Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Beginner’s Guide to Web3

Web3 is one of the biggest buzzwords in the tech space.

But what is Web3, exactly? And why is it important?

In this guide, we’ll cover everything you need to know about Web3 (aka web 3.0).

Let’s get started.

The Web3 Revolution

In this chapter, we’ll discuss what Web3 is, what makes it different than web 1.0 and 2.0, the key stats, and the technology enabling its growth.

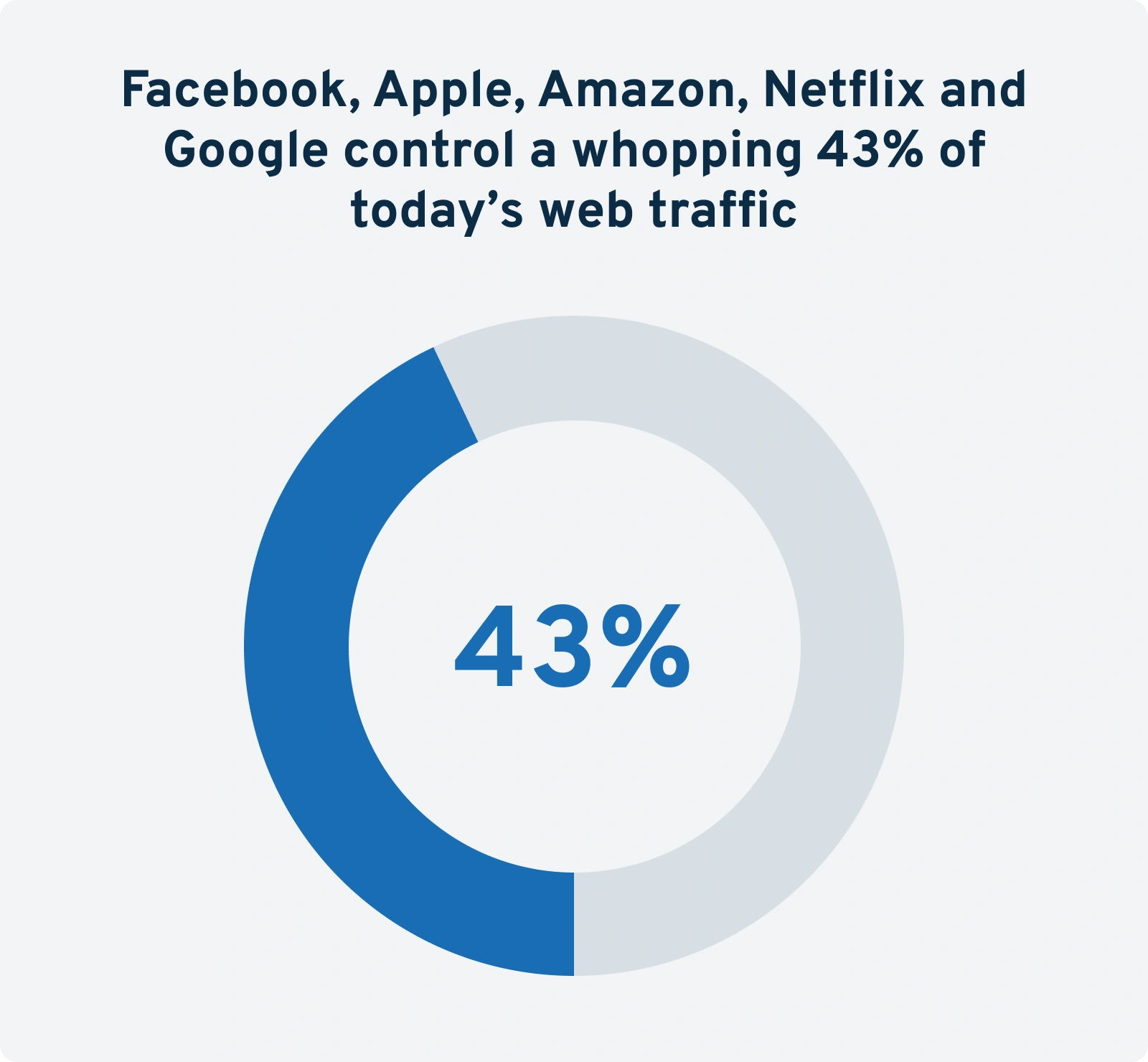

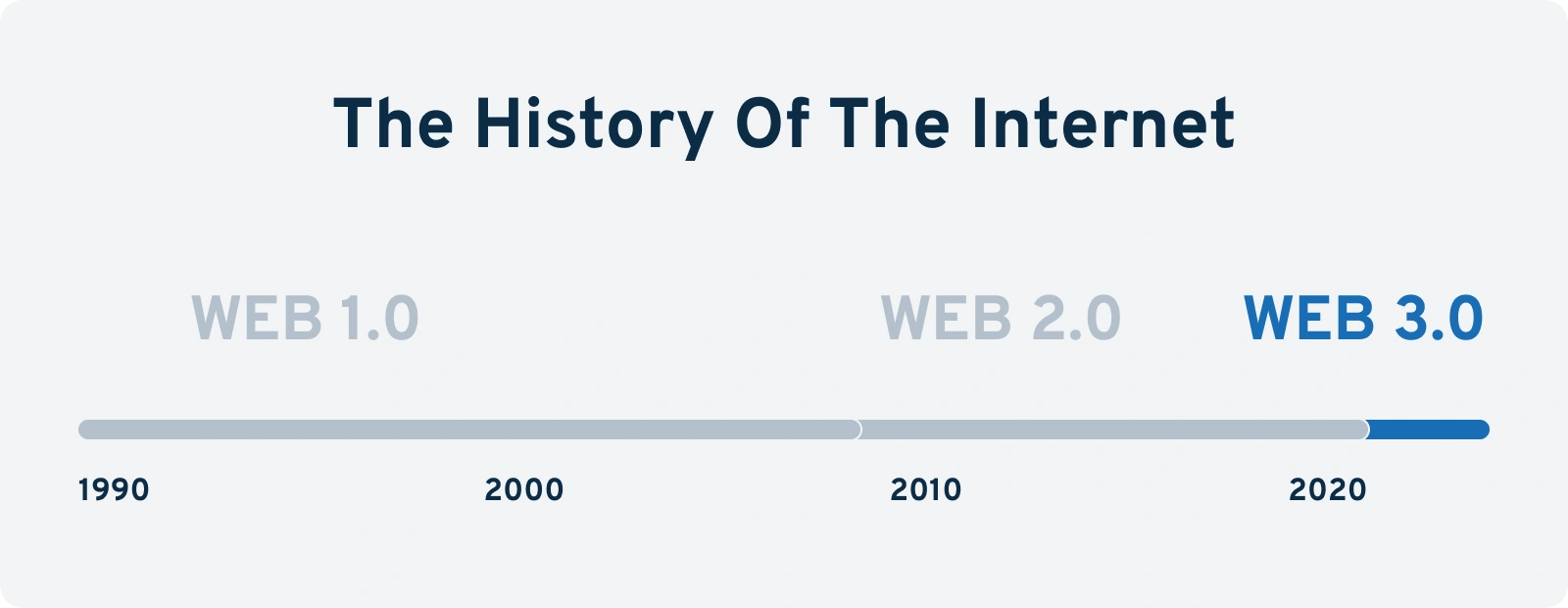

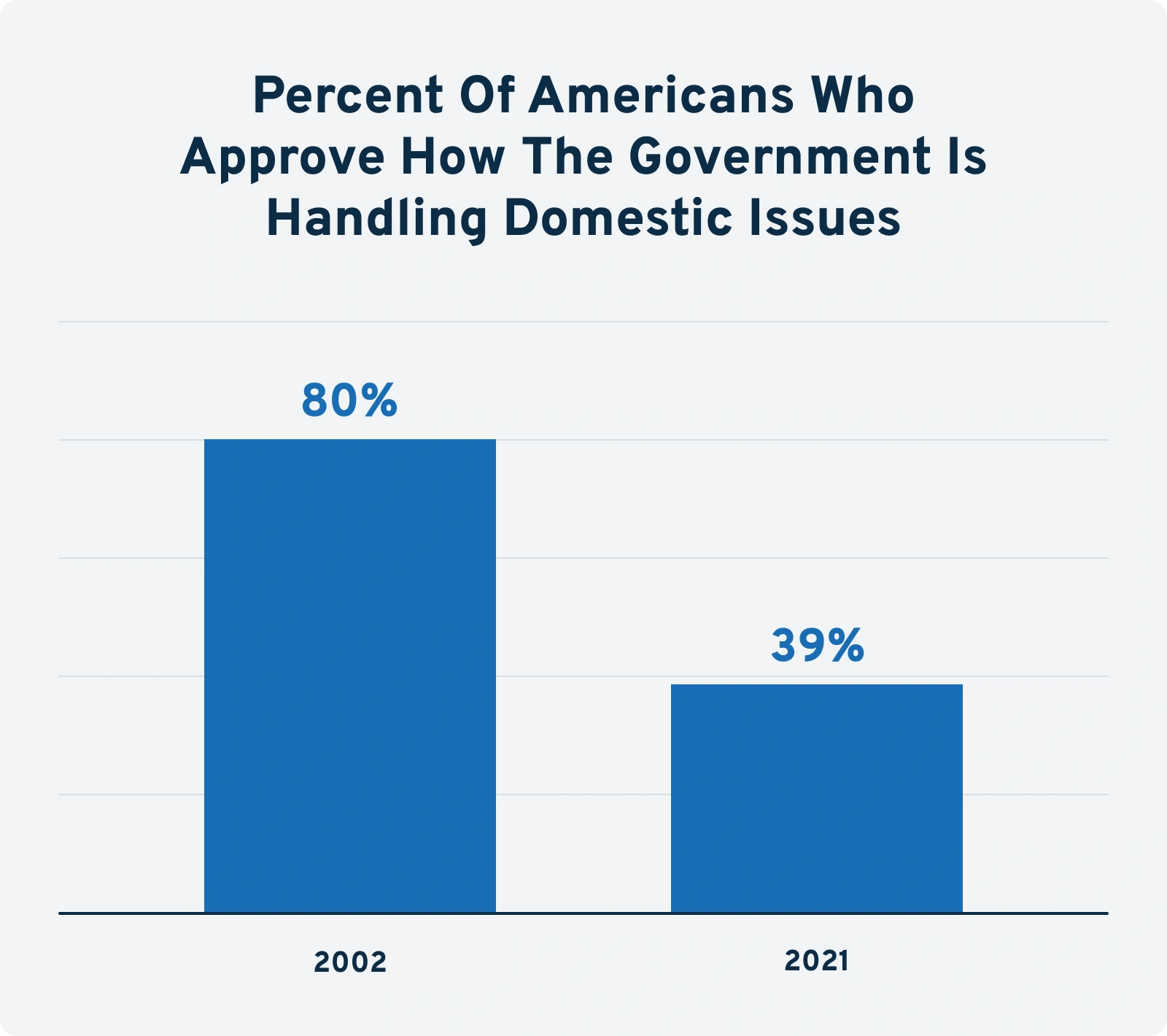

Web3 (also known as “Web 3.0”) is a concept of the internet based on decentralization, user ownership, and blockchain technology. Largely enabled by blockchain, Web3 is based on three fundamentals: The core ideal behind Web3 is that it’s an open-source version of the internet that isn't controlled by any one person or organization. Why does this matter? According to a recent study, five companies (Facebook, Apple, Amazon, Netflix and Google) control a whopping 43% of today’s web traffic. That doesn’t include the fact that over one dozen weather, dictionary, and governmental websites rank in the top 100 highest traffic websites. So while Web 2.0 put content creation in the hands of the public, the storage and distribution of that content is still highly centralized (largely among the five companies listed above). On the one hand, some see Web3 as nothing more than a libertarian dream. On the other hand, the data suggests that Web3 has the chance to put more power into the hands of individual users. While the concept of Web3 is larger than just cryptocurrency, the rapid growth of Web3 is most apparent in the world of Decentralized Finance (aka DeFi). In May of 2020, a study from Raynor de Best showed there was just $1 Billion locked in DeFi. Fast forward to today and DeFiLlama.com shows there are more than $39 billion dollars locked in decentralized finance protocols (as of December 2022). In fact, Celsius - one of the leading DeFi lenders in the US - ranks among the top 10,000 websites in the US, attracting millions of visitors per month. Web 1.0 was defined by a static stream of information controlled by a small number of websites. This was mainly due to the simple fact that, 20 years ago, very few people knew how to build and maintain websites. Web 2.0, however, turned that paradigm on its head. Between drag-and-drop website builders, the proliferation of social media, and the growth of broadband Internet, the second (and current version) of the Internet is defined by User Generated Content on a tremendous scale. And while we’re still living in a Web 2.0 world, many believe we’re on the cusp of a new version of the internet, commonly referred to as “Web3”. It’s been said that “History doesn’t repeat itself, but it does rhyme.” So while naysayers downplay the relevance of Web3, Web 2.0 had plenty of skeptics in the early 2000s. Skeptics that - over time - were proven wrong. While early adopters first signed onto AOL and Netscape in the early 90s, it took a full decade before we got a glimpse of what the “next Internet” might look like. And even after we got that first glimpse, it took another five years before Web 2.0 came to fruition (in the late 2000s). With that said, the Internet of today isn’t much different than it was 10 years ago. Yes, download speeds are faster, videos are crisper, and we have more sites to shop on. But generally speaking, today’s Internet is an upgraded version of what we had in 2010. Web3, however, represents a complete overhaul of how people use and interact with the web. And similar to what happened with Web 2.0, it's both innovation - and a shift in macro-trends - that are bringing Web3 mainstream. There are four core trends behind Web3 starting to see practical applications for the first time: While many associate Bitcoin with cryptocurrency, in reality, Bitcoin was the first practical application of a technology called Blockchain. Blockchain is a digital store of record that’s permanent, decentralized, and (largely) unhackable. On the surface, it can be hard to understand why these seemingly-simple traits are so revolutionary. However, as we’ll explain below, the invention of blockchain - combined with rapidly shifting trends - lies at the heart of why Web3 is exploding. Whether it’s organized religion, the government, or large corporations, Americans’ trust in large institutions is at multi-decade (and in many cases all-time) lows. For example, a September 2021 Gallup poll shows just 39% of Americans approve of how the government is handling domestic issues (compared to almost 80% in 2002). And it's not just the US. From France to Thailand, large institutions worldwide are suffering from a decline in public approval ratings. And as we’ll explain below, this decrease in trust is what makes Web3 an appealing alternative for many folks. Even in today’s high-tech society, the process of moving money from one country to the next is highly inefficient. Between fees and delays, both consumers and businesses are desperate for a faster, more cost-effective solution to move money and goods across borders. While many people lament the degree to which technology dominates our lives, the truth is we’re just getting started. While online gaming, content consumption and online shopping hovering near (and even breaking) all-time highs, initial studies show that early adopters of virtual reality (VR) plan to spend even more time with the technology in the near future. None of these trends individually are likely to lead to a “complete overhaul” of how we use the Internet. When we combine them together, however, it’s clear to see why Web3 is gaining momentum.What Is Web3?

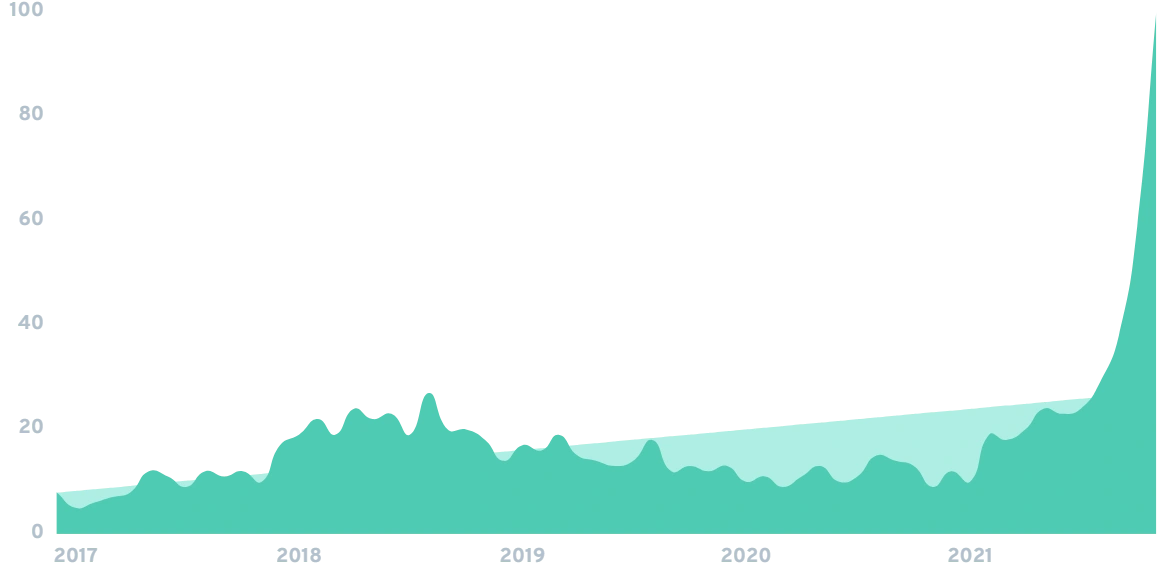

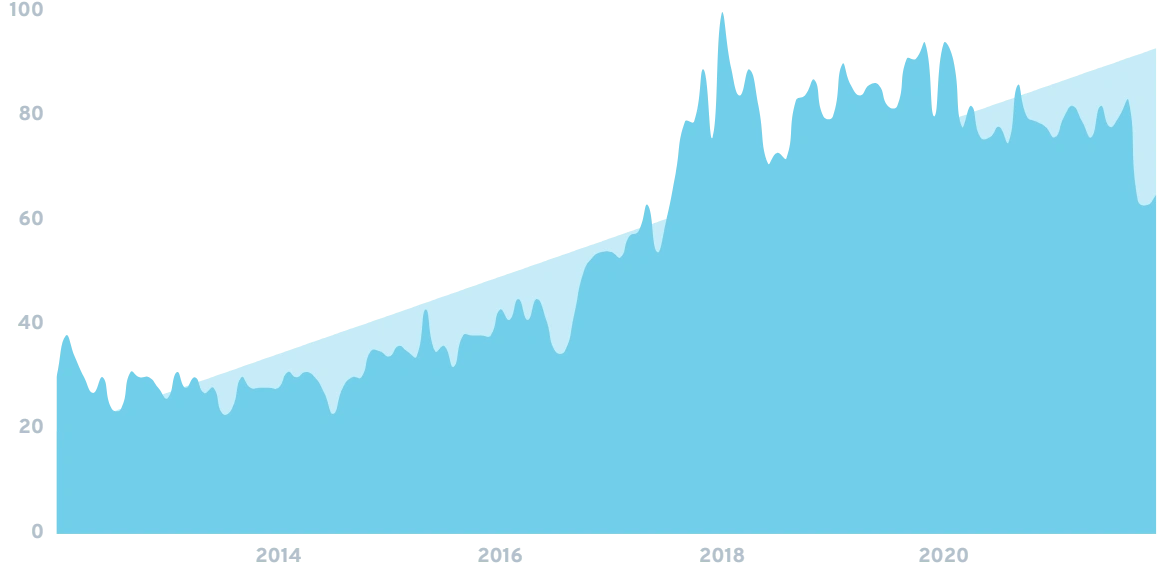

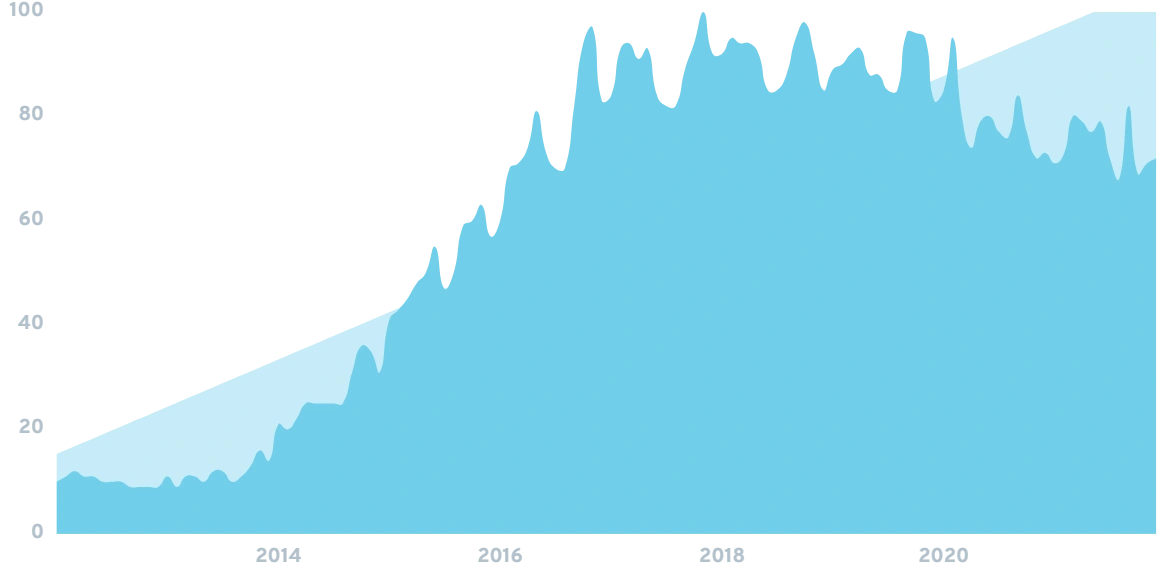

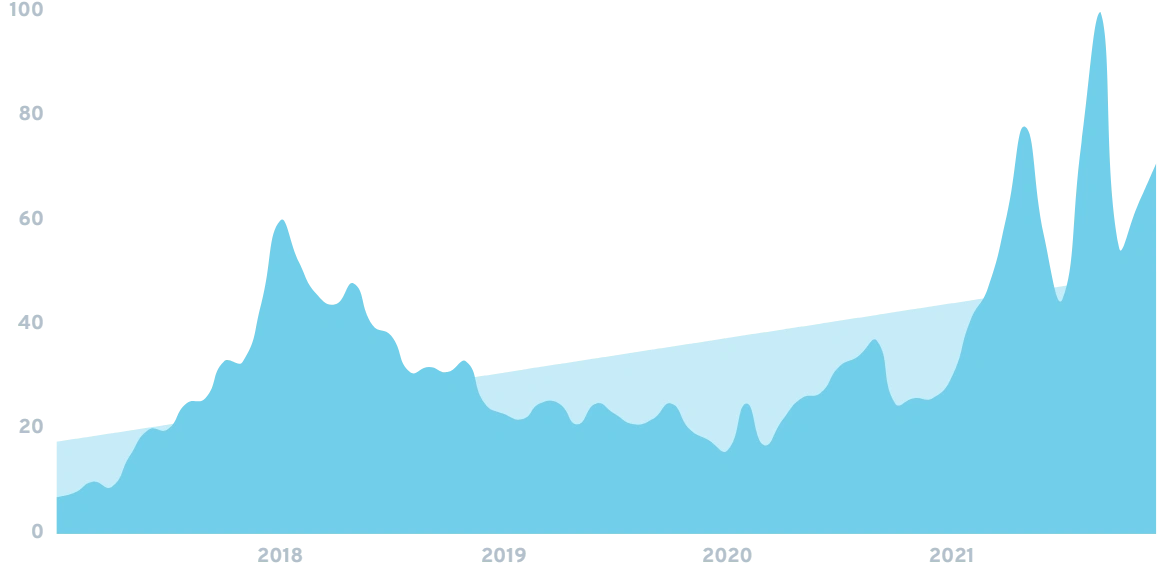

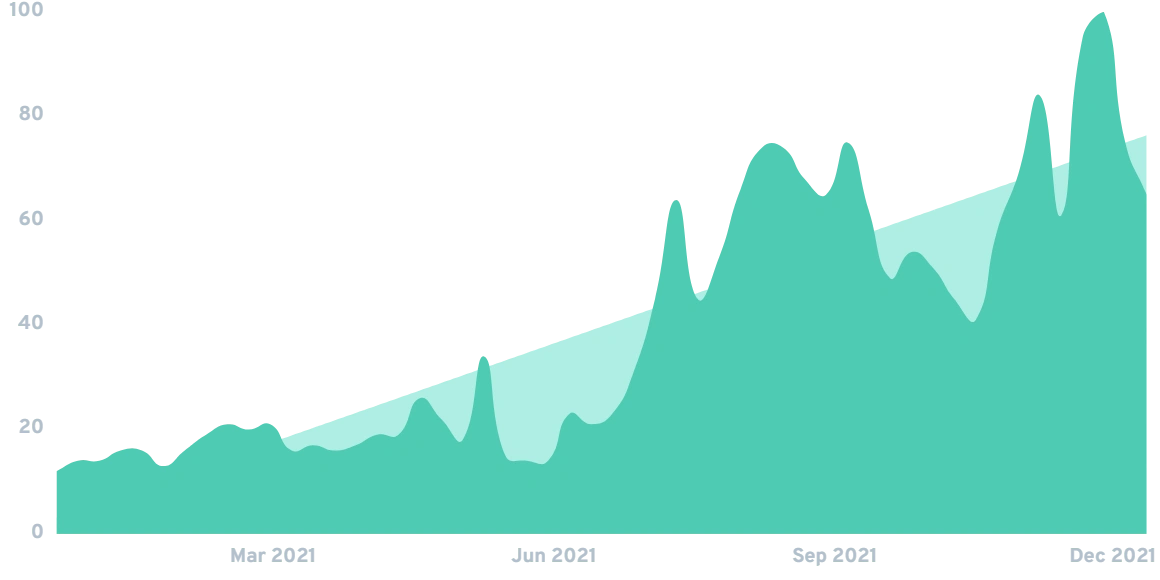

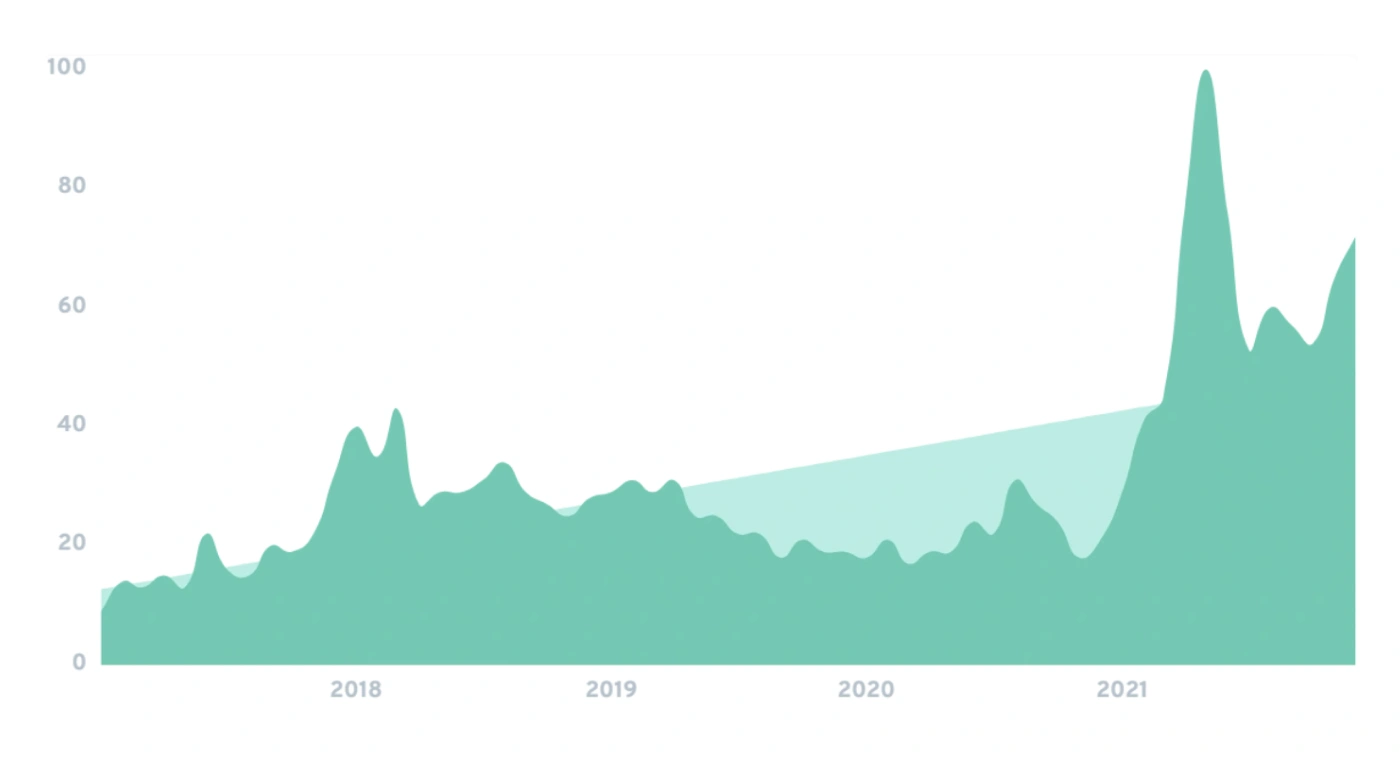

Searches for “Web3” have increased by 837% over the last five years

The First Two “Versions” of the Web

Why Web3 Took Off

Current Tech Trends Driving Web3

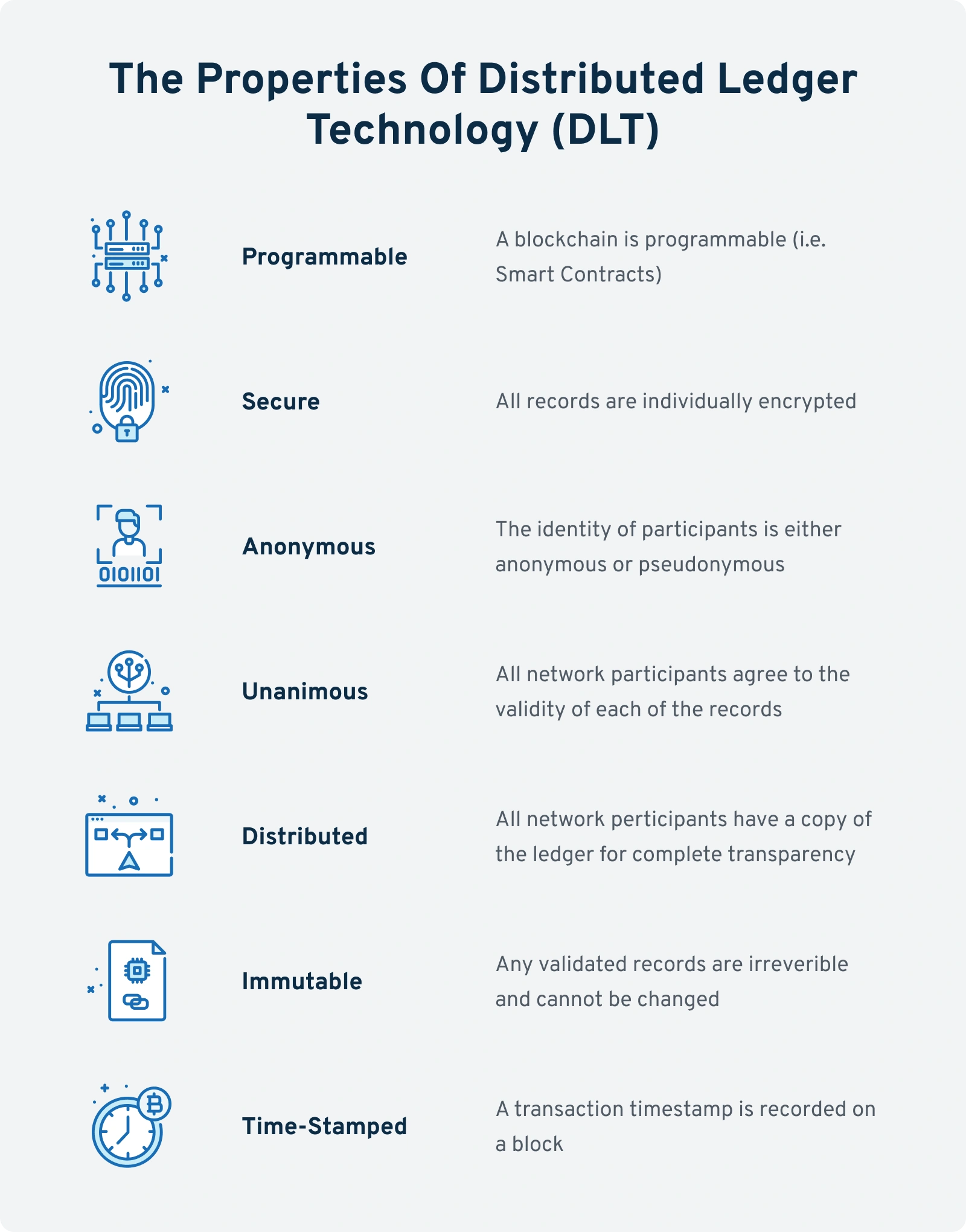

The Invention of Blockchain

Blockchain is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat the systemLoss of Trust in Large Organizations

Borders Are Becoming Less Relevant

The Future Will Be More Digital Than Today

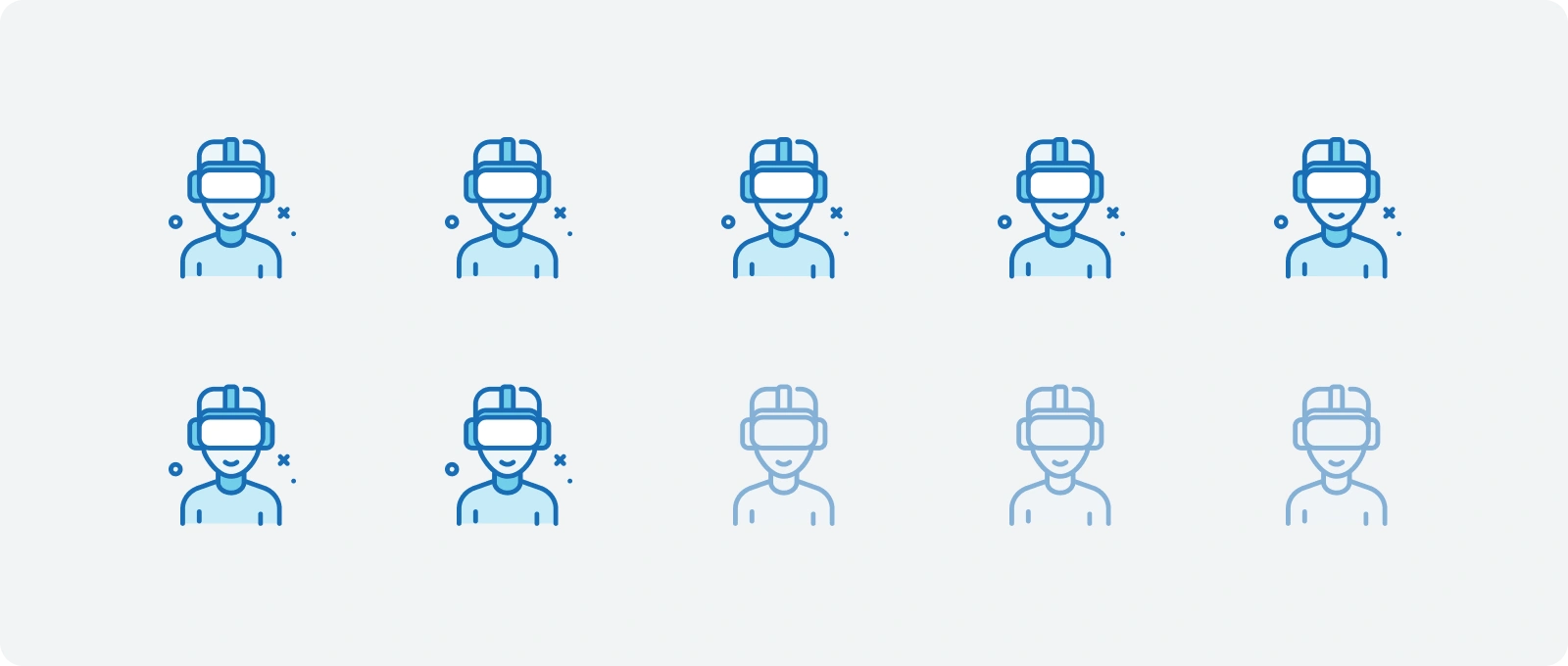

7 out of 10 VR users plan on increasing their VR activities in the next yearThe Perfect Storm

Web3 Explained

The three core tenets of Web3 are decentralization, trustless and permissionless interaction, and the practical application of artificial intelligence and machine learning.

Of these three interconnected traits, however, decentralization lies at the core.

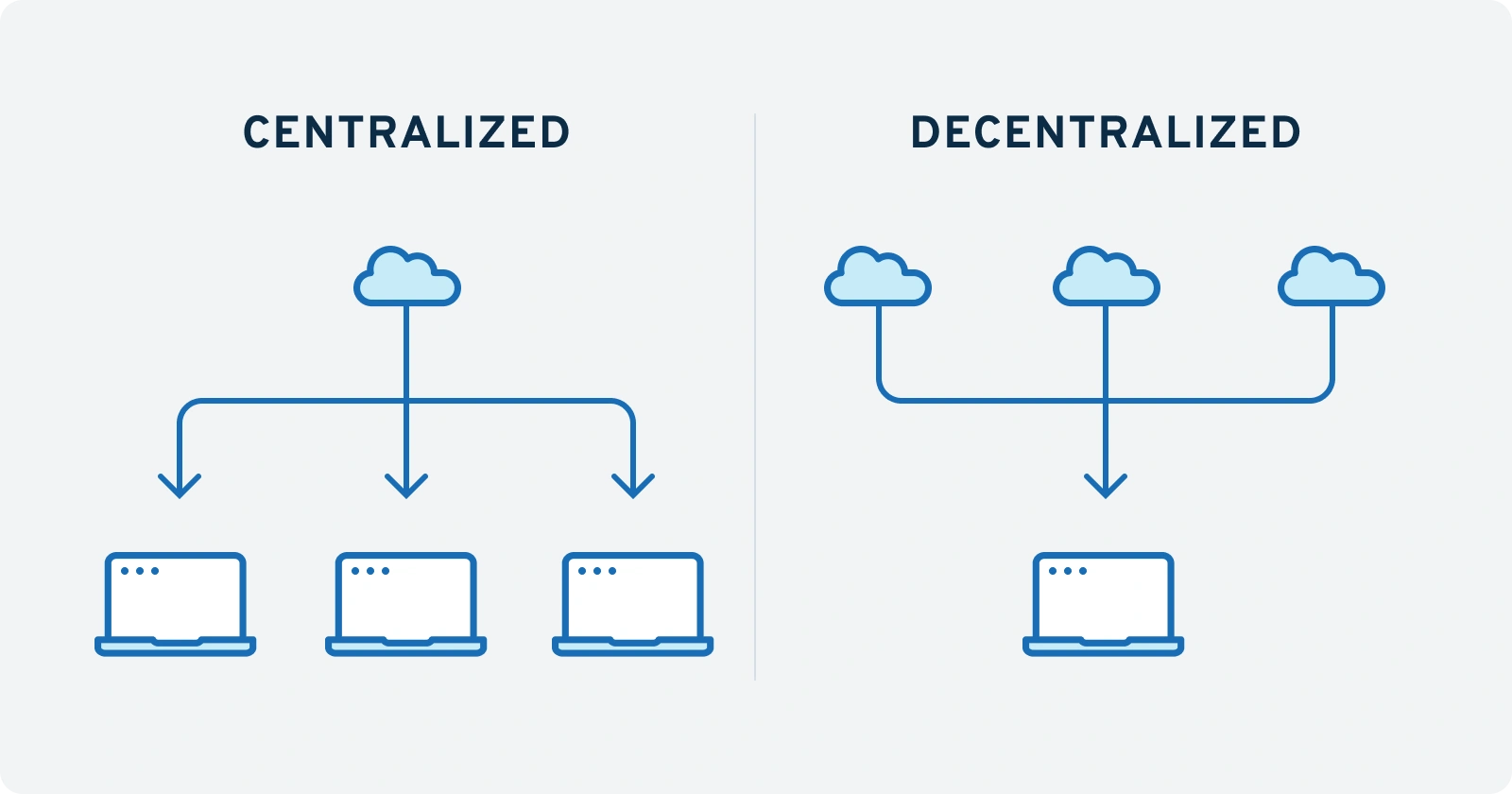

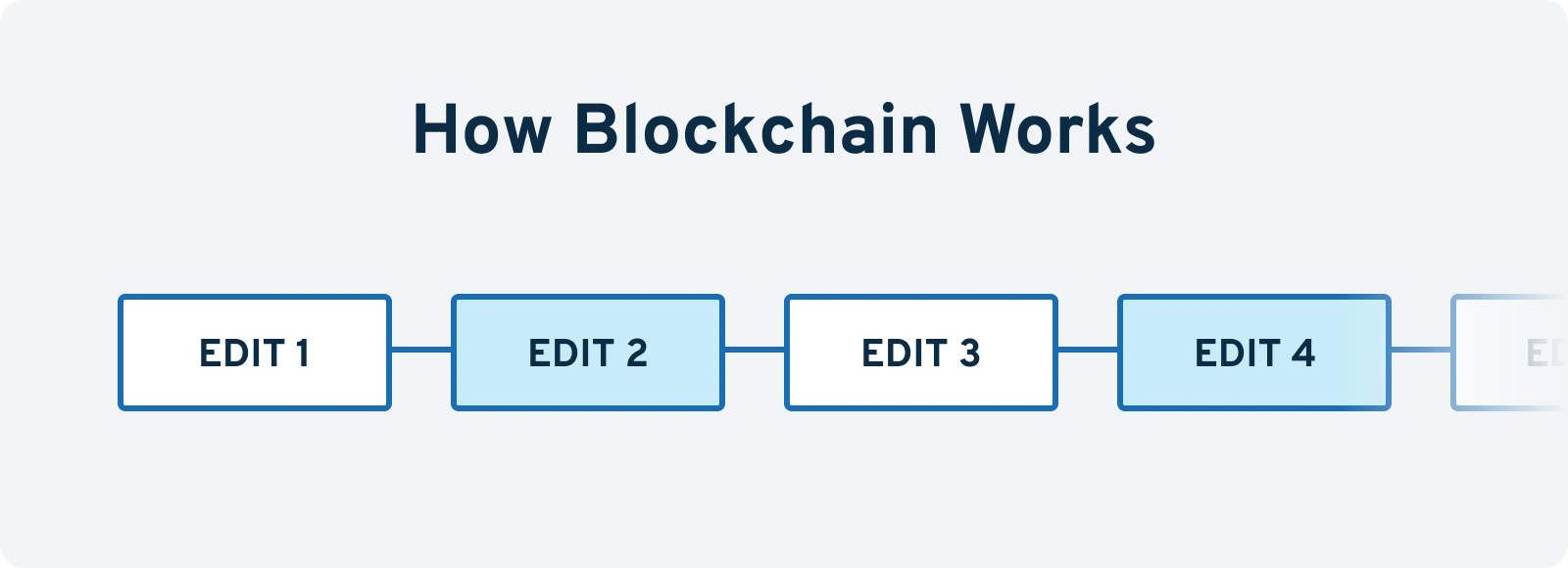

The dictionary definition of decentralization refers to “the dispersion or distribution of functions and powers.” Applied to Web3, decentralization refers to the idea of taking the powers and functions currently dominated by centralized organizations (governments, banks, corporations, etc.) and distributing them to the public. This stands in stark contrast to how the web operates today. On the social media side, Meta (aka Facebook) owns Facebook.com, Instagram and WhatsApp. On the search side, Google owns Google.com and YouTube. And on the shopping side, Amazon controls Amazon.com and a variety of the top 100 sites via their AWS cloud hosting platform. Because of this, these three companies not only control the flow of web traffic, they also control what content can and cannot be shared on their platforms. From free speech censorship to faulty fact-checking, many people (including high-ranking government officials) have grown uncomfortable with how much power “Big Tech” has amassed. In fact, over the past two decades, Microsoft, Facebook, Google and Apple have all faced anti-trust lawsuits. Web3, however, represents an opportunity to reduce some of the sway that these tech giants have. Since day one, any website you’ve ever interacted with has been hosted on a web server. Many of which are owned by companies like GoDaddy and Amazon. And because so much of the content we interact with is hosted and controlled by so few companies, today’s web content is highly centralized. Thanks to blockchain technology, however, internet users now have the option of decentralizing the web. One of the key features of a blockchain is that there’s no single entity that controls the storage and hosting of the content on the network. Instead, it’s distributed, highly encrypted, and continually updated by dozens, hundreds, and even thousands of individually owned and operated servers (referred to as Nodes) all at once. Think of it like when you and a colleague are both updating a Google Sheet at the same time. In that scenario, any edits either of you make are updated and realized on the spreadsheet instantly. Now imagine there are hundreds if not thousands of people updating that same sheet all at once. On the surface, you might think people would be editing on top of each other, clogging up the spreadsheet and canceling out each other’s data. But with blockchain, all updates happen in a perfectly chronological, linear sequence. In theory, it's “possible” to hack a blockchain. However, with a protocol like Bitcoin, doing so would require a level of quantum computing power that quite literally does not exist today (and will not in the near future). Yes, computers may eventually become strong enough to hack today’s technology. However, experts estimate that by then, developers will have increased security to the point even that technology won’t be strong enough. And while smaller chains “can” be hacked through brute force human manipulation (brute force hacks on larger chains are near impossible), developers have been so fast to thwart the hacks the negative effects were negligible. In fact, cryptocurrency as technology is based on incentivizing participants to act honestly and truthfully (via financial incentives) while punishing bad actors (with the threat of losing their funds and/or being removed from the network). And it’s not just crypto. The idea of a perfect, unhackable ledger can be applied to anything where ownership or accurate record-keeping matters. From preventing accounting fraud to certifying ownership of both digital and real-world assets (for example, NFTs), blockchain allows users to create a permanent, unalterable ledger. But this isn’t some advanced technology meant for Fortune 100 tech companies. Instead, blockchain was designed to put the power back into the hands of the people. The second core tenet of Web3 is that it is both Trustless and Permissionless. Similar to how Web 2.0 is based on centralized control of both web traffic and web hosting, the current state of the Internet is also based on you trusting - and being able to access - the websites you’re trying to use. When you send a bank transfer, you trust your bank will take that money and deposit it into the right person’s account. And when you send a Facebook message to your spouse, you trust no one at Facebook (or the government) will intercept that message. On the one hand, most transfers go through without a hitch and most people are not being spied on. Web3 proponents, however, don’t want to take any chances. One argument in favor of Web3 is that computer code removes human bias. Whether it’s a Twitter employee deciding what content to censor, or a mortgage broker deciding if someone is worthy of a loan, we as humans are prone to bias. Code, however, is not. It doesn’t see the color of your skin. It doesn’t know your job history or gender. Instead, it’s pre-programmed to make decisions based on a set of criteria that applies equally to everyone. Whether it’s politicians, police, or celebrities, no one’s perfect. In fact, the growing number of scandals is a large part of why trust in large institutions is eroding. On the flip side, code can be analyzed by security experts to ensure it operates like it's supposed to (on both a legal, moral and functional level). Because of that, and because code removes human bias, idealists believe Web3 creates a fairer Internet. But stripping today’s monopolies of their power is just half the equation. Because on top of putting their trust in the code, Web3 purists want their platforms to be available to everyone. While it's not something most people think about, the Internet today is highly segmented and regulated based on geography. As an example, the Netflix shows you get access to in Costa Rica are dramatically different from the ones you’d get access to in Canada. Japanese bank accounts (and the interest rates they pay) are only available to residents of Japan. The same goes for region-specific internet laws (like GDPR). In a permissionless Web3, however, there are no such limits on geography or status. The only thing needed to access a Web3 protocol is an Internet connection. The third (and least idealistic) trait of Web3 is its incorporation of Artificial Intelligence and Machine Learning. While technologists have been talking about AI for decades, most of its applications in modern society are pretty boring. From fraud detection to your phone’s autocorrect, AI lays behind many of the more mundane ways we use technology on a day-to-day basis. Web3, however, intends to integrate artificial intelligence on a scale we’ve never seen. While it’s fun to think about uber-smart robots we can hold a conversation with, the process of training an AI - known as Machine Learning - isn’t nearly as fun. Machine Learning involves feeding a software program tons of information in an attempt to train it to recognize patterns. As an example, imagine you want to train an AI to separate pictures of dogs from cats. To do this, you would feed the software program hundreds of thousands of images of cats so it can begin to recognize the patterns. The more images you feed it, the more accurate its pattern recognition abilities become. Next, you would feed it a bunch of dog photos so it could once again identify the patterns. From there, you would start testing the software to see how accurately it identifies the dog photos vs the cat photos. Then, when the software makes a mistake, you would update the pattern recognition algorithm so that - next time around - it doesn’t make the same mistake. Keep in mind the above example is extremely simple. In reality, training AI programs is mind-blowingly complicated (which is why Machine Learning and AI developers earn more than most any other category of programmer). So while technologists have been “talking about” artificial intelligence for decades, Web3 represents the first time AI can be applied on a mass scale. The first example involves the Internet of Things (aka IoT). The Internet of Things refers to the concept that, in the future, most “things” will be electronic, connected to the web 24/7, and make their own decisions. From self-driving cars that interact with the other cars around them to microwaves and ovens that communicate with each other, in the future most anything we plugin will use AI to operate more efficiently. And that’s just one example. As of today, personalized content is limited almost entirely to the shopping experience. Mainly through cookies and browsers that track your activity and attempt to show you relevant ads and keyword searches based on your browsing activity (a process digital privacy advocates are vehemently opposed to). In the future, your entire web browsing experience could be customized to your unique preferences. But instead of Facebook and Amazon owning your browsing data, you would own the data yourself while granting data scientists and Decentralized Apps permission to access that data. Data their machine learning programs would analyze to understand your preferences, allowing their AI programs to create a web experience that’s custom-tailored just for you (beyond simply serving targeted ads).Decentralization Defined

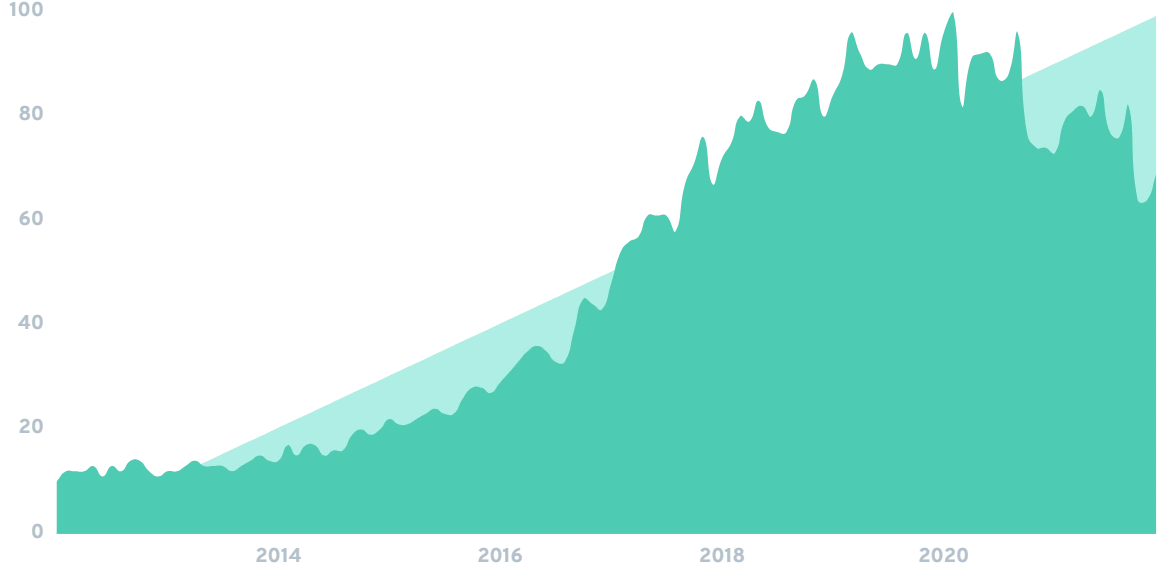

Searches for “Decentralized Application” are up 700% over the last five yearsA Centralized Web

A Monopoly on Web Content

A Decentralized Web

Decentralized = many entities control (host) the webBlockchain as a Decentralized Ledger

How Blockchain Works

Hacker Resistant

Cryptocurrency Is Just One Piece of Web3

Breaking the Internet Monopolies

Why Trustlessness Matters

Removing Human Bias

Code As Perfectly “Ethical”

Permissionless Interaction

AI and Machine Learning

Searches for “Artificial Intelligence” over the last decadeHow Machine Learning Feeds AI

Searches for “Machine Learning” have gone up 590% over the last 10 yearsComplex Pattern Recognition

AI as a Part of Web3

Searches for “Internet of Things” over the last decadeA Custom Tailored Internet

The Driving Forces Behind Web3’s Growth

Similar to the trends and innovations that drove Web 2.0, Web3’s explosive growth is based on a variety of financial, societal, and technological trends.

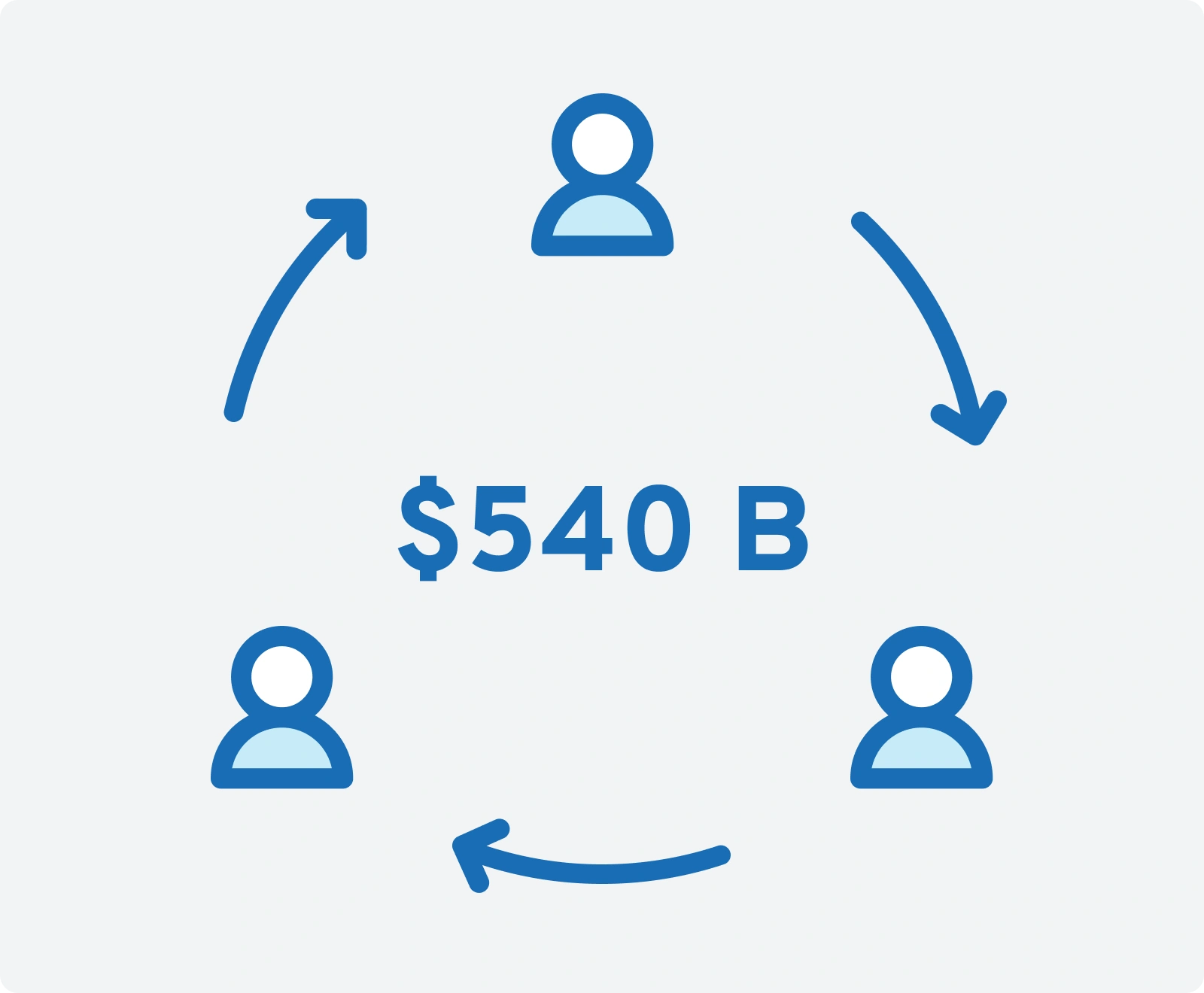

While blockchain was introduced as the underlying technology behind Bitcoin, it didn’t take long before a slew of competitors began to copy - and modify - Bitcoin’s blockchain concept. And while most of the cryptocurrencies that were launched in the early 2010s have faded into oblivion, one area where they’ve survived has been international remittances. According to a study from 2021, foreign migrants sent over $540 Billion in remittances in 2020 (mostly through services like Western Union). Unfortunately, many of these receiving members' families live long distances from the nearest claim center. Because of that, claiming their funds can involve day-long bus rides and 4-8 hour wait lines. Not to mention the 5-15% fees the sender has to pay, and any money that’s lost as a result of converting dollars to their local currency. On the flip side, migrants can use cryptocurrencies like Stellar Lumens to send near-instant transfers for pennies on the dollar. In 2019, the Lebanese government imposed highly controversial banking restrictions. Not only did they lock many people out of their accounts, the subsequent restrictions devalued the value of people’s savings by almost 40%. Afterward - and as a result - many Lebanese rushed to move their funds into Bitcoin to prevent further seizures. Arguably bank seizures are fairly rare, however, we’re seeing a similar situation play out in Afghanistan as the Taliban reclaim control of the government. With some of the highest inflation rates in the world, many countries in both Africa and Latin America have seen an explosive rise in Bitcoin adoption. While investors consider Bitcoin’s up and down moves to be highly volatile, in countries where double, triple, and even quadruple-digit inflation exists, Bitcoin is considered a highly stable store of value. Not only does blockchain allow organizations to create a permanent, encrypted database of most anything, but artificial intelligence applications known as Smart Contracts can also perform many of the tasks we now need a human to do. And they can do them almost instantly. Because of that, governments worldwide are exploring blockchain as a solution for making their processes more efficient. And it’s not just governments. Whether it’s updating outdated technology or syncing data after a corporate merger, large companies spend billions of dollars each year to reformat their databases. By adopting blockchain, however, companies can merge their data into a single network, allowing for seamless integration between apps and company departments. This, in turn, can save billions of dollars over the long haul. On a more simple level, the Internet as it exists today is ripe for both mistakes and manipulation. The most obvious example is how often we stumble upon broken website links. Known as “Link Rot,” studies have shown website links have a half-life of just 138 weeks. To put that in perspective, this means that any given week, one out of every 200 website links breaks. While this might not be a huge deal on your grandma's blog, it’s a major problem for research papers, academic journals and medical studies (where the ability to reference a piece of material from the past is critical to verifying authenticity and legitimacy). Because blockchain allows for a permanent store of record, however, link rot is not an issue. Instead, both links and the information being linked to are permanently stored on the blockchain - in their original state - forever (assuming enough network participants keep the ledger going). For many, link rot is an inconvenience that can be solved with some searching on archive.org. However, an increasing number of reports are coming out showing both content sites and hackers are intentionally manipulating articles, studies, and citations from the past for nefarious purposes. As an example, Dr. Elisabeth Bik recently identified over 6,000 instances of journals and academic institutions misrepresenting - or flat out manipulating - their findings. In 2014, Edward Snowden exposed how government agents intentionally manipulate articles and content pages to harm people’s reputations. Not to mention how many media manipulation tracking, retraction watch, and independent fact-checking websites are seeing an increase in traffic. But similar to its financial applications, blockchain’s permanent, immutable ledger largely solves these problems. Many look to Web3 as a censorship-resistant publishing platform. Which makes sense: Because Web3 apps are decentralized - and based on trustless, permissionless interaction - they by nature cannot be controlled or manipulated (censored) by any one person or entity. And it’s not just content creation people are fighting to decentralize. Instead, some of today’s most famous billionaires are fighting over the future of the digital world. Prior to Facebook’s October 28th, 2021 announcement, most people had never even heard of the Metaverse. Within minutes of Facebook announcing it was changing its name to Meta, however, the term was trending on Twitter and started to be a popular search term in Google. So what is the Metaverse? In short, it’s a digital world. Except unlike today’s Internet, which we interact with using phones and computers, the Metaverse is something we’ll immerse ourselves in using 3D technology and virtual reality goggles. Unfortunately, the Facebook brand has been tarnished by scandals and controversy and was voted the Worst Brand of the Year in 2020. Because of that, Web3 purists are strongly opposed to the idea of a big tech company having control over what may become the digital future. On the flip side, many companies, including Mark Zuckerberg’s arch-enemies - the Winklevoss Twins - are deploying funds of their own to build a decentralized Metaverse. In particular, a digital world that’s aiming to be trustless, permissionless, and censorship-free.Financial Trends

Remittances are often the most direct and well-known link between migration and development

Bank Seizures

Currency Devaluation

Endless Government Applications

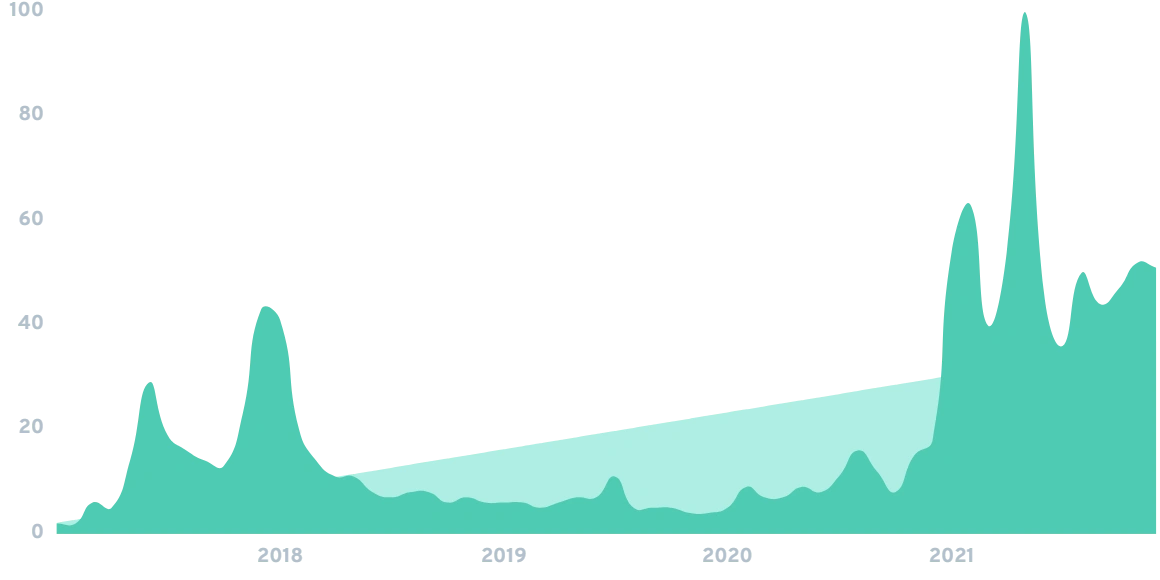

Searches for “Smart Contract” have gone up 914% over the last five yearsB2B Loves Blockchain

Technological Trends

Truly Permanent Links

Editing History

Societal Trends

The Metaverse

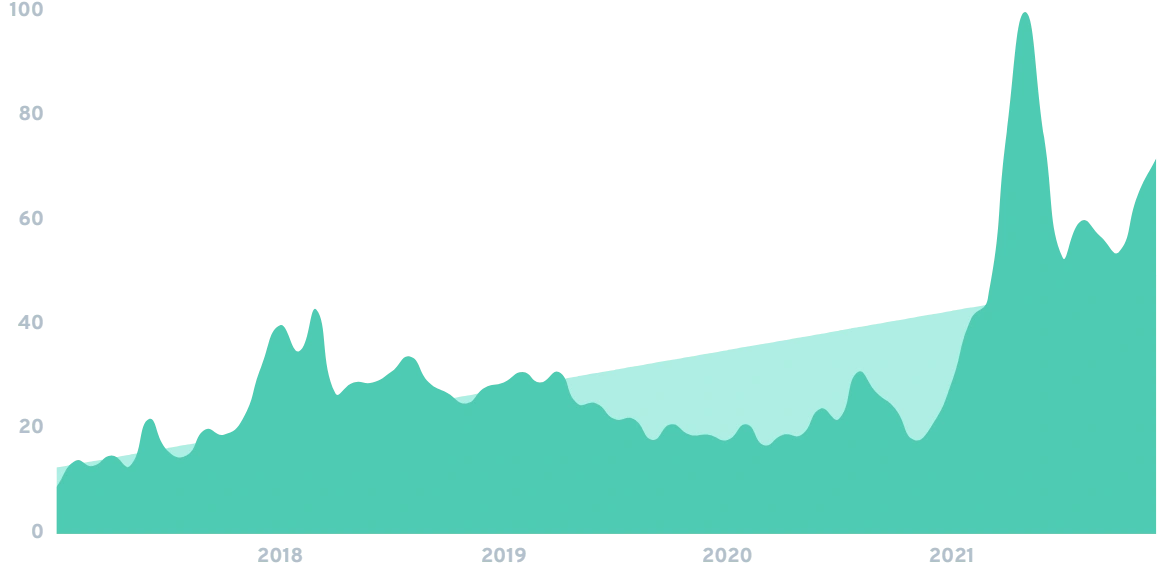

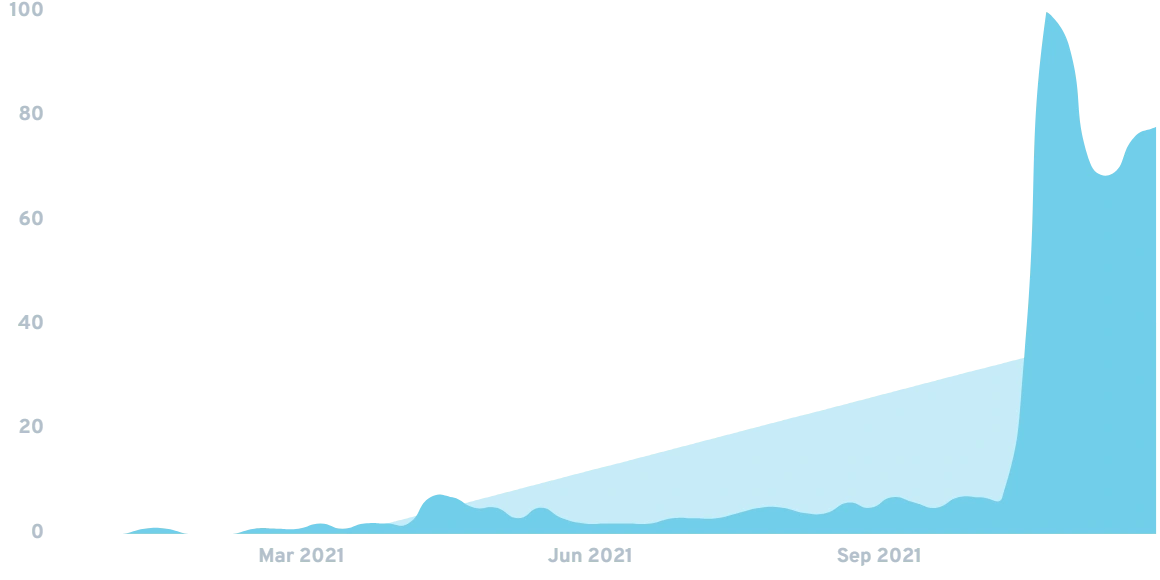

Searches for “Metaverse” have spiked massively in the last few monthsThe Battle for Decentralized Digital World

Web3 Use Cases

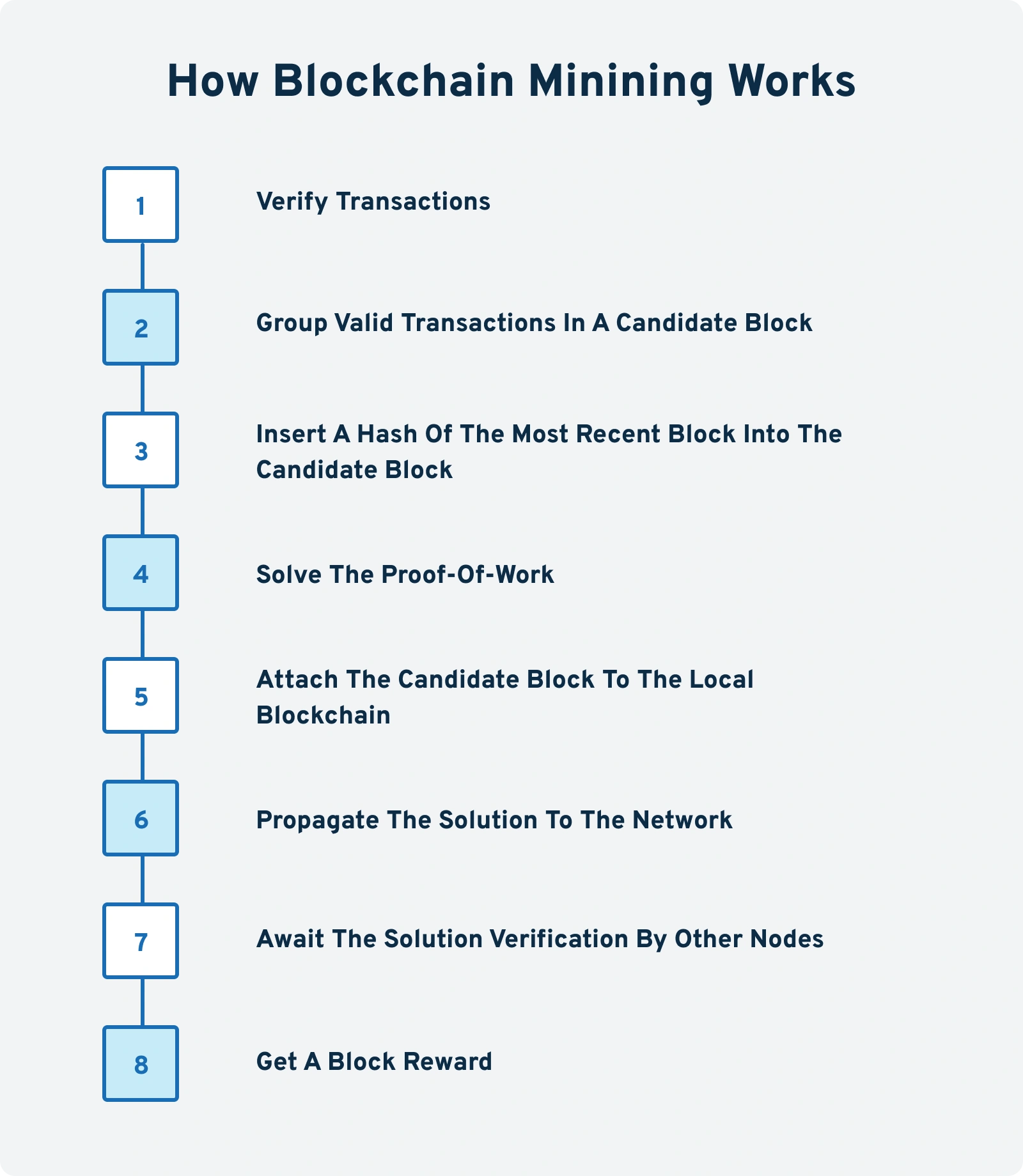

Because cryptocurrency is decentralized, there are no banks or merchant processors to keep the system up and running. So how does it work?

Through a process called Mining.

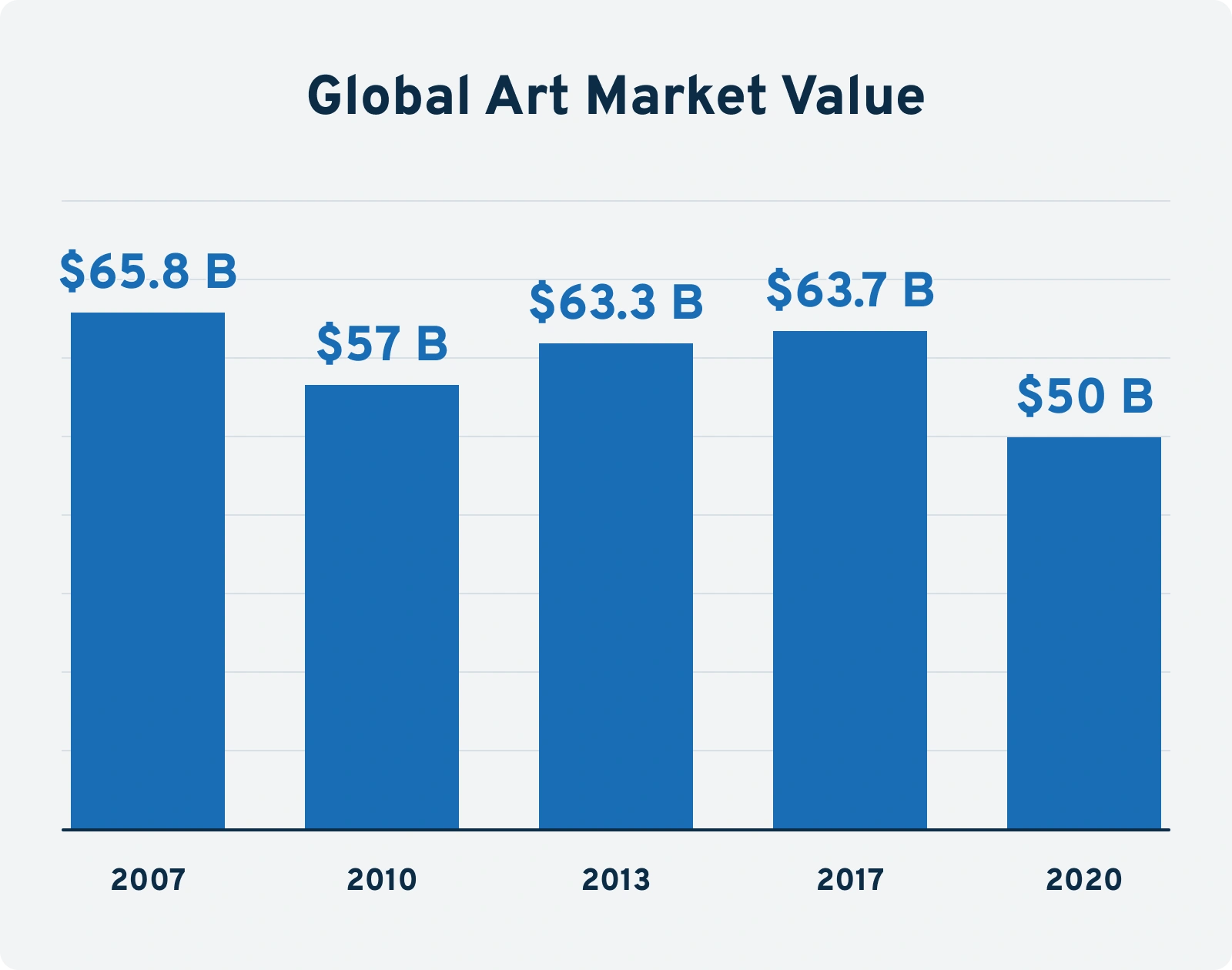

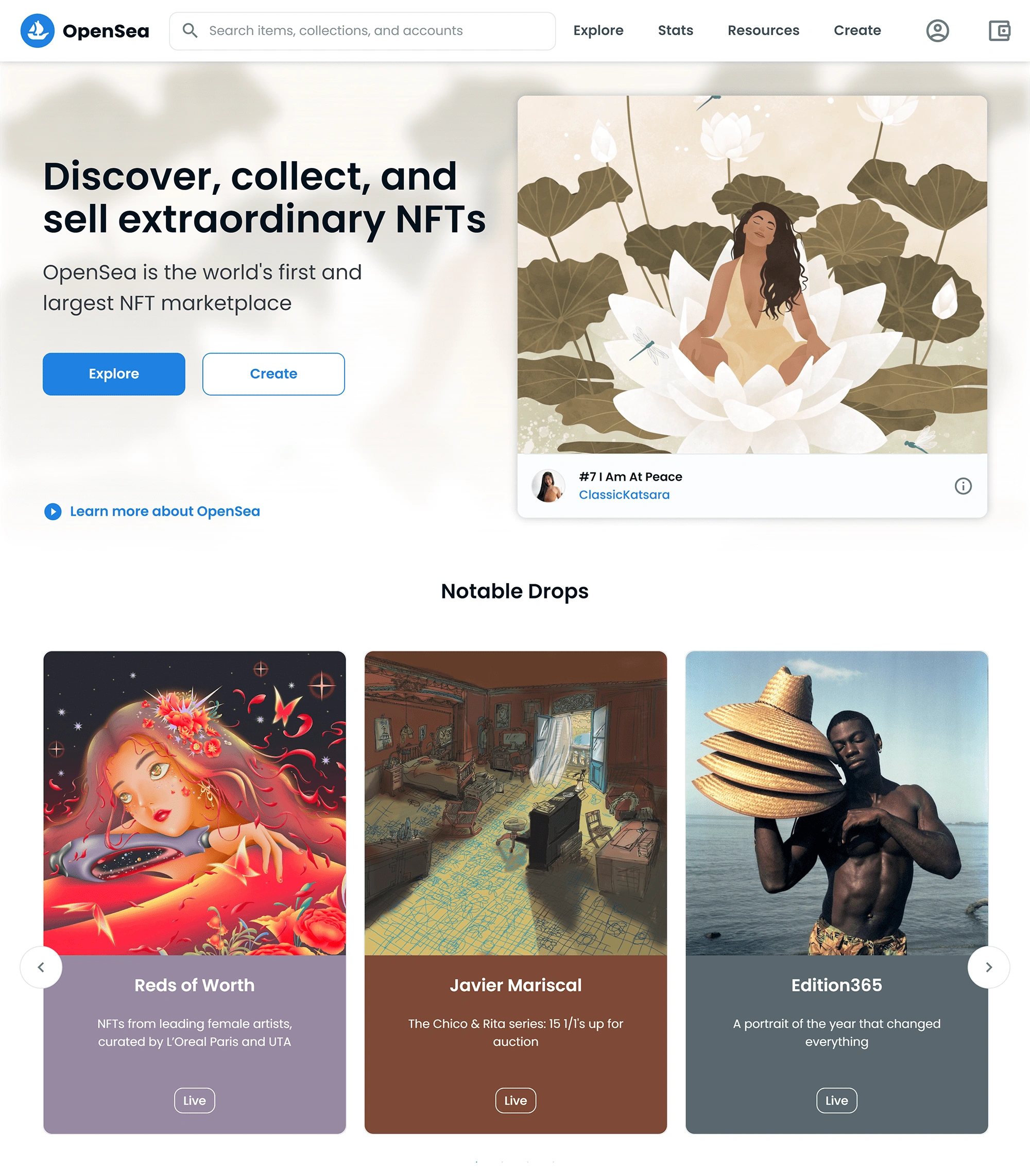

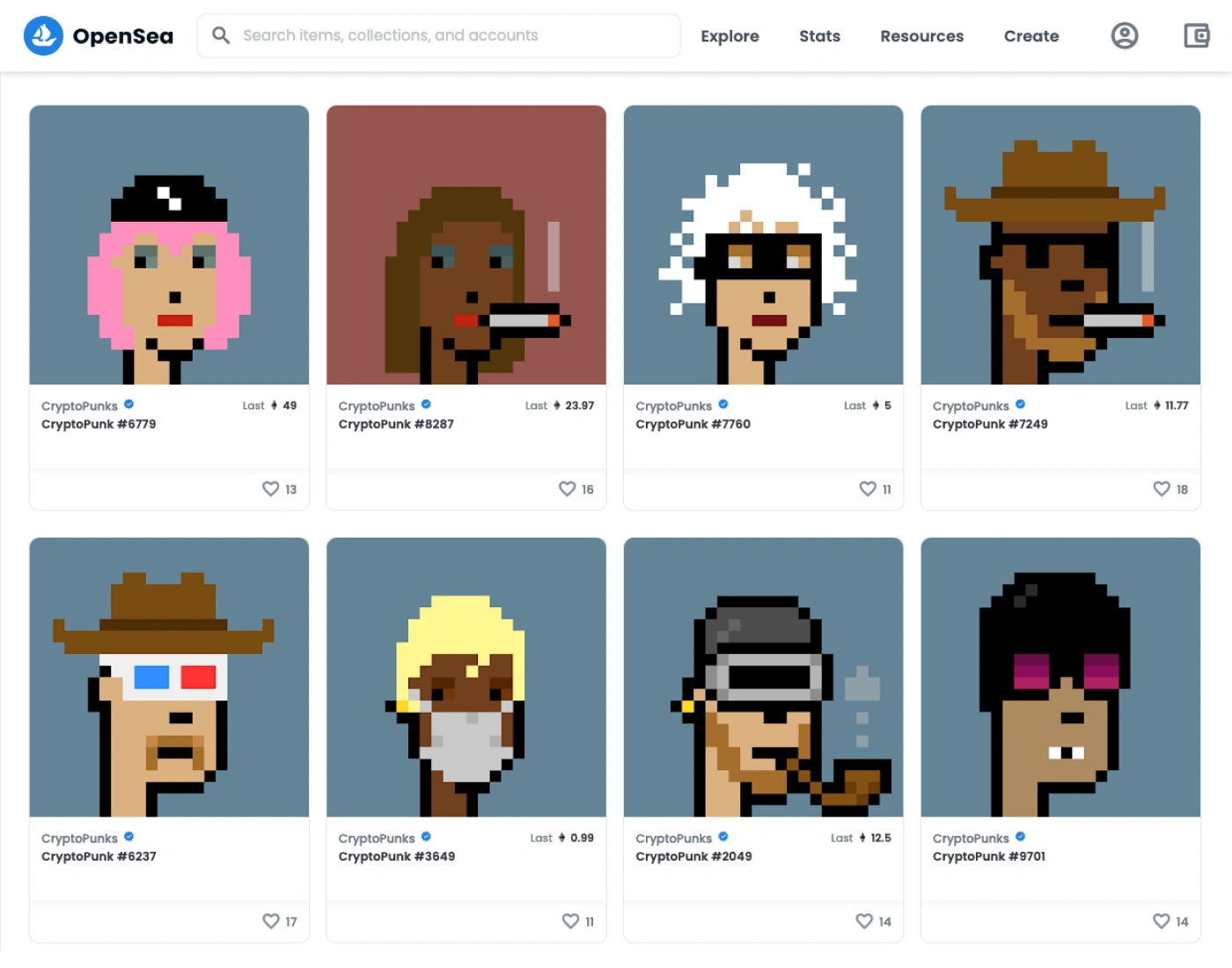

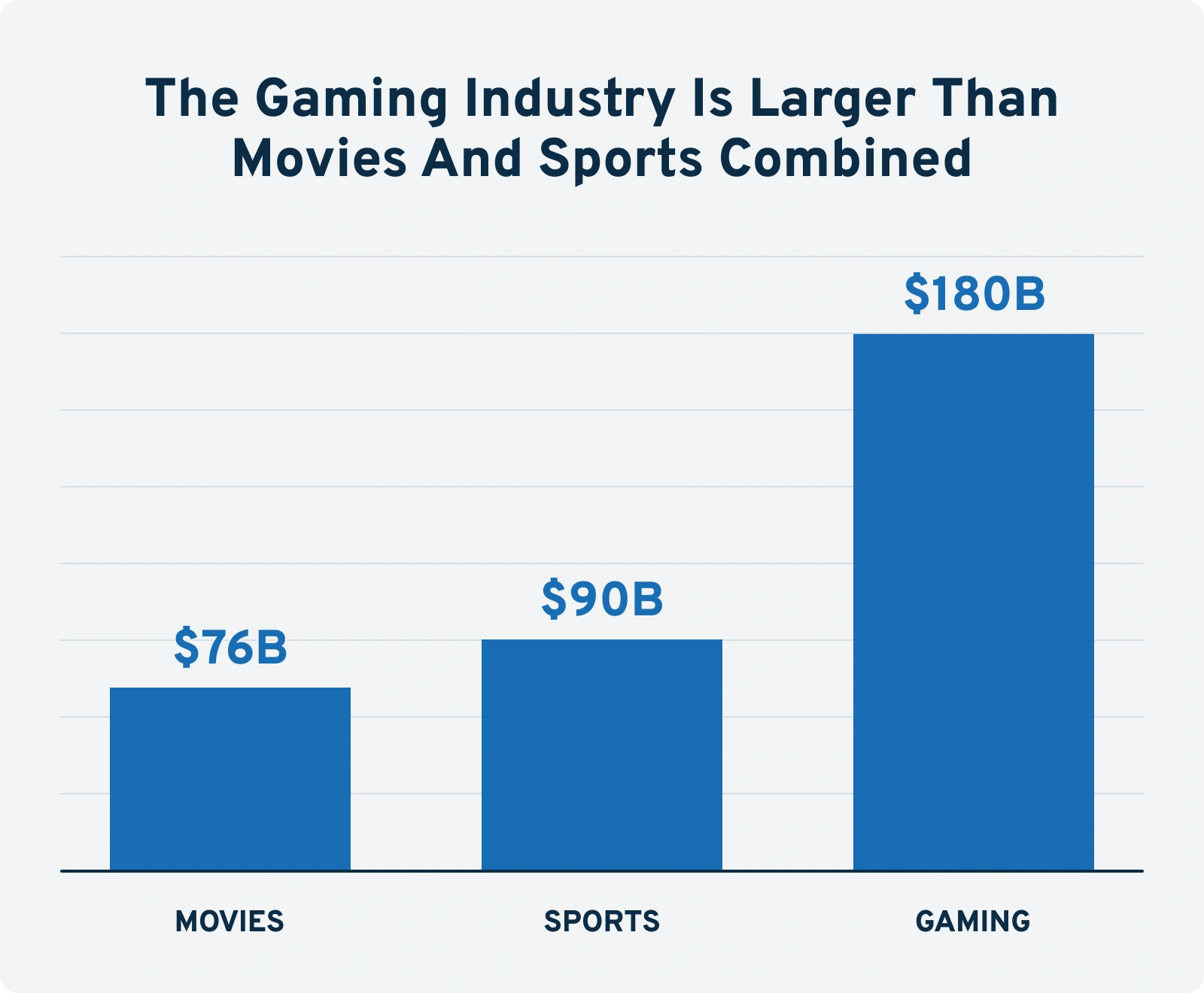

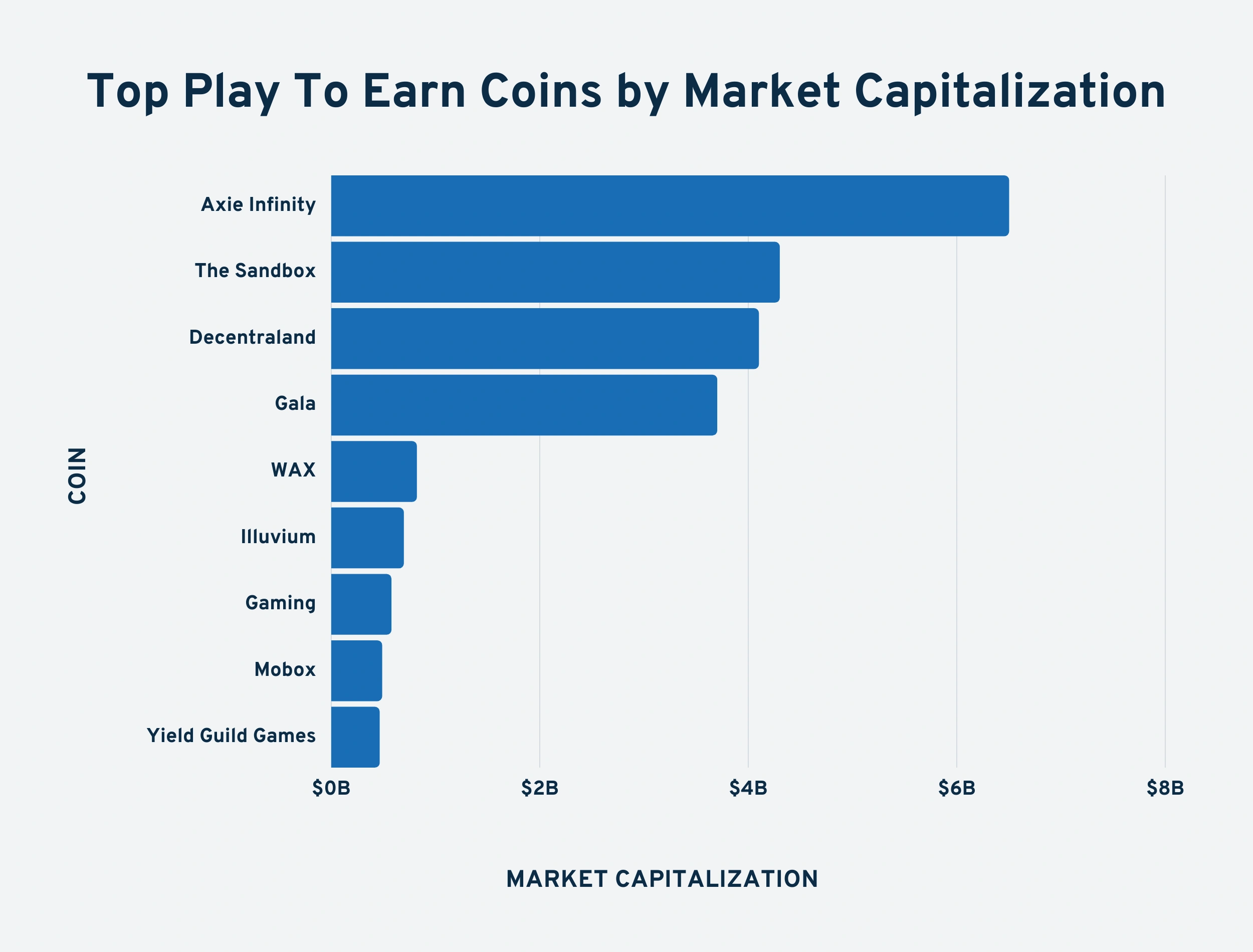

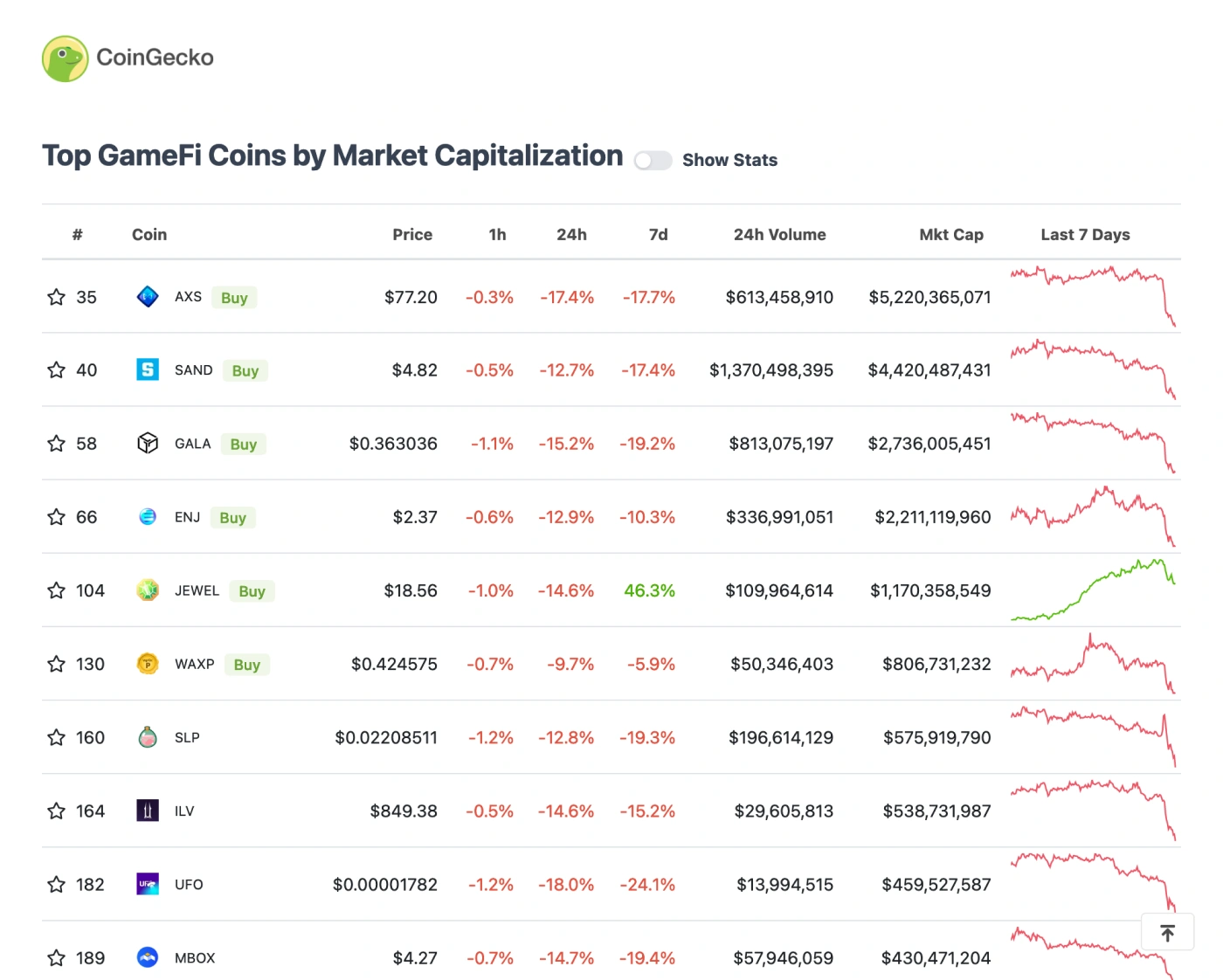

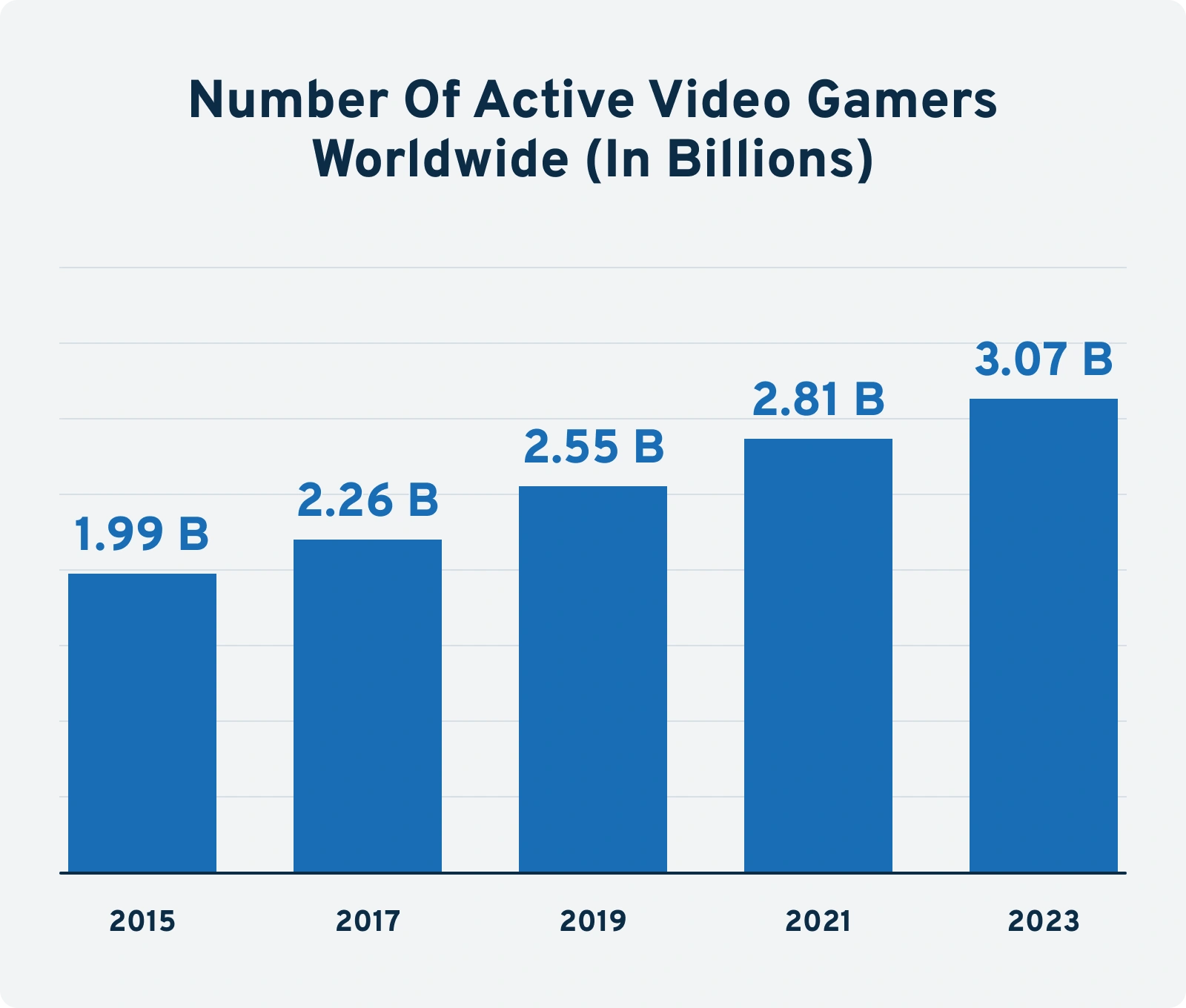

Mining involves setting up a large network of high-power computers - known as nodes - for the purpose of solving complicated cryptographic puzzles (which ensure the network remains encrypted / protected from bad actors). When a node solves a puzzle, the network gives it permission to write a new “block” to the blockchain. And in the world of cryptocurrency, there are two approaches to mining: Proof of Work (PoW) and Proof of Stake (PoS). Proof of Work is a complex encryption process that’s commonly mistaken for a math problem. In reality, Proof of Work encrypts data by putting it behind an encryption wall that can only be accessed if the participating node can “guess” the right answer (think of it as guessing a lottery number). And similar to the lottery, there are millions - if not billions - of potential answers. Because of this, the process computers must go through to solve the puzzle requires a mind-boggling amount of processing power (and some patience). Proof of Stake, however, is dramatically less resource-intensive. Instead, Proof of Stake delegates the verification process to random participants (node operators) with no requirement they solve any kind of cryptographic puzzle. Because Proof of Stake doesn’t involve advanced encryption, PoS networks rely on Game Theory to prevent bad actors from trying to manipulate the network for personal gain. As the first successful implementation of blockchain technology, Bitcoin is built on a Proof of Work algorithm. Satoshi Nakamoto - the anonymous inventor of Bitcoin - mined the first block on January 3rd of 2009 (his reward for doing so was 50 Bitcoin, worth over $2,000,000 as of this writing). Fast forward to today and developers have created hundreds of cryptocurrency spin-offs (known as Forks). None, however, has been more successful than Ethereum. Founded by Canadian-Russian computer programmer Vitalik Buterin, Ethereum is the #2 cryptocurrency behind Bitcoin (measured in terms of market cap). On one side, many consider Bitcoin to be a “store of value” (similar to a digital version of gold). On the other side, Ethereum is much more akin to a blockchain-based operating system. Mainly because, in addition to acting as a digital currency, there are thousands of applications (known as Dapps) built on top of the Ethereum blockchain. Admittedly, very few people got into cryptocurrency in the early 2010s. However, there’s no denying how much the industry has grown since then. While it's hard to know exactly how many people participate in cryptocurrency, it’s estimated that 76 million people own bitcoin. Overall, cryptocurrency’s market cap has grown from just $1.5 Billion in May of 2013 to more than $2.9 Trillion during its November 2021 peak. To further emphasize the industry’s growth, Exploding Topics data shows that crypto exchange Binance receives 76.7 million visits per month, ranking among the top 600 most visited websites in the world. Cryptocurrency, however, is just one of many applications of blockchain technology. Because blockchain creates a permanent, unalterable ledger, it can also be used to track the ownership and transference of digital content. And that ability has led to a surge in what are called Non-Fungible Tokens (or NFTs). According to Dictionary.com, fungibility is defined as a good, commodity, asset or bond that is “easy to exchange or trade for something else of the same type and value.” For example, if you lend a friend $10, it doesn’t really matter which $10 bill they pay you back with. Because of that, both cryptocurrencies and fiat money (dollars, yen, etc.) are referred to as being fungible (mutually interchangeable). On the flip side, something that’s non-fungible cannot be substituted or replaced. And when it comes to proof of ownership - both in terms of copyright protection and record keeping - having a perfect, unalterable ledger is a big deal. As anyone who’s gone through a divorce or estate battle knows, proving ownership of an asset can be tricky. From valuable antique furniture to cars and even homes, determining who paid for what - and when - requires meticulous record-keeping and lots of receipts. Records and receipts that - in many cases - tend to get lost (or destroyed) over the years. NFTs, however, solve that problem. By using the blockchain to record transaction data, users can now create a permanent chain of custody for almost anything you can imagine. And while there are more practical use cases for NFTs, including tracking land deeds and vehicle ownership, 2021 saw an explosion in demand for NFT-based digital art. According to Statista.com, fine art is a $50 Billion industry worldwide. Unfortunately, art is prohibitively expensive. Because of that, art is an asset class that’s reserved mostly for millionaires and billionaires. That is until NFTs came onto the scene. Because blockchain allows users to prove ownership of digital assets, there has been a Beanie Baby-like explosion in demand for one-of-a-kind digital art. In particular, avatar-like JPEGs many people use as their profile picture on Twitter, Telegram and Discord (which, not so coincidentally, are the three social networks most prominent among cryptocurrency users). The first NFT project - known as Quantum - launched in 2014. Shortly after, veteran projects like CryptoKitties and Crypto Punks launched in 2017. It wasn’t until the summer of 2021, however, that NFT sales began to explode. To put the surge in perspective, the #1 NFT trading exchange - Opensea - saw $375 Million in trading volume in July of 2021. By August, that number increased 10x to $3 Billion (not to mention a 500% increase in traffic to their website). The overnight sensation was driven by two core trends. First, because NFTs are hosted on the blockchain, they’re paid for using cryptocurrency. Because of this, and because NFTs are by definition “one of a kind,” investors were able to speculate on their value (similar to how art investors speculate on how much a painting is worth). Further, because many people already had money on the blockchain from prior investments, speculative investors were able to shift their funds from crypto to NFTs with almost no learning curve whatsoever. This, in turn, created a speculative bubble where early adopters - including children and teens - made millions of dollars buying and selling NFTs. In fact, speculative-driven demand was so huge projects like Crypto Punks and Bored Ape Yacht Club now sell for hundreds of thousands of dollars each. Because of this, crypto millionaires (and even celebrities) jumped on the NFT trend as a way to flaunt their wealth (making premium NFTs into a form of digital status symbol). In fact, household names like Jimmy Fallon, Mark Cuban, Shaq and Snoop Dogg are all proud NFT owners. But not everyone in the NFT space was looking for a quick flip. Instead, many people wanted to support artists whose digital art they resonated with. And because blockchain allows buyers to prove they’re the owners, many saw this as an early form of digital art investing. As is the case with most hype-driven investments, the mania eventually died down. With that said, many believe we’ll use these avatar-like JPEGs to represent ourselves in the Metaverse (similar to how people use pictures of themselves on their Facebook profile today). A conversation about Web3 wouldn’t be complete without discussing the rise of Play-to-Earn (P2E) Gaming. Since the invention of the first Atari, gaming has cost money. In fact, in 2021, video game consoles cost upwards of $550 while one game can cost $50 or more. With the introduction of blockchains, however, that flow of money is being redirected. While the general public tends to stereotype gamers as nerdy males, the gaming industry is larger than both the international movie and North American sports industries combined (at an estimated $180 Billion in 2020). Historically, that money has flowed to a small number of gaming studios, app creators and console manufacturers. With the invention of blockchain and cryptocurrency, some companies are flipping the monetization model on its head. Whether it’s a Fortnite upgrade or extra tokens for an iPhone game, most gamers are used to spending dollars (or euros, yen, etc.) to enhance their gameplay. But with games being built on the blockchain, the traditional currency is no longer relevant. Instead, blockchain gaming companies are building their own cryptocurrencies (called tokens), which act as the medium of exchange in the game’s ecosystem. But because those tokens can be sold and converted back into other cryptocurrencies (and therefore fiat money), this represents a massive paradigm shift in the gaming industry. Why? Because for the first time ever, gamers can take the tokens they earn from playing games and convert those tokens into disposable income. While the industry is so young it's hard to know how many people are participating in P2E games, we can look at other metrics to gauge the sector’s rapidly rising growth. As an example, Axie Infinity - the leading P2E gaming studio - is the #800 website in the world (with over 30 million monthly visitors). Further, as of July 2021, Axie had more than 400,000 active daily players (not to mention one of the largest Discord servers on the Internet). More important, Axie Infinity is one of more than 100 blockchain gaming companies. A sector that - despite delivering some of the highest gains in 2021 - represents just 1% of the entire cryptocurrency market cap. While many gamers are enticed by the concept of getting paid to play, how much money someone can make is dependent on a variety of factors. In many cases, it can cost upwards of $500 in tokens just to get started with a P2E game. On top of that, earnings are dependent on skill level and how successful of a “team” you’re on. So while P2E games have exploded in popularity in low-income countries like the Philippines, it's unlikely to provide a full-time salary for most players in Western countries. With that said, in the world of Web3, video games aren’t the only platforms allowing web users to earn an income. While they are very much in their infancy, many projects aim to dismantle billion-dollar content and entertainment industries by removing middlemen. One example is Basic Attention Token, which connects advertisers directly with consumers, allowing publishers to compensate web users for their attention in the form of micropayments. Another is Audius, which is a Spotify-like music streaming platform where musicians get paid micropayments when someone consumes their music. More important, these are real companies with real teams and roadmaps. As evidence of that, Basic Attention Token is working with major advertisers like Verizon and Purple mattresses while Audius is partnered with some of the largest names in the electronic music industry.

Proof of Work vs Proof of Stake

Proof of Stake

The First Blockchain

Ethereum

Searches for “Etherum” exploded by 2450% over the last five years.Cryptocurrency Today

Non-Fungible Tokens (NFTs)

Searches for “Non-Fungible Token” are up 90x over the last yearPerfect Record Keeping

Proof of Ownership

The Growth of the NFT Space

NFTs as Speculative Investing

NFT Millionaires

The Birth of Digital Art Collecting

Play to Earn Games

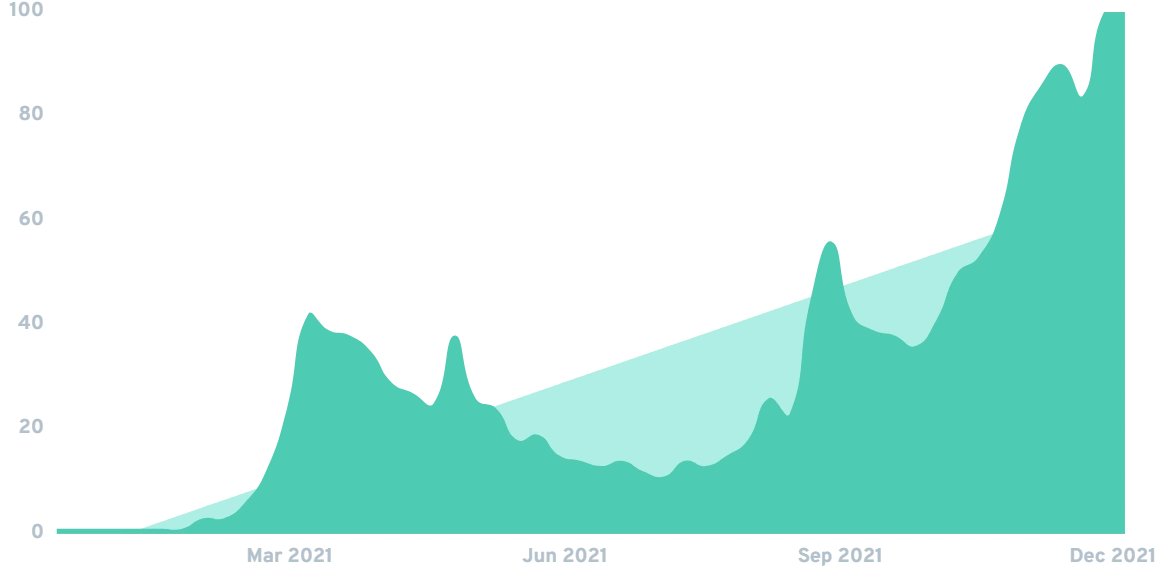

Searches for “Play to Earn Games” have increased by 614% in the last year alone.Gaming Is Bigger Than Movies and Sports

A Gamer’s Dream Come True

An Emerging Sector

Income Potential

Paying for Attention

Web3 Challenges

With their focus on decentralization - and trustless and permissionless interaction - Web3 proponents aim to create a fairer, more equitable web experience.

Many would argue a fairer, more equitable web is good for society. However, Web3 is facing multiple challenges that - over the long-term - will decide if this really is the “next Internet.”

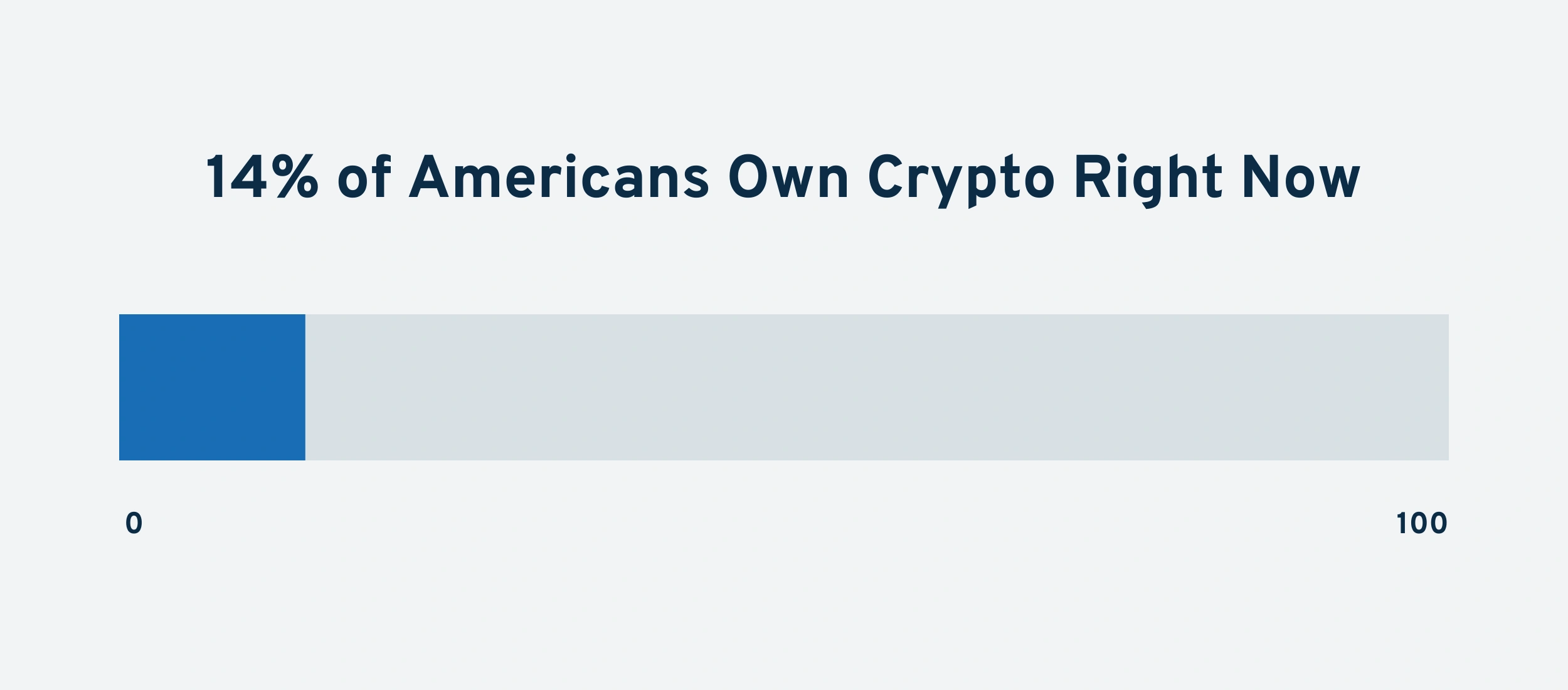

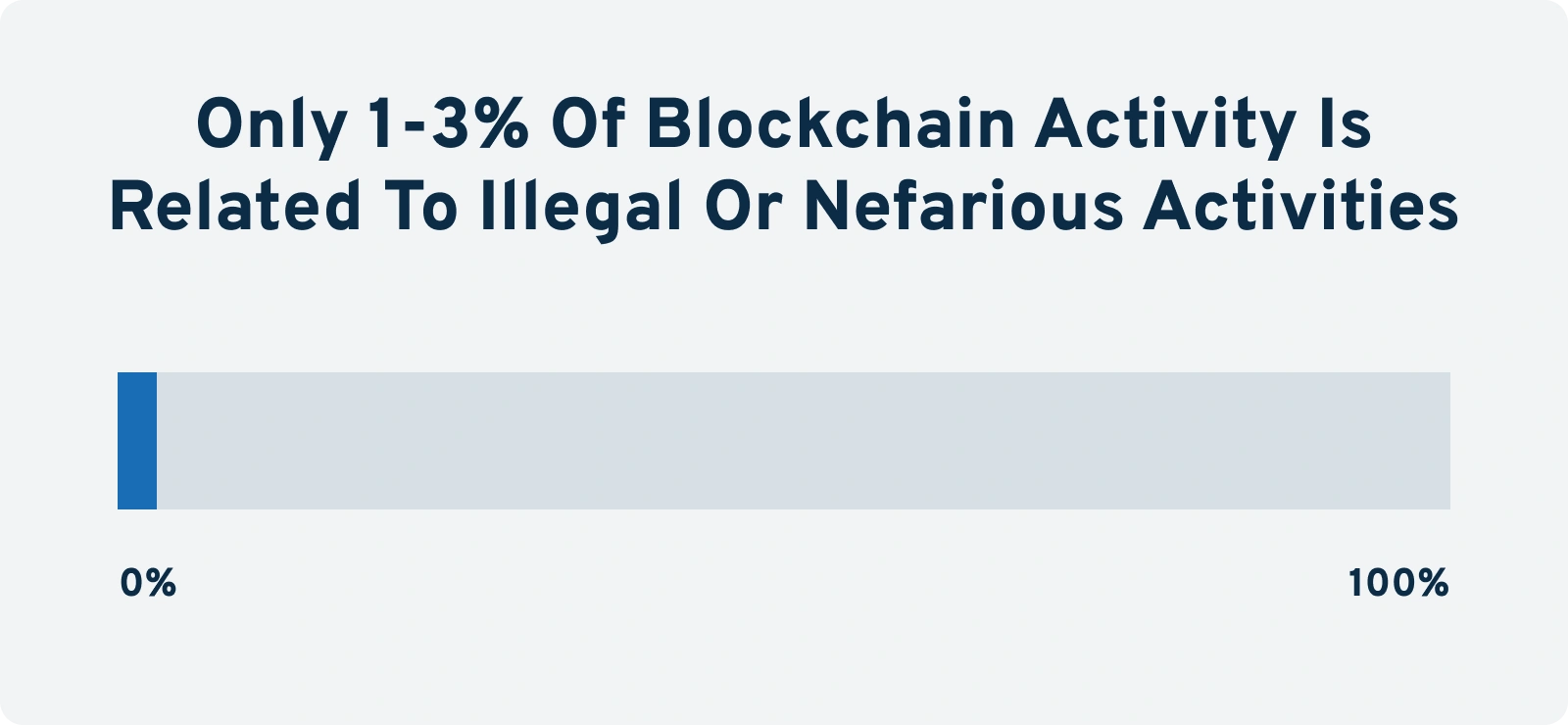

Nowhere are tech problems more common than with Web3 applications themselves. On the gaming side, blockchain games are known to have outdated graphics and what is considered by many to be a slow and clunky user interface. Because of that, it may be difficult for blockchain gaming companies to siphon users away from the visually stunning (and easy to use) games they’ve grown accustomed to. Further, blockchain games by their nature require players to buy and deposit cryptocurrency before they can play. Given just 14% of Americans even own any crypto, this is a major hurdle to mainstream adoption. And when it comes to decentralized finance, the situation isn’t much better. While DeFi participants are able to earn dramatically higher interest rates on their dollars (and crypto) than they would at a bank, they pay a price for that luxury. And that price comes in the form of hacks, high transaction fees, painfully slow delays and what most consider to be a terrible user interface. Because of that, it’s unlikely DeFi will achieve mainstream adoption until improvements are been made in the overall user experience. On top of that, the blockchains themselves are struggling under the weight of so many new users. Similar to how websites can crash if too many people try to visit them at once, blockchains can become highly congested if too many people are trying to process transactions at the same time. In fact, in 2021, the top-ranked Solana blockchain froze for 17 hours before developers could get it up and running again. Under the weight of all that congestion, fees for using the network can skyrocket (as users bid more and more to force their transactions and trades through). As an example, fees on Bitcoin have reached as high as $60 for one transaction. And on Ethereum, the #2 blockchain, they can reach into the hundreds of dollars. Further, with free money transfer services like Zelle and Venmo now available (and similar services like Pix available in countries like Brazil), the promise of using crypto for fast and easy money transfers has lost some of its appeals. So while blockchain has the potential to solve a variety of inefficiencies in the world of financial technology (aka FinTech), it's unlikely to go mainstream until the issue of scalability is solved. Because cryptocurrency is such a new industry, with few legal regulations and a nascent technology that’s prone to bugs, it's ripe for scammers and hackers. And because it can be hard to tie a cryptocurrency wallet back to its human owner, criminals have been using crypto to remain anonymous and launder money. Because of this, a handful of politicians have come out against crypto as a vehicle for crime. In reality, however, studies show only 1-3% of activity on the Bitcoin blockchain is related to illegal or nefarious activities. This leads to what is arguably Web3’s biggest future challenge: legal regulation. Despite being a $2.5 Trillion industry, the U.S. government has yet to take a stance on how cryptocurrency should be regulated. On the one hand, the world of Web3 includes everything from Metaverse gaming to smart devices. However, as the base financial layer, cryptocurrency lies at the heart of it all. From in-browser micropayments to billion-dollar investments, blockchain-based financial transactions are what power the Web3 world. As of December 2021, SEC Chairman Gary Gensler, Comptroller of the Currency Michael Hsu, and Fed Chairman Jerome Powell have all confirmed they have no intention to “ban” Bitcoin or cryptocurrency in general. Despite this, the threat of regulations looms large over the industry. From how “stablecoins” will be regulated, to the anti-money laundering laws included in Biden’s 2021 infrastructure bill, government officials are treading a fine line between stifling innovation and protecting consumers from scams, hacks, and threats to the larger economy. In general, many expect the US government will implement reasonable regulations. Some high-profile investors, however, think they could turn the lights off at a moment’s notice (which China did in 2021).Technological Challenges

DeFi Struggles

Scaling Solutions

Excessive Fees

Scams and Hacks

Government Regulation

Looming Regulation

The Future of Web3

While the regulatory situation is uncertain, trends in business, government, and consumer activity indicate Web3 is probably here to stay.

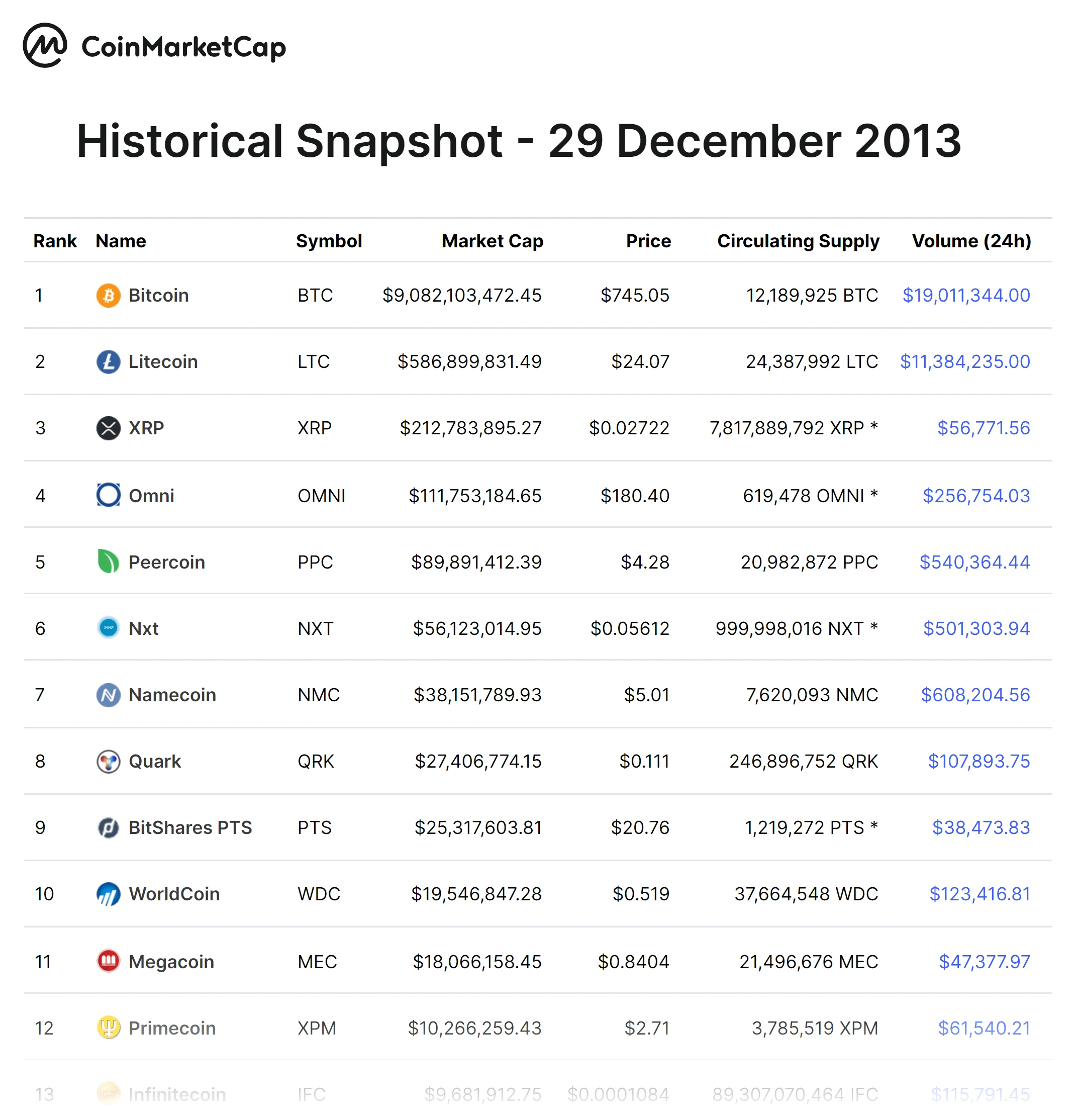

While most blockchain adoption is taking place in smaller governments like Ecuador and Tajikistan, larger countries like Italy are beginning to test the waters. And while the US has yet to integrate blockchain into its operations in a meaningful way, power players like India are dipping their toes in. From voting to accounting and even military tracking, the promise of an encrypted, immutable ledger has the potential to solve many of the inefficiencies that hobble modern governments (including corruption itself). And because of that promise, corporations have started to take notice. While most news headlines are focused on Bitcoin’s price action - or the latest celebrity to buy an NFT - companies across the globe are adopting blockchain at breakneck speeds. In China, power players like Tencent, Alibaba Group and the Bank of China have begun utilizing blockchain applications in their day-to-day operations. The same goes for Microsoft, Amazon, Walt Disney and a variety of Fortune 500 companies in the U.S. From logistics tracking to credit card processing fees, businesses worldwide are using blockchain technology to reduce expenses and increase efficiencies. Whether it's decentralized finance or the newest blockchain game, both hard data and anecdotal evidence show consumers are adopting Web3 technology more and more every year that goes by. And with 163 million gamers in the US alone, some industry experts predict it’s blockchain gaming - and not cryptocurrency - that will take Web3 mainstream. With that said, the industry - and the concept of Web3 - is still very much in its infancy. Nowhere is this more evident than the 2013 cryptocurrency charts. Of the 69 coins that existed in December of 2013, only four of them are still relevant today. The same goes for 2016, where just 12 of the top 100 coins still rank in the top 100 in 2021. Yes, Hollywood has teased us with the possibility of AI-enhanced robots and smart devices for years. As of today, however, the closest thing we’ve got are self-parking cars and Google keyword suggestions. Meaning, even though government and enterprise-level organizations are adopting blockchain, the expenses involved in doing so have prevented small and medium-sized businesses from joining the party. Because of that, many believe Web3 is still very much in its early years (similar to where the Internet was in the late 1990s). When the concept of Web 2.0 was introduced in the mid-2000s, there were plenty of skeptics. Fast forward to the 2020s and - well - it's fair to say the skeptics were wrong. Not only do social media sites rank among the most visited sites on the Internet, but drag-and-drop website builders like Shopify and WordPress have also allowed millions of everyday people to go into business for themselves. Admittedly, Web3 faces a variety of future challenges. With that said, the government, B2B, and consumer use cases are quite compelling. From international remittances to playing poker in a completely digital world (the Metaverse), Web3 promises a world of possibilities we are just now beginning to understand. Although the idea of a decentralized and trustless Internet is compelling, it does have its downsides. Especially as it relates to money. Because there is no “centralized” party - like Visa or PayPal - acting as a middleman for transactions, getting your funds back after being scammed (or sending it to the wrong address) is virtually unheard of. Further, while the security around today’s cryptocurrency wallets is quite strong, most hacks and thefts happen as a result of human error (e.g. giving your password or “seed phrase” to a bad actor). Because of that, understanding how to keep your cryptocurrency wallet safe is critical if you plan to dabble in the world of crypto, NFTs and blockchain gaming. Further, if you plan on buying crypto as a long-term investment, staying on top of the latest security tips - and learning how to set up and operate a cold storage wallet - is highly recommended.Government Adoption

B2B Adoption On the Rise

Consumer Growth

We’re Still in Round One

The Next Internet?

Staying Safe in a Web3 World

Wallet Safety

Conclusion

That wraps up our guide to Web3. From DeFi to decentralized social networks, it’s clear that Web3 has a number of interesting applications. So while the space is still early, it will be interesting to see how (or if) Web3 impacts the world of gaming, finance, and government in the near future.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.