Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Global Mattress Market Size, Growth, & Trends (2025-2032)

The global mattress market continues to grow steadily year over year.

Demand is on the rise, and budgets for home furnishings and bedding are also climbing.

With that in mind, we’ll cover these key mattress market statistics.

- Mattress Market Highlights

- Mattress Market Size

- Mattress Market Growth Projections

- Growth Drivers in the Mattress Space

- Key Players In The Mattress Market

- Mattress Market Geographic Breakdown

- Mattress Market By Type

- Mattress Market Consumer Preferences

Mattress Market Highlights

- The global mattress market is worth nearly $60 billion

- By 2032, the global market is expected to surpass $90 billion

- The global mattress market is growing at a CAGR of 6.59%

- The North American mattress market is valued at $14 billion

- Spring/coil mattresses have a market share of 66%

Mattress Market Size

As of 2025, the global mattress market is worth almost $60 billion.

Several factors are contributing to the steady growth of the market, including expanding budgets and the increased construction of housing units. Also, new DTC mattress brands (Casper, etc.) have pushed consumers to buy new mattresses more often.

Historical data shows significant growth over the past half-decade. In 2017, the mattress market was valued at only $27 billion. By 2020, this had jumped to an estimated $32.61 billion.

Sources: Fortune Business Insights, Zion Market Research

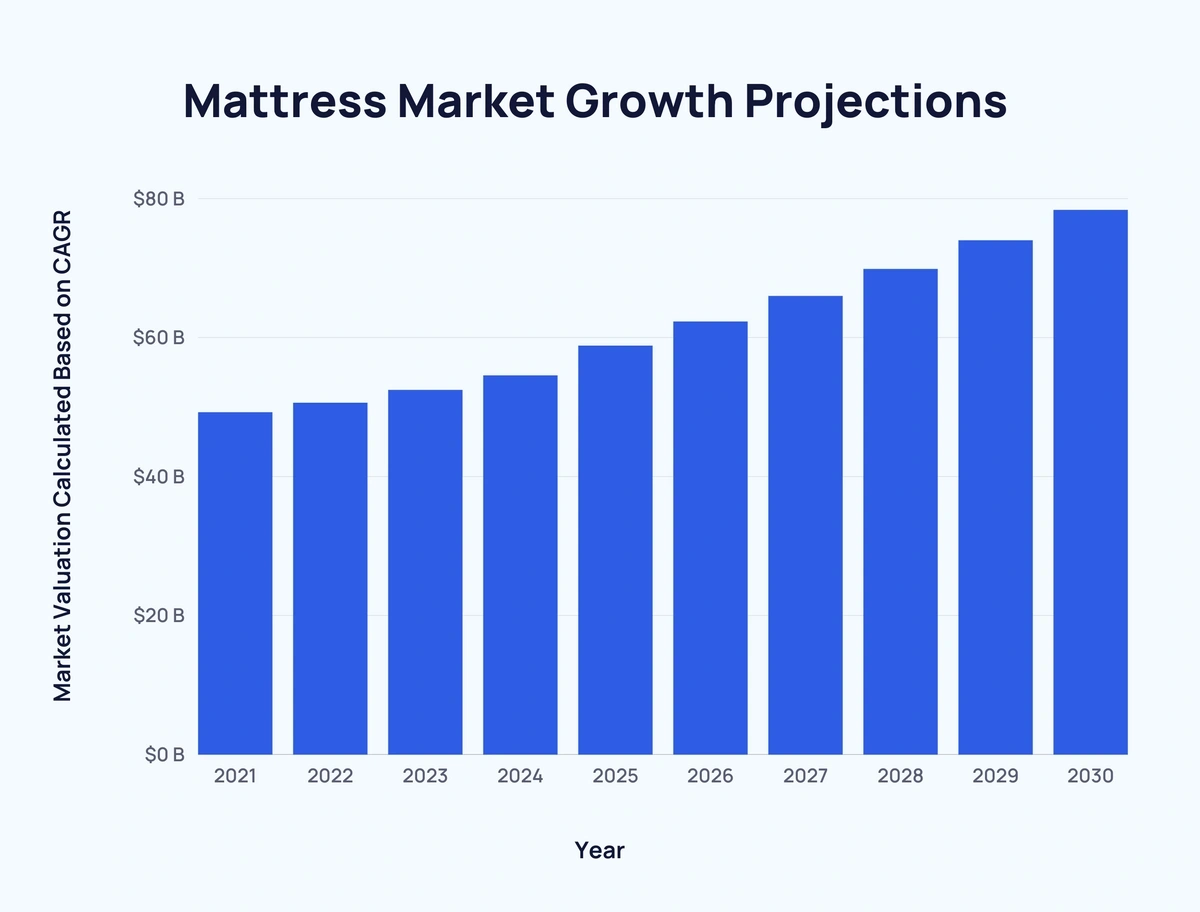

Mattress Market Growth Projections

The worldwide mattress market was valued at $49.24 billion in 2021.

The market is expected to reach $78.34 billion by 2030 at a compound annual growth rate (CAGR) of 6.59%.

Here’s a look at how the mattress market is set to progress:

|

Year |

Market Valuation Calculated Based on CAGR |

|

2021* |

$49.24 billion |

|

2022* |

$50.61 billion |

|

2023* |

$52.45 billion |

|

2024 |

$55.91 billion |

|

2025 |

$59.59 billion |

|

2026 |

$63.52 billion |

|

2027 |

$67.7 billion |

|

2028 |

$72.17 billion |

|

2029 |

$76.92 billion |

|

2030 |

$81.99 billion |

|

2031 |

$87.39 billion |

|

2032 |

$91.23 billion |

*Historical figure

Source: Fortune Business Insights

Growth Drivers in the Mattress Space

The major catalysts behind the continued growth of the mattress market include:

An increase in housing construction resulting in greater demand

In the US, the number of homes continues to climb year over year, rising from 132.29 million in 2011 to 141.95 million in 2021 – an increase of 7.3%.

While in Europe, single-occupancy households in EU countries have risen by 28.5% between 2009 and 2021.

Rising consumer spending on home furnishings

US consumer spending on furniture and bedding has grown year-over-year since 2009 from $83.2 billion to an estimated $119.8 billion in 2021. That’s an increase of 44%.

It’s a similar story in the UK, where furniture and home furnishing purchases have risen from £14.46 billion ($17.11 billion) in 2012 to £26.63 billion ($31.51 billion) in 2021.

Sources: Fortune Business Insights, US Census Bureau, Eurostat, Furniture Today, Office for National Statistics (UK)

Key Players in the Mattress Market

- Paramount Bed Holdings (Japan)

- King Koil (US)

- Kingsdown (US)

- Southerland Bedding Co (US)

- Tempur Sealy (US)

- Simmons (US)

- Sleep Number (US)

- Grupo Pikolin (Spain)

- Greiner AG (Austria)

- Sheela Foam (India)

- Purple (US)

- Nectar (UK)

- Casper (US)

- Helix (US)

- Tuft & Needle (US)

Sources: Mordor Intelligence, Fortune Business Insights, TraQline

Mattress Market Geographic Breakdown

North America dominates the mattress market with a 2024 market share of approximately $14.47 billion. The market is forecast to grow at a CAGR of 3.29% between now and 2029.

Given the number of key players based in the country, it is unsurprising that the US is the major driving force behind North America’s mattress market dominance. In fact, the US sleep economy is valued at $95 billion as of 2024.

Europe is seeing rapid growth in the mattress market. The European mattress segment is valued at an estimated $10.88 billion as of 2024. And is expected to grow at a CAGR of 2.13%.

Southeast Asia is an emerging market in the mattress space. The market may only be currently valued at $0.85 billion, but it is set to grow at a CAGR of 3.51%.

Sources: Statista, Frost & Sullivan, Statista (2), Statista (3)

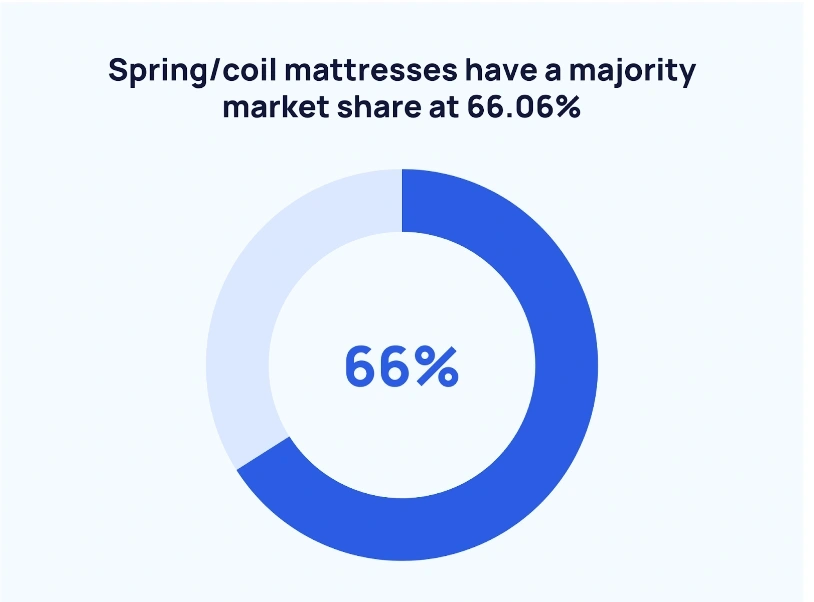

Mattress Market by Type

Spring/coil mattresses have a majority market share at 66.06%.

Foam ranks second with roughly one-quarter of that total. While latex currently has a fraction of foam’s market share.

The cost of a mattress varies hugely depending on the type. The average hybrid ($2,050) or latex queen mattress ($2,000) costs about double the price of a queen-size innerspring ($1,050) or foam mattress ($1,050).

Here’s the full breakdown of average US mattress costs by type in 2021:

| Mattress Type | Average Unit Price | |

| Twin | Queen | |

| Innerspring | $600 | $1,050 |

| All-Foam | $500 | $1,050 |

| Latex | $1,100 | $2,000 |

| Hybrid | $1,150 | $2,050 |

Sources: Fortune Business Insights

Mattress Market Consumer Preferences

Preference for the type of mattress appears to be split:

- 34% think pillow-top mattresses are best

- 22% think hybrid mattresses are best

- 22% think foam-only mattresses are best

Around 4 in 5 (83%) people agree that comfort and support are important features of a mattress.

While more than half of people say that size and thickness (57%) and materials/construction (56%) are key features.

2 in 5 people (40%) claim reputation is important. And just 16% are concerned with technology in mattresses.

The features considered to be most important to comfort/support are:

- Back support - 43%

- Firm - 33%

- Pillow-top - 26%

- Soft - 20%

- Contour to the body - 20%

- Motion isolation - 14%

Sources: Mattress Clarity, BedTimes

Key Takeaways

The mattress market may not be exploding, but steady growth looks assured.

A combination of improving technology, developing regional markets, increased demand, and larger budgets is set to keep the industry in good shape for the foreseeable future.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Fabio is a research associate at Exploding Topics. Since 2021, Fabio has researched, written, and edited articles for the Explo... Read more