Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Future of Advertising (2024-2027)

New technologies (like AI and generative media) are providing advertisers with tools and opportunities that they’ve never seen before.

Each tool also offers advertisers a new way to engage with consumers and provide an immersive brand experience.

In this report, we’ll discuss six developments that are set to dramatically impact the future of the advertising sector in the next few years.

The Future of AI in Advertising

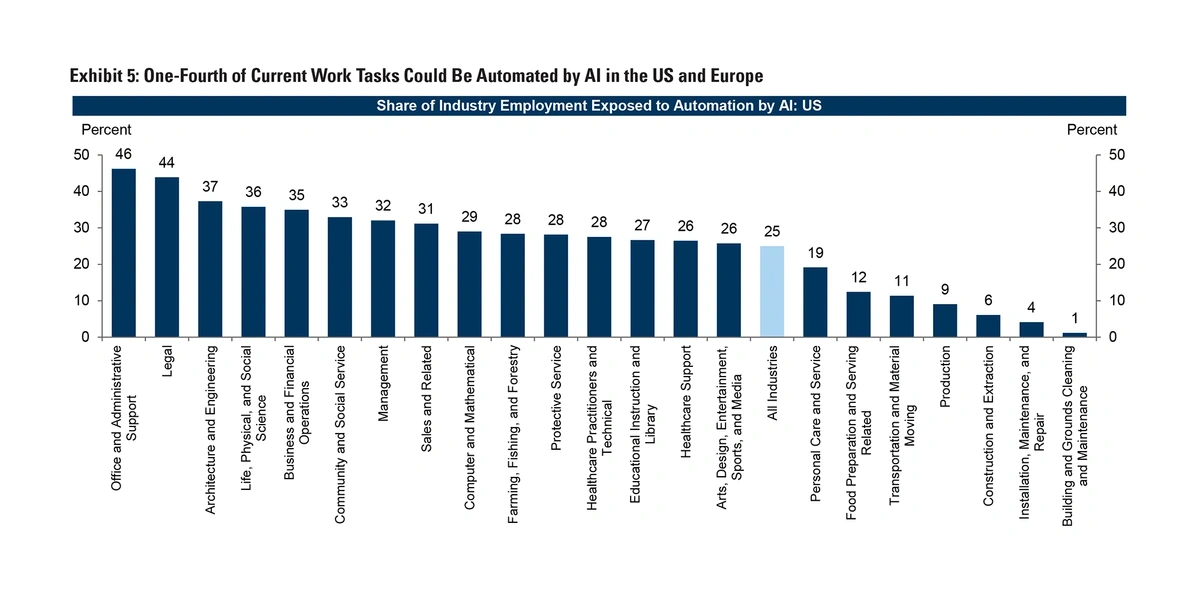

Goldman Sachs reports that more than 30% of the current work done by sales professionals and related departments in the United States could be automated with AI.

Many tasks in the sales industry and related jobs have the potential of being automated by AI.

In the advertising industry, AI is being used to do a wide variety of tasks like collect customer data, tailor marketing campaigns to specific audiences, and create ad content.

Enterprises still have access to customer data today. But with third-party cookies disappearing in the next year or two, they need to be able to retrieve data from other places—and AI can help with this task.

AI platforms and machine learning algorithms can collect and make sense of unstructured data like social media posts, reviews, and product comments.

Because this first-party data is self-reported, it’s the most accurate form of customer data.

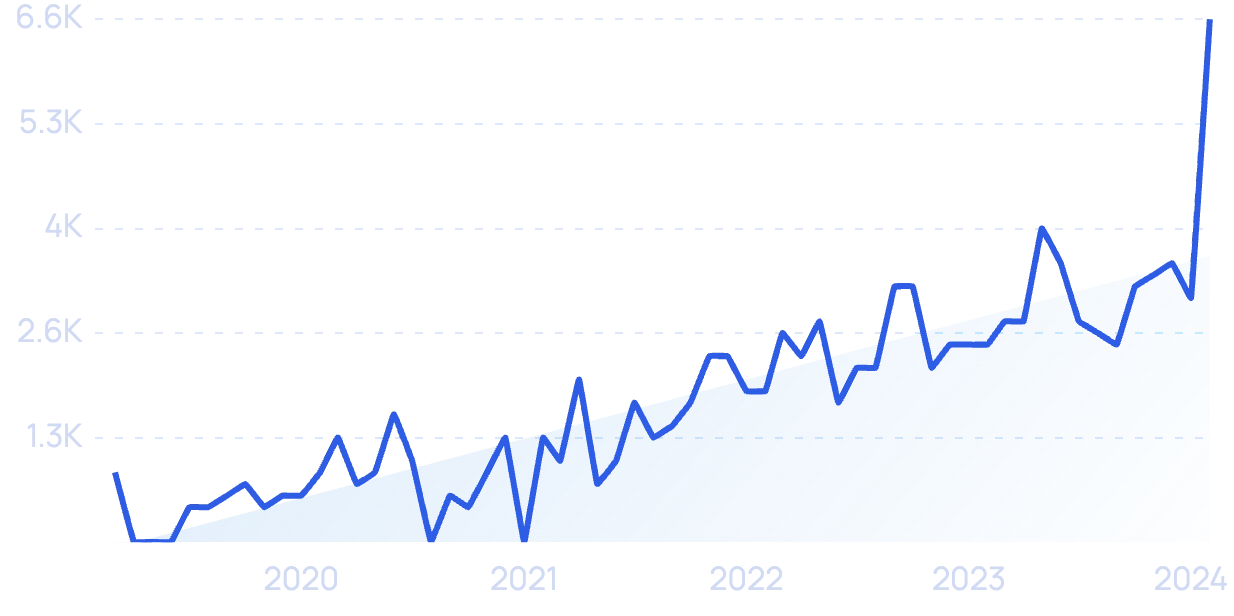

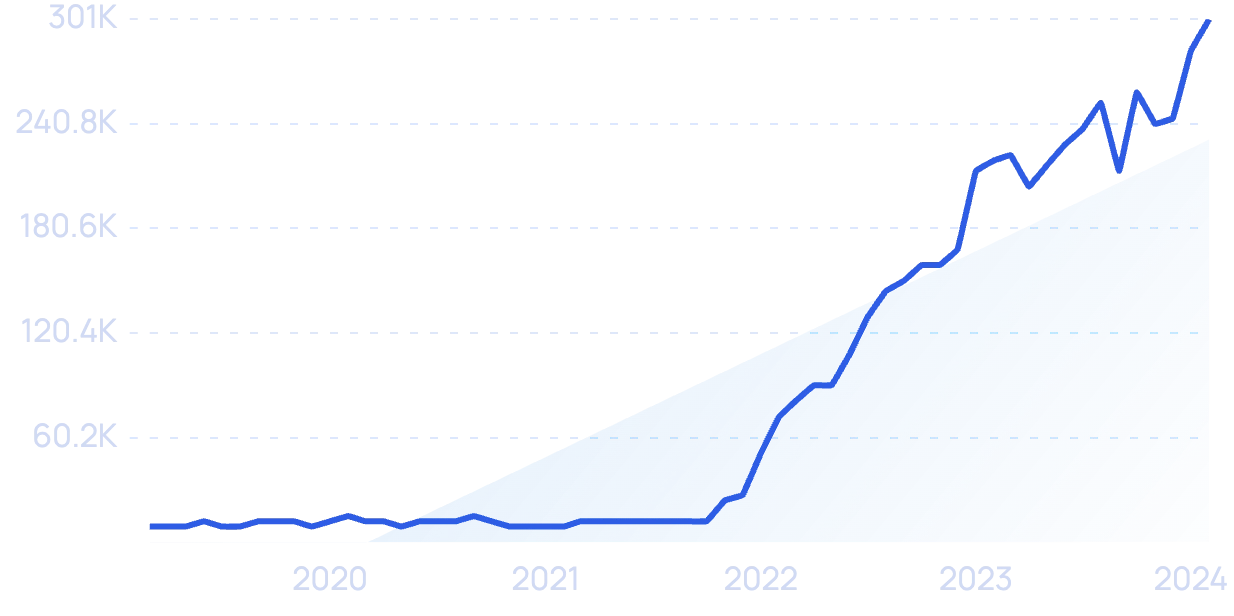

Search volume for “first-party data” is up over 650% in the past 5 years.

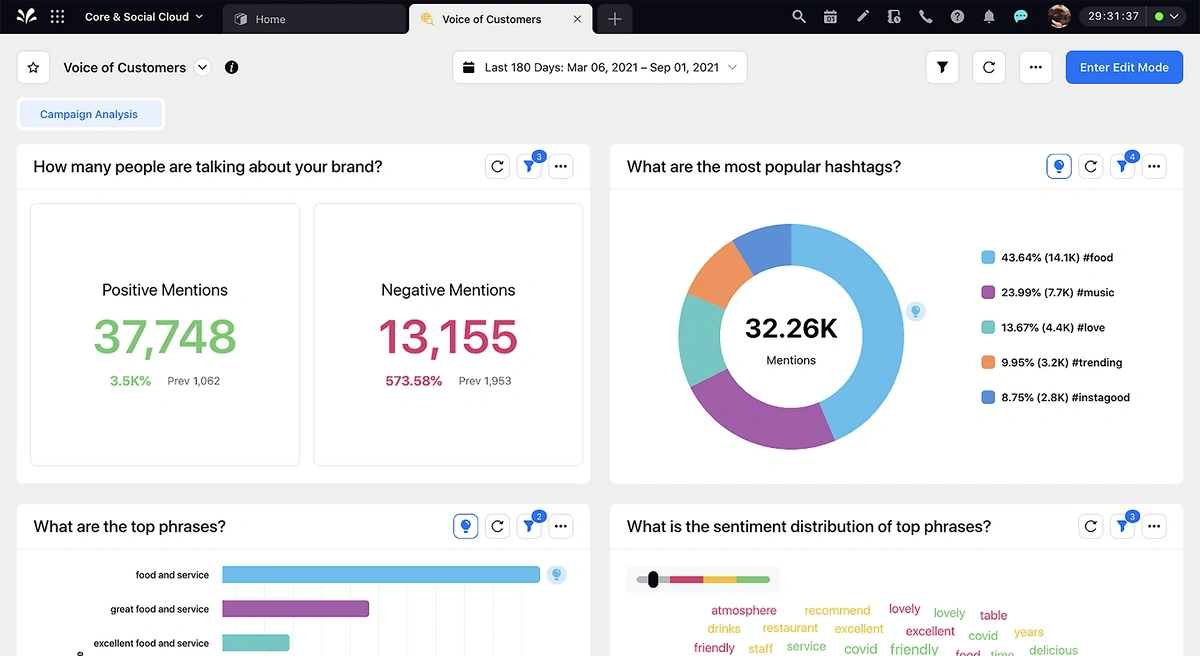

Sprinklr’s social listening platform is one tool that uses AI to collect voice-of-the-customer data from more than 30 digital channels and use that data to identify trends and discover untapped insights.

Sprinklr’s AI platform monitors digital channels and records meaningful data.

Demand for the company’s AI solutions is growing.

As of Q3 of 2022, they were providing 107 of their customers with at least $1 million in services. That was up 34% year-over-year.

Their Q3 revenue was also up 24% year–over-year in 2022.

In the future, more and more advertisers are also expected to turn to AI solutions to increase efficiency in the ad creation process.

In April 2023, Google announced it would integrate generative AI into its advertising platform in the near future.

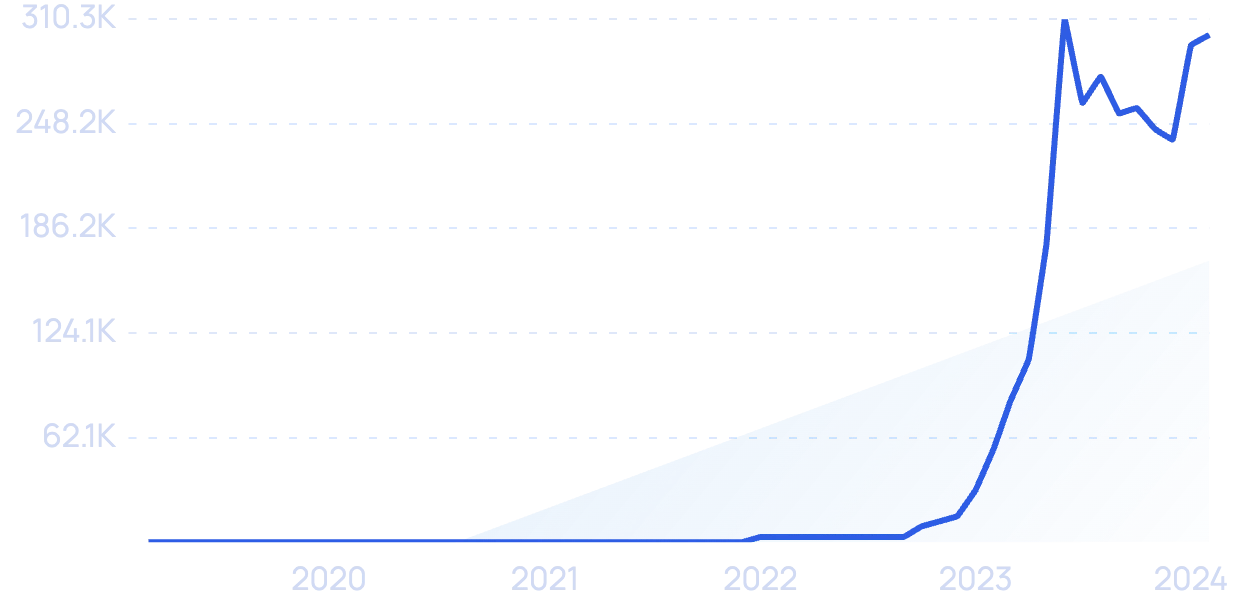

Search volume for “generative AI” is growing rapidly.

Users will load images, text, and video, and Google’s platform will mix and match the content in order to optimize performance.

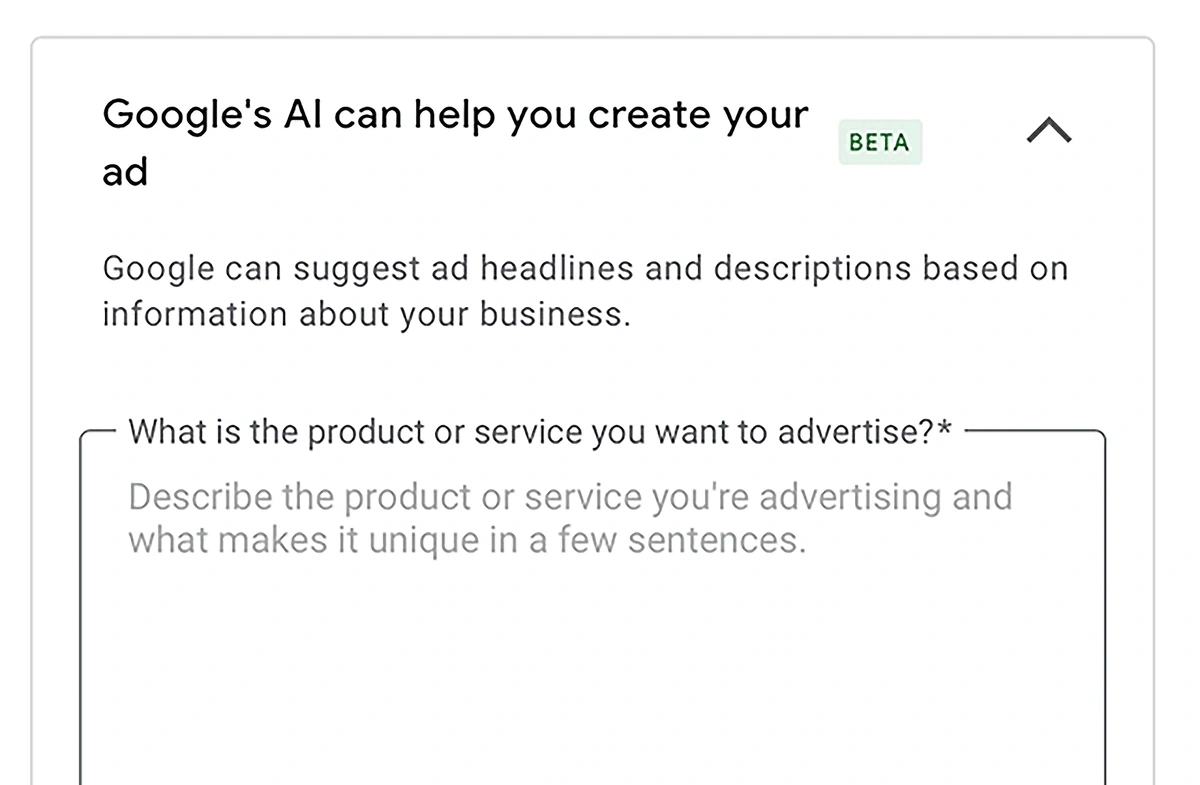

Google Ads is also testing AI features that suggest headlines and descriptions for ads.

AI-generated headlines and descriptions were recently launched as a test-feature on Google Ads.

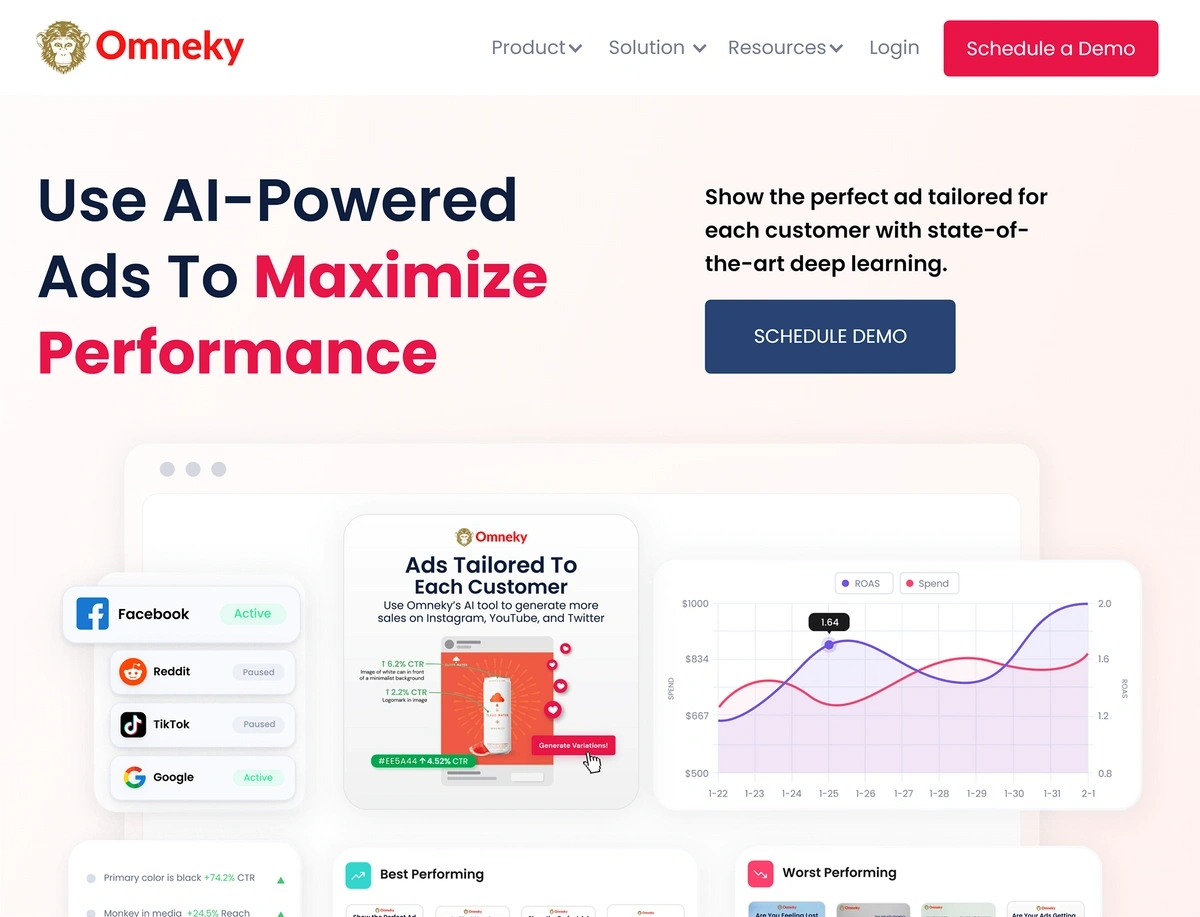

Omneky is a startup that’s offering this type of AI-powered ads in a SaaS model.

Omneky’s platform centralizes ad data and uses AI-powered insights to create new ads.

Their platform shows ad performance across digital channels and uses AI to automatically tag ads.

From that data, it recommends things like the dominant color to use in ads, how many people should be featured, and which taglines to use.

Omneky’s platform can also take that data and use it to create new ads.

The company’s most recent funding round brought in $7 million, which brought total investment to $10 million.

The Future of Programmatic Advertising

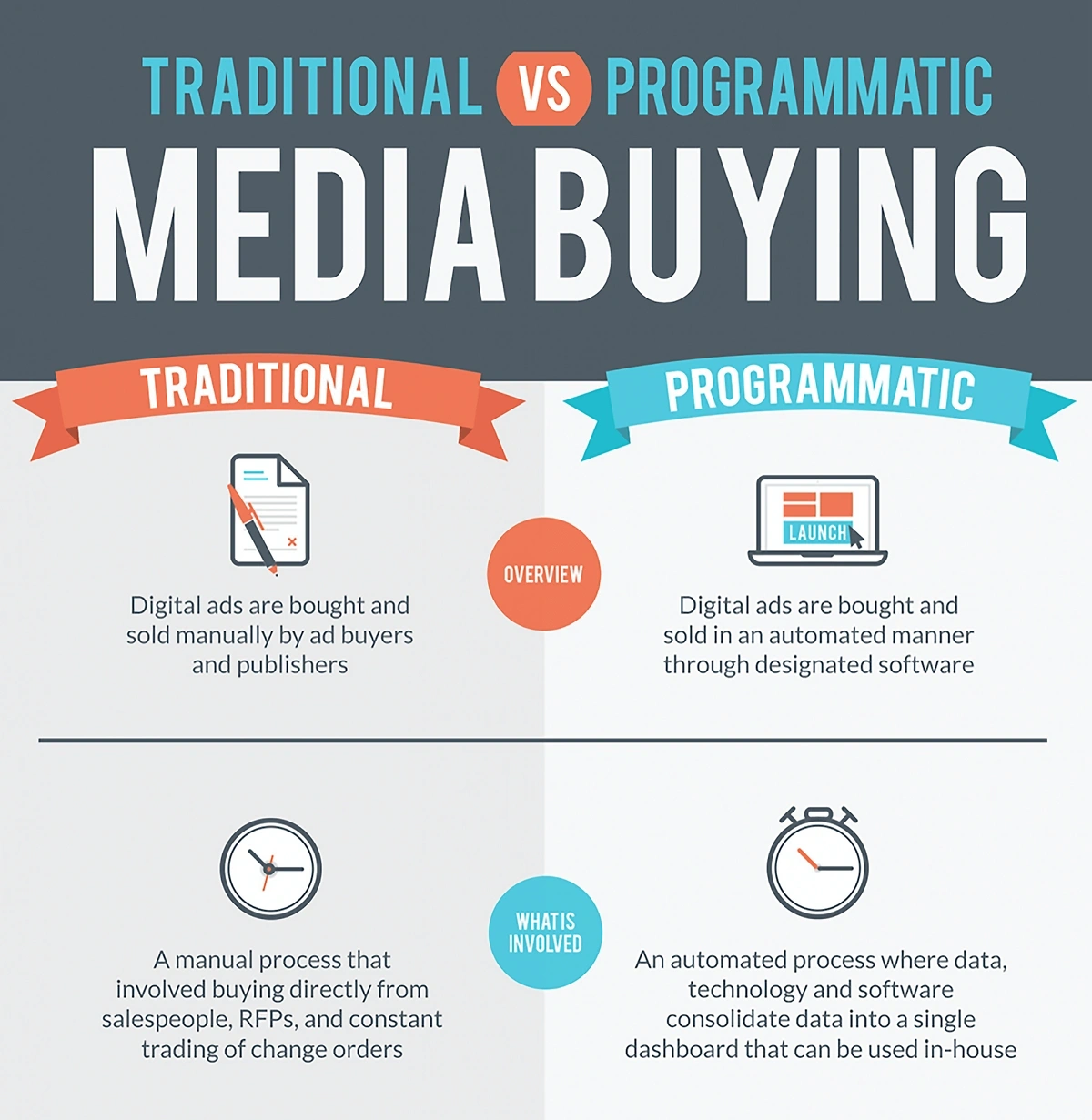

Ad buying is another avenue of advertising in which AI is expected to be critically important in the coming years.

The data analysis capabilities of AI platforms can empower brands to utilize programmatic advertising.

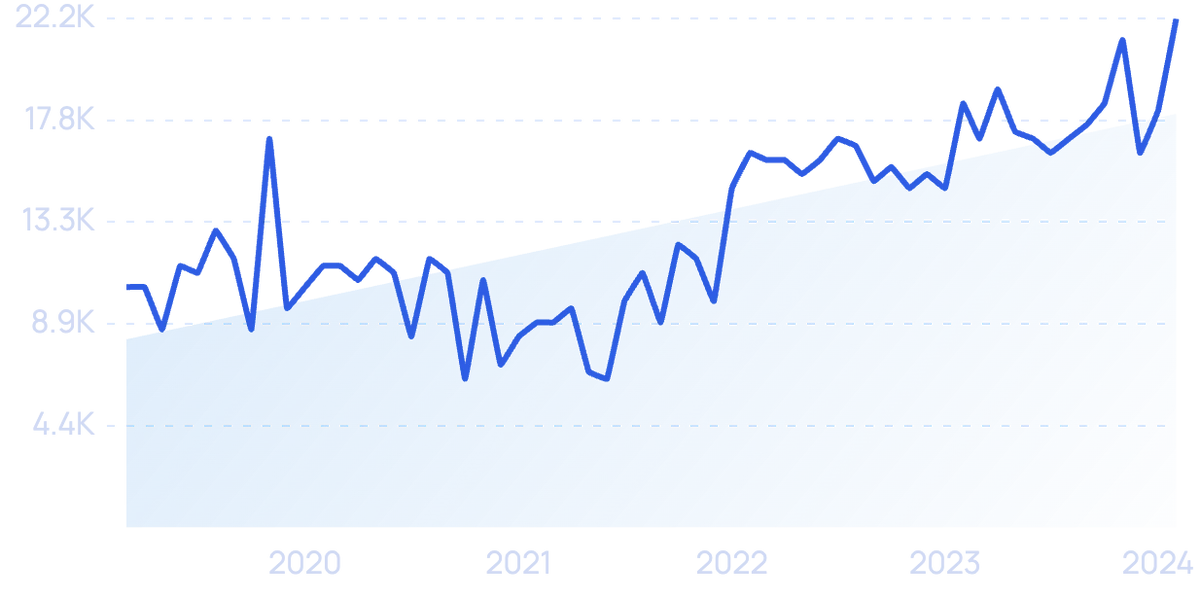

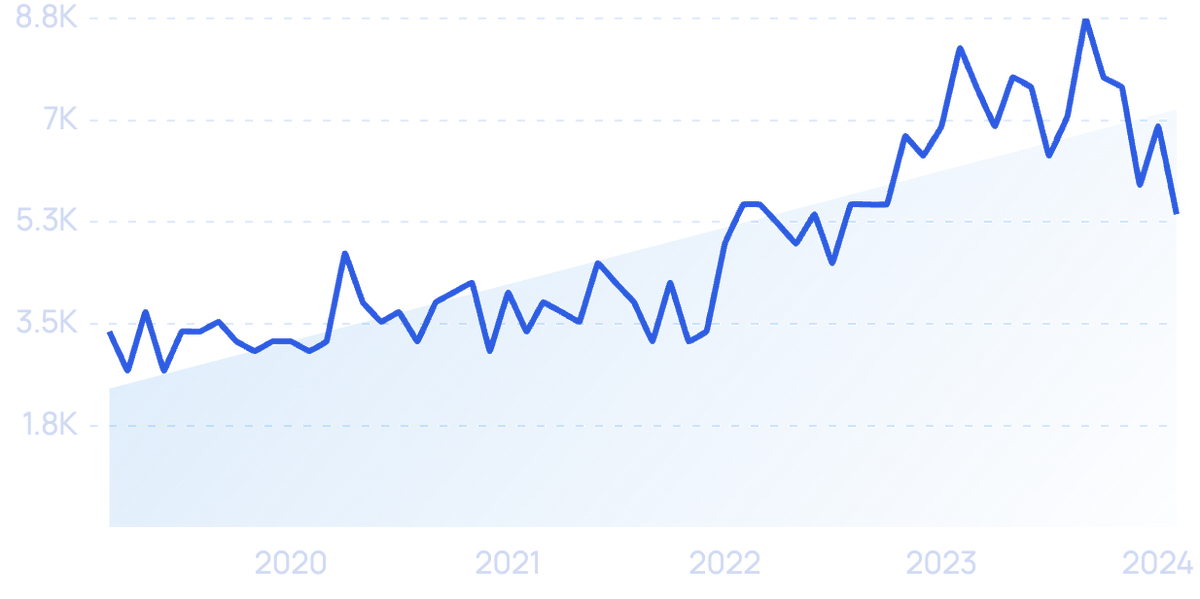

Search volume for “programmatic ads” has seen growth in recent years.

This type of advertising uses AI/ML in order to purchase ads that target specific audiences at optimized times and places.

The process works by bringing together two platforms.

One is used by brands — a demand-side platform (DSP) and the other is used by ad publishers — a supply-side platform (SSP). These two platforms use automation to lock in ad prices and placements in real-time.

The bidding changes and the auction can be decided in milliseconds.

AI feeds into programmatic ad buying and can enable companies to hyper-target customers.

This type of ad buying can also take advantage of third-party or first-party data.

Because the ads are hyper-personalized for these target customers, the rates of engagement and conversion are higher.

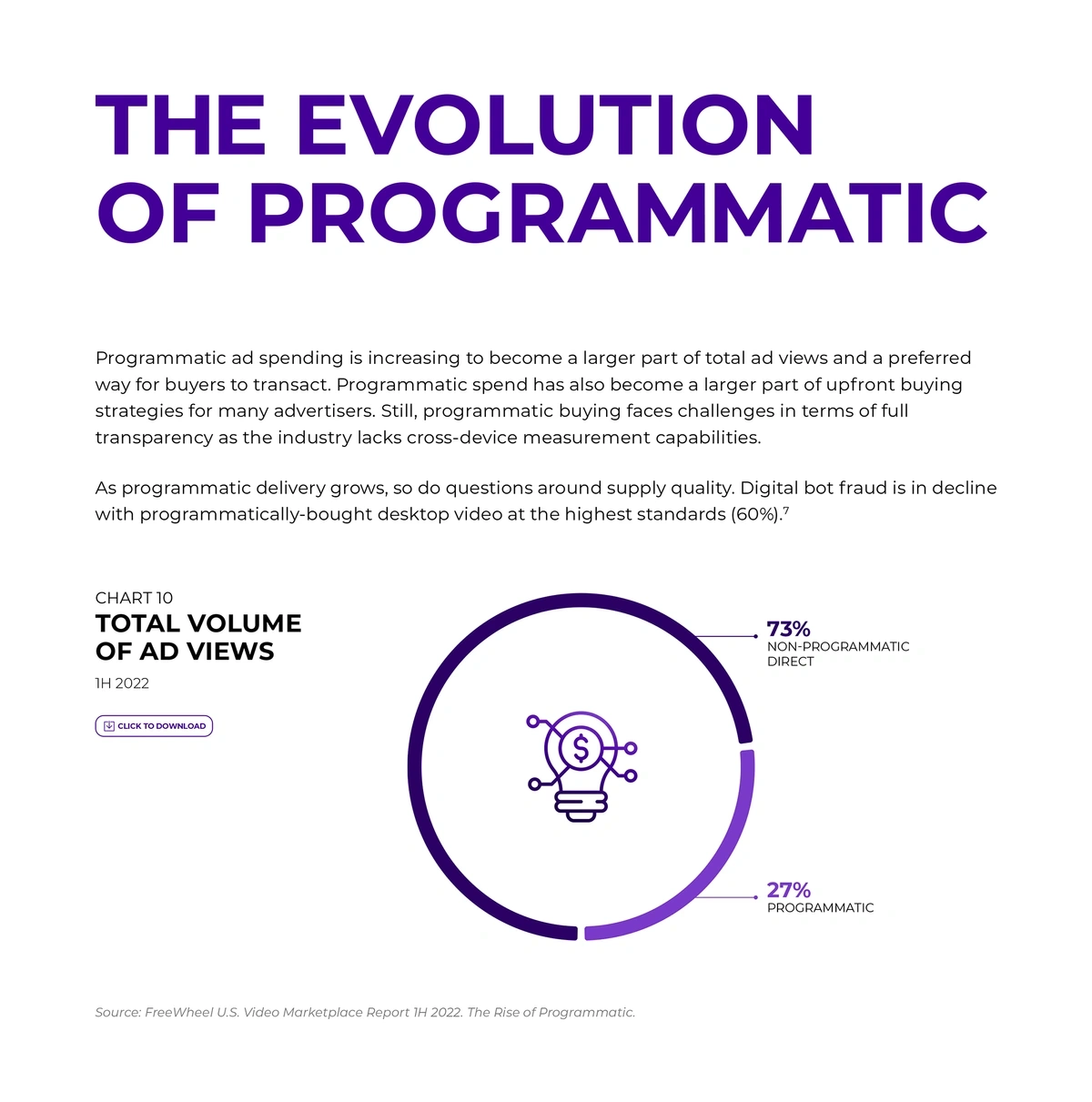

One analysis reported that programmatic ad views accounted for 27% of the total volume of digital video ads in the first half of 2022 and predictions say this number will jump to 50% by 2026.

The use of programmatic advertising is growing.

Insider Intelligence predicts that programmatic display ad spending will grow by nearly 17% in 2023 alone.

In one instance, an advertising executive said he utilized programmatic advertising to run a tailored campaign targeted at users within a geographical radius of 10 x 10 meters.

In another example of AI-powered programmatic advertising, an LA-based animal shelter ran a campaign to encourage animal adoption.

Based on consumer data and preferences, each individual saw one of six animal ads.

Images and text were optimized based on audience data.

Big names in the sector are revealing future goals for programmatic advertising.

Disney has said that more than half of its ad spend will come through automated channels by 2024.

Mcdonald's reportedly increased foot traffic in restaurants by 7.5% as a result of using programmatic advertising.

As we move into the future, also look for increased use of programmatic advertising for digital out-of-home ads and connected TV ads.

In all, forecasts predict that programmatic advertising spending will top $314 billion by 2026.

The Future of Connected TV Ads

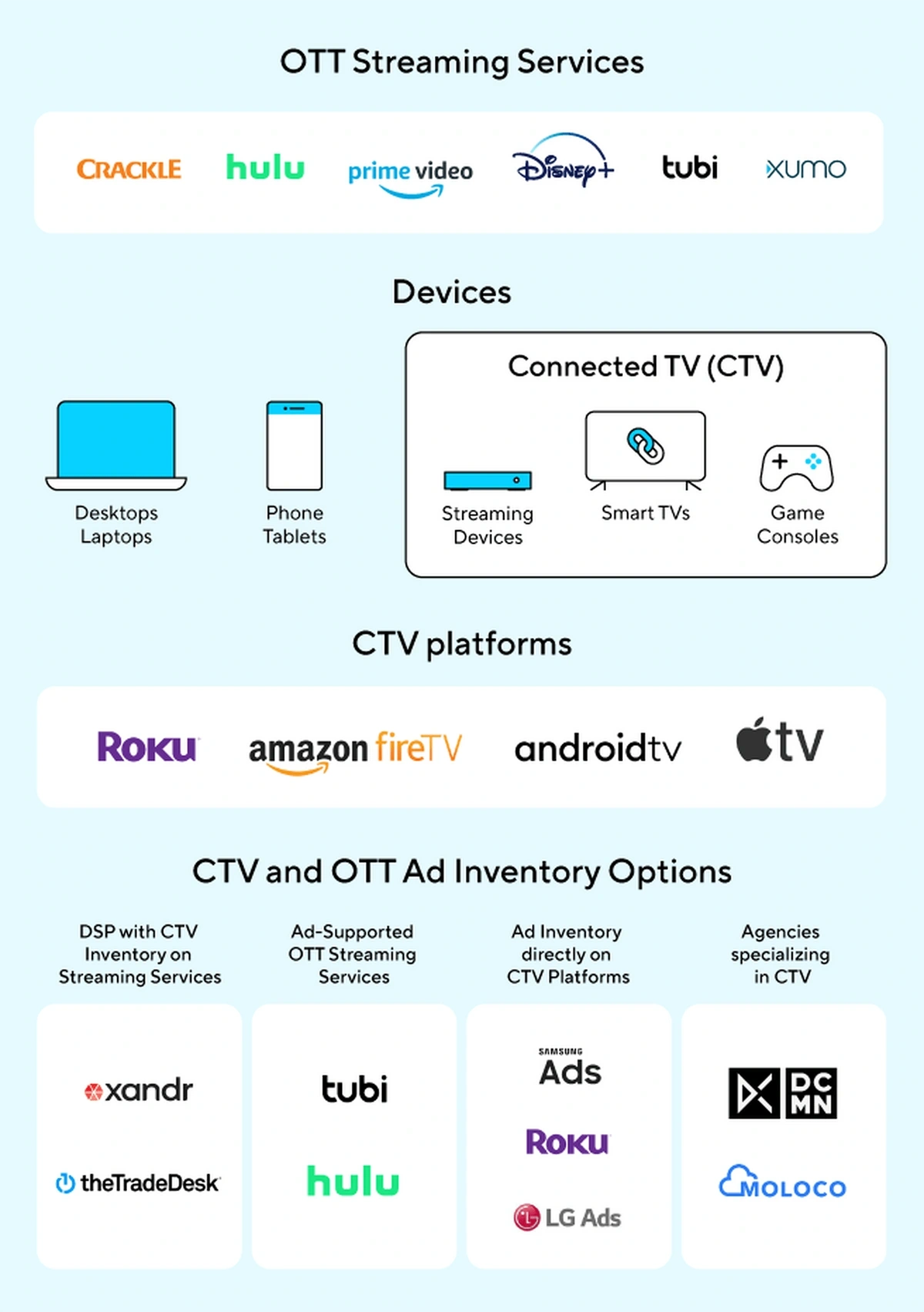

Connected TV (CTV) refers to devices that are connected to the Internet, allowing individuals to stream music and videos.

CTV platforms include Apple TV, Roku, and others.

More than 109 million U.S. households (83.6% of total households) have CTV.

With such broad adoption, it’s no wonder that opportunities for CTV ads are growing.

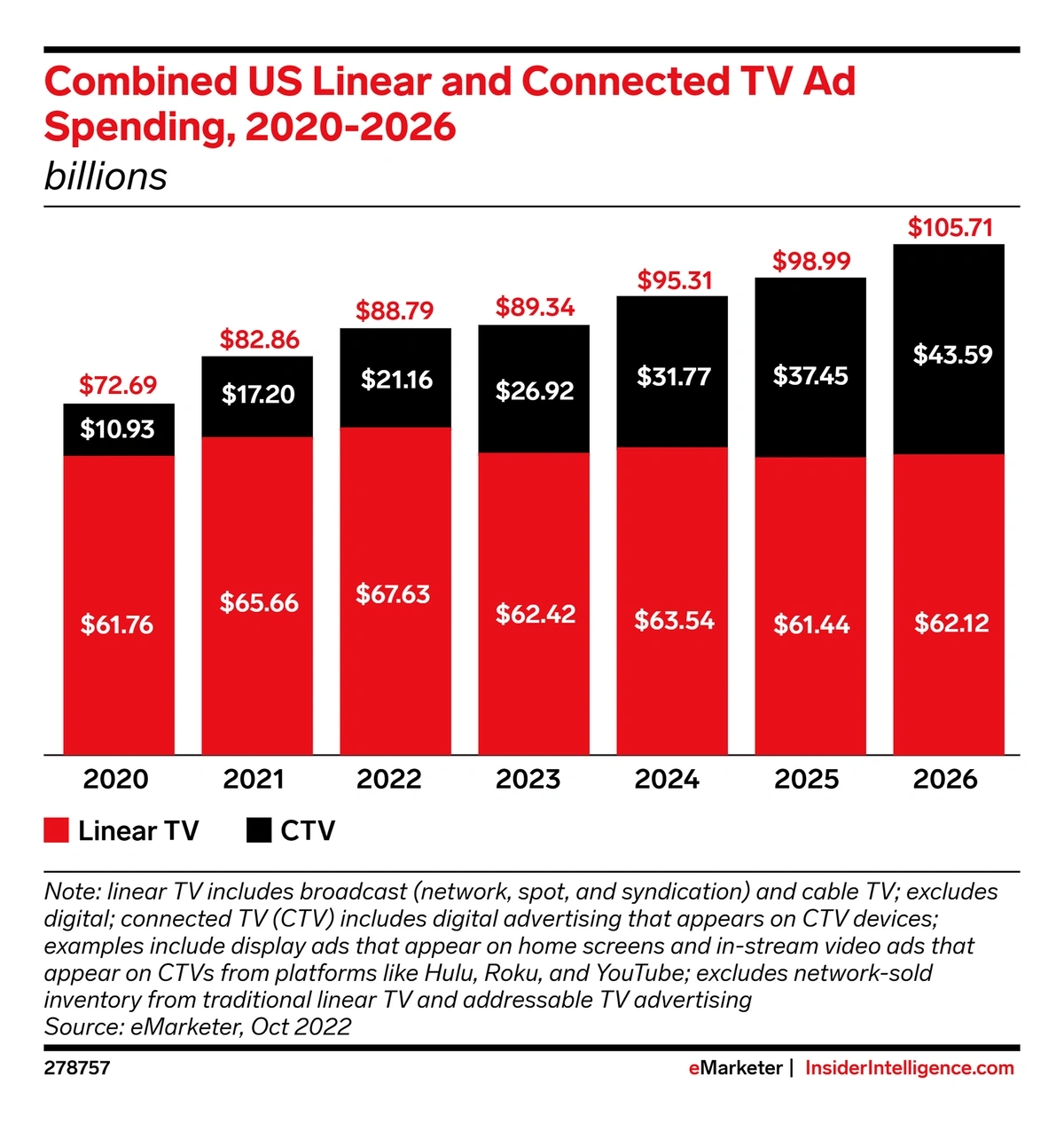

In 2023, CTV ad spending in the United States is expected to hit $26.92 billion. That’s a 27% annual increase over 2022.

By 2026, that number is predicted to have jumped to $43.59 billion.

CTV ad spend is growing while linear TV ad spend is stagnant.

Some of this growth is due to the fact that many consumers are hitting a “subscription ceiling,” as some industry experts call it.

The average person pays for fewer than three streaming services.

But these people are streaming free ad-supported TV (FAST) via CTV.

Search interest in “FAST channels” is up more than 100% over 5 years ago.

In fact, nearly 1,000 new FAST channels debuted in 2022, bringing the total number of channels to 3,720.

As consumer demand continues to increase, the growth in FAST channels is expected to continue well into the future.

And, advertising dollars are following the consumers.

Ad revenue via FAST channels is predicted to hit $5.3 billion in 2023 and surge to $6.1 billion by 2025.

Ad revenue in the FAST channel segment of CTV is growing dramatically.

Both Netflix and Disney+ announced ad-supported streaming options in late 2022.

In May 2023, YouTube (the most-watched CTV app) announced the availability of advertisers to purchase 30 non-skippable ads for CTV.

Given these moves by big players in the streaming industry, the CTV ad market could push even higher than future estimates.

Many marketers see these ads as more effective than linear TV ads because the data collected by the streaming service is useful for ad targeting.

In addition, research shows consumers pay more attention to CTV ads as compared to linear TV ads.

One study showed viewers paid attention to CTV ads for three seconds longer than linear TV ads.

One study found that 65% of CTV viewers in the U.K. are willing to watch ads in exchange for free content.

Another study showed viewers give 3x as much attention to CTV ads.

Viewers are more likely to talk about brands they see in CTV ads, too.

A survey of US consumers showed that 71% of participants said they were more likely to talk to a friend about a CTV ad than about a linear TV ad.

The Future of Video Ads

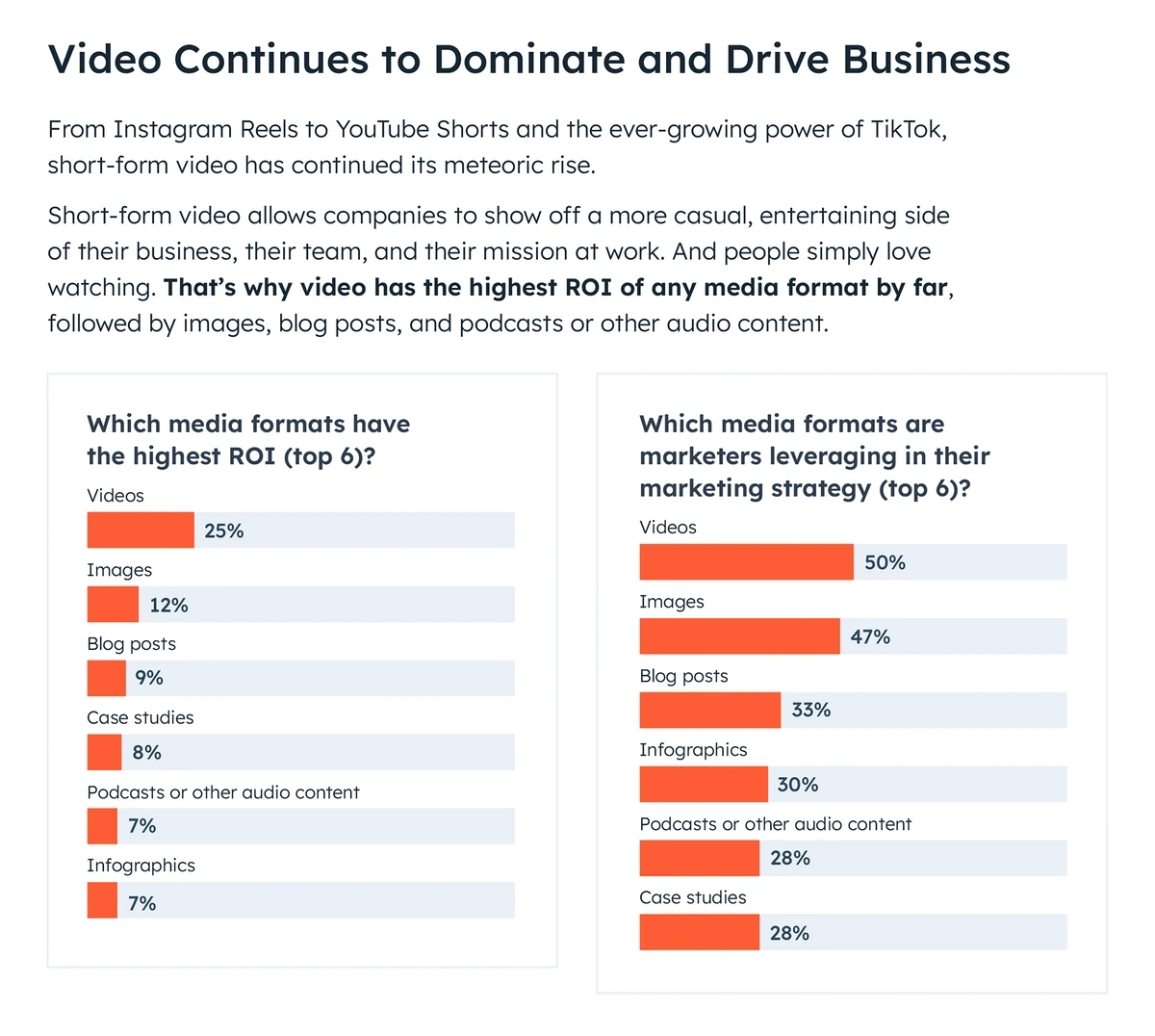

In a 2023 report from HubSpot, short-form video content ranked as the top strategy marketers plan to utilize in 2023.

It also reported that short-form video has the highest ROI.

Marketers say videos have the highest ROI.

And, of those companies not leveraging video content yet, 21% plan to do so this year.

Video ad spending continues to grow, as well.

The Interactive Advertising Bureau reports that digital video ad spending increased 21% in 2022.

They expect it to go even higher in 2023, up 17% to $55.3 billion.

This type of content is what consumers want.

Wyzowl reports that 91% of people say they want to see more videos from brands.

And, 89% say watching a video has convinced them to buy a product or service. That number was just 73% in 2015.

In the coming years, advertisers are looking for short-form videos to continue gaining popularity.

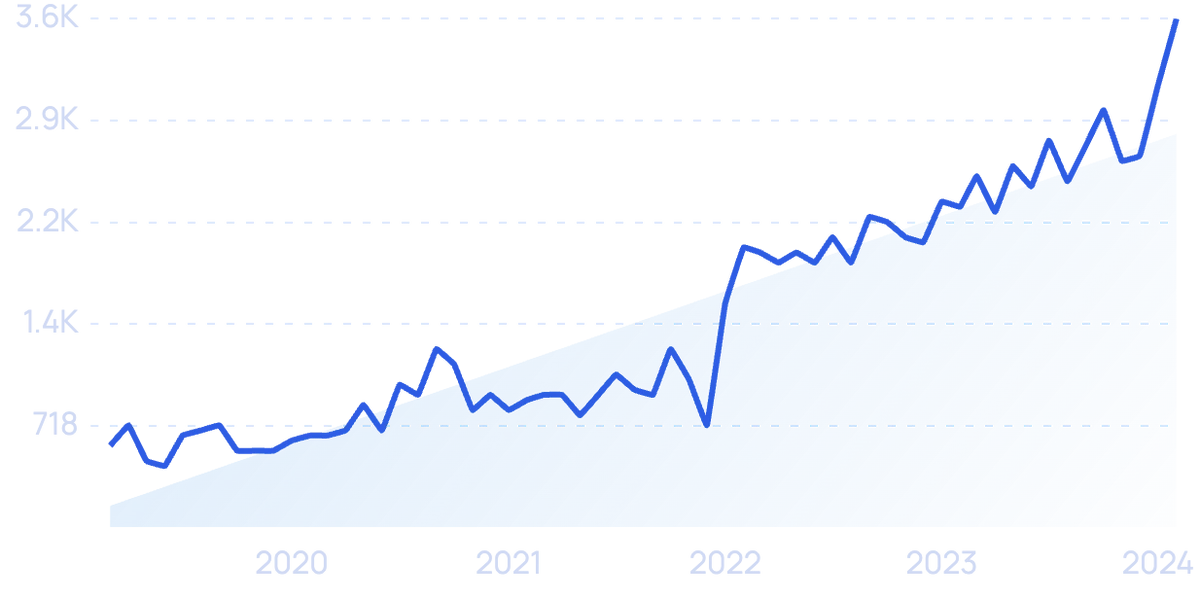

Search volume for “short form video” is up nearly 525% since 2019.

Even videos with as little as 10-second duration are gaining popularity.

Sprout Social found that consumers say short-form video is 2.5x more engaging than long-form video, and 66% say it’s the most engaging type of content on social media.

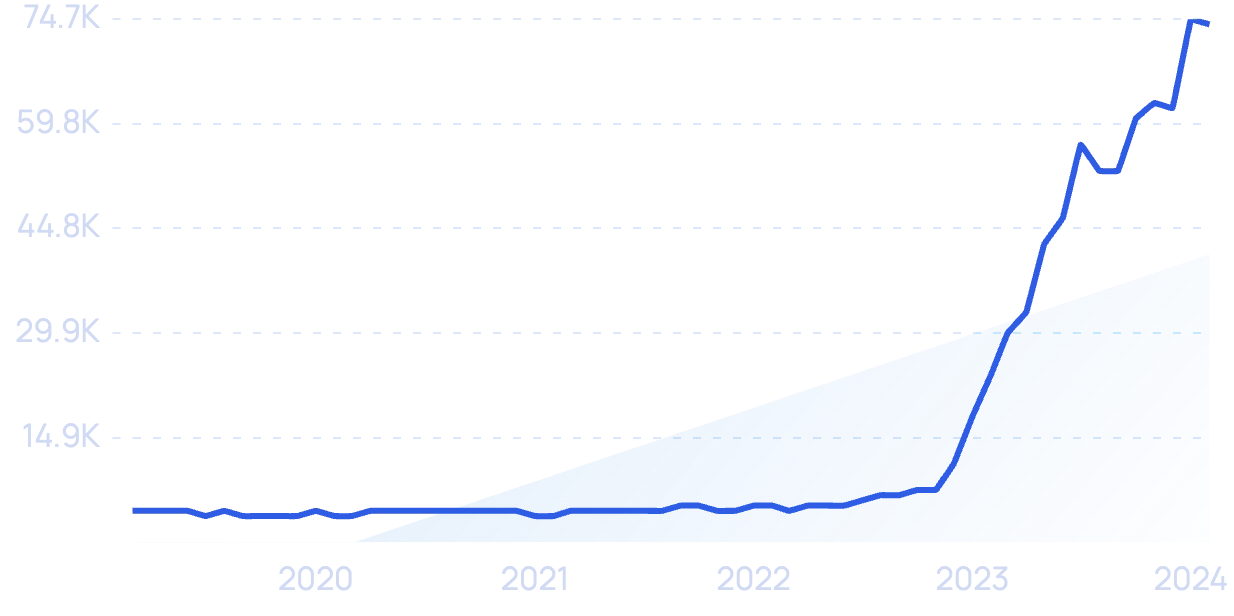

Video advertising is also gaining momentum because it’s getting easier to produce—thanks to the help of AI.

Search volume for “AI videos” is growing exponentially.

This AI-powered technology is in the beginning stages, but like other aspects of AI, it’s expected to rapidly take off.

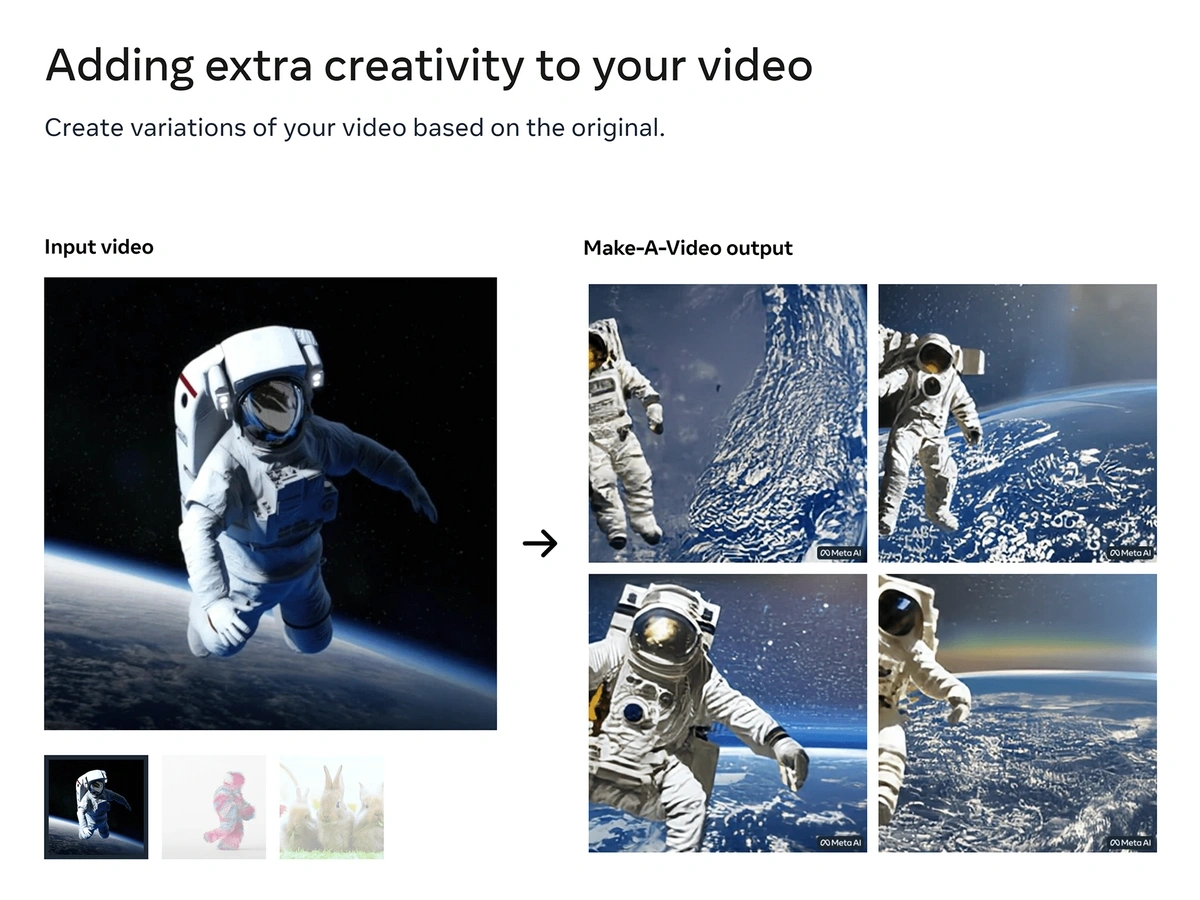

Facebook is testing what it calls Make-a-Video technology that creates videos based on text inputs.

It can also put two images in motion together and add variations to existing video content.

Facebook’s Make-a-Video could be an important tool for video advertising in the future.

Amazon has also announced it is working on AI video generation capabilities for ads.

The Future of Voice Optimization

By the end of this year, the number of smart speakers in the US is expected to surpass 200 million.

In 2020, just 24% of individuals owned a smart speaker, but by 2022, that number had jumped 10%.

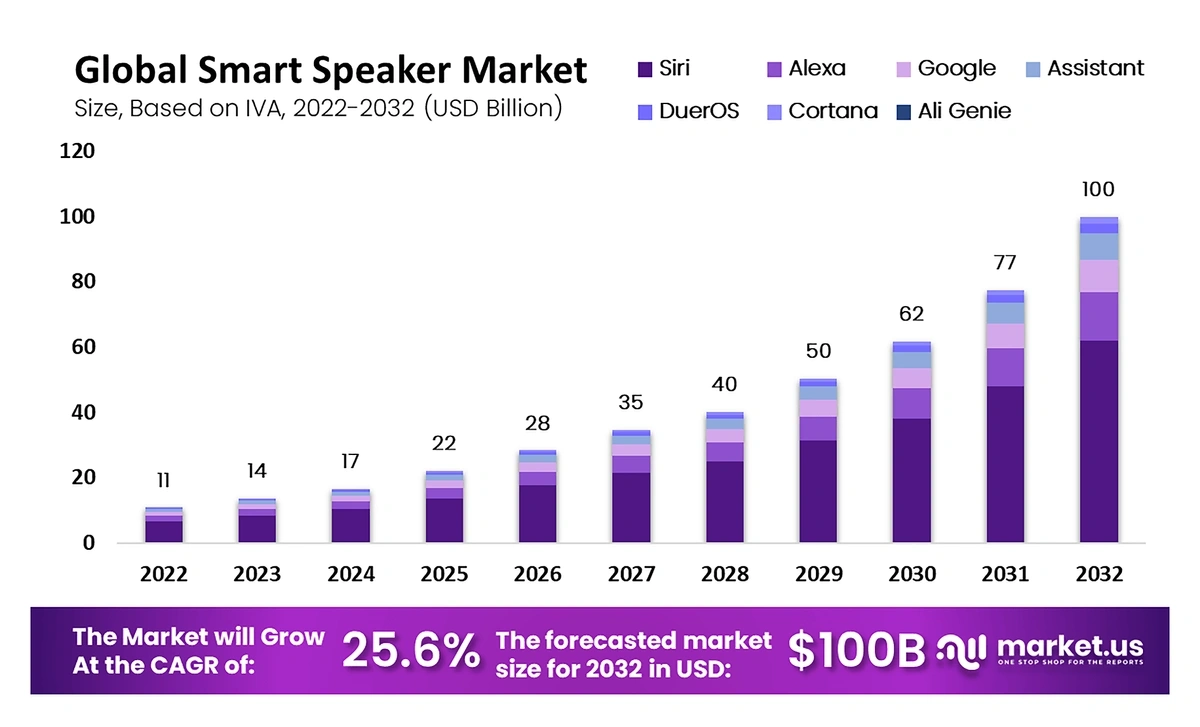

The smart speaker market is expected to continue to grow at a CAGR of 25.6% through 2032.

The smart speaker market is predicted to be worth $100 billion in 2032.

Because users often use smart speakers to start a search query, it’s a prime opportunity for advertisers and marketers.

One survey found that 58% of Americans between 25-34 use voice search every day.

When taking all Americans into account, 50% use voice search daily and 34% use it weekly.

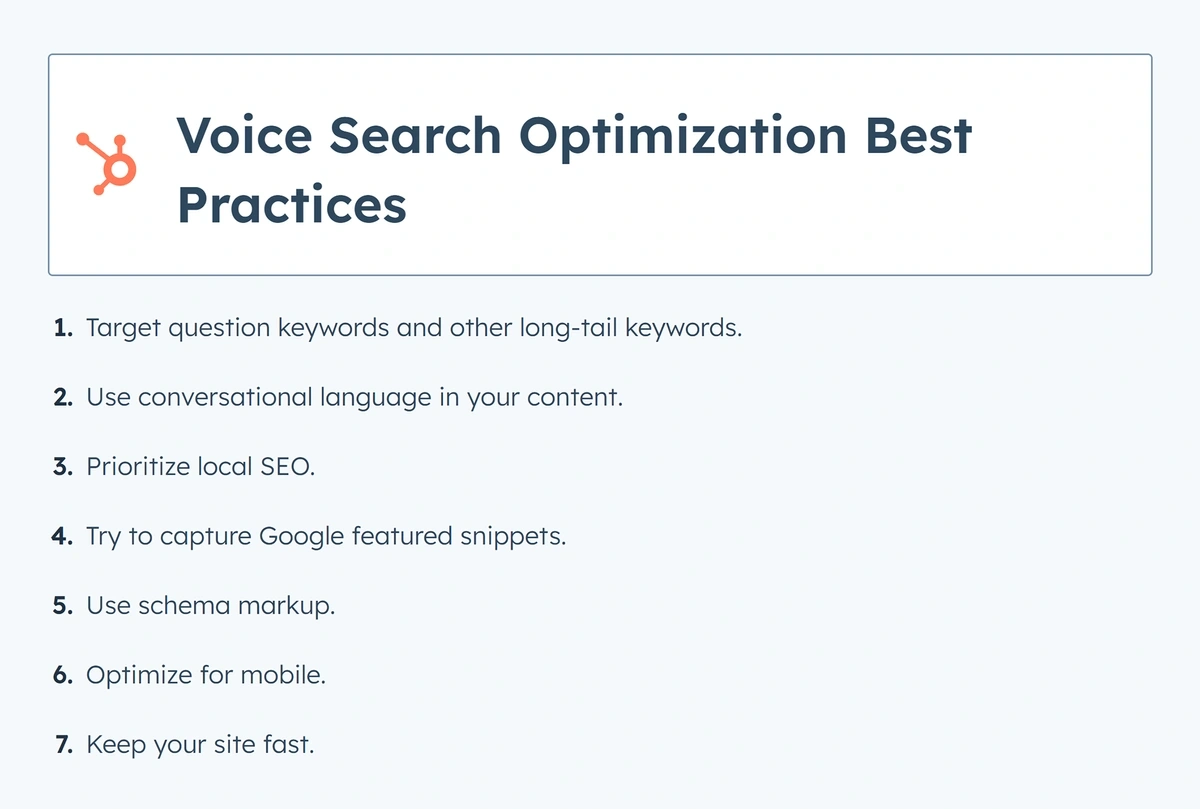

Advertisers have realized that voice searches aren’t the same as typed queries.

Voice searches tend to use long-tail keywords and conversational language. They’re also more likely to focus on personalized, local queries like “find Italian restaurants near me”.

Consumers are also most likely to be browsing or researching products when they’re using voice search.

One survey estimates that 44% of consumers use voice searches for this purpose. Only 11 use voice search for actual purchases.

Advertisers are starting to put all of this information together as they form a voice search strategy to employ in the months to come.

Many advertisers and marketers are optimizing their online content for voice search.

That’s why many brands are now including FAQ sections on their websites and optimizing their Google Business Profile.

Search volume for “Google Business Profile” jumped in 2022.

Beyond optimizing for voice search, advertisers are also seeing success from running ads on smart speakers.

A 2022 study showed that smart speaker ads trigger a 25% increase in brain activity when compared to standard audio ads.

When consumers engage with the ads, the impact is even more powerful. They react with more emotion and have increased memory-based responses.

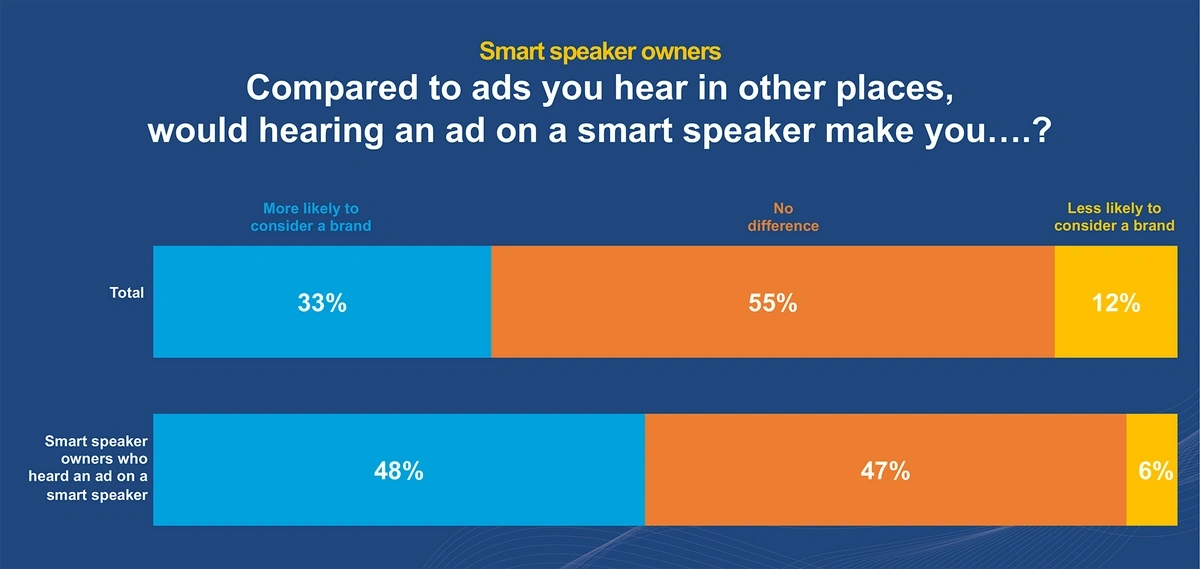

The 2022 Smart Audio Report from Edison Research showed that 53% of smart speaker owners say they’re likely to respond to ads, and 48% say they’re more likely to consider a brand that’s advertising on smart speakers versus in another place.

Nearly half of smart speaker owners say they’re more likely to consider a brand when they hear a smart speaker ad than an ad in another place.

In one early example of smart speaker ads, Audi ran audio ads that ended with the smart speaker asking users if they wanted to book a test drive. If the user said yes, AI was used to determine the nearest Audi location and begin the booking process.

Pizza Hut also experimented with smart speaker ads in 2022.

Their ad encouraged listeners to use voice commands to claim a discount on their next order.

The Future of Social Media Advertising

Social media has become one of the most influential advertising avenues in the world.

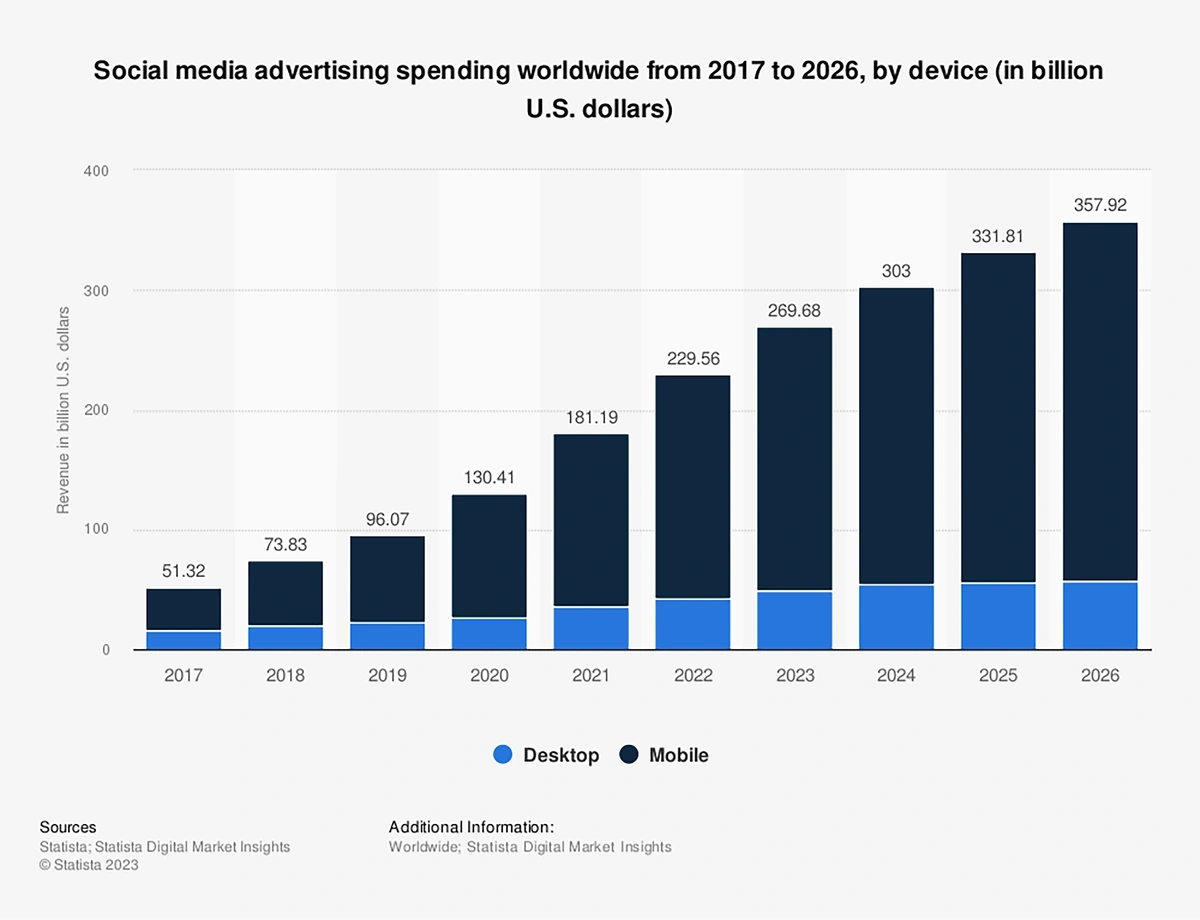

In 2022, global social media ad spend reached $230 billion.

In 2024, that number is predicted to climb to $303 billion.

Social media ad spending continues to climb. In 2025, it’s predicted that enterprises will spend nearly $40 per user on advertisements on social platforms.

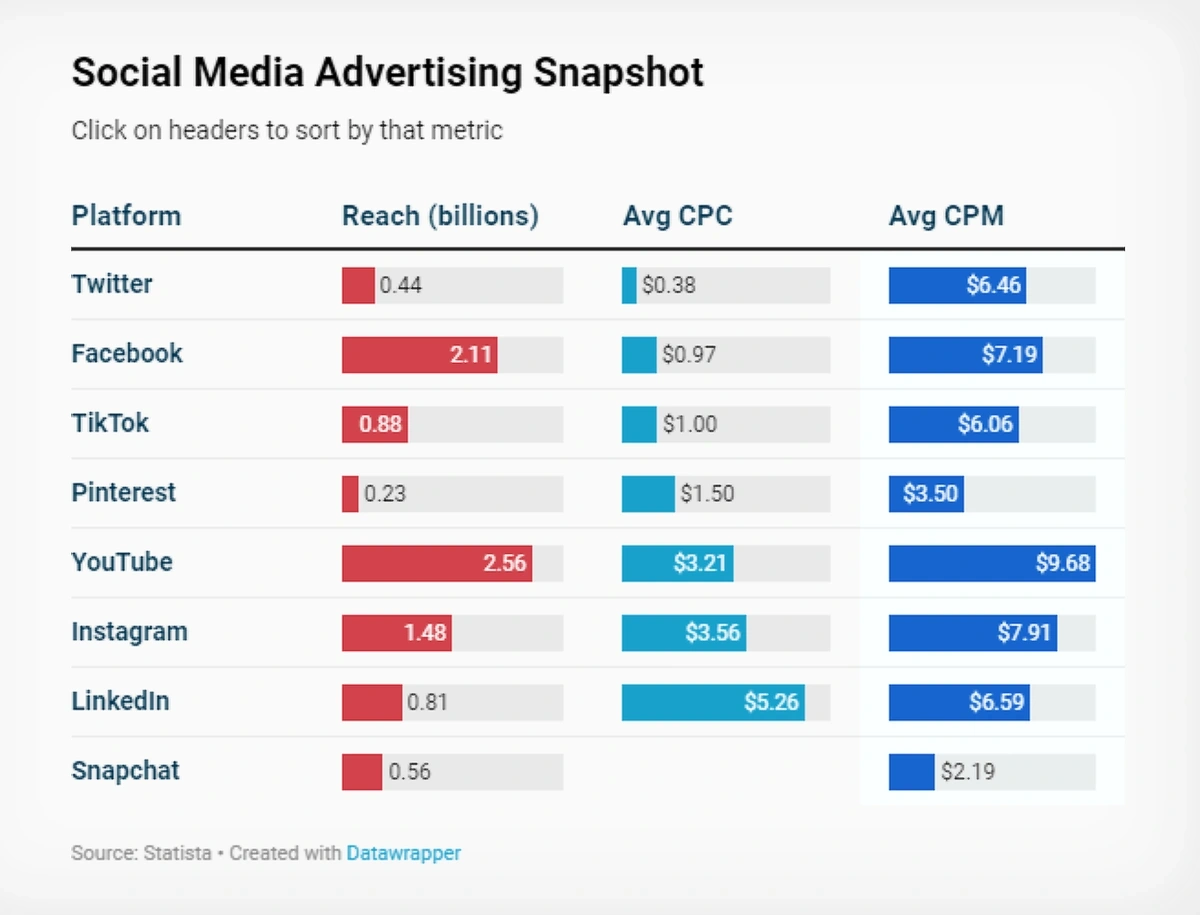

In terms of reach, YouTube and Facebook continue to dominate the market with more than 2 billion users each.

Social media ad reach is highest on YouTube, Facebook, and Instagram.

Advertisers spent $113 billion on Meta platforms in 2022.

And, ad spending on the platforms is still climbing.

In the first quarter of 2023, ad revenue was up 4% year-over-year.

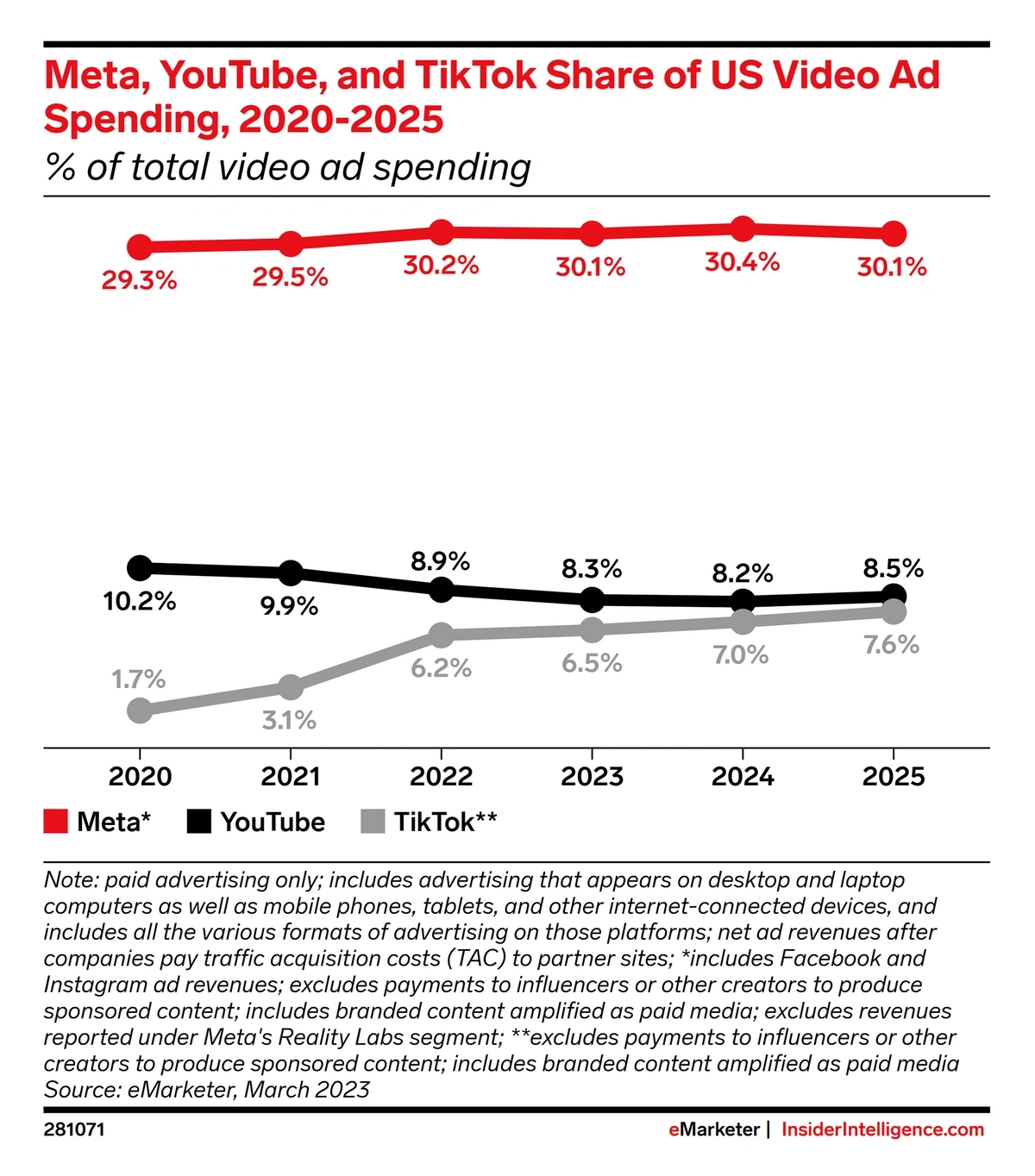

Insider Intelligence reports that Meta is responsible for more than 30% of video ad spending in the US.

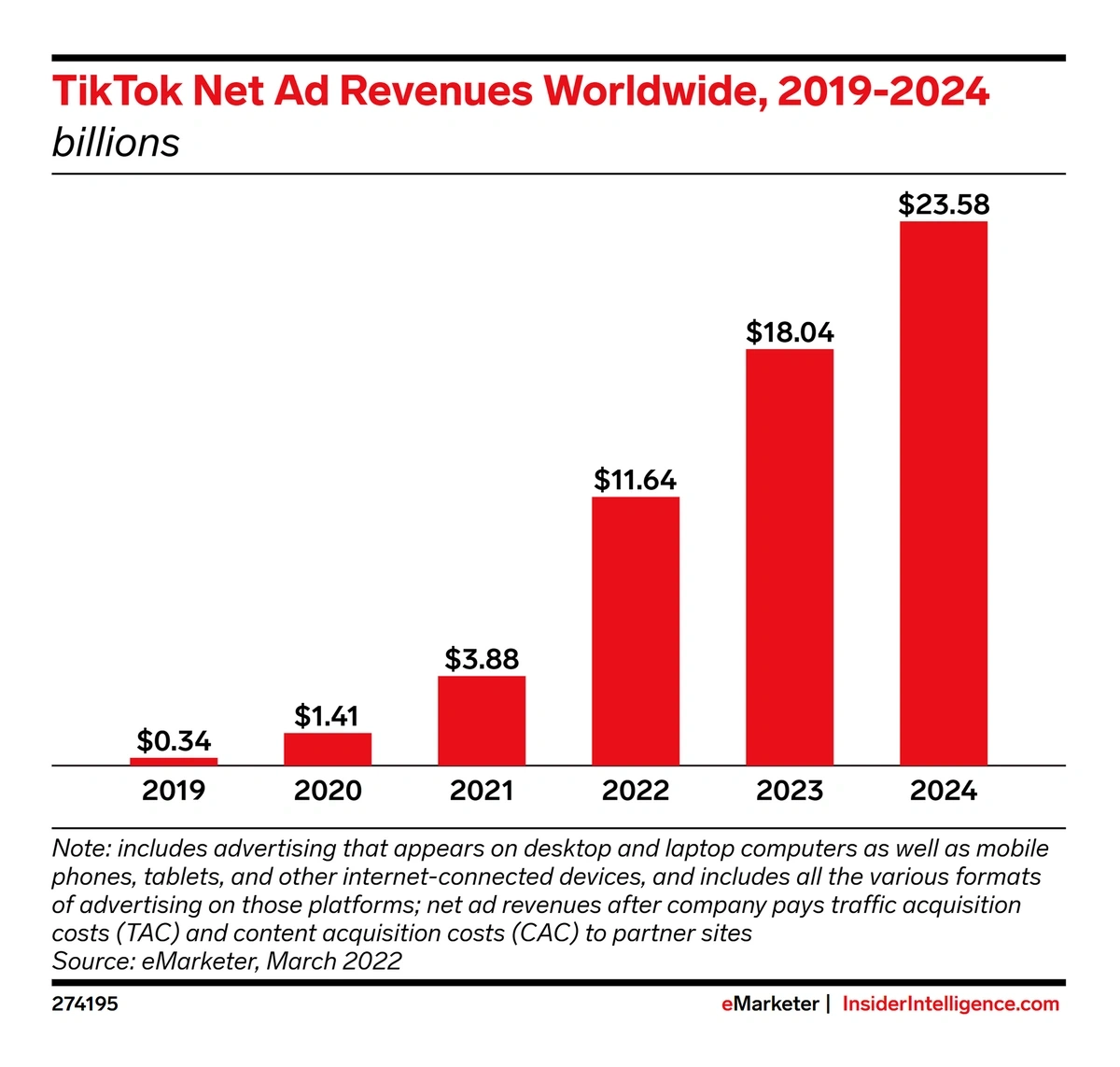

But in the last year, TikTok has made big strides.

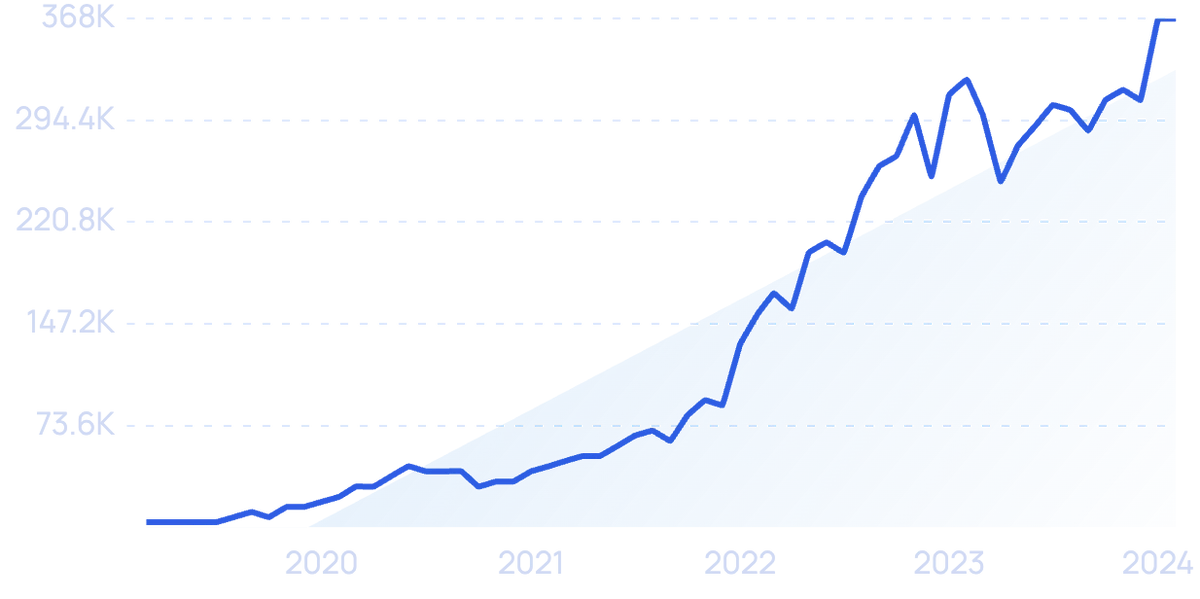

Search volume for “TikTok ads” is surging, up more than 99x in the past 5 years.

The platform accounted for 3.1% of US video ad spending in 2021 but bumped that number up to 6.5% in 2023.

By 2025, predictions put the platform just 1% below video ad spend on YouTube.

Meta dominates video ad spend in the United States.

Although TikTok has faced legislative pressure, Montana has banned the platform and the federal government is pushing for the same, it seems that its popularity for advertisers will continue to grow.

Ad revenue on the platform hit $11.64 billion in 2022, more than tripling revenue from 2021.

By the end of 2024, it’s expected that advertisers will have poured $23.58 billion into the platform.

TikTok ad revenue is growing exponentially.

As for advertising strategies used on social media, brands are expected to continue investing in videos and influencers.

Authenticity in posts and transparency in advertising are predicted to gain momentum, as well.

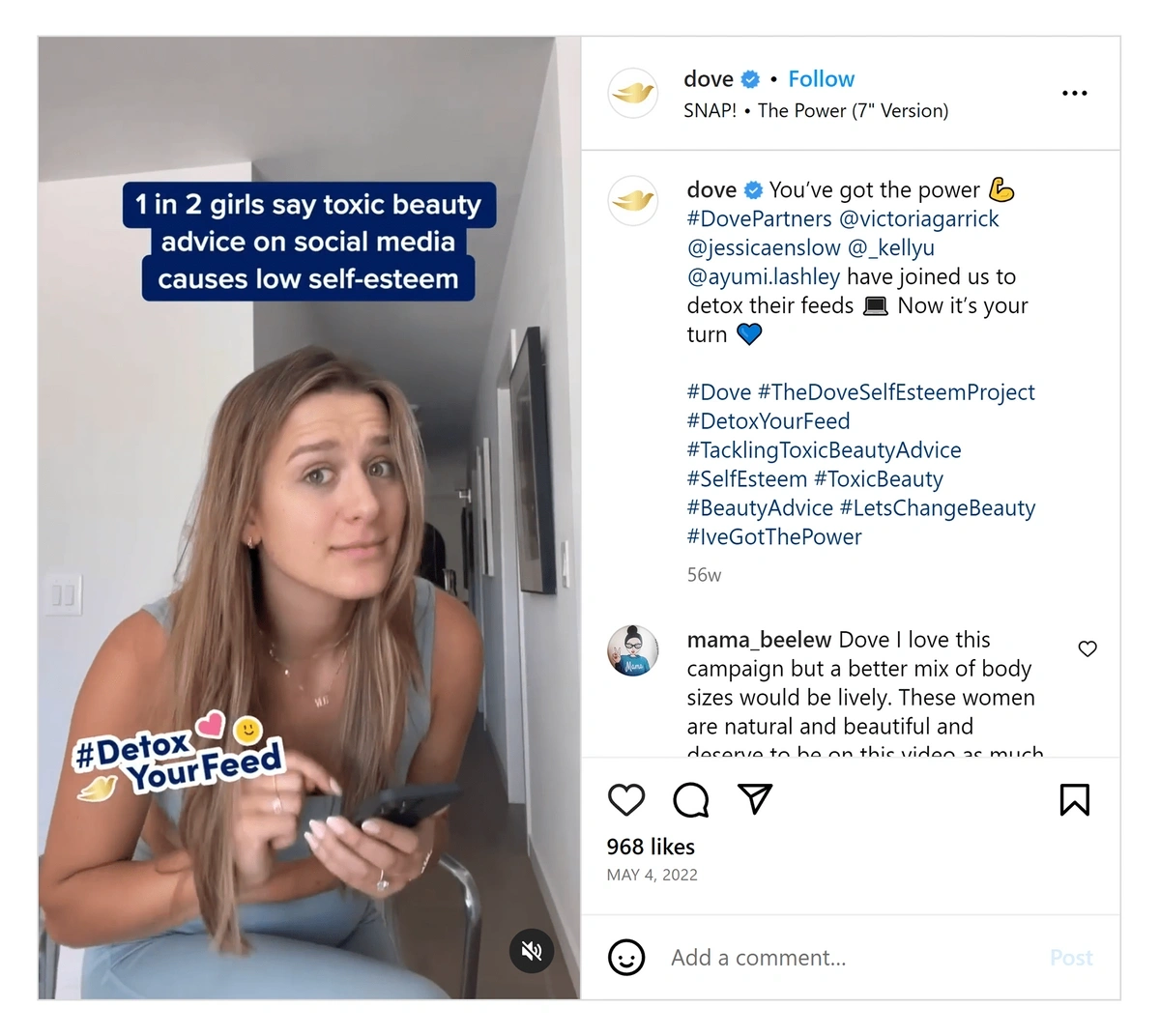

Dove is a brand that’s developed a reputation for authenticity in its ads and social campaigns.

Take its #DetoxYourFeed campaign of 2022.

Dove’s campaign was aimed at highlighting the danger of toxic beauty culture on social media.

The #DetoxYourFeed campaign was influential on Instagram and Twitter.

In 2023, the brand also started running ads that featured #KidsOnlineSafety.

Similar to their other campaigns, this one is aimed at preventing the negative ways in which social media affects kids’ body image.

Apple’s Shot on iPhone Challenge of 2022 is a prime example of brands blending social advertising with more traditional avenues.

Apple’s Shot on an iPhone billboards.

The iconic brand invited social followers to share their best macro photography examples (shot with the latest iPhone, of course).

The photos were tagged on Instagram and Twitter, and the winning shots were featured in other ad campaigns like billboards and in Apple Stores.

iPhone users continue to use the hashtag.

On Instagram alone, the campaign’s hashtag has more than 28 million posts.

Chips Ahoy, a big-name brand from the CPG space, has said that they’re shifting nearly all of their advertising dollars to digital and social advertising.

Chips Ahoy has nearly 455,000 followers on TikTok.

The company’s strategy is aimed at reaching Gen Z consumers through Instagram, Twitter, and TikTok.

This move echoes the data — 29% of Gen Zers pay the most attention to ads on social media versus TV or other online ads.

Conclusion

Changing consumer behavior and new AI technology are set to transform the advertising industry in the next few years. In fact, changes are already impacting the way advertisers buy ads and create content.

All of these changes mean industry-leading advertisers will have unprecedented opportunities to deliver highly tailored and immersive experiences to their audiences.

However, as third-party cookies disappear advertisers will have to work harder and smarter to access the data they need to gain valuable, and profitable, insights.

And they can start with a free Google Ads competitor analysis right here on Exploding Topics.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more