Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 10 Pitchbook Alternatives & Competitors (2025)

PitchBook is often used by venture capital (VC) and private equity (PE) firms that are actively investing in businesses.

Through a desktop app, mobile app, and various plugins, PitchBook users can access market data like:

- Financial information for public and private companies

- Details on who’s funding a company, and how

- Whether a company is funded via debt, loans, or investments

- The status of mergers and acquisitions (M&A) and bankruptcies

- Which advisors have been active in investment and merger deals

- Who’s in the executive suite, or on the board, of a given company

It’s this breadth of information that makes PitchBook a popular choice among investors—but if you don’t need all of its information (or are looking for a different price point) there are other options out there.

In this post we’ll take a close look at 10 top PitchBook alternatives to see what they offer, and why you might prefer them over PitchBook in certain situations.

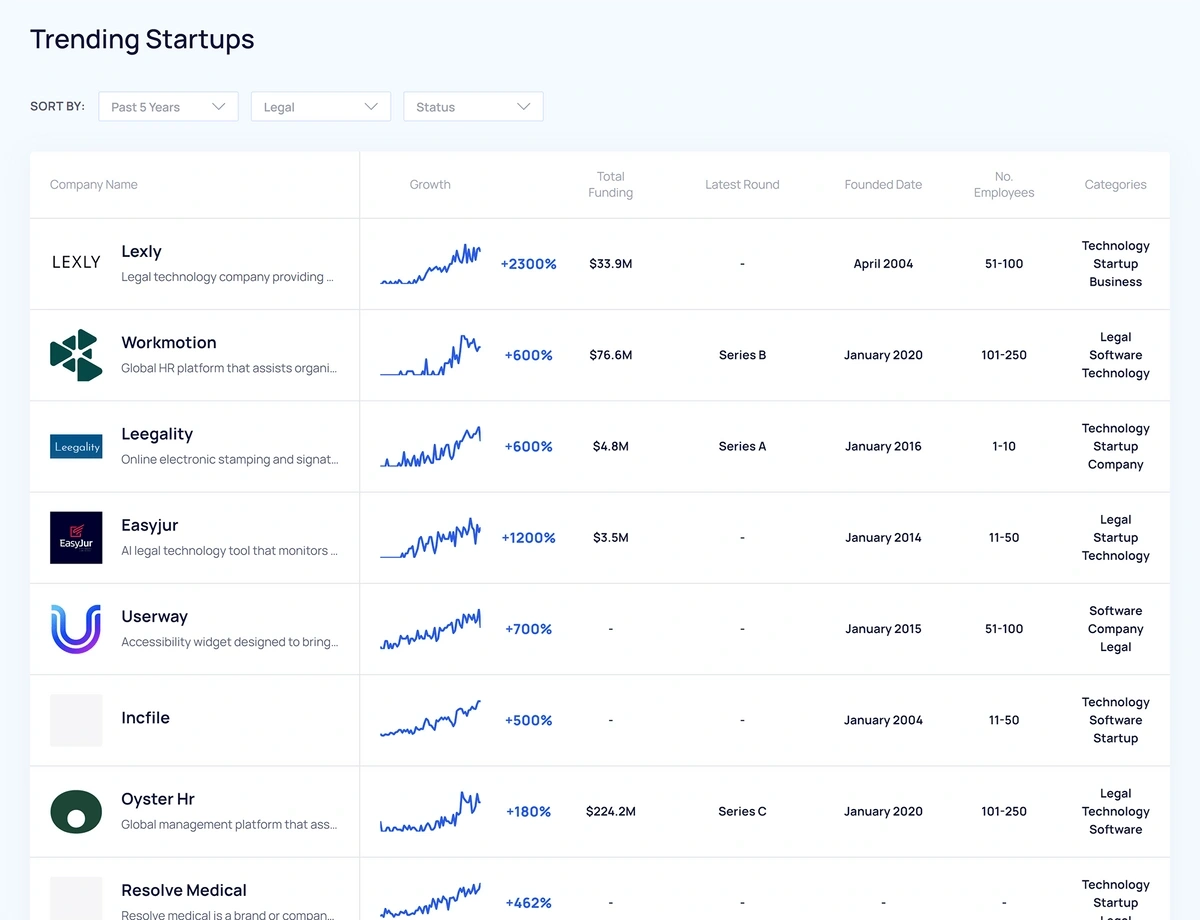

1. Exploding Topics

If you’re interested in investing in startups, Exploding Topics is a resource that can help.

Our trending startups database features key details about startups that we've flagged as having great growth potential.

Here’s how it works:

- Our artificial intelligence tools—the same ones we use for our proven trend spotting—scour the internet for signs of interest in, and information about, growing startups.

- We then review all of the data points collected by our AI, with human data analysis experts giving everything a careful look.

- After confirming that these startups have the potential to grow, we add their information into our database. (It’s updated every day, so you’ve always got timely information at hand.)

We’re finding valuable startups earlier than many other PitchBook competitors, too—meaning you can act quickly on companies that have the potential to take off.

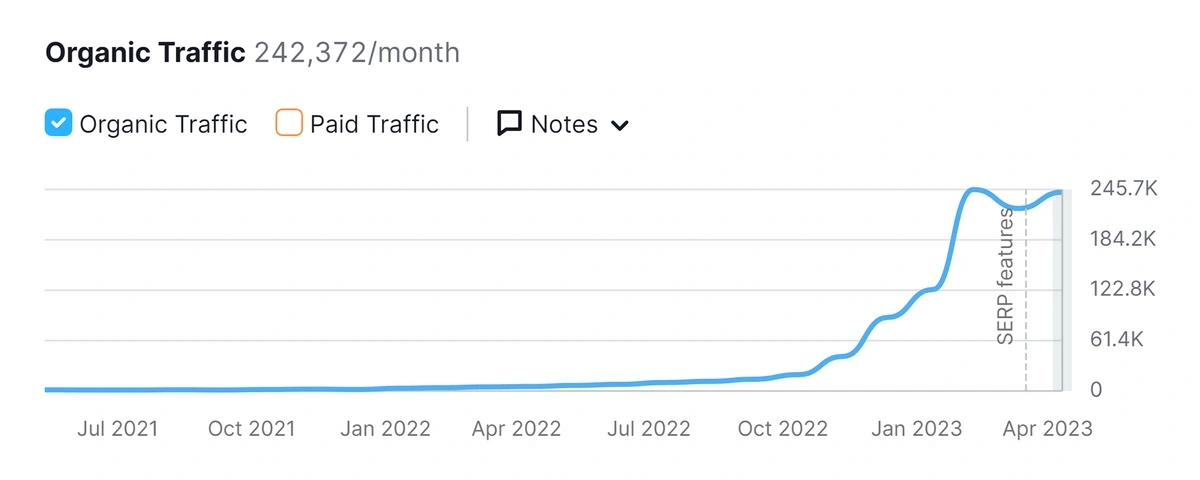

Take Writesonic as an example. This AI SaaS startup gained a lot of notice and popularity in Q1 2023 as more people started using it for help with writing. Just look at this spike in organic traffic as illustrated via Semrush:

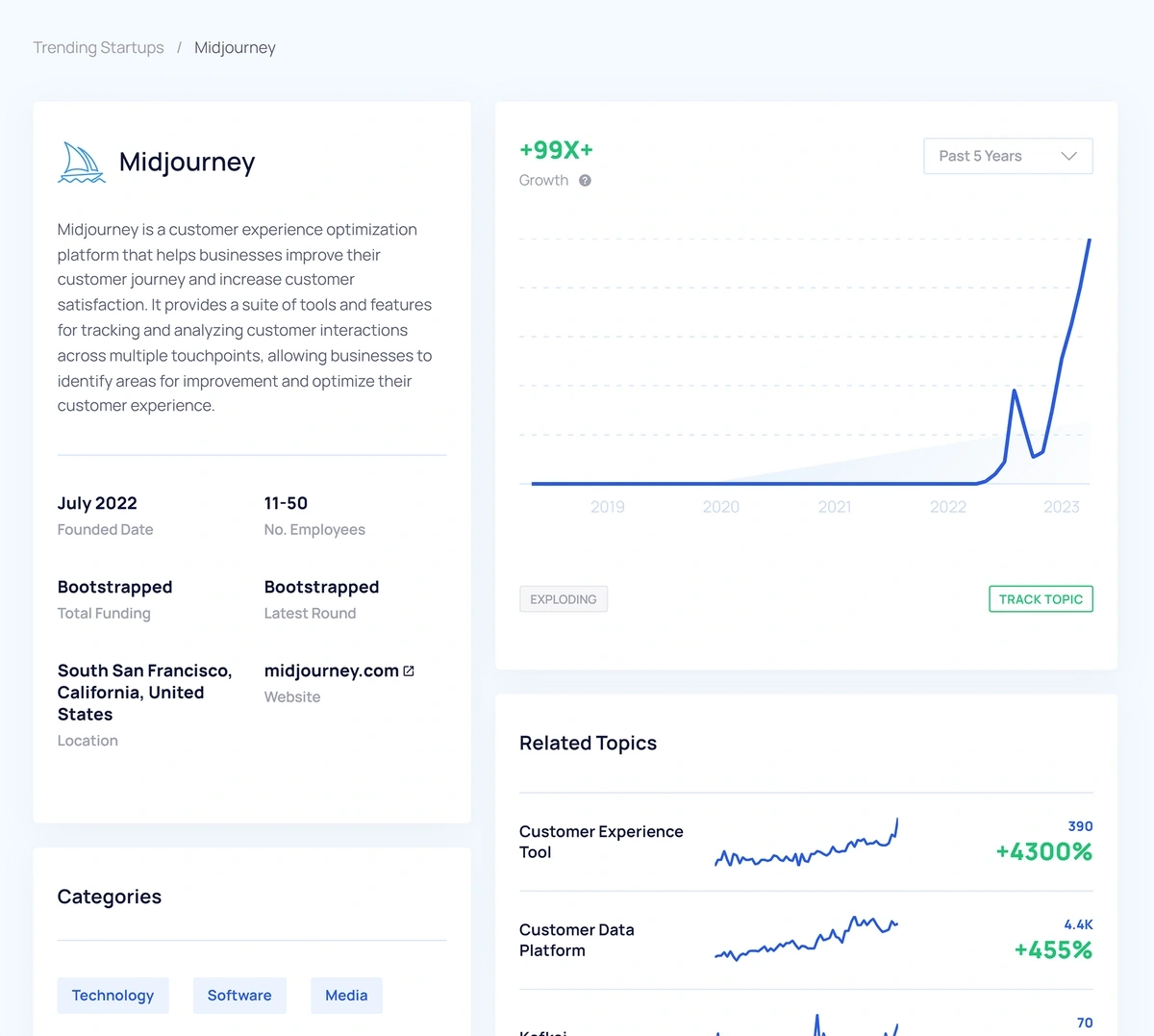

While you might be one of the many people just now learning about Writesonic, Exploding Topics Pro users have known about the company since April 2021, when we identified it as a startup to watch. Just look at that wild growth in popularity:

If you want to be among the first people to learn about startups with high potential, it’s easy. With an Exploding Topics Pro subscription you can search and sort our startup database by metrics like:

- Industry

- Length of operation

- Total funding and stage

- Number of employees

- Trending status (regular, peaked, or poised to explode)

From there, one click on a startup shows you more in-depth information about the company.

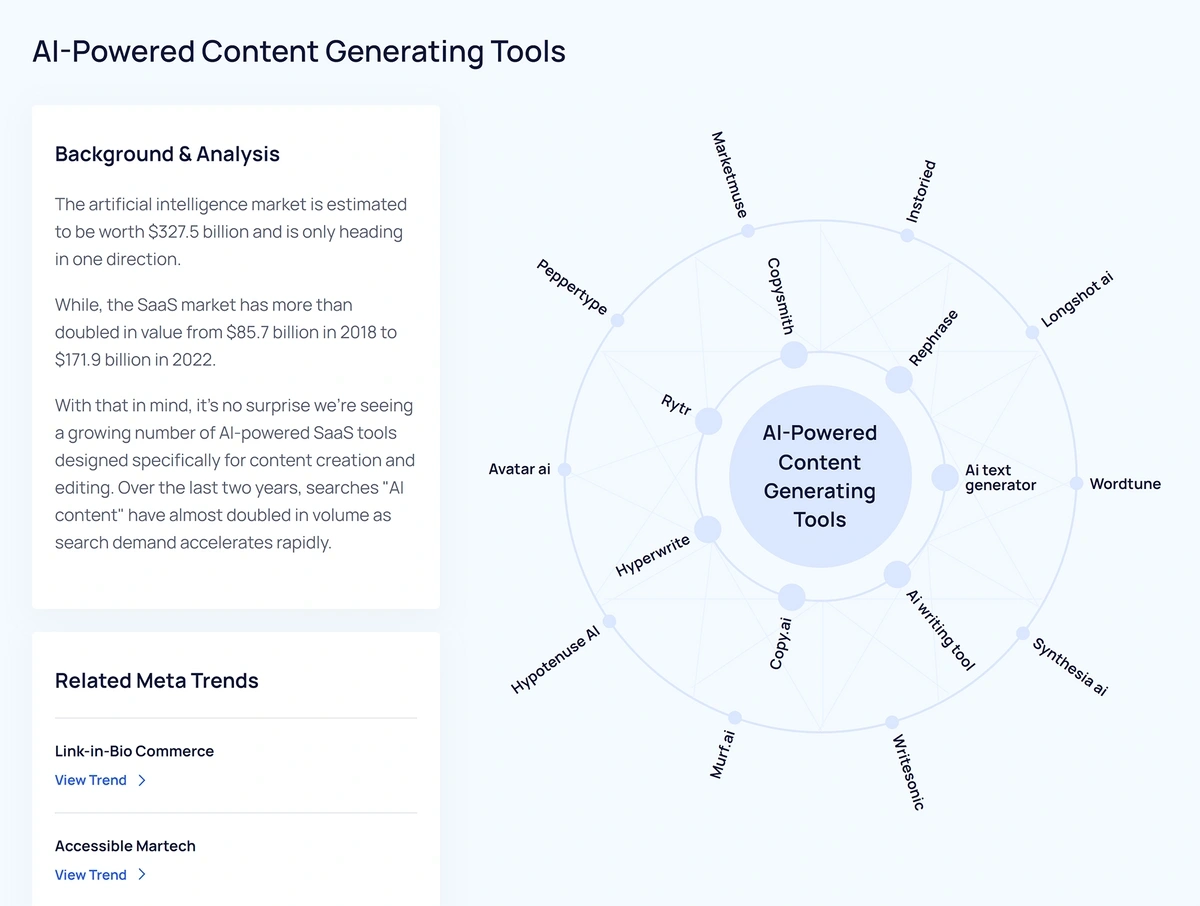

And if you want to dig deeper into the larger trends that make a startup worth watching, you can do so with our meta trend analysis tool. It visualizes connections between trends—ones that create broad industry shifts.

You can track trends of interest too, and revisit them at any time in your Pro workspace.

Give it all a try right now—new users can sign up for a 7-day free trial before joining Exploding Topics Pro for as little as $99 per month (billed annually) after that.

Exploding Topics: Key Details At A Glance

- Best for: Investors interested in identifying high-potential startups before anyone else

- Notable features: Early startup detection, company data, related trend analysis

- Starting cost: $99 per month (billed annually)

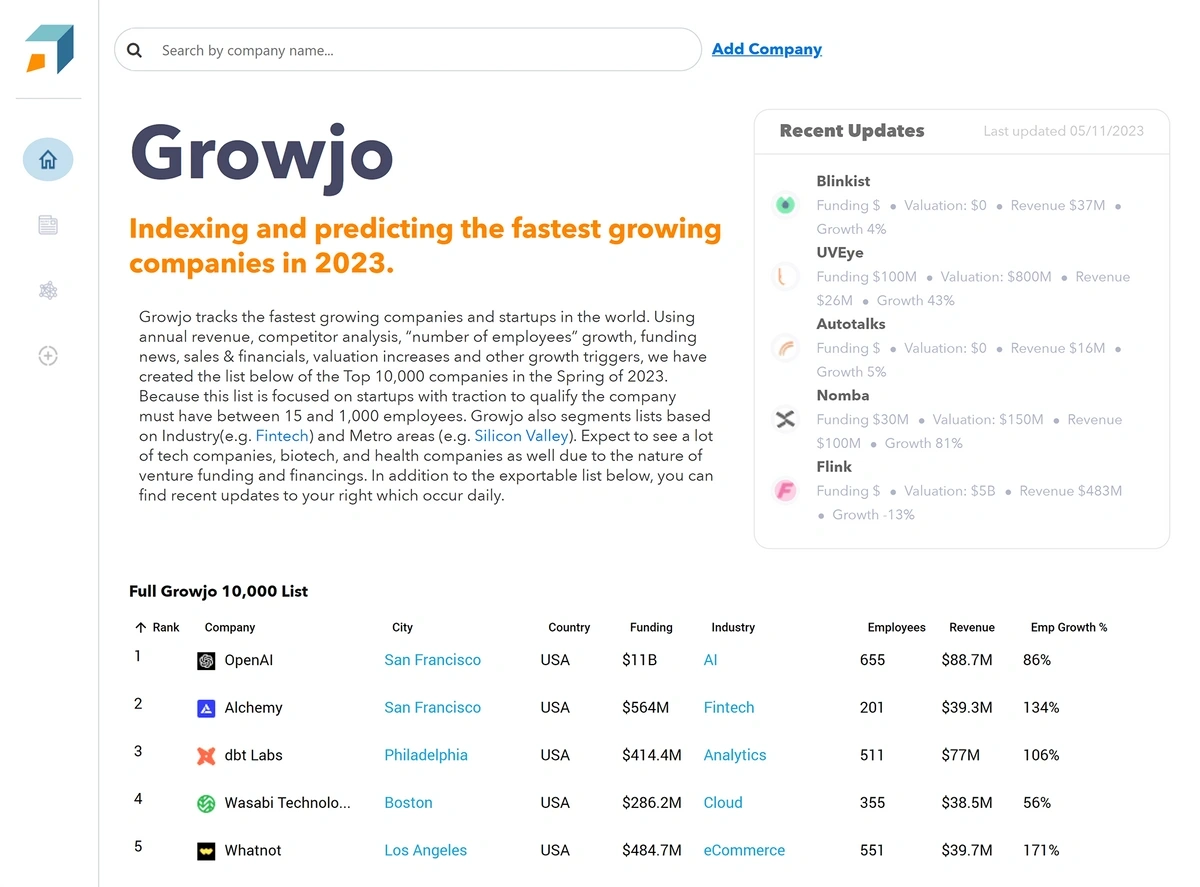

2. Growjo

Growjo is a free database that lists basic startup details including:

- Startup name and location

- Amount of funding

- Number of employees

- Estimated revenue

- Related competitors

The company gets its data from a few different sources:

- Directly from startups

- Blog posts

- News articles

- Public quarterly reports

Growjo also uses an algorithm to calculate estimated revenue for each company in its database.

The Growjo interface is pretty basic—and only updated once per month. If you need a way to quickly browse a list of popular startups and see top-level metrics, then it may work just fine for your needs.

If you need more details about a company’s funding stage and type, or you want to get information on startups that are still under the radar, then Grojo might not be the best alternative to PitchBook out there.

Growjo: Key Details At A Glance

- Best for: Anyone interested in casually checking up on startup valuations

- Notable features: Estimated revenue, free access

- Starting cost: $0

3. Dealroom

The Dealroom database includes information on more than two million startups and 120,000 investors.

You can use the platform to dig up information about:

- Investor strategies

- Investment portfolios

- Startup financials and funding

- Company valuations

- Startup leaders

- Headcount growth

You can also get bespoke research help from the Dealroom team.

Dealroom.co sources its data through a combination of machine learning tools and government reporting. Like other PitchBook competitors, Dealroom runs all of its metrics through a human verification process before publication.

If you’re an entrepreneur who needs details about investors—or you’re an investor who wants someone else to handle research for you—then Dealroom might be worth a closer look.

Dealroom: Key Details At A Glance

- Best for: Investors who want research help; startup founders seeking investors

- Notable features: Bespoke research services

- Starting cost: Custom pricing upon request

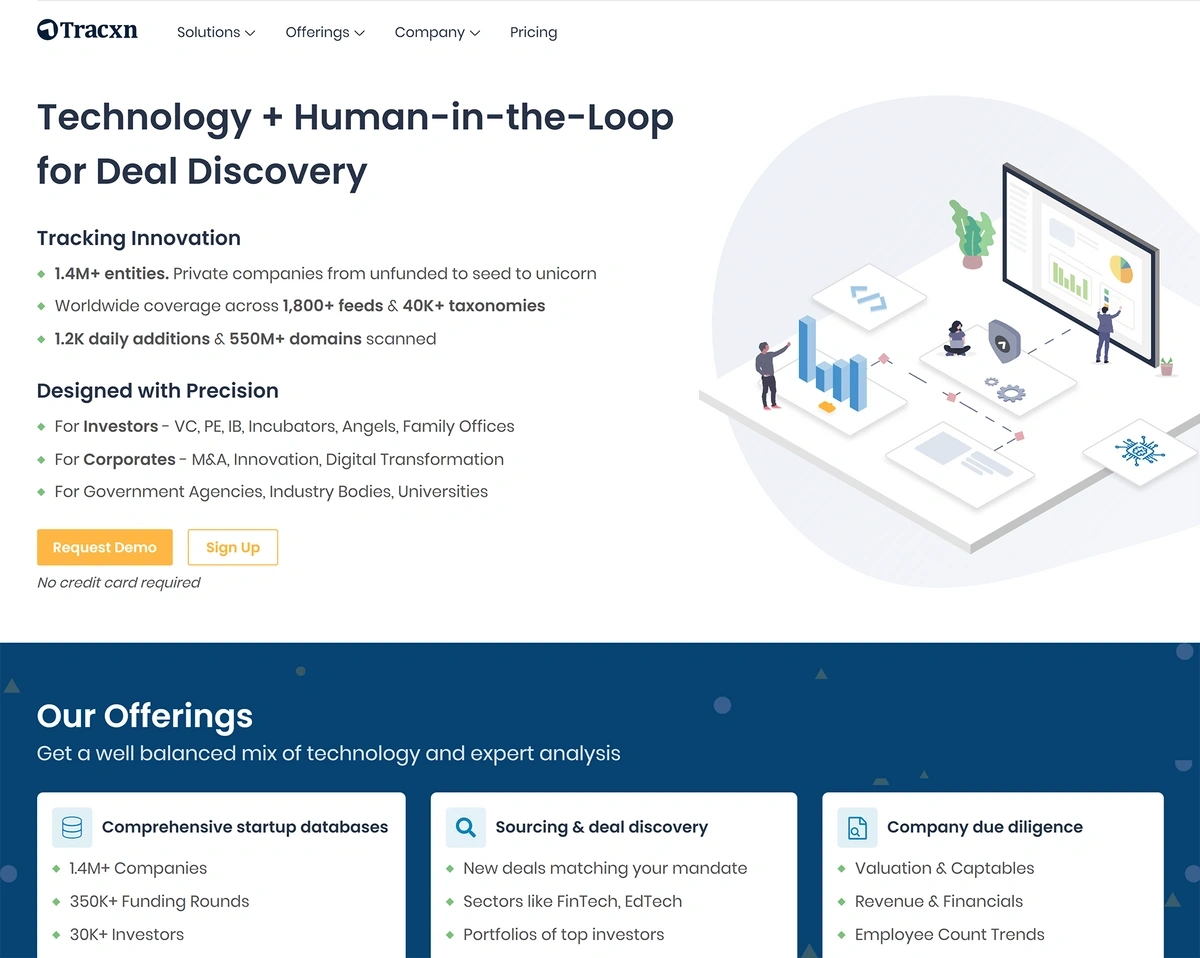

4. Tracxn

Tracxn provides financial and organizational data about more than 1.4 million companies.

You can use Tracxn datasets to research:

- Funding status

- Investor profiles and portfolios

- Top competitors

- Revenue trends

- Valuation patterns

- Hiring trends

- Industry data

Like Growjo, Tracxn’s data providers include the companies listed in its database.

Tracxn is primarily designed for use by VC and PE firms or M&A teams. Interestingly, though, Tracxn also provides data visualizations for use in the news.

So, if you’re a business journalist covering startups, Tracxn might help make your job a little easier.

As for investors, Tracxn offers many features similar to those found in other Pitchbook alternatives—if you like its price and its interface, then it may be worth a try.

Tracxn: Key Details At A Glance

- Best for: VC and PE firms or M&A teams; business journalists

- Notable features: Infographic creation service

- Starting cost: $1,100 per month for three users (billed annually)

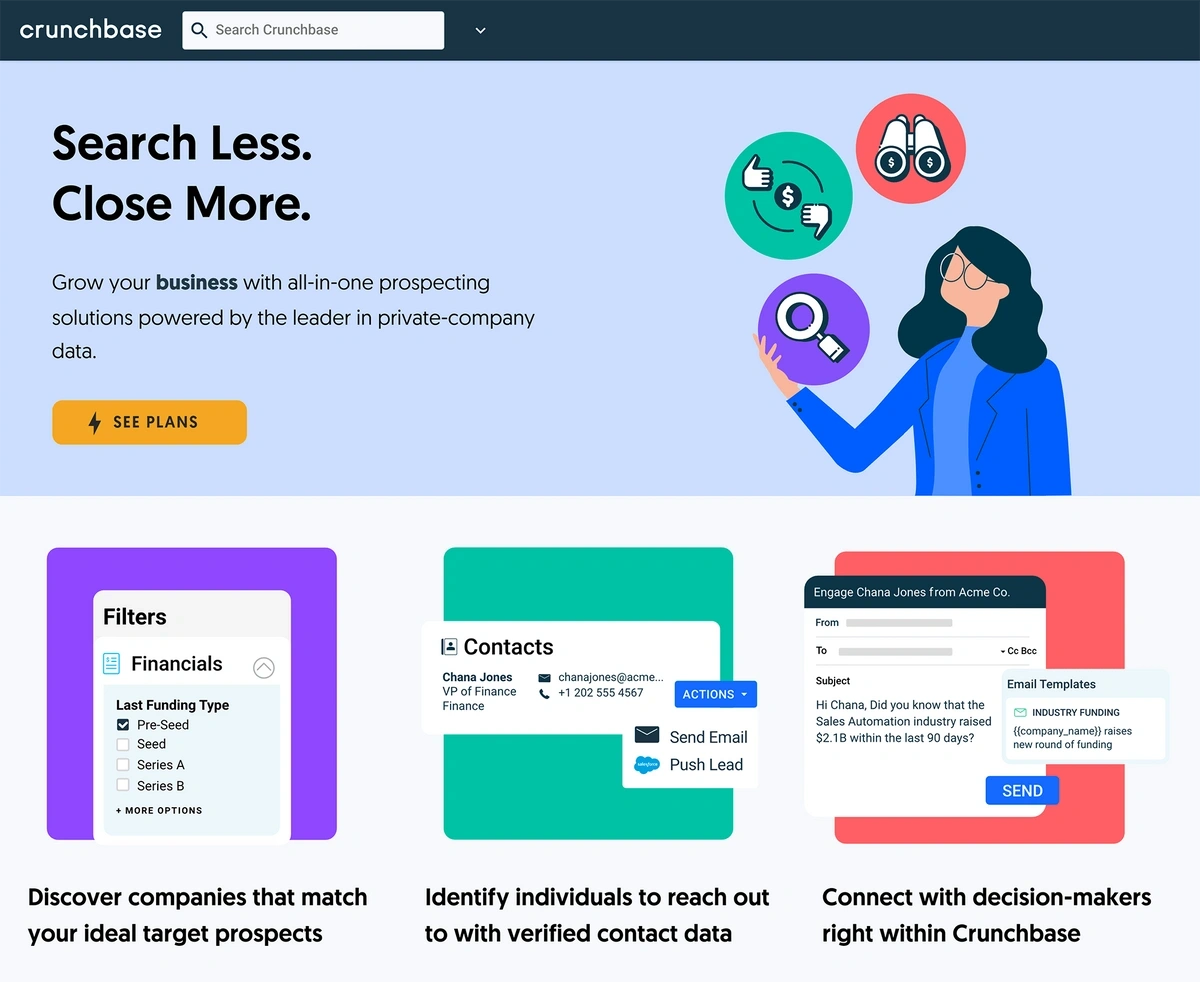

5. Crunchbase

Crunchbase is a multi-use prospecting database that can be used for sales or investment purposes.

When using Crunchbase, you can look up details like:

- Company funding round

- Total funding to date

- Length of operation

- Contact information

- Acquisition history

- Investor names and portfolios

Crunchbase acquires much of its data through:

- Direct submissions from company executives

- Monthly portfolio updates from over 3,700 investors

- AI and machine learning tools

- Human data analysts

One unique Crunchbase feature is the ability to reach out to company decision makers through the platform. If you were considering using Pitchbook for sales-related research, Crunchbase might be a nice alternative.

Crunchbase: Key Details At A Glance

- Best for: Startups seeking investments; VC and PE investors

- Notable features: Contact database and outreach tools

- Starting cost: $29 per month (billed annually)

6. S&P Capital IQ Pro

S&P’s market intelligence platform, Capital IQ Pro, offers up data on more than 50 million private companies.

You can use the tool to uncover financial and ownership information about public companies, too.

Key information in the Capital IQ Pro database includes:

- Corporate transaction details

- Credit ratings

- Risk scores

- Sustainability metrics

- Company growth projections

- Notifications related to tracked companies

- Analyst insights

Capital IQ Pro also includes a visualization tool that allows users to forecast what the footprint and outcome of a merger might be. If you’re serious about acquiring international companies (either public or private), then this feature alone may be worth investing in S&P’s software solution.

However, if you’re primarily interested in obtaining leads for sales or seeking out early-stage startups to invest in, you might not need the full set of tools included in the Capital IQ Pro package.

S&P Capital IQ Pro: Key Details At A Glance

- Best for: Corporate M&A teams

- Notable features: Visualization tool to map the impact of a merger

- Starting cost: Custom pricing upon request

7. Republic

Republic is an online investing marketplace that allows anyone — if they can meet certain financial minimums — to invest in early-stage startups as well as other assets like crypto and real estate.

When using Republic for startup investments, you can access information like:

- Total funding raised to date

- Other non-Republic funding sources

- Funding stage

- Number of employees

- Annual revenue

- Short- and long-term goals

- Key details about company founders and leaders

Republic also provides an overview of the company’s value proposition and easy access to SEC filings and documentation. This can make it a decent option for anyone who’s just beginning to invest in startups, or for founders who are interested in a crowdsourced funding model.

If you are looking to fully acquire a company or obtain an ownership stake through investing, though, Republic might not be the right fit.

You may be better served by conducting your research using one of the other tools in this list and pursuing a more traditional investment agreement.

Republic: Key Details At A Glance

- Best for: New investors, startup founders

- Notable features: Crowdfunding-type investments, online marketplace

- Starting cost: Free to browse; investment minimums vary by company

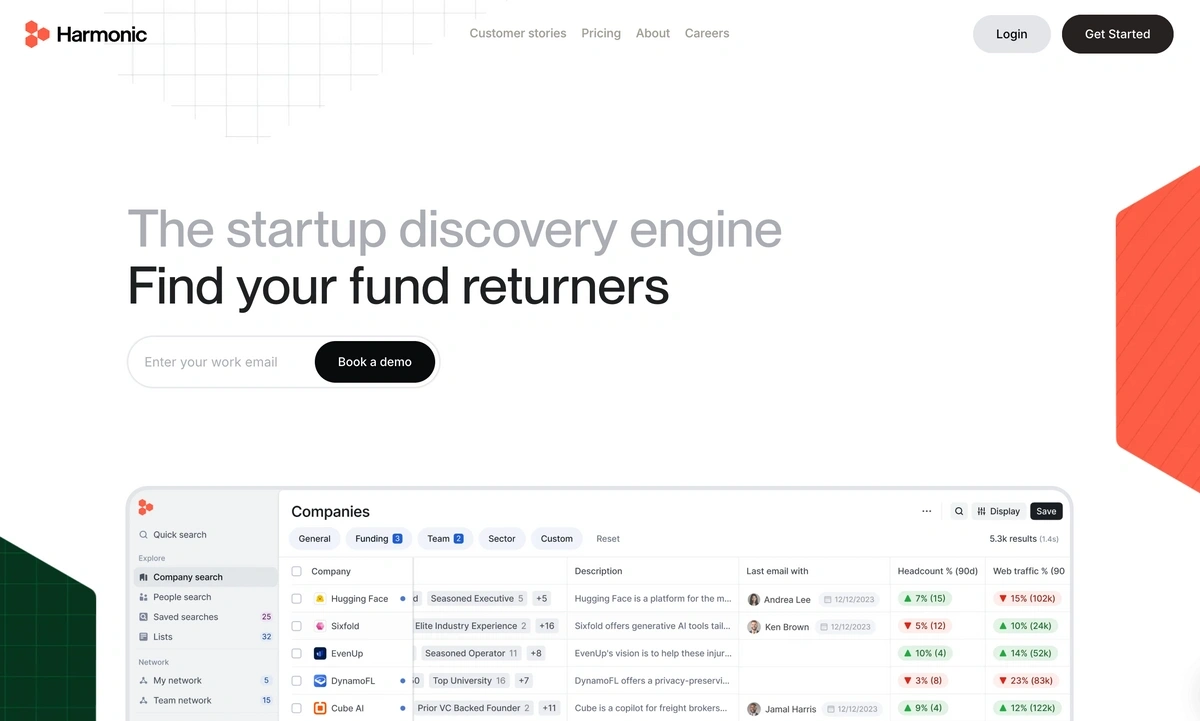

8. Harmonic AI

Harmonic is a startup intelligence platform that helps investors discover, track, and analyze private companies. It aggregates data from millions of sources (such as social media, company websites, and legal filings) to surface emerging startups, founder signals, and recent funding activity in real time.

When using Harmonic, you can:

- Search millions of startup and company profiles across industries, locations, and funding stages

- View detailed company data, including headcount growth, funding rounds, investors, and founders

- Track new financings and key hiring signals in real time

- Compare private companies by valuation, team size, or growth metrics

- Build custom lists of target startups or investors

- Export data to CSV or connect directly via API for deeper analysis

Harmonic also includes Scout, an AI-powered agent that can discover emerging companies, funding rounds, and founder movements that match your criteria.

The platform also enables users to map relationships between founders, investors, and companies. You can see who's invested in whom, identify shared connections between startups and funds, and track stealth companies. While it's not the best option for finding public company data, Harmonic is a popular choice for sourcing early-stage startups.

Harmonic AI: Key Details At A Glance

- Best for: Early-stage startup discovery

- Notable features: AI-powered Scout agent, founder and investor network mapping

- Starting cost: Custom pricing upon request

9. CB Insights

CB Insights is another intelligence platform and PitchBook alternative.

It's useful for investors who want to research specific companies, as well as those who are interested in learning more about entire industries before narrowing down prospects.

First, the platform pulls in information about tech businesses from news outlets, company reports, regulatory filings, stock markets, and industry analysts.

Then, CB Insights uses an AI-powered predictive algorithm to surface trends and help you evaluate which companies might be best for:

- Mergers or acquisitions

- Investments

- Partnerships

You can then take your research one step further by mapping deal flow pipeline, setting up tracked company alerts, and evaluating how investment prospects fit into their related markets.

CB Insights: Key Details At A Glance

- Best for: Small or large VC firms

- Notable features: Datasets submitted directly by participating tech companies

- Starting cost: Custom pricing upon request

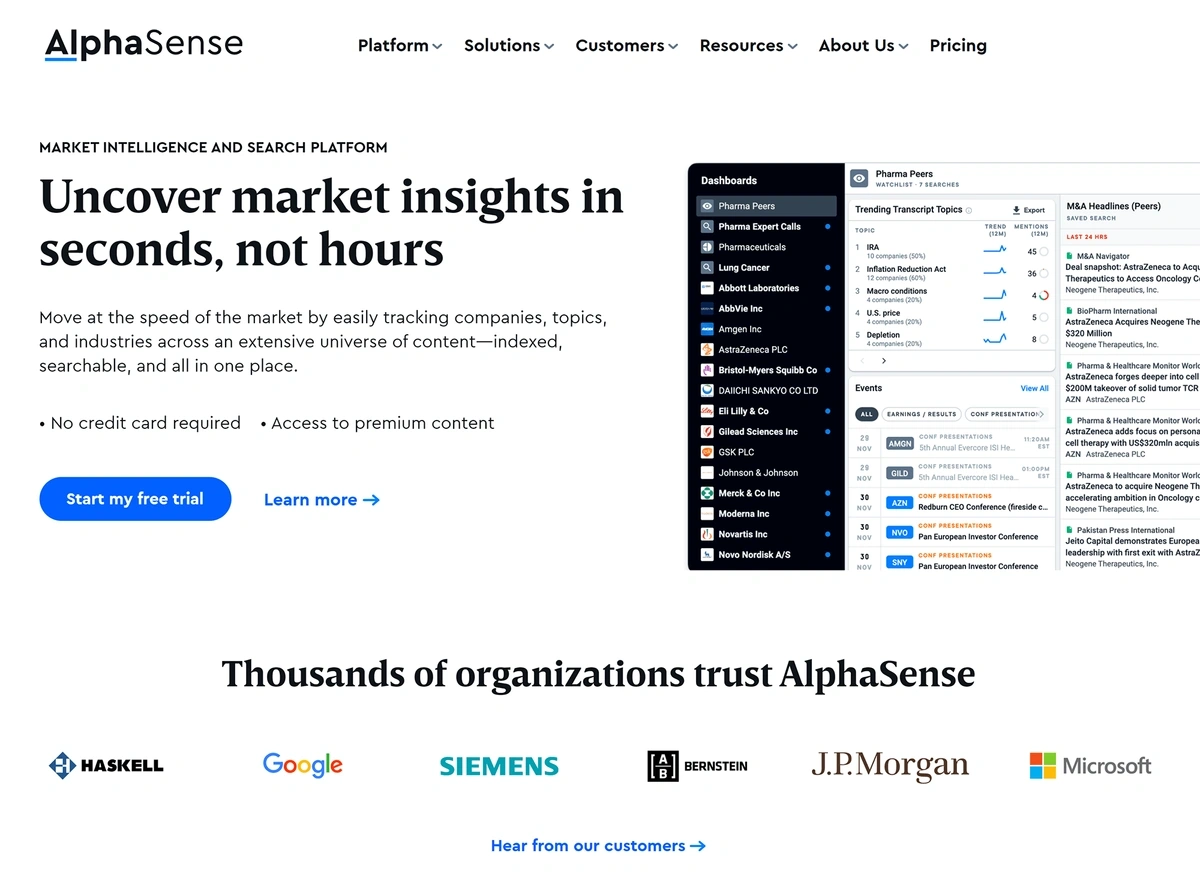

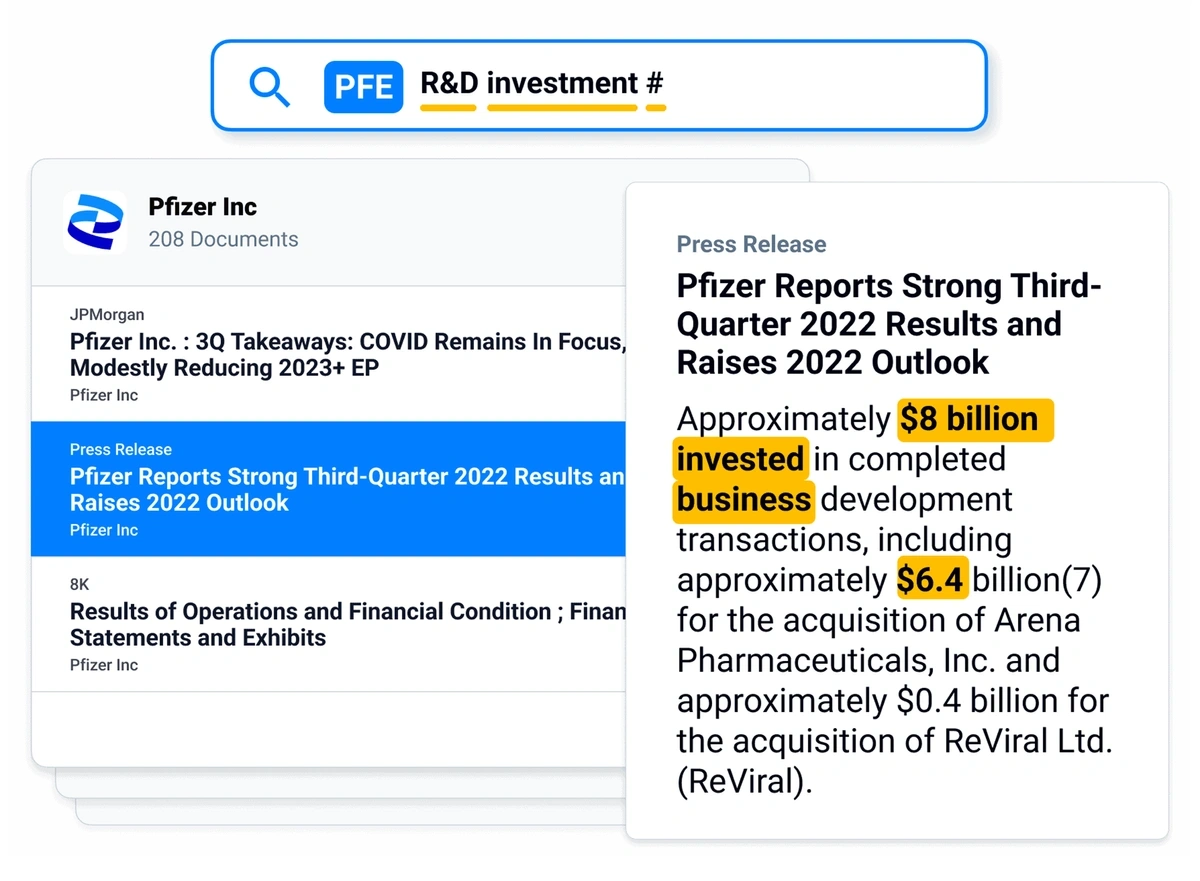

10. AlphaSense

AlphaSense is an AI-enhanced search tool for conducting market research.

Rather than combing through countless results on a Google search page, investors can turn to AlphaSense to quickly surface information including:

- Stock market price changes

- Upcoming shareholder events

- Earnings call transcripts

- Expert broker research reports

- Financial news

- M&A activity

- Regulatory statements

AlphaSense makes it easy to search for this information, too—you can simply enter a publicly traded company's ticker symbol and the topic you're seeking information on.

The tool will then produce a list of documents and results with matching terms for your review.

AlphaSense gives you access to more than 10,000 content sources and 300 million documents—including 35,000 call transcripts—right out of the box.

You can also upload, index, and search your firm's internal documentation.

AlphaSense: Key Details At A Glance

- Best for: Investment firms interested in tracking market data and organizing internal documentation all in one spot

- Notable features: AI-powered search function

- Starting cost: Custom pricing upon request

Conclusion

When it comes to investing in companies, early access to information is vital.

Exploding Topics is a great choice if you want access to new startup data before anyone else, as more than 73% of our listed companies can't be found through other portals.

And if you're focused on M&A, then PitchBook, CB Insights, and Dealroom are all solid choices.

Whatever your preference or goal, you'll want to choose a tool—or set of tools—that allows you to access new opportunities before other investors interested in the same market.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more