Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

How To Find Startups To Invest In (And Identify Hidden Gems)

Startups with growth potential don’t typically advertise the fact that they’re looking to raise capital.

Top investors already know about these companies. And they usually invite friends and colleagues in on the deals. So by the time you hear about these companies, they typically aren't accepting additional capital.

Building relationships with other top investors should definitely be a top priority so that you have high quality, passive deal flow. But genuine relationships can take years to cultivate, and asking for intros too soon can kill a budding relationship.

So we'll first provide a few quick methods to quickly find promising startups to invest in.

Then we'll discuss several additional offline strategies to find deals and build relationships with investors and founders.

1. Use A Startup Directory (With Specific Filters)

There are plenty of startup directories that make it easy to quickly find startups seeking capital.

Yet most users run into the problem we discussed earlier – identifying the top 1% of startups on these directories is like trying to find a needle in a haystack.

Sure, funding and employee headcount metrics can give you a general idea of a company's growth trajectory.

Yet many small companies with no funding and only a handful of employees are often just as promising – if not more so – than the highly publicized, well funded startups.

A better metric to accurately assess a startup’s growth trajectory is actually its brand search query trend, as brand queries often reflect customer demand.

And if consumer interest in a product is rapidly increasing, there’s a good chance that the startup has found product market fit and is on a strong upward trajectory.

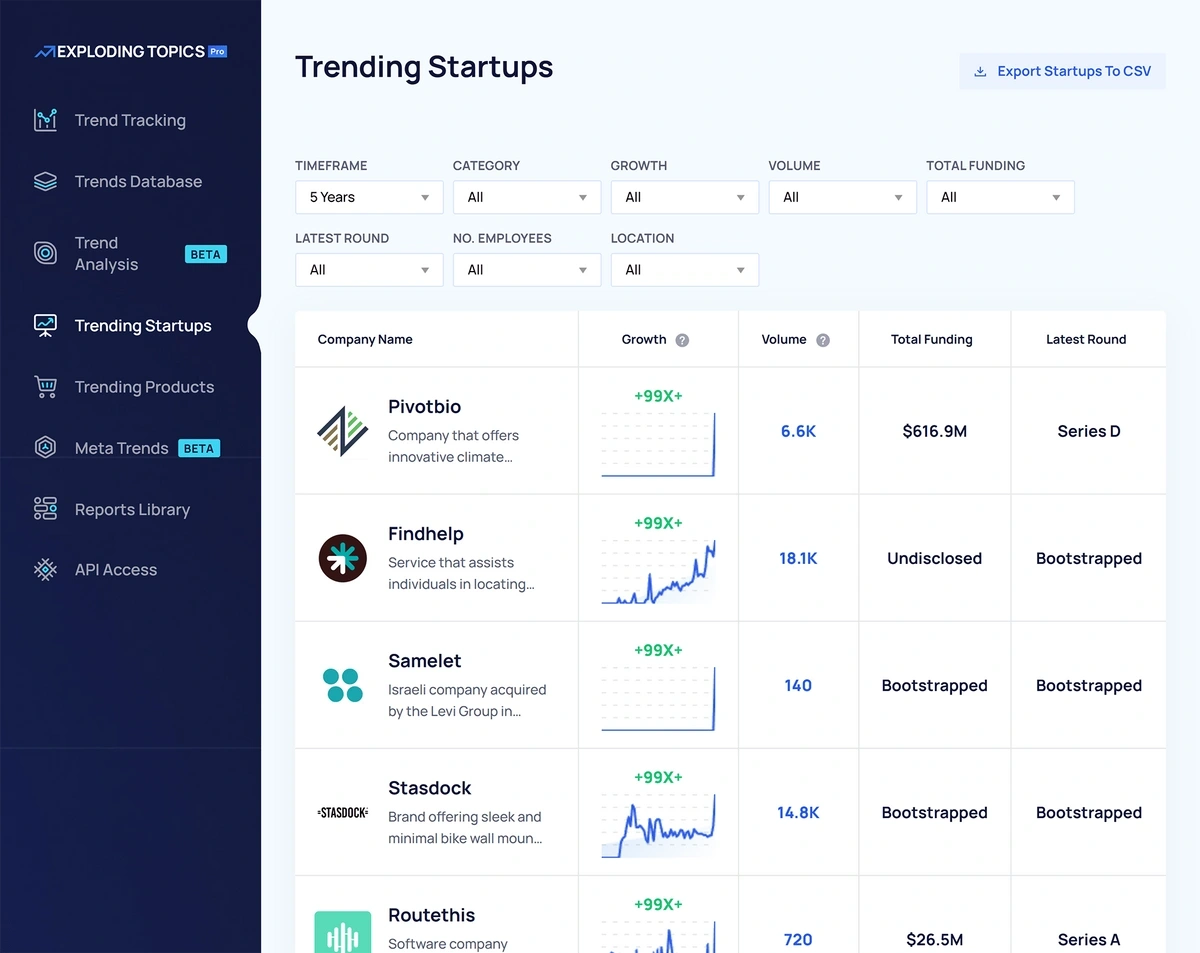

That’s why we built a startup directory that identifies and qualifies startups based on the brand name’s historical Google Search volume trend.

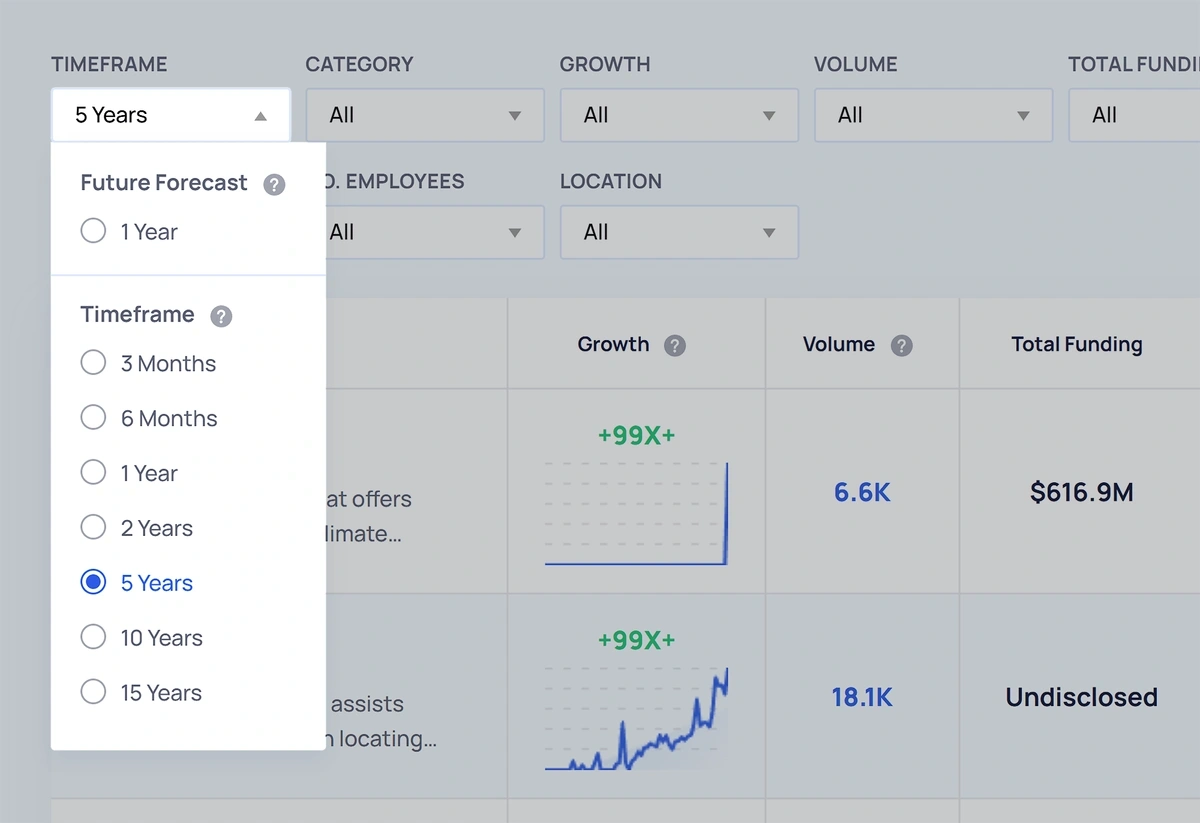

You can also adjust the time period filter from three months to up to 15 years, and the results will adjust to show the companies with the fastest growth rate over the selected time period.

Once we identify brands that have shown compounding growth for at least a few months/years, we also pull in metrics you might find helpful, like total funding amount, funding round, employee headcount, founded date, and location.

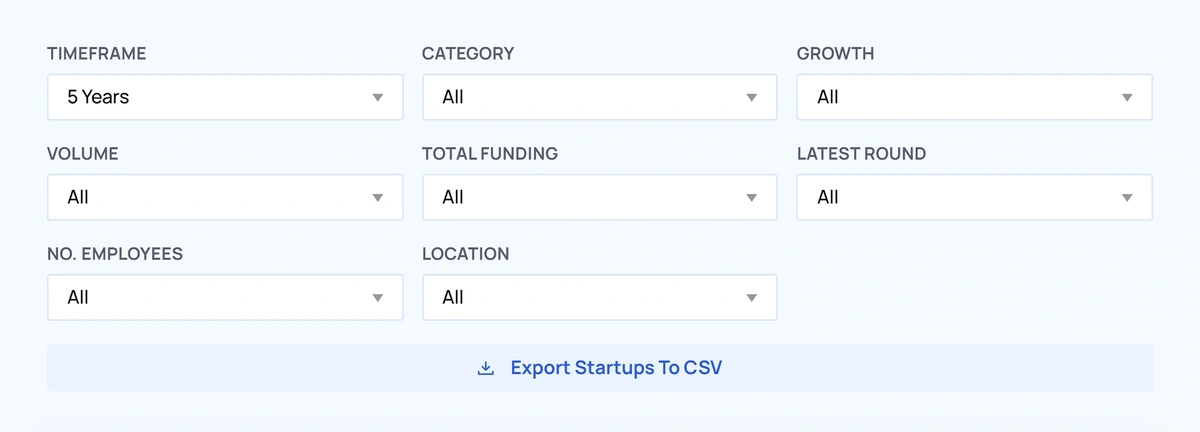

You can then further filter your search results by any of those metrics:

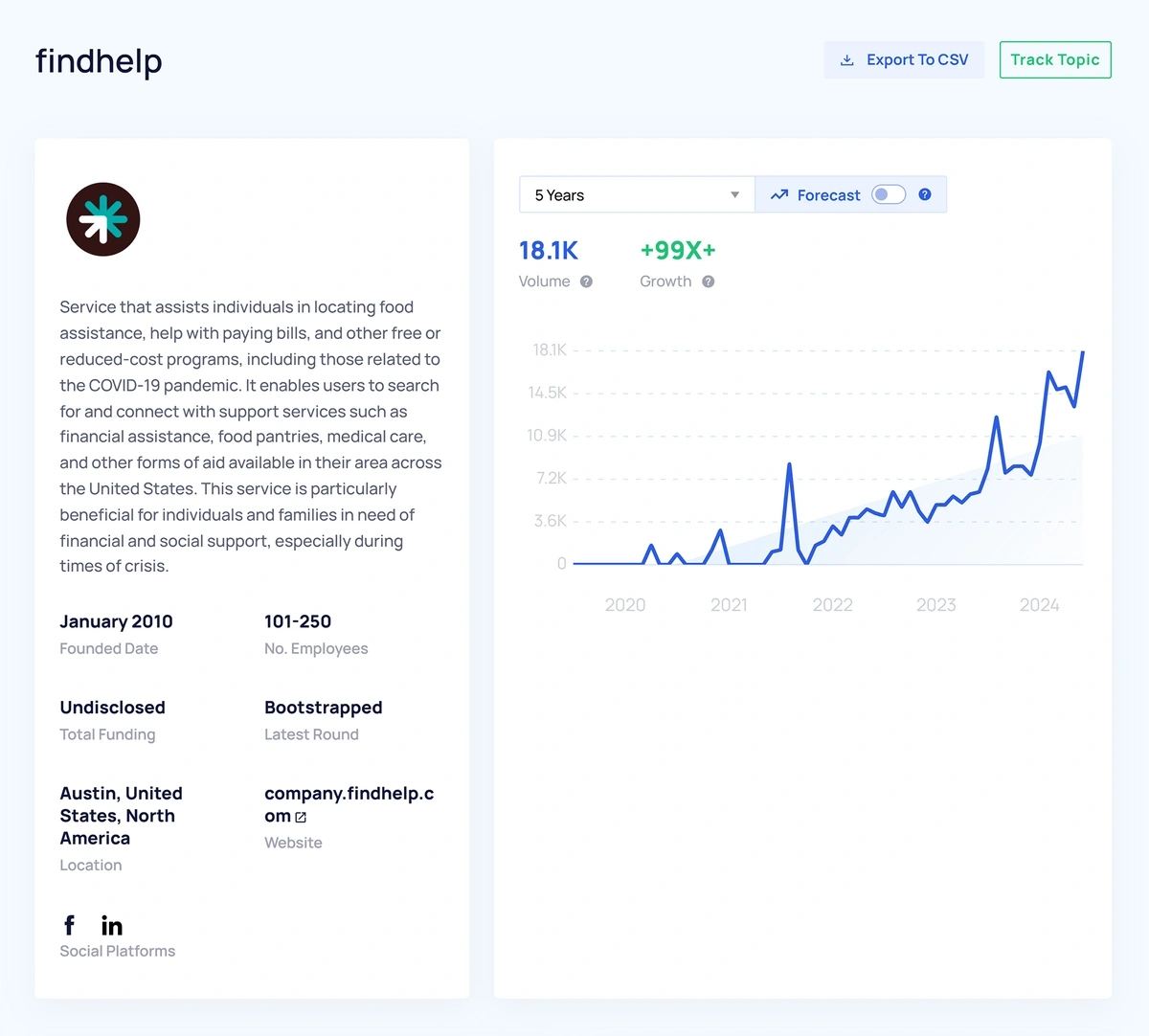

Once you spot a promising startup, click on it to see more detailed metrics.

If you want to save it for further analysis, you can click "Track Topic" and then add it to a Project. Projects live inside your Exploding Topics Pro account and make it easy to track the startups most relevant to you:

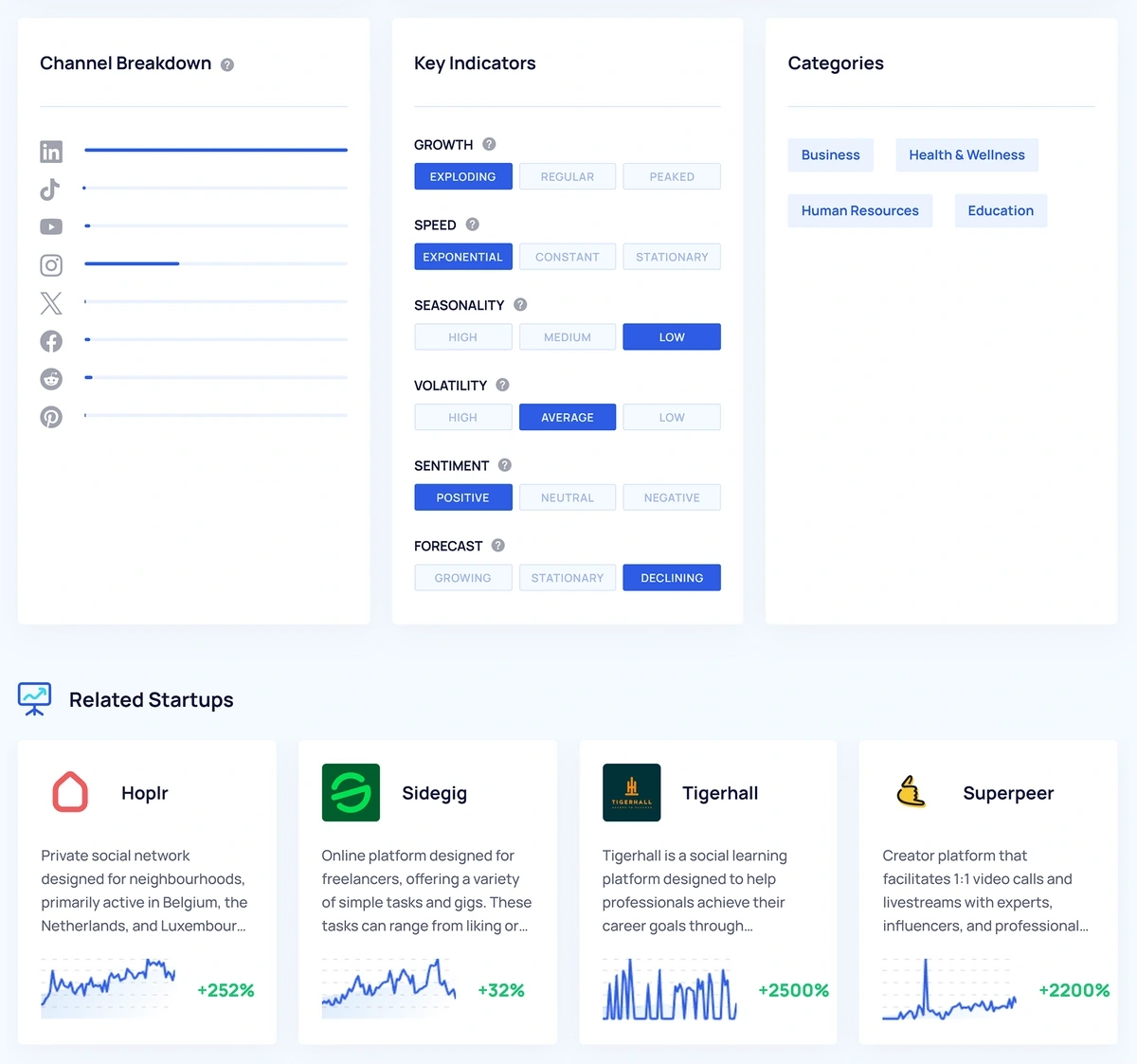

If you scroll down, you'll see other related trending startups, topics, and even a breakdown of which social media platforms the brand is most popular on:

The channel breakdown is particularly helpful for seeing which platforms the startup is seeing traction on.

If you want to learn more about Exploding Topics and try out the Trending Startups feature, you can either jump into the platform for free or sign up for a $1 trial today.

2. Identify Meta Trends And Related Startups

Even if a company has a team of amazing founders, A-player employees, and a well-designed, functional product, it may still fail if the market is dying.

In contrast, a company with an average product, team, and founders can still flourish if it's riding a growing trend.

So, a super easy way to find promising startups is to first identify growing meta trends and then search for trending startups within that meta trend.

Unfortunately, identifying these meta trends can be tricky as under-the-radar trends are, by definition, largely obscure. So we built the Meta Trends feature in Exploding Topics to make it easy.

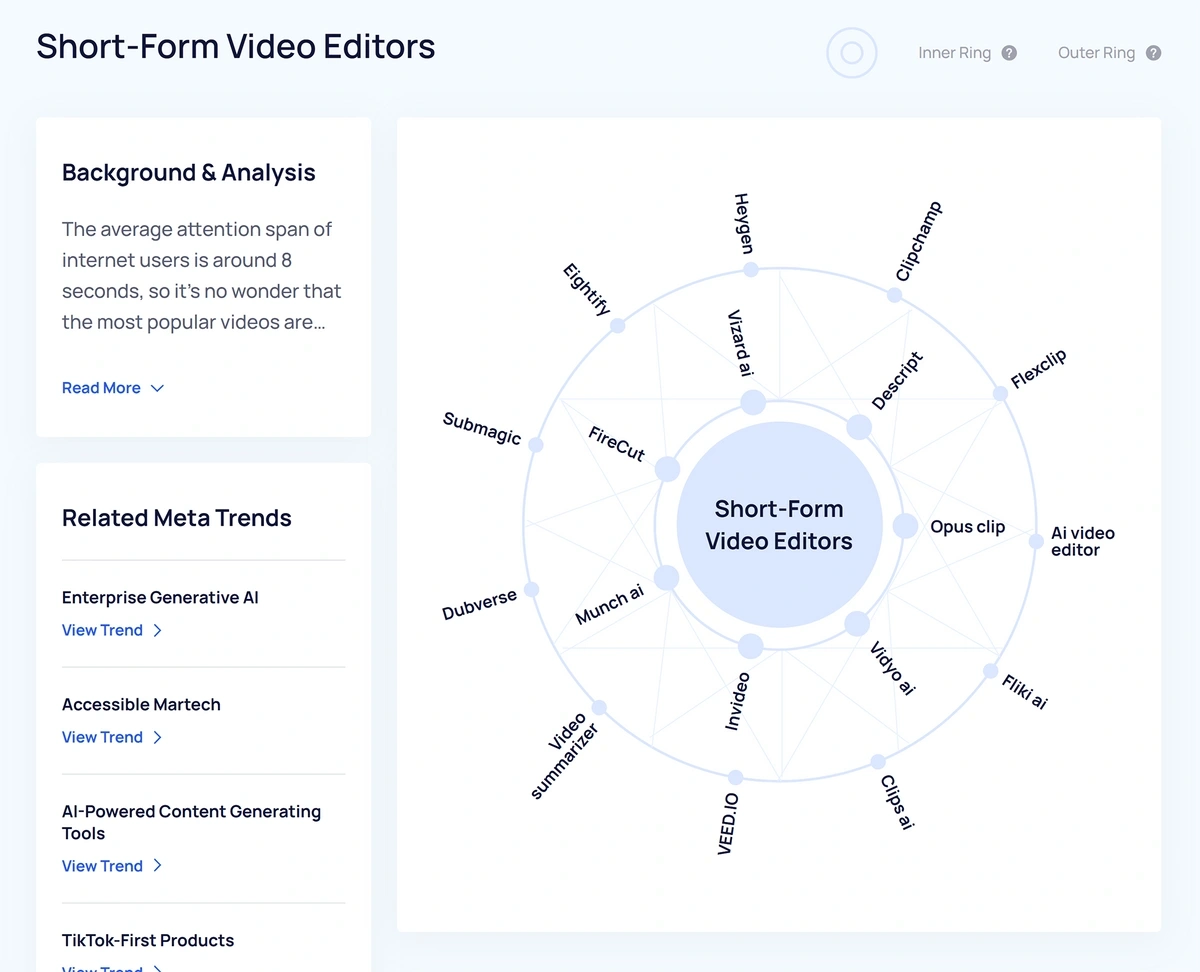

Meta Trends shows you the growing meta trend and related growing micro trends and brands. For example, the Short-Form video editing niche is clearly a growing meta trend, and within it, some brands you might want to explore include Vizard AI, InVideo, and Descript.

Even if those particular brands aren't accepting funding, you can look at their competitors and offer to invest in those companies.

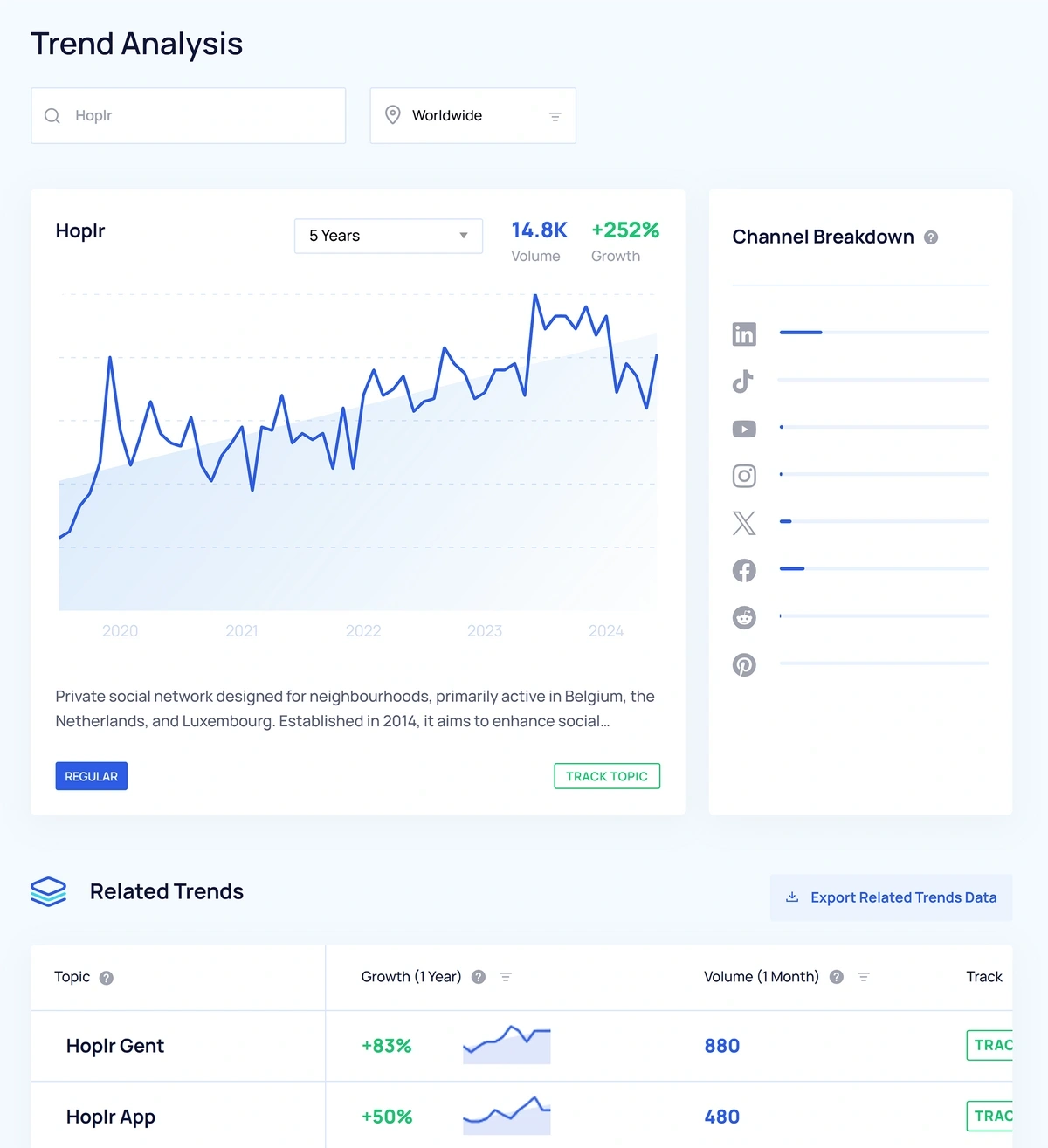

For example, a quick search shows that "Hoplr" is an alternative to findhelp. To check the growth status of Hoplr, type the keyword into another Exploding Topics feature, Trend Analysis, and see the historical Google Search volume for that brand query.

This trend clearly suggests that Hoplr might be another great company to invest in:

The trending product feature also shows that the brand is popular on LinkedIn, so you could go to LinkedIn to further research what people say about the company.

3. Search For Growing Brands By Industry

Meta Trends can help you identify brands riding niche market trends, but there are also plenty of excellent growing startups that aren't riding a new niche trend.

Instead, they're usually in broader, steadily growing markets, yet have a key differentiator that make them much more effective at solving a particular pain point for a specific persona.

Finding these startups that have strong product market fit can be tricky as they're often spending all of their resources just trying to keep up with demand and, therefore, may not be promoting their brand.

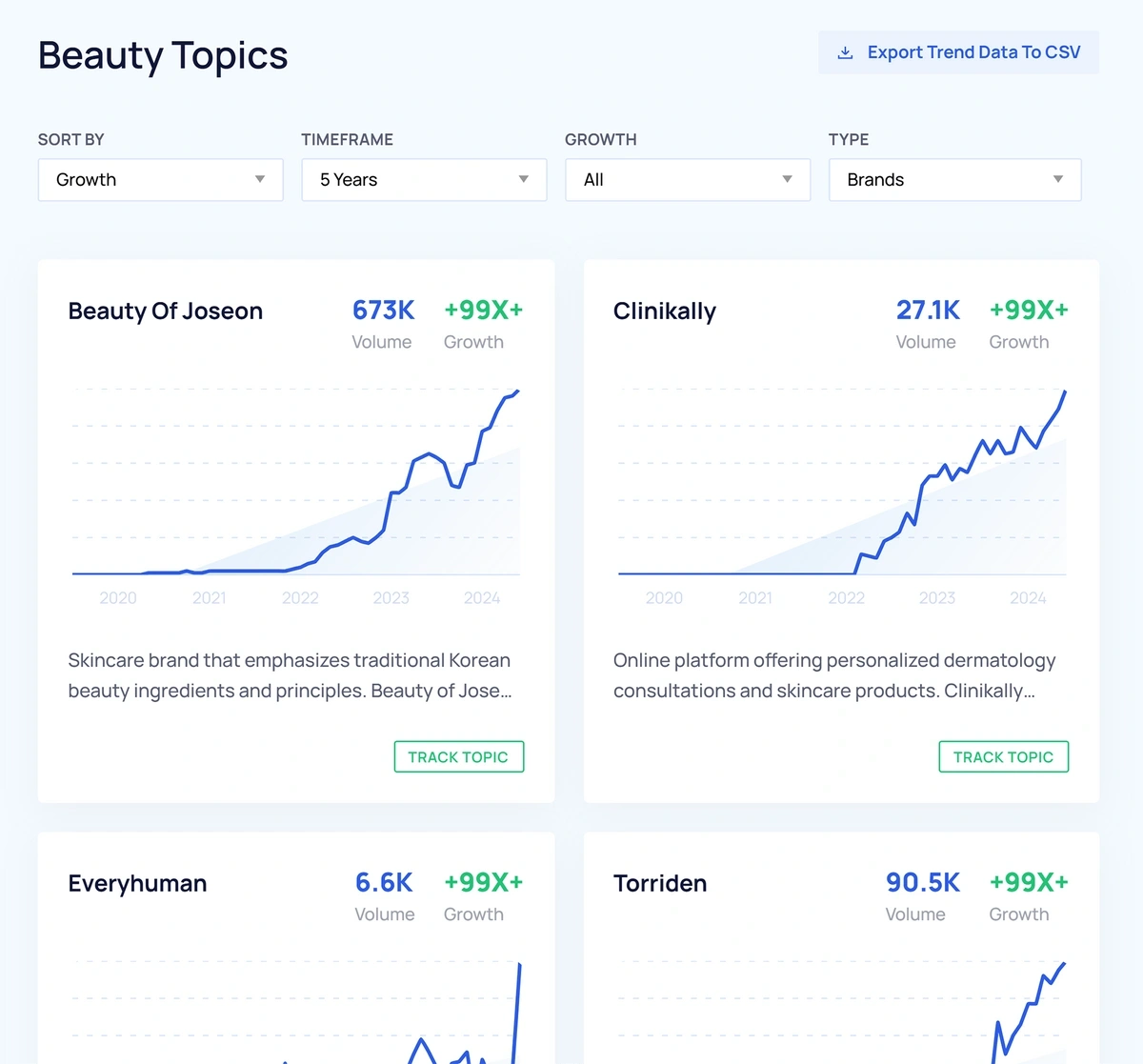

The Trending Topics feature helps you uncover these under-the-radar startups.

Select one of our dozens of categories (ranging from health and wellness to entertainment), and then you can filter by "brands" to only view trending brands in that category:

Once you find a trending topic, you can click on it to view other related trending topics, view the social channels it’s most popular on, and add it to a Project for further analysis by clicking “Track Topic.”

4. Track Products And Services You Currently Use

If a startup has raving customers and effectively solves a critical pain point, there's a good chance it will succeed.

If you're an investor who has never experienced the startup's customers' pain points, it can be difficult to gauge the value of the startup's product.

Instead, make a list of all of the products and services you use and love.

If you understand how the product solves your pain point better than any other competitors, there's a good chance many other people feel the same way, and that company probably has product market fit.

To confirm this, you can always enter the company's name into the Trends Analysis feature in Exploding Topics to confirm its growth trajectory. If it looks promising, contact the founder, mention that you're a customer, and offer to invest.

5. Use An Investing Platform

Another option to find promising startup companies to invest in is to use a platform like AngelList that allows accredited investors to passively invest in startups.

Rather than researching individual startups and doing all of the due diligence alone, AngelList allows you to invest alongside other top investors.

For example, the venture funds option allows you to invest alongside some of the top venture capital firms, like Sequoia Capital, Andreessen Horowitz, and Khosla Ventures.

As investing in new startups is inherently risky and an illiquid investment, investing alongside more experienced professionals minimizes the risk.

Alternatively, you could invest in some of their rolling funds, where you can invest alongside individual venture capitalists, like Naval Ravikant. Y

You can subscribe quarterly to this investment option and adjust your investment over time.

Investing in a rolling fund also makes it easy to diversify your investment strategy, as you aren't just investing in a single startup.

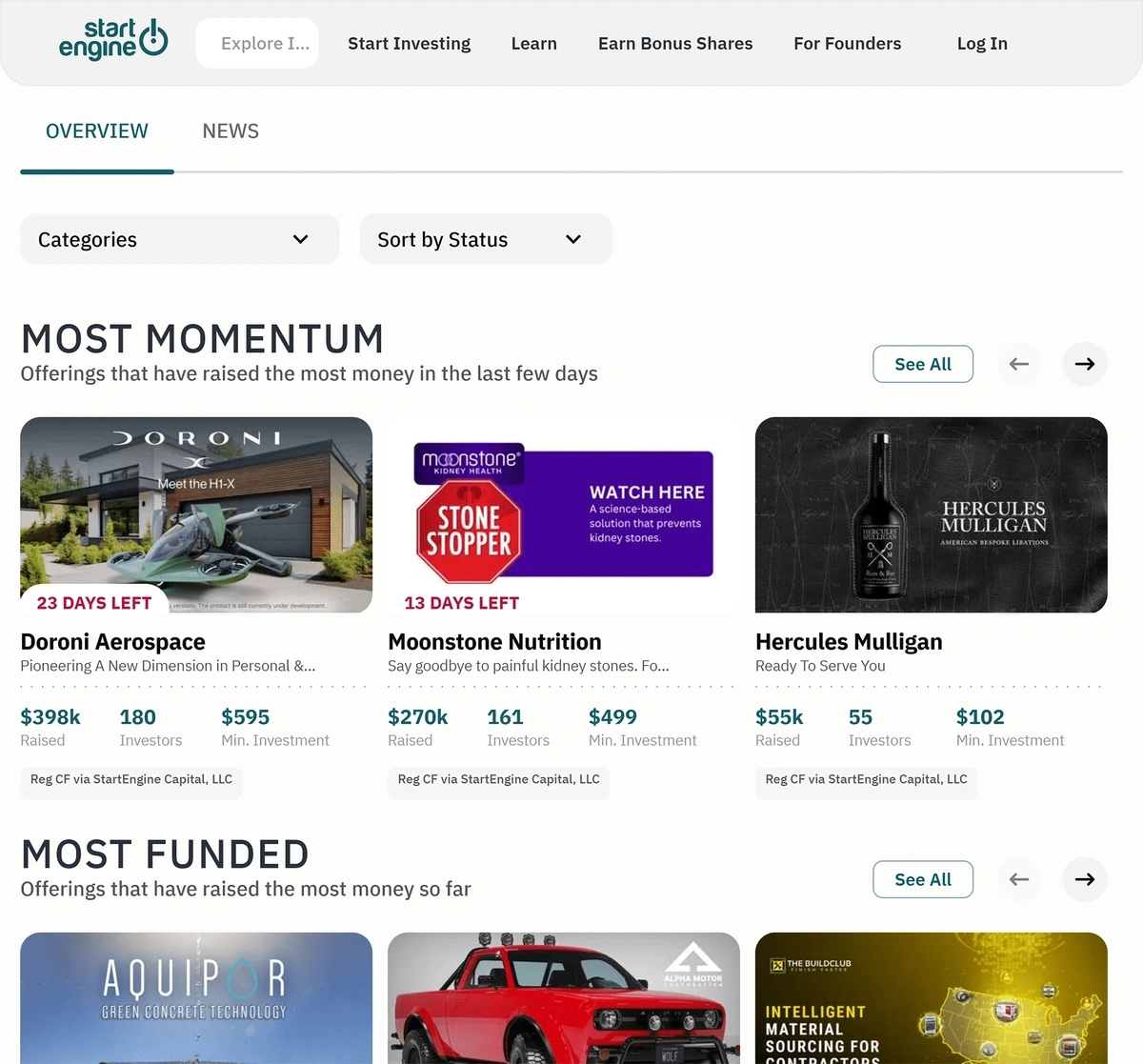

If you aren't an accredited investor, you can look at other crowdfunding platforms, like StartEngine (previously called SeedInvest), which allow you to invest small check sizes into early-stage startups.

6. Attend Startup Hackathons

Startup hackathons are typically 48 hour events where founders aim to build a product.

While many of these startups fail, some have gone on to succeed. In fact, the co-founders of Zapier met at a startup hackathon and built the initial product over the 48 hour period.

Even if none of the ideas are great, you will still likely find some interesting founders at hackathons that you can then build relationships with to potentially invest in down the road.

7. Attend Demo Days Hosted By Accelerators

Accelerators help startup companies get their idea off the ground, and many of them have demo days at the end of the program where potential investors invest in the companies.

A great example of an accelerator is Y Combinator. Only invited investors can attend their demo day, though there are plenty of other startup accelerators that have open demo days where any investors can attend and offer funding.

8. Offer Mentorship

Mentoring founders is a great way to find under-the-radar companies and help you see the strengths and weaknesses of a startup (and its founders) before investing.

The only drawback with mentorship is that, like startups searching for capitaLaunch Academy l, there are thousands of founders searching for mentorship.

Yet the most successful founders are typically selective about who they receive mentorship from.

To attract driven, successful founders, it's important to first actually have experience growing successful companies so that it's a mutually beneficial relationship.

In fact, many highly successful founders only accept funding because they want access to a network or mentorship – not because they need money.

So you must have something to offer them beyond just financial resources.

To find mentorship opportunities, start by searching for incubators. Idealab is an example of a highly-regarded incubators.

Most of them don't offer open applications for mentorship.

That said, you can look at their current mentors and reach out to them to learn more about how they became mentors.

Building relationships with these mentors alone is extremely valuable, as many of them have strong networks of founders and investors.

Another option is to search for local entrepreneur groups in your region. Many universities offer mentorship programs and even have startup pitch competitions.

These programs are typically best if you’re looking for early-stage investment opportunities as these founders are college students just getting started.

9. Attend Conferences And Events

The benefit of live events is that they allow you to connect with founders one on one, which can give you a good idea of the qualities that person possesses and their likelihood of success as a founder.

Before attending the conference, try to get a list of attendees so that you can do some preliminary research on startups beforehand and even reach out to founders you're interested in.

Many conferences also offer events that connect founders with investors, so be sure to check what the event offers before attending.

In addition to connecting with other founders, make an effort to also connect with other investors. They can guide you through the investing process and may even introduce you to some startups in their investment portfolios.

You can also attend local events and meetups in your area to further build your network of founders and investors.

If you're really serious about building relationships, the best strategy is to host events yourself.

It not only helps you connect with other founders and investors, but it also makes you more appealing to founders as it proves you can also offer them social capital. In fact, many founders only accept investments because they want access to a larger network, so positioning yourself as a prominent host makes you a much more desirable investor.

If you need help hosting your first event, consider reading the Two Hour Cocktail Party by Nick Gray. It gives you step-by-step instructions on how to host a party, from inviting the right people to the details of how to prepare your home to host guests.

10. Join Online And In-Person Communities And Masterminds

Joining online and in-person communities is another great method to find startup investment opportunities, as they allow you to build long-term relationships with both founders and investors.

While events and conferences can help you meet a lot of people in a short period of time, communities and masterminds help you develop longer-term relationships.

You can join either an in-person mastermind/community, like the Dynamite Circle or Leveling Up Founders.

After joining the community or event make a concerted effort to share advice and build relationships with other community members. The value you'll derive from the network is directly correlated to the effort you put into providing value to the community and building relationships.

So, if you want to build strong relationships, put effort into helping other people by responding to questions and offering connections.

Building a relationship with the community's founder can also help you maximize your value from the community, as they can introduce you to the right people. They are also incentivized to see you succeed in the community, as their business depends on recurring subscriptions.

Find The Right Startup To Invest In Now

There are plenty of different ways to find startups to invest in, though a downside is that most methods are time consuming and many new angel investors feel overwhelmed at the thought of identifying and selecting a startup to invest in.

So we built Exploding Topics to make it easier for you to quickly identify growing startups based on reliable data that reflects consumer interest in the company – Google Search volume data.

It also offers all the other metrics you’d expect from a reliable startup aggregator tool, like funding data, social media accounts, category, location, and more.

To see for yourself if Exploding Topics is the tool you’ve been looking for to identify the best startups to invest in, try it out for $1 today.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more