Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 Agtech Companies & Startups On The Rise In 2024

You may also like:

- 20 Surging Climate Tech Startups

- The 10 Biggest Sustainability Trends

- 7 Key Logistics & Supply Chain Trends

The agriculture industry is gradually transforming into the next high-tech sector.

Technologies like blockchain, artificial intelligence, and computer vision are being leveraged to improve crop yields, supply chains, and sustainability.

By 2030, the global agtech market is projected to reach $43.37 billion, growing at a 10.2% CAGR.

As new technologies continue being integrated into agriculture, the number of agtech startups is rising. We’ve rounded up 20 of the fastest growing agtech companies to keep an eye on.

1. DeHaat

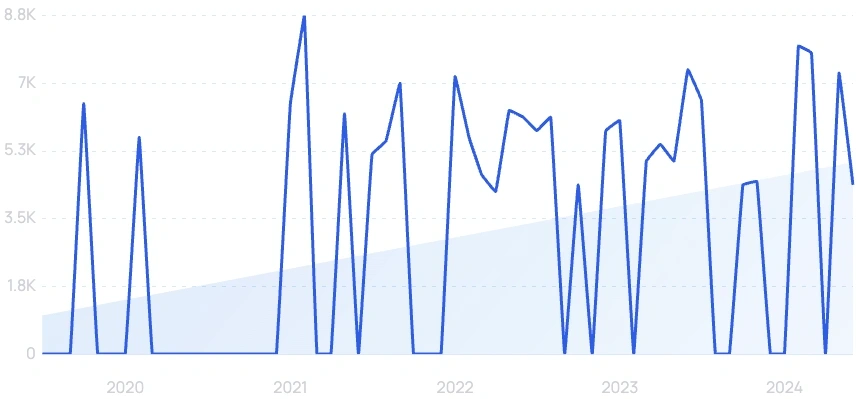

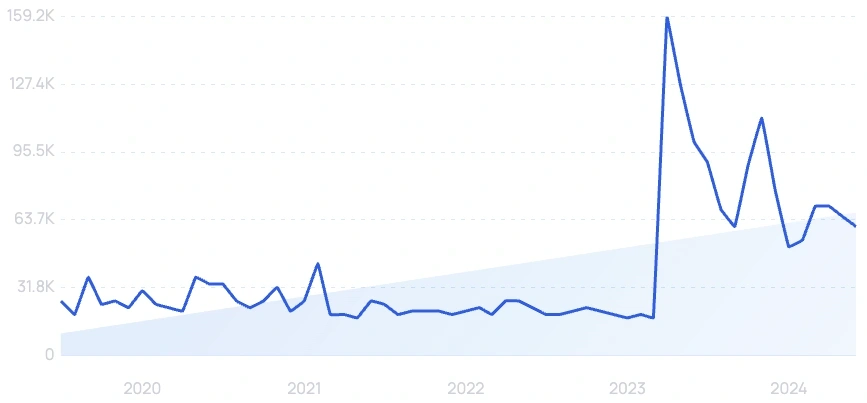

5-year search growth: 438%

Search growth status: Exploding

Year founded: 2012

Location: Bihar, India

Funding: $224.3M (Series E)

What they do: DeHaat is an Indian agtech startup that aims to empower small farmers by providing them with end-to-end agricultural services. The company offers a range of solutions, including access to quality seeds, fertilizers, and crop protection products, as well as advisory services and market linkages. Through its digital platform, DeHaat has helped thousands of farmers increase their yields, reduce costs, and improve their livelihoods.

2. The Crop Project

5-year search growth: 204%

Search growth status: Regular

Year founded: 2020

Location: Brooklyn, NY

Funding: $1.5M (Seed)

What they do: The Crop Project is an AgTech startup focused on regenerative agriculture practices. Specifically, the startup buys kelp from farmers. They then dry and mill that helps so that it can be used to make food, fertilizers, and biomaterials. According to the company, they work with kelp because it is a regenerative crop that can produce biomass with zero inputs, captures carbon, and reduces ocean acidification. The startup harvested over 5,000 pounds of kelp last year.

3. ProducePay

5-year search growth: 4,900%

Search growth status: Regular

Year founded: 2014

Location: Los Angeles, CA

Funding: $380.9M (Series D)

What they do: Combining fintech and agritech, ProducePay offers pre-harvest financing to fresh produce growers. They also offer a grower-distributor network, a pricing and weather alerts tool, and sales analytics. The company currently has 800+ customers. In February 2024, the startup raised $38 million in Series D funding to expand operations globally.

4. Future Fields

5-year search growth: 77%

Search growth status: Regular

Year founded: 2018

Location: Edmonton, Canada

Funding: $18.9M (Series A)

What they do: Future Fields is an agtech company focused on sustainable recombinant protein production. They utilize their own technology, the EntoEngine platform, to harness fruit flies to produce these proteins while reducing their environmental footprint. In February 2023, the startup secured $11.2 million in Series A funding to build a production facility and scale operations.

5. Robovision

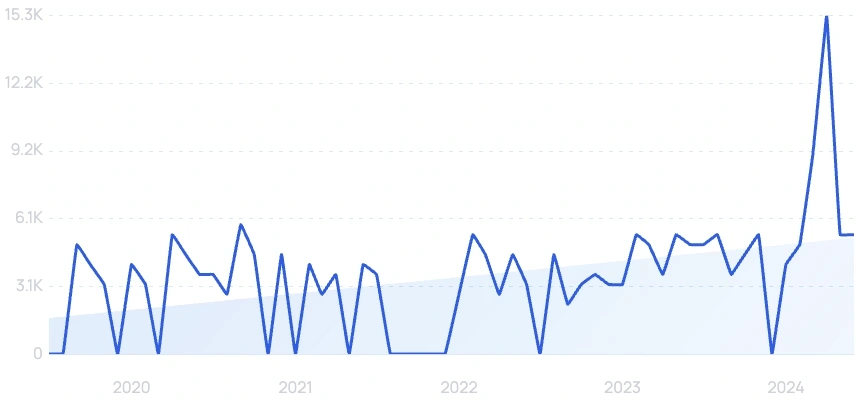

5-year search growth: 1,100%

Search growth status: Regular

Year founded: 2009

Location: Ghent, Belgium

Funding: $60.7M (Series A)

What they do: Robovision has developed a platform for managing AI-based vision systems in the agricultural sector. The startup's 3D deep learning technology is modernizing the industry by giving agricultural robots the ability to plant and harvest crops correctly. In fact, over 600 agricultural robots are integrated with Robovision's platform today. The startup raised $42 million in Series A funding in March 2024.

6. BharatAgri

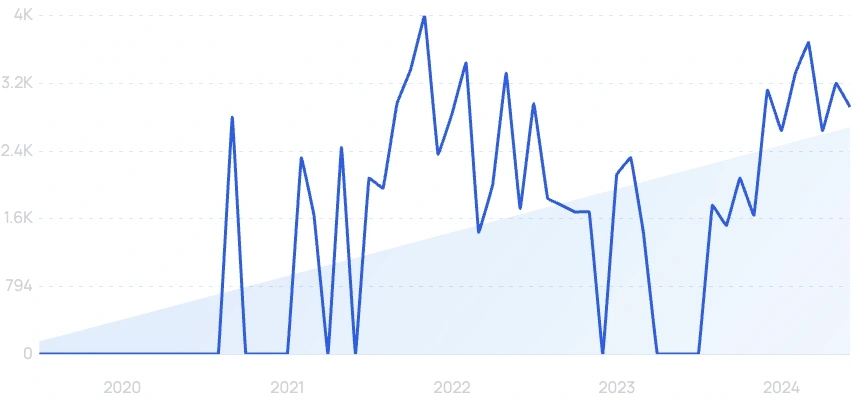

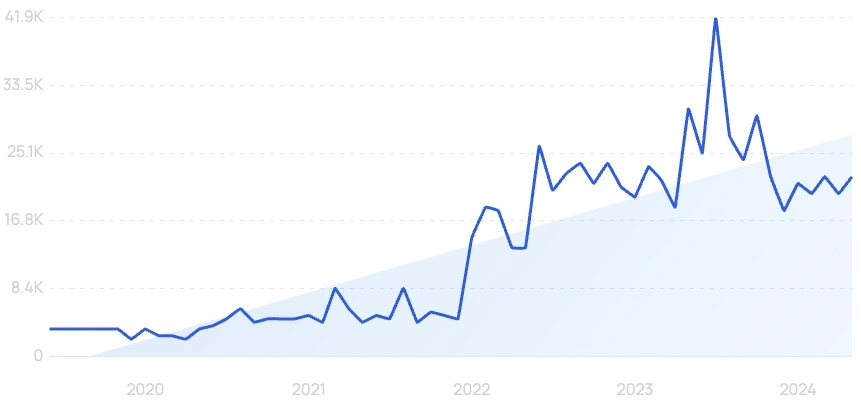

5-year search growth: 7,000%

Search growth status: Regular

Year founded: 2017

Location: Karnataka, India

Funding: $15.7M (Series A)

What they do: BharatAgri is an India-based farming technology platform that offers farmers personalized advice and actionable insights to increase farming output. The startups' algorithm, LeanNutri, assists farmers in decision-making and season-long planning with a focus on nutrient management and pest and disease control. Beyond these personalized services, the company has an online marketplace for farming related essentials including fertilizer, seeds, equipment, and more.

7. Oishii Farm

5-year search growth: 43%

Search growth status: Exploding

Year founded: 2017

Location: Kearny, New Jersey

Funding: $184M (Series B)

What they do: Oishii specializes in indoor vertical farming to grow high-quality strawberries and produce. They use 50 state-of-the-art robots to automate the growing and harvesting processes to grow produce year-round without the need for pesticides. In February 2024, the startup secured $134 million in Series B funding to expand operations and open a new solar-powered facility.

8. Sencrop

5-year search growth: 90%

Search growth status: Regular

Year founded: 2016

Location: Lille, France

Funding: $30M (Series B)

What they do: Sencrop is a micro-climate technology company that helps farmers limit their crop risks from environmental impact. The startup uses weather station technology to provide farmers with real-time information about weather conditions, water stress, plant growth stages, disease, pest development conditions, and more. Currently, Sencrop serves more than 20,000 farmers and professionals in over 20 countries.

9. Ynsect

5-year search growth: -15%

Search growth status: Peaked

Year founded: 2011

Location: Paris, France

Funding: $579.1M (Series D)

What they do: Ynsect is a French agtech company that specializes in insect breeding and processing for animal feed and plant fertilizers. They have developed a proprietary process to produce high-quality insect protein and oil products for aquaculture, pet food, and specialty feed markets. The company aims to provide a sustainable solution to the increasing demand for protein-rich feed and fertilizer alternatives while reducing the environmental impact of traditional farming methods.

10. Indigo

5-year search growth: 7%

Search growth status: Regular

Year founded: 2014

Location: Boston, MA

Funding: $1.4B (Series Unknown)

What they do: Combining digital technologies with microbiology, Indigo offers sustainable solutions to both growers and grain buyers. In addition to biological products, the company also offers a logistics platform and an online marketplace for farmers and buyers. According to their website, 100 million bushels have been transacted over the Indigo marketplace.

11. Augmenta

5-year search growth: 168%

Search growth status: Regular

Year founded: 2016

Location: Athens, Greece

Funding: $11.2M (Series A)

What they do: Offering precision agriculture solutions, Augmenta targets farmers and agricultural companies. They offer field analysis, fleet monitoring, and analytics designed to help improve crop yield and save money. Augmenta reports that their products have been used in 14,557+ hectares of farmlands.

12. Apeel Sciences

5-year search growth: 138%

Search growth status: Exploding

Year founded: 2012

Location: Goleta, CA

Funding: $719.1M (Debt Financing)

What they do: Apeel is a biotech company that offers a plant-based shelf-life extending solution. The company claims that their product can keep produce fresh for twice as long when compared to regular packaging. Apeel reports that, so far, they have saved over 61 million products from going to waste.

13. Aerobotics

5-year search growth: -31%

Search growth status: Peaked

Year founded: 2014

Location: Cape Town, South Africa

Funding: $26.8M (Series B)

What they do: Aerobotics offers solutions that provide insights to growers and insurers about crops and farm fields. They leverage drones and aerial imagery to help identify problems with crop yields. Aerobotics says that its customer footprint is spread across 18+ countries.

14. eFishery

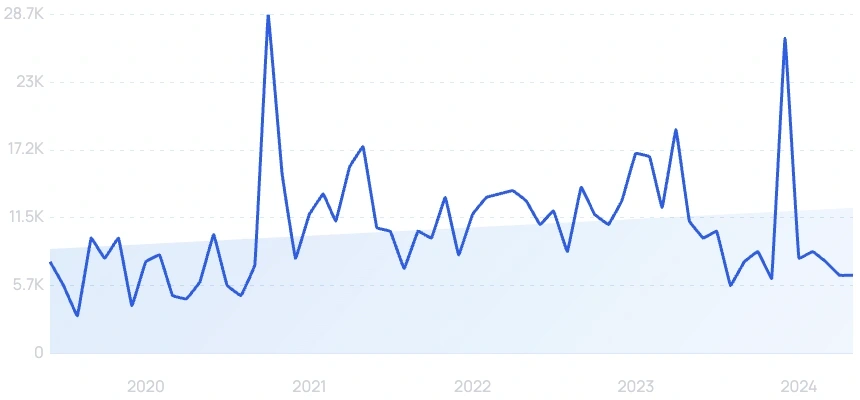

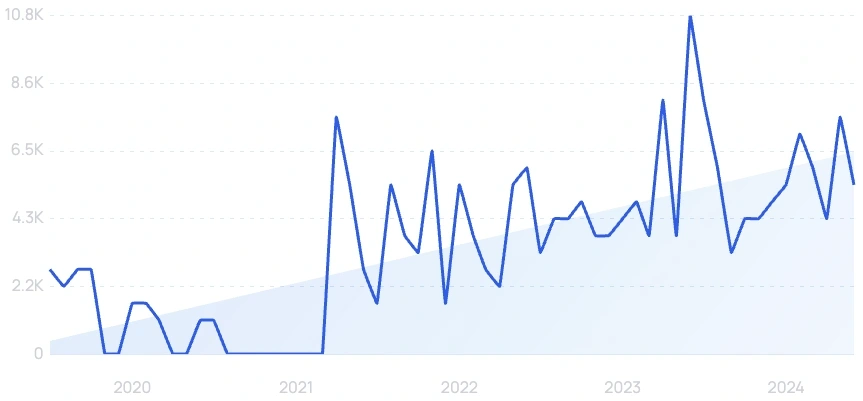

5-year search growth: 563%

Search growth status: Exploding

Year founded: 2013

Location: Bandung, Indonesia

Funding: $372.9M (Debt Financing)

What they do: eFishery is an agtech company that provides smart feeding products and a digital platform for fish and shrimp farmers. The startup's flagship product, an eFeeder, is an automatic feeding device that shortens the crop cycle by up to 74 days. Today, the company supports 70,000 fish and shrimp farmers across Indonesia.

15. Carbon Robotics

5-year search growth: 100%

Search growth status: Regular

Year founded: 2018

Location: Seattle, Washington

Funding: $178.9M (Series C)

What they do: Carbon Robotics has developed AI-powered farming robotic systems for weed control. The company's primary product, the Autonomous LaserWeeder, uses deep learning and laser technology to eliminate 5,000 weeds per minute without manual labor or chemicals. In May 2024, NVentures (Nvidia's venture arm) led an $85 million Series C funding round for Carbon Robotics.

16. Inari

5-year search growth: 33%

Search growth status: Exploding

Year founded: 2016

Location: Cambridge, Massachusetts

Funding: $609M (Series F)

What they do: Inari is an agtech startup focusing on seed innovation and sustainability. The company has developed the SEEDesign Platform, which enhances crop productivity through AI and multiplex gene editing. The fast-growing startup raised $103 million in Series F funding at a valuation of $1.65 billion.

17. TerViva

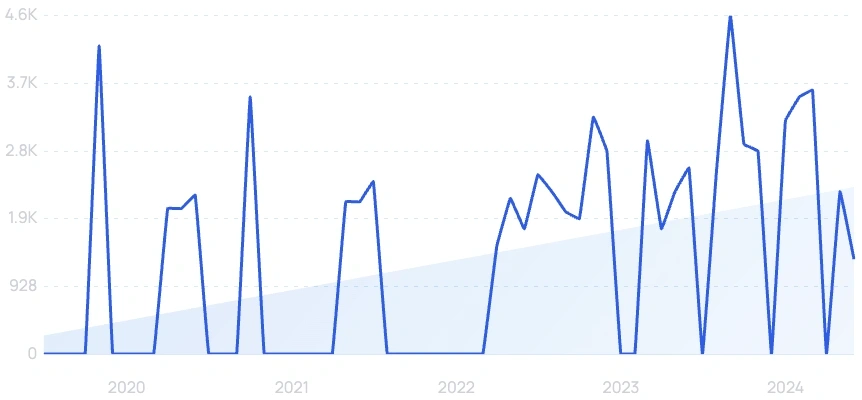

5-year search growth: 2,700%

Search growth status: Peaked

Year founded: 2010

Location: Alameda, CA

Funding: $98.6M (Series E)

What they do: TerViva is an agricultural technology company that focuses on restoring degraded farmlands. They do this by producing Pongamia trees that yield oil-rich seeds. TerViva claims that they currently have 150,000 trees under contract.

18. Infarm

5-year search growth: -35%

Search growth status: Peaked

Year founded: 2013

Location: Berlin, Germany

Funding: $604.5M (Series D)

What they do: Infarm is an IoT and agtech startup that builds vertical farms in cities. By placing their hydroponic indoor farms closer to the end destinations, the company aims to cut down on transportation costs and water usage. Infarm reports that their farms grow 250,000+ plants on a monthly basis.

19. Hazel Technologies

5-year search growth: 17%

Search growth status: Regular

Year founded: 2015

Location: Chicago, IL

Funding: $87.8M (Series C)

What they do: A biotech company, Hazel Technologies offers sustainable supply chain solutions. Specifically, they offer products designed to extend the shelf-life of fresh produce. It is reported that the company currently has 160 customers, including Zespri and Mission Produce.

20. XFarm

5-year search growth: 438%

Search growth status: Regular

Year founded: 2017

Location: Manno, Switzerland

Funding: $20.7M (Series B)

What they do: XFarm is a farming application and tech company that allows users to oversee all aspects of their agricultural operations from a single platform. Key features include field and activity management, machinery tracking, irrigation guidance, environmental monitoring, and crop protection. Today, XFarm is used by over 300,000 farms in more than 100 countries worldwide.

Conclusion

That concludes our list of 20 fast-growing agtech startups to keep an eye on in 2024.

With climate change becoming a pressing issue, agritech is going to play a crucial role in the future. And as we’ve seen above, agtech solutions are quite diverse, ranging from sustainable animal health food production to vertical farming and automation.

We can expect a lot of venture capital money to go into this industry in the years to come.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more