Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

8 Top Tools & Software For VCs (2025)

Whether you’re exploring startup financials or need help managing your fund, the eight companies on this list offer some of the best venture capital software tools right now.

Build a winning strategy

Get a complete view of your competitors to anticipate trends and lead your market

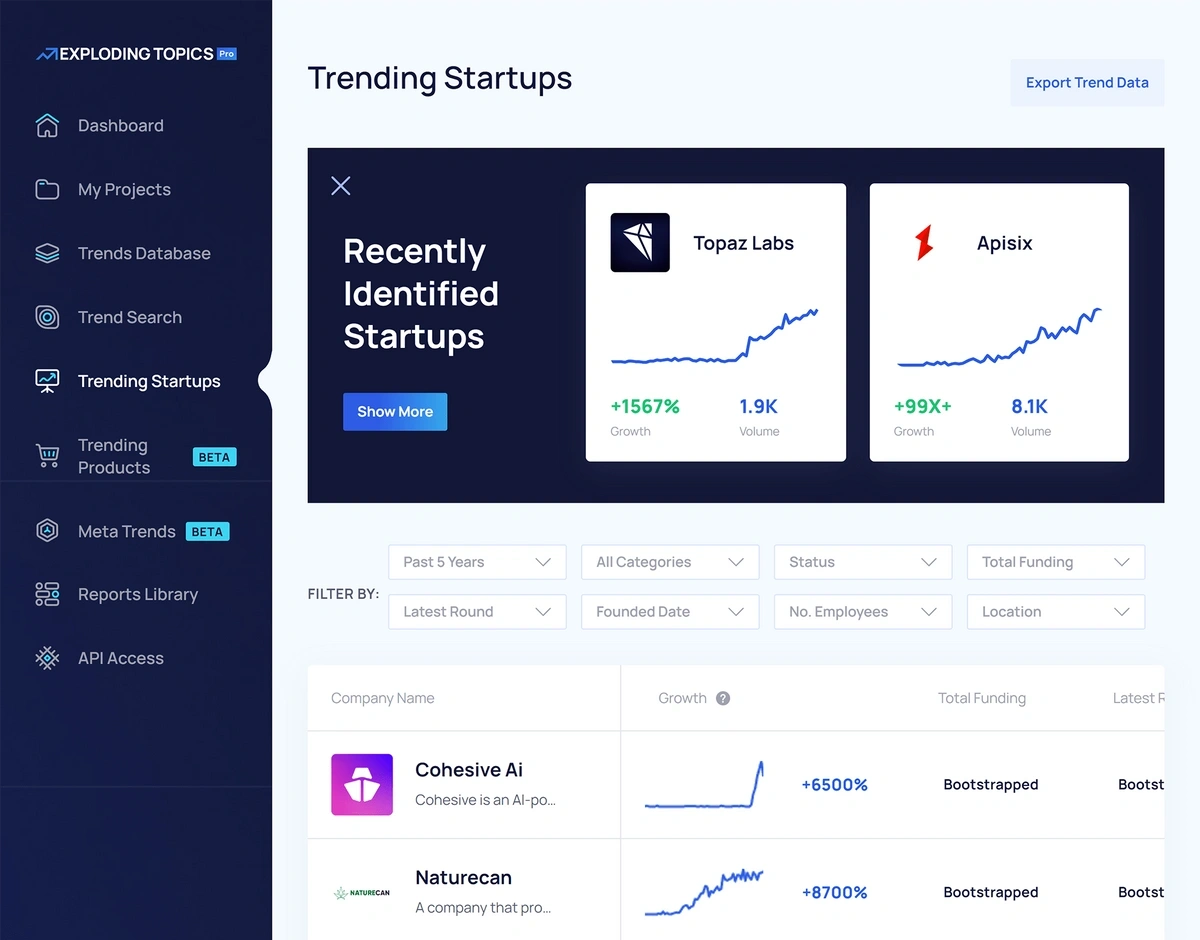

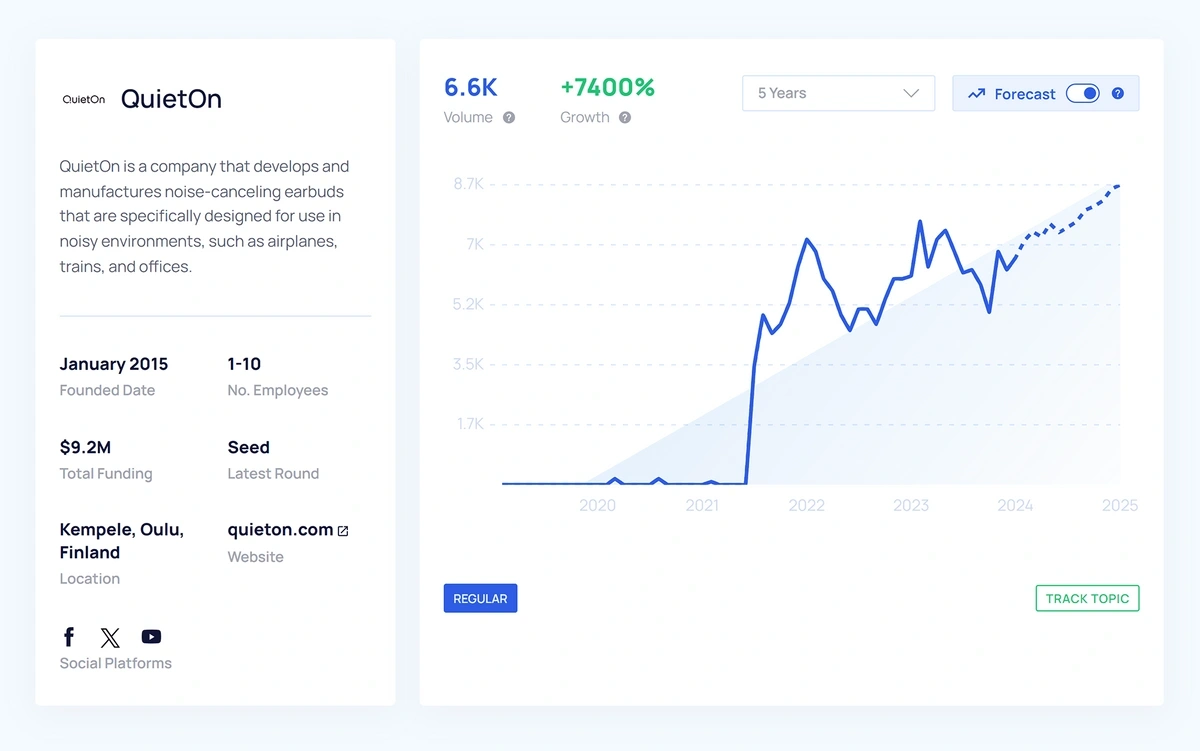

1. Exploding Topics: Best For Opportunity Research

Exploding Topics is a trend spotting tool that helps VC firms identify fast-growing industries and companies with investment potential.

Using a blend of artificial intelligence and human expertise, we continuously evaluate multiple online data sources including:

- Social media

- Company websites

- News outlets

- Blogs

- Online communities

We use these channels to pinpoint topics that are of growing interest among consumers and other businesses, including popular products and startups.

By keeping an eye on fluctuating interest levels in different markets or companies, you can get a sense for what’s about to be the next big thing—and worth your investment dollars.

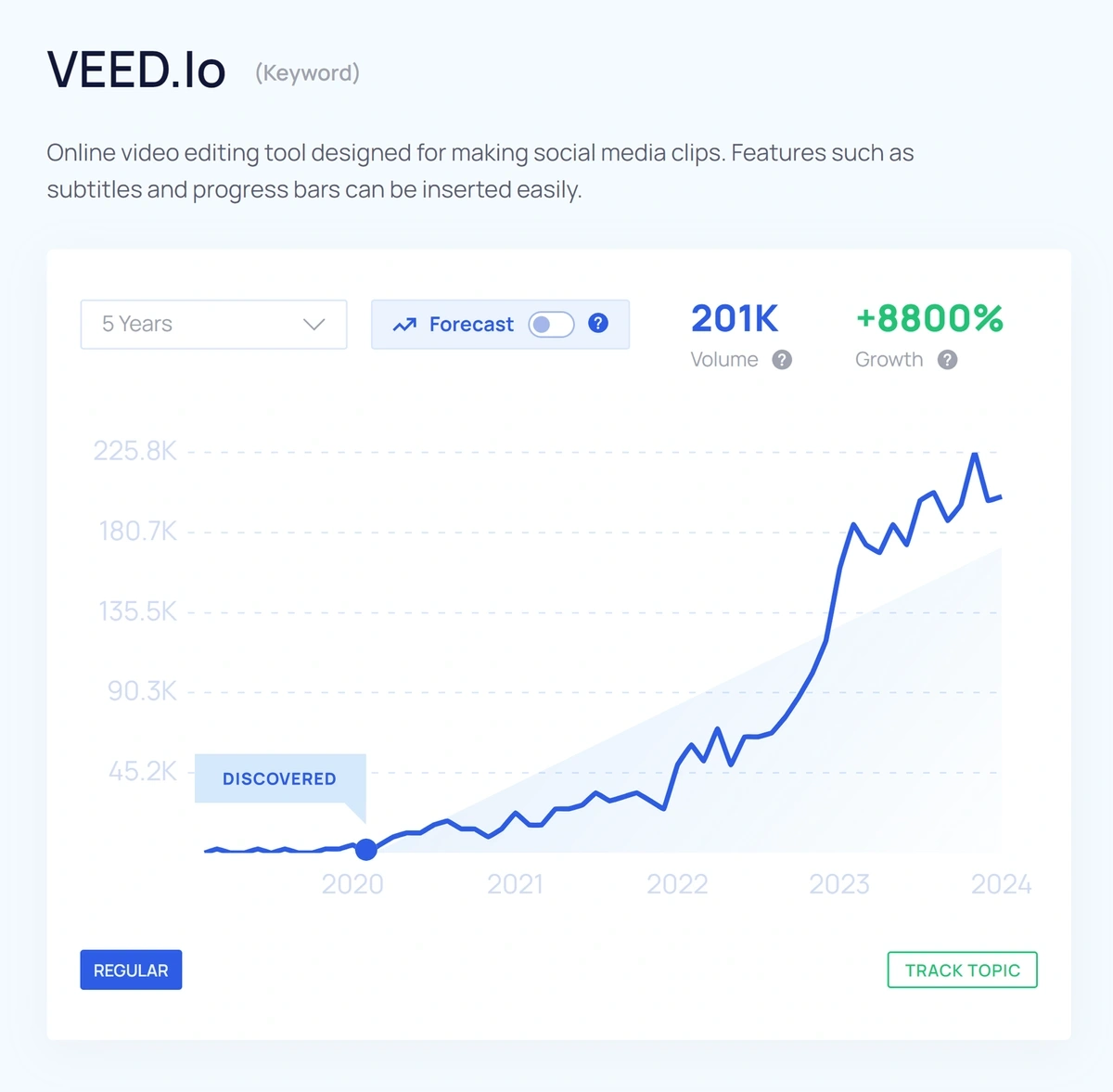

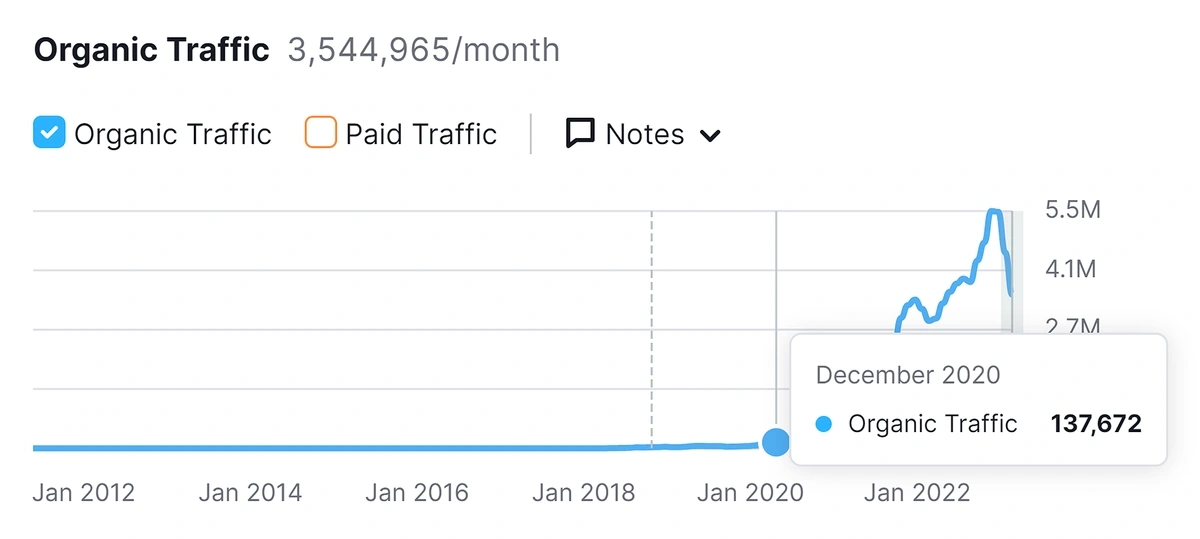

Take VEED.io as an example. We first identified the now-popular video editing app in December 2020.

At that time, the VEED.io website received just over 137,000 visits a month from organic search results.

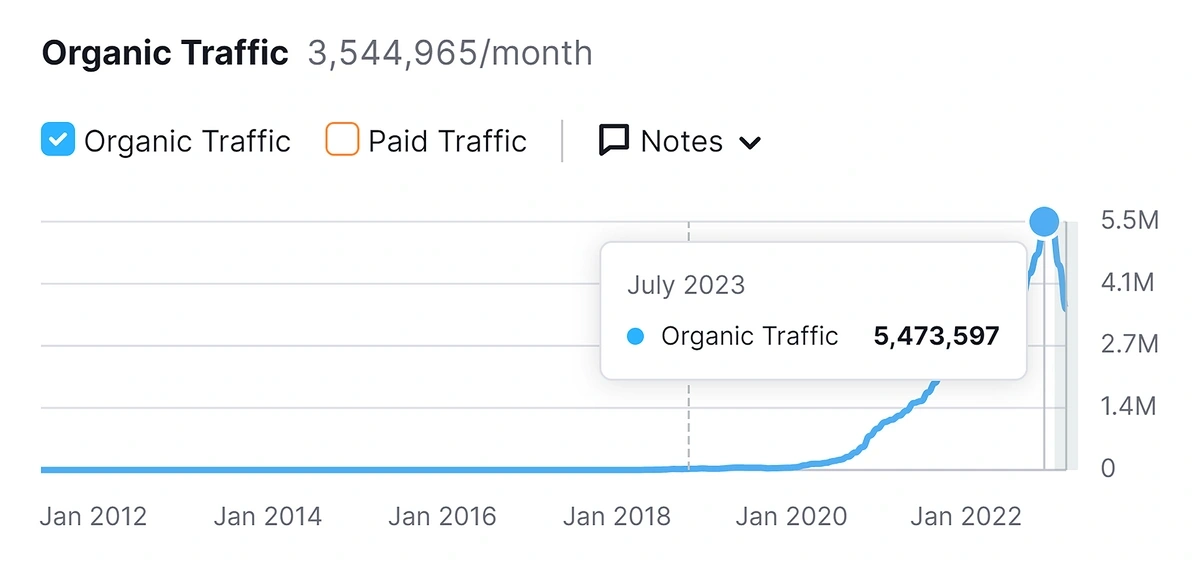

The company now receives more than 3.9 million visits from organic search results alone—with a peak of over 5 million visitors in July 2023. Just take a look at this data from Semrush:

VCs using Exploding Topics back in 2020 were some of the first to know about this startup’s high potential, putting them in the perfect position to make a smart investment.

How Much Does Exploding Topics Cost?

While anyone can begin searching our trend database for free right now, venture capitalists will want to select an Exploding Topics Pro plan to get full access to all our data.

Exploding Topics Pro is free to use for the first 7 days. After that, for $99 per month (billed annually), you’ll be able to dig into our complete library of information, including a list of the top trending startups you need to know about right now.

You’ll be able to see details like:

- How a company has grown over time

- Current funding amount and stage

- The number of employees at a startup

Plus, you’ll get access to Exploding Topics features, like trending products and meta trends analysis. These tools will continue to help you build out a complete picture of companies and industries that interest you.

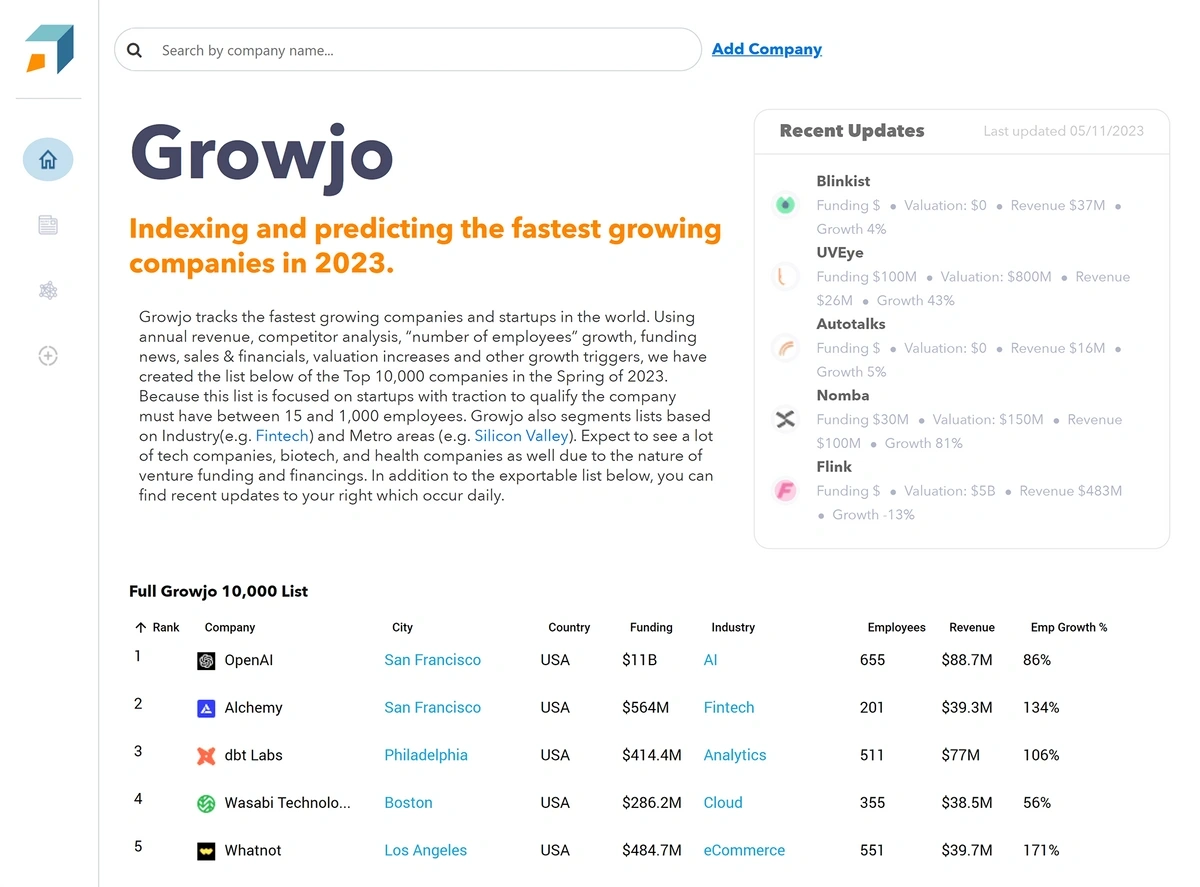

2. Growjo: Best For Startup Comparisons

Growjo is a free database of popular startups.

You can use the tool to see details like:

- How much funding a startup has raised

- The number of employees at a company

- Estimated startup revenue

- Industry competitors

It’s all laid out in a simple table format, and you can export it to a spreadsheet with just a click.

All of Growjo’s information comes from public sources, including blog posts, company reports, and news articles. While you could hunt this information down yourself, relying on Growjo to do so can save you valuable time.

How Much Does Growjo Cost?

There’s no charge to use Growjo—you can visit the website and begin browsing company information anytime.

3. PitchBook: Best For Financial Research

PitchBook is a research tool that makes it easy for VC fund managers to dig deep into company financials.

If you’ve identified companies you’d like to invest in, you can use PitchBook’s data sets to support your investment decisions. This data includes:

- Amounts of recent startup valuations

- A company’s funding sources

- How a startup is funded (debt, loans, or investments)

- Who’s advising specific companies

- Names of corporate board members

PitchBook’s data covers both public and private markets, so you can get a clear picture of nearly any business’ financials.

The platform offers more than just financial information, too. While we particularly like PitchBook’s clear breakdown of startups’ valuations, you can also use the tool to:

- Research how other private market companies get funds

- Find acquisition and investment targets

- Conduct due diligence

- Network with founders and investors

- Create investment fund benchmarks

How Much Does PitchBook Cost?

There are a lot of parts to the PitchBook platform, so you’ll need to get in touch with the company to discuss how they can help you—and get a price quote.

4. Dealroom: Best For Pipeline Development

Dealroom is a global database of over 2.5 million startups. You can use the tool as a research aid for venture capital pipeline development and deal sourcing.

When you’re seeking your next investment opportunity, Dealroom can help you:

- Look for high-potential startups that aren’t yet attracting attention from other investors

- Find companies that are like each other

- Locate founder contact information

- Watch the funding activity on companies of interest

- Connect with other investors

- Monitor industry trends

You can easily create lists of companies you want to invest in, founders you plan to reach out to, and other investors to collaborate with.

If you find that you’re having trouble finding just the right opportunities—or you simply prefer to outsource your research to someone else—you can pay Dealroom’s intelligence unit to conduct VC research for you.

How Much Does Dealroom Cost?

Dealroom offers several usage plans based on the number of user seats and data exports you plan to use. They don’t provide their pricing up front, though, so you’ll need to get in touch with the Dealroom team to generate a quote.

5. 4Degrees: Best For Deal Flow Management

4Degrees is a deal flow and investor relationship management platform.

Rather than trying to make a sales CRM work for your investment research needs, you can use 4Degrees to:

- Figure out how you’re connected to a founder or investor who you’d like to meet

- Keep track of your conversations and how they relate to potential deals

- Monitor contacts to find out when they change jobs or make other professional moves

- Get reminders to follow up with contacts you haven’t spoken to in a while

- Tag and organize contacts based on industry, company type, and more

- Build your deal pipeline

- Generate reports related to your deals

The 4Degrees platform is helpful for managing private equity activity, commercial real estate deals, or mergers and acquisitions, too.

How Much Does 4Degrees Cost?

All 4Degrees pricing is customized based on how you plan to use the tool. You’ll pay per user seat, but the total price can vary based on the features you’ll need to use.

Anyone interested in using 4Degrees can fill out a contact form on the company’s website to receive a quote.

6. Harmonic.ai: Best For Early-Stage Startup Discovery

Harmonic is an AI-powered startup discovery and deal-sourcing platform designed specifically for early-stage VCs.

You can use Harmonic to:

- Discover stealth and pre-seed startups weeks or months before their first raise

- Filter by hiring velocity, founder pedigree, product keywords, funding history, and tech stack

- Monitor founder activity and get alerts when they start new ventures

- Build custom target lists using your firm’s investment thesis

- Export enriched company profiles to your CRM or pipeline tracking system

As a Harmonic user, you can also get monthly digest reports on new startups that match your pre-defined criteria or categories.

How Much Does Harmonic.ai Cost?

Pricing for Harmonic is not publicly listed. Plans vary based on the number of users, API access, and data enrichment needs. To get a custom quote, you’ll need to request a demo through their website.

7. Tactyc: Best For Portfolio Management

Tactyc is a forecasting and planning tool for venture capital fund managers.

You can use the platform’s dashboard and tools to:

- Manage your existing portfolios

- Project the impact of potential investments or exits

- Develop funding strategies by tapping into market intelligence

- Track key performance indicators (KPIs) for your portfolio companies

- Create market benchmarks based on round sizes and valuations

- Estimate future cash flow

- Generate reports

- Store related deal documents

You can also use the tool to build out projections and use the platform’s reporting tools to share information with potential investors in your fund.

How Much Does Tactyc cost?

If you’d like to use Tactyc to model potential fund performance and share reports with limited partners (LPs), you can subscribe to the platform for $299 per month, or $249 monthly when billed annually.

When using Tactic to manage your existing fund, you’ll pay a varied amount based on the size of your fund.

For example, you’ll pay $299 per month (or $249 per month billed annually) for a million-dollar fund. If your fund reaches $100 million, you’ll pay $699 per month (or $583 per month billed annually).

Custom pricing is also available for larger venture capital firms that need multiple user seats.

8. Carta: Best For Fund Accounting

Carta is a back-office fund management tool. VCs that subscribe to the tool get access to experienced fund accountants and automation workflows designed to help improve investor efficiency.

Additional features available for VCs include:

- At-a-glance timelines of all the activity on your fund

- Done-for-you fund administration and tax filings

- Guided help for starting a new fund

- Tools to help you track where LPs are in your investment pipeline

- Audit compliant, ASC 820 valuations for your fund’s investments

- Investment modeling tools

- Cap table management features

If you’re new to running a fund, the hands-on help provided by Carta can make the process easier and smoother than when using a series of different tools or spreadsheets.

Lawyers can also use Carta to help their VC and startup clients manage valuations, compensation, and equity shares.

How Much Does Carta Cost?

Carta’s pricing is customized based on how you plan to use the tool, so you’ll need to contact the company by phone or through their website to set up a consultation.

Conclusion

Creating a fund and investing in valuable startups means you’ll be juggling a lot of data—and you may need to use more than one tool to get all the information you need.

It’s key to have a reliable research tool as part of your VC tech stack. Exploding Topics, Growjo, and Harmonic can help you get initial information about new companies and markets, while PitchBook provides deeper insights on financial reports and contact information.

From there, you could opt to manage pipeline development, report generation, and LP communication on your own in Excel—but dedicated VC platforms like Carta and Tactyc will make the process much easier.

It’s all about finding the right suite of venture capital tools for your fund, and the eight on this list are a great place to start.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more