Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 25 Finance Newsletters (2024)

Not only is managing your finances hard, but staying on top of developments in the world of taxes, retirement planning, etc., can feel downright impossible.

With that said, by choosing the right sources of information - and cutting everything else - staying on top of the most important financial developments can be done.

To help you achieve that, we’ve collected 25 of today’s most respected and widely read financial newsletters. Enjoy!

1. Sherwood Snacks

Year Started: 2019

Number of Subscribers: 40,000,000+

Send Schedule: Daily

What It Is: With a massive base of retail and even “meme stock” investors, Snack's daily newsletter delivers the biggest, most important business stories in a fun, simple, and easy-to-read language. Oh, and they claim it can be read in just three minutes per day. The Snacks newsletter now operates under Robinhood's news and information subsidiary, Sherwood Media.

2. Money Stuff

Year Started: Unavailable

Number of Subscribers: 150,000+

Send Schedule: Daily

What It Is: Produced by one of Bloomberg’s most closely followed writers - Matt Levine - Money Stuff contains powerful insights into the world of Wall Street finance. And with a deep history of experience as an investment banker and M&A attorney, Matt proves he knows what he’s talking about day in and day out.

3. The Average Joe

Year Started: 2020

Number of Subscribers: 250,000+

Send Schedule: Daily

What It Is: Self-proclaimed as the "IKEA instructions for investing," The Average Joe is a daily newsletter that contains news and updates on the latest market trends, statistics, and relevant investing resources. Instead of just giving out stock ideas, The Average Joe discusses the latest in the markets and how it's impacting the economy with numbers to back up the claims. Because of that and the daily memes, all of their newsletters and investing guides are free.

4. TKer

Year Started: 2021

Number of Subscribers: 25,000+

Send Schedule: Semi-Weekly

What It Is: Written by Chartered Financial Analyst (CFA) Sam Ro, TKer contains lessons on both personal finance and the stock market. Unlike a stock-picking newsletter, however, TKer discusses how the stock market affects the economy and what the implications are for both your investments and your personal finances.

5. Exec Sum

Year Started: 2021

Number of Subscribers: 250,000+

Send Schedule: Daily

What It Is: Written by the financial media company Litquidity, Exec Sum is a daily newsletter that covers major Wall Street and Silicon Valley news using humor and memes. Investment bankers and private equity, hedge fund, or venture capital investors can review the daily deal flow and also see what's happening in the crypto space.

6. Finimize

Year Started: 2014

Number of Subscribers: 1,000,000+

Send Schedule: Daily

What It Is: With a community of loyal readers and subscribers of more than one million strong, Finimize promises to deliver the “top financial news in just three minutes.” From retirement to personal finance strategies (and even market analysis), Finimize allows you to select the topics you’re interested in before delivering them in bite-size chunks each day.

7. Transacted

Year Started: 2023

Number of Subscribers: 60,000+

Send Schedule: Weekly

What It Is: With a focus on private markets, Transacted is the place to be for the latest on private equity, investment banking, and venture capital deals, trends, and fundraising events. Each weekly read is formatted like the standard deal summary, adding in-depth analysis and insights about the latest M&A and private equity deals.

8. Clark’s Newsletters

Year Started: Unavailable

Number of Subscribers: 330,000+

Send Schedule: Daily

What It Is: Produced by the writers behind Clark Howard’s highly trafficked Clark.com, Clark’s (multiple) newsletters focus heavily on personal finance. In particular, topics like saving and spending money, retirement and debt. And with 4M+ monthly blog visitors, there’s no denying people love Clark’s content.

9. Budgette

Year Started: 2020

Number of Subscribers: 2,000+

Send Schedule: Weekly

What It Is: Ranked among the top “money newsletters” by both NextAdvisor and Time.com, Budgette focuses on personal finance for solo earners (aka single people). With expenses rising, fewer tax breaks, and no one to split bills with, Budgette provides tips and strategies solo earners can use to maximize their finances.

10. Behavior Gap

Year Started: Unavailable

Number of Subscribers: Unavailable

Send Schedule: Weekly

What It Is: Written by Carl Richards - CFP and 12-year sketch contributor to the New York Times - Behavior Gap uses visual graphics to convey important financial lessons (including some personal development lessons as well). From identifying what “financial planning” even means, to understanding what next step you should take to improve your retirement savings, Carl’s sketches are a smash hit among fans.

11. Myth of Money

Year Started: 2019

Number of Subscribers: 10,000+

Send Schedule: Weekly

What It Is: Myth of Money takes a macro-view of the finance world. With frequent discussions of bubbles, money printing, the Fed and cryptocurrency, author Tatianna Koffman has a long history of making strong arguments against centralized banking (including what you can do to protect your finances should you agree with her views).

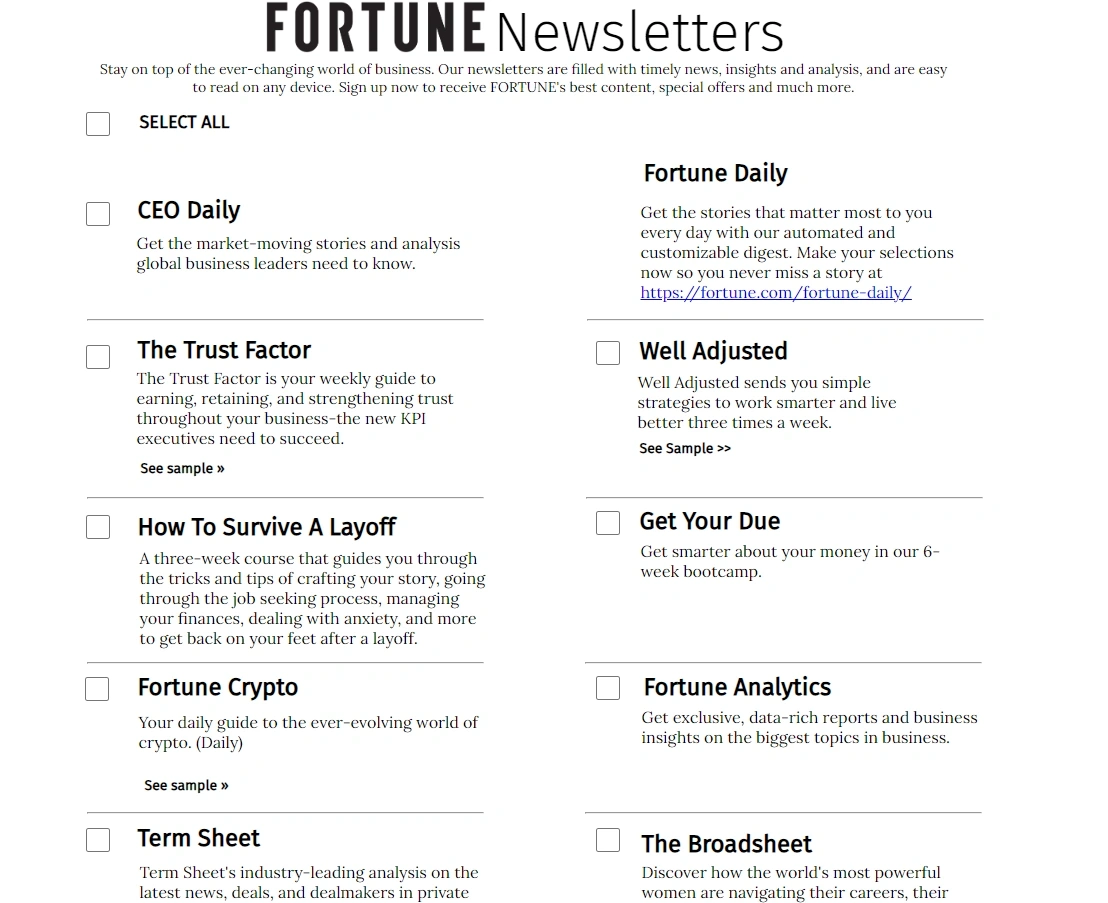

12. Fortune Newsletters

Year Started: Unavailable

Number of Subscribers: Unavailable

Send Schedule: Daily, Weekly, Bi-Weekly

What It Is: Published by the #1 magazine for all things money and wealth, Fortune produces more than a dozen newsletters. Topics covered include race in the workplace, artificial intelligence, the most powerful women in business and more. And if you’re a CXO of some sort, odds are they have a specific newsletter just for you.

13. Penny Hoarder

Year Started: Unavailable

Number of Subscribers: 1,200,000+

Send Schedule: Daily

What It Is: A fan favorite among everyday consumers, Penny Hoarder produces high-quality content on almost every money topic you can imagine. From budgeting and retirement to saving money on your next vacation, Penny Hoarder’s easy-to-understand, practical advice keeps readers coming back for more.

14. Jill on Money

Year Started: 2008

Number of Subscribers: Unavailable

Send Schedule: Weekly

What It Is: Not only is Jill Schlesinger the published author behind The Dumb Things Smart People Do with Their Money, she also runs a highly popular podcast (Jill on Money). In her newsletter, Jill - who has a CFP background - discusses actionable strategies for taking control of your financial life. Admittedly, this assumes you have excess finances to take control of in the first place.

15. MoneyWise

Year Started: 2017

Number of Subscribers: Hundreds of Thousands

Send Schedule: Weekly

What It Is: Owned and operated by Wise Publishing, Inc., MoneyWise publishes information and news about personal finance, investing, retirement planning, and business finance. The weekly newsletter is angled toward older readers preparing for retirement through long-term investing, saving, and proper budgeting. Because of that, don’t expect to find any high-growth stock picks or cryptocurrency topics mentioned.

16. Quartz Daily Brief

Year Started: 2019

Number of Subscribers: Unavailable

Send Schedule: Daily

What It Is: Branded as the newsletter that “inoculates readers against ignorance with intel, charts and discoveries,” Quartz’s Daily Brief letter examines the more serious side of financial news. In fact, Daily Brief writers tend to take a contrarian view toward common assumptions, taking what is - in many cases - a combative stance towards surface-level journalism.

17. I Will Teach You to be Rich

Year Started: 2013

Number of Subscribers: 1,000,000+

Send Schedule: Semi-Daily

What It Is: A product of best-selling author (and overall financial guru) Ramit Sethi, I Will Teach You To Be Rich aims to do exactly what you would expect. With a focus on personal finance, including “spending on what you love while mercilessly cutting what you don’t,” Ramit helps non-entrepreneurs think about their career, spending, savings and investing more effectively.

18. LifeHacker’s Two Cents

Year Started: Unavailable

Number of Subscribers: Unavailable

Send Schedule: Daily

What It Is: As any fan of (top 5,000 websites) Life Hacker knows, their content is highly practical. With topics that range from whether adopting a pet will fit into your finances, to ways to extract cash from your junk mail, Two Cents covers both the more common aspects of personal finance and those less explored.

19. Money.com Newsletters

Year Started: Unavailable

Number of Subscribers: Unavailable

Send Schedule: Daily & Weekly

What It Is: With more than 50 years of experience, including decades of print magazine publishing (pre-Internet), Money.com offers five different newsletters covering everything from real estate to retirement. Further, their Money Classic edition contains timeless gems from their print magazine archives (adding a dash of nostalgia to each issue).

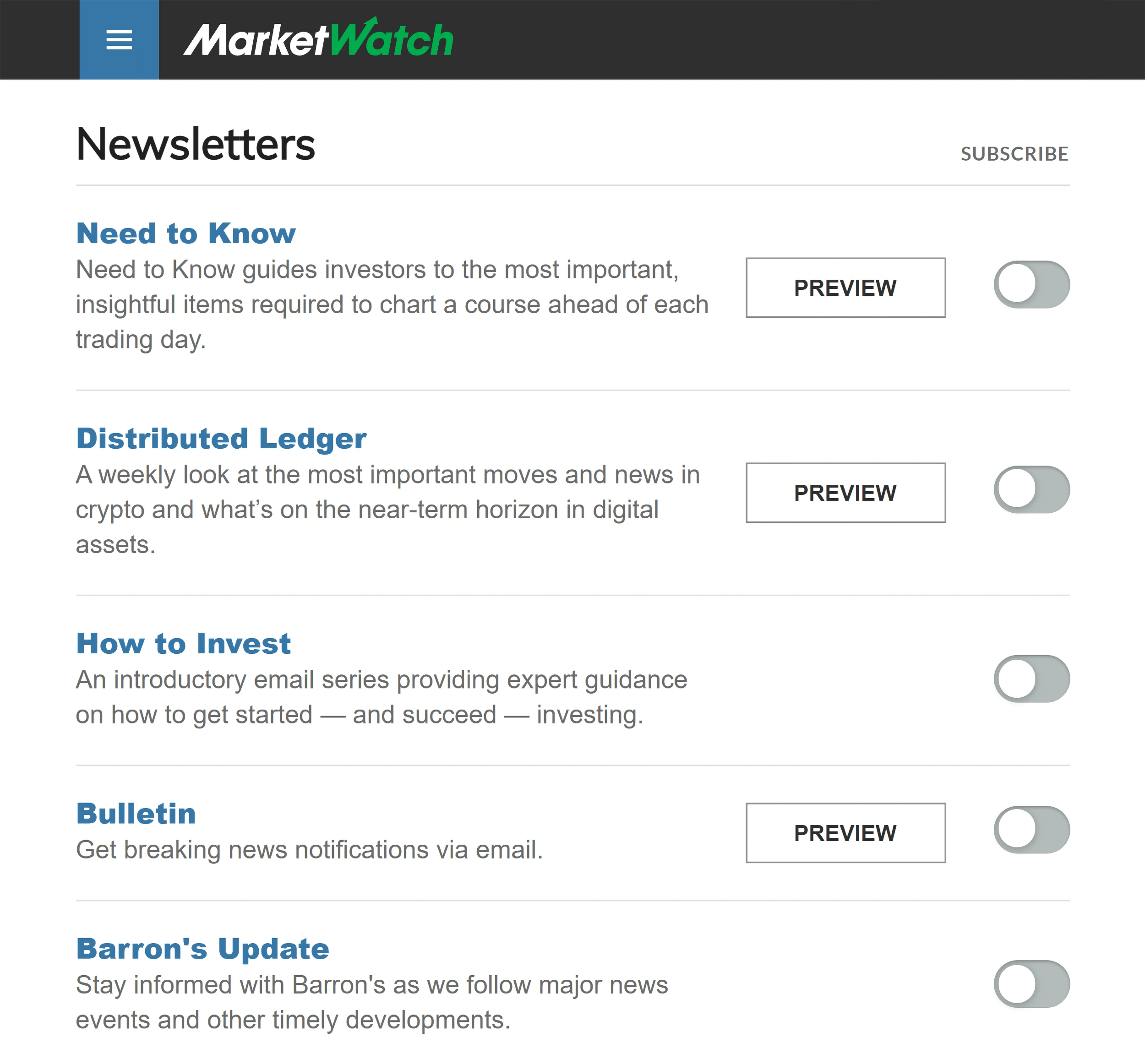

20. Market Watch Newsletters

Year Started: Unavailable

Number of Subscribers: Unavailable

Send Schedule: Daily & Weekly

What It Is: One of the most highly visited financial websites in the world, Market Watch publishes over a dozen newsletters focused on highly specific topics including ETFs, personal finance and more. Further, readers love their Money Digest issues, in which subscribers submit thorny problems for feedback from both experts and Market Watch’s team of writers and editors.

21. HerMoney

Year Started: Unavailable

Number of Subscribers: 12,000+

Send Schedule: Daily / Weekly

What It Is: A favorite among women, HerMoney is published by financial expert Jean Chatzky. With brand positioning that separates money from identity - while instead positioning it as a tool to be used - HerMoney helps women master everything from earning and saving to protecting and borrowing.

22. The Nerd Letter

Year Started: 2016

Number of Subscribers: “Thousands”

Send Schedule: Weekly

What It Is: With a bent toward freelancers and bootstrap entrepreneurs, the Nerd Letter combines both personal finance lessons (e.g. accomplishing financial goals) with business ones (e.g. taxes and payroll). Further, their specific blend of light humor and wit attracts a highly loyal subscriber base.

23. Money Under 30

Year Started: 2018

Number of Subscribers: 35,000+

Send Schedule: Bi-Weekly

What It Is: As you may have guessed from the name, Money Under 30 tailors its content to the 20s-something crowd. Because of that, don’t expect to find much content related to retirement (or even taxes). Instead, MU30 puts a heavy focus on credit card usage, loans, banking, and insurance.

24. Humble Dollar

Year Started: 2016

Number of Subscribers: Unavailable

Send Schedule: Daily

What It Is: Originally launched by Jonathan Clements, a personal finance columnist from the Wall Street Journal, Humble Dollar now hosts more than two dozen writers. Slanted towards responsible investing and delayed gratification, Humble Dollar’s writers cover everything from retirement (a common focus) to macro-financial news.

25. What the Elle

Year Started: 2014

Number of Subscribers: Unavailable

Send Schedule: Tri-Weekly

What It Is: Branded as the “money and career newsletter for women,” What the Elle publishes content that faces women’s issues head-on. From sexism in the hiring process to the reality women outlive women, Ellevest’s all women’s writing staff aims to empower “financial feminism” through their blog posts and newsletter.

Conclusion

There you have it: 25 newsletters you can rely on to stay on top of both corporate and personal finance.

While trying to stay on top of everything could very quickly erode your financial situation, the resources above should keep you up to speed with a minimal time commitment.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more