Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

11 Top SaaS Industry Trends (2024)

You may also like:

AI is quickly disrupting the SaaS industry.

In fact, many SaaS firms have already invested in AI tools that will appeal to their customer base and drive retention.

But other changes in the market are redefining how organizations utilize software.

Tailor-made SaaS offerings are making it relatively easy for businesses to harness the exact tools they need. And LCNC offerings mean they can build the tools they need if they can’t find them on the market.

Where are SaaS companies and products headed in the coming months?

Here are the top 11 SaaS trends to know in 2024 and 2025:

1. SaaS Tools Race to Integrate AI

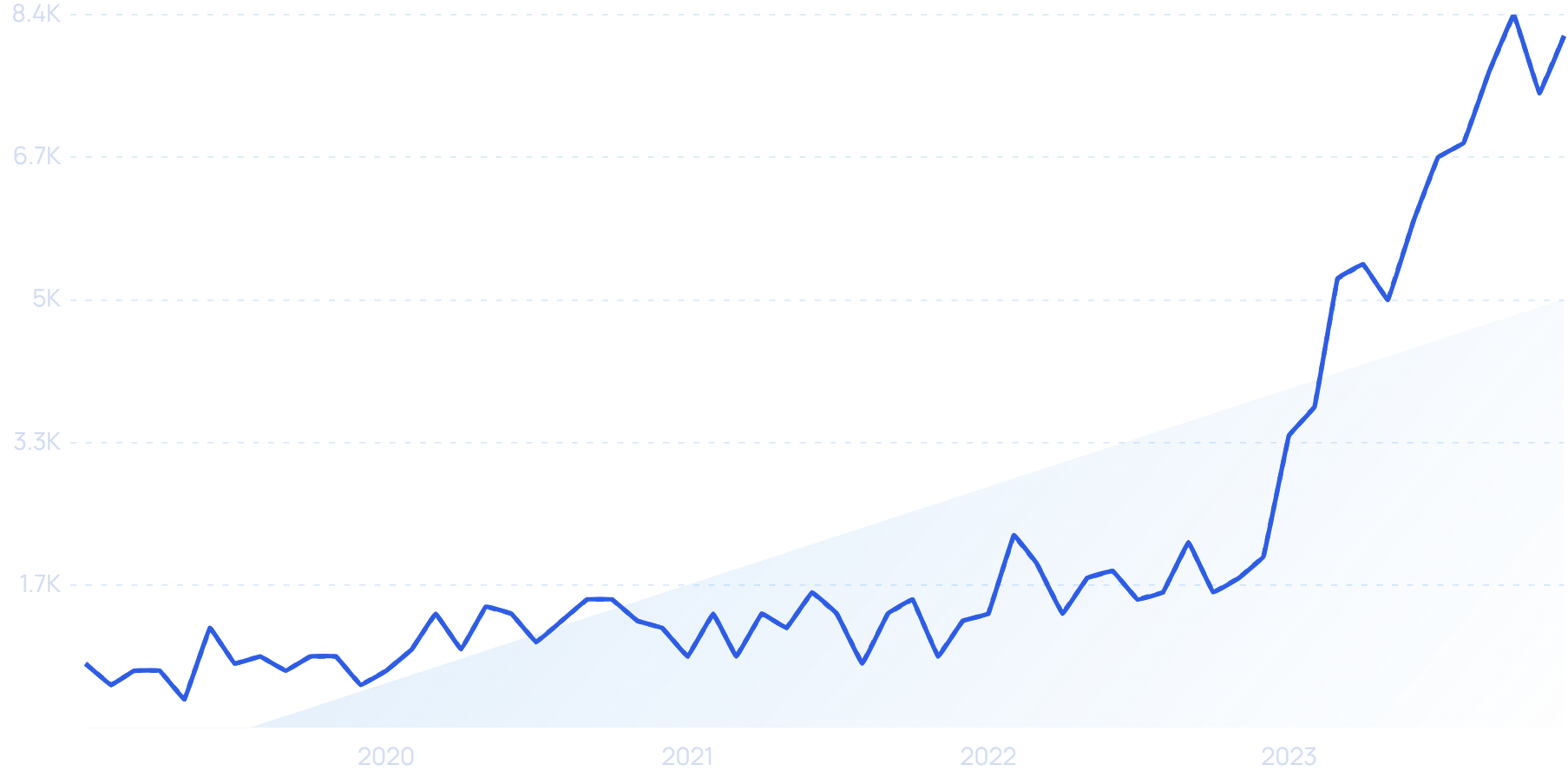

SaaS companies are quickly adding generative AI to their platforms.

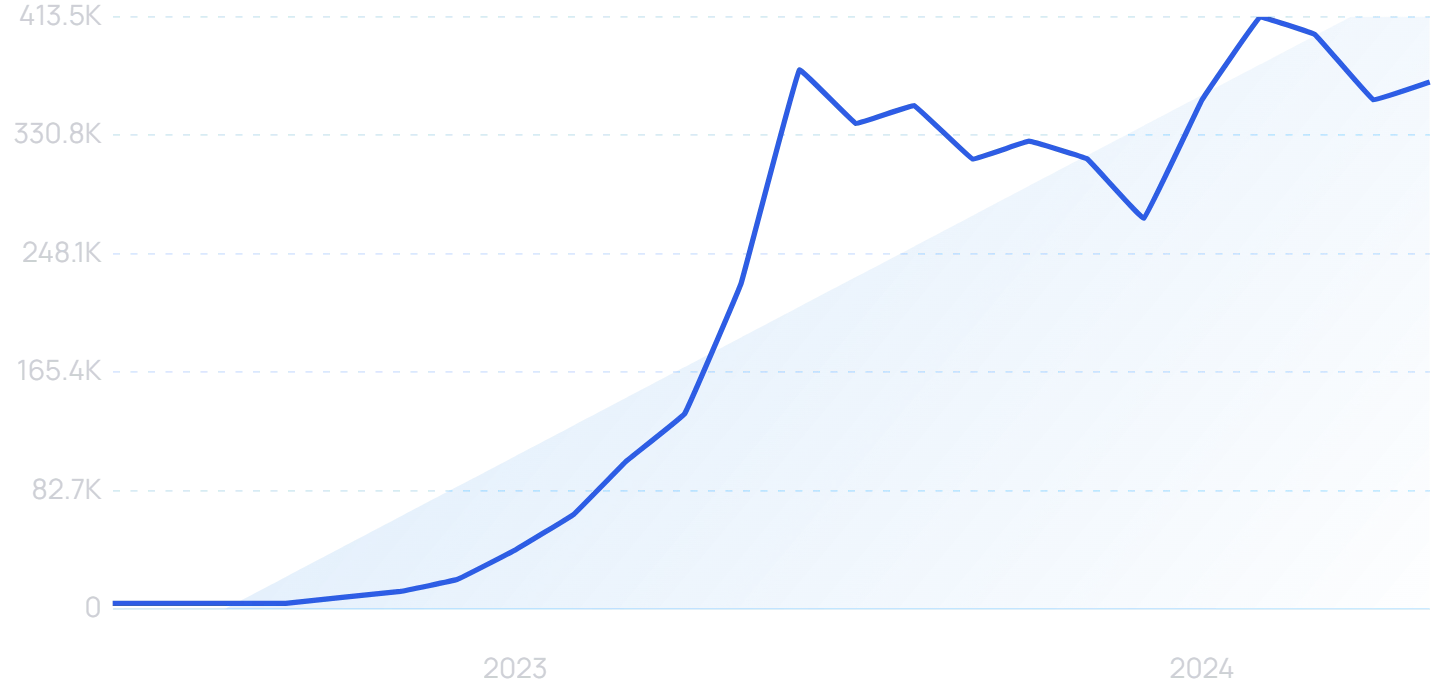

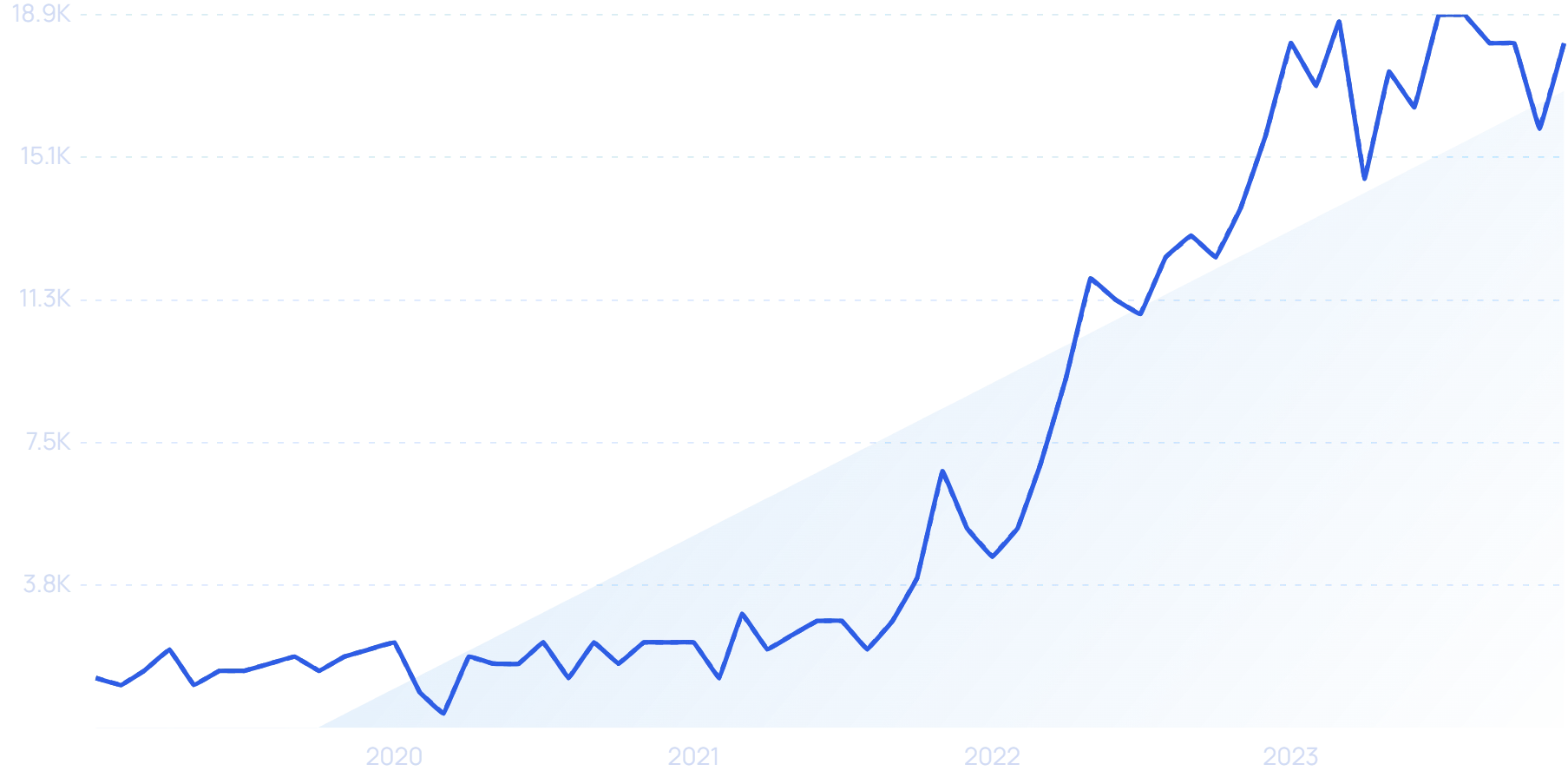

Searches for "generative AI" are up 8,800% over two years.In fact, many users are now expecting their tools to have AI capabilities.

For example, Canva has a ten-year history of making it easy for non-graphic designers to create visually appealing designs for emails, newsletters, and social media posts.

Shortly after the release of ChatGPT, Canva took a radically new approach to its mission: enabling users to create designs with AI.

And they took the feature live in less than four months.

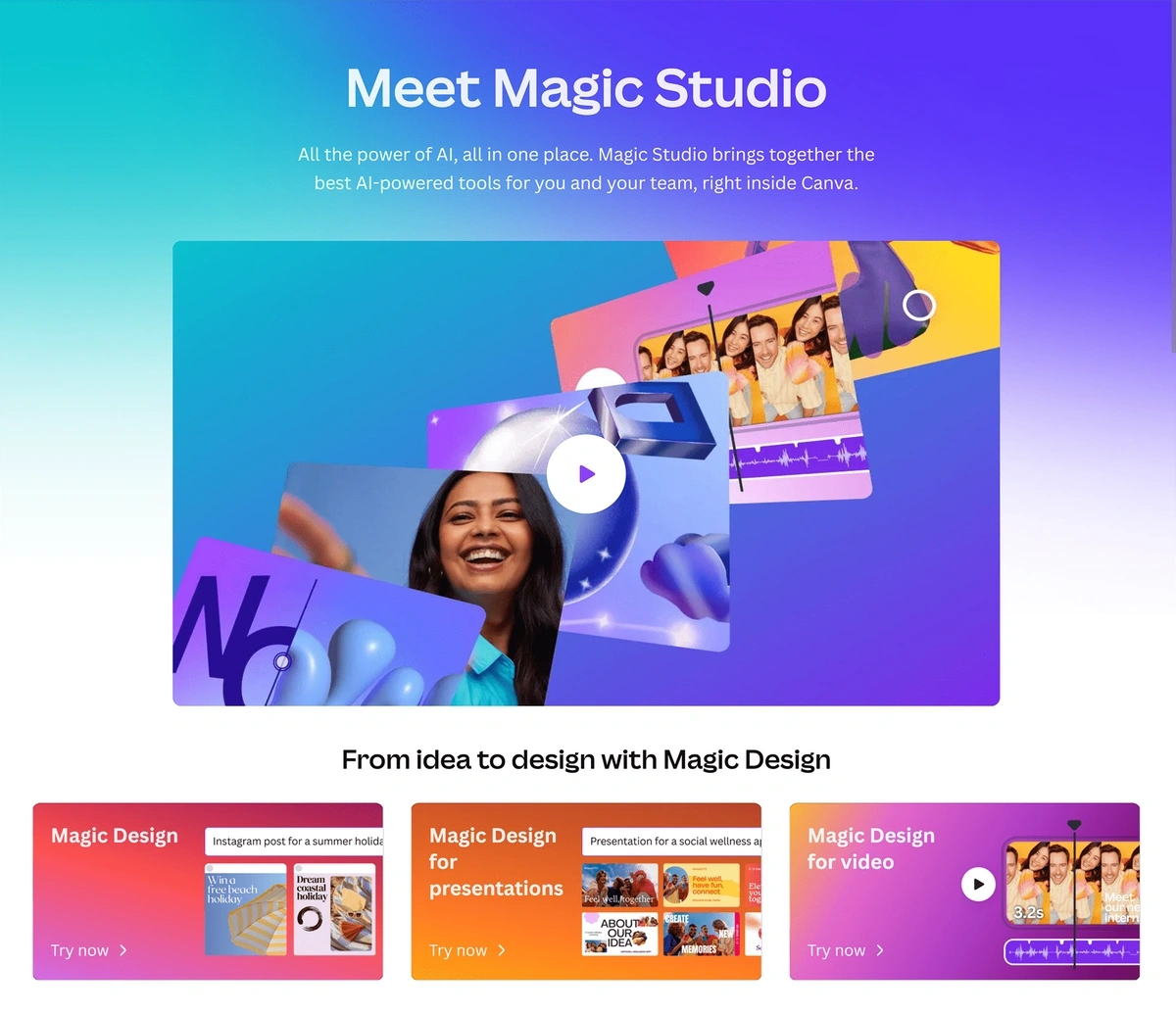

Magic Studio offers several generative AI tools.

Canva’s Magic Studio creates a set of designs based on user prompts.

Users also have the ability to use AI to generate text, animate designs, and edit photos directly from Canva’s interface.

Generative AI integrations in the human resources software marketplace have been moving slowly.

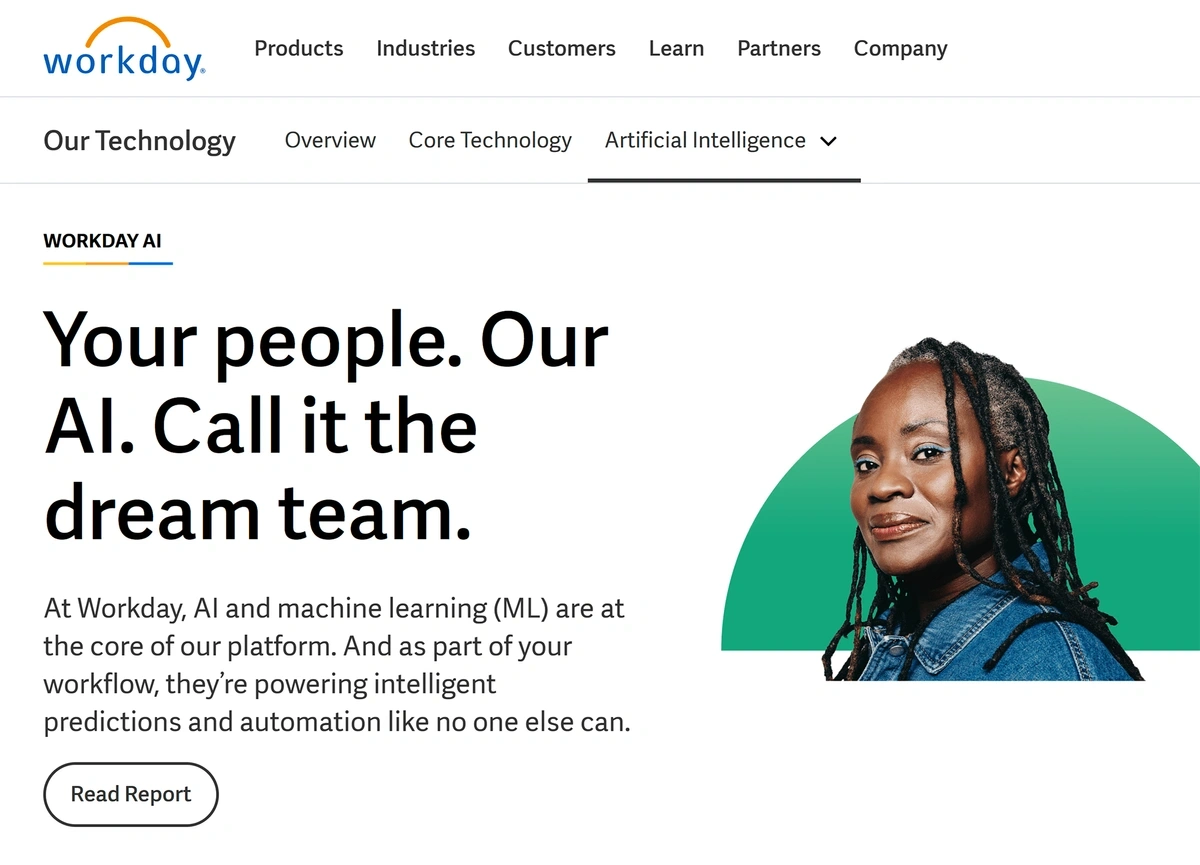

Still, Workday went from a typical SaaS company to "AI and machine learning (ML) are at the core of our platform" within months of ChatGTP's release.

Workday released new generative AI features to their 65 million users in 2024.

Their AI features will include generating job descriptions, analyzing contracts, writing content for employees, and generating code for Workday apps.

The company has said they won’t be charging customers extra for these AI-enhanced features.

That’s because Workday already benefits from customers sharing their data on the platform. The company plans to use that data to train LLMs and release additional products.

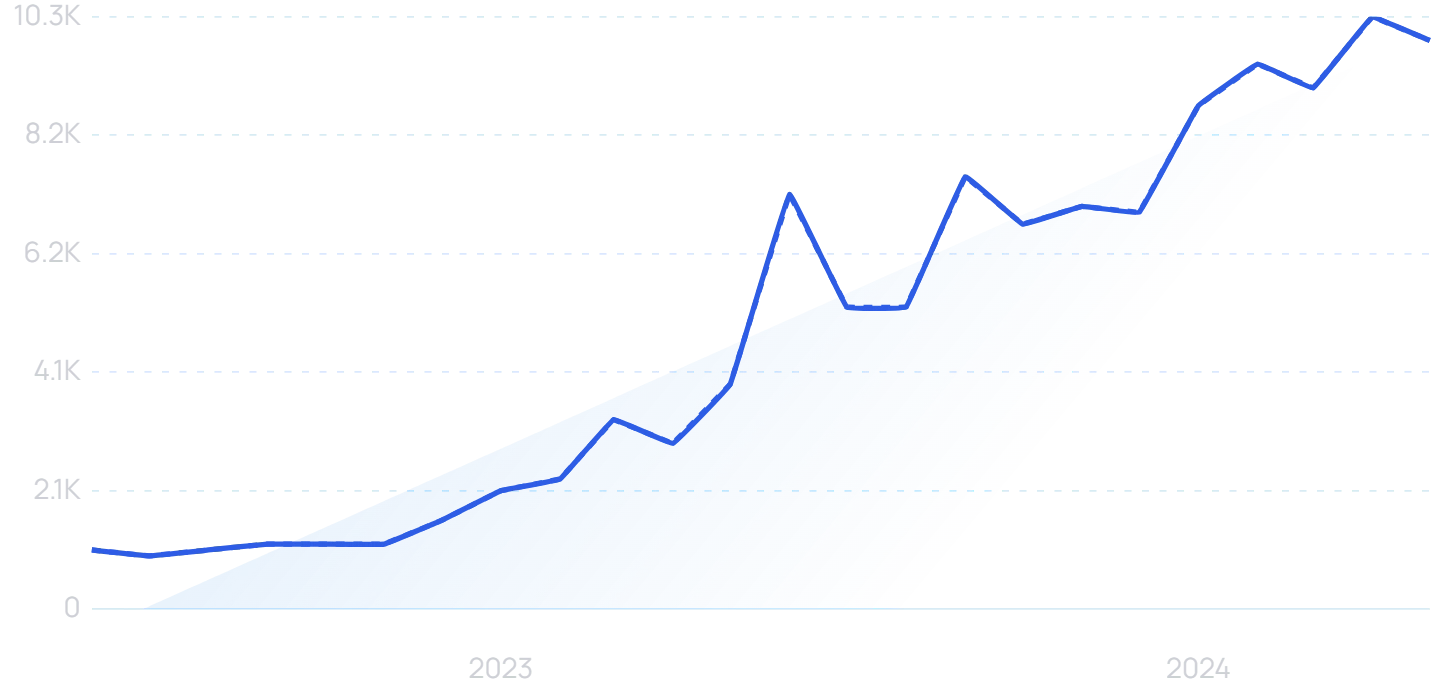

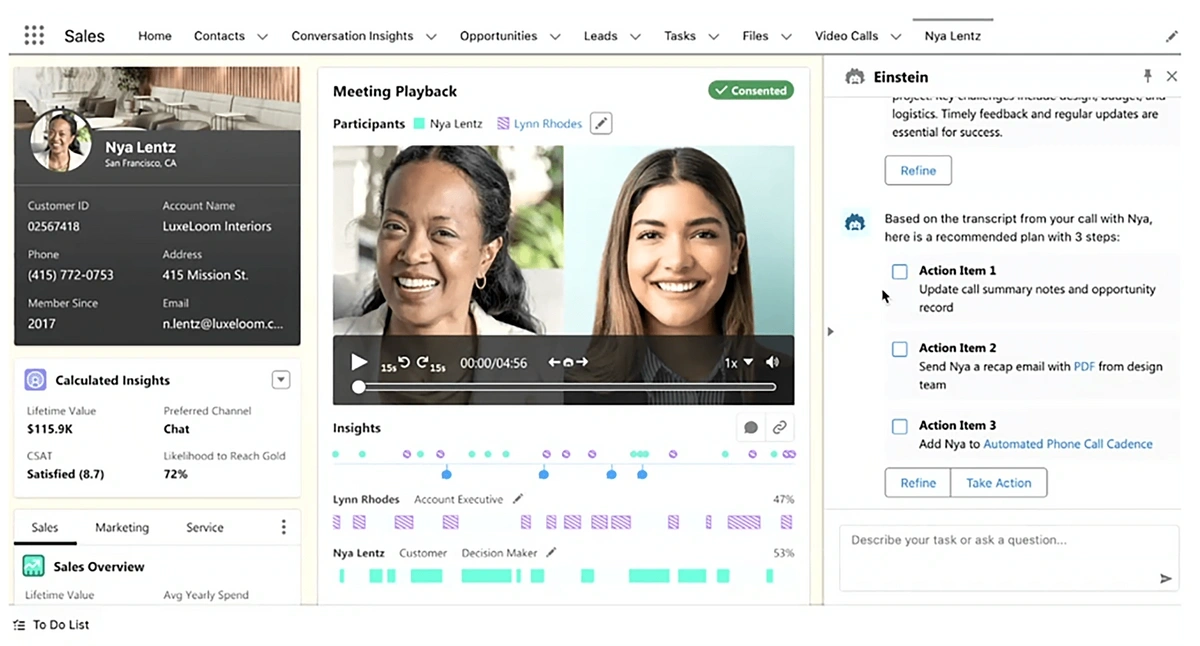

In another example, Salesforce has been consistently advancing the AI capabilities of its platform.

Search interest in “Salesforce AI” are up over 6x since 2021.

Salesforce's first AI tools debuted all the way back in 2016.

Fast-forwarding to more recent times and tech advancements, and the company is quickly adding AI to their offering.

Due to customer demand, Salesforce is currently taking AI a step further by implementing Einstein Copilot.

This generative AI bot is said to be able to complete tasks like answering complex questions related to customer accounts, extracting the next steps after video calls, managing catalog data, and writing code.

Einstein Copilot can create transcripts of video calls and automatically create action items.

Salesforce also says their Einstein Studio tool will enable enterprises to build and train their own generative AI models.

The tools are currently in beta testing. A release date has not been announced.

2. Increased Demand for Collaboration Software

Research shows collaboration improves workplace performance.

In one study, companies with collaborative workforces were 5x more likely to be high-performing businesses.

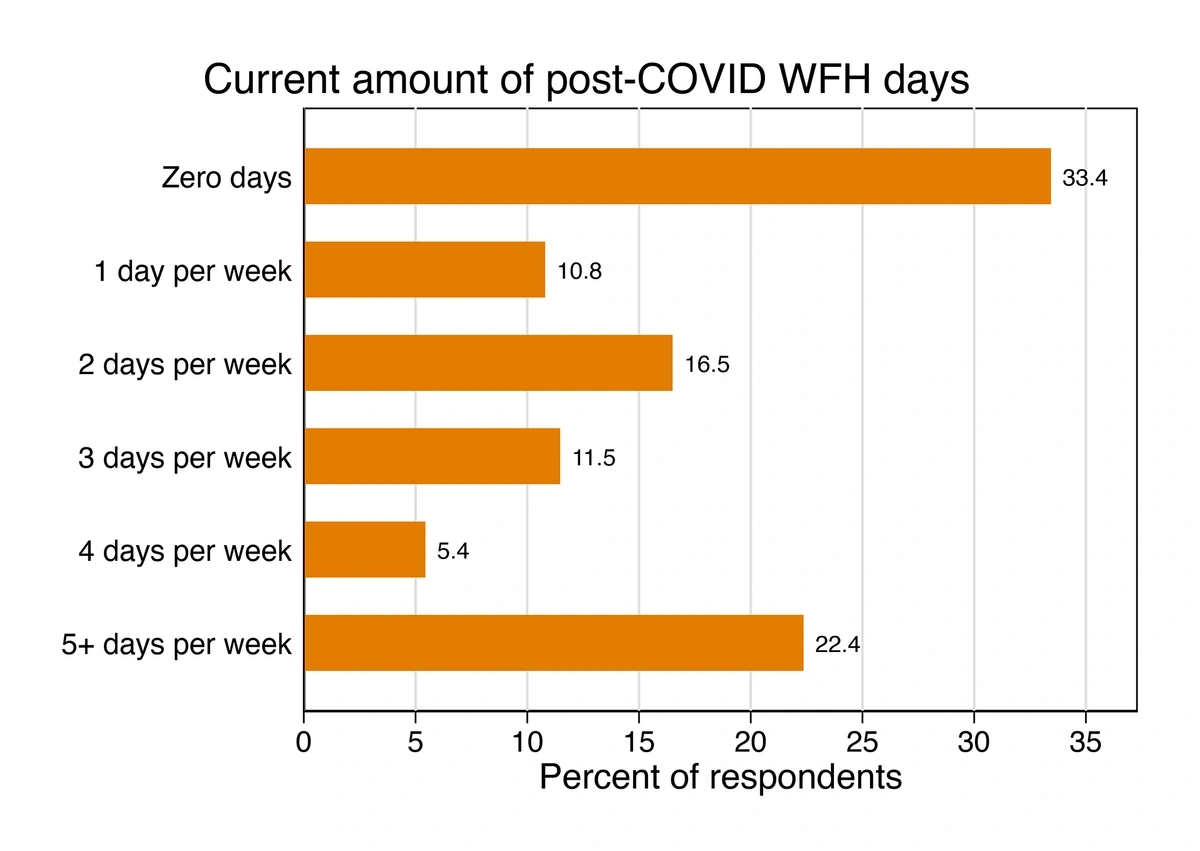

A survey from Stanford showed that, on average, employees are working remotely for 27% of full-time work days.

Only 59% of workers are fully on-site.

The majority of employees spend at least one day working remotely.

With such extreme schedule variances, collaboration is suffering.

One survey reported that 71% of employees are struggling with collaboration.

So, it comes as no surprise that companies are looking for tools to improve the way their employees work together.

Many of the tools that led businesses through the pandemic are still popular today.

Slack continues its upward climb with projections showing the app will have 79 million active monthly users by 2025.

Adoption of Microsoft Teams continues to grow, too.

Last year, Microsoft officials reported the collaboration platform has seen nine consecutive months of triple-digit revenue growth.

But new, more tailored SaaS offerings are emerging as well.

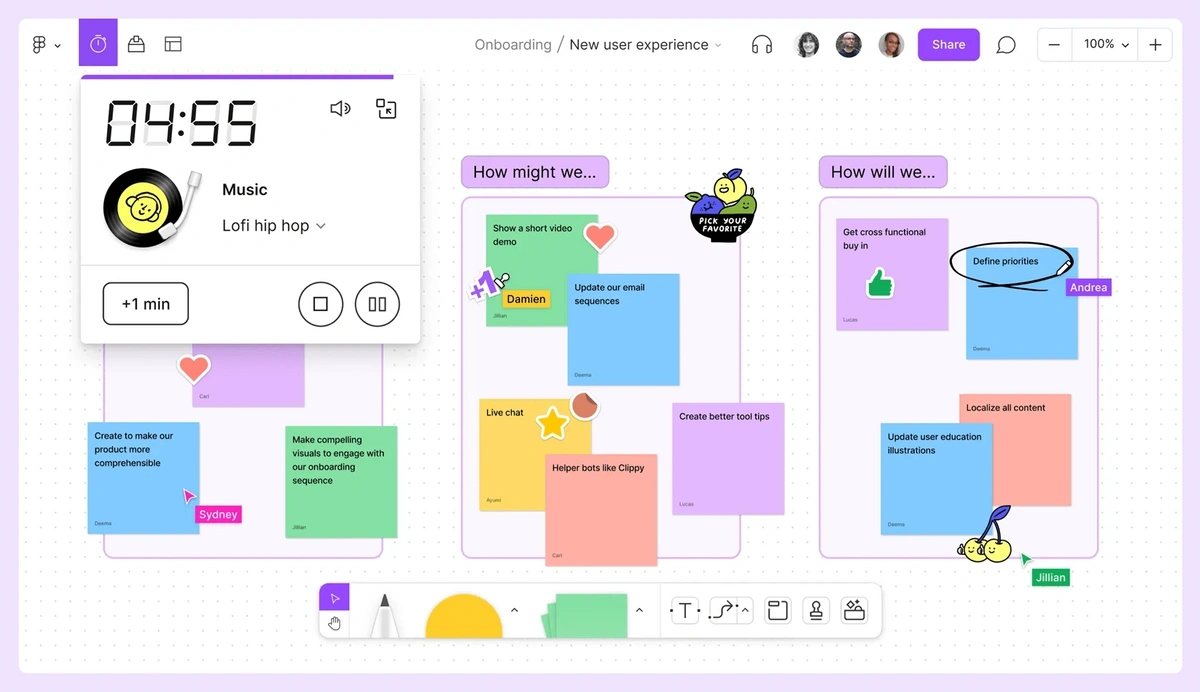

FigJam (an offshoot of Figma) is one example.

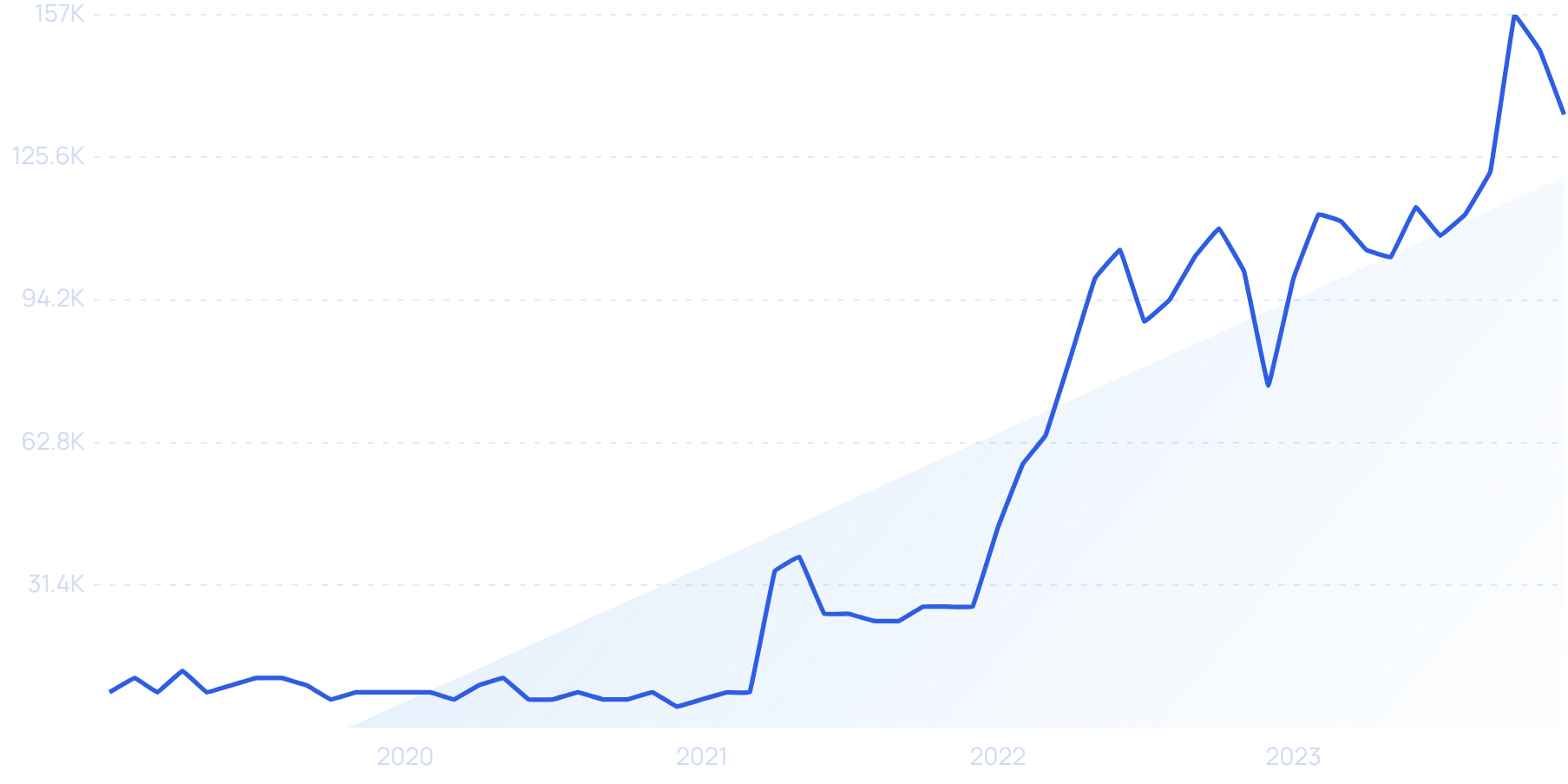

Search interest in “Figjam” is up more than 2,250%.

It pegs itself as a virtual “collaborative whiteboard” where teams can brainstorm and organize ideas.

FigJam enables employees to create workflows, meeting notes, timelines, and more.

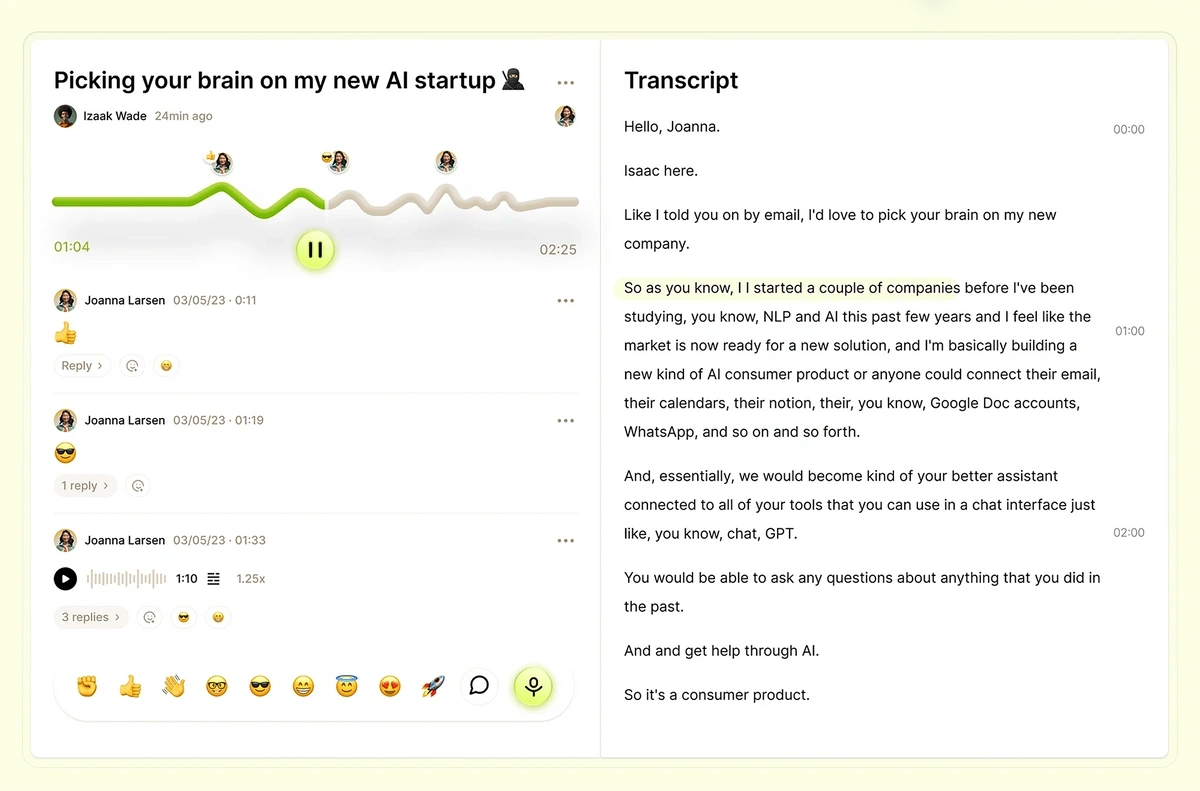

Async is another specialized collaboration software.

With Async, employees can send asynchronous voice messages instead of sitting in inefficient meetings.

Users can share the messages anywhere via a link. A transcript of the message is included, too.

By sending voice messages via Async, employees can avoid frequent calls and long meetings.

So far, the startup has raised $4 million in funding.

3. Dedicated AI Tools for Customer Service

According to McKinsey, two-thirds of Millennials expect real-time customer service.

Gen Z likes to see quick action from companies too—27% want a response from customer service within mere hours.

This means businesses are seeking out the tools they need to improve the customer service experience.

AI-powered SaaS options are proving to be a popular pick because they ease many of the pain points businesses are experiencing today.

Search interest in “AI for customer service” has increased by more than 600% over the past five years.

For example, AI customer service tools can:

- Act as the first line of customer service by using a chat interface to greet customers and provide answers to basic questions

- Automatically route customer interactions to the proper agents

- Detect customer sentiment and improve de-escalation efforts

- Lead to faster resolution of customer problems

- Offer discounts and cross-selling opportunities to customers

BCG reports that implementing AI-powered solutions can increase a company’s customer service productivity by up to 50%.

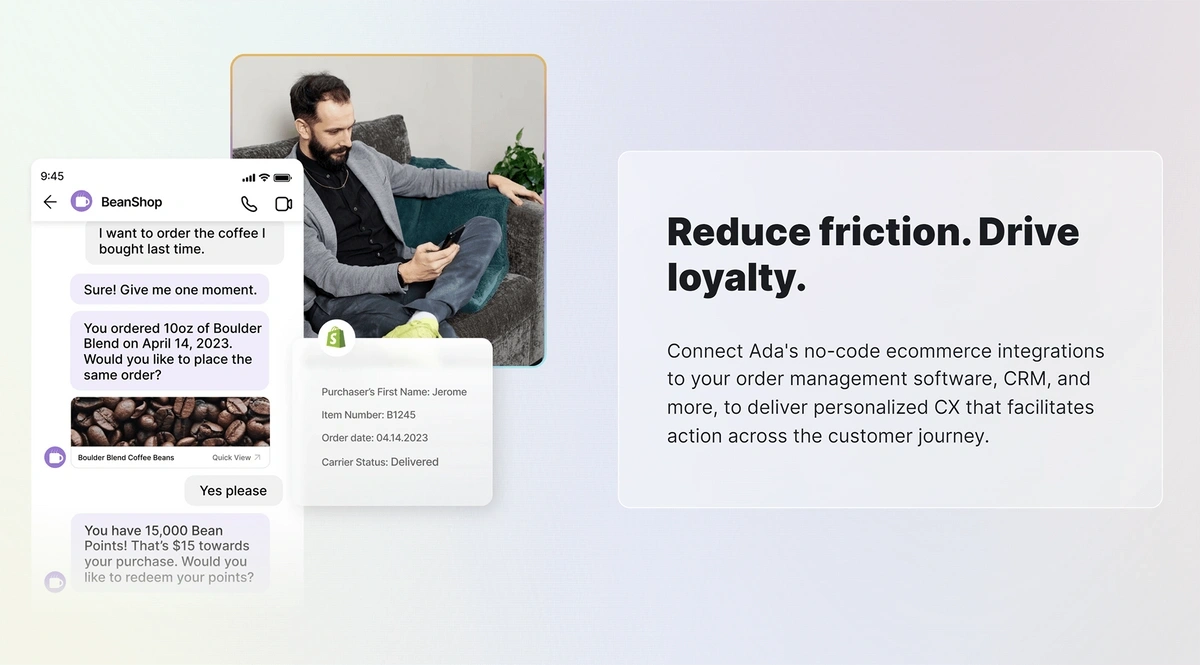

Ada is a SaaS platform that provides companies with an AI-powered customer service agent.

The platform’s LLM blends with each company’s knowledge base. This means the AI agent can provide personalized customer resolutions that are quick and accurate.

Ada’s AI solutions can be applied in a variety of industries like eCommerce, banking, and travel.

In addition, the platform offers no-code chatbots that can be set up in just a few days.

Big-name companies like Shopify, Meta, and Verizon are using Ada’s tools.

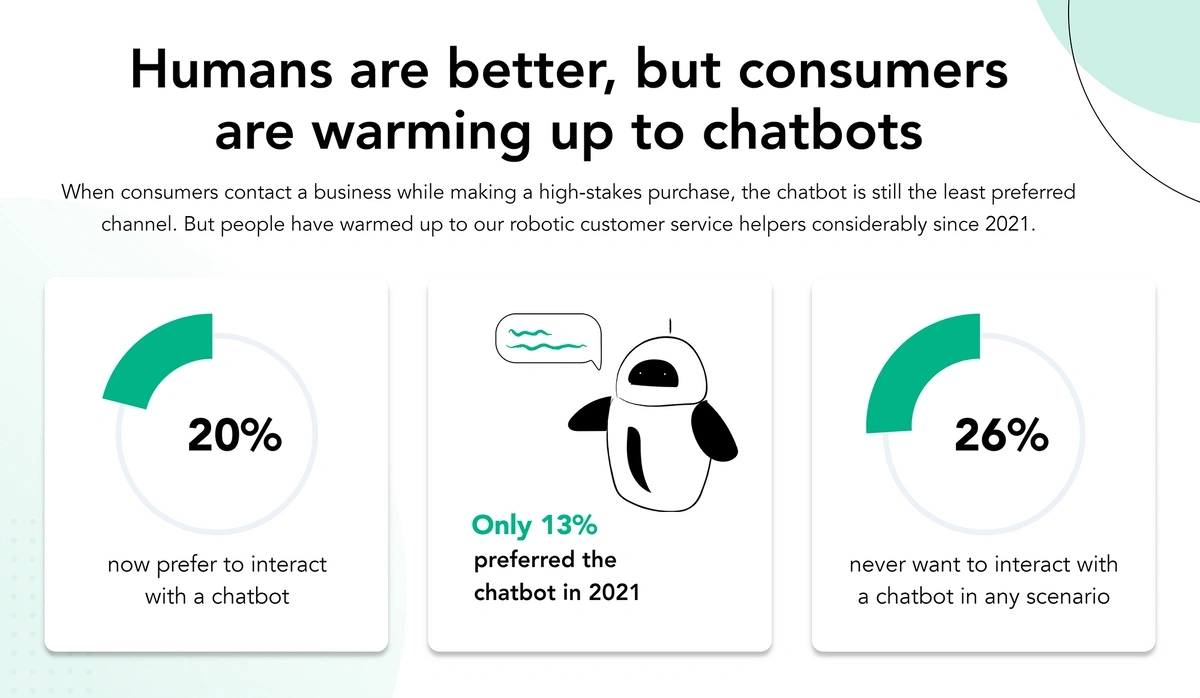

But AI-powered customer service tools do run the risk of disappointing customers with bot-like interactions.

In fact, 26% of consumers say they never want to interact with a chatbot and 30% say a chatbot is likely to make mistakes.

A recent survey showed that one-fifth of consumers will use a chatbot when making a big purchase.

Many SaaS companies are trying to create efficiency while maintaining a human element.

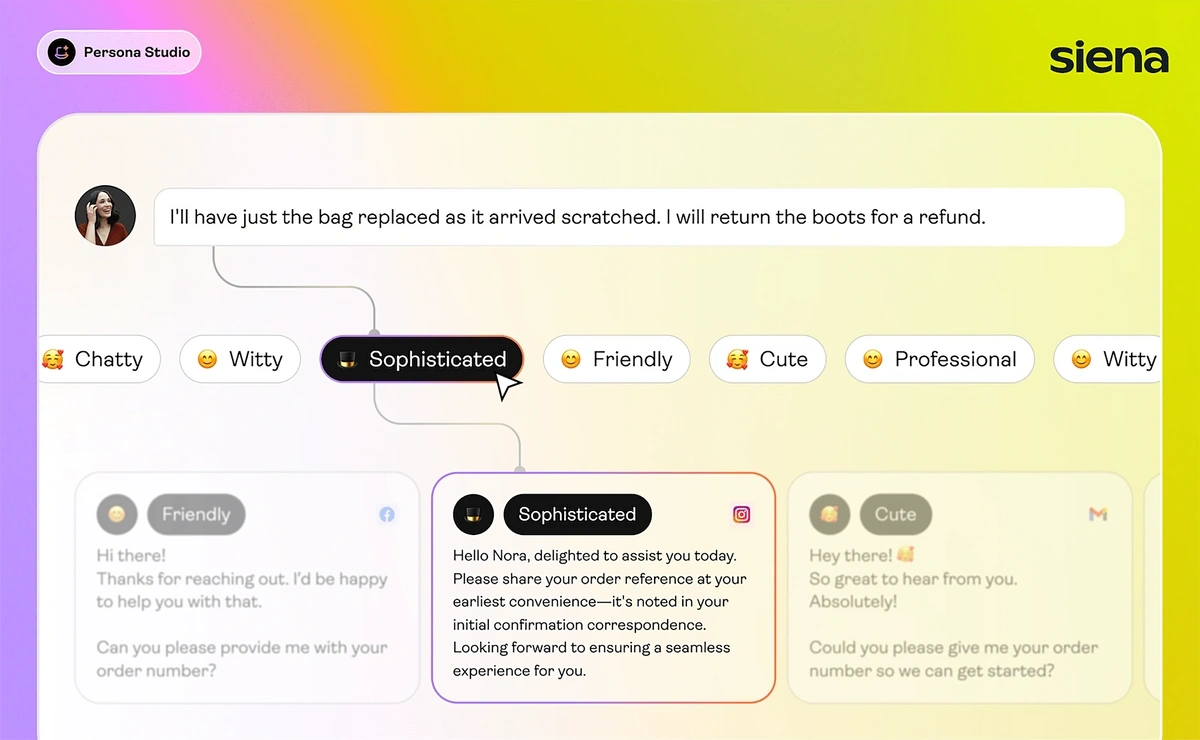

Take Siena AI, for example.

The company’s software allows enterprises to create multiple AI brand personas. This means that automated interactions come across as empathic and remain consistent across channels.

The software also utilizes a cognitive reasoning-based engine to choose the most efficient pathway to resolution.

Siena’s AI tool gives brands the opportunity to fine-tune the tone of their messaging.

4. Cost Increases Lead to Alternative Pricing Strategies

A recent report listed the year-over-year price inflation of SaaS products at 8.7%.

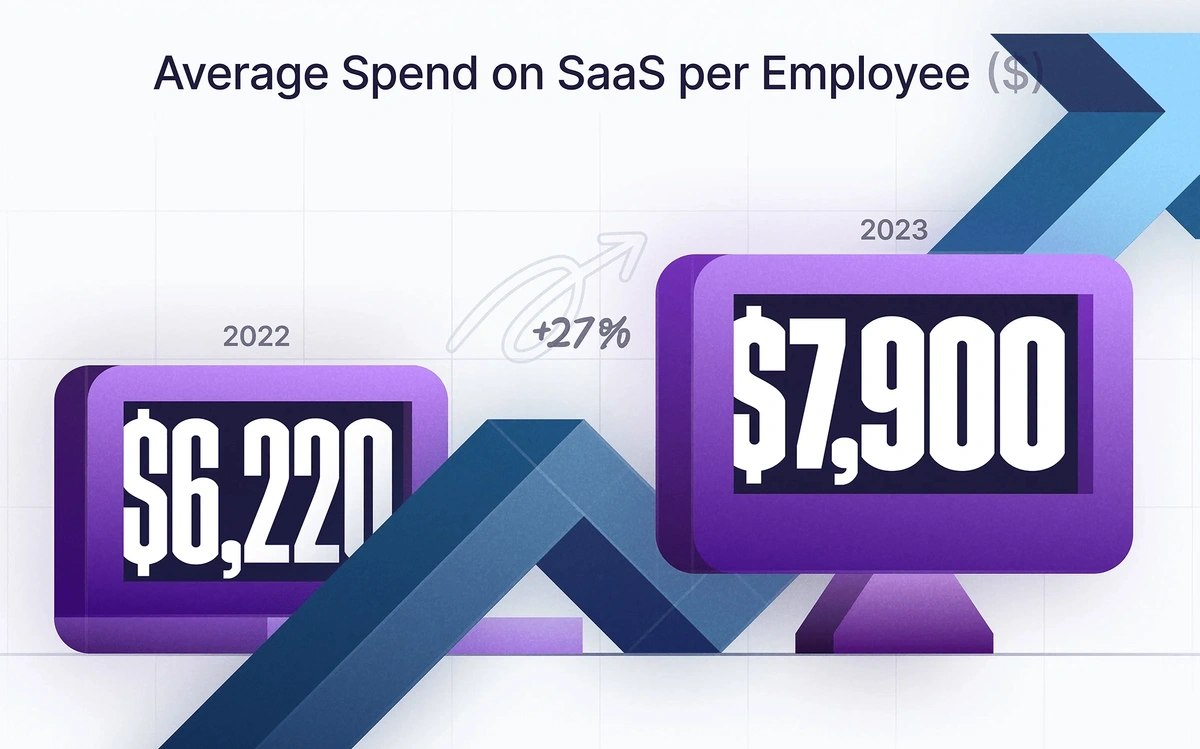

On average, businesses now spend $7,900 on SaaS tools per employee each year.

That’s a 27% increase over the last two years.

Nearly $200 billion is spent on SaaS globally—a large increase over 2022.

Other industry reports have noted “SaaS shrinkflation,” calling out the fact that one-quarter of businesses have seen their SaaS functionality reduced while the price remains the same.

Reduced discounting, bundling or unbundling, and use-it-or-lose-it pricing are just a few of the shrinkflation tactics being used across the SaaS market.

McKinsey data shows that 50% of software companies are planning to increase prices and tighten discounts in the coming months.

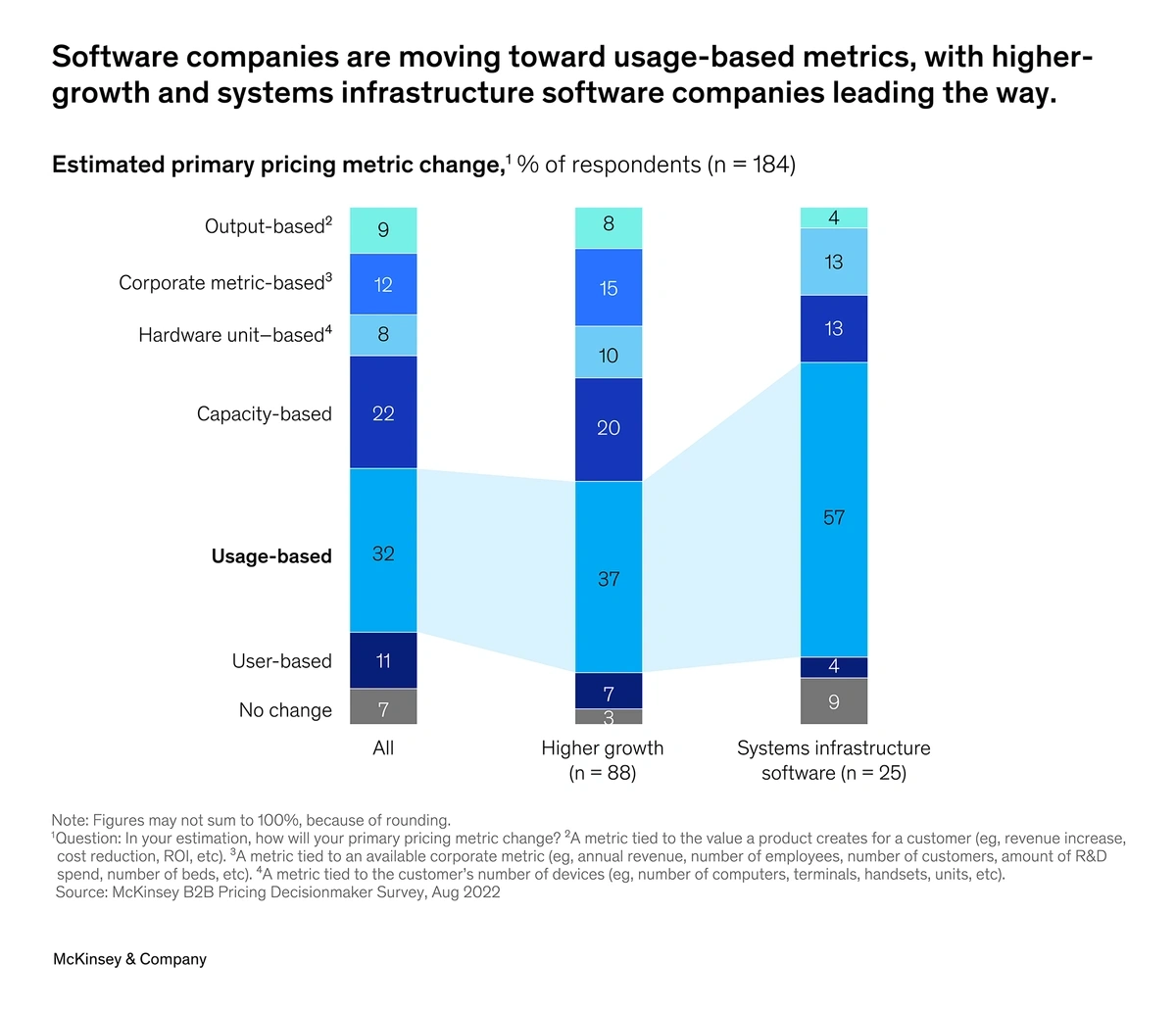

This could include a shift in pricing strategy altogether, McKinsey reports.

While 40% of software companies still charge per seat, some are considering shifting to usage-based (also known as consumption-based) pricing metrics in order to drive revenue growth.

McKinsey data shows higher-growth SaaS companies are leading the way toward changing pricing structures.

More than 60% of SaaS businesses used consumption-based pricing.

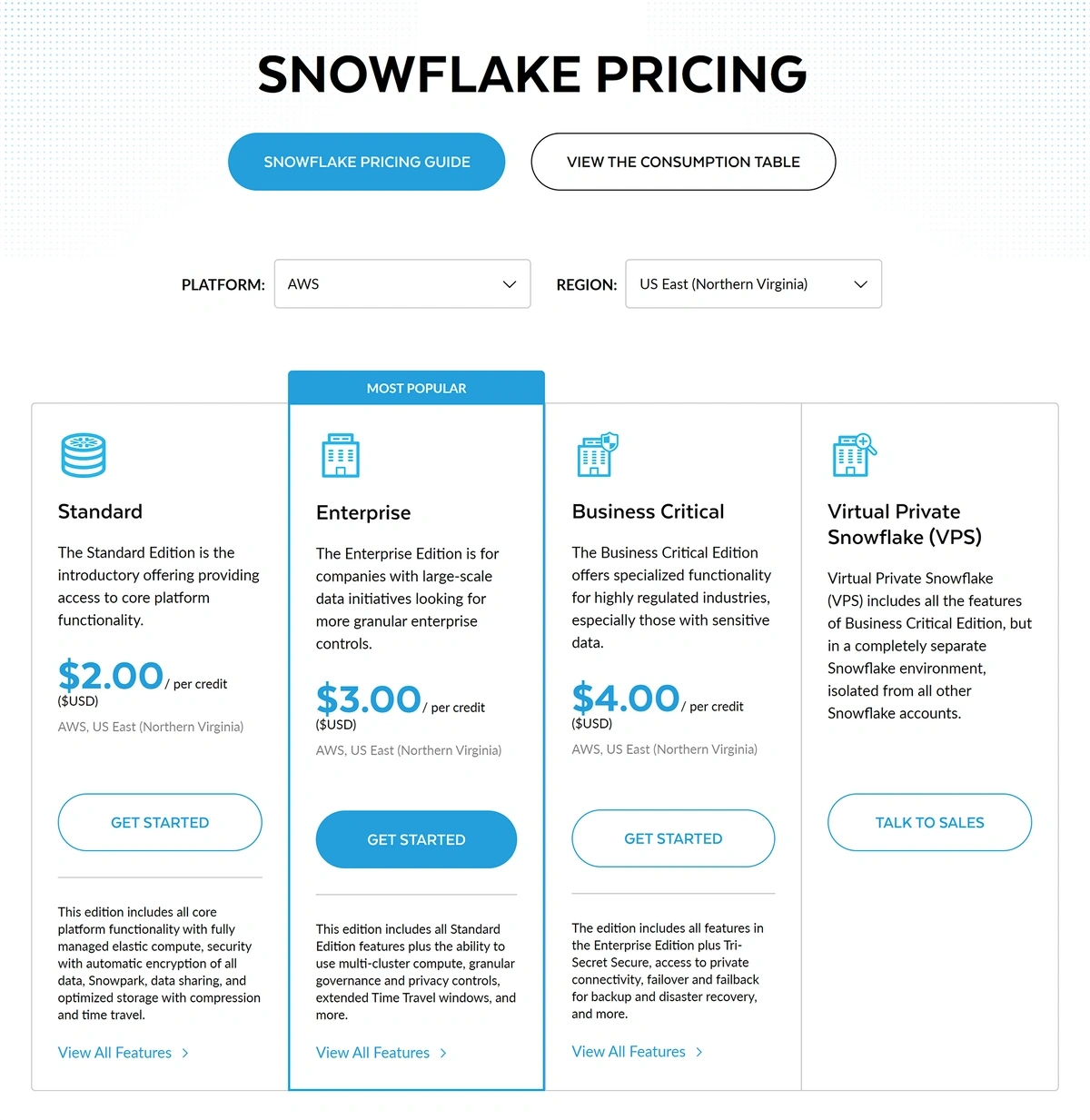

Snowflake, a data management company, has recently seen success using this pricing strategy.

The company sells its services on a credit-based model. The customer uses up credits at the pace that suits their business needs and they pay for exactly what they use.

Snowflake offers a tiered consumption-based SaaS model.

In the company’s 2023 Q3 reporting call, Snowflake officials predicted Q4 product revenue will surge up to $21 million above earlier estimates. Q3 revenue came in at $734.2 million.

Experts also predict the consumption-based model will grow more prevalent in the SaaS market because many AI tools are being presented in this payment model.

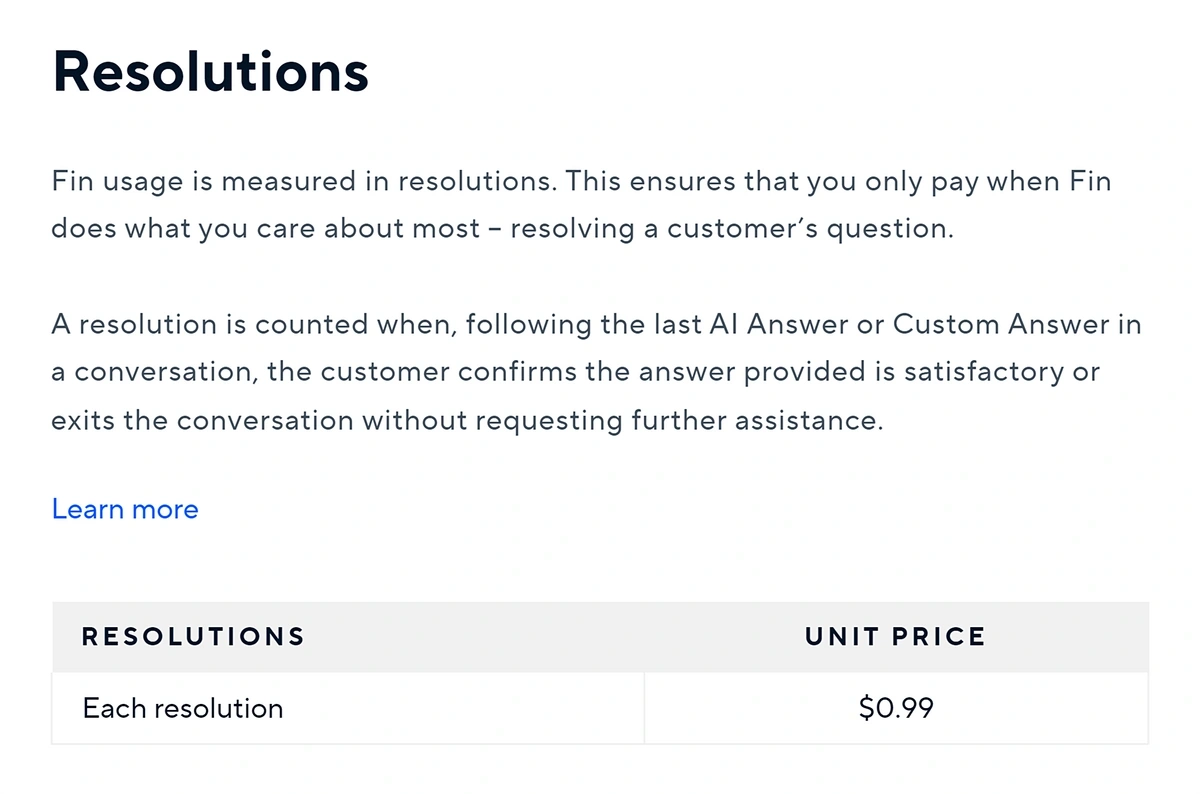

For example, Intercom, a customer support tool, charges per seat for its overall SaaS platform. But it charges $0.99 for each resolution that’s provided to customers by its AI-powered chatbot.

Intercom charges businesses each time the chatbot is successful.

5. LCNC Speeds Development of New SaaS Tools

Coding software from scratch is quickly becoming a thing of the past.

Instead, a growing number of software developers are building apps and websites with low-code/no-code (LCNC) platforms.

LCNC platforms provide a drag-and-drop style interface that’s relatively easy for non-tech entrepreneurs to understand.

This means that non-coders can develop apps and deploy SaaS offerings in a relatively short amount of time.

Bubble.io is one of the most popular LCNC platforms for SaaS development.

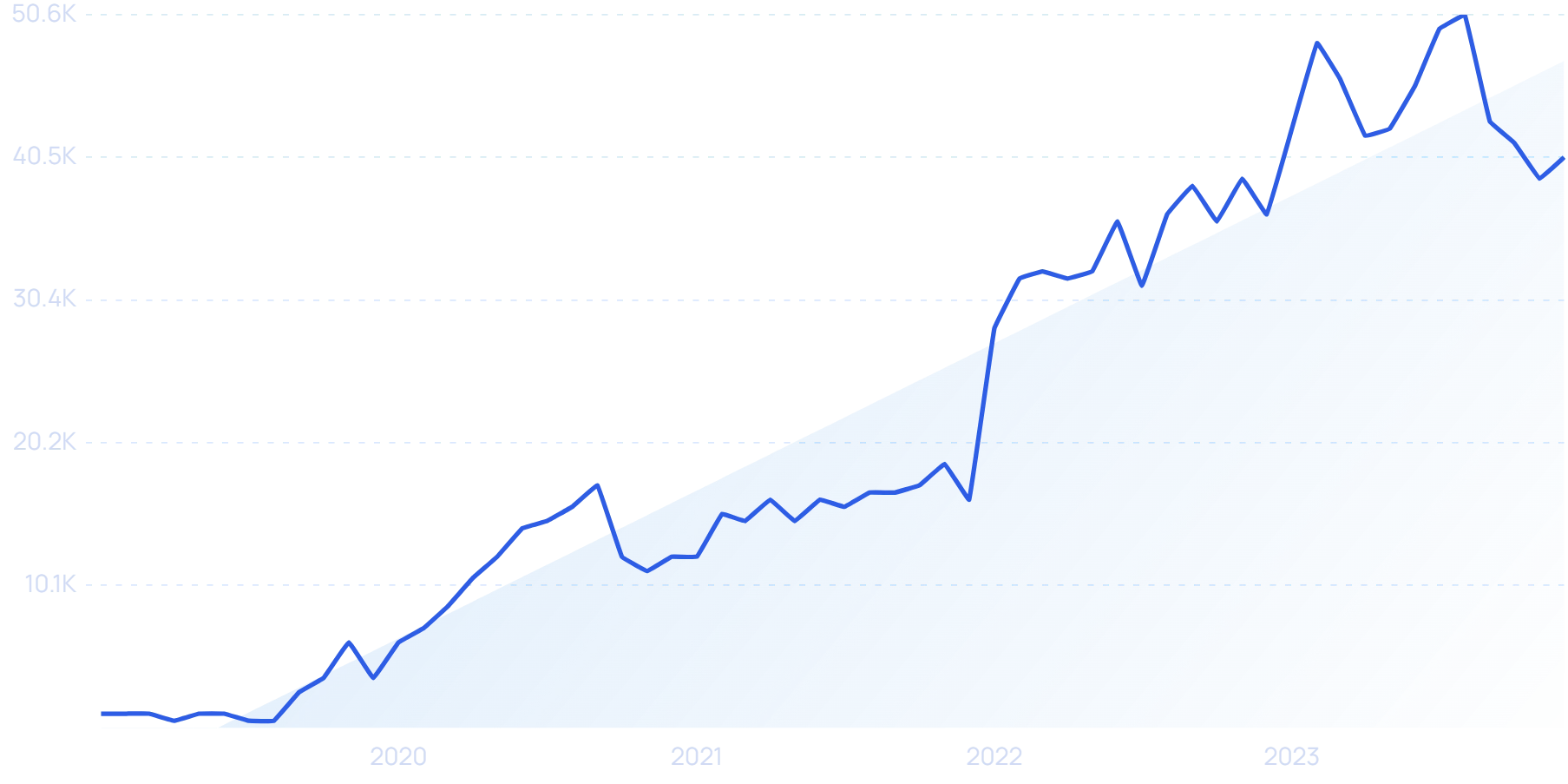

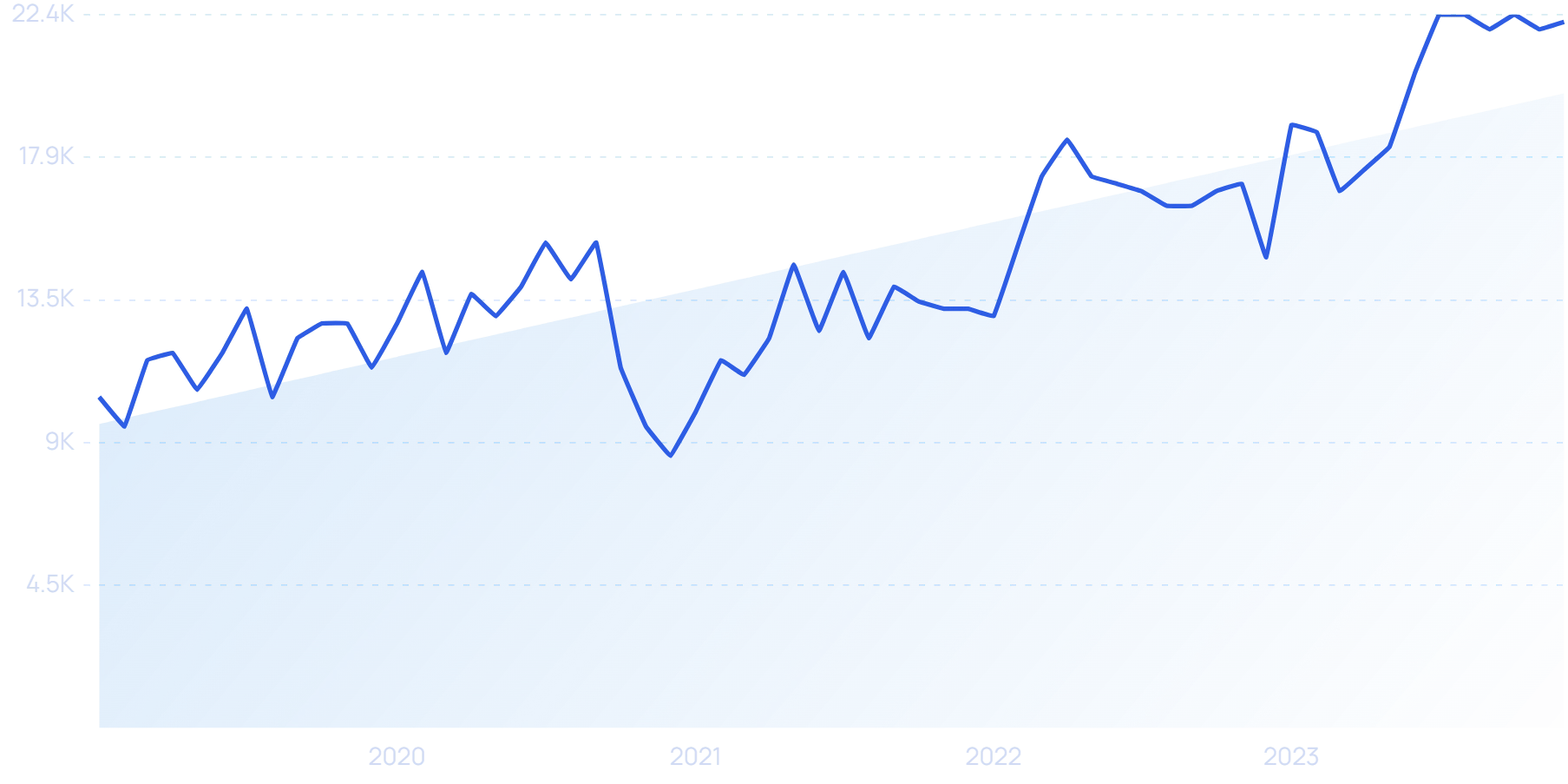

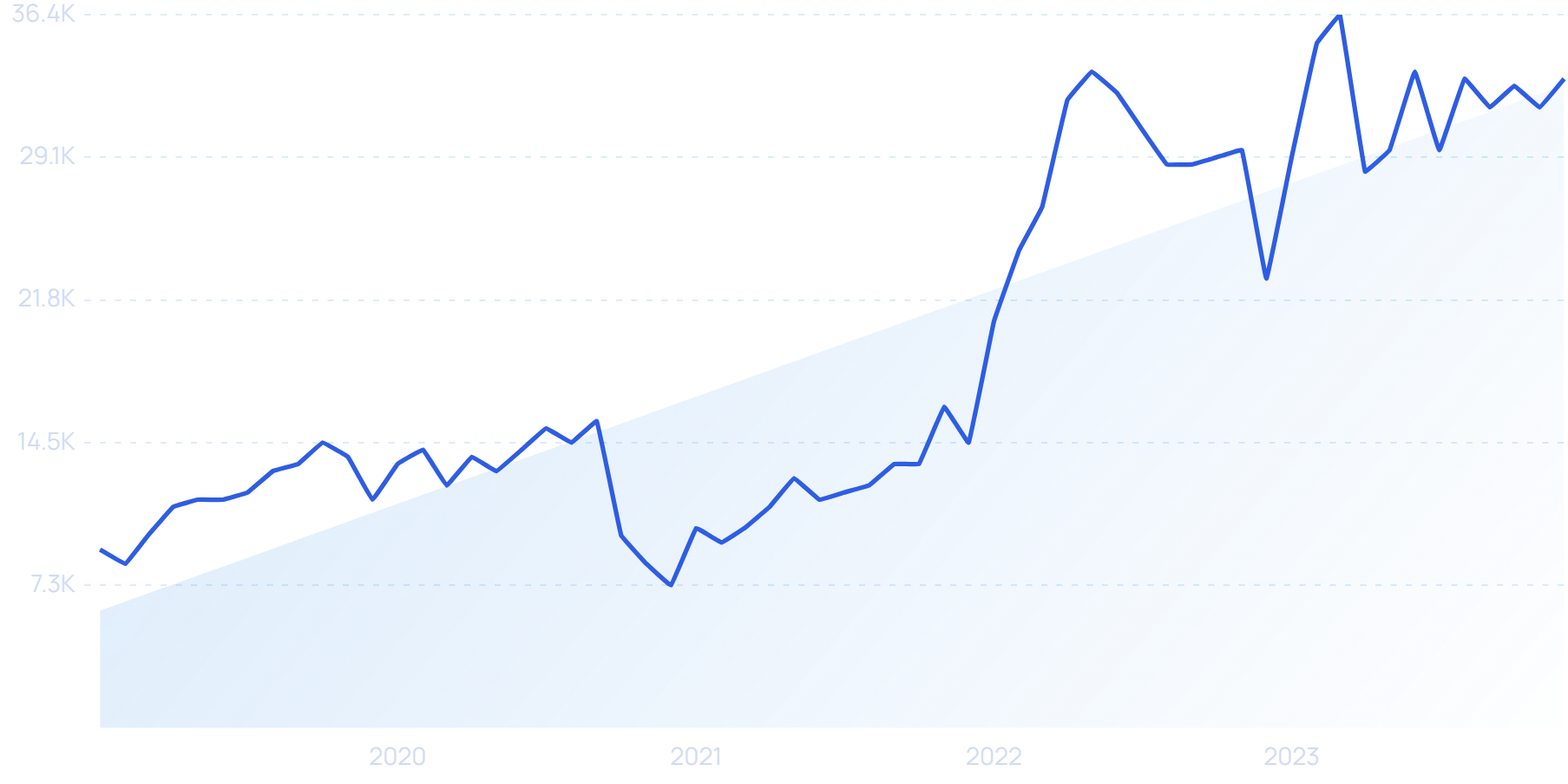

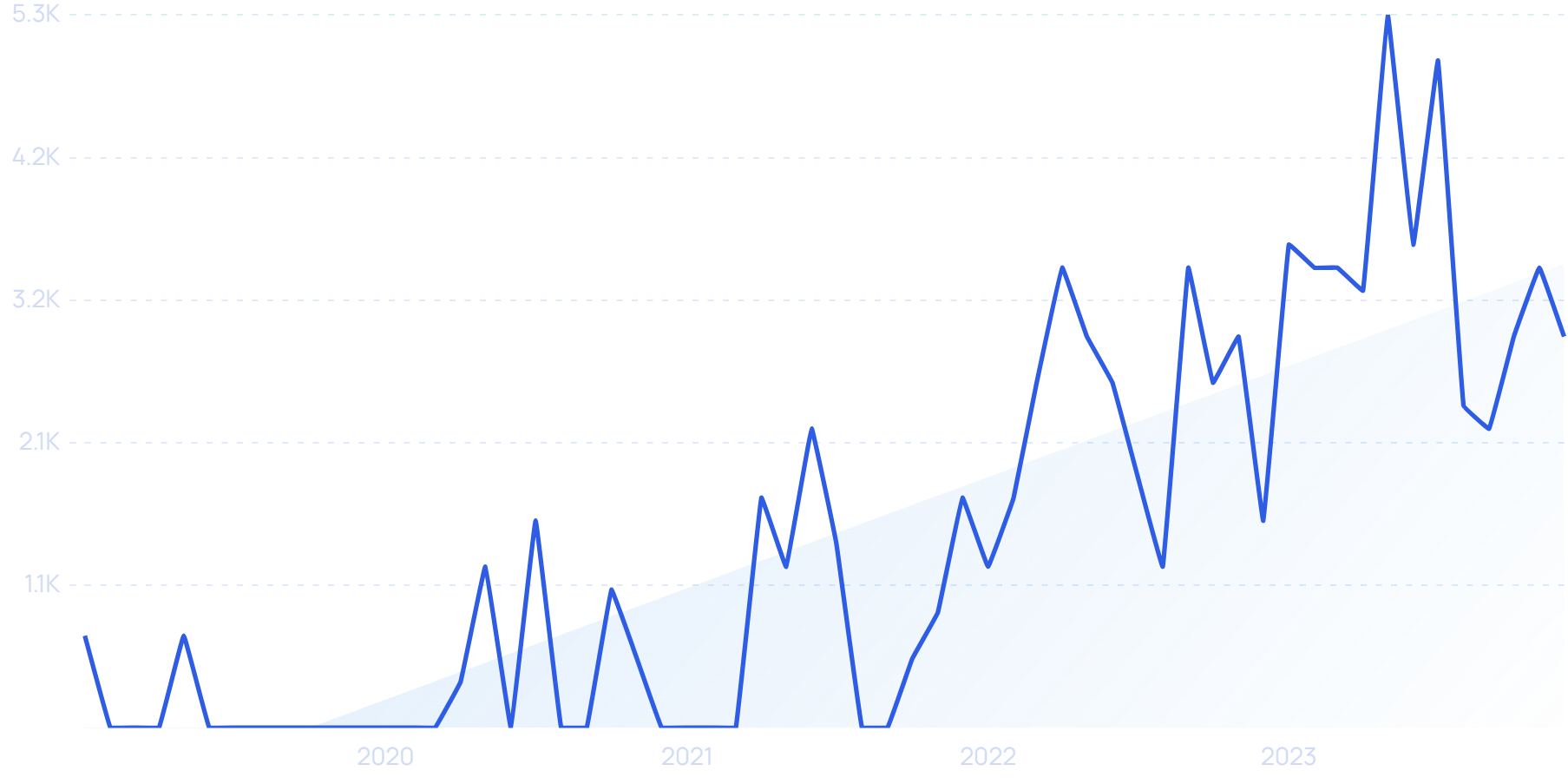

Search interest in “Bubble.io” has grown steadily over the past three years.

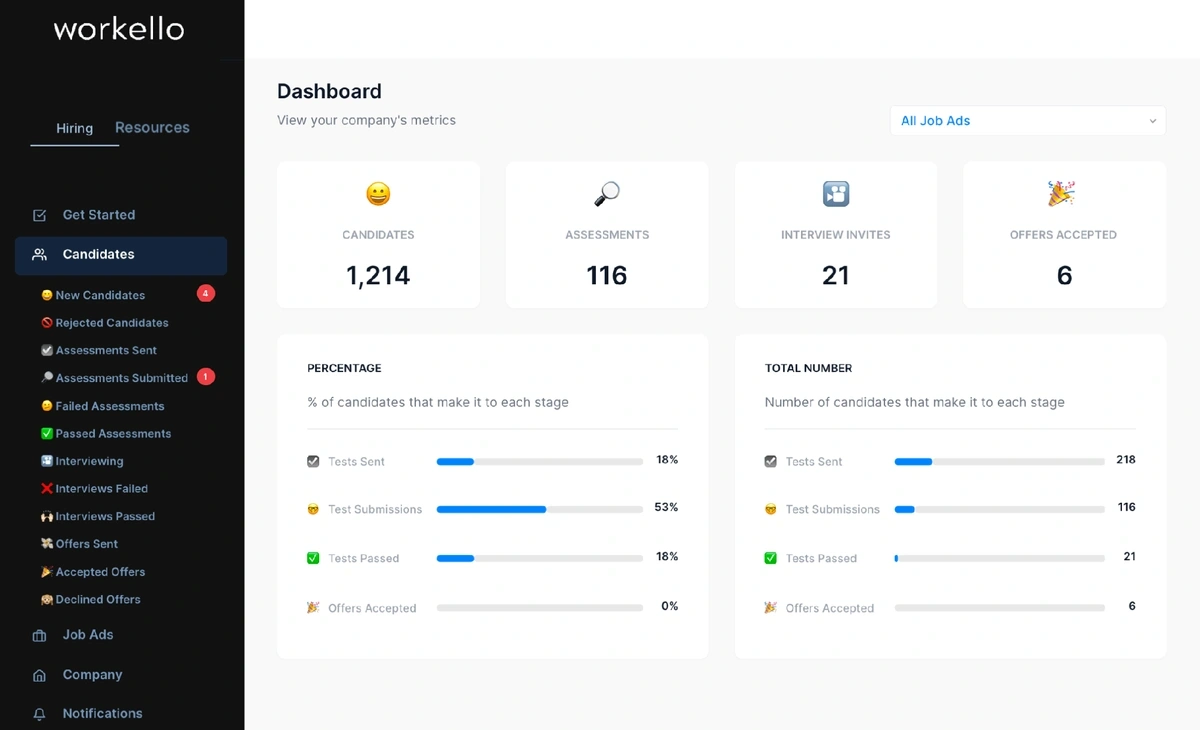

Workello (a hiring platform), Incomee (an invoicing platform for freelancers), and Byword (an AI content creation platform) are just a few examples of SaaS tools built with Bubble.

Workello’s platform gives customers a more efficient way to manage the hiring process.

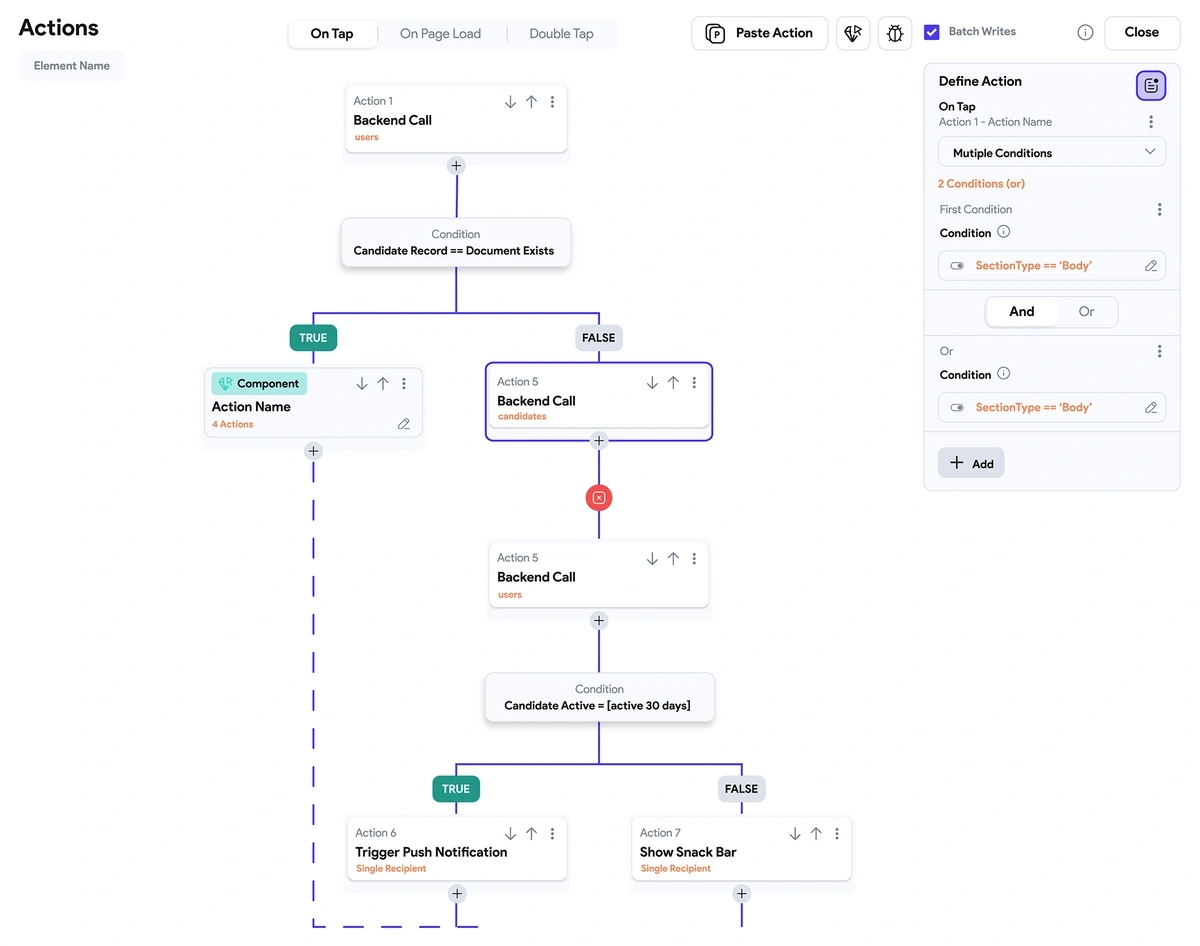

Flutterflow is another LCNC platform that’s becoming popular with non-technical users who want to launch a software product quickly.

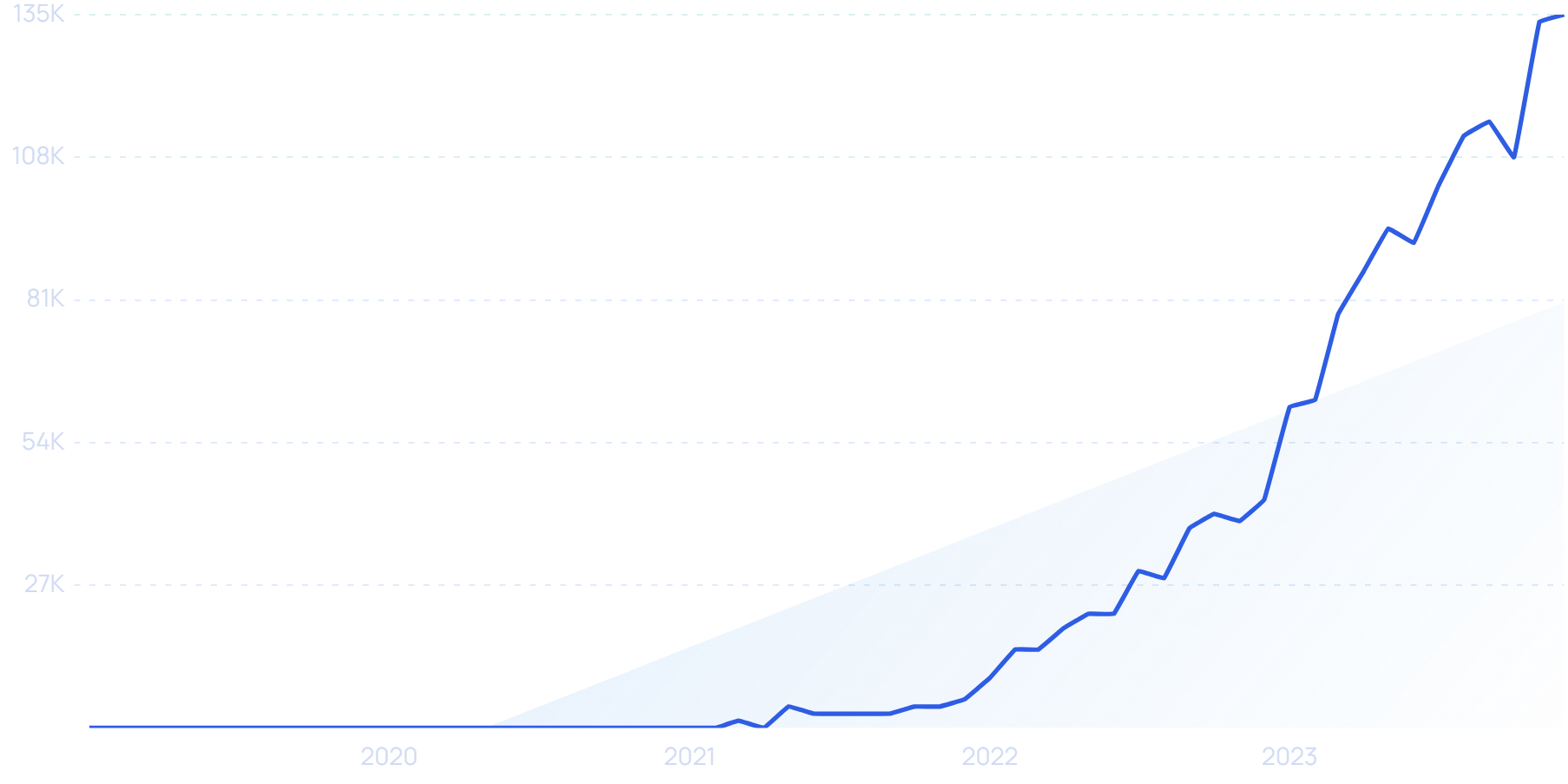

Search interest in “Flutterflow” has grown exponentially in the past year.

With Flutterflow’s visual development platform, a founder can build a fully-functioning app in a matter of hours.

Flutterflow’s visual layout makes it simple to map complex actions within the software.

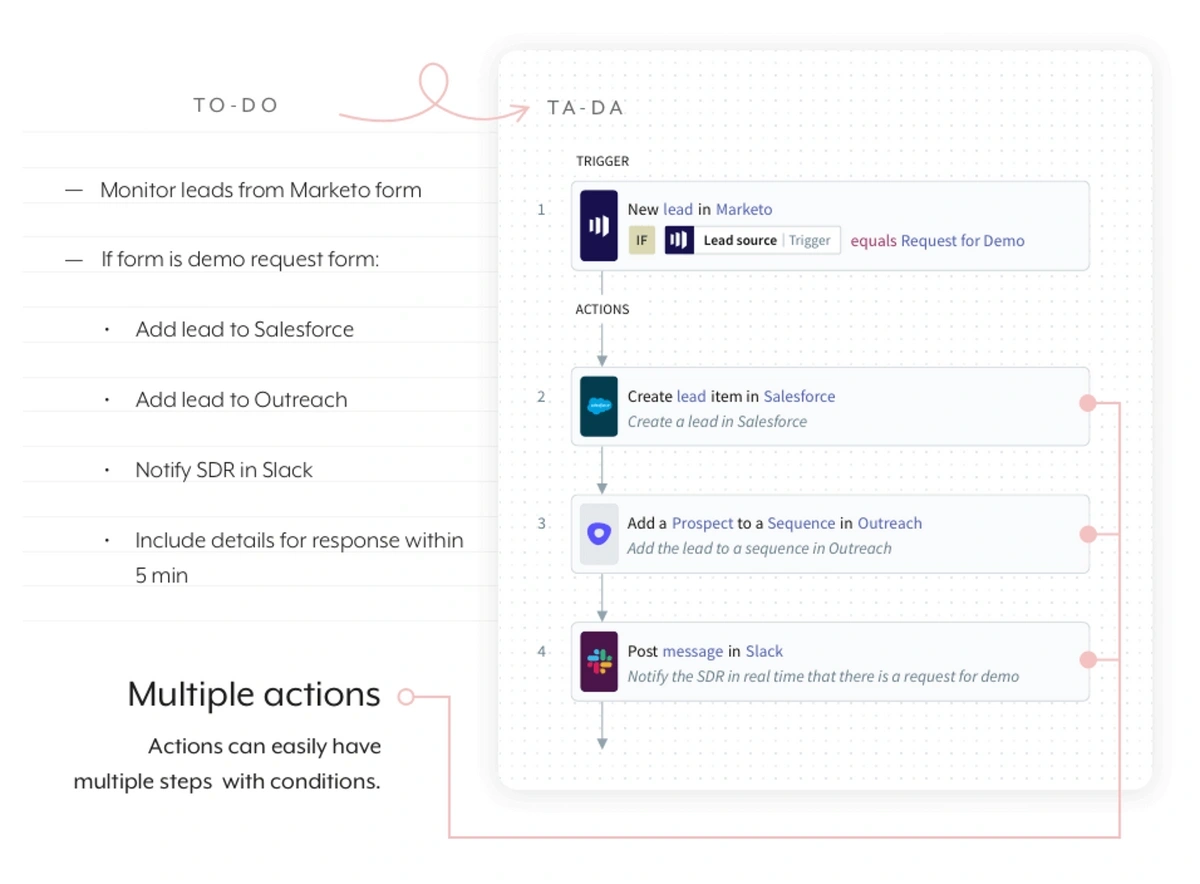

6. IPaaS Enhances Connectivity of SaaS Applications

Every business wants to be more efficient and agile.

That’s why Integration Platform as a Service (iPaas) is becoming so popular.

The iPaaS market is set to grow at a CAGR of 26% through 2027—an increase of $10.25 billion.

Search interest in “iPaaS” has grown nearly 200% in recent years.

These types of platforms enable automatic communication between various software tools.

In any given business, employees utilize several pieces of software to do their daily jobs.

Productiv found that the average enterprise ran 315 apps in 2022. In 2021, that number was just 254.

So, in simple terms, iPaaS allows employees to harmoniously work between all of their apps without worrying about new integrations or lost data.

This saves organizations time because they're not forced to jump between apps to find the information they need. Data is shared in real-time without the risk of human error.

For example, a company can connect its CRM platform to its ITSM tool so that customer support issues are directly routed to the right people.

Or a company can connect its CRM platform to its marketing automation tool so that sales leads are addressed right away.

With the capability to integrate more than 1,000 business applications, Workato is a top iPaaS provider.

Search interest in “Workato” is up nearly 200% since 2021.

The company has been recognized by Gartner as an industry leader for the past five years.

Workato’s iPaaS tool routes data between software and enables automatic actions.

There are also a few tech companies looking to combine the power of AI with iPaaS tools.

Integration.app is one of them.

Integration’s AI reads API documentation and creates specifications with little input from humans.

The tool uses large language models to decipher API documentation and learns how to integrate with an app. From there, the tool can apply what it's learned to connect multiple apps.

Zapier and Amazon have also recently released similar integration tools.

7. Misconfigurations Make SaaS Applications Vulnerable to Hackers

Who is responsible for SaaS security: the vendor or the consumer?

That’s a critical question, especially considering that losses associated with cybercrime total $10.3 billion according to the latest estimates.

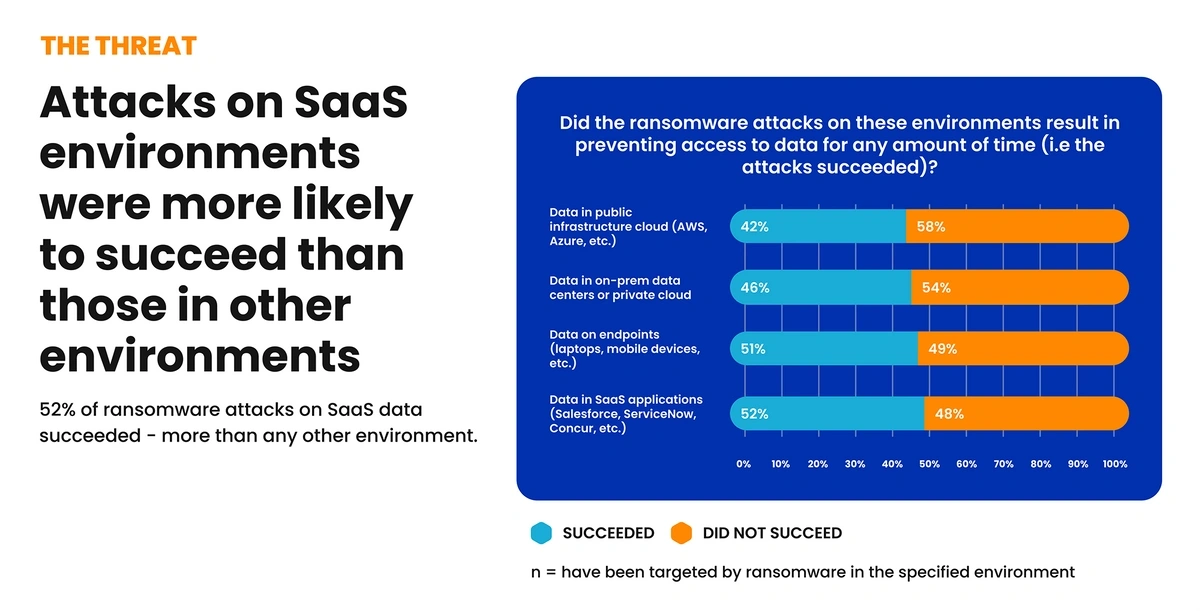

One research survey found that data stored in SaaS applications is very vulnerable.

More than 52% of ransomware attacks on SaaS data succeed.

When it comes to threats on SaaS data, more than half of all ransomware attacks succeed.

But survey data shows that enterprises are taking a much more active role in securing their SaaS applications lately.

Vendr, a SaaS buying tool, reported that security and compliance purchases were up 25% from Q2 to Q3 in 2023. And, Q3’s numbers were up 27% over 2022.

This includes increasing investments in password managers, compliance monitoring, authentication tools, and overall cybersecurity monitoring systems.

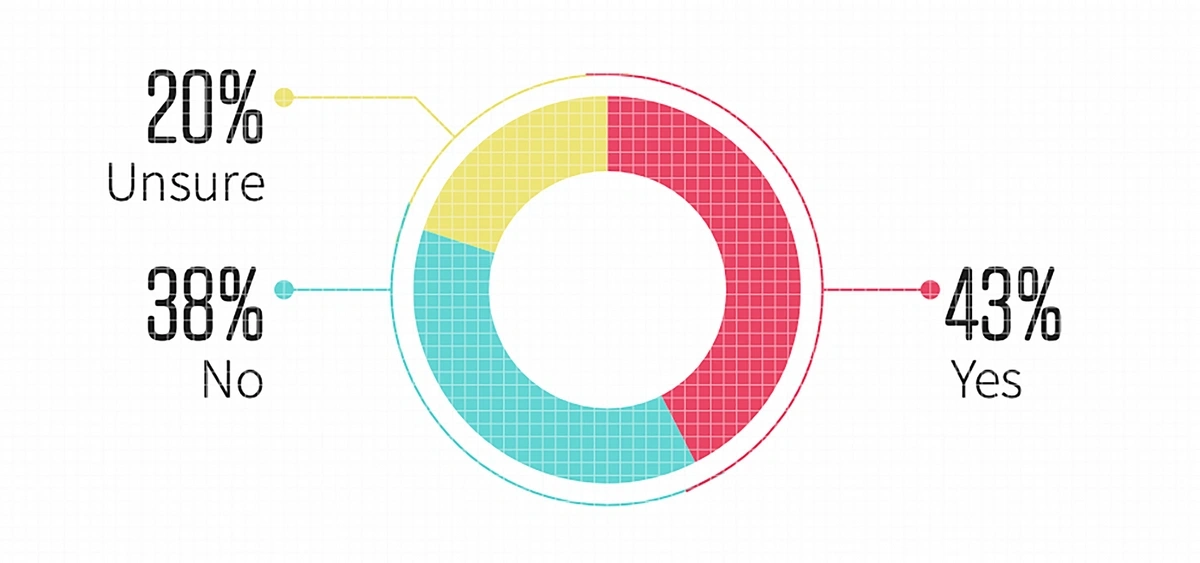

Studies show that one of the main SaaS security problems is misconfiguration.

The Cloud Security Alliance survey from 2022 proves just how extensive this problem is.

More than 40% of organizations have experienced one or more incidents related to misconfigurations.

Many enterprises have experienced multiple security incidents because of SaaS misconfigurations.

One-third of organizations say this is due to a lack of IT visibility into changes in security settings and another third say it’s due to the fact that several departments have access to SaaS security settings.

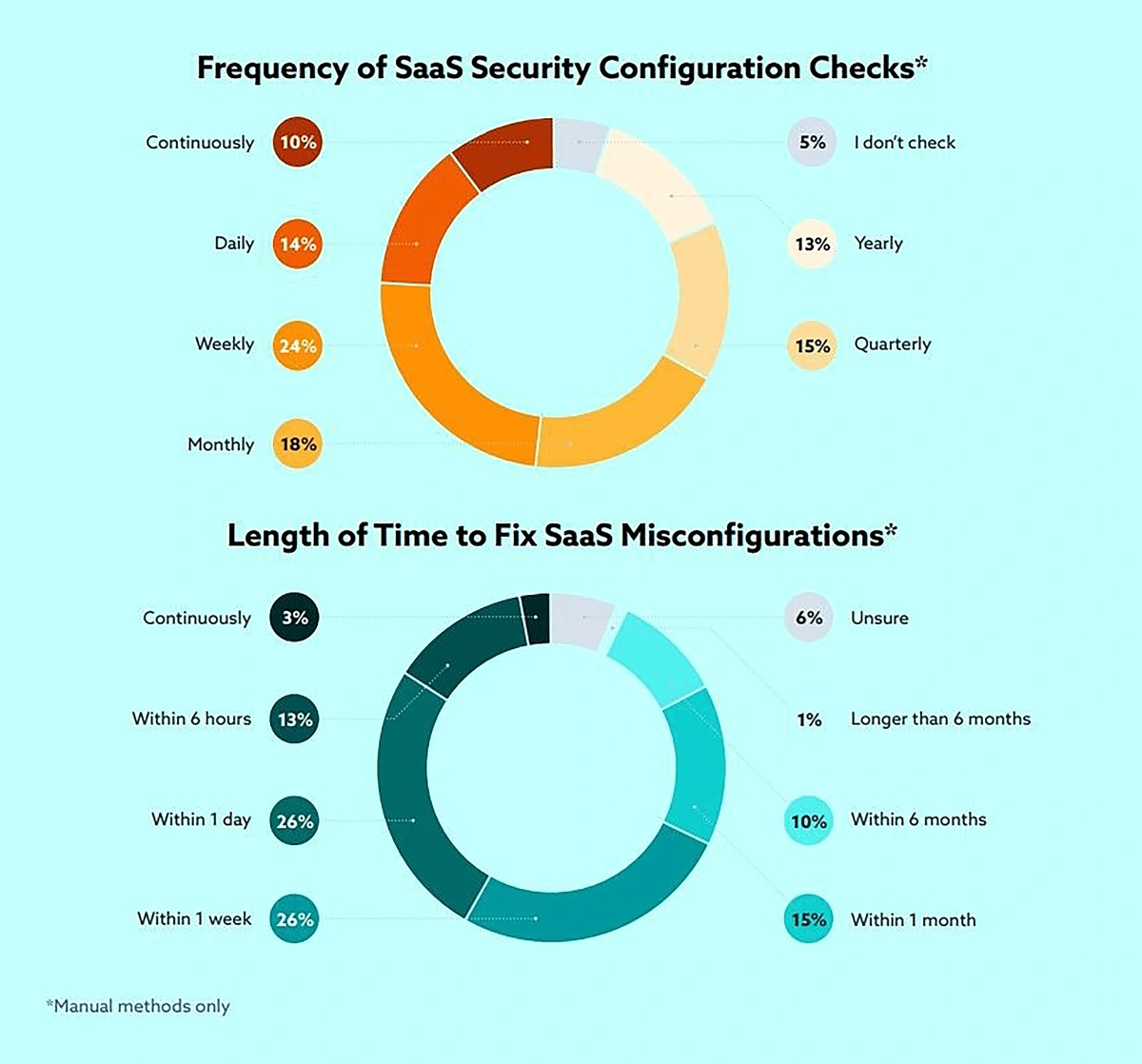

Worse yet, nearly half of these organizations say they check SaaS configurations once per month or less.

Infrequent SaaS security configuration checks are leading to problems in many organizations.

Tenable.io, HackerOne, and Crowdstrike are a few of the most purchased tools for securing SaaS applications.

But single sign-on providers like 1Password and compliance tools like Drata are also popular options.

Search interest in “Drata” has jumped 800% in the past few years.

8. Vertical SaaS Hones in on Specific Industries

Vertical SaaS is software created for a very specific niche.

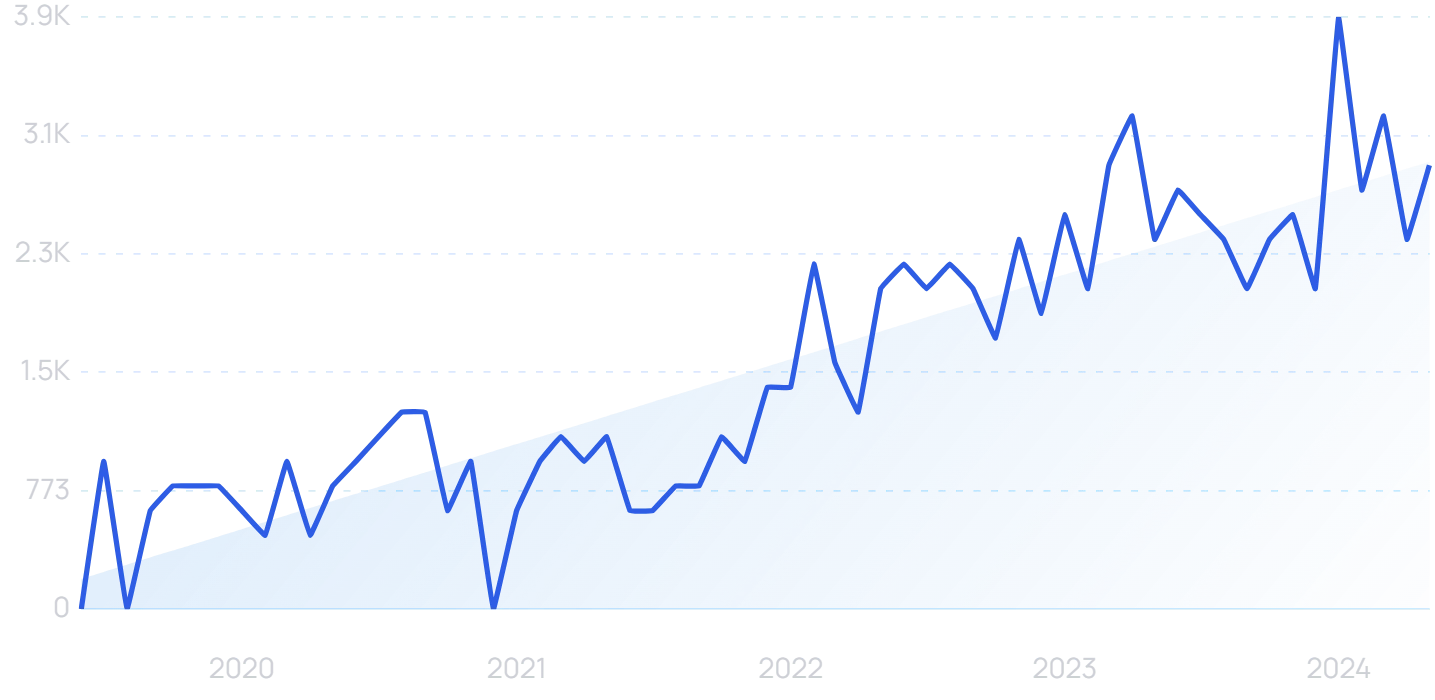

Searches for “vertical SaaS” have grown significantly since 2019.

Unlike horizontal SaaS, which attempts to cast a large net that covers several different industry needs, vertical SaaS is built and tailored by experts who have a deep understanding of a specific industry.

Vertical SaaS satisfies an organization’s very specific use cases and solves niche issues right out of the box.

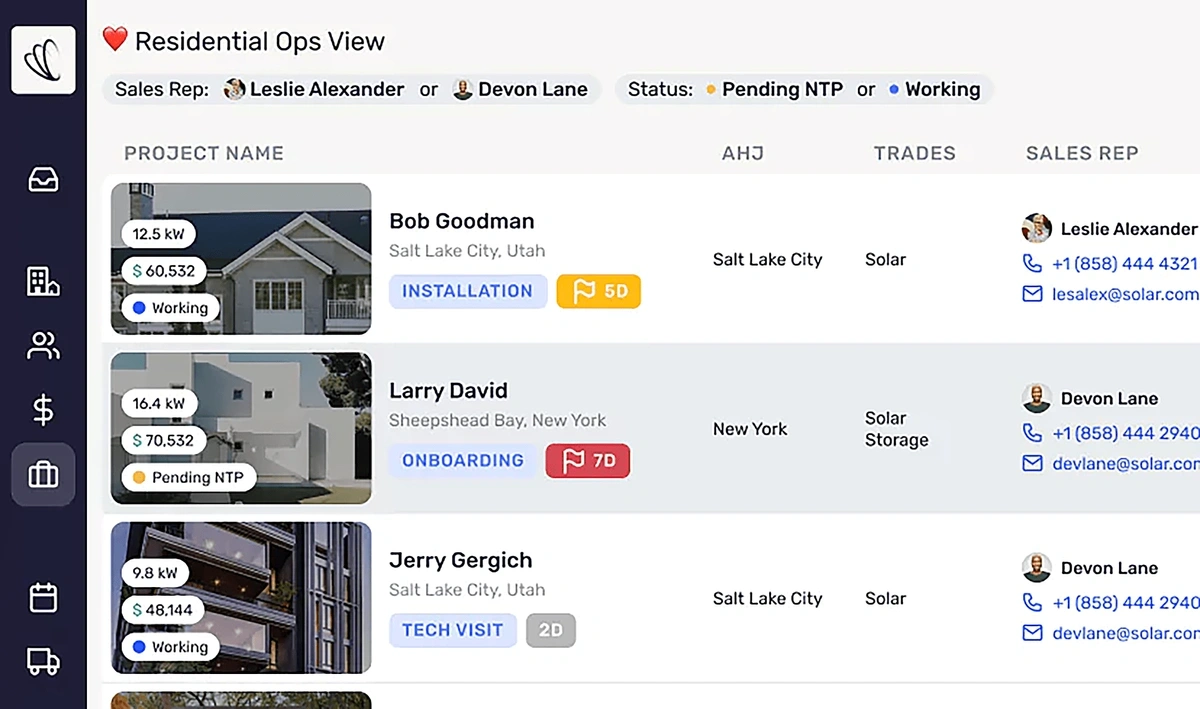

For example, Coperniq is a startup SaaS company that’s developing software especially for the project management needs of solar installers.

The solar economy is booming right now and the revenue of Coperniq is too—ARR is up 5x in 2023.

Coperniq’s platform is designed to meet the specific needs of solar companies.

According to company data, Coperniq’s system saves 17 hours per week per office worker and 12 hours per week per field worker.

Another example comes from the human resources space.

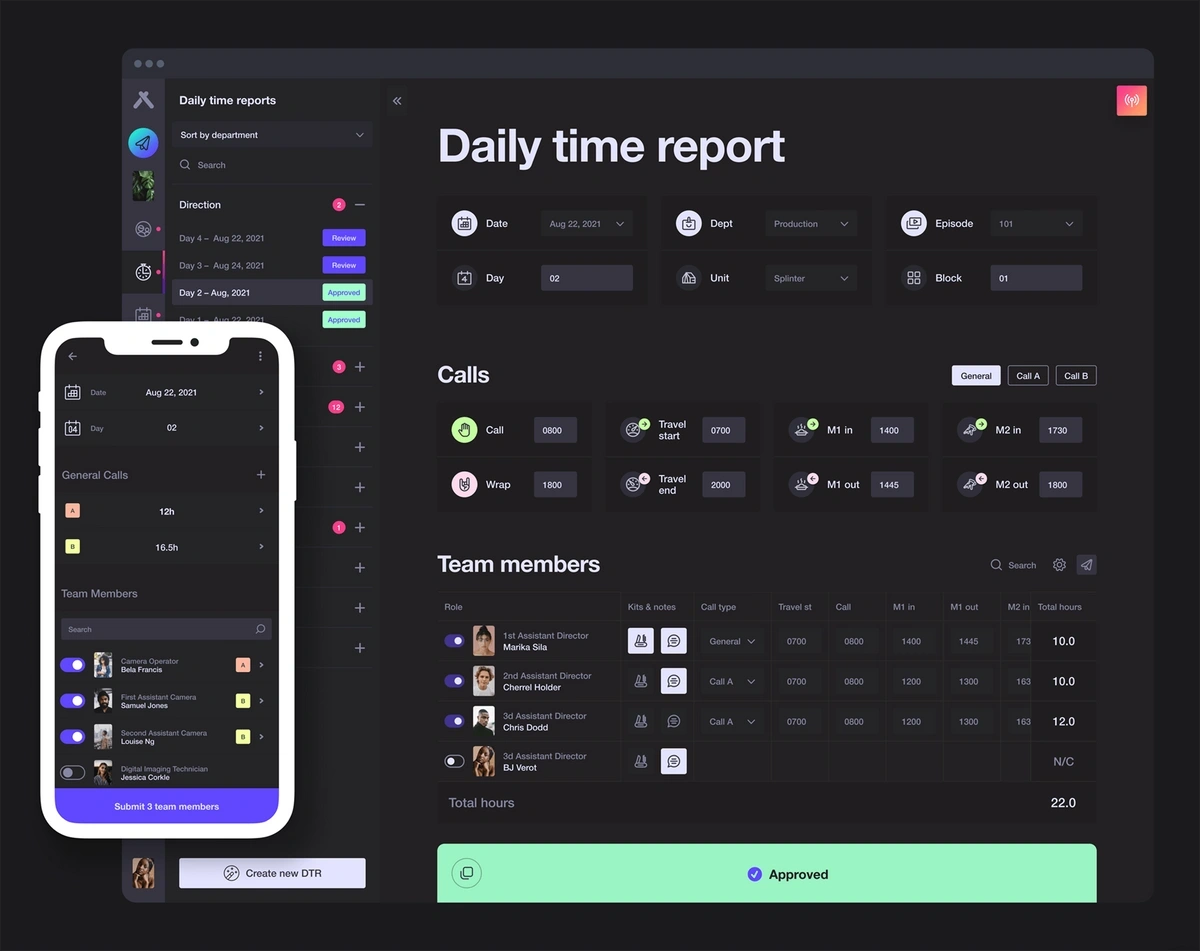

Circus is an HR platform designed especially for movie and television studios.

Their tools digitize the entire process of onboarding, time tracking, contracts, and payroll.

Circus’ platform is accessible from nearly any device.

For software in any vertical, SaaS SEO is critical in order to rank for relevant keywords.

9. Growth of Note-Taking Apps

When it launched in 2008, the Evernote mobile app offered something novel: the ability to quickly take notes on your phone and see them on your desktop later.

It was paired with freemium pricing, which was also uncommon at the time.

This made Evernote the default note-taking tool hundreds of millions of users.

But today, the market for note-taking SaaS has splintered.

There are popular free options like Google Keep, Apple Notes, and Microsoft OneNote.

As well as more advanced tools like Notion, Obsidian, and Bear.

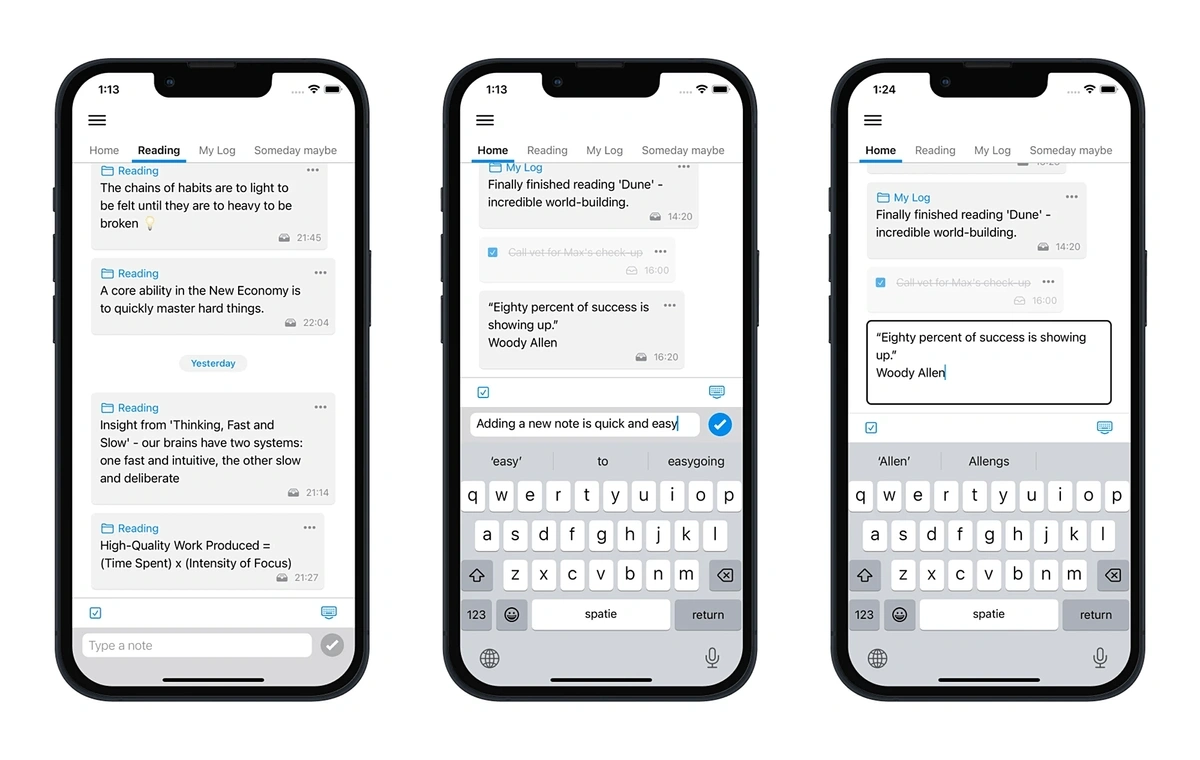

Some of the newer tools have gone with a minimalist approach, like Qept.

The app, which went live in August 2023, combines the basic functionality of a texting app with the power of a note-taking app.

With Qept, all notes stay in view instead of hidden behind cumbersome navigation and folders.

On the other end of the spectrum, some note-taking apps are incorporating AI-rich features to turn the platform into an all-in-one organizational system.

Take Mem, for example.

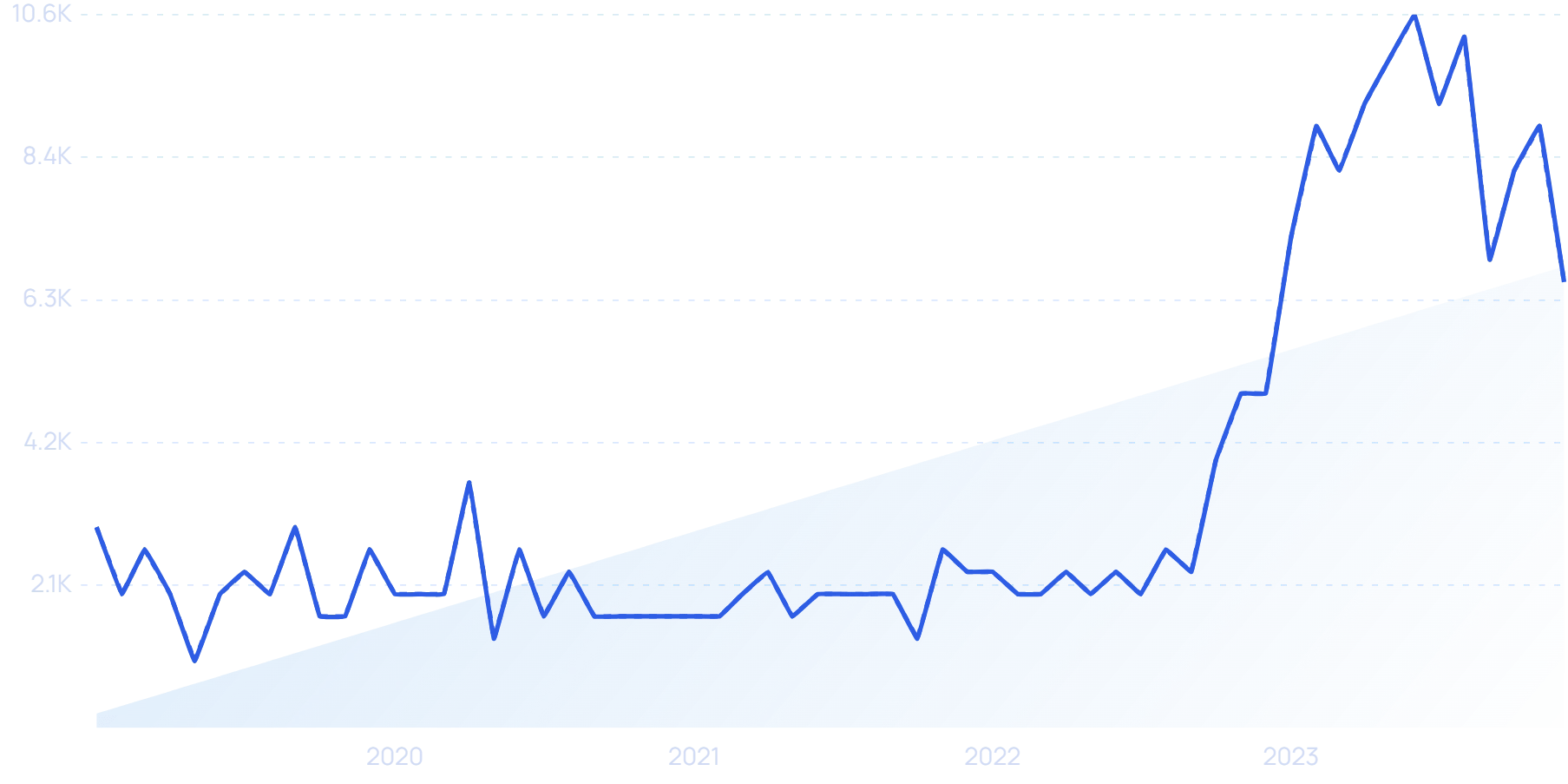

Search interest in “Mem AI” since late 2019.

Users can add notes, save websites, and import information from other sources.

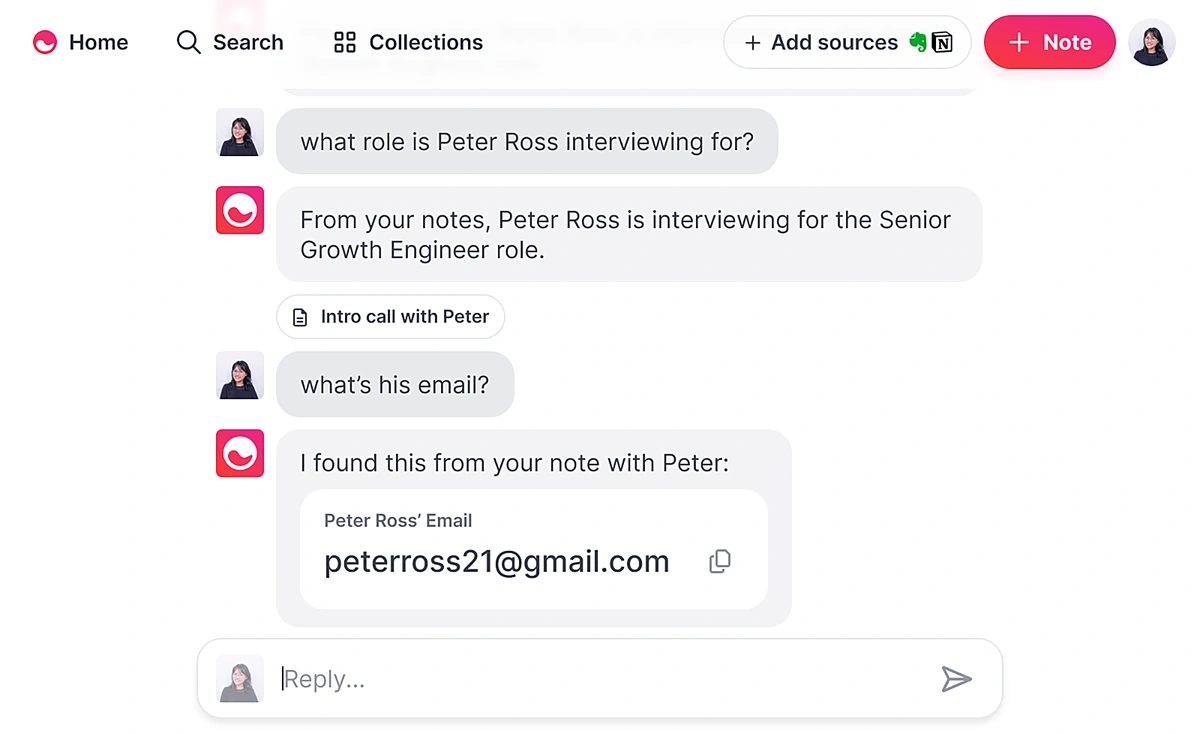

When users need to recall information or connect the dots between their information, they can use Mem’s chat interface to ask a question. The platform’s AI will scan all of the users’ uploads in order to find the answer.

Mem users can access information through an AI-powered chat interface.

10. The Market for ESG Reporting Software Expands Rapidly

ESG data and reports are no longer simply nice to have—they’re a necessity.

Many organizations are now required by law to publish ESG metrics.

But even if this type of reporting isn’t required, a large percentage of consumers and investors want to be able to reference the data in order to evaluate the company.

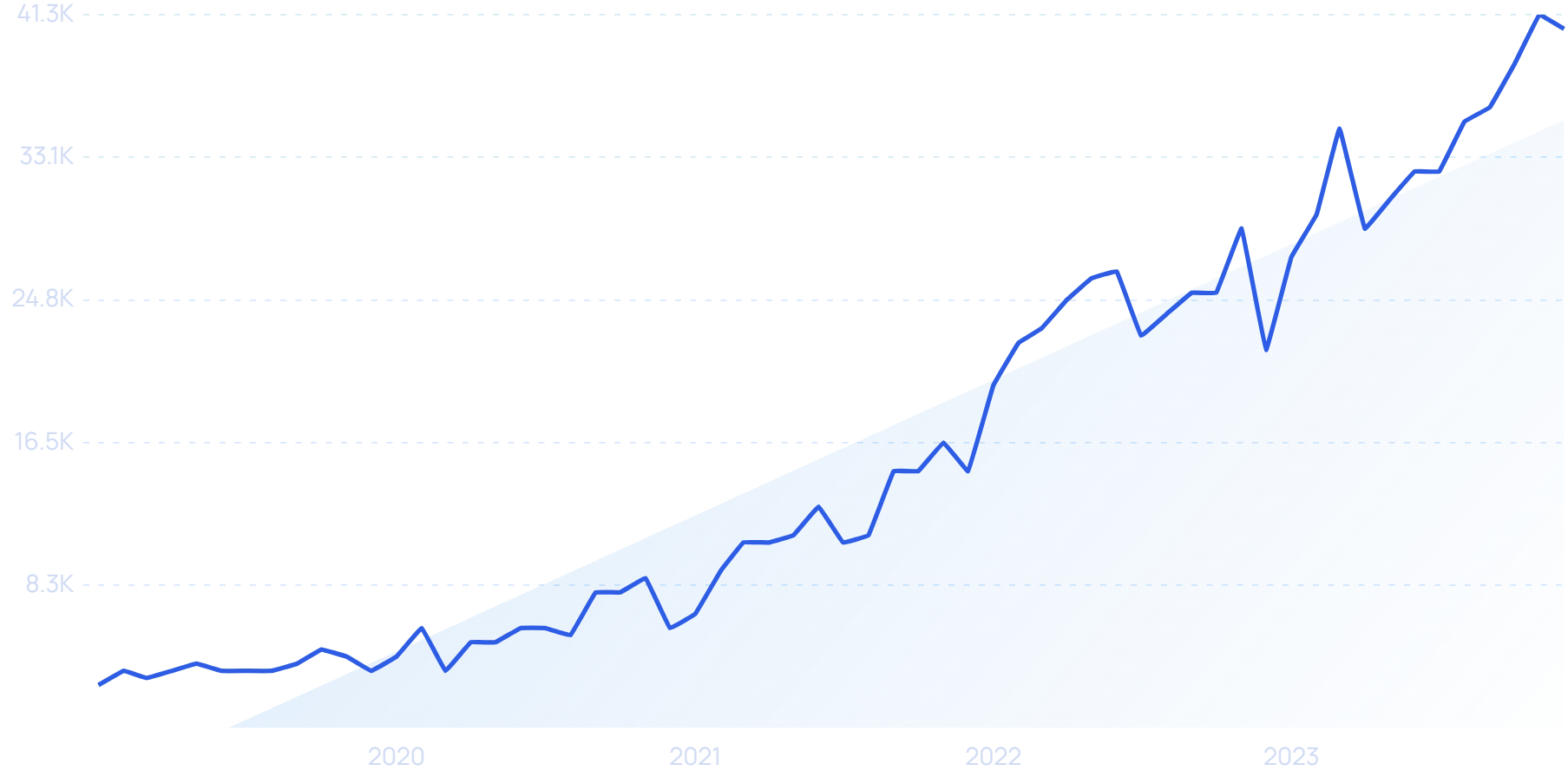

Search interest for “ESG reporting” has increased more than 2,000% since 2019.

But it’s also a time-consuming task that requires diligent data management and transparency.

Some enterprises are already using ESG reporting software to make the process smoother.

PwC estimates the penetration rate in Europe is about 14% and about 40% in Canada, the UK, and the US.

Their report says an “ESG software bonanza” is just beginning and predicts the market will grow fast.

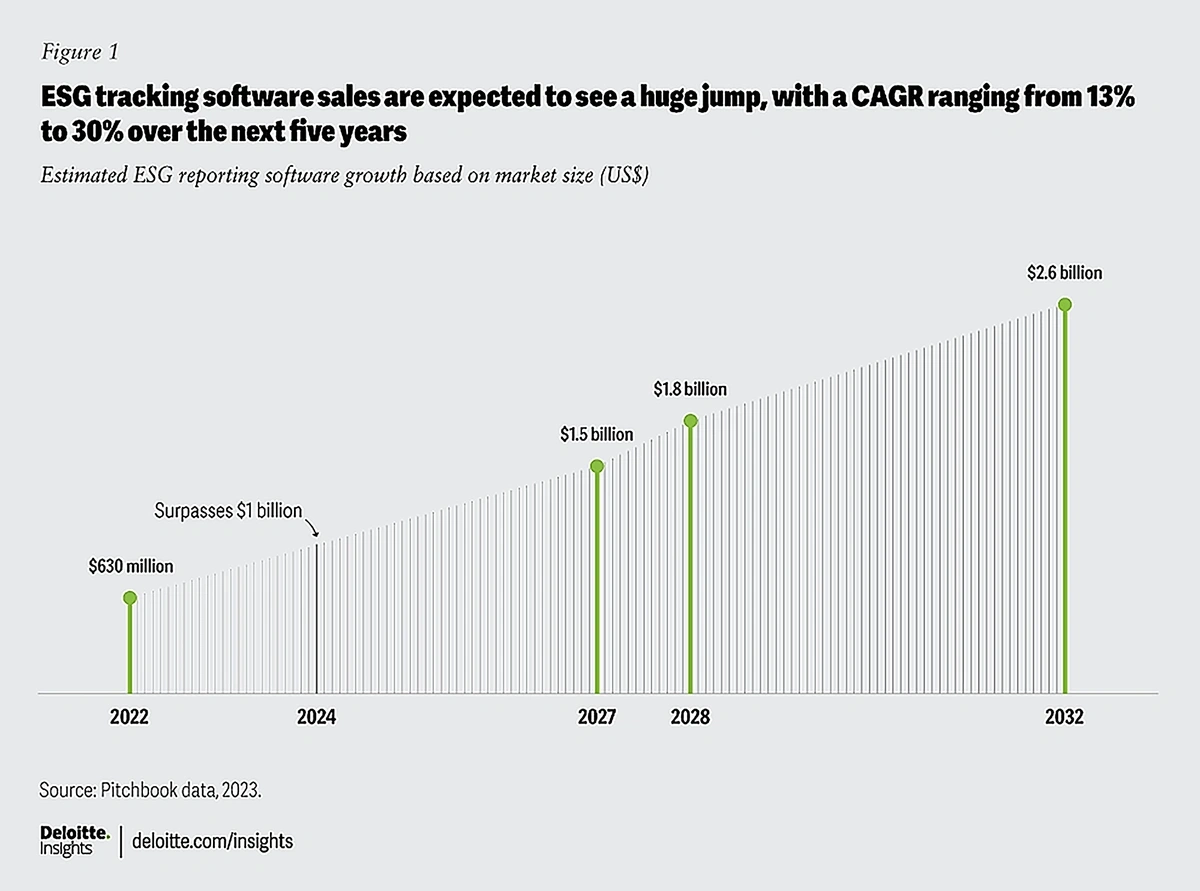

Deloitte echoes that prediction.

Their data estimates growth in the ESG software market will reach 30% in 2024 and predicts revenue will top $1 billion that year.

Deloitte estimates the ESG software market will reach $2.6 billion by 2032.

One SaaS company that’s already offering dedicated software for ESG reporting is Workiva.

With the software, companies can utilize more than 60 pre-built connectors in order to automatically load the data where it needs to be. Popular environmental reporting frameworks like SASB, GRI, and CDP are pre-loaded, too.

Workiva’s platform brings together data to unite ESG with financial reporting and risk management.

There’s also been several notable mergers and acquisitions in this space in recent months.

IBM acquired Envizi, an ESG-minded software provider, and Nasdaq acquired Metrio, a carbon accounting software provider.

And, startups are seeing success too.

Novisto, a startup that’s aiming to develop ESG tech stacks, raised $20 million in May 2023.

“Novisto” search volume is up more than 1,000% since 2019.

Industry experts say the possibility of broad government regulations could further increase demand for ESG reporting software.

11. SaaS Companies Fight Churn

Many SaaS companies are in a tight spot right now as buyers look to reduce costs and increase the efficiency of their software platforms.

The data is clear: SaaS churn rates are growing.

For 56% of SaaS companies with ARR between $3 million and $8 million, retention was lower in 2022 than the year before.

In the third quarter of 2023, the average annualized contract value (ACV) for SaaS companies was down 17% year-over-year.

And, customer acquisition costs are up.

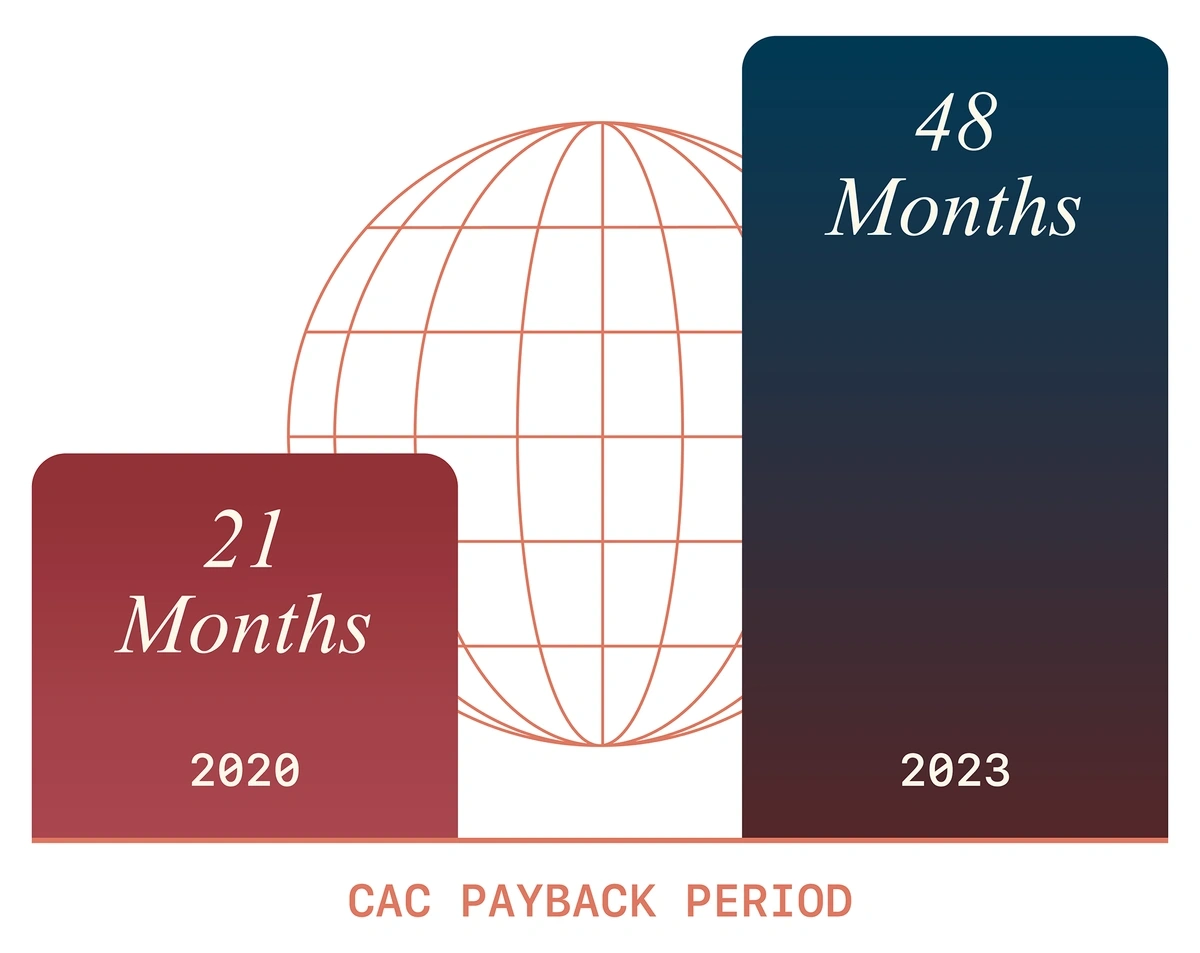

In 2021, SaaS companies needed just 21 months to recoup their costs. That number is up to 48 months.

SaaS businesses are facing serious challenges when it comes to customer acquisition costs (CAC).

So what are SaaS firms doing to ease customer churn rates?

There’s no shortage of strategies:

- User onboarding email sequences

- “Concierge” support

- Explainer videos and tutorials

- Annual billing

- New feature notifications

- Improving the overall customer experience

But for many SaaS businesses, these tactics aren’t enough.

This is why there’s a growing number of solutions out there specifically designed to combat churn.

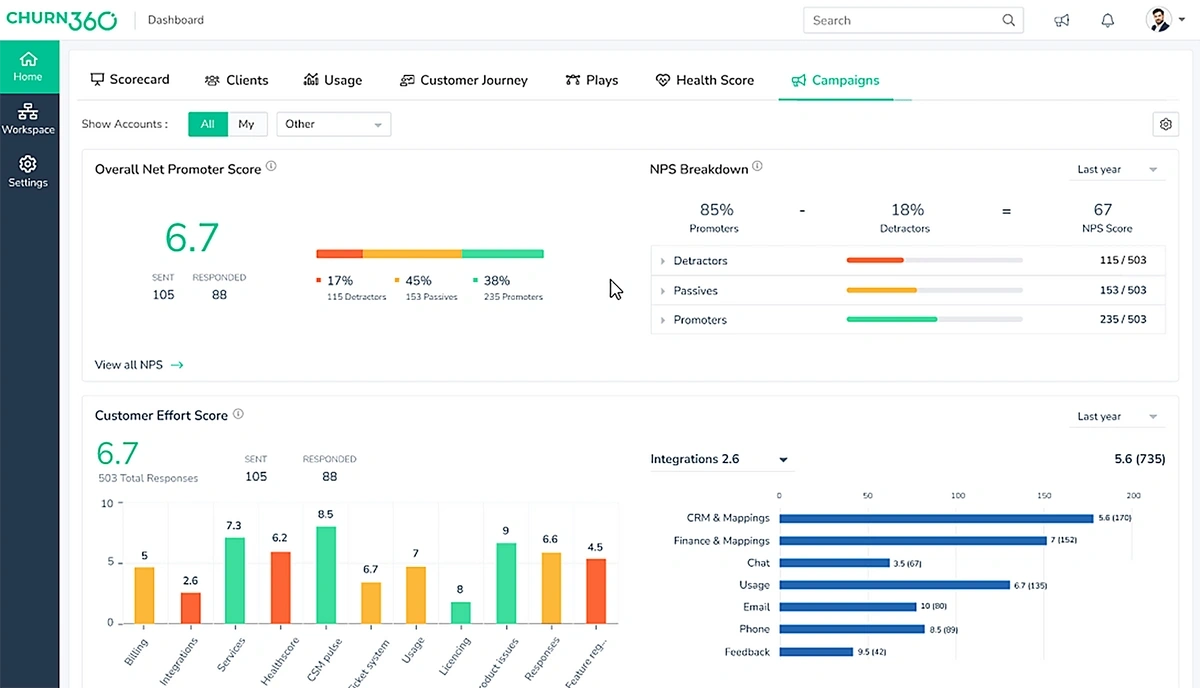

Churn360 is an AI-driven platform designed to help SaaS companies increase customer retention.

Churn360 integrates with other software and analyzes all the data in order to provide a complete picture of each customer.

The platform allows companies to track customers’ software usage and provides a “health score” to point to customers who may be at risk of dropping out.

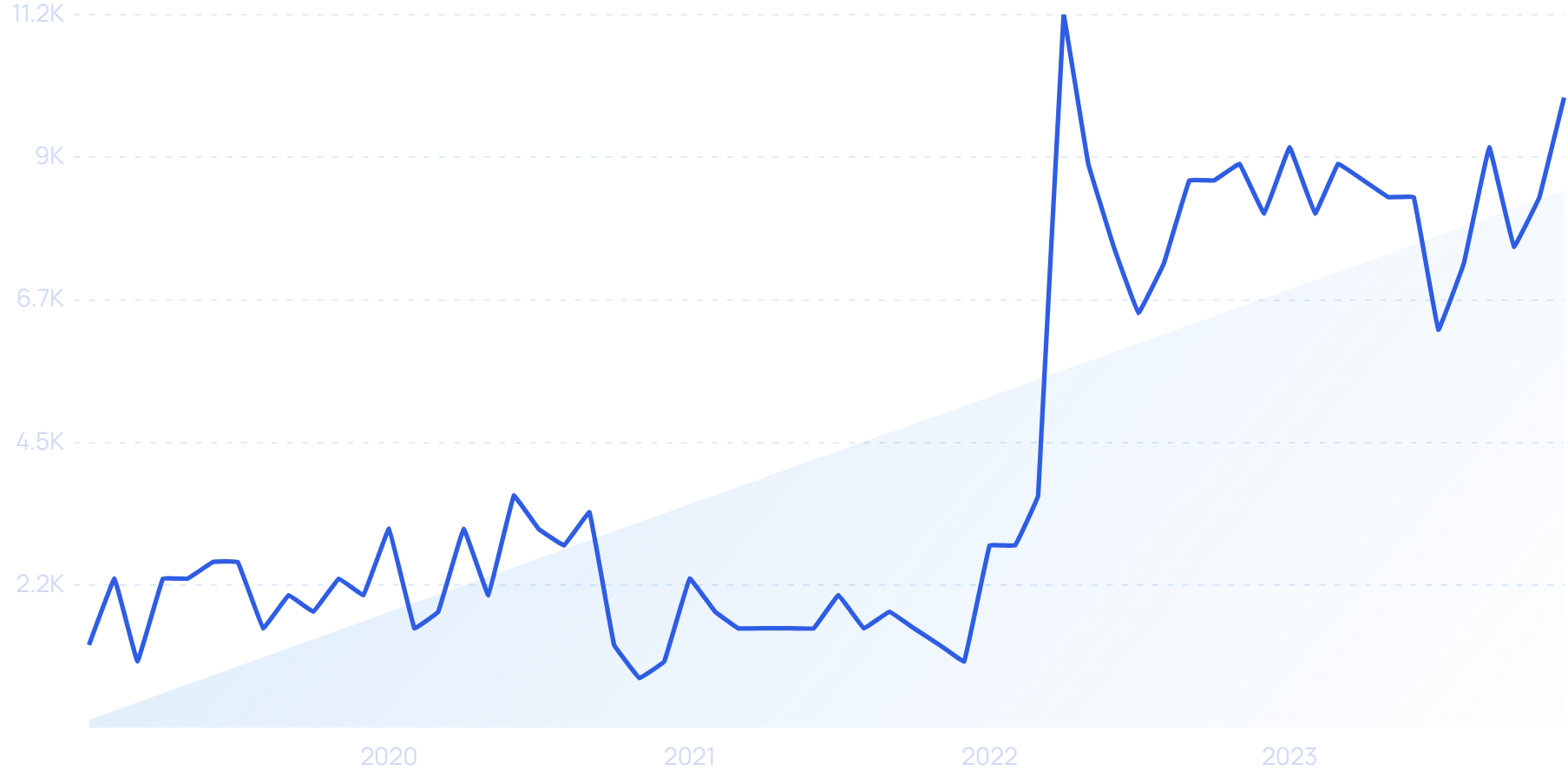

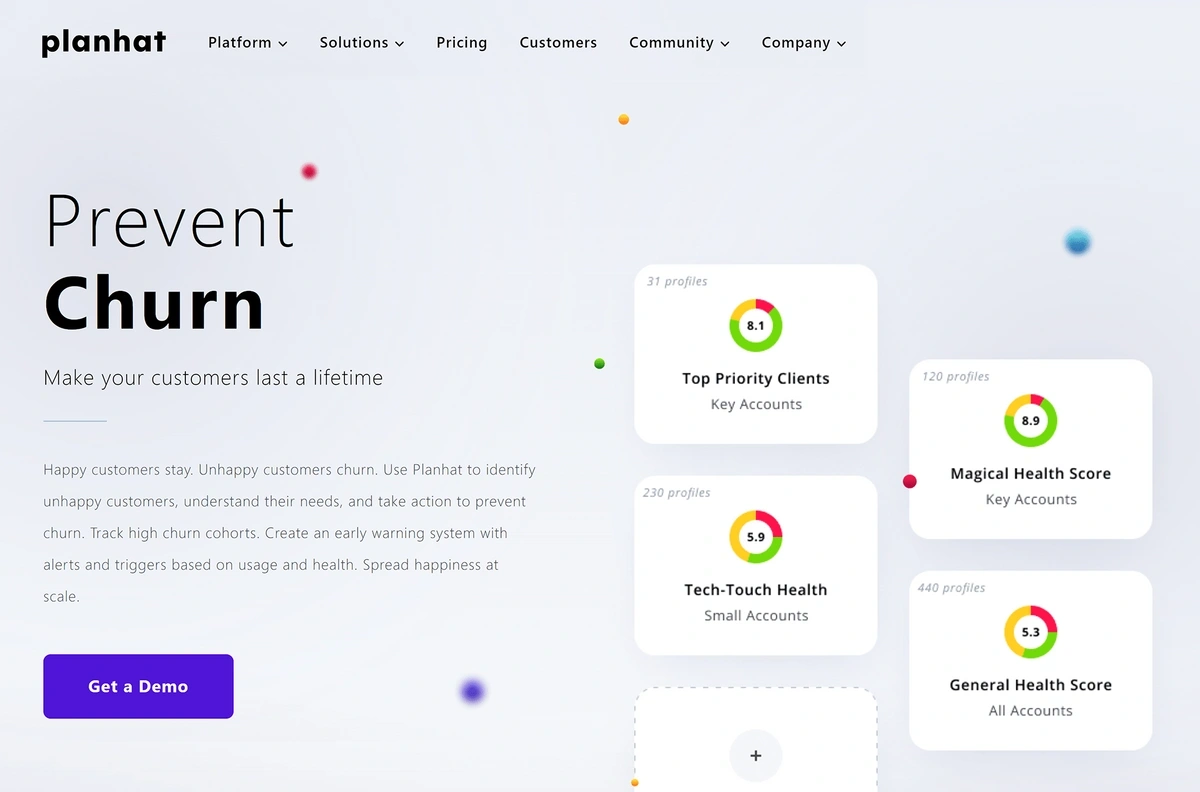

Planhat is another customer retention platform that’s growing in popularity.

Search volume for “Planhat” dramatically increased in 2022.

This platform also utilizes “health scores” to keep track of customer engagement in real-time. Users can also set up alerts to automatically trigger certain actions when health scores dip below an acceptable level.

Planhat also offers inbox capabilities so that users can easily access customer requests or cancellations.

Planhat’s platform provides insight into the entire customer journey.

Company officials say Planhat’s revenue is growing by 100% to 200% year-over-year.

Conclusion

That’s our list of the 11 biggest trends in the SaaS industry right now.

AI, LCNC, and vertical SaaS are all providing new ways for organizations to access the best software and tools. Rapid adoption is predicted but, as always, these functionalities come with new challenges.

Pricing and security are just two of the top challenges in today’s software world.

SaaS firms that are able to find the right balance between new technology, must-have features, and optimal revenue models are best suited for success in the coming years.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Alison is an accomplished copywriter with proven success in editing, marketing, research, and management. Before writing for E... Read more