Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

B2B Market Research: Step-By-Step Guide

So whether you're thinking of starting a new business or investing in a startup, figuring out what data you should gather and how to extract insights from that data can be challenging.

To solve this problem, here's a simple step-by-step guide to help you find the right data and uncover the insights you need to make sound strategic decisions.

What is B2B Market Research?

B2B market research is the process of collecting and analyzing data in a market where both the buyers and sellers are businesses.

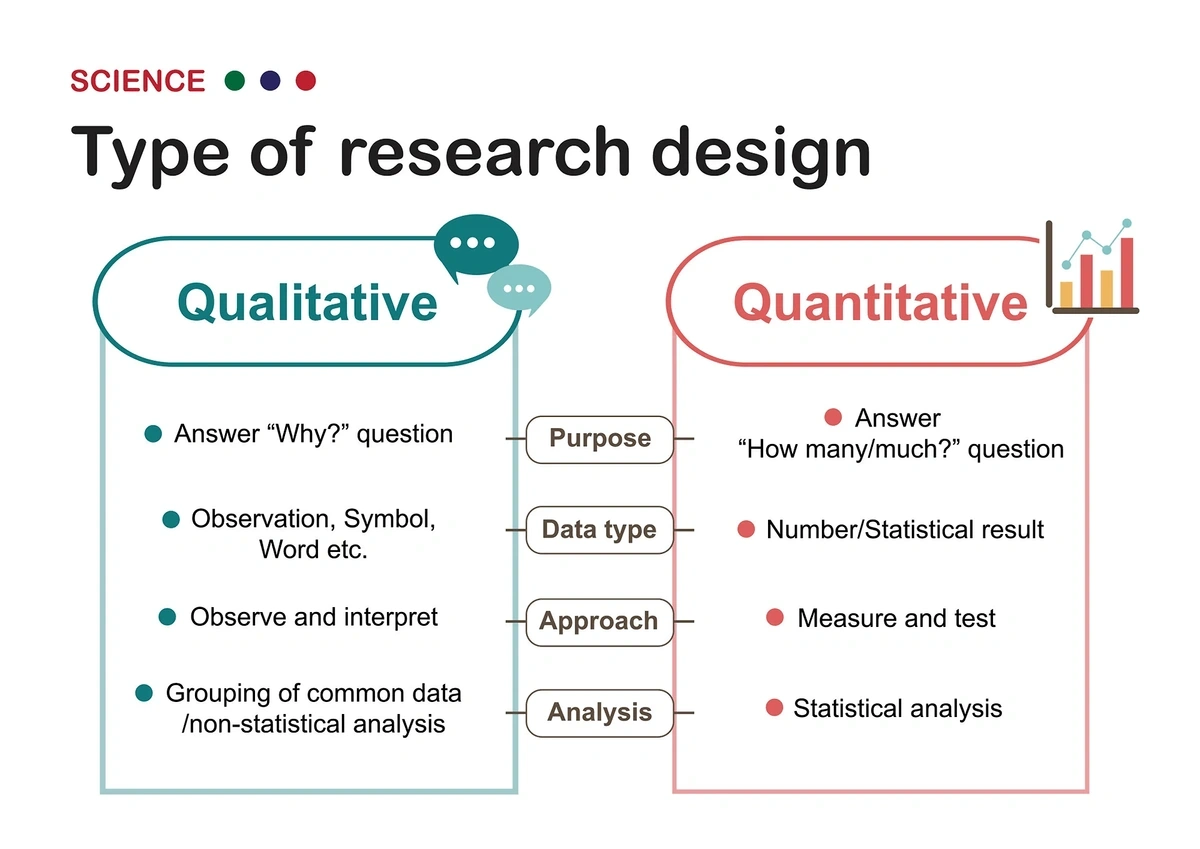

Data collected and analyzed for market research might include qualitative data, like customer surveys, or quantitative data, like market size growth over the past five years.

Business executives with budgets over five, six, and seven figures can't typically afford to guess how they should invest their resources. Which is why they use the data and analysis pulled from the B2B market research process to help them make sound decisions.

How B2B Market Research Can Improve Business Results

Here are some common use cases that demonstrate how stakeholders, investors, and executives leverage market research to guide their decisions.

Identify emerging market trends to capture the first-mover advantage

The success of a new product or company launch depends largely on timing.

If a business launches a new product too late and there's more supply than demand, it will likely fail due to too much competition. In contrast, if it launches too early, there might not be enough demand and it will still fail.

So ideally, you want to launch the product when there is clear consumer demand, but the trend is still early enough that there's limited supply.

For example, launching a B2B cybersecurity bootcamp now would make sense as consumer demand is growing exponentially:

The B2B market research process helps leaders discover emerging market trends and identify the right timing to launch a solution.

Track competitor activity and create differentiated positioning

Many B2B businesses use market research data to identify their competitors' strengths and weaknesses to create better products/services and establish a differentiated position in the market.

You can also use market research data to gauge your competitors' general business strategy and estimate how they invest their budgets.

For example, you might see that your competitor is hiring for a new department, suggesting that they might be releasing a new product shortly.

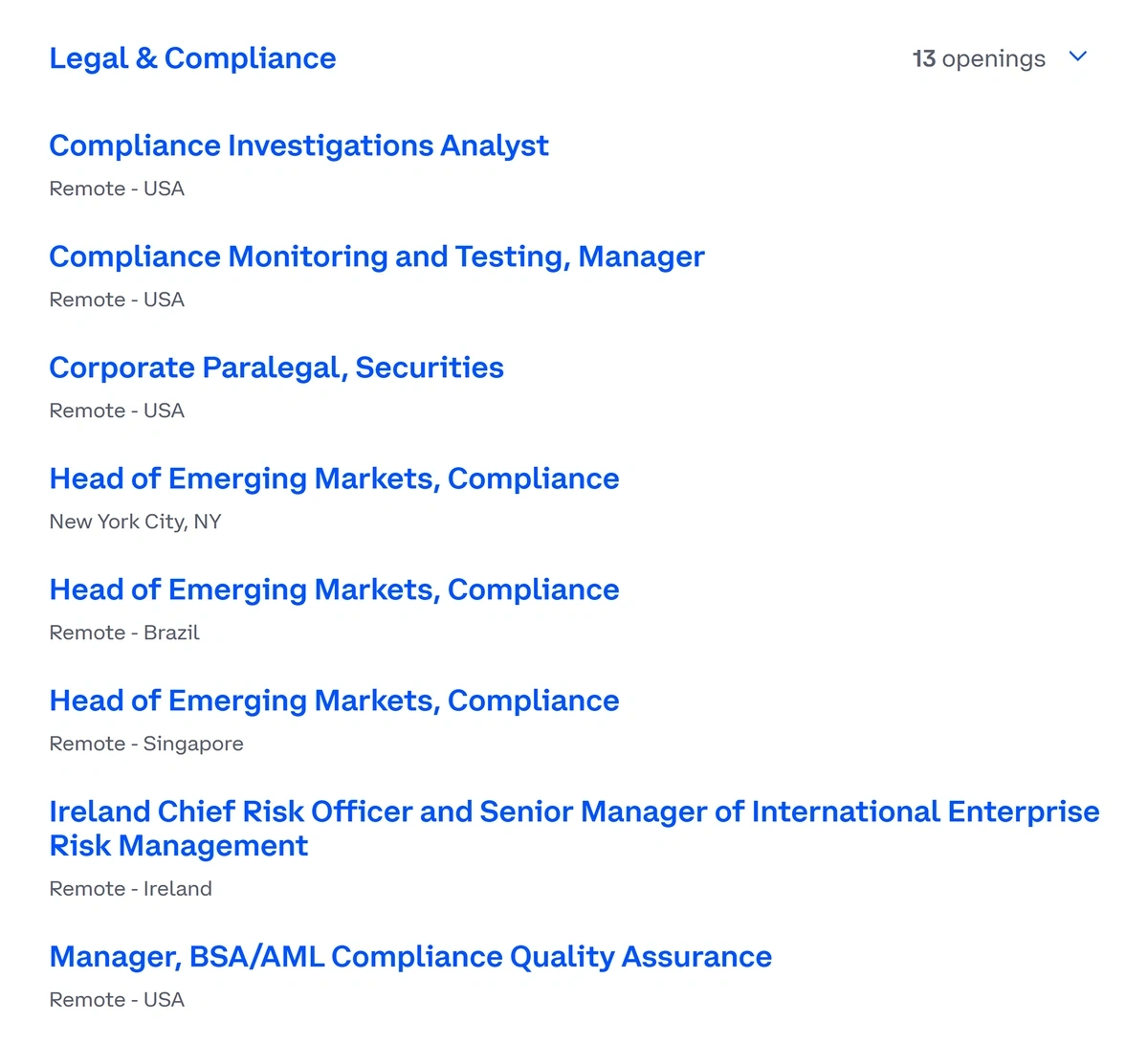

For example, Coinbase currently has 13 open positions for regulatory and compliance jobs, showing that they’re doubling down on safeguarding themselves against compliance dangers and they’re likely focusing on increasing brand trust. You can also tell that they’re expanding to Brazil and Singapore as two of the jobs are for a “Head of Expanding Markets” in those regions:

Monitor customer demand and expectations to respond accordingly

Even if a market has existed for hundreds of years, market demands shift over time as new innovations arise.

With the recent advancements in AI, many industries will probably experience dramatic market disruptions shortly, so it's essential to implement a market research process that tracks shifting customer demands.

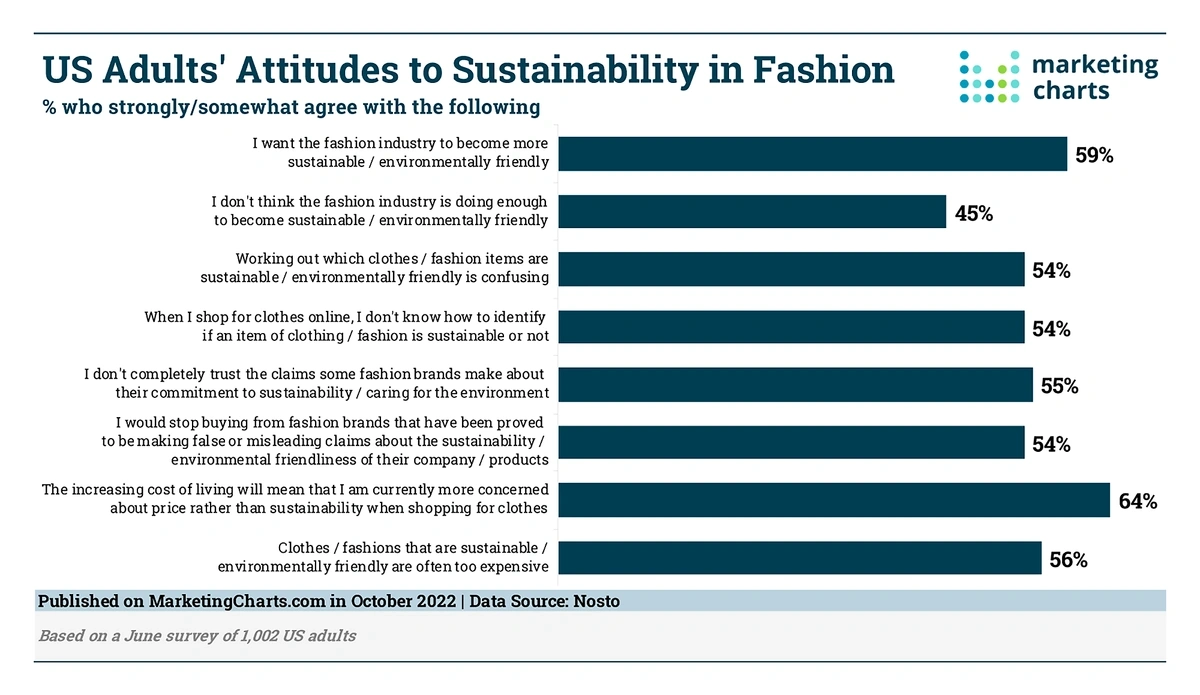

For example, data shows that consumers in the fashion market are becoming increasingly concerned about sustainability. So if you run a fashion company, this insight shows that you might want to reposition yourself as an environmentally friendly brand.

Prepare for market expansions and contractions

If executives can accurately forecast market expansions and contractions, they can adjust the business strategy to ensure the business is prepared for any fluctuations.

For example, if executives know that a market will likely contract soon, they can pad the emergency fund, make budget cuts, and pull back on expansion opportunities.

Or, if the business is in a stable position, executives may decide to use an economic downturn as an opportunity to acquire smaller businesses at a discount.

In contrast, if the market research data suggests that the market is about to expand, stakeholders may adopt an offensive business strategy and invest more in various business areas to get ahead of the competition before demand rises.

What Are The Different Types of B2B Market Research Data?

We already established that B2B market research is the process of collecting and analyzing data. But what data are you collecting?

Most of the content on B2B market research discusses how to conduct surveys and run focus groups, but those aren't the only forms of market research data.

In fact, the best B2B researchers realize that it's important to have diverse data sets from various sources to accurately assess a market and remove any potential biases.

So below, we'll introduce you to the most common types of data used for general B2B market research, and later on, we'll give you a step-by-step research process to use the data to drive strategic business decisions.

Qualitative Research Data

Qualitative data refers to data based on characteristics or a person's opinion. It's often subjective, but it's excellent for identifying unmet pain points.

Here are some examples of qualitative data you might use during the qualitative market research process:

- Interviews with customers or industry experts

- Feedback from focus groups

- Feedback from customer surveys and polls

- Customer sentiment analysis

- Observational data

Quantitative Research Data

Quantitative data refers to numerical data. Some examples of quantitative market research data you might collect include:

- Market size data

- Sales data for a company

- Google search traffic for brand/market keywords

- Market funding data

- Price trends

Below, we’ll show you how you can gather both qualitative and quantitative research data.

Primary vs Secondary Research

There are two main methods for gathering qualitative and quantitative data; primary and secondary research.

Primary research refers to research that you conduct yourself.

So running your own survey or conducting customer research interviews are examples of primary research.

Primary research often allows you to generate more detailed insights that your competitors can't access, but it's also typically much more expensive as you must conduct and manage the research process yourself.

Therefore, many people prefer to find or purchase research that a third-party conducted. This process is called secondary research.

So if you're looking to access a large sample size of data or a survey from hard-to-reach individuals (like executives), secondary research is often a much more feasible option.

Step By Step Process For B2B Market Research

B2B market research is a broad topic and there are many smaller processes within each step. However, the step-by-step process we lay out below gives you an overview of how you can go from the highest level of exploring a brand new market to testing a brand new product concept.

Step 1: Analyze General Market Data

Starting with high level market data gives you a sound compass of whether the market is expanding or contracting.

This can help you decide whether it's best to take an offensive or defensive approach to growth, and investors can use these metrics to qualify or eliminate new market opportunities quickly.

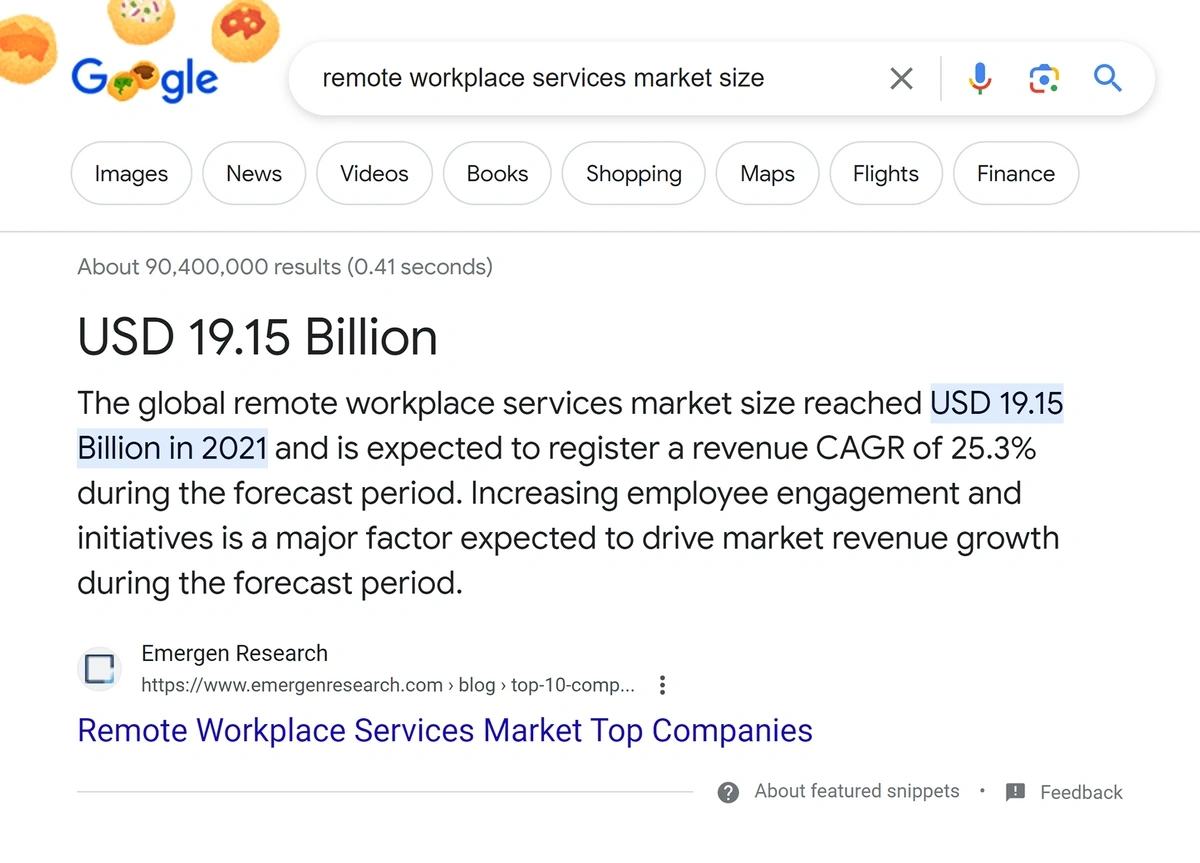

To find general market data, you can do a quick Google search to view the market's size and compounding annual growth rate (CAGR). Usually, you'll be able to find a free report from Globe Newswire, Grand View Research, or another similar research firm. Here's an example:

Another great way to gauge a market's growth and general health is to look at its venture capital funding trends. Venture capitalists don't always accurately predict a market's future growth. However, because they devote all of their resources to researching and forecasting market trends, it's a great additional signal to add to your research data.

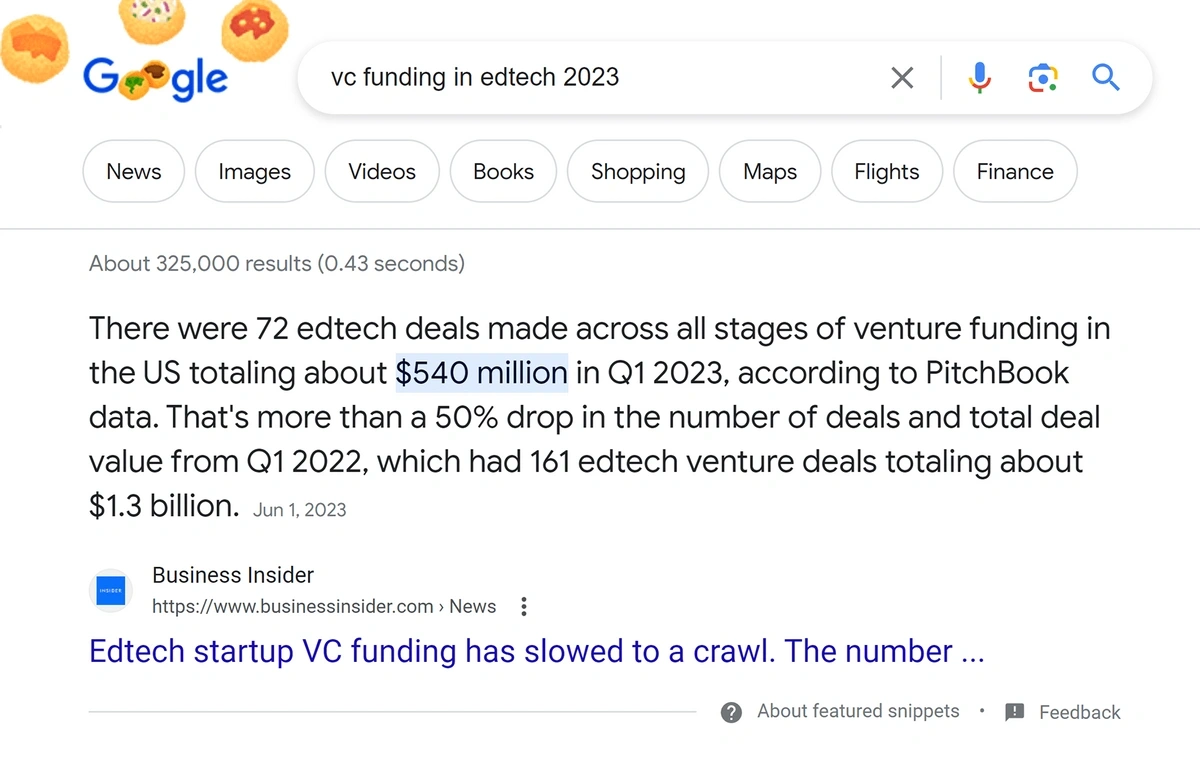

Pitchbook and CB Insights are excellent resources to access market funding data, but you can also do a quick Google Search for this data if you don't have the budget for one of these tools. For example, here's some data on venture capital funding in the edtech space from Business Insider:

Pro Tip: Whenever you're using Google to find data, check the source and ensure the data is reliable. You can do this by searching for reviews and looking at the credibility of other brands using that source's data.

Google Search volume for industry keywords is also a great metric to gauge global interest in a particular market.

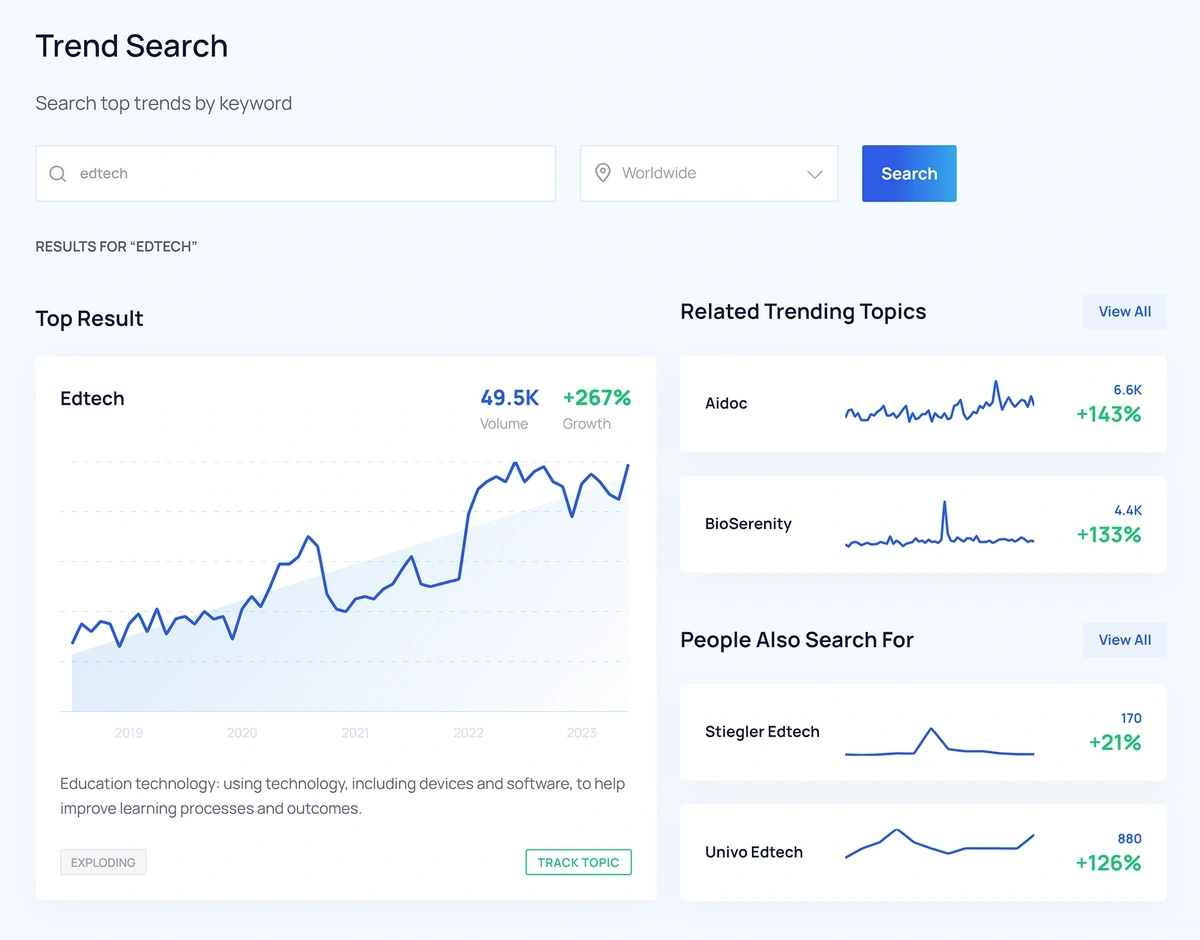

You can access these metrics using either Google Trends or the Trends Search feature in Exploding Topics. For example, if you're interested in the edtech market, you can type that keyword into Trends Search, and it will provide the search volume trend for that keyword and other related trending topics:

Google Search volume is a good general indicator of interest in the market as it draws from a global sample size (all Google Search users), making it fairly reliable.

At this stage, the main goal is to get a general pulse on the market's growth trend, and in the next steps, we'll discuss how you can draw more detailed insights.

Step 2: Identify Emerging Trends

Once you know that a market is trending upward, the next step is to identify the emerging trends within that market, as this can help you discover demand gaps and unlock new growth opportunities.

Some popular trend identification methods include talking to industry experts, reading industry publications, and browsing social media.

If you choose to use these research methods, here are some pro tips:

- Talk to industry experts: You can attend relevant conferences to talk with experts in-person, or book a call on a platform like Intro or Clarity. During the conversation, you can ask them about trends they're excited about and where they're planning to invest.

- Read industry publications: It can be time-consuming to skim through multiple industry publications daily, so consider using a tool like Feedly to track multiple publication sources and list all the most recent articles in one feed.

- Social media: Follow the experts in your industry and write down any trends they're discussing regularly. You can also track trending hashtags to find new trends.

The strategies above can help you find some emerging trends, but they are all relatively time-consuming, and there's still a chance you'll overlook the next big trend.

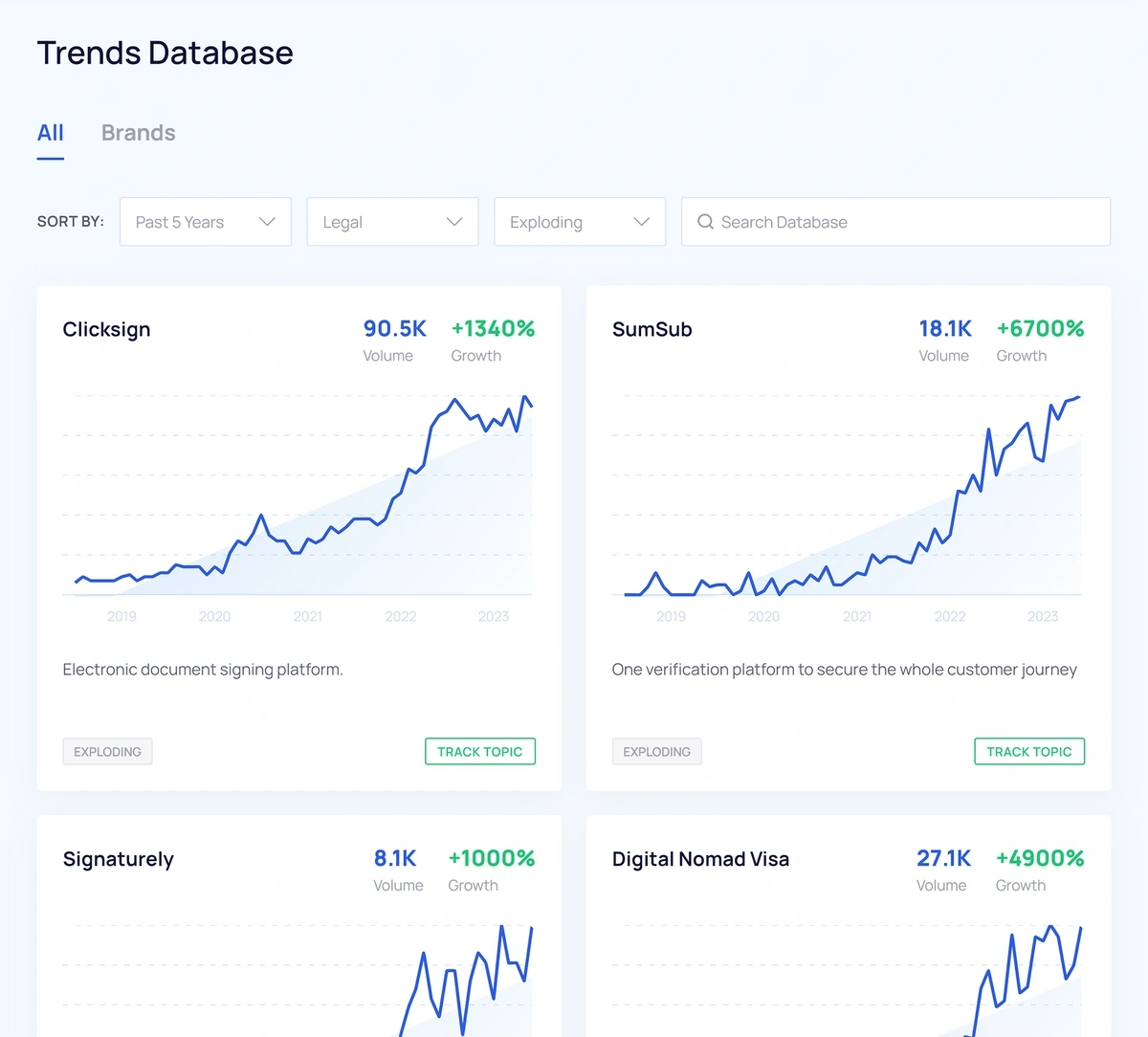

To help you discover new trending topics more easily, we built the Exploding Topics Trends Database to make trend discovery easy. Just select the category you're researching, and Exploding Topics will give you thousands of vetted trending topics (companies, products, and keywords) within that industry:

When you find an interesting topic, save it by clicking "Track Topic" and then add it to a Project for more analysis later in the process.

In addition to these features, we also offer a Trending Products and Trending Startups database, which offers more detailed insights into the growth trends for products and companies within a market.

Step 3: Track Competitor Activity

There are plenty of different trend predictions each year, but only a small percentage of trends are important in the long run. Unfortunately, investing in the wrong trends or fads can stunt business growth and distract your focus from the most important revenue drivers.

Instead of guessing which trends you should choose, just monitor competitor activity (or, if you're just exploring a new market, the top players in that market) and track how they're spending money. There are two main benefits to this strategy:

- Let competitors do the research for you: Before dedicating a budget to the trend, they probably thoroughly researched it and have a strong conviction that it's worth the investment.

- Learn from your competitors' mistakes: You get to watch their mistakes from the sidelines so that your launch is more successful.

To track trends your competitors are investing in, here are a few different metrics you can monitor:

- Hiring activity: Look at the titles they're hiring for (especially executive positions) and if they're hiring entirely new departments. LinkedIn Jobs and Indeed are both excellent platforms for viewing hiring activity.

- New product/feature releases: Most companies will actively promote new product/feature releases on their blog, through press releases, and on social media. You can also watch how customers respond to these new releases by using a tool like Brandwatch to monitor sentiment and brand mentions.

- Partnerships and acquisitions: If a brand really believes in a new trend, they often buy a company or partner with another brand that specializes in that trend. They'll usually announce these partnerships and acquisitions through press releases, which you can monitor with a tool like Crunchbase.

- Press releases: If a company invests in a new trend, they'll want to communicate it to customers and, therefore, often publish press releases. You can either monitor their blog for new press releases or follow PR sites like TechCrunch or Cision for general industry press releases.

- Positioning and messaging: You can watch their homepage and note any changes in their tagline or general messaging.

- SEO and thought leadership content: You can skim their recent blog posts and social media content to identify any new keywords they're targeting.

- Paid ads: You can look at keywords they're paying to rank for with a tool like Ahrefs or SEMrush. If they run Facebook or Instagram ads, you can also look at their ads in the Meta Ad Library.

While you can manually track competitor activity using the tools mentioned above, you can also use a competitive intelligence tool like Klue, Kompyte or Crayon.co to automatically track partnerships, positioning and messaging statements, paid ads, hiring activity, and new product/feature releases.

Step 4: Conduct Customer Research

Customer demand ultimately determines whether or not a trend will stick, so customer research is imperative before making any investment decisions. It can also help you identify pain points and gaps in the market that you can leverage to gain a competitive advantage.

Here are the most common forms of customer research, and we’ll discuss how to execute each one in detail below:

- Analyze customer reviews

- Analyze social media sentiment

- Conduct customer surveys

- Interview potential customers one-on-one

Analyze Customer Reviews

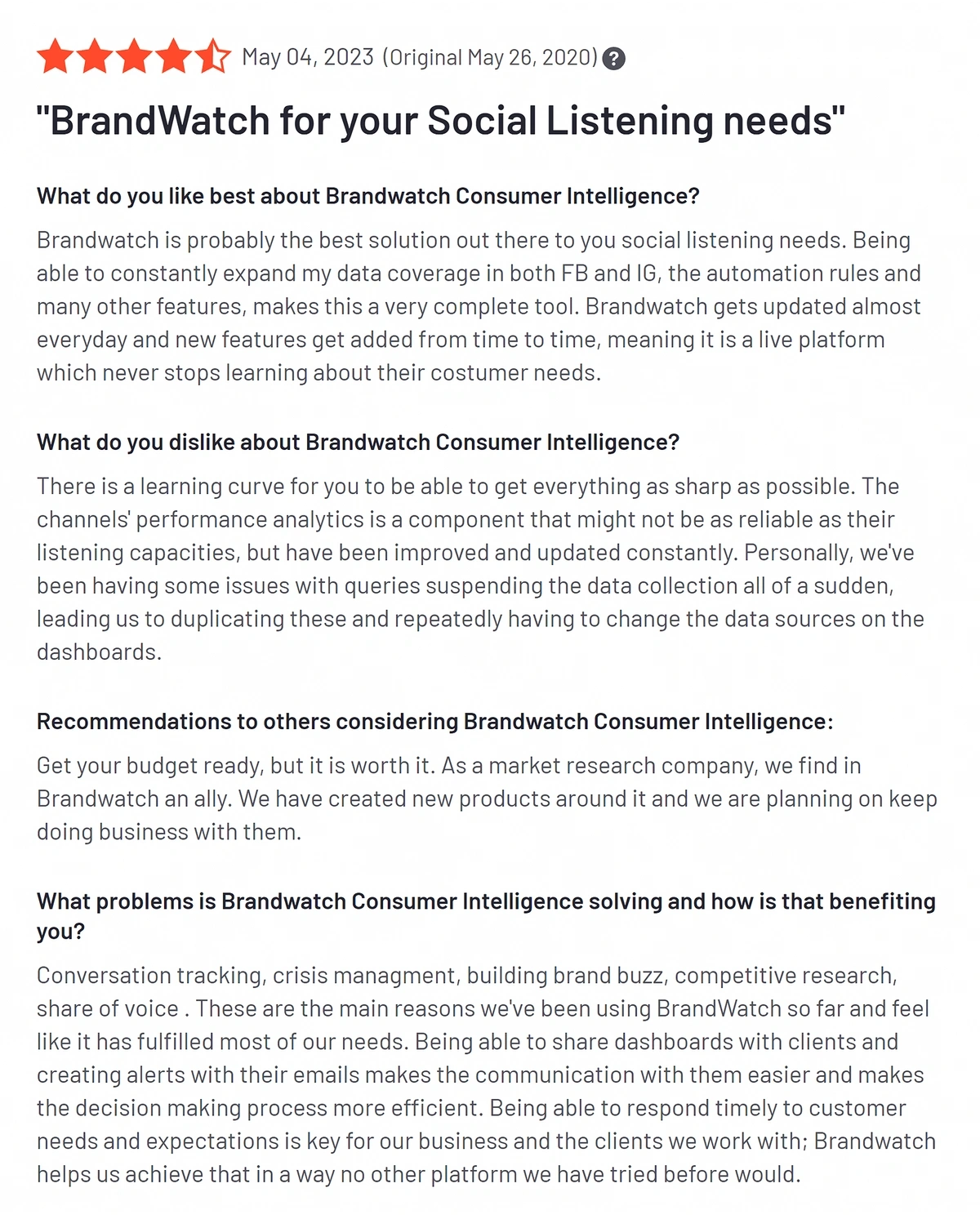

Make a list of your competitors and then look up their reviews on a website like G2 or Capterra. These sites make it easy to understand what customers like and dislike about a product and the pain points those customers are trying to solve.

You can read through these responses manually to uncover customer complaints with existing products and notate them in a spreadsheet. You can also use an AI review analysis tool like Viable to scan all of your competitors’ reviews and uncover common themes across the entire customer base.

Analyze Social Media Sentiment

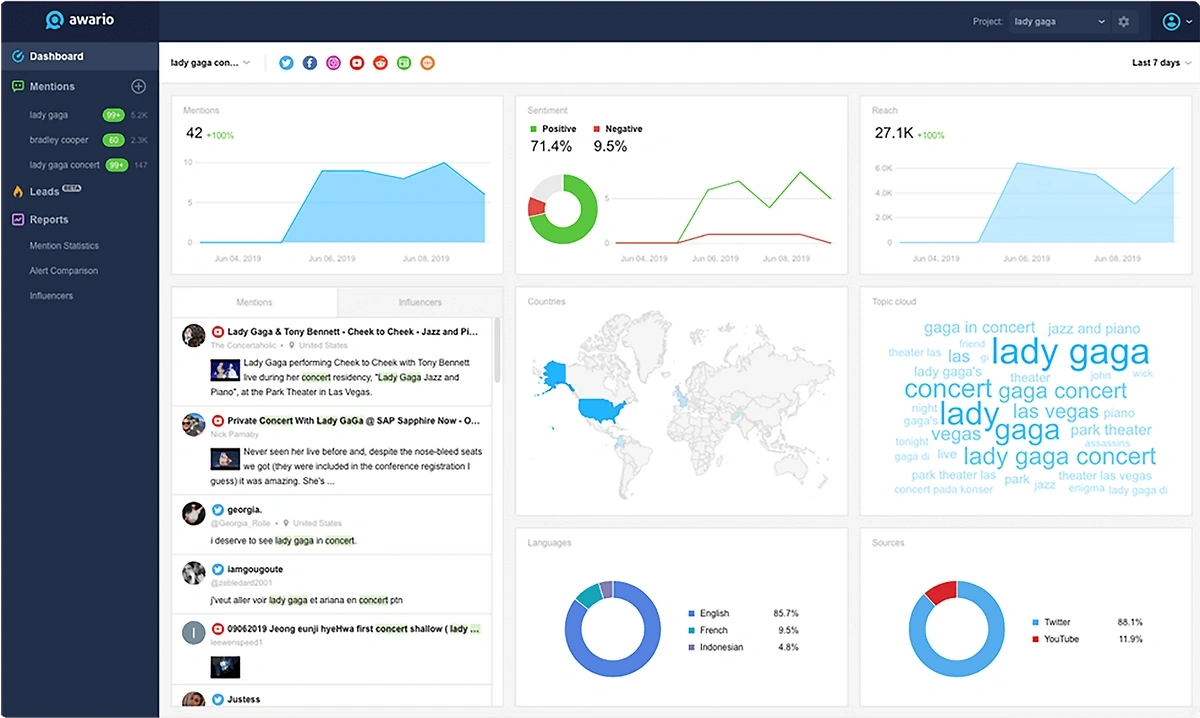

You can use a social listening tool like Brandwatch, Awario, or Pulsar Platform to monitor brand and keyword mentions on social media to gauge the general sentiment of your target audience.

Many of these tools allow you to drill down into negative sentiment and identify specific customer complaints with each brand, which can help you identify unmet customer needs:

Some tools also let you track a particular trend keyword to identify general audience sentiment toward that trend.

Conduct Customer Surveys

Analyzing customer reviews and social media sentiment can help you identify general pain points, but customer surveys allow you to ask follow-up questions related to those pain points. You can also use these customer surveys to gauge general market demand.

The easiest way to conduct customer surveys is to send a questionnaire to your email list. If you currently don't have a list of customers, consider partnering with a brand that does have an email list of your potential customers. Alternatively, you can use a tool like SurveyMonkey's Audience offering, which allows you to set the criteria of your target market, and then it finds respondents for you.

Interview Potential Customers One-On-One

You can interview potential customers and key decision-makers to get more in-depth qualitative data on a particular trend.

If you already have customers, offer an incentive for them to get on the phone with you for an interview. You can also ask the customer success team to gather data for you. For example, you can give them a list of three questions to ask at the end of each customer call.

Alternatively, you can use a tool like Respondent.io to book calls with any B2B buyers.

Step 5: Run Beta Tests And Collect Feedback

All of the steps up until now have helped you predict the potential of a new market trend, but the best way to discover if an idea is viable is to put it out into the world, sell it, and make improvements based on customer feedback.

So once you’ve identified a market trend and a gap in that market, the next step is to sell your product/service concept.

Notice that you’re selling the product/service before creating the product. This is on purpose.

Many founders invest thousands of dollars into product development only to discover on the launch day that the target market doesn’t actually want the product, so generating pre-sales for your product or service before creating a minimal viable product (MVP) validates that demand exists.

If you have a substantial following on any social media platform, you can pitch the product with a simple tweet like this:

If the following apply to you DM me:

— Alex Lieberman (@businessbarista) March 21, 2023

✅ you're a founder/exec

✅ you believe deeply in building personal brand

✅ you don't have the time/skill to create content & grow your brand

✅ you'd pay $5-10,000 per month to have a skilled content creator build your personal brand

In fact, this is the exact Tweet that Alex Lieberman used to validate his ghostwriting agency.

Otherwise, you can run LinkedIn or Twitter ads to a landing page and see if it drives sales.

If you don't receive enough sales to validate that it's a product or service you want to offer, you can always just refund the few sales you generated or pivot your offering to see if you can generate more sales.

Once you've validated the idea by generating a substantial list of pre-sales, the next step is to collect customer feedback and improve your offer.

Your first product or service probably won't be perfect, so ask your users how you can make it better.

Plenty of platforms, like BetaPage and BetaList, allow pre-launch startups to recruit beta users to provide feedback for the founders.

This is a great way to gather feedback from an audience that realizes you're still in the early stages of product development, and you can even use those initial product reviews for your launch.

In addition to collecting customer reviews, ask those beta users if you can get on a call to gather more detailed feedback about the product.

Once you have a high customer satisfaction score and plenty of positive feedback from beta testers, release the product to the rest of the world.

Start The B2B Market Research Process Today

B2B market research is key for guiding critical business strategy and investment decisions.

However, most executives, entrepreneurs, and investors find themselves spending too much time on market research, and even after dedicating hours to the process, many worry that they might have overlooked a new under-the-radar trend. Or worse, that the data they used to guide their decision-making process is inaccurate.

So we built Exploding Topics to solve these problems. It helps you find trending topics in your niche within seconds so that you can cut your market research time in half and find reliable, under the radar trending topics.

You can sign up for Exploding Topics Pro for just $1 today to see how it can help you find high quality trends.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more