Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Global AgTech Market Size, Growth, & Trends (2025-2034)

The global agtech market is on the rise.

Adapting consumer demands concerning food production and the improvement of agricultural technology are boosting growth.

With that in mind, we’ll explore the following agtech market statistics:

- AgTech Industry Highlights

- AgTech Market Size

- AgTech Market Growth Projections

- Growth Drivers In The AgTech Space

- Key Players In The AgTech Market

- AgTech Market Geographic Breakdown

- AgTech Growth By Segment

AgTech Industry Highlights

- The global agtech market is worth over $26 billion

- By 2034, the global agtech market is expected to surpass $74 billion

- The global agtech market is growing at a CAGR of 12.2%

- The North American agtech market is valued at $14.31 billion

- Precision agriculture is worth over $4 billion

AgTech Market Size

As of 2025, the global agtech market is currently worth $26.27 billion.

Several factors are contributing to the growth of the agtech market, perhaps most prominently growing concern over how food is produced.

Historical data shows that smart agriculture has grown from $9.58 billion in 2017 to $12.4 billion in 2020. And according to Precedence Research, the market is expected to grow to $74.03 billion by 2034.

Sources: Precedence Research, Foley, BIS Research

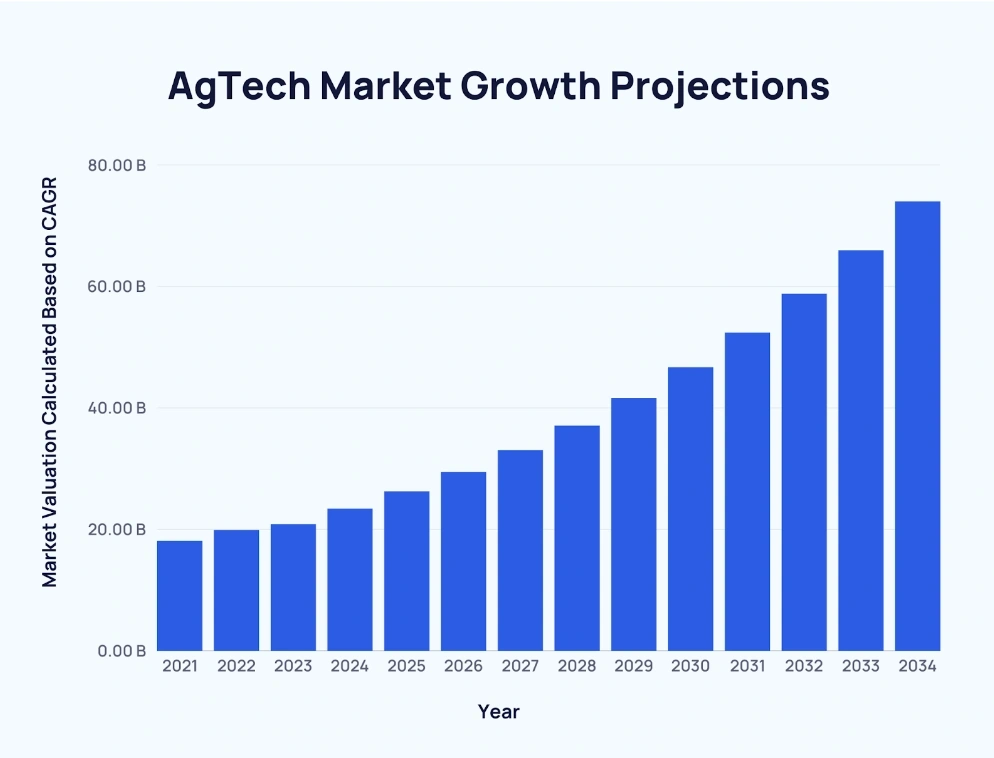

AgTech Market Growth Projections

The worldwide agtech market was valued at $18.12 billion in 2021.

The market is expected to reach $74.03 billion by 2034 at a compound annual growth rate (CAGR) of 12.2%.

Here’s a closer look at how the agtech market is forecast to grow:

|

Year |

Market Valuation Calculated Based on CAGR |

|

2021 |

$18.12 billion |

|

2022 |

$19.91 billion |

|

2023 |

$20.87 billion |

|

2024 |

$23.42 billion |

|

2025 |

$26.27 billion |

|

2026 |

$29.48 billion |

|

2027 |

$33.07 billion |

|

2028 |

$37.11 billion |

|

2029 |

$41.64 billion |

|

2030 |

$46.71 billion |

|

2031 |

$52.41 billion |

|

2032 |

$58.81 billion |

|

2033 |

$65.98 billion |

|

2034 |

$74.03 billion |

*Historical figure

Source: Precedence Research

Growth Drivers in the AgTech Space

AgTech funding increased year-over-year between 2018 and 2021 from $1.1 billion to $4.9 billion. And while that figure has grown further to $7 billion in H1 2024, it's down from H1 2023's $8 billion investment.

Changing perspectives on the importance of how food is produced is a major driver in the agtech market. Millennials especially are increasingly encouraging companies to find innovative methods of food production (like vertical farming).

Rising disposable income, urbanization, and the aforementioned changing habits have majorly driven demand for agtech applications in China, India, Brazil, and the US.

Sources: Crunchbase, AFN, Foley, Prescient & Strategic Intelligence

Key Players in the AgTech Market

- Cargrill (US)

- ADM (US)

- Bayer (Germany)

- AgroStar (India)

- Topcon Agriculture (US)

- DeLaval (UK)

- Trimble (US)

- Apollo Agriculture (Kenya)

- Benson Hill (US)

- Bowery Farming (US)

- Ceres Imaging (US)

- Conservis (US)

- CropX (US)

- Gro Intelligence (US)

- Impossible Foods (US)

- Indigo AG (US)

- LettUs Grow (UK)

- Ninjacart (India)

- Pivot Bio (US)

- Plenty Inc (US)

- AGCO Corporation (US)

- InnovaSea (US)

- Semiosbio (Canada)

- Afimilk (Israel)

- Aker (US)

Sources: Global Banking and Finance, Transparency Market Research, Grand View Research, BizVibe

AgTech Market Geographic Breakdown

The North American agtech market is valued at over $14 billion.

The next-largest market, Europe, is worth just shy of $6 billion.

Here’s a breakdown of the agtech market by region according to Juniper Research data:

| Year | North America | Europe | Far East & China | Latin America | Rest of World | |||||

| Value | Share | Value | Share | Value | Share | Value | Share | Value | Share | |

| 2020 | $5.2 billion | 57.2% | $2.5 billion | 27.5% | $598 million | 6.6% | $46 million | 0.5% | $746 million | 8.2% |

| 2021 | $6.22 billion | 59.3% | $2.79 billion | 26.6% | $665 million | 6.3% | $42 million | 0.4% | $781 million | 7.4% |

| 2022 | $7.54 billion | 60.8% | $3.29 billion | 26.5% | $726.6billion | 5.9% | $47 million | 0.4% | $803 million | 6.5% |

| 2023 | $9.25 billion | 62.2% | £3.92 billion | 26.4% | $808 million | 5.4% | $53 million | 0.4% | $837 million | 5.6% |

| 2024 | $11.46 billion | 62.9% | $4.8 billion | 26.3% | $933 million | 5.1% | $59 million | 0.3% | $979 million | 5.4% |

| 2025 | $14.31 billion | 63.4% | $5.95 billion | 26.4% | $1.1 billion | 4.9% | $67 million | 0.3% | $1.15 billion | 5.1% |

Although not specifically represented in the data above, the Asia-Pacific region is predicted to be the fastest-growing agtech space. The increased adoption of agricultural AI in major nations including India, China, Australia, and Japan is largely behind this. China’s agtech market is expected to grow at a CAGR of 27% between 2020 and 2030.

Sources: Juniper Research, P&S Intelligence

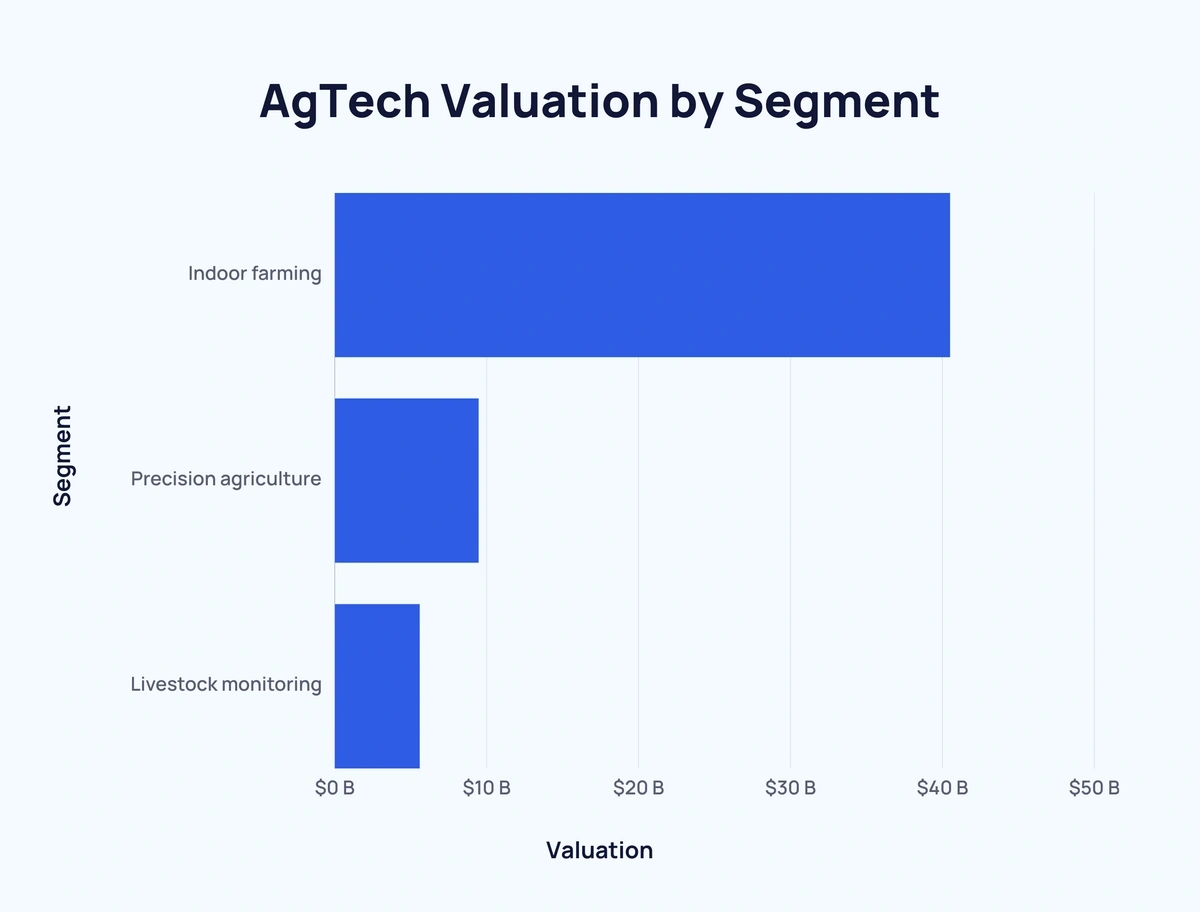

AgTech Growth by Segment

The agtech market can be broken down into a few key segments. According to recent data, indoor farming is the largest of those segments, valued at $40.51 billion.

This was followed by precision agriculture ($9.48 billion) and livestock monitoring ($5.6 billion).

The order of valuation is projected to remain the same, but those valuations are expected to at least double across the board by 2026.

Within the precision farming space, six applications are expected to grow at a CAGR of over 11%. Precision spraying is the fastest growing application with a CAGR of 15.38% between 2018 and 2025.

Source: BIS Research

Key Takeaways

The agtech industry is growing in valuation year-over-year as investment gathers pace.

Changing consumer demands and an improvement in technology within the space are presenting new opportunities for growth within the market.

If you found these agtech stats interesting, take a look at our other related content: Emerging AgTech Industry Trends and Agtech Startups On The Rise.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Fabio is a research associate at Exploding Topics. Since 2021, Fabio has researched, written, and edited articles for the Explo... Read more