Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Customized skincare to be $62 billion market within a decade as demand for personalization grows

Skincare has been growing ever more specialized in recent years, with increasingly well-informed consumers demanding the best active ingredients. The newest frontier is customization.

A report has valued the global customized skincare market at $29.3 billion. By 2034, it forecasts that this figure will have increased to $62.4 billion, at a 7.8% CAGR.

The Indian market is expected to lead this growth, with a CAGR of 10.7% over the next decade. Customized skincare in Australia is also projected to outpace global market growth, at a CAGR of 8.2%.

Growth in the United States and United Kingdom is forecast to be a little slower, but the customized skincare market is still expected to grow at a CAGR of 4.5% and 4.9% respectively.

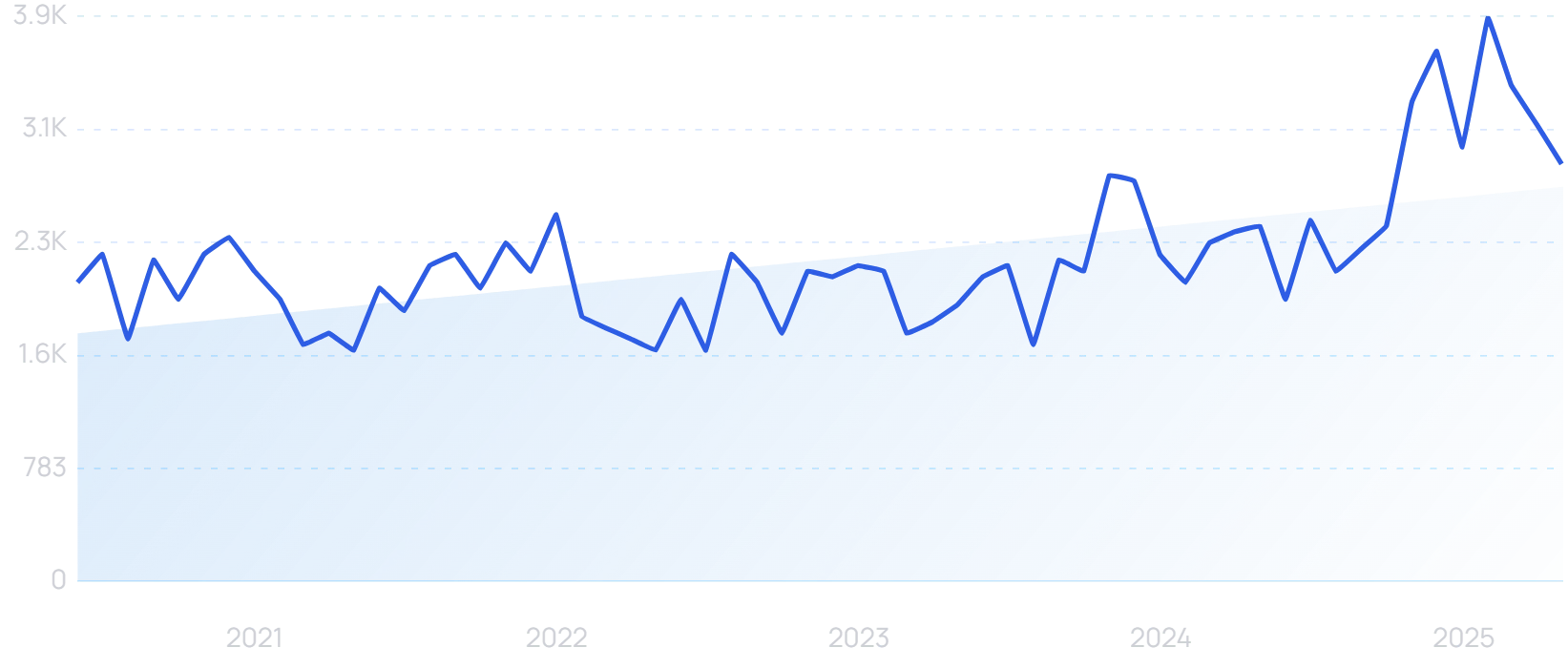

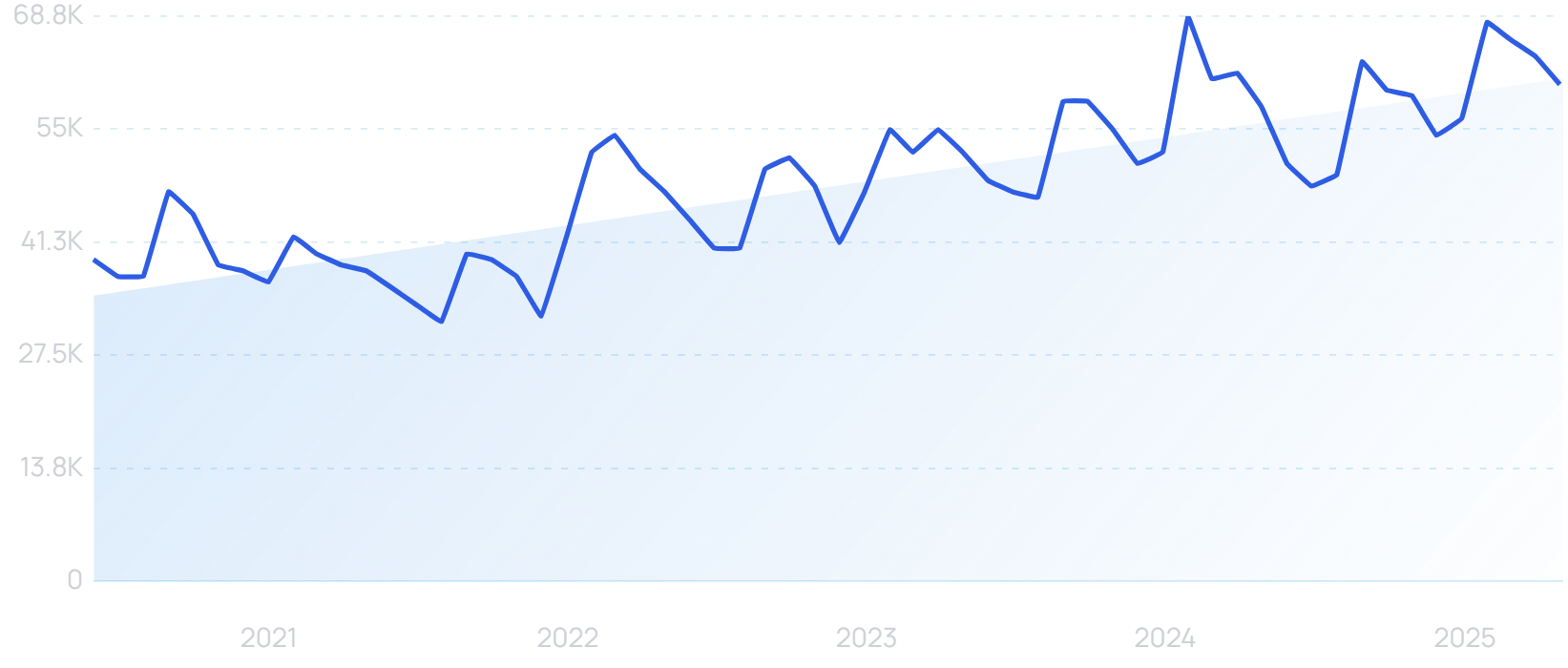

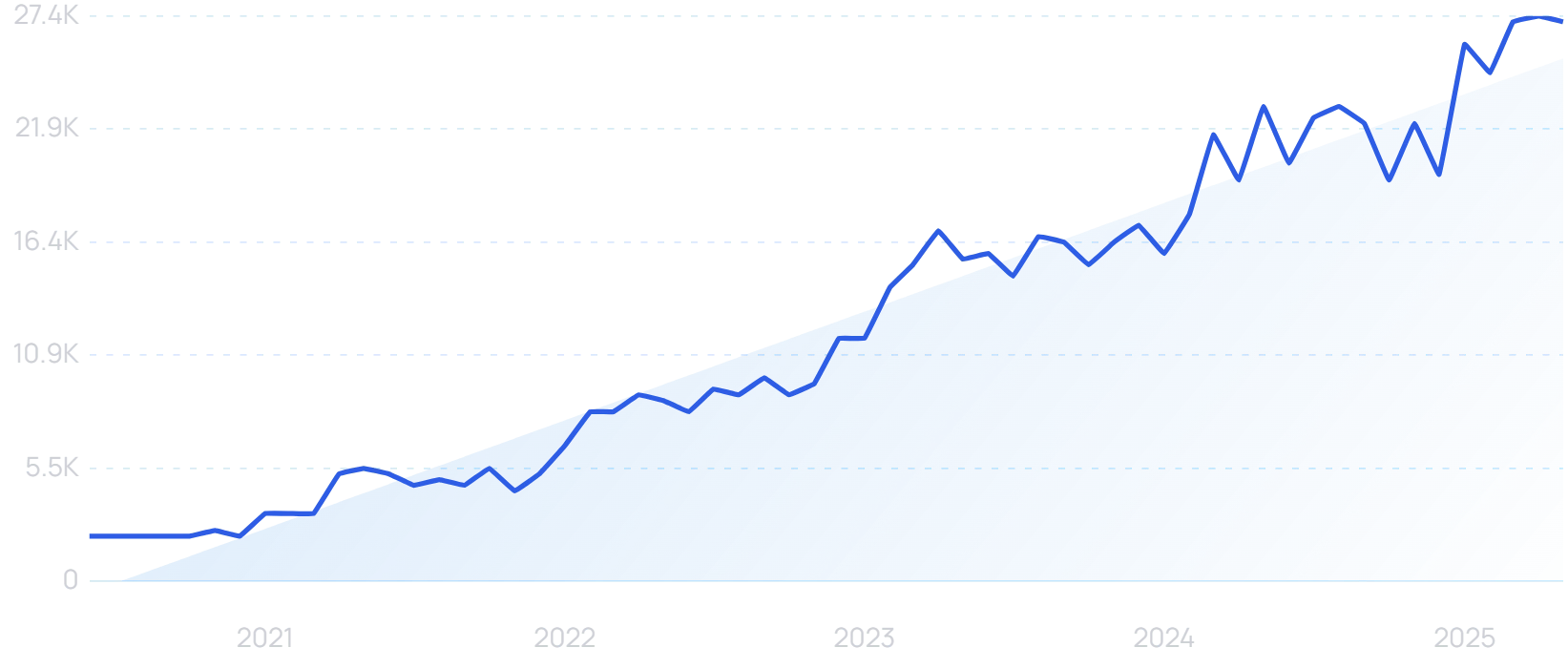

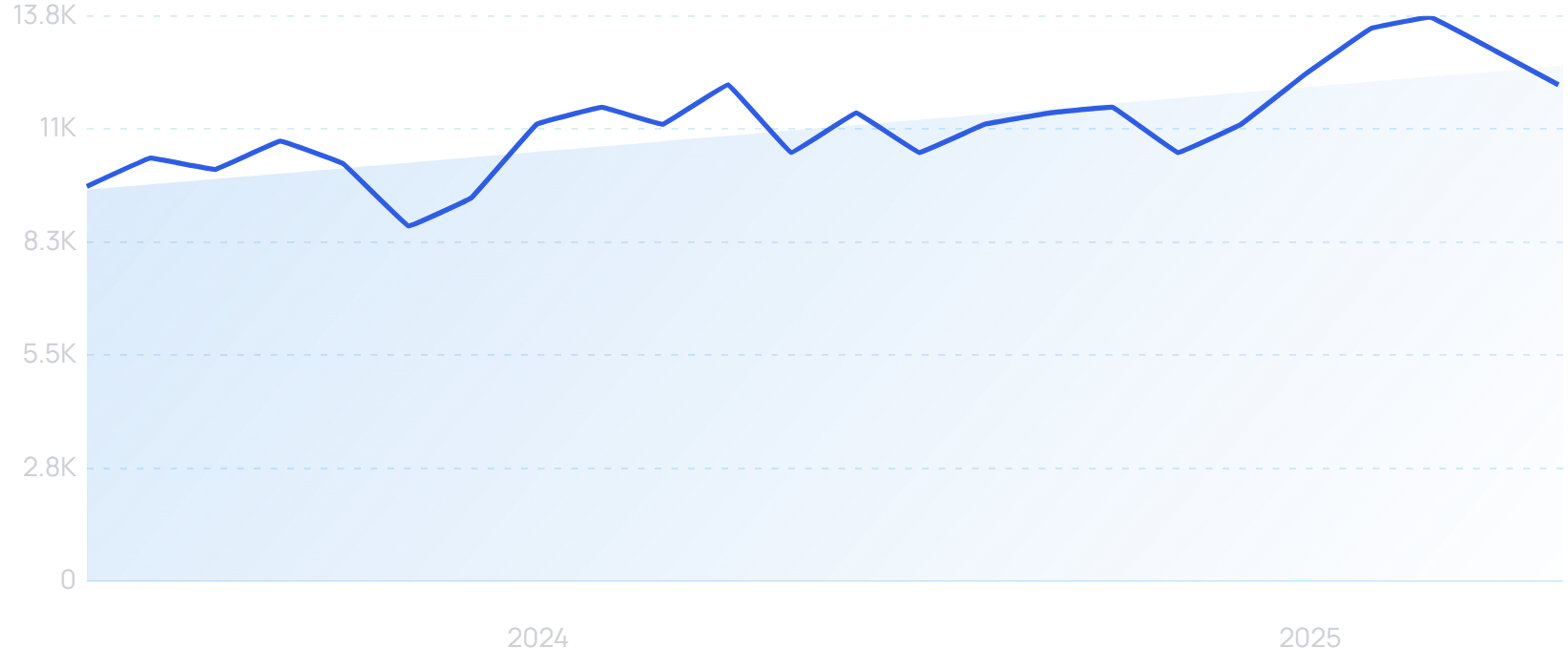

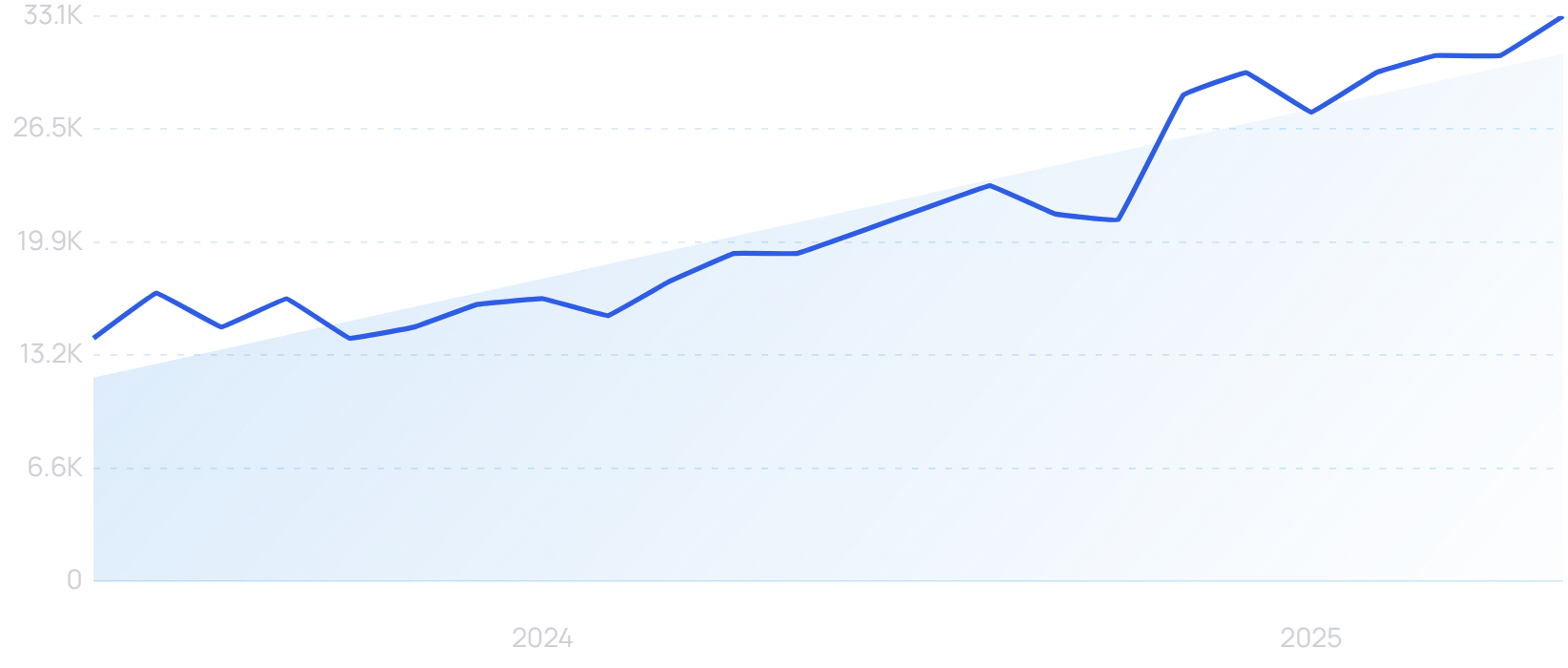

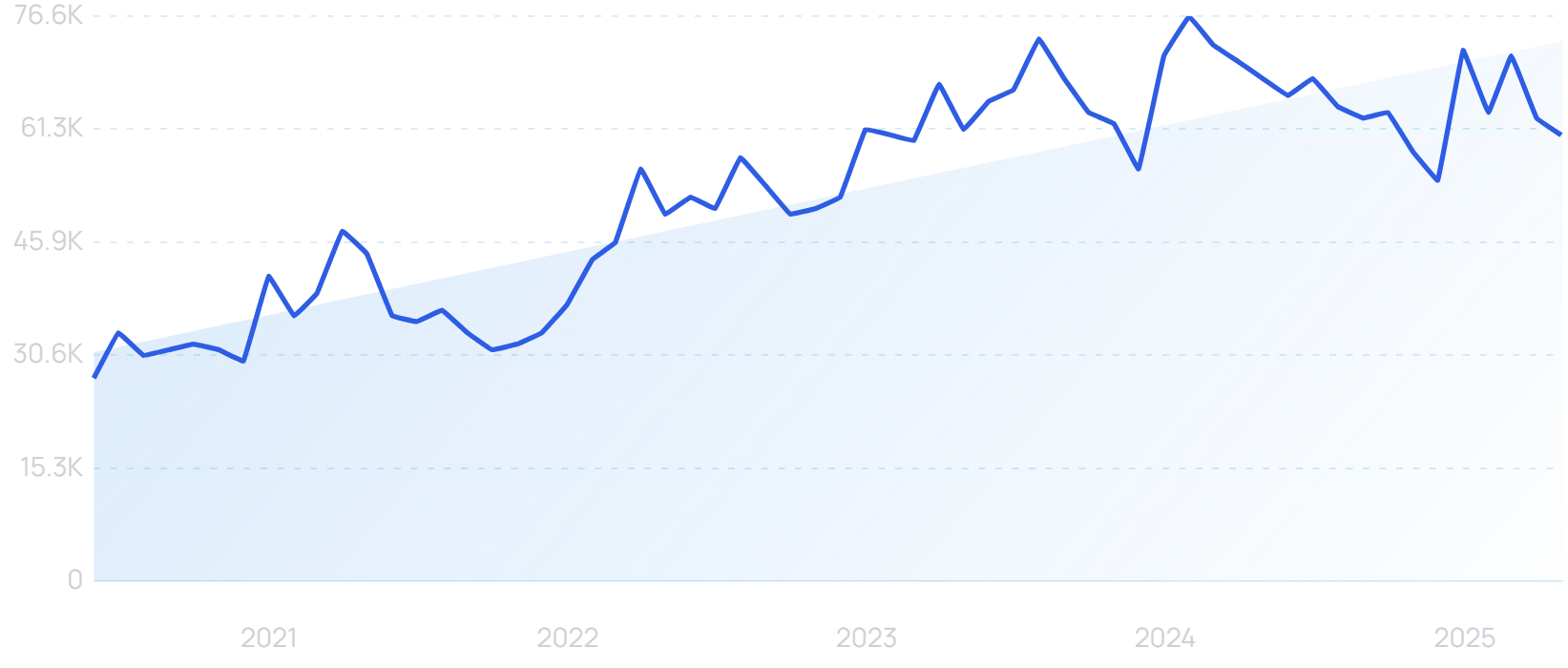

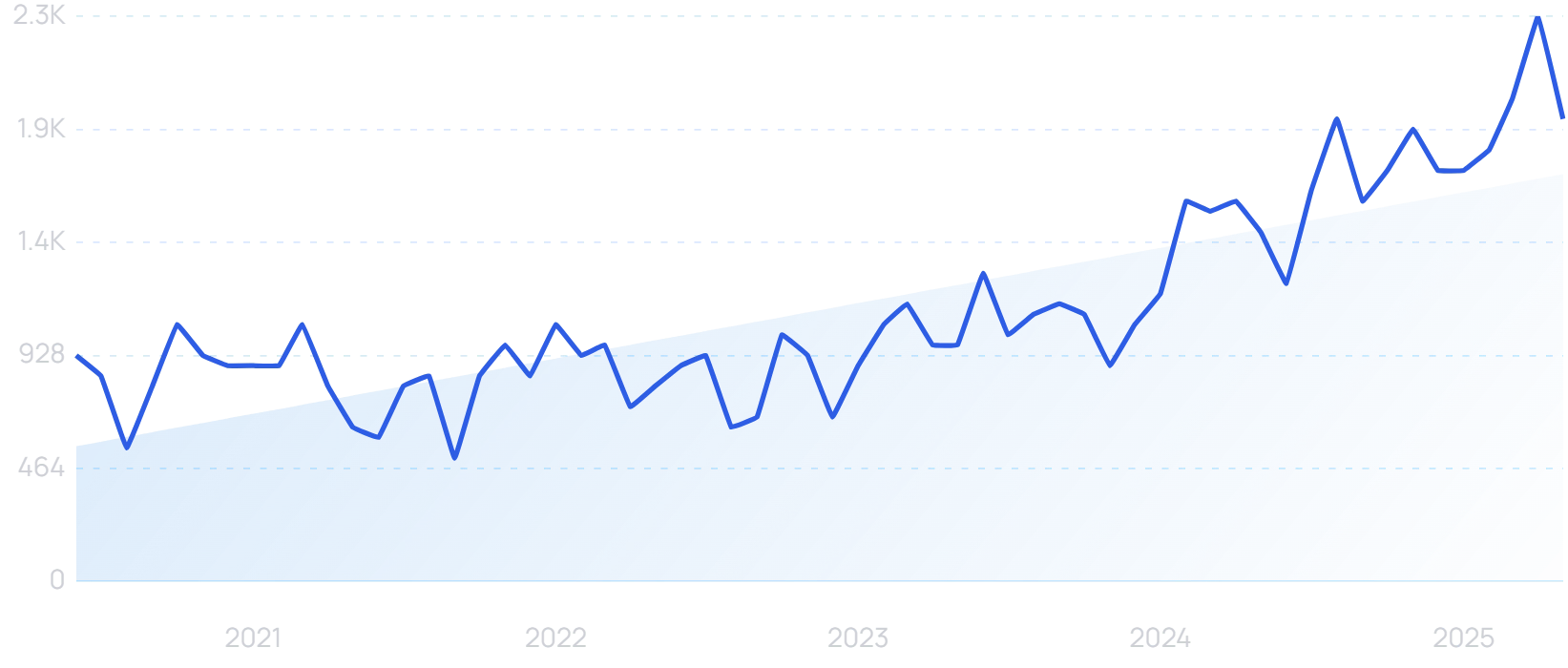

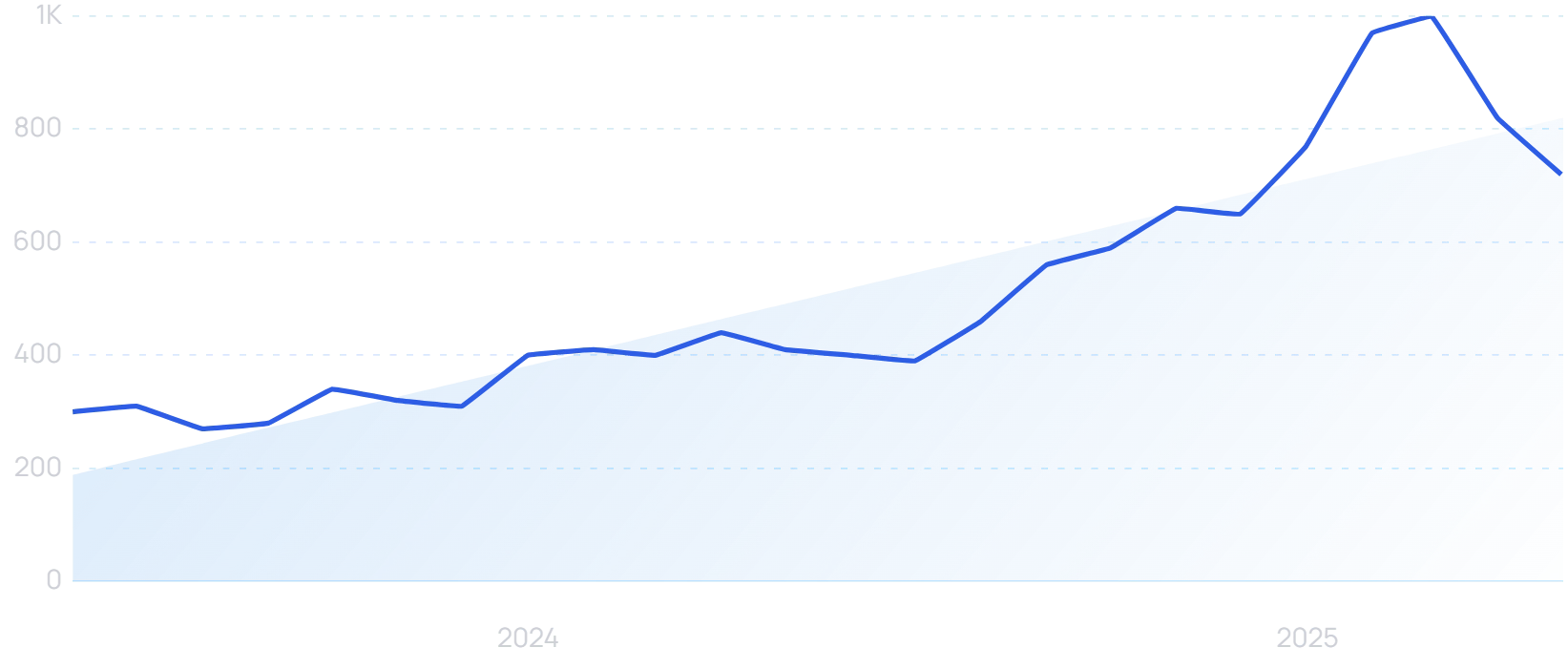

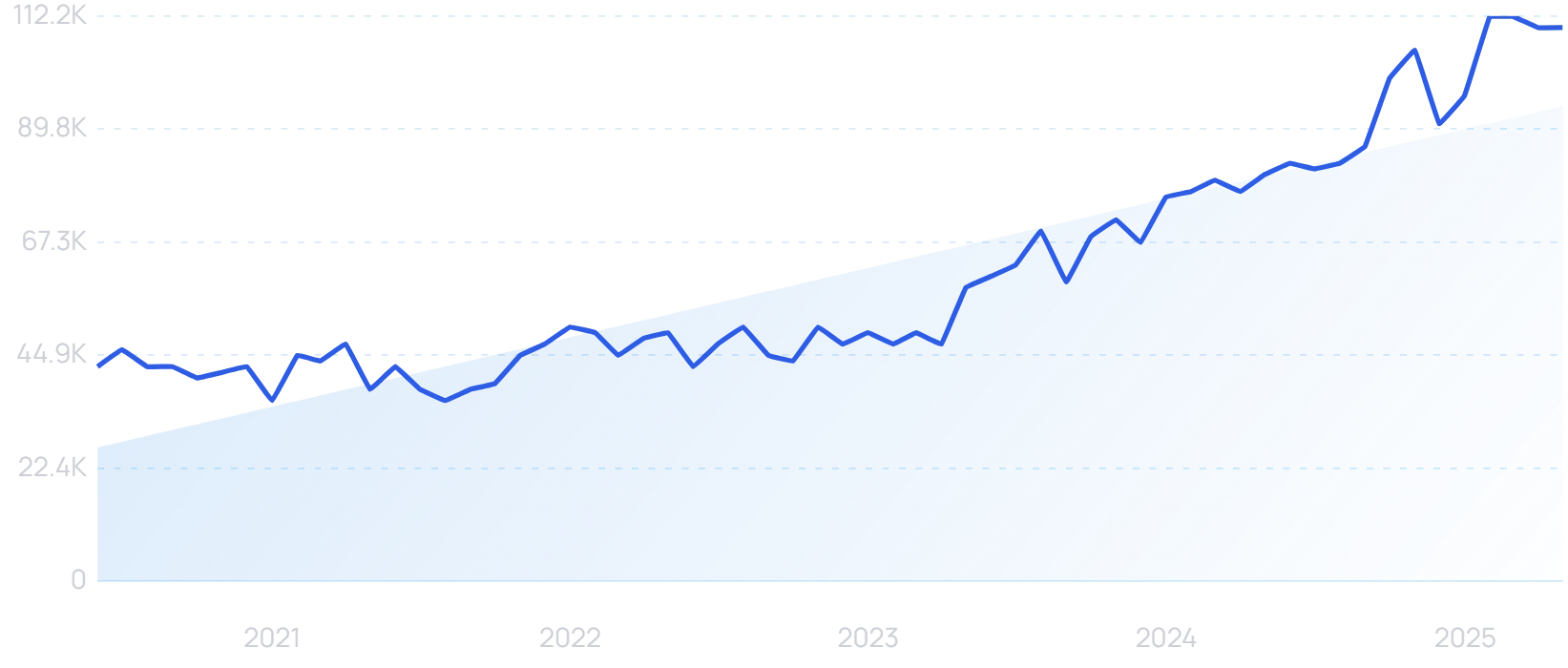

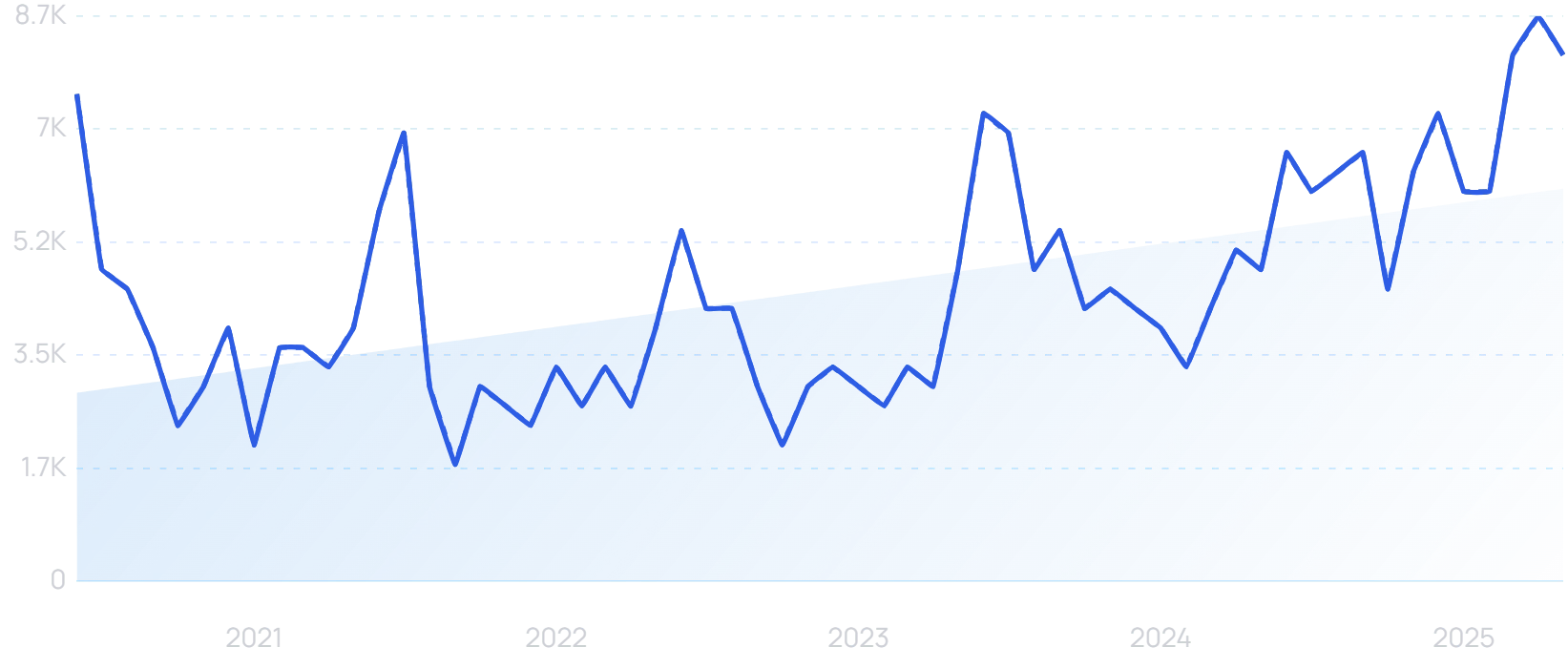

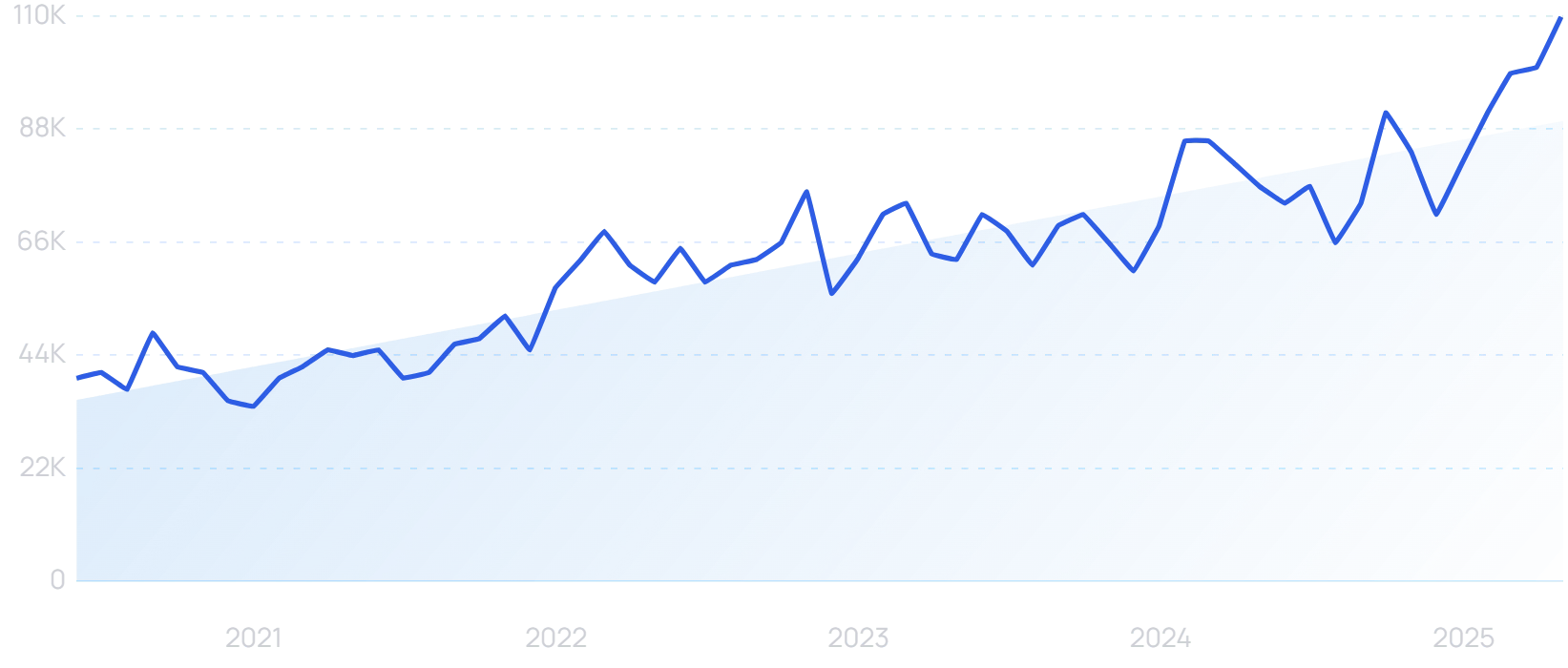

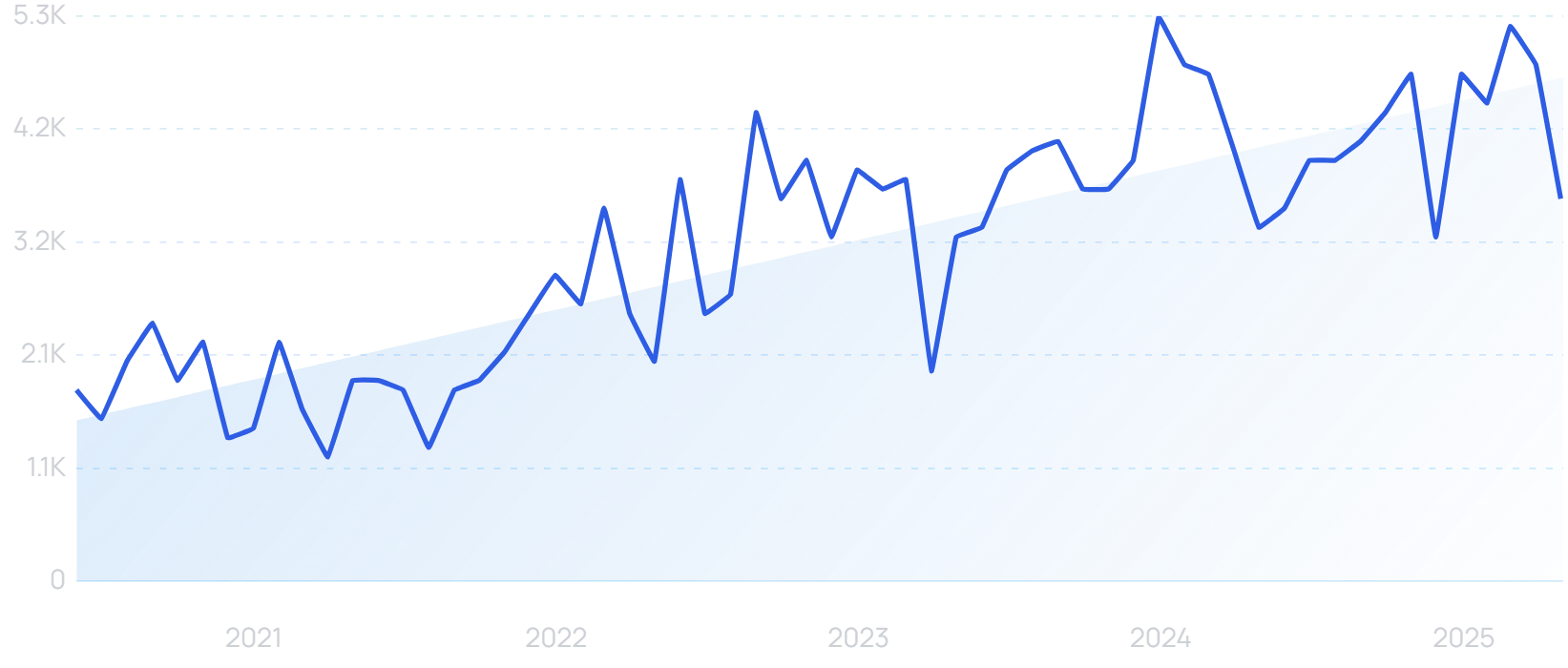

“Custom skincare” searches are up 40% in the last 5 years.

Changing consumer expectations, advances in technology like AI and even robotics, and a wider cross-industry demand for customization and personalization are all driving this trend. I’m going to explore all of this in more detail.

Increasing specialization of skincare

These figures from Future Market Insights reflect a majorly increased appetite for personalized skincare solutions. But why?

According to the American Academy of Dermatology, there are five primary types of skin: oily, dry, normal, combination and sensitive.

Searches for “skin type” are up 54% in the last 5 years.

For a long time now, there has been growing understanding from both consumers and manufacturers that different skin types have different needs. This has spawned increasingly specialized products.

For example, the Beauty Pie Trends Report 2025 has picked out “waterless skincare” as a major upcoming trend. Water tends to have a drying effect, so products that cut it out entirely appeal to those whose skin is already prone to dryness.

Additionally, waterless products place all the emphasis on active ingredients. These are many and varied — as one example, tranexamic acid is currently showing strong search growth.

Searches for “tranexamic acid moisturizer” are up 71% in the last 2 years.

Like waterless skincare, tranexamic acid is named in the Beauty Pie report. It targets dark spots and discoloration. Over a period of 8-12 weeks, daily use is said to restore a natural, even look.

The Exploding Topics database also shows major search growth for:

- Niacinamide body lotion for locking in moisture

- Glycolic acid exfoliating toner for gently removing dead skin cells

- Bakuchiol eye cream for reducing wrinkles around the eyes

Keeping on top of the latest trending active ingredients is a great way for skincare brands and creators to rank on Google and produce helpful content. Exploding Topics is a highly useful tool in this regard, especially when combined with the Semrush platform.

In one case study, an SEO agency used the Semrush Keyword Magic Tool to generate nearly 25,000 relevant skincare keywords. That helped the client, L'Oréal Turkey, receive 1 million organic impressions in just 10 months.

“SkinTok” - The Role of TikTok

Sure enough, there is a thriving skincare creator ecosystem. “SkinTok” has attracted more than 450 million posts on TikTok.

Influencers are further educating consumers on skin types, active ingredients, and more. There are 800,000 posts under the “niacinamide” hashtag alone.

These creators are also typically selling a product.

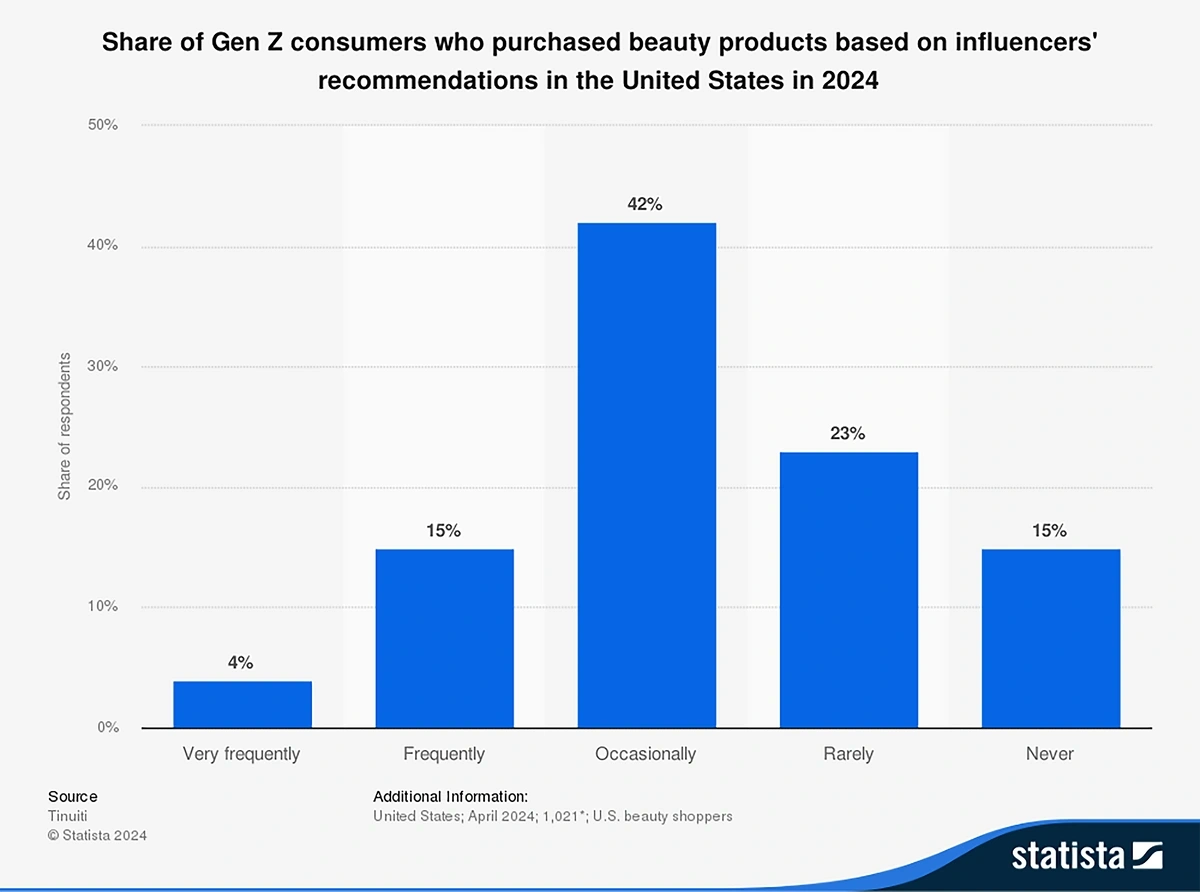

In the US, in 2024, 84% of Gen Z consumers purchased beauty products based on influencer recommendations. 61% did so at least “occasionally” (as opposed to rarely or never).

The majority of Gen Z consumers sometimes listen to influencer beauty recommendations.

Gen Alpha is also increasingly engaged. 66% of beauty users aged 12-14 who use social media say that it helps them to discover new brands and products.

And 50% of consumers aged 18-24 said they started thinking about anti-aging products while still in their teens.

On TikTok, these consumers are increasingly not even having to leave the platform to make their purchases. The explosion of TikTok Shop and social commerce has created a highly direct sales funnel.

E-commerce statistics show that 81% of US TikTok Shop sales are in the beauty and health categories. While the continued threat of a TikTok ban could be significant, the effect on consumer awareness of specialized skincare has already happened.

And it’s easier than ever for skincare brands and marketers to post to TikTok using the Semrush Social Media Poster. The AI assistant will even help to generate text and visuals.

Customized skincare arrives

The average skincare consumer is more informed now than a decade ago. But the rapid specialization of the industry has also left some feeling overwhelmed.

In a 2023 survey, 72% of consumers said they needed clarification on some of the scientific terminology being used in the beauty industry. 69% said they had bought a health or beauty product without understanding the label.

Democratizing access to dermatologists

Even as skincare users seek to keep up with the latest ingredients, the one thing they really know is what effect they want from a product. They understand their own skin needs.

The result is a growing demand for skin consultations, where experts can match consumer needs to the wealth of available active ingredients.

“Skin consultation” searches are up 26% in the last 5 years.

Especially since the pandemic, consumers are used to being able to access healthcare professionals remotely. There’s Lifestance for therapy, Sesame for general appointments, and even a growing interest in vet telehealth.

It’s no surprise that people expect a similar service when it comes to skin health. Clinikally is one company seeking to meet that demand.

Searches for “Clinkally” have increased by 133% in the last 2 years.

The startup is based in India, which is among the leading growth markets for customized skincare. It offers online access to dermatologists.

Products that are recommended by the dermatologist are delivered directly to the consumer. 98% of customers report positive results after the first Google Meet consult.

Custom prescription skincare

As well as clinical recommendations like these, we are also starting to see true customized skincare: unique formulations tailored to individual consumers.

After a free consultation, subscription-based service Skin + Me handpicks appropriate ingredients, which are prescription-strength where necessary. They then send out the customized skincare products monthly.

Skin + Me claims to have multiple advantages over “generic” skincare.

The startup offers ongoing check-ins. If a user’s skincare needs change, they will alter the formulation of the products for free.

Dermatica provides a similar service.

“Dermatica” searches are up by 119% in the last 5 years.

Users share their treatment goals and upload some selfies. This information is then reviewed by a dermatology team, who devise a personalized formula.

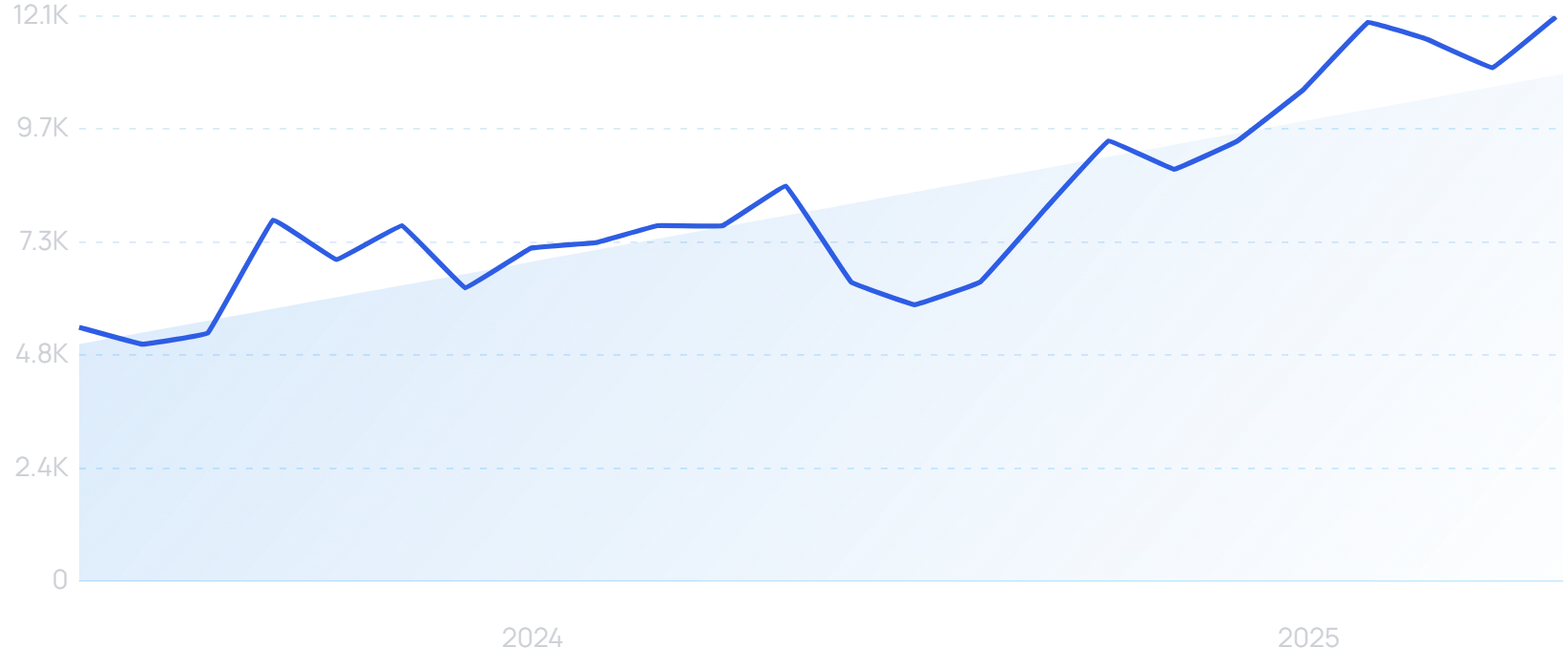

SimilarWeb estimates Dermatica’s annual revenue at $10-15 million. Per Semrush, it attracts 22.1K clicks a month through organic search traffic.

Klira produces bespoke skincare night creams. According to Elle, its customization goes even further than Skin + Me and Dermatica.

“Klira” searches are up 105% in 5 years.

The founder describes Klira as “fusing the worlds of medical treatments and luxury skincare”.

To achieve greater personalization, it does away with the classic five skin types, using its own 1-12 scale defined by collagen, melanin, sebum and barrier.

Klira achieved 322% growth in 2024. As a result, it raised “significant investment” in December last year.

AI Skincare

Across numerous industries, AI is making it easier than ever to offer personalization. It’s no different in skincare.

The next logical step from skin consultations? AI skin consultations.

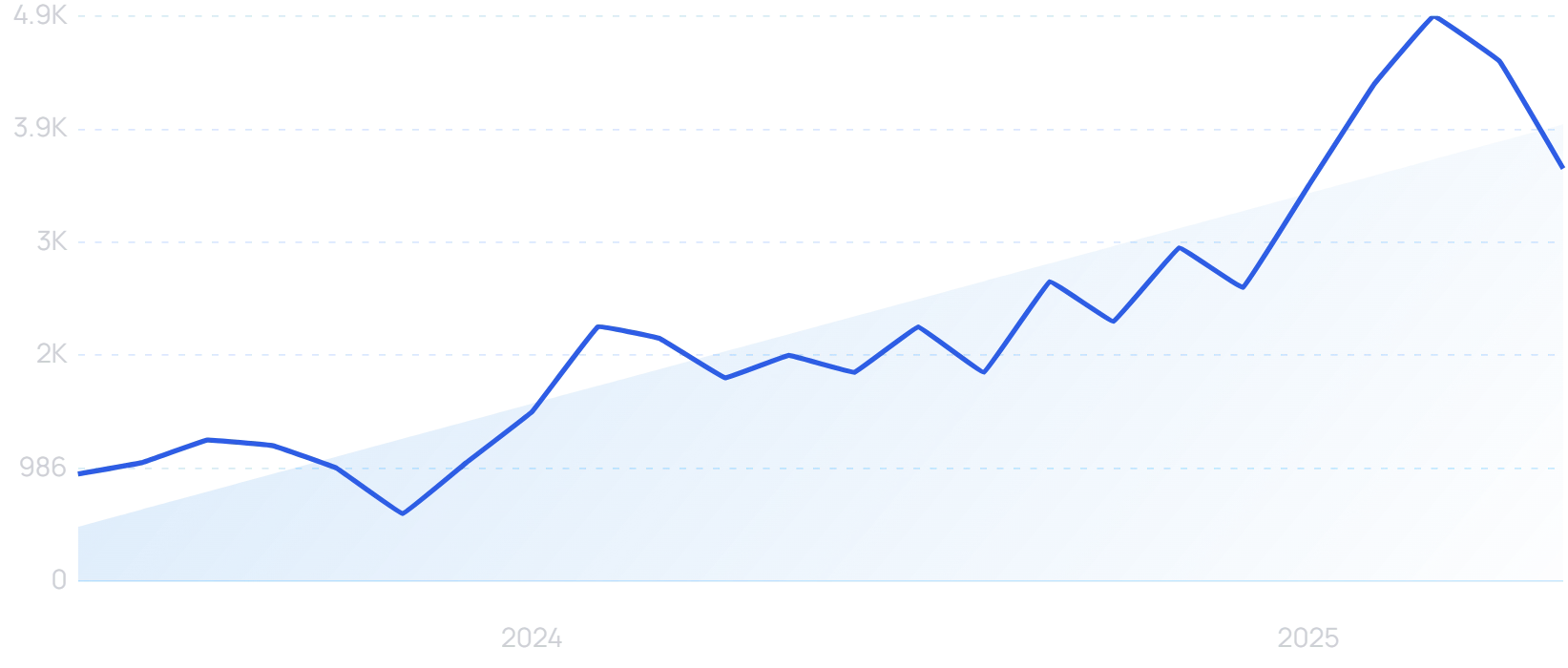

Searches for “AI skincare” are up by 140% in the last 2 years.

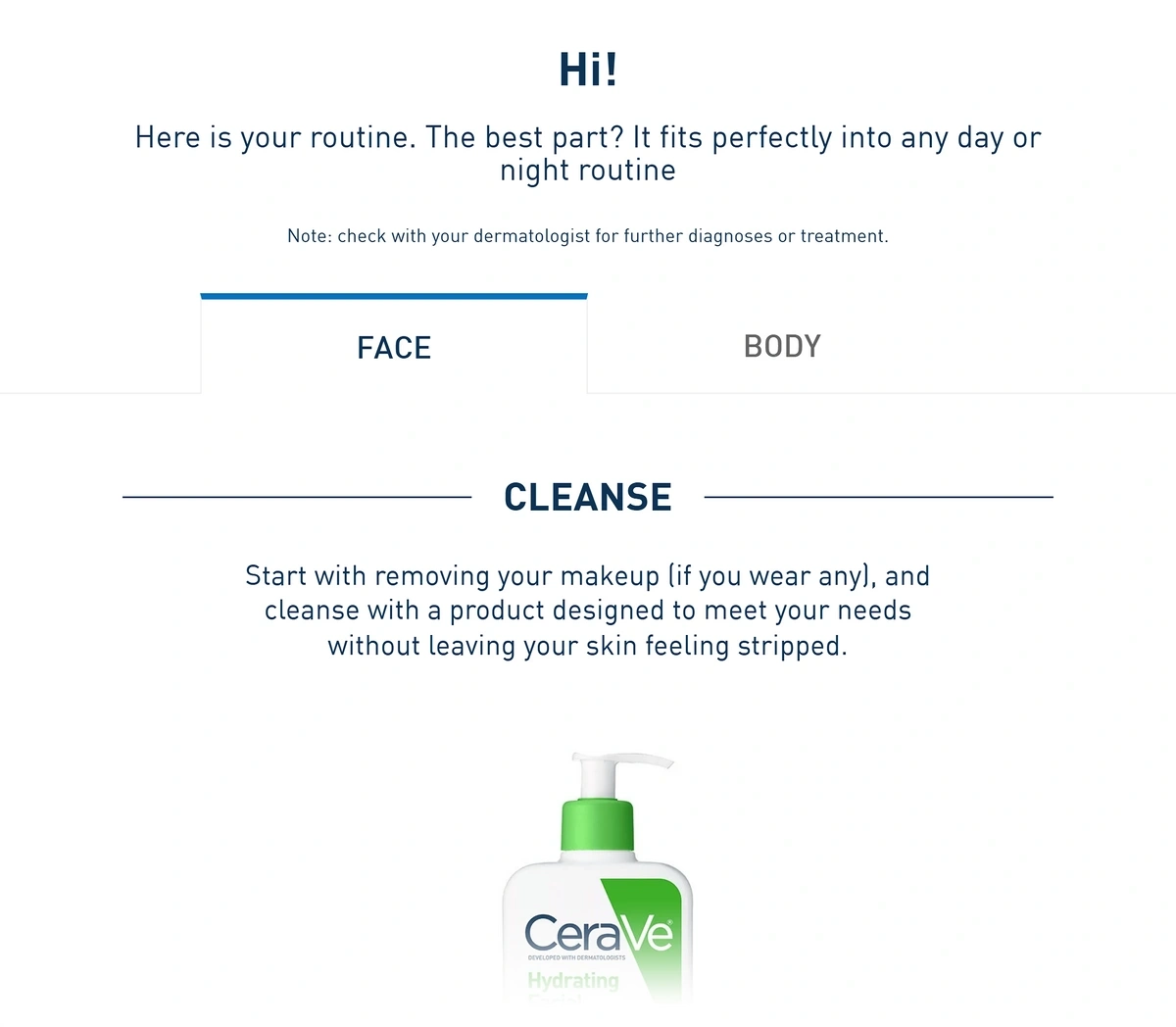

Brands have long been offering virtual consultations of one kind or another. Cerave’s Skincare Finder Quiz is a prime example of a simple but effective multiple-choice questionnaire.

Consumers specify their primary concerns and goals from a list. The quiz ultimately returns a customized routine.

Cerave users can answer a few quick multiple-choice questions, and get a personalized skincare routine.

As AI gets more powerful, the possibilities improve. Brands are now offering AI skin analysis, using face scanning technology to return skincare recommendations.

Haut.AI provides its AI skin-scanning technology to various skincare and beauty brands including Ulta Beauty.

“AI skin analysis” searches are up 284% in 2 years.

Its AI has been trained on more than 3 million data points. It has a reported 98% accuracy rate.

And brands using Haut.AI technology have seen a 62% growth in customer conversion and 34% increase in order value. Haut itself is profitable, with revenue figures in the “several millions”.

Lots of major brands are adopting similar technology. Lancome E-Skin Expert is built on a database of 40,000 skin pictures, and analyzes 9 clinical skin parameters.

For instance, I now know that “radiance” is what I should be targeting with my skincare routine.

The Lancome E-Skin Expert assesses a variety of skin markers before returning product recommendations.

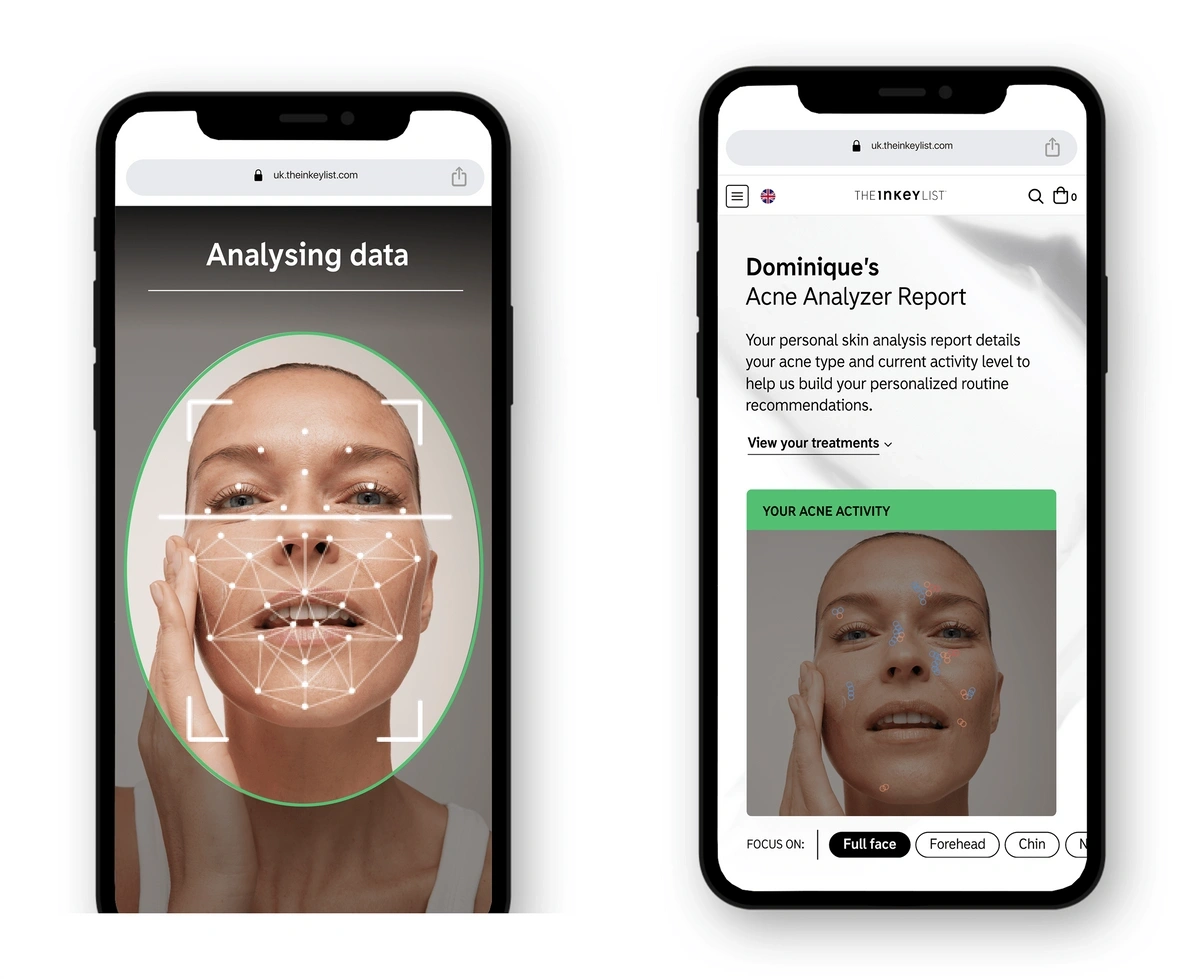

The Inkey List offers a more targeted AI scan for signs of acne.

A hyper-personalized analysis spots emerging breakouts and activity levels, identifying the type of acne and recommending a treatment plan.

It generates a detailed personal skin report in under 3 minutes.

Use of tools like these is hugely popular with Gen Z. In the US, 57.7% of consumers who are engaged with digital beauty solutions are under 34, highlighting the huge potential for growth in the market.

A particularly nascent area is the use of AI to not only offer product recommendations, but to create brand new customized skincare products — effectively a combination of the Dermatica/Klira/Skin+Me and Haut.AI innovations.

An early player in this space is SkinCeuticals, a L’Oreal brand. Its “Custom D.O.S.E” product uses a proprietary algorithm to help devise personalized skincare serums.

SkinCeuticals is harnessing technology to offer custom skincare products.

Currently, customers need to visit select professional locations to get a scan from the SkinCeuticals diagnostic tool, which is guided by a skincare professional. From there, as the name suggests, a custom dose is formulated.

Clinical studies have shown a 42% improvement in skin clarity among Custom D.O.S.E users, a 34% improvement in skin texture and an 18% improvement in radiance.

Turn AI Mentions Into Your Next Strategic Move

Analyze how LLMs like ChatGPT feature your brand and get actionable recommendations to improve your business strategy, products, and market position.

AI robot skincare

Tracing the thread of custom skincare through to this point, I could not help but feel that it was inexorably leading to an AI-powered system that does everything: assesses custom skincare needs, devises a formula, and dispenses it to the consumer.

Sure enough, while the technology is nascent, that does appear to be the direction of travel. SmartSKN recently secured a $7 million deal to exclusively introduce AI-driven Korean skincare robots to the US market.

Within custom skincare, there is increasing demand for “K-Beauty” products. Searches are up 158% in 5 years.

The robots are manufactured by Lillycover. Developed in Korea with the support of government funding, they generate custom K-beauty skincare products.

SmartSKN has been showcasing the robots at skincare lab pop-ups throughout the US this year. Feedback is said to have been “amazing”.

Lillycover’s AI robot can produce custom skincare formulations in under 4 minutes.

Could robots like this ultimately be present in cosmetics stores across the US? It doesn’t seem wholly implausible.

Personalized skincare in a medical context

At present, customized skincare is primarily being explored in a cosmetic context. But there may also be medical applications.

In particular, individual skin analysis has the potential to be really powerful in the early detection of skin cancer.

SkinVision is an app that allows users to scan any marks on their skin.

“SkinVision” searches are up 12% in the last 2 years.

Over 3 million users have completed more than 5 million scans. The app has a clinically validated accuracy of over 90%, and connects customers with doctors and insurers.

As of May 2025, the UK’s National Health Service has conditionally green-lit another app that scans suspicious skin lesions. Its clinical use could halve the number of dermatologist referrals under the urgent skin cancer pathway.

Likewise, the FDA has approved a device named the DermaSensor. In a study, it showed 96% sensitivity across all 224 types of skin cancers.

Skincare digital twins

In the emerging AI healthcare space, digital twins are increasingly significant.

“Digital twin” searches are up 186% in the last 5 years.

The basic premise is that patients can have identical digital personas, which can then be used for modelling various treatment options and reaching better decisions. There’s no reason why that shouldn’t apply to dermatology as well.

Dutch company SkinTwin is doing just that. It digitally stores factors like skin type, past UV damage, and presence of moles, in a record that is easily available to healthcare professionals.

The skin twin is updated over time. Comparing the “baseline” twin to later scans can help in the early detection of skin cancer.

Updating the skin twin requires multiple scans. But it’s not too difficult to imagine a world where this process becomes seamless.

One of the major reasons for the rise of digital twins in healthcare is the increased availability of live data. 43% of users now own connected monitoring devices like smart watches.

There’s no real-time equivalent when it comes to monitoring the skin. But with the rise of AI skin analysis, millions of people are submitting photos of themselves, and this data could theoretically be used to update skincare digital twins.

One study suggested a smartphone app could prompt users to submit regular photos of potential at-risk areas of the skin, providing the required data to unlock the full potential of digital twins in this context.

The dawn of personalized everything

It’s worth examining where customized skincare fits into the bigger picture. Supercharged by the growth of AI, there has been a surge in hyper personalization.

”Hyper personalization” searches are up 100% in the last 5 years.

Across all sectors, 81% of consumers prefer companies that offer a personalized experience.

When working with accurate data, AI can generate a detailed customer profile in seconds, optimizing communications, offers, and tone accordingly. It unlocks a far more personalized experience.

The Segment State of Personalization Report 2024 found that 73% of business leaders think AI adoption will fundamentally change personalization and marketing strategies. 89% of decision-makers consider personalization invaluable to business success over the next 3 years.

And with the growth of AI analytics, this won’t just be “reactive” personalization. 86% of respondents anticipate a significant shift to “predictive” personalization, harnessing the power of AI to meet consumer preferences based on more than just their previous purchases.

Much of this is about personalizing the sales experience. But AI is also helping to create more bespoke products.

To use the example of skincare: this isn’t just a product for people like you, it’s a product made especially for you.

AI tutors customize the content being offered based on the assessed needs of the individual user.

“AI tutor” searches are up 122% in the last 2 years.

One tutor, Squirrel AI, uses a Large Adaptive Model that has been trained on data from more than 24 million students and 10 billion learning behaviors. Its courses are divided into thousands of “knowledge points”, and the AI is designed to spot gaps in students’ understanding.

In another industry altogether, EightSleep uses “Autopilot” AI in its intelligent sleeping pod, which gradually learns more about the user and adjusts accordingly.

EightSleep pods use “autopilot” technology which adapts to the individual user.

The pod alters factors like temperature and tilt. It has been shown to reduce snoring by up to 45%.

Dominate the skincare market by keeping on top of trends

Personalization is happening everywhere. But the skincare market is home to some of the most exciting developments.

As the report from Future Market Insights shows, customized skincare is already a lucrative niche, and it is set to grow at a rapid rate. It has become a significant segment within the $189.5 billion global skincare market, and is projected to grow as a percentage of the overall industry over the next decade.

Ready to capitalize on the growth of the customized skincare market? With the industry forecast to be worth $62.4 billion by 2034, and growing at a 7.8% CAGR, there's never been a better time to strengthen your market position.

Discover how the Semrush toolkit can help you:

- Target the right keywords in a market where "custom skincare" searches have grown by 40% in 5 years

- Identify emerging active ingredient trends, like the 317% spike in "bakuchiol eye cream" searches we’ve seen over the past 2 years

- Reach the 84% of Gen Z consumers who purchase beauty products based on digital content

- Generate thousands of relevant keywords, just like the ones that helped L’Oréal Turkey achieve 1 million organic impressions in 10 months

- Stay on top of the latest changes in SEO

Join the brands successfully navigating the growth of customized skincare.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

James is a Journalist at Exploding Topics. After graduating from the University of Oxford with a degree in Law, he completed a... Read more