Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

7 Trends For The Future of FinTech (2024-2032)

The financial technology space is currently worth $340 billion.

And the industry is projected to be worth more than $1 trillion globally by 2032.

So it’s clear that FinTech is on the rise.

But as technology and regulations continue to change, the FinTech space will need to adapt.

With this in mind, here are seven ways the financial technology industry is set to change in the future.

1. FinTech Further Embraces AI

59% of Americans trust AI to invest their money. And nearly three-quarters view the adoption of AI in financial services as “positive”.

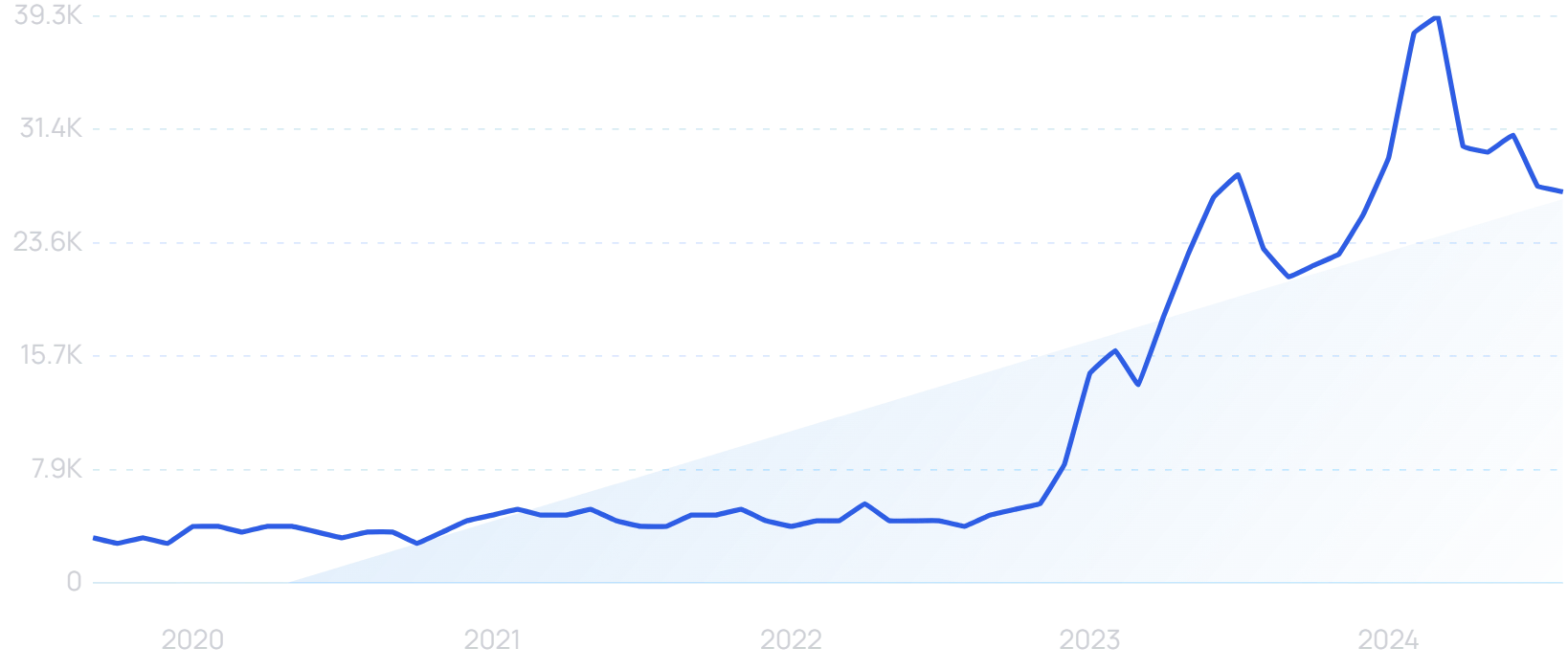

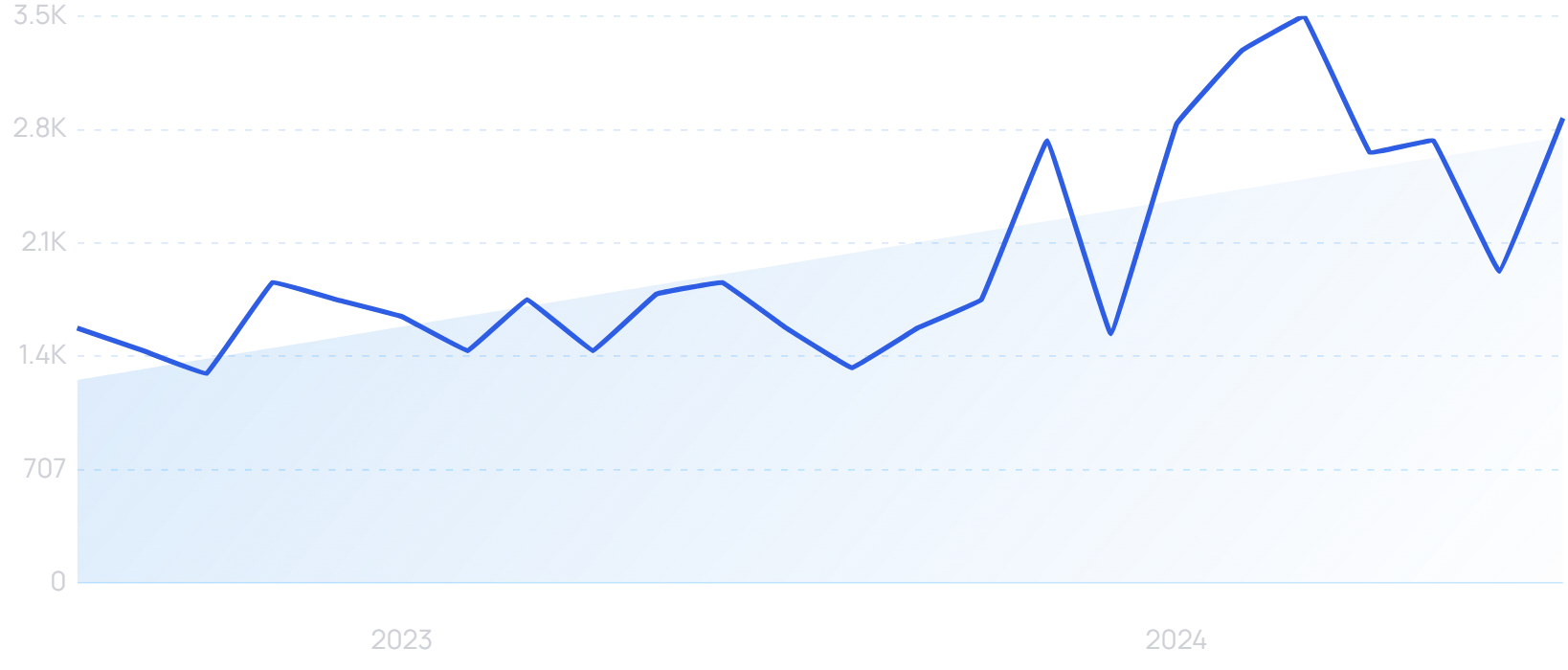

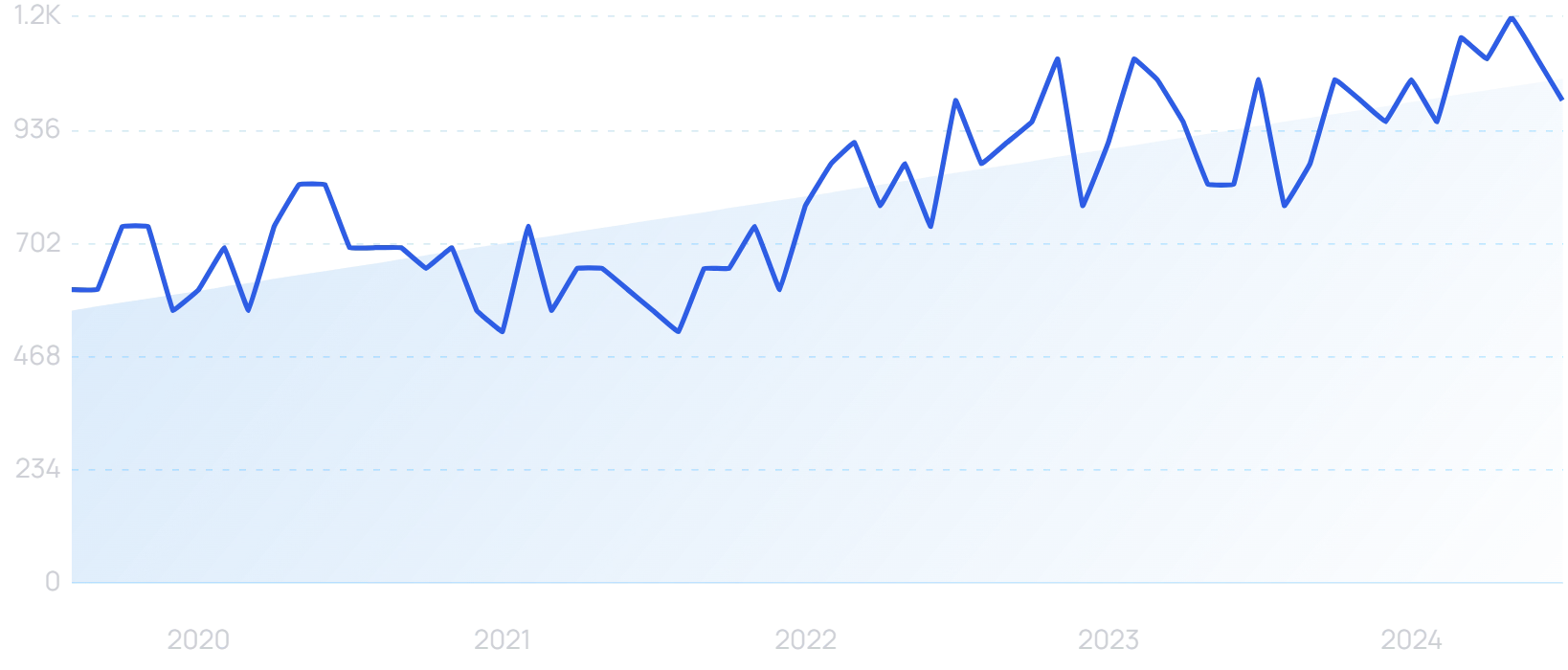

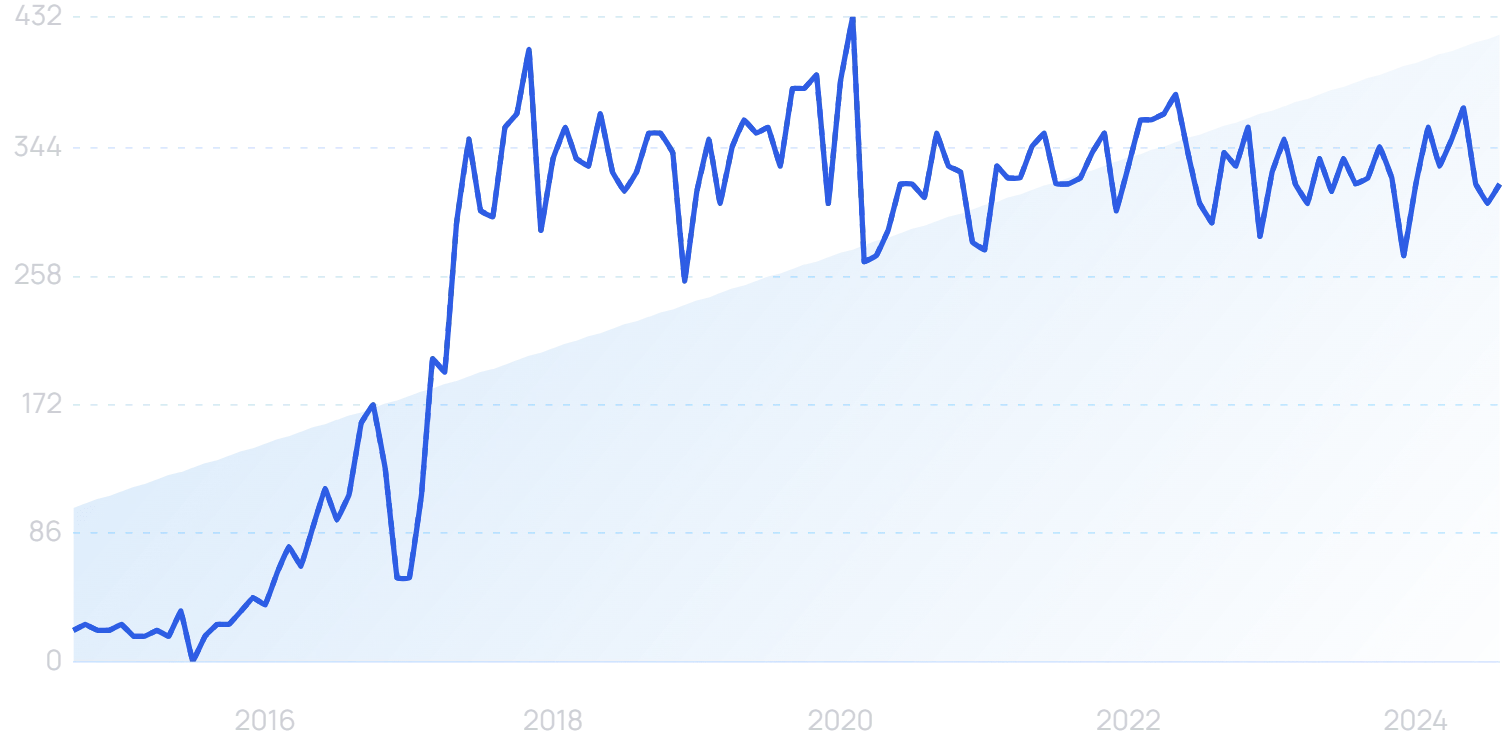

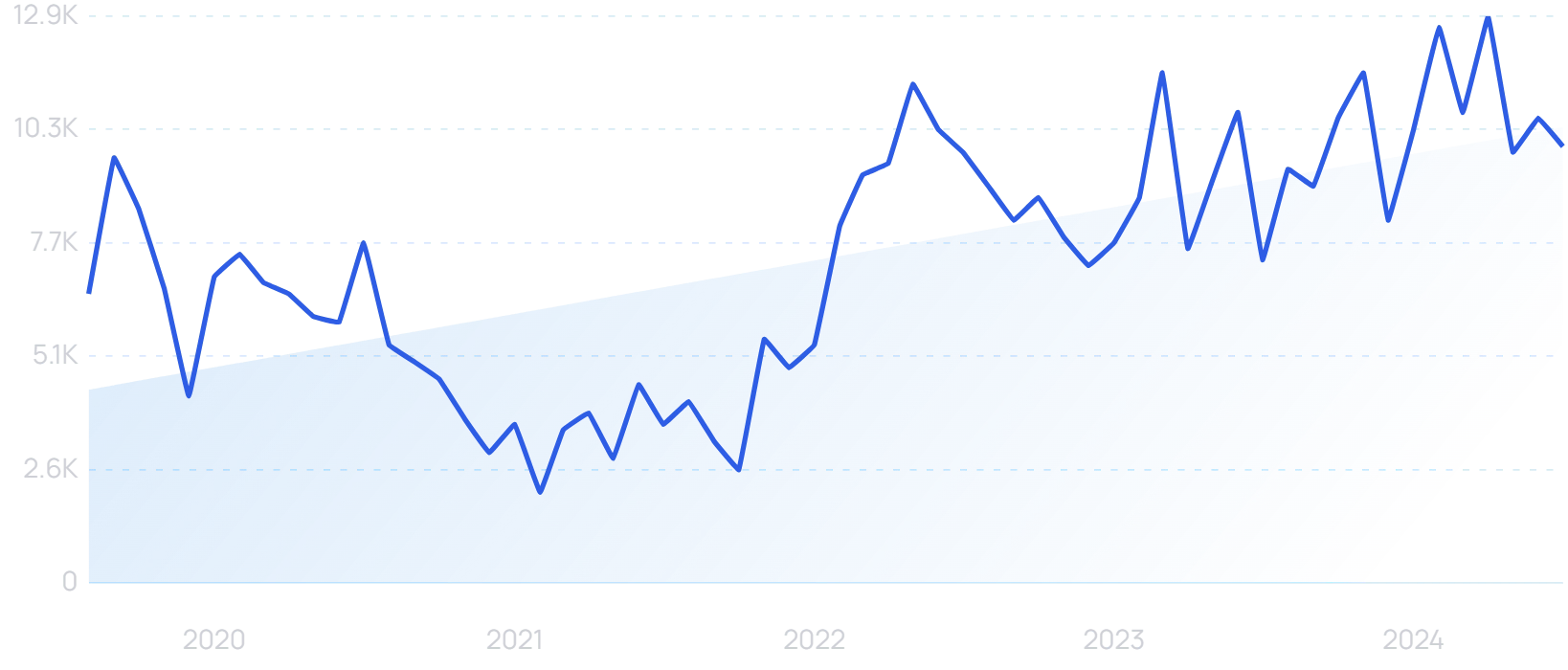

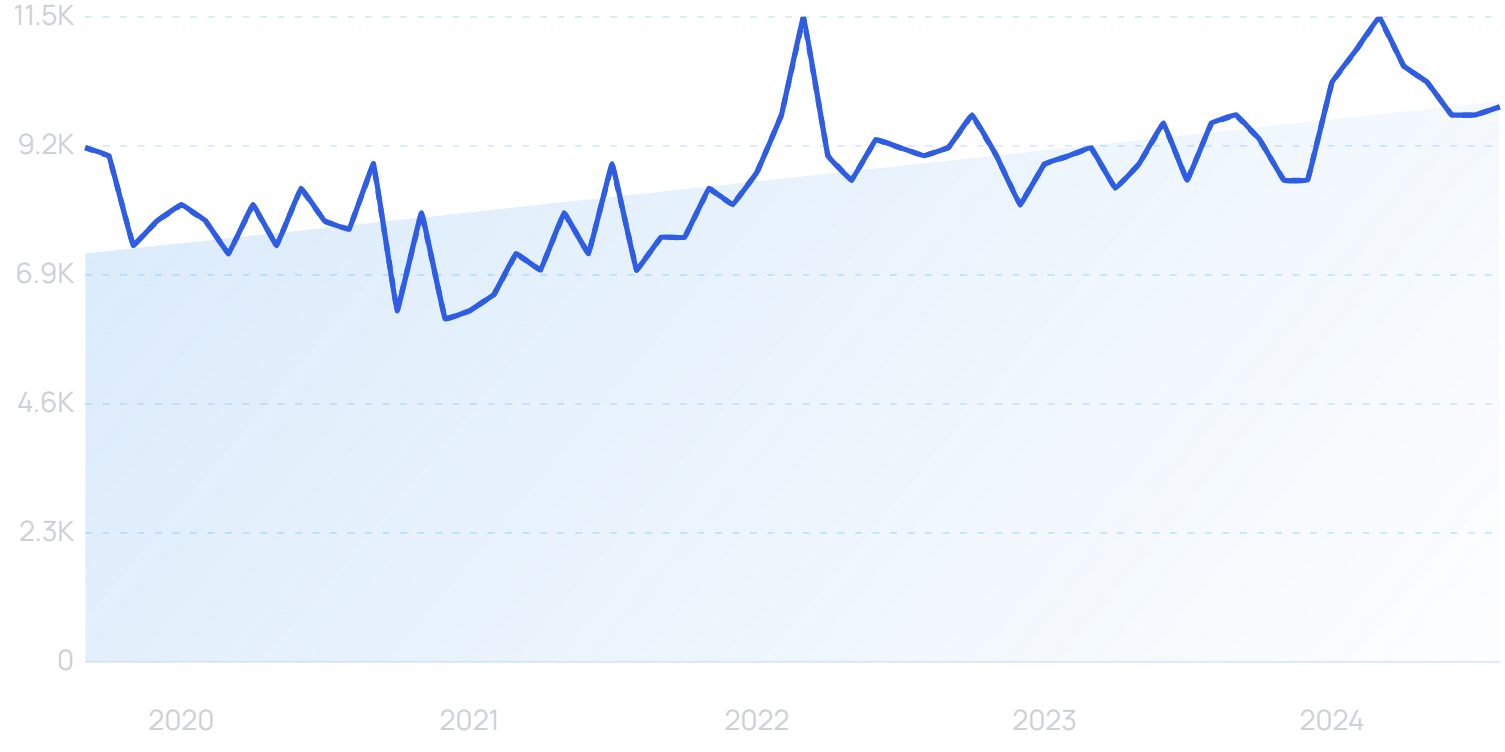

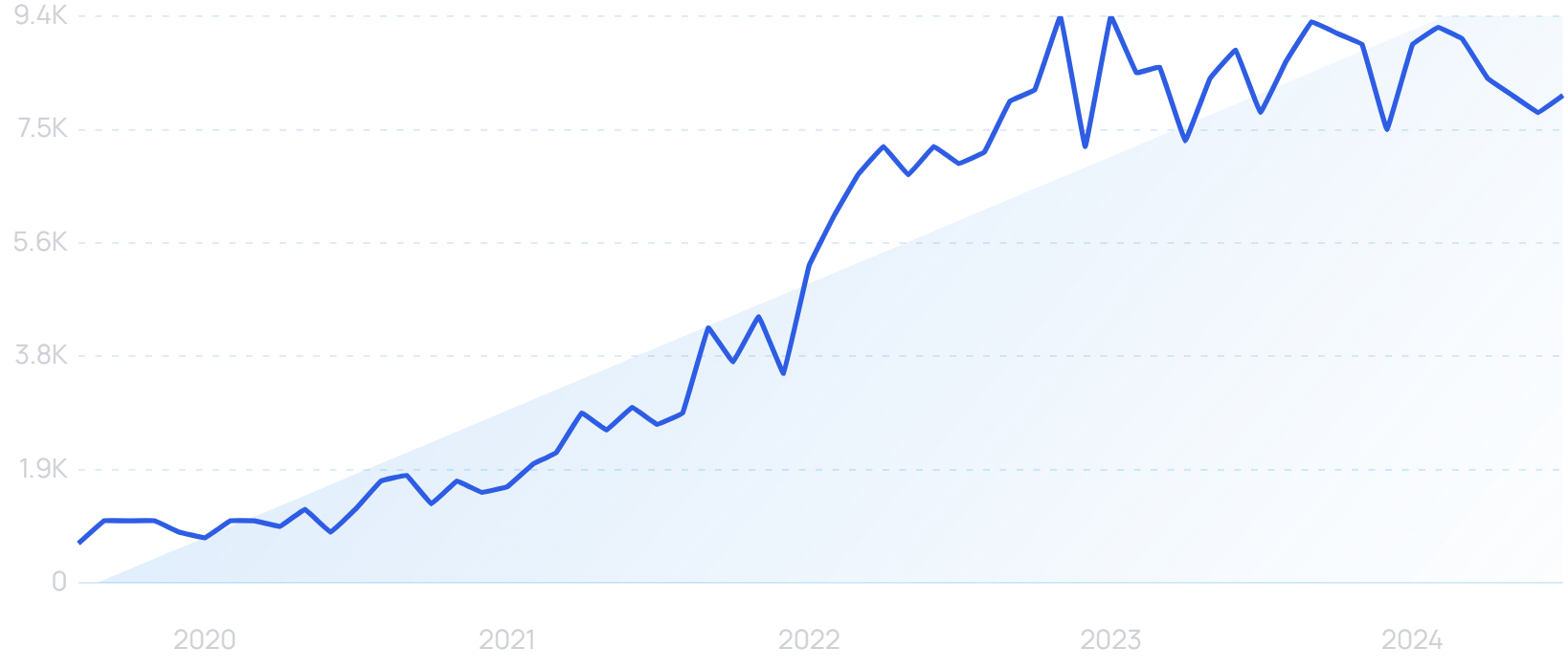

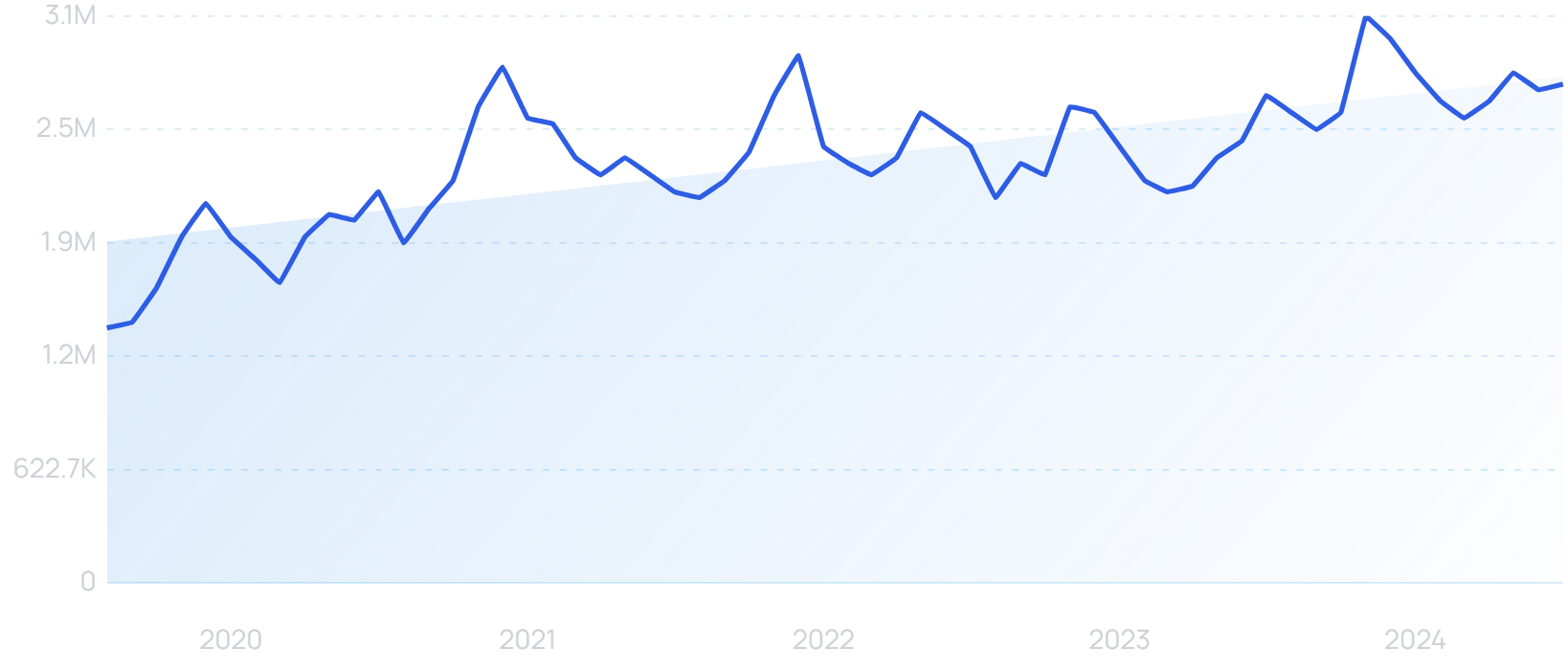

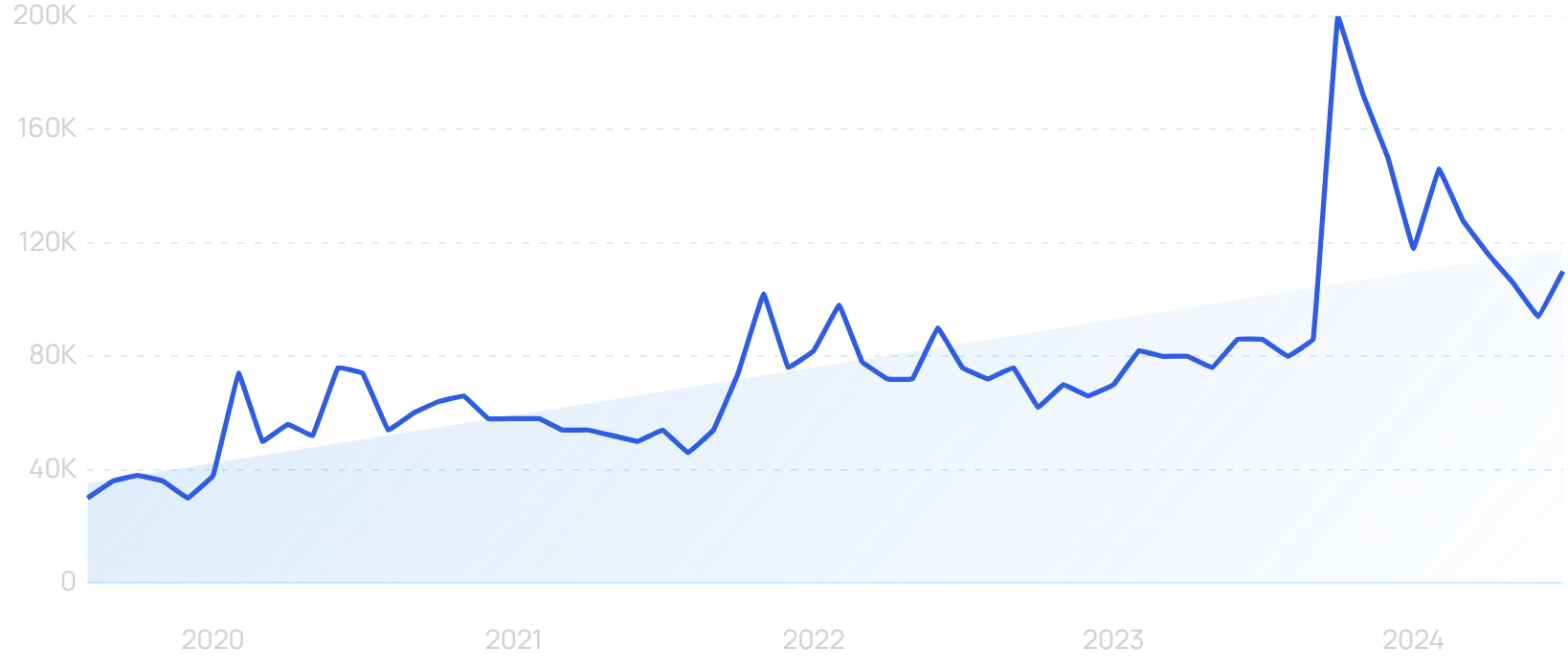

“AI investing” searches are up 813% in 5 years.

So it’s little wonder that 69% of financial services businesses are already using AI for data analytics, according to an Nvidia study.

The same study found that 51% of people within the industry see AI as important to their company’s future success, compared to just 29% the previous year.

From fraud defense to customer support, the applications of AI in fintech are varied.

French-based DeFacto uses AI to power business lending decisions.

DeFacto relies on AI for its finance offerings.

Michael Kent is a founder of multiple FinTech enterprises and a venture partner at VC firm Headline. He says DeFacto is now doing around $500,000 worth of lending with a staff of just 20 or so people.

Gupshup focuses on generative AI for the finance industry.

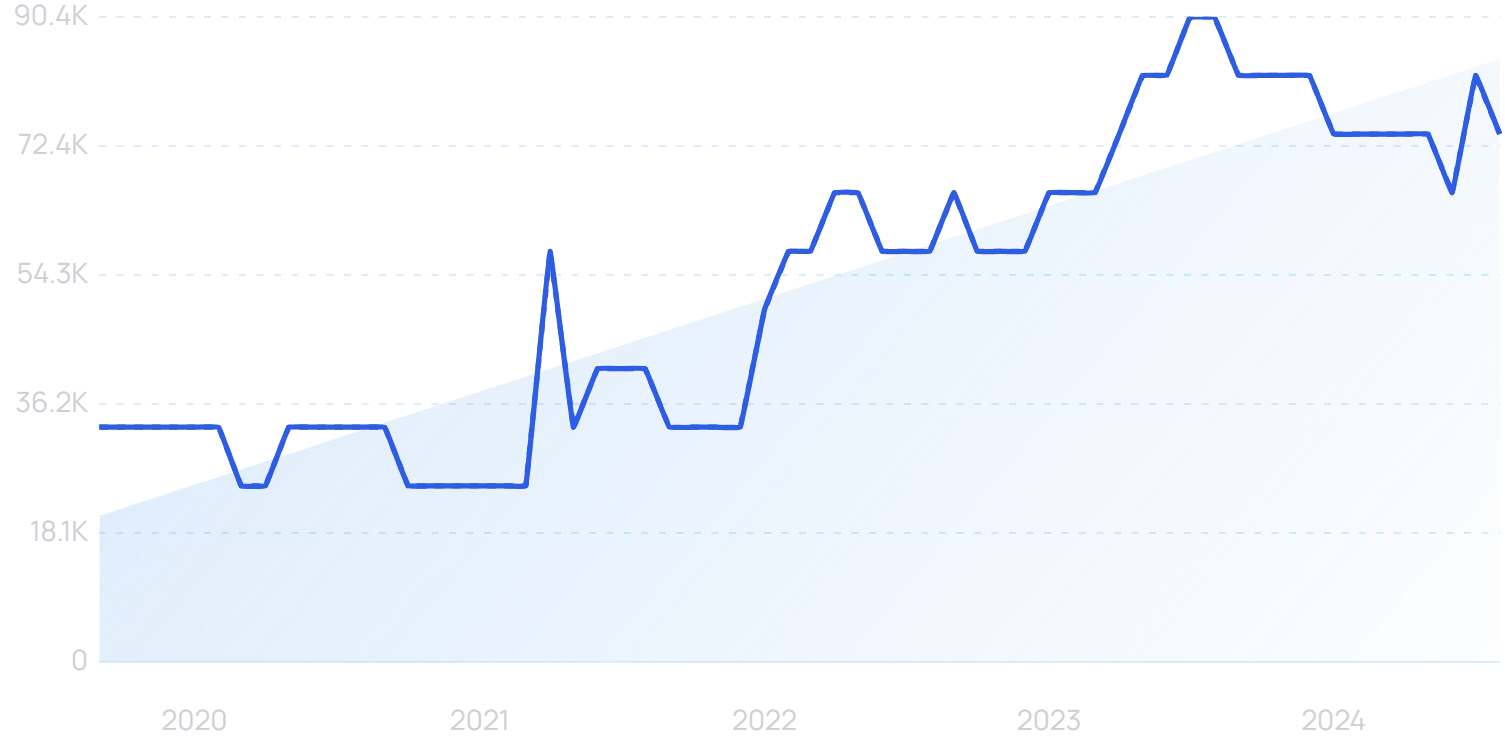

Searches for “Gupshup” are up 125% in 5 years.

Its specialized chatbots (which also serve other industries) boast more than 45,000 customers. And send more than 10 billion messages per month.

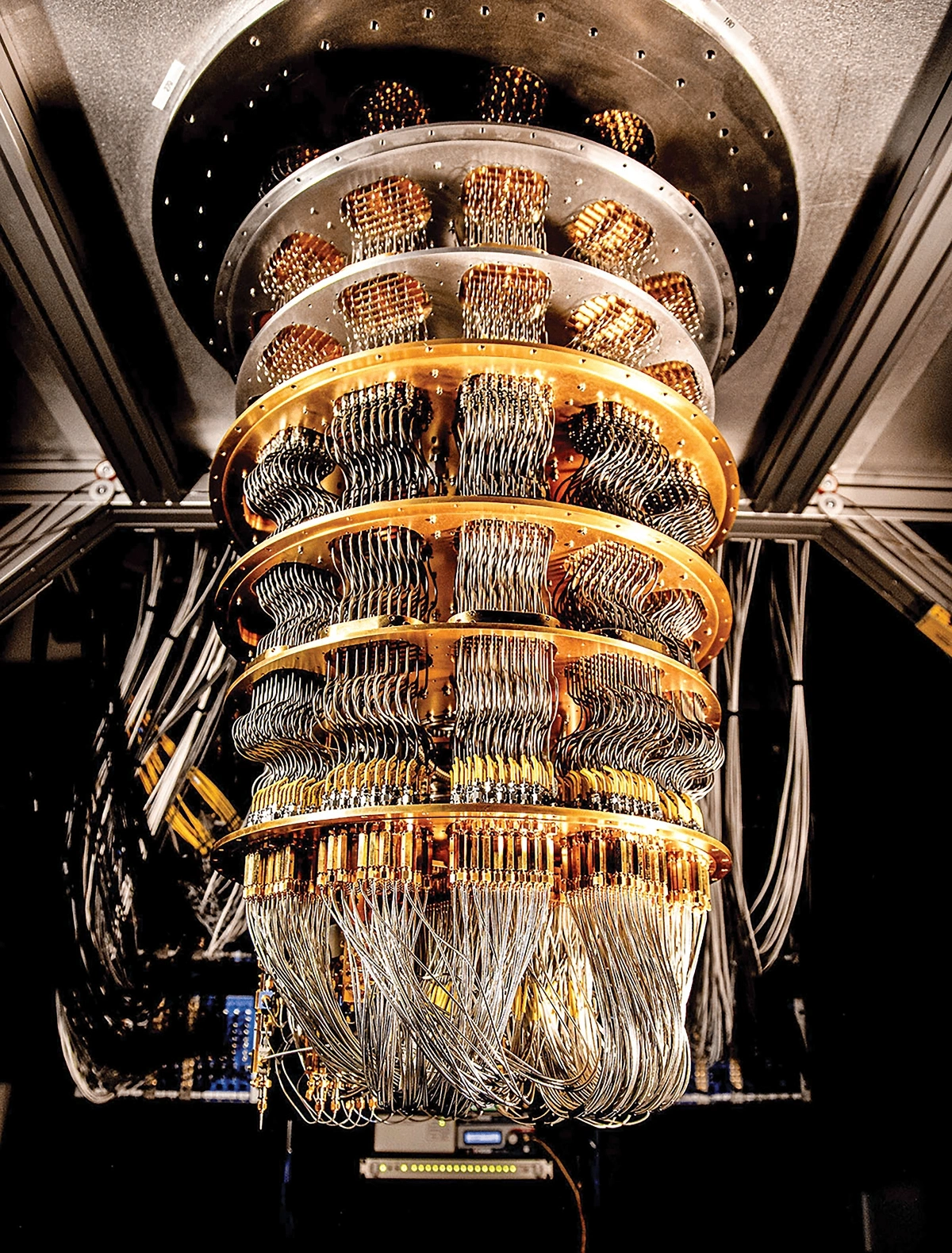

2. Quantum FinTech Arrives

Once a fault-tolerant quantum computer becomes a reality, it could add $622 billion of value to the finance industry.

That technology could be in place by 2035.

So the future of FinTech will most likely be powered by quantum computers.

Searches for “quantum computing” have grown by 92% in the last 5 years.

Quantum computing’s biggest advantage is that it is incredibly fast. In FinTech, that will allow it to make more accurate predictions using unimaginably large datasets.

A complex calculation that might take a supercomputer 47 years to complete can be completed instantly via a quantum computer.

This speed enables companies to take in a vast amount of data and analyze it within minutes.

Google’s quantum computer instantly solved a problem that would have taken a supercomputer many years.

The potential of quantum computing in the financial industry is already being studied by major players in this market.

JP Morgan and Goldman Sachs are examples of large banks that have unveiled plans to integrate this technology into their operations.

VCs have started to take notice too.

Multiverse Computing, referred to as FinTech’s first quantum computing startup, raised $27 million in funding in March. The investment round valued the business at over $100 million.

Searches for “Multiverse Computing” have grown by 82% in the last 2 years.

Multiverse is demonstrating how quantum technology can influence FinTech (and other fields) even before technical advancements reach full maturity. It is already using “quantum-inspired” tensor networks that can compress large language models by as much as 93%.

Meanwhile, developments in quantum technology continue at pace. Universal Quantum is focused on developing machines that can ultimately be deployed at scale.

Searches for “Universal Quantum” are steadily rising.

It claims to have made a breakthrough that enhances quantum error correction by a factor of six, among other significant benefits.

3. RegTech Grows In Significance

RegTech is already a $15.8 billion market. By 2032, that figure could be as high as $85.9 billion.

RegTech falls under the FinTech umbrella. But it specializes in helping finance companies to maintain regulatory compliance.

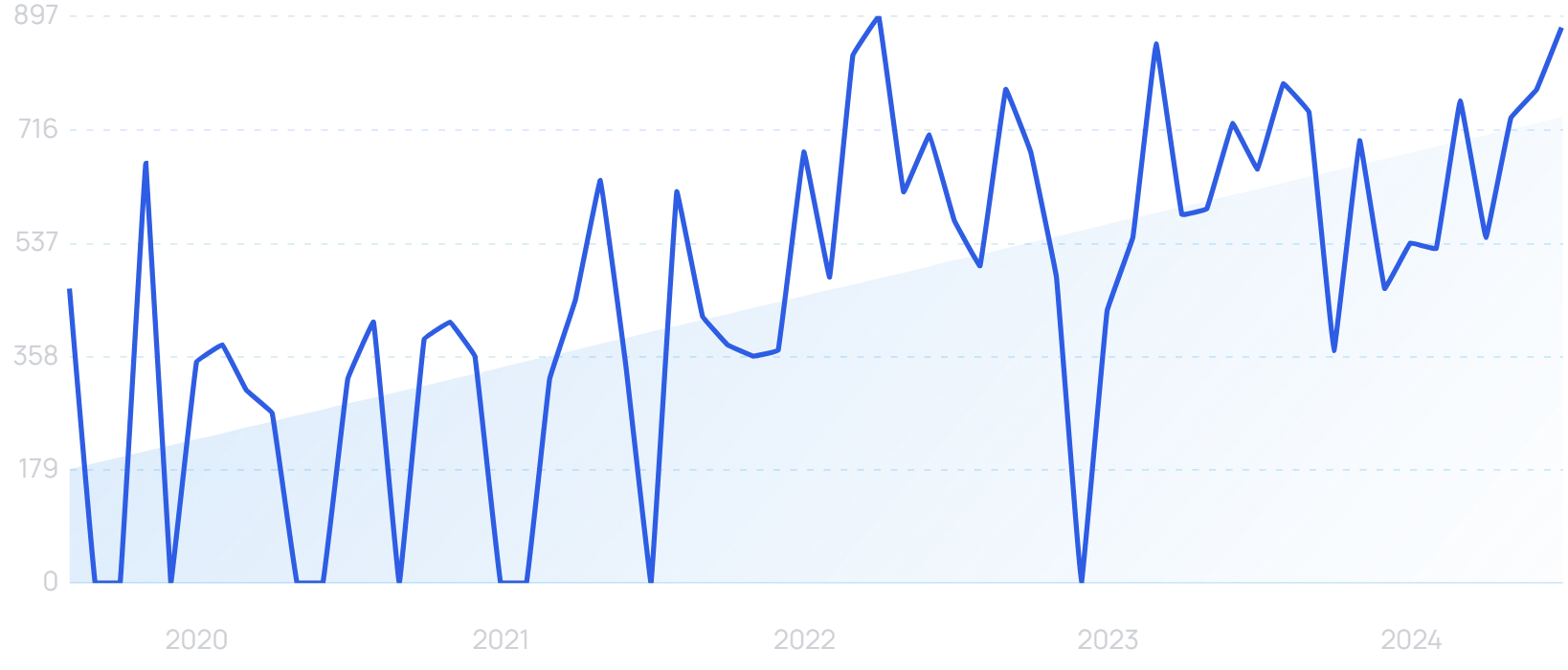

Searches for “RegTech” are up 6900% in 10 years.

Last year, banks were fined $6.6 billion solely in relation to anti money-laundering (AML) regulations. So there’s a huge financial incentive to secure compliance.

ComplyAdvantage uses AI to detect AML risk and possible fraud.

“ComplyAdvantage” searches are up by 51% in 5 years.

It claims to reduce false positives by up to 70%. Santander UK reduced onboarding times by up to 80% with ComplyAdvantage, with the AI technology automating a number of checks typically performed by compliance officers.

Forter focuses more on point-of-purchase consumer transactions.

Searches for “Forter” are up 32% in 5 years.

Its AI tech reduces chargeback rates by 72% and false declines by 46%. It is now listed on the AWS Marketplace.

4. Every Company Becomes A FinTech Company

Financial services are expected to generate approximately $45 trillion in 2028.

And the rise of embedded finance has enabled non-financial companies to grab a piece of this market.

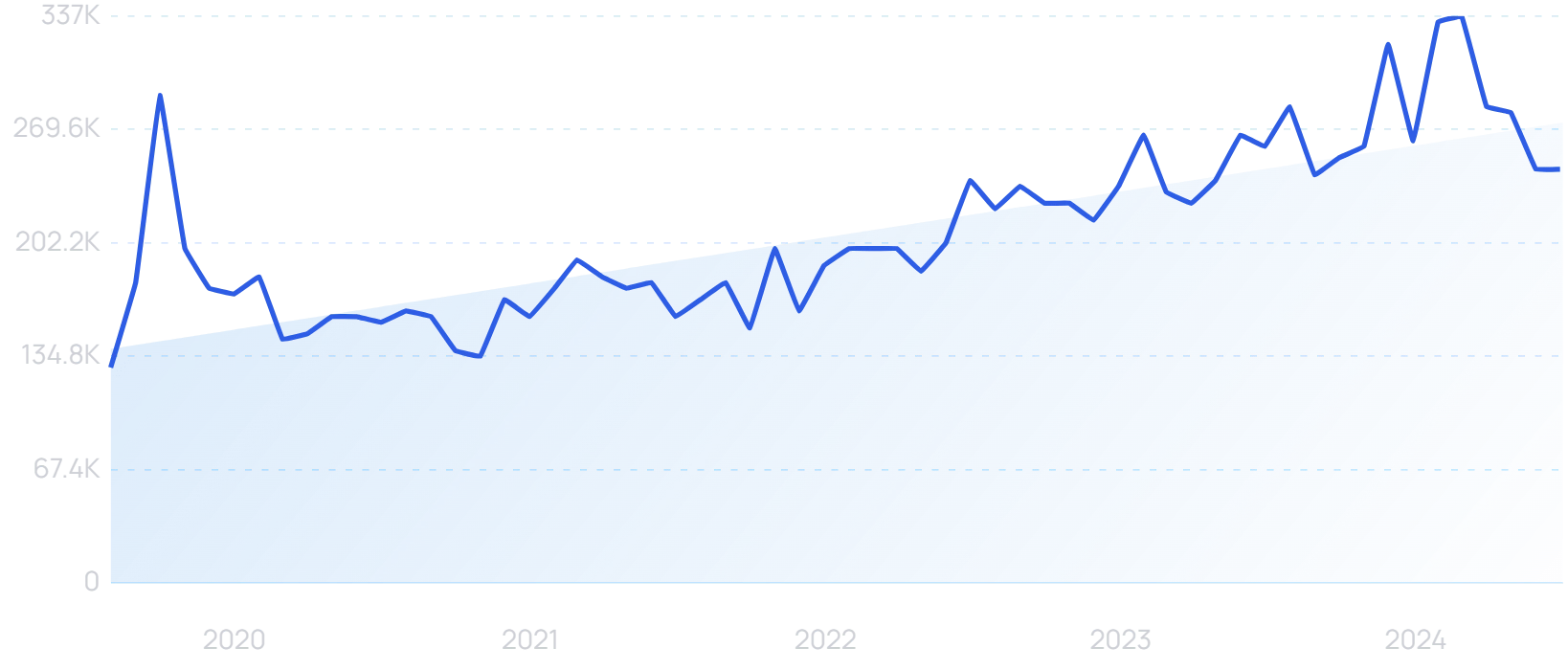

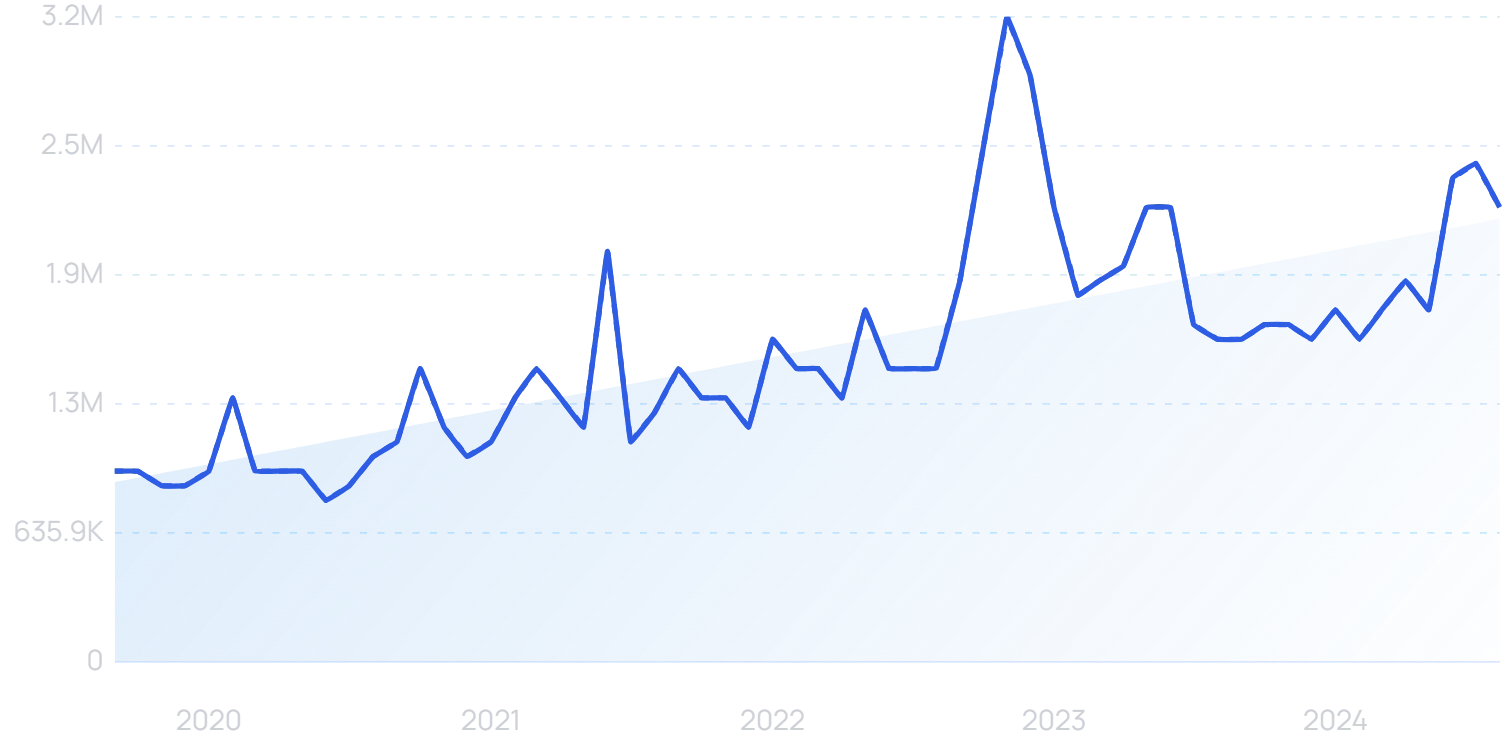

Searches for “embedded finance” have grown by 1,129% in the last 5 years.

Embedded finance enables non-financial companies to integrate financial services into their products and offerings.

We are already seeing this technology impacting several primarily non-financial players.

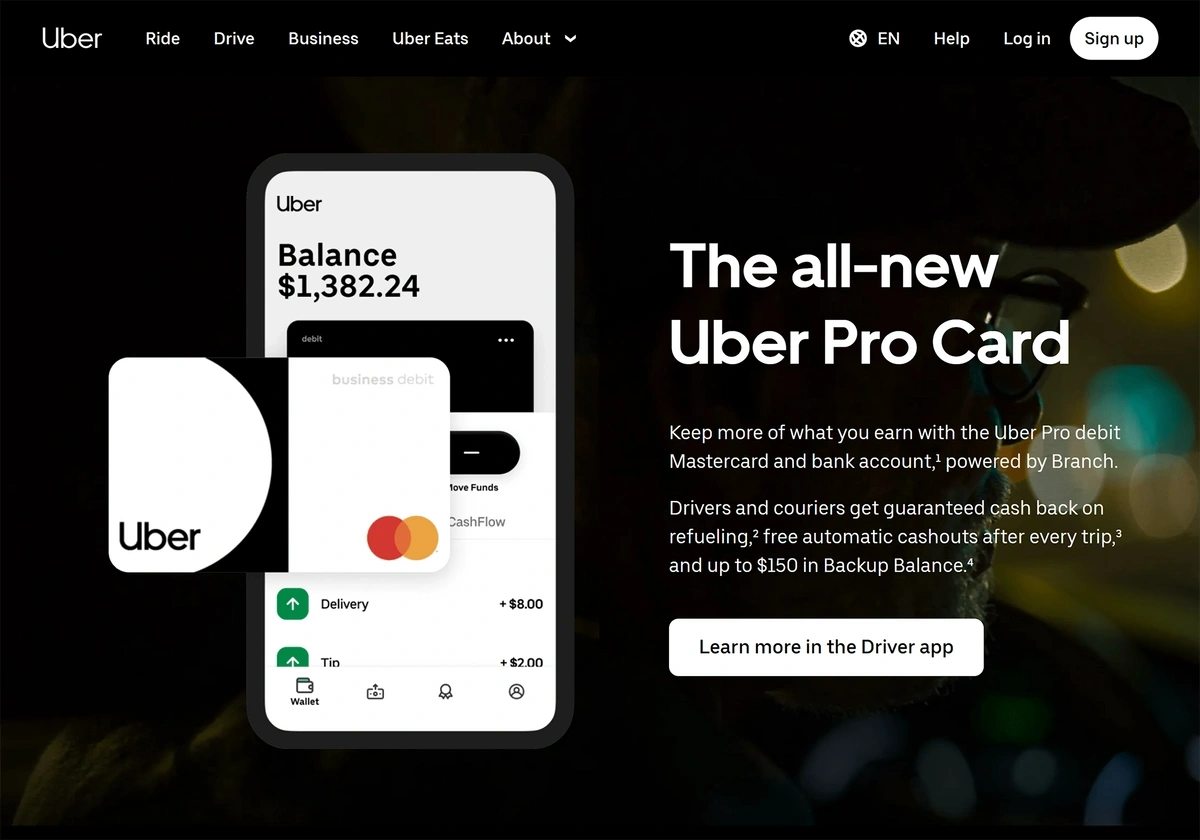

Uber, with the launch of its Uber Pro debit card, aims to become a bank account for its drivers.

It offers industry-specific perks like cashback on refueling.

Uber is now effectively a FinTech company when it comes to its drivers.

Apple has walked away from its own BNPL offering, but major brands continue to embed third-party credit services to improve customer checkout experience.

“Klarna”, a major BNPL player, has seen steady search growth of 96% over the last 5 years.

And more than 2000 UK or EU companies, many of which are not traditional finance businesses, acquired Payments Institution or Electronic Money Institution authorization between 2017 and 2024.

Notably, embedded finance is very consumer-facing.

Meaning that it is all about making it easier for the consumer to access capital and manage their finances.

52% of consumers aged 25-34 cite financial offerings from their favorite brands as their preferred way to pay, offering greater convenience than traditional banks.

And companies that aim to stay on track with consumer trends will have to implement a FinTech infrastructure within their offerings in order to make purchasing easy for customers.

That’s why, as more companies continue to adopt it, embedded finance is forecast to become a $730 billion industry by 2032.

So, in the not-so-distant future, even the smallest companies might offer their own financial solutions to make it easier for consumers to purchase, use and upgrade their products and services.

5. New-Look DeFi Changes The Financial Ecosystem

The blockchain FinTech market is forecasted to grow at a CAGR of 43.8% in the next eight years.

And perhaps blockchain’s most significant impact on this industry will be enabling a secure peer-to-peer, decentralized finance ecosystem.

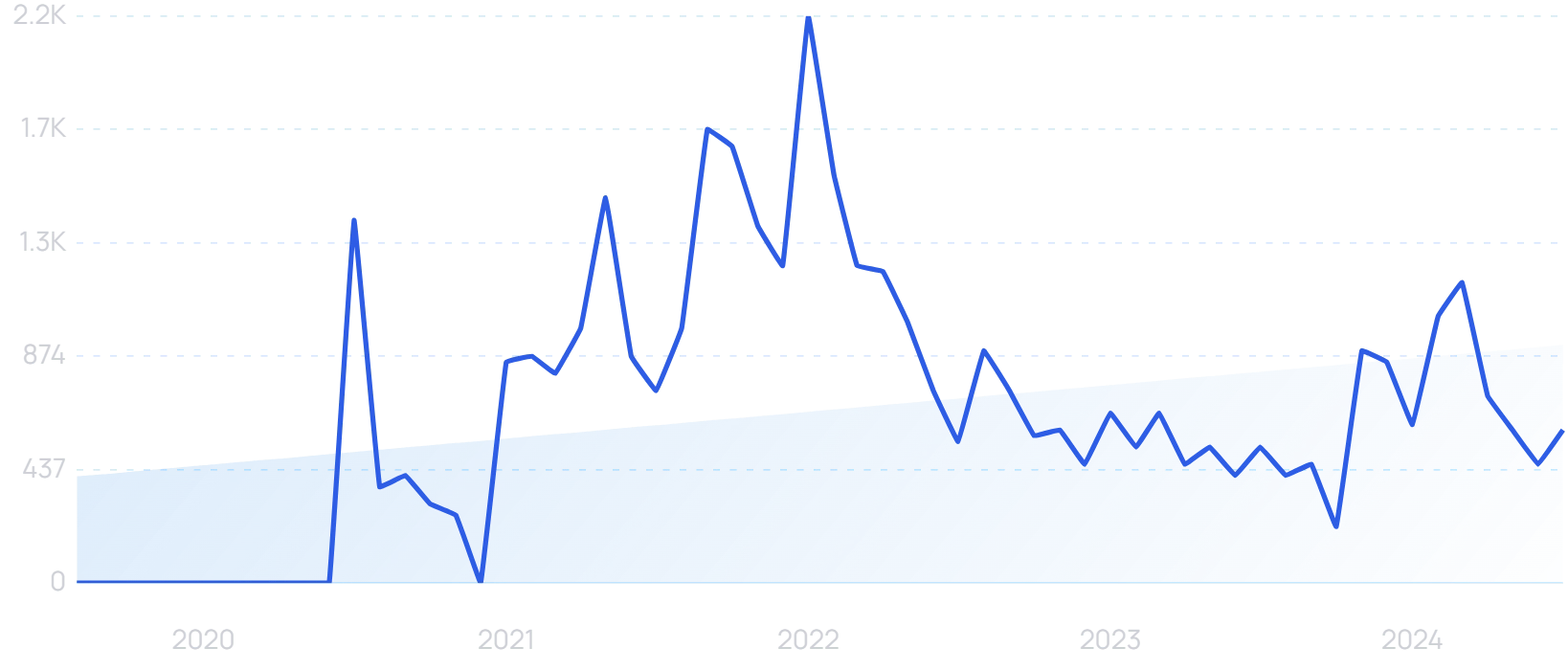

At first glance, the DeFi bubble looks to have burst.

“DeFi ecosystem” searches dropped off sharply in 2022.

The total value locked (TVL) in DeFi reached an all-time high of around $170 billion in late 2021, according to Defi Llama.

That saw a sharp decrease in 2022. But the future outlook still shows promise.

TVL has rebounded from below $40 billion to back above $80 billion. And crucially, lessons have been learned from the nascent steps of DeFi, and the underlying technology remains primed to change the FinTech industry.

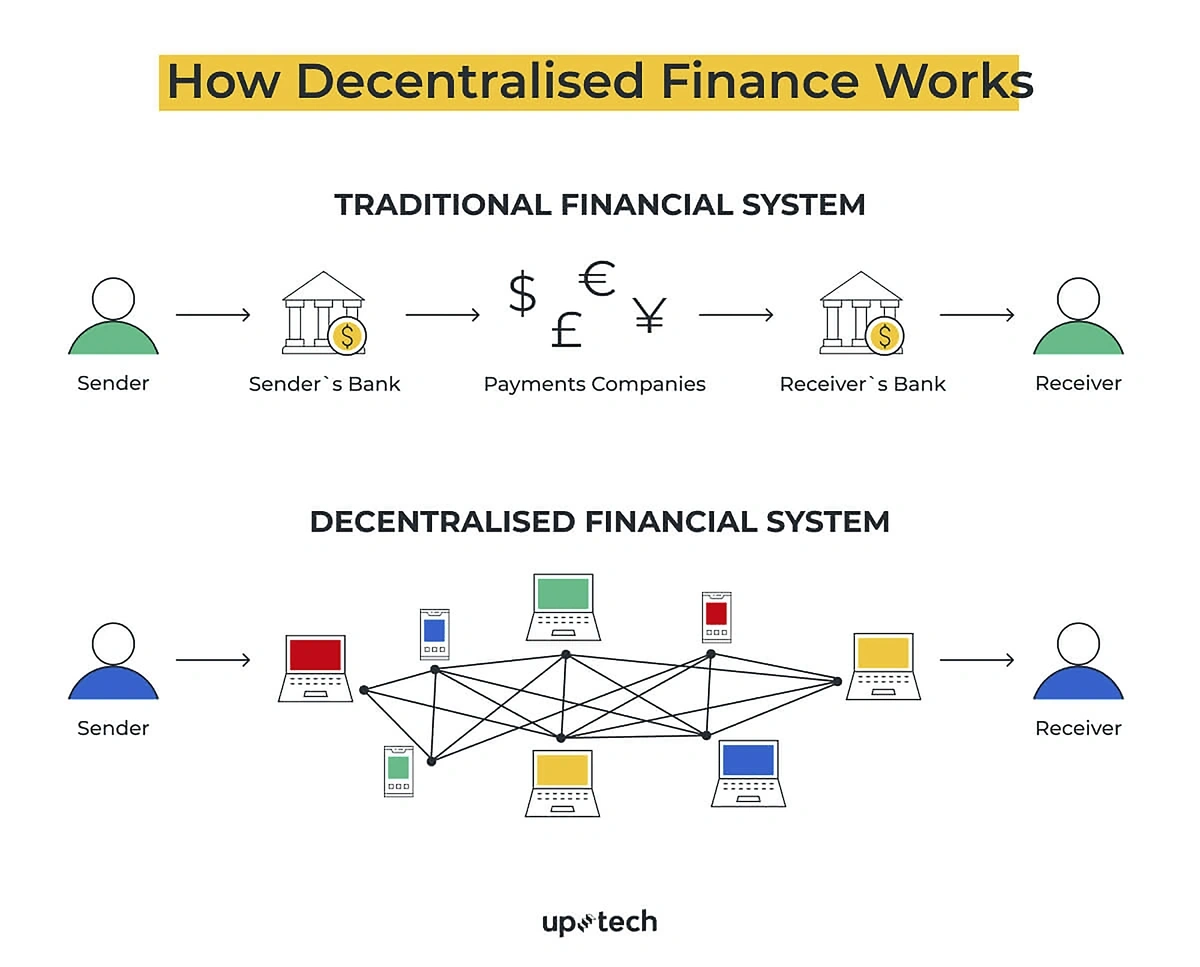

Dubbed the “future of FinTech”, DeFi will likely become a significant competitor to traditional finance systems.

CeFi vs DeFi.

Instead of using a bank to borrow money, consumers will use various peer-to-peer networks secured by the blockchain.

Sending and exchanging money could also be conducted entirely between individuals without the need for an intermediary.

And asset tokenization is even enabling the trading of real-world assets (RWAs) on the blockchain.

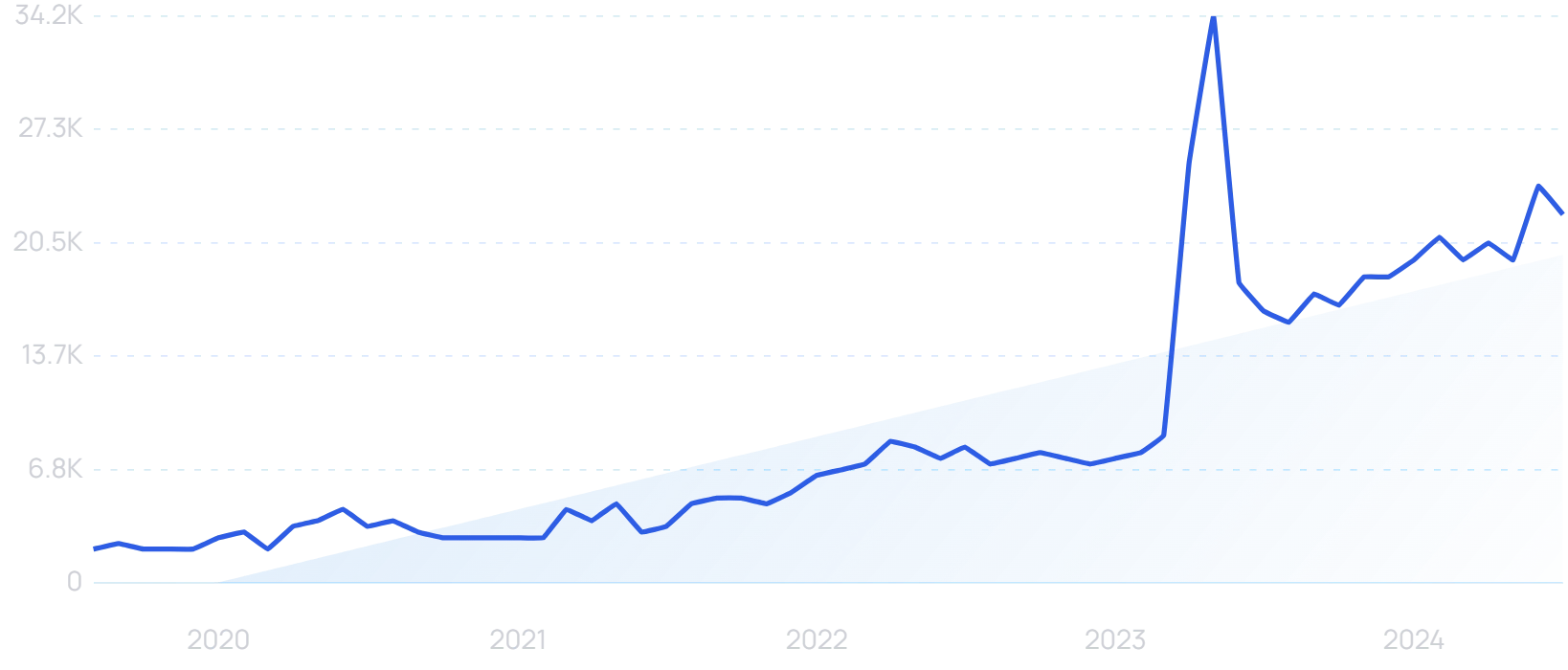

Searches for “asset tokenization” are up 8500% in 5 years.

Tokens can act as a proxy for (whole or part) ownership of an essentially endless list of RWAs, from fine art to intangible assets. According to Forbes, this has the potential to “democratize access”.

There’s also a movement towards use of decentralized technology in centralized settings, with asset tokenization offering major benefits to institutional players.

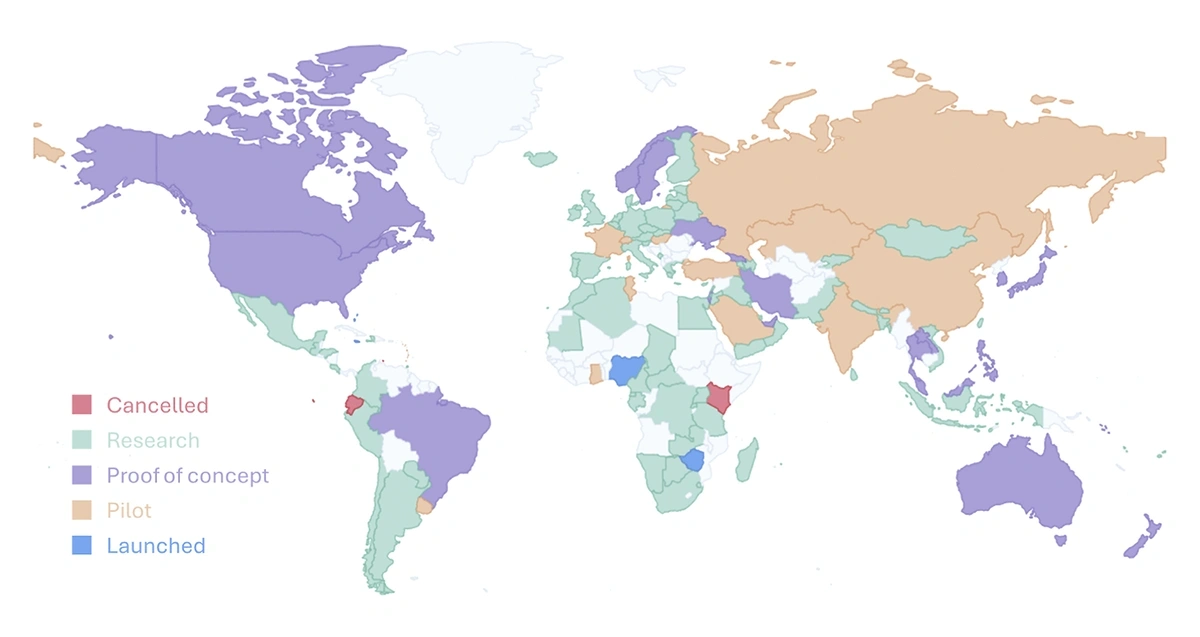

Most countries are at least exploring the idea of a Central Bank Digital Currency.

The market value of tokenized assets could be as high as $10 trillion by 2030.

As new innovations continue to occur, DeFi is by no means finished when it comes to transforming FinTech and the financial institution as a whole.

6. Metaverse Payment Systems

Shopping might look entirely different in the next decade.

The rise of the metaverse will combine physical and online shopping. This means that people will be able to go into a 3D version of a store and browse their 3D items.

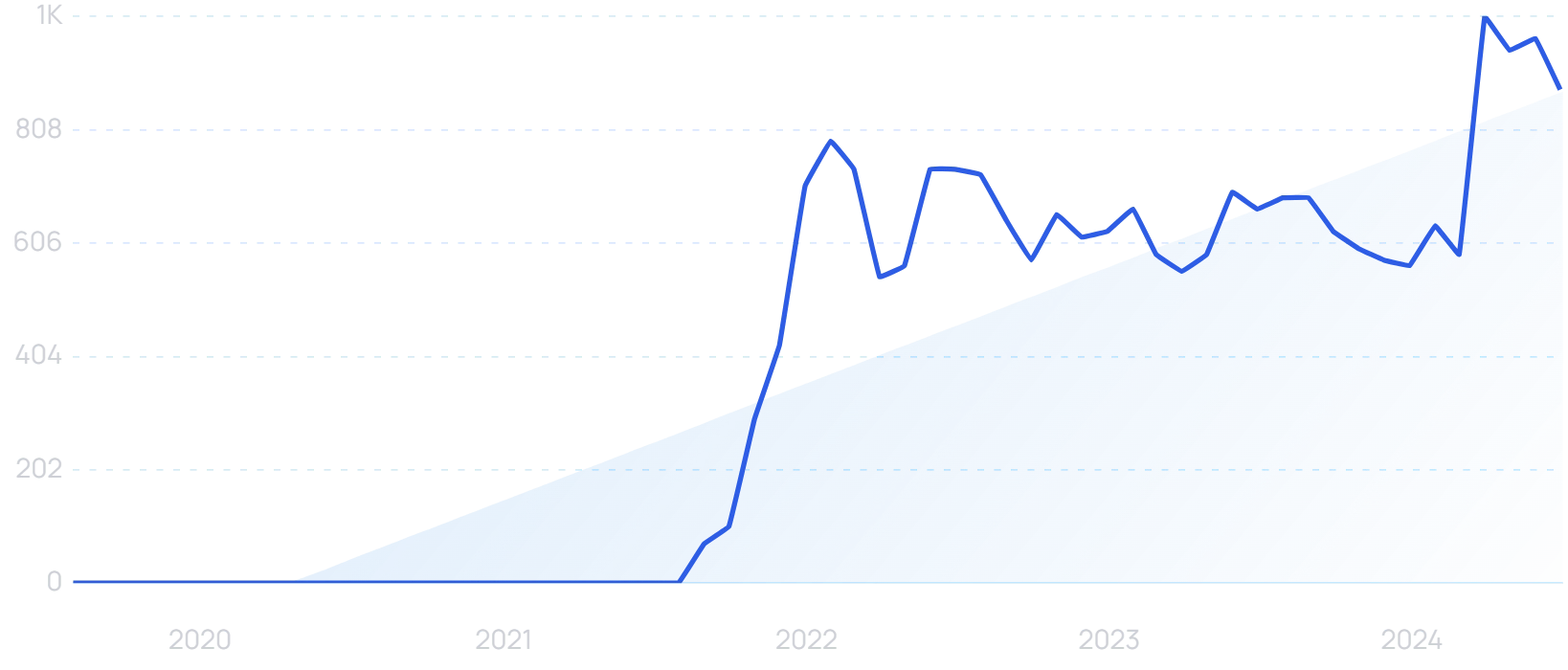

Searches for “Metaverse development” are up 8600% in 5 years.

When they like a product, they can order it in the metaverse. If it’s a physical product, it will be shipped to their real-life address.

This entire process is called metaverse shopping.

And while there are some fears over waning interest in the concept of the metaverse, retail is one of the most clearly-defined use cases, allowing online shoppers to visualize what they are buying more clearly than ever.

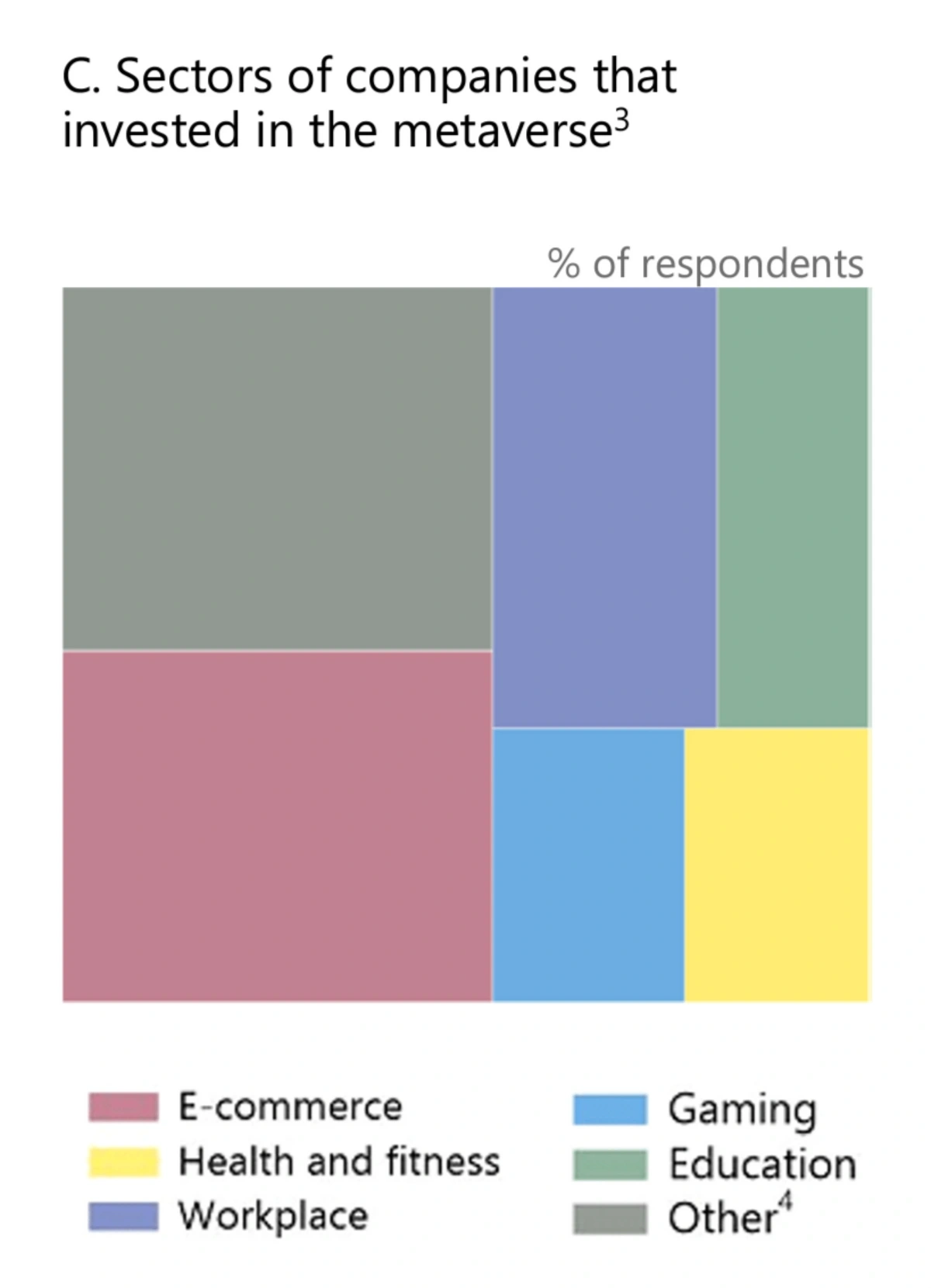

No single sector has invested more in the metaverse than E-commerce.

The metaverse is already a $74 billion industry, and is projected to grow to over $500 billion by 2030.

And it makes sense that there will be demand for a sophisticated payment system to support this growth.

For metaverse commerce to work, the payment system has to be seamless.

It’s been predicted that WebGPU could be a “game-changer” for the metaverse in general, including marketing and commerce opportunities.

“WebGPU” searches are up 983% in 5 years.

Apple, Google, Mozilla, Microsoft, and Intel were among those to collaborate on WebGPU, which is intended to unlock significantly greater graphics capabilities within browsers.

In a demonstration video, Google shows how a virtual art gallery can now be rendered to a high level within Chrome, which could clearly have implications for wider access to the metaverse - and purchasing opportunities within it.

Besides making this process immersive, integration is another potential challenge for metaverse payments.

Each metaverse might adopt its own cryptocurrency. In fact, the average metaverse user holds money across five different metaverse platforms.

This situation calls for systems that can instantly exchange cryptocurrencies to ensure that the transactions go through quickly.

These challenges provide many opportunities for financial technology companies that want to solve them.

Leading FinTech company Worldline already offers white-label stores within metaverse environments where users can pay with real-world currencies.

“Wordline” searches are up by 267% in 5 years.

And in December last year, it extended its platform in order to offer significantly enhanced graphics capabilities and accessibility.

7. Africa Becomes a FinTech Powerhouse

Just under half of Africans do not have a bank account.

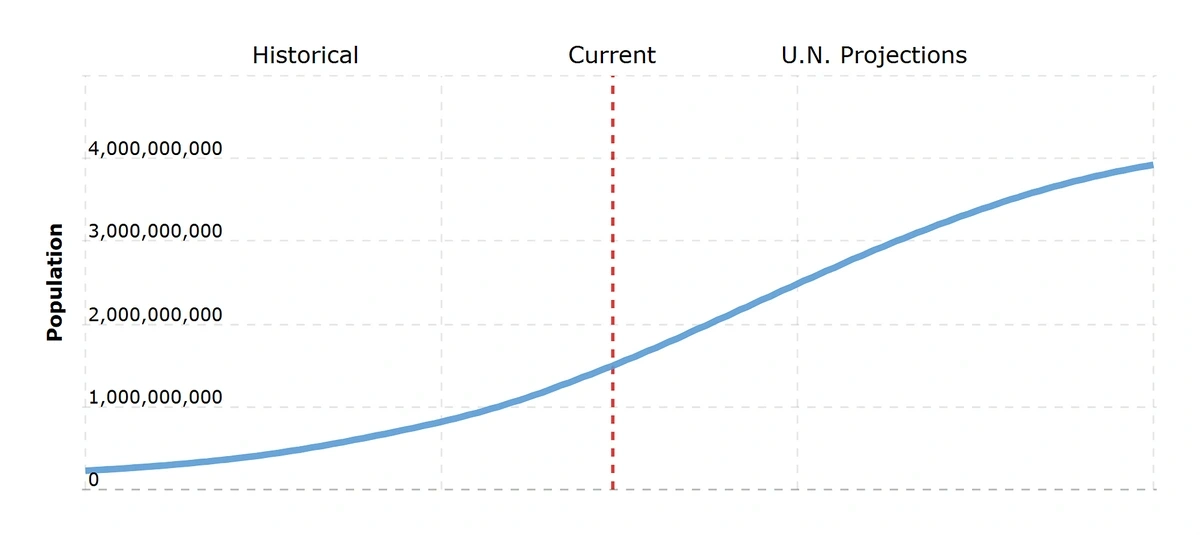

Meanwhile, the population in Africa is estimated to increase by around 1 billion by 2050.

Trends in African population size from 1950 to 2050 (projected).

These two parallel trends represent an ample opportunity for African FinTech startups to grow.

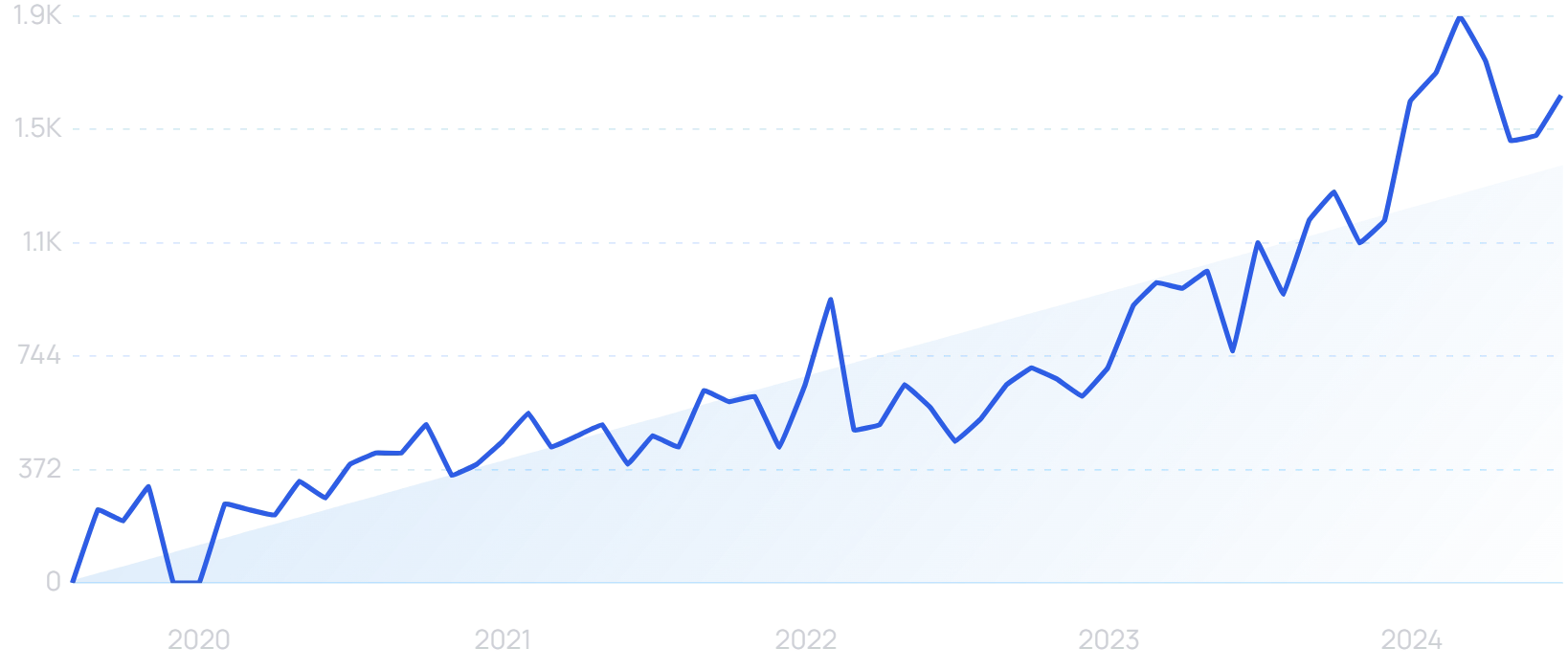

As a niche search term, interest in “African FinTech” is spiky. But it is trending upwards.

We’re already seeing an influx of African startups offering financial services.

African FinTech businesses received $1.55 billion in funding last year alone.

Of that, $400 million went to MNT-Halan, an Egyptian company that has become the country’s first unicorn.

Searches for “Halan”, the app offered by MNT-Halan, are up 183% in 5 years.

It has since raised a further $157.5 million to target expansion beyond Egypt. Offering services to the underbanked and unbanked, it now serves as a kind of financial “super-app” to more than 7 million customers.

If current trends persist, Africa might see a massive spike in the FinTech market size in the next decade.

This is already happening, with Africa the fastest-growing continent for FinTech revenue. The market is projected to be worth $65 billion by 2030, a 4x growth.

Conclusion

This completes our analysis of the future of FinTech.

Increased competition, new powerful technologies, and emerging economies will all have a significant impact on this market.

Therefore, this is an industry well worth monitoring in the coming years.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more