Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

8 Top Venture Capital Management Software (2024)

If you're still managing your venture capital fund in Excel, check out these eight top VC tools that can help you streamline your investment operations.

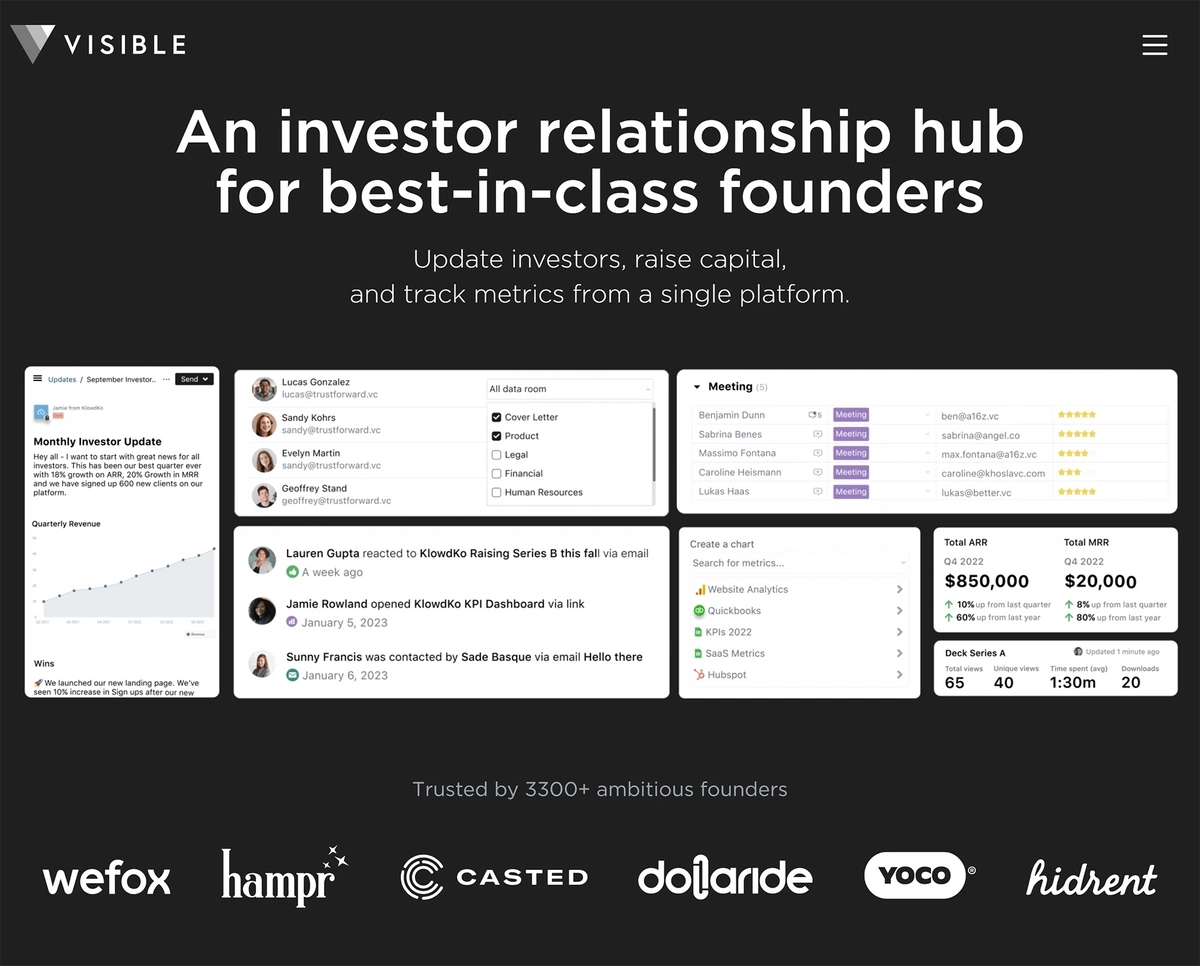

1. Visible: Best For Investment Management

Visible is a portfolio management tool for VC firms.

The platform allows users to build dashboards that display metrics about your fund and portfolio companies, including:

- Revenue changes

- Cash balances

- Invested capital per company

- Investment funding rounds

- Overall portfolio makeup

- Company market values

You can also use the tool to email reports and updates to limited partners (LPs)—without requiring them to log into an investor portal.

How Much Does Visible Cost?

Visible pricing varies based on the venture capital management features that you plan to use. All pricing is custom—you'll need to get in touch with the company to schedule a demo and receive a price quote.

2. DealCloud: Best For Deal Pipeline & Relationship Management

DealCloud is a CRM platform built with investors in mind.

You can track every contact in DealCloud and filter them by various parameters like:

- Company name

- Related deals

- Board appointments

- Liquidity preferences

- Funding history data

VC investors can use DealCloud simply to keep track of who they've talked to and when, or rely on the tool for complete deal flow management.

When using DealCloud, you'll be able to track key back-office metrics like:

- Deals by stage

- Amount to be invested in each target

- Month-over-month and year-over-year investment changes

- Funding analytics by round

- Compliance-related documentation

The platform's dashboards and reports are customizable on the user level, so your team members can adjust their views as needed.

How Much Does DealCloud Cost?

DealCloud uses a custom pricing model, so you'll have to schedule a demo on their website before getting a price quote.

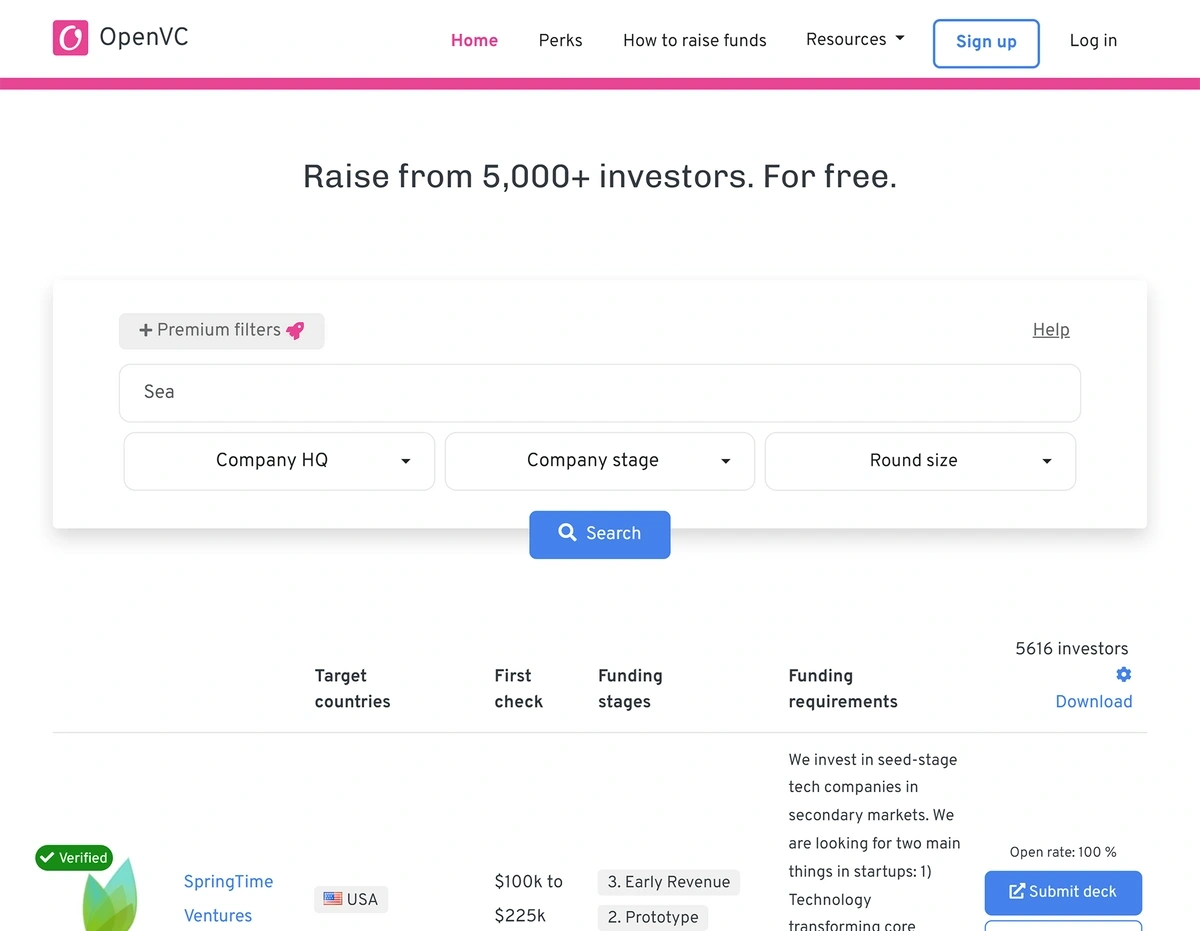

3. OpenVC: Best For Passive Pipeline Development

OpenVC is a platform that helps investors connect with startups to invest in.

Once you establish an investor profile on OpenVC, you'll become part of a searchable database that founders use to find potential investment partners.

Most of the startups and entrepreneurs using OpenVC to find investors are:

- Pre-seed stage

- Seed stage

- Early stage

If you're interested in making investments at that level, the platform is a nice way to keep passively finding investment opportunities.

OpenVC says that they screen all deal flow in order to prevent VCs from getting spammed, and investors can expect to receive about one message a week from founders seeking funding.

How Much Does OpenVC Cost?

There's no charge for investors to use the OpenVC platform.

4. Dealroom: Best For Finding Co-Investors

Dealroom is a business intelligence platform.

You can use Dealroom in multiple ways, including connecting with founders and conducting research on prospects.

It stands out from other companies on this list, though, because of its investor database.

Unlike OpenVC, which allows founders to search lists of investors, Dealroom lets investors find each other.

As a VC, you can use this feature to network with other investors and find potential co-investors to partner with in the future.

Dealroom also lets you keep an eye on competing VC firm activity, which is useful when planning your next investment decision.

How Much Does Dealroom Cost?

Dealroom offers a few different plans based on the number of user seats and data exports you need.

You can add Dealroom API access to any plan, too.

All pricing is custom, though, so you'll need to get in touch with their team to get a quote.

5. Softledger: Best For VC Fund Accounting

Softledger is a cloud-based, multi-entity accounting platform.

Because Softledger allows you to create books for more than one company or asset, it's a nice choice for VC firms managing multiple funds.

With a Softledger account, VCs can:

- Manage the total performance of different funds

- See investment-level accounting details for each fund, including balance sheets

- Consolidate multiple funds for bigger-picture reporting

- Manage cryptocurrency investments

- Account for investments made in different currencies

- Create automations and workflows for routine actions related to accounts receivable or accounts payable

Softleger also offers an API that firms can use to connect the other tools in their fund management ecosystem. This can accelerate the process of creating entries and reports for a variety of fund accounts.

How Much Does Softledger Cost?

Softledger plans start at $750 per month.

All plans support multi-entity management; the number of users and entities you need to manage can push your plan price up to a higher tier.

6. SS&C Intralinks: Best For Investor Reporting

SS&C Intralinks InvestorVision™ is a platform for fund tracking and reporting.

It offers some features that are like those found in Visible, but SS&C Intralinks' report-focused interface is great for developing strong investor relations.

The platform uses bank-grade security to protect financial data and report documents. VC firms can use the InvestorVision tool to:

- Monitor fund investors' accounts and balances

- Generate reports on capital balances, cash flow, fund performance, and more

- Split large files into individual K-1 reports and statements

- Securely manage and share documents related to funds

- Communicate key updates to investors

When you use SS&C Intralinks, the platform auto-generates an audit trail, too, which may help to make compliance activities easier.

How Much Does SS&C Intralinks Cost?

SS&C Intralinks uses a customized pricing model, so you'll need to get in touch with the company to set up a demo and get a price quote.

7. iDeals: Best For Document Sharing

iDeals is a virtual data room (VDR) service that allows investors to securely share documents.

It's a good choice for investors who only need a secure document portal, without any of the additional features provided by tools like SS&C Intralinks.

The iDeals platform is an online file sharing system that employs a variety of security features. When using iDeals, you can:

- Restrict portions of documents from view

- Redact sections of documents

- Enforce encryption

- Track document views and downloads

- Remotely revoke document access

- Automatically apply watermarks when documents are viewed or downloaded

- Securely view spreadsheets without opening Excel

This functionality is useful when conducting due diligence or working to close a new investment deal.

How Much Does iDeals Cost?

All iDeals plans allow for unlimited users, customizable watermarking, and encrypted storage.

Plan pricing depends on the number of projects you need to work on simultaneously, and how many administrator user seats you require.

The company doesn't publish its pricing publicly, though. You can instead start a free trial on the iDeals site and then speak to a member of their team about a price quote.

8. Seraf: Best For End-to-End Fund Management

Seraf is a complete portfolio management software solution for venture capital firms.

It can take the place of various tools on this list and is useful for a variety of fund administration tasks, including:

- Contact management

- Deal flow funnel development

- Investment tracking

- Portfolio valuation management

- Cash flow monitoring

- Stakeholder report generation

- KPI progress tracking

You can also use Seraf as a limited VDR. It doesn't offer quite the same level of security features that iDeals does, but supports document storage and permissions-based access.

How Much Does Seraf Cost?

Enterprise-grade Seraf plans, which are suitable for VC use, are only available through a custom demo and pricing process.

Conclusion

Whether you need more streamlined portfolio management, deal flow monitoring, accounting, or growing your network, the eight VC tools on this list can help your firm close more deals and improve investor relationships.

Having the right software stack in place is only part of the equation, though. To take your investment activities to the next level, you’ll want to make sure you’re keeping an eye on VC trends, investor news, and fast-growing startups. Or check out our regularly updated list of tools for VCs.

By doing so—and exploring the tools on our list—you'll be actively setting your VC firm up for success this year and beyond.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more