Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

CB Insights vs. PitchBook: The Best Research Tool for Investors in 2024

This is a detailed breakdown of Pitchbook and CB Insights.

Both are well-established sources of research that offer a wide range of data, analysis, and insights into venture capital, private equity, and M&A activity. But, as an investor, which is the right one for you?

In this post we put these two data giants under the microscope, helping you decide which one is the perfect fit for your needs.

CB Insights: Product Overview

CB Insights offers investors an extensive database on hundreds of thousands of startups with detailed financials, industry trends, and news about new investments.

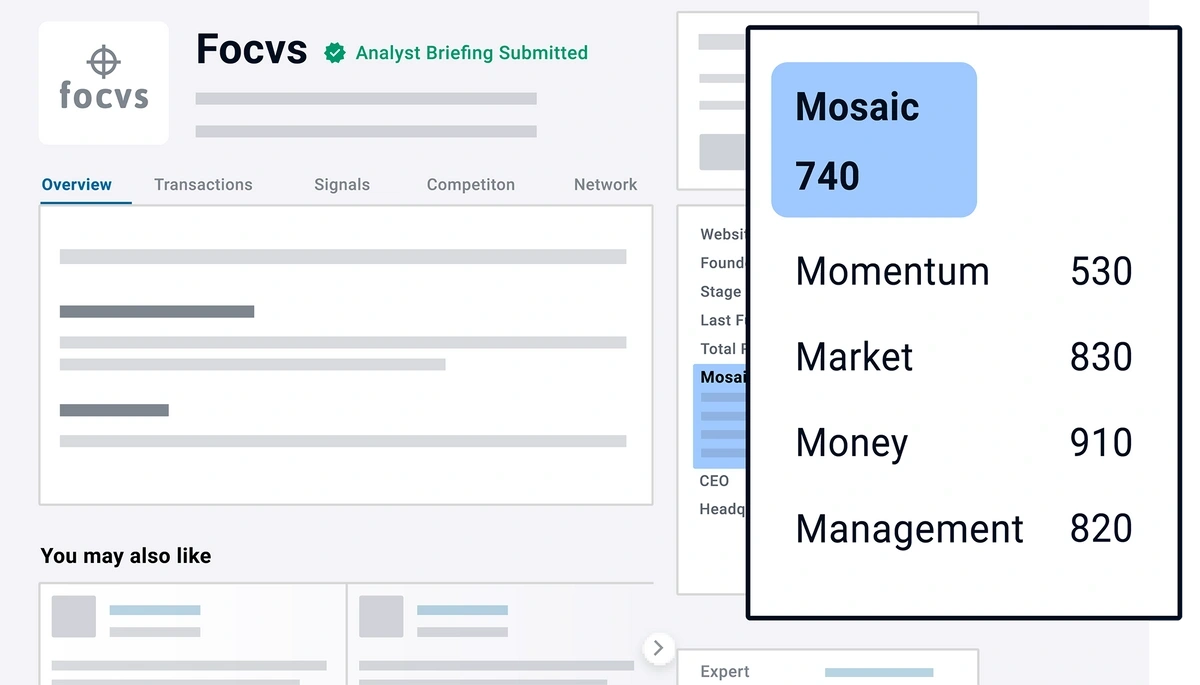

The platform also provides access to proprietary analytics, such as Mosaic scores, that measure startup health across various industries.

With its AI-driven algorithms, CB Insights can quickly identify potential investment opportunities by analyzing large datasets from around the world. Plus, it allows you to search for companies based on your desired criteria, such as location or sector focus, so you can find the best possible investment targets.

Over 500 leading organizations now use CB Insights, including major banks like Goldman Sachs, corporations such as Microsoft Ventures, and media outlets like Bloomberg Businessweek, which have all recognized its value as a powerful tool for understanding market trends across tech sectors.

CB Insights: Key Features

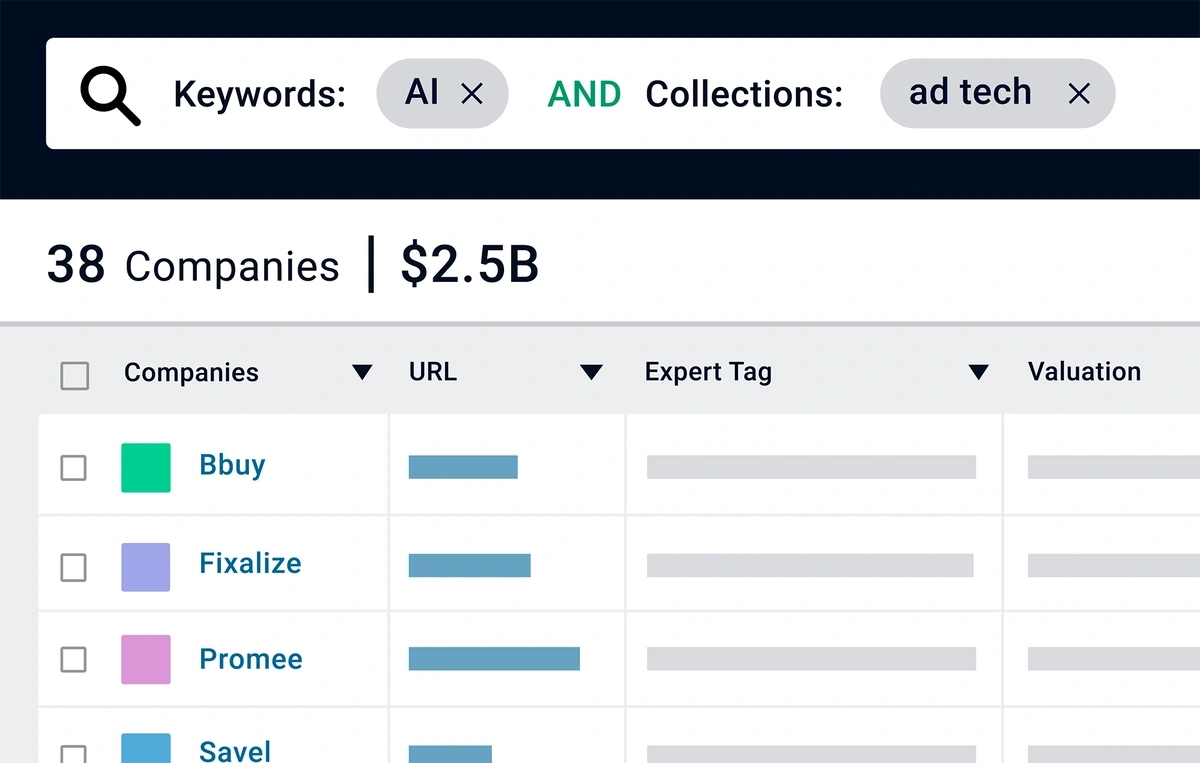

Tech Search Engine

Find new tech or monitor market or company trends via CB Insight’s technology search engine. Run your specific query and then drill down into company details, create collections, and sort your results by valuation, geography, maturity, or other useful filters.

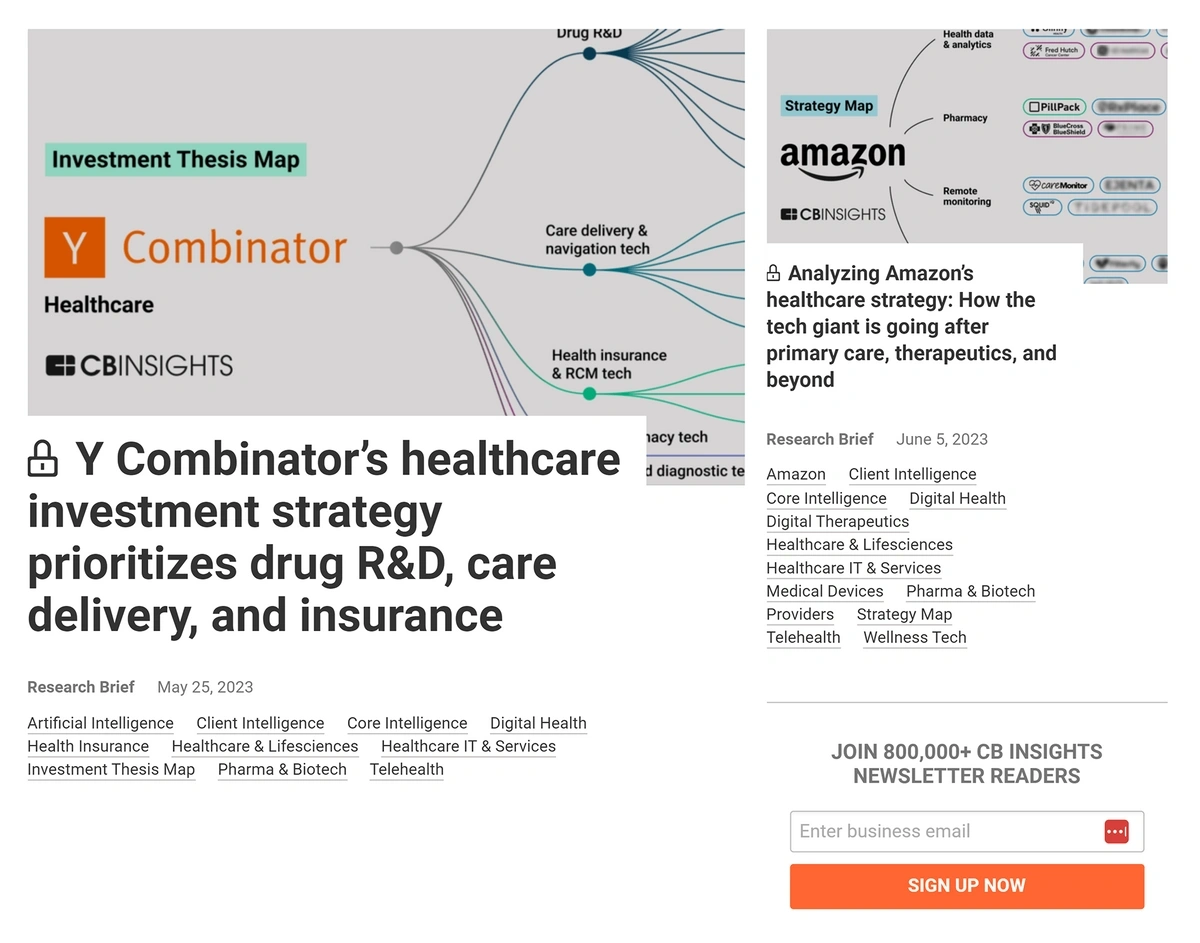

Industry Reports & Research Tools

CB Insights provides industry reports and investment research tools to help you better understand market trends across tech sectors. That way, you can make informed decisions when considering potential investments, as well as gain an understanding of the sector’s current landscape.

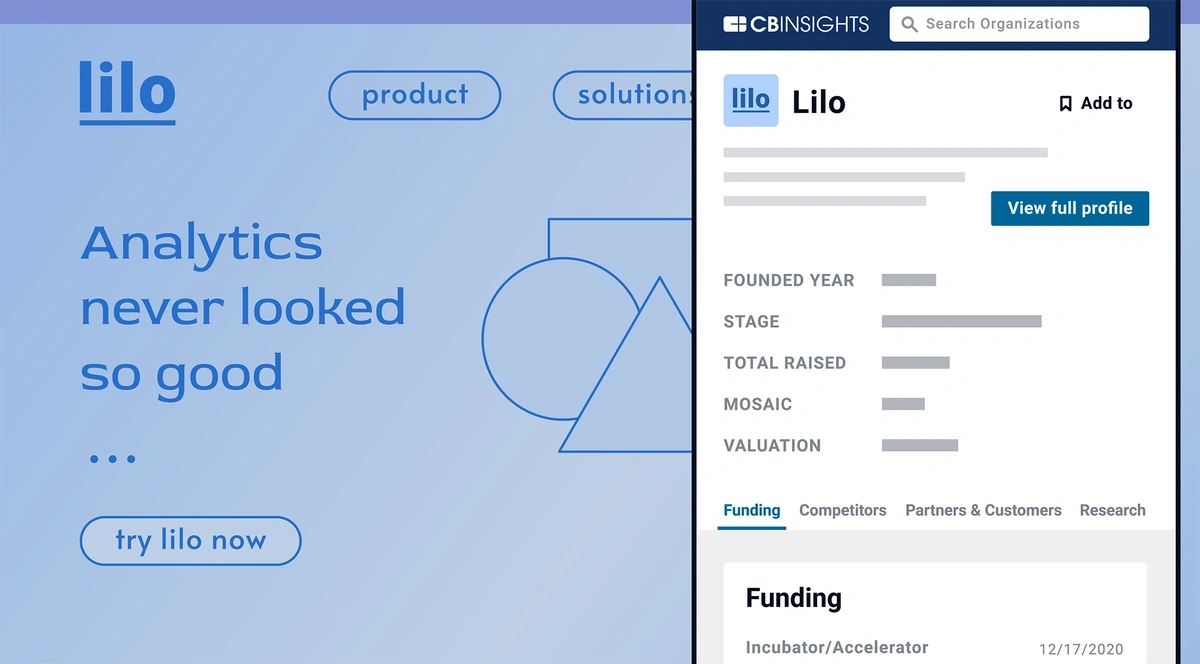

Browser Extension

Access any CB Insights company profile with just a highlight and a click to get an at-a-glance breakdown of any company in the database, including details on funding, competitors, business relationships, and more. Or open up the extension to input a quick company search in the search bar to find the information you need fast.

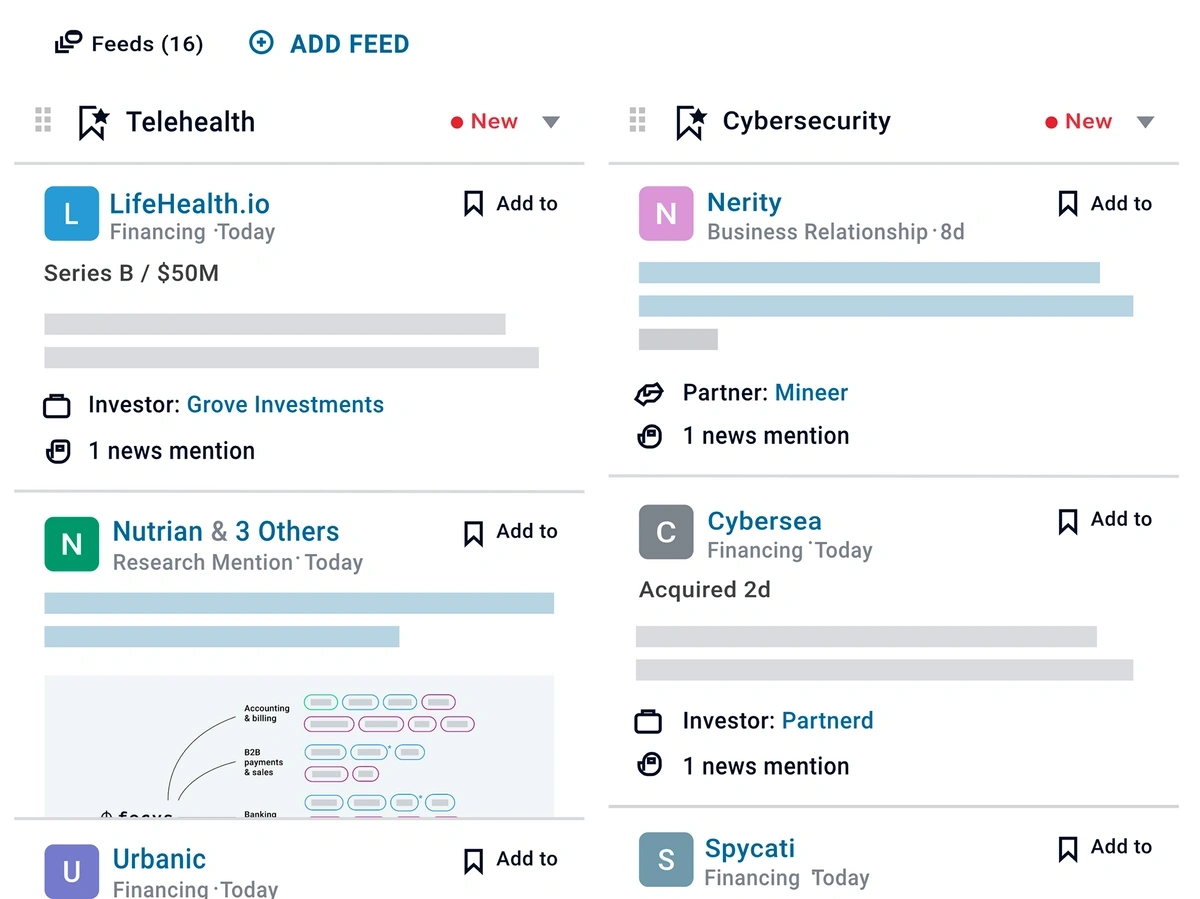

Live Data Feeds & Dashboards

Access live data feeds with real-time updates on relevant news and industry information, so you stay up-to-date with the latest developments in your sector. Additionally, you can create custom dashboards that display all the important metrics you need in one easy-to-understand view.

Machine Learning & AI Analysis

CB Insights uses machine learning and advanced analytics to identify potential investment opportunities and provide insights into private companies that are often overlooked. This makes it easier for you to make educated decisions about your investments.

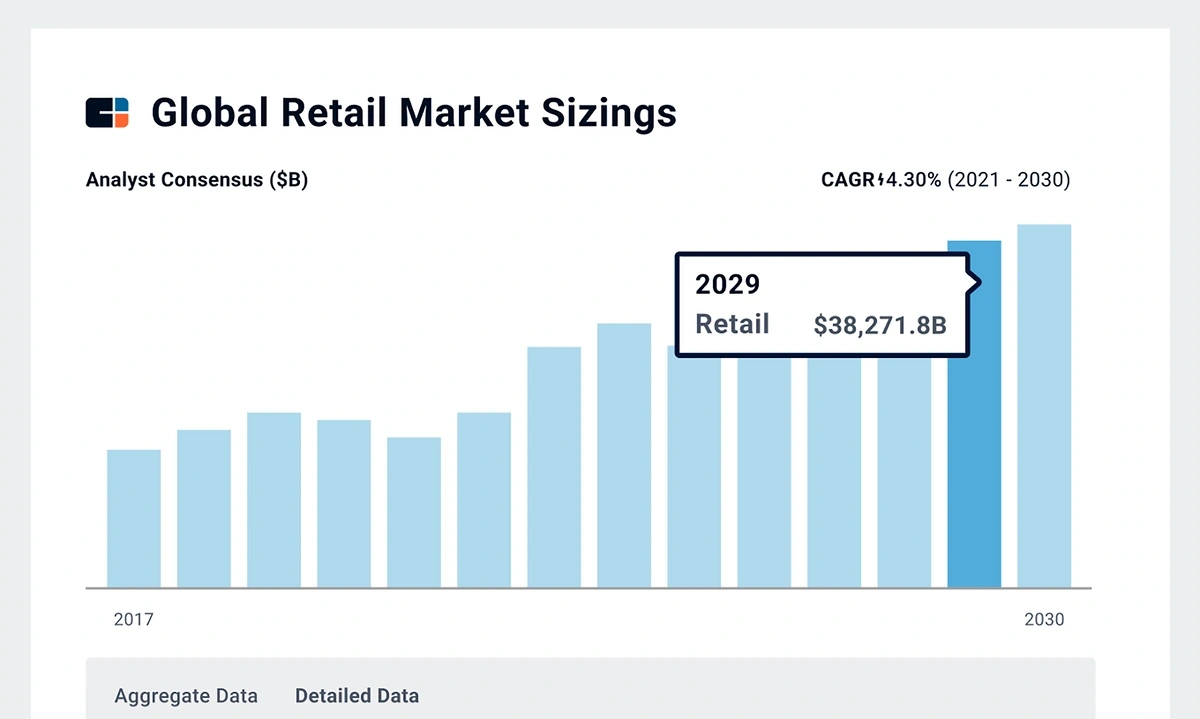

Market Sizing & Forecasting

With its market sizing and forecasting capabilities, the CB Insights platform allows you to size up markets before investing in them as well as helping you make predictions about future market trends.

Investment Opportunities Finder

CB Insights’ Investment Opportunities Finder is a powerful tool that helps business owners find the right investor for their business from its network of over 500 leading organizations worldwide. This includes both venture capital firms such as Sequoia Capital and media outlets like Forbes.

Automated Valuation Model

The platform also provides an automated valuation model to help you accurately estimate the value of potential investments. This model takes into account factors such as market size, competitive landscape, and financial performance of a company in order to arrive at a more accurate assessment of its worth.

Proprietary Mosaic Score

Formulated to help you predict startup success based on a wide range of factors (not just financial), the Mosaic score consists of four criteria:

- Momentum

- Market

- Money

- Management

CB Insights: Reviews

Scores

G2 score: 4.3 out of 5 (based on 14 reviews)

TrustRadius score: 8.2 out of 10 (based on 17 reviews)

3 Things People Like About CB Insights

1. Its comprehensive and high-quality database

- "Excellent database of vendors for digital projects, they have (a) curated set of collection(s) of vendors with scoring provided for each."

- "CBInsights provides (an) up to date collection of VC funding in emerging technologies areas such as AI, Cyber, Climate Tech among others."

- "Good database of emerging tech startups with expert collections and good quality research reports."

2. The quality and timeliness of research reports

- "The research reports are also quite good."

- "Good quality research reports."

- "The research reports that they publish are quite good. Notably the ones covering the VC landscape in terms of what specific investors are doing in each industry. There's also a news-like quality to reading their reports where they feel more timely than the standard quarterly reports that other platforms such as Pitchbook publishes."

3. Its unique insights and analysis

- "Brilliantly analyzes in real-time every and any marketplace that you are looking to best understand."

- "They have access to private company data. But the team that adds their own intelligence is even better than the AI they use."

- "You could find great insights on big companies strategies like Amazon, Google, Apple, Uber and so on."

2 Things People Dislike About CB Insights

1. User Interface and Search Functionality

- "The UI is (a) little complex to use, especially the advanced search functionality. They can make it more user friendly by adding drag and drop options etc."

- "The UI is (a) little clunky, it takes time to get used to it."

- "Interface and searching is easy to use, but hard to refine to get what you're really looking for if you want to get hyper-specific or filter on less traditional variables."

2. Limited Expert Collections and Lack of Updates

- "The expert collection of startups are also underwhelming. They can work on it to keep it updated, peers like Tracxn are going way ahead here."

- "I have experienced that compared to its competitor database (Tracxn, Pitchbook), there are limited 'expert collections' - so every time I end up building a query to create my own collection of startups for a particular use case."

CB Insights: Pricing

CB Insights doesn’t reveal their pricing publicly. However, some sources have indicated that their plans start at $60,000 per year and can go up to $265,000 for the all-inclusive Insider package. Users have noted that, based on pricing alone, the platform is better suited to larger firms or established investors.

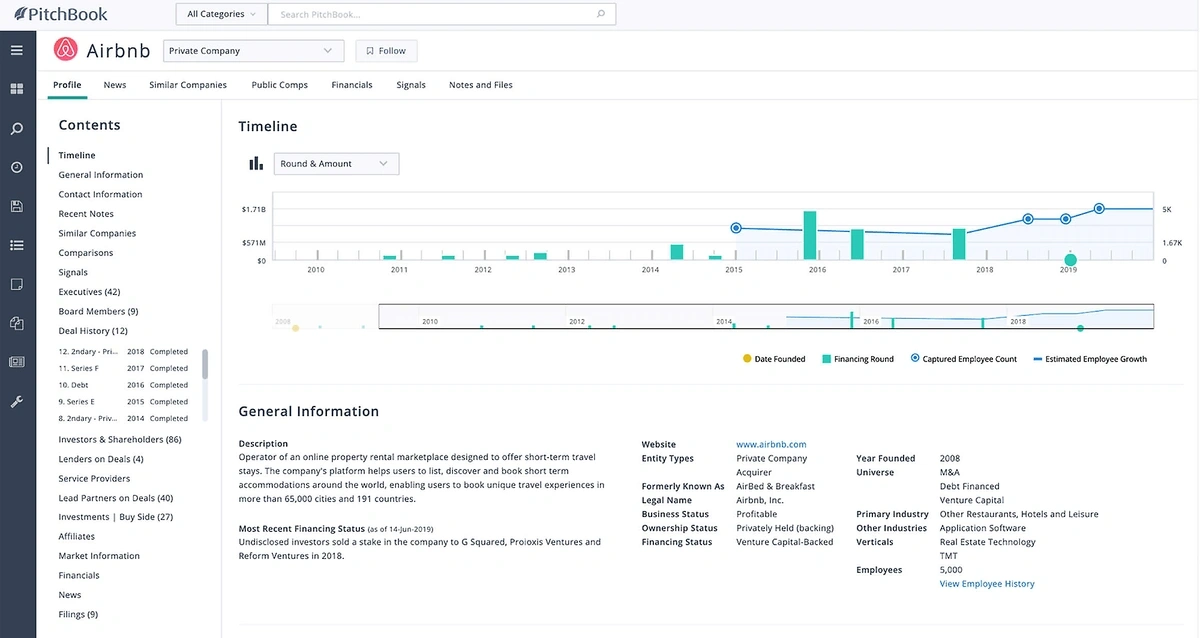

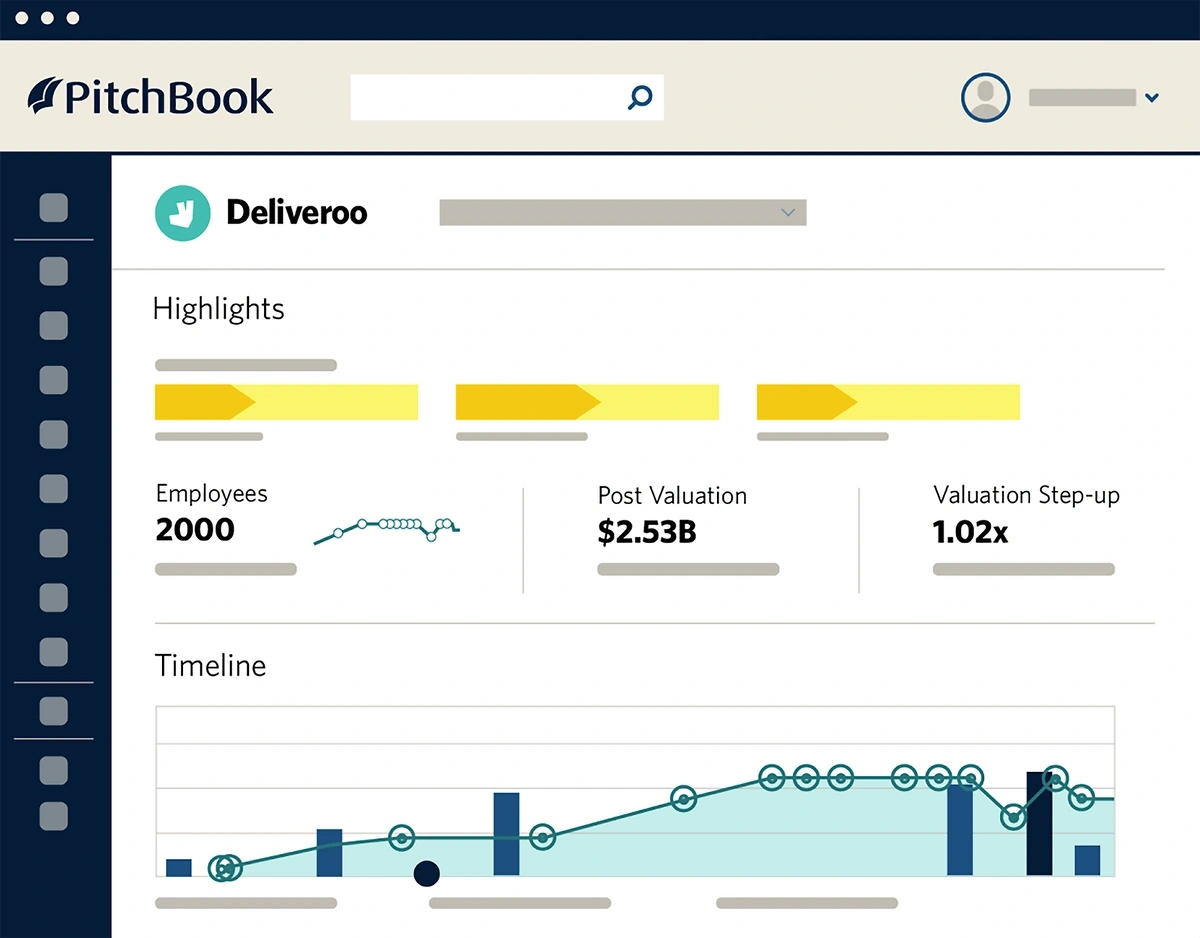

PitchBook: Product Overview

PitchBook offers a comprehensive suite of financial data, analysis, and insights for investors.

It provides users with access to a global database of private companies with detailed insights into their operations, finances, and market trends.

Pitchbook is ideal for helping investors identify potential investments or uncover new opportunities in the industry. Its portfolio management tools allow users to track performance metrics over time while its advanced analytics provide valuable intelligence on alternative investments such as private equity and venture capital.

The platform today provides research tools to over 19,000 firms worldwide, including hedge funds, private equity firms, venture capitalists, corporate acquirers and investment bankers. Its proprietary database includes data on over 70,000 private equity firms, investors and funds, as well as 500,000 M&A transactions.

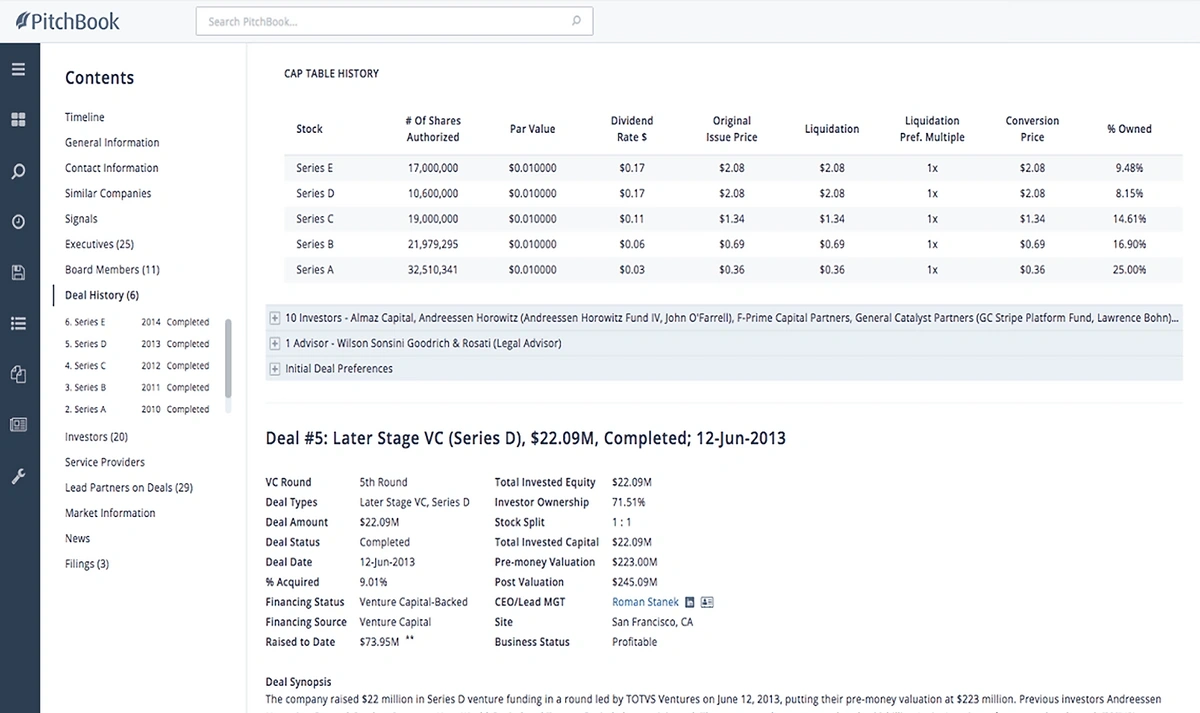

PitchBook: Key Features

Private Company Database

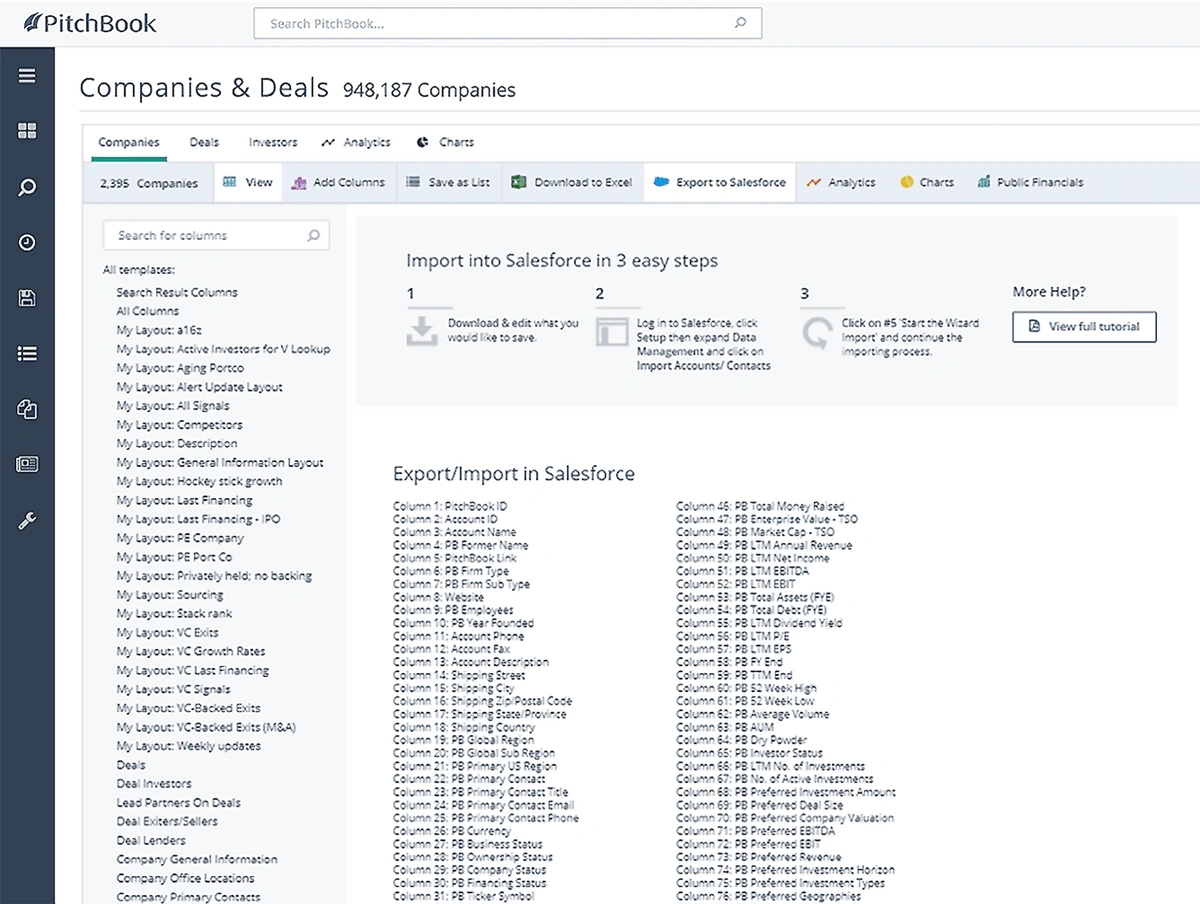

Quickly find information on relevant companies with PitchBook’s database of more than 3 million private companies across multiple industries. This includes financials, funding history, and investor profiles, so you can easily identify startups that are well-positioned for success.

Comprehensive Research Reports

Get detailed research reports on various topics related to private markets, such as the latest M&A activity, venture capital investments and private equity trends. These reports are regularly updated and provide up-to-date information that helps you stay ahead of the curve.

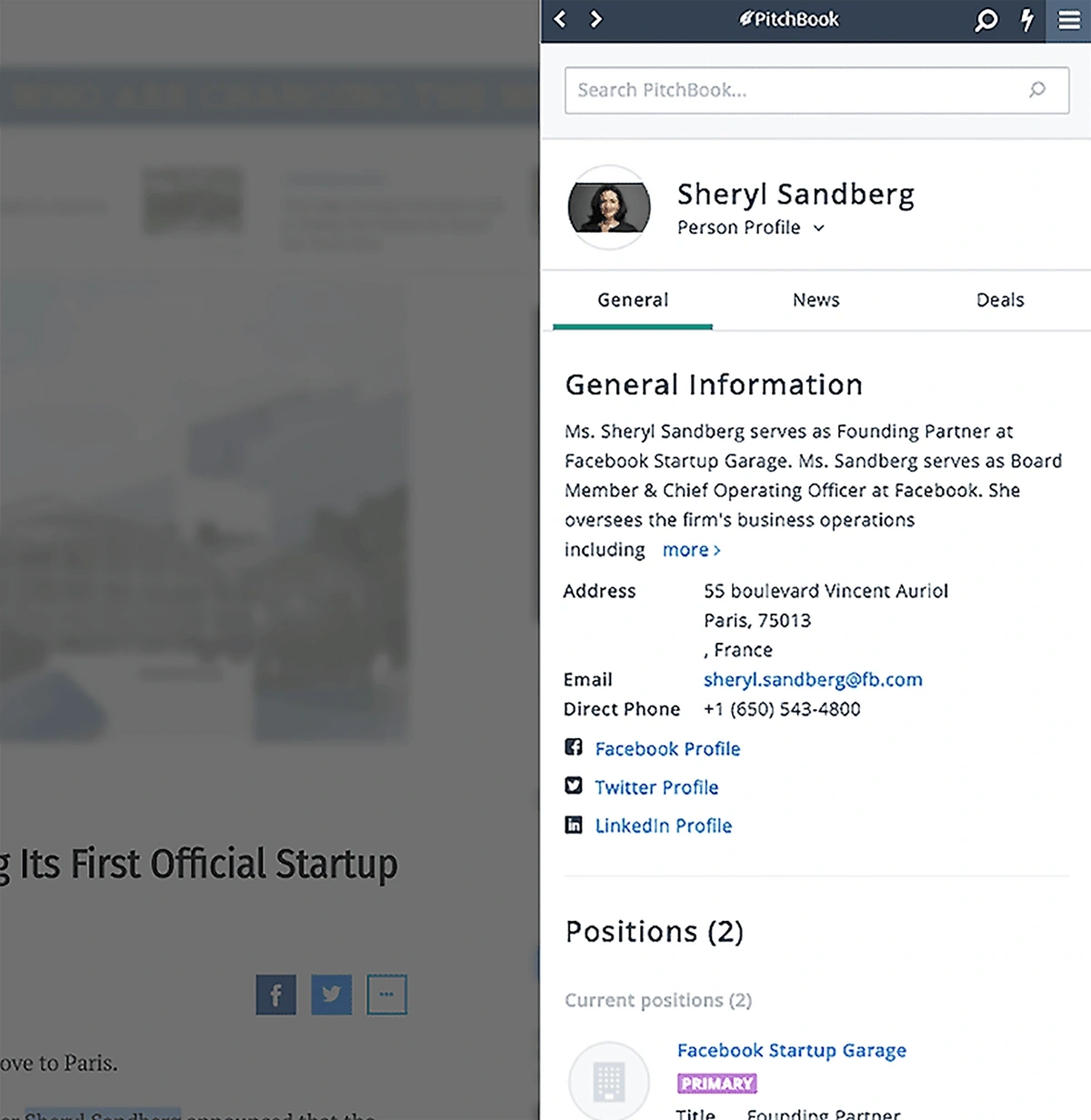

Chrome Extension

Like CB Insights, PitchBook offers an extension you can add to your browser to quickly access PitchBook’s data while visiting a website or doing your research online.

Deal Alerts

Pitchbook’s deal alert feature notifies you when a company they are tracking raises money or has other key developments related to its financial health. This real-time data helps you make informed decisions about your investments quickly and efficiently.

Comparison Tools

Pitchbook offers comparison tools that allow you to compare companies side by side in order to uncover potential investment opportunities or perform thorough due diligence on existing businesses.

Portfolio Tracking

Track the performance of your investments over time and analyze how your picks have performed in the past so you can make adjustments going forward.

News & Commentary

Pitchbook’s news and commentary section provides users with access to daily updates on market trends as well as timely analysis from leading industry experts. This helps you stay up-to-date on important developments in the world of private markets and identify potential opportunities before others do.

Valuation Modeling

The platform also offers a comprehensive valuation modeling tool that allows you to accurately estimate the value of potential investments. This model takes into account a range of factors such as market size, competitive landscape, customer demand and more, helping investors make better decisions.

CRM Integration

Offered as an optional add-on to your PitchBook subscription, you can improve your outreach with PitchBook’s data connected directly to your CRM to cut out additional steps and save you time.

PitchBook: Reviews

Scores

G2 score: 4.3 out of 5 (based on 45 reviews)

TrustRadius score: 8.7 out of 10 (based on 55 reviews)

3 Things People Like

1. Comprehensive and Detailed Database˝

- "The feature of Pitchbook that appeals to me the most is that it is a thorough database with details on several startups, financiers, and venture capital agreements."

- "Fantastic and extremely thorough database for background research needed for M&A transactions."

- "Pitchbook has a huge selection of companies from all over the World, with a focus on the US and EMEA. They have up-to-date information on public and private companies as well."

2. Useful Screeners and Search Capabilities

- "I find it extremely useful to run screeners that incorporate different criteria to draw up a comprehensive list of buyers, sellers, investors and companies."

- "With Pitchbook I can easily have a clear picture of a specific company related to recent funding, M&A, management and where available financial data. I also like the ability to pull a list of compan(ies) based on selected criteria to then export to Excel."

- "I appreciate how easy it is to use. The product is very customer centric. The ability to search different pieces of information about companies is incredibly helpful."

3. High-Quality and Informative Reports

- "Also, Pitchbook frequently publishes informative reports. These studies include in-depth analysis on subjects like the busiest VC firms, the most valuable startups, and the biggest VC transactions."

- "They offer a variety of research reports and analyst's notes."

2 Things People Dislike

1. Incomplete or Outdated Data

- "The data for companies and investors is either incomplete, missing, or well out of date."

- "The data can often be stale and dated. Information such as contact information especially is unreliable."

- "Furthermore, the material on Pitchbook is not always current or correct, so you might need to conduct further investigation to confirm the data you discover."

2. Difficult User Interface and Navigation

- “Finding the information you need may take some time due to the difficulty of the navigation and search processes."

- "The UI is a little clunky and it is sometimes hard to find a specific piece of information you're looking for."

PitchBook: Pricing

PitchBook doesn’t make its pricing information known publicly, but certain users have suggested that pricing is around $12,000 per year per seat. This information doesn’t include if there is a minimum number of seats required or if there is a minimum commitment requirement.

That being said, this pricing would make PitchBook cheaper than CB Insights. However, as users say, it’s quite costly for smaller firms, but worth it for larger ones. There is a third option we’ll cover below if you’re interested in a highly cost-effective option.

CB Insights vs. PitchBook: Detailed Breakdown

Target Users

CB Insights might be a better fit for the following:

- Technology Analysts and Strategists: CB Insights has a strong focus on technology sectors, tracking startups, emerging tech trends, patent activity, and more. This makes it a valuable tool for tech-focused professionals who need to stay on top of the latest developments in the technology landscape.

- Innovation Teams and R&D Departments: With its predictive analytics and patent analytics, CB Insights can provide valuable insights for teams looking to innovate or develop new technologies.

- Venture Capitalists and Angel Investors: The platform's extensive data on startups, combined with its predictive analytics capabilities, can be valuable for investors looking for promising investment opportunities.

PitchBook might be a better fit for the following:

- Private Equity Professionals: PitchBook has a strong focus on private equity, with comprehensive data on PE firms, funds, and deals. This makes it an excellent tool for private equity professionals.

- Investment Bankers: With its detailed transaction data, valuations, and comparables analysis, PitchBook can be a valuable tool for investment banking professionals involved in M&A, IPOs, and other transactions.

- Business Development Professionals: PitchBook's extensive data on companies and investors, combined with its CRM integration feature, can be useful for business development professionals looking to identify and track potential partners or clients.

- Financial Market Researchers and Analysts: The platform's extensive data on financial markets, combined with its research reports and industry analysis, can be valuable for researchers and analysts studying financial markets and trends.

Differentiators

Overall, CB Insights is the stronger data source, both in terms of the scope of data and its quality. CB Insights also utilizes AI and is better suited for investors interested in tech companies and startups. Pitchbook might not have the same quality of data, but it is the more affordable option. Pitchbook’s market focus is more on private equity and generally offers more financial information on private companies and M&A transactions.

Data Quality

When it comes to data quality, CB Insights has a clear edge over Pitchbook. The platform is known for its rigorous data verification process, which ensures the accuracy of its datasets. Plus, they regularly update their database with the latest information and trends in the market.

Pitchbook does provide access to an extensive dataset, but its data quality can be inconsistent at times. Additionally, its proprietary metrics may not always reflect the true state of the market as accurately as CB Insights.

Customer Support

Both CB Insights and Pitchbook provide excellent customer support, including responsive phone and email support, as well as online chat support. Additionally, CB Insights offers specialized support that can help customers with customized queries and research needs, while Pitchbook offers targeted webinars and training sessions.

Key Differentiators

The key differentiators between CB Insights and Pitchbook come down to the level of detail and depth provided. CB Insights is known for its comprehensive market maps that offer granular details and insights about various industries and startups, while Pitchbook provides more in-depth data around deals, funds, and investors.

Another area of differentiation is Pitchbook’s advanced analytics tools, which allow you to create customized reports and gain deeper insights into market trends.

| CB Insights | PitchBook | |

| Key differentiators | Higher-quality data source, more granular details around tech companies and startups | Market focus on private companies, rich analytical tools, data on deals and M&A transactions |

| Target users | Tech analysts and strategists, innovation teams and R&D departments, VCs, angel investors | Private equity investors, investment bankers, business development professionals, financial market analysts |

| Data quality | Rigorous data verification process, more frequent updates to data set | Extensive dataset but notable occasional inaccuracies noted by users |

| Customer support | Responsive phone, email, and chat support, help with queries and research needs | Responsive phone, email, and chat support, targeted webinars and training sessions |

| Pricing | $$$$ - by custom quote only | $$$ - by custom quote only |

Conclusion

The platform that best suits you will depend on your needs and how you plan to use it. If you’re on the fence, take advantage of each platform’s customer support team. It’s a great opportunity to ask questions that pertain to your needs but also to gauge how accessible and helpful their customer support teams are.

That being said, there is a third option if you’re looking to get ahead of trends before they blow up.

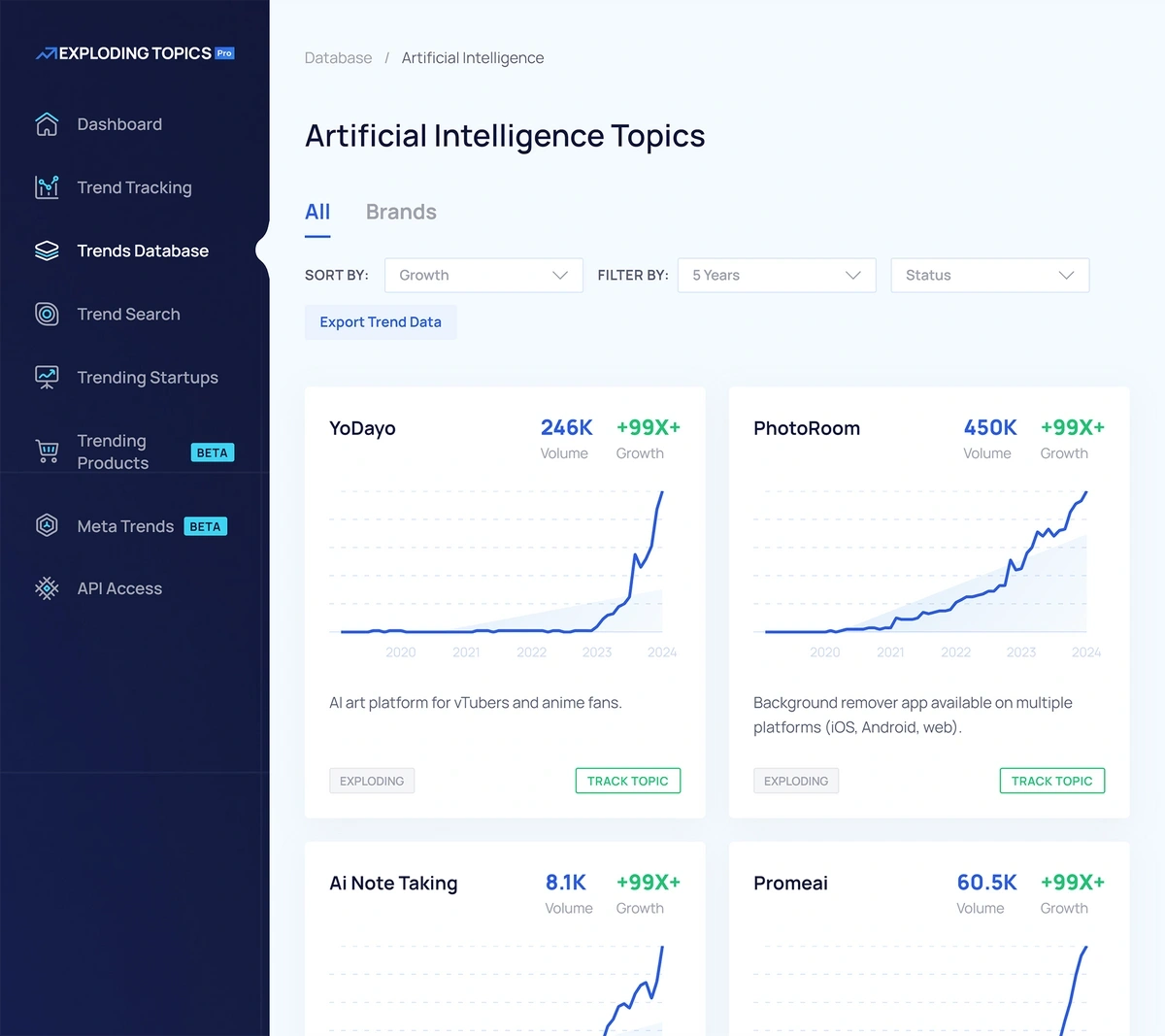

Bonus Option: Exploding Topics Pro

As a third option, you might also consider Exploding Topics Pro, which offers additional insights to help investors identify new opportunities.

It uses AI-driven algorithms to track and analyze trends across the internet in real time so you can spot emerging business trends 6+ months before they take off.

Exploding Topics Pro offers this and more at just a fraction of the price of CB Insights or PitchBook, with our Investor plan starting at just $99 per month. Theoretically, you could start off with Exploding Topics Pro if you’re a smaller firm without a huge budget, or you could use Exploding Topics Pro alongside either CB Insights or PitchBook.

With Exploding Topics Pro, you get access to the full Trends Database, where you can search by company or industry to find what you’re looking for. You can keep up with the weekly Exploding Topics trends report, track Meta Trends (see what’s going on in SaaS, finance, and AI), and follow specific trends with instant alerts if a topic is starting to gain traction.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more