Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 Trending Personal Finance Companies & Startups (2024)

You may also like:

As household debt reached an all-time high ($17.3 trillion) in 2024, the state of personal finance in the U.S. is in question.

In fact, a survey showed that 63% of Americans don't see their personal financial situations improving in 2024.

However, there are hints in other areas that at least some people are now experiencing a sea change in their attitudes toward money.

More people are budgeting, retirement savings are growing, and Americans have hope for their financial future despite their setbacks.

It’s fitting that so many startups focused on banking, investing, financial planning, and budgeting are ponying up to enter the global financial tech market, which is slated to hit $1.5T by 2030.

We’ve rounded up 20 of the most intriguing companies in this space below.

1. Cowrywise

5-year search growth: 127%

Search growth status: Regular

Year founded: 2017

Location: Lagos, Nigeria

Funding: $3.3M (Seed)

What they do: Cowrywise is a Nigeria-based personal finance startup that helps users make the most of their money, whether by better financial planning, smarter saving, or targetted investing. The startup also offers easy money-sending capabilities and has a social component. Founder Razaq Ahmed started Cowrywise, which announced a $3M investment round in early 2021, to provide better savings and investment options to more people.

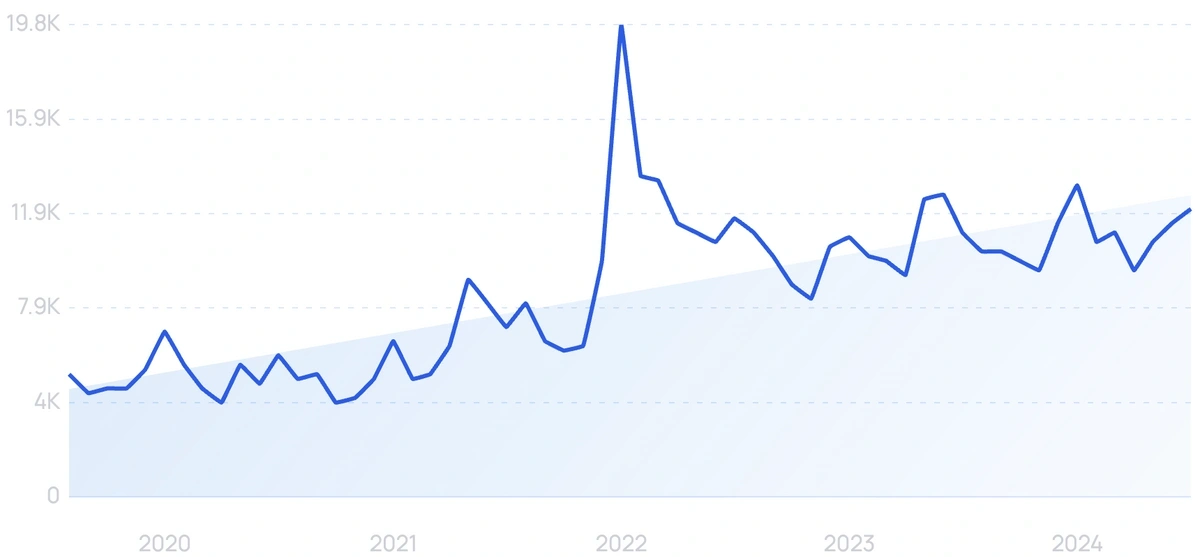

2. Revolut

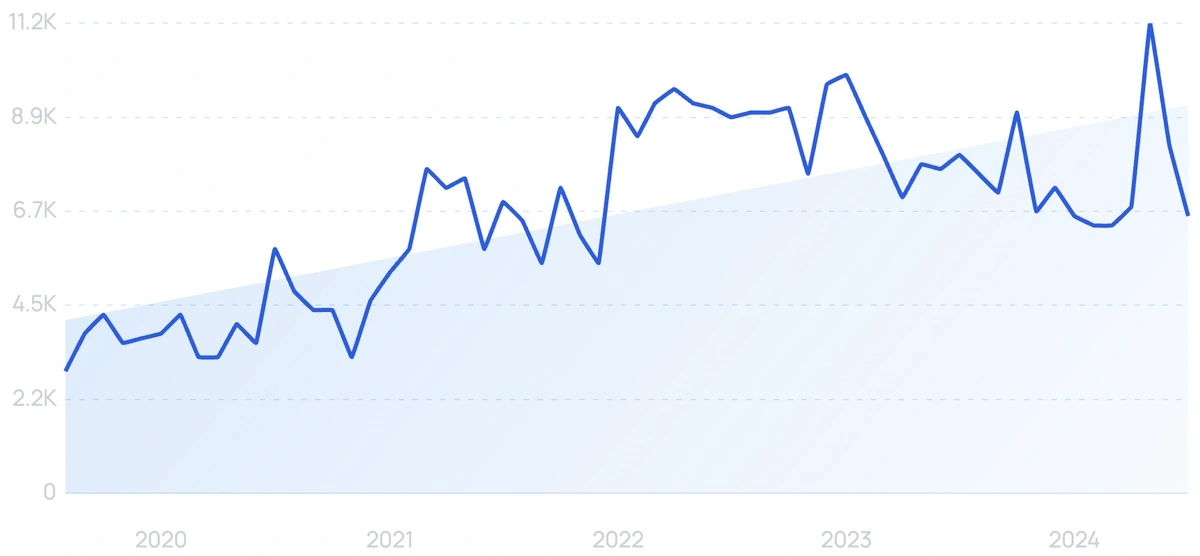

5-year search growth: 177%

Search growth status: Exploding

Year founded: 2015

Location: London, England

Funding: $1.7B (Secondary Market)

What they do: Revolut is a money management app with tools ranging from transfer and payment services to budgeting to global spending in over 30 currencies. Founded in the U.K. and now used globally, Revolut has raised an estimated $1.7B, with the most recent 2021 Series E round bringing in $800M.

3. Zoro Card

5-year search growth: 6,900%

Search growth status: Exploding

Year founded: 2019

Location: Austin, Texas

Funding: $3.1M (Seed)

What they do: Zoro Card was created to help people improve their credit with a card that functions like a debit card. The company offers users a low monthly fee and a quick approval process. The Indiana-headquartered startup, founded by former Indiana University Kelley School of Business students Roger Morris and Zak Grove, has yet to be fully launched and is still only available through early access.

4. FamPay

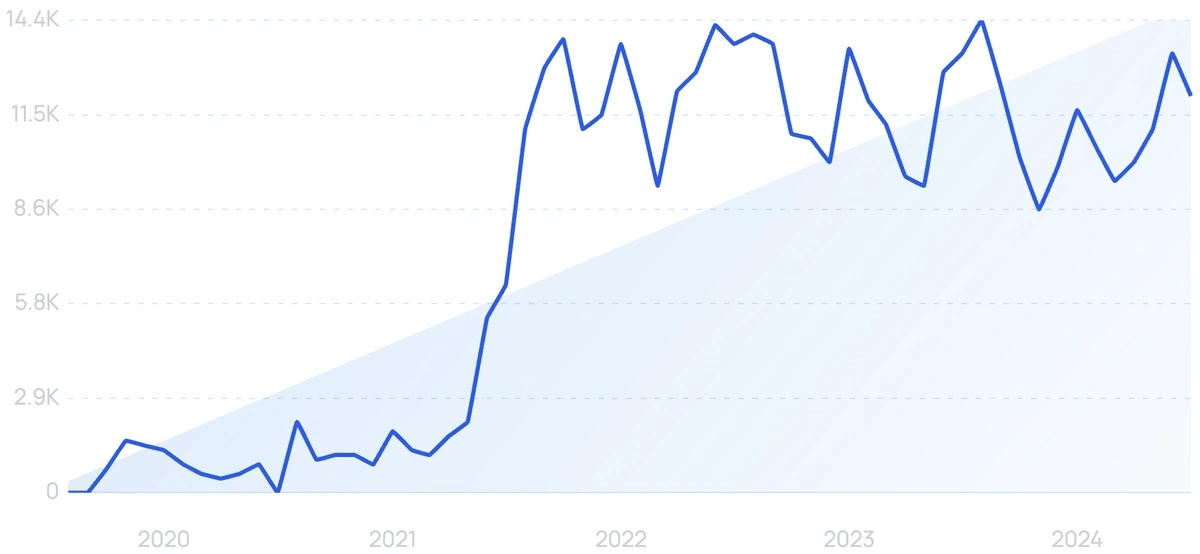

5-year search growth: 6,400%

Search growth status: Regular

Year founded: 2019

Location: Bengaluru, India

Funding: $42.9M (Series A)

What they do: FamPay is an Indian fintech startup that provides digital banking and payment services for teenagers. The mobile-based bank includes a numberless prepaid card (FamCard) that allows children 11+ to make payments without a bank account. Other parent-friendly features include a UPI ID, peer-to-peer payments, parental controls, and more.

In 2023, it was reported that FamPay had over 10 million users.

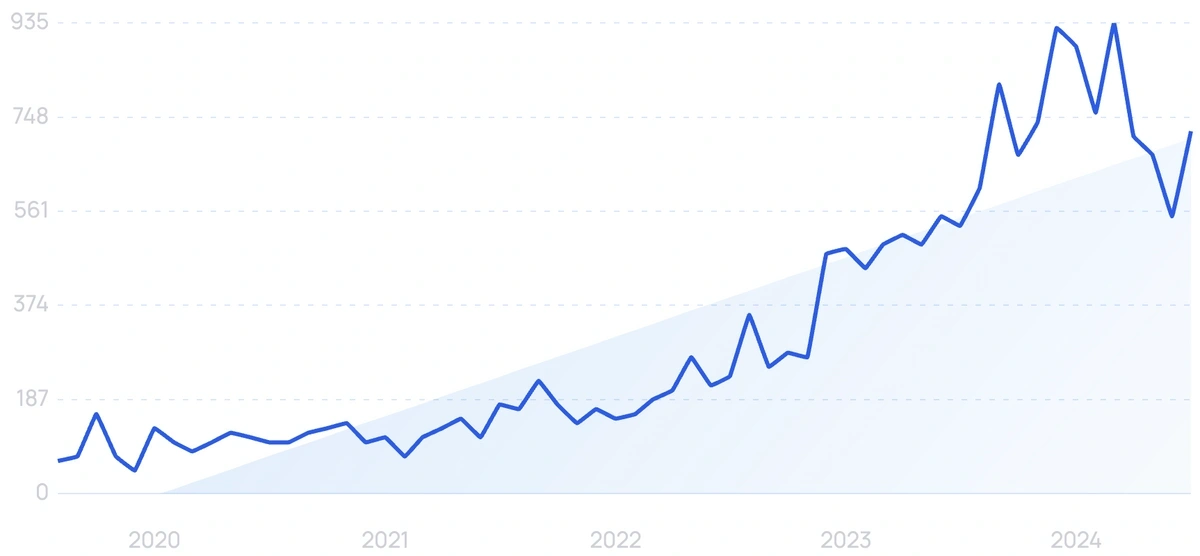

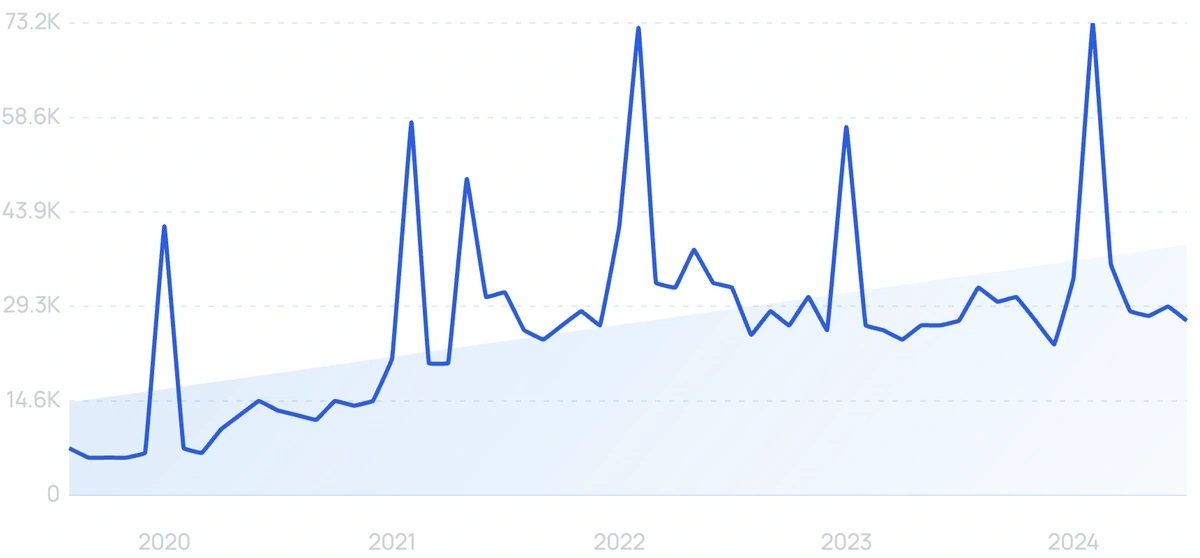

5. Monarch Money

5-year search growth: 1,500%

Search growth status: Exploding

Year founded: 2019

Location: Covina, California

Funding: $19.8M (Series A)

What they do: Intuit officially shut down the Mint app in March 2024, leaving a gap in the market for a new player. That's where co-founder and former Mint product manager Val Agostino stepped in with Monarch Money. This budgeting and personal finance management app allows users to create personalized budgets, customize expense categories, set and track savings goals, link their bank accounts, and analyze their spending habits in one place.

As of May 2024, the app has generated over 100,000 downloads on the Google Play Store

6. Kuda

Search growth status: Peaked

Year founded: 2019

Location: Lagos, Nigeria

Funding: $91.6M (Series B)

What they do: Kuda is a Nigerian digital bank that provides financial services through a mobile app. The startup aims to make banking services more accessible to customers by providing free debit cards, no monthly fees, and no ATM fees. Users can also open an account and start using the bank's services in just a few minutes, without the need to visit a physical branch.

7. Copper Banking

Search growth status: Regular

Year founded: 2019

Location: Seattle, Washington

Funding: $42.3M (Series A)

What they do: Copper Banking is focused on helping teenagers manage money and grow their financial literacy. Customers can access mobile banking and use a debit card to make purchases and withdraw cash from ATMs. The company, founded by professionals with experience at PayPal, Stripe, Intuit, and other companies, raised $29M in a 2022 Series A round.

8. TipMe

5-year search growth: 2,100%

Search growth status: Exploding

Year founded: 2019

Location: Monrovia, Liberia

Funding: Undisclosed

What they do: TipMe provides a range of digital financial services to customers, including a mobile money wallet, bill payment, instant money transfers, and more. The also platform works for businesses with a ticketing system and instant salary payment support. On the Google Play Store, the app has generated more than 50,000 downloads.

9. HyperJar

Search growth status: Regular

Year founded: 2016

Location: London, England

Funding: $24M (Series A)

What they do: HyperJar is a personal finance and budgeting app that allows users to plan and manage their spending. It offers a unique feature called 'jars' that lets users create separate pots of money for different purposes such as groceries, bills, or travel. Users can also share their jars with friends and family, making it easier to split expenses and manage shared budgets.

In September 2023, HyperJar announced $24 million in Series A funding to continue B2B and B2C product development for their 550,000+ customers.

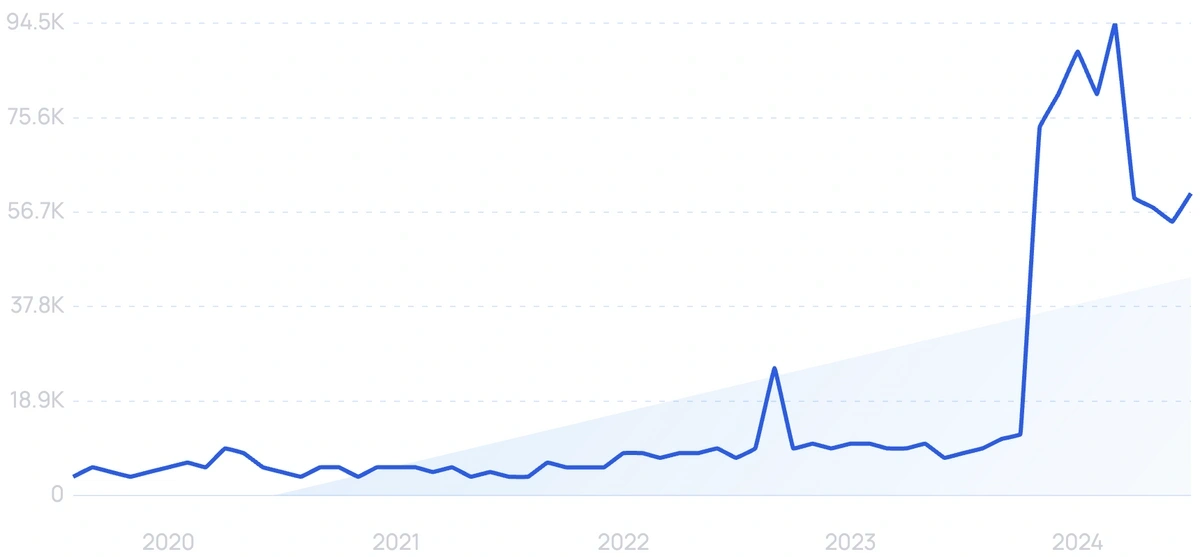

10. Wagepay

5-year search growth: 8,300%

Search growth status: Exploding

Year founded: 2020

Location: Brisbane, Australia

Funding: $6.6M (Debt Financing)

What they do: Wagepay is an Australian fintech startup that offers wage advances for employees who cannot wait until their traditional payday for money. Customers who use this feature are charged a 5% flat fee and 24% interest per annum. As of February 2024, Wagepay estimates that they've processed over $180M in advances for 310,000 users.

11. Lunar

Search growth status: Peaked

Year founded: 2015

Location: Aarhus, Denmark

Funding: $511.7M (Undisclosed)

What they do: Lunar is a Danish financial services startup marketed as “your other bank.” The free service provides digital banking and debit cards and touts low interest rates, no unnecessary fees, and better visibility into transactions. Lunar boasts 850,000 users and, in April 2024, announced an additional $25.9 million in funding, bringing their total investment to over $500M.

12. Up

5-year search growth: 419%

Search growth status: Exploding

Year founded: 2017

Location: South Melbourne, Australia

Funding: Undisclosed

What they do: Up is a digital banking company that allows customers to open an account in minutes directly on their mobile devices. Notable banking features include easy savings account access, budgeting tools, and social features for sending money or splitting bills with friends. The bank has already attracted more than 800,000 total customers.

13. Creditas

5-year search growth: -5%

Search growth status: Regular

Year founded: 2012

Location: São Paulo, Brazil

Funding: $1.1B (Convertible Note)

What they do: Creditas is a Brazilian fintech startup that offers low-interest loans to its users. Valued at $1.75B as of December 2020, Creditas is one in a wave of Latin American finserve companies that have garnered investor interest in recent years, with money injected into this industry hitting $2.1B in 2020.

14. M1 Finance

5-year search growth: 35%

Search growth status: Regular

Year founded: 2015

Location: Chicago, Illinois

Funding: $323.2M (Series E)

What they do: M1 Finance is a multi-functional finance platform designed to help individuals manage their money better. The company—which enables investment, lets users borrow money, offers banking, and more—advertises low fees and strategies designed to help customers grow long-term wealth.

With a $150M Series E in mid-2021, the company’s valuation hit $1.45B, giving it a unicorn status. The startup currently has over one million users and $8B+ in client assets.

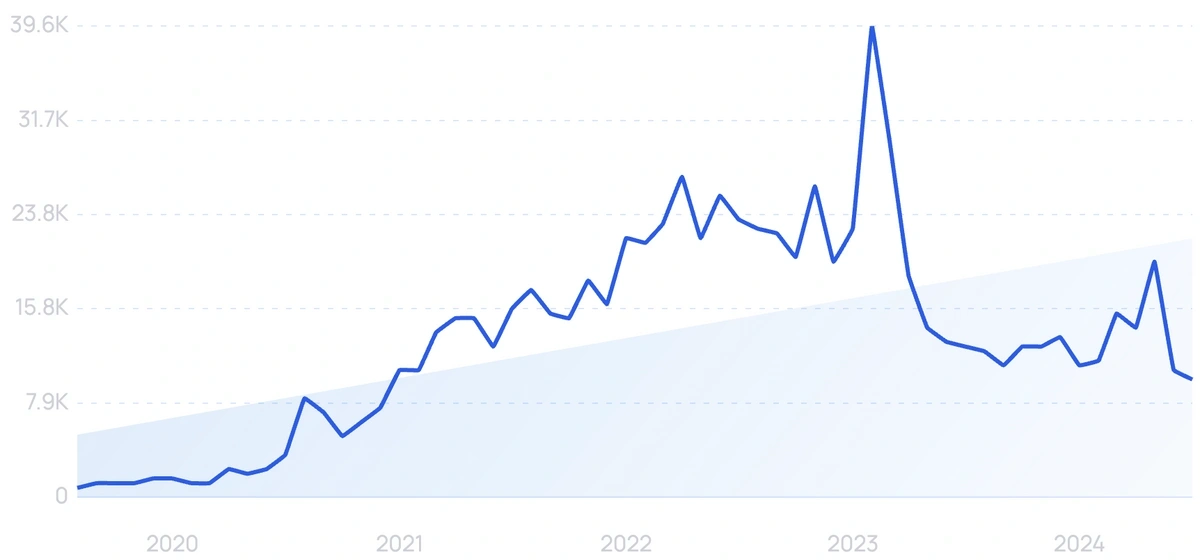

15. Chipper Cash

5-year search growth: 1,500%

Search growth status: Peaked

Year founded: 2018

Location: San Francisco, CA

Funding: $337.2M (Series Unknown)

What they do: Chipper Cash is a fintech startup that provides mobile-based, cross-border payment services in Africa. It allows users to send and receive money across countries, and also provides a virtual card for online purchases. The company aims to address the challenges of cross-border payments in Africa, which can be expensive and time-consuming, by offering a seamless and affordable solution for users.

16. Varo

Search growth status: Exploding

Year founded: 2015

Location: San Francisco, California

Funding: $1B (Undisclosed)

What they do: Varo is a neobank focused on democratizing finance with affordable banking solutions. Customers can join Varo Money without a credit check and use the bank’s services without fees or a minimum balance. In 2020, the startup officially received the green light from the Office of the Comptroller of the Currency to grow into a national bank, a milestone for fintech startups.

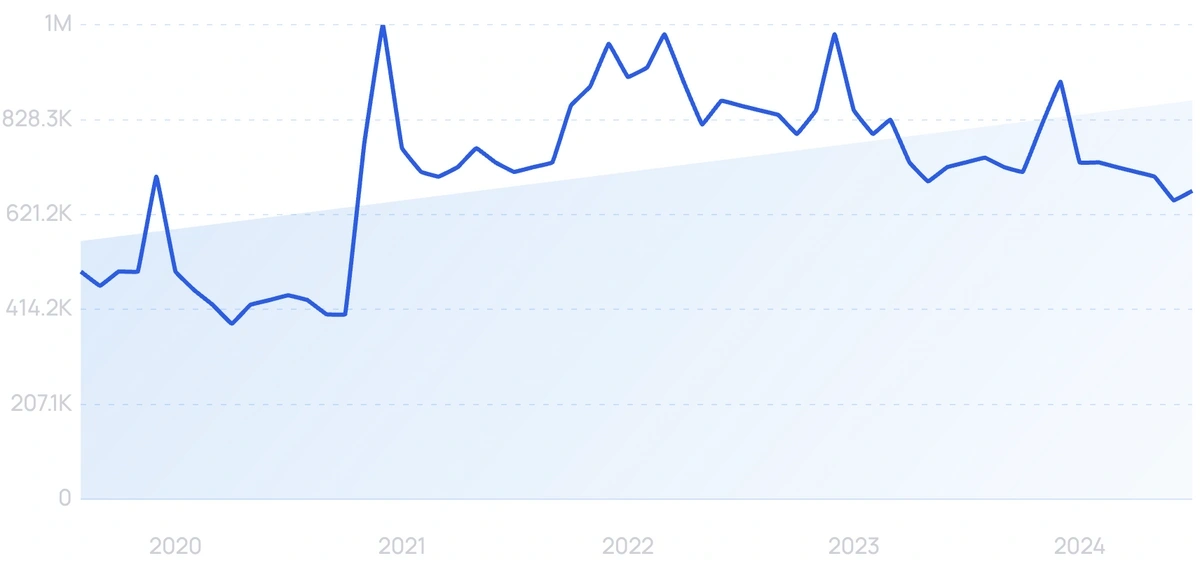

17. Chime

Search growth status: Regular

Year founded: 2013

Location: San Francisco, California

Funding: $2.3B (Secondary Market)

What they do: Chime is a fintech startup that offers banking from Stride Bank and The Bancorp Bank and advertises no fees (even for overdrafts to a certain amount), credit building options, and early access to paychecks. The company raised $750M in a summer 2021 Series G and is eyeing an IPO in the US in 2025.

18. Keeper Tax

5-year search growth: 40%

Search growth status: Peaked

Year founded: 2019

Location: San Francisco, California

Funding: $15.8M (Series A)

What they do: Keeper Tax is a service that can help identify available tax deductions for people who work on a contract or freelance basis. The startup allows professionals to keep track of potential write-offs throughout the year and also offers tax filing if desired. In April 2021, the company publicized their $13M Series A funding round, which they planned to use to advance hiring and their business as a whole.

19. Selma Finance

5-year search growth: -43%

Search growth status: Peaked

Year founded: 2016

Location: Zurich, Switzerland

Funding: $12.2M (Equity Crowdfunding)

What they do: Selma Finance is an automated investment advisor that helps users allocate their investments. Founded in Finland, the Swiss-regulated company allows people to start with a relatively low minimum investment (2,000 Swiss francs). In early 2021, the company received an investment of 3.5M SF (about $3.7M) with plans to expand its product offerings to its current geographical audience.

20. Vivid Money

5-year search growth: 625%

Search growth status: Regular

Year founded: 2020

Location: Berlin, Germany

Funding: $185.7M (Series C)

What they do: Vivid Money is a German fintech startup that helps customers manage their money in several ways, including fractional investments, savings, payments with multiple currencies, and more. They provide users with a card that doesn’t have usual payment details on it. This card can be managed by the user and connected with several different payment apps. The startup raised $114M in early 2022, reaching a valuation of $886M.

Conclusion

That wraps up this list of fast-growing companies in the personal finance space.

A significant theme that ties many of these startups together is the trend toward digital banking.

Whether a startup like Chime that partners with a traditional bank or a truly 21st-century institution like Varo that has achieved official bank status, it’s clear that the finance world is increasingly moving online.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more