Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

4 Important Venture Capital Trends (2024-2026)

You may also like:

In Q3 2023, global venture funding totaled an estimated $73 billion.

And it's no secret that the venture capital arena is hotter than ever.

This means trends in this space impact which companies and sectors will be dominant for years to come.

If you want to see the most important trends impacting the venture capital industry right now, read on.

1. The Number of Mega-Deals Continue to Increase

A “unicorn” is a privately held start-up that has reached a $1 billion valuation.

It used to be a term that described a very small and exclusive cohort of private companies. That has now changed.

Back in 2015, there were roughly 142 unicorns in the world.

According to CB Insights, there are now 1,233 unicorns.

(With a collective value of $3.85 trillion.)

Looking at CB Insights’ data, we can see that there are at least two hectocorns on the list (a privately-held start-up worth at least $100 billion).

One of those companies is ByteDance, the Chinese firm that owns the popular social media app, TikTok.

Search growth for "ByteDance" is up 217% in 5 years.

Alongside Bytedance ($225 billion valuation), SpaceX is also now considered a hectocorn with a valuation of $150 billion.

Also on that list are around 50 decacorns (companies worth at least $10 billion).

Some of the more well-known include Squarespace, Robinhood, Instacart, Epic Games, and Chime.

What’s the reason for this rapidly growing number of highly-valued startups?

One reason is that venture capital funding rounds are getting larger.

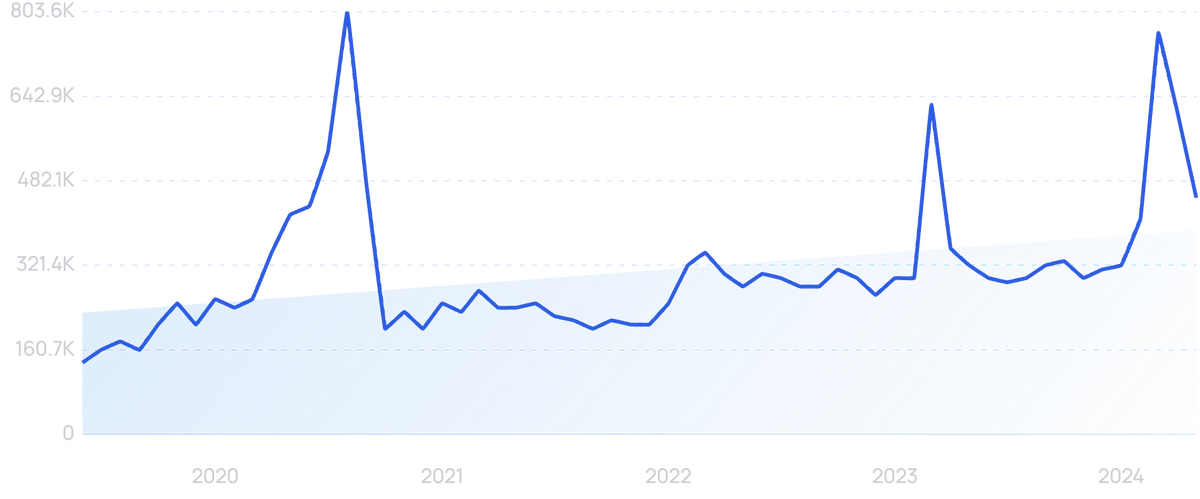

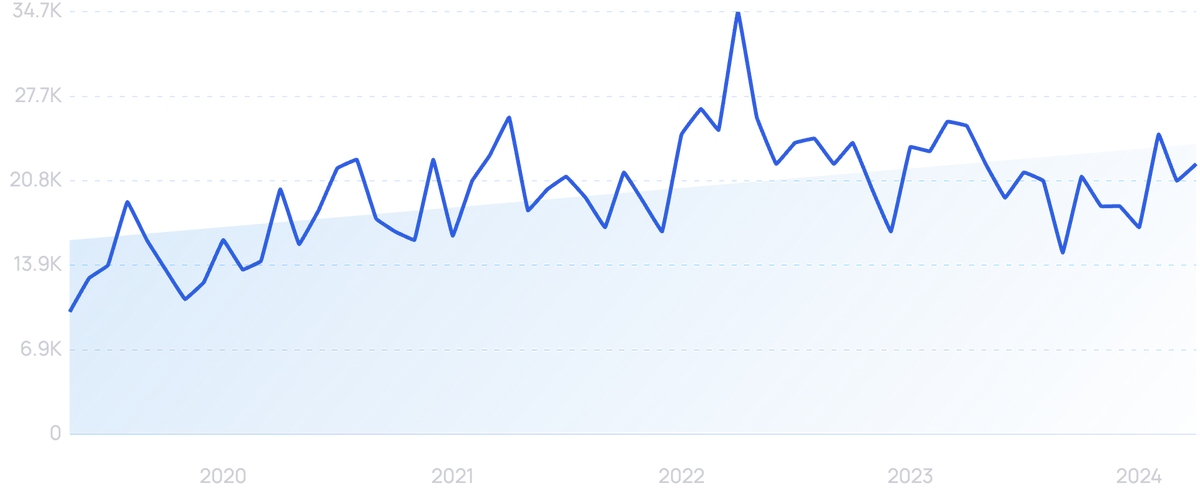

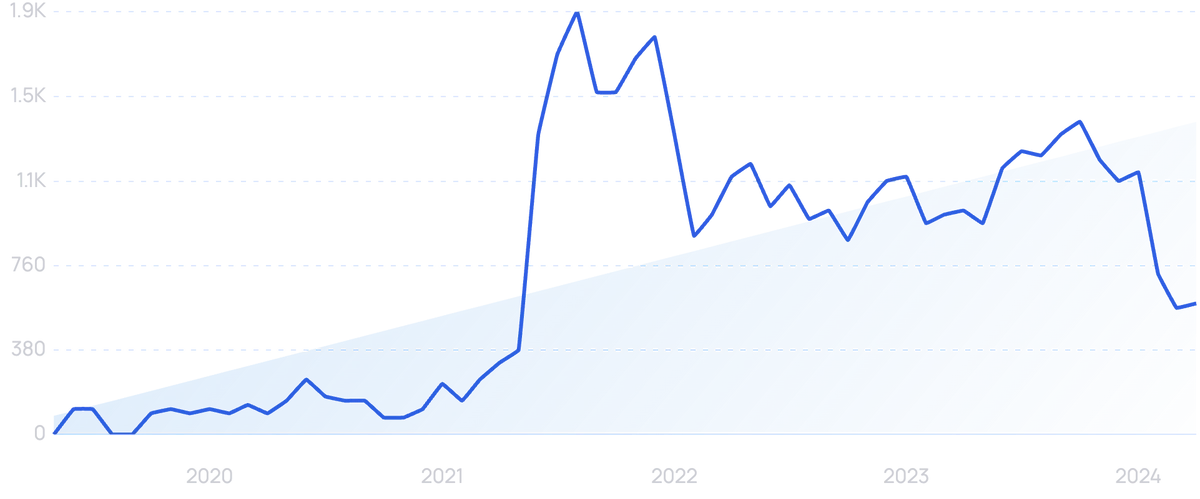

The number of venture rounds worth at least $100 million has been steadily increasing since the second half of 2020.

Number of funding rounds worth at least $100 million committed.

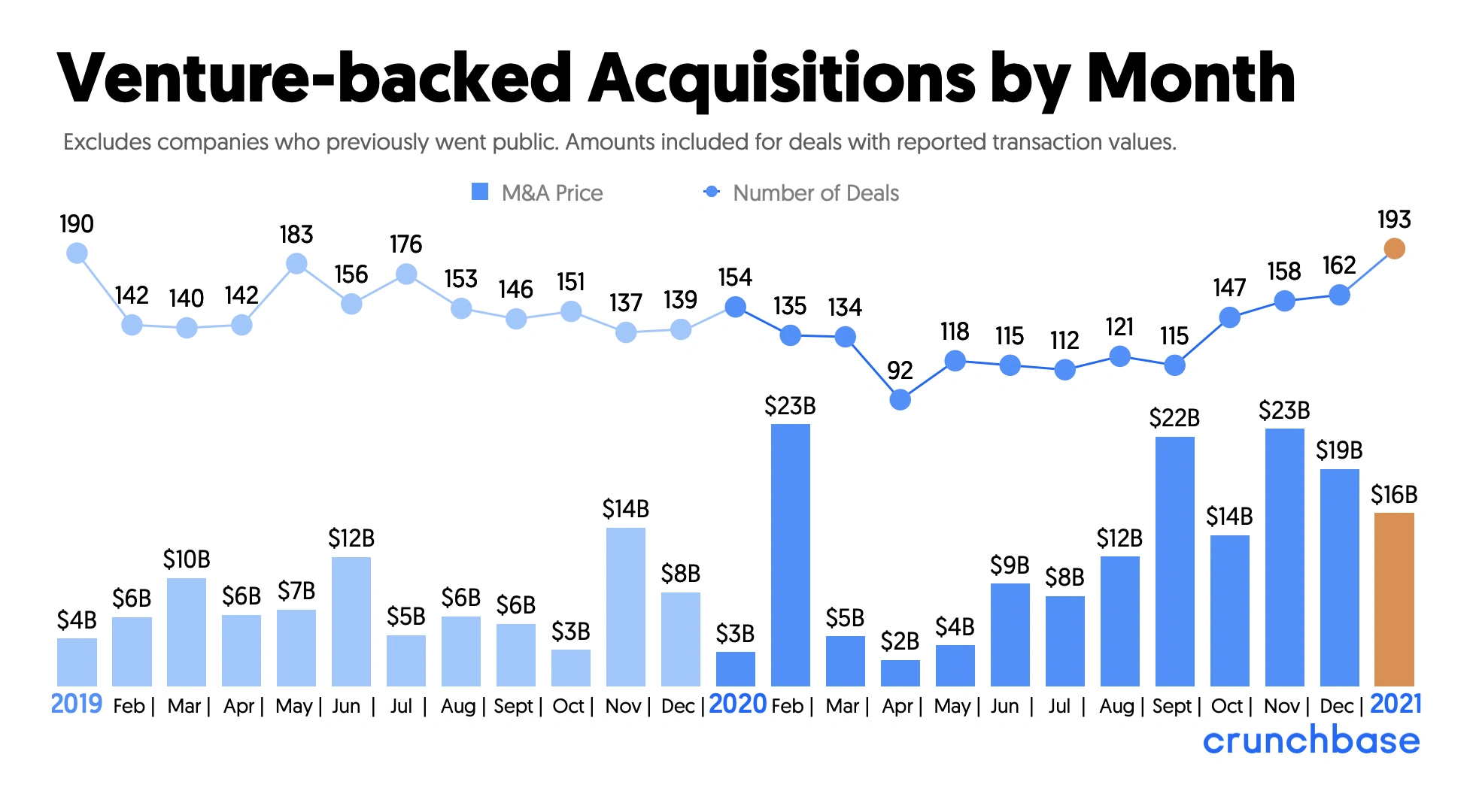

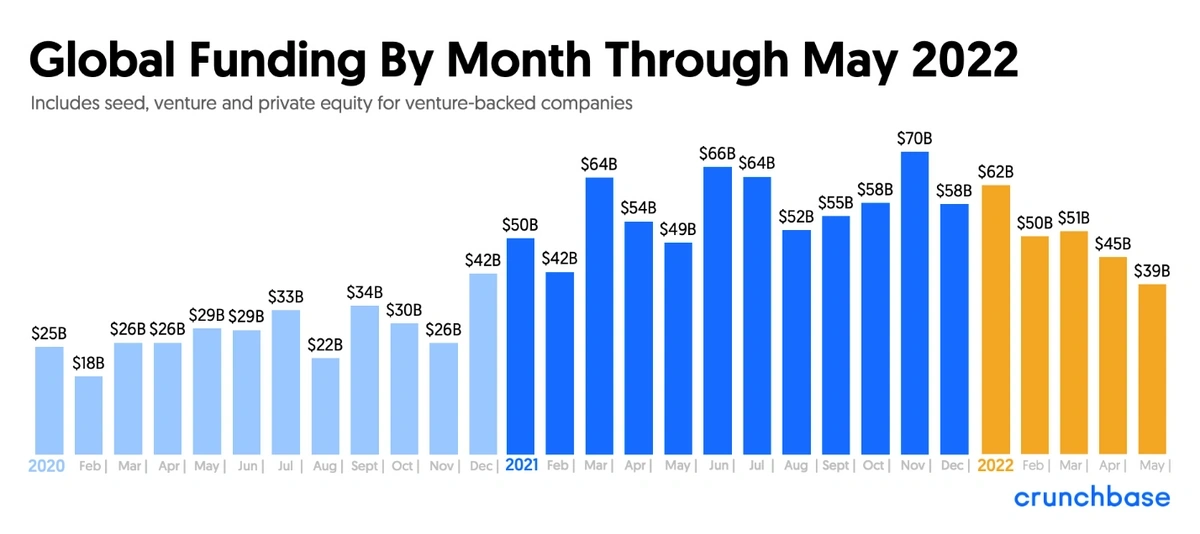

December 2020 and January & February 2021 all saw record funding compared to prior years.

Monthly venture funding.

In fact, in January 2021 alone, 38 new unicorns were created (23 of them in the United States). And in October, 43 new startups joined the unicorn list.

However, recently, the number of new unicorns minted has fallen. In the first half of 2023, just 44 new unicorns were minted. That's compared to 151 in H1 2022.

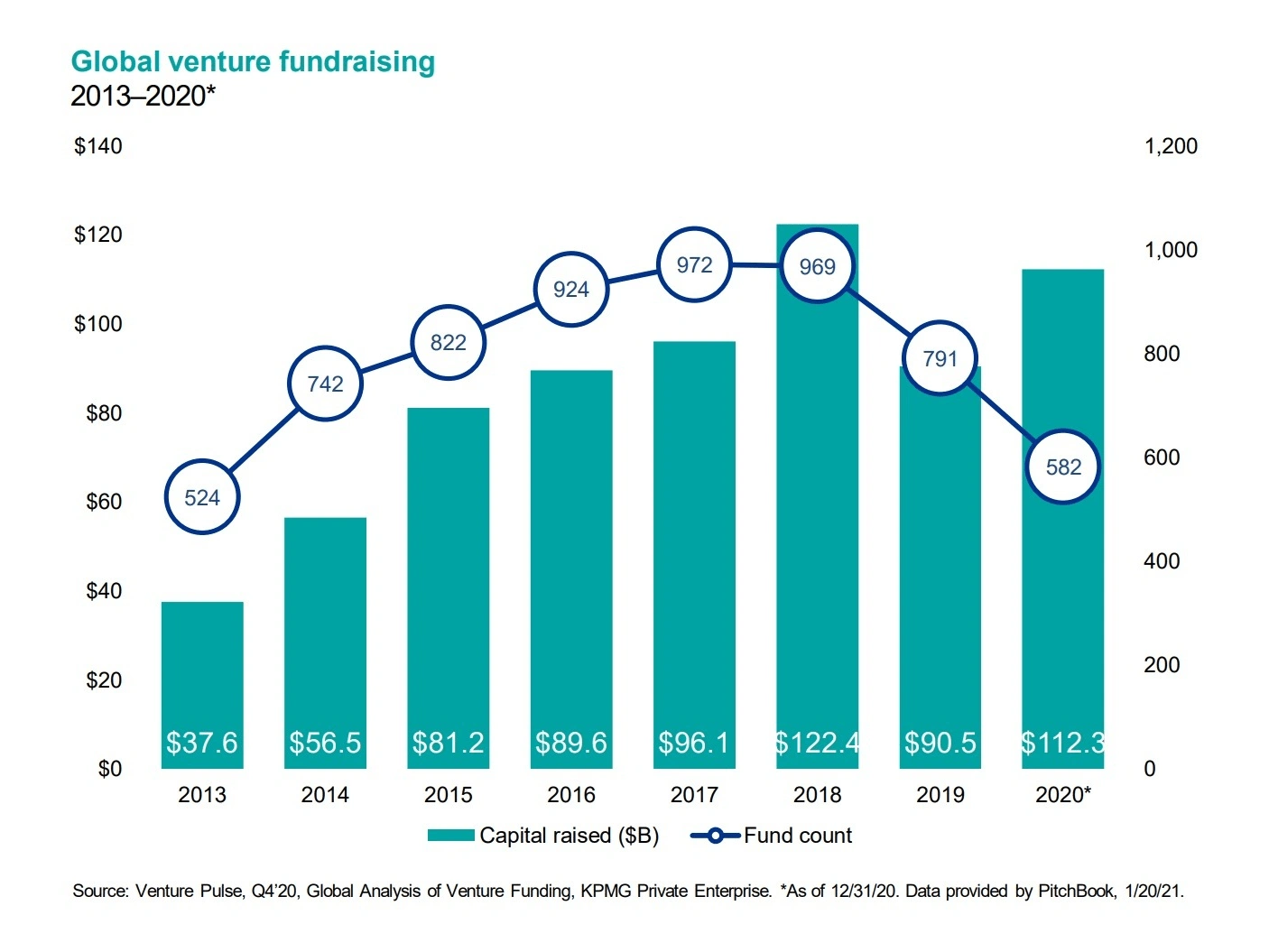

Even in an impressive year like 2020, there were significantly fewer funds involved in venture fundraising.

Total number of funds involved in venture financing each year.

In fact, Pitchbook also found that 15% of VC funds raised in the first nine months of 2020 were part of funds worth $1 billion or more.

While nothing has quite reached the level of Softbank’s Vision Funds, Andreeson Horowitz did raise two mega-funds in 2020, collectively worth $4.5 billion.

2. Equity Crowdfunding Gives Normal People Access to Venture Assets

Venture capital firms have dominated the startup world for as long as there have been traditional “startups”.

Now, investors from all other areas of the financial and business world are looking to gain access to the impressive returns enjoyed by the venture community.

Equity crowdfunding has begun to play a huge part in this.

Basically, equity crowdfunding platforms allow non-traditional (and even unaccredited) investors to have access to startups by pooling their money with other small investors.

There are basically two ways that equity crowdfunding platforms allow unaccredited investors to access private companies: Regulation Crowdfunding (CF) and Regulation A+.

In 2016, a section of the 2012 JOBS Act called Regulation CF came into effect.

This section allowed unaccredited investors to invest in private companies through equity crowdfunding platforms.

The platforms have to be broker-dealers or funding portals registered with the SEC.

And anyone can now invest using equity crowdfunding platforms, regardless of their net worth or income.

There is, however, a cap on the size of each investment made in a company.

Before 2020, that number stood at $1.07 million.

But as of early 2021, the SEC raised the cap to $5 million in a 12-month period, giving unaccredited investors access to significantly larger funding rounds.

The SEC raised limits on funds that unaccredited investors can put into equity crowdfunding platforms.

And Regulation CF has led to a surge in equity crowdfunding since 2016.

In 2020, Crowdwise estimated that $214.9 million was raised through equity crowdfunding platforms.

That’s more than double 2019’s number ($104.7 million).

In fact, 2020’s number is more than the total equity crowdfunding amount raised in 2016-2018 put together ($194 million).

And that upward trend continued into 2022.

Regulation A+, on the other hand, allows private companies to basically do a mini-IPO.

The companies can raise up to $75 million from both accredited and unaccredited investors.

While private companies can do this on their own, they typically raise the money through broker-dealers or crowdfunding portals (more on that later).

A Regulation A+ offering allows private companies to raise significantly more money from the public (think later venture rounds), but subjects them to higher reporting standards than Regulation CF.

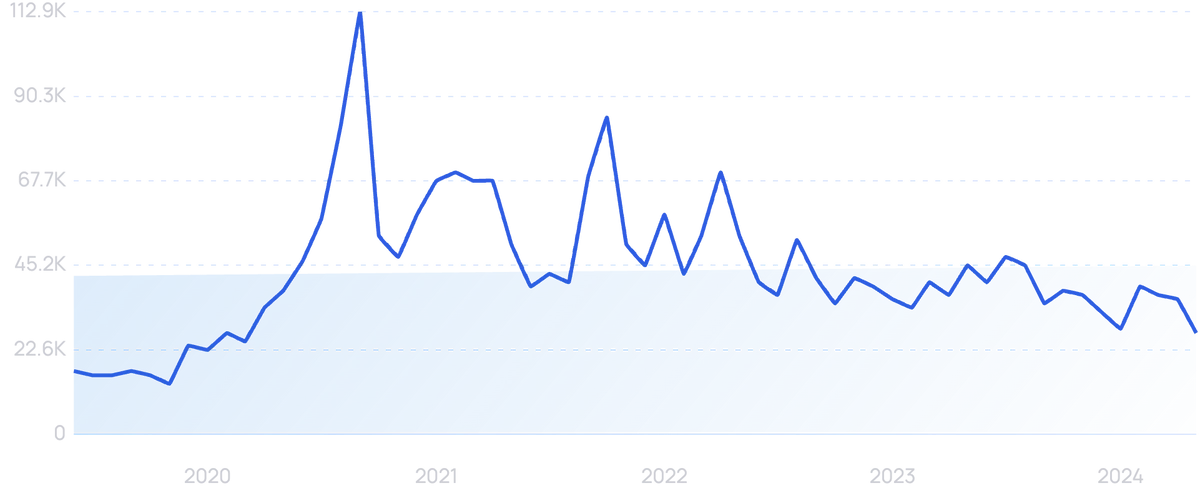

WeFunder is the largest company in the Regulation CF funding space.

Searches for “WeFunder” have grown by 121% in 5 years.

Combined with StartEngine, the two companies raised 59% of all Regulation CF crowdfunding. Wefunder alone raised $132 million – a significant increase on 2020's total ($87 million).

WeFunder allows investors to join a pool of funds with as little as $100. And the company claims it has now attracted over a million users.

By the end of 2020, WeFunder had provided about $188 million in funding for startups and small businesses.

As of April 2024, that figure now sits at $738 million.

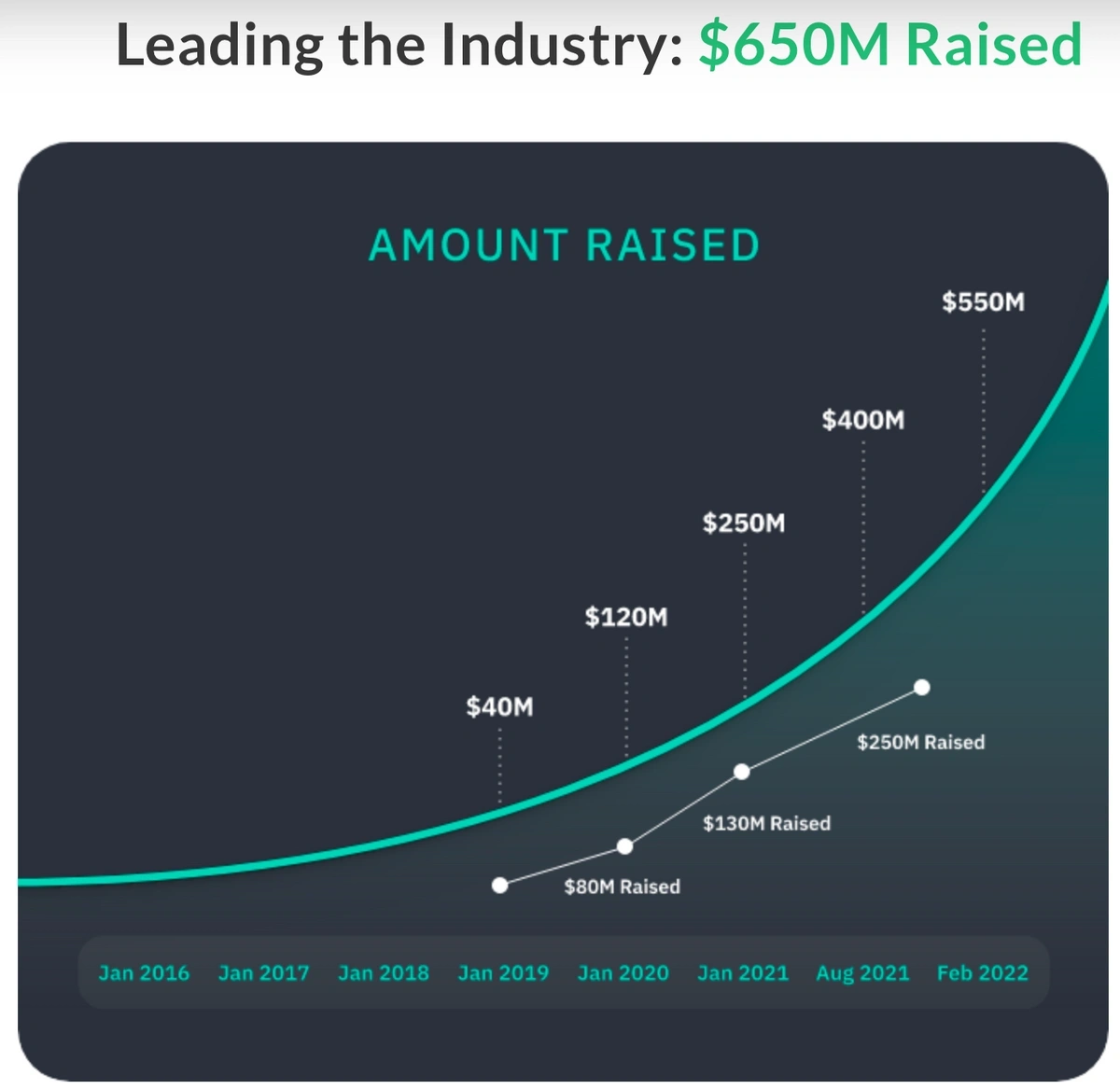

StartEngine is the second-largest equity crowdfunding platform in the Regulation CF market. But it is the largest in the Regulation A+ market.

Searches for “StartEngine” have grown by 60% over the last 5 years.

The company has now raised over $760 million for startups and other private companies since its inception.

In 2020 alone, StartEngine raised $147 million for private companies (a year-over-year growth rate of 236% vs. 2019).

And in 2022, four different companies received over $10 million from a single round of funding.

Source: StartEngine

The company also boasts over 1 million users.

And it has participated in 550+ offerings.

The company counts Shark Tank star Kevin O’Leary as a strategic advisor (you may have seen his commercials on channels like CNBC).

And StartEngine has even staked its own valuation on Regulation A+ funding.

It went public in October 2020 through a Regulation A+ offering.

Since crowdfunded companies typically have illiquid shares and don’t want to comply with onerous SEC reporting requirements on public exchanges, StartEngine created its own secondary market in October 2020 for Regulation A+ and Regulation CF-funded companies to trade on.

After StartEngine and WeFunder, Republic.co is one of the largest equity crowdfunding platforms in the Regulation Crowdfunding space.

Searches for “Republic.co” have grown by 3,000% in 5 years.

Overall (including Reg. A+ and CF), Republic has raised over $500 million in over 500 deals on its platform. And much of this has come since the start of 2020.

Republic has even raised $2.35 million and $11.2 million for popular private companies SpaceX and Robinhood through its platform.

Republic, in its dedication to the small investor, even allows investors to contribute as little as $10 to an investment.

However, it does note that the typical starting level is $100-$150.

In March of 2021, Republic itself raised $36 million in a Series A round to fund its ongoing growth.

This is especially important since the equity crowdfunding caps are rising this year.

3. Venture Capital Leaves Silicon Valley

Traditionally Silicon Valley has captured the lion’s share of the venture capital and startup market.

Recently, however, a shift has begun.

But today, more of the VC industry is moving from Silicon Valley to other parts of the US and the world.

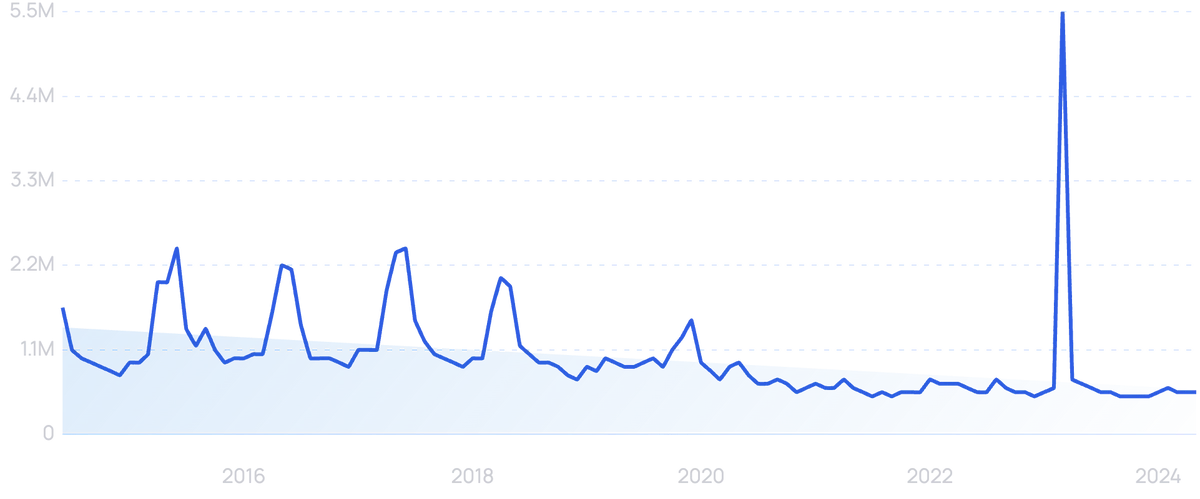

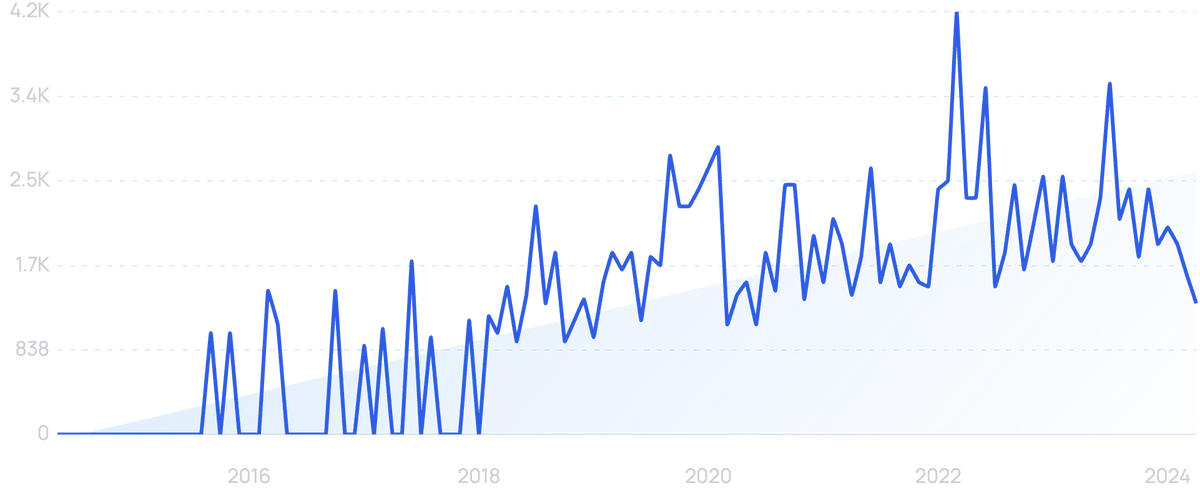

Search interest in “Silicon Valley” over the last 10 years.

According to Pitchbook’s 2021 Venture Capital Outlook, Silicon Valley was expected to account for under 20% of total VC funding in the US by the end of 2021.

That’s the lowest it has ever been.

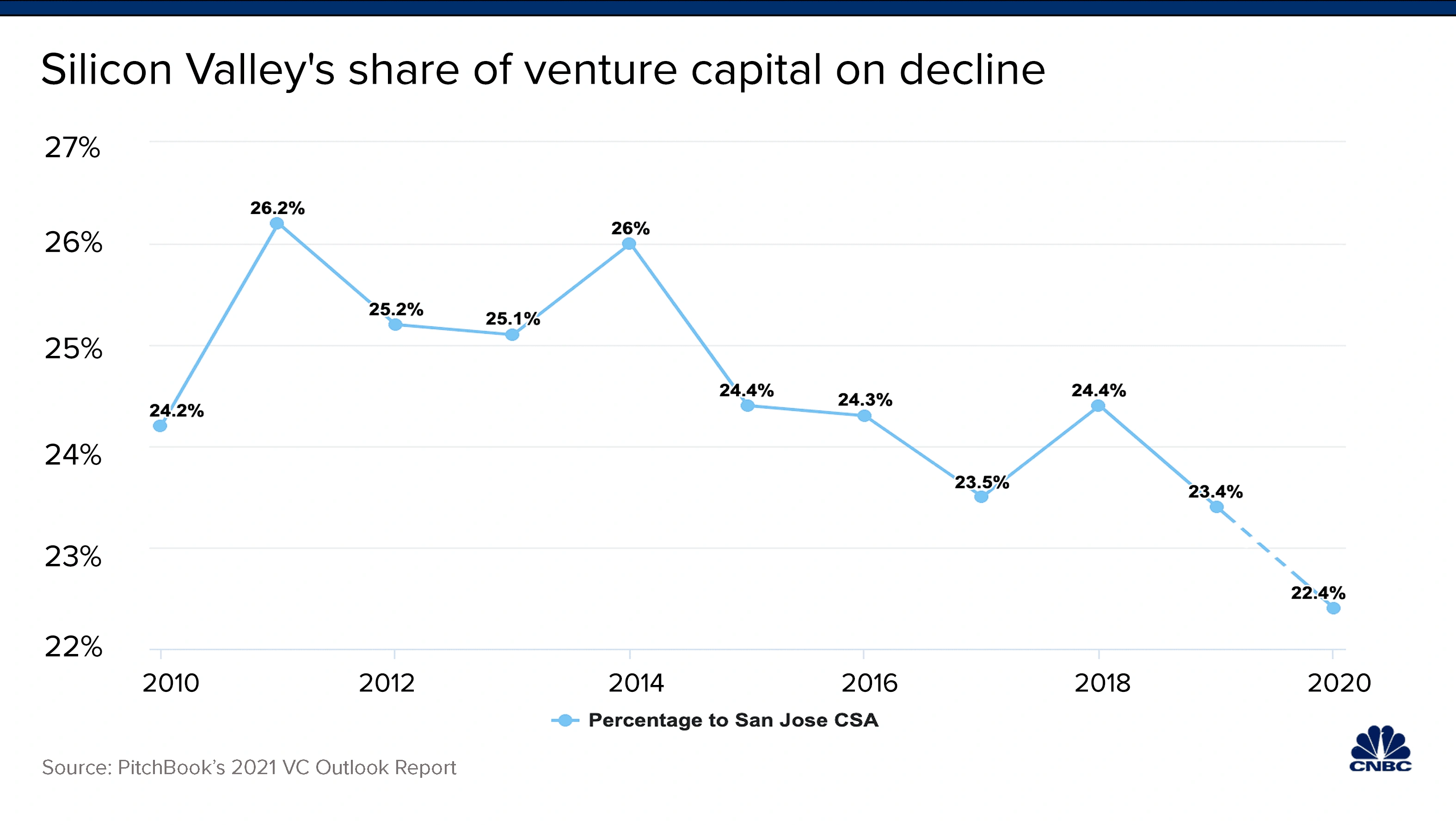

In 2020, 22.7% of the total venture capital funding took place in Silicon Valley, the lowest it’s been in over 10 years.

In fact, according to CNBC, Silicon Valley’s share of total funding has been on the decline since 2006.

Source: CNBC

Part of the reason for this is the fact that a lot of startup founders are finding it less desirable to live in Silicon Valley.

From healthcare to cybersecurity, to SaaS, more and more startup-related work can be done remotely.

And the Bay Area housing market is making it difficult for employees to find Silicon Valley livable.

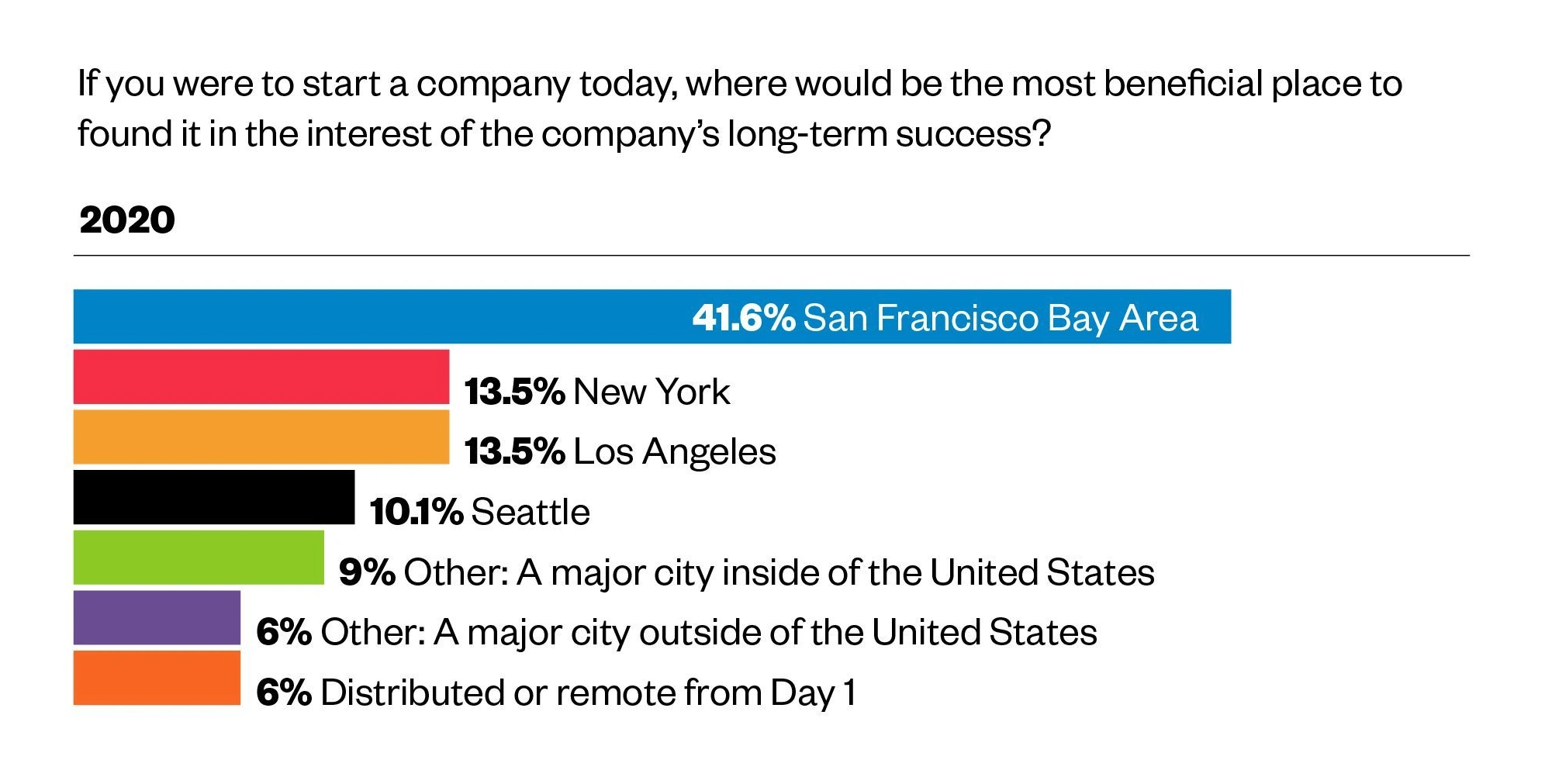

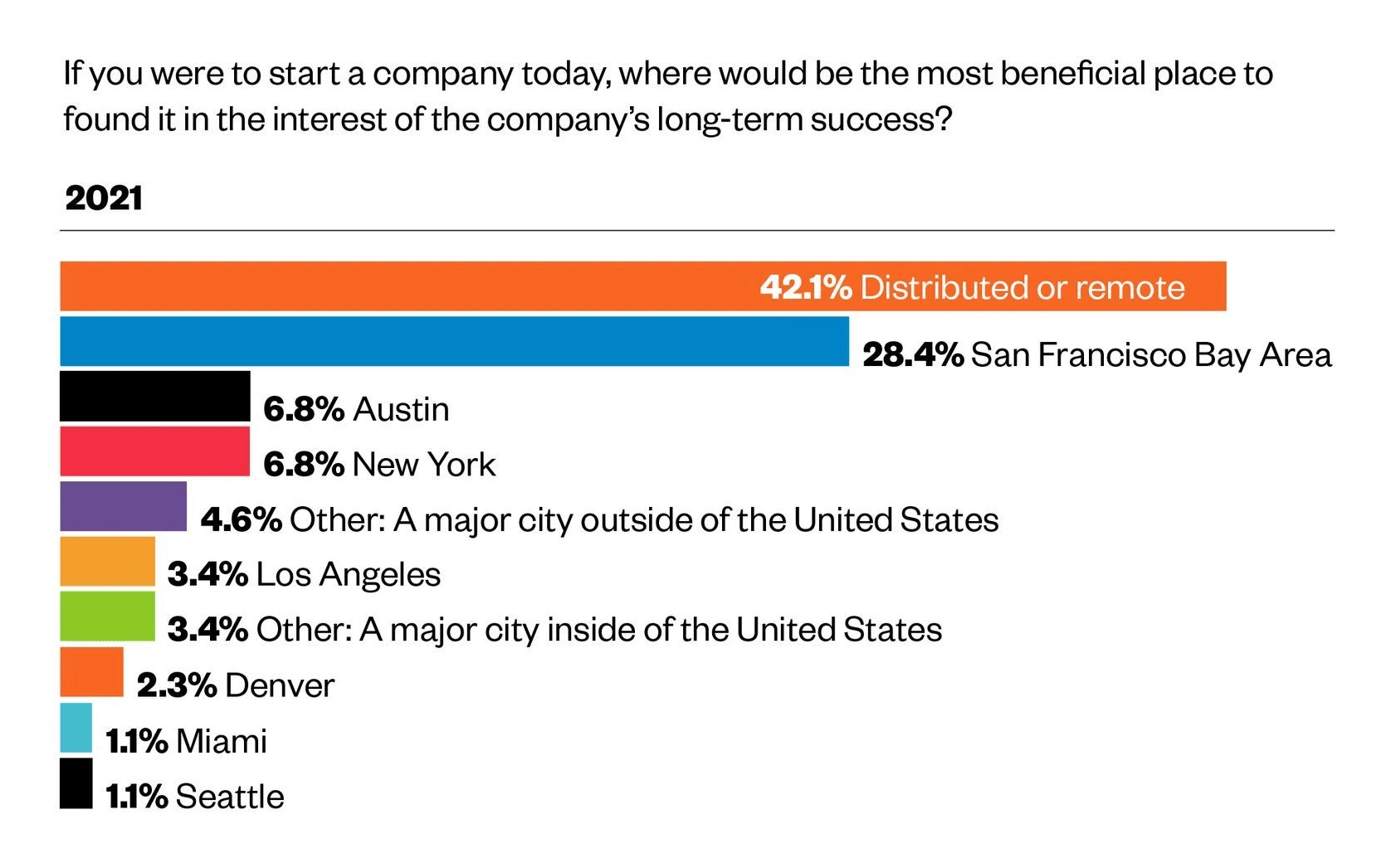

Venture firm Initialized conducted a survey in 2020 and February 2021 to see where the founders of their portfolio companies would base a startup if they had to do it again.

The findings were instructive.

Before the COVID-19 pandemic, the vast majority of the respondents chose Silicon Valley as the most desirable location.

Source: Initialized

By February of 2021, the most popular choice wasn’t a location at all.

Instead, 42.1% of respondents said that they would prefer their company to be completely remote.

Source: Initialized

While Silicon Valley remained the runner-up, Austin (a city that wasn’t listed in 2020) is now tied with New York for the third-most desirable location.

In addition, Seattle is basically out of the running. And cities like Denver and Miami are now considered contenders.

In fact, a fair amount of VC money is leaving the US altogether.

The US accounted for 50% of global VC investments in 2020.

That’s dropped significantly since 2008 when 68.25% of all venture investments came from the US.

Put in raw terms, VC investments outside the Americas totaled $136.2 billion in 2020.

Asia-based investment platforms are seeing significant growth.

According to Crunchbase, there are 6,452 VC investment organizations based in Asia.

Startup Bangladesh is a venture capital fund founded by the National ICT Ministry.

Searches for "Startup Bangladesh" are up 3,000% in the last 10 years.

The organization, which is set up as a limited company, announced a round of investments worth $1.75 million at the end of March 2021.

The funding was distributed among 7 early-stage businesses.

The fund intended to invest in 50 startups by the end of 2021.

Wise Road Capital is based in China.

The fund focuses on semiconductors and other high-tech industries.

The group makes worldwide investments.

In 2020, Wise Road acquired a Swiss sensor company from Siemens.

Wise Road made headlines with its acquisition of Huba Control.

Wise Road was a founder of the Financial and Information Technology Alliance, a global group of more than 100 finance and technology companies.

4. VCs are Cashing Out

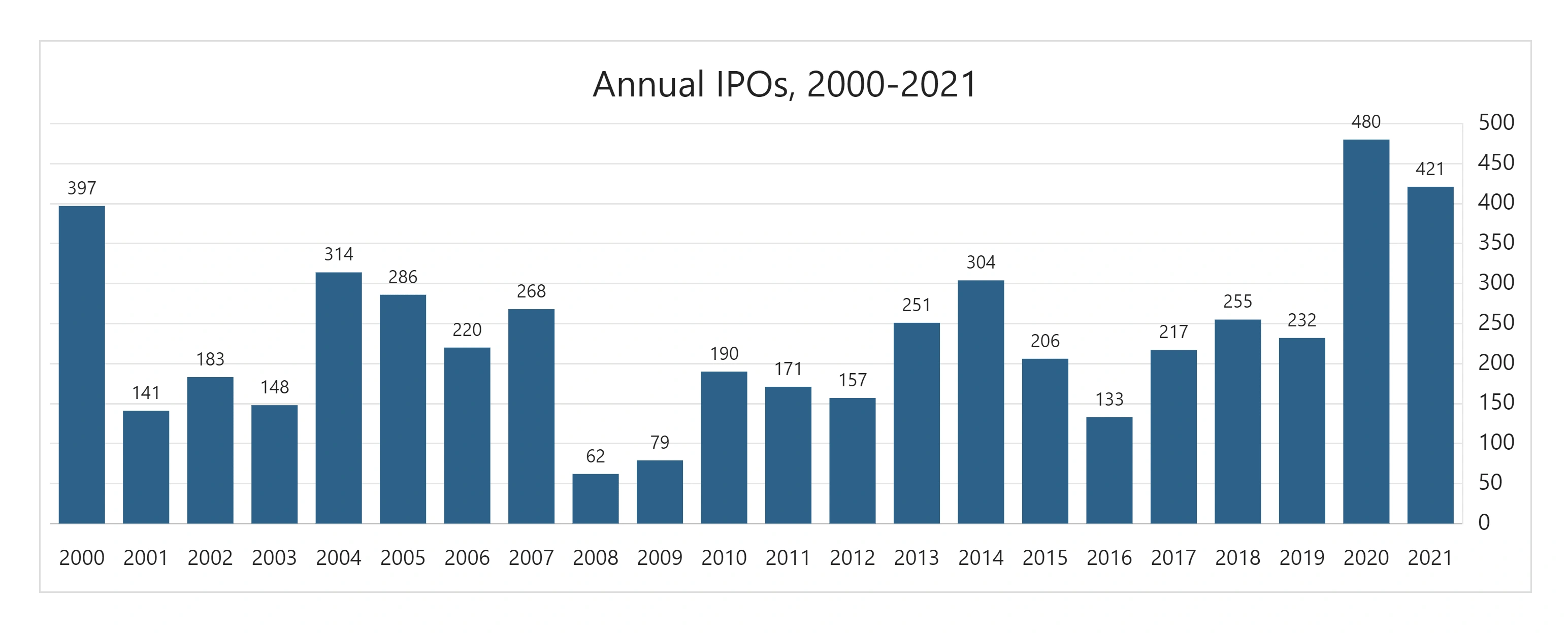

2020 and 2021 saw a record number of IPOs and SPAC transactions.

Both the number of deals and the amount invested have been enormous.

In fact, 2020 and 2021 saw the most IPOs since the 2000 tech bubble.

Source: Stock Analysis

Of the IPOs in 2020, 103 of them involved venture-backed companies.

The group came public at a collective valuation of $220 billion – the highest annual exit value ever.

The number of SPAC IPOs in 2020 and 2021 is also unprecedented.

There were 247 SPACs created in 2020 (more than 4x the number of SPACs in 2019).

And total deal volume increased by over 6x 2019’s amount, growing to $75.39 billion from $12.01 billion.

Source: Skadden Arps

A Special Purpose Acquisition Company (SPAC) is a vehicle through which private equity investors can take a company public.

Essentially, the SPAC sponsors raise capital for acquisition by issuing stock and warrants in a blank-check company.

The company has a mandate that requires it to complete an acquisition in two years or it will be forced to return capital to the shareholders.

Because SPACs can acquire private companies, this method of going public can be quicker and less onerous than a traditional IPO.

Overall, just shy of half of 2020’s total IPO market by volume was represented by SPACs.

More impressive than 2020’s results, however, are 2021’s.

In just the first few months of 2021, 306 SPACs were created. And they raised about $99 billion in gross proceeds.

However, these figures have dropped off somewhat.

The market saw a 64% drop in 2023 compared to 2022.

Conclusion

Whether it’s the size of deals, the number of IPOs, or the rise of SPACs, it’s clear that the venture capital industry is changing.

The financial aspects of the market as well as the demographics are starting to affect how startups are funded.

Keep an eye on these VC trends. They're poised to continue to shake up the space over the next few years.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more