Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 5 Alternative Data Use Cases & Examples

From spotting novel investment opportunities to maintaining a razor-sharp competitive edge, the increasing utility of alternative data in the investment landscape is clear.

Today we will delve into the intricacies of how alternative data is driving investment outcomes across different stages of the investment process. We’re going to cover specific use cases and examples of alternative data being used to inform investment decisions.

1. Deal Sourcing

Alternative data's most profitable application is likely in finding investment opportunities.

Monitoring evolving trends using unconventional data gives investors unique insights, offering not just opportunities for investments but sparking innovative business ideas.

Example: When a Gulfstream V, owned by Occidental Petroleum Corp., was seen at an Omaha airport in April of 2019, Quandl, a corporate jet tracking service, quickly notified its clients. What could this mean?

Occidental Petroleum was in a protracted battle against Chevron, another oil giant, for the acquisition of Anadarko Petroleum, a smaller producer that was active in the coveted Permian Basin.

Source: CNBC

After Quandl’s tip, savvy investors connected the dots: Occidental was seeking financial backing from Warren Buffett’s Berkshire Hathaway Inc., based in Omaha, for their $38 billion offer for Anadarko. And indeed, in just two days, Buffett announced a whopping $10 billion investment in Occidental.

Alternative data users were able to profit from the 5% gain in Occidental stock the week after the announcement.

Example #2: Data often tells a story, but sometimes the real narrative lies behind the numbers. This distinction becomes even clearer when considering alternative data, which occasionally demands a more hands-on approach.

As depicted in Michael Lewis's "The Big Short," investor Steve Eisman wasn't convinced by the upbeat data during the housing boom leading up to 2008. While the data celebrated soaring home prices and booming mortgages, Eisman decided to delve deeper.

Macro investor Steve Eisman. Source: Bloomberg

In Florida, the epicenter for the real estate frenzy, he uncovered a grim reality. Mortgage brokers, driven by skewed incentives, were sanctioning loans without thorough credit checks. Banks, once the custodians of these mortgages, now repackaged and sold them, transferring the risk to third parties.

The rising market wasn't buoyed by stable homeowners but by speculators hoping to capitalize on soaring prices. Recognizing the impending crash, Eisman crafted a strategy to bet against the U.S. housing market.

This foresight led his hedge fund to double its assets under management, reaching $1.5 billion.

2. Due Diligence

Once an investment idea has been sourced, it needs thorough vetting. The due diligence phase, where potential risks and rewards are analyzed, heavily relies on a comprehensive set of data—alternative data can help.

Example: Investment veterans Dan David and Carson Block were investigating the flurry of activity of Chinese companies being listed in U.S. and Canadian stock exchanges.

They were using a strategy called a ‘reverse merger’, where, by buying defunct American listed companies, Chinese companies could go public and access U.S. capital markets without going through the tough scrutiny of a regular Initial Public Offering (IPO) process.

American investment banks, in turn, were eager to push these companies’ stocks to their clients, claiming they’d have exposure to attractive growth prospects seen only in Emerging Markets.

As told by the 2017 documentary ‘The China Hustle’, their investigation into two companies, Orient Paper Inc. and Sino-Forest Corporation, included satellite images of the company’s properties, as well as plenty of boots-on-the-ground research.

They suspected the companies were vastly inflating their profits and operations (in the case of Orient Paper) and overstating their timber assets (in the case of Sino-Forest).

Sino-Forest claimed to have $5.7 billion of timber assets. Source: The Globe and Mail

Their analysis proved correct, and investors using their research were able to steer clear of these fraudulent companies, or even profit from the dramatic fall (60% and 95%, respectively) in their stock prices.

3. Investment Validation

While market research has its place, at times, entrepreneurs need to dive in, iterate, and adapt based on real-time market feedback. Especially in sectors like e-commerce, where trends evolve rapidly, alternative data can dramatically streamline the product validation phase.

Example: This is particularly relevant in the e-commerce sector, which has surged post-COVID. E-commerce ventures often experiment with multiple products before one truly resonates with the market.

But how can smaller players stay competitive? Every iteration consumes time, resources, and money, which is limited without access to institutional capital. Here, alternative data provides an edge.

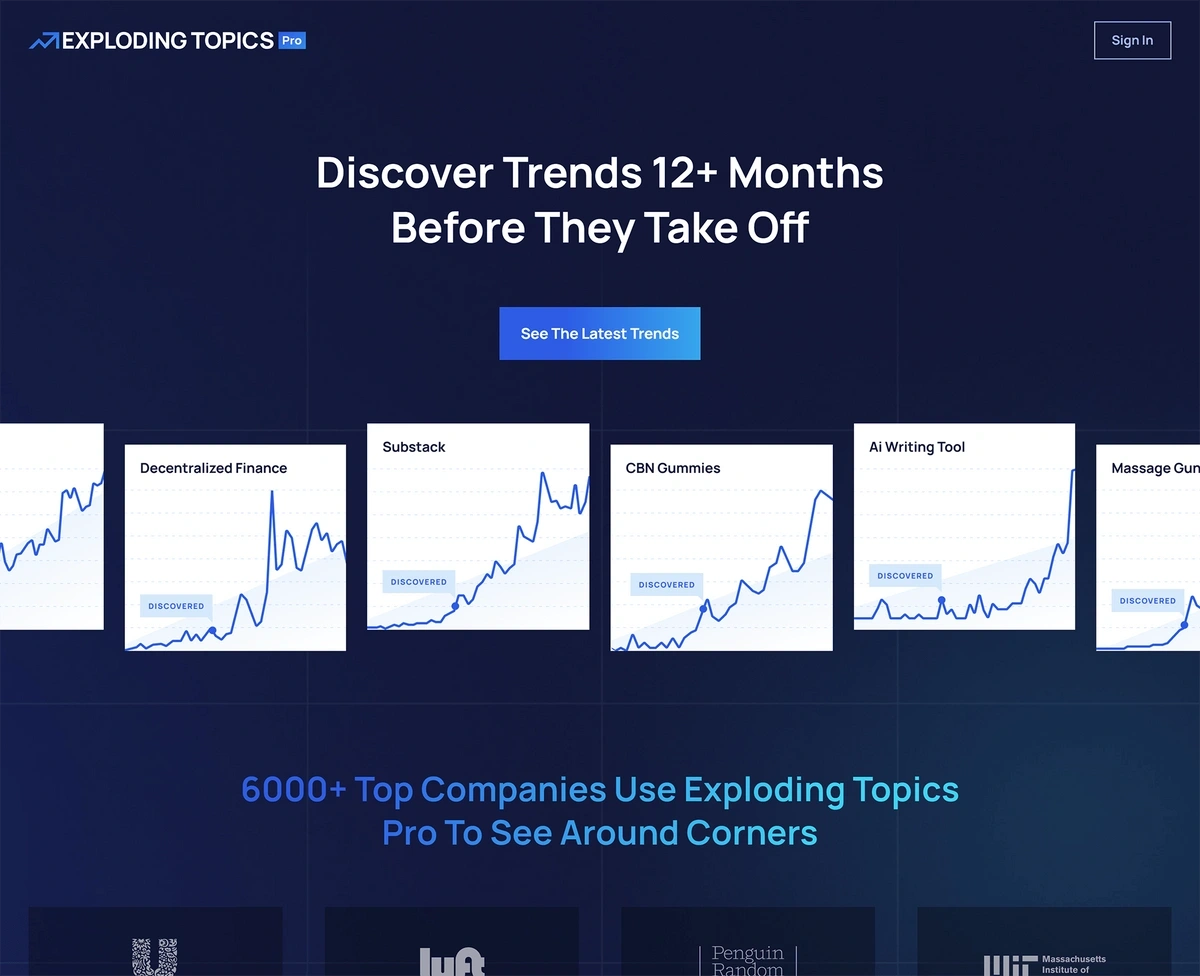

Source: Exploding Topics

Using verified trends, entrepreneurs can bypass extensive experimentation, honing in on validated products and niches with higher chances of success. For instance, Exploding Topics suggests emerging e-commerce opportunities like:

- Discoloration serum (5k searches)

- Magnesium Glycinate (1M searches)

- Rotating Car Seat (22k searches)

4. Portfolio Management

After identifying and investing in a deal, what's next? The real work begins for investment managers who then scrutinize their investments' performance, constantly reassessing their initial assumptions and biases.

Example: The appeal of alternative data lies in its real-time insight. Traditional economic data from companies and governments is released intermittently due to how cumbersome it is to gather, compile, and present the data.

In stark contrast, alternative data provides ongoing, near-instant updates. If a company forecasts a lucrative quarter, but alternative data such as foot traffic reveals dwindling store visits, savvy investors can exit their position early, sidestepping potential losses that catch others off-guard during the next earnings reveal.

Renaissance Technologies, a famously secretive hedge fund, pioneered the large-scale use of alternative data.

Renaissance Technologies founder Jim Simons. Source: The Wall Street Journal

Founded by mathematician Jim Simons in 1988, Rentech incorporated news snippets, weather trends, and speech analysis from CEO interactions into their trading models. The result? Rentech's Medallion Fund yielded a 66% annual return from 1998-2018, amassing over $100 billion in cumulative profits.

5. Stock Trading

In the fast-moving world of stock trading, alternative data allows retail investors to level the playing field against their institutional competitors.

In the past, an informational edge was only accessible to large funds and asset managers, through direct access to the companies they invested in or very expensive high-end research.

Now, retail investors are able to leverage real-time data from unconventional sources and obtain insights that can lead to investment alpha.

Conclusion

Today's competitive investment landscape demands more than just traditional data.

From deal sourcing to portfolio management, alternative data provides unparalleled insights, ensuring that informed decisions aren't formed gradually—they're made in real-time. Investors armed with alternative data insights will lead the charge.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

... Read more