Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

11 Key Types of Alternative Data For Investment Insights

In today's investment landscape, traditional data no longer suffices. A multitude of savvy hedge funds, pension funds, and sharp corporate treasurers, all backed by armies of analysts, are eager to consume data.

But if everyone is looking at the same data, how do you beat the market? The answer: alternative data.

Alternative data allows for deeper insights into market trends and uncharted investment opportunities. From tracking foot traffic to private jet activity, these new data streams are revolutionizing decision-making processes.

Dive into the different types of alternative data and discover how savvy investors are harnessing innovation to gain a competitive edge.

Physical Alternative Data

Satellite Images: Data From Above

Satellite images provide a bird's-eye view of global activity, revealing patterns and changes inaccessible through conventional means.

In terms of alternative data, satellites offer a glimpse into agriculture, infrastructure development, and even oil reserves in real time.

Satellite data can be particularly useful when there’s a dearth of reliable data coming from official channels.

For example, the Chinese economy is extremely relevant to the global demand for goods and services, and yet, economic data coming from China is sparse and opaque.

Specifically, satellite images that monitor parking lot occupancy and factory activity can help fill that gap.

Source: NASA

Foot Traffic: Tracking Consumer Behavior

Walking past a store and glancing in? You're now a data point.

Foot traffic data measures how many people walk into or near specific locations, like stores or attractions. Advan uses both satellite imagery and mobile data to deduce the popularity of specific venues.

In addition to foot traffic, the company tracks employee counts, truck traffic, and dwell patterns for a complete picture of store and venue activity.

Armed with that data, hedge funds and investment managers are able to estimate a company’s revenue growth “‘by proxy”, and make alpha-generating investments especially if the alternative data disagrees significantly with Wall Street consensus.

Tracking Shipping Containers: The Pulse of Global Trade

Massive ships in the harbor are carrying more than just goods—they're bearing data. Monitoring shipping activities can predict trade flows and hint at broader economic activity.

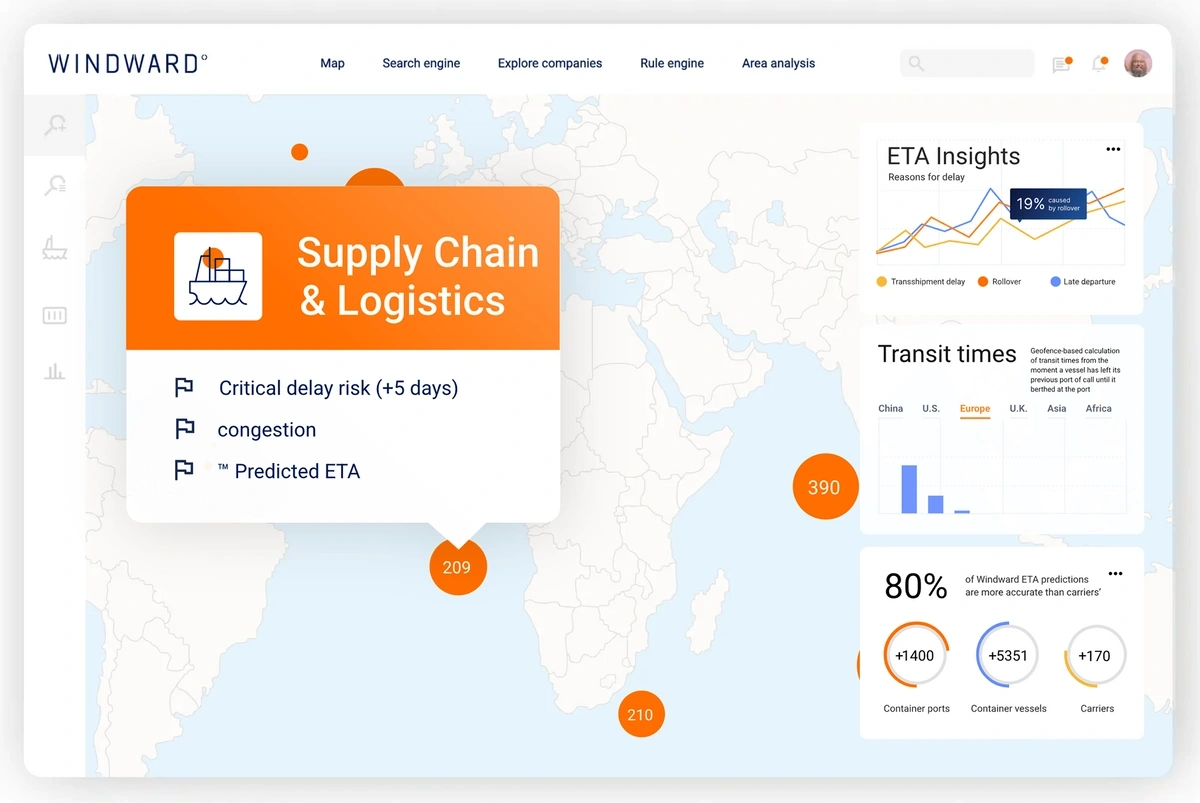

For example, companies like Windward specialize in tracking container activity, offering unique insights into the maritime sector and global trade flows.

Source: Windward AI

As the Russia/Ukraine war drags on, Windward's AI technology emerged as indispensable to commodity investors and traders.

Partnering with the London Stock Exchange Group (LSEG), Windward tracks and evaluates potential illicit activities of global vessels, particularly spotting the skirting of sanctions by Russian-affiliated tankers.

Given that Russia is responsible for 10% of global oil production, assessing de facto oil supply in real time is key to investors seeking an informational edge.

Transactional Alternative Data

Consumer Transactions: Peeking into Wallets

Observing spending behaviors can predict economic health and trends.

Facteus empowers asset allocators with real-time transaction data. Whether people are splurging or scrimping, transaction data breaks the news - in real time.

This provides a clear advantage compared to waiting for and interpreting official economic data.

For example, Consumer Price Index (CPI) data only comes out once a month, and GDP data is only released quarterly.

Armed with transaction data, a macro hedge fund is able to access snapshots of the economy as it’s evolving. Not only that, but investors are able to tap into data down to the SKU level.

In the current times of rising and elusive inflation, this granular spending data is key. For example, if a CPI report shows the bulk of inflation is coming from transportation prices, an investor can monitor inflation in real time by honing in on gas station transactions.

If it’s coming from food, supermarkets and convenience stores are the right place to look.

Source: Facteus

Email Receipts: What's in the Inbox Matters

With 62% of leading hedge funds using four or more sources of alternative data, the importance of diverse insights in shaping investment strategies has never been clearer.

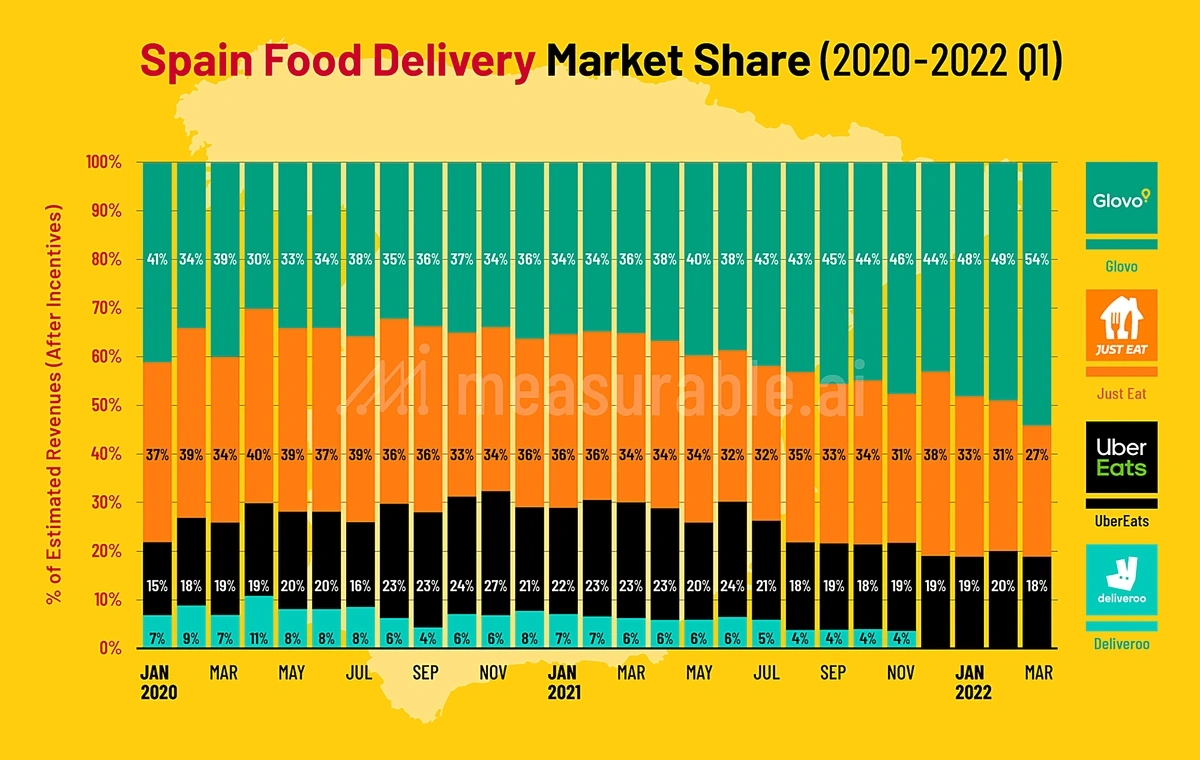

Analyzing digital receipts, for example, can highlight purchasing behaviors and product trends. Measurable AI tracks online purchases via e-receipts, offering a peek into consumers' digital shopping carts.

An investor in ride-hailing apps or food delivery stocks, for example, can deduce each company’s market share by having access to Measurable AI’s email receipt data, and make more informed investment decisions.

Source: Measurable AI and Foodeli

Online Retail Rankings: The Digital Scoreboard

Product rankings on e-commerce platforms indicate brand performance and can hint at a company's financial health.

Kabbage (now owned by American Express) taps into this e-commerce data, making lending decisions and spotting new credit opportunities.

When a product ranks higher, it's not just good news for the brand, but it's also data gold for investors. They’re able to interpret that positive momentum in e-commerce rankings as a leading indicator of a company’s success, compared to backward-looking financial statements.

Informational Alternative Data

Search Volume: Collective Intel

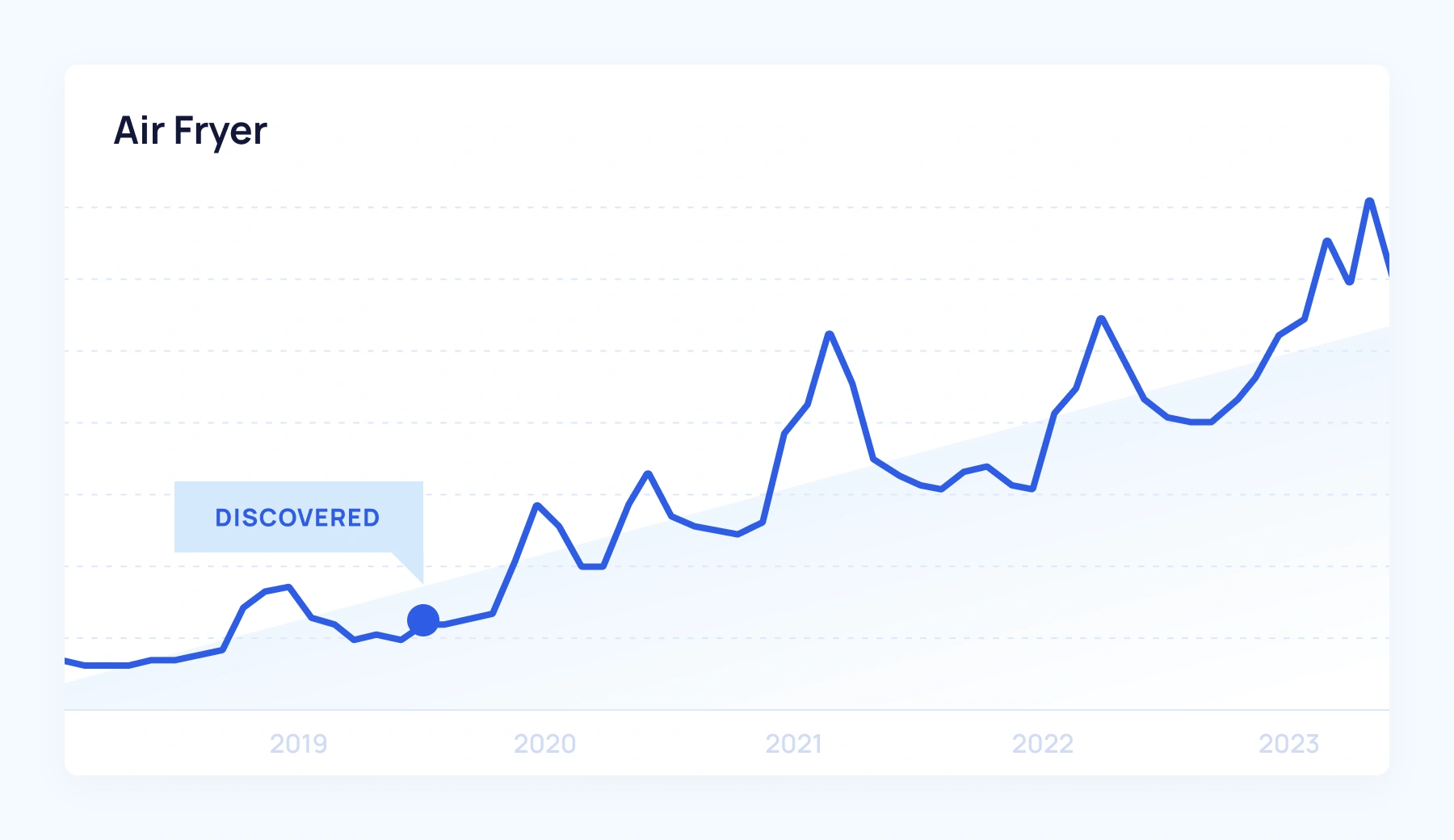

Every query typed into the search bar becomes part of a statistic. Tracking how often terms are searched on the internet reveals demand trends and shifts in public interest.

Exploding Topics, for instance, zooms into these data patterns, spotting valuable search terms just as they're skyrocketing in popularity.

A VC fund, for example, can discover up-and-coming startups building exciting products, keep up with trends, and unearth entirely new markets.

Source: Exploding Topics

Web Data: More than Just Numbers

Monitoring website interactions, session length, and traffic can lead to a cornucopia of insights. Data that is scraped from the web can be equally useful.

Companies like Neudata are on the hunt, looking for unique data sources like these to unearth alpha-generating insights. The scraping and analyzing companies’ SEC filings is a clear value-add to institutional investors.

Instead of combing through a company’s quarterly 10-K report (usually hundreds of pages long), investors can access condensed insights through alternative data providers’ scraping and natural language processing (NLP).

Not only that, but these services allow for the comparison of several competitors’ SEC filings. If a company’s management discussion includes optimistic comments about raising prices (and this sentiment is lacking from competitors’ filings), this pricing power is likely to lead to higher earnings in the next quarter.

Social Media & News Sentiment: The Modern Mood Ring

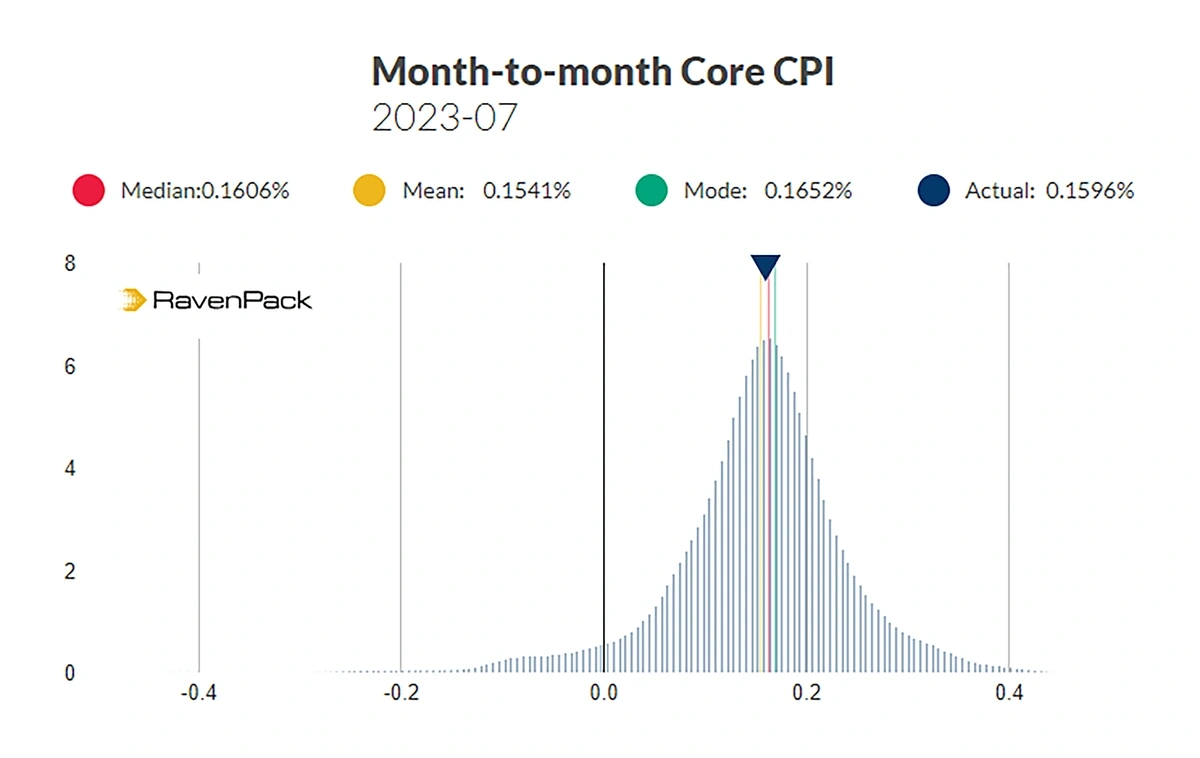

Tweets, comments, and news articles offer a peek into the public's mood and sentiment.

Raven Pack decodes this vast swath of text data, gauging market sentiment and possible investment shifts. In the age of information overload, every digital expression counts.

Not only that, but Raven Pack can analyze a firm’s internal digital content, and derive insight from that.

Source: Raven Pack

As they combed through emails, internal chats and research of a $1 billion European hedge fund, the company found that 80% of stock-related events were found in the firm’s internal content, while only 20% originated from public news.

Job Listings: Predicting Corporate Health

A company’s hiring spree or a sudden freeze in recruitment? There's a story there. Job listings can hint at company growth, upcoming projects, or potential financial challenges.

LinkUp accesses vacancy data to dive deep into the global job market, guiding investment strategies.

ESG Ratings: More than a Gold Star

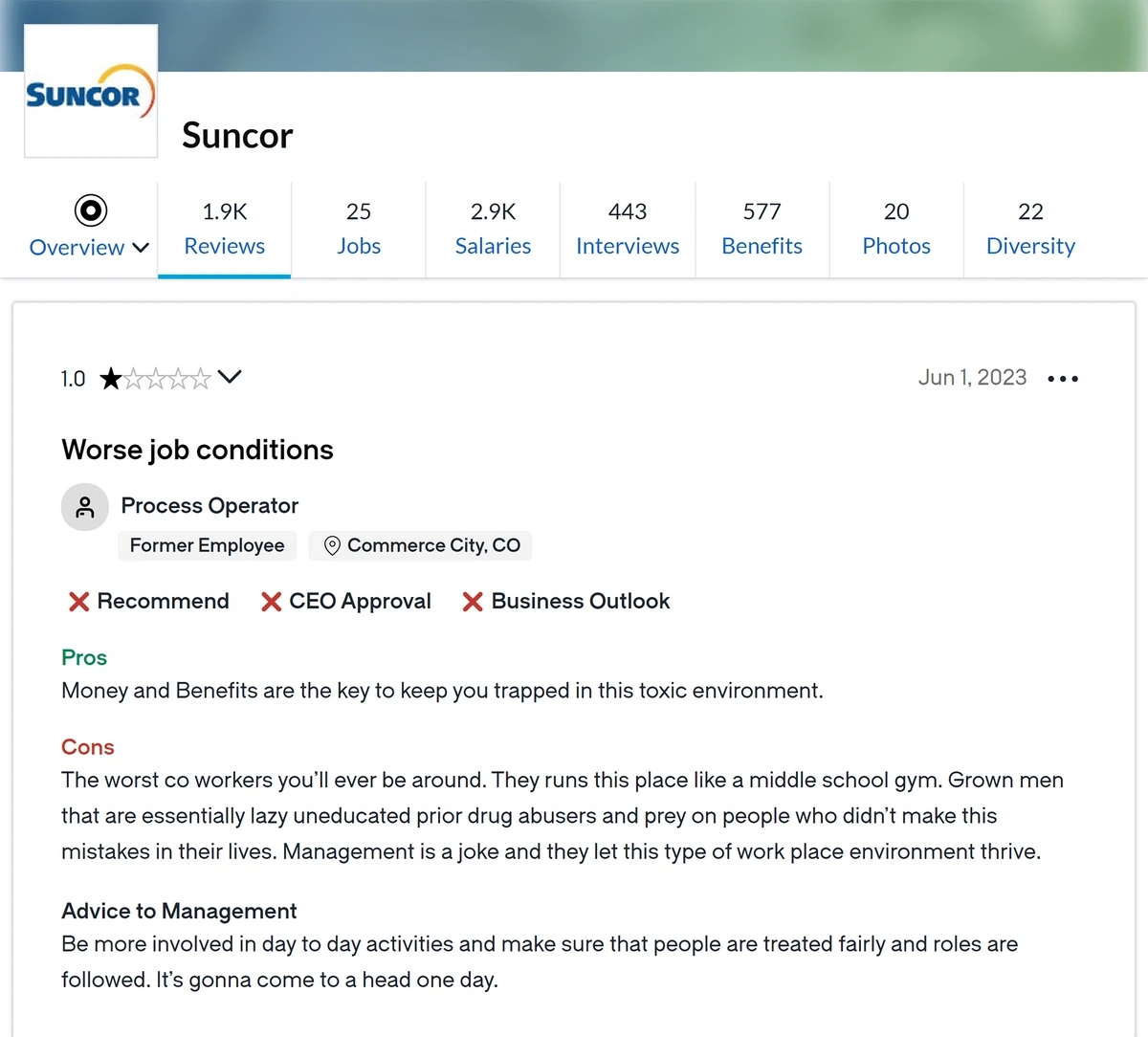

Reviews on platforms like TrustPilot or Glassdoor offer more than customer feedback—they're windows into company culture, product quality, and even ESG practices.

These ratings can help investors look past potential greenwashing by a company’s PR/Communications department.

Suncor Energy, for example, is an oil company that appears committed to employee welfare and safety.

Source: Suncor Energy Investor Relations

However, nearly 2,000 Glassdoor reviews tell a different story.

Source: Glassdoor

Investors who value employee welfare as one of the components of lasting profits would likely steer clear of Suncor as a potential investment.

Conclusion

The investment world is no longer just about balance sheets and quarterly reports. In the age of information, alternative data offers a clearer, more nuanced view of market realities.

Whether it's tracking ships, analyzing email receipts, or gauging online sentiment, the smart money knows where to look. Harness the power of alternative data, and stay a step ahead in the investment game.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more