36 Growing B2B SaaS Startups (2024)

You may also like:

- 40 Skyrocketing SaaS Companies & Startups

- 25 Growing Cloud Computing Companies & Startups

- 11 Important SaaS Trends

Revenue in the global SaaS market is expected to reach $339.1 billion in 2024, and it shows no signs of slowing down.

By 2029, revenue is projected to hit $818.8 billion. That's a CAGR of 19.28%.

80% of businesses use at least 1 SaaS application (largely due to the simplicity for companies to set up internally.) And that number continues to rise considering there are over 30,000 SaaS companies worldwide.

Our list of 36 B2B SaaS startups contains companies that take on a wide range of roles: including marketing, sales, accounting, and HR.

Read on to learn about the startups that made our list.

1. Databricks

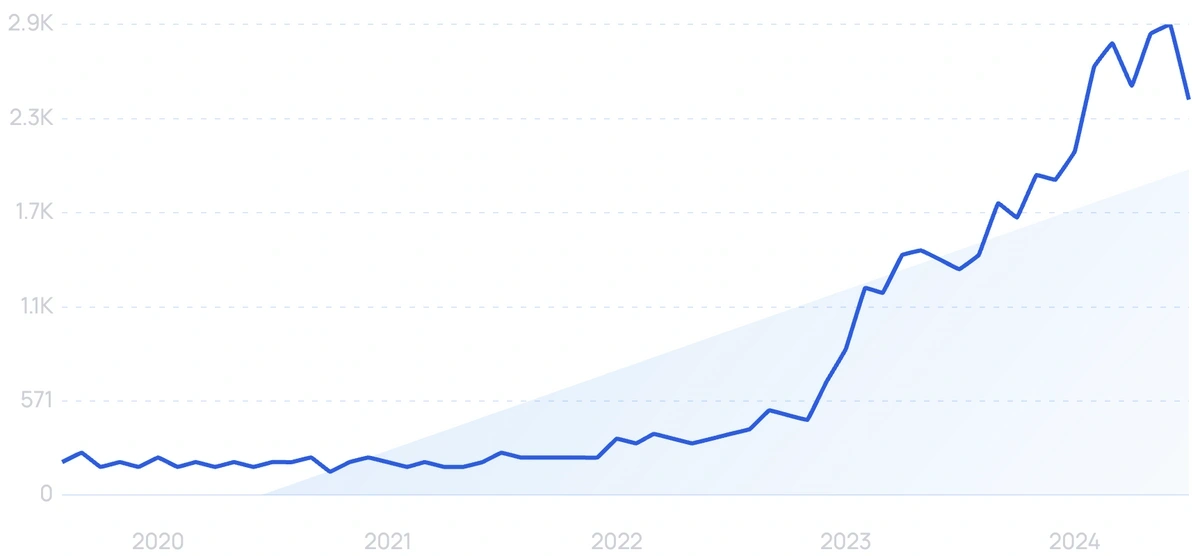

5-year search growth: 592%

Search growth status: Exploding

Year founded: 2013

Location: San Francisco, California

Funding: $4B (Series I)

What they do: Data inside a business is often siloed and hard to reach. Databricks unifies data inside a company with their Databricks Lakehouse, a play on data lakes and data warehouses. By combining data, analytics, and AI, companies can harness true insights from their data.

Some of the largest enterprise data teams in the world are Databricks customers. CVS Health, Shell, Conde Nast, and HSBC all use Databricks for unifying their data. In September 2023, Databricks raised $500 million at a valuation of $43 billion.

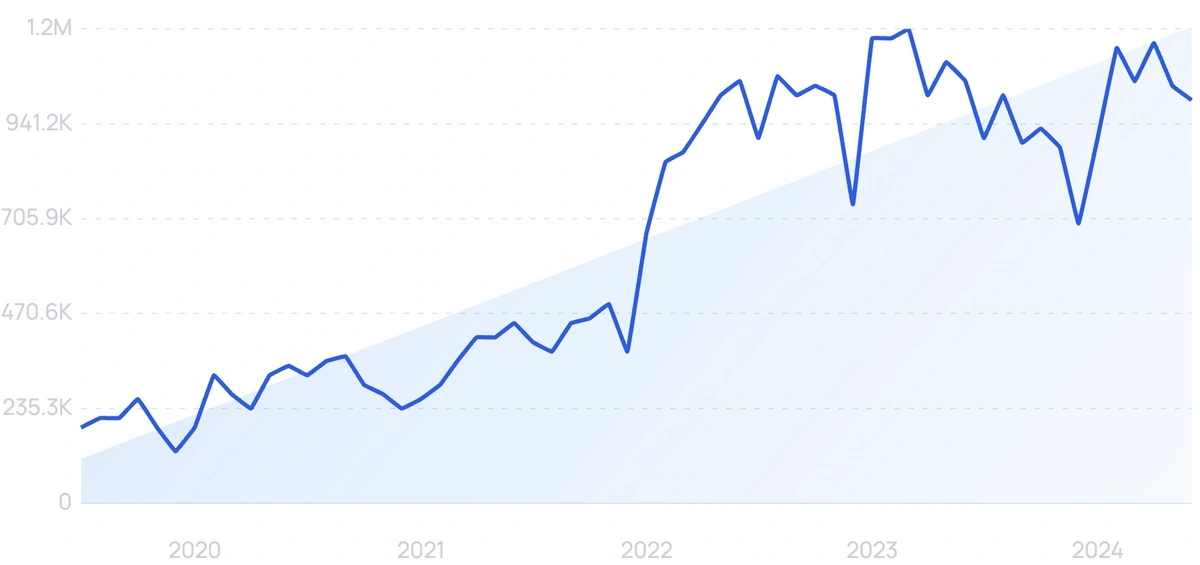

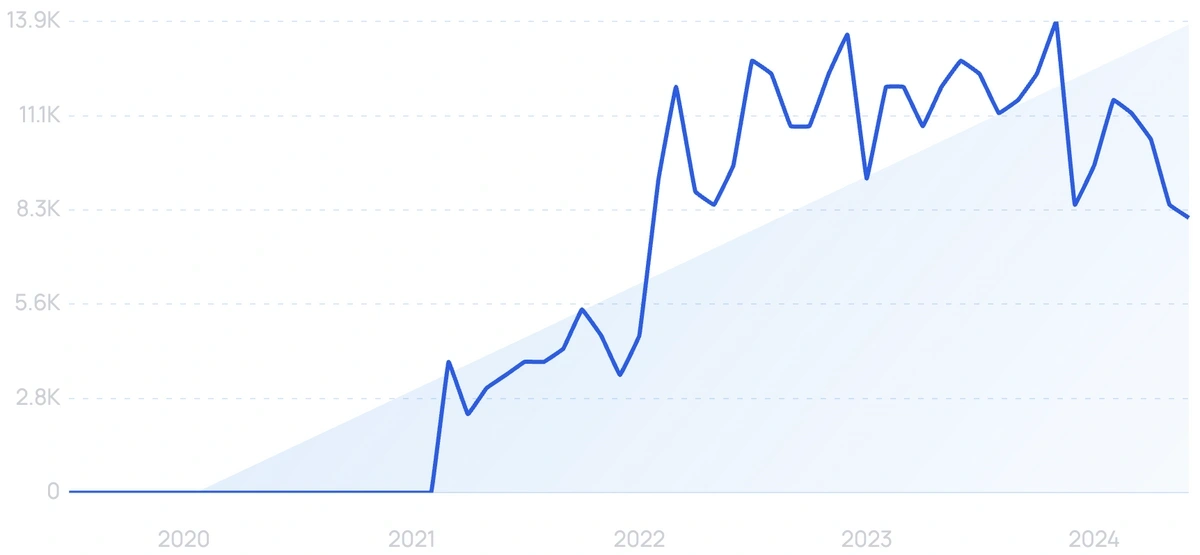

2. ClickUp

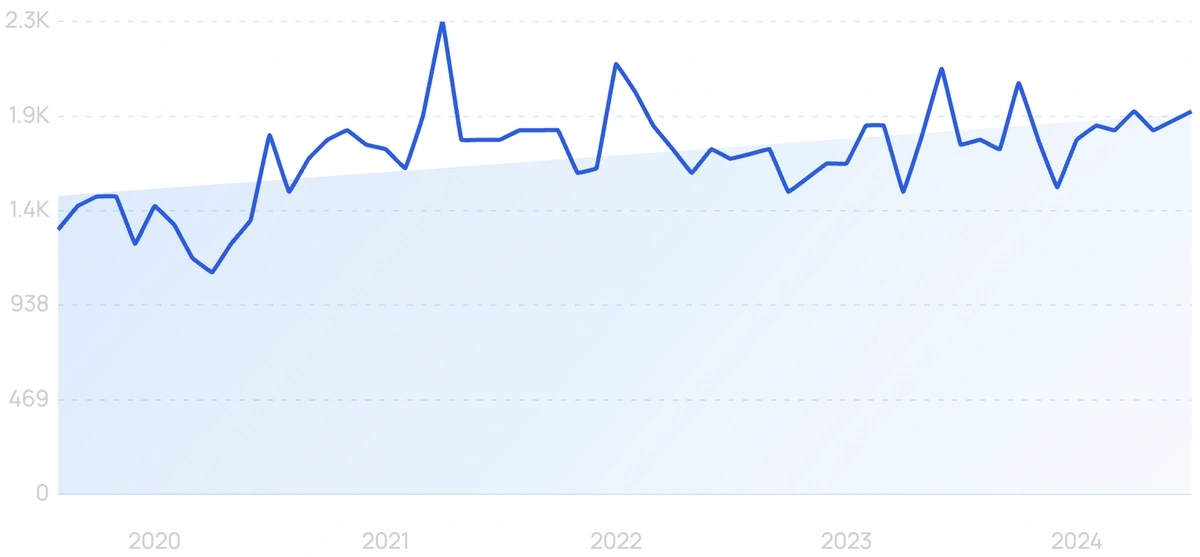

5-year search growth: 492%

Search growth status: Exploding

Year founded: 2017

Location: San Diego, CA

Funding: $537.5M (Series C)

What they do: A workplace productivity app, ClickUp allows users to integrate their documents, chats, lists, goals, and tasks in one SaaS product. The app also works as a project management tool, allowing users to plan, track, and manage multiple projects and teams. Clickup also has integrations with other tools like Asana, Trello, Jira, and Airtable. Recently, ClickUp raised $400M in Series C funding at a $4 billion evaluation.

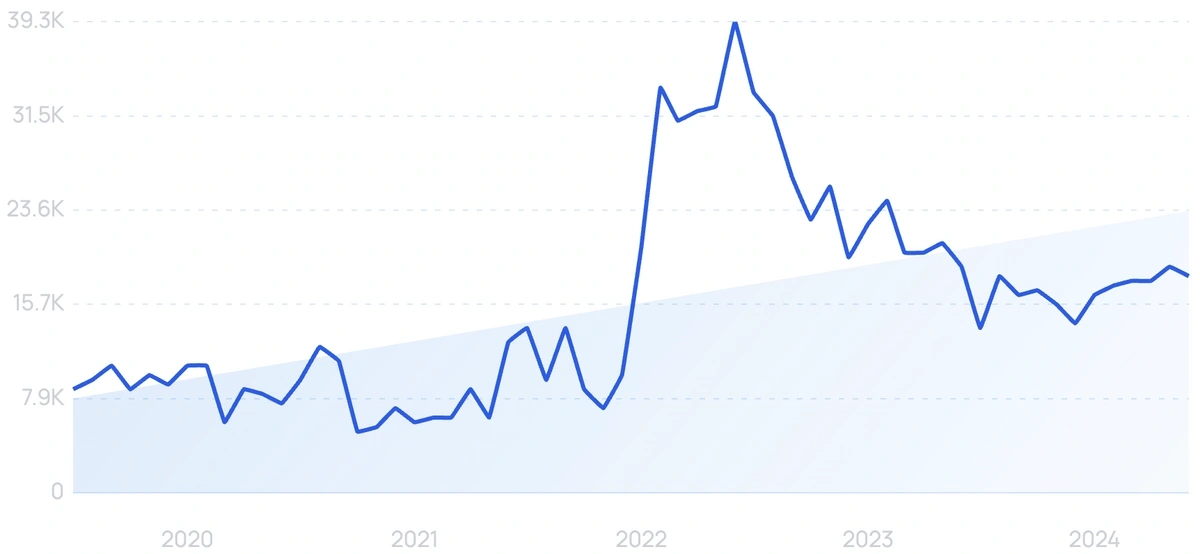

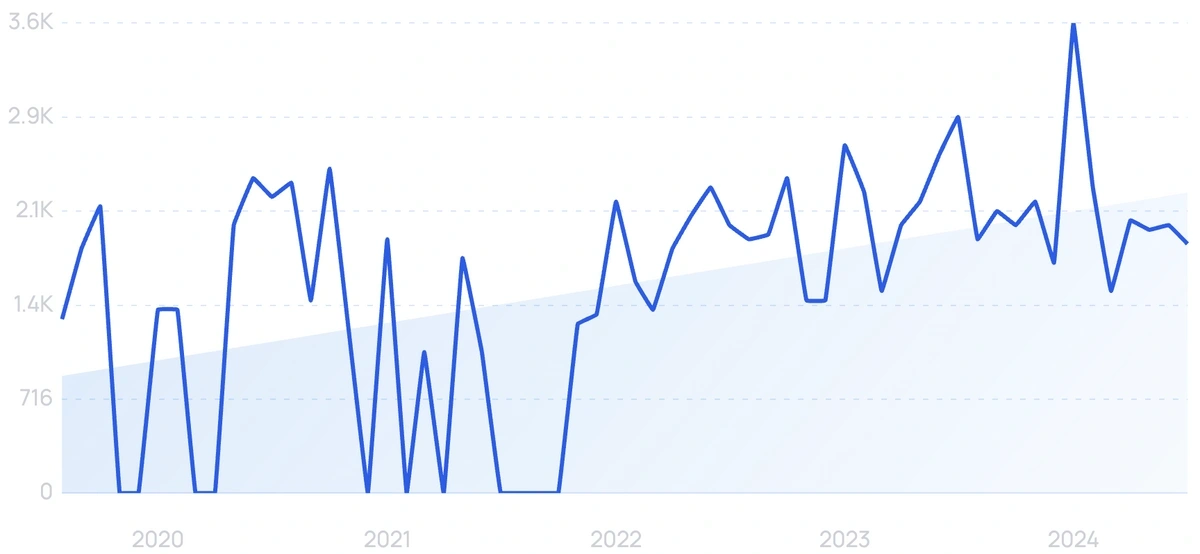

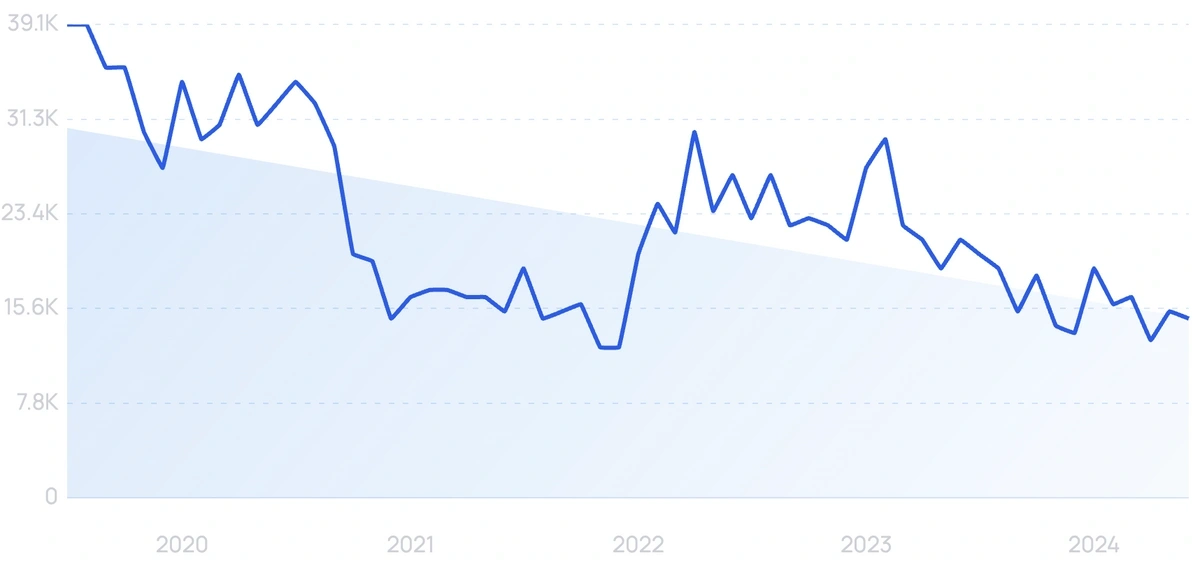

3. Lemlist

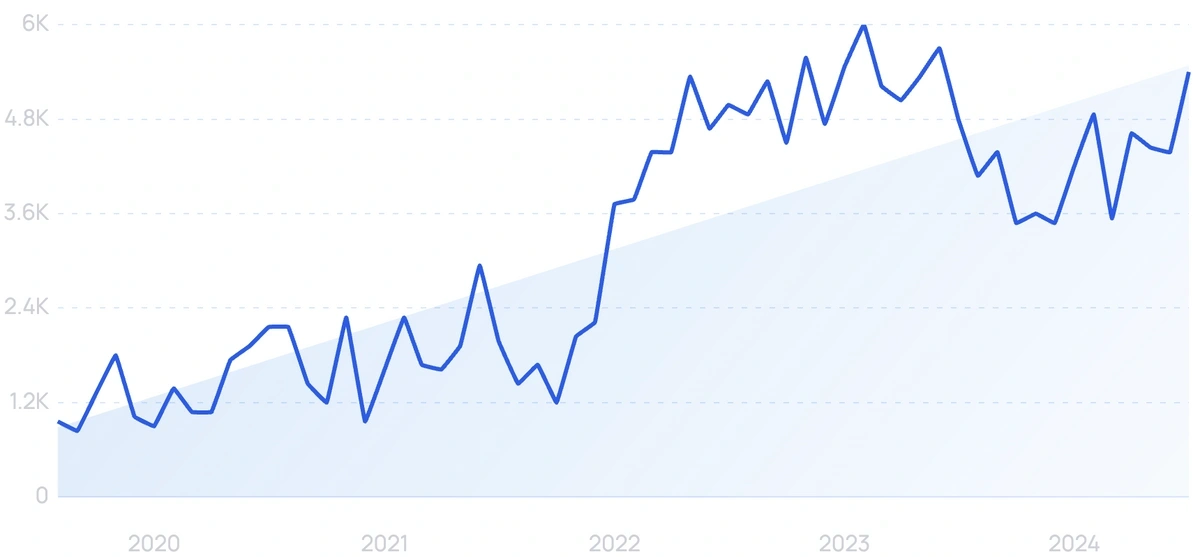

5-year search growth: 625%

Search growth status: Peaked

Year founded: 2018

Location: Paris, France

Funding: Undisclosed

What they do: Lemlist is an email outreach platform designed to improve email open and engagement rates. Furthermore, the company allows several direct integrations with email providers, CRMs, project management software, and conferencing tools. Lemlist recently announced that they surpassed $20m in ARR without any prior funding.

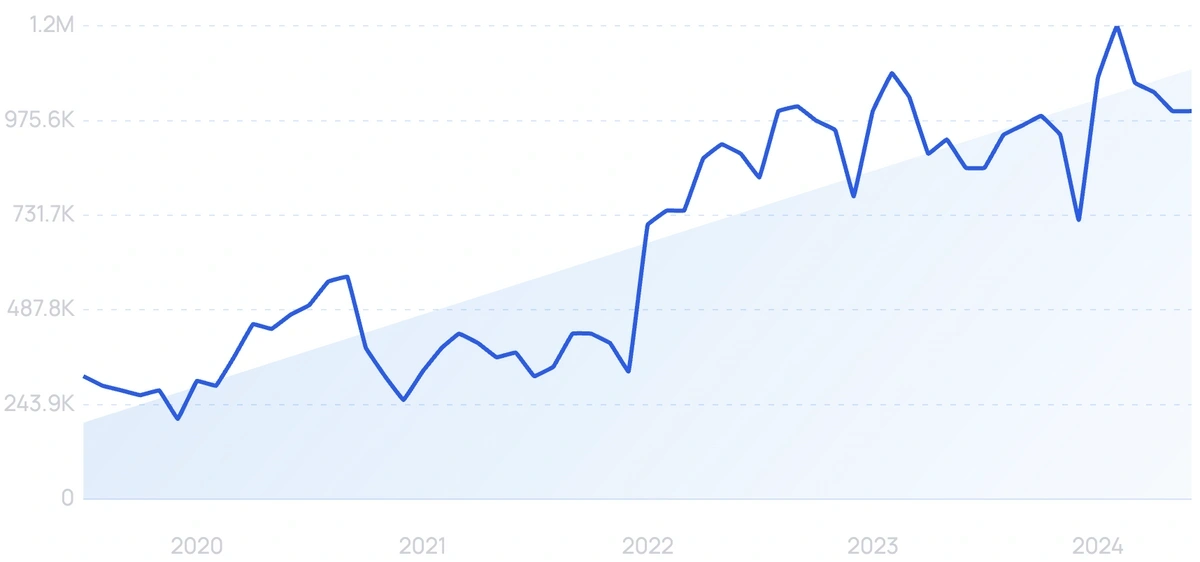

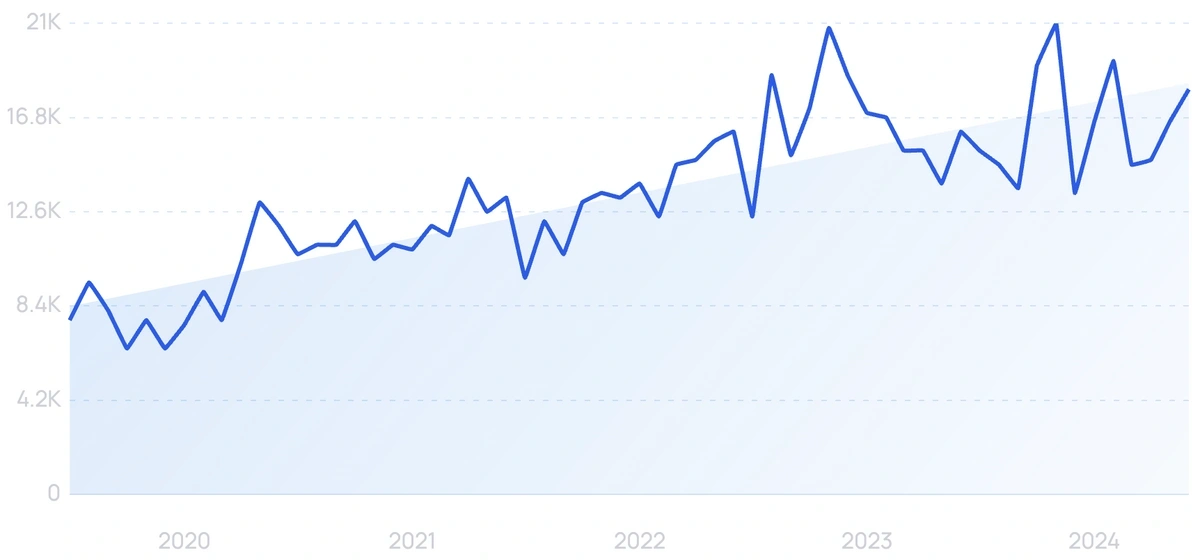

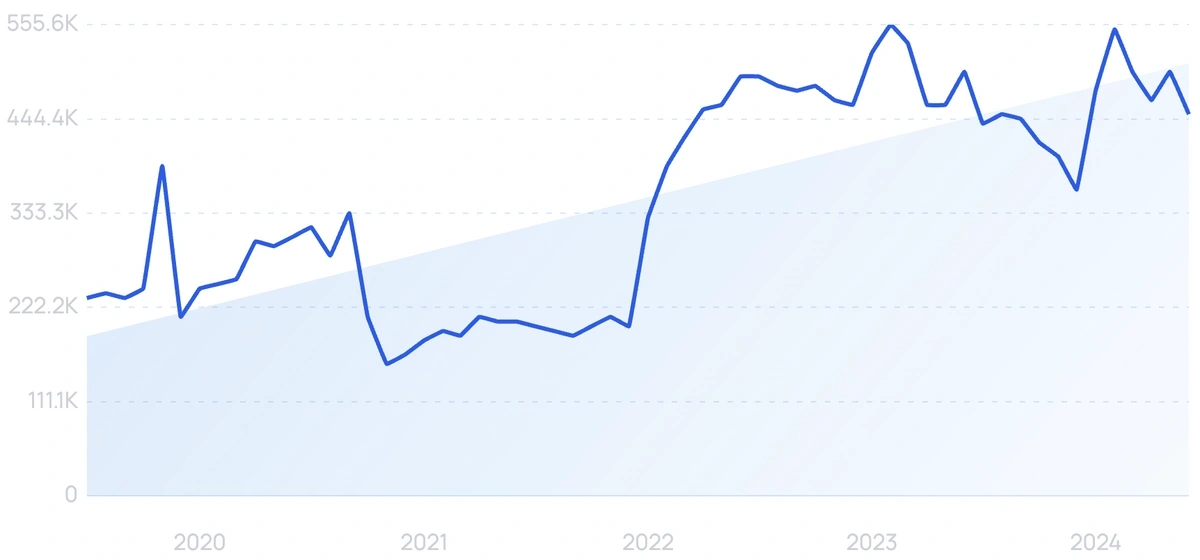

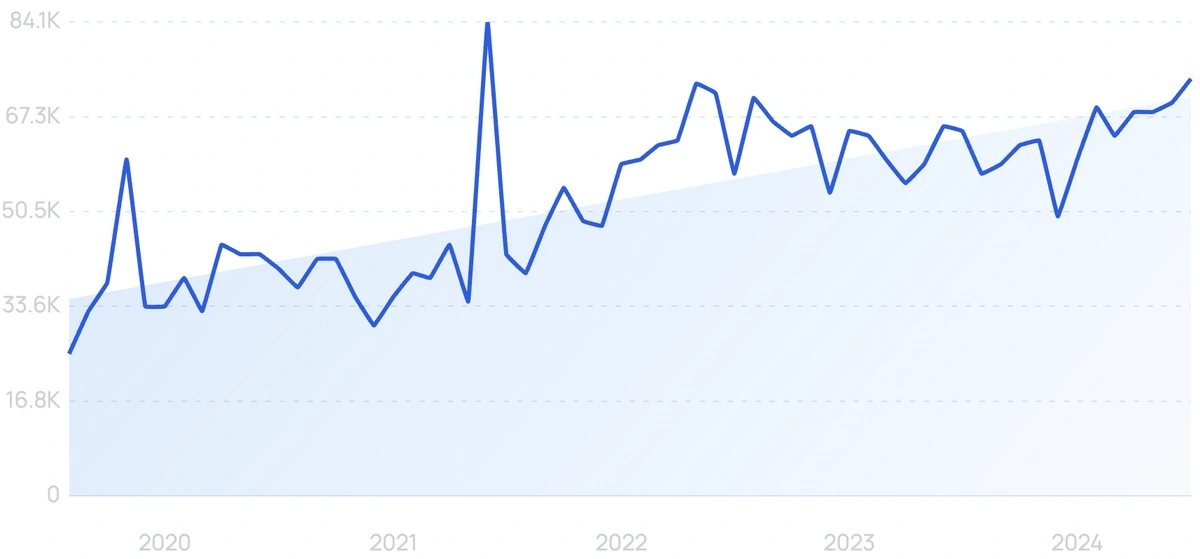

4. Calendly

5-year search growth: 215%

Search growth status: Exploding

Year founded: 2013

Location: Atlanta, Georgia

Funding: $350.6M (Series B)

What they do: Calendly is a digital calendar that lets an enterprise sales team, or internal corporate teams, book appointments and schedule meetings in a frictionless manner. After seeing the enormous amount of wasted time and email going back and forth to schedule a simple meeting, Calendly was born.

As of September 2023, Calendly has 20 million users across 230+ countries and platform adoption grew 61% year over year.

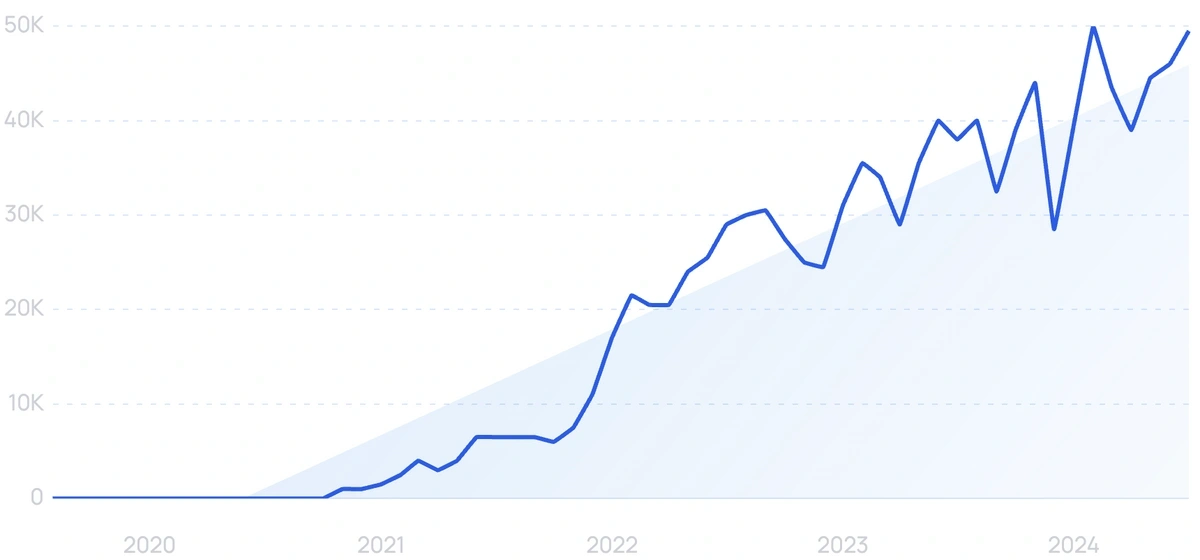

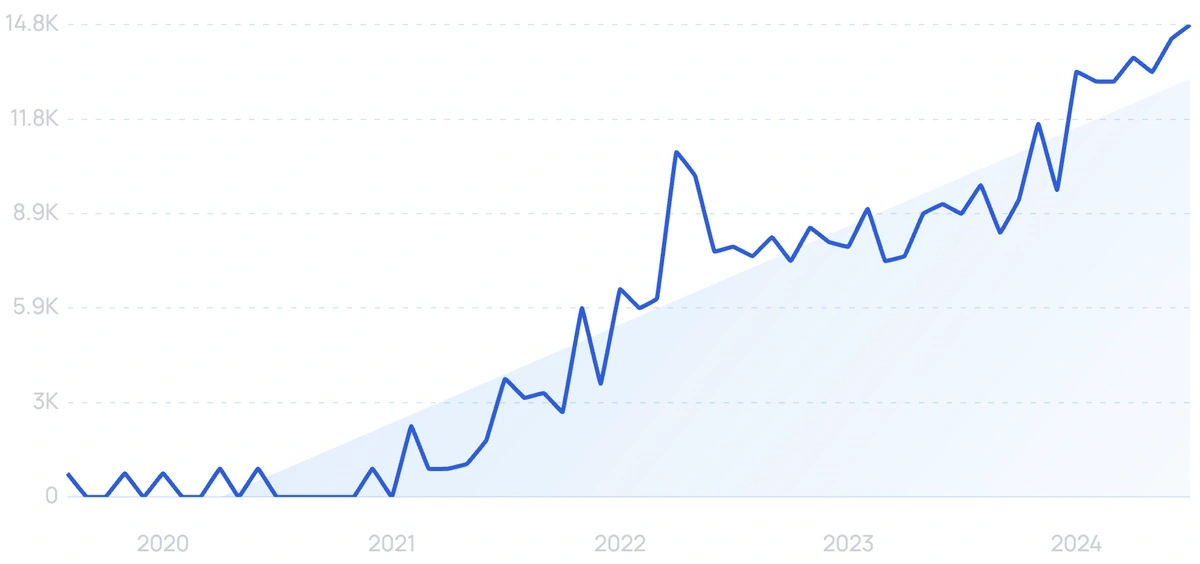

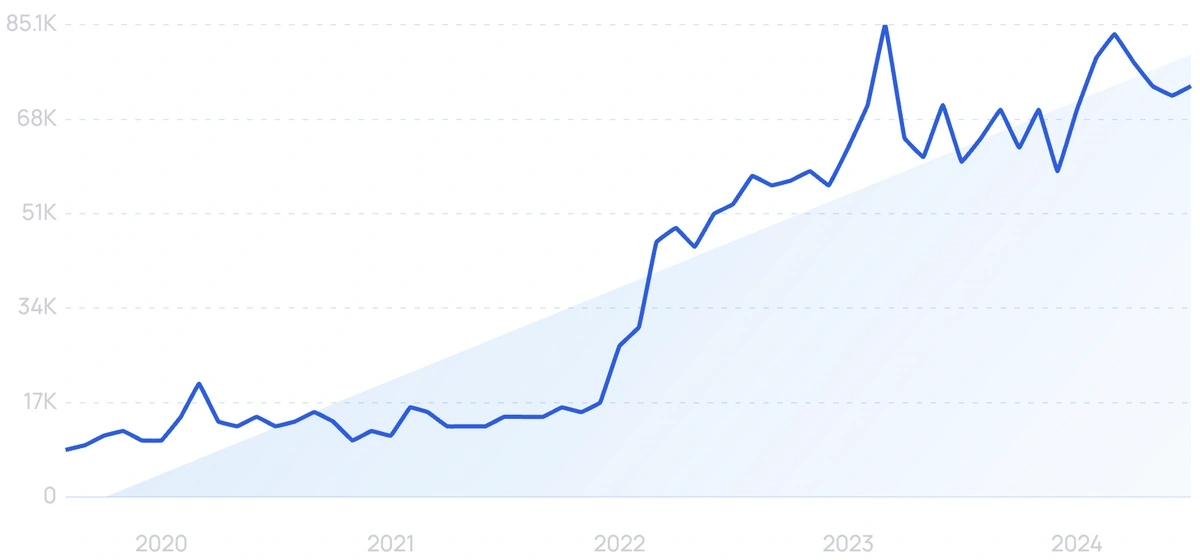

5. TestGorilla

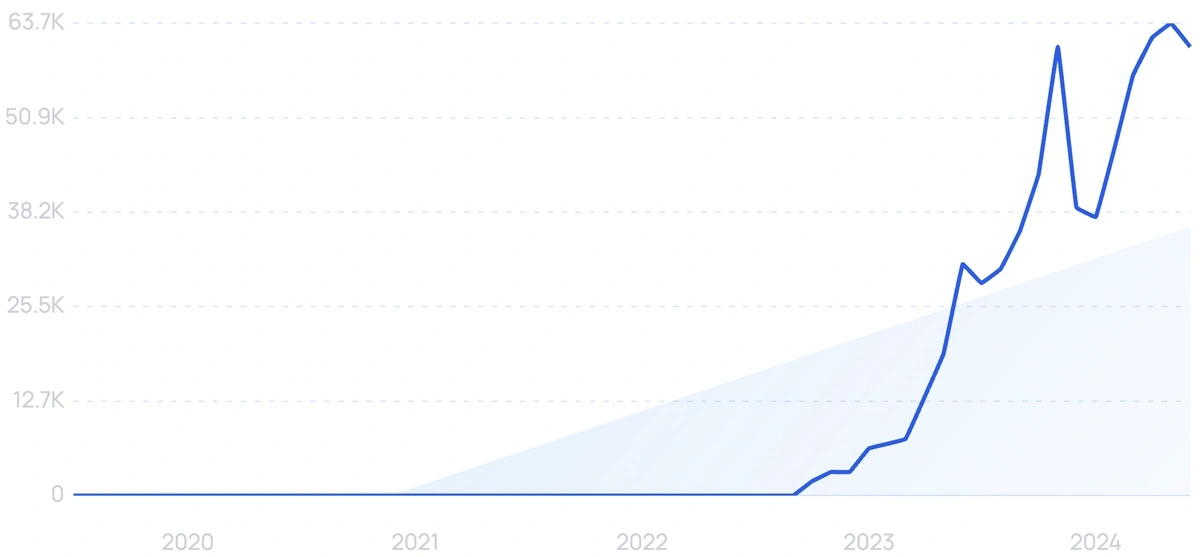

5-year search growth: 9,400%

Search growth status: Exploding

Year founded: 2018

Location: Amsterdam, Netherlands

Funding: $81.2M (Series A)

What they do: TestGorilla is a human resources management software that creates talent assessments to screen potential job candidates. Available TestGorilla assessments can be used to test job-specific skills like coding or general skills like critical thinking. This B2B SaaS startup has over 5,300 customers, including top brands like Sony, PepsiCo, Oracle, and H&M.

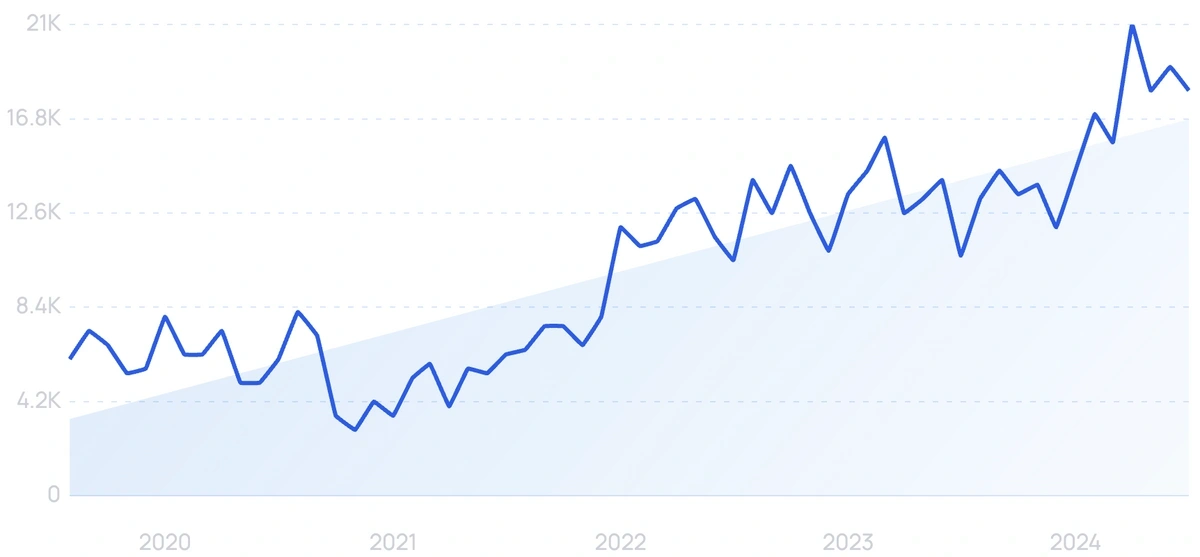

6. FloQast

5-year search growth: 236%

Search growth status: Exploding

Year founded: 2013

Location: Sherman Oaks, California

Funding: $302.9M (Series D)

What they do: FloQast’s SaaS is focused on serving B2B clients’ needs around seamless accounting and auditing. QuickBooks and other accounting software have been the de facto standard for quite a while, but FloQast’s powerful automation, transparent tracking, and simple reconciliations offer modern accounting departments an updated toolkit. FloQast currently serves more than 2,500 customers.

In April 2024, FloQast raised a new Series E funding round of $100 million at a post-money valuation of $1.6 billion.

7. Eloomi

5-year search growth: 80%

Search growth status: Regular

Year founded: 2015

Location: Copenhagen, Denmark

Funding: $78.7M (Private Equity)

What they do: Eloomi’s SaaS offering is trying to make training more rewarding for both the onboarding employee and the company they’re joining. Onboarding, compliance, training, and continued learning are all part of Eloomi’s streamlined and simplified platform.

Eloomi is worldwide, with offices in Orlando, Copenhagen, and London. They count over 700+ companies as customers across 25+ countries.

8. Native AI

5-year search growth: 1,300%

Search growth status: Exploding

Year founded: 2018

Location: New York, New York

Funding: $5.7M (Seed)

What they do: Native AI is a market intelligence platform that tracks customer feedback and consumer trends. Users can automate product or keyword tracking, create customizable analytics dashboards, and connect third-party data sources. By leveraging AI and large-scale data analysis, users can also create digital twins to track competitors more precisely.

9. Iterable

5-year search growth: 10%

Search growth status: Regular

Year founded: 2013

Location: San Francisco, California

Funding: $342.2M (Series E)

What they do: Iterable provides enterprise clients with a comprehensive cross-channel marketing platform in a convenient SaaS package. With all of the noise in the marketplace and the ever-growing number of e-commerce advertising online, Iterable provides clients a toolkit for owning their marketing data and delivering personalized messaging at scale.

Rapidly-growing brands like Doordash, Ritual, and Stack Overflow use Iterable to drive increased conversions, generate text message marketing campaigns, and more.

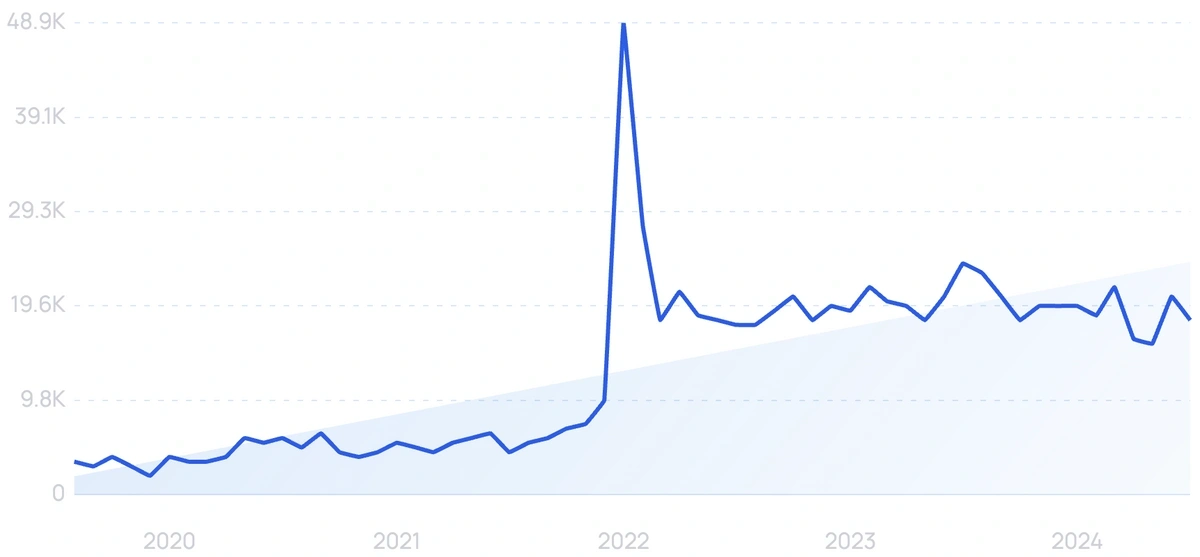

10. Ahrefs

5-year search growth: 196%

Search growth status: Exploding

Year founded: 2010

Location: Singapore, Singapore

Funding: Undisclosed

What they do: Ahrefs is an all-in-one SEO toolset used by marketers from innovative companies like Netflix, Adobe, Uber, and LinkedIn. By focusing on 5 core tools, Ahrefs has simplified the often complex process of continually optimizing a site's SEO. Ahrefs now generates $100 million in revenue each year with zero outside investors.

11. Customer Labs

5-year search growth: 45%

Search growth status: Regular

Year founded: 2013

Location: Chennai, India

Funding: $100K (Seed)

What they do: Customer Lab’s no-code Customer Data Platform lets B2B marketers track, unify, and sync data across disparate marketing tools, their website, and the company's CRM. A CDP is usually a hassle for developers and internal IT teams to mess with, so providing marketers a tool to unify data that doesn’t rely on IT is a time saver. Marketers also gain independence from their IT teams.

Over 1500 companies use CL’s product today. Customer Labs was voted as 2023’s most innovative marketing technology by The MarTech Weekly.

12. DealHub

5-year search growth: 255%

Search growth status: Exploding

Year founded: 2014

Location: Austin, TX

Funding: $84.5M (Series C)

What they do: DealHub is a SaaS startup that offers a sales engagement platform for B2B companies. Their platform provides sales teams with a suite of tools to help them manage and automate the sales process, including sales content management, contract management, and e-signature capabilities. With their platform, DealHub aims to improve sales efficiency, increase deal velocity, and enhance the overall sales experience for both sales reps and customers.

13. Credflow

5-year search growth: 6,600%

Search growth status: Regular

Year founded: 2019

Location: New Delhi, India

Funding: $8.34M (Seed)

What they do: Credflow is a SaaS company that provides a platform for automated invoice management and cash flow forecasting. Their platform helps businesses track and manage their outstanding invoices, automate payment reminders, and forecast future cash flow based on historical data. With Credflow, businesses can save time, reduce the risk of late payments and cash flow gaps, and make more informed financial decisions.

14. CoachHub

5-year search growth: 106%

Search growth status: Peaked

Year founded: 2017

Location: Berlin, Germany

Funding: $333.4 (Series C)

What they do: CoachHub is the "global leader in digital coaching." The platform allows organizations to create coaching programs for their employees by providing one-on-one coaching experiences. CoachHub has more than 1,000 enterprise clients, including top brands like Fujitsu, Babbel, and KPMG.

15. TextCortex

5-year search growth: 9400%

Search growth status: Exploding

Year founded: 2021

Location: San Francisco, California

Funding: $1.2M (Pre-Seed)

What they do: TextCortex is an AI-powered writing assistant and content creation tool. It operates as an all-in-one AI copilot that runs on the startup's proprietary Zeno model. Notable tools and features included with a TextCortex membership are ZenoChat, Zeno Assist, TextCortex Toolbar, Custom Personas, and more. The startup has hundreds of thousands of users, including B2B enterprise clients like Salesforce and Zoho.

16. UserPilot

5-year search growth: 5,800%

Search growth status: Regular

Year founded: 2018

Location: Middletown, Delaware

Funding: $5.9M (Seed)

What they do: Over 500+ companies leverage UserPilot to deliver more personalized in-app experiences to their customers and app users. By unlocking the ability to gauge consumer sentiment and real-time engagement, product marketers and UX professionals are rapidly able to iterate and improve their app’s offerings on the fly.

17. Adalo

5-year search growth: 4,150%

Search growth status: Exploding

Year founded: 2018

Location: St. Louis, Missouri

Funding: $9.8M (Series A)

What they do: Adalo is a SaaS startup that offers a no-code platform for building mobile and web applications. Their platform provides a visual drag-and-drop interface that enables users to create custom apps without the need for coding or technical expertise.

With Adalo, businesses and individuals can quickly and easily create functional and professional-looking apps that meet their specific needs, without the time and cost associated with traditional app development.

18. Chili Piper

5-year search growth: 109%

Search growth status: Regular

Year founded: 2016

Location: New York, New York

Funding: $54.4M (Secondary Market)

What they do: Revenue teams use Chili Piper’s dynamic forms and meeting software to instantly connect with inbound leads, and seamlessly schedule handoff meetings from SDR to AE without mistakes.

The CRM is integrated with Chili Piper’s software so meetings, notes, and dates are all automatically updated within a company’s central source of truth for sales data. The results from using Chili Piper are stats like 300% more revenue, improving conversion by 70%, or 4xing inbound conversion rates.

19. Truework

5-year search growth: 132%

Search growth status: Regular

Year founded: 2017

Location: San Francisco, CA

Funding: $118.9M (Corporate Round)

What they do: Truework is a SaaS API-based platform for employment and income verification. Their platform automates the verification process for HR departments, lenders, and other third-party verifiers, reducing the time and resources required for manual verification. With advanced security and privacy features, Truework ensures the safe and secure exchange of sensitive personal and financial information.

20. Mighty Networks

5-year search growth: 129%

Search growth status: Regular

Year founded: 2017

Location: Palo Alto, CA

Funding: $66M (Series B)

What they do: Mighty Networks is a B2B SaaS platform for creating and managing online communities. Their platform provides users with the tools to create custom branded networks with features such as courses, events, and digital content, as well as communication and engagement tools. With Mighty Networks, businesses, creators, and organizations can build loyal communities, foster deeper relationships with their audience, and monetize their content and services. In 2023, Mighty Networks saw creator earnings grow to $370 million.

21. LogRocket

5-year search growth: 59%

Search growth status: Regular

Year founded: 2015

Location: Boston, MA

Funding: $55M (Series C)

What they do: Engineering and product teams use LogRocket to create an improved digital experience for website and app users. This product analytics tool offers session replay and error tracking to troubleshoot and debug web application issues. LogRocket has more than 3,000 customers, including Cisco, Ikea, and Whole Foods.

22. Rippling

5-year search growth: 277%

Search growth status: Exploding

Year founded: 2016

Location: San Francisco, CA

Funding: $2B (Secondary Market)

What they do: Rippling is a SaaS startup that provides a platform for HR and IT management. Their platform offers a comprehensive suite of tools, including payroll, benefits administration, device management, and employee onboarding and offboarding. With Rippling, businesses can streamline their HR and IT operations, reduce administrative tasks, and automate workflows, enabling them to focus on their core business activities.

23. Stytch

5-year search growth: 99x+

Search growth status: Exploding

Year founded: 2020

Location: San Francisco, California

Funding: $126.3M (Series B)

What they do: Stytch has created an identity and authentication platform for developers. The platform can simplify and improve user authentication processes by offering various APIs and SDKs to businesses. The company's CEO believes Stytch can provide developers with a “Stripe-like experience” for passwordless authentications inside apps.

24. Gusto

5-year search growth: 16%

Search growth status: Regular

Year founded: 2011

Location: San Francisco, CA

Funding: $746.1M (Series E)

What they do: Gusto is a cloud-based human resource management B2B SaaS company. Specifically, Gusto provides payroll, benefits, and time tracking features. The software also assists in hiring, onboarding, and talent management. The company has also integrated tax support in its system for organizations of all sizes. According to their website, over 200,000 businesses use Gusto for their internal systems.

25. Signaturely

5-year search growth: 2,000%

Search growth status: Regular

Year founded: 2020

Location: Walnut, CA

Funding: Bootstrapped

What they do: Signaturely is an e-signature software company that lets b2b customers sign and send documents electronically. The company allows for several integrations with cloud-based tools like Google Drive, DropBox, and OneDrive. This startup is completely bootstrapped and has grown to 30,000 user signups in 12 months.

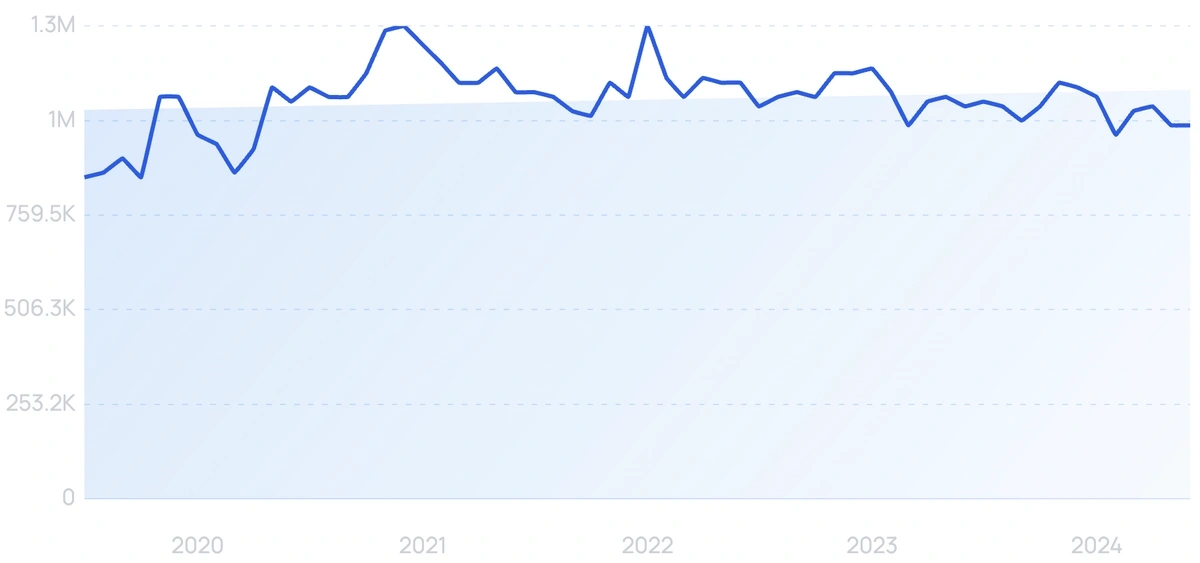

26. Stripe

5-year search growth: 59%

Search growth status: Exploding

Year founded: 2010

Location: San Francisco, CA

Funding: $9.4B (Secondary Market)

What they do: Stripe is an online payment platform that helps businesses accept mobile and web payments. The company’s products are designed for online, in-person, software, and subscription-based businesses. Users can also use the platform to find financing, manage business spending, send invoices, issue physical and virtual cards, and fight against fraud.

Stripe generated around $7.4 billion in revenue in 2020, the highest of any privately-held Silicon Valley company. The startup also crossed 1 trillion in total payment volume this year.

27. Grafana

5-year search growth: 127%

Search growth status: Exploding

Year founded: 2014

Location: New York, NY

Funding: $535.2M (Series D)

What they do: Grafana is a SaaS open-source platform for data visualization and monitoring. Their platform provides users with the tools to create custom dashboards and alerts, query and visualize data from multiple sources, and track performance metrics. With Grafana, businesses can gain valuable insights into their data, troubleshoot issues in real-time, and make data-driven decisions to optimize their operations.

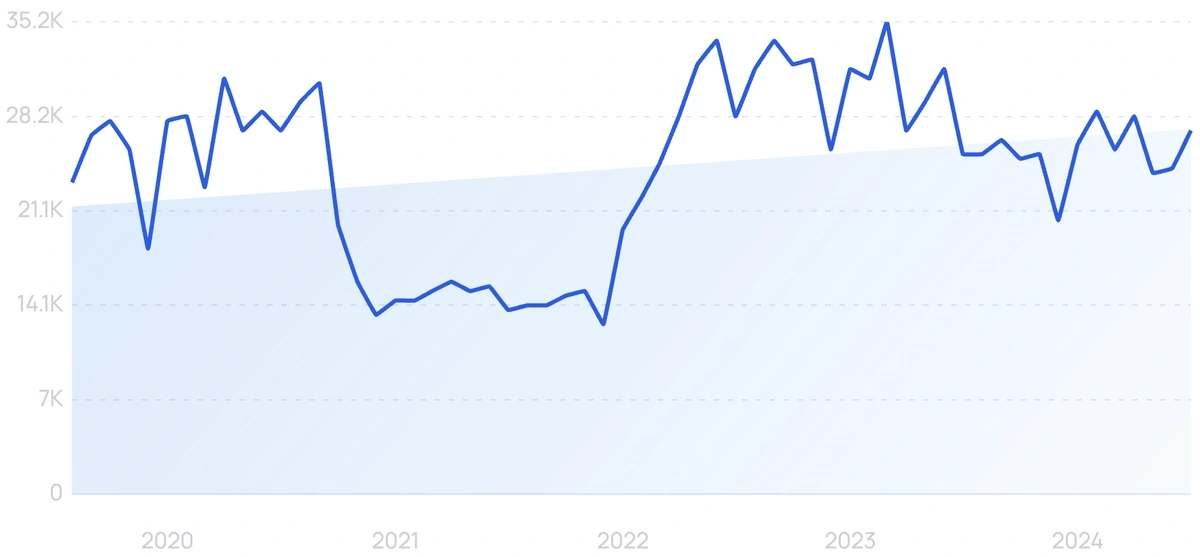

28. PartnerStack

5-year search growth: 429%

Search growth status: Peaked

Year founded: 2015

Location: Toronto, Canada

Funding: $36.2M (Series B)

What they do: PartnerStack is a partner relationship management (PRM) platform that enables users to recruit and manage affiliate, referral, and reseller partners. Specifically, their platform helps automate the full partnership cycle, from recruitment and onboarding to payouts.

Users are also able to place partners in custom tiers to incentivize different levels of earners. According to PartnerStack’s website, partners on the platform have driven more than $180M in revenue in the past year.

29. PocketSuite

5-year search growth: 1,100%

Search growth status: Regular

Year founded: 2013

Location: San Francisco, CA

Funding: $2M (Grant)

What they do: PocketSuite is designed to help schedule client payments. The software also acts as a messaging and reminder tool, assisting in client management. Some other features of PocketSuite include video conferencing, online booking, invoicing, and team staffing. In 2019, the company received a grant of $500K to further expand its offerings.

30. Airtable

5-year search growth: 93%

Search growth status: Regular

Year founded: 2013

Location: San Francisco, CA

Funding: $1.4B (Secondary Market)

What they do: Airtable is a cloud-powered software company that simplifies the creation and sharing of relational databases. The tool combines spreadsheets and databases to help users with project management, task tracking, and marketing automation. Users can create multiple workspaces and boards while importing data from other software and tools. Airtable reached $148.4M in revenue and over 300,000 customers in 2023.

31. CoSchedule

5-year search growth: -62%

Search growth status: Peaked

Year founded: 2013

Location: Bismarck, North Dakota

Funding: $2.5M (Series Unknown)

What they do: A marketing management B2B software, CoSchedule helps users execute social and sales strategies. CoSchedule also offers a marketing suite, marketing calendar, and a headline studio. The company landed a spot on the Inc. 5000 list from 2018 to 2020.

32. Celonis

5-year search growth: 143%

Search growth status: Regular

Year founded: 2011

Location: Munich, Germany

Funding: $2.4B (Debt Financing)

What they do: Celonis is a SaaS platform for process mining and analytics. Their platform uses AI technology to analyze and visualize business processes, identify inefficiencies and bottlenecks, and provide insights for process optimization. With Celonis, businesses can improve operational efficiency, reduce costs, and enhance customer experience by gaining a comprehensive understanding of their internal processes.

33. Retool

5-year search growth: 770%

Search growth status: Exploding

Year founded: 2017

Location: San Francisco, CA

Funding: $141M (Series C)

What they do: Retool is a SaaS startup that provides a platform for building custom internal tools. Their platform offers a drag-and-drop interface that enables users to create custom web apps using pre-built components and connecting to a variety of APIs and databases. With Retool, businesses can quickly and easily build tools to automate and streamline internal processes, reducing the need for manual work and increasing productivity.

34. Supermetrics

5-year search growth: 3%

Search growth status: Regular

Year founded: 2013

Location: Helsinki, Finland

Funding: $46M (Series B)

What they do: A business-to-business software company, Supermetrics provides data for social media, SEO, web analytics, and online marketing. As a marketing platform, the software collects marketing and customer data from various sources and brings it to the user’s storage, reporting, or analytics platforms. In 2020, Supermetrics raised $39.9M in Series B funding from Highland Europe.

35. DemoDesk

5-year search growth: 3,500%

Search growth status: Peaked

Year founded: 2018

Location: Munich, Germany

Funding: $10.6M (Seed)

What they do: DemoDesk is behind the Intelligent Customer Meeting Platform, a comprehensive platform that delivers real time sales advice and objection handling, real time customer information, and internal notes around a company. This is designed to help arm sellers with all of the information they need to move a deal through the pipeline.

DemoDesk claims to cut down ramp time by 50%, increase deal win rates by 30%, and save time performing manual tasks by 25%.

36. UpKeep

5-year search growth: 51%

Search growth status: Exploding

Year founded: 2014

Location: Los Angeles, CA

Funding: $48.8M (Series B)

What they do: As a mobile-first CMMS software, UpKeep provides maintenance teams with a centralized maintenance command center. The software provides maintenance and reliability teams with the tools and information they need to make maintenance more efficient. Companies can also integrate their ERP, EAM, APM, and financial data and use UpKeep as an asset operations management solution.

Conclusion

The startups on our list are some of the fastest-growing B2B SaaS companies in the world.

From simplifying tedious accounting work to allowing enterprises to have real conversations with prospects in a human manner, these SaaS stars cover many of the critical functions in the B2B ecosystem.