Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

The Definitive Guide to Alternative Data

Like everything else in today’s tech-focused world, financial research has evolved beyond gathering information through SEC filings and earnings reports.

These additional sources of information are collectively known as “Alternative data.”

All indications are that the demand for alternative data will continue to increase. In fact, according to the 2022 Alternative Data Global Market Report, the global alternative data market will surpass $3 billion in the coming year.

With that speed of market growth, we expect alternative data to be a major player in the future of investing. In this guide, we’ll cover everything you need to know about the fast-changing world of alternative data.

- What Is Alternative Data?

- Why Is Alternative Data Useful?

- Where Does Alternative Data Come From?

- Traditional Data Vs. Alternative Data

- Types Of Alternative Data

- Uses Cases Of Alternative Data

- Entity Mapping And Ticker Tagging

- The Future Of Alternative Data

What Is Alternative Data?

Alternative data refers to data used for investment purposes that isn't found in traditional financial reports. Examples of alternative data include credit card transactions, metadata of social media activity, satellite imagery, payroll information, mobile app store data, and internet browsing activity.

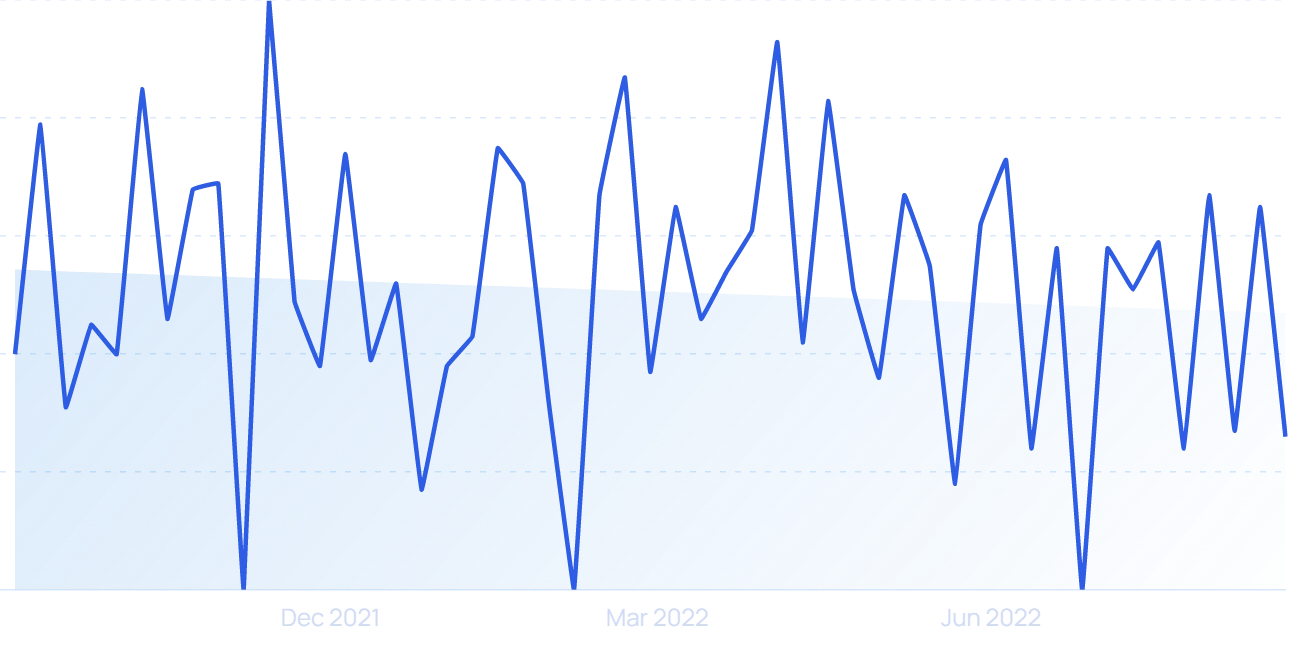

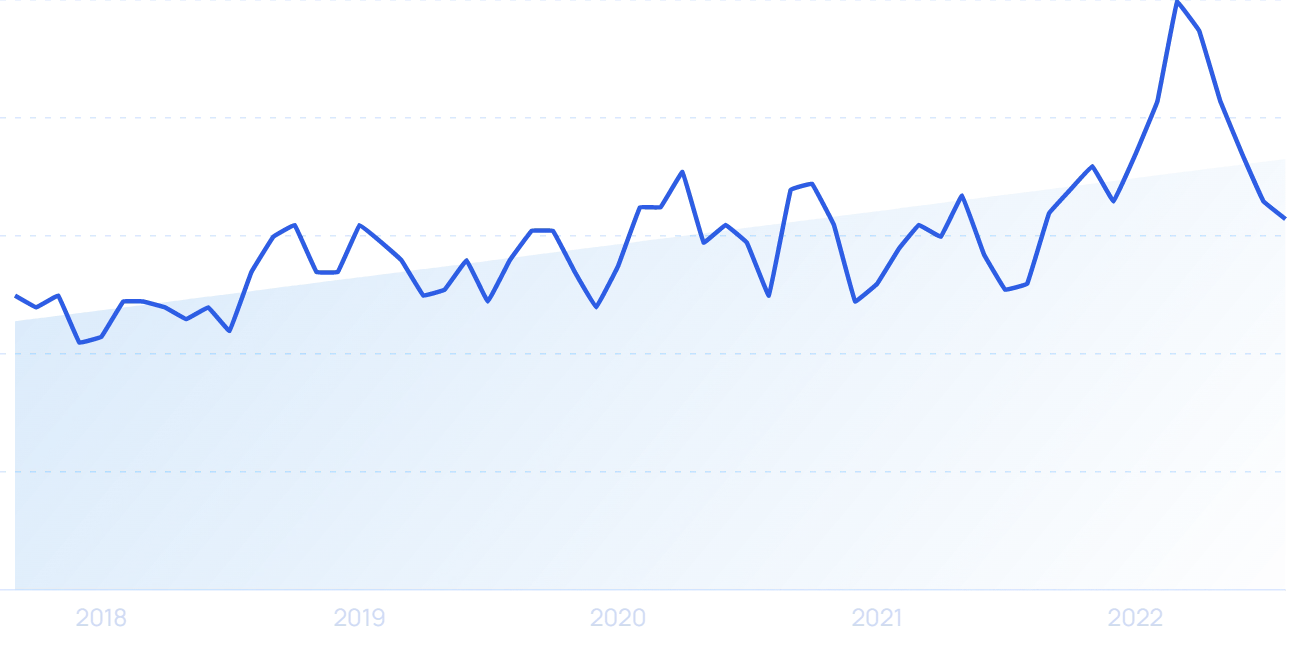

Searches for “alternative data” have increased by 47% over the last 12 months.

There are few limits as to what might be considered alternative data. If the data in question can inform a business or investment decision, it can usually be considered alternative data.

For example, analyzing credit card sales helped grocery store chain Whole Foods understand consumer trends during the COVID-19 pandemic.

Whole Foods is one of many businesses using alternative data to improve business outcomes.

Despite a 10% sales increase, they were seeing fewer customers overall. This data allowed Whole Foods to create strategies for corrective action.

The downside of alternative data is that, unlike traditional financial metrics that public companies disclose, alternative data isn’t always easy to obtain.

This is why firms looking to utilize alternative data must first weigh the benefit of information against the costs of obtaining that data.

But if untapped data sources help optimize investment decisions, it is easy to see how alternative data can be not only worthwhile but even necessary to maintain a competitive edge.

Why Is Alternative Data Useful?

Alternative data gives businesses and investors an additional source of data that can be analyzed to make more accurate predictions.

Specifically, investment firms and financial analysts find alternative data useful in predicting the market activity of public company stocks.

While the patterns of stocks can be forecasted using financial reports and SEC filings, alternative data gives analysts more information about a wide range of forces that may impact share values and market activity.

Entrepreneurs, business professionals, and marketing managers can also find significant value in alternative data.

Analyzing unstructured data about customers, competitors, and other market factors allow them to adjust their operations to fuel growth strategies and compensate for competitor behaviors.

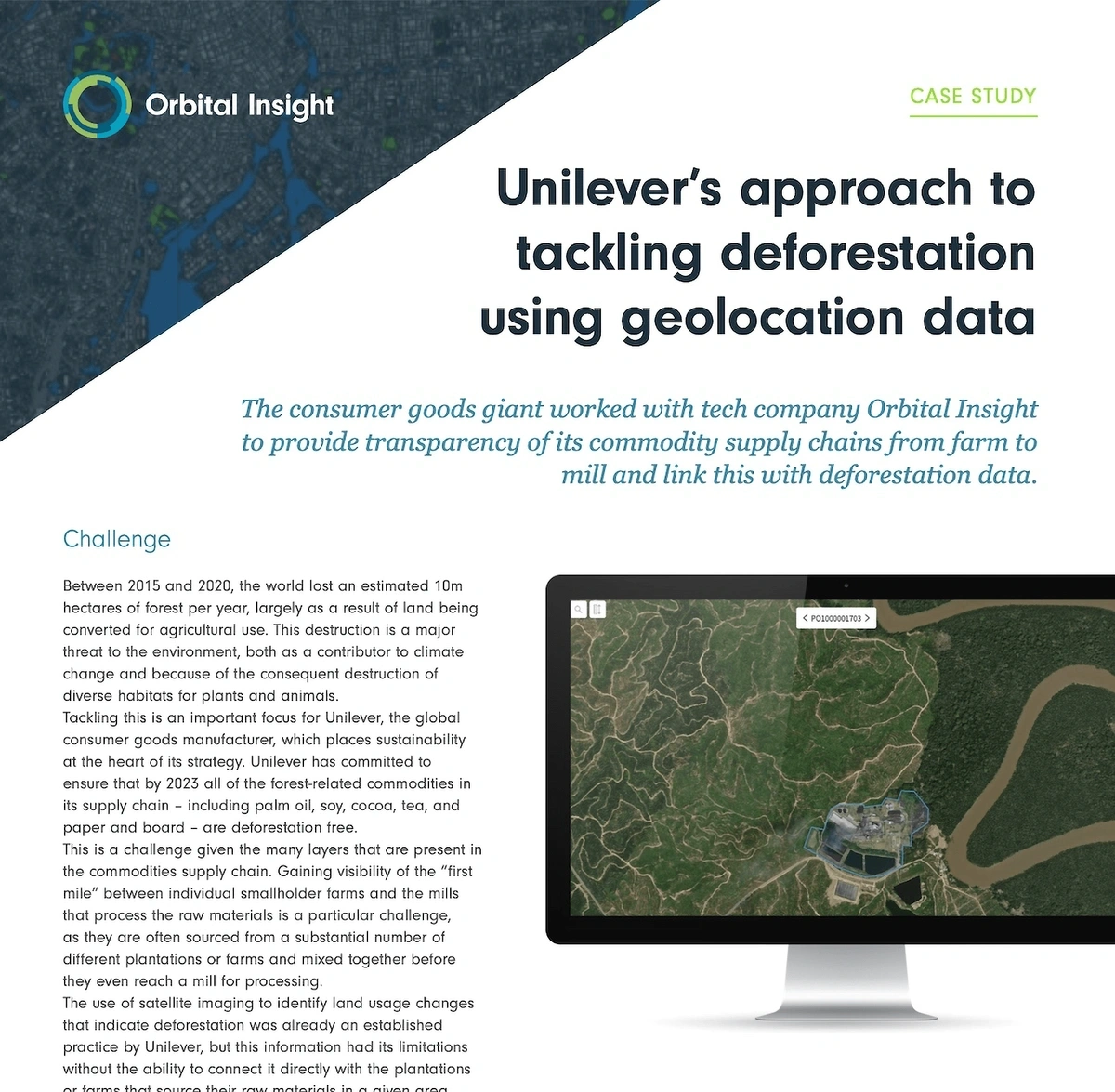

For example, Unilever used analysis of satellite images to work to prevent deforestation in the regions where they source raw materials in keeping with their sustainability goals.

Satellite images are used fairly often to collect alternative data.

Where Does Alternative Data Come From?

Thanks to the rapid advancement of technologies like IoT and fintech, there are more ways to obtain alternative data than ever before, including:

- Sensors

- Aggregate financial data

- Blockchain

- Satellite images

- Website traffic

- And more

Social Media

Social media can be an especially fruitful source of alternative data.

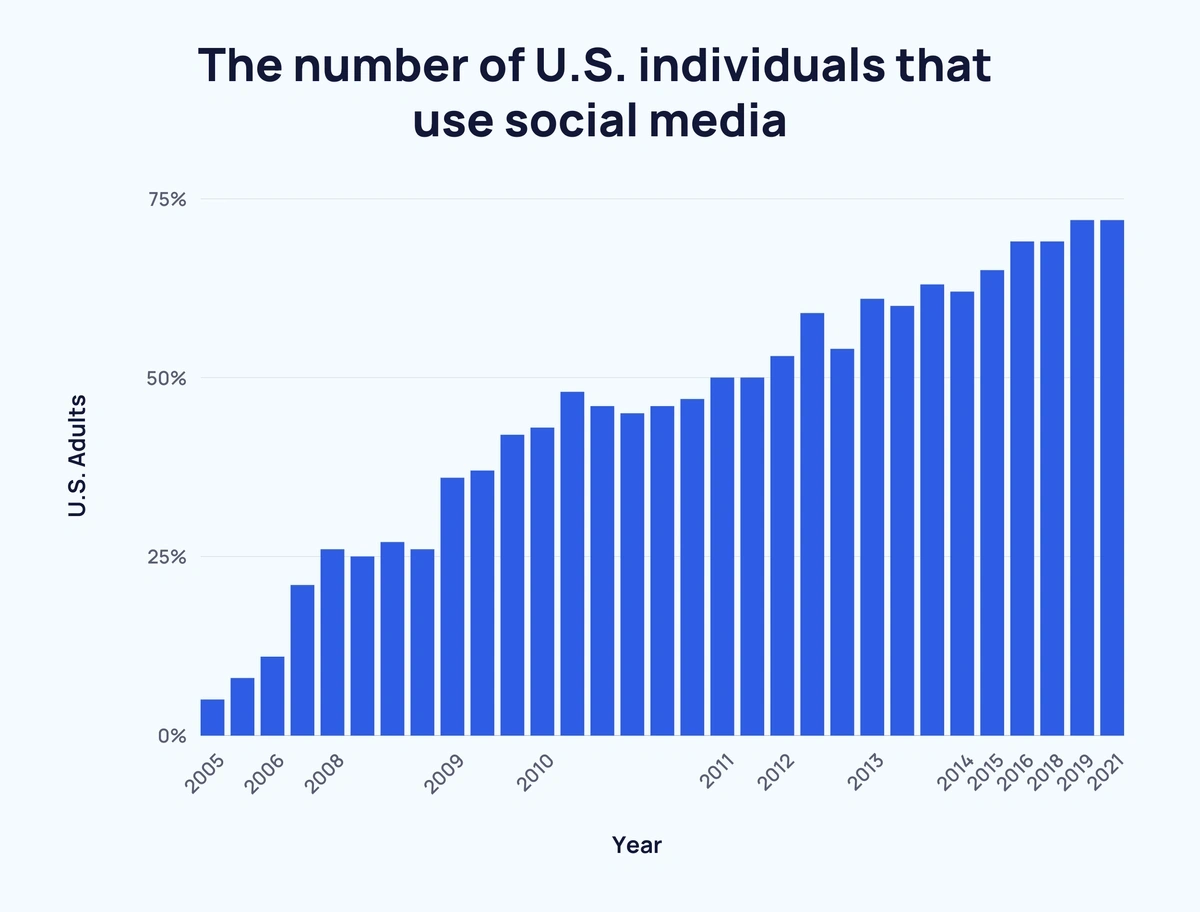

Over the last two decades, the number of individuals that use social media has increased to an incredible 70% of the United States population.

As social media becomes a natural part of daily life, in the U.S. and worldwide, individuals' social media posts are becoming one of the largest sources of alternative data.

Often called web scraping, this technology can be used to collect data about patterns, attitudes, and habits from their use of the internet and social media.

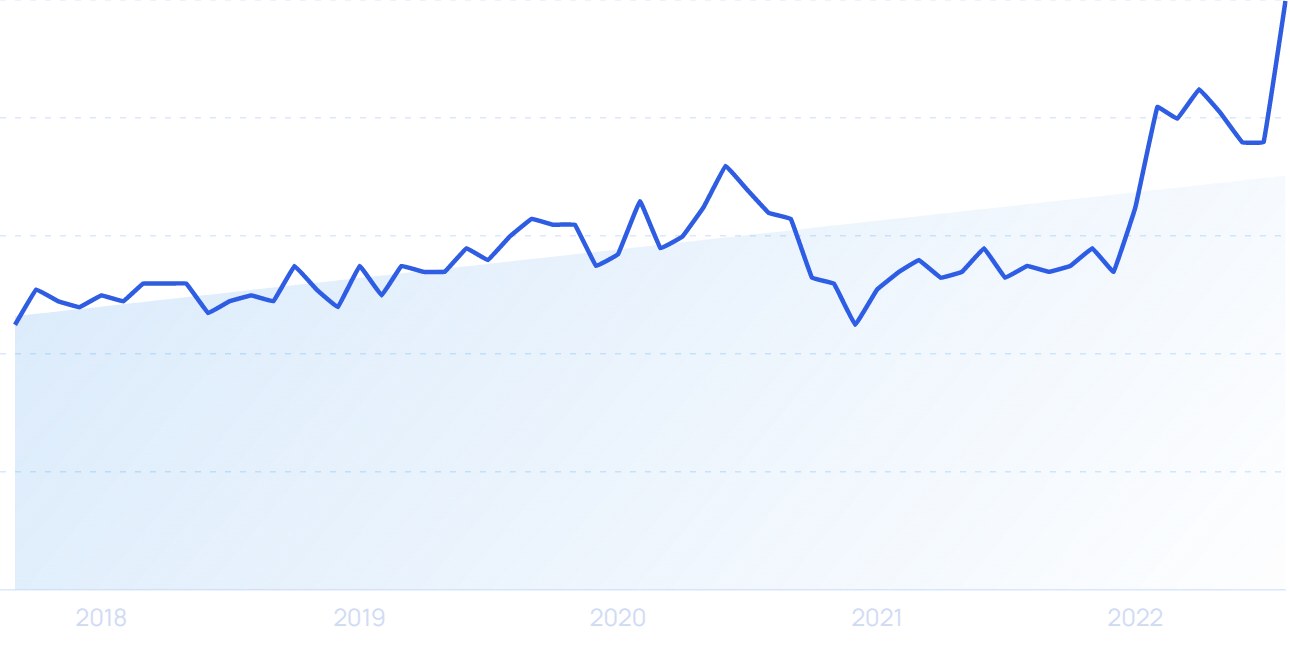

Searches for “web scraping” are up 50% since 2018.

For example, a corporation may analyze data on their existing customers to uncover general trends like where they shop, whether or not they are budget conscious, or even if they are likely to be pet owners.

This data can then be used to find and target new customers with similar preferences.

Business Processes

Alternative data from businesses include:

- Debit and credit card transaction details

- Online purchases

- Supply chain activity

- Data provided to the government about corporations.

Unlike other forms of alternative data, which can be tricky to interpret, credit card activity and other business process data is structured. This gives strong indications about the current and potential performance of the business’s finances and future revenues.

Sensors

In addition to data collected from businesses and individuals, alternative data is also harvested from sensors including:

- Weather-predicting equipment

- Satellite images

- Wi-Fi enabled geolocation devices and trackers

Sensors generate the largest, most unstructured pool of alternative data so it requires a high level of organization and analysis.

Traditional Data vs. Alternative Data

Traditional data is structured data that is sourced openly and available to the public.

Traditional data can be found in financial statements and reports, management and investor presentations, security exchange commission (SEC) filings, and press releases.

Alternative data is unstructured and unprocessed data that cannot be used until it is cleaned, translated, and analyzed.

Alternative data provides unique insights into investment opportunities both for established corporations and startups that may not have a long track record of operating.

Because the technology used to gather alternative data is often advanced, it can often provide more real-time insights than traditional data (which tends to have a significant lag period.) These insights are also multilateral, meaning that they offer more than one basic layer of information that can be used and accepted by different groups.

Traditional data will remain useful to investors and analysts, but the addition of alternative data sets provides an additional source to use for making more accurate predictions and business decisions.

Types of Alternative Data

Alternative data is a catch-all term that describes literally thousands of different types of data. That said, certain sources of data are already common in the practice of providing investment and financial insight, while other types of alternative data remain relatively rare and untapped.

Geolocators

Have you ever wondered about the coincidental timing of that Target ad for half-priced bottled water just as you pull into the parking lot of the retail giant on a hot summer day? Knowing the exact time and location to post advertisements isn’t a coincidence at all. It’s geolocation at work.

Geolocation data is created when individuals use their cell phones. The mobile phone carriers can track the location of the person by mapping the GPS data from their phones moving through different cell service providers’ networks.

Specifically, geolocation works by tracking the location, in terms of latitude and longitude, of an electronic device connected to the internet or using cellular data.

Satellite Images

There is a tale told in Walmart’s history, that Sam Walton, the founder of Walmart, would use the number of cars in the store parking lots to predict sales figures.

Today, satellite imaging has made real-time data, like the number of cars at a retailer’s location, an actual tool used to analyze income patterns and share values of common stock.

There are more than 2,000 satellites in the orbit surrounding earth. Many of those satellites, like those used by Google Earth and other image databases, can create and share images useful to financial analysts who are searching for insights about finance, e-commerce, research, and strategic enterprise planning.

Analysts can also use images to evaluate the spread of natural disasters and forecast supply chain issues.

Shipping Data

Many companies use sales data to predict future business trends, but shipping container data can be used to make the same forecasts even before products even reach the shelves.

For example, wireless sensors on ships can provide real-time updates about delays that companies can then use to price their products that are already in store.

Using shipping information is not new in predicting financial performance, the transportation index is one of the reliable indicators used in the Dow Theory.

Social Listening Tools

Social listening tools scrape user-generated content, like the online comments left after someone makes a purchase on Amazon or the reviews someone leaves on Yelp after eating at a restaurant, and provide aggregate insights into consumer preferences and behaviors.

Google search volume for “social listening” have increased by 82% since 2018.

Startups, researchers, and established corporations can use the alternative data generated from reviews to analyze and improve brand perception.

That same information and public interpretation of brand names and products can be used by financial analysts and investment firms to make forecasts and predictions about the market activity of companies’ stocks.

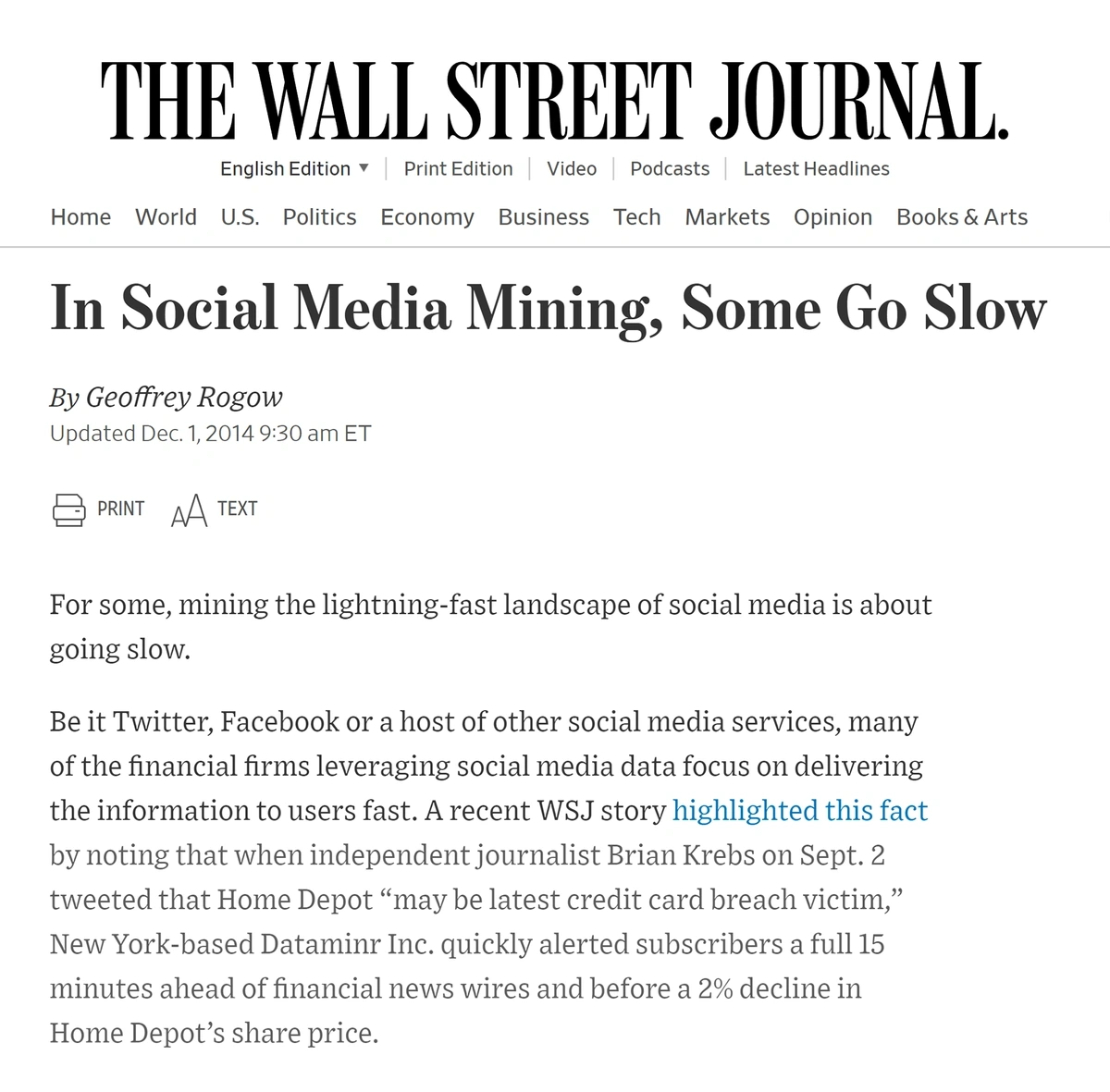

When Home Depot experienced its 2014 data breach, a social listening company notified its subscribers a full 15 minutes before major news outlets reported it because they picked up a Twitter thread that was talking about it.

Social listening can lead directly to a trading advantage for many investors.

This allowed subscribers to get an edge on a 2% drop in Home Depot stocks that happened after mainstream outlets ran the story.

Sales Data

Alternative data can be created by using credit card transaction details and data from Point of Sale (POS) systems. Sales information is used to predict the spending patterns of consumers as well as brand awareness, product acceptance, and price trends.

Jet Tracing

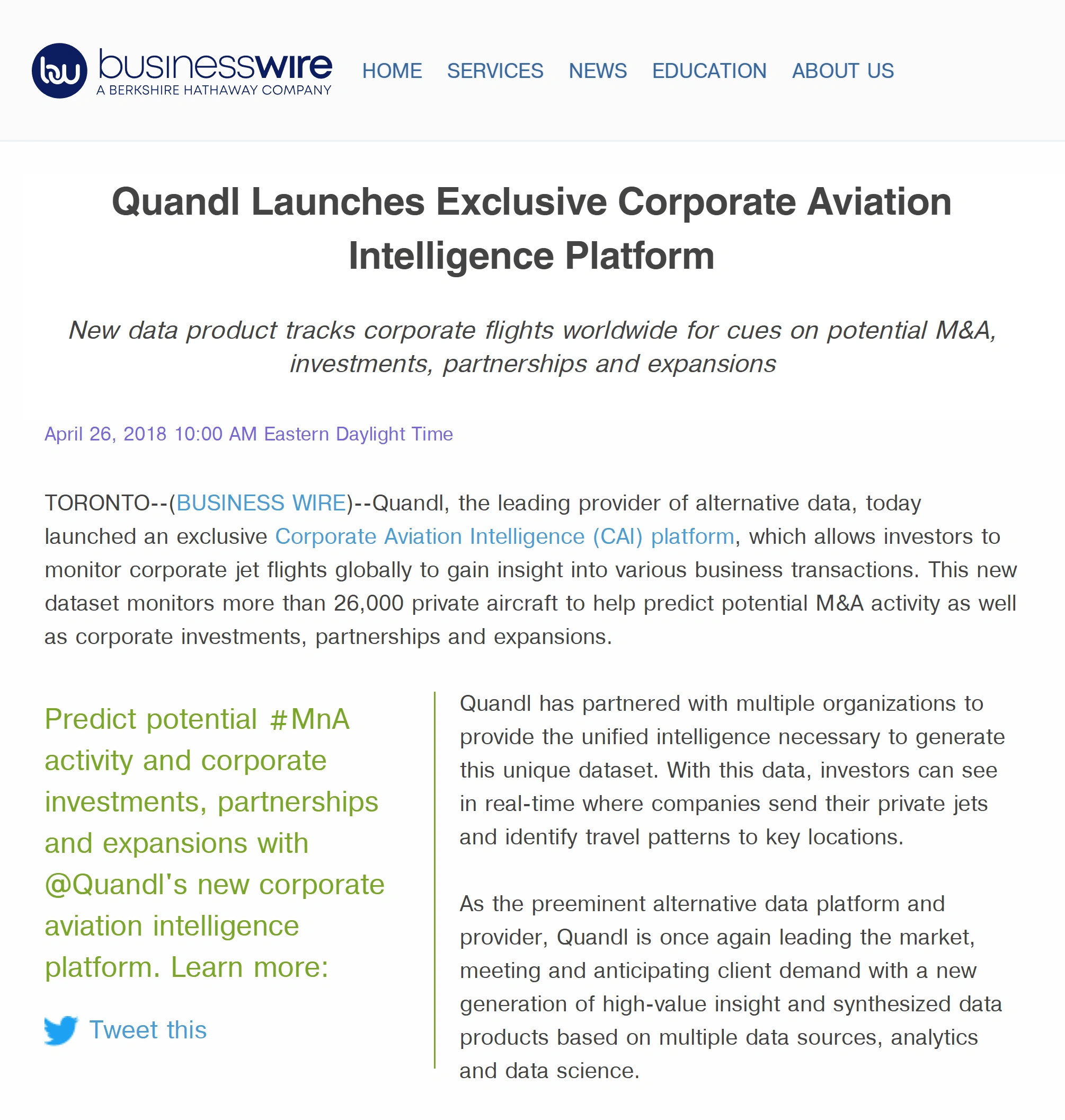

Jet tracing is a niche-specific source of alternative data. It can be used to track the movement of high-level company executives, which is translated into marketable information about the financial health of a company.

Labeled “corporate aviation intelligence” by providers like Quandl, jet tracing is used to monitor and report on the movement of corporate executives.

Corporate aviation intelligence is an example of alternative data that can be difficult to interpret. But is highly valued by many investors.

The gathered information is used by investment experts to predict new merger and acquisition (M&A) activity and other business deals.

The data provided by tracing the movement of corporate executives is available to analysts and the public through sites like Quiver Quantitative.

Uses Cases of Alternative Data

Alternative data brings a new level of information to investors, analysts, consultants, and financial experts. There are many use cases for companies that choose to collect alternative data.

More Efficient Algorithms

Alternative data gives financial analysts deeper insight into both historical market performance and the current and future patterns of customers, paving the way to create accurate algorithms used to predict financial patterns.

Alternative data, like that obtained from web scraping, gives analysts details in real-time to better understand potential financial or operational issues.

Improved Customer Service

With the help of alternative data, companies can use the information posted online to monitor the performance of their customer service efforts and make necessary improvements.

For example, a company monitoring social channels may pick up that one of their products is lacking a feature and modify it to meet customer demand, or they might respond with a PR campaign focusing on that product's strengths.

Innovative Product Development

Many inventors and research and development (R&D) teams are looking for “the next big thing.”

Alternative data, along with traditional R&D approaches (like focus groups), can help inform those new initiatives.

For example, social listening can give an edge to companies who want to understand the needs and frustrations of potential customers, and then design solutions that address them.

Unique Viewpoints

Alternative data brings new information to light that was formerly unavailable or unused. Which gives analysts additional insights and views that were previously inaccessible.

In finance, the term “alpha” is used to describe a market advantage that analysts, hedge fund managers, and investment firms strive to achieve.

Specifically, when analyzing stocks and market activity, alpha is used to describe a scenario where the return on investment is larger than expected. It is becoming increasingly common to rely on alternative data to achieve that “alpha.”

For example, a traditional analyst might read a financial report for a publicly traded tech company and see that sales are down, so they make a decision not to invest in that stock.

But an analyst using alternative data uses social listening tools to pick up buzz about the brand from a key demographic that wasn’t reflected in the financial statements (yet).

That extra layer of info would allow the analyst to buy the stock earlier than anyone else, before the price had even started to go up, thus beating the rest of the market and achieving alpha.

M&A Intelligence

Alternative data allow analysts and merger and acquisition specialists to have more informed evaluations and predictions about potential acquisitions. For example, they can use alternative data to understand the overall sentiment around a company. A sentiment that won’t be found in that company’s P&Ls.

Competitive Advantages

Corporate advisors and advertising executives can use alternative data to gain a competitive edge over other brands in similar industries. Comparing the movements and social media patterns of potential consumers allows companies to gain a powerful competitive advantage.

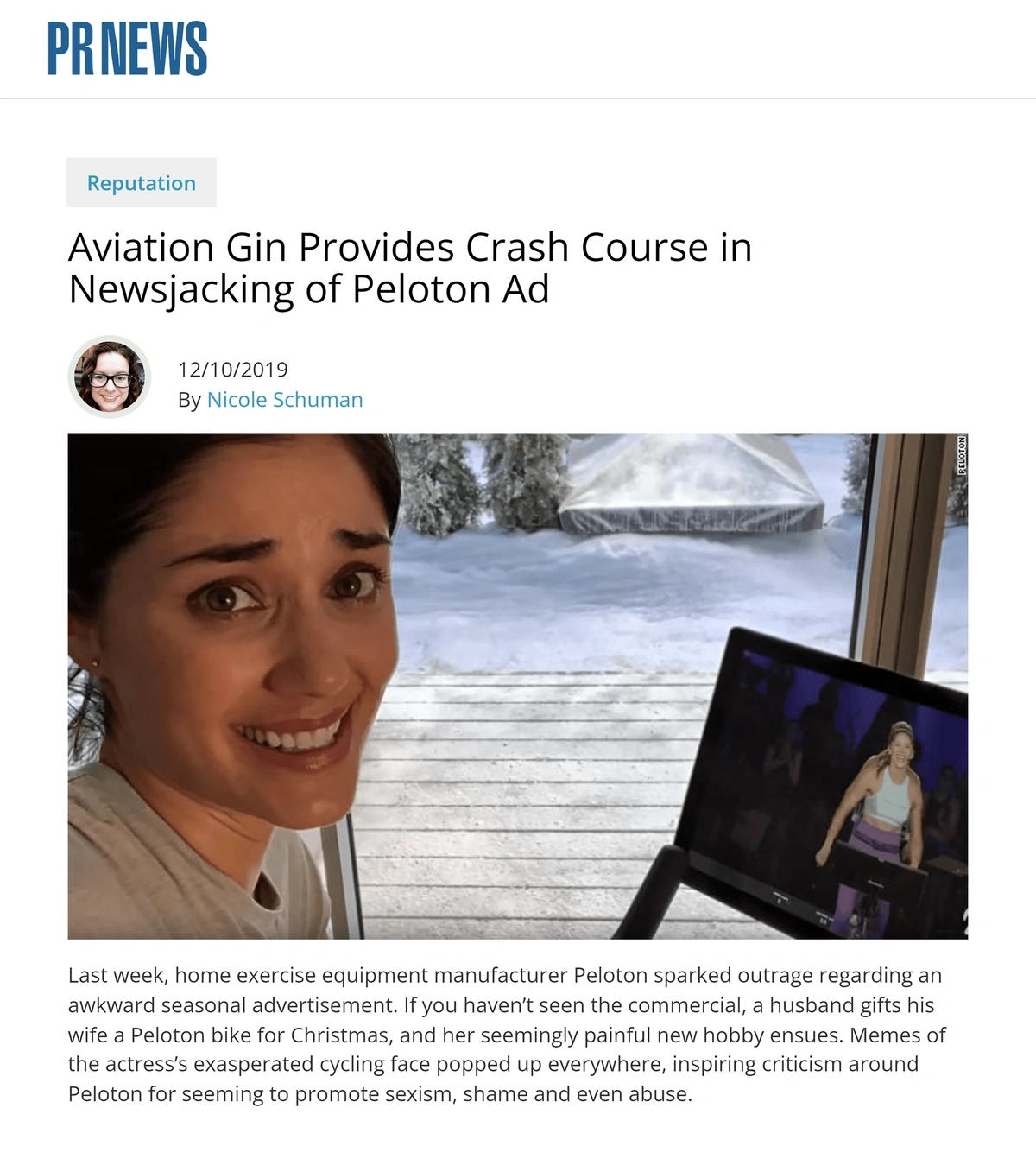

Aviation Gin did this when they leveraged the critical social media response to a Peloton ad to create their own offshoot ad using the same actress.

Aviation Gin used social listening to inform their business decisions in real-time.

By paying attention to the social media uproar, they were able to take advantage of the situation in real-time and gain a significant brand lift.

More Informed Lending Decisions

Alternative data makes new information about loan candidates and credit-seeking businesses available to lenders and wholesalers. The credit checks and income evaluations give banks, lenders, and companies fair insight into potential borrowers, but alternative data like geolocation, gives financial institutions more insight.

ID Verification

Alternative data can be used for VAT matching, which validates a company’s tax ID number. Whether evaluating a company for a loan or authenticating a new business venture, VAT matching, made possible with alternative data, can create the data necessary to review any business activity associated with the given tax ID number.

Entity Mapping and Ticker Tagging

How does raw alternative data get organized and aggregated into useful information? First, the data must be “cleaned,” or made useful, by the providers.

This process begins with collecting a large set of raw data. The raw data is then analyzed and manipulated into figures and performance indicators that are understood by the targeted end-user.

Two processes that occur to make raw alternative data marketable to hedge funds, investment firms, and analysts are entity mapping and ticker tagging.

Entity Mapping

During entity mapping, alternative data that has been retrieved from a source is sent to its intended destination. The data may be sent or mapped, to a universal database or a data warehouse.

The course and treatment of raw alternative data are determined based on the potential use cases for the data (the end user or intention is not always known when data is sourced, which is the purpose of storage like data warehouses.)

Alternative data providers often use intermediary companies to retrieve the raw data from the original source, translate it to usable data, and then pass it along to qualified data providers.

The intermediaries take on the responsibility of vetting the providers and ensuring that they follow federal regulations regarding privacy and the harvesting of alternative data.

These intermediaries are also responsible for validating the data and placing them into machine learning investment models, which makes it available for third-party use.

Once the raw data is extracted from the source, validated, and put into the investment model or a data warehouse, a data qualification report is generated.

The validation process varies depending on the source, the intention for the data, and the purchasing data provider.

Aside from dealing with an unknown destination in many cases, alternative data specialists must also keep up with privacy regulations regarding data. Experts have turned to alternative data providers to express concerns about the following privacy issues:

- Unreliable sources

- Inconsistent or incomplete data sets

- Lack of security controls

- Failure to protect consumers from identity theft

- Lack of transparency

Providers prepare to map raw data while staying accountable to the most recent privacy regulations, like the General Data Protection Regulation.

For alternative data to be considered valuable and trustworthy, there must be a record of disclosures that notes the flow of information from the original source to the end user.

Another precaution being taken by alternative data providers is to maintain data records that are accessible to consumers. While consumers would need to purchase the data, just like a hedge fund or financial institution, the regulations state that much of this data must be made available to consumers.

Ticker Tagging

When alternative data is collected, the purpose is often to predict future market activity of companies and products. The raw data must be sorted and organized into associated company references.

Ticker tagging occurs when the stock symbol, or ticker tag, of a certain company or brand, is matched to a set of alternative data.

A practical example can be seen in alternative data that stems from online reviews. The author of the review may note a new location for a national brand but shorten the name of the restaurant. It is very unlikely that the reviewer will mention the ticker, or stock symbol, for the restaurant chain.

Ticker tagging refers to the process that is used to match the review to the stock symbol and formal name of the business, making the data marketable.

Alternative data providers, like Thinknum or Infotrie, offer the data after entity mapping and ticker tagging have been completed. The translation of the data, or the ticker tagging, is what brings value to the data.

Hedge fund managers, investors, marketing managers, and financial advisors are willing to purchase data sets that cost as much as $50,000.

The Future of Alternative Data

There are currently 445 alternative data providers. And 78% of hedge funds are using alternative data now or plan to use alternative data over the next twelve months.

These statistics only apply to those companies and investors that openly share the data supporting their financial forecasts. But these numbers do indicate that the use of alternative data in finance and business is increasingly utilized each year.

This does not mean that the need for traditional analysts and raw data specialists will disappear, however. The value of the alternative data lies in the interpretation provided by specialists and analysts. Even data that has been thoroughly cleansed, mapped, and tagged must be interpreted by experts.

Alternative data simply adds another layer of evidence that information analysts and investment firms are evaluating.

When McDonald’s made headlines for supposedly increasing foot traffic by 33% using only a $1,000 advertising budget, it didn’t take long for analysts to realize that Mcdonald's was misinterpreting the data set. They had only increased “check-ins” on social media, and not foot traffic.

This goes to show that interpretation is everything, and careful work is still needed to truly understand the data that is received.

As entity mapping and ticker tagging techniques advance, alternative data will become more and more useful to analysts.

Alternative Data Outside of Finance

Getting an edge in the markets is the most common use for alternative data. But as the acquisition and cleansing of alternative data becomes more widely accepted, nearly every industry has opportunities to benefit.

Travel

Travelers often turn to the web for information before stepping foot in an airport.

Travel companies can use alternative data to learn more new desirable destinations and overall travel trends in order to maximize revenues.

Everything from Twitter conversations, hotel reviews, and geo-locating maps can be analyzed by travel companies to help people have enjoyable experiences in destinations that people are increasingly interested in.

Construction

Despite supply chain issues, pandemic disruptions, and worldwide migration patterns, new homes, businesses, government buildings, and infrastructure are always going to be needed.

Alternative data can give construction executives and their financial analysts access to shipping receipts, material purchases, satellite images of new developments, and more. The high level of detail available in the data can be used to strategically plan expansions and manage or bid on projects. Alternative data can also be used to efficiently project costs, analyze lending patterns, and understand financial risks associated with large corporate projects.

Sustainability

Alternative data can help businesses and corporate offices make informed decisions about their sustainability practices. And data retrieved from sources like satellite images and internet traffic can be used to review the performance of companies in similar industries that have made social and environmental changes.

Final Thoughts

Alternative data is not a new concept–people have been analyzing information looking for an edge for many years. But the technologies available today make it more accessible than ever before. Business leaders cannot afford to ignore the opportunities available and should make every effort to regularly acquire and use alternative data for strategic decision-making.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more