Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 Emerging CPG Brands to Watch in 2024

You may also like:

- 9 Important CPG Industry Trends

- 25 High Growth DTC Companies & Startups to Watch

- 20 Notable Customer Experience Startups

The CPG (Consumer Packaged Goods) market is now worth $2.29 trillion in 2024. This figure is expected to grow to $3.17 trillion in 2032 with a forecasted CAGR of 4.1%.

And small CPG companies reported higher revenue growth compared to large manufacturers.

Check our list of growing CPG startups disrupting the industry. We’ve researched key company data and added search growth and funding information.

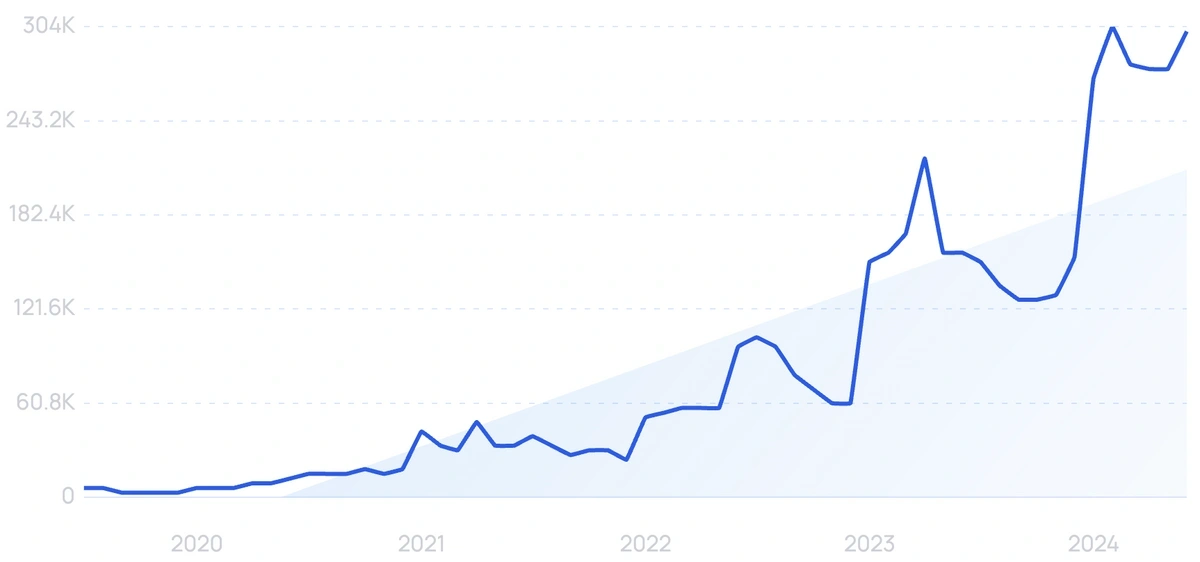

1. OLIPOP

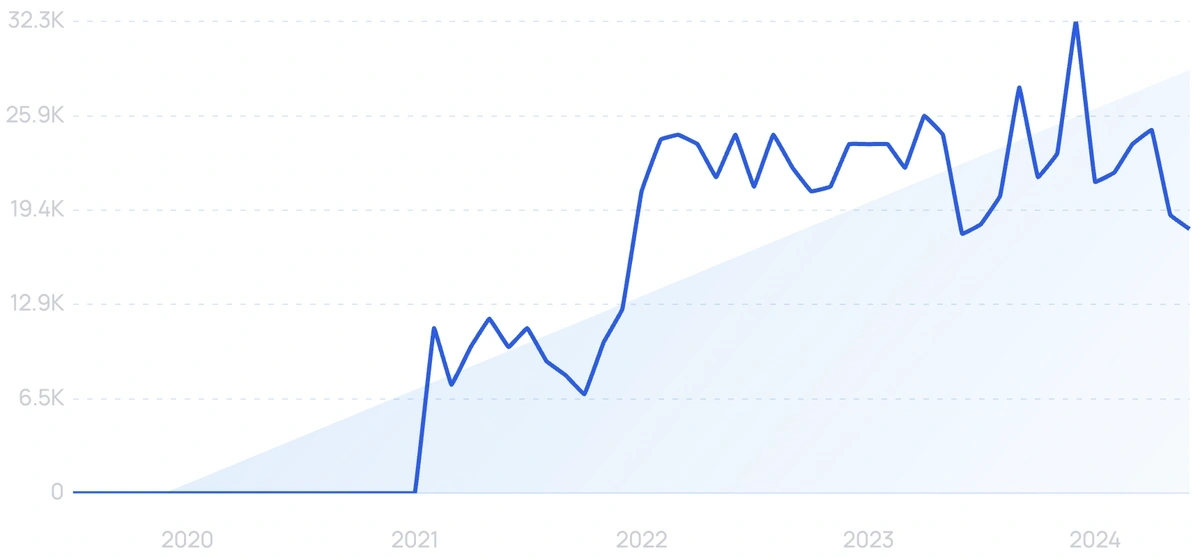

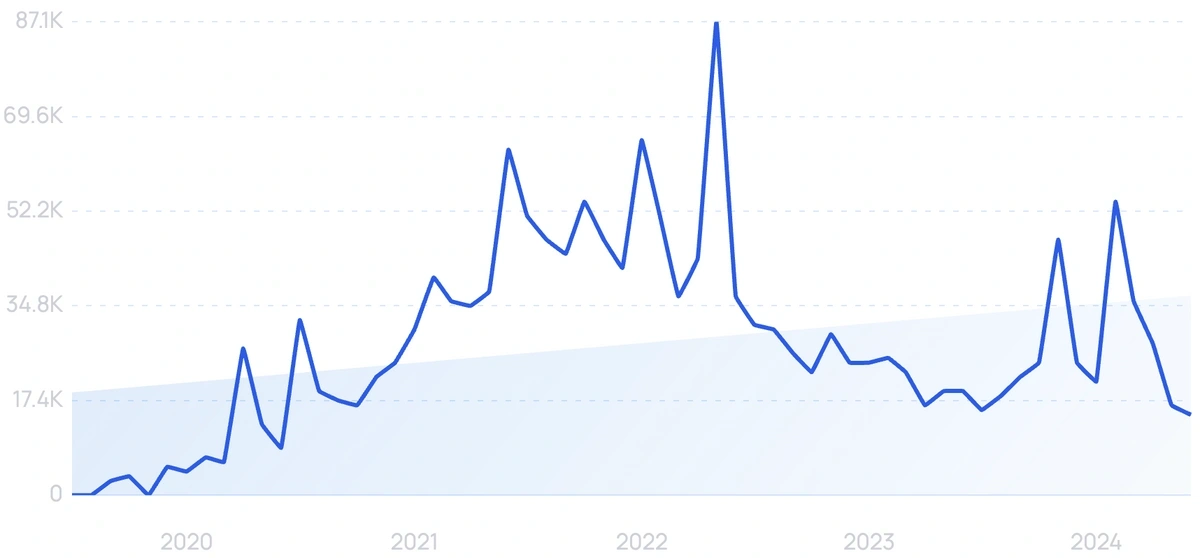

5-year search growth: 4,850%

Search growth status: Exploding

Year founded: 2017

Location: Oakland, CA

Funding: $43.5M (Series B)

What they do: Olipop is a sparkling soda with reduced sugar content. Each can contains 9 grams of fiber and features probiotics and botanicals. Their product portfolio consists of 7 different flavors of sparkling tonics, from vintage cola to orange cream.

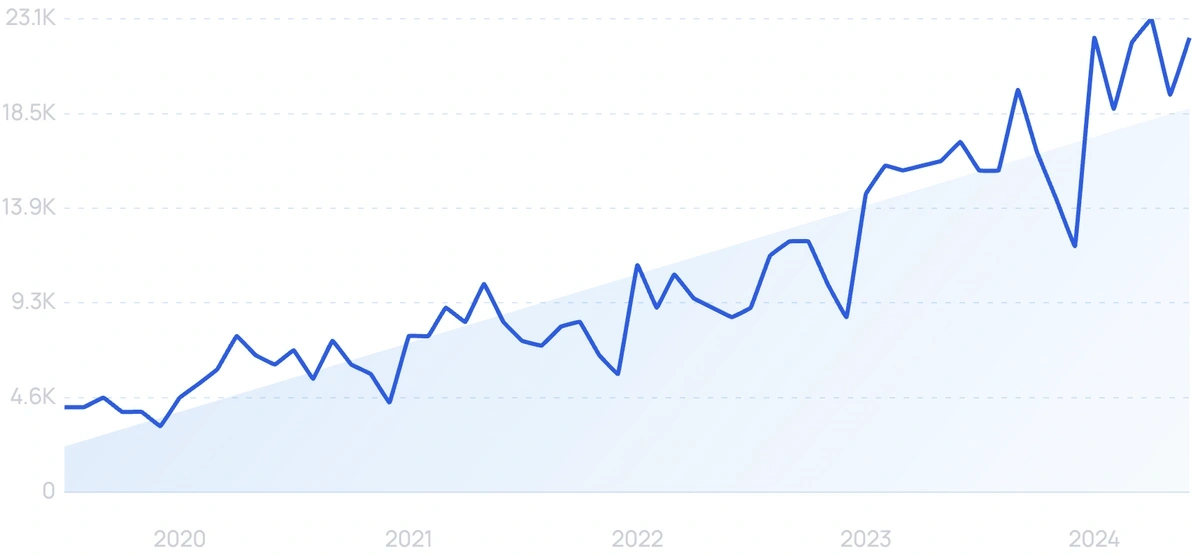

2. Truvani

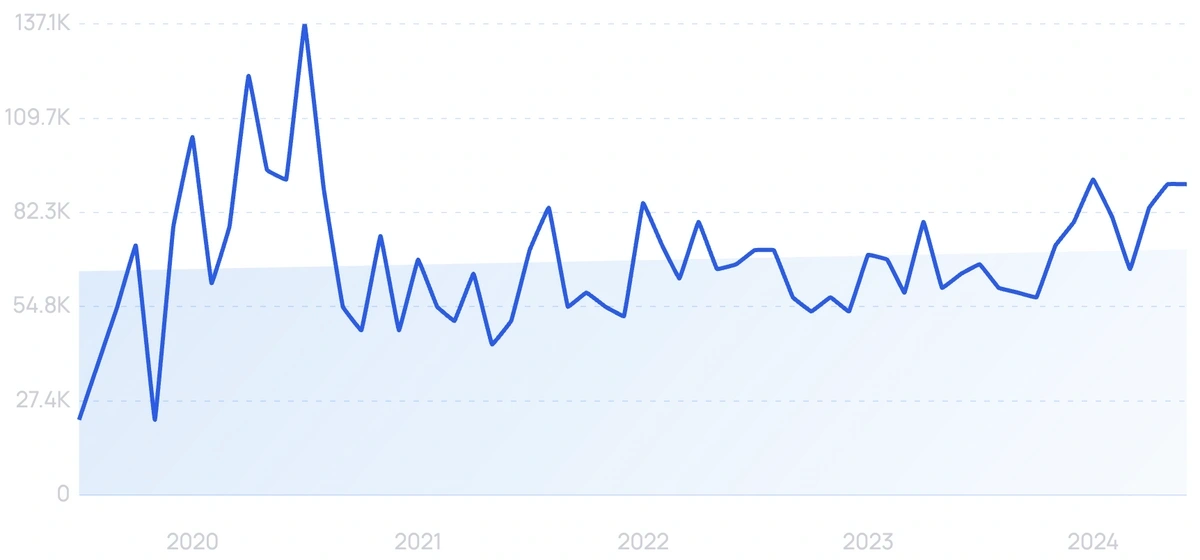

5-year search growth: 433%

Search growth status: Exploding

Year founded: 2018

Location: New York, NY

Funding: Undisclosed

What they do: Truvani is a DTC organic supplement brand. One of the brand’s bestsellers is a line of plant-based protein powders, which come in 7 varieties. Besides protein powder, the company has a wide range of vitamins and supplements, from vitamin C to digestive enzymes. Truvani also recently introduced a line of personal care products, including organic deodorant and fluoride-free toothpaste.

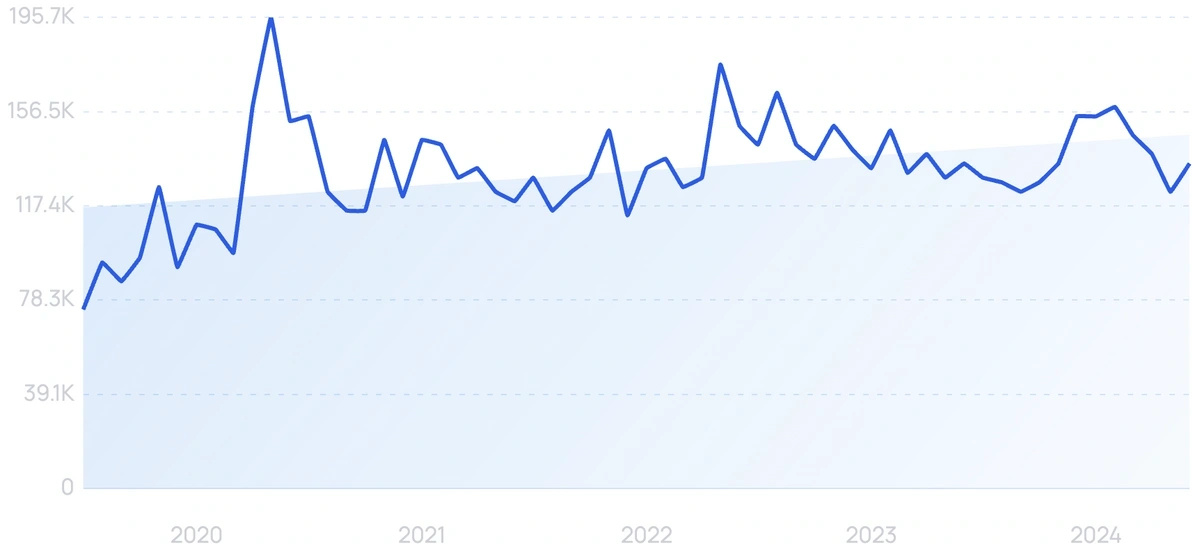

3. Kosas

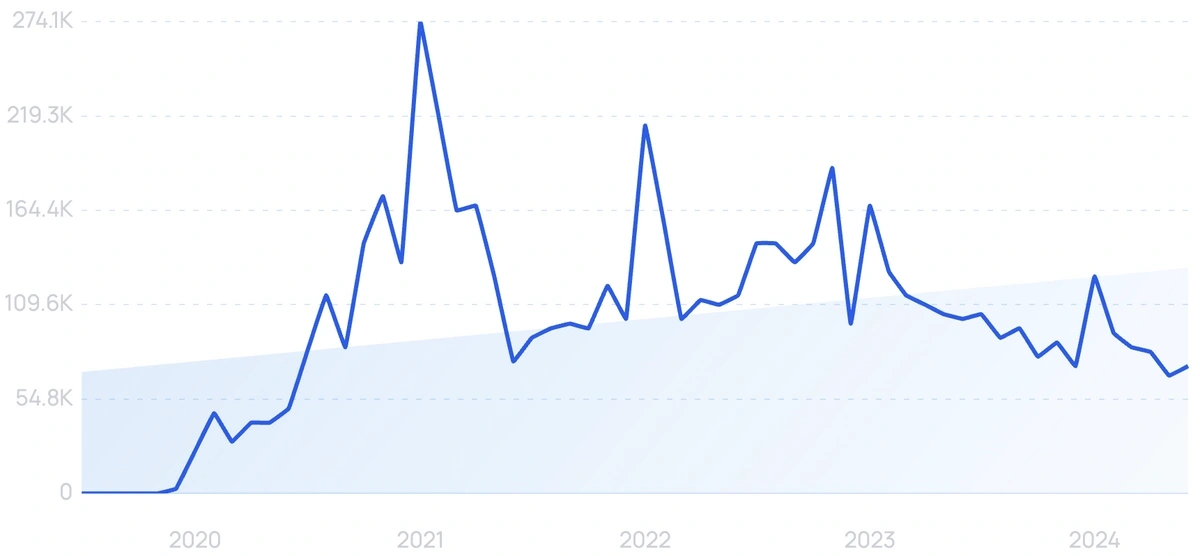

5-year search growth: 405%

Search growth status: Exploding

Year founded: 2015

Location: Encino, CA

Funding: $14M (Series Unknown)

What they do: Kosas is a clean cosmetics startup. Kosas’ product collection includes 30 SKUs, with a focus on makeup. All of their formulas are free from talc, sulfates, and parabens.

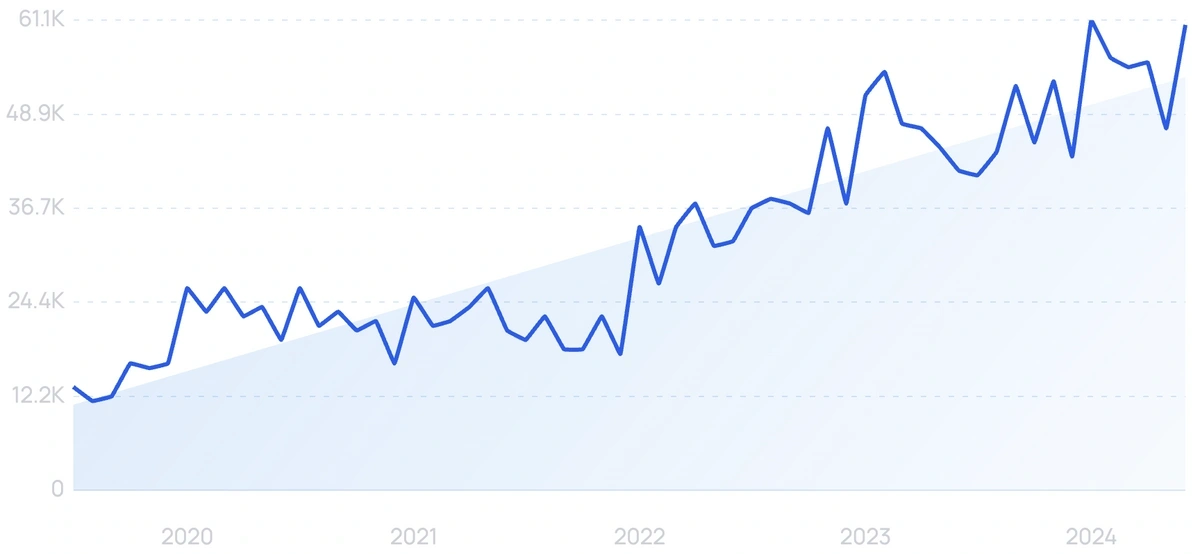

4. Serenity Kids

5-year search growth: 567%

Search growth status: Exploding

Year founded: 2016

Location: Austin, TX

Funding: $11.5M (Series A)

What they do: Serenity Kids sells baby food with low sugar content. Their product catalog includes 19 SKUs across meat, veggie pouches, purees, and puff snacks. Startup generated $9 million in revenue in 2020, a 3x increase over the past year.

5. Beauty Pie

5-year search growth: 82%

Search growth status: Regular

Year founded: 2018

Location: London, United Kingdom

Funding: $100M (Series B)

What they do: Beauty Pie sells makeup, fragrances, personal care products, and supplements. The startup defines itself as “Costco for luxury beauty” as it uses a membership model and offers lower prices than those found at retail stores.

6. Koia

5-year search growth: 89%

Search growth status: Exploding

Year founded: 2013

Location: Los Angeles, California

Funding: $7.5M (Convertable Note)

What they do: Koia is a protein drink company that makes refrigerated, ready-to-drink plant-based protein beverages. The brand's vegan protein shakes are sold in big chain stores like Whole Foods, 7-Eleven, and Publix. The company crossed $100 million in revenue in 2023 and CEO Christopher Hunter expects them to cross $200 million within 2 years.

7. Branch Basics

5-year search growth: 350%

Search growth status: Exploding

Year founded: 2012

Location: Minneapolis, MN

Funding: $1.2M (Series Unknown)

What they do: Branch Basics is a brand of refillable home cleaning essentials. The company’s products are plant-based, fragrance-free, and are shipped in reusable bottles.

8. Dropps

5-year search growth: -5%

Search growth status: Regular

Year founded: 2005

Location: Philadelphia, PA

Funding: $16M (Series Unknown)

What they do: Dropps sells laundry and dishwasher detergent pods. The brand has 6 scent options, including unscented. Dropps’s products do not contain phthalates and phosphates. The startup ships products in compostable packaging, and offsets carbon emissions for delivery. Following a funding round in February 2021, the startup reached an estimated valuation of up to $95 million.

9. SakuraCo

5-year search growth: 5,500%

Search growth status: Regular

Year founded: 2015

Location: Tokyo, Japan

Funding: Undisclosed

What they do: SakuraCo is a Japanese subscription box service focused on Japanese snacks.The startup differentiates themselves by sending customers seasonal treats, which helps ensure each box is unique. SakuraCo’s authentic snacks have helped it go viral on social media. Videos mentioning the startup have over 520 million views on TikTok.

10. Verb Energy

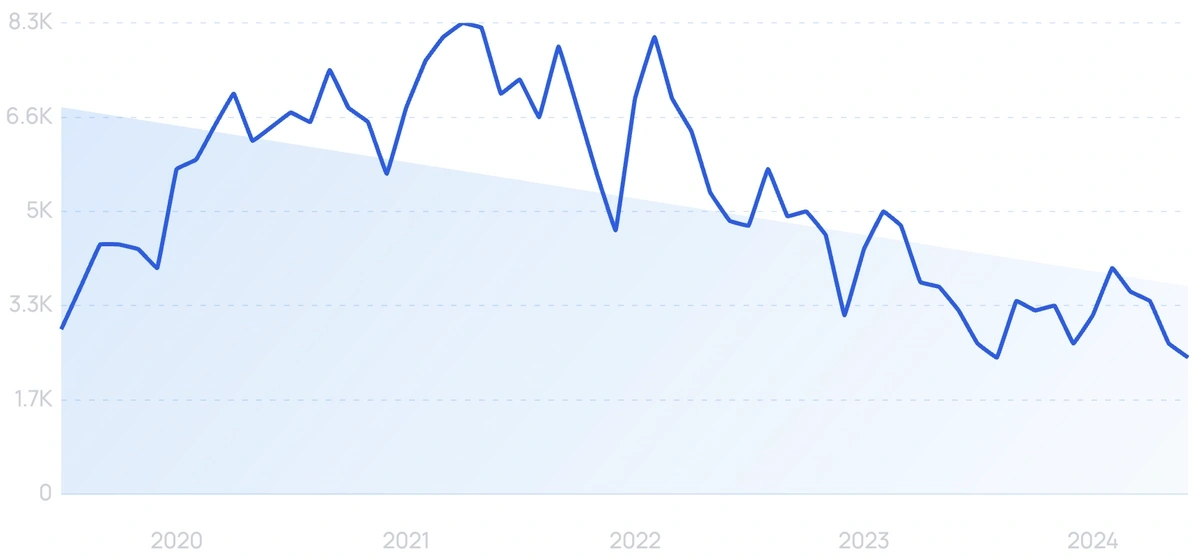

5-year search growth: -17%

Search growth status: Peaked

Year founded: 2016

Location: New Haven, CT

Funding: $12.9M (Series Unknown)

What they do: Verb Energy makes caffeinated bars. The company derives caffeine from green tea. And reports that each bar has similar caffeine content as an espresso. The brand currently has 11 flavors for each of its snacks, from coconut to chai.

11. Catalina Crunch

5-year search growth: 373%

Search growth status: Exploding

Year founded: 2017

Location: Wilmington, DE

Funding: $9.2M (Series Unknown)

What they do: Catalina Crunch produces keto-friendly foods, including cereal in 8 flavors, 3 types of smoothies, and 4 varieties of cookies. The company uses flour made of pea protein and guar gum for their cereal. All products have reduced sugar content, while their cereal contains 0 grams of net sugar.

12. Alani Nu

Search growth status: Regular

Year founded: 2018

Location: Louisville, KY

Funding: Undisclosed

What they do: Alani Nu is a workout nutrition and supplement brand largely targeting female consumers. The brand offers supplement essentials, from multivitamins to collagen powder. For fitness enthusiasts, they have protein powders and workout/recovery supplements.

13. Goli Nutrition

5-year search growth: 48%

Search growth status: Peaked

Year founded: 2019

Location: West Hollywood, CA

Funding: Undisclosed

What they do: Goli Nutrition is a supplement brand most known for its apple cider vinegar gummies. Their gummy vitamins rank first by sales on Amazon US in the health and household category. Besides apple cider vinegar gummies, the company recently introduced an ashwagandha supplement in the same format.

14. Inno Supps

5-year search growth: 6,800%

Search growth status: Regular

Year founded: 2020

Location: Las Vegas, NV

Funding: Undisclosed

What they do: Inno Supps is a sports supplement brand. Specifically, they sell products for muscle building (protein powder, creatine), fat-burning (carnitine), and a general wellness line (turmeric, greens complex). Their products do not contain artificial sweeteners and are manufactured in a GMP facility.

15. HighKey

5-year search growth: 66%

Search growth status: Regular

Year founded: 2018

Location: Orlando, FL

Funding: Undisclosed

What they do: HighKey makes keto-friendly, gluten-free snacks. The brand currently sells cookies, cereal, and baking mixes. Instead of sugar, most products (including their popular cookies) use stevia and monk fruit as sweeteners. Another popular product from the brand is a breakfast cereal that contains 16 grams of protein per serving.

16. JuneShine

5-year search growth: 40%

Search growth status: Regular

Year founded: 2018

Location: San Diego, CA

Funding: $24M (Series B)

What they do: JuneShine is a hard kombucha brand. The company’s product portfolio includes 7 flavors, from chili mango to acai berry. Beverages have a 6% alcohol content and include green tea, cane sugar, and honey as base ingredients.

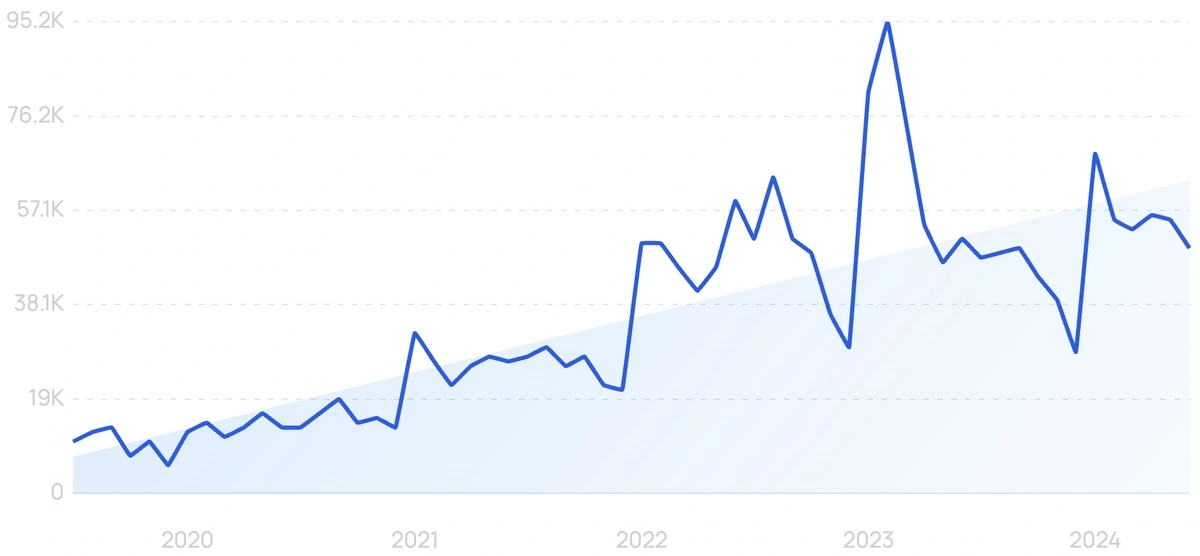

17. Thrasio

5-year search growth: 1,600%

Search growth status: Peaked

Year founded: 2018

Location: Walpole, Massachusetts

Funding: $3.4B (Series Unknown)

What they do: Thrasio is a CPG startup that acquires and operates Amazon FBA (Fulfillment by Amazon) businesses. With a focus on ecommerce, Thrasio offers its portfolio companies expertise in digital marketing, supply chain management, and logistics. Their business model has been successful in acquiring and scaling brands to achieve significant growth, enabling Thrasio to become one of the fastest-growing companies in the world.

18. Blueland

5-year search growth: 313%

Search growth status: Regular

Year founded: 2019

Location: New York, NY

Funding: $23M (Seed)

What they do: Blueland offers eco-friendly cleaning products. The company sells starter kits along with refills. Each starter kit is supplied with reusable bottles. Refills are available in tablet format and shipped in compostable pouches. Blueland has shipped 9 million units of its products since 2019.

19. Everdrop

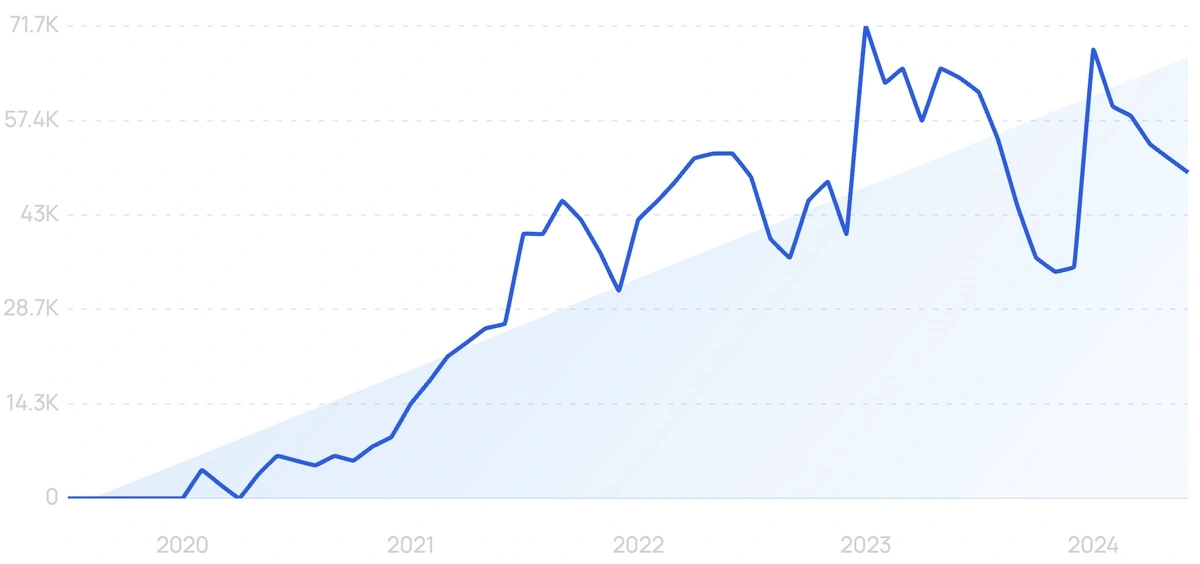

5-year search growth: 2,600%

Search growth status: Peaked

Year founded: 2019

Location: Munich, Germany

Funding: $107.7M (Series B)

What they do: Everdrop sells sustainable household cleaning products including laundry detergent and plastic-free cleaning tablets. The startup uses reusable packaging for all of its products. The German startup reached an estimated valuation of up to $131 million following a funding round in February 2021.

20. Bloom & Wild

5-year search growth: 14%

Search growth status: Peaked

Year founded: 2013

Location: London, England

Funding: $186.7M (Series D)

What they do: Bloom & Wild is a UK-based CPG startup that specializes in delivering fresh flowers and plants to customers across Europe. With a focus on sustainability, Bloom & Wild has developed innovative packaging and supply chain solutions to reduce waste and improve the environmental impact of their business. They also offer a range of personalized gift options and have been recognized for their exceptional customer service, earning them a loyal following among consumers.

Conclusion

That completes our list of the top CPG startups to watch in 2024.

One thing that these startups have in common is that many founders have a strong understanding of their target consumer base, often derived from personal experience.

For instance, the founder of Catalina Crunch couldn't consume sugar due to diabetes, so he has built his own food company to tackle that problem. While the motherhood experience of Serenity Kids' founder taught about healthy nutrition issues for babies, she went ahead with a new brand to help other parents.

With more consumers switching to online shopping for their consumer goods, a growing number of CPG brands are seizing the opportunity. And we can expect an increasing number of new brands considering the growth of the industry overall.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more