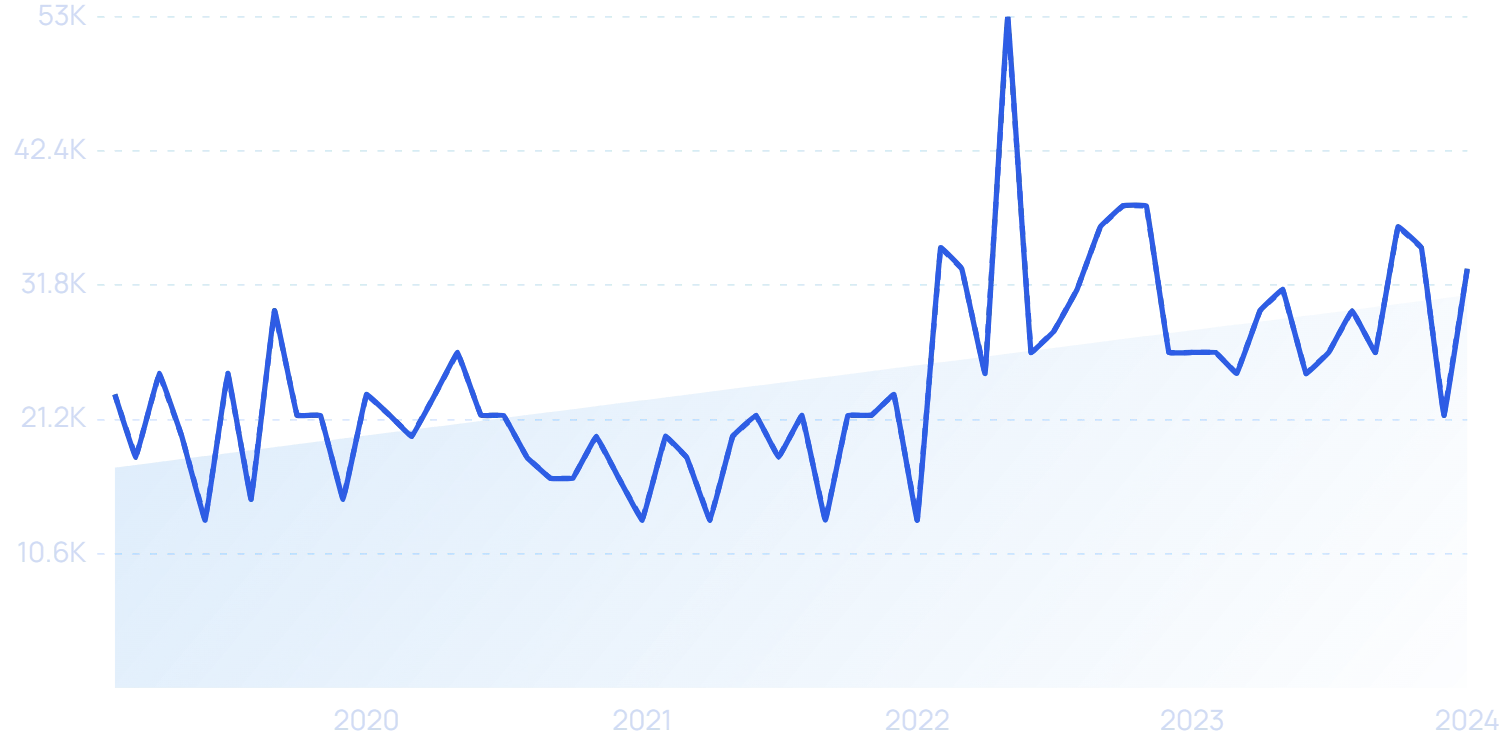

Consumer search trend data shows a nearly 300% increase in interest in “cell and gene therapy” in the past 10 years.

Gene therapies are able to replace a defective gene with a fully functioning, healthy gene. In many cases, this therapy is successful in just one treatment.

However, the technology and research to develop the treatments, and thereby the costs for treatments, are incredibly expensive.

For example, a gene therapy for spinal muscular atrophy, called Zolgensma, costs patients more than $2 million.

This means big money in revenue for the pharmaceutical companies, as well. Each gene therapy drug could net as much as $1 billion in annual profit, according to some reports.

If that holds true, reports show the gene therapy market could surpass $82 billion in value by 2032.

There is plenty of room for growth at the moment.

Currently, the FDA has approved 34 cellular and gene therapy treatments but there are thousands more in clinical testing.

CRISPR Therapeutics is one pharmaceutical company that recently made big news in the gene therapy sector.

The company received FDA approval for a gene therapy drug to treat sickle-cell disease.

Search volume for “CRISPR Therapeutics” has jumped more than 350% in recent years.

Pharmaceutical giant Novartis has made notable acquisitions in this space in recent years and looks to continue on the same path in 2024.

In 2023, the company purchased a gene therapy candidate treatment from Avrobio for $87.5 million.

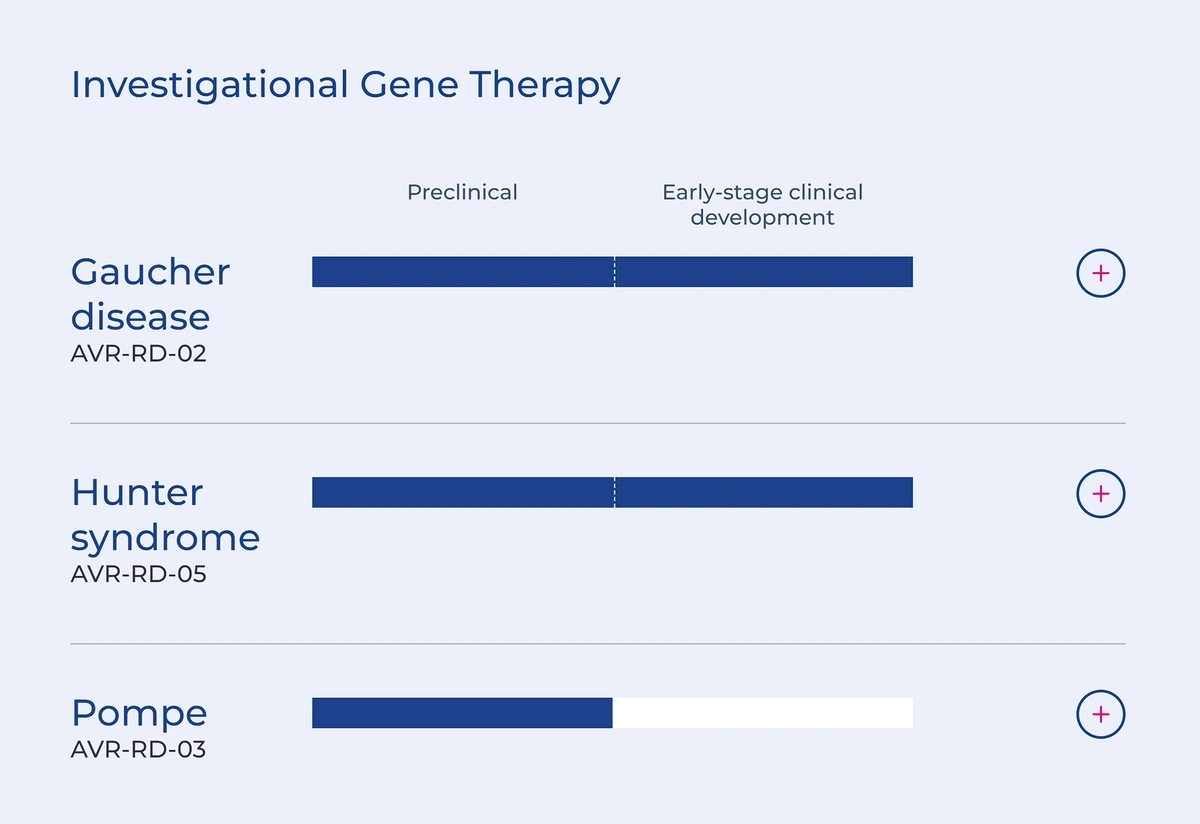

Avrobio’s gene therapy pipeline.

The company followed that with a $1.3-billion deal involving Voyager’s gene therapy candidates in early 2024.

In addition, AstraZeneca recently announced a $245 million partnership with gene therapy company Cellectis.

Cellectis currently has 25 gene therapy targets in the pipeline with 10 being actively explored.

Trending Topics to Explore

- Beam Therapeutics: A gene editing-focused pharmaceutical company with approximately $78 million in annual revenue.

- Caribou Biosciences: A biopharmaceutical company focused on developing gene therapy drugs to treat cancer.

- Krystal Biotech: A company that recently released the world’s first-ever topical gene therapy in an effort to treat a rare genetic skin disorder.

6. Autonomous Technology

Autonomous technology takes an automated system, adds sensors, and then incorporates AI to leverage the sensor data and execute actions accordingly.

Overall, data shows that the global autonomous technology market was valued at $22 billion in 2023, and it's predicted to grow to over $59 billion by 2030.

The market for autonomous technology is climbing as various industries look to maximize the impact of these solutions.

In recent months, venture capitalists have been highly interested in the robotic technology space.

Global VC investments in July 2023 totaled nearly $2 billion.

The most popular consumer-facing application of this technology is self-driving cars, but it powers robots for a variety of purposes. Here are just a few other use cases:

- Warehouses: Robots can perform repetitive tasks, sort products, and even follow humans around to help where necessary.

- Healthcare: Robots can assist during high-precision surgeries like coronary artery bypass and cancer removal.

- Agriculture: Robots can pick fruits, milk cows, and even operate tractors.

- Delivery systems: Robots can deliver goods and services directly to customers' doors.

One specific type of autonomous technology that’s seeing growth is agricultural drones.

Search volume for “agricultural drones” is up more than 200% in recent years.

These autonomous drones carry fertilizer and seeds in on-board tanks and drop them across fields.

The market for these specialized drones sat at $4.5 billion in 2023 and is predicted to grow at a CAGR of more than 30% through 2028.

Manufacturers are also investing in autonomous technology and robots.

Part of this growing demand has been caused by labor shortages. Estimates say there could be 2.1 million unfilled jobs in the sector by 2030.

Grand View Research estimates the industrial robotics market could grow to $60 billion by 2030.

In addition, the sheer number of autonomous technology startups in specific sectors is signaling future growth.

For example, there are more than 250 VC-funded startups in the agricultural robotics space alone.

Trending Topics to Explore

- Anduril Industries: A tech company that builds autonomous vehicles and AI technology for national security and defense purposes.

- Unitree Robotics: A Chinese company that’s currently manufacturing quadruped “robo dogs” and testing humanoid robots.

- AMP Robotics: A robotics company focused specifically on developing AI and robots for the recycling sector.

7. Digital Health

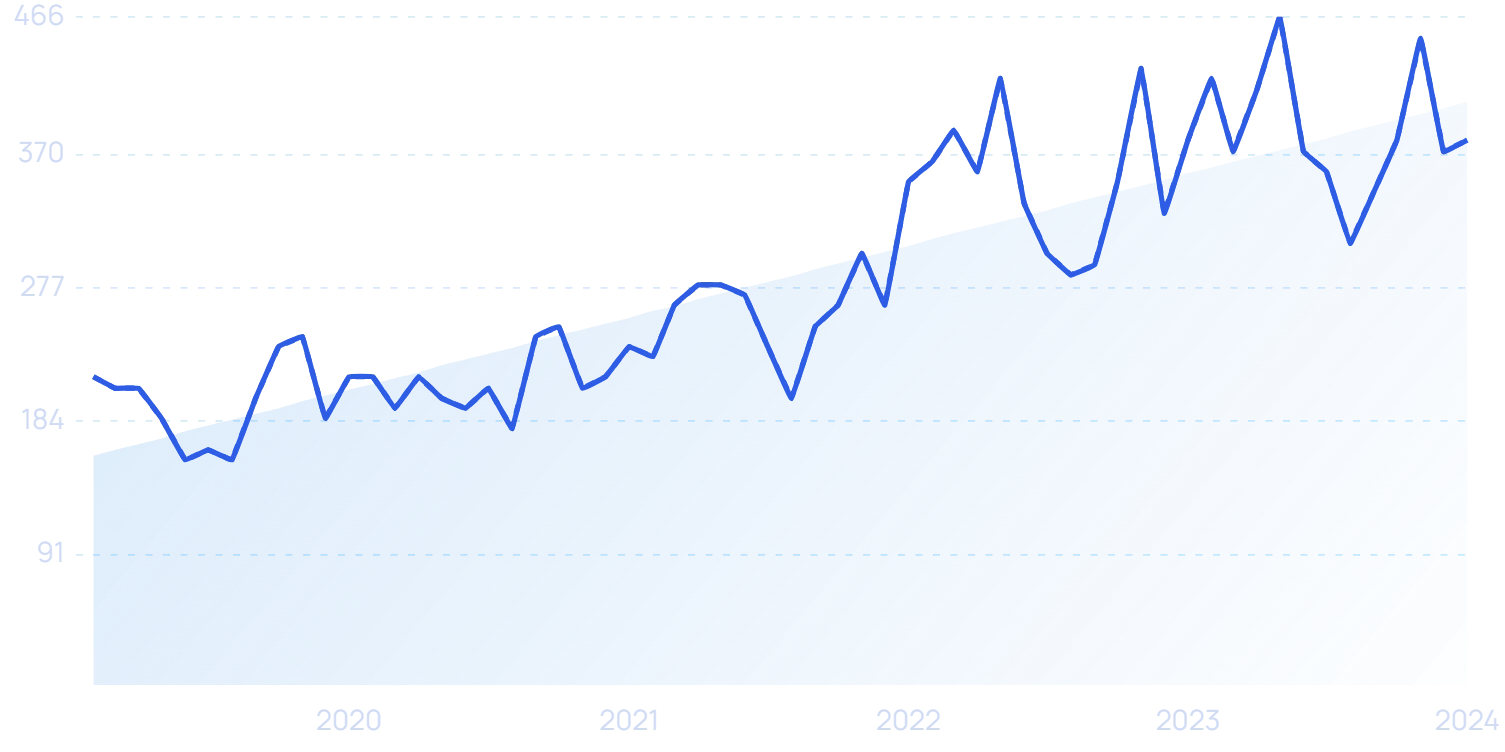

The digital health sector grew rapidly during the pandemic and, even though the pace is slower now, the space is still experiencing significant growth.

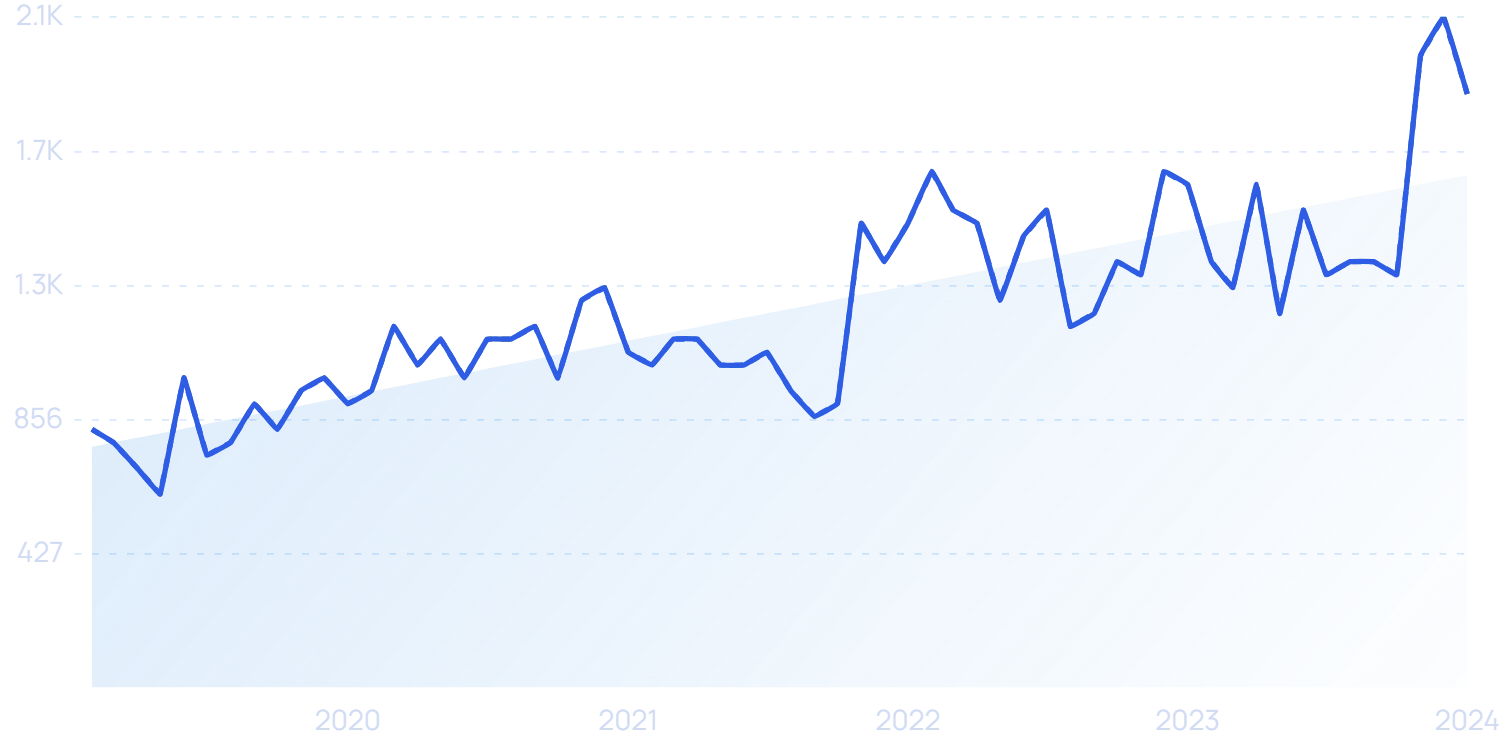

Search volume for “digital health” continues to climb.

The ongoing shortage of healthcare professionals combined with individuals’ desires to access care and medical information at their convenience means consumer demand in this sector is set to continue growing well into the future.

Estimates show the digital health market is valued at $180 billion in 2023 and is set to hit nearly $550 billion by 2028. That’s a 25% CAGR.

Like many other sectors, VC funding for digital health was down in 2023, but still brought in $10.7 billion in 492 deals.

In addition, digital health startups were responsible for 65% of global VC funding in the second quarter of 2023.

Google Search volume trends also point to a growing interest in digital healthcare solutions.

Search interest in “remote healthcare” has grown by 400% in recent years.

Remote patient monitoring is one area that’s seeing rapid deployment thanks to advances in AI and wearable technology.

Search volume for “remote patient monitoring” has climbed 250% since 2020.

Rather than asking patients to attend in-person follow-up visits, remote monitoring solutions allow doctors to rely on tech and artificial intelligence to alert them of any changes in the patient's condition.

Common wearable technologies can measure basics like EKGs, blood pressure, oxygen levels, and glucose, though more advanced solutions for specific use cases can also measure other patient metrics.

Trending Topics to Explore

- Lyra Health: A mental health platform for employees.

- Aktiia: A wearable device, the size of a bracelet, that automatically measures blood pressure.

- Folx Health: A virtual healthcare platform for the LGBTQ community.

8. Gaming

There are a handful of opportunities poised to benefit the gaming sector in the coming years.

The Metaverse, AR gaming, mobile gaming, and eSports are just a few.

Search volume for “AR gaming” is up 160% in recent years.

These new developments are starting to impact the sector already.

Revenue is predicted to grow 13% in 2024 to land at $282.3 billion.

The number of players is growing, too.

In 2023, more than 3.38 billion people played video games across the world—a 6.3% increase over 2022.

In the U.S., two-thirds of all individuals under 18 years old play video games.

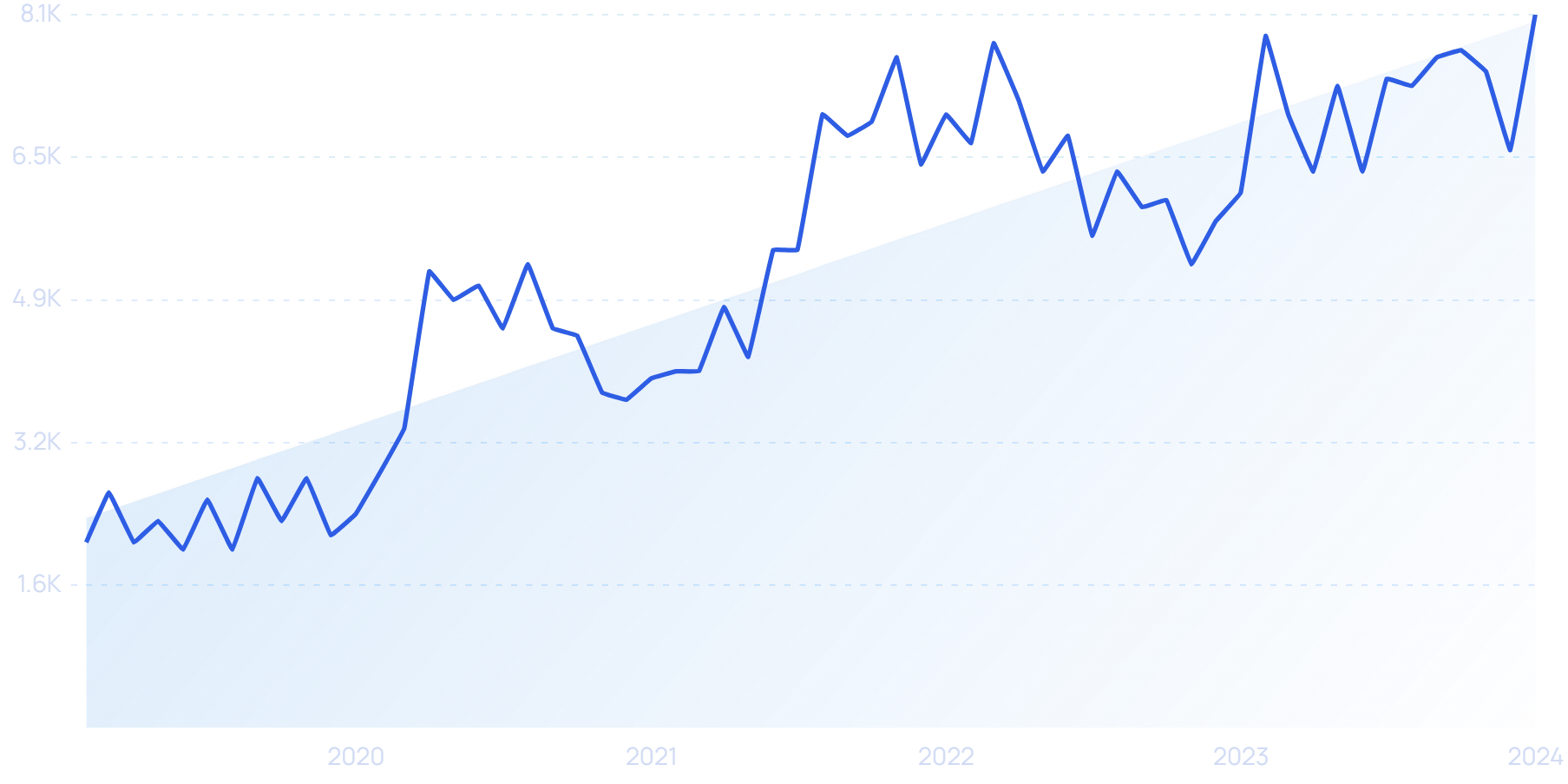

All of these users are driving up consumer spending in this sector.

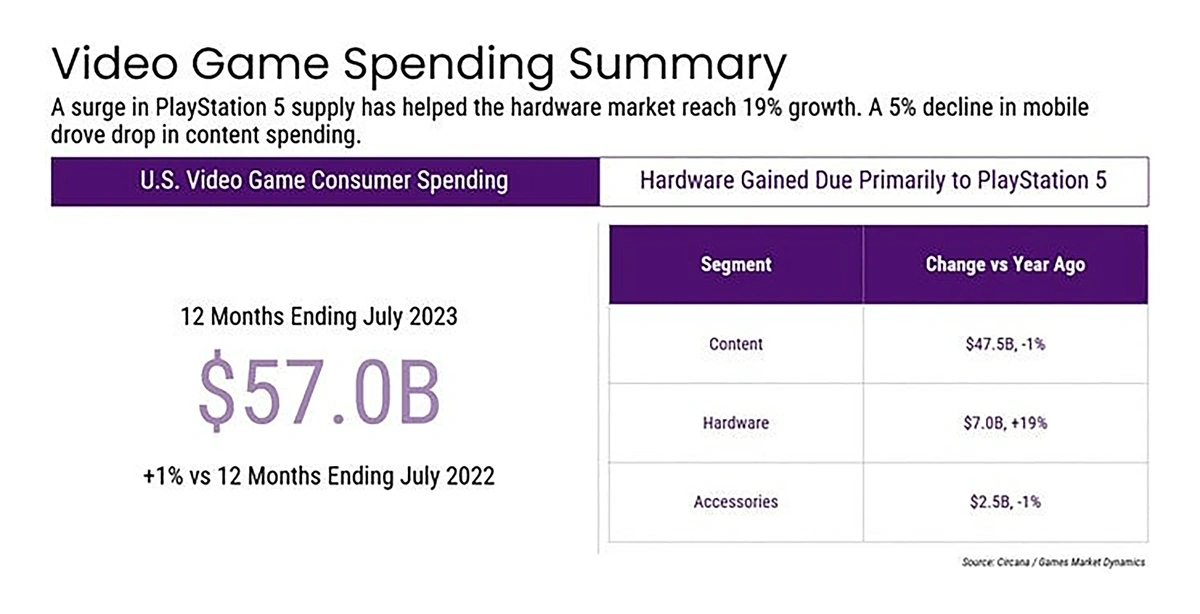

Between July 2022 and July 2023, consumer spending topped $57 billion.

Consumers spent nearly 20% more on gaming hardware between July 2022-23 than during the previous 12 months.

Funding in the gaming space has dropped since peaking during pandemic lockdowns. However, venture capitalists still poured $13.3 billion into video game startups in 2022.

In addition, Microsoft recently completed the largest acquisition in video game history when it took over Activision Blizzard for $68.7 billion.

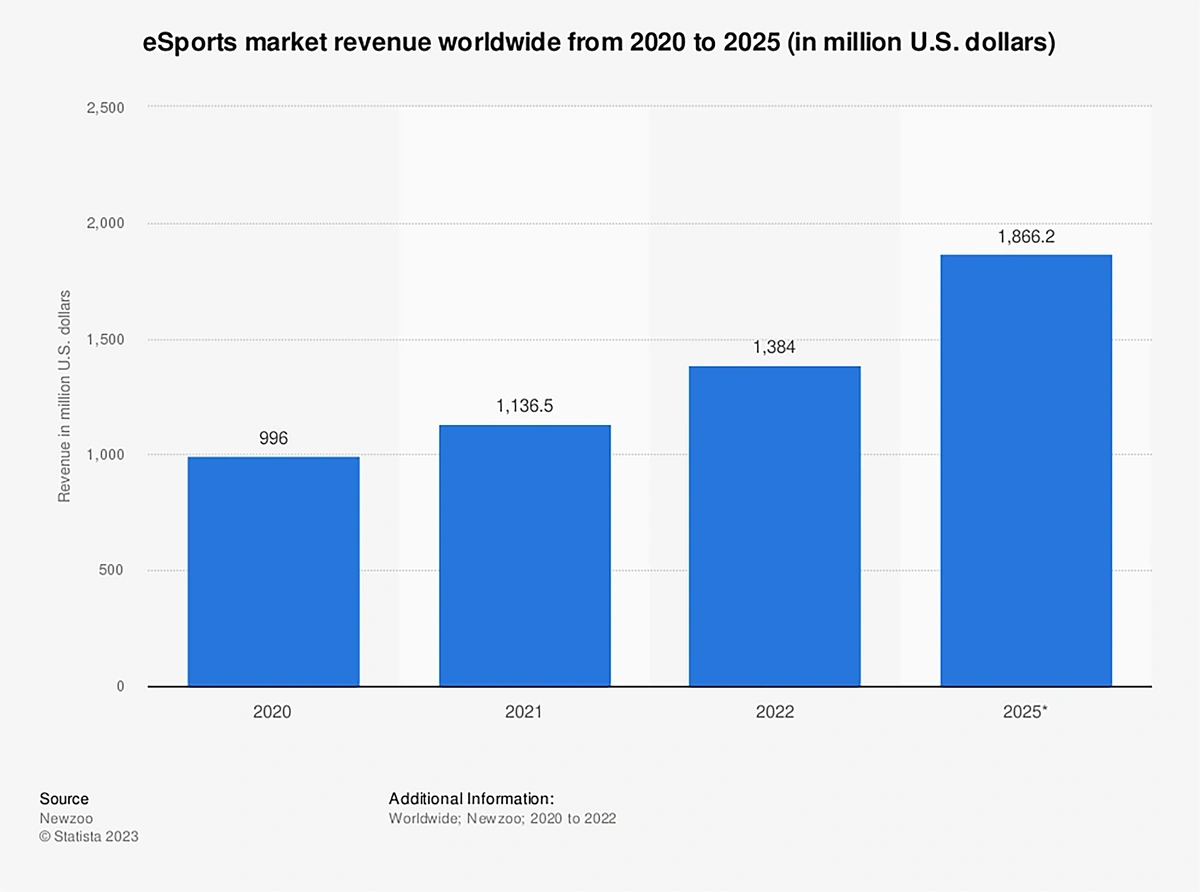

As for the future, gaming industry experts are looking for eSports to explode in popularity.

The market revenue could rise to $1.866 billion by 2025.

eSports revenue is predicted to top $1.8 billion by 2025.

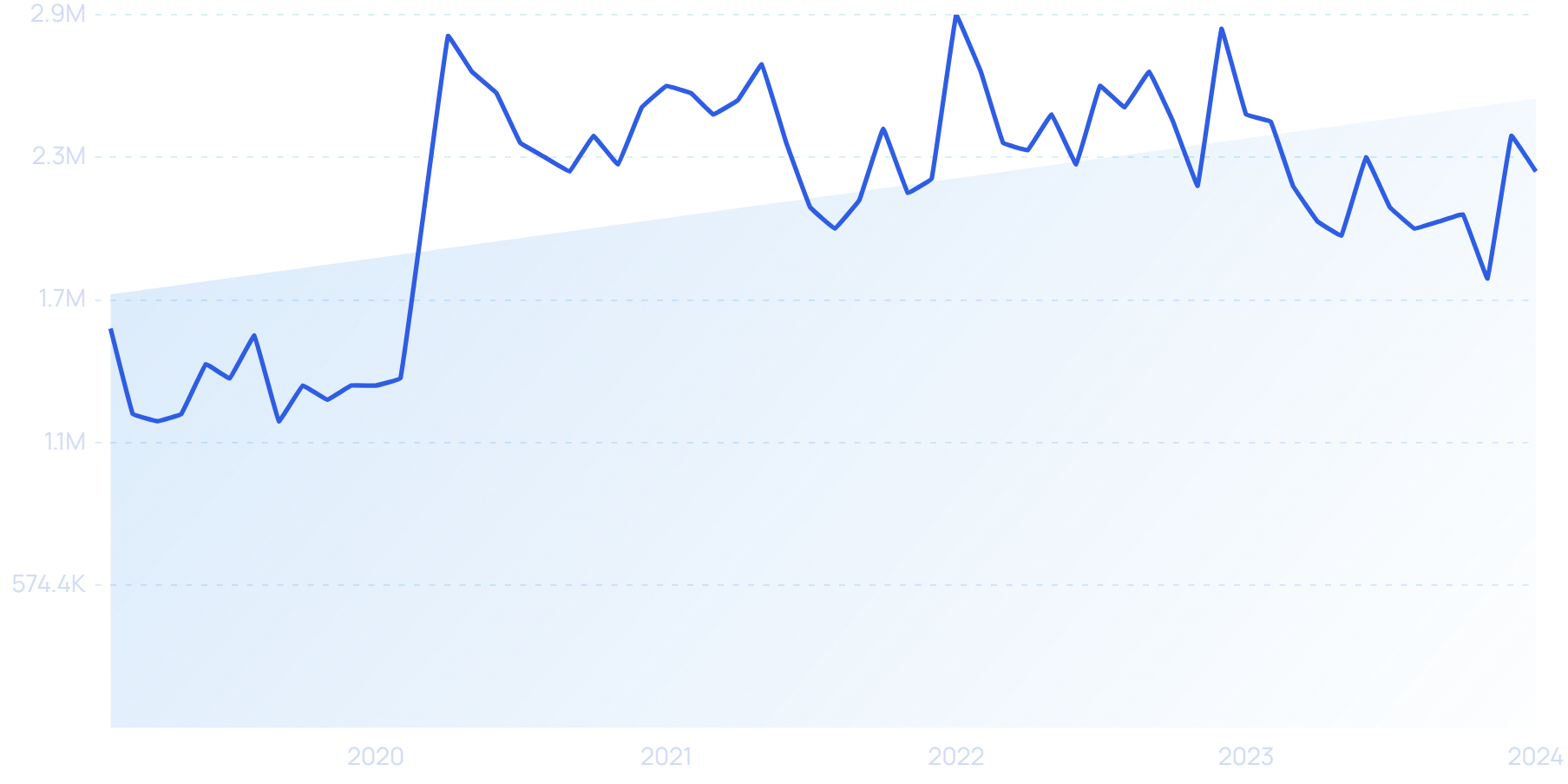

Viewership of eSports is growing, as well.

Twitch is one of the most popular live-gaming platforms in the U.S. with 31 million daily visitors.

Search volume for “Twitch.tv” grew rapidly in 2020 and has remained high.

Trending Topics to Explore

- Wildlife Studios: A mobile gaming company with more than 60 games and 3 billion downloads.

- Voldex: A UGC gaming company that’s launching games on Roblox.

- Rec Room: A virtual reality platform with player-made rooms, content, and games.

9. Semiconductor Manufacturing

The rapid digitization of the world requires one key component: semiconductors.

The semiconductor shortage of a few years ago has given way to growth for many manufacturers in 2023, and experts predict that growth will continue well through 2030.

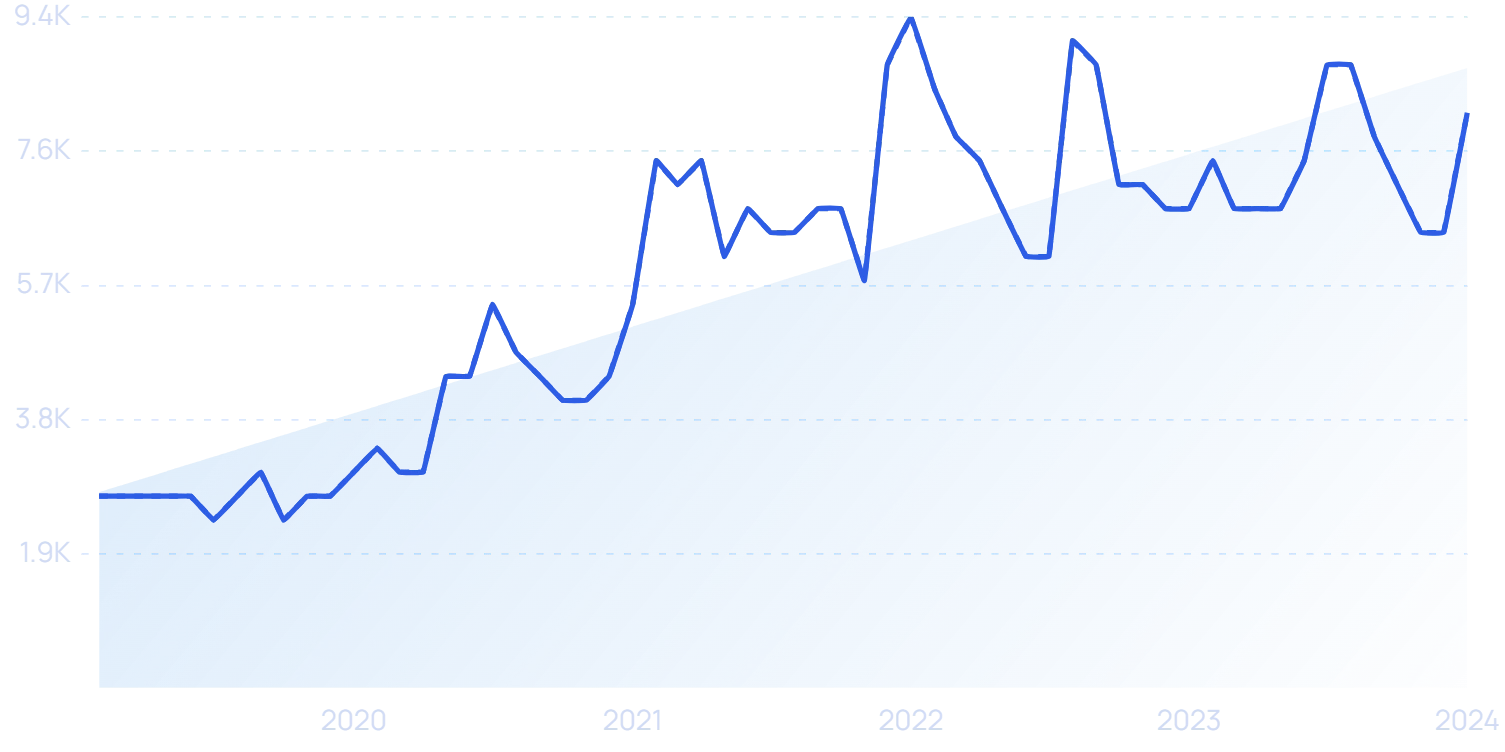

Search volume for “semiconductor manufacturing” has grown more than 200% in recent years.

That year, McKinsey experts estimate, the semiconductor market will rake in $1 trillion in revenue.

Nearly three-quarters of that growth, they say, will come from three sectors: automotive, data storage, and wireless.

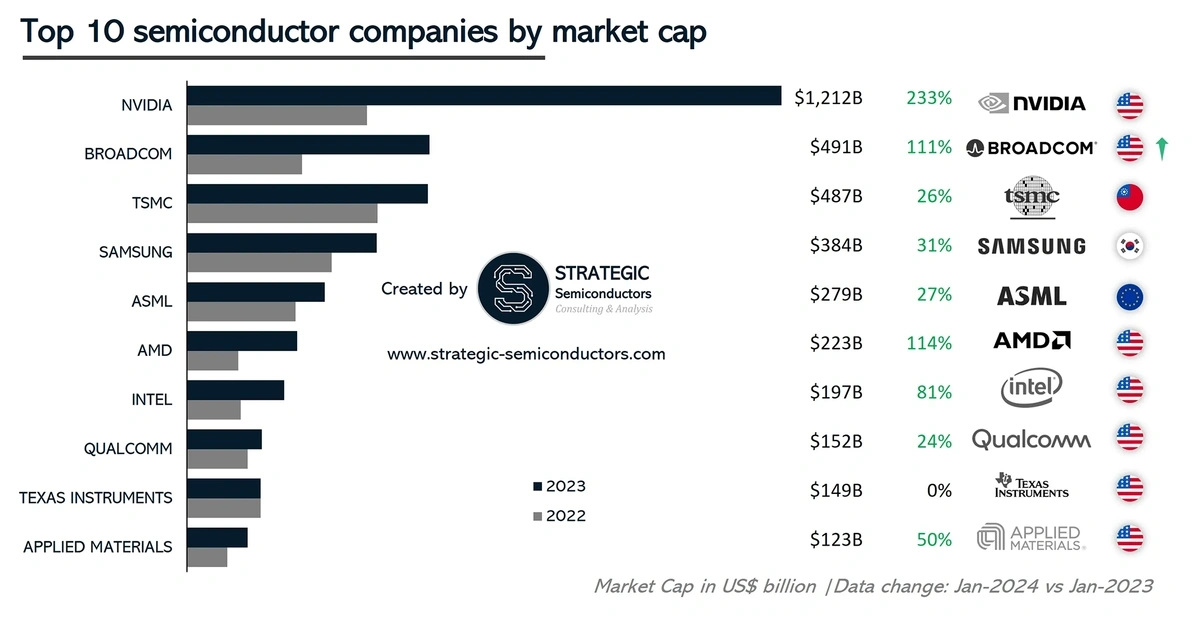

Taiwan Semiconductor Manufacturing Company is the clear leader in this market with a hold on 13% of the total market share in 2023.

But Nvidia holds the largest market cap at $1.212 trillion.

Companies like Nvidia, AMD, and Broadcom saw substantial growth in 2023.

However, there is room for growth among smaller companies and startups.

The semiconductor R&D process is notably expensive, which plays a role in VC backing.

In fact, the average early-stage deal for semiconductor startups from 2020-2023 was $36 million while total VC funding for this space in 2023 was $10.3 billion.

There are some startups designing semiconductors specific to AI applications, and this specialized area of the market is attracting investors.

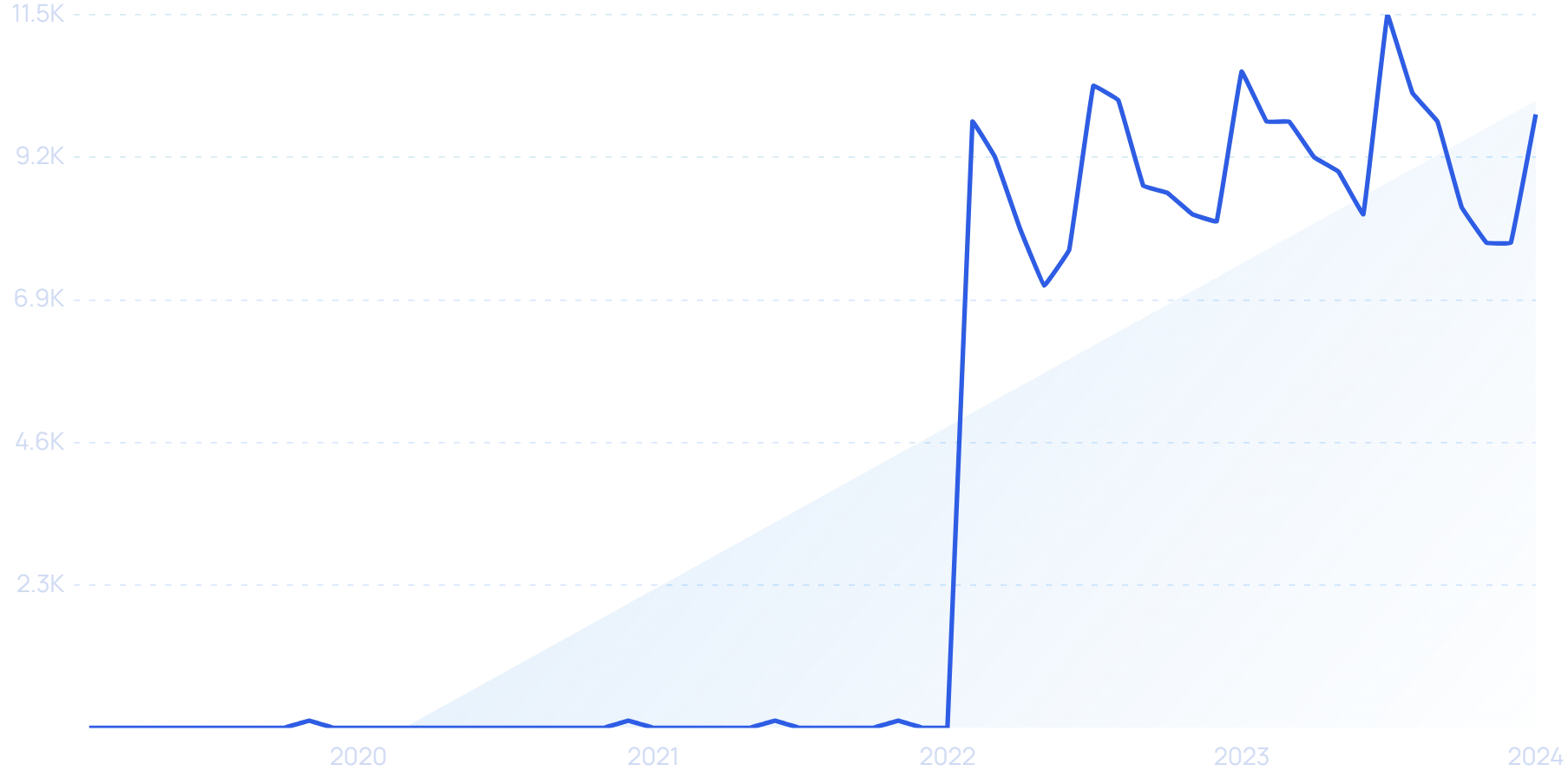

Search volume for “AI chips” has grown more than 500% in the past five years.

Predictions show that sales of AI chips will grow at a CAGR of 35%—10x the growth rate for non-AI chips.

In 2027, that means sales could climb to more than $83 billion.

For example, D-Matrix manufactures semiconductor chips that power AI workloads in data centers.

The company raised $110 million in a Series B funding round in late 2023.

Trending Topics to Explore

- Tenstorrent: A startup that’s partnered with Hyundai and Kia to build CPUs and AI co-processors for cars and robots.

- Aestera Labs: A fabless semiconductor company that sells connectivity tools designed especially for cloud and AI infrastructure.

- ASML: A Netherlands-based company that produces software and equipment for semiconductor manufacturers.

10. Solar Power

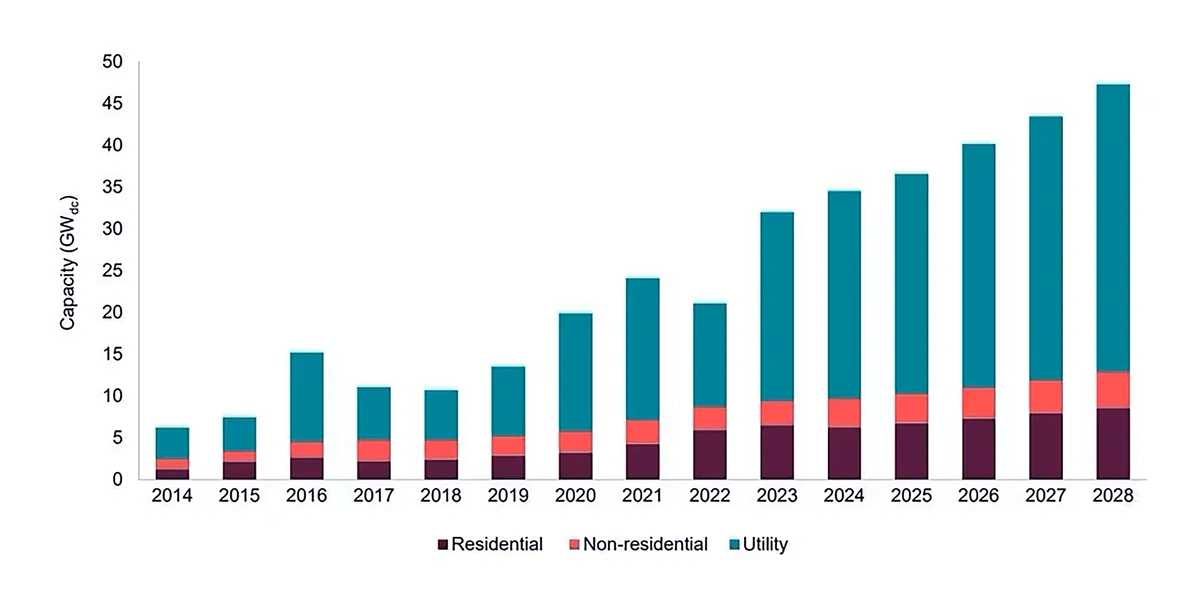

Between 2018 and 2023, the solar power industry has grown an average of 19.3% per year.

In the third quarter of 2023 alone, there were 6.5 gigawatts of solar capacity installed in the U.S.—a 35% year-over-year increase.

That jump contributed to a record high for the year, 32 gigawatts of solar capacity installed, and a 51% increase over 2022.

And the market is still growing.

A report from Fortune Business Insights predicts the solar industry will create 37 gigawatts of new capacity in 2024.

Predictions show increasing numbers of solar installations.

VC funding in this sector has been high, as well.

1KOMMA5°, a German startup focused on solar power systems, brought in the most VC money in 2023 with $471 million in funding.

Search volume for “1KOMMA5°” has grown rapidly in the past two years.

In 2023, solar power businesses brought in $6.9 billion in VC funding. That included 26 deals that topped $100 million.

Thanks to the Inflation Reduction Act and other tax breaks, it’s likely that consumer solar panel installations will continue to increase.

The average cost for the consumer is now approximately $25,000. That’s down 50% from 10 years ago.

In addition, with the rise in off-the-grid living, a growing number of people are becoming interested in solar-powered systems to fulfill their electricity needs.

In the past few years, there’s been a dramatic increase in search volume for “off-grid living.”

Trending Topics to Explore

- Enpal: A German renewable energy company that’s providing solar-as-a-service by leasing solar panel systems to customers while providing tech support and maintenance.

- Enphase Energy: A company that provides homeowners with a comprehensive solar system so they can make, use, save, or sell the power their panels generate.

- EcoFlow: A sustainable energy company that manufactures solar panels, generators, and batteries.

Taking the Next Steps in Your Investment Journey

That wraps up our top 10 picks for the best industries to invest in for 2024.

Rapid technology developments combined with uncertain consumer spending habits are bound to make 2024 an interesting year. We hope this list helps you add some diversification to your investment portfolio and introduces you to promising new industry groups.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Alison is an accomplished copywriter with proven success in editing, marketing, research, and management. Before writing for E... Read more