Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

11 Important Consumer Trends (2024-2027)

You may also like:

Consumer preferences are constantly changing.

From changes in shopping habits to new technology, there's no question that businesses of all sizes need to keep tabs on ever-shifting consumer preferences.

If you want to learn about important global consumer trends to watch for the next 2-3 years, read on.

1. Consumers Demand Control of Their Data

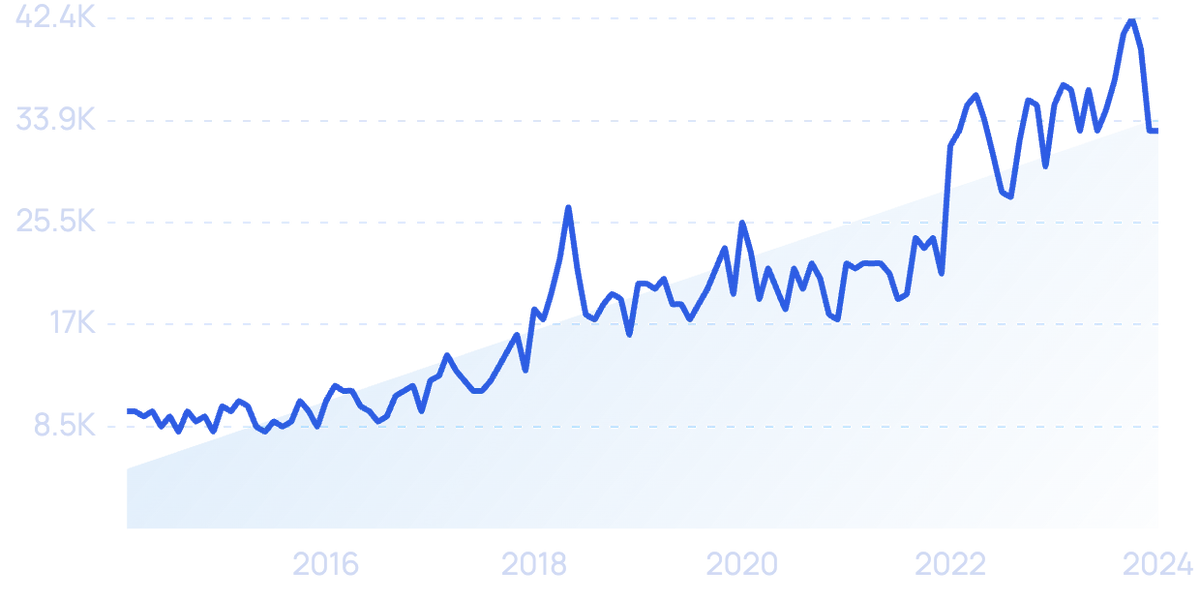

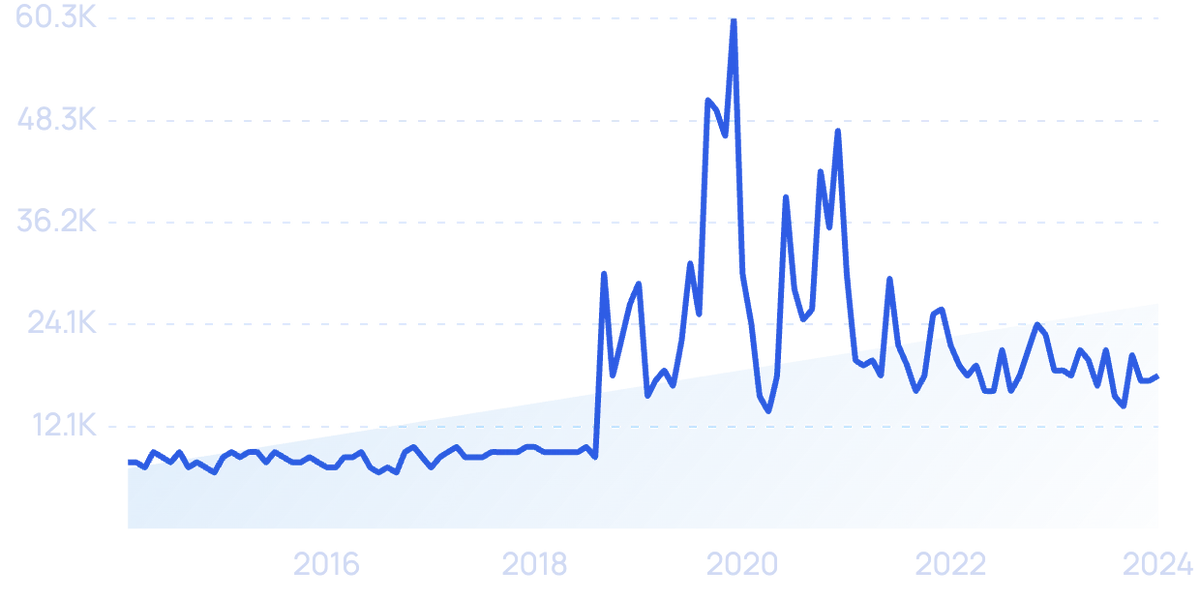

Google searches for "data privacy" have increased by 239% over the last decade.

Consumers want to take back control of their own data.

In fact, a recent KPMG survey of more than 1,000 consumers found that 56% wished they had more control over their data.

And this increased focus on privacy is directly impacting consumer behavior.

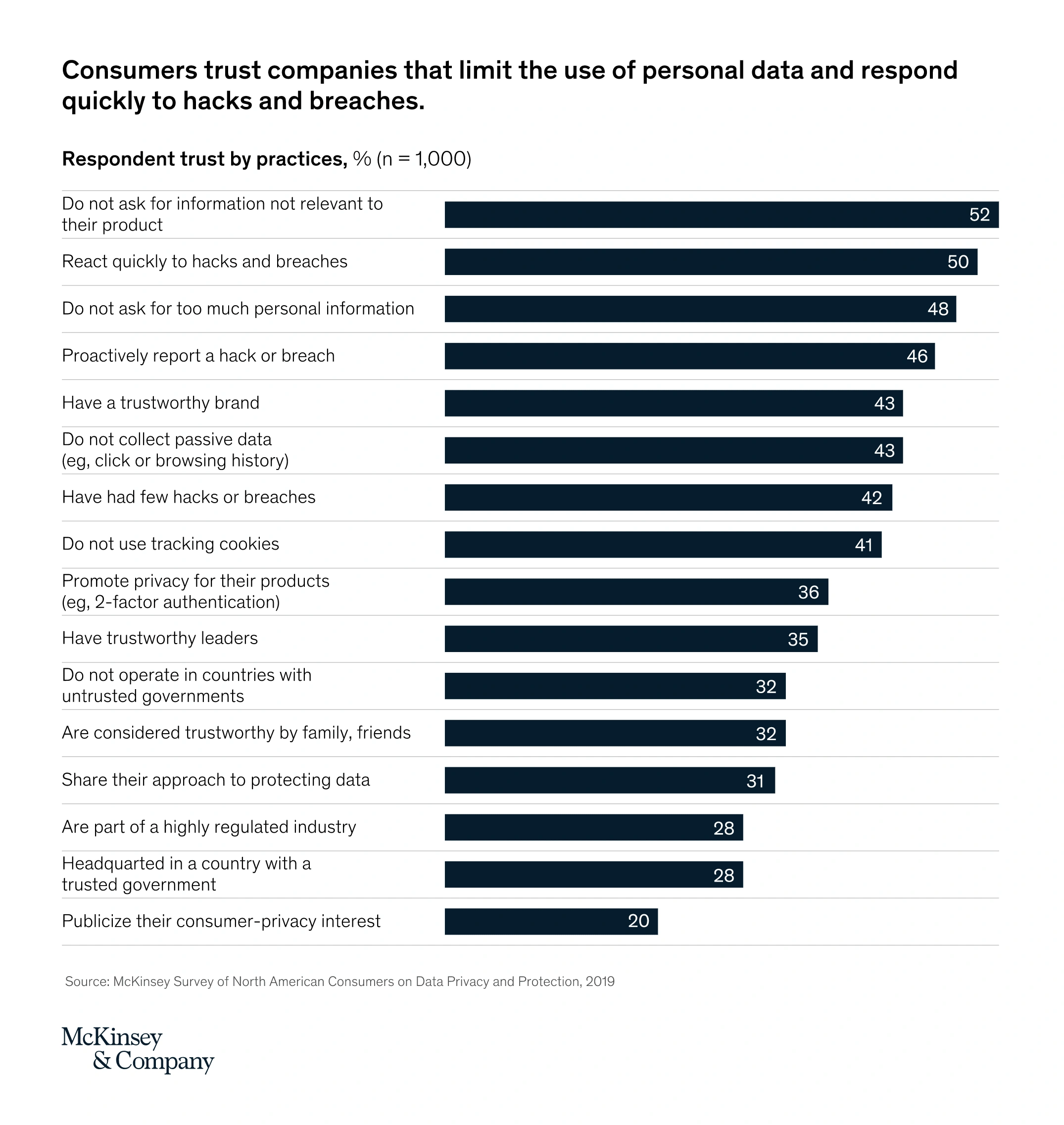

In fact, according to McKinsey, 87% of North Americans said they would not do business with a company if they had concerns about its data practices.

More than half of consumers also trust a company more if it does not ask for information that is irrelevant to its product.

For many consumers, privacy even takes precedence over convenience.

In a study conducted by payment security company Paysafe, 82% of respondents felt there was an imbalance between security, convenience, and fraud protection.

And 48% of American consumers said they were willing to accept tightening security protocols if they would eliminate fraud.

After the adoption of the General Data Protection and Regulation Act (GDPR) by the European Union in 2018, legislative action has only increased. In 2019 alone, legislation related to consumer data was proposed in 25 US states and Puerto Rico.

While most of the proposed bills have failed, California passed the California Consumer Privacy Act (CCPA) on January 1, 2020.

This Act gives California residents the right to ask businesses to disclose personal information they have collected on the resident. It also gives Californians the right to be notified before a business collects their personal information.

The largest companies are also taking action. Apple announced that it would offer a way for consumers to sign into apps without giving data over to third parties.

While many marketers push back at these changes, consumers will likely exert further pressure on corporations and governments to protect their data.

90% feel that governments and businesses have a responsibility to protect their data.

However, 70% of consumers also say that they cannot trust those businesses to do so.

2. Augmented Reality Enhances the Customer Experience

As the shift to digital-first shopping continues, consumers are increasingly looking for a way to enhance their experience.

Augmented reality and virtual “try-before-you-buy” features are meeting this need.

Industry leaders estimate that 35% of people say they would shop online more if they could virtually try a product before buying it.

And according to a survey of more than 30,000 consumers, over half (51%) said the biggest drawback of online shopping was not being able to “touch, feel, and try a product”.

This has led many of the largest retailers to simulate in-store shopping online.

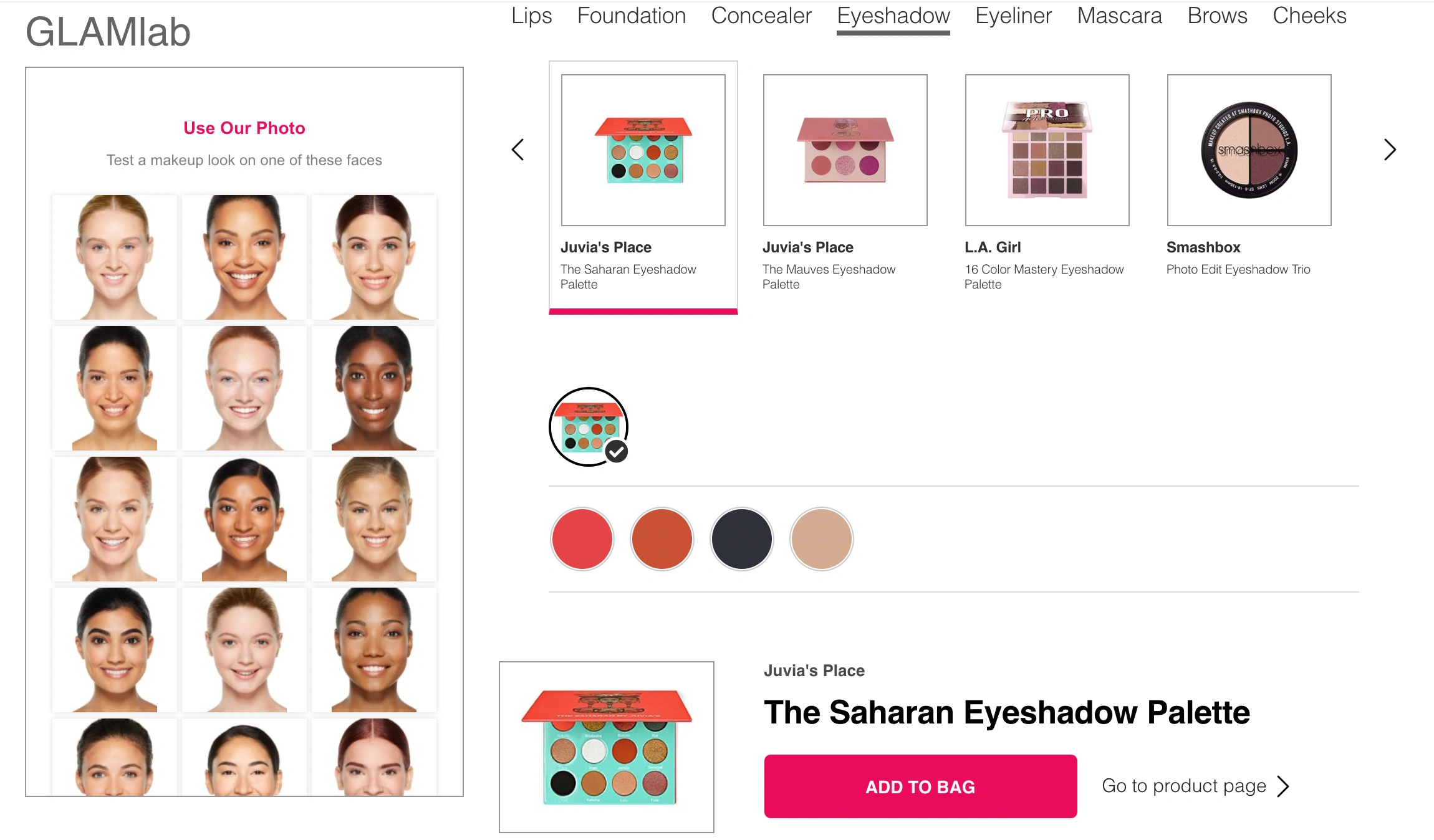

Ulta’s virtual try-on-tool GLAMlab has seen engagements increase 7x since the beginning of the pandemic.

(For a full rundown of post-pandemic consumer behavior, check out our post.)

Ulta's virtual GLAMlab.

L’Oreal’s virtual makeup experience, launched in 2019, has doubled website engagement time and tripled conversion rates.

Kohl’s announced a partnership with Snapchat, which enables the retailer to offer a Virtual Closet experience through the popular app.

This new feature is expected to expand the company’s market to the more than 75% of 13 to 34-year-olds that Snapchat reaches.

Snapchat claims that their daily active users engage with AR content nearly 30 times a day, making them an ideal match for a retailer looking to include these offerings.

Kohl’s Virtual Closet Tool in Snapchat.

Moreover, these tools are working. Shopify recently released data showing that products with interactive AR content displayed a 94% higher conversion rate than products without AR.

And in March 2021, the platform added built-in support for AR and 3D models.

3. Voice Commerce Becomes the Starting Point for Purchases

There’s no question that convenience has become a top priority for many consumers.

In fact, a report by the National Retail Federation found that 83% of consumers value convenience when shopping more today than 5 years ago.

Nowhere has this sentiment been more clear than in the adoption of voice commerce.

Devices like the Amazon Echo and the Google Assistant are often the starting point in modern retail transactions.

Consumers are increasingly using their voice to shop.

The voice commerce market was valued at $40 billion in 2022. And companies like Amazon and Google are constantly finding more ways to make buying even easier.

Searches for “echo auto”, an Amazon product that allows the Alexa home smart hub to be added to the user’s car, are up 131% in 5 years.

A 2019 study found that 62% of regular voice-activated speaker users were likely to buy something through their device in the next month.

With 38.5% of the US population expected to have used a voice assistant at least monthly in 2020, that number is likely to grow larger in the future.

In fact, close to half (43%) of smart speaker owners used the technology to shop in 2020.

Digital assistants are also a form of lead generation.

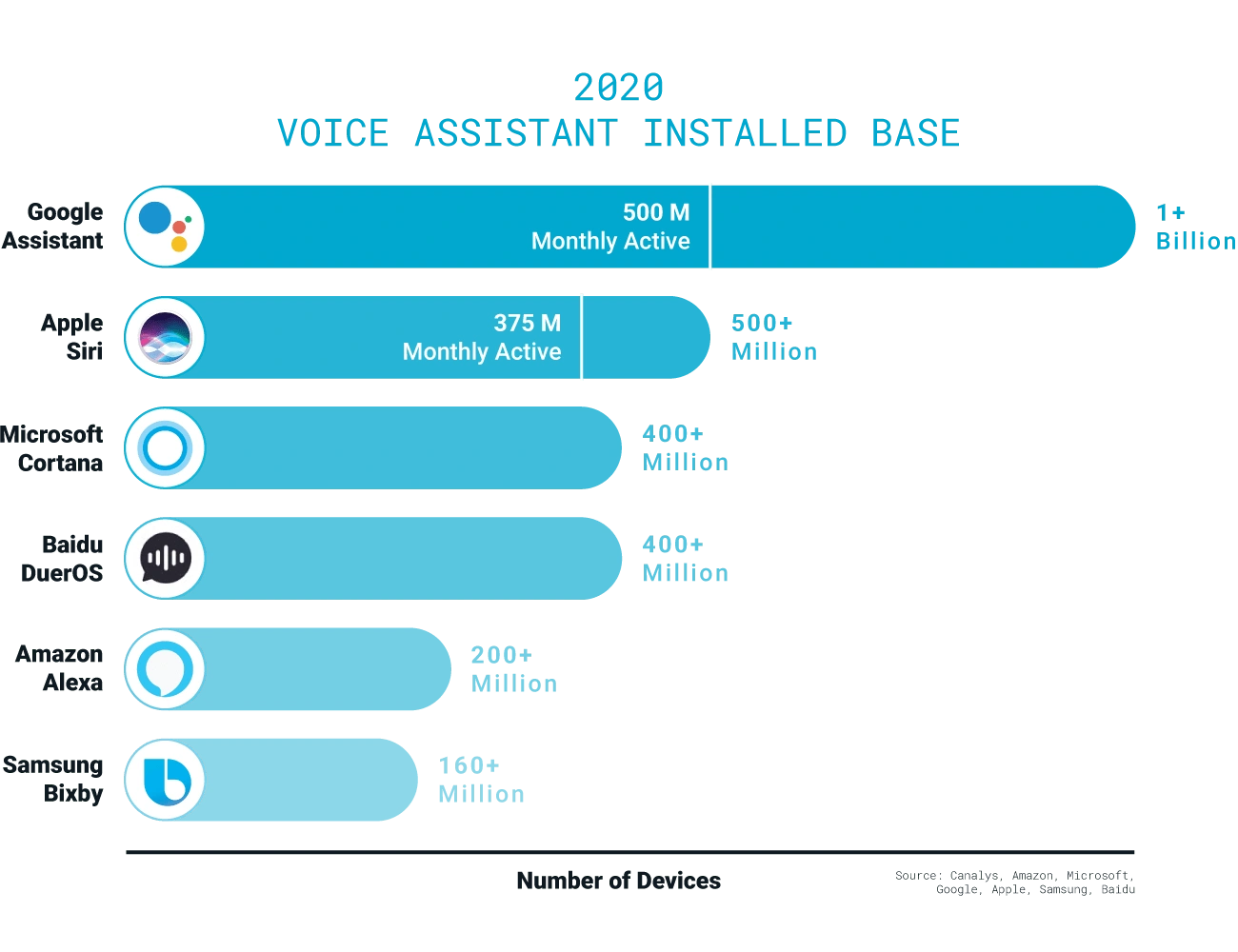

The largest tech companies still own the market, with a few billion users and an installed base that is growing by the day.

Google leads the pack in voice search with 500 million monthly active users and an estimated install base that reaches more than 1 billion people.

Large retailers like Walmart have even partnered with Apple to add Siri-enabled voice shopping on any Apple device.

4. Digital Wallets and Biometric Payment Usage on the Rise

Searches for "digital wallet" are up 562% over 10 years.

As online privacy concerns rise, the use of digital wallets and biometric payments is taking center stage.

What is a digital wallet, exactly?

It’s basically a digital version of someone's financial accounts.

Platforms like Apple Pay, Paypal, Google Pay, or Venmo allow users to pay for online goods and services from their devices without having to enter debit card or bank information into third-party websites or applications.

Importantly, financial information entered into digital wallets is encrypted. And can only be accessed by authorized third parties.

Because of this, wallets can help alleviate certain consumer privacy and fraud concerns.

In fact, recent surveys indicate that roughly two-thirds of consumers feel more comfortable making online payments through a digital wallet rather than traditional methods.

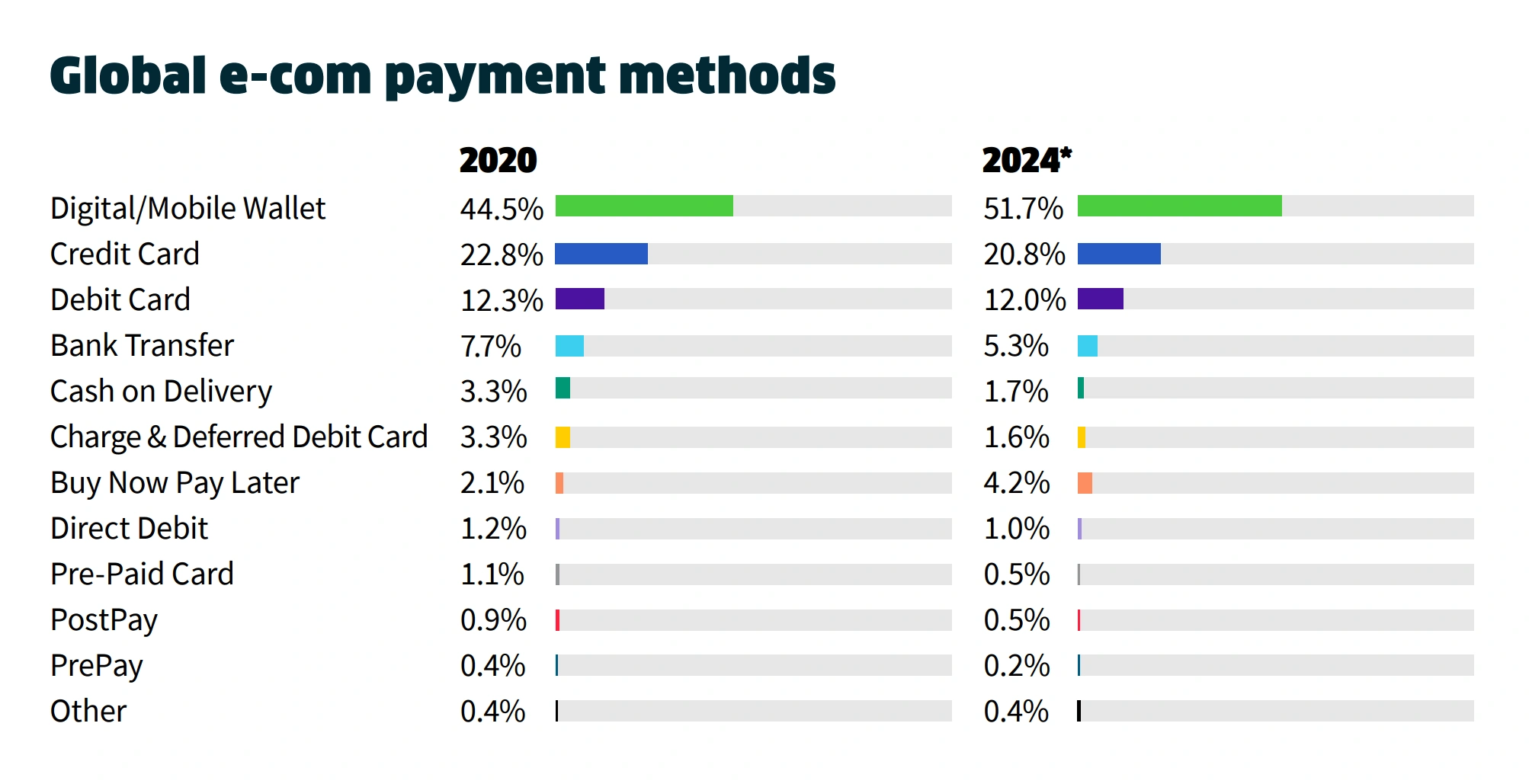

According to Worldpay, 44.5% of all US eCommerce transactions already take place through digital wallets.

One industry study found that 44.5% of eCommerce purchases are made via a digital wallet of some kind.

And interest is rising, as 27% of all US consumers say they would like to pay with their smartphones all the time.

Market research firm Juniper Research predicts that nearly half the world population is expected to use digital wallets by next year.

The same study also estimates that US annual spend per digital wallet is expected to increase to $6,400 in 2024 from $3,350 in 2019.

In addition, future growth may be boosted by the increasing adoption of proximity mobile payment (PMP) in the U.S.

PMP occurs when a consumer pays with their mobile device while checking out in a physical store.

Example of a PMP shopping experience.

In China, 81% of mobile phone owners made a proximity payment in 2019, compared to just 29% in the US.

Similar rates of PMP adoption in the US could lead to an explosion of digital wallet usage.

Although the adoption of PMP has been slow in the US, 2020 has had a meaningful impact.

Apple Pay added 66 million new users worldwide between September 2019 and September 2020, bringing its grand total to over 500 million. This means that as of late 2020, 51% of all iPhone users had activated Apple Pay, compared to 48% in 2019.

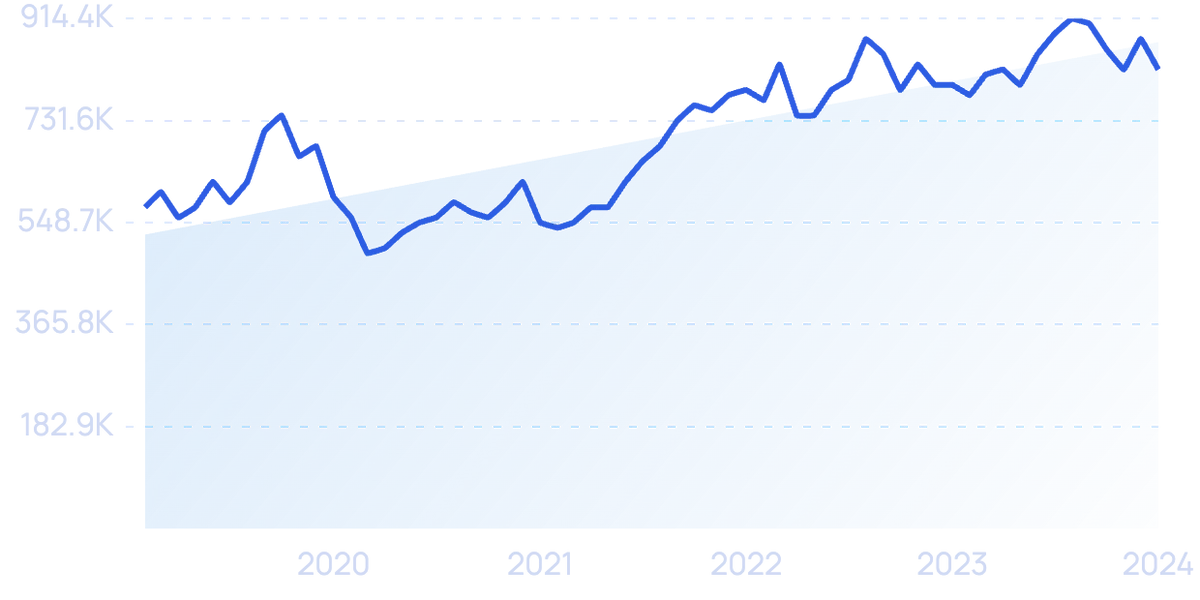

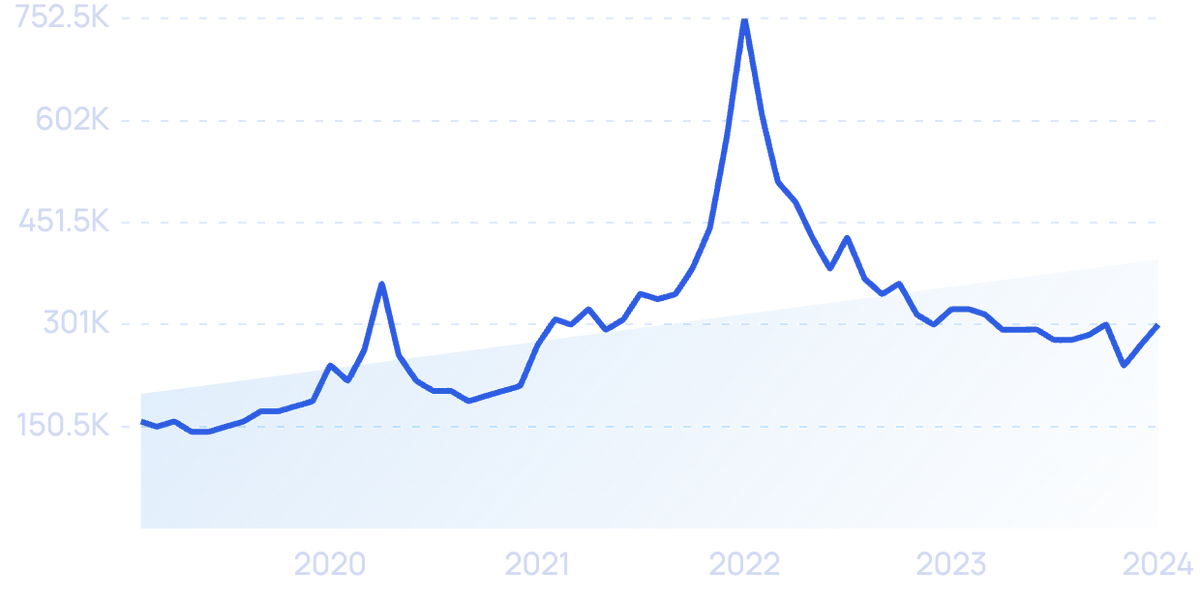

Searches for "Apple Pay" are up over 5 years.

Venmo has also seen significant user growth.

Consumers are increasingly finding it more convenient to pool their resources using a digital wallet vs a physical one.

Venmo’s user base grew from 10 million in 2017 to 52 million in 2020 (at a CAGR of 73%). As of 2022 there are around 83 million.

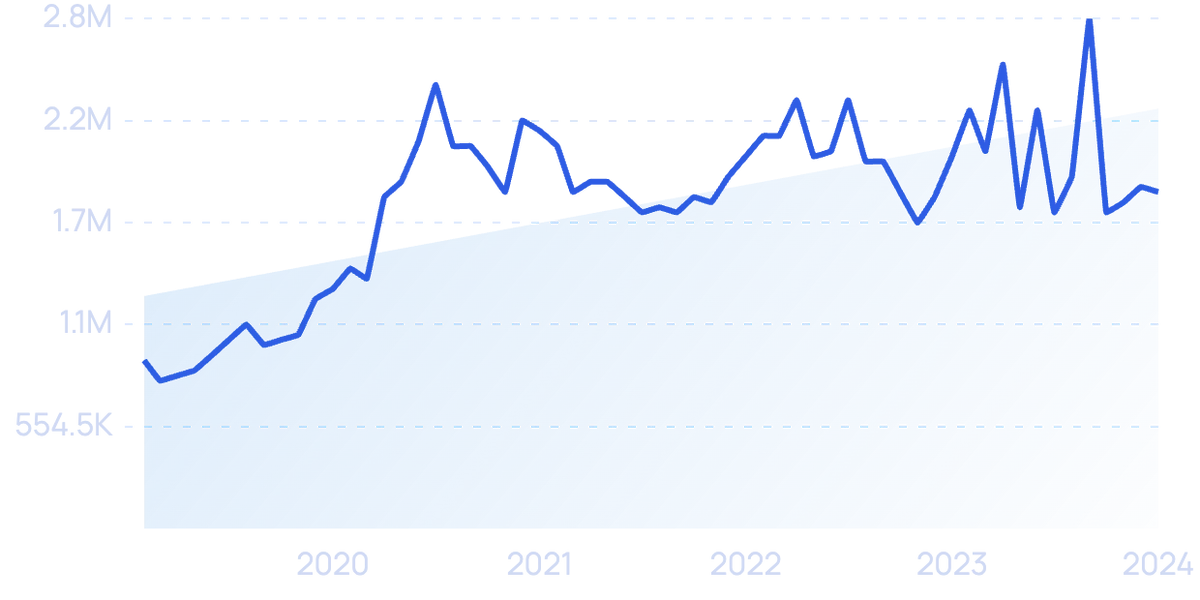

Square’s Cash App has also seen significant growth over the last 24 months.

The payment company’s peer-to-peer money transfer app allows users to pay vendors through the app, transfer money to friends, trade stocks, and even buy bitcoin.

Cash App also released its own debit card in 2017, the Cash Card, which seven million Cash App users now own.

After surpassing Venmo in total downloads back in 2019, Cash App has only continued to grow.

The cashless payment app reported 90 million downloads in 2020 as well as 30 million monthly active users.

Interest in Square’s "Cash App" has increased significantly over the last 5 years, growing 100%.

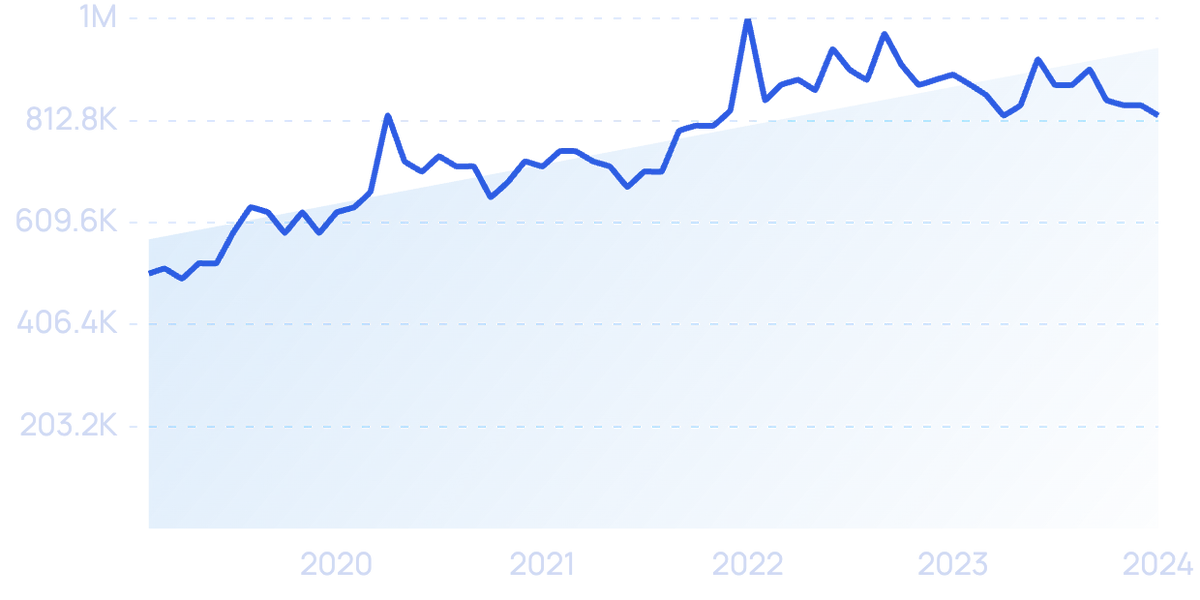

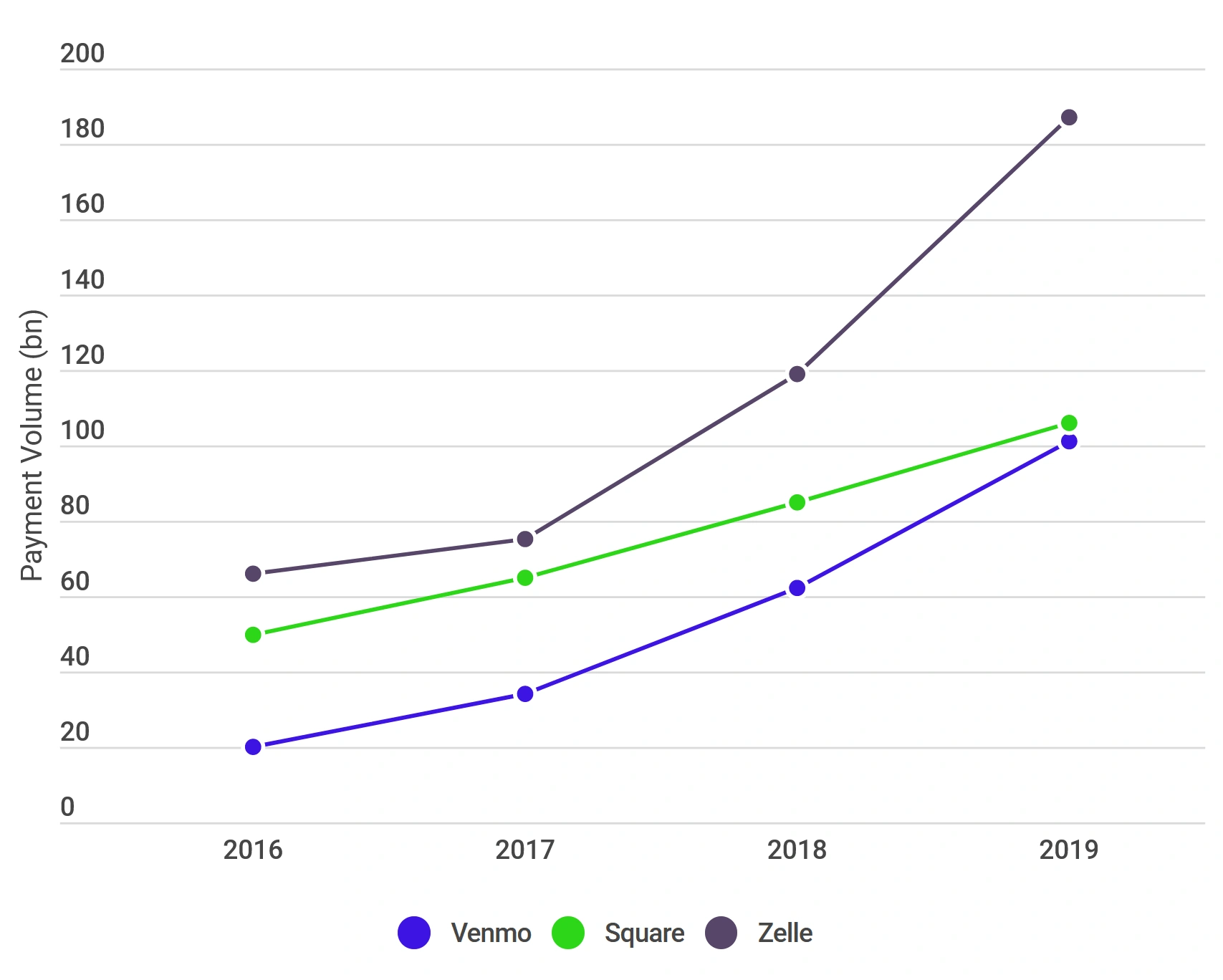

Some of the largest US banks have also gotten in on the action, developing their own mobile payment app called Zelle.

Zelle is a standalone app that allows peer-to-peer digital transfers, much like Venmo and Cash App.

The major difference, however, is that Zelle is integrated with many of the major banks’ own mobile banking apps and technology, allowing peer-to-peer transfers between consumers’ actual bank accounts.

Searches for "Zelle" have increased by 62% over 5 years.

Zelle has grown even faster than both Cash App and Venmo.

$133 billion was transferred through Zelle just in the first half of 2020. This is compared to $187 billion in all of 2019.

Source: Business of Apps

(Note: Square’s total payment volume includes its seller business as well as Cash App. If only Cash App was included, Venmo may have a larger volume.)

Many of these digital wallets are secured by biometric authentication.

In a world where contactless payment is becoming the norm, consumers are demanding an easier form of verification.

Biometric authentication allows this. Instead of memorizing a PIN, consumers are now able to pay with the tap of a thumb.

Even with the potential privacy concerns, it is clear that many consumers prefer biometric authentication options.

In fact, a study found that 56% of consumers would prefer to use a biometric sensor on their payment card instead of a PIN.

This is doubly so for mobile phone payments, as 65% of consumers are already using biometric authentication on mobile devices.

And this number is poised to grow.

Over 75% of newly released mobile devices feature some form of biometric technology.

5. Consumers Want Local Shopping Options

Consumers are increasingly shopping locally. But doing it online.

This 1-2 punch satisfies a need for community as well as a desire for efficiency, sustainability, and convenience.

Hyperlocal delivery is basically delivery of goods from a close proximity.

This typically involves a physical retailer that also offers delivery or omnichannel services to local consumers.

As more consumers are turning to digital-first shopping, there is a chance for retailers to satisfy the need for convenience.

41% of consumers say that they are willing to pay extra to receive same-day shipping.

Annual on-demand consumer spending was about $57.6 billion in 2020, and it is only expected to grow.

In fact, the food delivery market alone is expected to reach $161.74 billion this year.

A breakdown of annual on-demand consumer spending (2020).

Obviously, the typical food delivery giants like Grubhub and Uber Eats are taking advantage of this consumer trend.

But there have also been other startups to emerge in previously untapped niches.

One of the most successful is goPuff.

The Philadelphia-based startup operates as an online convenience store, delivering products ranging from over-the-counter medicine, wellness products, baby food, and alcohol.

goPuff picks the products up from a local drug store or convenience store and delivers them to the customer in 30 minutes or less.

The service is already available in 500 cities throughout the US, and the company has raised $3.4 billion in total funding.

Search interest in "goPuff" has increased by 90% over the last 5 years.

6. Buying Habits are Largely Based on Reviews

Searches for review portal "Trustpilot" are up 296% over the last 5 years.

When it comes to consumer buying habits, online reviews are affecting purchasing decisions more than ever.

A 2020 study by Trustpilot found that 89% of consumers worldwide read reviews before purchasing a product.

And over half of consumers read at least 6 reviews before purchasing a product.

This trend has increased since the start of the pandemic, as reviews assist in online purchasing decisions.

Power Reviews found that, by November of 2020, people who interact with online reviews were converting at a 25% higher rate than in 2019.

This trend isn’t just limited to pure ecommerce goods.

Brightlocal, in its 2020 Consumer Review Survey, found that 87% of consumers read online reviews for local businesses in 2020.

That’s up from 81% in 2019.

Reviews also help in discovering local business.

According to Podium’s 2020 State of Reviews study, 21% of consumers said that reviews played a big role in their discovery of local businesses.

As for where consumers find and write these reviews, Google is by far the leader.

2% of the respondents in Podium’s report said that they are most likely to turn to Google to see reviews.

Podium also found that 38% of users require at least a 4-star rating to even engage with a business.

The average consumer has slightly lower standards, but still demands a rating of 3.6 out of 5 to consider parting with their money.

It’s hard to talk about reviews without addressing the proliferation of fakes.

According to Brightlocal’s study, 81% of consumers believe they have read at least one fake review in the last year.

Google Chrome extensions like Fakespot can help in alleviating this, especially since the majority of reviews are written and viewed on Google.

Even with the prevalence of fake reviews, they remain a significant factor in consumer buying decisions.

As more people start their buying journey through a digital medium, expect the importance of online reviews to increase.

7. Sustainability becomes a top consumer priority

Across the globe, consumers are taking an increased interest in environmentally friendly and sustainable goods.

Search volume for “sustainable goods” is up 104% compared to 5 years ago.

Google searches related to sustainable products have increased more than 70% since 2016.

85% of global consumers have shifted their purchase behavior toward being more sustainable in the past five years. That’s according to a survey conducted by Simon-Kucher & Partners.

More than 80% of consumers confirm they’ll be purchasing more environmentally friendly products in the next five years.

Consumers are willing to pay more for sustainable and environmentally friendly goods, as well.

Two-thirds of consumers are reportedly willing to pay more for sustainable products.

This is especially true for younger generations: 25% of Gen Z and 22% of Millennials will pay up to 20% extra.

In the UK, the market for ethical and sustainable goods has risen 4x in the last 20 years, reaching $43 billion.

It’s not just products that matter; packaging matters too.

Search volume for “sustainable packaging” is up 94% in 5 years and still climbing.

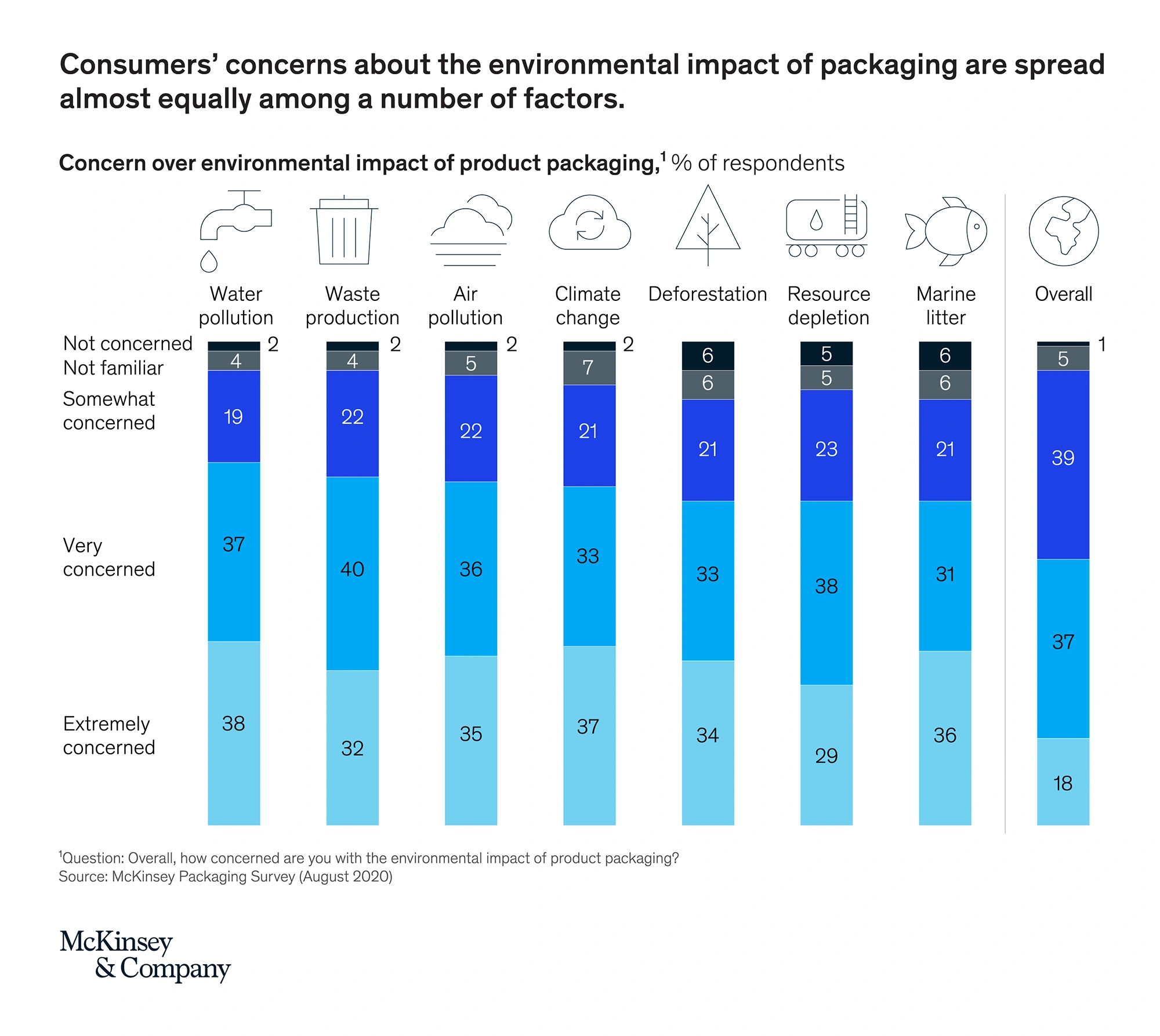

McKinsey reported that 55% of US consumers are extremely or very concerned about the environmental impact of product packaging.

McKinsey’s survey found that consumers are concerned with how packaging impacts a variety of environmental issues.

In one survey, 77% of consumers said plastic was the worst type of packaging.

Instead, consumers prefer sustainable packaging like paper and cardboard.

One survey showed 66% of people say paper and cardboard are the best material for the environment.

Retailers are taking notice of this trend.

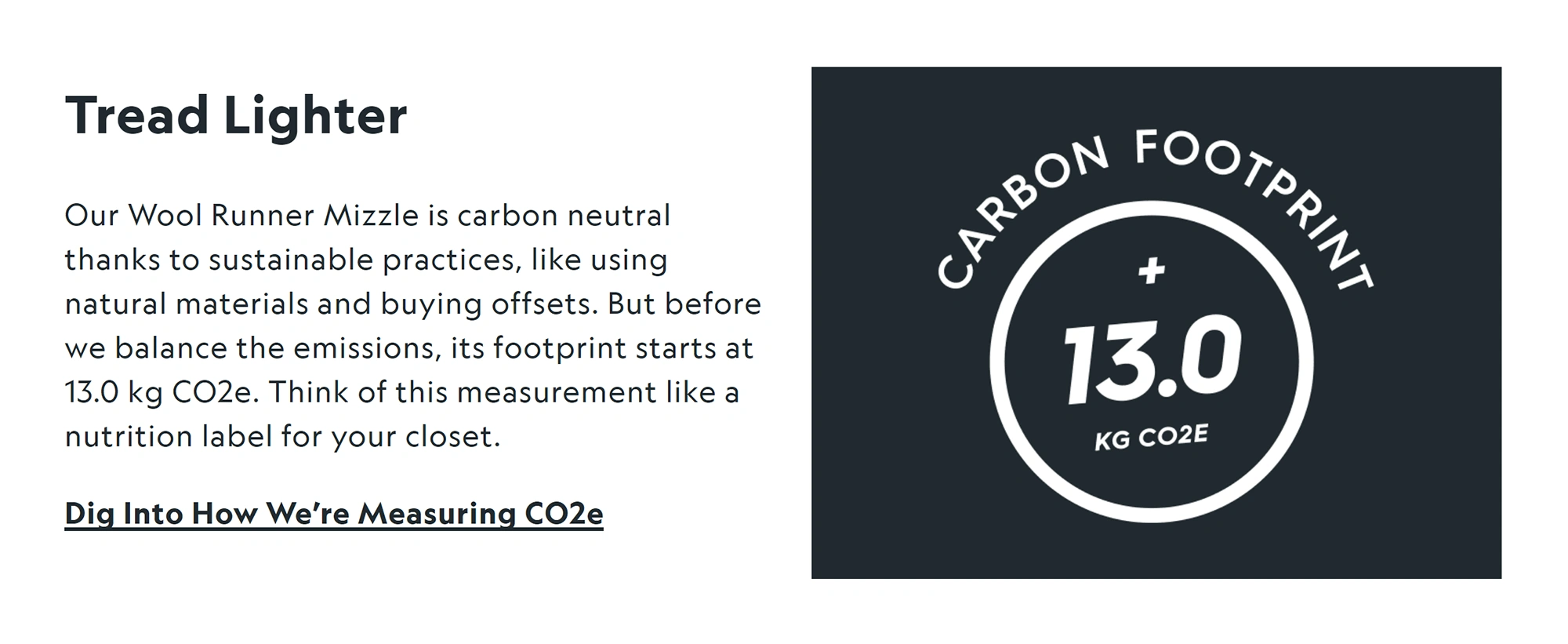

One fashion manufacturer, Allbirds, is clear on their commitment to sustainability.

The brand focuses on using natural materials like wool, sugarcane, and eucalyptus trees to make shoes.

They became carbon neutral in 2019 and, in 2020, began labeling each of their products with a carbon footprint.

Allbird’s commitment to sustainability includes showing each product’s carbon footprint on the packaging.

8. Consumers demand secondhand goods

Newsweek reports that more than 40% of retail executives say resale (also termed “recommerce”) will become an important part of their business within the next five years.

For many consumers, this shift has already arrived.

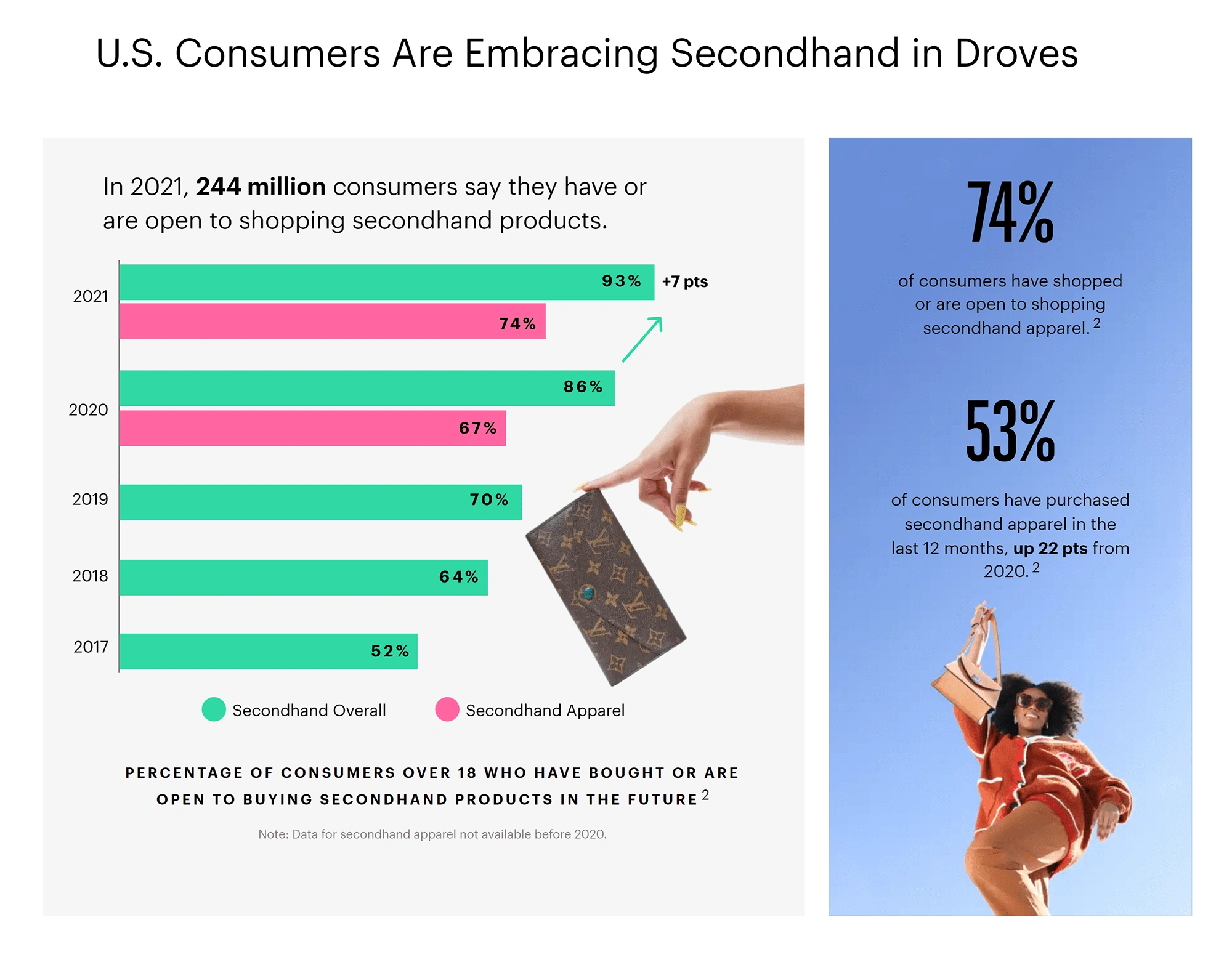

As of 2021, half of consumers were either buying or selling secondhand products.

This trend even held true during the holiday shopping season when 77% of adults said they were likely to buy at least one secondhand item.

Consumers have a variety of reasons for buying secondhand. As expected, saving money is the top reason, but sustainability and avoiding supply chain issues are also important to consumers.

The secondhand product trend is particularly relevant in the fashion industry.

The secondhand apparel market is worth an estimated $141 billion in 2023. By 2026, experts say it will have more than doubled in size to $218 billion.

ThredUp, a widely-known platform for secondhand apparel, reports that 74% of consumers have shopped for secondhand clothing or are open to it.

Recommerce is especially popular in the fashion industry — 53% of consumers have purchased secondhand apparel in the last 12 months.

Their research also shows that 41% of all consumers look to secondhand apparel first when they’re shopping. When considering the shopping behavior of individuals in Gen Z and the Millennial generation, that number jumps to 62%.

The URBN retail corporation, which owns Urban Outfitters, Free People, Anthropologie, and other brands, responded to this consumer trend by launching its own recommerce platform, Nuuly Thrift, in late 2021.

The resale marketplace has more than 18k listings.

Recommerce is popular in other industries, too.

Ebay’s 2021 Recommerce Report showed that 42% of sellers list pre-owned tech products, 28% list secondhand books, and 28% list pre-owned toys.

There’s also Chairish, a vintage furniture site that was started by the co-founder of Hotwire.

Chairish features resale home furnishing goods from 10,000 sellers.

The company has experienced “exponential growth” in the past two years, in part due to supply chain issues experienced by manufacturers pushing out new furniture.

The brand’s 2021 Home Furnishings Resale Report predicted that the resale home furnishings market would grow 54% over the next five years. That would mean the segment is growing 3.5x faster than retail.

As a company, Chairish is reaping the benefits. The brand experienced 39% year-over-year revenue growth in 2020 and 54% year-over-year revenue growth in 2021.

9. Young consumers favor buy now, pay later options

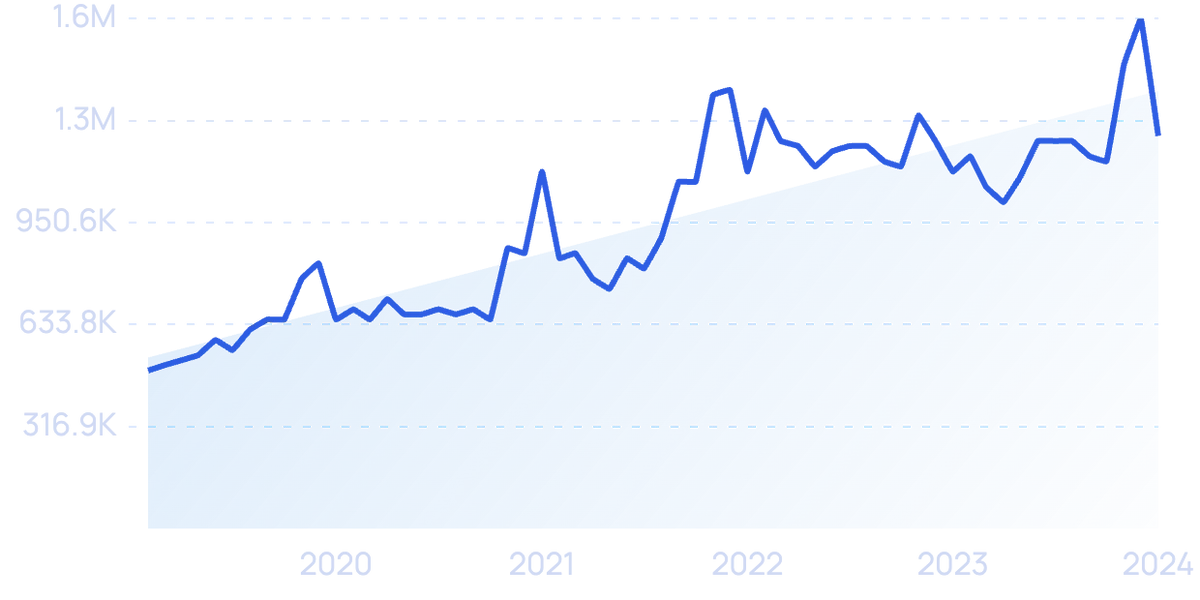

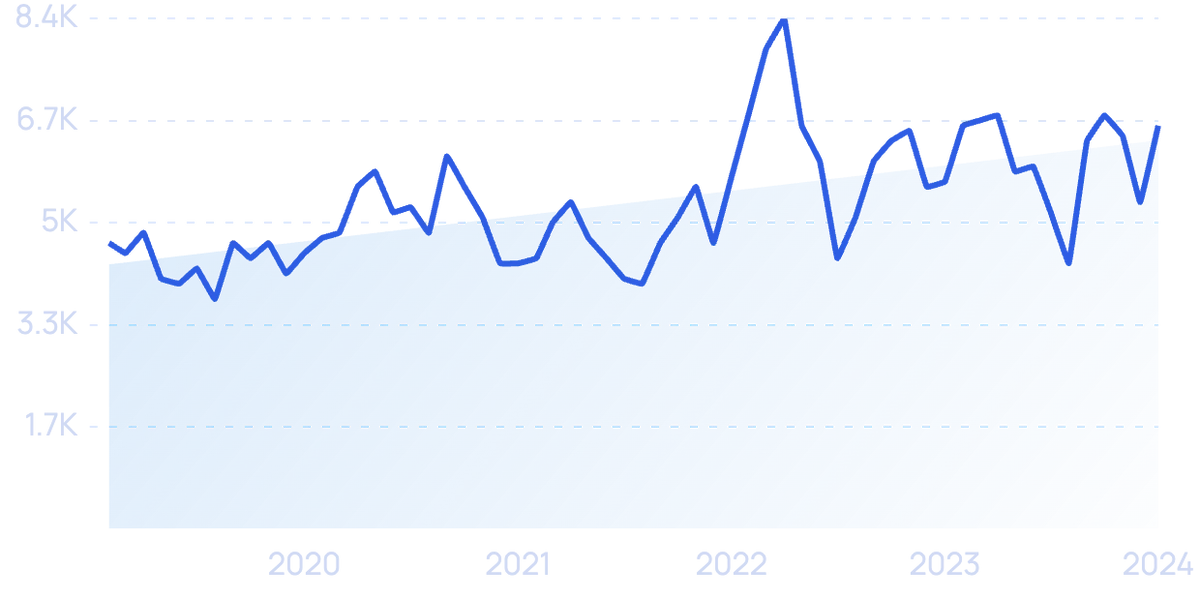

Many experts predicted that 2022 would be the year in which buy now, pay later (BNPL) payment structures go mainstream.

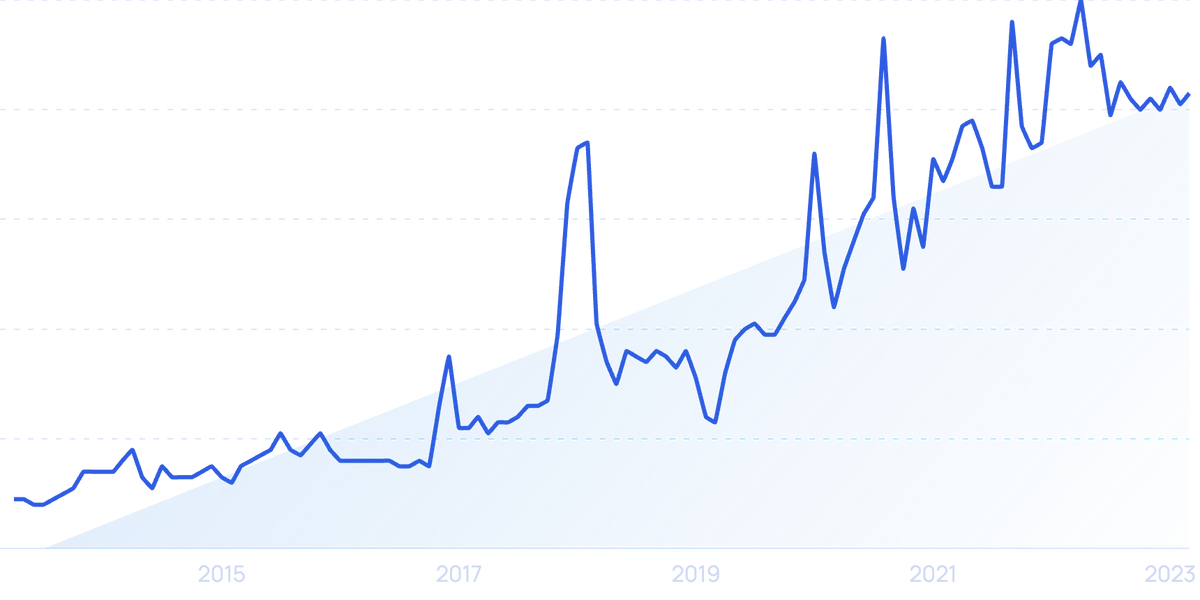

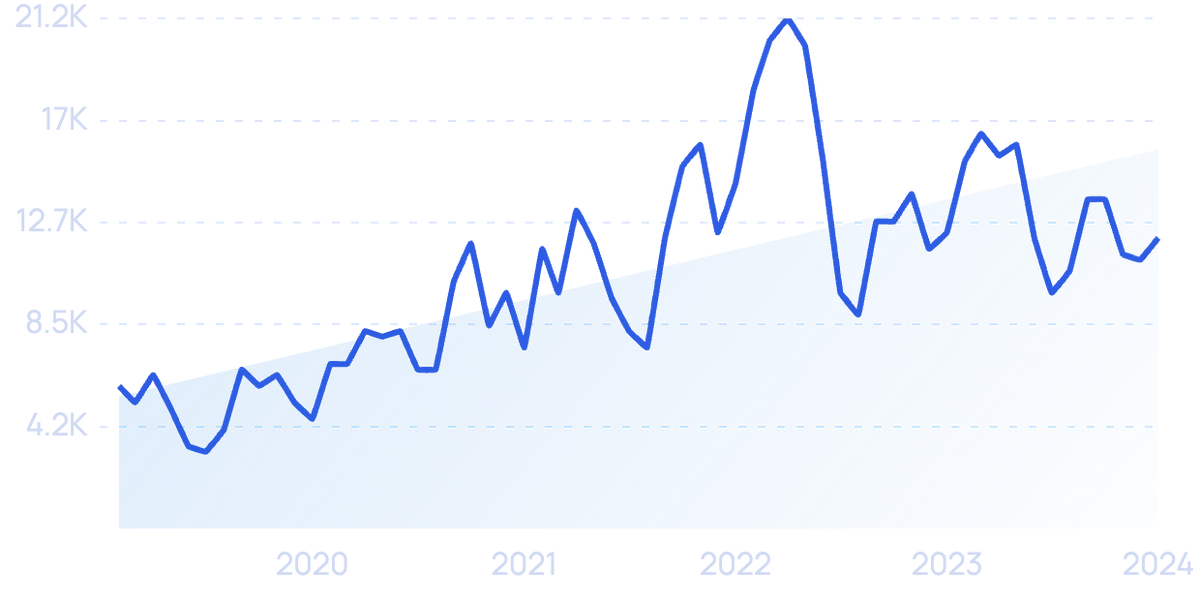

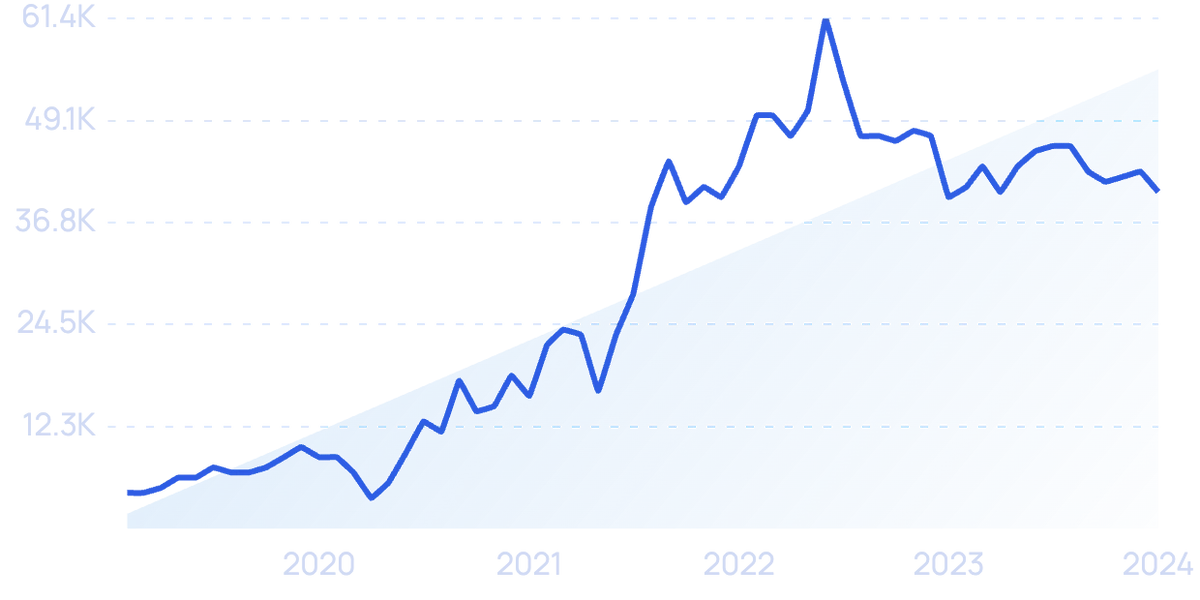

Search interest for “BNPL” has risen dramatically in the past few years.

Put simply, BNPL allows consumers to make a purchase and pay for it in interest-free installments. This payment structure has been used for big-ticket items like furniture in the past, but now, it’s available for nearly any purchase.

In 2021, BNPL accounted for just 9% of ecommerce transactions, but by 2026, data shows that will rise to 25%.

This trend is emerging all around the globe.

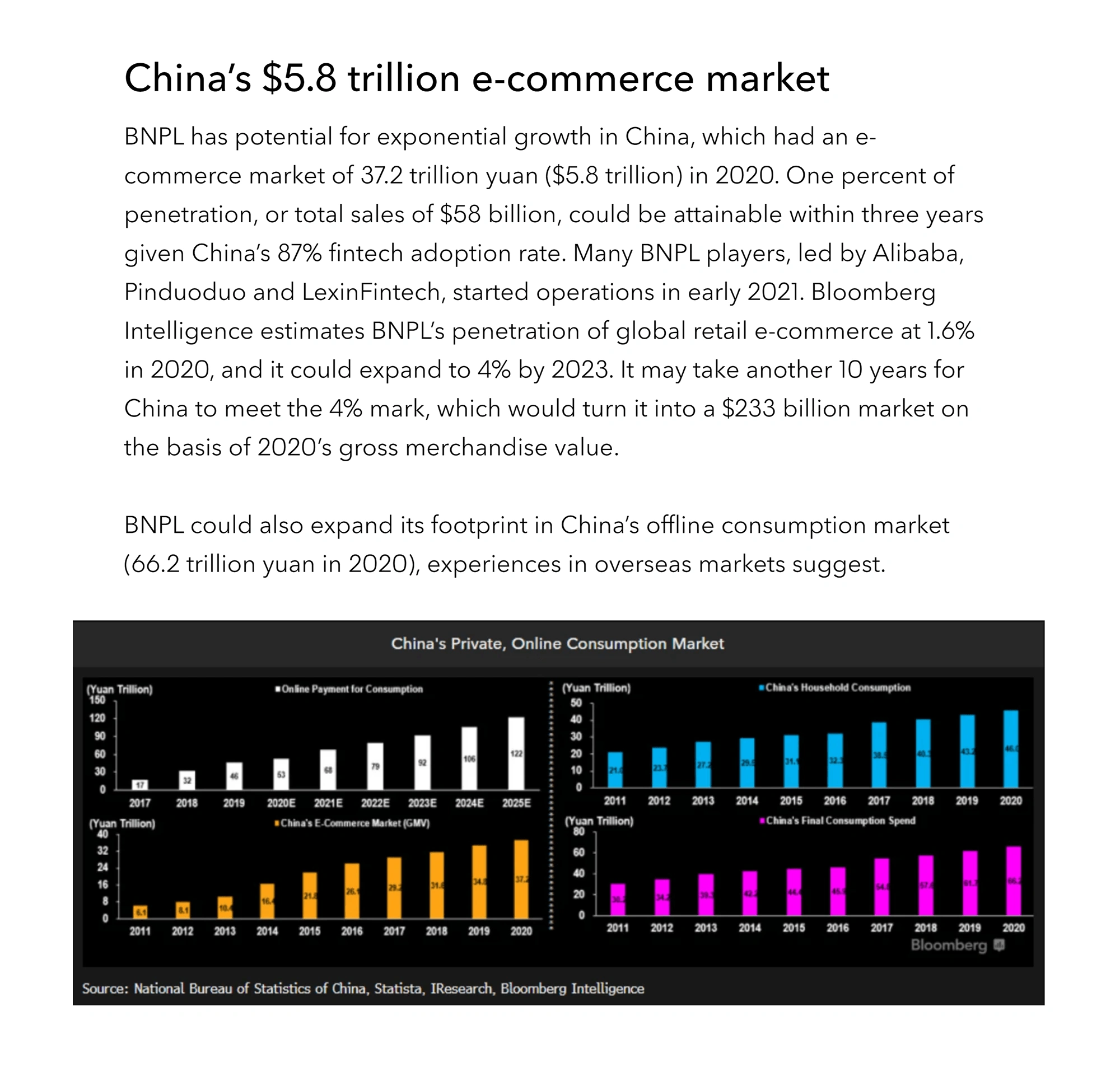

In China, experts say BNPL could account for $58 billion of all ecommerce sales within just three years.

BNPL has the potential to dramatically impact China’s ecommerce market.

Australia is already seeing A$900 million funnel through BNPL options, a growth of 55% between 2019 and 2020.

In Europe, the BNPL industry is growing by an annual rate of 54.7%. It’s especially popular in the UK.

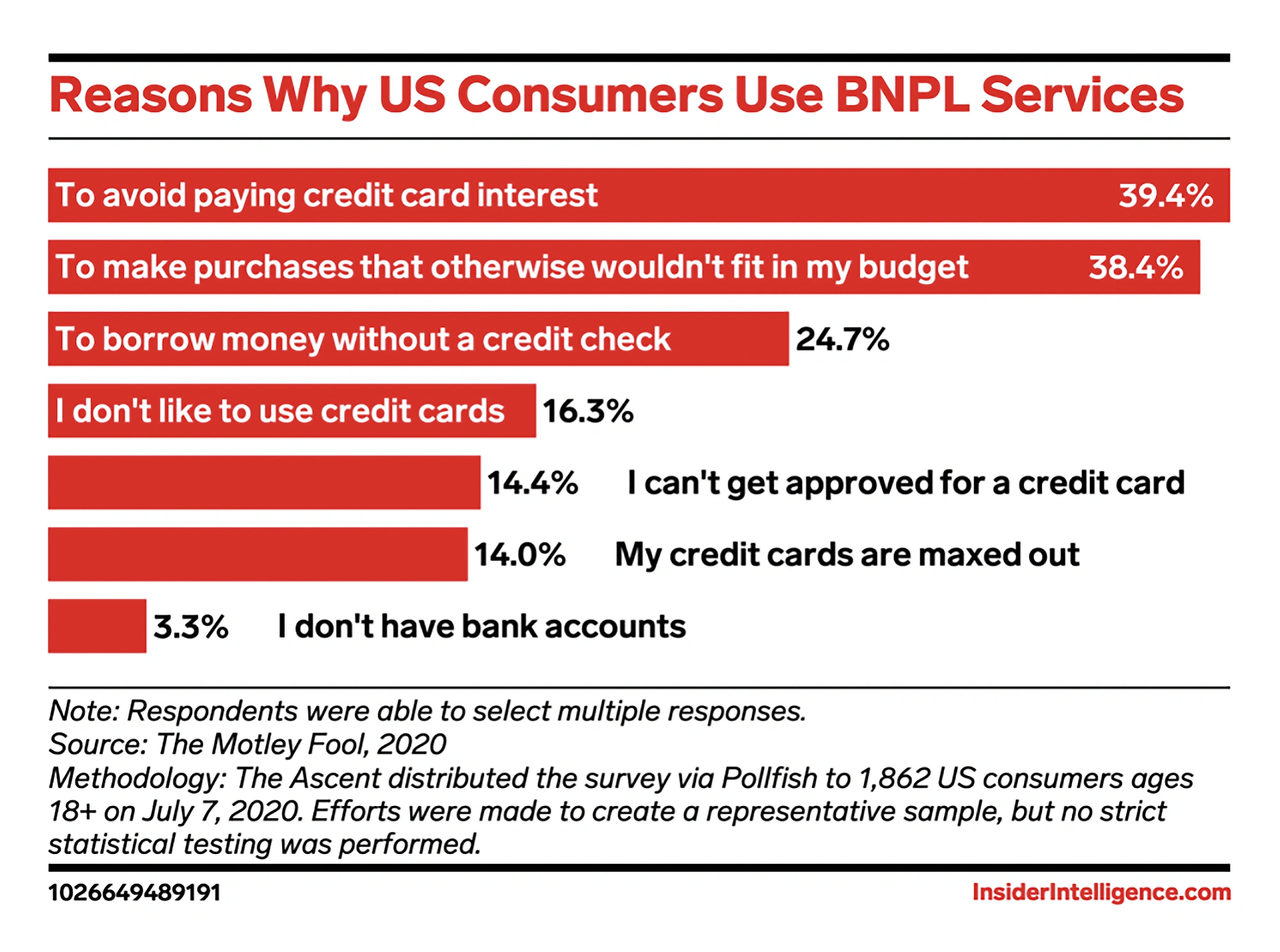

Consumers choose BNPL for a variety of reasons: avoiding credit card interest, making purchases they couldn’t otherwise make, avoiding a credit check, and others.

Nearly 40% of people use BNPL in order to avoid credit card interest.

These benefits appeal specifically to young consumers who haven’t had the time or means to save for big purchases or build up their credit scores.

Data from Insider Intelligence shows that more than 40% of BNPL consumers were Millennials in 2020 and this generation is expected to continue to account for the largest share of users through 2025.

Insider Intelligence reports that many Gen Z buyers are opting for BNPL, too: 44% will have used BNPL by the end of 2022, they predict.

The 2022 Commerce and Payments Trend Report from Global Payments shows that merchants are responding to consumer demands for BNPL: 65% of merchants planned to add BNPL options in 2022.

At the same time, some financial experts are sounding the alarm about BNPL.

They caution that this type of payment results in irresponsible spending.

One survey found that 45% of BNPL users are most likely to use the option when their finances are tight.

In addition, more than one-third of users have fallen behind on one or more of their payments and many of them saw their credit score decrease as a result.

Falling behind on payments is a particularly notable problem for younger generations.

43% of Gen Zers have missed a payment in the last year.

As a result, government authorities are attempting to regulate the BNPL industry.

The United Kingdom implemented new rules for lenders in mid-2022.

The UK government is enacting stricter regulations for short-term interest-free credit.

California has been the most aggressive state in the US to regulate BNPL companies. The state recently reclassified BNPL as a loan, bringing the system under a new set of regulations.

The federal Consumer Financial Protection Bureau also opened an inquiry to collect information about the risks and benefits of BNPL. The companies required to provide information are Affirm, Afterpay, Klarna, PayPal, and Zip.

Search volume for “Affirm” is up 148% in the past 5 years.

10. Direct-to-consumer sales see continued growth

As ecommerce sales have surged during the past few years, direct-to-consumer (DTC) sales have also increased at a surprising rate.

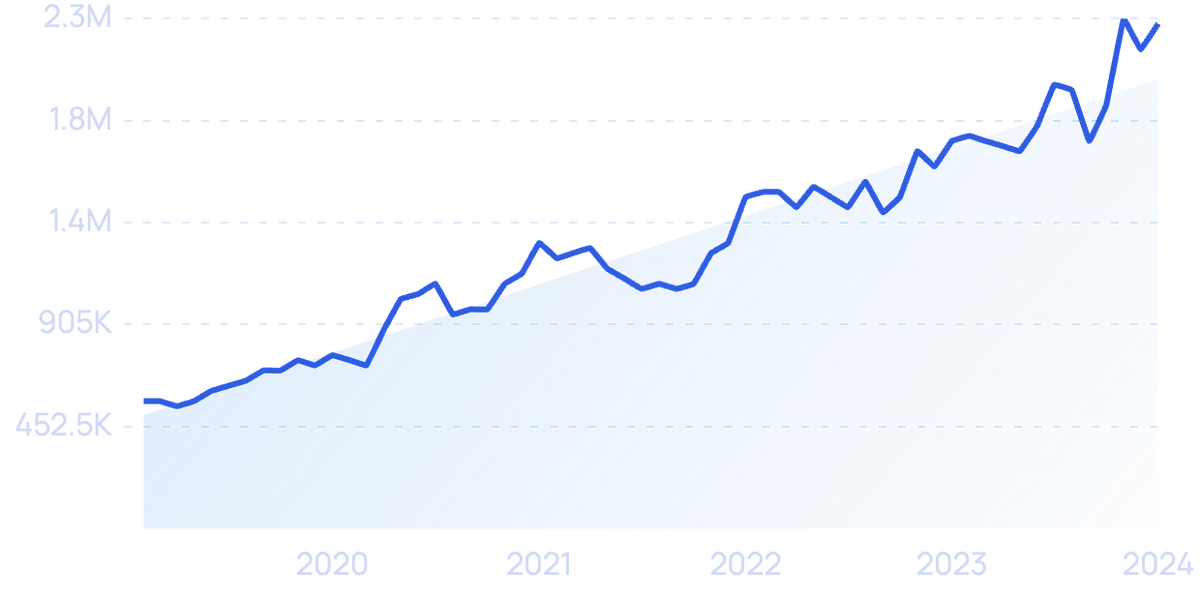

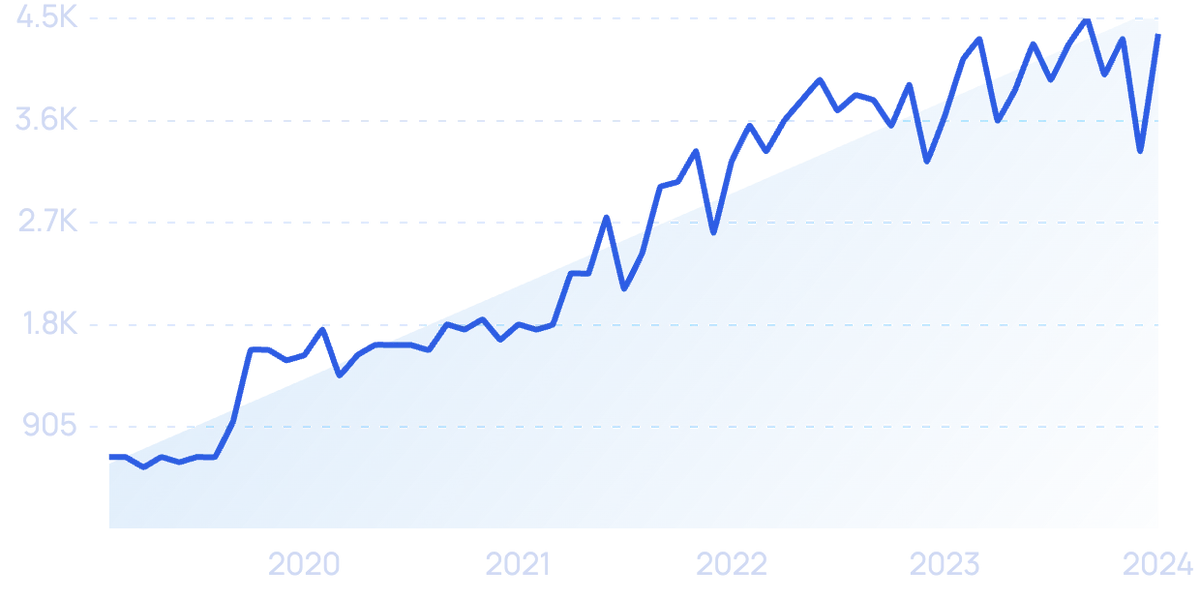

Search volume for “direct to consumer” over the past 5 years.

DTC sales cut wholesalers and retailers out of the customer journey, saving brands on expenses and providing convenience to the customer.

Total DTC sales are on the rise.

In 2019, consumers spent $76.68 billion on DTC goods. That number is expected to reach $174.98 billion this year.

DTC sales have been climbing since 2019.

Ecommerce sales accounted for about 2% of all CPG sales in 2017 and that number is up to 6.6% now. DTC sales are responsible for 40% of that growth.

Today, many consumers go directly to a brand to make a purchase instead of seeking out a big-box distributor.

In 2021, nearly six in 10 consumers made a DTC purchase and 65% of consumers planned to do it again in 2022.

Insider Intelligence estimates similar numbers and shows that consumer interest in DTC purchases is growing.

In 2019, their data showed that just 59% of consumers were regularly buying directly from a brand. In 2022, that number was up to 64%.

One example of a customer-favorite DTC brand is Bombas, a sock and undergarment brand that does 97% of its business online.

After appearing on Shark Tank, the company went from doing 500 transactions per day to 4,000 per day. There were so many orders that the brand had trouble with its DTC online platform and lost $15k in just a few minutes.

The brand found a better tech solution and posted a 300% year-over-year growth.

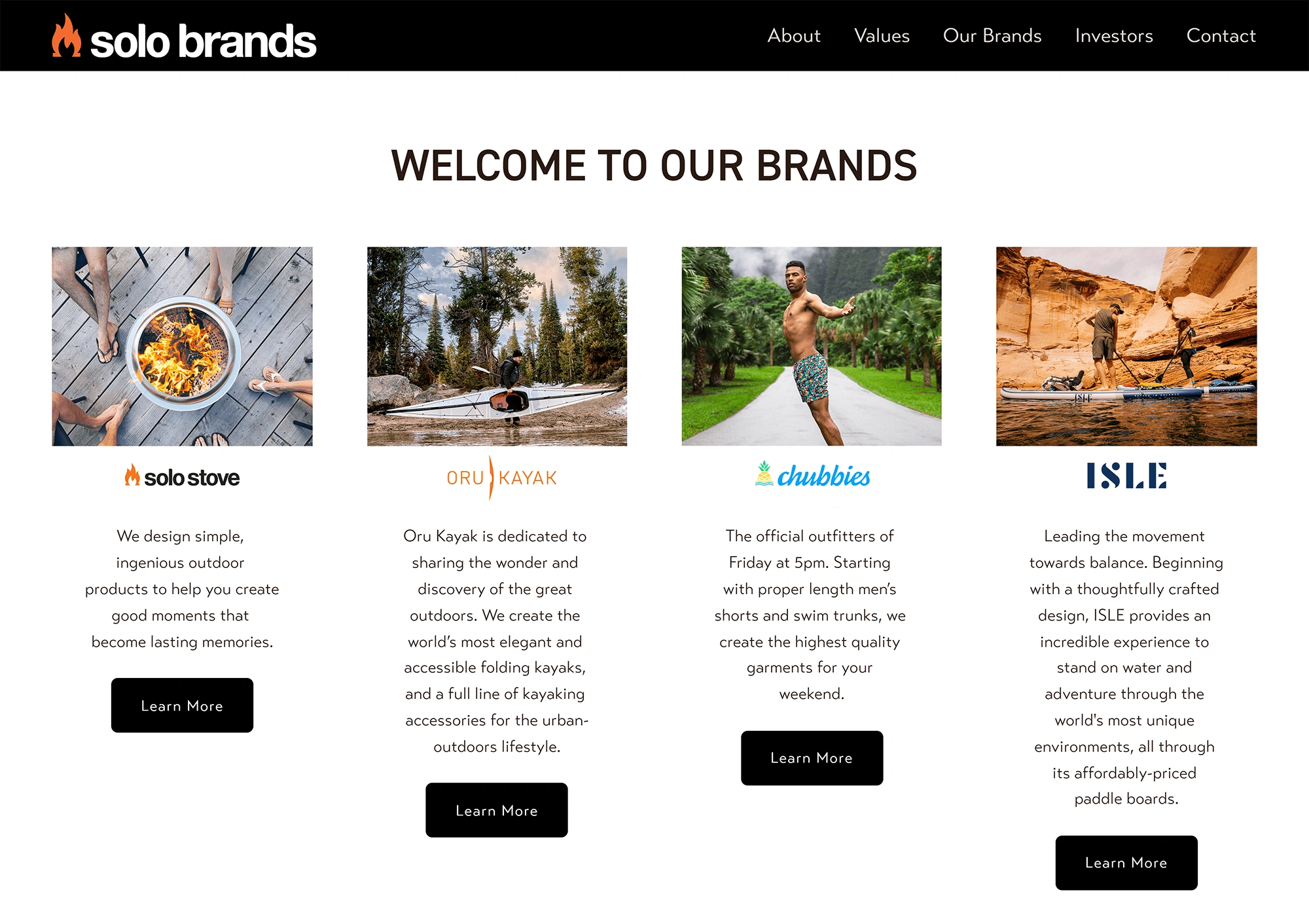

One company betting on the DTC future of commerce is Solo Brands. Their brands include Solo Stove, Chubbies, Isle, and Oru Kayak.

Solo Brands feature a wide variety of DTC companies.

Company officials say that 82% of their business comes directly from their websites.

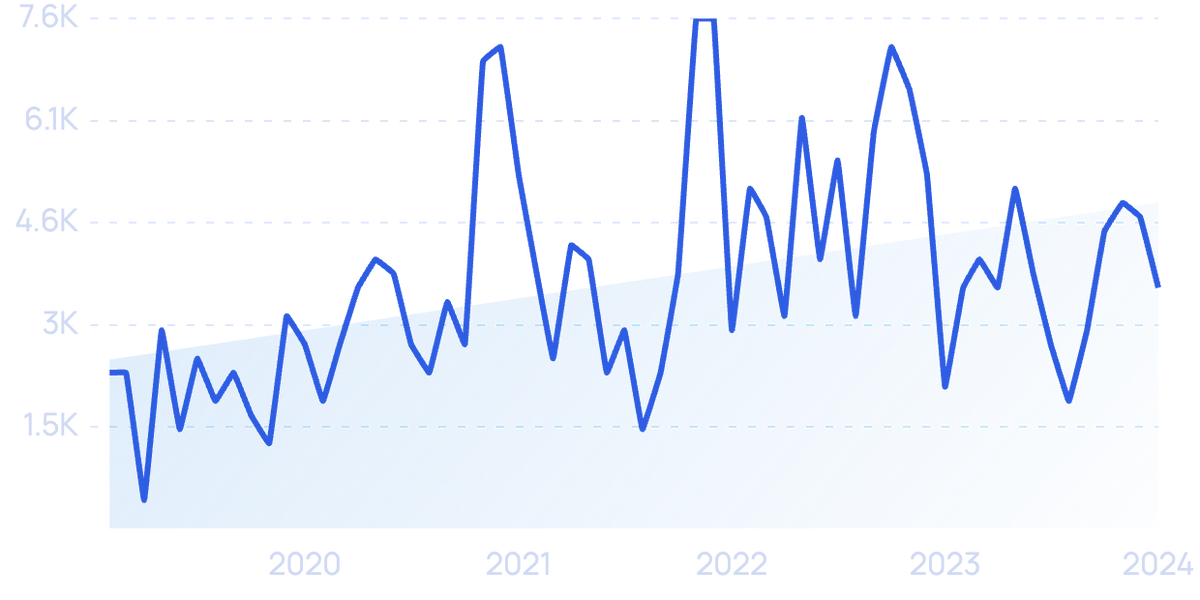

Search volume for “solo stove campfire stove” the brand’s most profitable product, peaked in 2021 and is climbing again.

The company went public on the New York Stock Exchange in late 2021 under the ticker symbol “DTC” and posted a yearly revenue of $400 million.

11. Brands attempt to recapture consumer loyalty

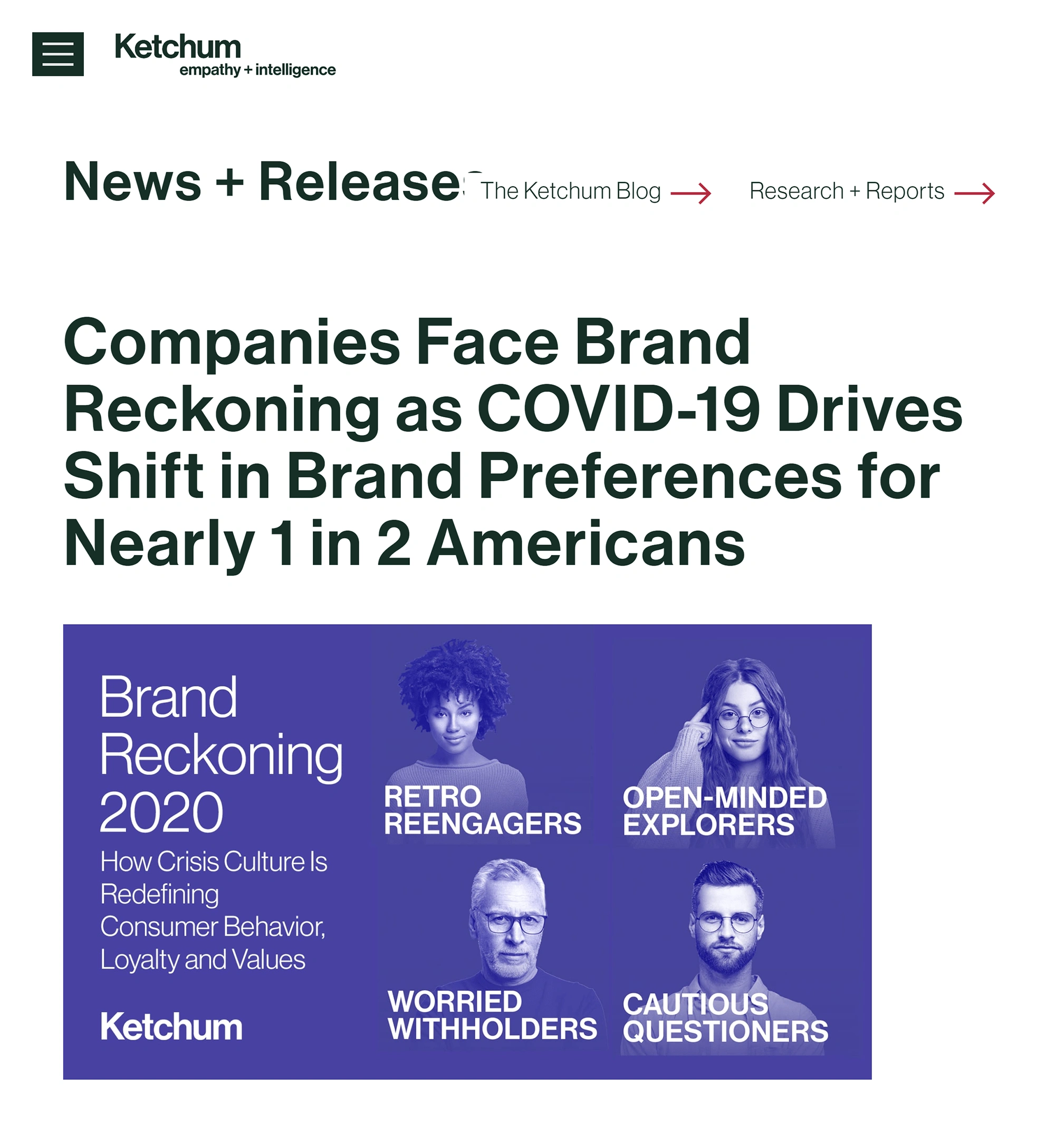

Data shows that the pandemic dealt a crushing blow to brand loyalty.

Three-quarters of consumers tried new shopping behaviors during the pandemic and nearly 40% of consumers left brands they said they trusted for new brands.

Another report, this one from June 2020, showed that 45% of consumers said their brand preferences had changed.

Many individuals have shifted their thinking and preferences in recent years.

Accenture reports that half of global consumers have totally revised their personal purpose and what’s important for them in life. Their revised thinking includes their thoughts about brands and shopping habits.

More than 70% of them expect brands to understand how their needs and objectives are changing.

Nearly 60% of these people say they’ll switch retailers if they don’t get the fast and flexible delivery options they want.

The same number of these consumers will switch brands to get a more sustainable product.

Company values and other ESG (Environmental, Social, and Corporate Governance) issues are impacting brand loyalty, too.

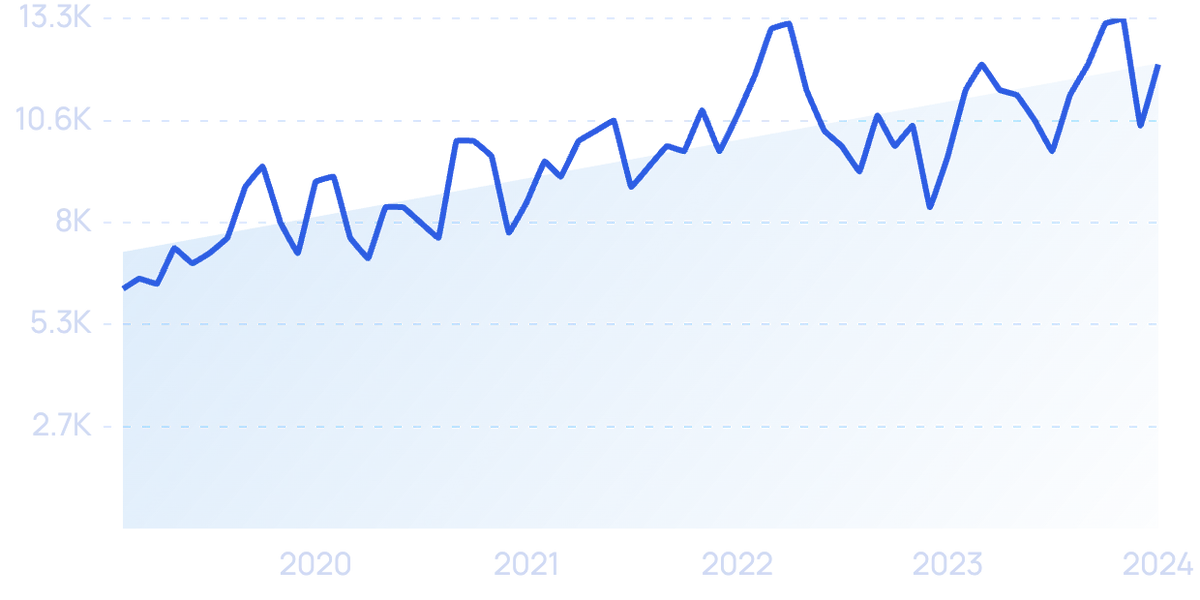

Search interest in “ESG data” has been steadily climbing over the past 5 years (593%).

Consumers aren’t afraid to switch brands if those brands act in a way that violates their values. A 2019 survey reports that more than 80% of individuals say they’d do just that.

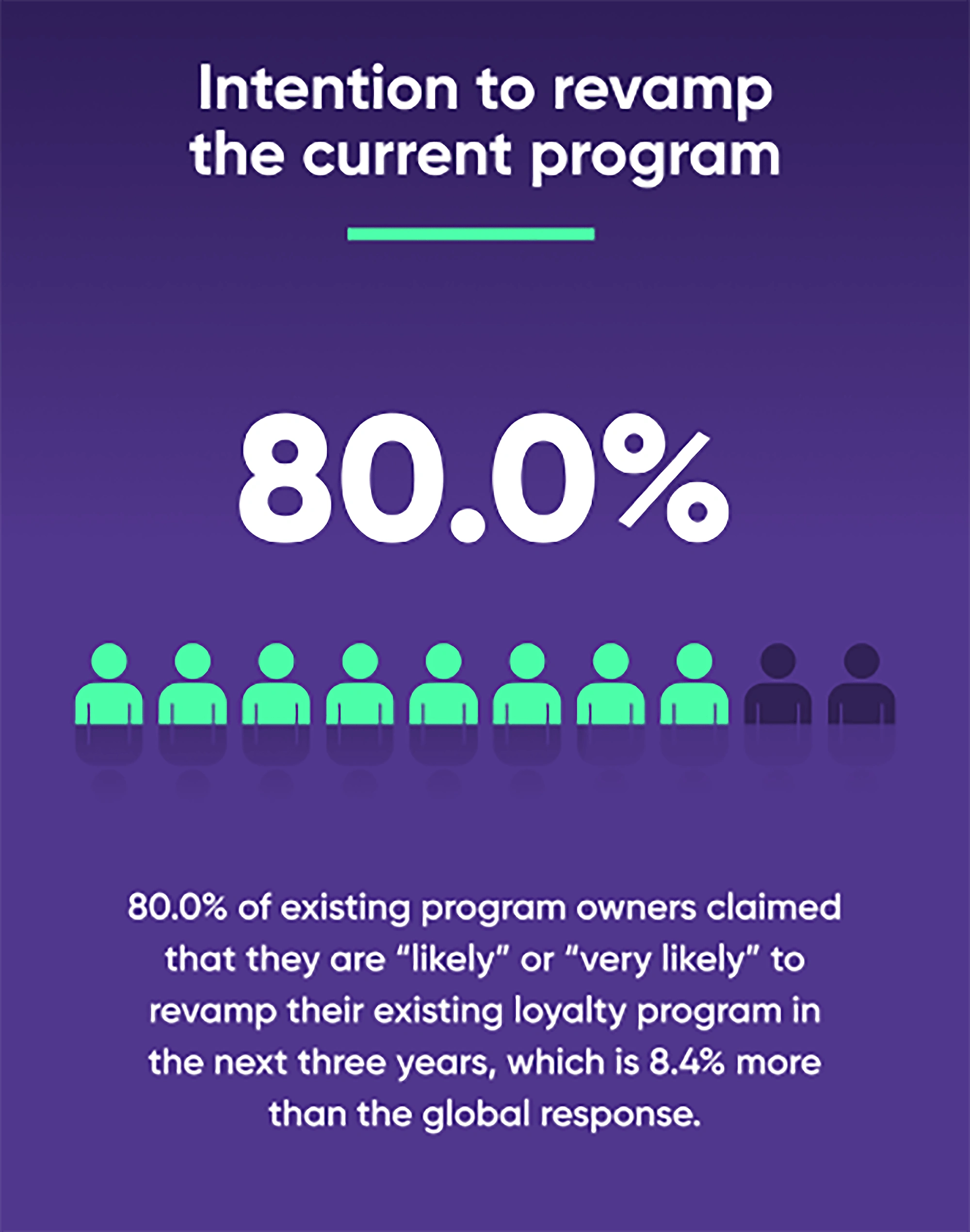

One way retailers hope to retain customers is by revamping their loyalty programs.

These programs are popular with consumers across several sectors. As of 2021, the average US consumer belonged to nearly 17 loyalty programs and was actively using seven of those programs.

Research from Antavo, a loyalty management firm, shows that 80% of leaders running loyalty programs in North America say they are likely or very likely to revamp their programs within the next three years.

Revamping brand loyalty programs looks like it will be a major goal for businesses in the coming years.

The travel industry is one sector in which brands began refreshing their loyalty programs in response to pandemic fallout.

Many airlines made it easier for consumers to reach “elite” status in their programs. They also made it easier to earn points and extended the deadline for points expirations.

United Airlines offers consumers 100k bonus points for signing up for their loyalty program.

Marriott’s Bonvoy program was the second-ranked hotel loyalty program in a recent survey commissioned by Bond Brand Loyalty.

The program offers six levels with sought-after benefits at each level.

As a nod to the exclusivity of the loyalty program, members can use their points to bid on one-of-a-kind experiences like private concerts, VIP tickets to sports games, and luxurious culinary tastings.

Conclusion

That’s all for the top consumer trends happening right now.

If there's one thing that ties many of these trends together, it's technology. Technology in fintech (digital wallets), social media (social shopping), and AR (VR/AR shopping) are driving many of the trends on this list.

The pandemic certainly accelerated most (if not all) of these shifts. But many of them are poised to continue growing even as the world opens up and people return to their daily lives.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more