Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

10 Growing Crowdfunding Companies & Startups (2024)

You may also like:

The COVID-19 pandemic led to significant growth in smartphone-based investing apps like Robinhood and niche financial communities on sites like Reddit. Importantly, this also led to a newfound interest in pooling resources for investment purposes: also known as crowdfunding.

Crowdfunding, which is simply sourcing small amounts of money from a large number of people, is a relatively new industry. It's expected to grow to around $17.9B in 2024. However, that’s projected to nearly double by 2028 reaching $32.9B.

Crowdfunding is attractive for a few different reasons. Investors can access assets that are usually reserved for accredited investors, like commercial real estate. And niche investments, like art, sports collectibles, and movie memorabilia are usually too expensive for the average investor to afford. But are now accessible thanks to crowdfunding.

Scroll below for our list of exciting crowdfunding startups that are changing the game for fundraising worldwide and providing access to exotic investments to millions of new investors.

1. Republic

5-year search growth: 132%

Search growth status: Regular

Year founded: 2016

Location: New York City, New York

Funding: $214M (Series Unknown)

What they do: Republic’s team has identified several investment areas where Millennials seem to be most interested: crypto, real estate, video games, and startups. With innovative opportunities like “city funds” that focus on real estate in Miami, Austin, and similar dynamic cities, investors get access to exotic assets that are more interesting than your typical index fund.

Republic has already facilitated over $2.6B in investments from 3+ million people globally, and their team has expanded to six countries. Backed by brand names like Motley Fool, Galaxy Digital, and Binance, the future looks bright for the NYC-based Republic.

2. Spotfund

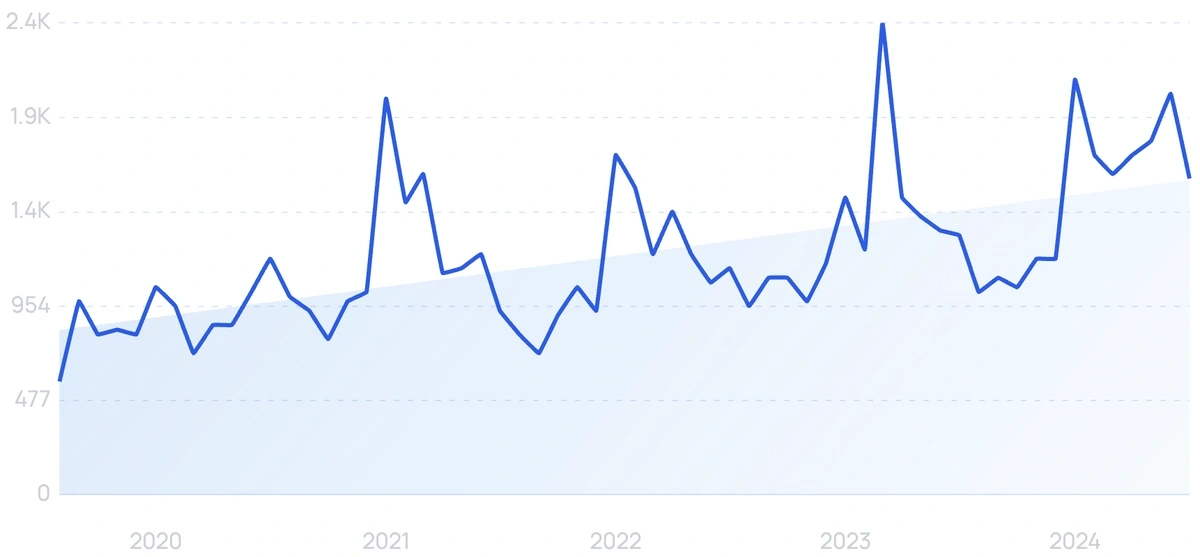

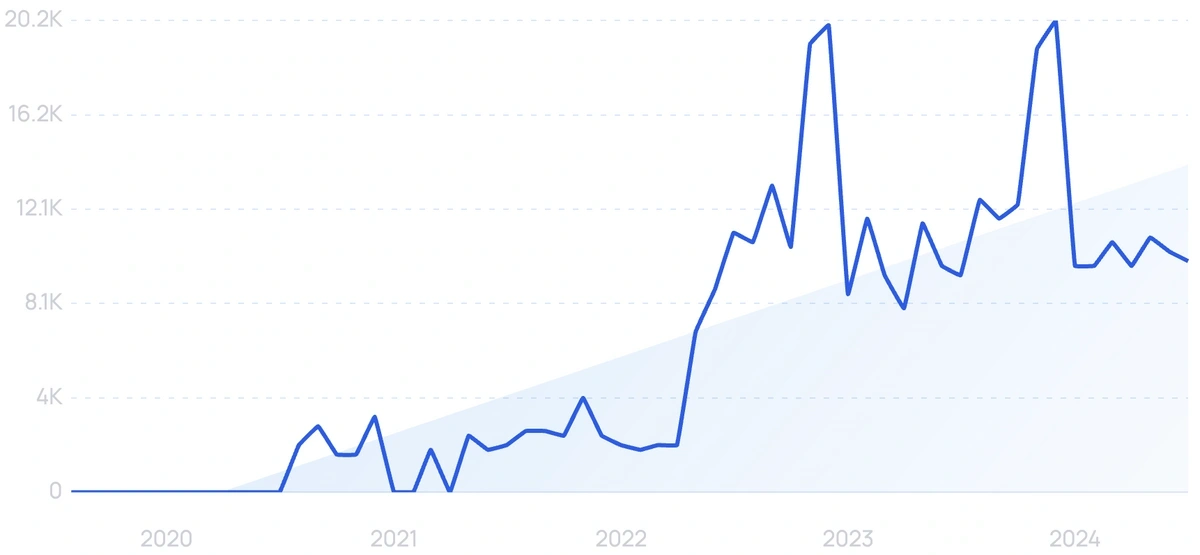

5-year search growth: 2,400%

Search growth status: Peaked

Year founded: 2015

Location: New York, New York

Funding: $1.5M (Seed)

What they do: Spotfund’s platform helps folks fundraise for charities and causes without charging any platform feeds to the fundraiser. Trusted by brands like Marvel, Tao Group, Creative Artist Agency and more, their streamlined process also allows users to share their campaigns in social media-friendly formats while having access to Spotfund’s customer care team.

3. Patreon

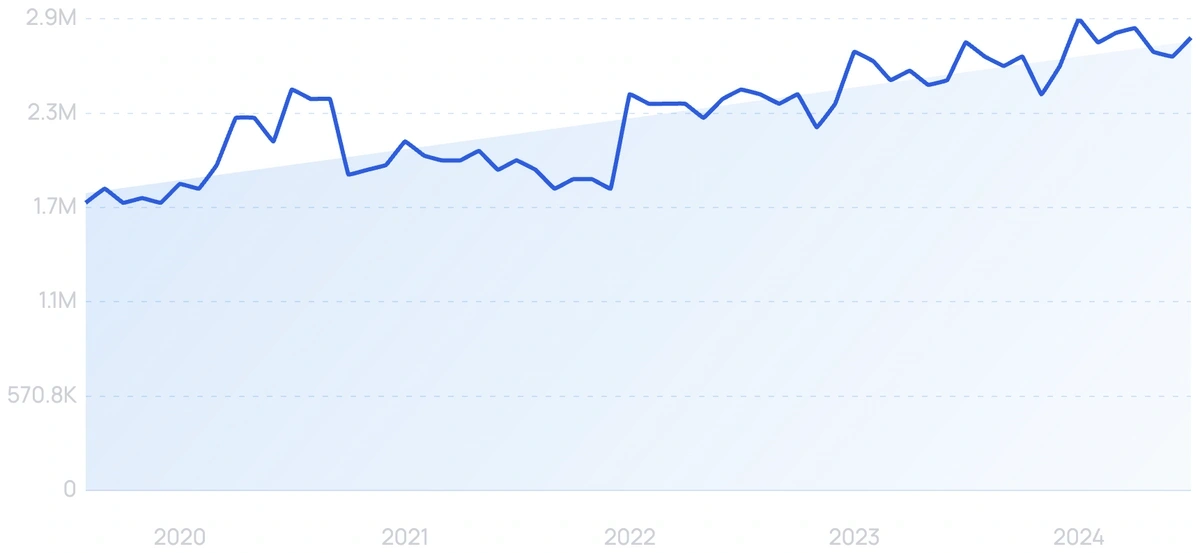

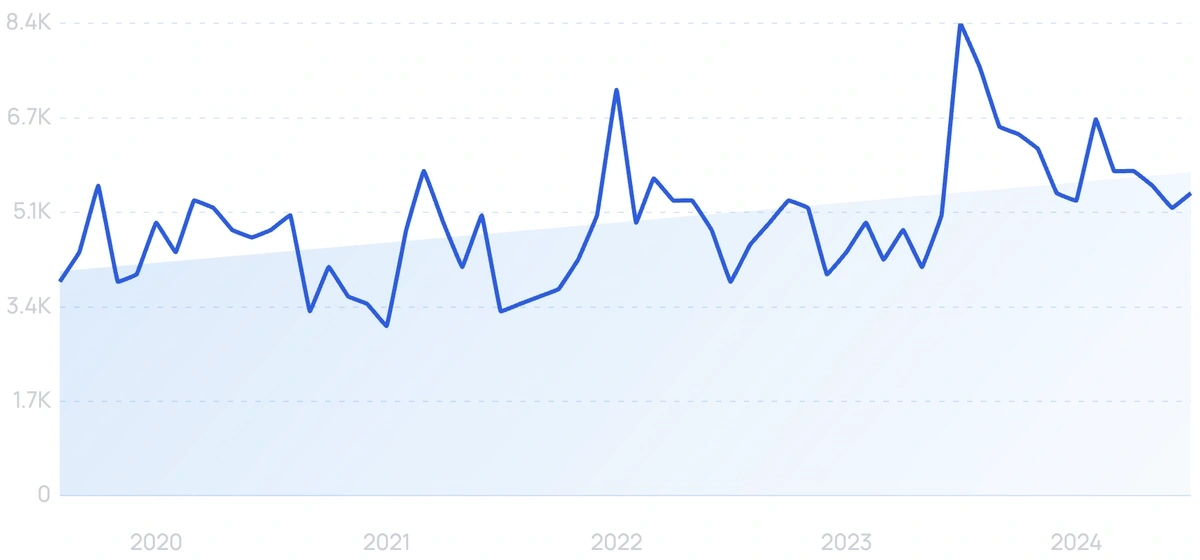

Search growth status: Exploding

Year founded: 2013

Location: San Francisco, California

Funding: $413.3M (Secondary Market)

What they do: Patreon’s crowdfunding platform has taken off since its inception in 2013, with over 8 million monthly active members. Creators can set up a profile on Patreon displaying their craft, their music, or whatever other creative projects they’re working on. “Patrons” or supporters, can then set up monthly or one-time donations to support their favorite artists.

As of May 2024, the Patreon platform supports 250,000+ creators and has paid $3.5 billion in creator earnings.

4. YieldStreet

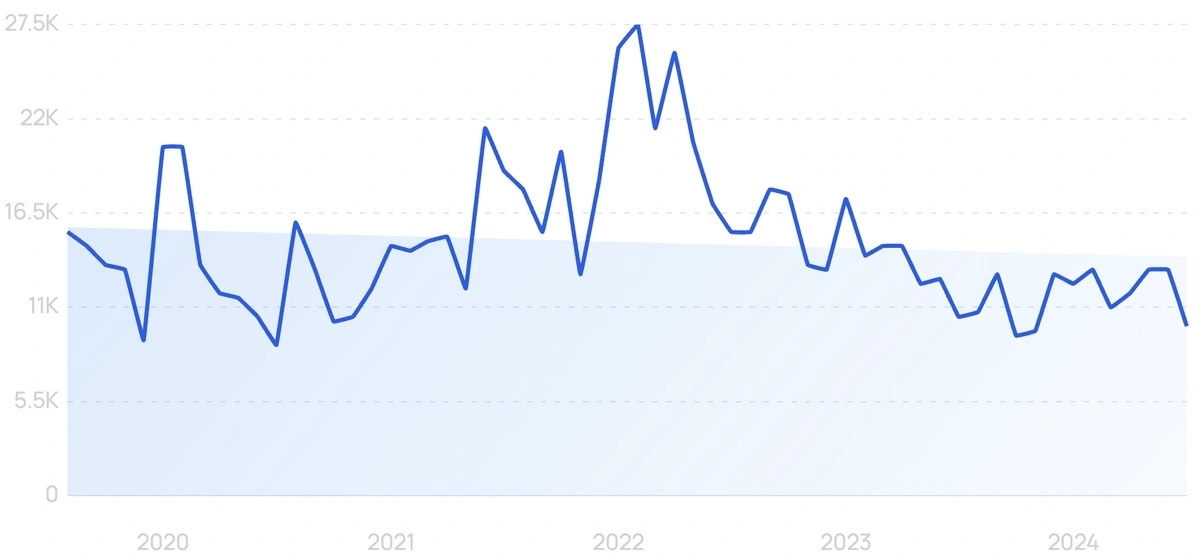

5-year search growth: -32%

Search growth status: Peaked

Year founded: 2015

Location: New York City, New York

Funding: $794.7M (Debt Financing)

What they do: Since its inception, over $4.3B has been raised on YieldStreet’s alternative investment crowdfunding platform. Boasting a membership base of over 460,000, YieldStreet’s early 2015 start helped it get ahead of the curve in terms of its crowdfunding competitors.

5. Givebutter

5-year search growth: 7,900%

Search growth status: Regular

Year founded: 2016

Location: Washington, D.C.

Funding: $57M (Series A)

What they do: Givebutter is a free-to-use nonprofit fundraising platform. With over 160 features, users can create customizable donation forms and fundraising pages, set up recurring donations, manage events, and access 1,000+ third-party app integrations.

Givebutter estimates they've raised over $500 million from 1.3 million donors since inception. In April 2024, the startup secured a $50 million investment from BVP Forge to continue developing the platform.

6. Finbee

5-year search growth: 70%

Search growth status: Exploding

Year founded: 2015

Location: Vilnius, Lithuania

Funding: $37.9M (Private Equity)

What they do: Finbee is a peer-to-peer lending platform that connects investors with borrowers who need funds. While the platform's primary focus is on P2P lending and consumer loans, the company has facilitated over 4,500 crowdfunding loans to 3,000 businesses.

7. BackerKit

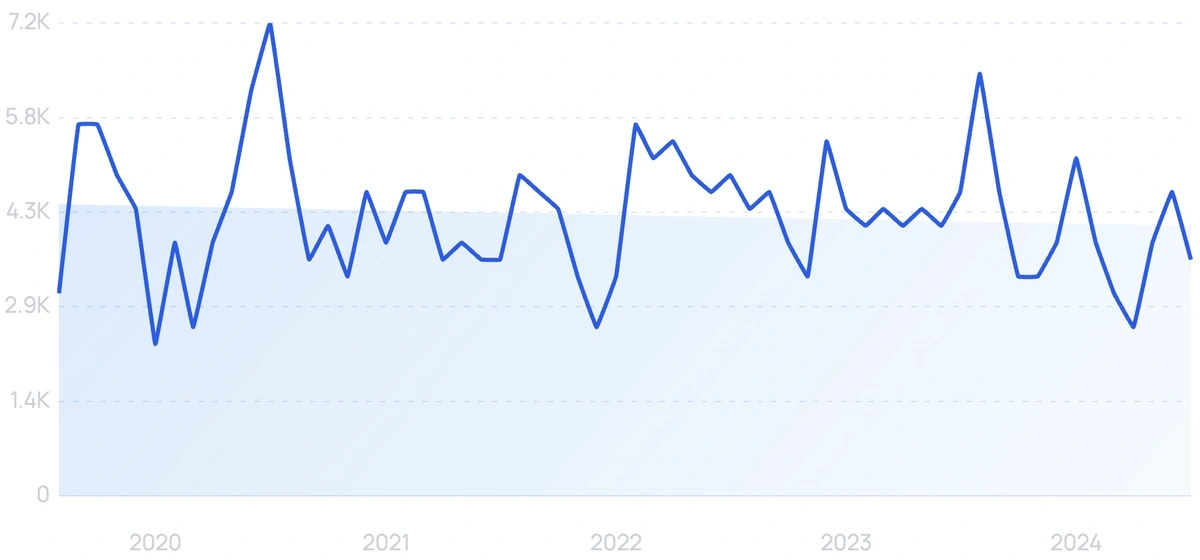

5-year search growth: 175%

Search growth status: Peaked

Year founded: 2012

Location: San Francisco, California

Funding: Undisclosed (Pre-Seed)

What they do: So you’ve launched a successful crowdfunding campaign and the dollars are rolling in. Great. Now, what do you do? BackerKit recognized the immense amount of work that goes into managing campaigns, pledging gifts, delivering rewards, and keeping the community you’ve just built engaged and informed. Backer Kit’s software manages the whole crowdfunding process from start to finish.

Creators who partner with BackerKit typically earn 15% more than those who don’t. BackerKit claims they've helped raise $331M from 15.5 million backers on the platform.

8. FundRazr

5-year search growth: 17%

Search growth status: Peaked

Year founded: 2008

Location: Vancouver, Canada

Funding: $245K (Pre-Seed)

What they do: Crowdfunding-as-a-service isn’t a common phrase, but FundRazr’s free online platform aims to put powerful cloud-based crowdfunding software in the hands of organizations and individuals who need it most. Named as a top 10 crowdfunding site by Forbes, FundRazr has launched over 200,000 fundraising campaigns and raised over $325M since they began.

Think of FundRazr like PayPal. Instead of a separate fundraising website or portal, FundRazr integrates into an existing website and embeds donation functionality directly on-site.

9. RaiseRight

5-year search growth: 5,400%

Search growth status: Regular

Year founded: 1994

Location: Grand Rapids, Michigan

Funding: Undisclosed

What they do: RaiseRight is a scrip or gift card fundraising platform. Participants purchase gift cards through the RaiseRight platform, earning the organization a profit on the gift card. According to the company's website, the platform has helped over 50,000 organizations raise more than $800 million.

10. Fundable

5-year search growth: 62%

Search growth status: Regular

Year founded: 2012

Location: Powell, Ohio

Funding: Undisclosed

What they do: Instead of focusing on individuals and sourcing crowdfunding, Ohio-based Fundable has taken a different approach. Crowdfunding solely for companies. Over $700M has been funded to various startups that were seeking an alternative route to traditional fundraising (like venture capital and equity investors.) Fundable operates by taking a percentage of investments raised through its platform.

Conclusion

As Millennials and Gen Z continue to enter their peak earning years, crowdfunding platforms are likely to become even more significant than they are today. With a totally different investment thesis than older generations, crowdfunding represents investing in things that have real meaning and impact for the people investing in them.

Follow these startups as the democratization of investing continues to unfold worldwide to traditionally underrepresented and underserved groups of young investors.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more