Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

30+ Cord Cutting Statistics (2024-2027)

We are witnessing a cord-cutting revolution.

Thanks to the rising cost of cable TV subscriptions and the absolutely massive content libraries of streaming services, people are leaving behind traditional pay TV in droves.

Whether they’re looking to escape advertisements, save money, or both, millions of cord-cutters are ditching cable and satellite TV every year. There’s even an emerging demographic of “cord-nevers”, adults who have only ever used streaming services for entertainment.

Despite that, cable TV is still holding on with millions of loyal and returning customers.

To fully understand the cord-cutting revolution, you have to dig into the data. Let’s get started.

Contents

- Top Cord Cutting Stats

- General Cord Cutting Statistics

- Cord Cutting Consumer Statistics

- Video Streaming Statistics

Top Cord Cutting Stats

Looking for a quick overview of the current state of cord-cutting? Here are some notable stats to get you started:

- There will be 80 million cord-cutting US households by 2026.

- Cable and satellite TV providers have lost over 20 million US subscribers since 2014.

- There will be 1.68 billion global SVOD subscriptions by 2027.

- Adults ages 18 to 29 are the most prolific cord-cutters.

- 30% of Americans who currently have cable TV subscriptions say they are likely to cancel.

- 52% of cord-cutters say they don’t miss anything about cable TV.

General Cord Cutting Statistics

How many subscribers are cable companies losing each year? What will cord-cutting look like in the near future? Here are the big-picture cord-cutting statistics you need to know.

By 2026, it is estimated that there will be 80 million cord-cutting US households (eMarketer)

Cord-cutting households outnumbered pay TV households for the first time in 2023. By 2026, there will be 80.7 million cord-cutting households in the US compared to just 54.3 million pay-TV households.

Pay TV providers have lost over 20 million US subscribers since 2014 (Statista)

US cable and satellite TV providers have been losing net subscribers at an accelerating rate since 2014. The COVID-19 pandemic appears to have had a massive influence, as over 5 million subscribers cut the cord in 2020.

There are 354 million streaming subscriptions in the US alone (Digital TV Research)

The number of streaming households in America is massive, and it’s only getting bigger. By 2027, 86% of households with a TV will have a streaming subscription, with 458 million total subscriptions and an average of 4.37 per household.

The average household cable package costs $217.42 per month (Allconnect)

The high cost of cable is a key driver behind the cord-cutting revolution. On average, households pay more for cable ($217.42/mo) than they do all other utilities ($205.50/mo) combined.

Since 2025, the share of American adults who subscribe to cable or satellite TV has dropped by 26% (Pew Research)

In 2015, 76% of American adults paid for cable or satellite TV packages. As of 2021, that number is down to just 56%.

Comcast has lost over 8 million cable TV subscribers since 2014 (Statista)

Cord cutting has taken its toll on the largest cable TV provider in the United States. Comcast had 22.6 million video subscribers in 2014. Today, that number has reduced to 14.5 million.

DirecTV has lost 8.42 million subscribers over the same period.

89% of marketers believe advertising on streaming platforms is equally or more effective than traditional TV advertising (The Trade Desk)

Marketers are shifting from traditional and cable TV to over-the-top (OTT) platforms like Netflix and Hulu. In fact, 43% of marketers now view streaming as the top channel for brand storytelling, more than social media (29%) and traditional TV (26%).

Over one-third of Americans have both cable and streaming subscriptions (YouGov)

32% of Americans say they have cable subscriptions in addition to streaming channels like Netflix and Hulu. An additional 3% say they used to only have streaming services but have since added a cable subscription. 11% of Americans say they have only ever used streaming services.

Almost half of cable TV subscribers are former cord-cutters (nScreen Media)

A recent survey of 500 cable TV subscribers found that nearly half had returned to the service after previously cutting the cord. The top reason for coming back to cable TV was live sports (18.4%), followed by live entertainment events (10.0%), and cable being part of a bundle (9.7%).

Cord Cutting Consumer Statistics

Consumers choose to cancel or keep cable for a multitude of reasons. Here are the latest cord-cutting consumer statistics.

Adults ages 18 to 29 are the most prolific cord-cutters (Pew Research)

The share of 18-29-year-olds with a cable TV subscription went from 65% in 2015 to 34% in 2021. That’s the biggest change across age demographics.

For the 30-49 demographic, the share of cable TV subscribers went from 73% to 46% in the same timeframe.

Baby Boomers are the most loyal cable TV subscribers: 86% of US adults age 65+ had a subscription in 2015 and 81% remain subscribers today.

Around 3 in 5 of Americans watch Netflix at least once per week (YouGov)

Netflix remains the most popular streaming platform among American audiences. Other top platforms for weekly viewing are YouTube (44%), Hulu (42%), Amazon Prime Video (39%), and Disney+ (27%).

Easy access to content is the top reason for people to ditch cable and satellite TV (Pew Research)

71% of cord-cutting US adults say “having online access to the content they want” was the main reason behind canceling their cable subscriptions. 69% also said that cable and satellite TV were too expensive. 45% said they don’t watch TV often enough to justify paying for a subscription.

30% of Americans who currently have cable TV subscriptions say they are likely to cancel (YouGov)

Of the 45% of Americans who had a cable subscription in February 2022, 21% said they were likely to cancel in the future while 9% said they were very likely to cancel. 25% were neutral, 11% were unlikely, and 34% were very unlikely.

More than half of cord-cutters say they don’t miss anything about cable TV (eMarketer)

Most cord-cutters don’t miss having cable TV. Just under half do have things they miss about cable and satellite TV, however. The top things people miss about cable are live events on TV (23%), national or local news (22%), and live sports (19%).

25% of Americans “churn and return” to video streaming services (Deloitte)

A 2022 survey by Deloitte found that a quarter of Americans have canceled and returned to a streaming service in the past 12 months. That number is even higher for younger generations. 35% of Gen Zs and 38% of Millennials have canceled and re-subscribed to a streaming platform in the past year.

89% of recent cord-cutters say they would have canceled cable even if the COVID-19 pandemic didn’t happen (Media Play News)

What role did the pandemic play in cord-cutting? In July 2020, 31% of cord-cutters said they wouldn’t have canceled their pay TV subscriptions if the pandemic didn’t happen. But in February 2021, only 11% of cord-cutters said the same.

Video Streaming Statistics

Cord cutting wouldn’t be a thing without SVOD services like Netflix, Hulu, and Amazon Prime Video. Streaming lets viewers consume entertainment on their own terms: on-demand and without commercial interruptions.

It is estimated that there will be 1.68 billion global SVOD subscriptions by 2027 (Digital TV Research)

According to projections by Digital TV Research, streaming video-on-demand (SVOD) subscriptions will increase by 475 million between 2021 and 2027. The top services by the number of subscriptions in 2027 will be Netflix (251 million), Amazon (250 million), Disney+ (207 million), Paramount+ (82 million), and HBO Max (77 million).

There are over 11,000 seasons of TV available for streaming between Hulu, Netflix, and Amazon Prime Video (Ampere Analysis)

With just 3 subscriptions — and less than $40 per month, cord-cutters can access over 11,000 seasons of commercial-free television shows. The 3 services also stream a combined 13,000+ movies.

Netflix earns close to $30 billion in annual revenue (Netflix)

10 years ago, Netflix was earning just over $3 billion in annual revenue. Today, that number has ballooned to $29.7 billion with a net income of $5.16 billion. The company also has over 11,000 employees spread across 60 countries.

Around 2 in 5 Americans agree that Netflix offers the best original streaming content (eMarketer)

In 2019, 45% of Americans thought Netflix had the best original library. That number has shrunk since then, but Netflix is still miles ahead of the competition. The next best platform for original content is Amazon Prime Video, with 11% of viewers believing its content is the best. Hulu comes in 3rd place with 9%, followed by HBO Max with 8%.

Apple TV + has 25 million paid subscribers (Statista)

With originals like Ted Lasso and the Oscar-winning film Coda, Apple TV + is attracting new subscribers by the millions. The platform currently has 25 million paid subscribers and an additional 50 million users with free promotional access.

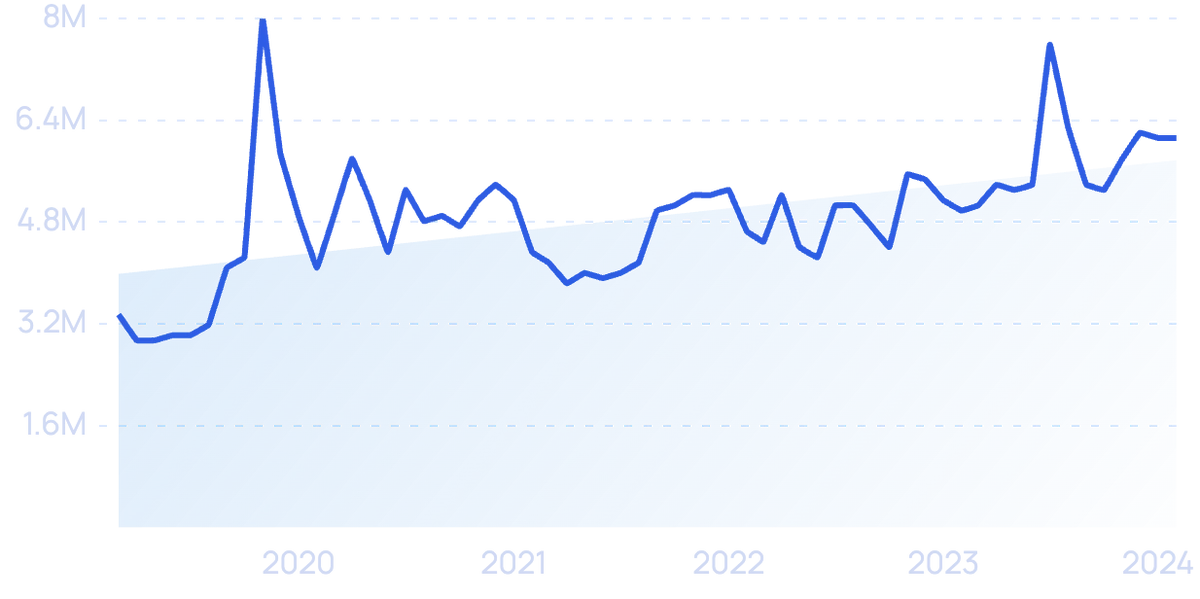

Google searches for “Apple TV” over the past 5 years.

Ad-supported streaming services are growing faster than subscription-based streaming services (Comscore)

Households streaming ad-supported video increased by 29% between 2020 and 2022, outpacing subscription streaming services, which grew by only 22% in the same period. Platforms like Sling and Tubi give viewers access to content with no need for monthly subscriptions. Instead, the content is funded by ads, much like broadcast television.

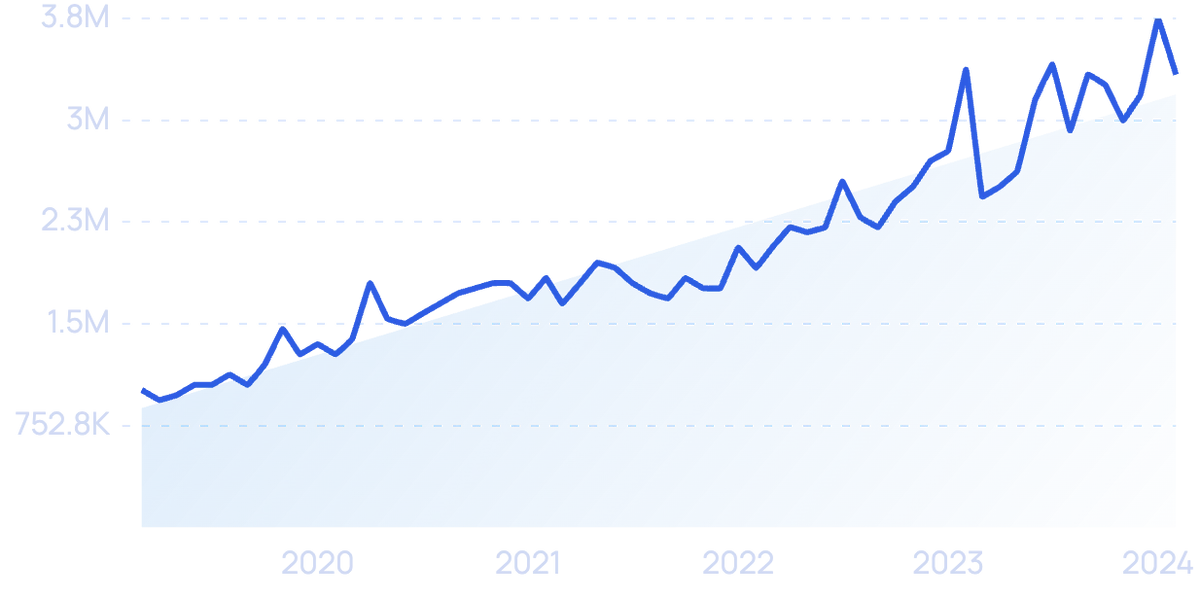

Google searches for “tubi” over the past 5 years.

Wrap Up

Millions of consumers are cutting the cord on cable each year. Streaming services offer a virtually unlimited amount of content at a fraction of the price of cable TV subscriptions. For many people, making the switch is an easy decision.

That doesn’t mean cable and satellite TV is dead. Live sports and entertainment events help pay-TV companies to hold onto their subscriber base. And notably, millions of consumers have shown they’re willing to pay for cable and streaming services.

It all amounts to an entertainment world with more choices than ever.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more