Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Alternative Data Market Size and Projected Growth (2025-2030)

While SEC filings and other readily available sources of data remain widely used, alternative data sets are increasingly vital to investors of all sizes. Specifically, a growing number of hedge fund managers are now using alternative data to obtain a market edge.

Overall, the alternative data market is set to skyrocket in the coming years.

In this report, we’ll cover the current state (and future growth projections) of this interesting space.

Here are some of the alternative data market areas we’ll explore:

- Top Alternative Data Market Stats

- Alternative Data Market Size

- Alternative Data Market Growth Forecast

- Growth Drivers For The Alternative Data Market

- Key Players In The Alternative Data Market

- Alternative Data Usage

Top Alternative Data Market Stats

- The global alternative data market is valued at an estimated $18.74 billion

- Alternative data is forecast to exceed $135 billion by 2030

- The alternative data market is currently growing at a CAGR of over 52%

- 17 in 20 leading hedge fund managers use two or more alternative data sets

Alternative Data Market Size

The global alternative data market is valued at approximately $18.74 billion.

The growth of smart technology is playing a role in the alternative data market. Notably, there are still avenues of alternative data yet to be explored. As internet penetration rises and markets develop, it’s expected that new use cases will be discovered and utilized.

Source: Grand View Research

Alternative Data Market Growth Forecast

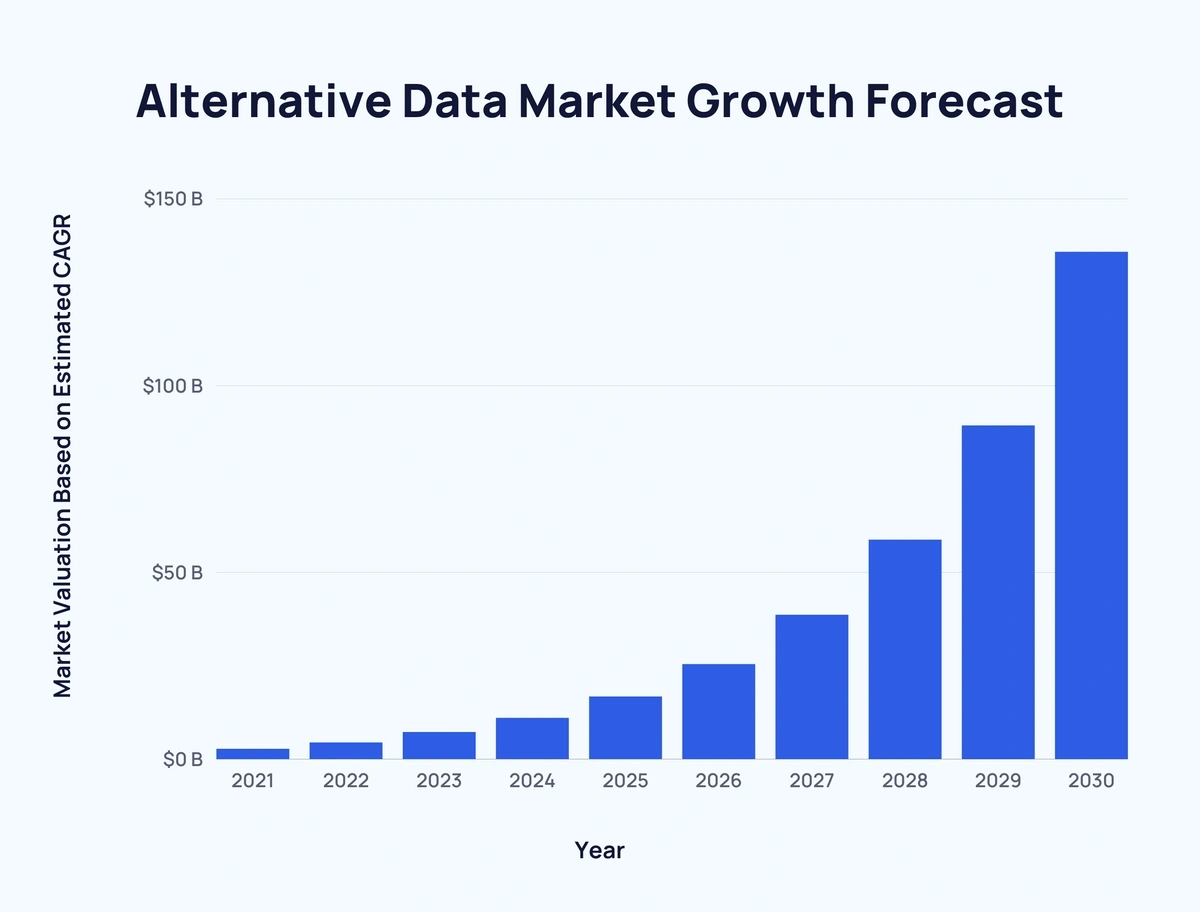

The alternative data market is predicted to reach a value of $135.8 billion by 2030, growing at a compound annual growth rate (CAGR) of 52.1%.

The table below shows how the alternative data market is set to grow with each passing year:

| Year | Market Valuation Based on Estimated CAGR |

| 2021 | $2.7 billion |

| 2022 | $4.4 billion |

| 2023 | $7.2 billion |

| 2024 | $11 billion |

| 2025 | $16.7 billion |

| 2026 | $25.4 billion |

| 2027 | $38.6 billion |

| 2028 | $58.7 billion |

| 2029 | $89.3 billion |

| 2030 | $135.8 billion |

Source: Grand View Research

Growth Drivers for the Alternative Data Market

The alternative data market is growing rapidly thanks to several key drivers.

The global move towards smart technology is unsurprisingly supporting growth. Smart tech and IoT allow for near real-time data collection at scale.

Further to this, ever-increasing internet penetration and 5G adoption provide new sources of alternative data.

Agreeable government initiatives are expected to boost the alternative data market further, particularly in developing countries.

Source: MarketResearch

Key Players in the Alternative Data Market

- 1010Data (US)

- Advan (US)

- Dataminr (US)

- Earnest Research (US)

- M Science (US)

- Preqin (UK)

- RavenPack (Spain)

- Thinknum Alternative Data (US)

- UBS Evidence Lab (US)

- YipitData (US)

- Eagle Alpha (Ireland)

- 7Park Data (US)

- Convergence (US)

- Geotab Inc (Canada)

- JWN Energy (Canada)

- Talkingdata (China)

Sources: Grand View Research, PR Newswire

Alternative Data Usage

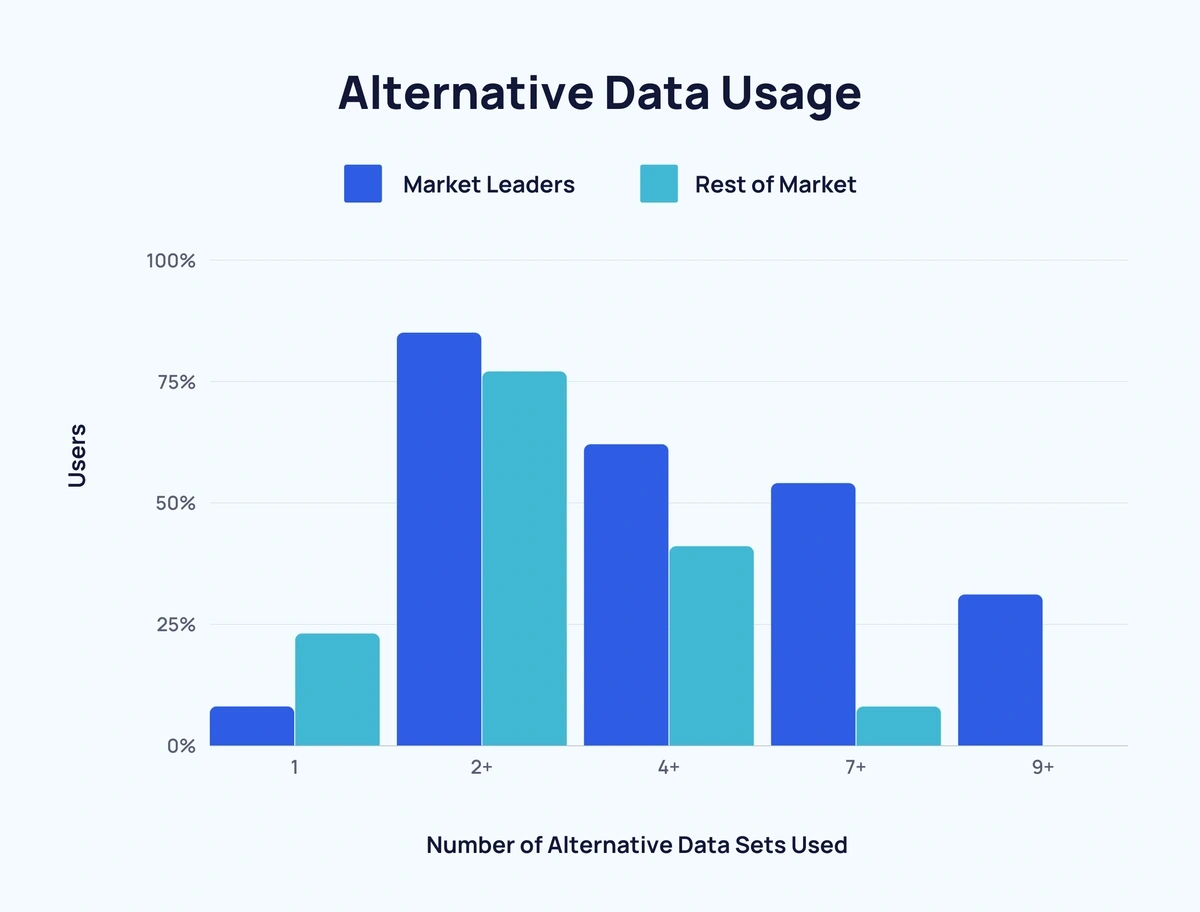

Hedge fund managers have adopted alternative data en masse. The latest statistics show that 85% of market-leading hedge fund managers use two or more alternative data sets.

In fact, over half (54%) of market-leading hedge fund managers use seven or more alternative data sets. While there are more managers who use 9+ alternative data sets than managers who use only one.

Here’s a full breakdown of the usage data:

| Number of Alternative Data Sets Used | Market Leaders | Rest of Market |

| 1 | 8% | 23% |

| 2+ | 85% | 77% |

| 4+ | 62% | 41% |

| 7+ | 54% | 8% |

| 9+ | 31% | 0% |

Almost half of all hedge fund teams (46%) spend 20% or more of their time working on alternative data.

This is compared to 31% who spend between 10% and 20% of their time using alternative data. And a combined 24% who spend less.

Source: AIMA

Key Takeaways

The alternative data market is set to take off in a big way.

And the market's intrinsic link with smart technology and 5G means that sharp growth appears inevitable.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more