Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

5 Key Consumer Product Trends (2025-2027)

In recent times, we’ve seen consumers become more conscious about prices and sustainability.

Retailers and manufacturers are quickly adapting to give consumers the products they demand, but the success of their strategies hasn’t been determined just yet.

Keep reading to see the key consumer product trends that are impacting the industry in 2025, and are likely to continue to grow in importance in the coming years.

1. Developing Innovative Products With Sustainability in Mind

According to a 2024 report from Deloitte, around 3 in 4 brands encourage a sustainable "circular economy" approach.

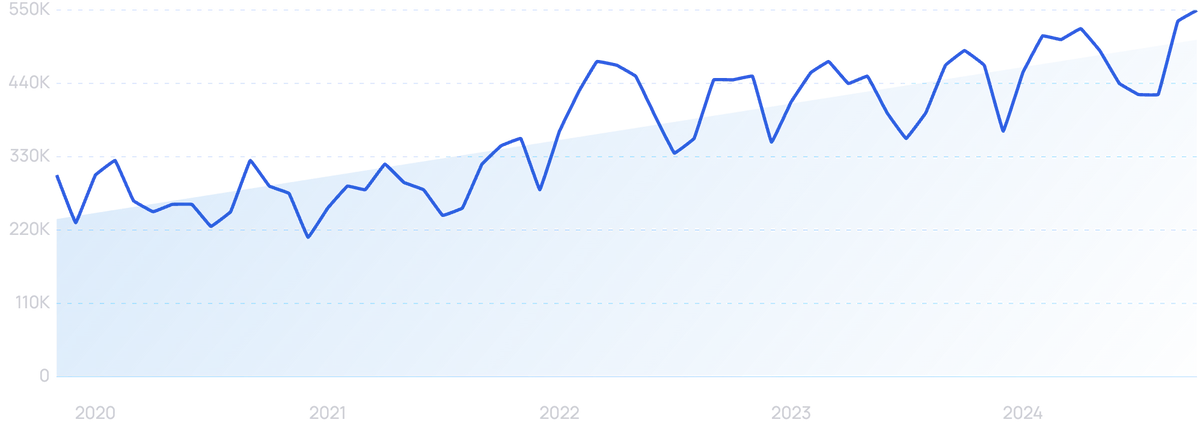

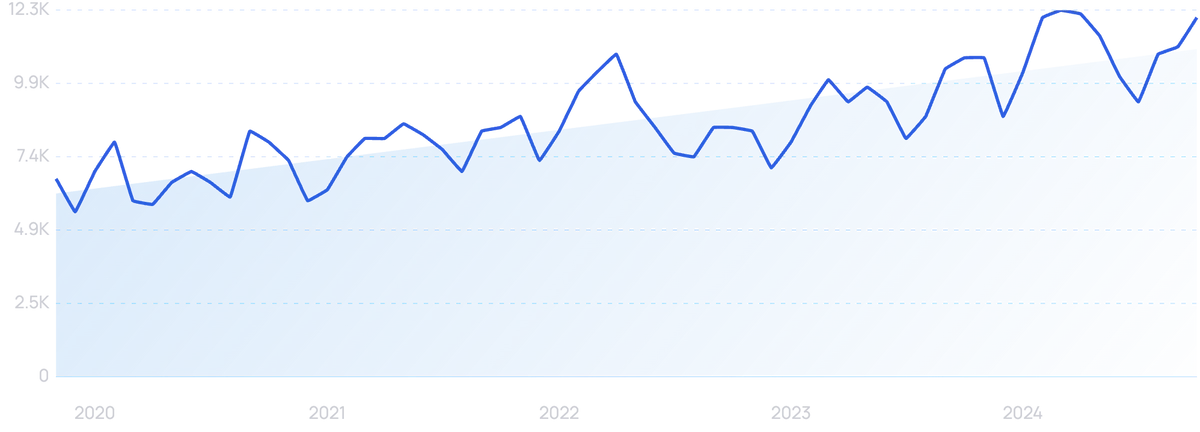

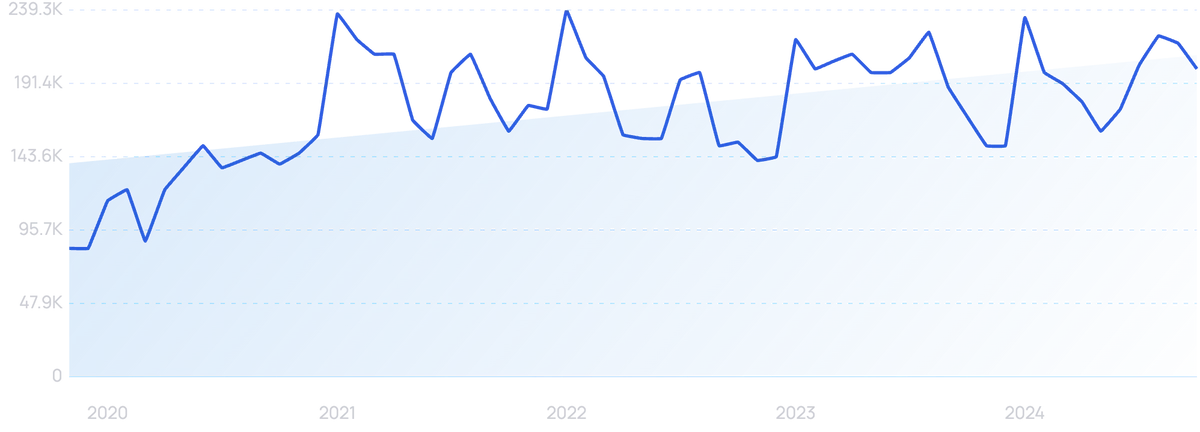

Search volume for “sustainability” has shown growth in the past 5 years.

This is directly in line with consumer thinking.

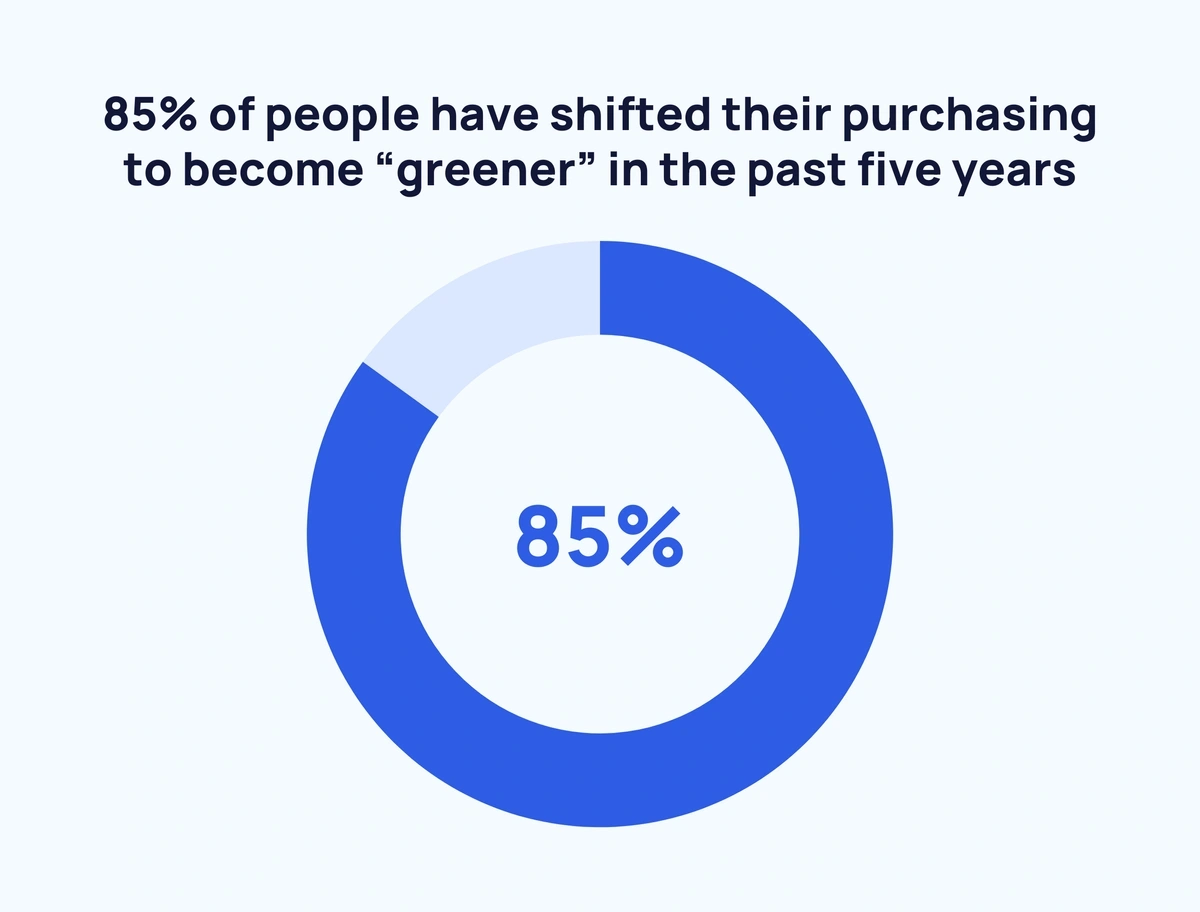

A global survey of consumers reported that 85% of people have shifted their purchasing to become “greener” in the past five years.

The survey showed that this attitude is especially prevalent among Millennials.

More than 30% of Millennials have significantly changed their behavior to become more sustainable and the same amount will choose a sustainable product, if available, over a non-sustainable product.

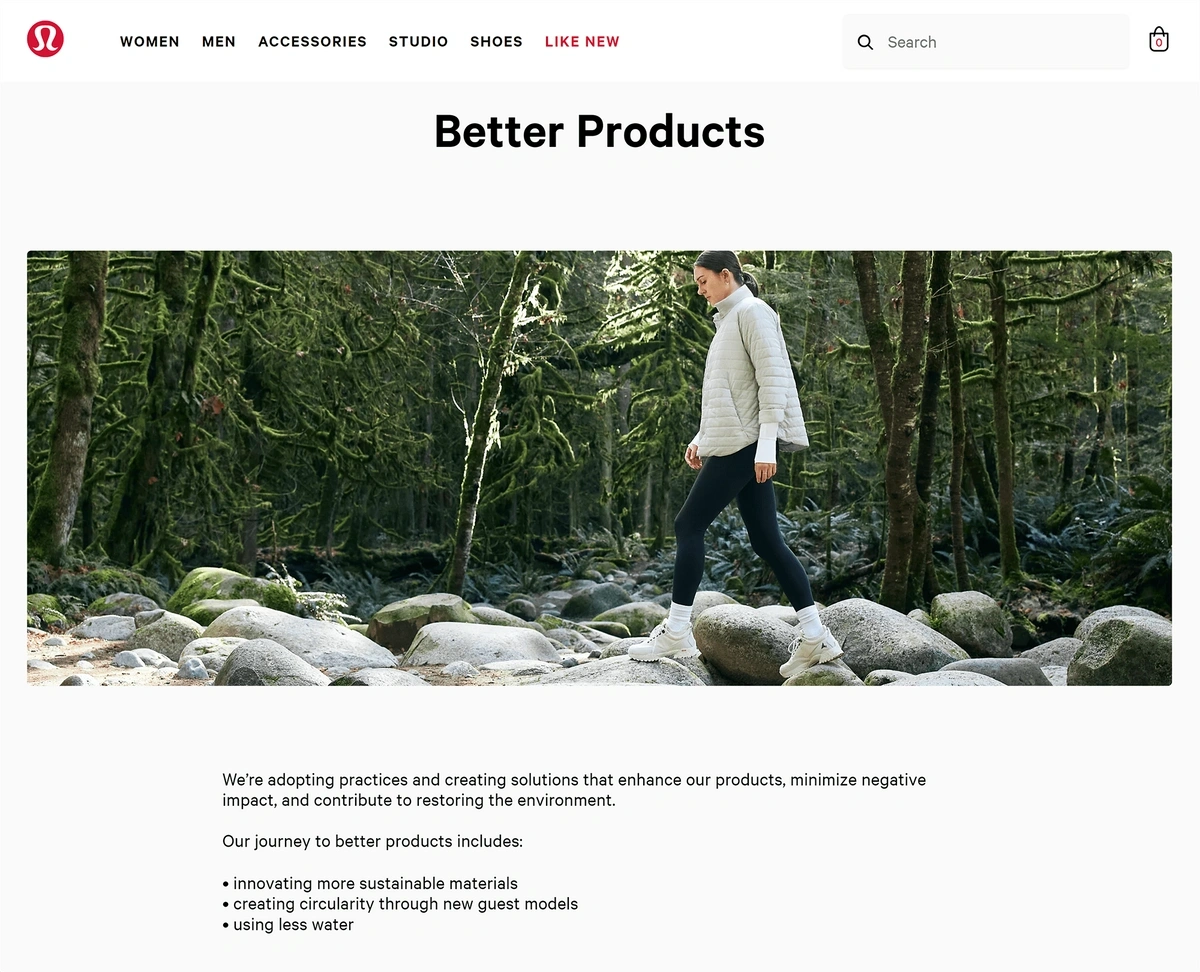

Lululemon is one company that’s shown a deep commitment to sustainability.

Lululemon has a goal to manufacture their products using 75% sustainable materials by 2025.

They were recently named on Fast Company’s list of the top 10 most innovative companies in corporate social responsibility.

In May 2021, the brand launched a clothing collection in which garments were dyed with plant waste from beets and oranges instead of synthetic dyes.

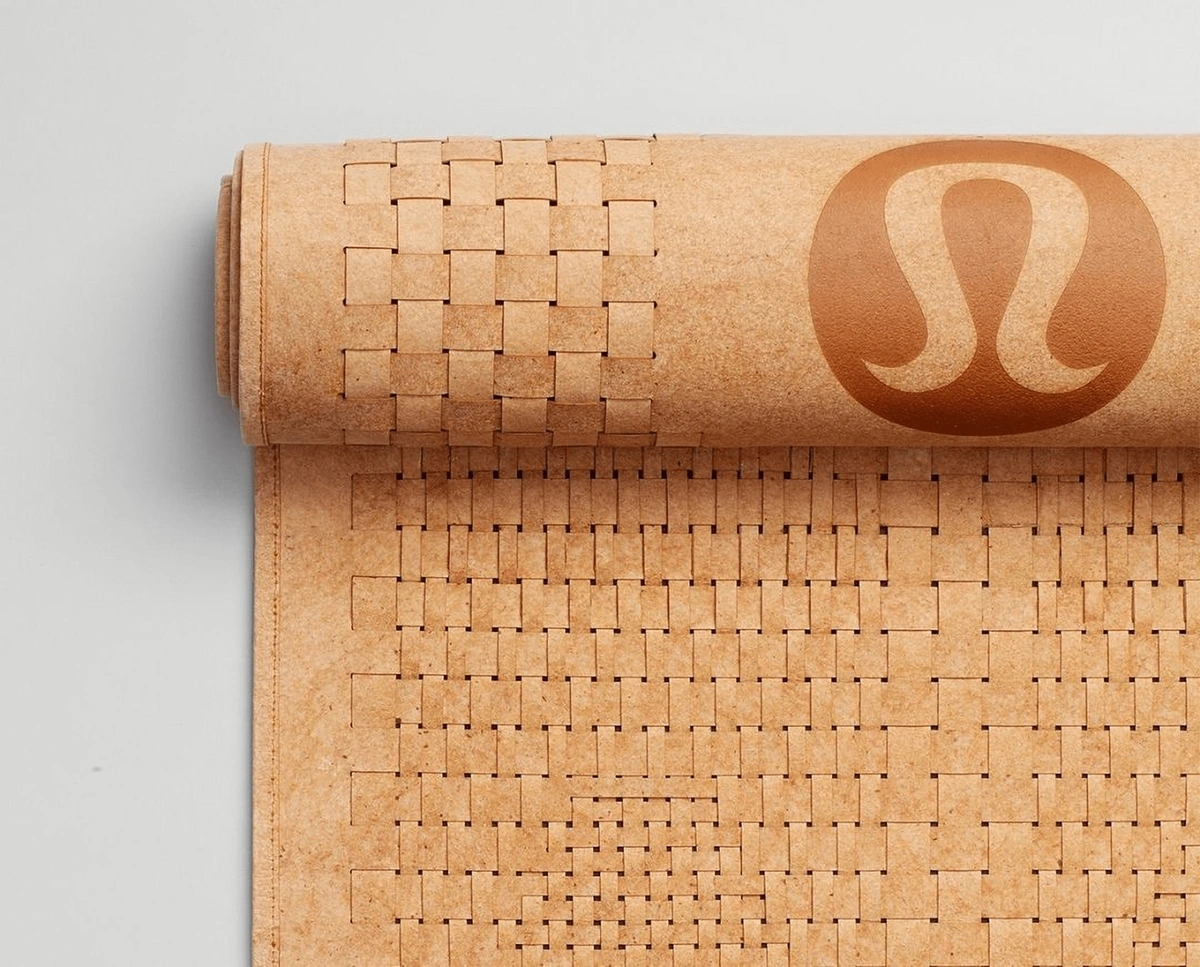

They’ve also created yoga mats using mycelium, the root of a mushroom, and pioneered the production of lab-grown polyester.

Lululemon’s eco-friendly yoga mats are made from Mylo, a vegan leather that’s made up of mycelium.

Packaging of consumer goods is one area in which many brands are looking to make improvements in terms of sustainability.

Search volume for “sustainable packaging” is up nearly 81% in the past 5 years.

Switching to sustainable packaging could potentially reduce value chain emissions by as much as 30%.

In China, Procter & Gamble is testing their Air Capsule Express packaging.

The Air Capsule requires 75% less warehousing space than items packed in corrugated boxes.

This packaging is specifically made to protect fragile items during last-mile delivery.

It weighs 40% less than traditional packaging, and it’s recyclable.

2. Brands Develop Resilient Supply Chains

Supply chain disruptions were the norm during the pandemic, but logistics specialists say the supply chain problems are here to stay now that the pandemic is over.

Taking all industries into account, supply chain disruptions lasting a month or longer are expected to happen every 3.7 years.

Consumer product brands are heeding this warning.

In 2021, 28% of CEOs ranked supply chain disruption as one of their greatest challenges for the years to come. That number jumped to 38% in 2022.

Brands are taking various actions in order to create more resilient supply chains.

McKinsey reports that companies are taking key steps in order to do this:

-

improving transparency and communication

-

digitizing the supply chain

-

hiring new talent

-

embracing e-commerce.

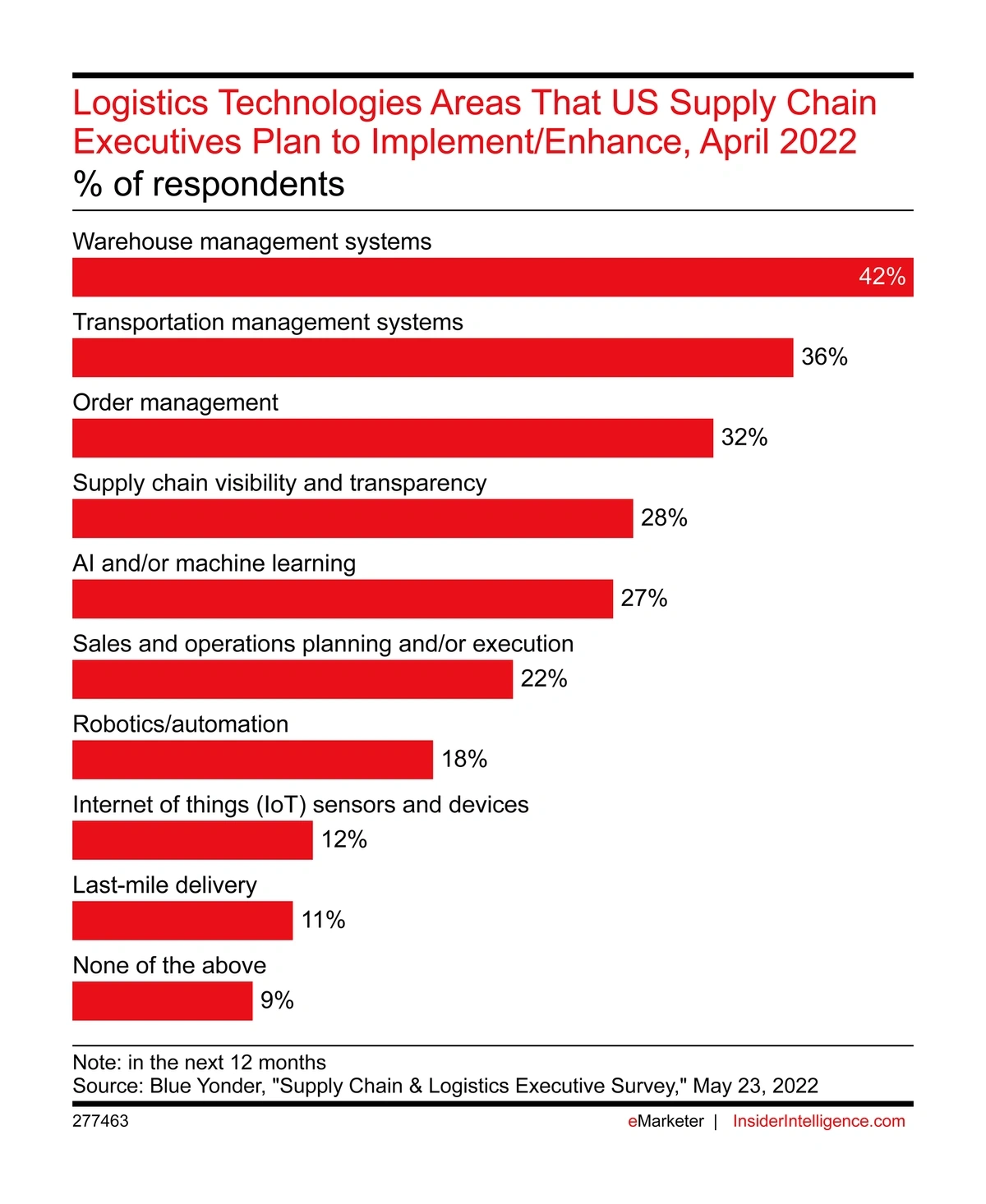

Insider Intelligence breaks down the types of technology being implemented in order to solve supply-chain challenges.

Warehouse, transportation, and order management systems top the list — more than 30% of executives plan to implement each one of these solutions. AI/machine learning and robotics were mentioned by more than 15% of executives, too.

Businesses are utilizing several types of new technology and data points in order to strengthen their supply chains.

Walmart is one retailer that’s investing heavily in AI supply chains and robotics solutions.

The company recently acquired Alert Innovation, an order-picking solution that uses robots to fulfill online grocery orders.

Alert Innovation’s robot provides the technology grocery stores need in order to execute a one-hour or less pickup model.

Robots will soon be deployed at Walmart’s 42 regional distribution centers, too.

These robots are courtesy of Symbotic, which uses an AI-powered platform and robots in order to receive, pick, and store products.

At the end of 2024, Symbotic was valued at $13.2 billion.

3. Consumers Demand Personalized Products

In recent months, personalization has emerged as a key strategy for consumer brands.

McKinsey reports that nearly 90% of consumers prioritize personalization as much or more than they did just a few years ago.

We are seeing enhanced personalization in marketing but also in consumer products.

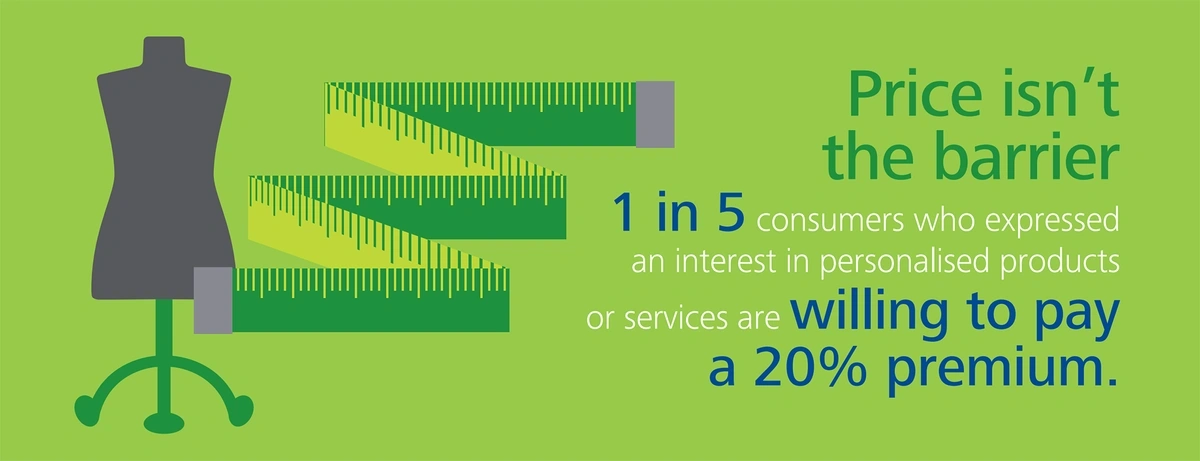

Deloitte reports that 1 in 5 people who want a personalized product are willing to pay 20% more for it.

Research shows consumers are willing to pay more for personalization.

Customized skincare is projected to be a $62 billion market by 2034. In another example, 71% of Gen Z are interested in personalized supplements.

Gainful is a brand offering personalized supplements specifically for athletes.

First, consumers are first prompted to fill out an online quiz to determine their nutrition needs. After that, Gainful sends the supplements with automatic monthly delivery.

The company reported “significant growth” during the pandemic and, in January 2021, raised $7.5 million in Series A funding.

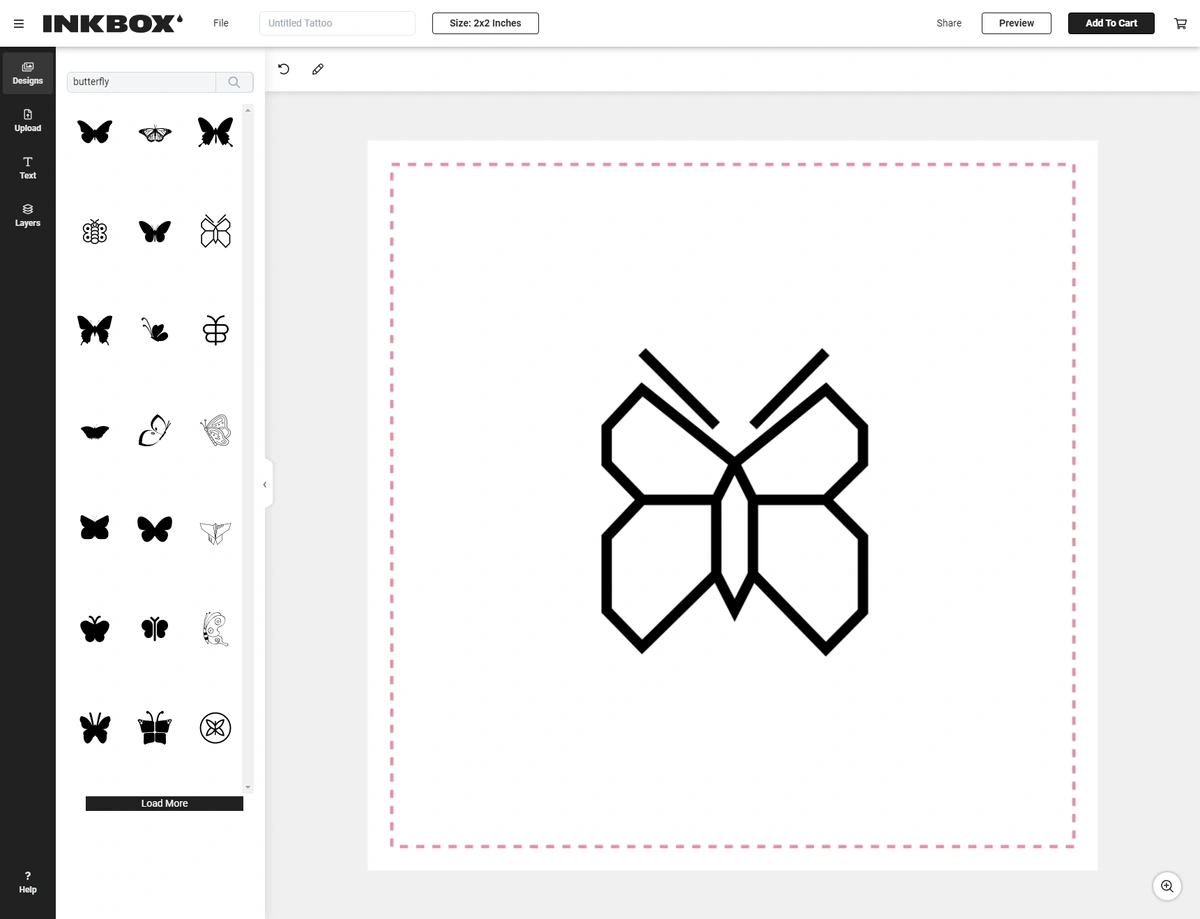

In another example, Inkbox is a DTC brand that’s revolutionizing the way consumers view tattoos.

Consumers can easily log on to the website, upload their own designs, and receive a customized “for now ink” tattoo that lasts up to two weeks on the skin.

Inkbox’s custom tattoo design platform offers the hyper-personalization that today’s consumers want.

BIC acquired Inkbox in 2022 for $65 million.

The brand brings in an estimated $44 million in annual revenue.

4. Sustained Demand For New Wellness Products

The global wellness market is worth approximately $6.19 trillion, and it’s estimated that the market will reach a valuation of $9.25 trillion by 2033.

Around 4 in 5 consumers plan to purchase wellness and fitness products in 2025.

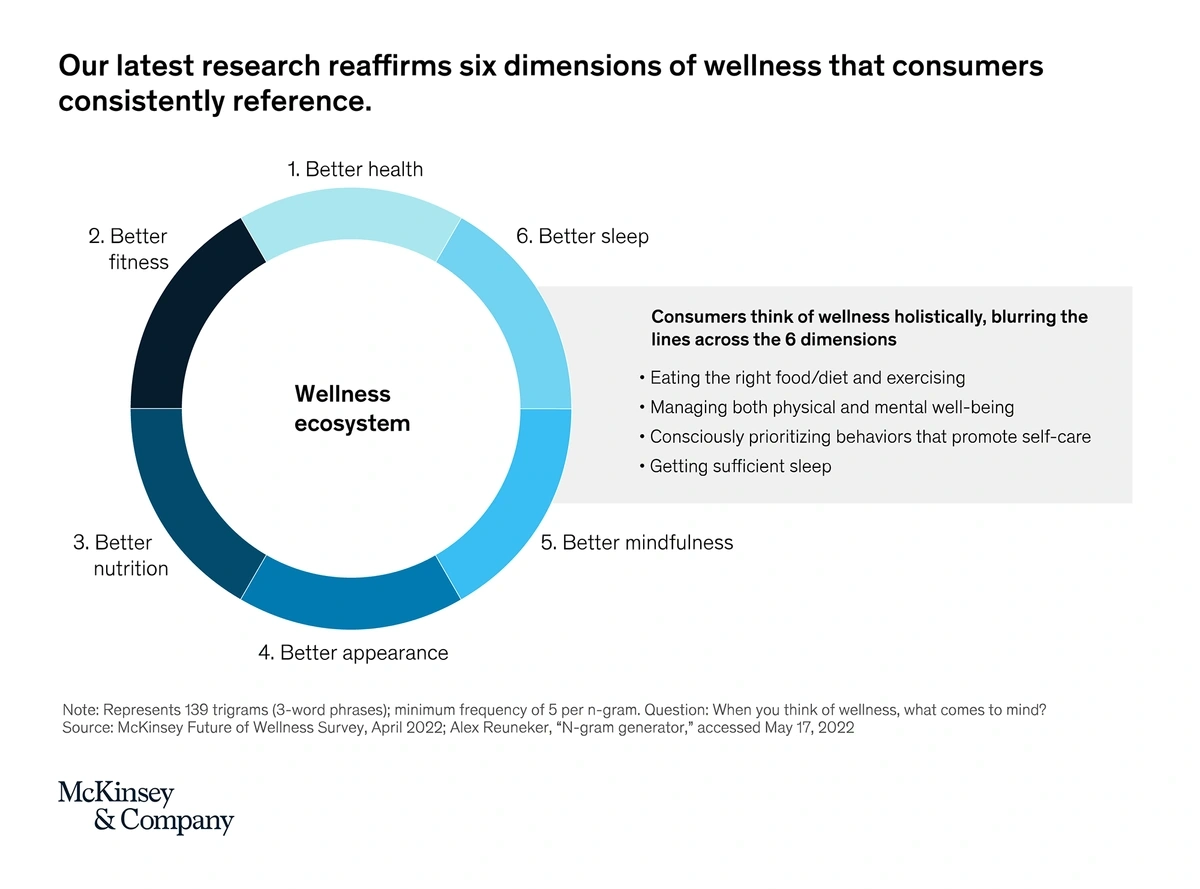

The concept of wellness encompasses several areas of consumer products: health, fitness, sleep, and appearance, just to name a few.

Brands are now offering wellness products that meet a wide variety of needs among consumers.

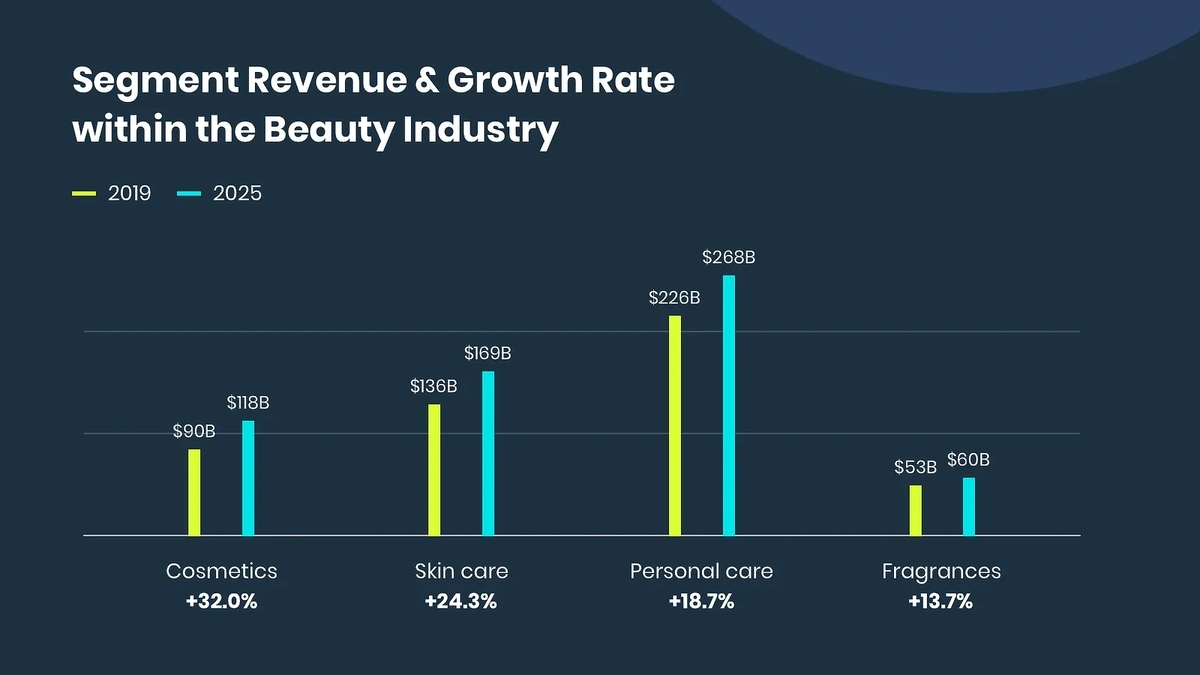

Skincare is one product category that weathered the pandemic well and is driving the wellness sector forward.

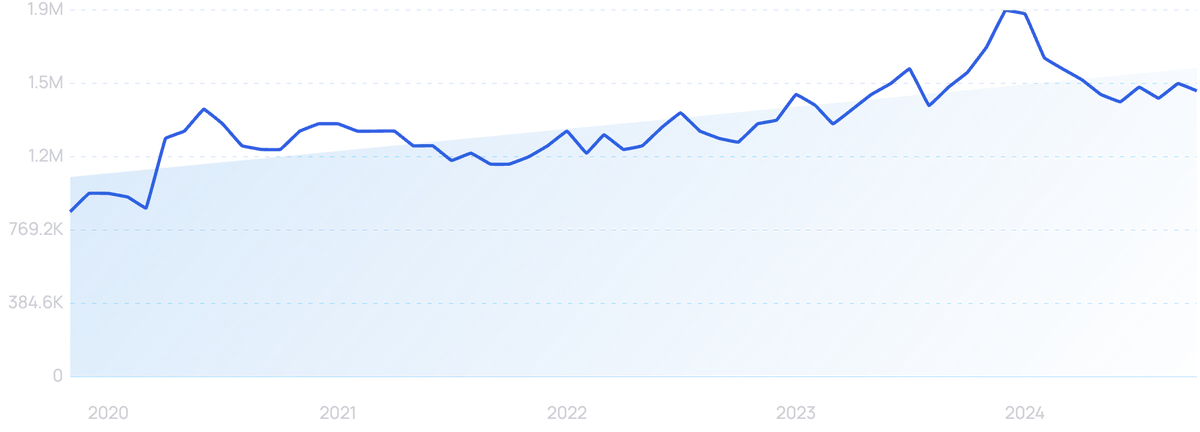

Search volume for “skincare” is up nearly 73% in 5 years.

Predictions show the skincare market ending 2025 with a $169 billion valuation. That’s more than 24% above 2019.

The skincare sector is one of the fastest-growing segments in the wellness industry.

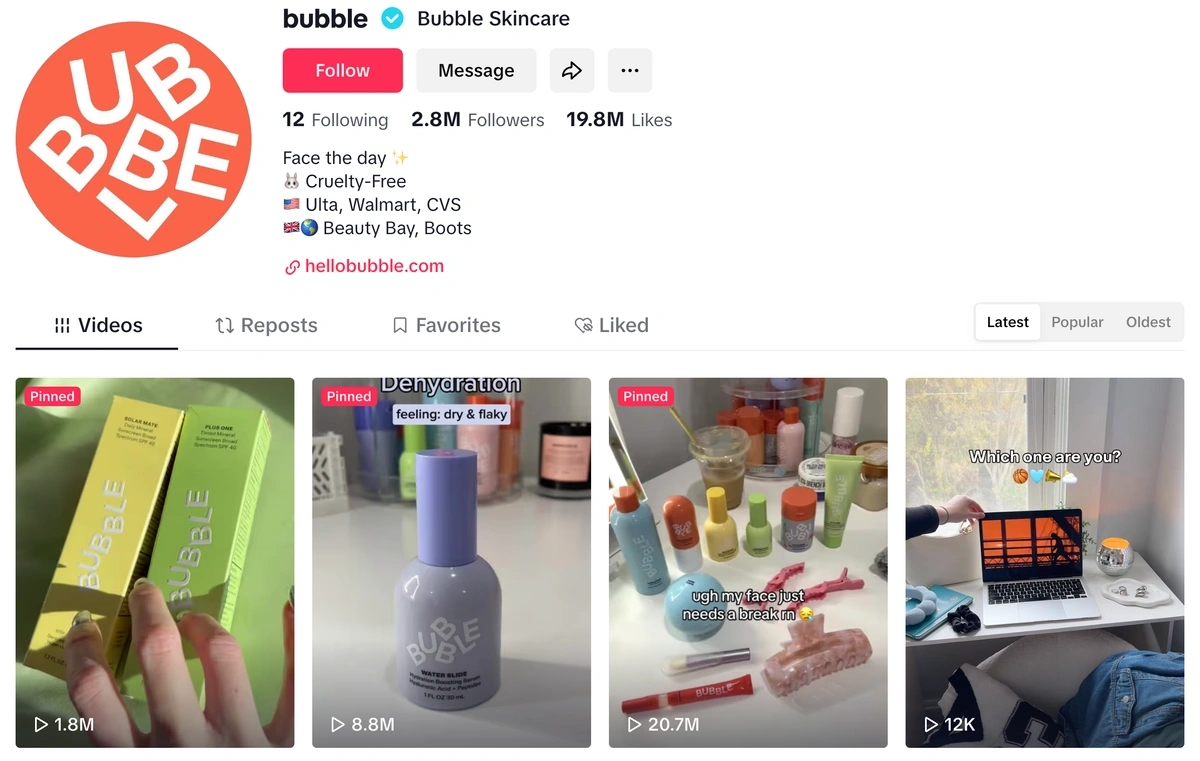

Bubble is a skincare company that’s seen tremendous growth in the past few years.

It started as a DTC brand during the pandemic. But now, the brand’s products are available for purchase at retail giants like Walmart and CVS.

To take their devotion to wellness a step further, the company donates 1% of product sales to support mental health initiatives.

Another factor contributing to Bubble’s success is its connection with its target audience: Gen Z.

The brand offers a “skin school” section of its website that’s aimed at educating this young generation on everything from skin conditions to skincare routines.

They’ve also built a loyal following on TikTok and utilize a variety of Gen Z influencers on the platform.

With a special emphasis on engaging Gen Z, Bubble’s TikTok page features how-to videos, endorsements from dermatologists, and influencer posts.

Another wellness product category seeing tremendous growth is sleep enhancers.

The “sleep economy” is expected to surpass $950 billion in valuation by 2032.

This includes a diverse set of consumer products like wearable monitors, herbal pillow sprays, specialty mattresses, weighted eye masks, and sleep supplements.

The market for sleep supplements is expected to rise from $7.6 billion in 2024 to $12.9 billion in 2034.

Melatonin gummies are a sleep aid that’s popular for adults and children.

Search volume for “melatonin gummies” shows a 140% increase over 5 years.

5. Consumers Tighten Their Budgets

Amid soaring inflation, retailers are evaluating consumer price sensitivity and carefully adjusting their price positioning.

More than 60% of retailers are passing on manufacturer price increases to consumers in addition to compressing their margins.

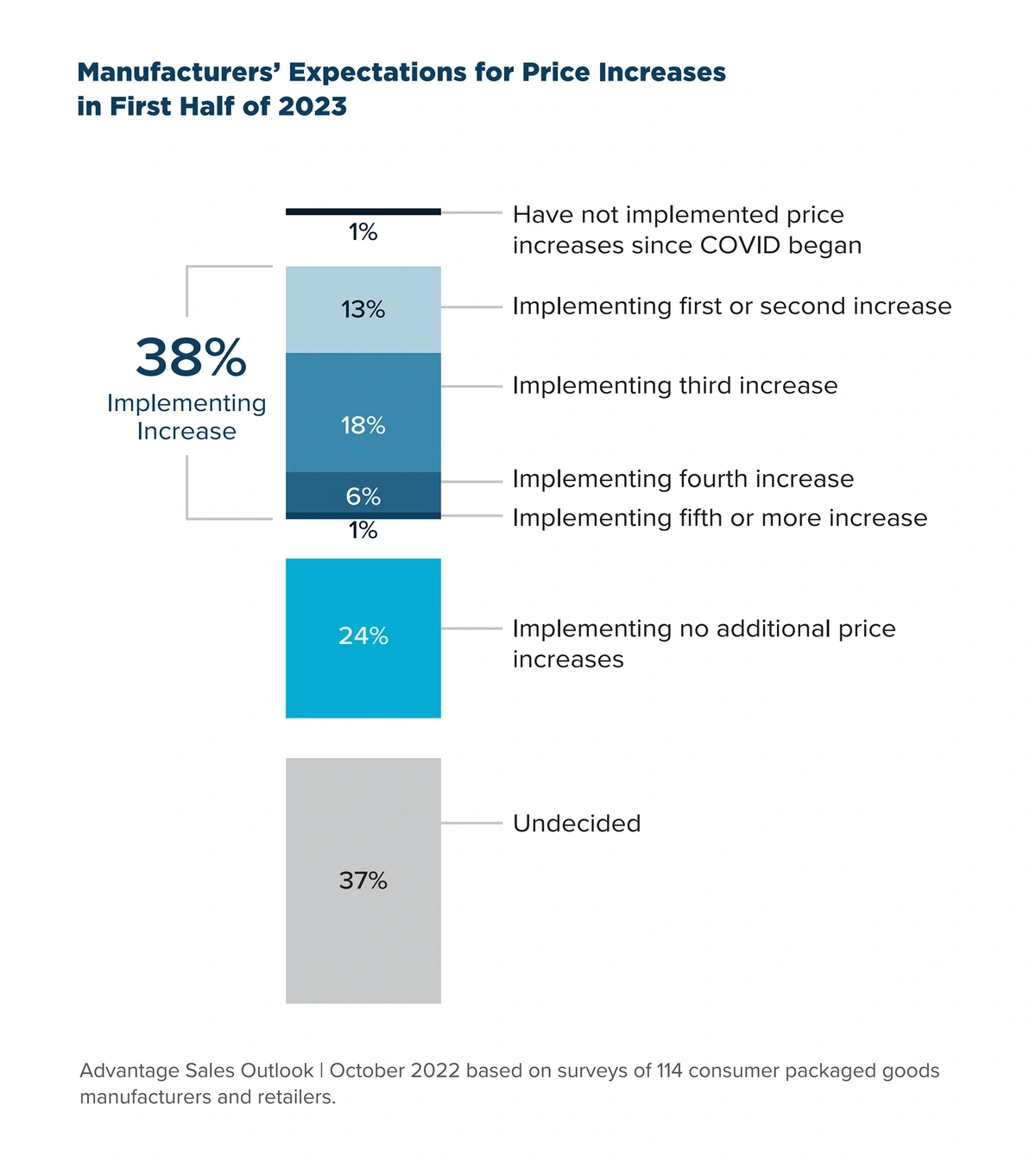

However, in the first half of 2023, only 38% of manufacturers said they’d be putting additional price increases into place.

The Advantage Sales Outlook from October 2022 shows more than one-third of manufacturers plan to increase costs in 2023.

Several recent consumer surveys show that Americans may have little tolerance for additional price increases.

In late 2021, 56% of consumers in the US said they felt prices for transportation, housing, consumer goods, and other necessities seemed higher than six months ago.

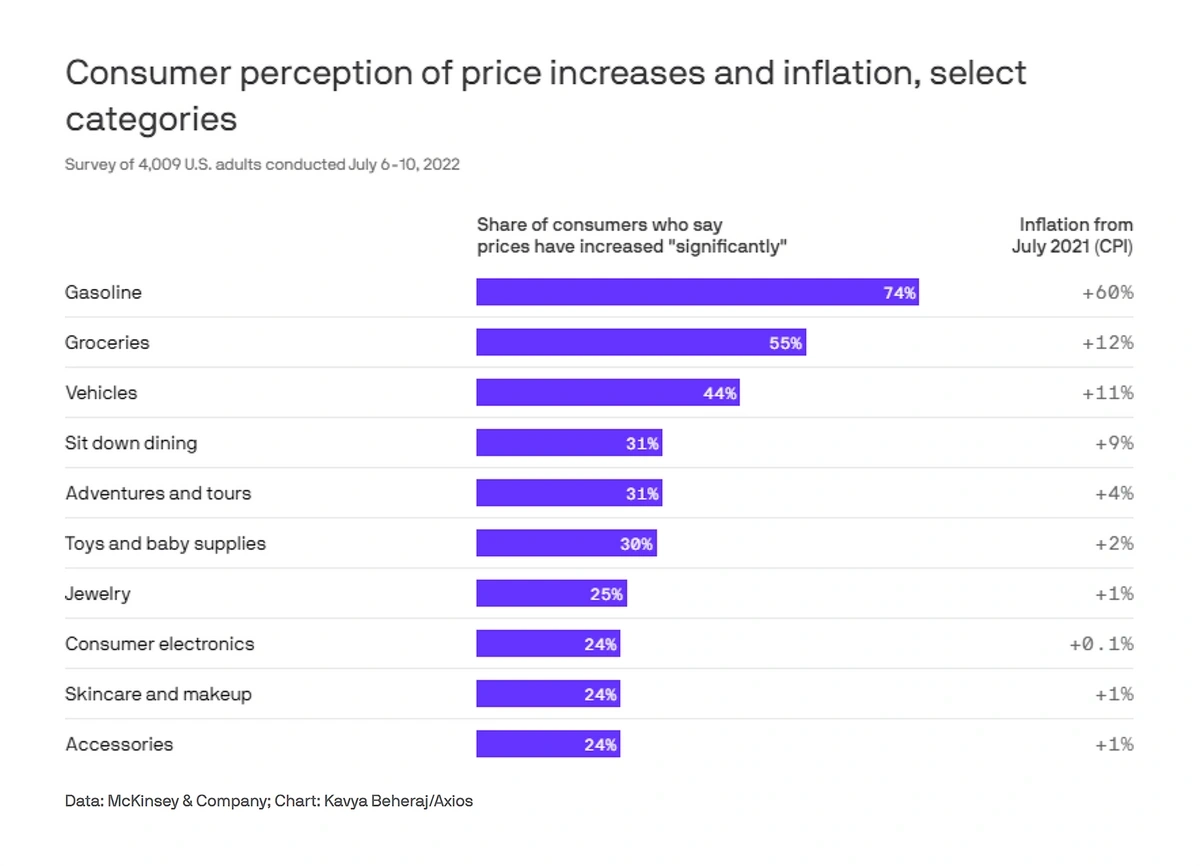

Many retail industry experts point out that the perception of inflation and rising costs of goods is often worse than the actual inflation.

For example, 30% of individuals surveyed in July 2022 said the cost of toys and baby supplies had increased “significantly” over the course of the year. The actual inflation number was just 2%.

These 2022 survey results show a disconnect between consumer perception and the actual numbers.

No matter if it’s perception or fact, many Americans are tightening their budgets and have little tolerance for higher costs.

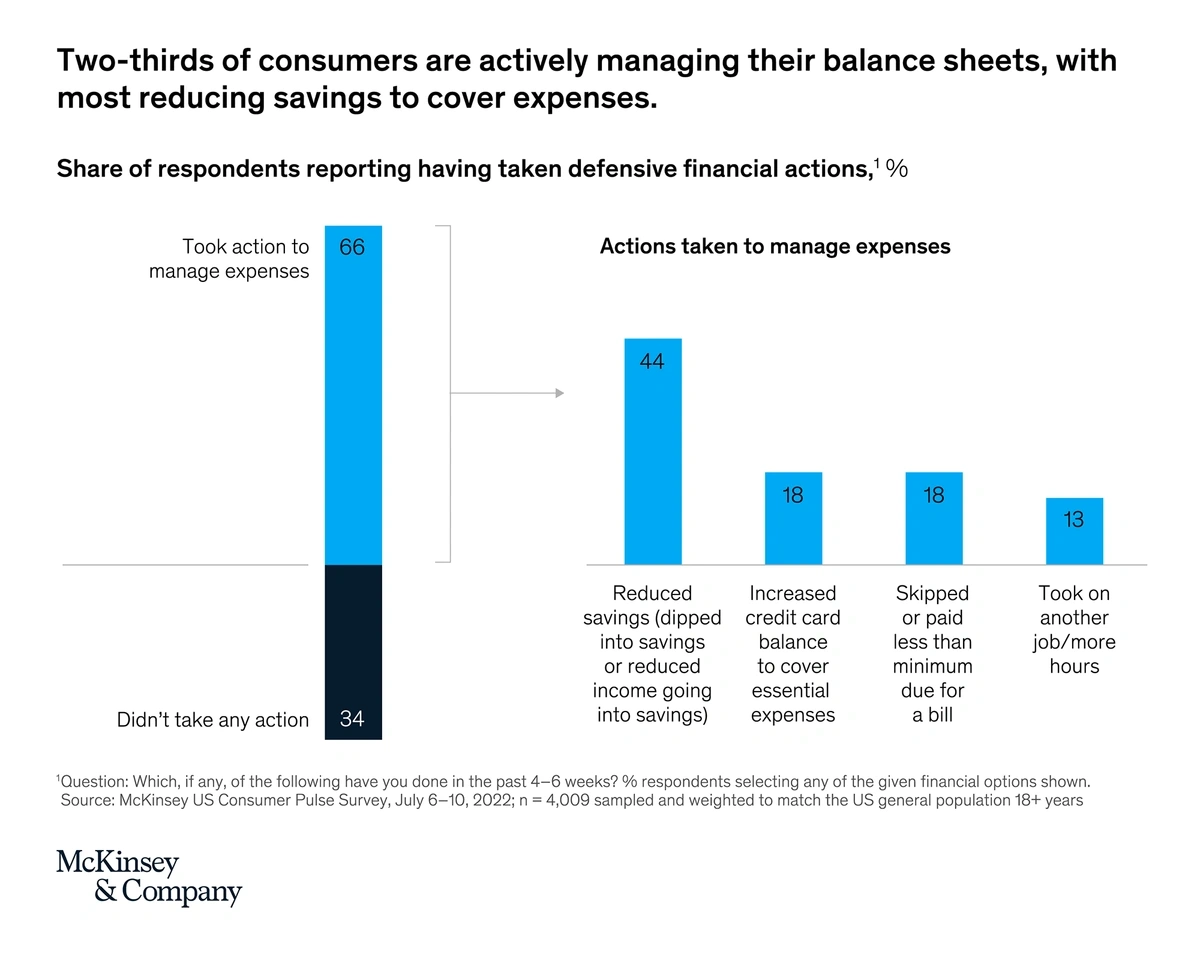

Survey data from July shows that 65% of Americans are concerned about rising prices and inflation, and 65% have taken action to manage their expenses like dipping into savings accounts or increasing credit card balances.

In the same survey, 74% of US consumers said they’ve “traded down” in some way when buying goods.

This includes adjusting the quantity that they bought, delaying the purchase, and changing to a lower-cost brand.

No matter if it’s perception or fact, many Americans are tightening their budgets and have A consumer survey from Ipsos in early 2022 shows that more than 60% of individuals said their household budget can’t sustain any more price hikes.

And, more than half of the people surveyed worry about being able to afford basic goods.

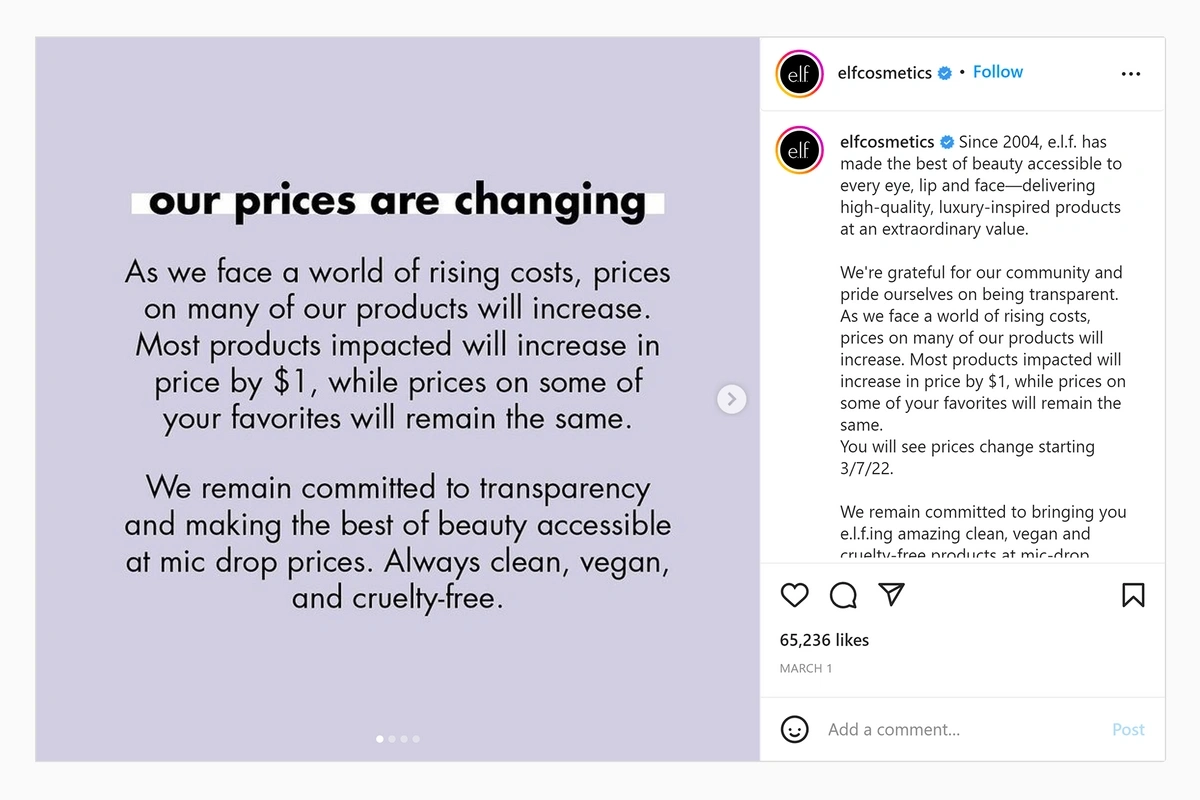

In March 2022, cosmetics company e.l.f. Beauty revealed a pricing increase to customers and the outcome was surprisingly positive.

The company said pricing would remain the same on one-third of its low-cost products, but pricing would increase for higher-cost items.

The price increase is modest, $1 for most products, and consumers seemed to be unfazed when the company announced the changes on social media.

e.l.f. Beauty announced its pricing changes on Instagram.

Key Takeaways

That wraps up our outline of the top five consumer product trends in 2025.

Consumers have more choices in the retail market than ever before. They want to get sustainable products and a personalized experience every time they buy something.

Many retailers and manufacturers are already adjusting their businesses to match consumer demands. Unfortunately, some are still struggling with strategic questions like pricing and supply chain management. Others are investing in smart tech solutions to stay ahead of the competition.

Moving forward, we expect to see even more emphasis on AI solutions, high-tech sustainable manufacturing methods, and products that contribute to the health and wellness of consumers.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more