Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

The Beginners Guide to Fintech

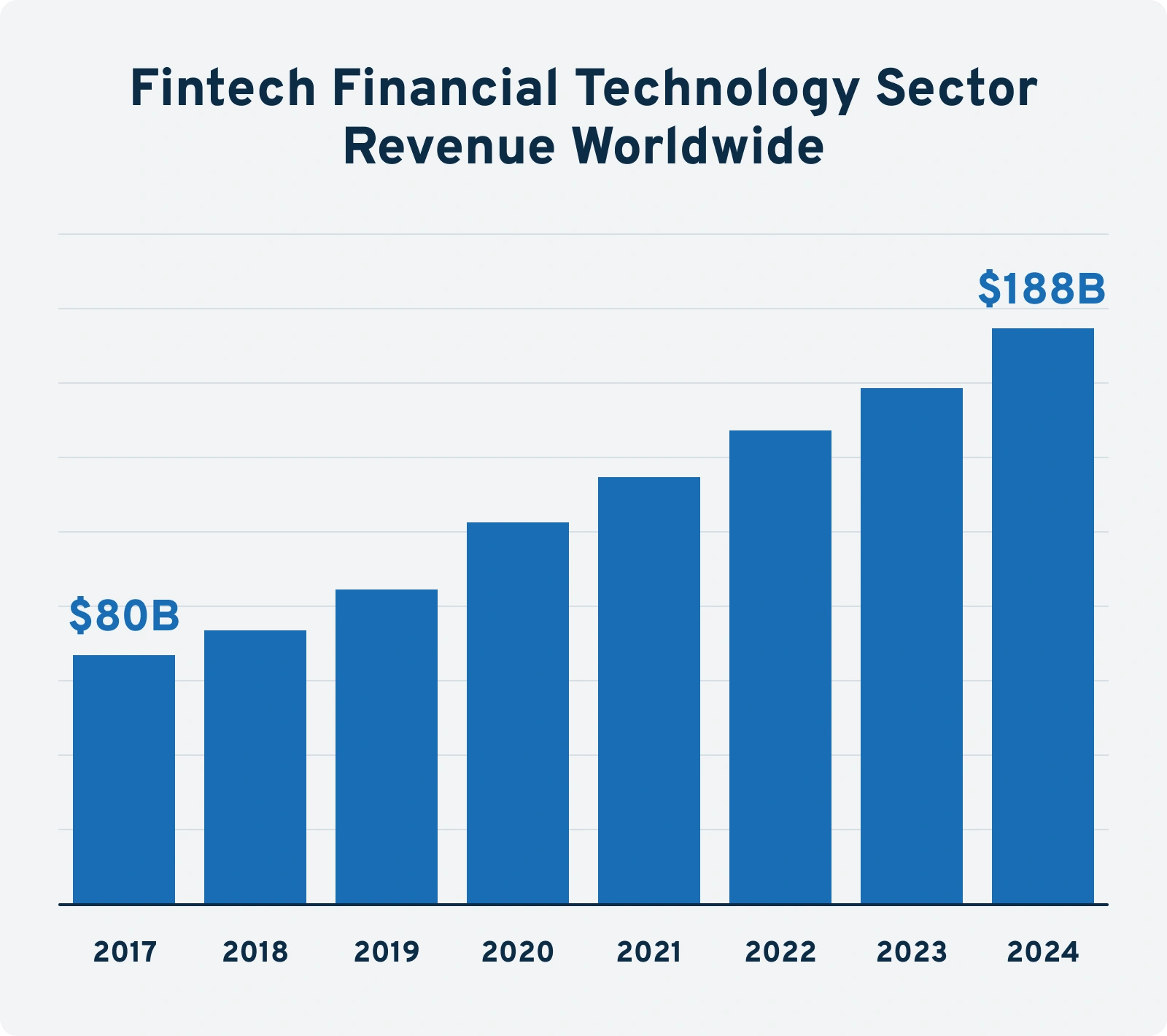

Financial Technology (Fintech) is one of the hottest sectors on Wall Street and in Silicon Valley.

With the potential to disrupt the traditional banking system, fintech companies have become some of the fastest-growing startups on the planet.

In this new guide, we’ll explain what fintech is, how it works, practical use cases, and what obstacles the industry currently faces.

Intro to Fintech

In this chapter, we’ll define fintech, explore its origins, and dive into statistics showing just how fast the industry is growing.

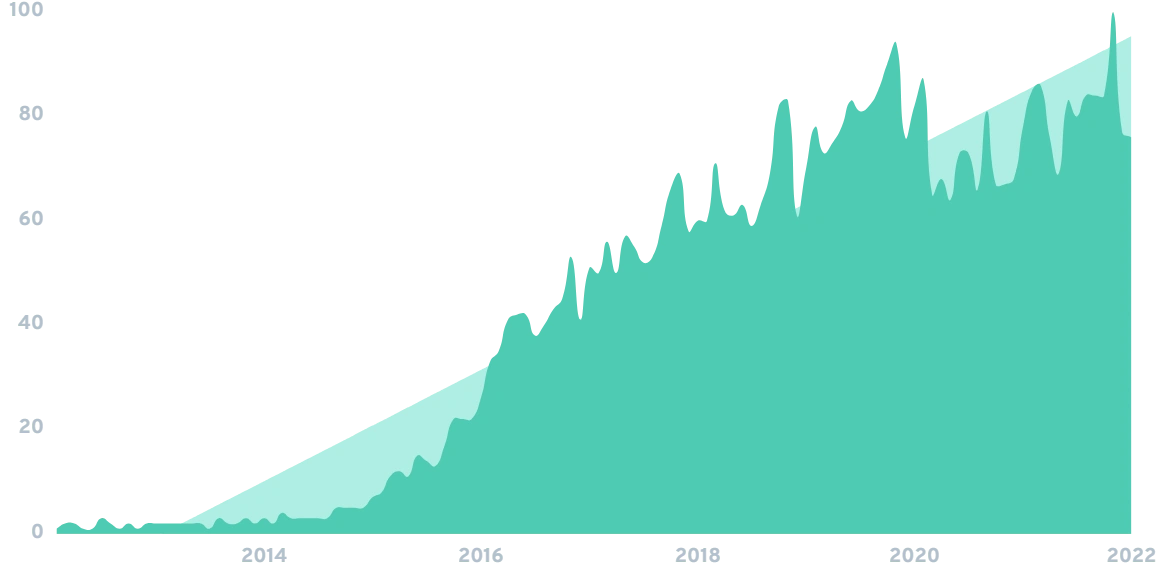

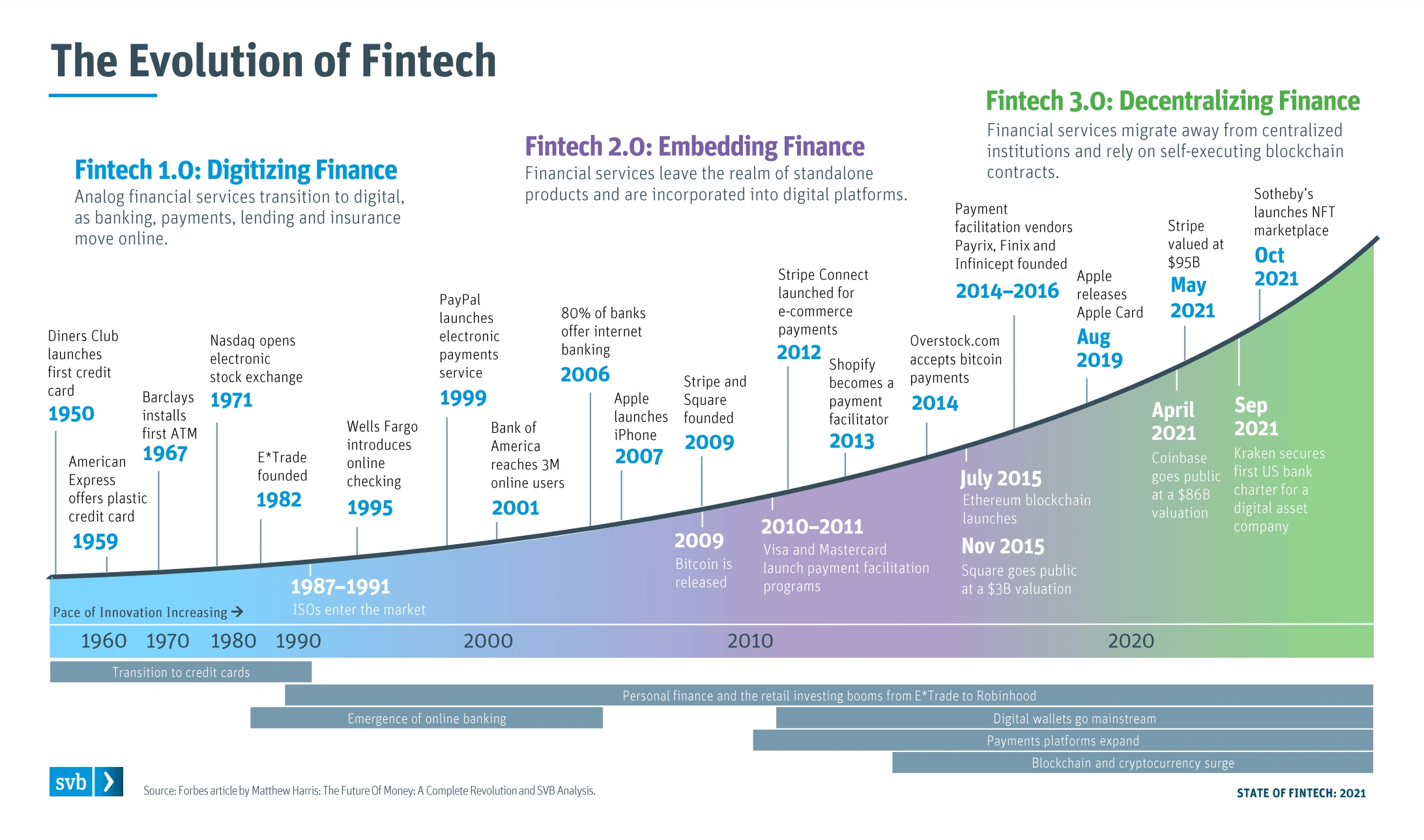

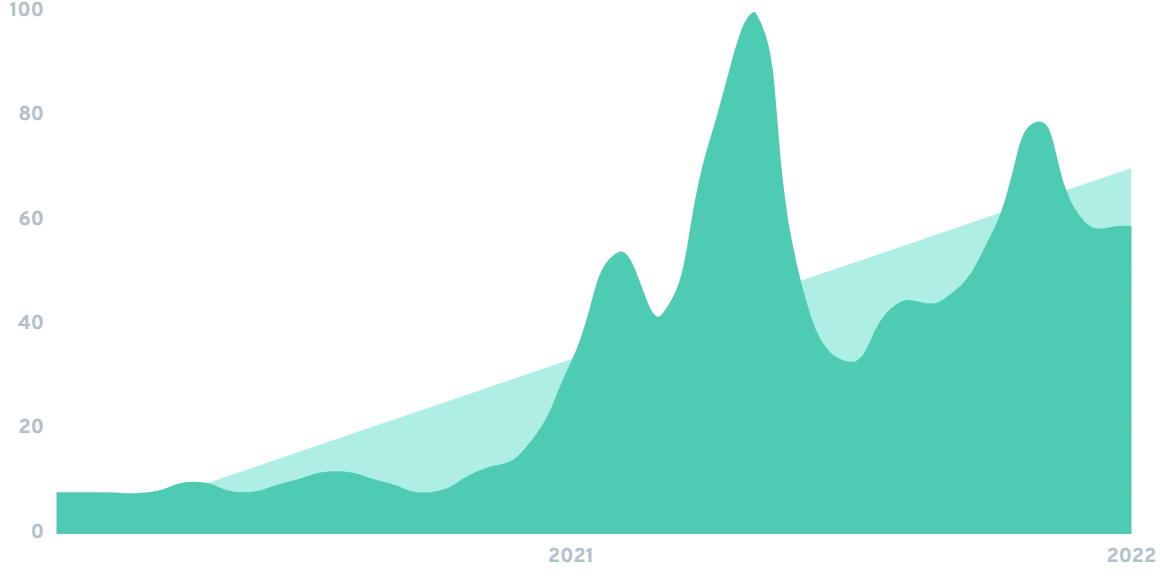

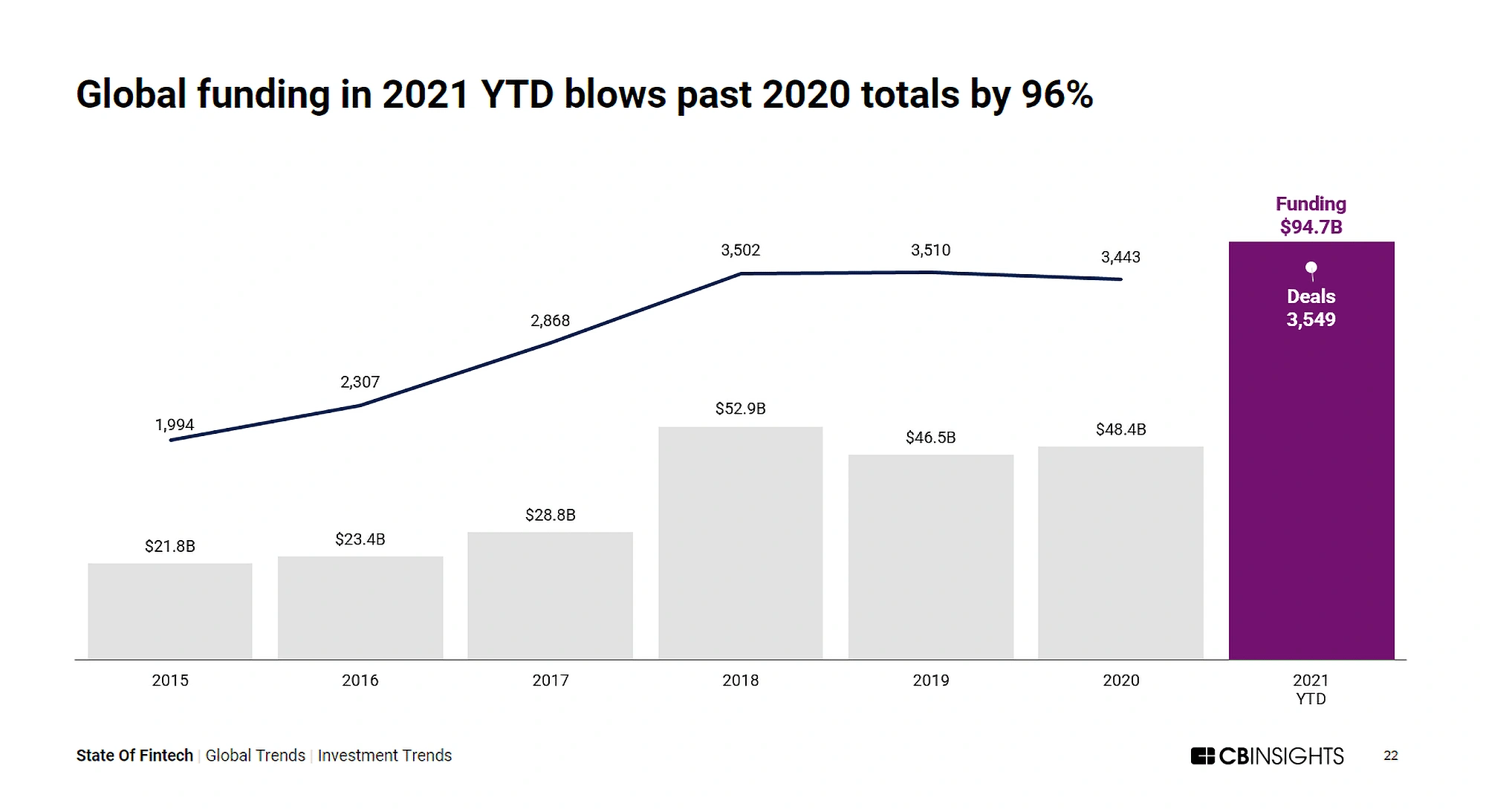

Fintech, short for “financial technology”, refers to any application of new technology (specifically, software) designed to disrupt, enhance, or replace traditional financial services. For businesses, fintech companies aim to help clients reduce expenses while improving the speed and efficiency of their systems, processes and operations. For consumers, fintech companies attempt to offer easier, more convenient, and more streamlined financial services. Most of which are designed to grab market share from traditional financial services companies and the legacy banking system. In both situations, however, the end goal of fintech is the same: changing and improving existing financial systems. In most cases, they do this by adapting to the market more quickly, serving under-served segments of the countries they operate in, and launching easier, more convenient solutions. While industry pundits didn’t discuss financial technology as its own industry until 2014, fintech is considered to be in its third “phase” right now (similar to how we went from Web 1.0 to Web 2.0 and are now seeing the first manifestations of Web3). The first (and longest) epoch kicked off when Diner’s Club launched the first publicly available credit card in 1950. From there, one could argue it ended around the mid-2000s (at which point 80% of banks offered online banking services). Fintech entered its second phase (known as Fintech 2.0) in 2009. This was a massive turning point for the industry, as it marked the year in which Bitcoin, Stripe and Square launched (all of which laid the foundation for the industry as we know it today). While it's hard to say exactly when we transitioned into the current 3.0 era, one could argue 2021 was yet another pivotal turning point in the industry. 2021 was the year two of the industry’s largest players - Coinbase and Stripe - reached double-digit billion-dollar valuations. But more important, 2021 was an explosive year for cryptocurrency and blockchain technology. A year in which: Regardless of how you define the epochs, however, there’s one thing no one can deny: Financial Technology as an industry has absolutely exploded since 2014. On the B2C side, adoption rates show consumers are warming up to fintech in a big way. First, studies show that 63% of Americans use some form of digital banking. In fact, the mobile payments market (which is arguably the largest sub-segment of the industry) is estimated to reach $12.07 trillion dollars by 2027 (with 75% of consumers worldwide using some kind of mobile funds transfer or payment method in 2019). And while consumer adoption rates are impressive (210 million Americans use fintech products), the investments and deals being made on Wall Street are even more eye-popping. In 2015 there were 1,994 fintech investments made (globally) worth $21.8 billion. By 2021, however, that number climbed to 3,549 deals worth $94.1 billion (a 327% growth rate over six years). In many cases, those investments paid off quite handsomely. As an example, in 2019, there were 57 fintech “Unicorns” (meaning the company had a one billion dollar or higher valuation) with a combined aggregate valuation of $192 billion between them. By 2021, just two short years later, there were 167 Unicorns (more than a 200% increase) with a combined aggregate valuation of $665 billion between them (a more than 240% increase). With money into fintech companies like water, it's no wonder fintech companies accounted for one out of every four “Unicorns” in 2021.What is Fintech?

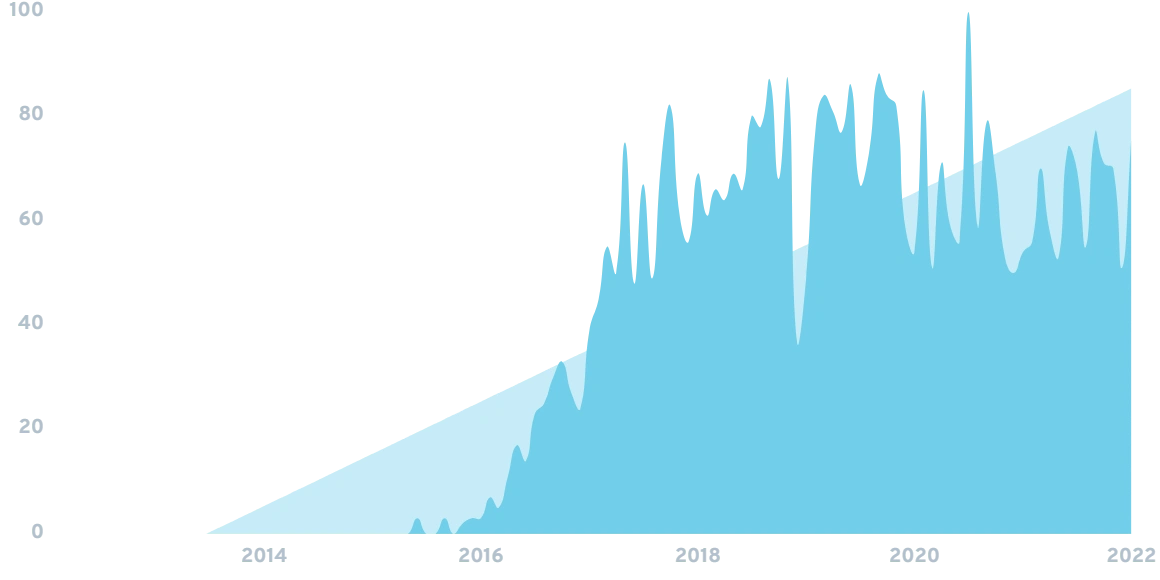

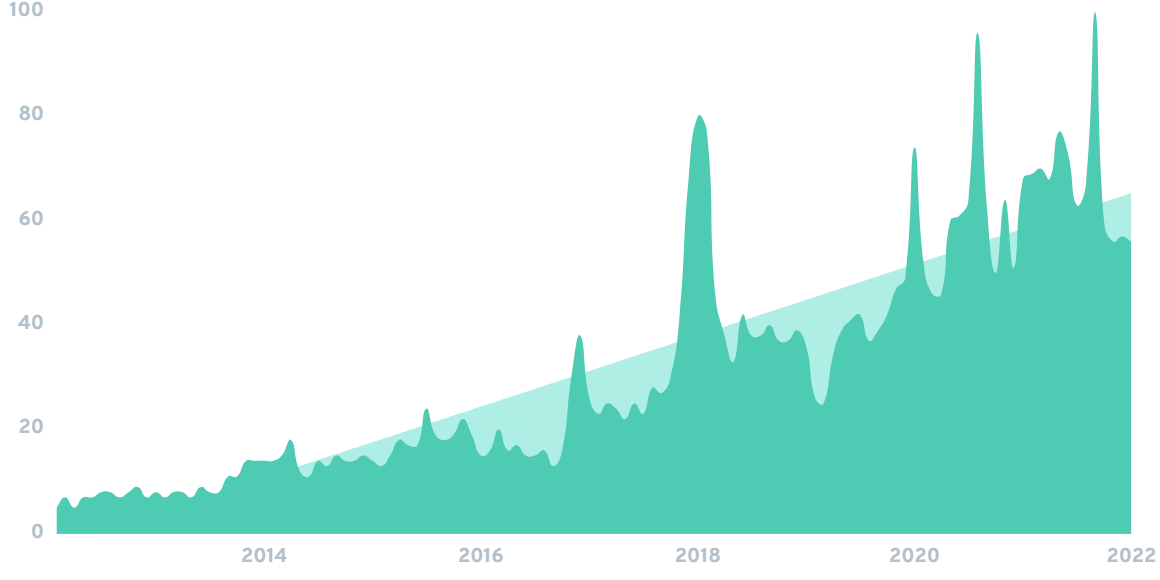

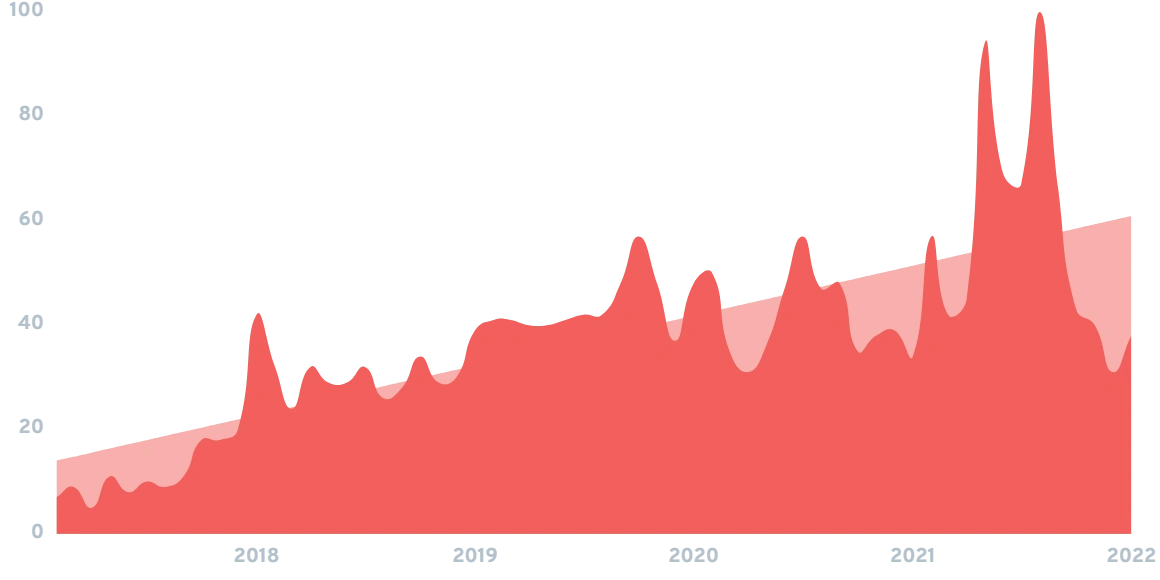

Searches for "FinTech" have gone up 7500% in the last decadeDisrupting Legacy Financial Services

A Brief History of Fintech

Mobile, Blockchain, and Fintech 2.0

2021 Was a Pivotal Year for the Fintech Industry

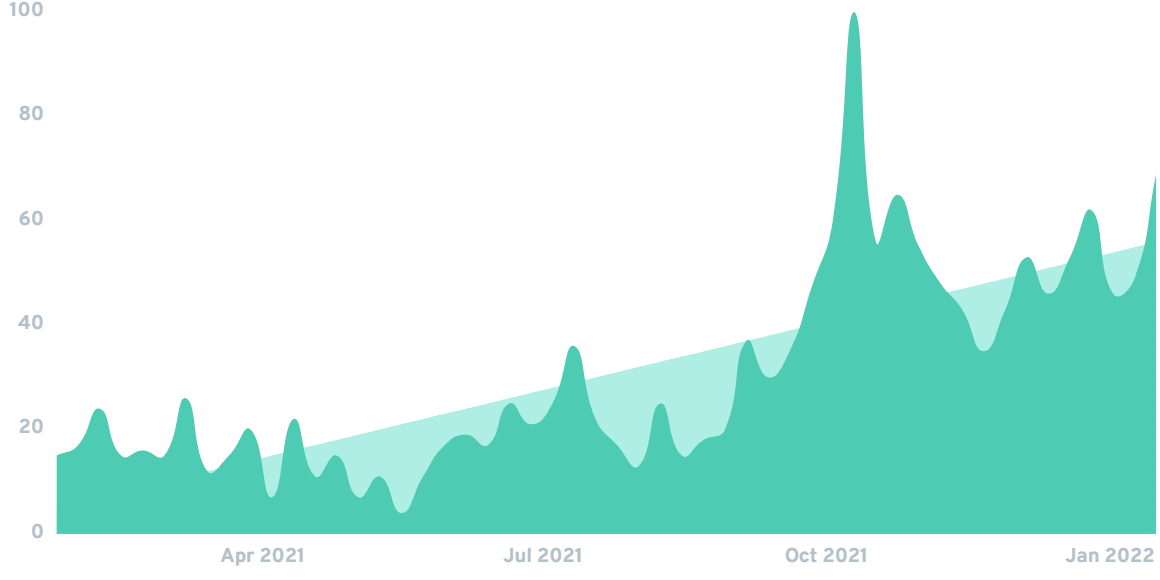

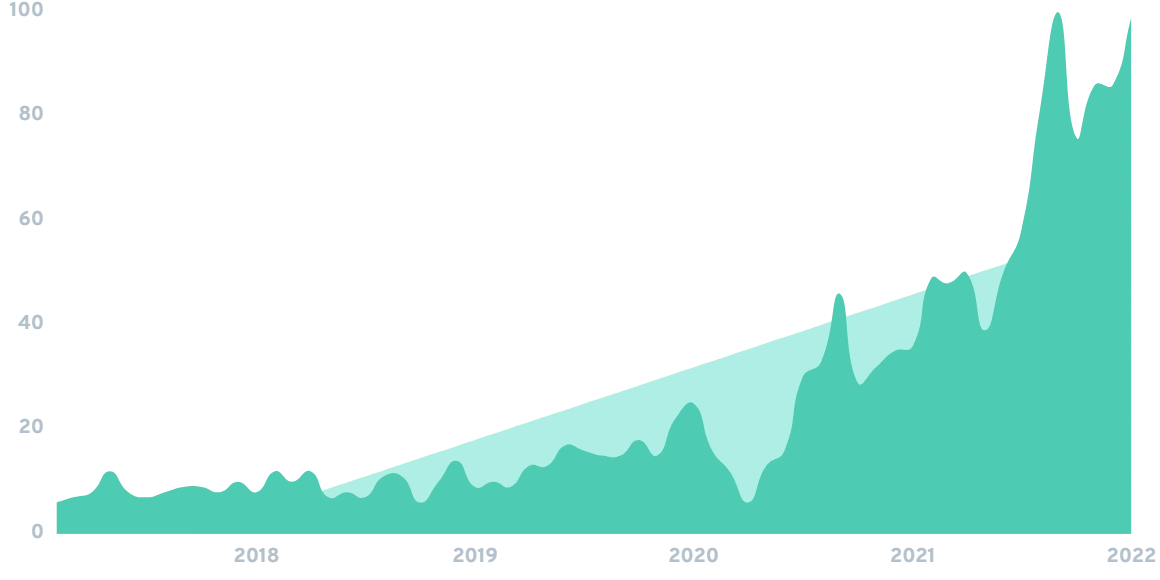

Searches for "cryptocurrency" exploded in 2021

Fintech’s Explosive Consumer Adoption Rates

Fintech Deals Are Red Hot Right Now

FinTech’s Core Use Cases

In this chapter, we’ll discuss the four sub-segments of the industry and the real-world utility that fintech companies bring to the table.

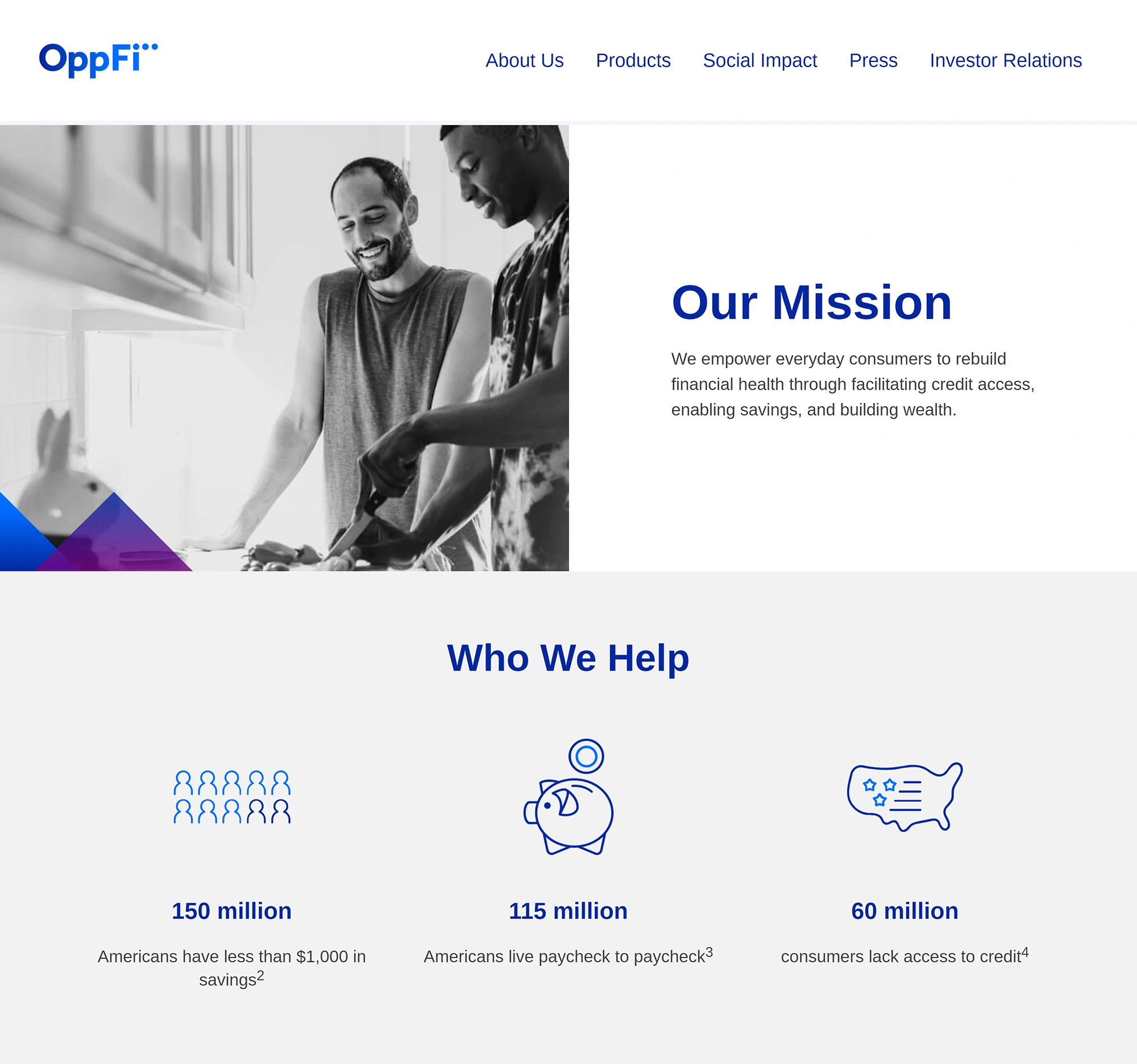

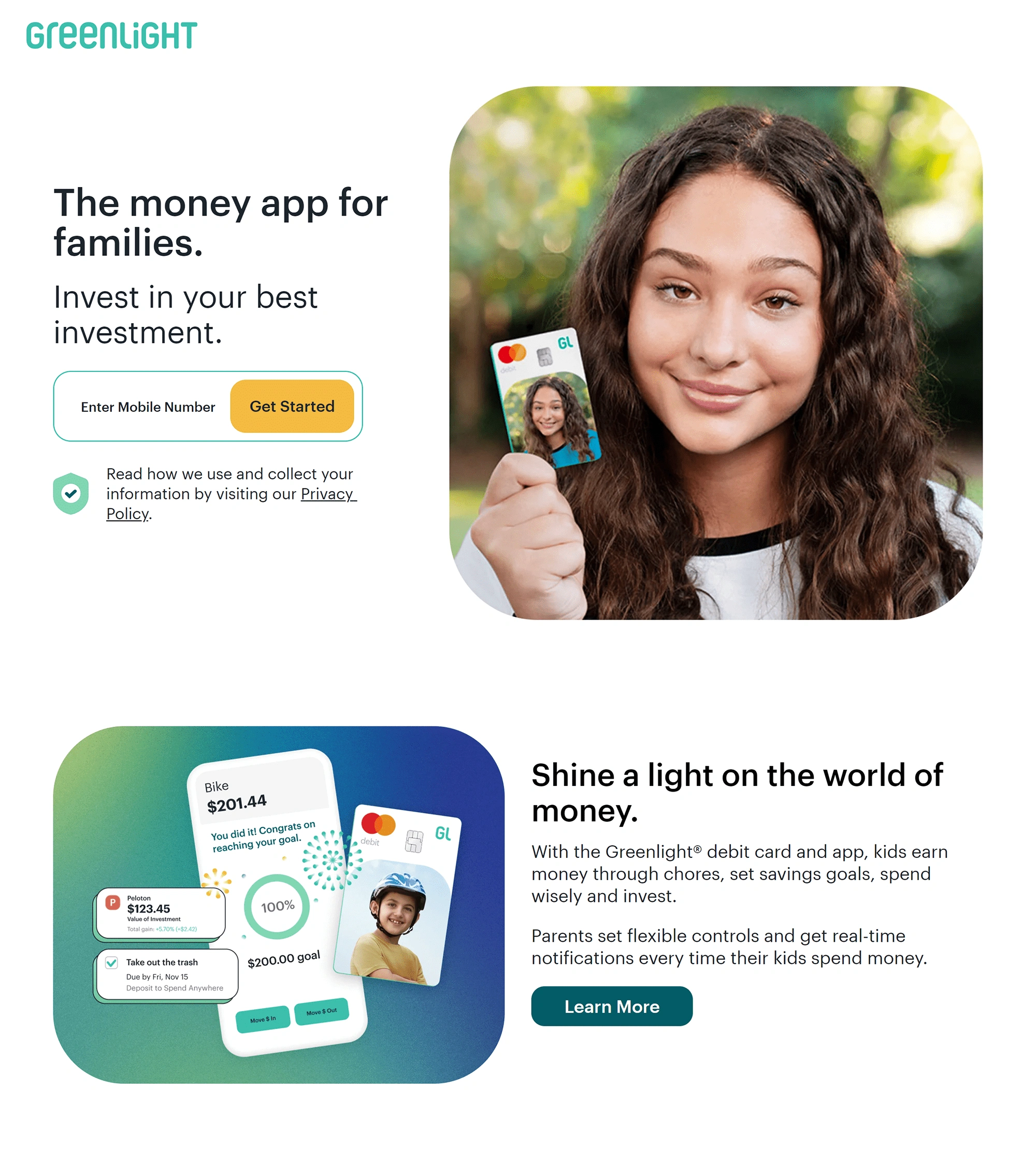

From lending and money transfers to automated wealth advisors and crypto, here are the most common applications of financial technology in the consumer sector. Over the last decade, we’ve seen a dramatic shift in how Americans earn an income. From the gig economy to NFT traders, an increasing number of adults are making money outside of traditional 9-5 careers. Because of that, a growing number of fintech companies have moved beyond the “Income + Credit Score” method of processing loans. Instead, they’re using cutting-edge technology to assess a consumer’s risk profile based on a much larger set of criteria. As an example, Earnest bases their loans on how much consumers think they can afford each month, while companies like Oppfi don’t even look at people’s credit scores. As Gen X’ers and Millennials inch closer to retirement, a growing number of the 30s, 40s and even 50s somethings have realized it’s time to get serious about their money situation. To serve their needs, fintech companies are turning their backs on physical bank branches and are instead launching virtual banks (also referred to as internet only, digital, or neo-banks). As their name suggests, virtual banks operate entirely online, with no physical branches (and in many cases, no physical ATMs whatsoever). By eliminating the overhead associated with having physical locations, these banks pass on those savings to consumers in the form of free and low-cost financial services. And while most of these services are designed for adults, companies like Greenlight are working to help kids and teens establish financial literacy (via parentally supervised debit accounts). While industry insiders refer to the sector as “Payment Facilitation,” one of the payment trends right now is the concept of Buy Now, Pay Later (BNPL). Unlike traditional credit cards, which require applicants to qualify, BNPL allows providers to “finance” the purchase of goods and services without using credit. Instead, the fintech company assumes the debt while allowing consumers to make multiple payments over time (or one lump sum payment in the future). This, in turn, unlocks financing for millions of consumers who don’t have access to credit cards. While many people associate crypto with speculative investing, the technology behind cryptocurrency - known as blockchain - is at its core a “financial technology.” With that said, most of today’s top blockchains are not companies or corporations. Instead, the operation and maintenance of the blockchain are handled by hundreds (if not thousands) of independent miners and node validators. So while blockchains themselves run independently, the buying and selling of cryptocurrency tokens is big business. Because of that, many of today’s Unicorns provide services that allow users to convert their dollars (and euros and yen) into cryptocurrency and/or NFTs. Examples include crypto trading exchanges like Coinbase, Kraken and Gemini and NFT marketplaces like OpenSea. In fact, of the 64 crypto Unicorns in the US, 39 of them achieved billion-dollar valuations in 2021 alone. Another sub-sector that’s seen rapid growth is “insurtech,” which involves the application of financial technology to the insurance industry. While century-old giants hold a grip on traditional insurance markets, fintech startups are using their ability to stay nimble to address micro-segments of the market Fortune 500 companies aren’t interested in serving. One example is Shift Technology, which helps insurers use AI to identify fraud while processing claims more quickly. Another is Cuvva, a mobile-app provider that offers car insurance on a daily (and even hourly) basis. Another sector gaining momentum involves using financial technology to serve High Net Worth (HNW) individuals and families. And nowhere is that more apparent than in the world of robo-advising. Designed to mimic many (but not all) of the functions of a financial advisor, robo-advisors rely on machine learning and artificial intelligence to guide users towards appropriate investment decisions. As a new technology, robo-advisors hold just 1% of the $110 trillion dollars traditional advisors have in Assets Under Management (AUM). With that said, that number is expected to grow by 16.7% annually. One example is Bambu, which uses proprietary algorithms and machine learning to make “saving and investing more straightforward” for their clients. Another industry that’s ripe for disruption is that of real estate investing (aka REI). Up until recently, most investments were processed through traditional service providers (real estate agents, mortgage lenders and banks). However, as fintech companies disrupt the traditional lending market (and new innovations allow for concepts such as fractional ownership) the world of REI is transforming fast. As an example, companies like Cadre are using data analysis to source deals that, without their platform, would be impossible to organize. Further, Cadre’s platform helps investors of all sizes reduce acquisition fees while enabling owners to monetize what were previously illiquid properties. And that’s just the consumer side. As the B2C market becomes more competitive, a growing number of companies are focusing their solutions on corporate needs. Admittedly, B2B companies don’t get as much press as consumer favorites like Coinbase and Stripe. However, with hundred million dollar deals taking place, and over one hundred billion dollars in revenue being processed, the B2B side of fintech is alive and well. With that said, there’s a dramatic difference between how small businesses and enterprise-level corporations use financial technology. Given small businesses have limited budgets, the application of fintech to SMBs tends to focus on more practical problems. In particular, problems areas related to lending, accounting and payroll. As an example, FlexWage works with small businesses to give employees immediate access to their paychecks (versus having to wait until the 1st or 15th of each month). The same goes for Payfully, which allows real estate agents to access their commissions sooner. On the accounting side, Kyriba helps small businesses use AI to manage future liquidity based on past invoice data (and is planning to launch a tool that will allow owners to run hypothetical “What if…” scenarios). And for around $20 per month, small business owners can use services like MoneyLion, which provides savings, lending, and wealth management app. Not to mention the wide variety of fintech companies rolling out solutions related to loyalty credit cards and payment facilitation. On the opposite side of the budget spectrum, we have enterprise companies. With what most consider to be “unlimited” budgets, enterprise companies can afford to invest in more elaborate (and even experimental) fintech applications. One enterprise-level company is Stampli, which helps corporations organize and visualize their corporate spending data in a variety of easy-to-understand dashboards. Another is Remote.com, which helps companies organize the paperwork and payment details needed to hire, pay and employ people from foreign countries (an increasingly common problem as borders become more fluid and the #WorkFromHome movement gains momentum).Consumer Fintech Applications

Disrupting the Lending Market

Reducing the Cost of Banking

Searches for "Neobank" have gone up 360% in the last year aloneBuy Now, Pay Later

Searches for "BNPL" are exploding over the last few yearsCryptocurrency and Fintech

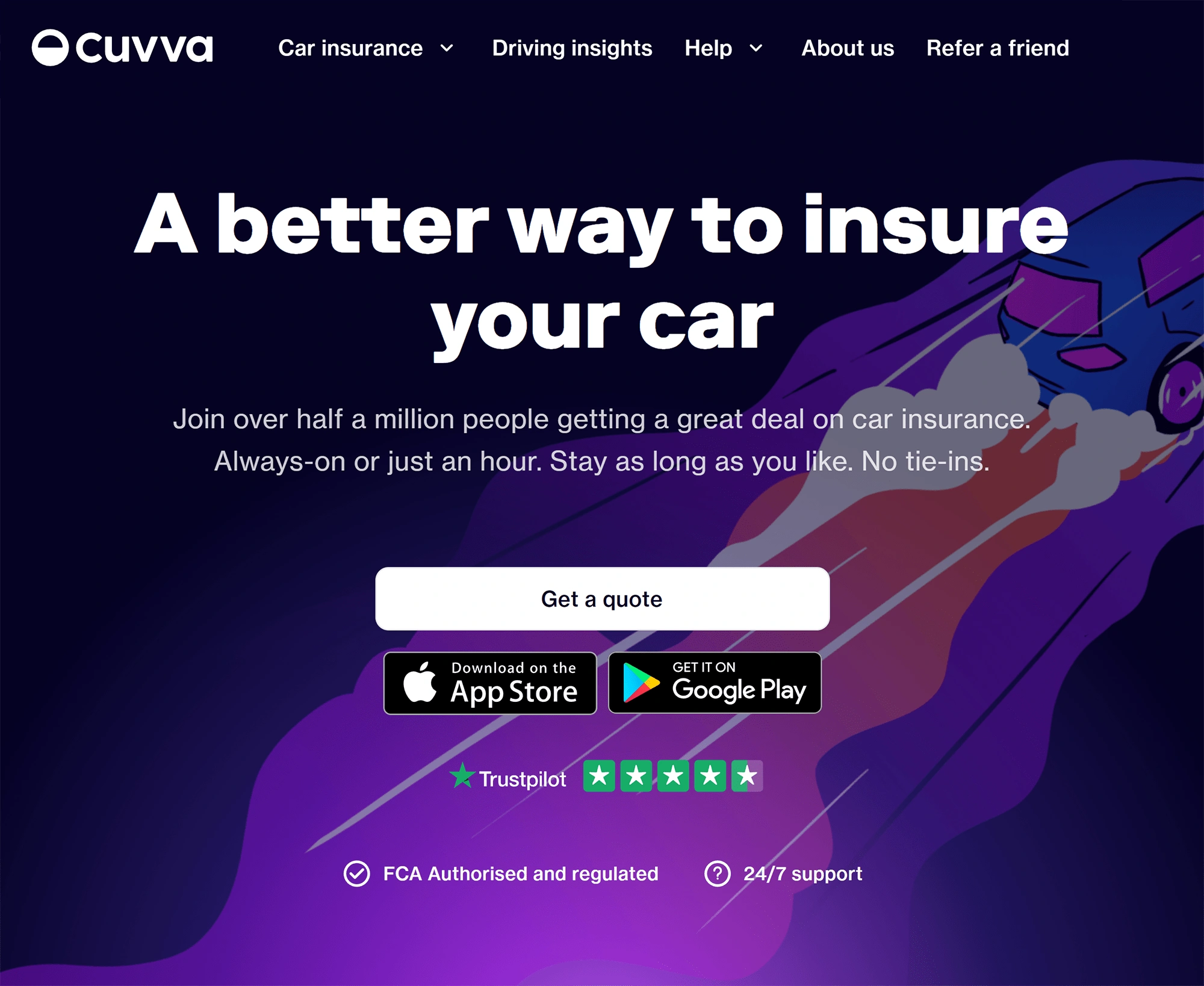

Insurtech As a New Industry

Searches for "insurtech" spiked up rapidly five years ago and never died downRobots as Financial Advisors

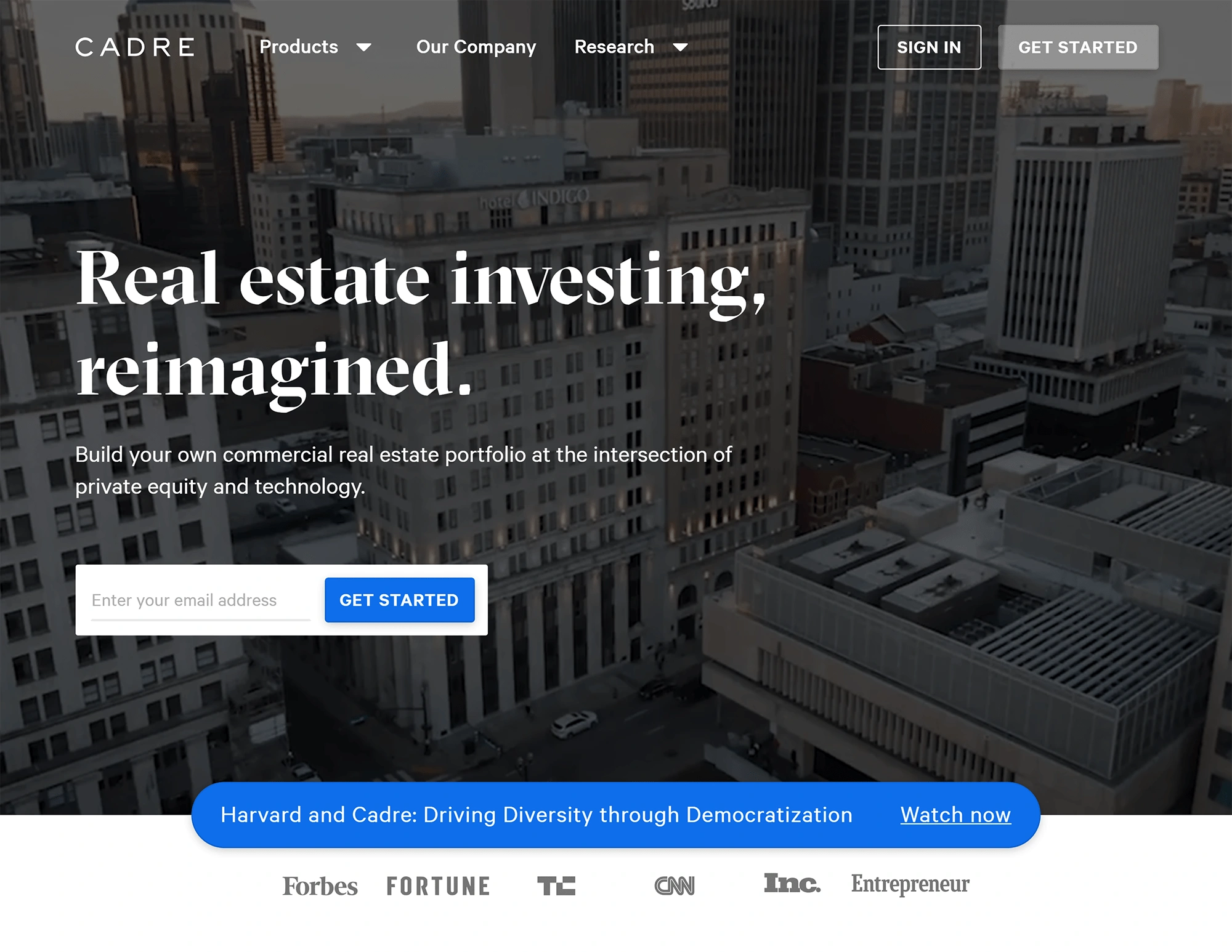

Fintech in Real Estate Investing

B2B Fintech Is a Growing Sub-niche

How SMBs Use Fintech

Fintech at the Enterprise Level

The Tech Side of Fintech

In this chapter, we’ll discuss the cutting-edge technology behind today’s hottest fintech companies.

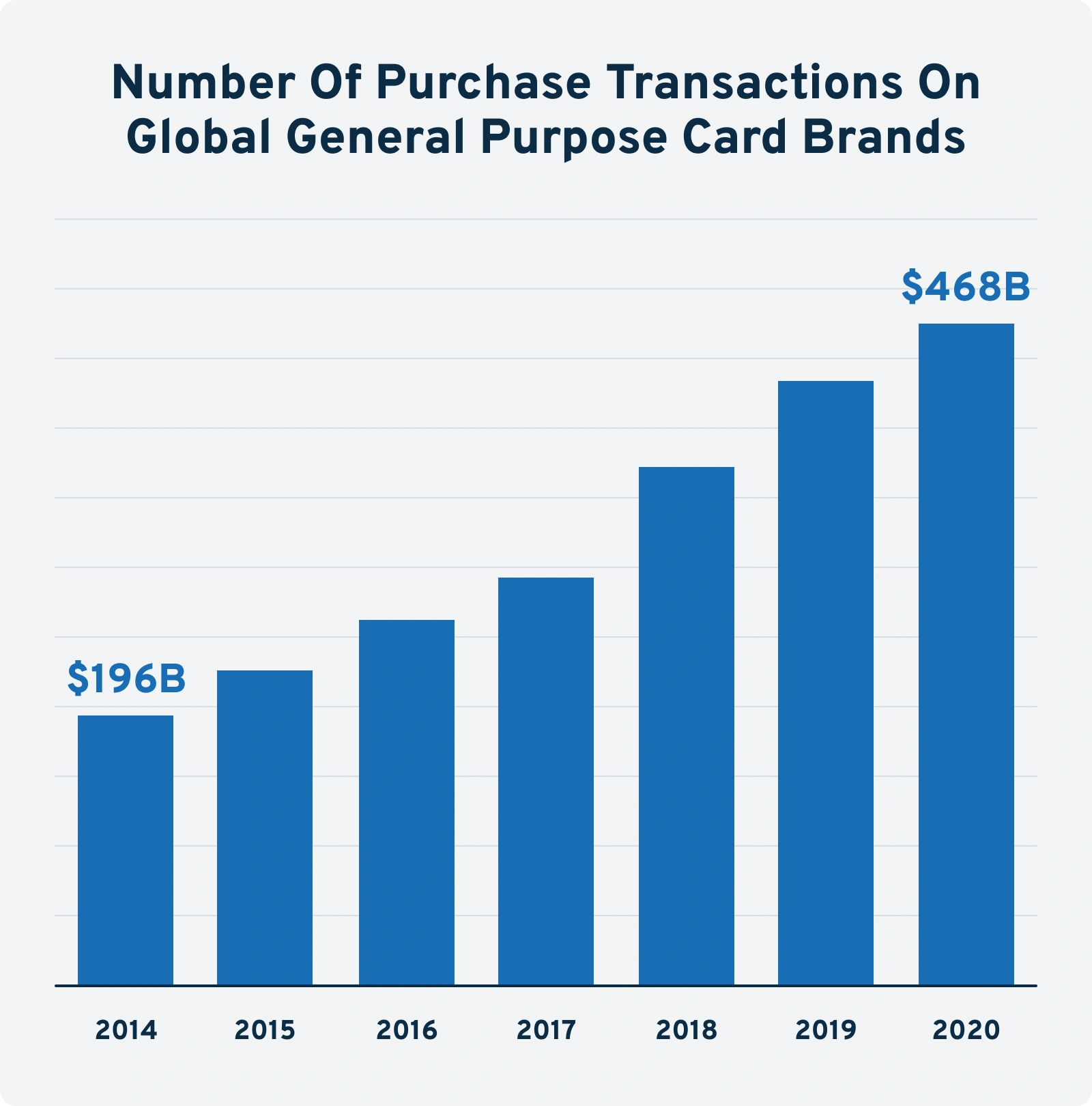

From credit card swipes to loan applications, financial services companies process hundreds of millions (if not billions) of transactions every single year. In the past, these transactions (and documents) were processed, organized and stored as physical paperwork. As society became more digital, however, the overwhelming majority of financial documentation was moved online. With server after server accumulating billions of records and transactions, computer scientists eventually realized they could mine that data to identify patterns. Patterns corporations could use to gain insights on everything from their customers to their systems and processes. Fast forward to today and the analysis of big data lies at the heart of financial technology. In fact, while the Internet didn’t gain consumer adoption until the late 1990s, financial services companies began using algorithms as far back as 1986. Since then, both artificial intelligence and fintech as an industry have made dramatic progress (to the point AI lies at the heart of most modern fintech services). And nowhere is this more obvious than the banking industry. In 2020, today’s top credit and debit card companies processed over 468 billion transactions. While it's hard to know precisely how many of those transactions were illegal, credit card fraud consistently ranks as one of the top financial crimes (accounting for more than 25% of complaints submitted to the Federal Trade Commissions). To fight back, today’s banks and merchant processors depend on artificial intelligence to identify and block fraudulent transactions before they happen. Fortunately, banks have data points (geographic, spending amount, etc.) on hundreds of billions of legitimate transactions. Because of that, AI programmers are able to create elaborate criteria regarding what is and is not a valid transaction. From there, the AI’s algorithms alert banks when a transaction deviates from the “norm.” In fact, if you’ve ever received a text message or email after having one of your purchases declined, it's safe to assume an AI flagged your purchase as potentially being fraudulent. As an example, Resistant AI not only helps companies prevent fraudulent transactions (via the process outlined above), but uses AI to identify bank statements and proof of address documents that have been tampered with. With that said, the processing power required to analyze all that data is above and beyond what even the most powerful computers on the planet can handle. Because of that, many fintech companies now rely on what’s known as Distributed Computing. Per IBM, distributed computing refers to a “distributed computer system that consists of multiple software components that are on multiple computers, but run as a single system.” Think of it like buying multiple desktop computers or laptops, then linking them so you can combine their processing power into one “supercomputer.” As it relates to fintech, there are four core benefits that make distributed computing attractive for fintech applications. The first and arguably most important is the ability to scale. By combining the processing power of dozens, hundreds and even thousands of servers, fintech companies gain the processing power they need to power the global financial system. Second, distributed computing networks allow AI programs to function at peak performance. By providing excess processing power, fintech companies avoid stressing their servers by running them at peak capacity all the time (similar to how you would never drive your car at max RPM for more than a few seconds). Third, distributed computing networks provide redundancy. With everything from credit card transactions to million-dollar stock trades on the line, it's too risky for fintech companies to have a single point of failure. With distributed computing, however, everything keeps running even if one (or multiple) servers go down. Last, distributed computing networks are affordable. Mainly because, rather than relying on highly expensive supercomputers to get the processing power they need, fintech companies can link up a large number of low-cost servers to achieve the same outcome. Unlike AI and machine learning, which are designed to process immense amounts of data while continually learning from their own successes and failures, robotic process automation (RPA) serves a more simple purpose. In particular, RPA is designed to mimic redundant tasks a human would normally have to handle on their own. Examples include scraping data from websites, transferring information from one digital form or document to another form (or database), and so on. Admittedly, today’s robots are not perfect. However, in clearly defined “rules-base” situations, they bring many advantages to the table relative to human employees. In particular, robots do not get tired, can work 24 hours per day, and (when programmed correctly) make dramatically fewer mistakes than us humans. Despite serving a more simple purpose, however, integrating RPA into a company’s systems and processes can be highly complicated. Because of that, fintech companies have only scratched the surface in terms of what RPA will be capable of automating in the future. While blockchain technology lies at the heart of today’s most popular cryptocurrencies, its potential is much larger than just speculative investments. By creating a permanent, unalterable, and distributed ledger, blockchain has the power to solve a wide variety of problems in the fintech industry. The first and most obvious is the ability to track transactions. As it stands now, executives have to worry about everything from nefarious employees to hackers and even natural disasters wiping out their financial records. With blockchain, however, none of these are an issue. Instead, the ledger is constantly updated on hundreds (if not thousands) of computers at once, making it both impossible to manipulate and natural disaster-proof. The implications of this for fintech companies are staggering. From preventing fraud (at both the government and corporate level) to tracking land deeds, blockchain was the hottest sub-sector of the industry in 2021.The Role of Big Data in Fintech

Combining Big Data with Financial Services

Fintech in the Banking Industry

Preventing Fraudulent Transactions

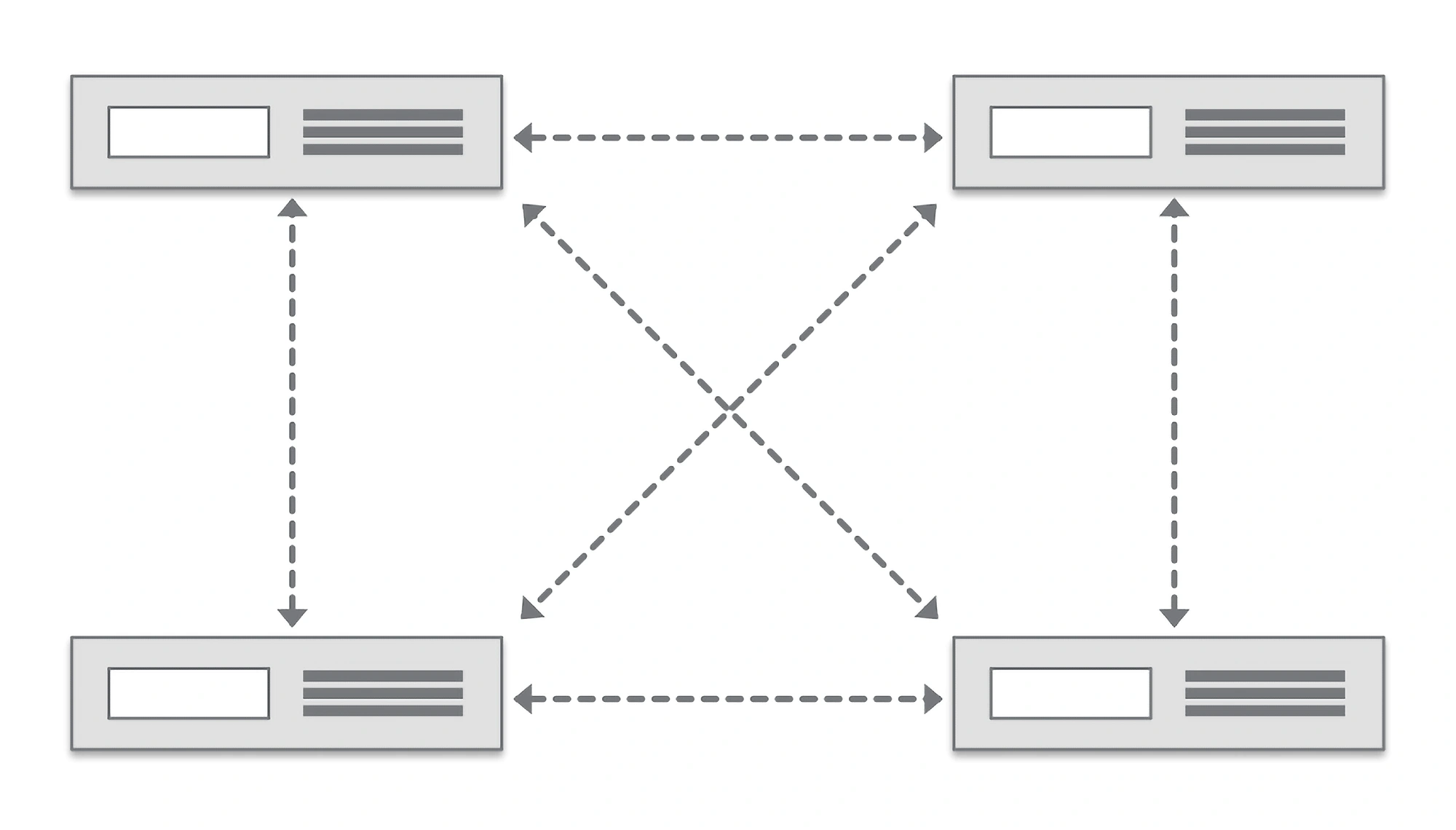

How Fintech Companies Process Big Data

In distributed computing, multiple computer servers are tied together across a network to enable large workloads that take advantage of all available resourcesThe Benefits of Distributed Computing

Robotic Process Automation

Searches for "robotic process automation" over the decadeBlockchain Adoption in Fintech

The Hottest Trends in Fintech

In this chapter, we’ll discuss the hottest trends in financial technology in 2022 and beyond.

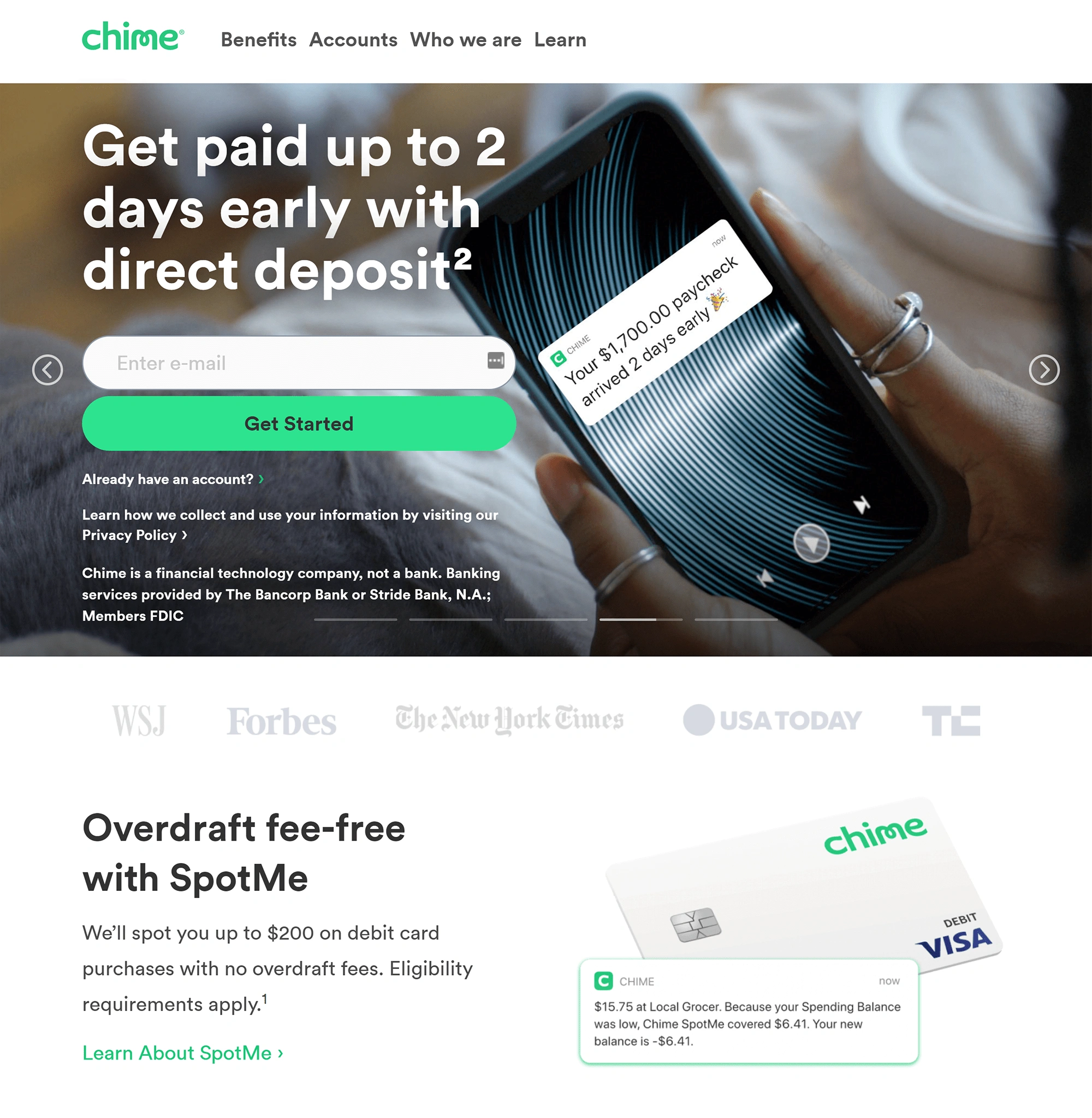

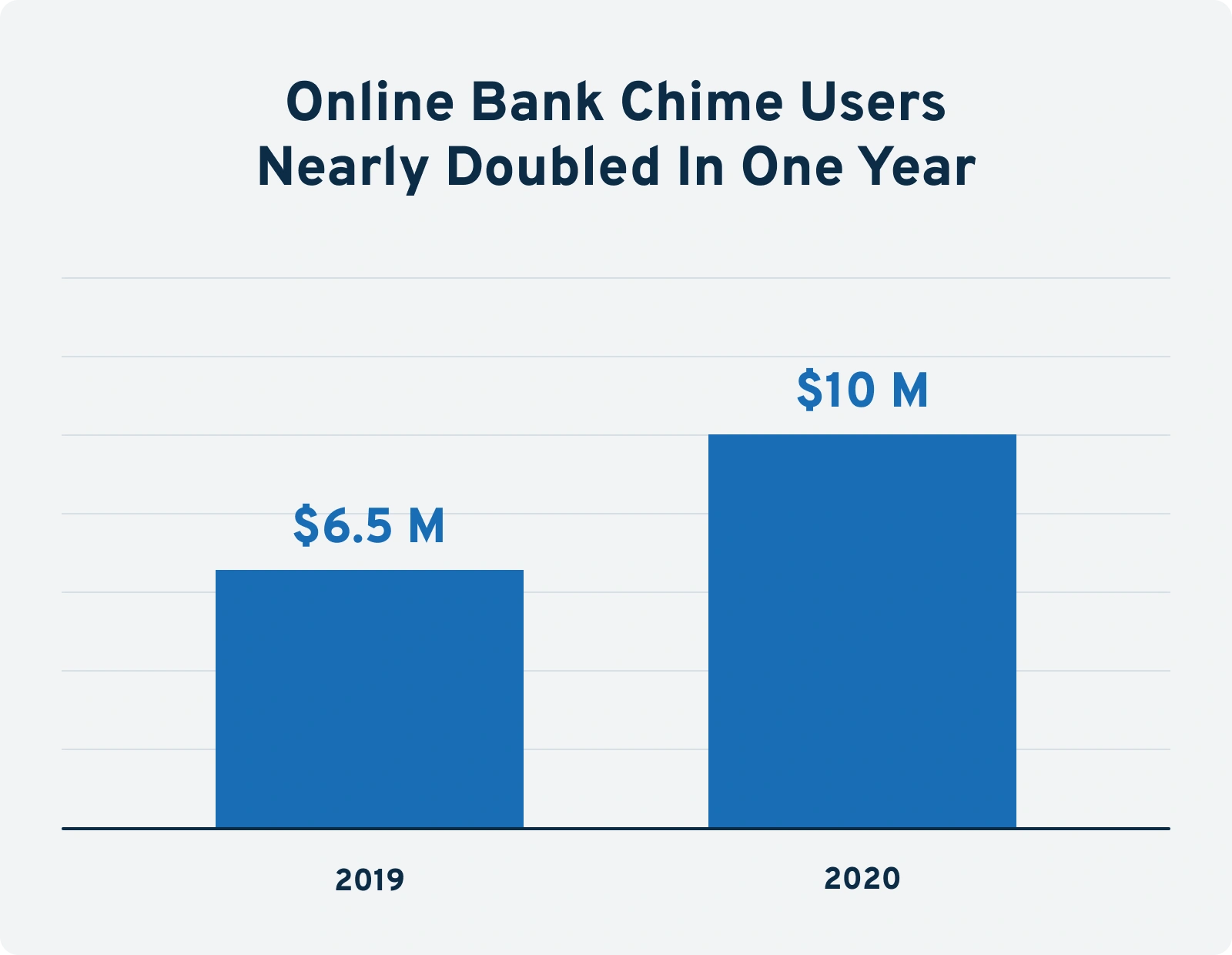

While the concept of banks with no (or few) branches is nothing new, the 2020 pandemic accelerated the pace at which Americans shifted to digital banks. (Digital Banks are referred to by a variety of names, including Online Only Banks, Virtual Banks, Internet Banks and Neobanks.) There are two reasons for this. First, with many bank branches shut down (or reduced to limited operating hours), many people realized they never really “needed” to go to the bank in the first place. Second, because their expenses are typically much lower than traditional banks (which have to pay for rent, property insurance, etc.), virtual banks are able to pass those savings along to their customers in the form of no and low-cost services (e.g. checking accounts, etc.). At a time when the US was facing historic unemployment, this combination of convenience and affordability made digital banks highly attractive. As an example, online bank Chime grew from 6.5MM customers in 2019 to over 10MM in 2020. As a result of their rapid growth, Chime went from having a $1.5 billion valuation in 2019 to a stunning $25 billion valuation by 2021. The same goes for Chime’s competitor Dave, which ranked #5 on the 2020 Inc. 5,000 list after growing revenue by 29,000% since 2017. One of the most fascinating trends taking the fintech world by storm is the concept of Super Apps. Historically speaking, dealing with a separate company for your banking, mortgage, 401K and crypto investments has been considered normal. Super App companies, however, aim to break down those barriers by offering a variety of financial services under one roof (or should we say, inside of one app). While industry heavyweights like PayPal, RobinHood, and Coinbase have expressed interest in becoming “super apps,” none have come close to actually pulling it off. With that said, the strategy for achieving super app status is quite simple: Start off with a niche service (like Wise did with international money transfers), dominate the market, then roll out other services to your existing users. More importantly, while the concept of super apps is new to the US, they’re a smash hit in Southeast Asia and China. Because of that, it's safe to assume American companies will continue working to bundle their services. In what is a blurring of the lines between contactless cards and super apps, mobile wallets were yet another beneficiary of the pandemic. While the concept of a mobile wallet was first introduced in 2014 (via Apple Pay), mobile wallets as a trend exploded in popularity in 2020 (with adoption growing by 25% in 2020 alone relative to 2019). And it's easy to understand why: With most adults trying to protect themselves from COVID-19, typing your PIN number into a point-of-sale machine (or ATM) with bare fingers became a potentially serious health risk. In addition to the safety benefits, both mobile wallets and contactless payment methods are more convenient than using cards. Because of that, it should come as no surprise the number of people using contactless payment methods jumped from 440 million in 2018 to 760 million just two years later. With that said, it can be hard to define what a “mobile wallet” really is. On the one hand, most of us have been using Google Chrome’s and Amazon’s online wallet services for years. Mainly because they allow us to buy things online without constantly having to type in our credit or debit card number. However, this is just one example of a “mobile wallet.” In addition, a wide variety of non-financial services companies now offer mobile wallets (including Apple, Samsung and Facebook). With the ability to swipe your phone on a point-of-sale machine, these services were instrumental in reducing physical contact during the COVID-19 pandemic. Combined with the launch of Facebook’s Pay service - which allows users to integrate their banking info into WhatsApp - global mobile wallet adoption stood at 50-55% in 2020 and is expected to increase to 75% by 2025. Not to be confused with virtual banking, open banking involves giving customers the option of sharing their financial data with fintech companies (via API). On the one hand, banks are known for being highly protective of their customer’s information (for both obvious reasons and because of government regulations). However, as consumers trend towards apps like Mint and Plaid - which allow users to see all of their credit and debit accounts balances in one app - banks have been forced to either give consumers access to their data or risk losing customers. With that said, the sharing of data is handled via highly secure, encrypted APIs. Because of that, some banks are leaning into open banking as a way to gather insightful information regarding who their customers are and how they can serve them better. While bundling financial services into a super app may be a hot topic among fintech executives, some consumers are opting to leave the legacy financial system entirely. How? By taking their money out of the banks and converting it into cryptocurrency. Known as decentralized finance (aka DeFi), this fintech sub-sector involves allowing consumers to borrow, lend, invest and receive interest payments using cryptocurrency instead of traditional fiat money (dollars, yen, etc.). Admittedly, converting your life savings into crypto may sound like a terrifying concept. Especially for baby boomers who grew up trusting in the power and reliability of legacy banks. With that said, DeFi as an industry has been growing at a blistering pace. To the point deposits made on DeFi protocols increased from just one billion dollars in January of 2020, to more than a quarter trillion dollars by 2021. While fintech companies have the technological prowess required to bring new and exciting services to market, the collection, storage and distribution of financial data is highly regulated. Because of that, fintech companies are in a constant battle between launching innovative solutions and obeying the law. To address this, a growing number of fintech companies are focusing their services on helping financial services companies (including other fintechs) stay compliant. Known as Regulatory Technology - or RegTech - companies in this sector help their clients avoid fraud, money laundering, data breaches and more. As an example, Ascent uses AI to organize and compile relevant regulatory documents for their clients in real-time, allowing clients to stay up-to-date on regulations as soon as they’re released by the government. And with regulations a constant thorn in the side of many fintech companies, RegTech is expected to become a $130 billion industry by 2025.Banks With No Branches

Chime is a leading neobank in the USThe Rise of Super Apps

American Fintechs Attempt to Clone China’s Success

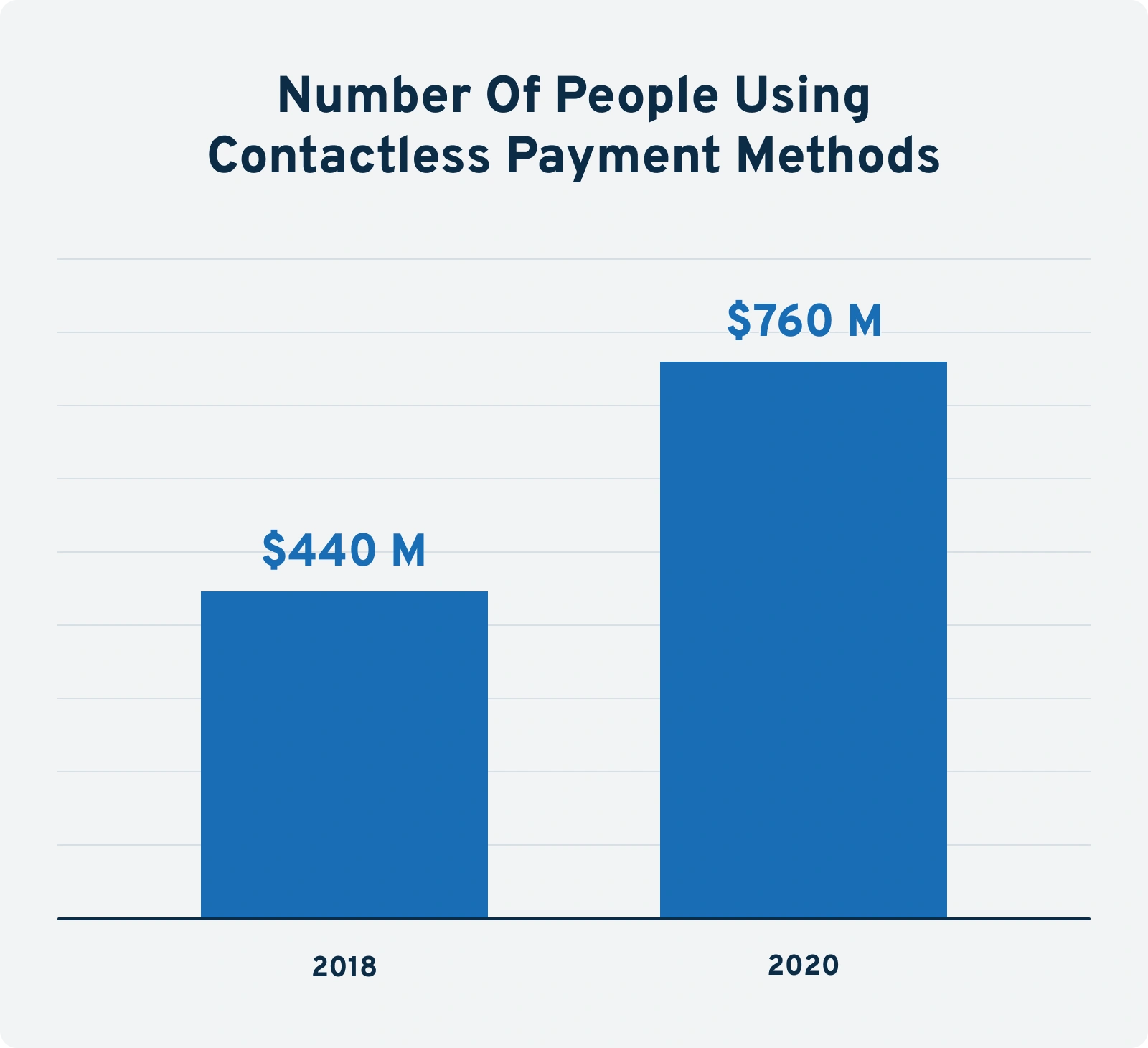

Mobile Wallets and COVID

Searches for "digital wallet", as mobile wallets are also called, have gone up over 1000% in the last 10 yearsOnline Wallets vs Mobile Wallets

The Growth of Open Banking

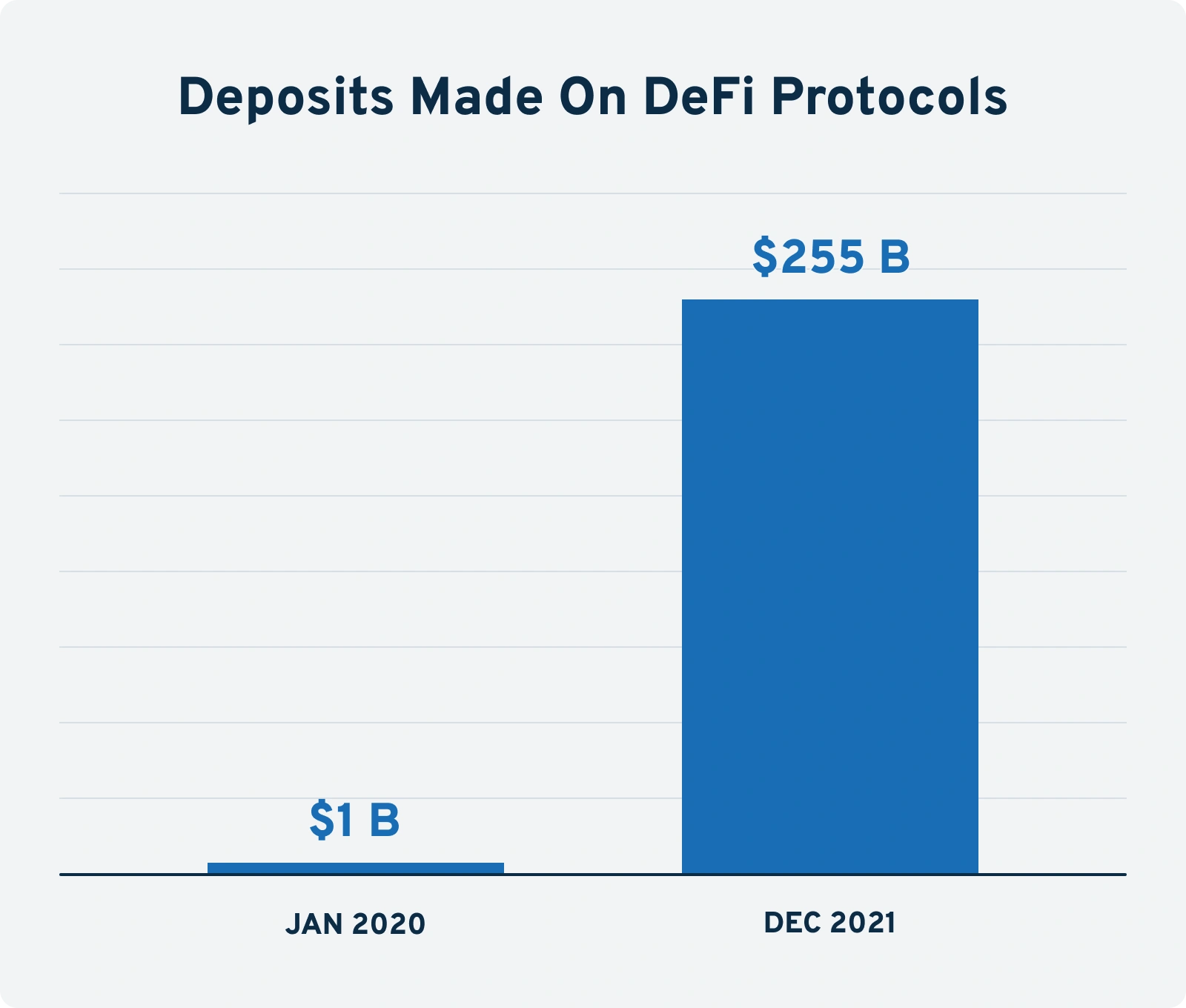

Searches for "open banking" over the last five yearsThe Explosive Growth of Decentralized Finance

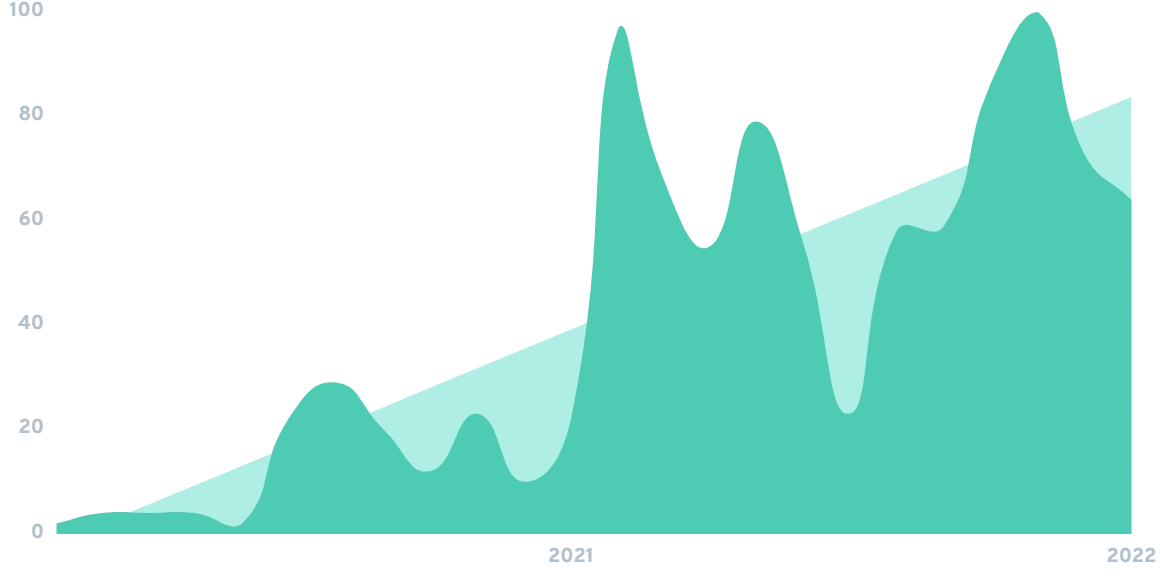

Searches for "decentralized finance" exploded over 2750% in the last two years aloneAutomating Regulatory Compliance

RegTech to Become a $100 Billion Industry

Obstacles Facing the FinTech Industry

In this chapter, we’ll discuss the various obstacles and headwinds today’s fintech companies must deal with.

As open banking and mobile wallets take the consumer market by storm, fintech companies are tasked with handling an increasing amount of sensitive financial data every month that goes by. Because of that, many fintech companies have to protect themselves from hacks, cyber-attacks and ransomware. On the positive side, the blistering growth of fintech shows both consumers and businesses are interested in adopting this new technology. On the other hand, technology is most vulnerable when it's brand new (given its bugs and kinks haven’t been identified or patched up yet). A reality that’s resulted in financial regulators - whose job it is to protect consumers - monitoring the industry quite closely. In fact, not only are fintech companies being watched by eight separate federal regulatory departments, but they also have to deal with countless industry watchdogs and a variety of state-level regulators. Here’s a small sample of the laws and regulations used to ensure fintech companies stay compliant. Also known as the Financial Modernization Act, regulators lean on the GLBA to ensure fintech companies explain how customers' data is being shared. They also use it to ensure customers’ data is being safeguarded properly. This is a big one for fintech companies, as the amount of sensitive financial data they possess makes them a ripe target for hackers. Most often enforced by the FTC and Consumer Financial Protection Bureau, the FCRA is used to regulate how fintechs can collect consumers’ credit records. It’s also used to ensure consumers can access their credit reports. While the majority of fintech companies operate within the law, their existence on the bleeding edge of technology means bad actors can use their power, skill and technological prowess to launder money. Because of that, some fintech companies come under close watch from the Financial Crimes Enforcement Network (the department of the US government responsible for pursuing money laundering crimes) and a variety of organizations in the UK. With no federal department responsible for regulating cryptocurrencies, the SEC has become the de-facto enforcer for most cryptocurrency crimes. And because some fintech companies use what are known as Initial Coin Offerings (ICOs) to raise capital, they too can fall under the purview of the Securities and Exchange Act.Fintechs Are Ripe Targets for Cyber Criminals

Regulators Are Watching the Industry Like a Hawk

What Federal Regulators Watch For

Gramm-Leach Bliley Act (GLBA)

Fair Credit Reporting Act (FCRA)

US Anti-Money Laundering (AML)

Securities and Exchange Act

The Future of Fintech

In this chapter, we’ll discuss the future of the financial technology industry as a whole.

While fintech companies face more scrutiny than almost any other industry (except for maybe healthcare), regulators have no interest in stifling innovation or “shutting the industry down.” And while hacks and cyberattacks do happen, some of the largest companies in the world (including Facebook, Adobe and Twitter) have recovered from large-scale data breaches. Because of that, it's unlikely fintech is going anywhere anytime soon. In fact, fintech has grown at such a rapid pace that executives from traditional financial institutions see them as a major threat to their business model. As an example, 88% of legacy banks and financial services companies “believe they will lose part of their business to the fintech sector in the next five years.” To avoid falling behind, studies show 82% of financial institutions “expect to partner with fintech companies in the next three to five years.” Here are some of the newest trends these companies will be taking action on. First and foremost, industry experts expect the number of consumers using robo-advisors to continue growing. Why? Because the “Great Wealth Transfer” - in which baby boomers pass on assets to their Gen Z and Millennial children - will result in over $68 trillion of assets moving to younger generations. Younger generations that grew up with computers and have already shown their willingness to engage with robo-advisors. While most of us still use our fingers to operate our computers and phones, many experts believe voice commands will be the next “disruptive” wave in technology. And fintech companies agree. From payments to biometric verification, financial technology companies are betting on voice-command tech in a big way. With regulators watching closely, fintechs are on a constant lookout for anything that can make their services more secure. Because of that, a growing number of companies are integrating everything from fingerprints to eye-scanners into their security protocols. While the 2020 pandemic put a damp on international travel, global tourism has grown exponentially over the past few decades. And it’s not just travelers. Over the last five years, the number of expatriates relocating to foreign countries has hit record highs. Because of that, and because of the growth in new payment technologies like mobile wallets and cryptocurrency, it’s critical today’s businesses stay on top of cutting-edge trends. To help them do so, fintech companies have begun offering Fintech as a Service. From white-label e-wallets to identity verification, FaaS enables small businesses (that would not have the budget otherwise) to both use - and offer - fintech services.Fintech Is Here to Stay

Too Big to Ignore

Continued Robo-Advisor Adoption

Voice Command Banking

Biometric Security As a Compliance Tool

Fintech As a Service (FaaS)

Conclusion

Despite its young age, the fintech industry has exploded at breakneck speed. With billions of users and trillions of dollars in transactions, financial technology companies aim to disrupt almost every facet of how we interact with money. On the one hand, the constant digitization of our finances presents criminals with an increasing number of ways to commit crimes. Reality regulators are well aware of. However, as society trends towards the convenience of a digital future, it's safe to assume fintech as an industry will continue to grow.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.