The Beginner’s Guide to NFTs

NFTs are all the rage right now.

From celebrities to Fortune 500 companies, everyone seems to be getting in on the action.

So are NFTs really the future of digital art? Or just another collectible fad?

That’s what we aim to explain in this guide.

Intro to NFTs

In this chapter, we’ll discuss the emergence of NFTs, hard statistics that show just how fast the industry is growing, and explain why the concept of “fungibility” matters.

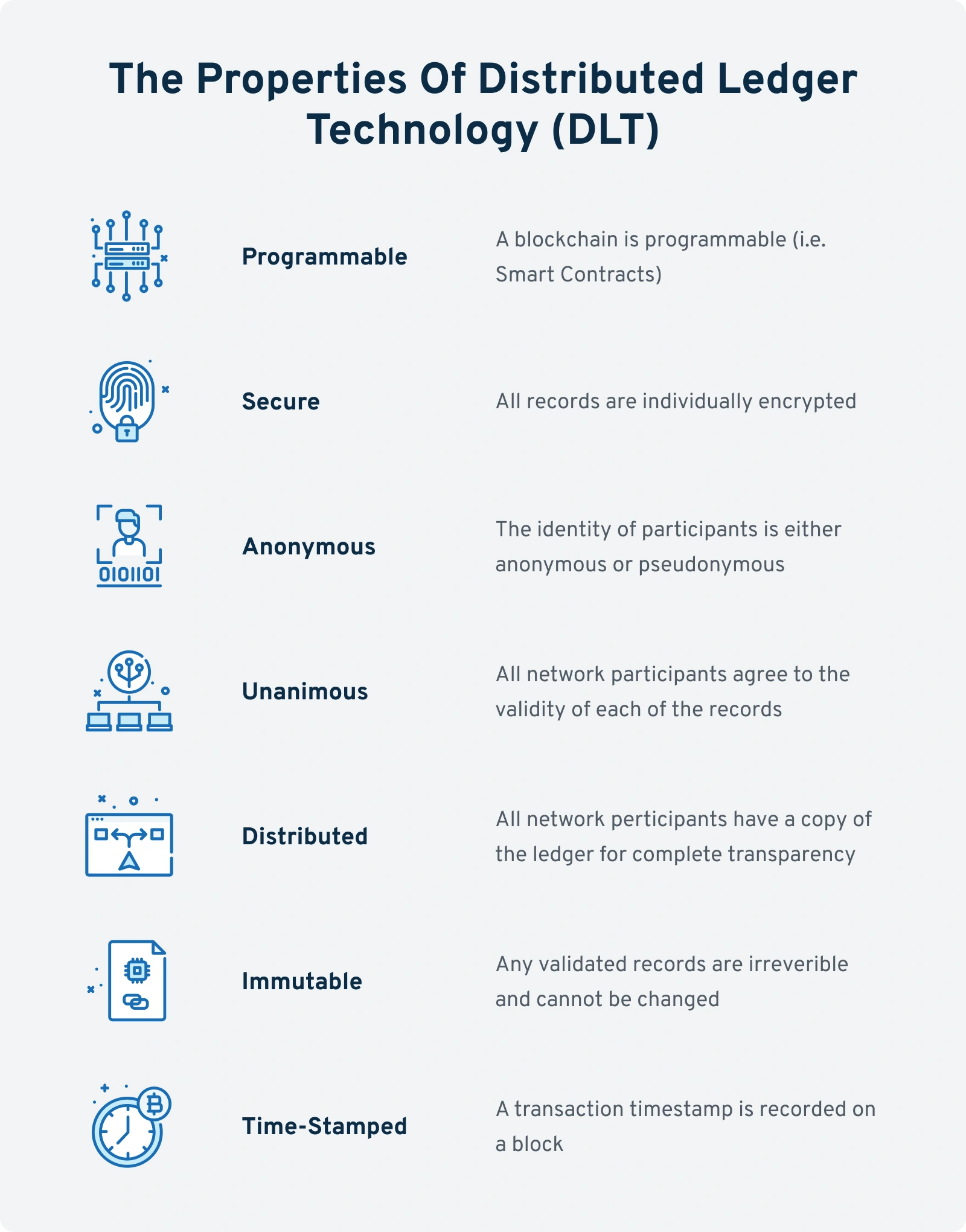

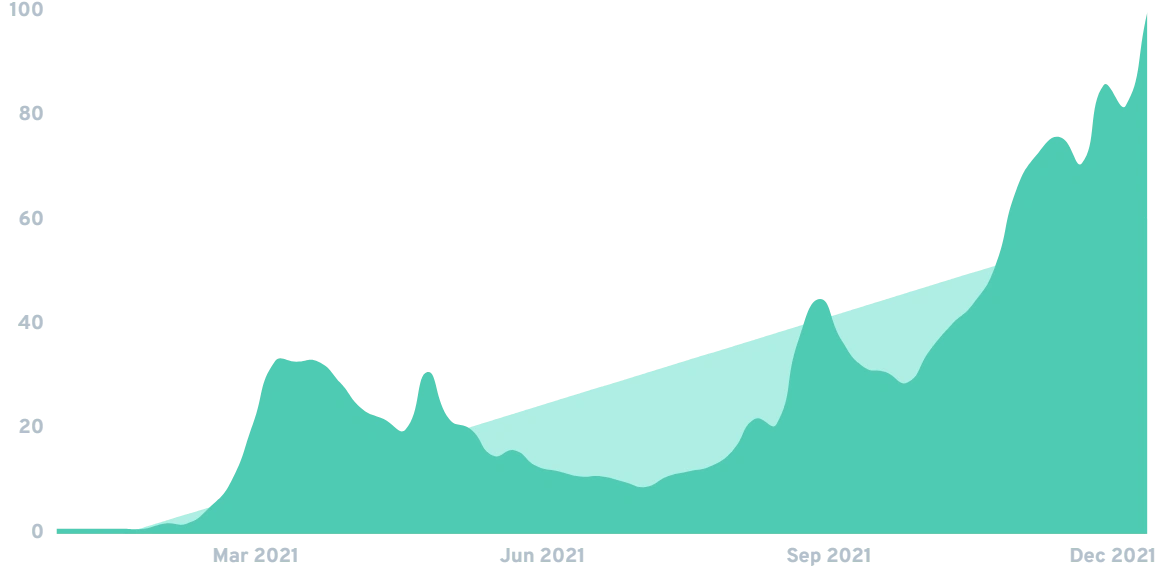

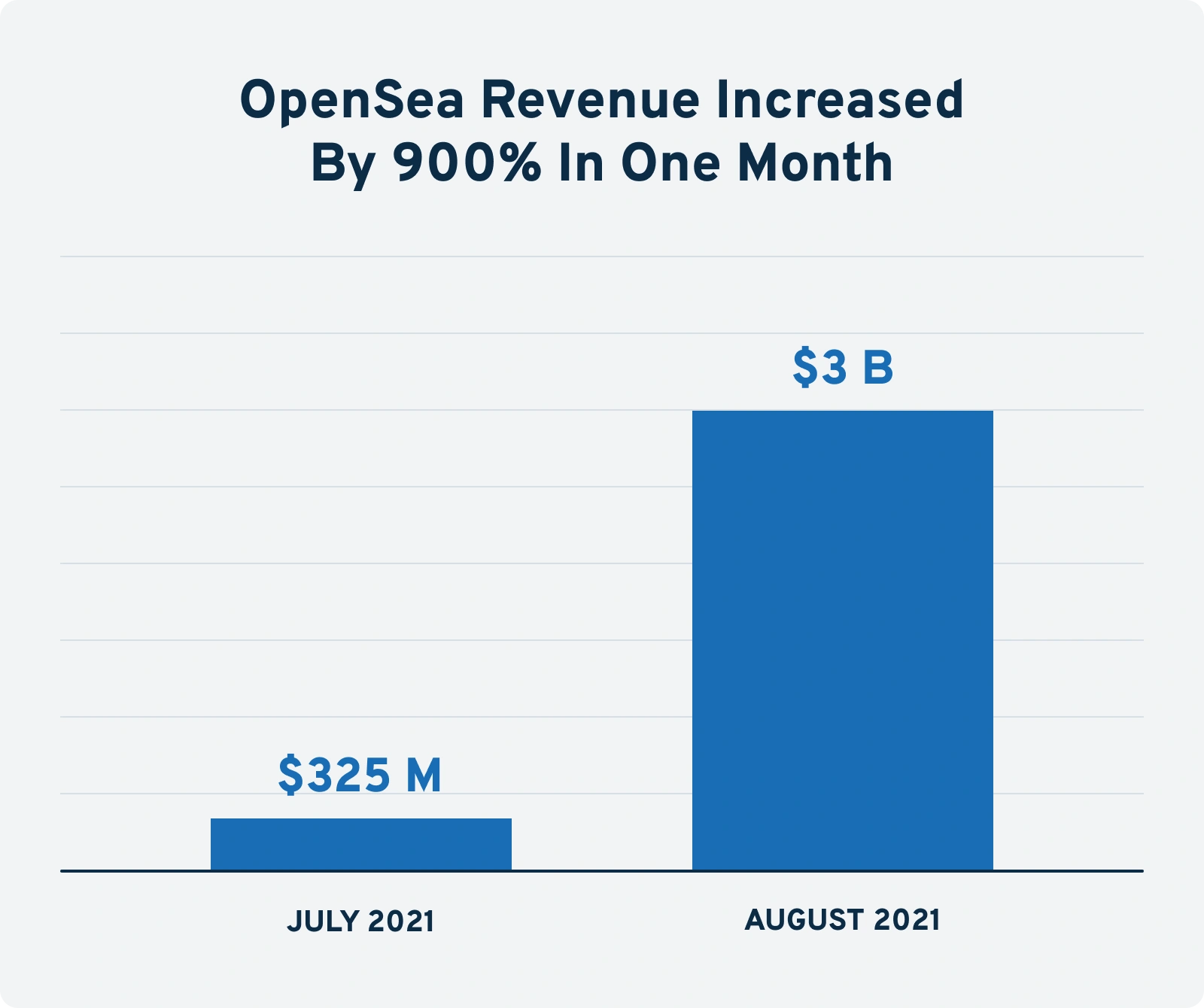

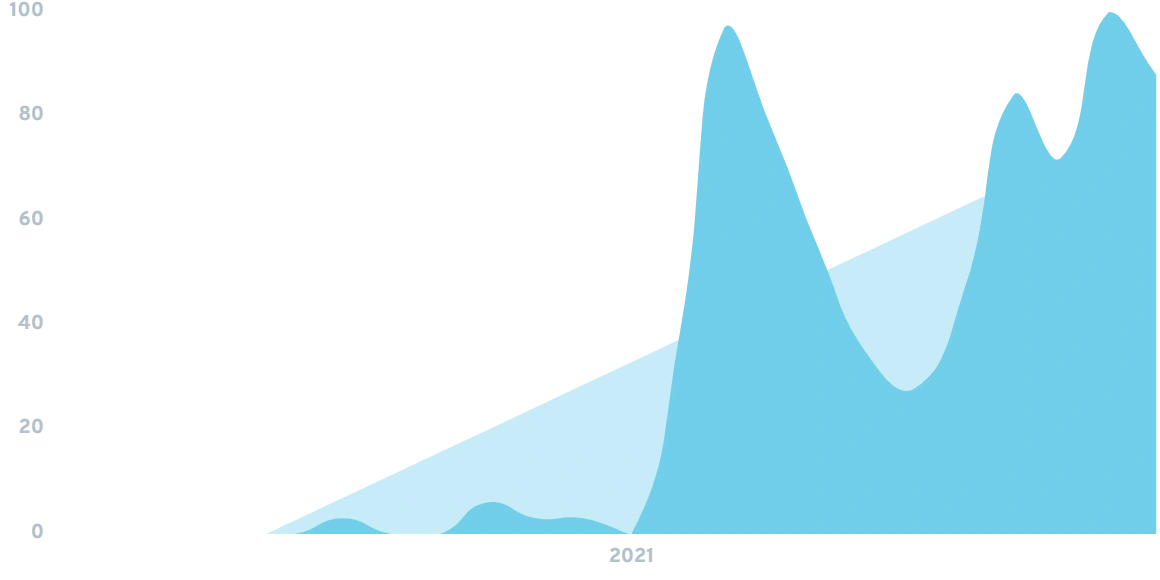

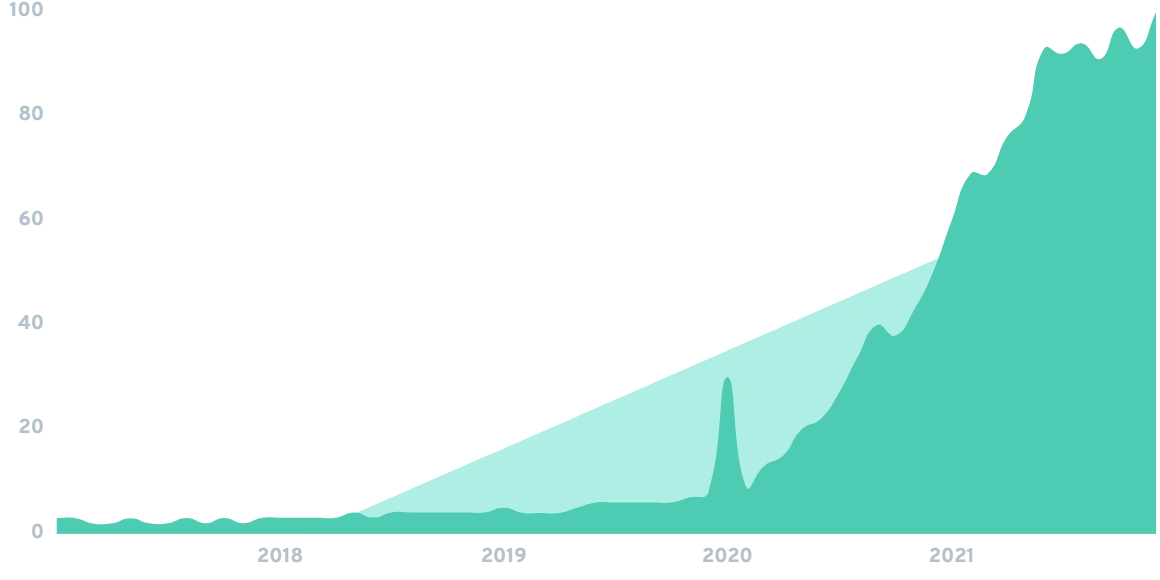

An NFT (short for “non-fungible token”) is a unit of data stored on a blockchain’s digital ledger. Unlike cryptocurrencies, which are mutually interchangeable with one another, NFTs are both unique and non-interchangeable. And while NFTs are typically associated with collectible digital images, the technology can be applied to text documents, videos, and even real-life assets. With that said, the data contained in the file - and in particular, the proof of who owns the file - is what makes NFTs so unique. To understand why this matters, it's critical to understand the importance of “fungibility.” According to Dictionary.com, fungibility is defined as a good, commodity, asset or bond that is “easy to exchange or trade for something else of the same type and value.” Meaning, by definition, something that is non-fungible is something that is not “easy to exchange or trade for something else of the same type and value.” As an example, if you lend someone $5, you don’t really care if they pay you back with five $1 bills, the same $5 you gave them, or another $5 bill. Mainly because the $5 you gave them is mutually interchangeable with any combination of bills and coins that amount to $5. However, if that $5 was signed by Abraham Lincoln, it would become non-fungible. Why? Because the signature adds to its intrinsic value, meaning that a particular $5 bill is no longer mutually interchangeable with a regular $5 bill. Now, imagine a collector (supposedly) has a $5 bill signed by Abraham Lincoln. How would they “prove” the bill was created in the early 1860s before Lincoln died (increasing the likelihood it’s a real signature)? Sure, they could point out the year it was produced and show samples matching his signature to other documents. But at the end of the day, you’d have to take their word for it (meaning you’d have to “trust” them). Further, if a thief broke into your house and stole that $5 bill - and was then caught ten years later - how would you prove it was yours, to begin with? Unless you had a photo or the original receipt showing the serial number of the bill, you couldn’t. NFTs, however, fix this problem. How? By using blockchain technology to create a permanent, unhackable, verifiable and chronologically documented chain of custody. Similar to saving a file on your computer’s hard drive, blockchains like Bitcoin and Ethereum write “blocks” of data to a chain (network) of servers. Further, they do so in a perfectly chronological, unhackable format. Except instead of updating one file on a central server, that file is updated on thousands of “nodes” (individually owned servers) at once. Because of that, blockchain technology allows users to create a permanent chain of custody for almost any type of digital file, including the tokens that make up cryptocurrency networks. Further, once that data is “written” onto the chain, it becomes permanent and unalterable. In most cases, blockchains are used to track cryptocurrency transactions. Over time, however, developers realized they could use blockchain technology to create a chain of custody for almost any type of file (from JPEGs to real-world assets like land deeds). If you were to ask your neighbor what an NFT was in 2020, odds are they would have no idea what you’re talking about. Fast forward to 2022 and the term ‘NFT’ was Collins English Dictionary “Word the Year” last year. As is the case with any emerging trend, a handful of (highly outspoken) skeptics see this as one big fad. The statistics, however, are quite compelling. Searches for “NFTs” on Google have absolutely skyrocketed (to the tune of a 99X+ increase according to Exploding Topics - the highest possible increase a term can get). According to Twitter, users produce more than 10,500+ tweets with an #NFT or #NFTs hashtag every hour. And nowhere is this emerging trend more obvious than OpenSea, the #1 largest NFT marketplace (by sales volume). As of November 2021, OpenSea ranked as one of the top 500 websites in the world, getting over 68 million visitors. In fact, OpenSea has become so popular their revenues went from $325 million to $3 billion in just one month (from July to August of 2021). As anyone who’s familiar with Wall Street investing knows, increasing sales by 900% in one month is virtually unheard of. With consumers, celebrities, investors and corporations jumping on the trend, many believe NFTs are here to stay. So what is an NFT?What are NFTs?

Fungible vs Non-Fungible Currency

What Makes Non-Fungibility Compelling

Blockchain-Based Tokens

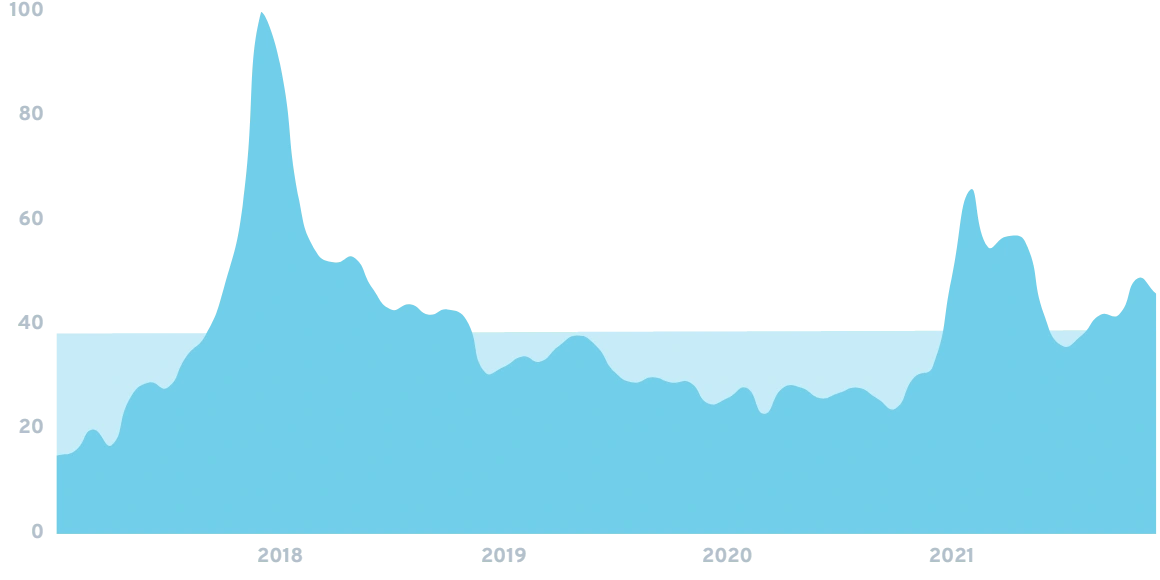

Searches for “Blockchain” in the last five yearsBlockchain for Non-Crypto Tracking

An Emerging Trend

The Data Behind The NFT Space’s Massive Growth

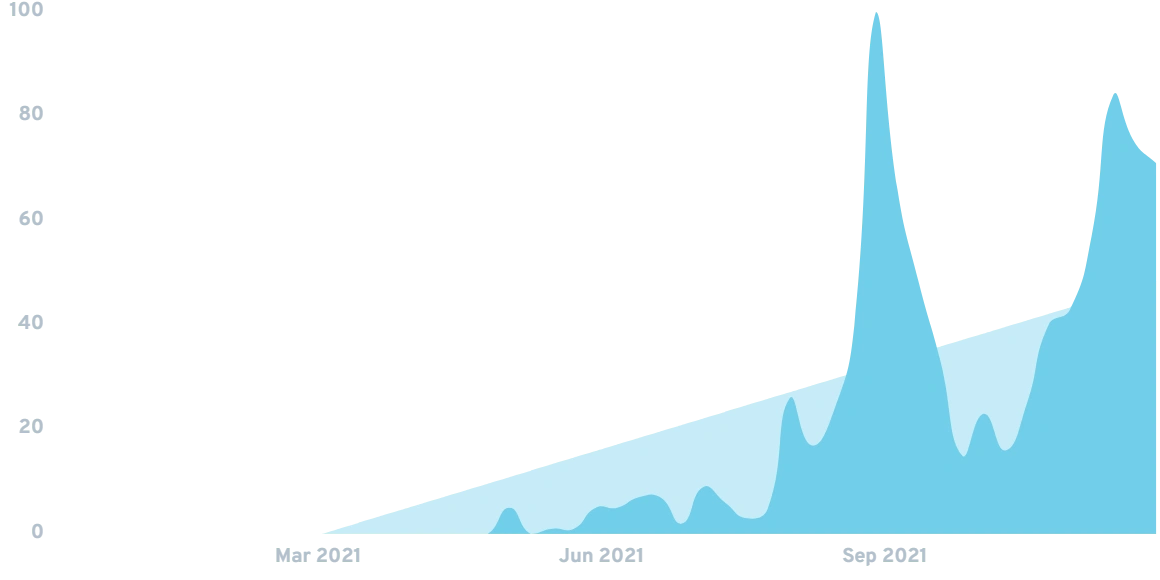

Searches for “Non-Fungible Token” have spiked 99X+ in the last year

The State of the NFT Industry

In this chapter we’ll discuss the very first NFT ever created, which projects first gained mainstream adoption, and why 2021 was a breakout year for NFTs.

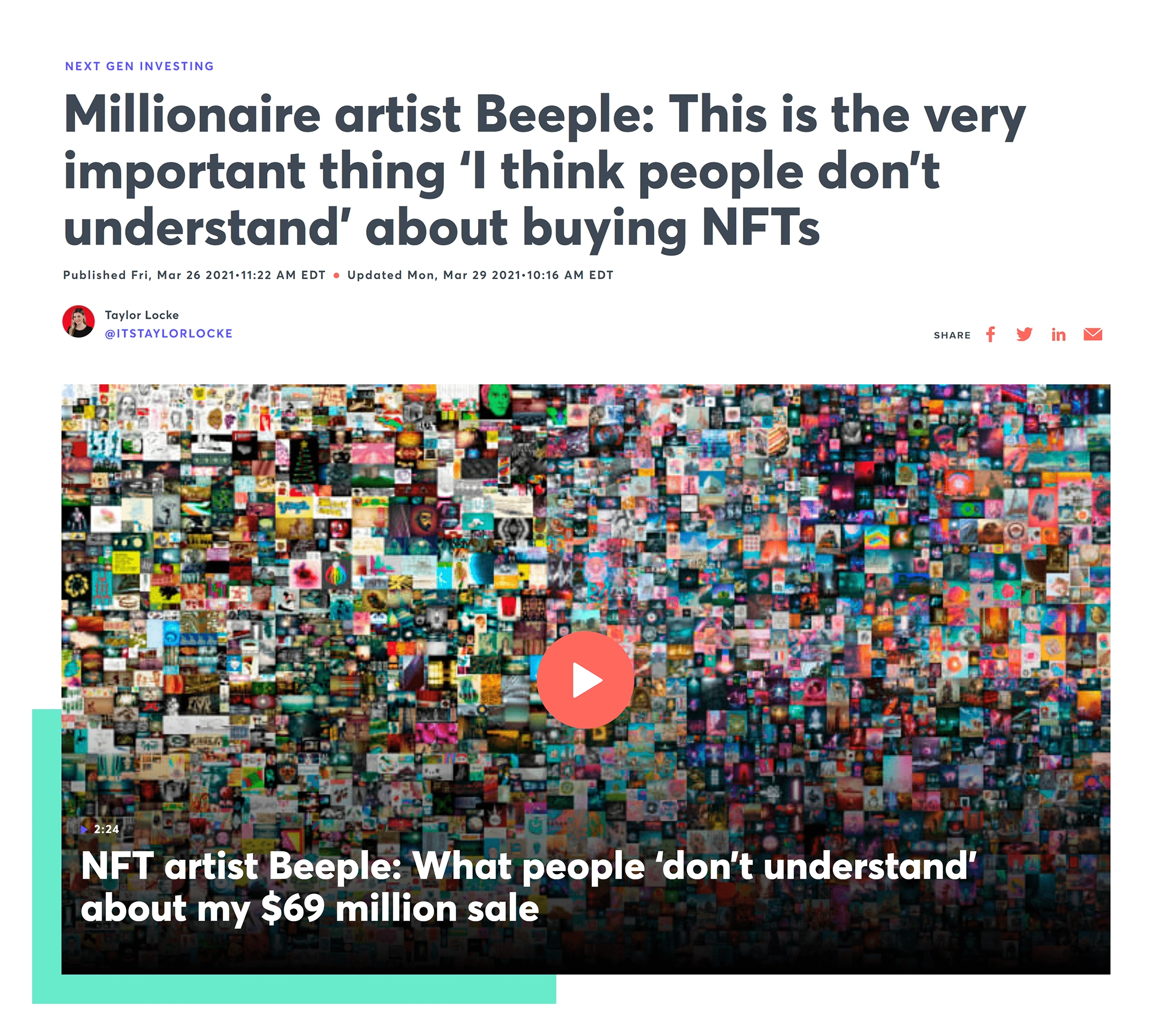

A long-time artist, Kevin McCoy created the first NFT in 2014 (via a process known as “minting”). Because of its historical significance and Kevin’s reputation in the art community, the piece - known as Quantum - sold for $1.4 Million in June of 2021. Between that first NFT launch and 2017, however, the space went dormant. In 2016, a handful of Ethereum users began trading Pepe the Frog NFTs (a meme that has become iconic in the world of cryptocurrency). But because the collection was so small, and because the financial value of NFTs hadn’t been established yet, the project failed to gain momentum. Then, in 2017, the executives at a company called Dapper Labs had a bright idea. After observing the wild success of collectible projects like Pokemon and Tamagotchi, Dapper Labs took the concept one step further by cloning the concept onto a blockchain. In doing so, they replicated the fun gaming aspect of Pokemon while adding something no one had ever seen before: Verifiable ownership and a working financial marketplace. Fast forward a couple of months and CryptoKitties - Dapper’s NFT project - became the largest project on Ethereum, causing fees to skyrocket while slowing down the network worldwide. Shortly after, a company known as Larva Labs launched CryptoPunks. Unlike Dapper Labs, however, Larva limited their project to just 10,000 NFTs. A move that, over time, would spark the NFT mania of 2021. Randomly generated by a software program, punks are low-resolution avatars designed to look - for the most part - like everyday people. Each punk is made up of a combination of traits (e.g. having an earring, a mohawk, etc.), with 6,039 male versions and 3,840 female ones. And while the punks were originally given away for free, their status as the first limited edition collection quickly made them into collector’s items. Fast forward to today and the average punk sells for over $340,000, while items with rare (one of a kind) traits have sold for as much as $11 million (ignoring one highly suspicious $532 million sale). Dapper Labs, however, was ahead of its time. Because it wasn’t until 2021 limited edition “avatars” would take the NFT world by storm. In March of 2021, a digital artist known as Beeple sold an NFT for $69 million. A transaction that - combined with news media headlines - lit the fuse for what would become a worldwide phenomenon. At the time, OpenSea’s sales were in the low single-digit millions. By June, however, that number would climb to $150 million. And by August - just two months later - that number would jump to more than $350 million. The industry’s explosion was driven by three trends. First, the value of Ethereum (the #2 cryptocurrency after Bitcoin) skyrocketed from $353 on September 30th, 2020, to over $4,000 by May of 2021. Meaning, investors who got into ETH early - and held on - became 10x richer in a matter of months. More important, OpenSea relies on the Ethereum blockchain to launch and sell NFTs. Because of that, it was a natural transition for newly wealthy ETH investors to speculate in the emerging and rapidly growing market. Anyone who’s ever studied economics knows it’s supply and demand that determine the price of an asset or commodity. So while CryptoKitties allowed users to create an unlimited number of NFTs, CryptoPunks went the opposite direction (limiting their collection to 10,000). And that limited supply - combined with increasing demand - would lead to a surge in how much people were willing to pay to get their hands on a CryptoPunk. But with only 10,000 CryptoPunks in existence, there just weren’t enough punks to satiate the public’s demand. So, to cash in on the trend, artists from a variety of backgrounds launched their own avatar projects (known as Profile Pics, or PFPs). On the one hand, NFTs and PFP avatars were one of the first ways digital artists could generate hundreds of thousands (if not millions) of dollars in a short period of time. With artists getting rich overnight, this led to an explosion in the number of graphic designers launching avatar NFTs (almost all of which were based on zoo animals). But as we know from economics class, supply and demand work in both directions. With a glut of low-quality projects flooding the market, and the price of Ethereum beginning a 30% decline on September 9th, the NFT market came to a grinding halt (with OpenSea sales dropping from $350M to less than $50M in two short months). The summer of 2021 will go down in some artists' memories as a time when they created life-changing wealth. However, the crash that followed was yet another example of how unsustainable it is when a market is fueled by greed and speculation. Because of that, industry experts now predict the future of NFTs - which some refer to as NFTs 2.0 - lies in real-world utility.The First NFT Ever

Kevin McCoy’s “Quantum” non-fungible tokenThe First “OG” NFT Collection

The First Mass Adoption NFT Project

Searches for “Pokemon NFT” exploded in the last yearThe First Limited Edition NFT Collection

The CryptoPunks are 10,000 uniquely generated charactersA Glimpse of the Future

NFT Mania

Ethereum Price Increase as a Driver

NFT Supply and Demand

Searches for “PFP” exploded at the start of 2020 with the rise of NFTThe First NFT Bear Market

The NFT Movement Evolves

NFT Use Cases

This chapter will discuss the two primary use cases for NFTs and a handful of lesser-known, but emerging use cases.

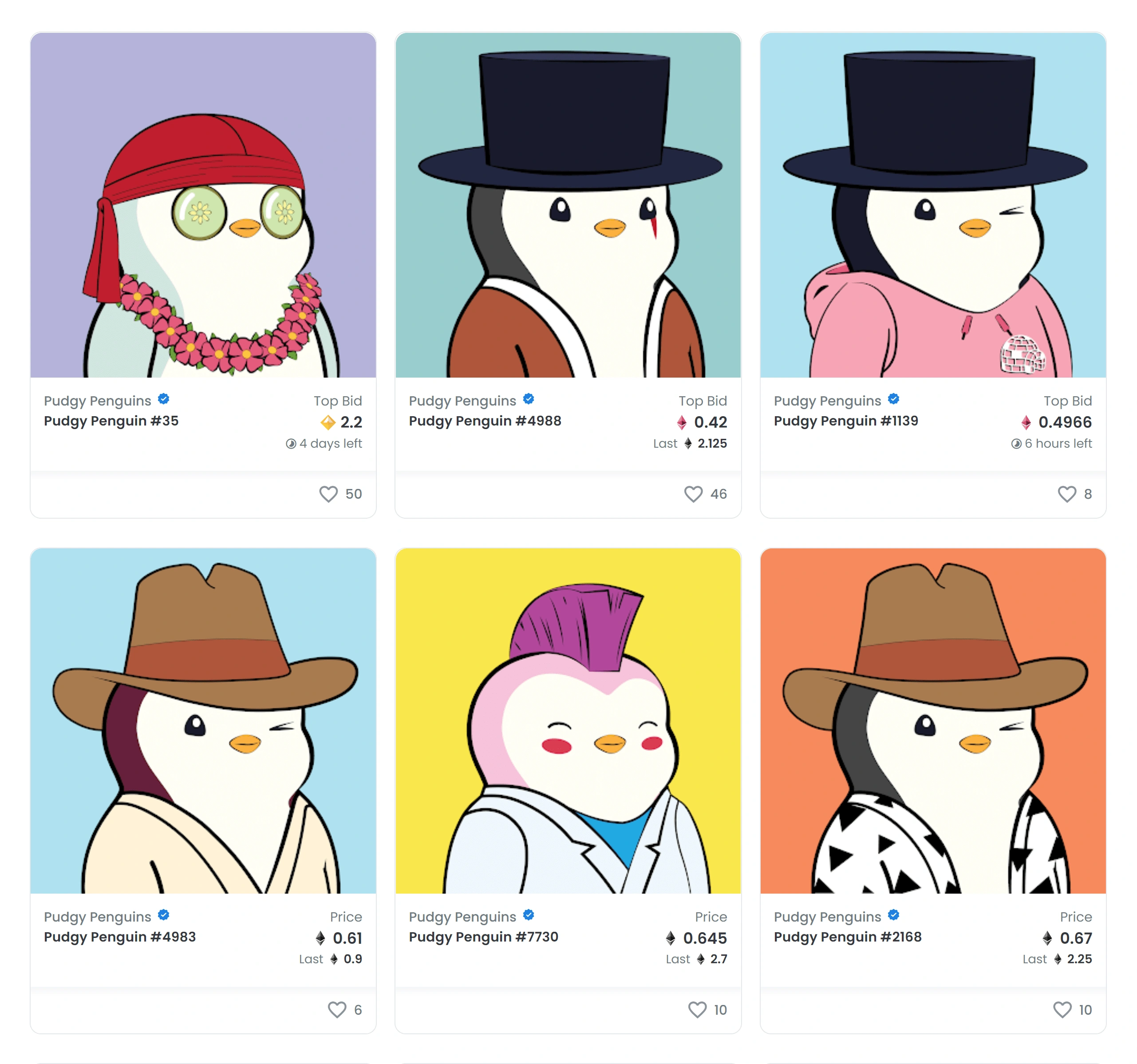

While the mania of 2021 was driven by speculators seeking profit, not everyone was looking to make a quick buck. Before the NFT boom, most anyone who wanted to earn a living as a digital artist had no choice but to work as a graphic designer. But with how easy it's become to save and screenshot graphics from the web, there was no economic incentive for consumers to spend hundreds or thousands of dollars (let alone millions) on “digital art.” Blockchain technology, however, changed that. With consumers able to verify ownership of a digital image, the ability of others to copy and clone that image became dramatically less relevant. Think of it like owning the Mona Lisa. Yes, there may be millions of posters and copies floating around out there. However, knowing you own the original - and being able to tell other people - makes all those copycats irrelevant. Further, paid membership platforms like Patreon proved consumers are willing to support artists, influencers and content creators they believe in. In some cases, to the tune of hundreds of dollars per month. And because NFT platforms charge minimal transaction fees, almost 100% of any sale goes directly to the artist. Because of that, NFTs have become a direct vehicle for supporting artists and creators. And while famous bands, celebrities and authors have always had diehard fans, traditional art was the only industry where someone could truly “own” an artists’ work. NFTs, however, changed all that. By providing buyers with intellectual property rights over the artist’s work, fans move from mere supporters to owners. This principle of fractional ownership is at the heart of web3. Which is largely possible due to NFT technology. And while the value of owning an artist’s work is subjective, history shows diehard fans will spend big money to own part or whole of an artist’s work. While no one knows who the first true “fashionista” was, the concept of expressing one’s self through fashion dates back thousands of years. But when it comes to expressing ourselves online, the only real outlet most people have is their social media feed. Because of that, it should come as no surprise NFT mania was driven by profile picture avatars. With a wide variety of designs, ranging from cute penguins to gangster-looking babies, NFT PFPs allowed consumers to express their personality through the avatar they chose. In addition to using one’s NFT as a social media profile picture, each project has its own online community (which is normally hosted as a Discord server). As you can imagine, the people interested in owning a cute-looking penguin have a different “vibe” from the gangster baby fans. Because of this, using an NFT as your profile picture has become a way of “signaling” which communities you’re a part of. And whether it’s Scientology or the local kickball club, tribalism plays a massive role in how humans identify with the communities around them. In the world of fine art, an artist sells a painting once and is done with it. In the world of blockchain-based NFTs, however, artists have the option of receiving ongoing royalties anytime an NFT changes hands. Because of that, NFTs allow graphic artists to create not just art, but assets that generate ongoing passive income. But it's not just artists and their fans that care about NFTs. Instead, NFTs have developed a wide variety of real-world use cases (some more ephemeral than others). With prices in the hundreds of thousands and even millions of dollars, some NFTs projects have become status symbols unto themselves. In fact, as companies like Apple prepare to launch their Augmented Reality glasses - and Facebook / Meta invests billions of dollars into building a digital world - some see NFTs as the digital equivalent of a Rolex or Lamborghini. But flexing wealth isn’t the only way people are using NFTs. Because of their high price tag, some projects use NFTs as the “key” that unlocks access to their community (similar to membership in a country club). In some cases, like with the Bored Ape Yacht Club, those communities are focused on networking and partying. Some, however, like Neo Tokyo, exist to create an elite group of investors, developers and gamers who are building the next generation of blockchain video games. Because NFTs are hosted and sold on cryptocurrency blockchain platforms (like Ethereum and Solana), some projects have shied away from the art side of NFTs in favor of the “making money” side of crypto. As an example, the MicroPets project pays upwards of 500% APY (in their native token) to owners who “stake” their NFTs for 30 days. With users spending hundreds of dollars to buy just one Micro Pet NFT, this can amount to hundreds (if not thousands) of dollars in passive income. Unlike cryptocurrency, which in most cases trade like stocks on a stock market, NFTs are illiquid. Meaning, if you own an NFT and want to sell it - but can’t find a buyer - you’re out of luck. Services like NFTfi, however, look to solve that problem. Because the value of an NFT can be easily verified (based on the past sale price, etc.), NFTs can be used as collateral to borrow against (similar to using your car as collateral for a personal loan). This creates the best of both worlds, allowing investors to “liquify” what was previously an illiquid asset. Similar to how players choose from a selection of characters (avatars) before playing an RPG game, in some blockchain games you’ll be able to use your NFT as your avatar. Nowhere is this more apparent than the Bored Ape Yacht Club (BAYC) project. In November of 2021, the BAYC team announced they’re building a metaverse game where owners can use their NFT to play with - and even fight against - other BAYC owners. In fact, similar to how we use profile pictures on social media, some experts predict we’ll use NFTs to represent ourselves in the Metaverse. On a more practical level, the ability to create a permanent, unalterable chain of custody has a wide range of implications. From documenting (what can be highly contested) land deeds to tracking the ownership and transfer of antiques and fine watches, NFTs represent a breakthrough technology for any asset where proof of ownership matters. And while the industry is very much in its infancy, investors are dropping thousands (and even millions of dollars) to snatch up digital land in the Metaverse. Land that’s documented, sold and transferred in the form of NFTs.The Emergence of Digital Art as an Asset

Proof of Ownership

Financial Support for Artists and Creators

Fans Can Become Owners

Art as an Expression of Self

Part of Pudgy Penguin collectionCommunity Building

Ongoing Royalties

NFTs as a Status Symbol

Elite Community Access

Searches for “Bored Ape Yacht Club” have spiked 7000% in the last yearNFTs as Yield Bearing Assets

NFTs as Crypto Loan Collateral

Avatars for Blockchain Games

Alternative NFT Use Cases

Popular NFT Projects

In this chapter, we’ll discuss the most popular NFT projects, from PFPs like CryptoPunks to one-off art pieces and digital metaverse projects.

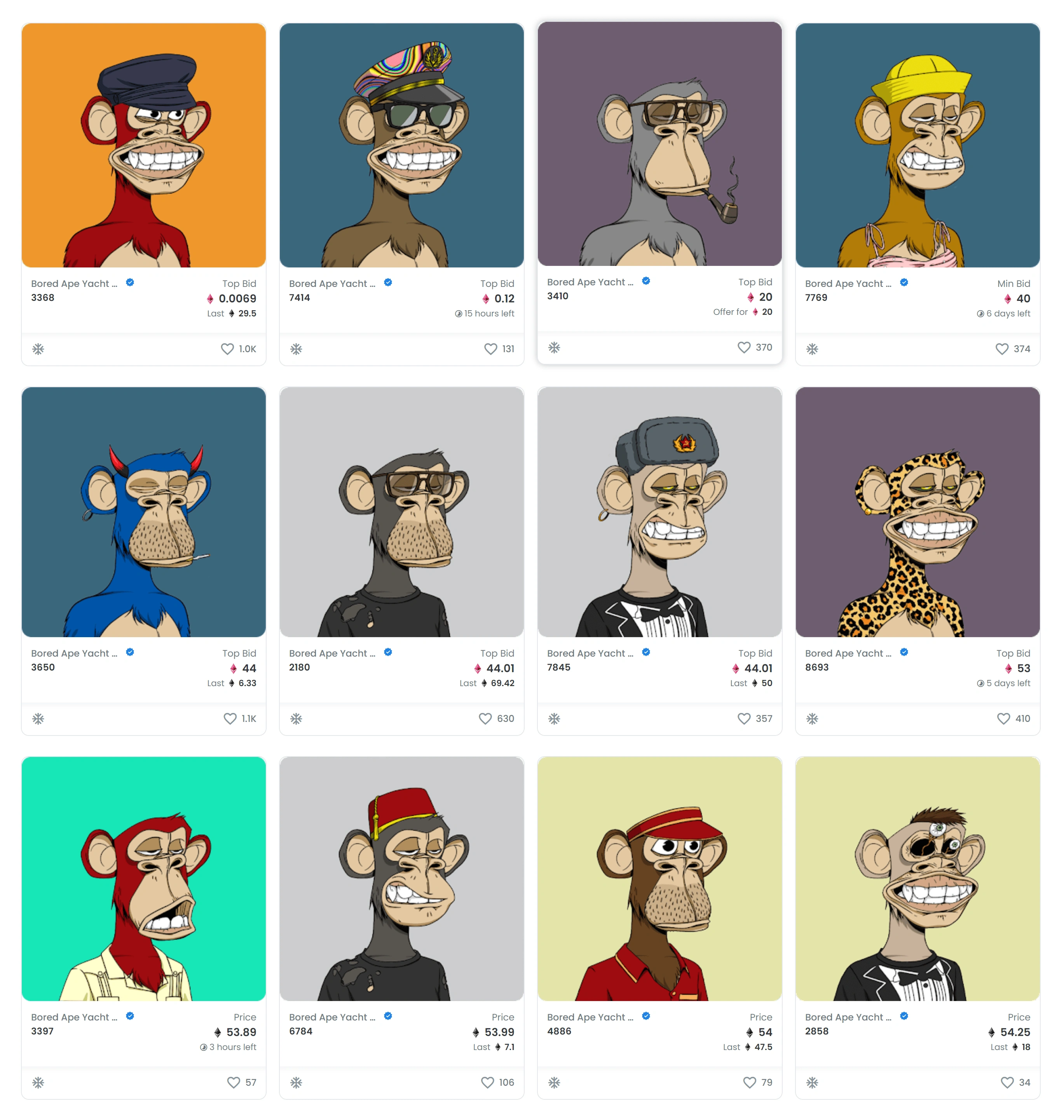

While CryptoPunks are considered the original - and therefore quintessential - PFP project, 2021 ushered in hundreds of avatar-based copycats (many of which were based on zoo animals). And none has become more famous than the Bored Ape Yacht Club. Launched in April of 2021, the Bored Ape Yacht Club collection contains 10,000 apes who - well - look like they’re bored. Originally listed for just 0.08 ETH - or approximately $190 at the time - BAYC NFTs now sell for hundreds of thousands of dollars. On the surface, BAYC is but one of hundreds of animal-based PFPs. However, after putting serious effort into building their community and brand - which landed them multiple celebrity endorsements - BAYC is now considered a runner-up to CryptoPunks’ status as the “coolest” PFP project. In addition to BAYC, other popular animal projects include Cool Cats (endorsed by Mike Tyson) and The Doge Pound (of which world-famous DJ Steve Aoki has 21). And it’s not just animals. From gangster baby GEVOLs to the simple, pastel Doodles, consumers with a wide range of preferences are snatching up PFPs left and right. Admittedly, much of the price speculation that happened in the summer of 2021 was driven by “investors” trying to make a quick buck. However, a large number of artists struck gold selling unique, one-of-a-kind art that had nothing to do with profile pictures or zoo creatures. One example is the top-selling Art Blocks project, which curates pieces from individual artists to include in their high visibility collection. Another includes the Vortex, a collection of 1,000 animated GIFs that contain fractal and rotating vortices (while selling for over $3,000 apiece). As companies invest more and more money into building immersive, digital worlds (known as Metaverses), investors with money to burn have begun snatching up digital land. And nowhere is this trend more pronounced than on Sandbox, the leading metaverse platform. With a minimum price of 3 Ethereum - which equals about $12,000 as of this writing - investors are snatching up NFT-based plots of digital land. In some cases, to the tune of millions of dollars. The same goes for Sandbox’s primary competitor, Decentraland (where plots are now selling for 3.4 ETH, which comes out to about $13,000). As of now, these plots serve no real-world utility. However, if the Metaverse becomes as big as social media - or the Internet itself - these plots of land can be used for digital commerce (just like they can here in the real world). And based on the hundreds of millions of dollars being poured into digital land, many see prime metaverse real estate as the digital equivalent of Malibu beachfront property.Profile Pic Projects

Bored Ape Yacht Club

Other Avatar PFPs

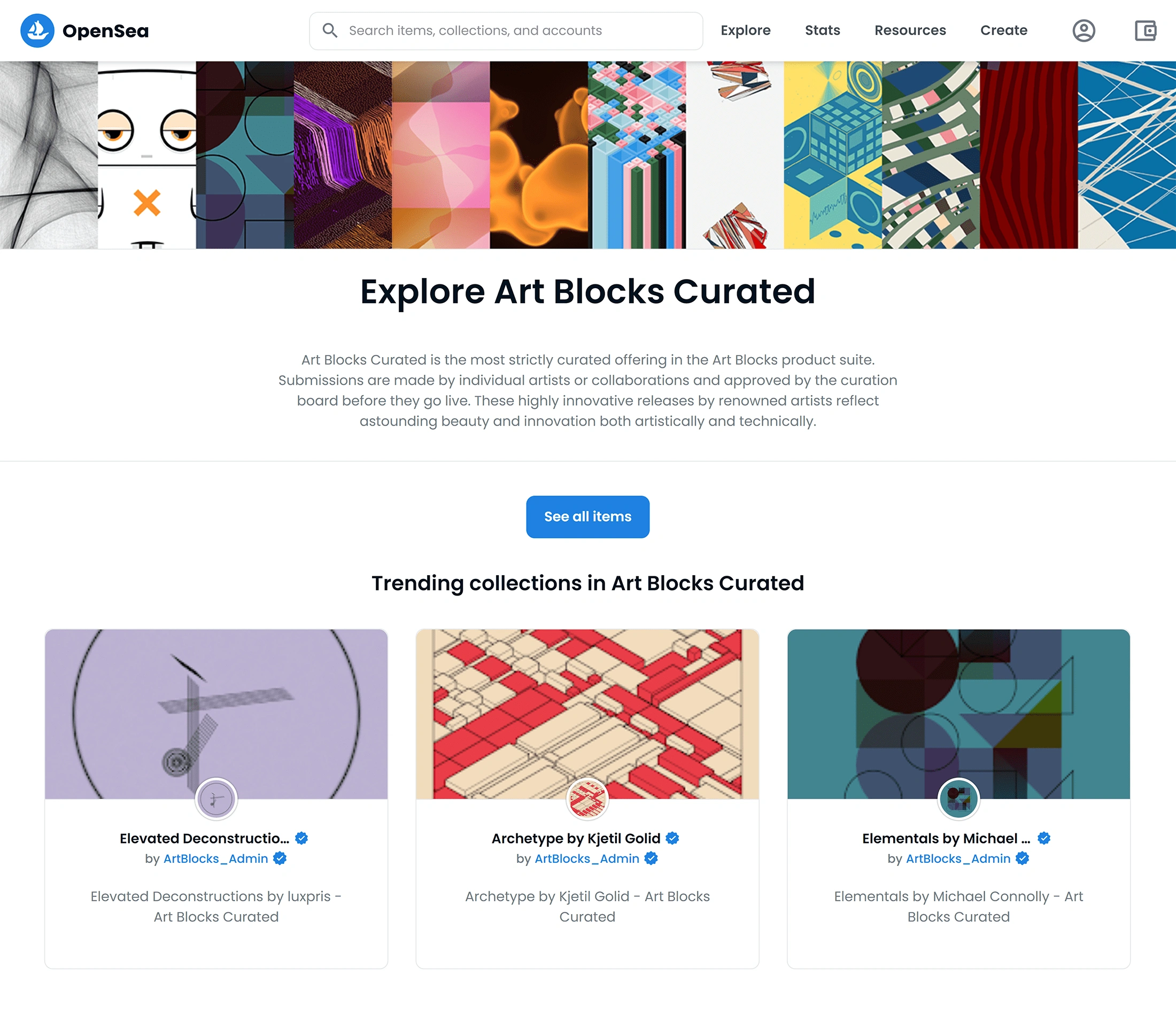

Non-Avatar Projects

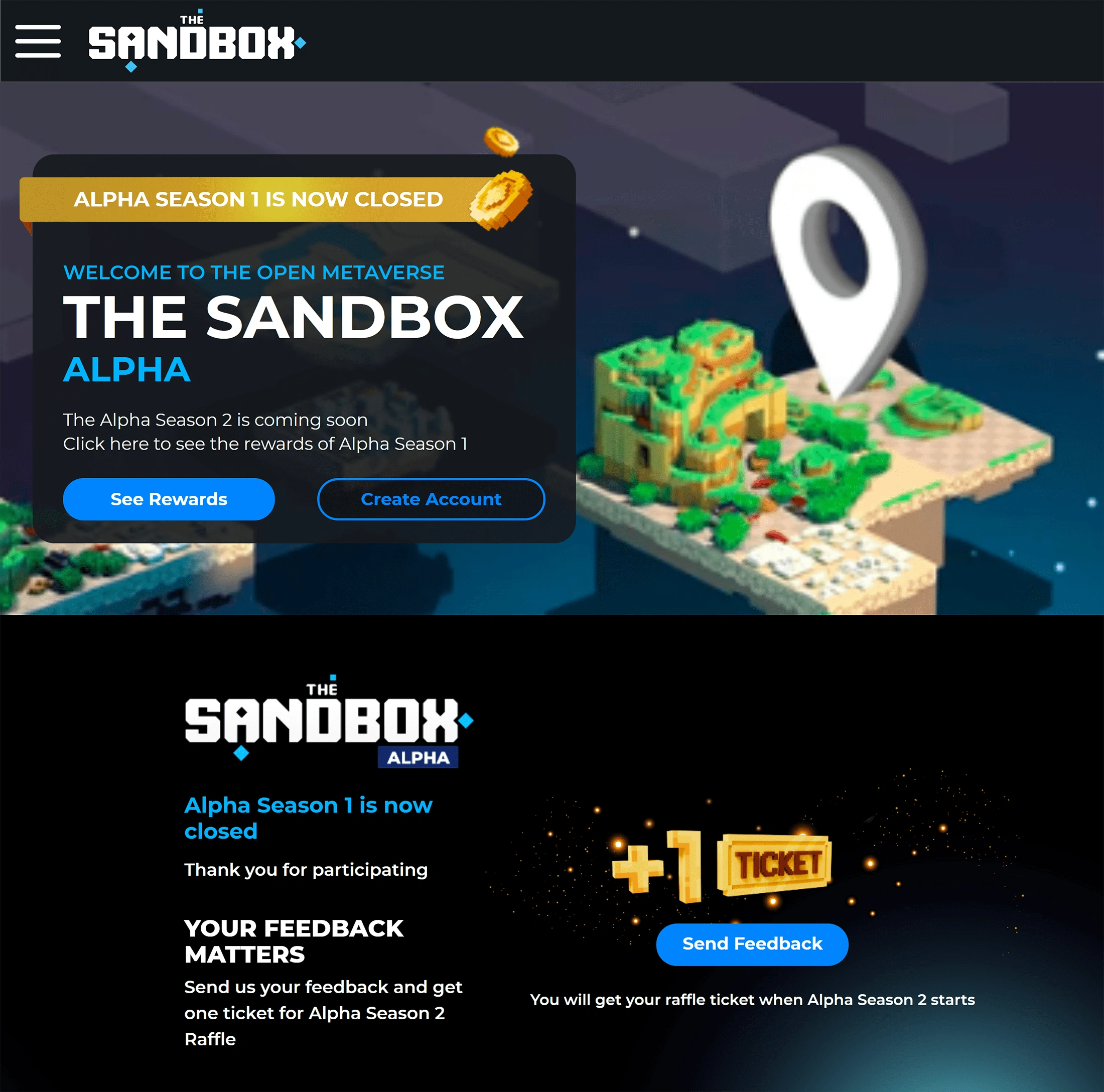

Digital Land in the Metaverse

Where (and How) to Buy NFTs

In this chapter, we’ll discuss where consumers can buy NFTs and the payment methods available as part of the purchasing process.

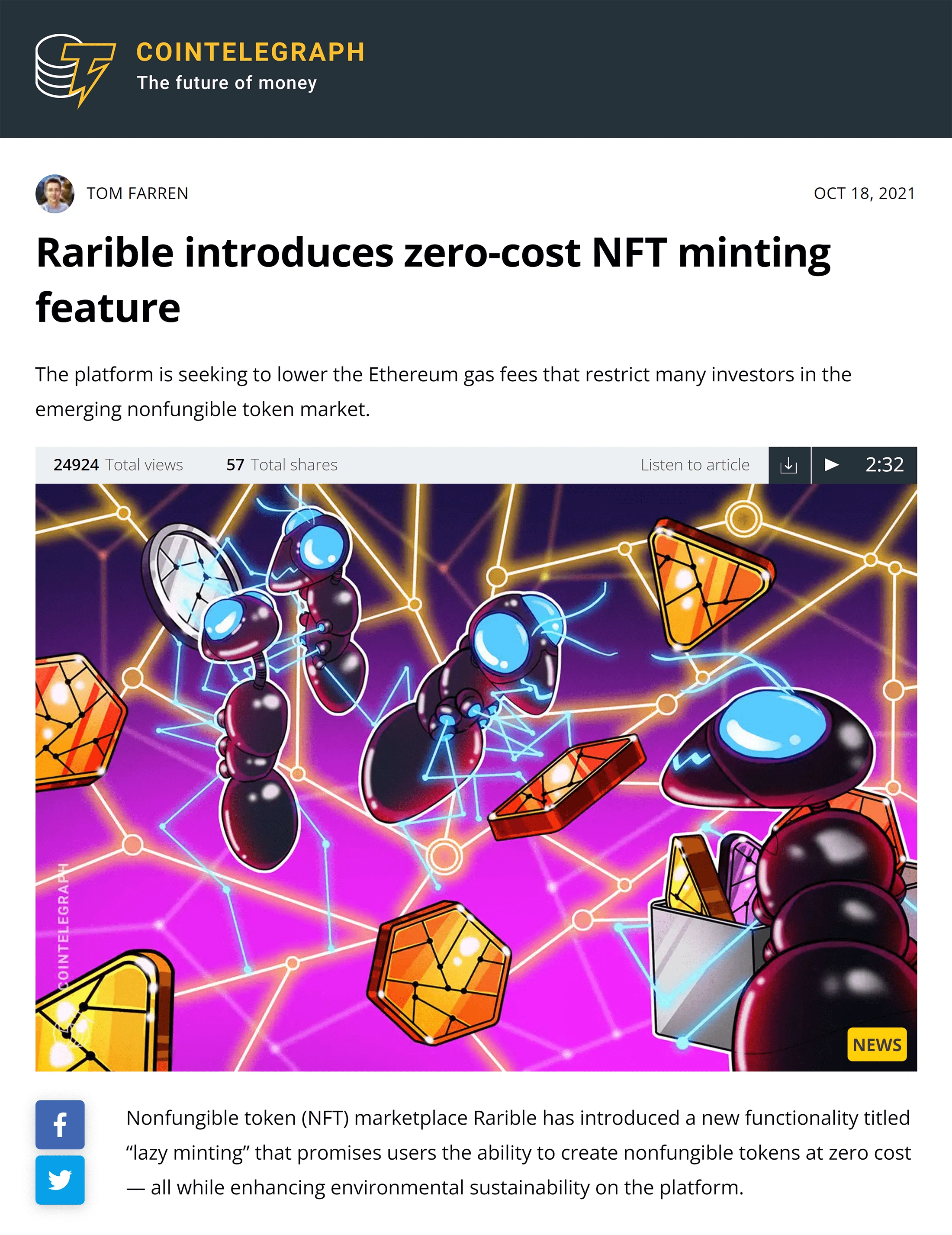

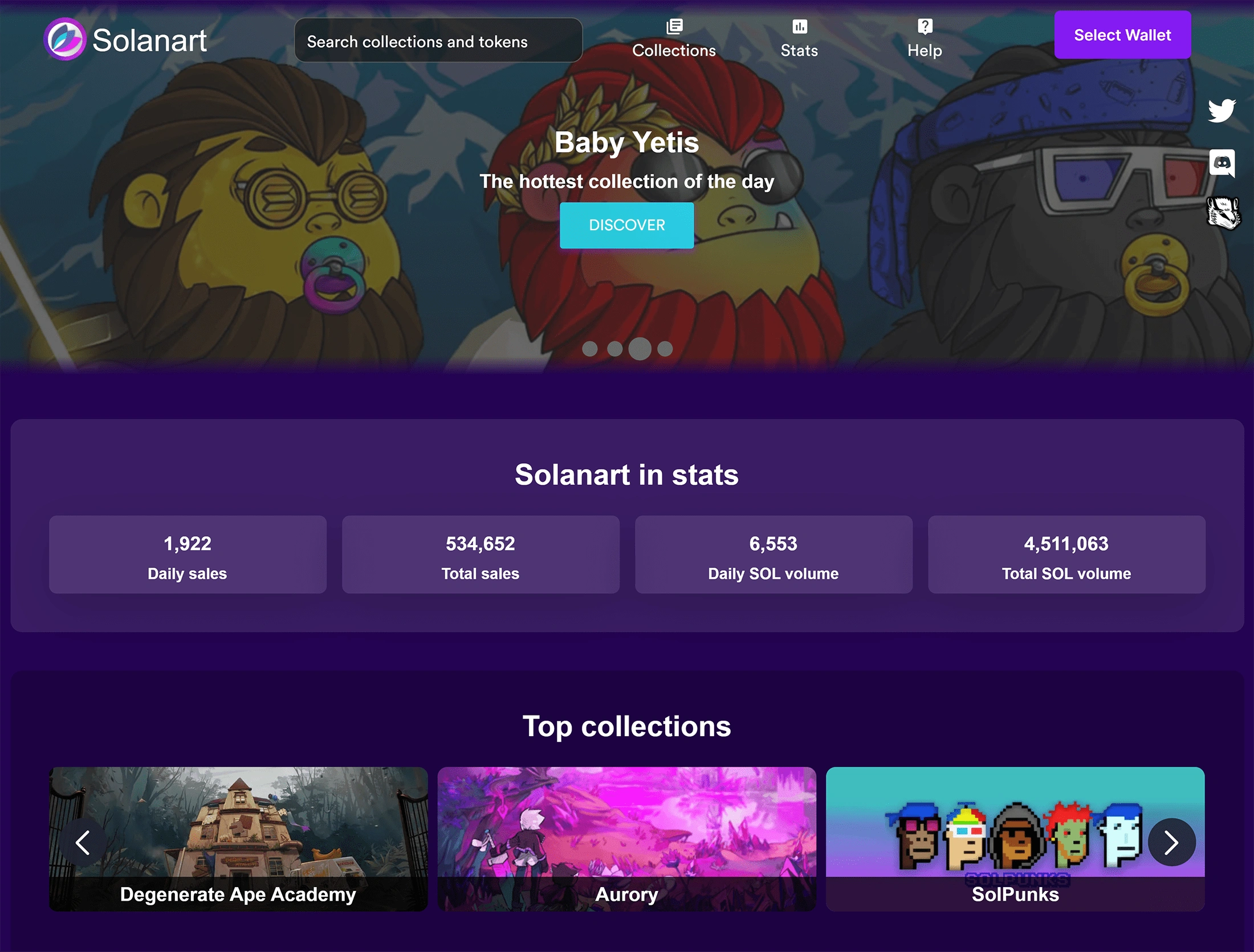

One of the first decisions NFT buyers have to make is what cryptocurrency platform (aka blockchain) they want their NFT hosted on. Up until mid-2021, the overwhelming majority of NFTs projects were hosted on the Ethereum blockchain. Mainly because Ethereum was one of the only platforms that had the technology needed to store and transfer the data that’s tied to an NFT. However, when Ethereum prices climbed 10x between late 2020 and mid-2021, fees to use the network (known as “gas fees”) climbed 10x as well. To the point, some Ethereum users have paid hundreds (and even thousands of dollars) just to “mint” one NFT. In fact, high fees were a large part of why the NFT market collapsed in September of 2021: Everyday consumers just couldn’t afford the fees. With that said, Ethereum has enjoyed a bit of a network effect. When the NFT mania began in early 2021, Ethereum was the only mainstream blockchain with working NFT technology. Because of that, Ethereum is still the #1 blockchain in terms of NFT sales volume. And when it comes to searching for and buying NFTs, OpenSea, Rarible, and SuperRare are three of the top marketplaces. However, because of the high fees involved, an increasing number of NFT projects - and marketplaces - are launching on the Solana blockchain (where fees are mere pennies). Examples include Solanart and SolSea. Further, some platforms - including OpenSea - allow users to purchase NFTs with credit and debit cards (in which case the Ethereum gas fee is included in the purchase price). Whether you choose Ethereum, Solana or another chain, the purchase process is virtually the same. First, you’ll need to set up an online cryptocurrency wallet (which acts as a virtual wallet that you interact with via your Internet browser). Options include MetaMask, Trust Wallet, and a host of others. Tutorials on how to set up each one can be found on YouTube. Once that’s done, you’ll use your wallet to log into the NFT platform you’re interested in buying from. Almost every platform has a “Connect” button in the top right corner of their website. Click that button to connect your wallet. If you’ll be paying with a card, navigate to the NFT you wish to purchase and click the Buy Now button. From there, you’ll pay following the same process you do for any other online transaction. Once you’re done, the NFT will be deposited into your wallet (the process for viewing the NFTs in your wallet varies on each platform). If you prefer to pay with crypto (or do not have a choice), you’ll need to buy some Ethereum or Solana and deposit it to your virtual cryptocurrency wallet. Regardless of what country you live in, you will first need to purchase some Ethereum or Solana tokens and transfer them to your online wallet (before you’ll be able to purchase the NFT). *Once again, because the fees for doing this on Ethereum can range upwards of $100, we recommend purchasing your NFTs with a card if at all possible. If you cannot pay with a card, this tutorial explains how to buy cryptocurrency using Coinbase, the #1 crypto exchange in the US. If you’re outside the US, please find the appropriate marketplace and read through their tutorials (or find a video on YouTube) to discover how you can buy crypto on their platform. Once you’ve purchased your Ethereum or Solana, this tutorial explains how to transfer it to your virtual wallet (the process is the same for both coins). And please note: If you make a mistake during the transfer process, it is highly unlikely you will be able to get your funds back. Because of that, be extremely careful when copy / pasting your virtual wallet address into the exchange you’re sending your crypto from (and vice versa). Once the funds have been successfully deposited into your wallet (this tutorial explains how to verify your transfer), the checkout process is very similar to buying a good or service online. Just remember: In addition to the price of the NFT, you’ll need to leave some extra money for “gas fees” (the fees blockchains use to process transactions). Without extra funds for fees, you won’t be able to purchase your NFT. Sadly, many ETH users end up having to pay gas fees twice because they forgot to include extra ETH in their first transfer. On Solana, however, the fees are so minimal this shouldn’t be an issue. The process of viewing your NFT once you’re completed your purchase is different for every platform and wallet. Because of that, we recommend you do some searching on Google or YouTube regarding how you can view your NFT(s) once your purchase is completed.Choosing a Blockchain

The Downside of Ethereum NFTs

The Marketplaces

The Purchase Process

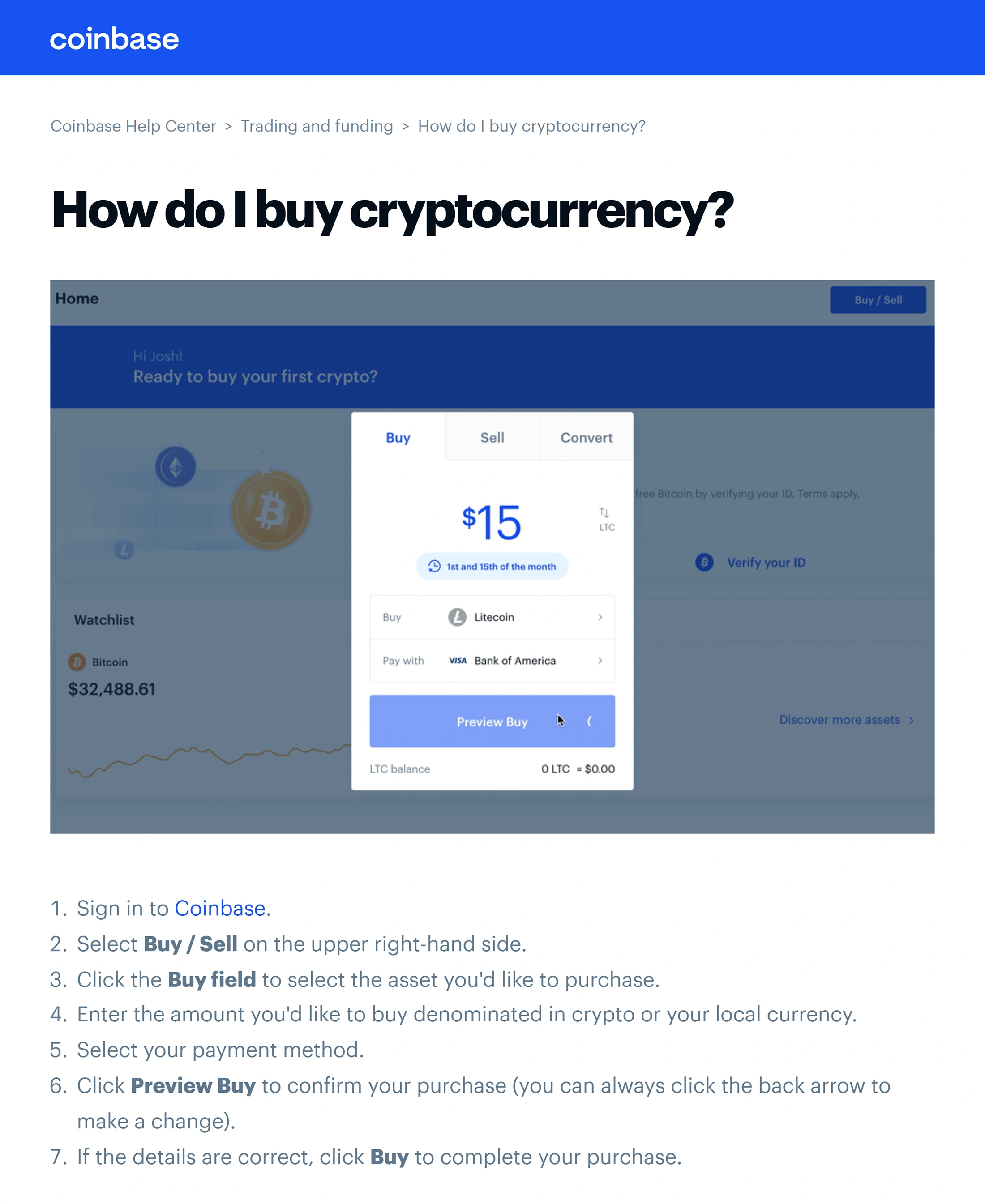

Paying with Crypto

Tutorials

Paying for Your NFT

Viewing the NFT in Your Wallet

The Future of NFTs

In this chapter, we’ll discuss the future of NFTs in the near and medium-term future.

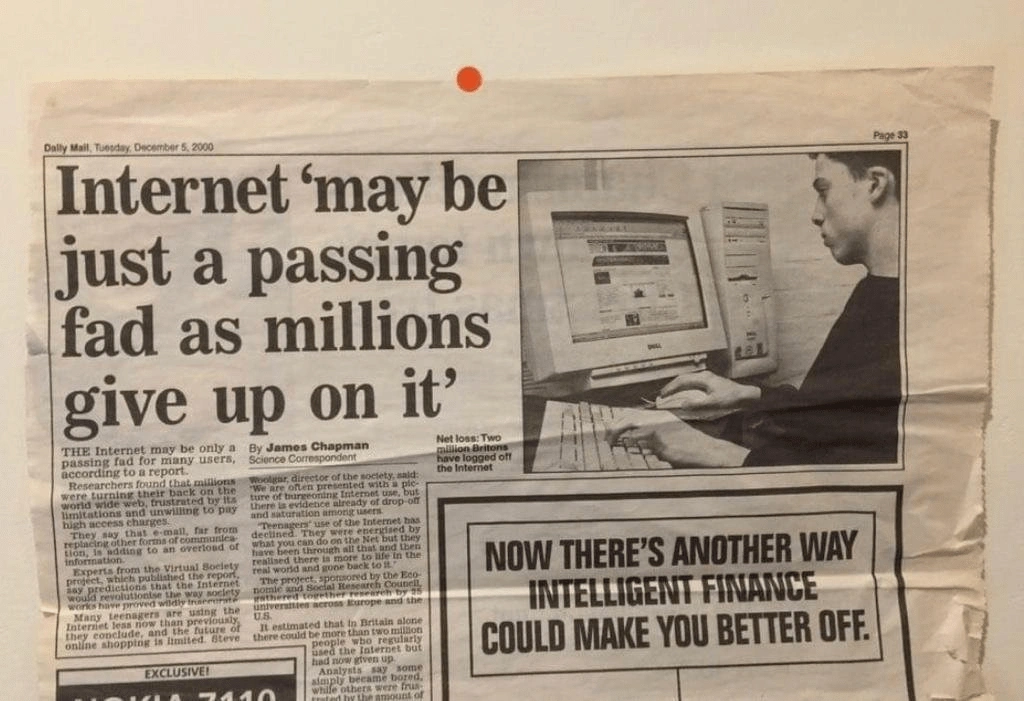

From Tulip Mania to the Beanie Baby craze, hundreds of years of history have proven speculative bubbles almost never end well. And when it comes to NFTs, the same could be said. After a meteoric rise to prominence in the summer of 2021, NFT sales fell off a cliff in mid-September (dropping from $350 million in sales in August to right under $50 million by November). Unlike beanie babies, however, NFTs have real-world utility. Because of that, it's possible NFTs as an asset class follow in the footsteps of real estate and certain sectors of the stock market. Sometimes they’re hot, sometimes they’re cold, and sometimes they bubble up into overvalued territory before crashing back to earth. Despite those crashes, however, they continue pushing forward. Further, the idea of NFTs 2.0 is compelling. Rather than being driven by speculation and computer-generated animal pictures, artists, consumers, and blockchain companies are looking to solve real-world problems using NFT technology. While the appreciation of art is highly subjective, the numbers don’t lie. And in 2021, auction houses made a killing off NFT sales. Internationally famous, both Christie’s and Sotheby’s generated tens of millions of dollars in revenue from NFT auctions in 2021. In fact, thanks to NFTs, Sotheby’s had a record-breaking year. Further, NFTs represent what is - for most consumers - their first opportunity to invest in art. Historically speaking, the art market has been dominated by millionaires and billionaires. And for good reason: Most pieces range from the high six-figures into the tens of millions. Many NFTs, however, are both one-of-a-kind and highly affordable. And while skeptics predict most NFTs will become worthless, works from established and budding artists could increase in value over time (in some cases, exponentially). And it’s not just artists and their fans. Instead, businesses from a wide variety of industries are jumping on the NFT bandwagon. And while it looks like a publicity stunt, Pepsi recently announced they’ll be releasing 1893 NFTs to celebrate the year they went into business (1893). Taking a similarly nostalgic approach, the National Basketball Association (NBA) is now selling NFTs as well - a project known as Top Shots. A hybrid between a highlight reel and a sports card, Top Shots NFTs contain photos and videos of historic moments in NBA history (with some selling for six and even seven figures). In a similar vein, sports behemoth Nike recently acquired virtual shoe studio RTFKT as part of their expansion into creating metaverse clothing. As of now, it's unclear if Nike’s NFTs are designed to be collectibles or digital footwear. With how much money consumers are spending on digital goods, however, we wouldn’t be surprised if it's both. Studies of the wildly popular computer game Fortnite show users spent an average of $85 on digital accessories for their virtual players (known as “skins”). In fact, in 2020 alone, America’s 221 million gamers spent an average of $205 on video games and accessories. A category that includes everything from consoles like PlayStation to smartphone apps and in-game purchases. Doesn’t matter if it's a console, computer, or smartphone game: Consumers have shown they’re willing to spend money to express themselves - and upgrade their experience - in the digital world. And with companies like Facebook and Google pouring billions into AR, VR and the Metaverse, many people believe NFTs will become the avatars / profile pics we use to interact with virtual worlds. A phenomenon some refer to as the Identity Layer for the Metaverse. In the year 2000, news goliath Daily Mail published a piece declaring the “Internet May Just be a Passing Fad as Millions Give Up On It.” While it's clear this prediction was wildly off target, it's easy to forget just how long it can take for new technology to establish itself. Admittedly, NFTs have their fair share of skeptics. Skeptics who, in many cases, make good arguments. With that said, NFTs are very much in their infancy (similar to web browsers in the early 1990s). And because of that, artists, consumers, and the companies building picks and shovels around the industry are likely to go through massive growing pains. With that said, the collectibles industry alone is a $372 billion dollar market. Not to mention the $175 billion dollars per year gaming industry or the $50 billion per year art market. And while those industries took decades to mature, the NFT industry skyrocketed from virtual obscurity to more than $7 billion in just one year.The Rise and Fall of NFT Speculation

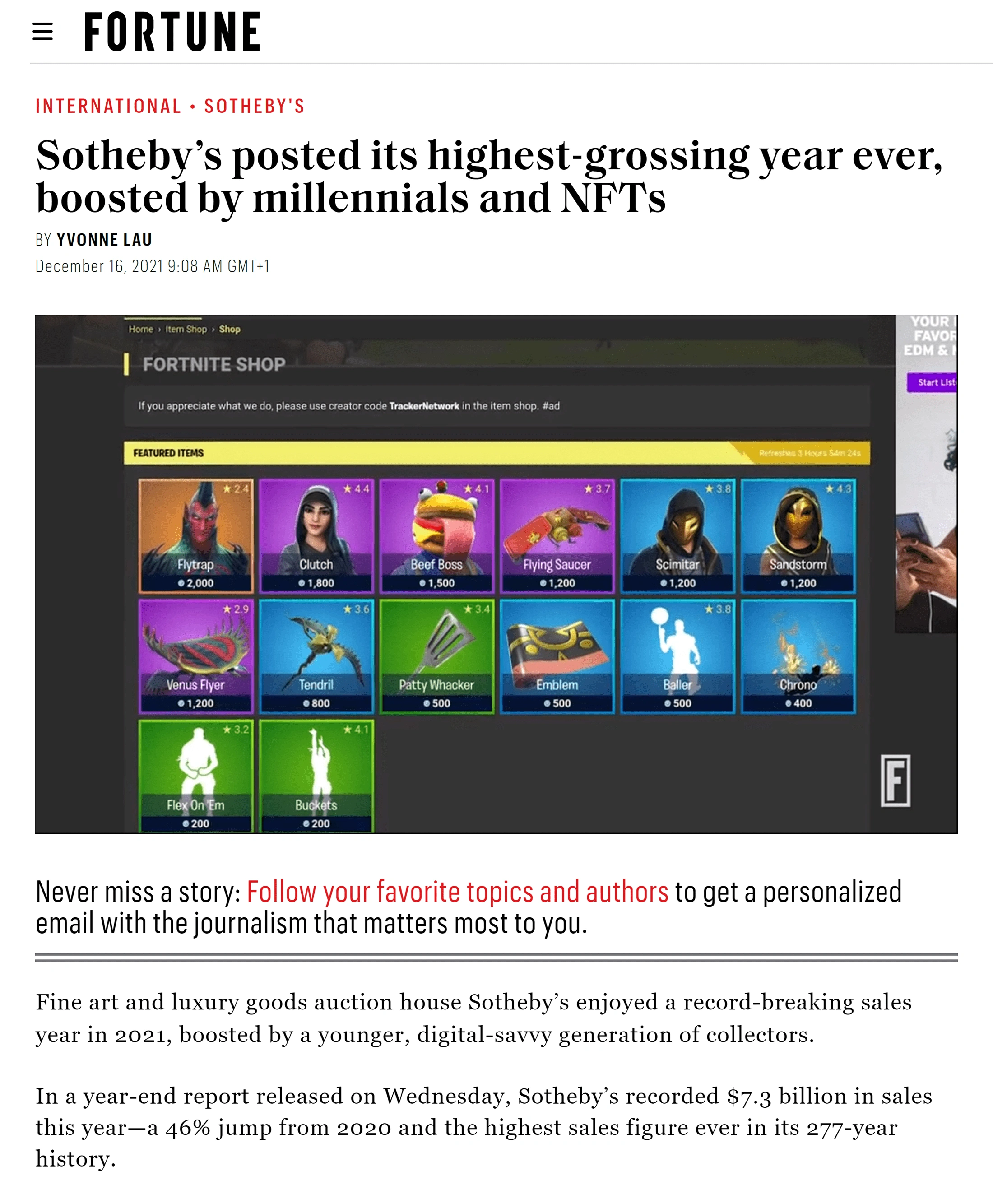

Auction House Participation

Consumers as Art Investors

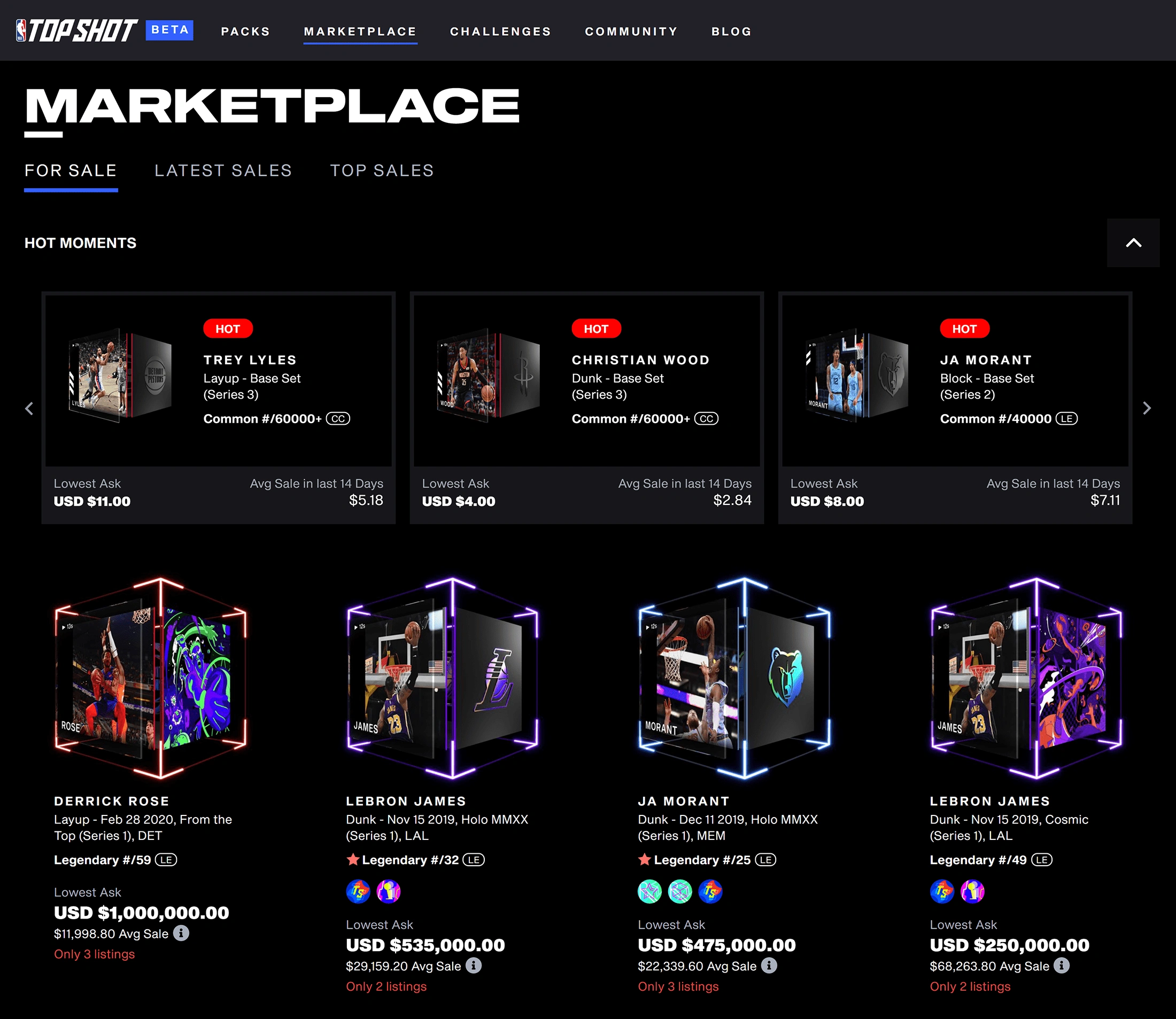

Corporate Participation

The Future of Profile Pics

Addressing the Skeptics

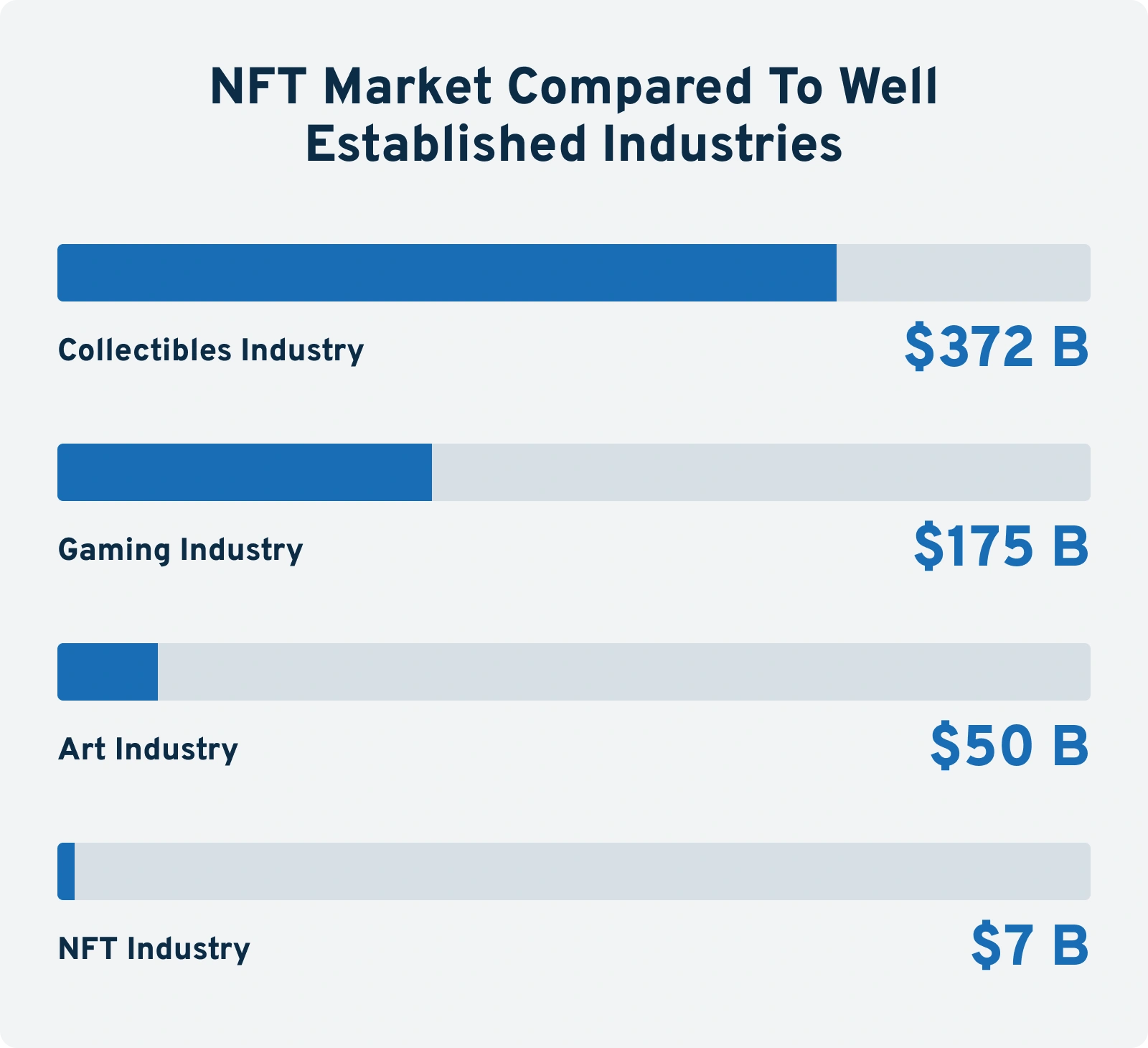

Not Bad For Their First Year

Conclusion

At the end of the day, only time will tell what happens to this nascent technology. On the one hand, NFTs solve a variety of real-world problems. Problems that - so far - no company or technology has been able to solve. On the flip side, media headlines have been dominated by stories of price speculation, scams and wild valuations. Because of that, many believe NFTs are just another form of (dangerous and highly volatile) cryptocurrency investing. With that said, no one can deny the industry’s stunning growth. And if crypto, social media, and the Internet itself are any sign, NFTs are here to stay.