Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

76 Top Fintech Companies & Startups (2024)

You may also like:

From processing payments to financial services, these are the top fintech companies and startups right now:

1. Sunbit

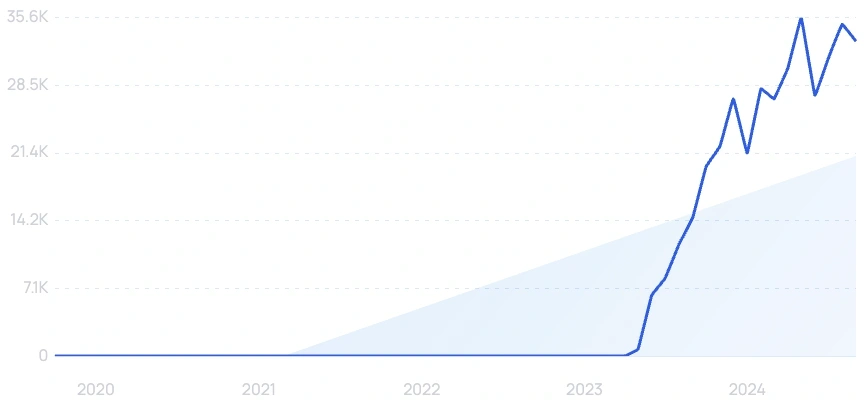

5-year search growth: 669%

Search growth status: Exploding

CEO: Arad Levertov

Year founded: 2016

Location: Los Angeles, California

Funding: $770M (Debt Financing)

What they do: Sunbit specializes in point-of-sale financing solutions for both customers and merchants. The organization facilitates instant installment payment plans at the point of purchase, making it easier for consumers to afford products and services while supporting merchant sales growth. By eliminating the barriers of traditional financing, Sunbit enhances the buying experience and fosters financial inclusivity for customers across various industries.

2. Akur8

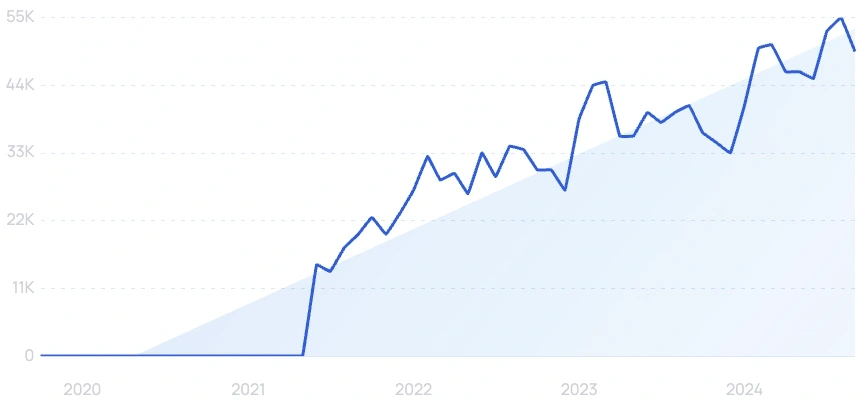

5-year search growth: 488%

Search growth status: Exploding

CEO: Samuel Falmagne

Year founded: 2019

Location: Paris, France

Funding: $186.9M (Series C)

What they do: Akur8 is an AI-powered insurance pricing and reserving platform. The company uses proprietary machine learning algorithms to automate and optimize the insurance pricing process. It offers modules for various aspects of pricing, including risk modeling, rate optimization, and pricing strategy deployment.

In September 2024, the startup raised $120 million in Series C funding. Today, the platform is used by more than 250 major insurers and supports 2,400+ users in 40+ countries.

3. Sendwave

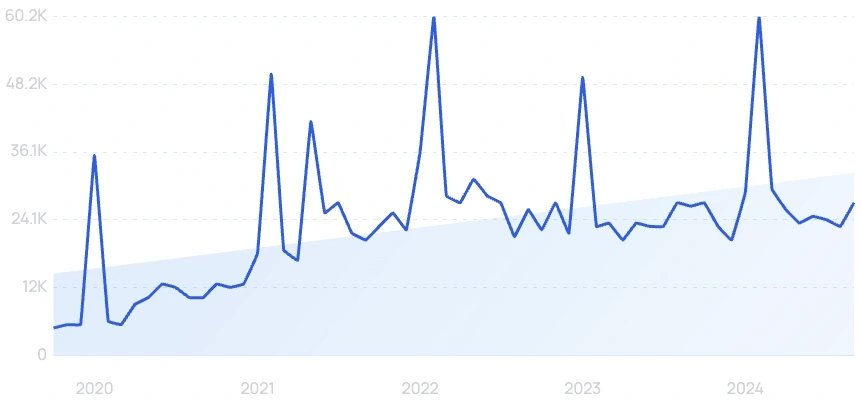

5-year search growth: 575%

Search growth status: Exploding

CEO: Drew Durbin

Year founded: 2014

Location: Boston, Massachusetts

Funding: $200M (Series A)

What they do: Sendwave is a leading money transfer service that focuses on enabling quick and secure cross-border remittances. Operating primarily in North America and Europe, Sendwave allows individuals to send money to several countries in Africa and Asia, providing an efficient and cost-effective alternative to traditional remittance channels. The startup has over 1 million global users in 130 countries.

4. Rapyd

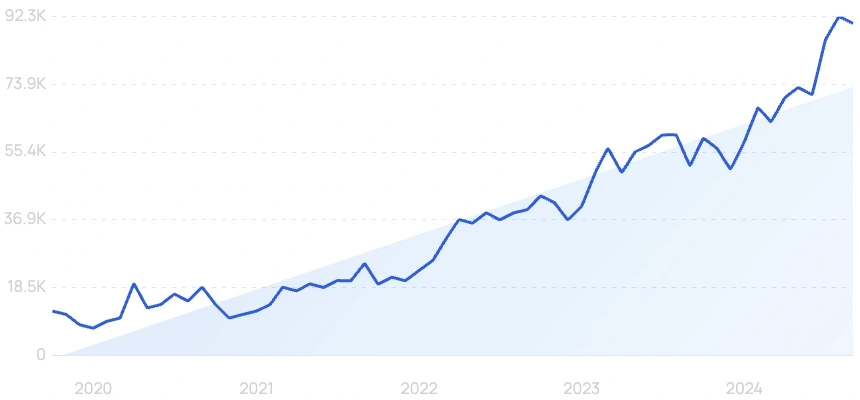

5-year search growth: 20%

Search growth status: Regular

CEO: Arik Shtilman

Year founded: 2016

Location: London, UK

Funding: $770M (Secondary Market)

What they do: Rapyd is a payment gateway focused on international card payments. Some of the startup's services include Rapyd Wallet (a multi-currency digital wallet), Rapyd Disburse (global payouts to 190+ countries), Rapyd Virtual Accounts (local bank accounts in 40+ countries), and Rapyd Card Issuing. After acquiring PayU in July 2023, the company was valued at $8.75 billion.

5. Tonik Bank

5-year search growth: 1,200%

Search growth status: Regular

CEO: Greg Krasnov

Year founded: 2018

Location: Singapore, Singapore

Funding: $175M (Series B)

What they do: Tonik Bank is a trailblazing digital bank headquartered in Singapore. Operating solely through digital channels, Tonik Bank leverages technology to provide seamless and accessible banking services to its customers. The bank offers user-friendly mobile and online platforms, enabling individuals to open savings accounts, apply for loans, and manage their finances efficiently, all while delivering an exceptional banking experience.

6. Cash App

5-year search growth: 68%

Search growth status: Regular

CEO: Luis Oliveira

Year founded: 2013

Location: San Francisco, CA

Funding: $10M (Pre-Seed)

What they do: Cash App is a mobile payment solution that enables users to send and receive money. Customers can also purchase and sell Bitcoin as well as invest in equities. Cash App has become an increasingly popular tool for peer-to-peer payments, managing personal finances, and doing business with small organizations. In May 2024, Cash App reported that it supports 57 million monthly transacting active users.

7. Razorpay

5-year search growth: 300%

Search growth status: Exploding

CEO: Harshil Mathur

Year founded: 2014

Location: Bangalore, India

Funding: $816.3M (Secondary Market)

What they do: Razorpay is an Indian fintech startup offering business banking, payroll, payment, and solutions. The company's integrated platform allows businesses to manage operations and accept 100+ payment methods. In 2023, Razorpay reached 450,000 customers and $226.6 million in revenue.

8. Chime

5-year search growth: 17%

Search growth status: Exploding

CEO: Chris Britt

Year founded: 2013

Location: San Francisco, California

Funding: $2.3B (Secondary Market)

What they do: Chime is a neobank that provides users with zero-fee mobile banking solutions. The company is FDIC-insured and has a growing customer base of over 22 million. As the startup eyes an IPO in 2025, it also reported 7 million monthly active users and profitability in the first quarter of 2024.

9. Altruist

5-year search growth: 167%

Search growth status: Exploding

CEO: Jason Wenk

Year founded: 2018

Location: Culver City, California

Funding: $449.5M (Series E)

What they do: Altruist is a custodian and self-clearing brokerage startup. The platform is primarily used by independent financial and registered investment advisors because of its all-in-one custodial services, trading capabilities, and portfolio management tools. More than 3,000 advisors, including firms like Venrock and Vanguard, use the Altruist platform today.

10. Tradovate

5-year search growth: 3,233%

Search growth status: Exploding

CEO: Rick Tomsic

Year founded: 2014

Location: Delaware, Ohio

Funding: Undisclosed

What they do: Tradovate is an online brokerage firm that specializes in futures and options trading. The company equips both novice and experienced traders with powerful tools, real-time market data, and competitive pricing, enabling them to execute trades and manage their portfolios.

11. Trueaccord

5-year search growth: 213%

Search growth status: Regular

CEO: Ohad Samet

Year founded: 2013

Location: Lenexa, Texas

Funding: $153M (Series Unknown)

What they do: Trueaccord is a machine-learning solution to aid in debt collection. Specifically, their "HeartBeat" algorithm is engineered to improve debt collection success rates automatically. As of today, TrueAccord has worked directly with over 20 million consumers.

12. Stripe

5-year search growth: 82%

Search growth status: Exploding

CEO: Patrick Collison

Year founded: 2010

Location: San Francisco, California

Funding: $9.4B (Secondary Market)

What they do: Stripe has quickly become one of the most valuable private companies in any industry. The online payment processor is now used on 1.9 million different websites, ranging from small startups to large enterprise brands. In 2023, Stripe processed $1 trillion in total payment volume. Today, it's still the biggest private fintech company with a $65 billion valuation.

13. Klarna

5-year search growth: 80%

Search growth status: Exploding

CEO: Sebastian Siemiatkowski

Year founded: 2005

Location: Stockholm, Sweden

Funding: $4.5B (Series Unknown)

What they do: Klarna is a payment solution for eCommerce merchants and shoppers. Like many "BNPL" solutions, Klarna offers consumers the option to checkout with installment payments plan (typically without charging any interest or fees). The company currently works with 550,000 merchants to support 150 million active consumers worldwide.

14. Tickertape

5-year search growth: 3,067%

Search growth status: Exploding

CEO: Vasanth Kamath

Year founded: 2021

Location: Bangalore, India

Funding: $4.5M (Seed)

What they do: Tickertape is an investment research platform providing real-time financial data and analysis for Indian investors. The platform offers stock screeners, market news, and analytics tools, enabling investors to make informed investment decisions. Tickertape's mission is to empower Indian investors with reliable and actionable financial data and analysis.

15. Wise

5-year search growth: 61%

Search growth status: Regular

CEO: Kristo Käärmann

Year founded: 2011

Location: London, UK

Funding: $1.7B (Post-IPO Debt)

What they do: Wise (formerly TransferWise) initially started as a money transfer service that allowed users to send money abroad without the hassle of hidden charges or high currency exchange rates. They have since grown their offering to include neobank services, like credit cards and real estate management services.

16. InfinitePay

5-year search growth: 1,900%

Search growth status: Exploding

CEO: Stephen Ford

Year founded: 2013

Location: São Paulo, Brazil

Funding: $658.1M (Debt Financing)

What they do: InfinitePay (parent company CloudWalk) offers seamless cross-border payments with relatively low transaction fees and currency conversion rates. Its platform provides a range of payment options, including card payments, wire transfers, and virtual accounts, making it easier for businesses to make and receive payments globally. InfinitePay recently released InfiniteCash, which enables users to create loans via smart contracts in the crypto space.

17. Affirm

5-year search growth: 102%

Search growth status: Exploding

CEO: Max Levchin

Year founded: 2012

Location: San Francisco, California

Funding: $1.5B (Post-IPO Equity)

What they do: Affirm is a buy now, pay later (BNPL) lender. The firm has been operating for over a decade, with total funding reaching $1.5B over 12 funding rounds. The company employs more than 2,000 people and has over 18 million users.

18. Creditas

5-year search growth: -18%

Search growth status: Peaked

CEO: Sergio Furio

Year founded: 2012

Location: São Paulo, Brazil

Funding: $1.1B (Convertible Note)

What they do: Creditas is a Brazilian digital consumer loan platform. Their credit score system uses homes and automobiles as collateral against loans. The company was originally called BankFacil before rebranding to Creditas.

19. GoHenry

5-year search growth: 37%

Search growth status: Peaked

CEO: Alex Zivoder

Year founded: 2012

Location: London, UK

Funding: $121.2M (Series B)

What they do: GoHenry is a money management platform that teaches young people how to handle their finances. Children can make transactions using debit cards that are prepaid and controlled by parents. The company reports there are over 2,000,000 paying customers using GoHenry.

20. Nubank

5-year search growth: 50%

Search growth status: Regular

CEO: David Vélez

Year founded: 2013

Location: São Paulo, Brazil

Funding: $4.2B (Post-IPO Debt)

What they do: Nubank is a neobank. They offer consumers credit cards, cashback rewards, digital bank accounts, and personal loans. In May 2024, Nubank reported $8 billion in revenue, $1 billion in net profit, and 100 million total customers (92 million in Brazil).

21. Vivid Money

5-year search growth: 833%

Search growth status: Regular

CEO: Esmond Berkhout

Year founded: 2020

Location: Berlin, Germany

Funding: $204.5M (Series C)

What they do: Vivid Money is a financial and mobile banking application solution. Their platform includes high-interest savings accounts, multi-currency access, and reporting features. Most recently, they expanded the platform to include brokerage capabilities to let users buy or sell stocks and ETFs. They also offer lucrative cashback options to spend and store money within their platform.

22. Monzo

5-year search growth: 12%

Search growth status: Regular

CEO: TS Anil

Year founded: 2015

Location: London, UK

Funding: $1.7B (Series I)

What they do: Monzo is a digital bank based in the UK. Besides offering a variety of bank account and loan products, Monzo's app includes a number of features to help with budgeting and spend tracking. In March 2024, the company raised an additional $430 million in Series I funding at a $4.6 billion valuation.

23. Revolut

5-year search growth: 162%

Search growth status: Exploding

CEO: Nikolay Storonsky

Year founded: 2015

Location: London, UK

Funding: $1.7B (Series Unknown)

What they do: London-based Revolut has quickly emerged as one of the most valuable fintech startups on the planet. The company reports that they have 15 million personal customers across 35 different countries. And they've recently expanded into the US with their sights on acquiring a UK license by the beginning of 2022.

24. Bookipi

5-year search growth: 457%

Search growth status: Exploding

CEO: Tim Lee

Year founded: 2016

Location: Sydney, Australia

Funding: $1M (Seed)

What they do: Bookipi is a user-friendly invoicing and accounting app designed for small business owners, freelancers, and self-employed individuals. The app allows users to easily create and send professional invoices, track their expenses, and manage their business finances in one place. Bookipi streamlines the invoicing process with its intuitive interface, automated features, and customizable options, helping users save time and improve their cash flow.

25. Gumroad

5-year search growth: 388%

Search growth status: Exploding

CEO: Sahil Lavingia

Year founded: 2011

Location: San Francisco, California

Funding: $16.1M (Equity Crowdfunding)

What they do: Gumroad is an eCommerce platform enabling independent creators to sell digital content directly to their customers. Several well-known musicians including Eminem and Bon Jovi have used the platform to sell products.

26. OnCredit

5-year search growth: 300%

Search growth status: Peaked

CEO: Roman Katerynchyk

Year founded: 2019

Location: Ho Chi Minh, Vietnam

Funding: Undisclosed

What they do: OnCredit is a digital lending platform that provides short-term loans to consumers and small businesses in emerging markets. It uses advanced data analytics and machine learning algorithms to assess creditworthiness and offer personalized loan products, enabling borrowers to access credit quickly and efficiently.

27. Brex

5-year search growth: 6%

Search growth status: Regular

CEO: Henrique Dubugras

Year founded: 2017

Location: San Francisco, California

Funding: $1.5B (Series D)

What they do: Brex's online banking platform focused almost 100% on the B2B market. Specifically, high-growth startups. Products they offer include corporate credit cards, cash management accounts, and built-in analytics tools.

28. PayMongo

5-year search growth: 363%

Search growth status: Regular

CEO: Jojo Malolos

Year founded: 2019

Location: Taguig, Philippines

Funding: $45.7M (Series B)

What they do: PayMongo is a payment processing company serving The Philippines. The company's revenue grew by 60% in 2020.

29. Lumanu

5-year search growth: 138%

Search growth status: Regular

CEO: Tony Tran

Year founded: 2017

Location: Oakland, California

Funding: $15.8M (Series A)

What they do: Lumanu is a contractor management platform with invoicing, onboarding, compliance, and payment features. Instead of managing multiple invoices and payments to individual contractors, the Lumanu platform consolidates a business's contractor spending in one place. The startup has over 50,000 customers who have processed more than $500 million in payouts.

30. Pitchbook

5-year search growth: 135%

Search growth status: Exploding

CEO: John Gabbert

Year founded: 2007

Location: Seattle, Washington

Funding: $13.8M (Series B)

What they do: Pitchbook is a platform that aggregates and collects data for VCs. Specifically, they have data on 3 million companies, including funding rounds.

31. Dana

5-year search growth: 30%

Search growth status: Regular

CEO: James Kamsickas

Year founded: 2017

Location: Jakarta, Indonesia

Funding: $554.5M (Secondary Market)

What they do: Dana, a subsidiary of Emtek, is a digital wallet serving the Indonesian market. The company provides an e-wallet for customers to do three main tasks: send money, pay bills, and shop online. They saw an increase of 100% last year in total transactions.

32. Ivalua

5-year search growth: 22%

Search growth status: Regular

CEO: David Khuat-Duy

Year founded: 2000

Location: Massy, France

Funding: $134.4M (Private Equity)

What they do: Ivalua is an online procurement management platform. The cloud-based software offers a wide range of solutions, from risk tracking to invoice automation. They continue to expand their financial products with a new array of solutions launched last year.

33. Toast

5-year search growth: 144%

Search growth status: Regular

CEO: Aman Narang

Year founded: 2011

Location: Boston, Massachusetts

Funding: $962M (Secondary Market)

What they do: Toast helps restaurants manage their finances. Toast's financial product offerings include point-of-sale systems, email marketing software, and payroll management tools. More than 112,000 restaurants are currently using Toast's technology.

34. Kueski

5-year search growth: 111%

Search growth status: Exploding

CEO: Adalberto Flores Ochoa

Year founded: 2012

Location: Guadalajara, Mexico

Funding: $323.3M (Series Unknown)

What they do: Kueski is a Mexican fintech company that specializes in providing online microloans to individuals. Leveraging machine learning algorithms and alternative credit scoring models, Kueski offers fast and convenient loan approval processes without requiring traditional credit history checks. By addressing the credit needs of underserved populations, Kueski aims to promote financial inclusion and provide accessible financial solutions to those who may have limited access to traditional banking services.

35. Fundiin

5-year search growth: 6,900%

Search growth status: Regular

CEO: Cuong Anh Nguyen

Year founded: 2019

Location: Ho Chi Minh, Vietnam

Funding: $6.8M (Series A)

What they do: Fundiin is an innovative financial technology company that specializes in providing access to alternative funding solutions for businesses. Their platform connects entrepreneurs and small to medium-sized enterprises (SMEs) with a diverse network of lenders, investors, and financial institutions. By leveraging technology and data-driven insights, Fundiin streamlines the funding process, enabling businesses to secure capital quickly and efficiently, fostering growth, and fueling entrepreneurial success.

36. Credflow

5-year search growth: 7,200%

Search growth status: Regular

CEO: Kunal Aggarwal

Year founded: 2019

Location: New Delhi, India

Funding: $1.8M (Seed)

What they do: Credflow is an Indian fintech that provides an AI-powered credit risk assessment platform for small and medium-sized businesses. Its platform analyzes business financial data and provides insights on creditworthiness and risk exposure, helping lenders make better credit decisions and reducing the risk of default for borrowers. By utilizing these features, SMEs can optimize their cash flow and improve their financial management practices.

37. Apurata

5-year search growth: 116%

Search growth status: Exploding

CEO: Patrick Wakeham

Year founded: 2016

Location: Lima, Peru

Funding: $150K (Seed)

What they do: Apurata allows users to apply for loans online. The company specifically targets the Latin American market. Apurata claims that it can issue loans up to $1,000 in just 29 minutes.

38. SportTrade

5-year search growth: 8,400%

Search growth status: Regular

CEO: Carsten Koerl

Year founded: 2018

Location: Camden, New Jersey

Funding: $36.1M (Undisclosed)

What they do: SportTrade is a sports betting and trading exchange where sports bets are traded like stocks. The platform is an unconventional take on sports betting modeled after the financial market. The company is currently backed by nine investors.

39. Anyfin

5-year search growth: 64%

Search growth status: Peaked

CEO: Mikael Hussain

Year founded: 2017

Location: Stockholm, Sweden

Funding: $138.1M (Series C)

What they do: Anyfin is a fintech startup based in Stockholm, Sweden, that aims to revolutionize the way people manage their existing consumer loans. The company allows users to refinance their loans at lower interest rates and better terms, saving them money in the process. Anyfin achieves this by using its proprietary technology to analyze user data and negotiate with banks on their behalf, offering a hassle-free and cost-effective solution for loan management.

40. OctaFX

5-year search growth: 200%

Search growth status: Peaked

CEO: Georgios D. Pantzis

Year founded: 2014

Location: London, England

Funding: Undisclosed

What they do: OctaFX is an international online forex broker that offers trading services in various financial markets, including forex, commodities, indices, and cryptocurrencies. OctaFX caters to both beginner and experienced traders seeking to participate in global financial markets, with their user-friendly trading platform, competitive spreads, and access to multiple trading instruments. The company is known for its focus on customer satisfaction, transparent pricing, and robust trading conditions.

41. Modern Treasury

Search growth status: Exploding

CEO: Dimitri Dadiomov

Year founded: 2018

Location: San Francisco, CA

Funding: $183M (Series C)

What they do: Modern Treasury is a financial technology company that provides a modern payment operations platform for businesses. Its platform automates and streamlines payment workflows, reduces errors, and provides real-time visibility into payment activities. The company’s mission is to make B2B payments faster, easier, and more efficient.

42. Swan Bitcoin

5-year search growth: 3,300%

Search growth status: Regular

CEO: Cory Klippsten

Year founded: 2019

Location: Los Angeles, California

Funding: $6M (Series A)

What they do: Swan is a simple Bitcoin savings app that converts weekly, monthly, or paycheck deposits from dollars to Bitcoin. Removing many of the barriers to buying crypto that plague the industry, Swan’s aim is to simplify the purchase and storage of Bitcoin. A smooth mobile application and online wallet interface allow users to see transaction history and the growth of their Bitcoin investment. In their most recent funding round (November 2021), Swan received $6 million and has a pre-money valuation set at $90 million.

43. Pixpay

5-year search growth: 2,267%

Search growth status: Exploding

CEO: Benoit Grassin

Year founded: 2019

Location: Paris, France

Funding: $11.9M (Series A)

What they do: Pixpay is a mobile banking app designed for teenagers and their parents. The app allows parents to set up and manage their children's pocket money, monitor their expenses, and teach them financial literacy. Pixpay also offers a debit card for teenagers that can be used online and in-store.

44. Trade Republic

5-year search growth: 2,500%

Search growth status: Exploding

CEO: Christian Hecker

Year founded: 2015

Location: Berlin, Germany

Funding: $1.3B (Series C)

What they do: Trade Republic is a Berlin-based mobile brokerage platform that enables users to invest in stocks, exchange-traded funds (ETFs), and other securities The company offers commission-free trading, real-time pricing, and a user-friendly app that aims to simplify investing. With its transparent fee structure, low minimum investments, and extensive range of investment options, Trade Republic is rapidly becoming a popular alternative to traditional brokerages in Europe.

As reported in February 2024, Trade Republic now has over 4 million customers and surpassed $38 billion in client assets.

45. Nium

5-year search growth: 229%

Search growth status: Exploding

CEO: Prajit Nanu

Year founded: 2015

Location: Singapore, Singapore

Funding: $338M (Series E)

What they do: Nium is a real-time, cross-border payments and financial services company. The startup enables businesses to send and receive funds globally and operates in 220+ countries and territories. In June 2024, Nium raised $50 million in Series E funding at a $1.4 billion post-money valuation. They currently process $8 billion in payments yearly while serving 130+ million end customers.

46. TrueLayer

5-year search growth: 54%

Search growth status: Regular

CEO: Francesco Simoneschi

Year founded: 2016

Location: London, UK

Funding: $271.5M (Series E)

What they do: London-based TrueLayer is a developer-friendly fintech platform with applications that connect critical bank data, transactions, and verification inside one unified location.

TrueLayer claims that 50% of open banking traffic in Spain, Ireland, and the U.K. flows through their platform, with a 22% higher payment conversion than competitors. With offices in 5 cities worldwide, TrueLayer continues to expand rapidly.

47. Wagepay

5-year search growth: 8,500%

Search growth status: Regular

CEO: Tony Chan

Year founded: 2020

Location: Brisbane, Australia

Funding: $6.5M (Debt Financing)

What they do: Wagepay is a fintech startup that provides an earned wage access solution to help employees access their earned but unpaid wages. The company partners with employers to offer this service, which helps employees to avoid payday loans and overdraft fees. Wagepay also provides employers with real-time data on employee wages and spending habits.

48. Rocket Money

5-year search growth: 1,200%

Search growth status: Exploding

CEO: Haroon Mokhtarzada

Year founded: 2015

Location: Silver Spring, Maryland

Funding: $84M (Series D)

What they do: It’s easy to get swamped with mountains of bills from streaming services, apps, subscriptions, and meal services. Rocket Money streamlines the process by clearly tracking your bills and making them easy to cancel. The company reports that 2 million customers use Truebill and have saved over $100M on unnecessary subscription costs.

49. PhonePe

5-year search growth: 109%

Search growth status: Exploding

CEO: Sameer Nigam

Year founded: 2015

Location: Andheri, India

Funding: $2.6B (Private Equity)

What they do: PhonePe is a digital wallet and payment platform based in India. The app allows users to make payments, transfer money, recharge mobile phones, pay bills, and more. PhonePe is integrated with several major banks in India and offers a secure and convenient way for users to make digital payments. With Walmart as its largest shareholder, the corporation is currently valued at $12 billion.

50. Relay Financial

5-year search growth: 464%

Search growth status: Exploding

CEO: Yoseph West

Year founded: 2018

Location: Toronto, Canada

Funding: $51.6M (Series B)

What they do: Relay is an online banking and money management platform for businesses. They offer business checking and savings accounts, receipt management, accounts payable, and bookkeeping software integrations. In May 2024, the startup raised $32.2 million in Series B funding to continue supporting their 100,000+ customers.

51. Payactiv

5-year search growth: 69%

Search growth status: Regular

CEO: Safwan Shah

Year founded: 2011

Location: San Jose, CA

Funding: $133.7M (Series C)

What they do: Payactiv is a financial wellness platform that provides earned wage access, bill pay, savings, and budgeting tools to employees. The company partners with employers to offer these services as an employee benefit, which helps to reduce financial stress and improve employee retention. Payactiv also partners with financial institutions to provide access to credit and other financial products.

52. Method Financial

5-year search growth: 88%

Search growth status: Regular

CEO: Jose Bethancourt

Year founded: 2021

Location: Austin, TX

Funding: $18.5M (Series A)

What they do: Method Financial is a fintech startup that provides businesses with an automated accounting platform. Its platform uses machine learning to analyze financial data and provide insights to help businesses improve their financial performance. Method Financial aims to simplify the accounting process and help businesses make more informed financial decisions.

53. PayDo

5-year search growth: 129%

Search growth status: Exploding

CEO: Donato Vadruccio

Year founded: 2017

Location: London, England

Funding: $990K (Seed)

What they do: PayDo is a fintech company that provides a range of payment solutions and merchant services. It offers online payment processing, multi-currency accounts, card acquiring, and payment gateway services to businesses of all sizes. PayDo's comprehensive suite of services enables merchants to accept payments securely, manage transactions, and expand their reach in the global market, making it a valuable partner for businesses looking to streamline their payment operations.

54. Payoneer

5-year search growth: 100%

Search growth status: Regular

CEO: Scott Galit

Year founded: 2005

Location: New York, NY

Funding: $570M (Post-IPO Equity)

What they do: Payoneer is a global fintech company that provides cross-border payment solutions and digital banking services. Its platform enables businesses and freelancers to receive and send payments worldwide in multiple currencies. With features like virtual accounts, prepaid Mastercards, and integrated payment services, Payoneer empowers individuals and businesses to expand their reach and streamline their international transactions.

55. Tabapay

5-year search growth: 113%

Search growth status: Regular

CEO: Rodney Robinson

Year founded: 2017

Location: Mountain View, California

Funding: Undisclosed (Series A)

What they do: TabaPay is an instant payment platform for fintech companies. They provide direct connections to 14 networks and 15 banking partners for real-time money movement. The platform also offers API, compliance, and fraud mitigation features. The company claims to support more than 2,500 customers and processes 1+ million transactions daily.

56. Neomoon

Search growth status: Peaked

CEO: Fedor Saldivia

Year founded: 2020

Location: Miami, Florida

Funding: $2M (Seed)

What they do: Neomoon is a Miami-based digital bank that provides financial services to Latin American countries. Specifically, the startup uses stablecoins to protect funds from devaluation (a growing problem in many Latin American countries). Launched in April 2022, the platform has more than 50,000 registered users and is adding approximately 570 new users daily. Neomoon has raised $2M in funding.

57. Informed

5-year search growth: 109%

Search growth status: Exploding

CEO: Justin Wickett

Year founded: 2016

Location: San Francisco, CA

Funding: $20M (Series A)

What they do: Informed operates a consumer auto financing platform that revolutionizes the loan origination process. Their platform incorporates a digital assistant that efficiently gathers loan documents from borrowers and leverages machine learning and optical character recognition for advanced analysis. By automating loan origination, the company empowers auto lenders to streamline their operations and enhance efficiency in processing loans.

58. Remitly

5-year search growth: 150%

Search growth status: Exploding

CEO: Matthew Oppenheimer

Year founded: 2011

Location: Seattle, WA

Funding: $527.6M (Post-IPO Equity)

What they do: Remitly is a digital remittance service that specializes in providing affordable and secure options for immigrants and their families to send money internationally. The platform offers various payment options and delivery methods, including bank transfers, cash pickup, and home delivery, with competitive exchange rates and low fees. Additionally, Remitly provides supplementary services like mobile phone top-ups and bill payments in certain countries.

59. Moneypay

5-year search growth: 2,300%

Search growth status: Peaked

CEO: Mehmet Mustehlik

Year founded: 2020

Location: Istanbul, Turkey

Funding: Undisclosed

What they do: Moneypay is a financial technology company that focuses on providing innovative payment solutions and merchant services. Their offerings include mobile payment apps, point-of-sale systems, and e-commerce payment gateways, catering to businesses of all sizes. Moneypay's solutions aim to streamline payment processes, enhance customer experiences, and enable businesses to adapt to the evolving landscape of digital payments.

60. Addi

5-year search growth: 300%

Search growth status: Exploding

CEO: Santiago Suarez

Year founded: 2018

Location: Bogota, Colombia

Funding: $462.3M (Debt Financing)

What they do: Addi is a Colombian fintech startup that offers digital lending and point-of-sale financing solutions. Their platform integrates with e-commerce websites and physical stores, allowing consumers to access affordable installment payment options at the point of purchase. Addi leverages data analytics and machine learning algorithms to provide instant loan approvals, enabling consumers to make purchases and merchants to increase sales conversion rates and customer satisfaction.

61. Moneymax

5-year search growth: 309%

Search growth status: Exploding

CEO: Lim Yong Guan

Year founded: 2009

Location: Makati, Philippines

Funding: $200M (Post-IPO Debt)

What they do: Moneymax is a financial comparison website based in the Philippines that helps consumers make informed decisions about various financial products. From insurance and credit cards to loans and investments, Moneymax offers an easy-to-use platform for comparing and applying for financial products from different providers. By providing transparent information and empowering consumers with choices, Moneymax aims to promote financial literacy and enable individuals to achieve their financial goals.

62. LemFi

5-year search growth: 9,200%

Search growth status: Exploding

CEO: Ridwan Olalere

Year founded: 2020

Location: Toronto, Canada

Funding: $33.9M (Series A)

What they do: LemFi is a digital banking startup that provides North America and Europe-based immigrants with bank accounts in both their country of origin and their country of residence. This allows customers to send, receive, convert, and save money in multiple currencies. It currently supports remittances to over 20 countries, including Nigeria, Ghana, Kenya, India, China, and Pakistan. The company currently has more than 1 million customers.

63. Waystar

5-year search growth: 50%

Search growth status: Regular

CEO: Matthew Hawkins

Year founded: 2000

Location: Louisville, Kentucky

Funding: Undisclosed

What they do: Waystar is a finance healthcare technology company that provides innovative revenue cycle management solutions for healthcare providers. Their platform combines data analytics, automation, and artificial intelligence to streamline the billing and payment processes, improve revenue capture, and enhance the financial performance of healthcare organizations. Waystar's solutions help providers navigate complex reimbursement systems and optimize their revenue streams while improving patient satisfaction.

64. Prodigy Finance

5-year search growth: 79%

Search growth status: Regular

CEO: Cameron Stevens

Year founded: 2007

Location: London, England

Funding: $2.4B (Debt Financing)

What they do: Prodigy Finance is a global fintech platform that specializes in providing educational loans to international students. By utilizing a data-driven approach, Prodigy Finance offers loans to students pursuing higher education abroad, particularly in fields such as business, engineering, and healthcare. Their unique lending model takes into account factors like the student's future earning potential and academic profile, enabling access to education financing for individuals who may have limited options due to traditional lending constraints.

65. GoodLeap

5-year search growth: 8,900%

Search growth status: Exploding

CEO: Hayes Barnard

Year founded: 2003

Location: San Francisco, CA

Funding: $800M (Secondary Market)

What they do: GoodLeap provides affordable loans to homeowners looking to make energy-efficient home improvements. The company's mission is to make it easier for homeowners to finance and undertake energy-saving renovations that not only benefit the environment but also lower their utility bills. GoodLeap offers a range of loan products with flexible terms and competitive interest rates, along with personalized support to guide customers through the lending process.

66. Lunar

5-year search growth: 463%

Search growth status: Regular

CEO: Ken Villum Klausen

Year founded: 2015

Location: Aarhus, Denmark

Funding: $511.6M (Undisclosed)

What they do: Lunar is a neo-bank that offers a variety of financial services, including investments, loans, and savings accounts. Customers primarily interact with the services through the free mobile app (which has approximately 900,000 users to date). Customers can choose from three different subscriptions, including the free “Standard” plan and the two paid plans, “Premium” and “Pro.”

67. PayJoy

5-year search growth: 809%

Search growth status: Exploding

CEO: Doug Ricket

Year founded: 2015

Location: San Francisco, California

Funding: $410.2M (Debt Financing)

What they do: PayJoy is a lending company that provides credit to customers in emerging markets. Customers use their smartphones as collateral for loans with no high interest rates or late fees. Instead, if a customer misses a payment their smartphone gets locked. According to the company's CEO, they serve 10+ million customers across Latin America, Africa, and Southeast Asia and have surpassed $300 million in annualized revenue.

68. Qonto

5-year search growth: 270%

Search growth status: Exploding

CEO: Alexandre Prot

Year founded: 2016

Location: Paris, France

Funding: $709.5M (Series Unknown)

What they do: EU-based Qonto provides online banking services for small and medium-sized businesses (SMBs) as well as freelancers. Customers can try the startup’s services for free for 30 days, and then choose a subscription. Used by 250,000 businesses, the subscriptions range from €9 to €39.

69. ThinkMarkets

5-year search growth: 123%

Search growth status: Peaked

CEO: Nauman Anees

Year founded: 2010

Location: London, England

Funding: $30M (Debt Financing)

What they do: ThinkMarkets is a renowned global provider of online trading services, known for its expertise in forex, CFDs, and commodities. Powered by cutting-edge technology and a commitment to innovation, the company offers a highly sophisticated trading platform that serves both retail and institutional clients. With an extensive selection of financial markets, advanced tools, educational materials, and exceptional customer support, ThinkMarkets stands as a trusted and all-encompassing choice for traders seeking a reliable and comprehensive trading experience.

70. Toss

5-year search growth: 336%

Search growth status: Exploding

CEO: Seung-Gun Lee

Year founded: 2011

Location: Seoul, South Korea

Funding: $1.4B (Series G)

What they do: Toss is a mobile financial service startup based in South Korea. Using the Toss app, in addition to peer-to-peer cash transfer and traditional banking features, customers can track spending and schedule payments.

71. Airwallex

5-year search growth: 654%

Search growth status: Exploding

CEO: Jack Zhang

Year founded: 2015

Location: Melbourne, Australia

Funding $902M (Series E)

What they do: Airwallex is a payment and banking platform for businesses. Customers can accept payments and move money domestically and internationally. Currently used by thousands of businesses across the world, the startup offers free international card transactions and company cards, as well as global accounts in 11 currencies.

72. Flutterwave

5-year search growth: 209%

Search growth status: Peaked

CEO: Olugbenga Agboola

Year founded: 2016

Location: San Francisco, CA

Funding: $509.5M (Series D)

What they do: Flutterwave is a fintech company that builds technology and infrastructure to support global merchants and payment providers. Used by 1M+ businesses, including Uber and Microsoft, customers can sell online, process payments, and more. The startup accepts payments in more than 30 currencies and averages 500K+ processed payments per day.

73. Zego

Search growth status: Regular

CEO: Sten Saar

Year founded: 2016

Location: London, England

Funding: $281.7M (Series C)

What they do: Zego is a fintech startup that offers vehicle insurance for both individual drivers and fleets. The policy timelines range from 1 hour to 1 year. Since the startup’s inception in 2016, over 200,000 vehicles have been insured. Used by partners such as Uber, Zego has a Trustpilot review of 4.7 stars out of 5, with over 5K reviews.

74. Wefox

5-year search growth: 189%

Search growth status: Exploding

CEO: Julian Teicke

Year founded: 2015

Location: Berlin, Germany

Funding: $1.5B (Debt Financing)

What they do: Wefox provides insurance to over 2 million customers across five European countries. The startup offers insurance in three areas: vehicle, private liability, and household. Given Wefox’s focus on digitizing the insurance process, customers can upload documentation related to their claims and interact with the claims team via the app.

75. iDonate

5-year search growth: 233%

Search growth status: Exploding

CEO: Ray Gary

Year founded: 2010

Location: Dallas, TX

Funding: $48.8M (Series Unkown)

What they do: iDonate is a financial technology company that offers a comprehensive fundraising platform for nonprofits and charitable organizations. Their platform combines online donation processing, peer-to-peer fundraising, event management, and donor management tools to facilitate efficient and impactful fundraising campaigns. iDonate's solutions empower nonprofits to engage donors, streamline fundraising processes, and maximize their fundraising efforts to support their missions effectively.

76. Spendesk

5-year search growth: 43%

Search growth status: Regular

CEO: Rodolphe Ardant

Year founded: 2016

Location: Paris, France

Funding: $311.8M (Series C)

What they do: Spendesk develops software for finance teams and employees to track and monitor spending. The platform is designed to streamline the process of managing and tracking departmental spending. To date, the platform is used by 3,500 finance teams, and customers can request unlimited virtual and physical cards.

Conclusion

We have reached the end of our list of companies operating in the fintech space in 2024.

As you can see from the startups on our list, much of fintech is focused on developing innovative products designed to common financial tasks (like transferring funds and opening bank accounts) easier for customers. Along with automating tasks that would traditionally require a financial advisor.

Another common trend from this list was the number of startups creating simplified B2B payment solutions for merchants. With the eCommerce space seeing rapid growth, it's no surprise to see more companies cashing in. We expect this trend to continue as shoppers continue to migrate online for their purchases.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more