Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

9 Top Investment Trends (2024 & 2025)

You may also like:

The investing landscape is changing faster than ever before.

Investor preferences are constantly shifting. And technological advances are allowing investors to construct portfolios in new ways.

Below is a list of the top trends impacting the world of investing right now.

1. AI Powers the Next Generation of Robo Advisors

Generative AI is dramatically changing the decision-making process in the financial investment and stock trading sectors.

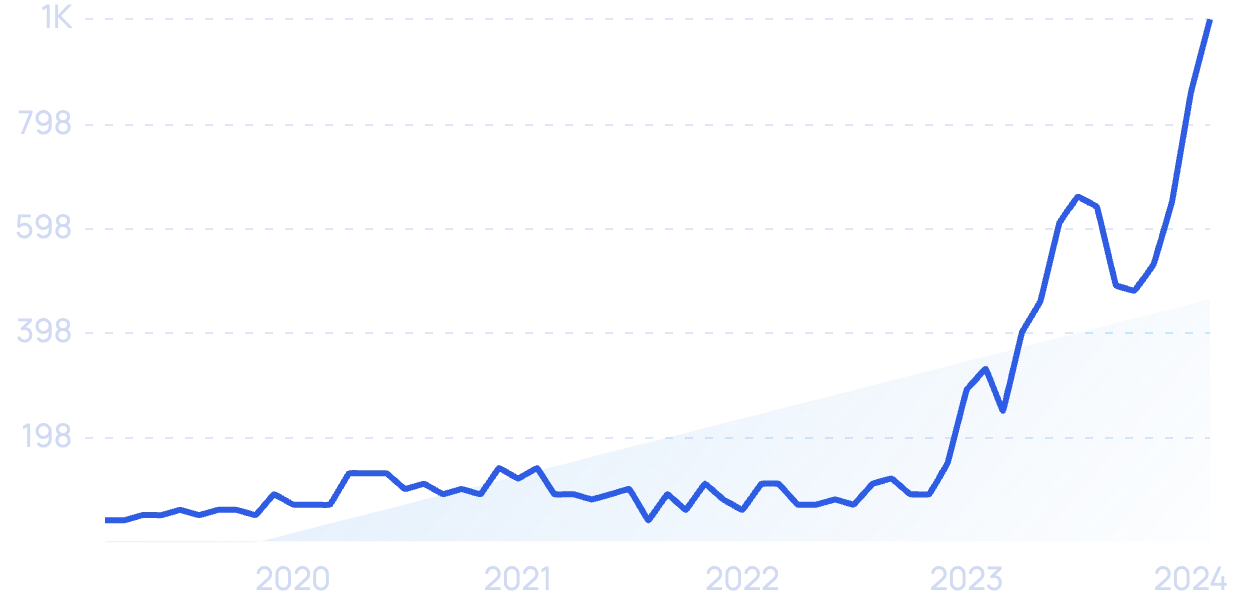

Search volume for “AI stock trading” has grown more than 2,400% over the past 5 years.

Primitive AI models have been around for more than a decade. Betterment, the first robo advisor, was launched in 2008.

Still today, many robo advisors simply run on automation and build passive portfolios based on modern portfolio theory.

But the next generation is coming.

Next-gen robo advisor platforms can model a wide variety of potential shifts in the economy and predict the best investment strategies in those situations.

There are numerous applications for AI in the financial sector.

Other AI-powered robo advisors can come up with new trading strategies in a matter of milliseconds.

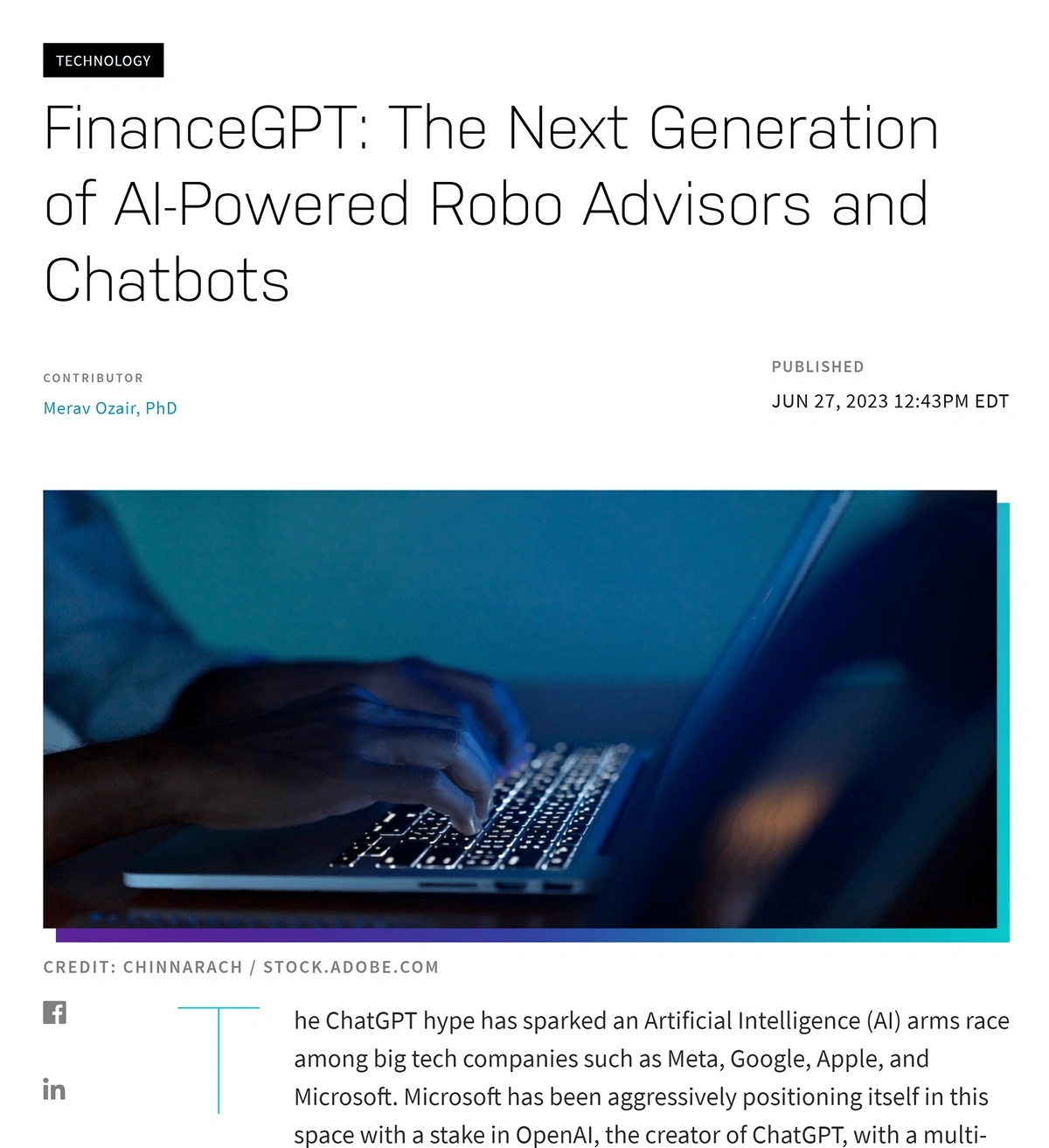

JPMorgan Chase is one firm that’s investing heavily in AI technology.

They’re currently developing IndexGPT, a generative AI platform that will select investments tailored to the needs of users.

The firm recently applied to trademark the platform. Signs point to an actual release within three years.

JPMorgan Chase has been utilizing AI in recent years and is expecting a billion-dollar impact from the technology this year.

As robo-advisor technology has advanced, so has the adoption rate.

Predictions say that AUM in the robo-advisor market will cross $1.8 billion in 2024. That number is expected to continue growing at a nearly 8% CAGR through 2027 to land at $2.27 billion that year.

And there’s a growing demand for AI-powered investment advice.

A 2023 study from Capgemini reported more than half of individuals trust generative AI to assist with financial planning.

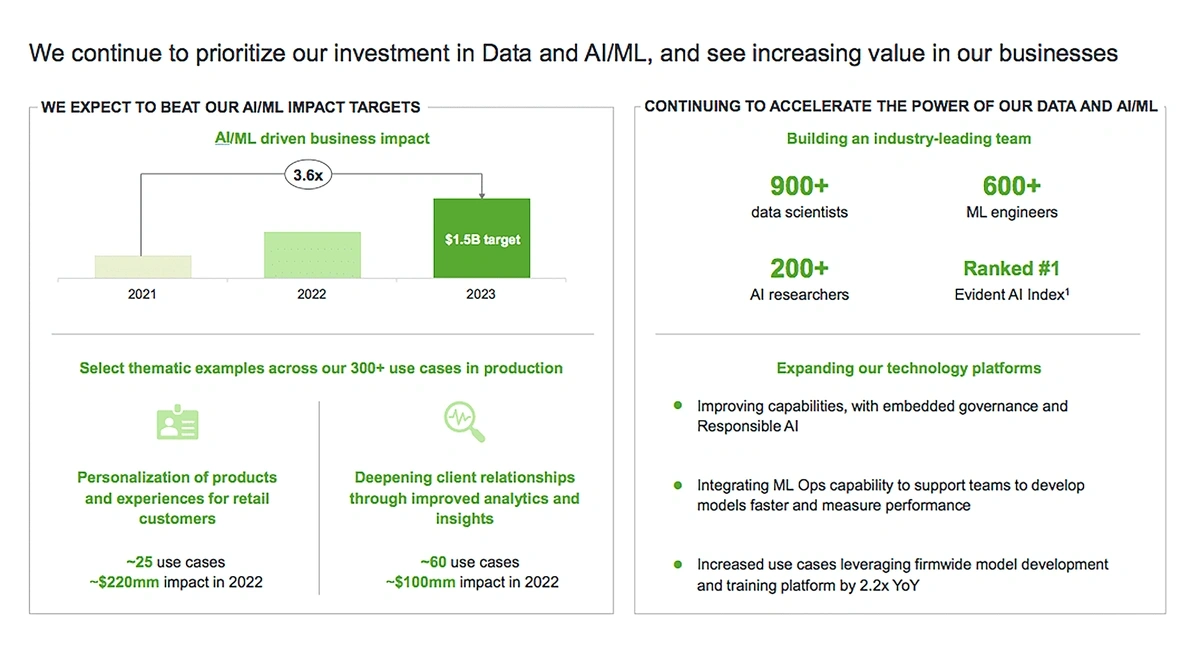

According to a poll from the Certified Financial Planner Board of Standards, nearly one-third of investors would use AI as their advisor and they would be comfortable taking advice directly from AI without verifying it with a second source.

More than half of the people polled were comfortable with an AI advisor if they could verify the advice.

Comfort levels of working with an AI-powered advisor increase when users can verify the advice.

2. Quant Funds Post Sizable Gains

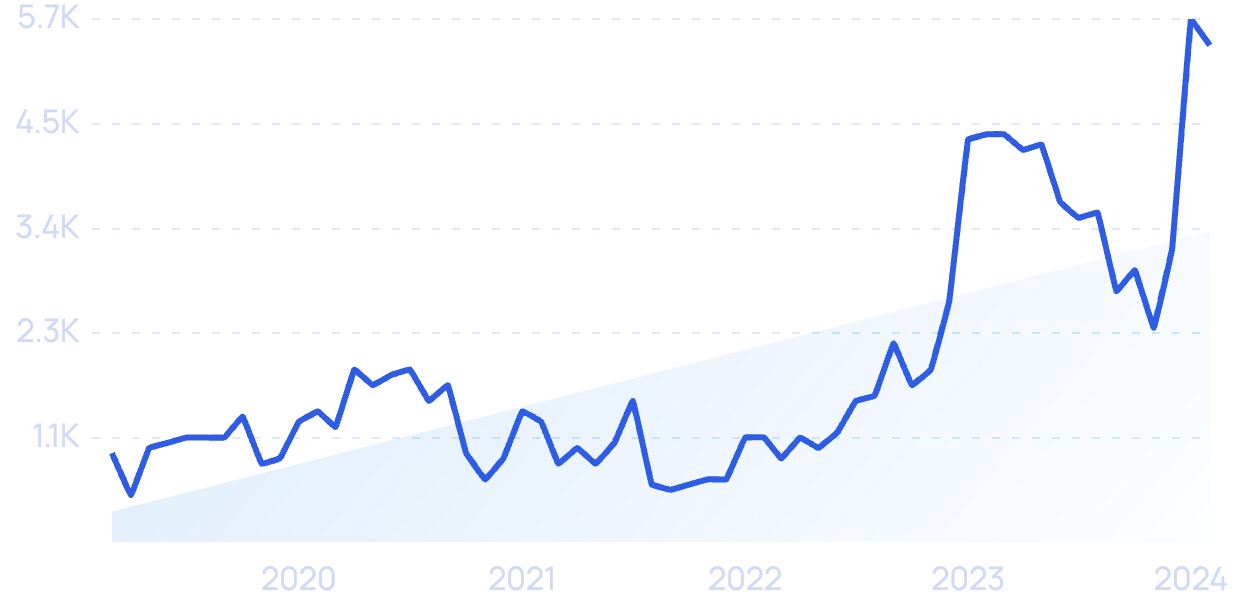

One specific area in which AI is being applied to investing is in quant funds.

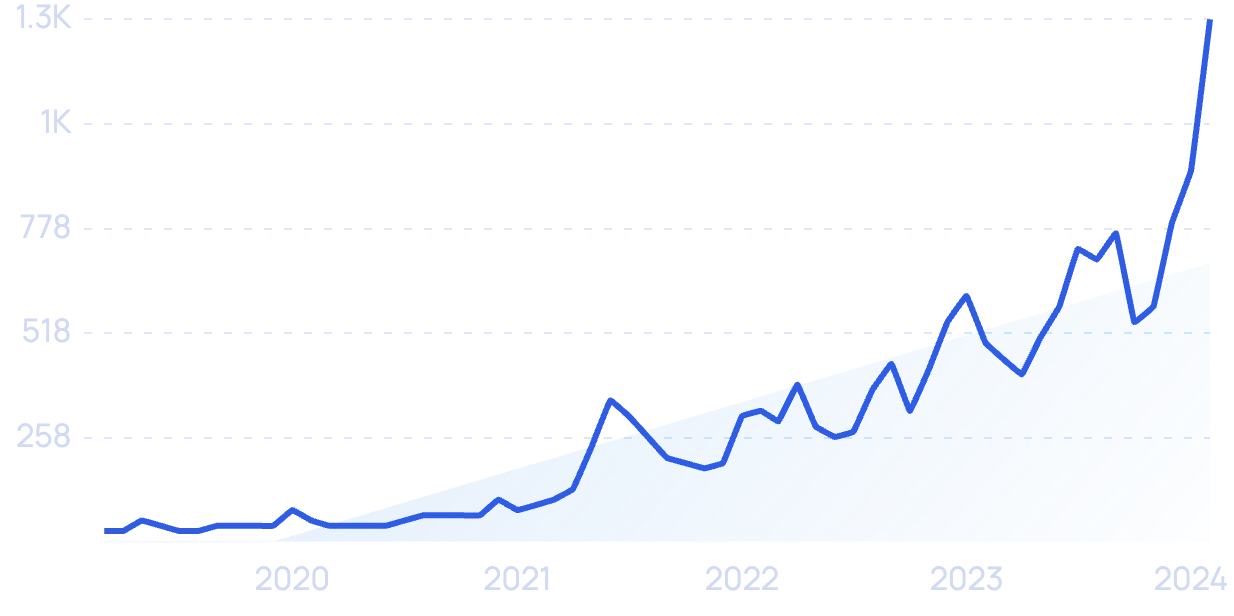

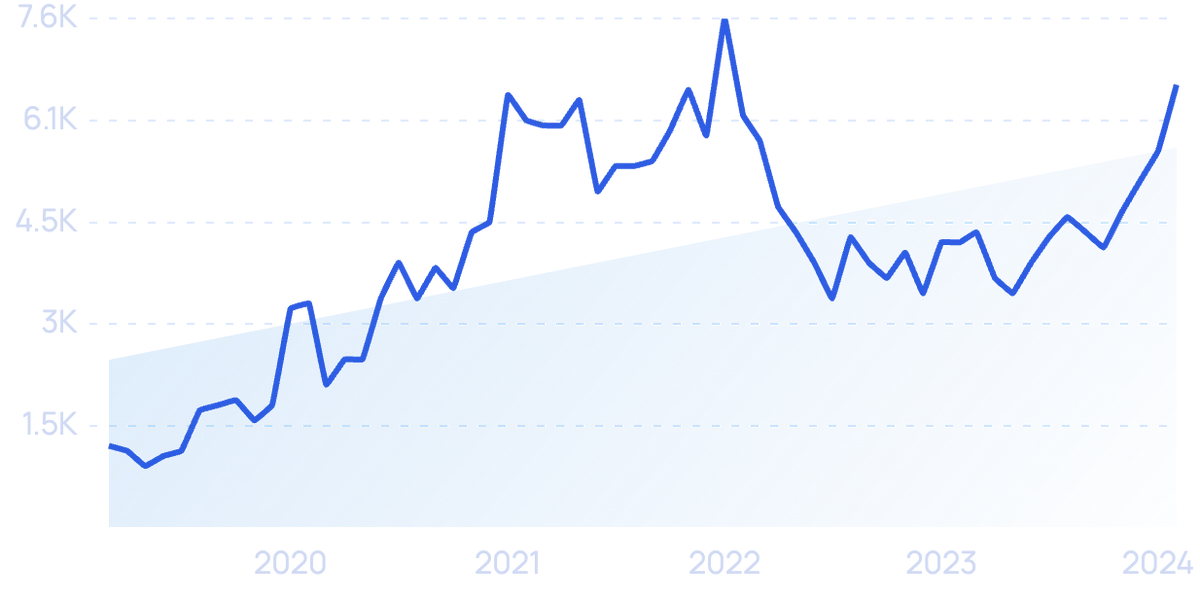

Search interest in “quant fund” has increased by more than 4,900% since 2019.

Unlike investments that are dictated, at least partially, by fund managers, quant funds are run solely by software models and numerical data.

Increasingly, the quant fund algorithms are being run by AI.

In the United States, quant assets make up about 29% of the total hedge fund market.

That amounted to more than $1.13 trillion at the end of March 2023.

2022 was clearly a successful year for quant funds.

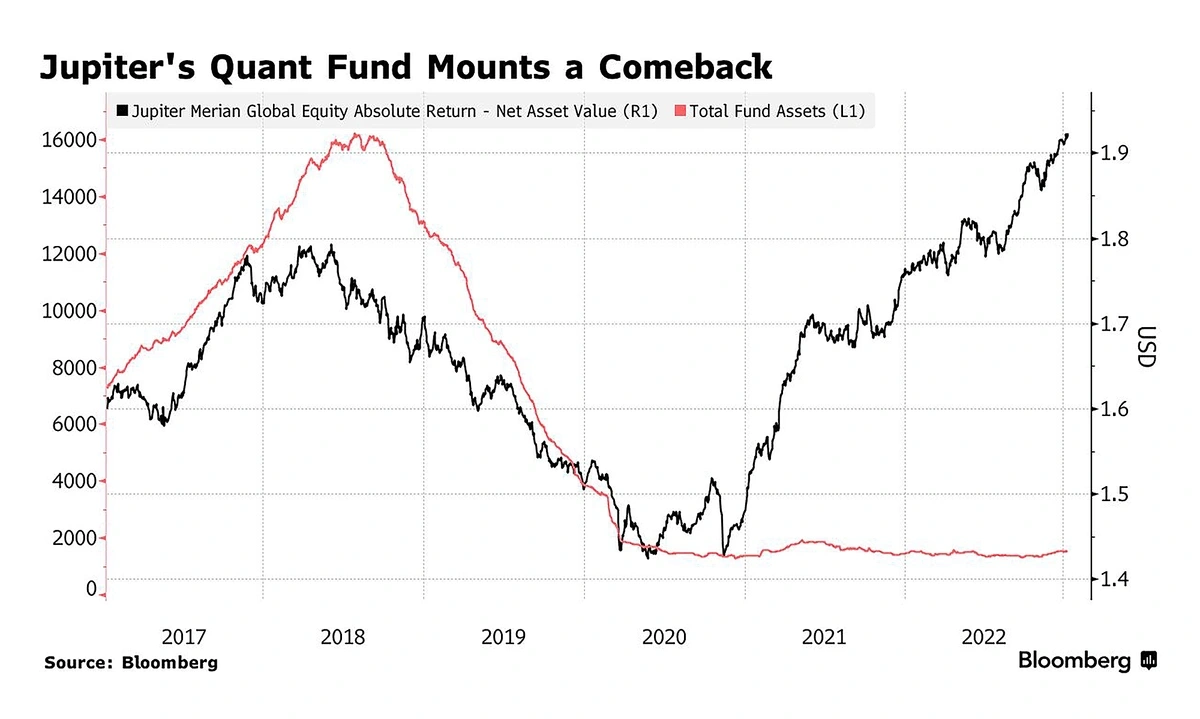

The performance of the Jupiter Quant Fund has been climbing since late 2020.

D.E. Shaw, one of the largest quant funds in the US, outperformed industry averages to post a nearly 25% gain.

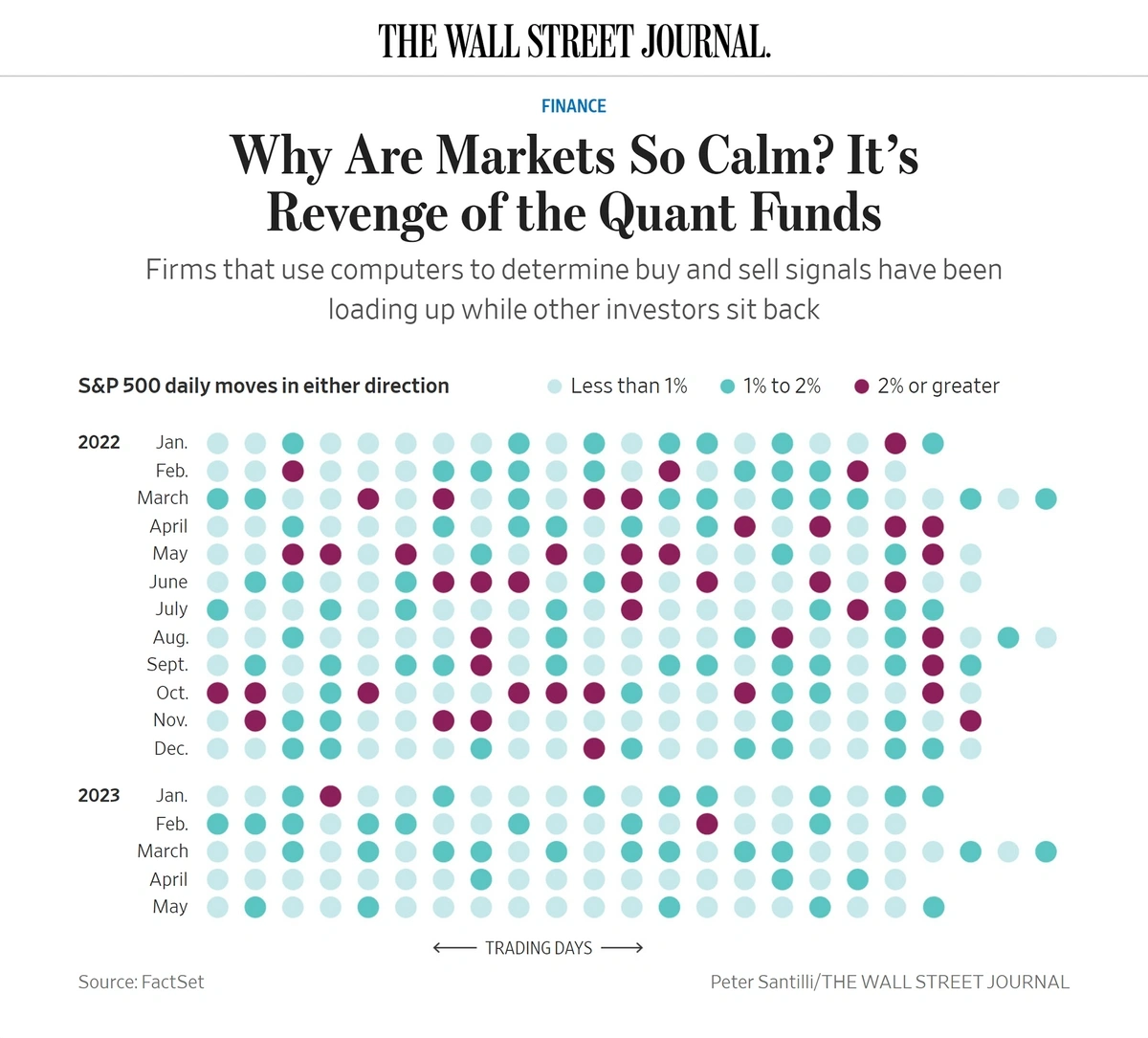

And, the Wall Street Journal credited quant funds for stabilizing the stock market during the turbulent months of 2023.

The Wall Street Journal reported on the importance of quant funds in the market.

So far in 2023, Renaissance Technologies (with $82 billion in total assets) has posted a return of 22.8%.

According to Morgan Stanley, the recent success of quant funds lies in the fact that the trades they power are informed by historical data and trends.

Recent market swings dictated by monetary policy, interest rates, and other macro trends favor the type of strategy used by quant funds.

3. ESG Becomes an Essential Investment Strategy

Environmental, Social, and Governance (ESG) investing has taken the financial world by storm over the last several years.

Search interest in “ESG investing” has increased in recent years.

Morningstar reported that nearly 70% of asset owners believe ESG factors have become more important over the past five years.

And the data supports that sentiment.

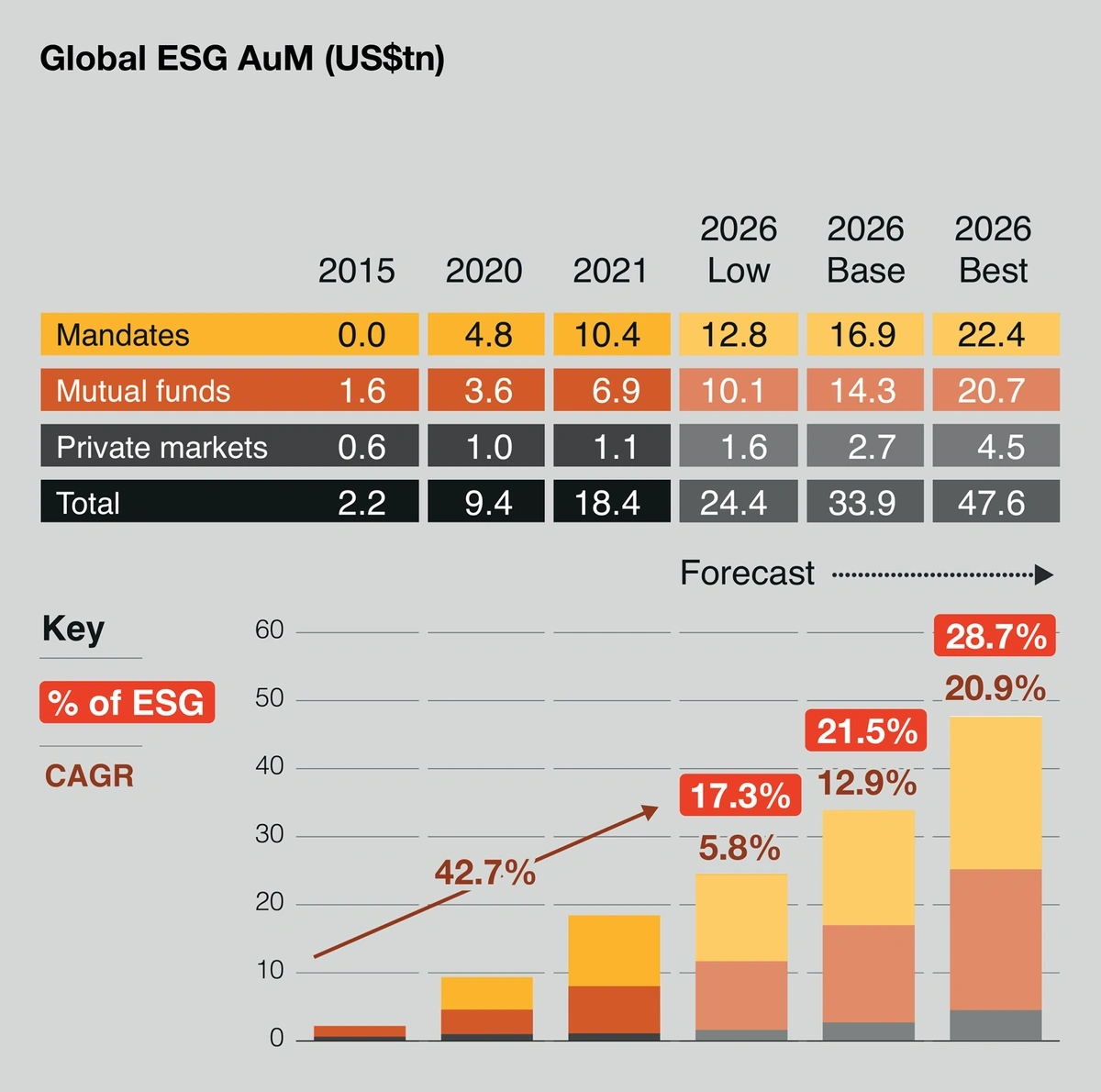

In 2021, US ESG funds had $4.5 trillion AUM but that number is expected to swell to $10.5 trillion by 2026.

By 2026, PwC predicts ESG assets will comprise one-fifth of all assets.

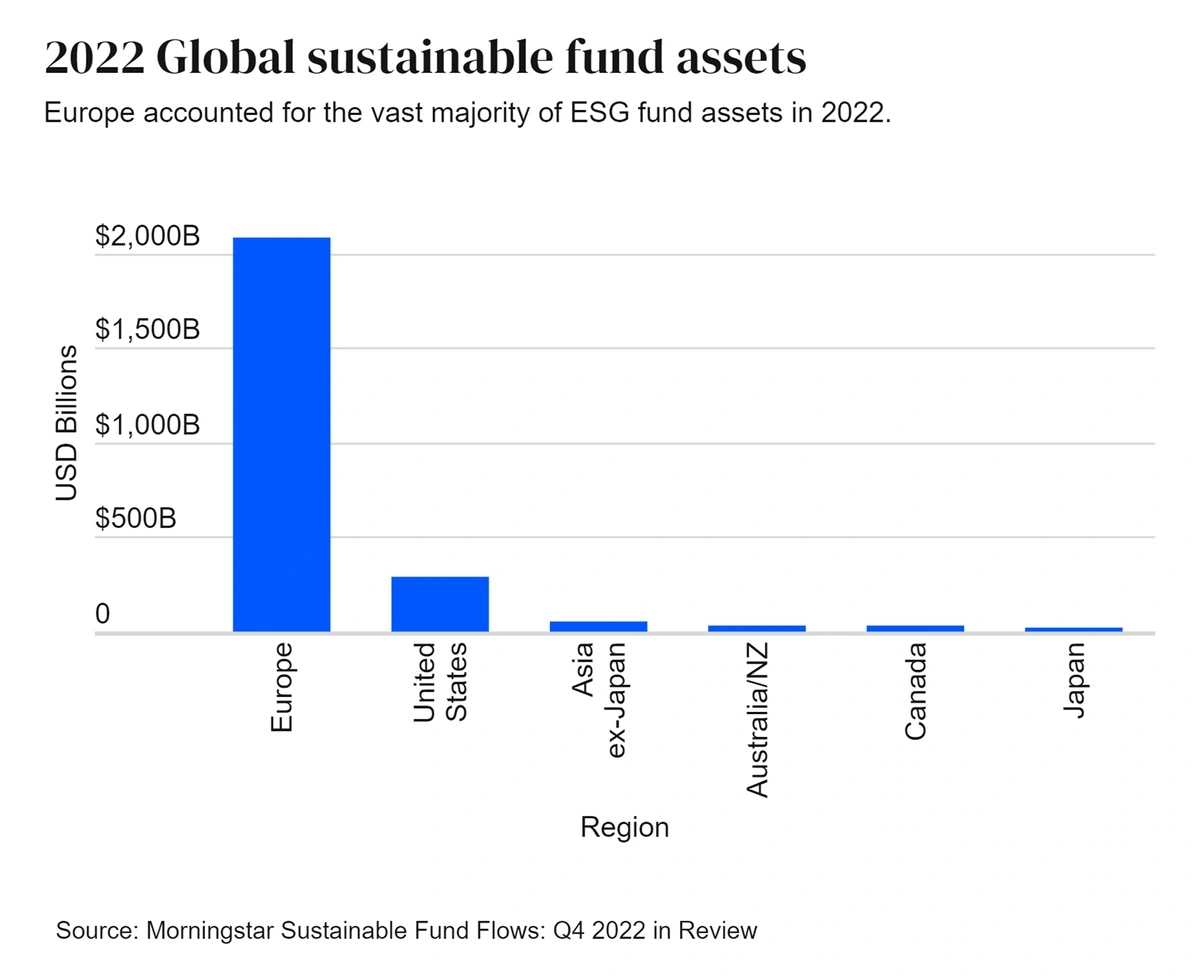

Data from the close of 2022 shows that Europe is leading ESG investment growth.

The US accounts for about 11% of ESG fund assets while Europe is responsible for 83% of those funds.

Europe leads the world in ESG assets.

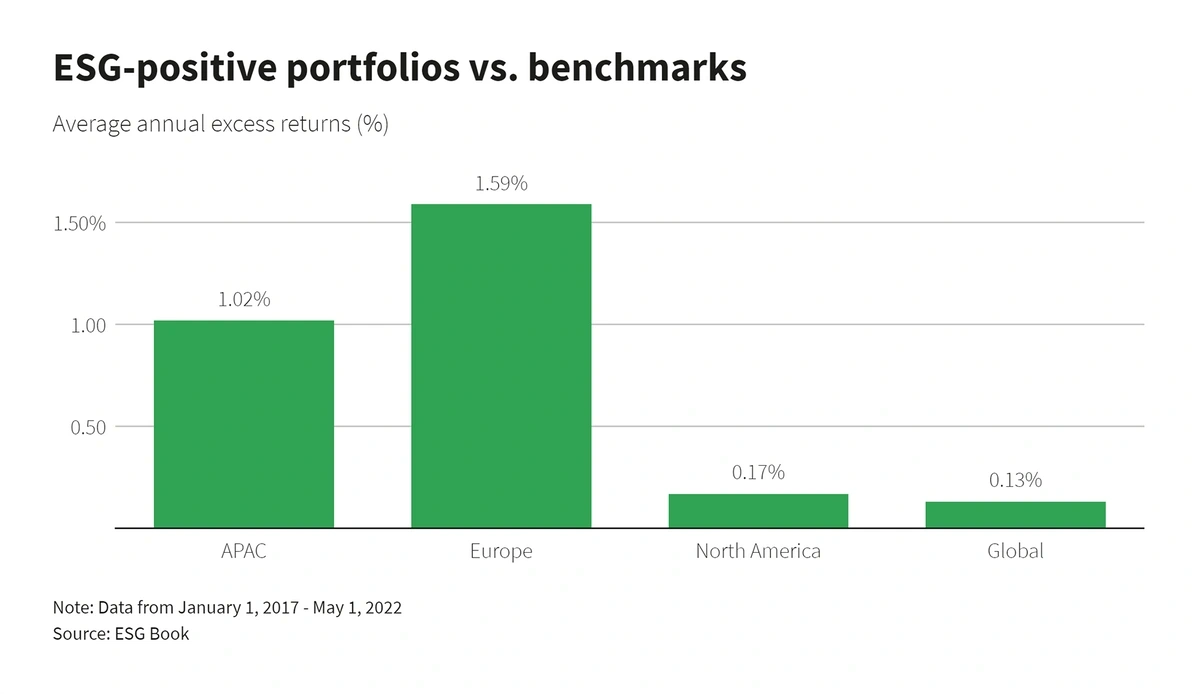

Research shows that ESG portfolios have provided better returns over the past five years, as well.

The excess returns are most notable in Europe where ESG portfolios provided a 1.59% excess return annually.

Globally, ESG portfolios produced 0.13% better returns when compared to benchmarks.

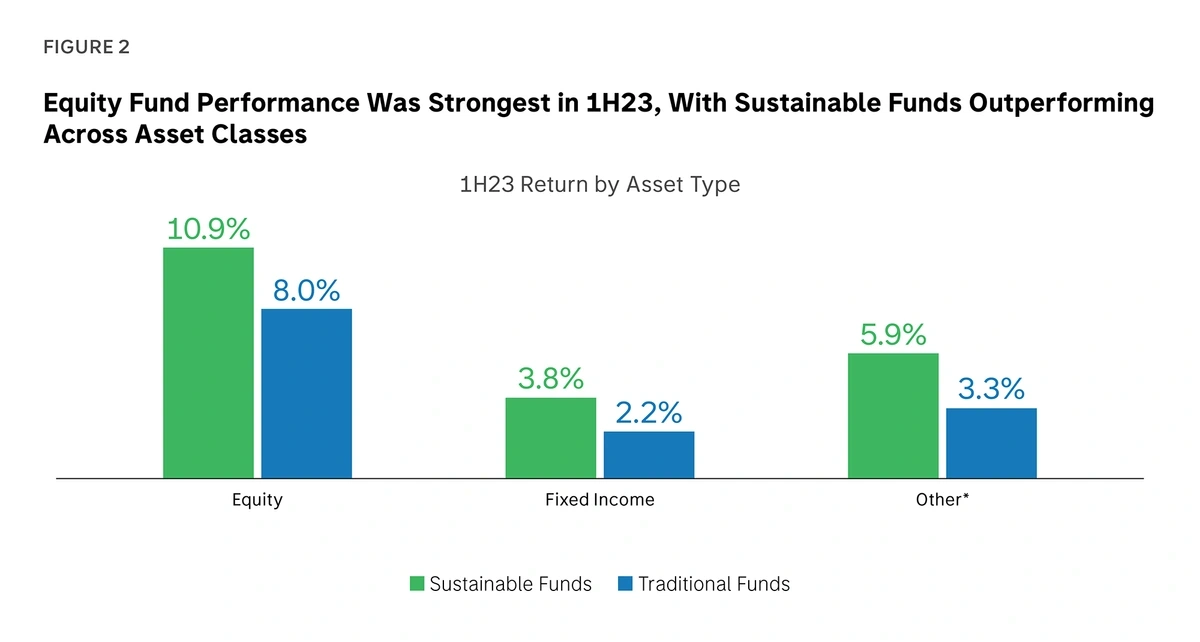

The performance of ESG funds was up in the first half of 2023, as well.

Morgan Stanley reported sustainable funds posted a median return of nearly 7% compared to a 3.8% return from traditional funds.

Positive performance was reported across all sustainable asset classes.

Much of the growth in this space has taken place in new ESG-focused ETFs.

Search interest in “ESG ETF” has grown more than 444% over the past 5 years.

At the close of 2022, ESG ETFs had assets surpassing $97 billion.

ESG ETFs grew rapidly in 2022.

As of mid-2023, the United States had more than 295 sustainable ETFs but that number is in flux.

Demand is not as high as it was in 2021, leading some firms to close certain ETFs while launching new ones.

For example, BlackRock recently closed two sustainable ETFs with total assets of $55 million. At the same time, the firm launched two other ETFs with $9 million in assets.

4. Gen Z Drives Continued Interest in Copy Trading

Social trading and copy trading first made headlines in 2020 when GameStop’s stock shot up due to a coordinated buying spree that was spurred on by social media.

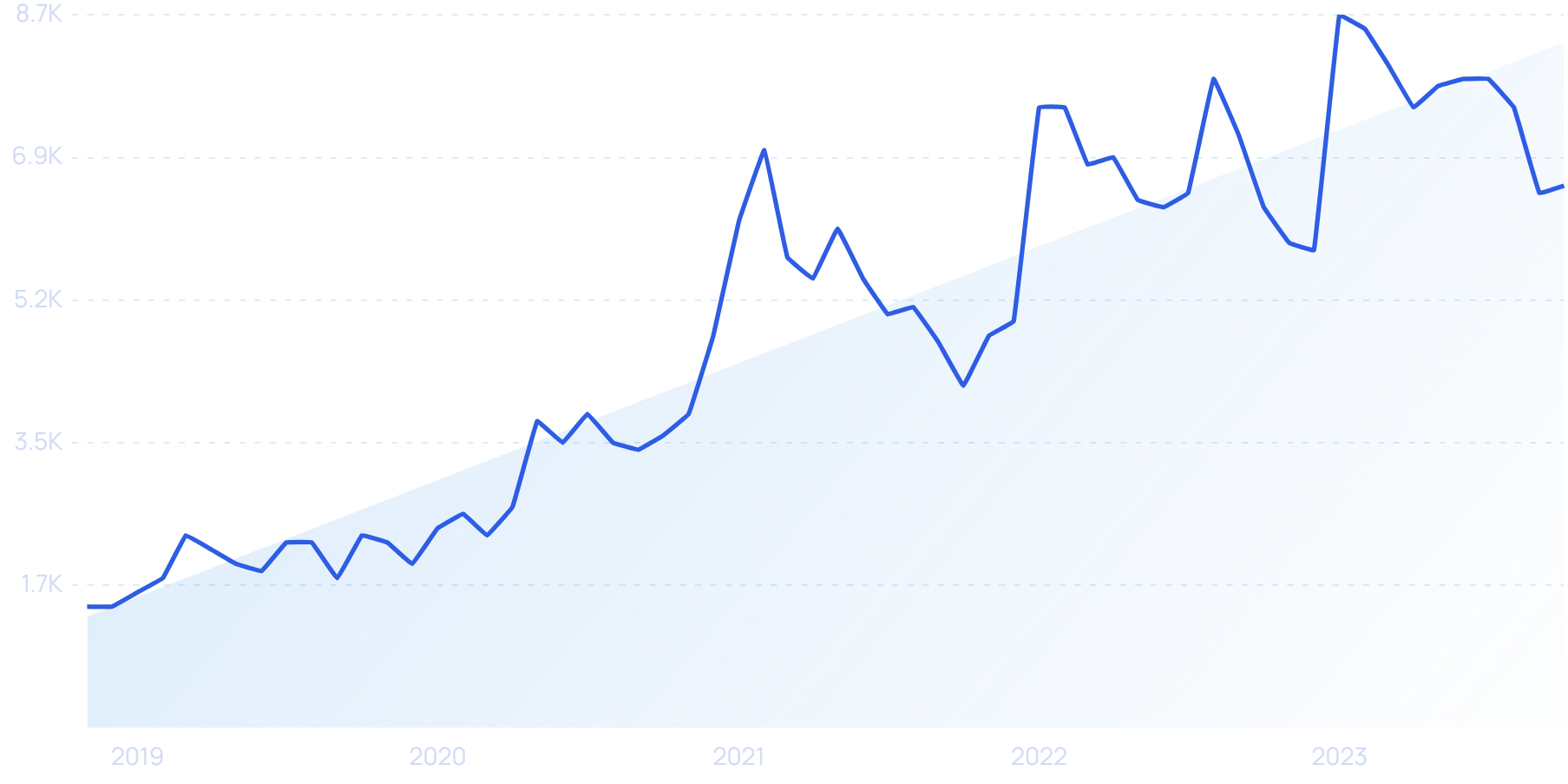

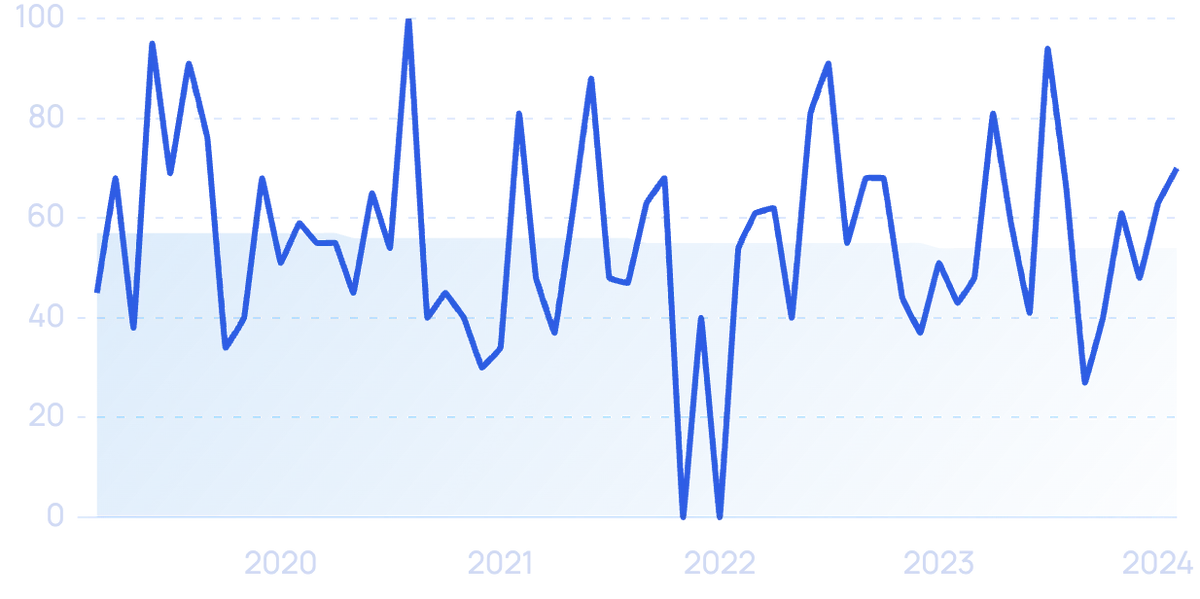

Search interest in “copy trading” has jumped more than 288% in the past 5 years.

Copy trading is the practice of replicating the trades of more experienced investors. This happens automatically via a copy trading platform, but the concept of copying trades is popular on social media communities like Reddit, too.

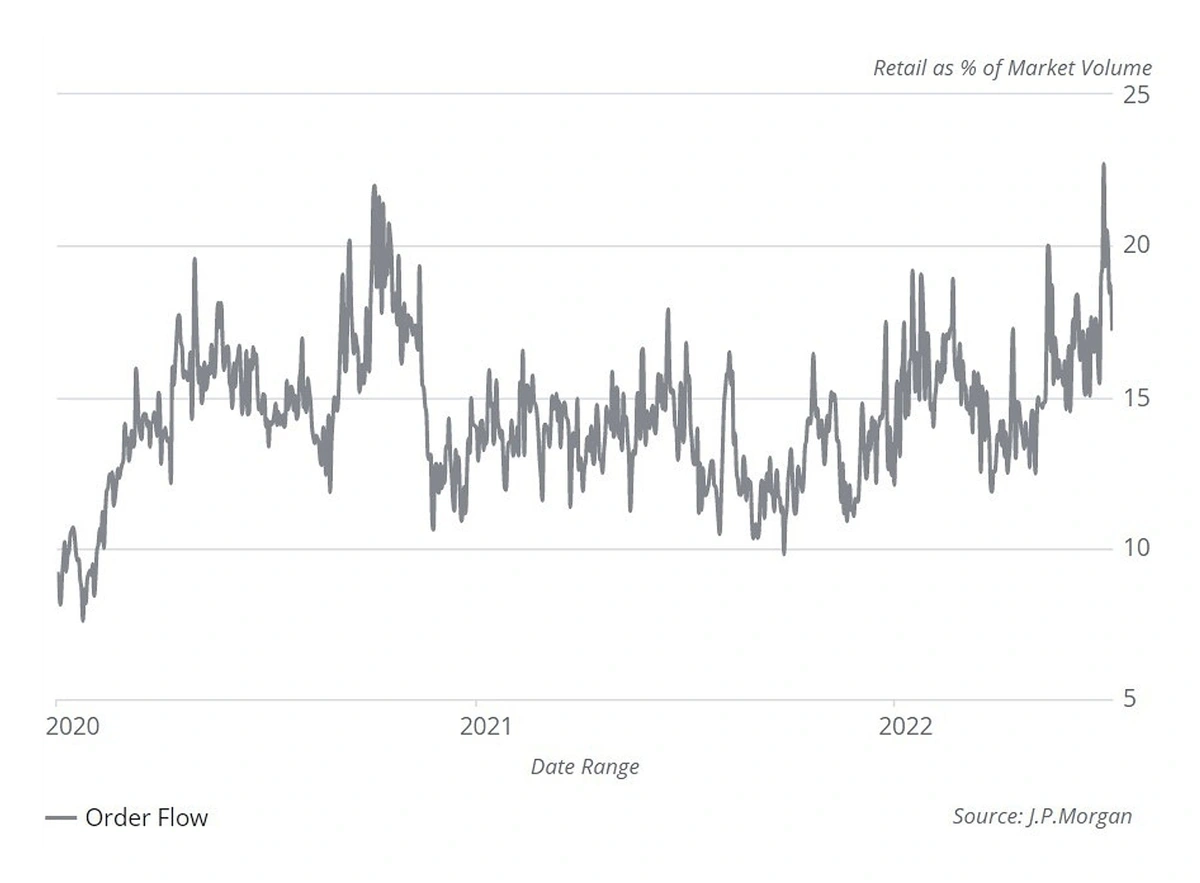

There was a bit of a lag in retail trading in 2021, but retail as a percent of market value surged to new heights in early 2023.

At the height of the GameStop surge retail as a percent of market value reached 22%, but in January 2023, it hit 23%.

Spikes in retail trading were seen in late 2020 and early 2023.

By mid-2023, retail trading was responsible for $1.36 billion per day.

The latest surge shows that social trading is still wildly popular.

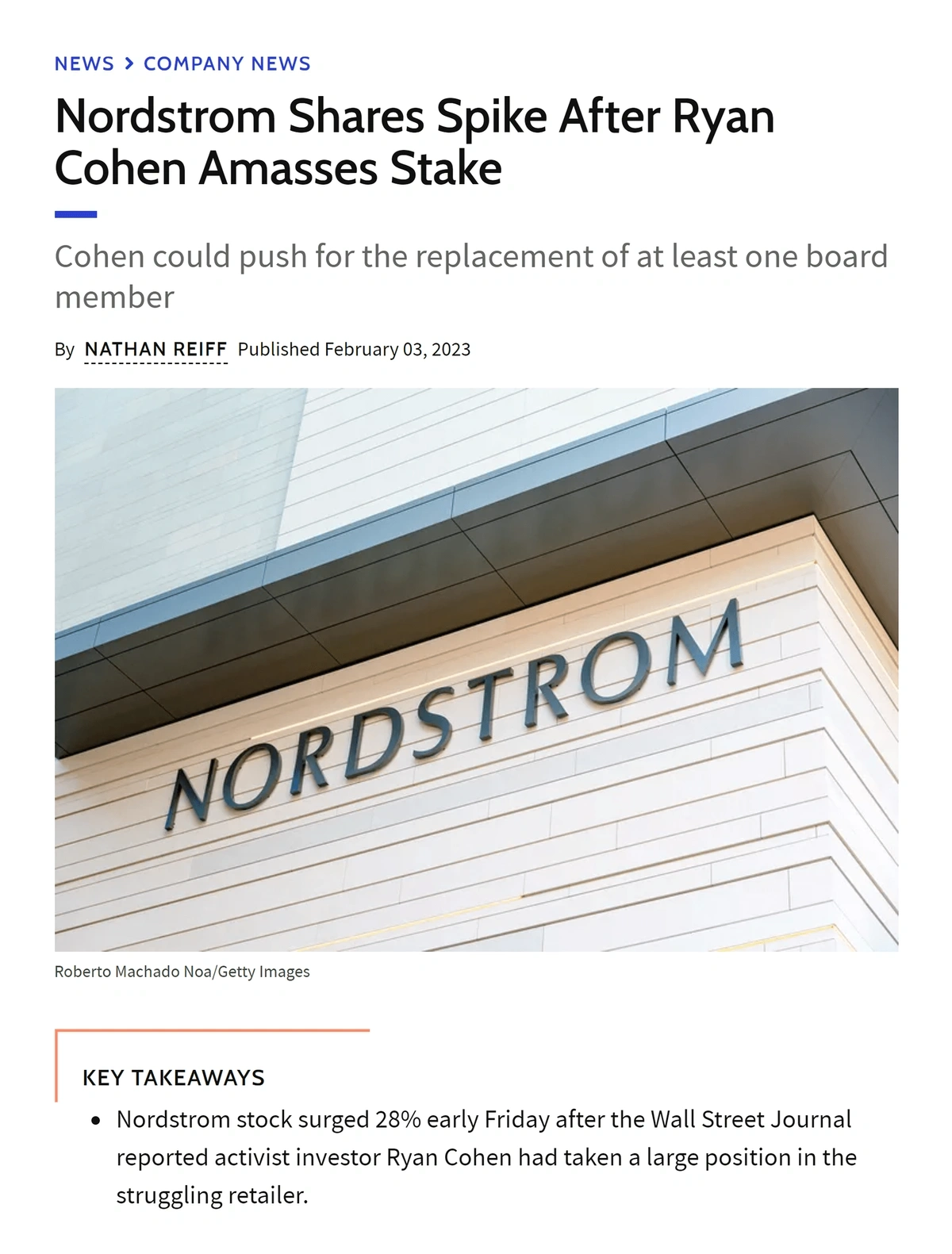

For example, Ryan Cohen, an activist investor who was largely influential in the GameStop meme stock, bought up a big stake in Nordstrom in early 2023. Once online investor communities noticed, shares of Nordstrom’s stock shot up nearly 30%.

Ryan Cohen’s investments often spur copy trading.

Gen Z is driving much of the interest in retail trading and copy trading.

According to the Financial Industry Regulatory Authority (FINRA), more than 40% of Gen Zers are currently invested in stocks compared to 38% of Millennials.

And they started investing at a young age — before they were 18 years old.

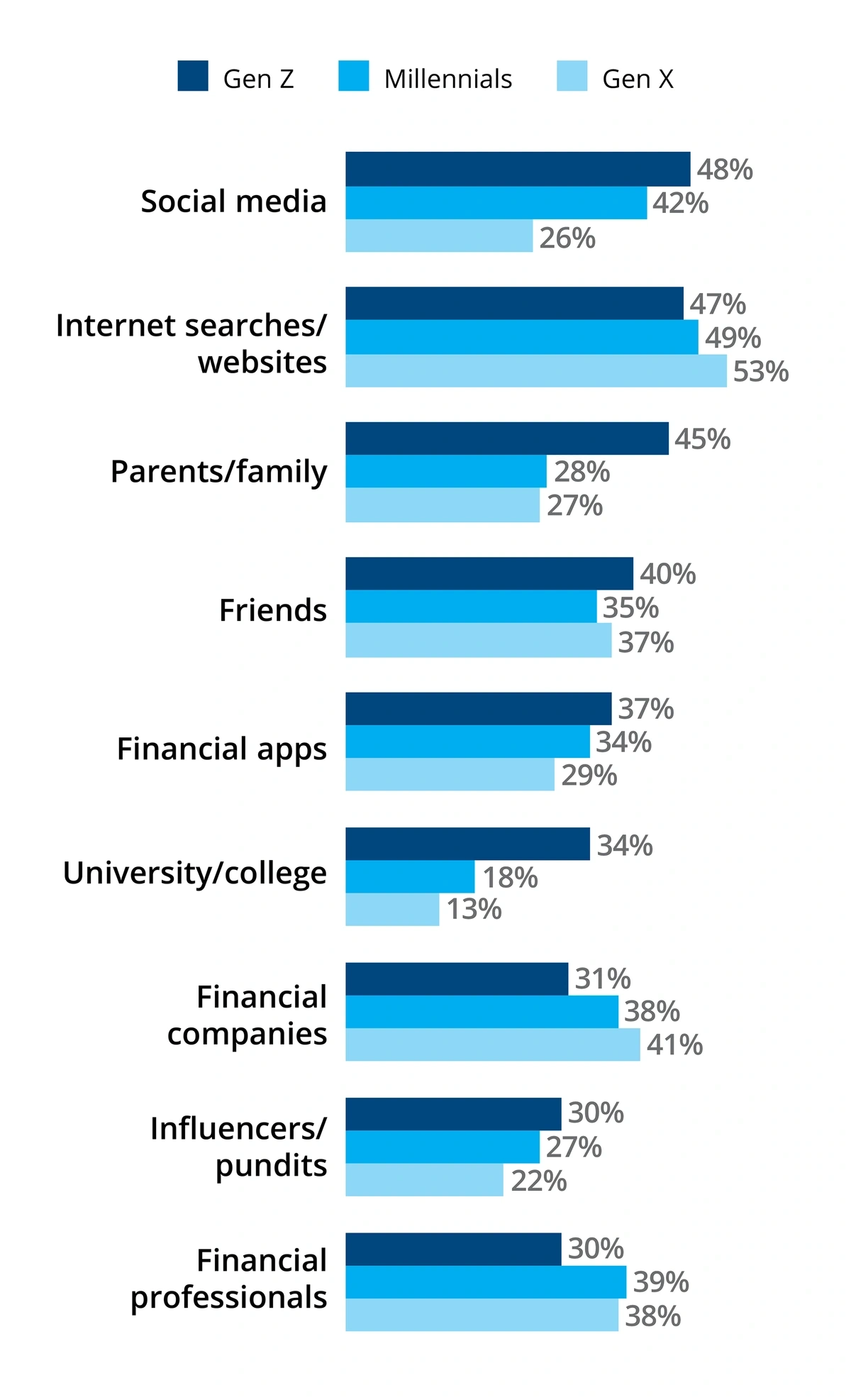

Gen Z primarily uses social media and internet searches to find out about investments, according to FINRA data.

Nearly half of Gen Zers use social media to learn about investments.

YouTube is the number-one resource with 60% of Gen Zers saying they use the site to learn about financial investing. Nearly 45% use Instagram and 37% use TikTok.

C3.ai (2.6 million views on TikTok), Tupperware (4.6 million views on TikTok), and Blackberry (647 million views on TikTok) are a few of the biggest meme stocks from 2023.

Search interest in “C3.ai” surged in 2021 and 2023.

5. Alternative Investments Lead to Non-traditional Portfolios

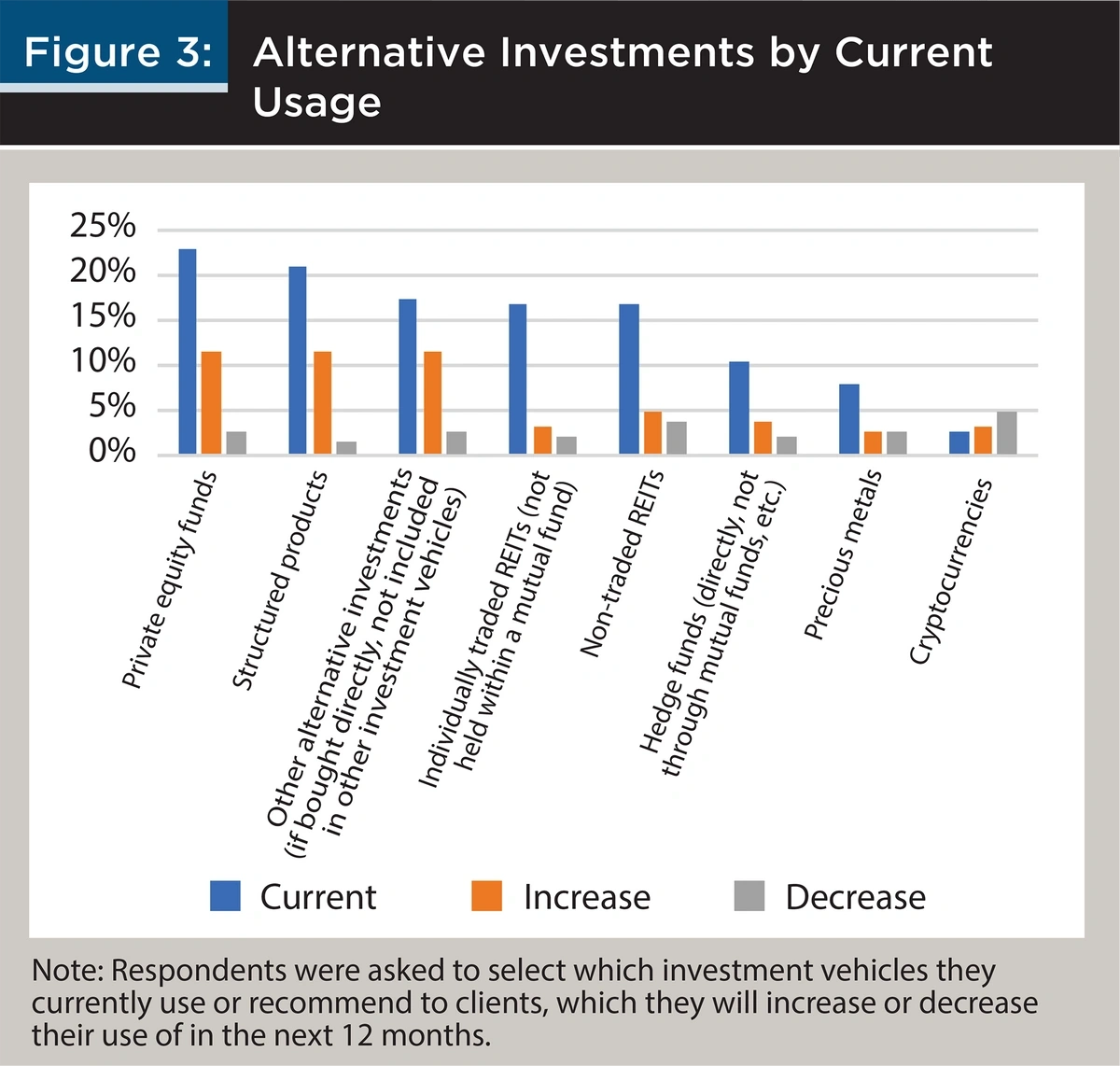

Nearly 30% of investment professionals are actively searching for or already using alternative investments for their clients. That’s according to a recent survey from The Journal of Financial Planning.

Interest in alternative investments if growing.

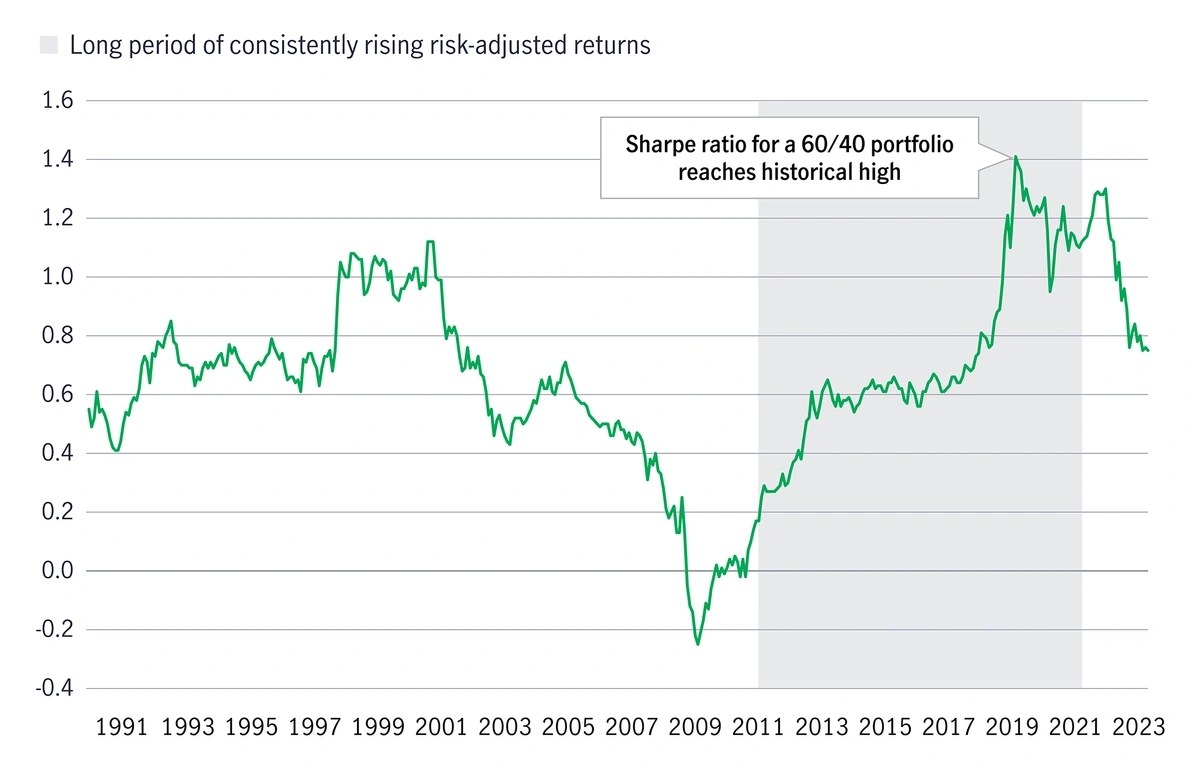

The rise in alternative investments comes as returns for the traditional 60/40 stock-bond portfolio take a hit.

In 2019, the 60/40 portfolio saw its highest returns in more than 40 years.

Both private equity and private debt are attractive investments at this time since they present the possibility of low volatility and high cash yields.

In fact, private capital investments are expected to grow to $1.3 trillion by 2027.

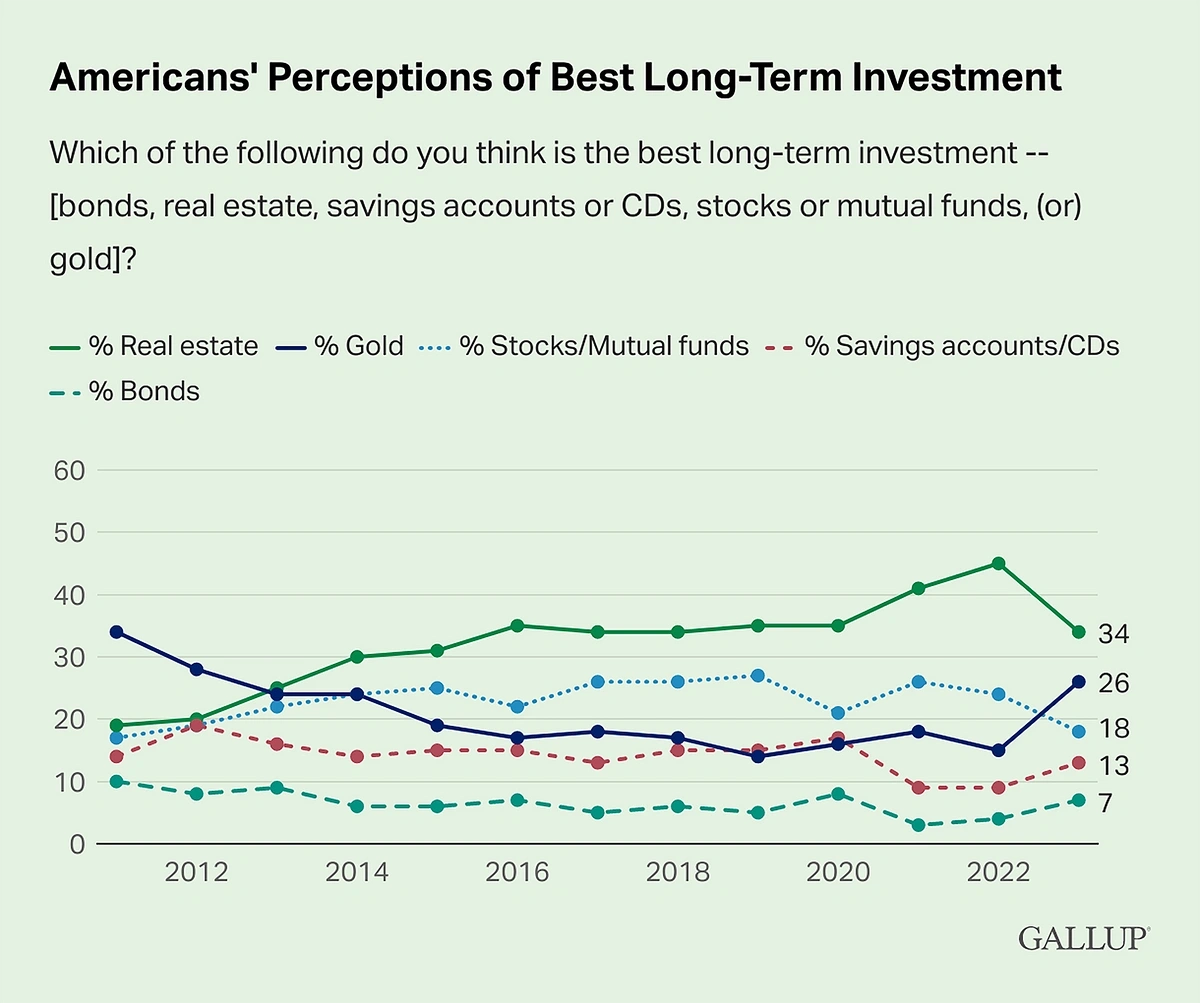

Gold is an alternative investment that’s most often popular during times of economic uncertainty.

Today, investments in both physical gold bars and gold IRAs are on the rise.

A Gallup poll reported that the number of people who believe gold is the best long-term investment nearly doubled between 2022 and 2023, from 15% to 26%.

Gallup’s poll reported on American’s opinions regarding the best long-term investments.

Gold prices were up 8% for the year as of August 2023, and analysts expect to see gold trade between $1,850 and $1,970 throughout the remainder of the year.

On the other hand, investing in art is a relatively new way people are diversifying their portfolios.

Masterworks was the original platform in the fractional art market, but many new platforms have emerged in recent years.

The Freeport app is just one example.

Search interest in the “Freeport App” in recent years.

The platform allows individuals to purchase shares in pieces of art. They can trade shares or collect a payout when the art is sold.

Data supplied by the company suggests 8.9% annualized returns and performance that’s 40.4% better than returns from the S&P 500.

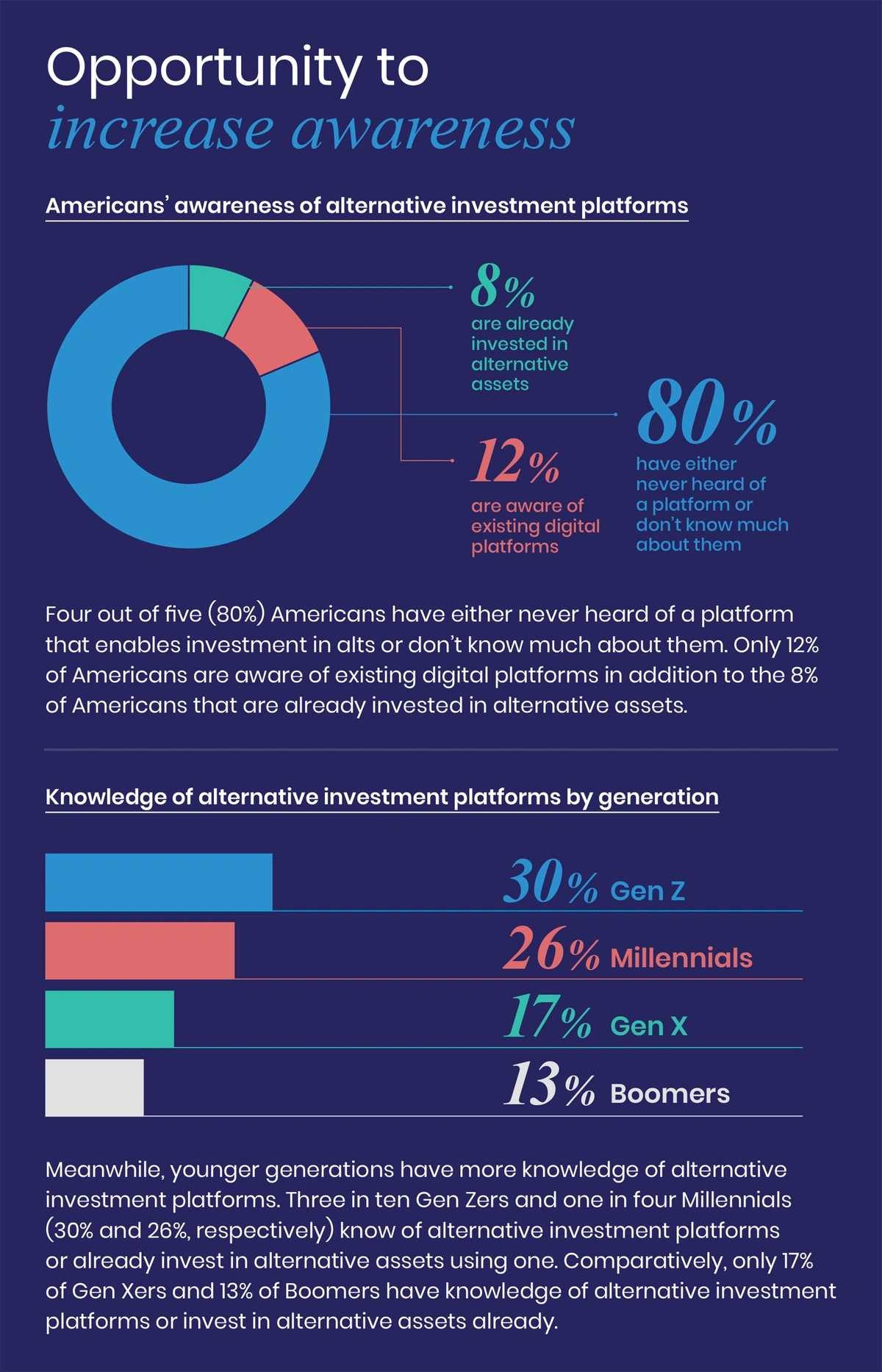

Overall, data shows that alternative investments are another trend being driven by young investors.

When looking at all Americans, just 8% are investing in alternative assets.

However, 30% of Gen Zers and 26% of Millennials are knowledgeable about alternative assets or already taking part in this strategy.

Alternative investments are especially popular among younger generations.

In all, PwC predicts the AUM of alternative asset classes will reach more than $21 trillion by 2025, representing 15% of global AUM.

This growth is particularly true for high-net-worth individuals.

Nasdaq reports that billionaires currently have approximately 51%-54% of their assets invested in alternatives.

6. A New Way to Invest in Real Estate

With rising prices and interest rates, many are considering investments in commercial real estate and residential homes to be too risky right now.

However, fractional real estate is an alternate investment that’s booming.

Search interest in “fractional real estate” has jumped more than 214% in recent years.

This type of investing allows individuals to buy shares of a property, presenting a significantly lower price than if they wanted to buy the entire property on their own.

People are drawn to this type of real estate investing because it’s liquid and generates passive income. And, it’s easy to do.

A number of fractional real estate platforms have popped up in recent years.

The first platform, Fundrise, emerged about 10 years ago.

The platform now has more than 387,000 investors and a portfolio worth more than $7 billion. That includes single-family homes, multi-family apartments, and industrial real estate.

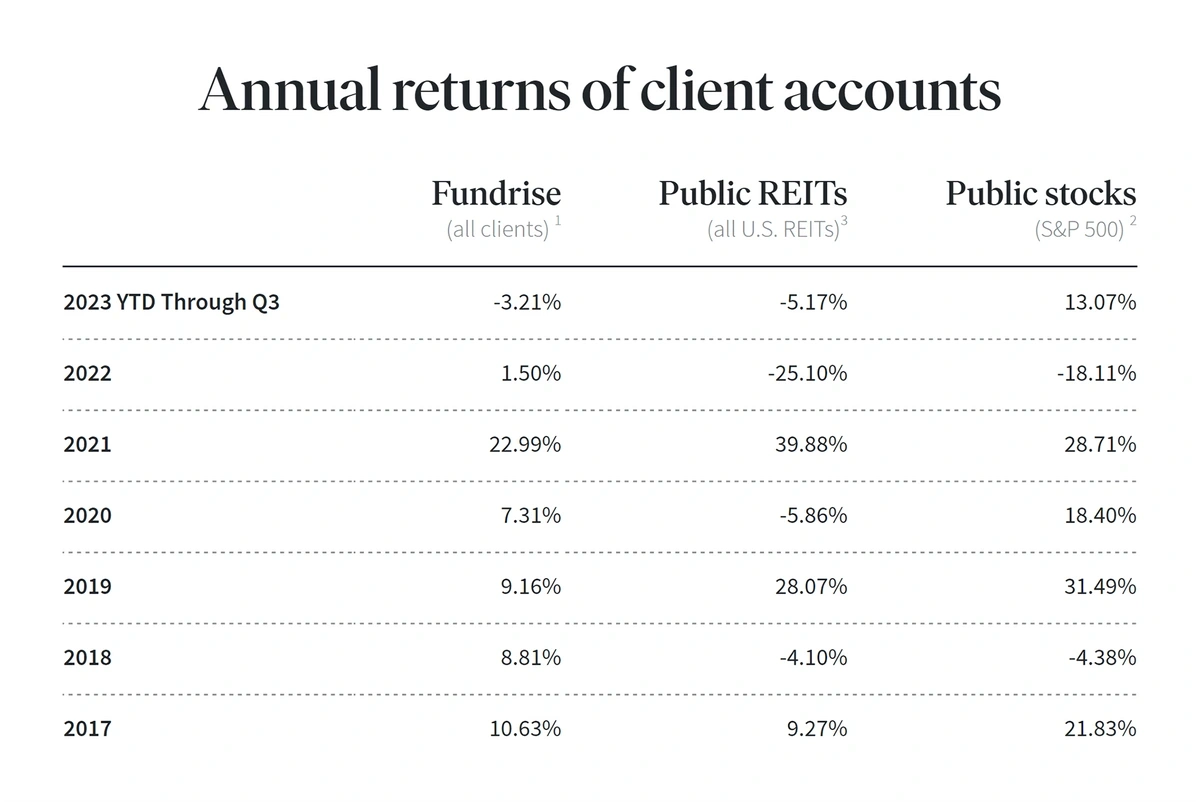

Returns over the past few years have varied.

2021 was a blockbuster year with a nearly 23% annual return. Since then, returns have been modest but the investment has performed well in comparison to REITs.

2021 was the best year for investors on Fundrise.

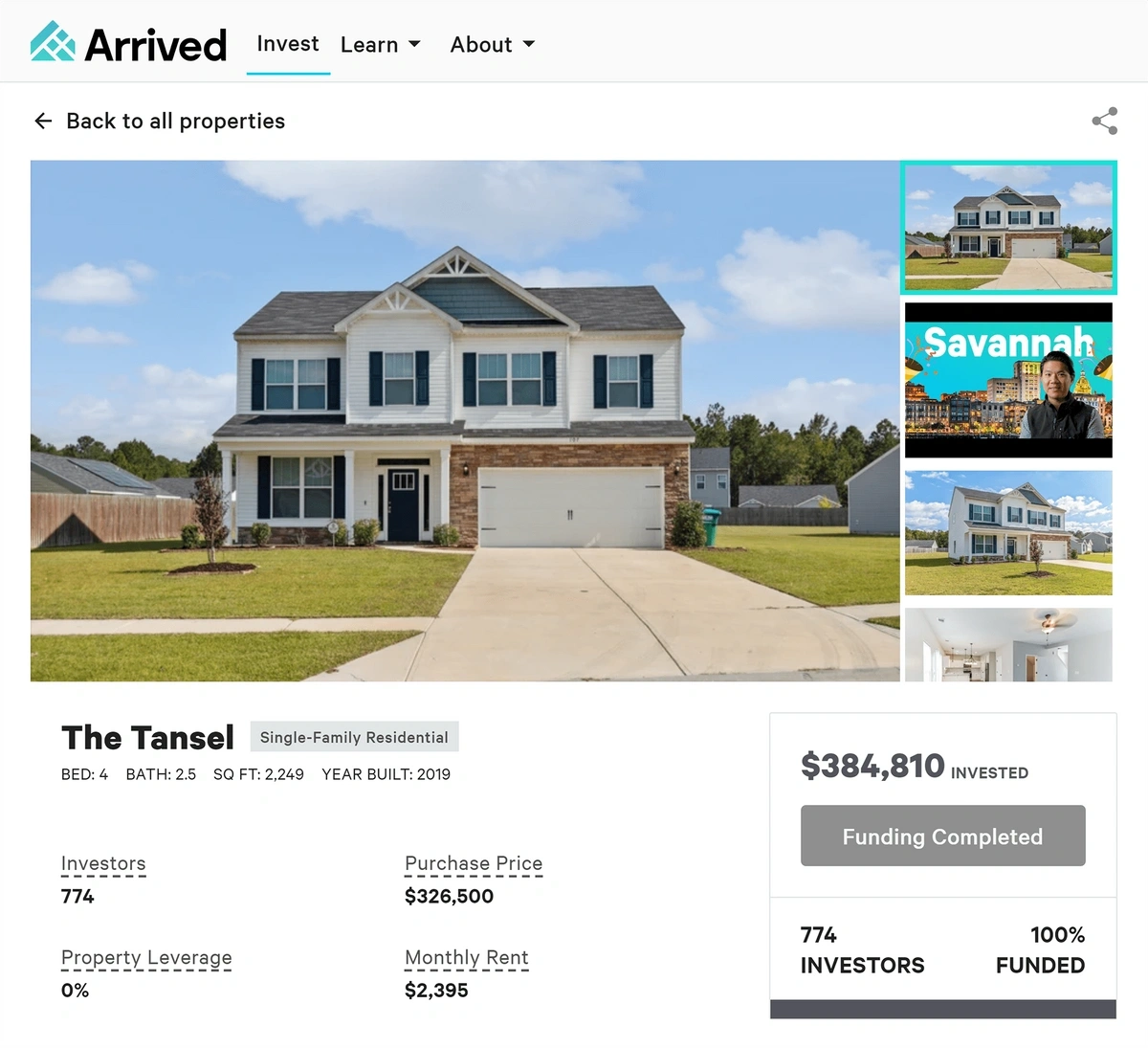

Arrived Homes is a startup platform launched in 2020 that’s focused on fractional ownership of rental and vacation homes.

The company has secured funding from Jeff Bezos and Uber CEO Dara Khosrowshahi, as well as completing a $25-million Series A funding round in mid-2022.

This home in Georgia was funded by 775 individual investors.

And its base of investors is growing quickly. There are already more than 451,000 investors on the platform.

There’s so much demand, in fact, that homes have sold out in less than 24 hours.

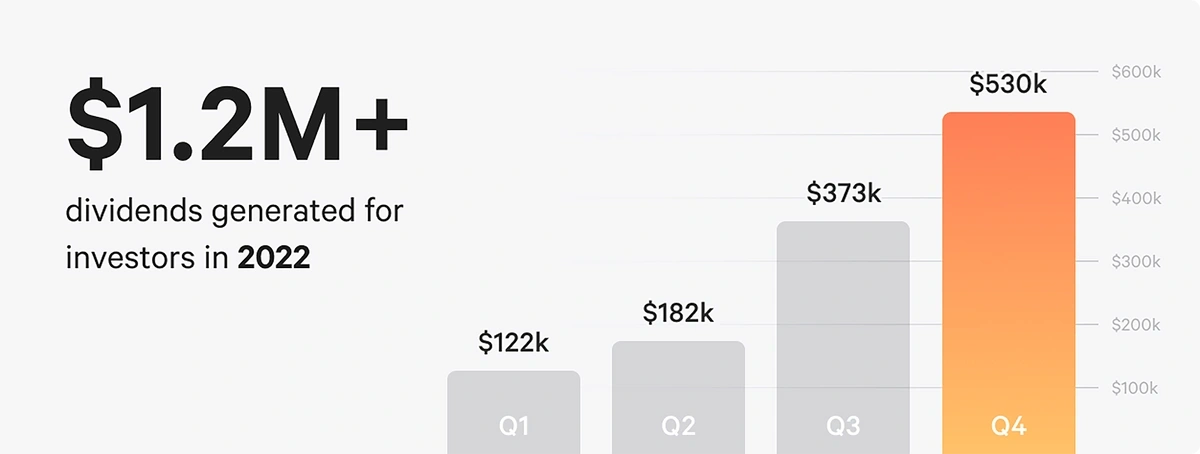

In 2022, investors on Arrived were paid a total of $1.2 million in dividends.

Arrived’s dividends grew throughout 2022.

7. Investors Renew Their Interest in Global Markets

With economic uncertainty still looming in the US economy, some investors have turned their attention to overseas markets.

As of mid-2023, holdings in US equity mutual funds and ETFs were down $7 billion but US investment in non-US funds of the same type were up $56 billion.

Investors seem to have a particularly optimistic outlook when it comes to Asian markets.

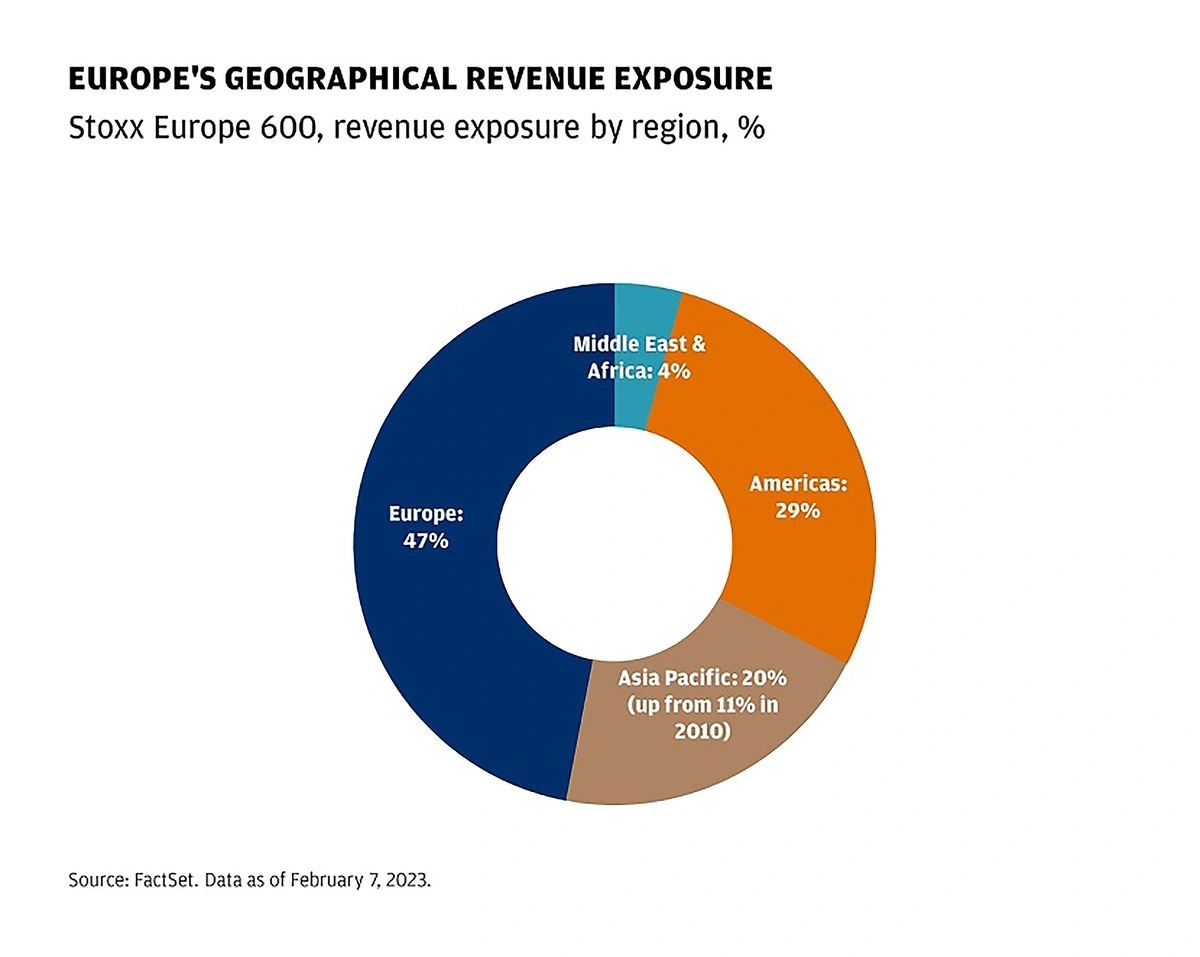

Since 2010, Asia’s share of the Stoxx Europe 600 has increased from 11% to 20%.

Asia has shown rapid growth in the Stoxx Europe 600.

Analysts believe inflation has already peaked in Asia and they don’t expect any more policy rate hikes.

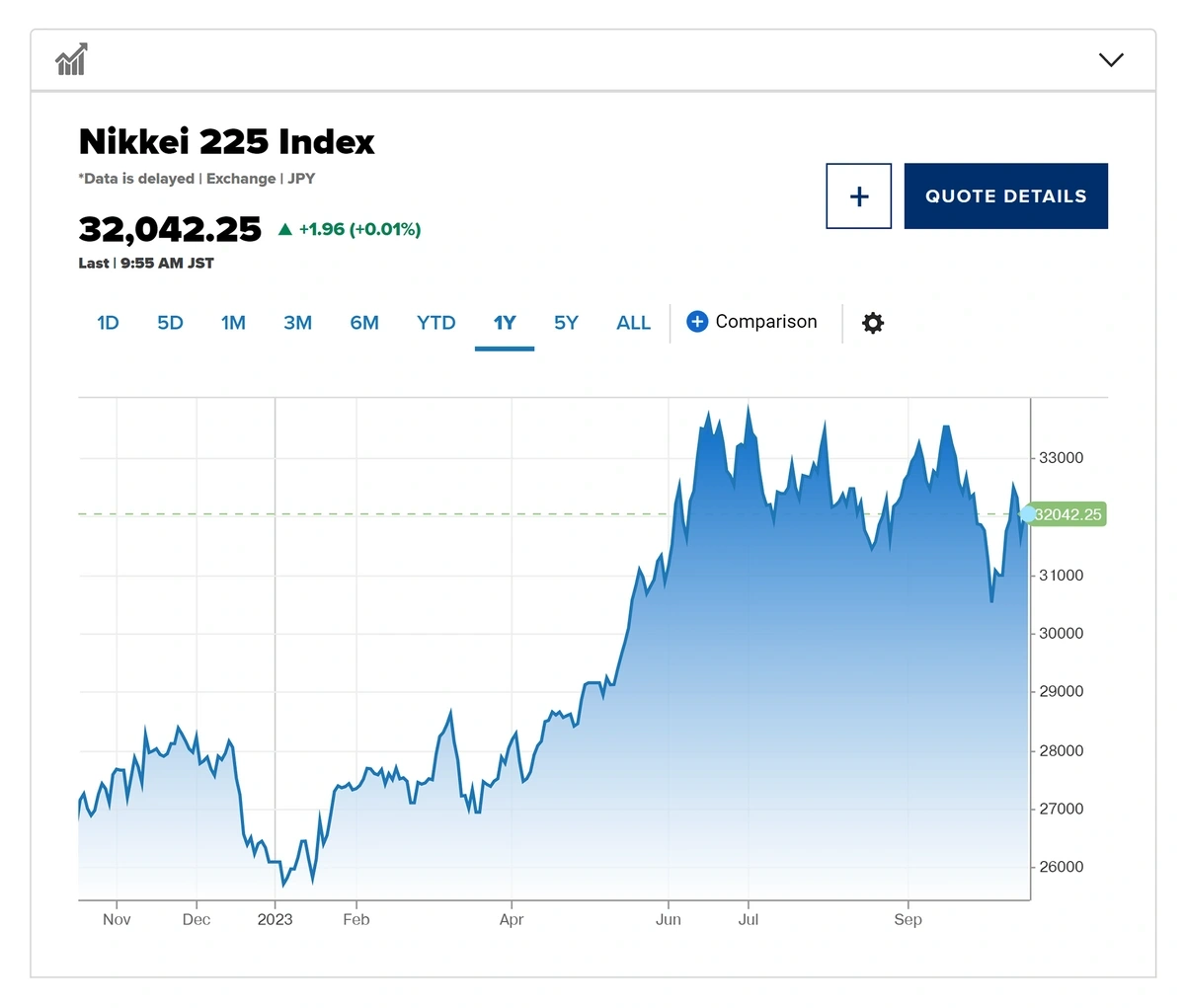

In one example from Asia, Japan’s markets showed exceptional performance in 2023.

By mid-year, the Nikkei 225 was up nearly 25% and the TOPIX was up more than 21%.

The Nikkei 225 surged in mid-2023.

In April 2023, Warren Buffett said that he intended to up his investment in Japanese stocks.

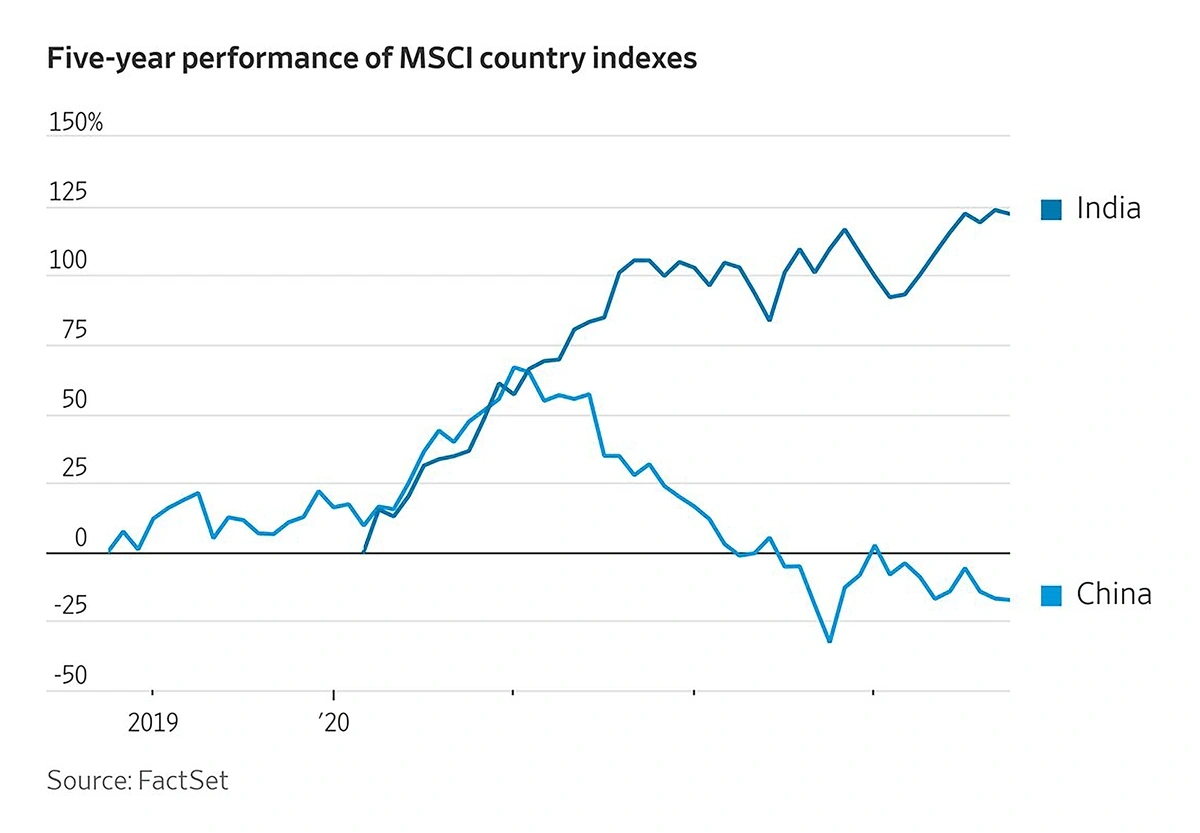

Investors are also taking notice of India’s stock market.

The MSCI India index was up 7% year-over-year as of October 2023.

India’s MSCI index is outperforming China’s MSCI index.

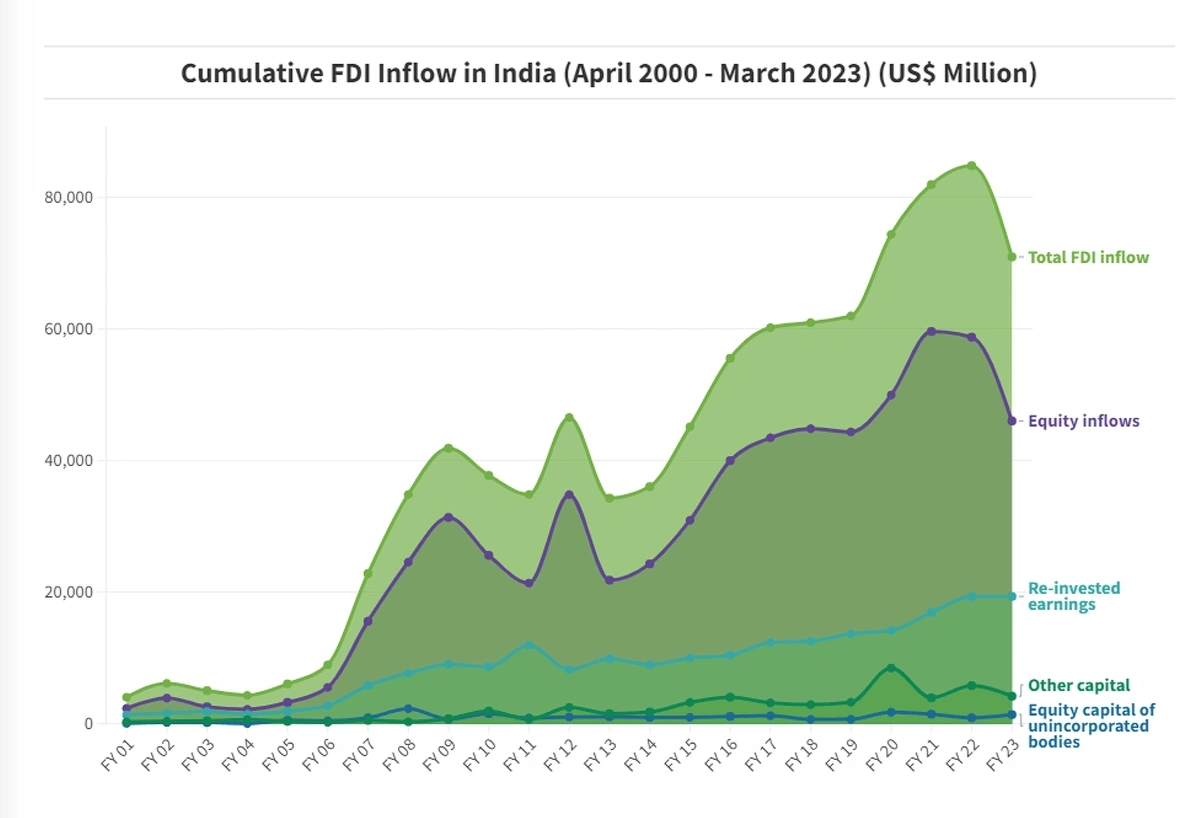

Between April 2000 and March 2023, foreign direct investments in India have added up to more than $919 billion.

Total FDI inflow in India has been growing despite a drop in inflows in 2023 due to global pressures.

The value of Indian equities now totals more than $3.5 trillion.

India’s growing population, young (and wealthy) workforce, and increase in tech firms are just a few of the reasons Americans are looking at investments in this emerging market.

8. Fixed-Income Investments Offer Stability and High Returns

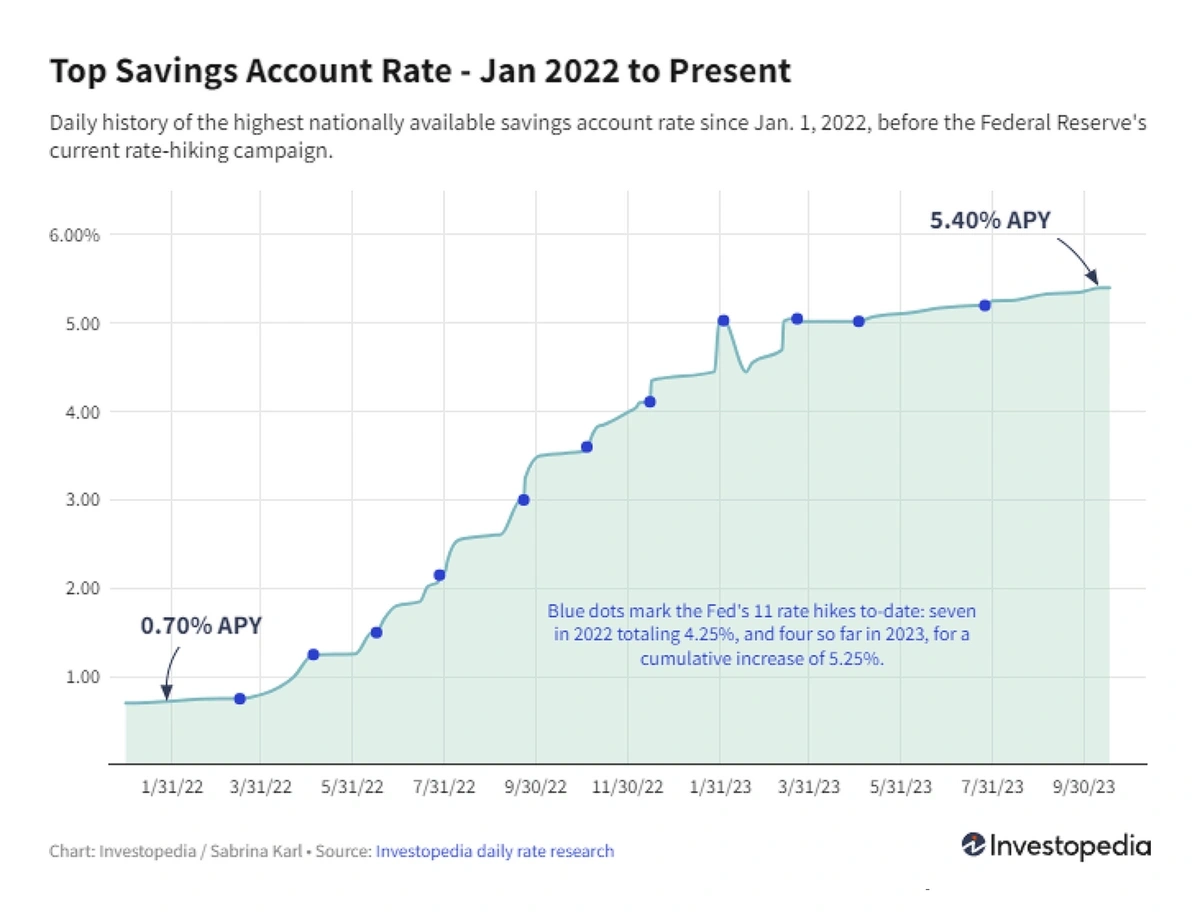

Thanks to high interest rates, fixed-income investments posted returns above 5% in 2023.

High-yield savings accounts (HYSA) are one area of interest for conservative investors.

The national average rate for savings accounts is 0.58%, but a HYSA can yield over 5%.

For instance, Ally, which offers one of the most popular HYSAs, offered an APY of 0.6% in May 2022. As of August 2023, the rate was up to 4.25%.

Search interest in “Ally High Yield Savings Account” jumped in late 2022.

And, if the Fed continues to raise interest rates, these yields could increase even more.

Interest rates continue to rise on high-yield savings accounts.

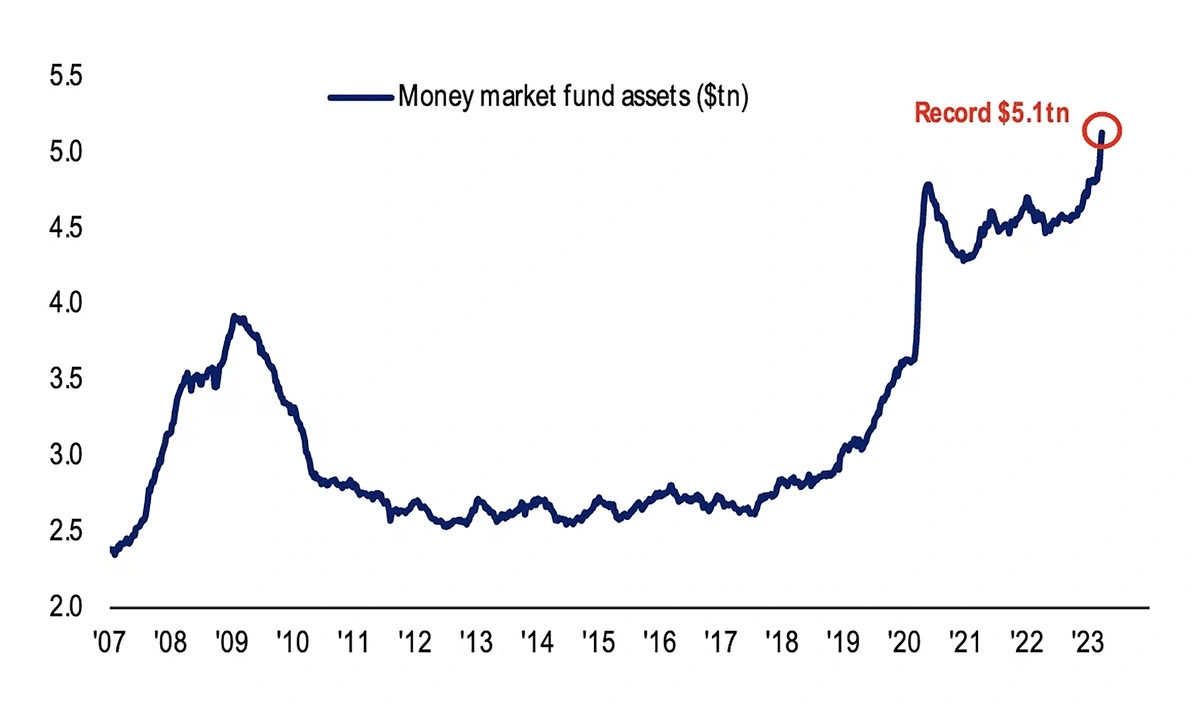

Another trending fixed-income investment is money market funds.

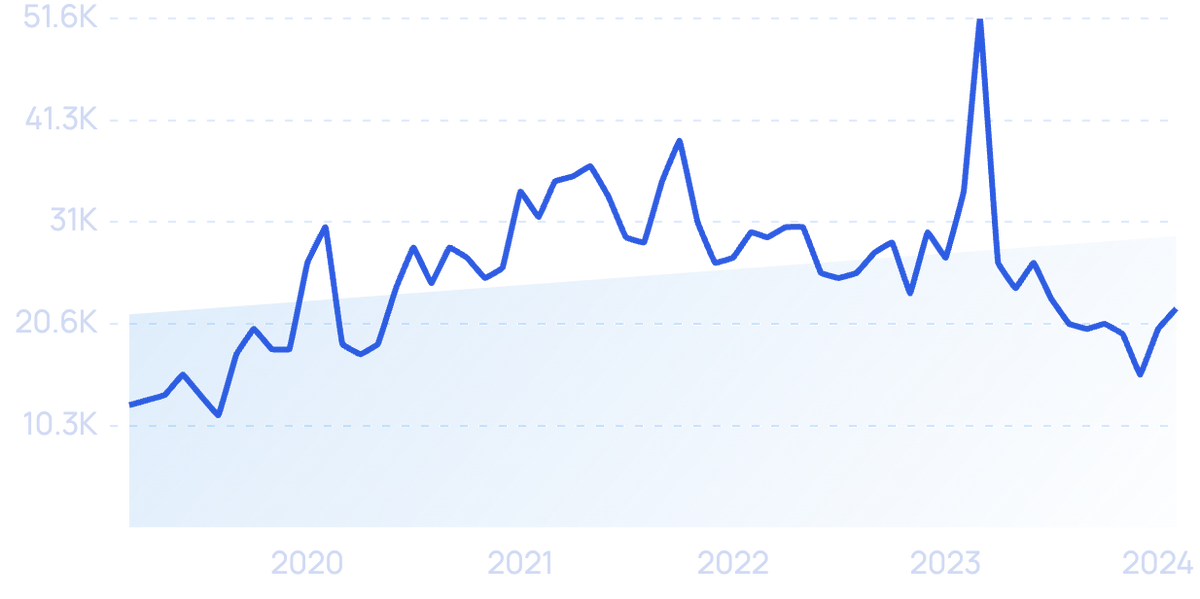

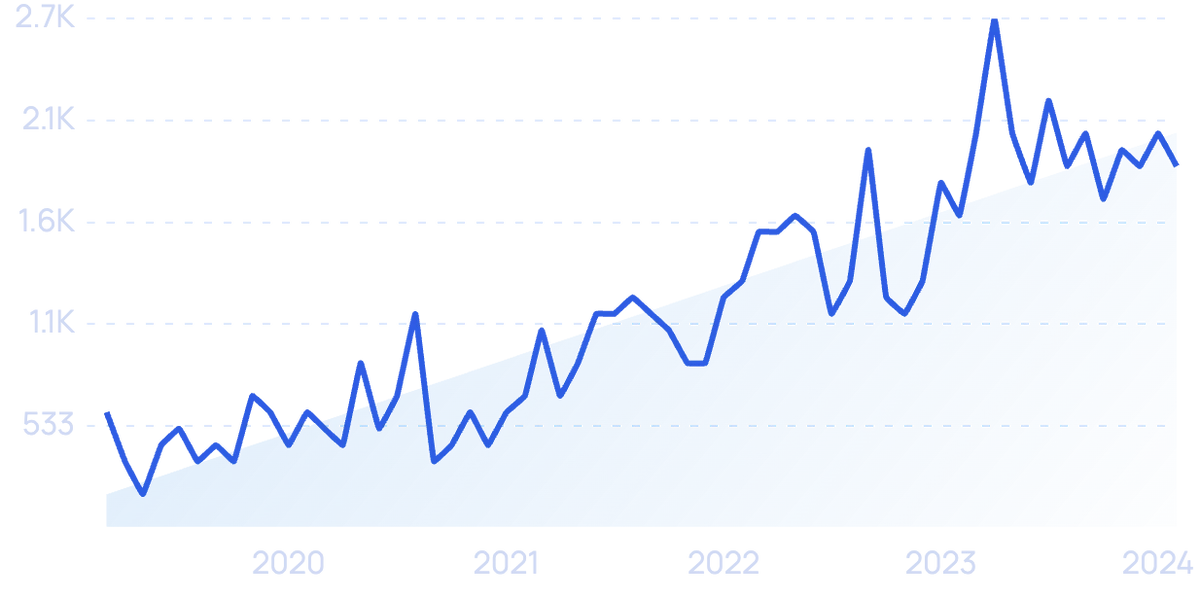

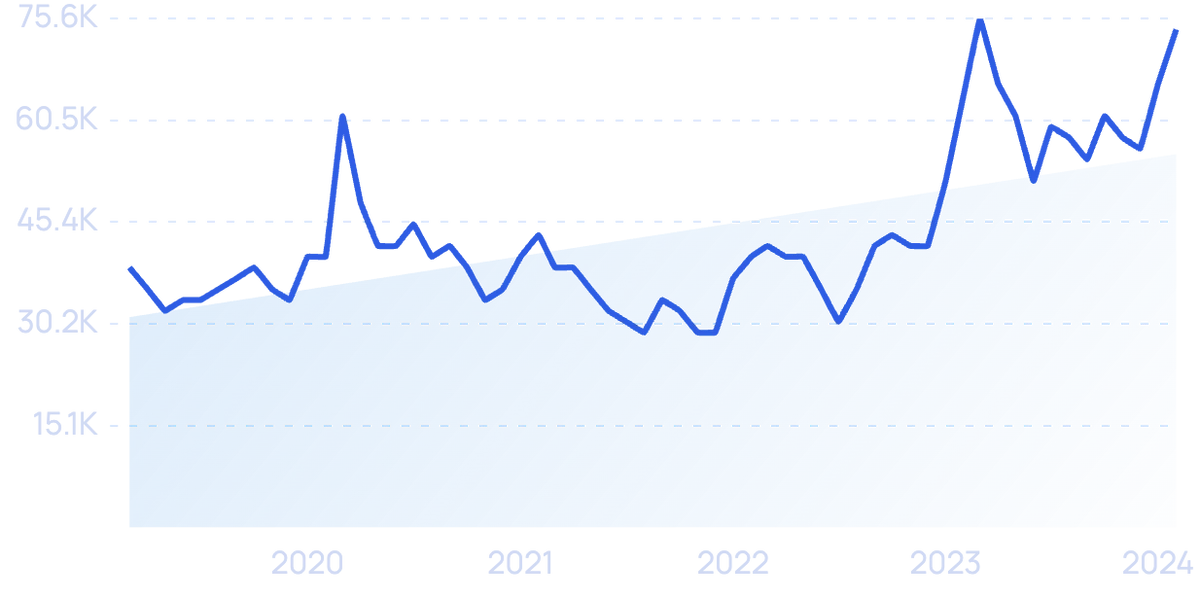

Search volume for “money market fund” spiked in 2023.

Assets in money market funds totaled more than $5.1 trillion in the first quarter of 2023.

AUM in money market funds dramatically increased in 2020 and continue to climb to record highs in 2023.

Some analysts predicted a record-setting year with more than $1.5 trillion flowing into money market funds in 2023 alone.

Much like high-yield savings accounts, rates for money market funds have been hovering around 5% in 2023 — the highest rates in 15 years.

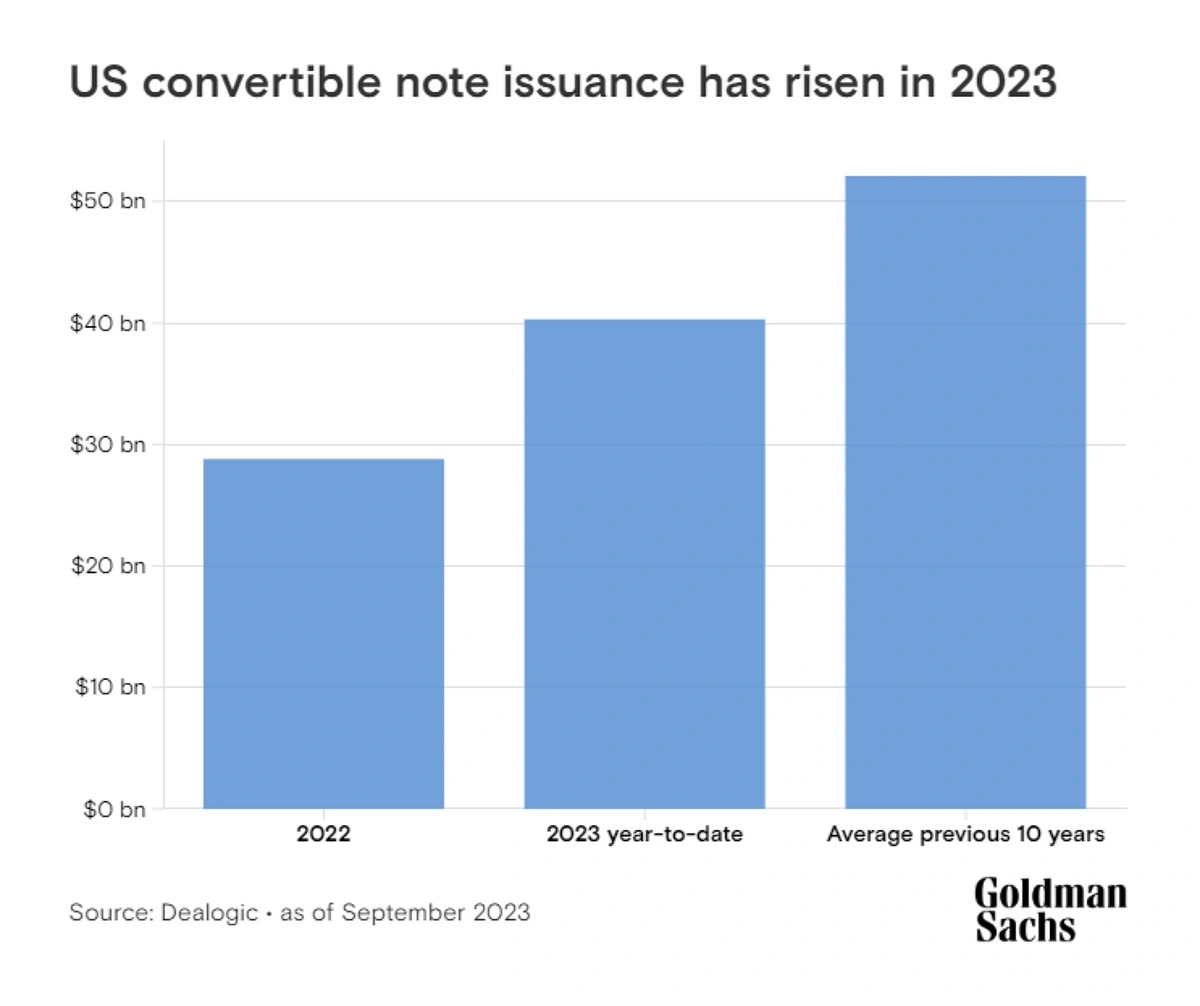

Goldman Sachs reported that US companies have issued more than $40 billion of convertible bonds as of September 2023.

That included one single week in which there were $5 billion of convertible bonds issued.

Convertible bond issuance.

Much of this uptick has come from the utilities, energy, and semiconductor sectors, according to Goldman Sachs.

The firm expects this surge to continue well into 2024.

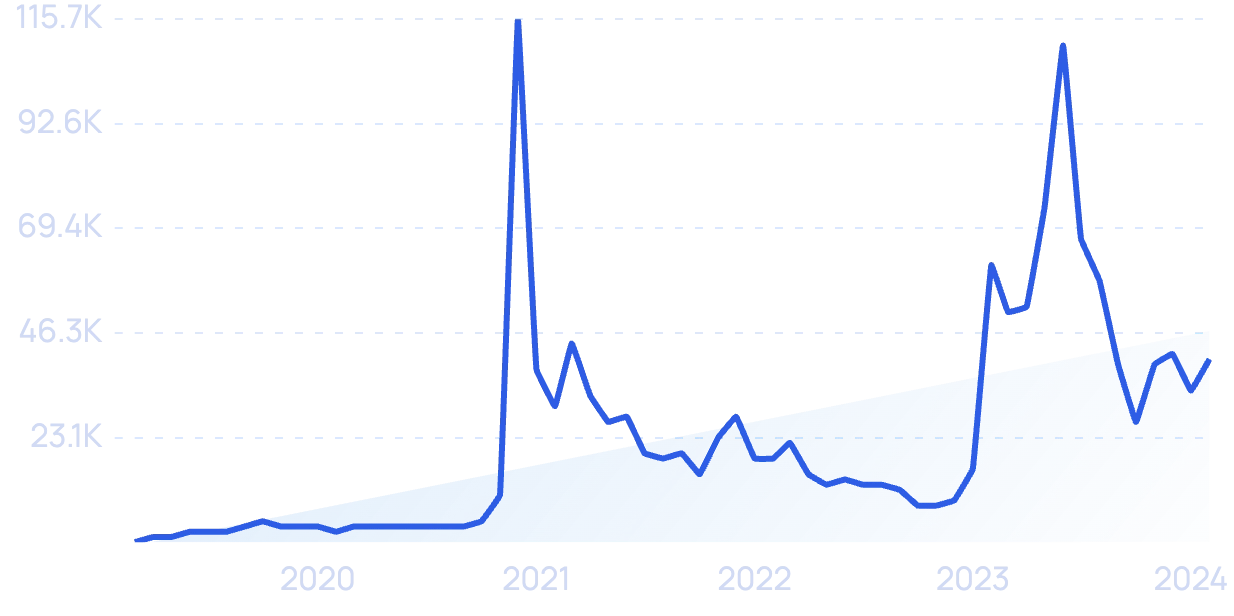

9. Uncertainty Amid Optimism in Cryptocurrency Sector

The cryptocurrency market has been a rollercoaster for investors in recent years.

Despite that, some analysts are signaling optimism for investing in the crypto market.

In early 2023, the cryptocurrency market surpassed $1 trillion in market capitalization.

One bright spot is Bitcoin.

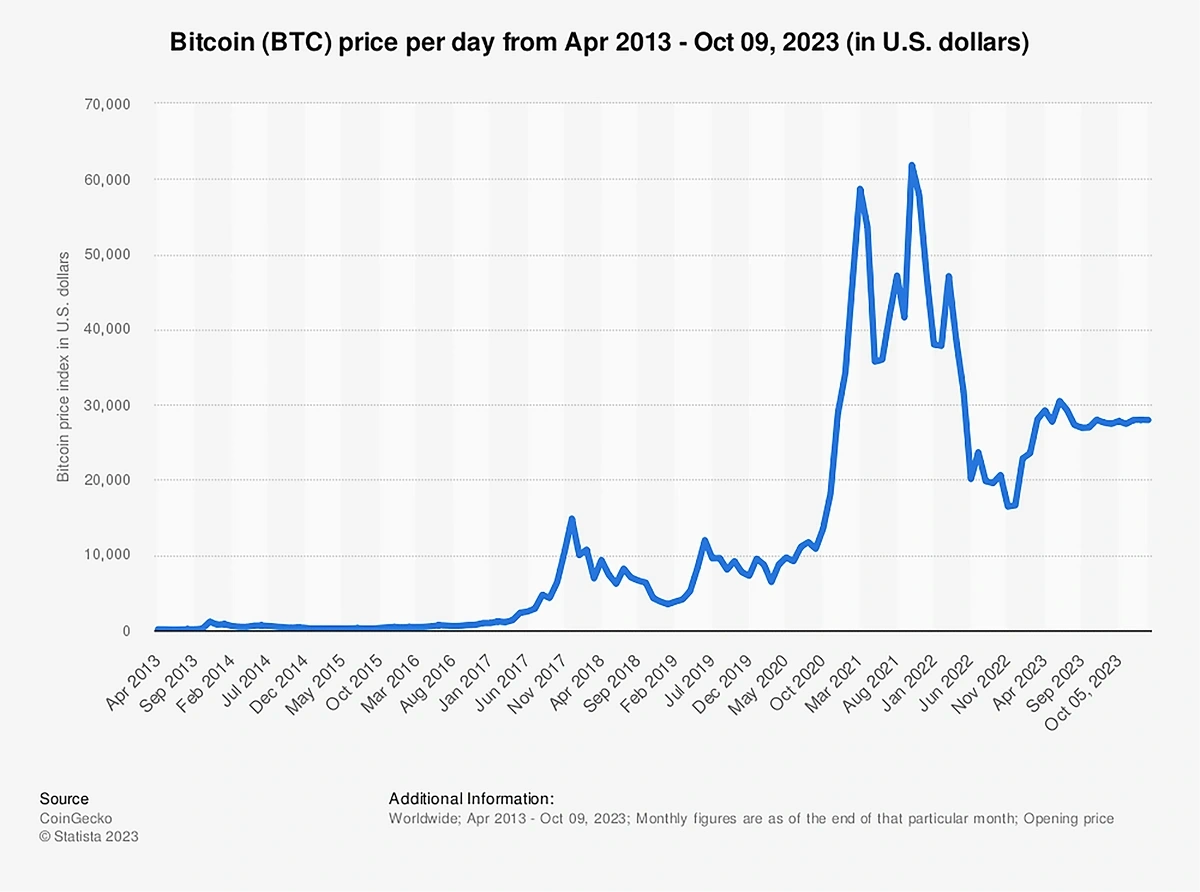

BTC hit an all-time high of $68,000 in November 2021.

By late 2023, its value was down to just $27,000—but that was up more than 60% for the year.

Bitcoin’s price has been volatile in recent years.

British bank Standard Chartered is extremely optimistic about Bitcoin’s value, saying it could hit $100,000 by the end of 2024.

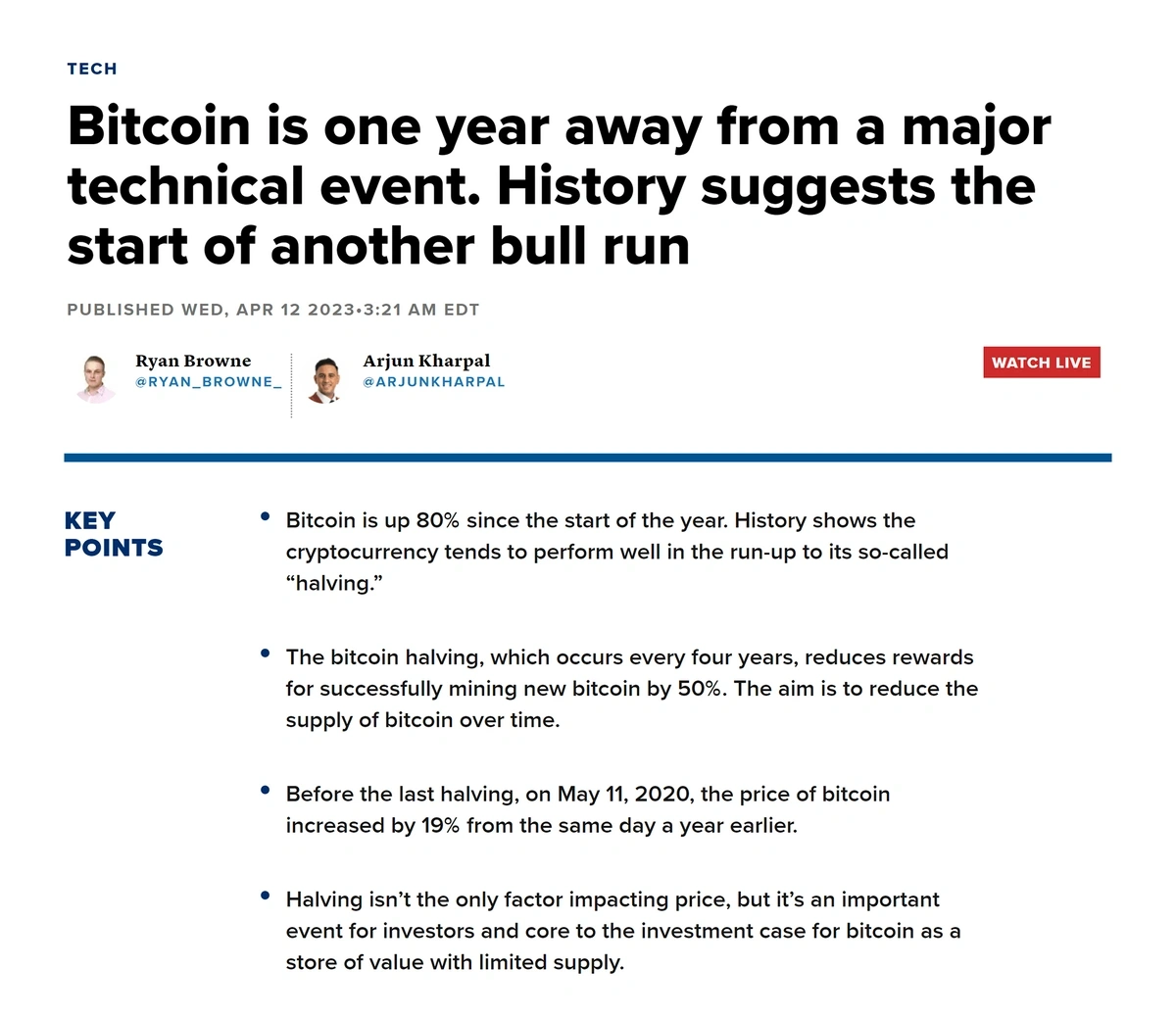

The upcoming halving — an event that maintains the scarcity of Bitcoin—is one factor that could drive prices up. It’s predicted to happen in April 2024.

Investors are looking toward the next halving event to see where it takes the cryptocurrency market.

There’s also hope within the sector that the SEC will soon approve a spot ETF for Bitcoin.

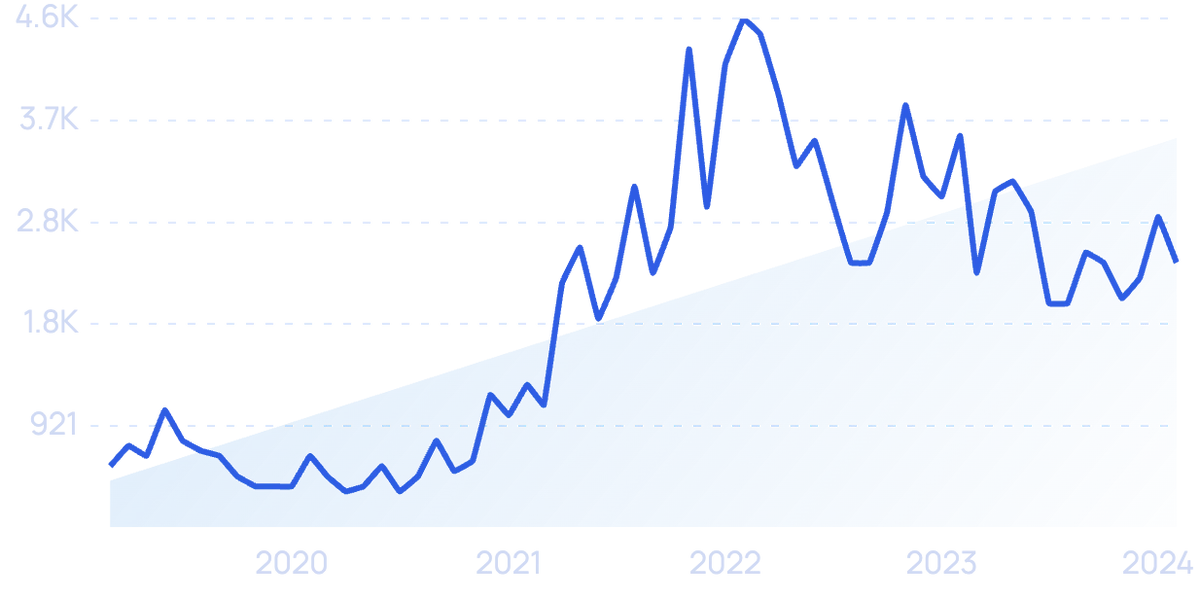

Search interest in “crypto regulation” has held high since 2022.

This type of fund is alluring for investors because it would track with Bitcoin’s spot price and has the potential to bolster Bitcoin’s standing in the market.

The first spot Bitcoin ETF in Europe hit the market in August 2023.

Current investment in cryptocurrency remains a mixed bag, though.

A recent report showed that 55% of Gen Z, 57% of Millennials, and 39% of Gen X are invested in crypto.

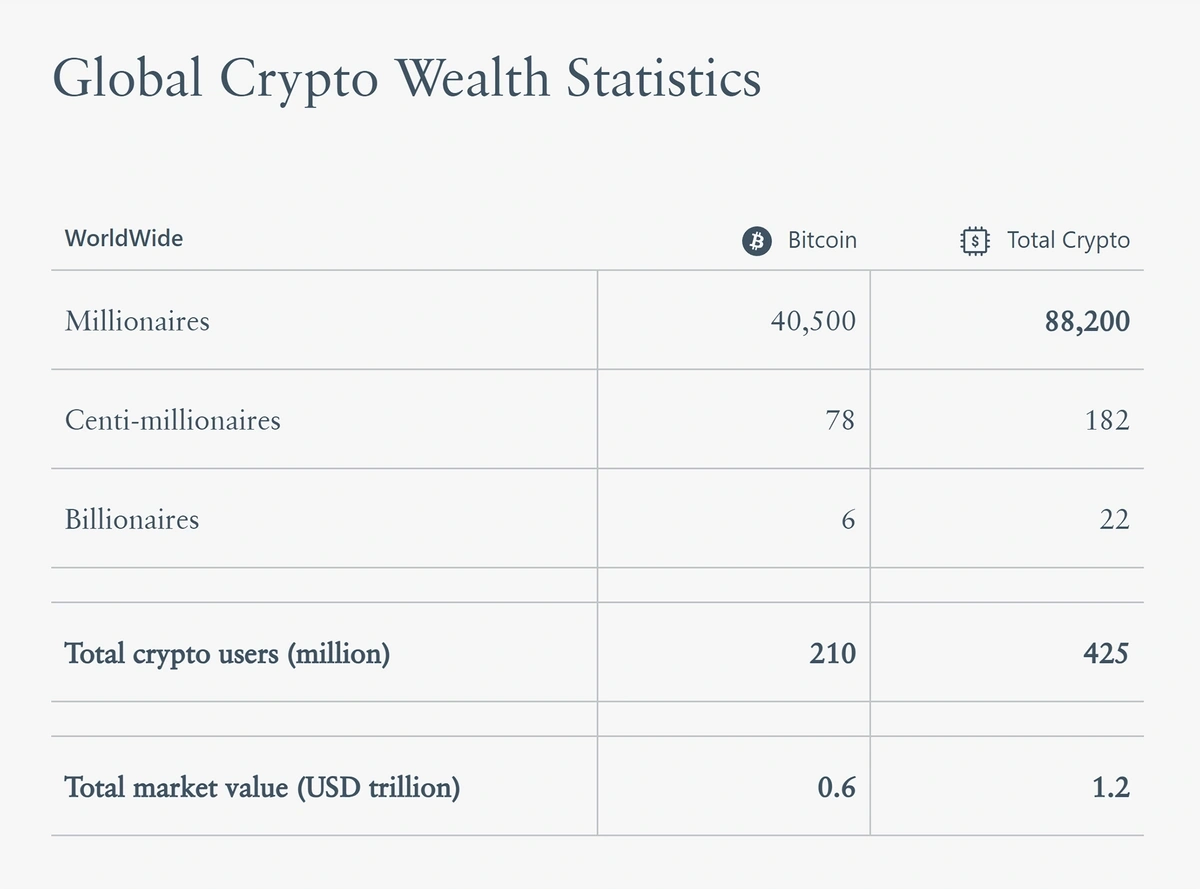

Globally, there are more than 425 million crypto users and 88,000 investors hold more than $1 million in crypto.

According to one report, the crypto market value is $1.2 trillion.

However, 75% of Americans who have heard about cryptocurrency have doubts when it comes to the safety and reliability of investing and trading crypto.

Conclusion

That’s all for the top investing trends of 2024.

Whether it’s a new technology, digital offerings, or socially-based trading strategies, there is no shortage of innovation in the investing world.

And if the rise of retail traders and copy trading has taught us anything, it’s to expect the unexpected in this space.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more