Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

The Future of Cryptocurrency (2024-2027)

You may also like:

Once ignored by all but the most diehard tech nerds, recent data shows approximately 20% of Americans have dabbled in crypto.

With Main Street, Wall Street, and even small countries involved, it’s hard to deny crypto is here to stay.

On the flip side, crypto has struggled to find its niche.

In fact, some pundits have labeled both blockchain and crypto in particular as “a solution looking for a problem”.

So, in today’s report, we’ll discuss the future of cryptocurrency.

In particular, where the next wave of both adoption and capital injection could come from.

1. Emerging Use Cases Drive the Next Wave of Adoption

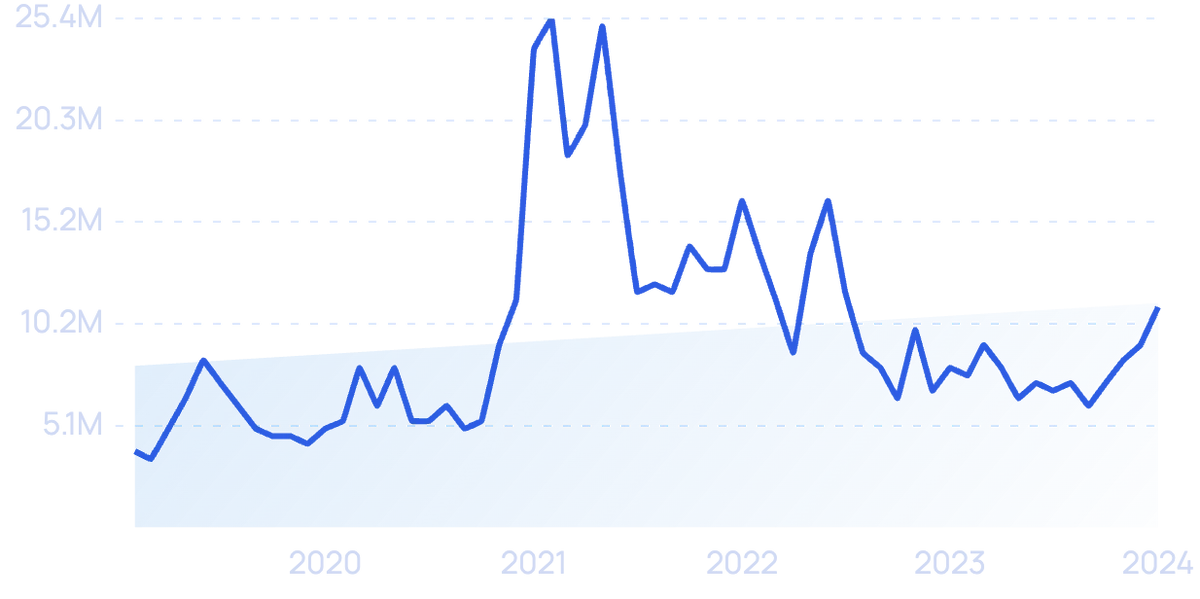

The data is clear: plateauing blockchain wallet creation and decreasing traffic to crypto websites indicate consumer interest in crypto has peaked in the near term.

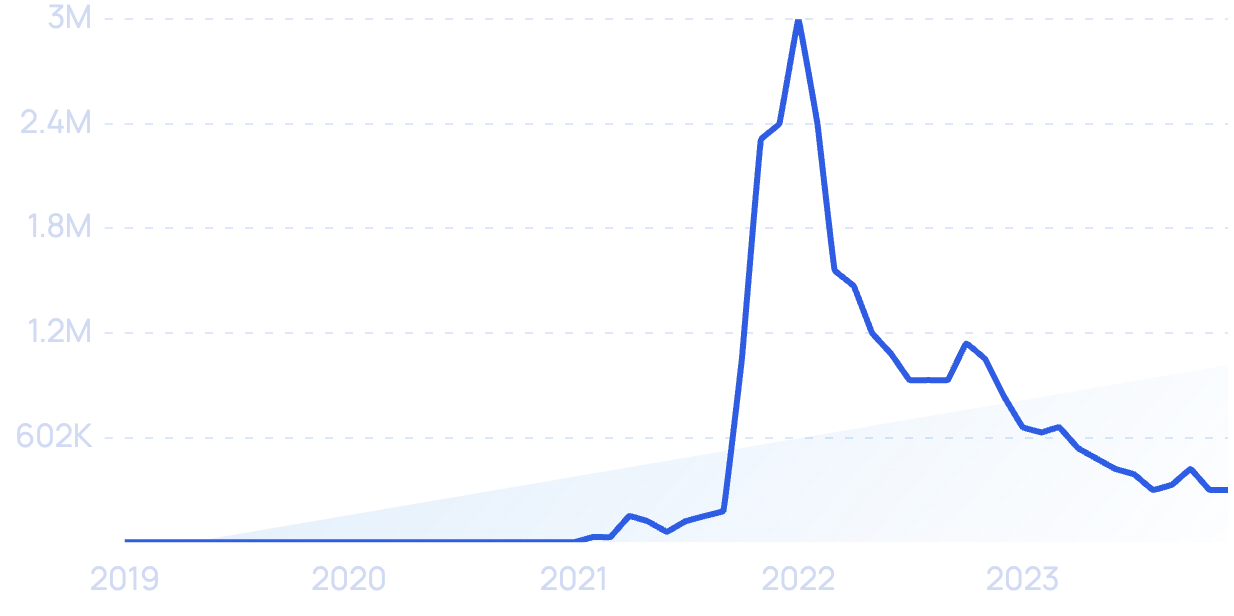

Searches for “bitcoin” have largely been on the decline since 2021.

History suggests that the next bull market is likely to reignite consumer interest. However, many predict that the practical application of crypto - and not crypto investing itself - will drive the next adoption wave.

Beyond Speculative Investing

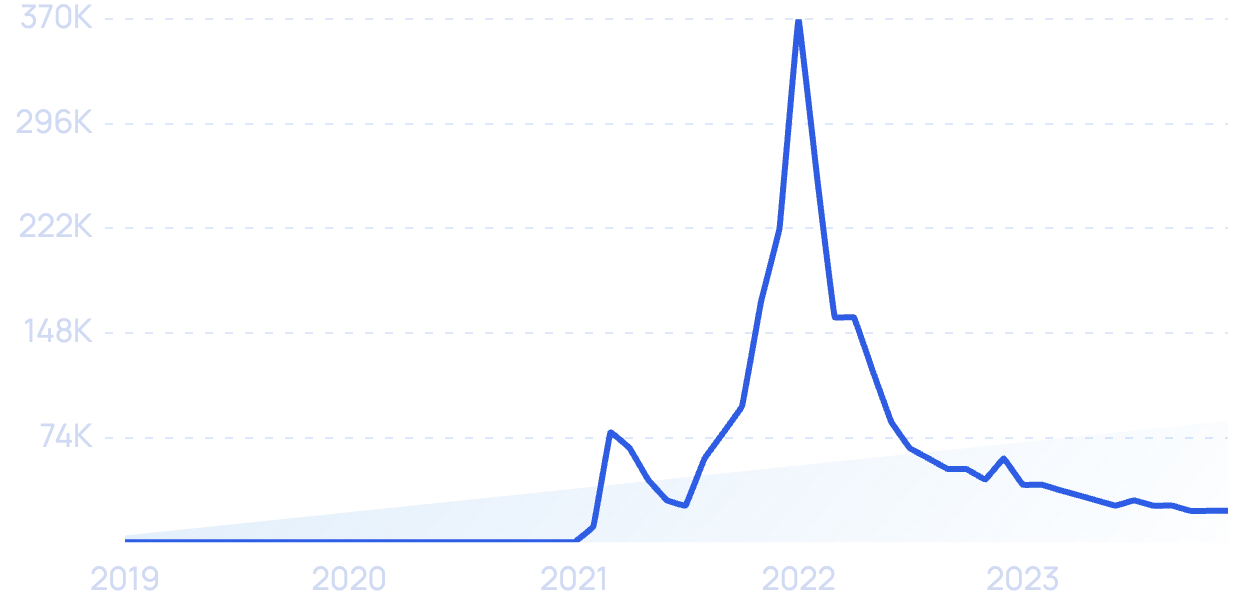

NFTs quickly went from being virtually unheard of to driving billions of dollars in monthly trading volume.

Searches for “non-fungible token” shot up in January of 2022.

Admittedly, much of this activity was concentrated among a small group of approximately 250,000 diehard traders.

That said, the potential market for NFTs - which are bought and sold using crypto and are themselves a unique form of crypto token - is much larger.

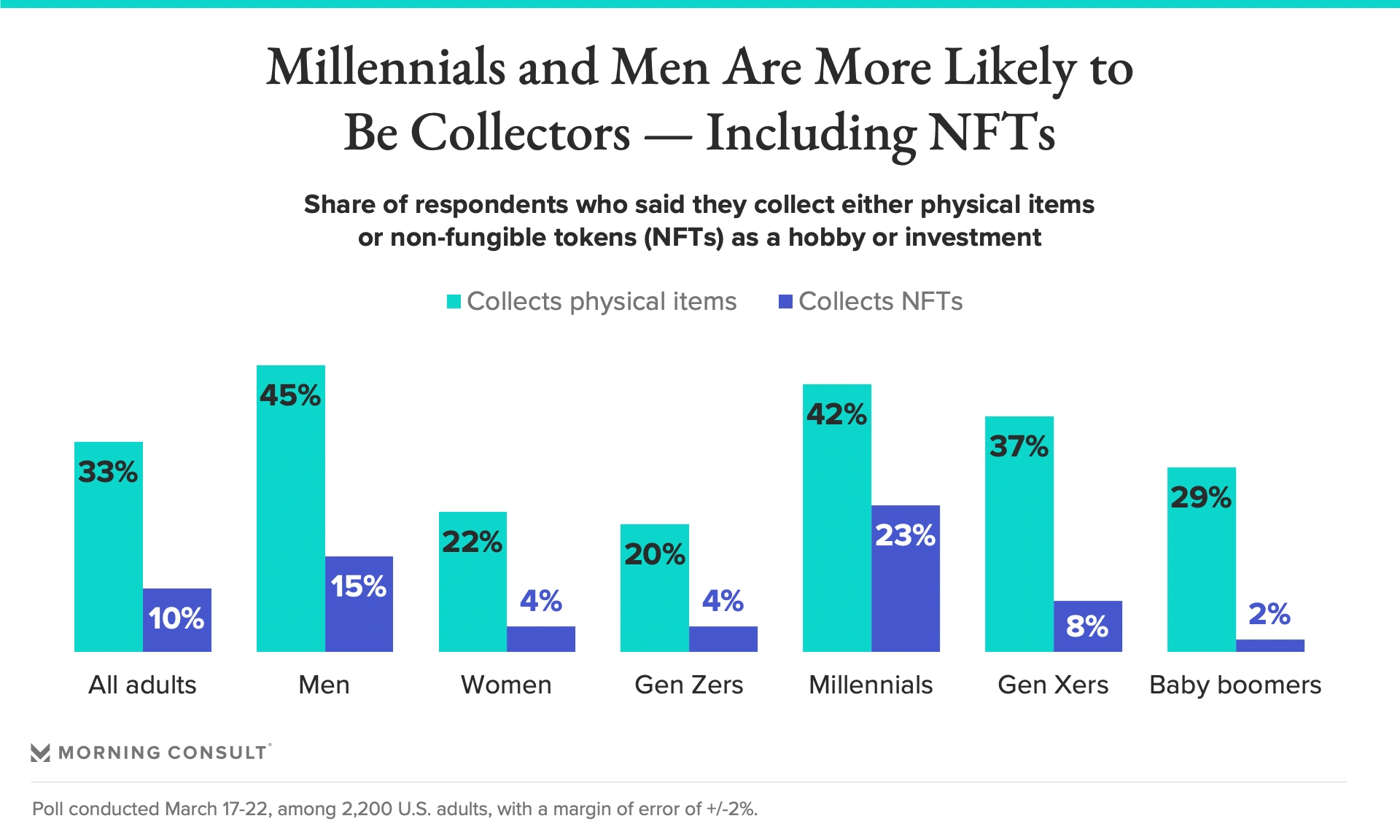

Collectors Are Open to NFTs

According to Morning Consult, of the 33% of American adults who consider themselves collectors, a full 50% are interested in NFTs.

With an adult population of 260 million+, that represents more than 43.6 million potential users in the US alone. In addition, interest in NFTs spans much further than just the US.

In fact, in terms of NFT ownership, Asia leads the way.

Millennials Are Especially Drawn To NFTs

Per a 2021 study, 42% of millennial households own cryptocurrency. That’s more than double the ownership rates seen amongst Gen X’ers, who came in at just 18%.

Further, given millennials are projected to be the largest beneficiaries of the Great Wealth Transfer, it’s likely both they and their digitally-native Gen Z counterparts will continue adopting both crypto and NFTs in the future.

Blockchain Gaming

And it’s not just NFTs capable of driving mass adoption.

With 3.24 billion gamers worldwide, some industry experts predict it’s blockchain gaming - and not NFTs or speculative investing - that will drive the next 100 million (or billion) crypto users.

As an example, one of the earliest players in the space - Axie Infinity - reached 8.3 million users by December of 2021, with over one million playing daily (making it the first blockchain game to surpass 1 million daily users).

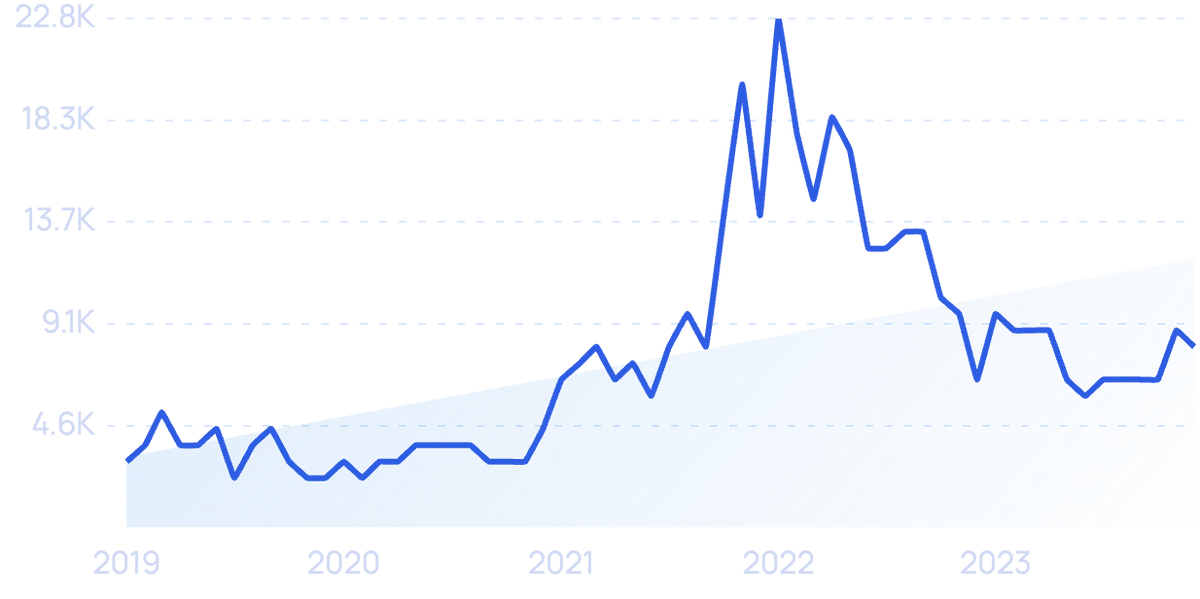

Google search volume for “blockchain gaming” over 5 years.

After seeing Axie’s success, a variety of competitors jumped into the market. Fast forward to today and dozens of blockchain games have achieved $50 million+ market caps, including Alien Worlds, Mines of Dalarnia and more.

And with blockchain gaming growing 2,000% in 2022 - including growing 52% during what was essentially a bearish Q1 - the future of blockchain gaming looks bright.

The Metaverse

Last, it's possible the upcoming Metaverse could also drive up the number of crypto users.

On the one hand, the Metaverse is not one single entity, but a variety of virtual worlds. Some of these are being built by centralized corporations like Microsoft and Meta (aka Facebook), neither of which have discussed incorporating crypto into their plans.

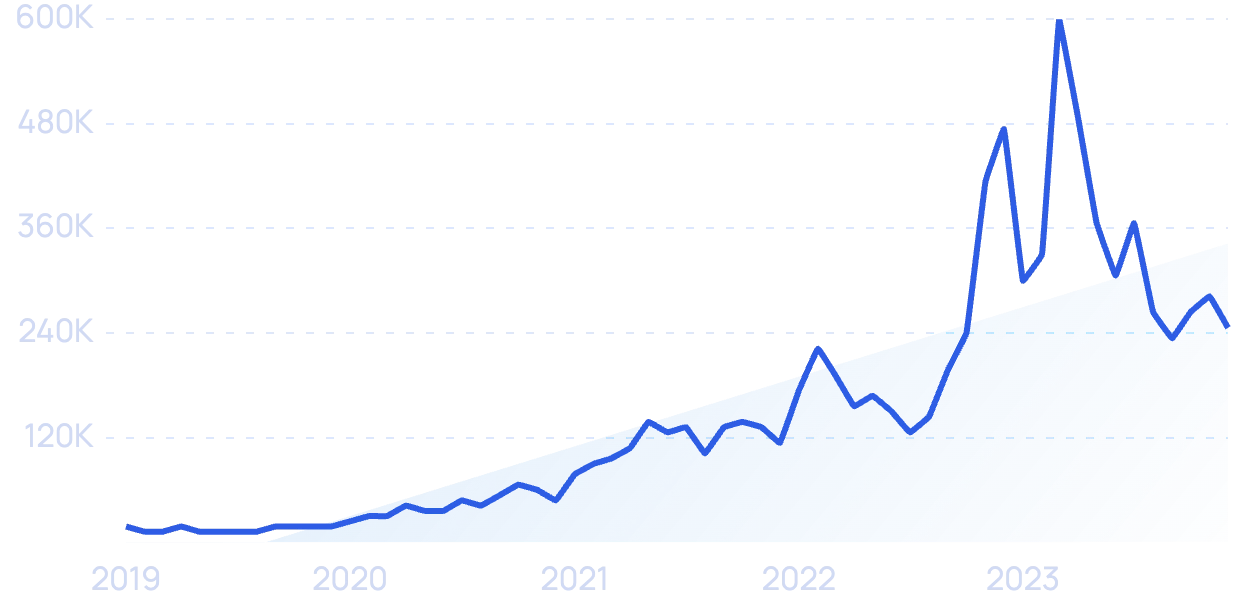

Search interest in “metaverse” in the last 5 years.

On the other hand, leaders in the decentralized metaverse space - including Decentraland and The Sandbox - have crypto at their core (with virtual land being bought and sold using crypto).

More important, Wall Street firms like CitiBank and Goldman Sachs have projected the Metaverse to be a multi-trillion dollar opportunity.

Meaning, even if crypto-based metaverse worlds only account for 10% of market share, that could easily drive hundreds of billions of dollars and hundreds of million of users into the space.

2. Crypto-backed Mortgages Go Mainstream

For crypto investors who have large portfolios, the traditional process for acquiring a mortgage can be problematic.

Mainly because, if someone has most (or all) of their net worth in crypto, coming up with the cash to provide a down payment could require them to sell a portion of their crypto holdings.

This, in turn, would result in them having to pay capital gains on that sale.

With traders paying short-term gains equivalent to their tax bracket, and long-term holders paying the nation’s 15% capital gains tax, those taxes could be substantial.

The Nation’s First Crypto-backed Mortgage

To address this, a startup called Milo is now offering no down payment mortgages for borrowers who put up crypto as collateral.

Similar to many startups, founder Chris Matta launched the company as a solution to a problem the founder himself had to deal with.

Despite departing Goldman Sachs with substantial savings and a wife who had consistent W2 income, the banks frowned upon the fact his net-worth was tied up in Bitcoin and Ethereum (with some “laughing him off the phone”).

Fast forward to today and Milo has 40 employees on six continents. Further, they allow borrowers to finance up to $5 million while offering mortgage rates similar to those found in traditional mortgages.

More important, the process of getting a crypto-backed mortgage isn’t substantially different from the traditional route. The only difference is, instead of providing a down payment, borrowers transfer their crypto to a third-party custodian company that holds it as collateral.

From there, as the borrower makes mortgage payments (and home values rise), some of that crypto can be transferred back to the borrower (similar to taking equity out of a home).

For Now, Lenders Are Holding Back

Admittedly, Milo is the only company currently offering this style of a mortgage in the US.

With the US government failing to provide clarification regarding how cryptocurrency will be regulated or taxed at the corporate level, it's understandable why lenders are holding back.

Adding to those hesitations is the fact the cryptocurrency market has lost 60% of its value since the November 2021 peak.

As we know, however, investor sentiment swings both ways.

Because of that, it's likely more lenders adopt this model once regulatory clarity is provided and the market turns bullish again.

3. More Governments Launch CBDCs

With decreasing demand for physical cash and expenses of anywhere from 5-20% per bill printed, governments across the world have begun exploring what is known as CBDC (Central Bank Digital Currency).

Interest in CBDC is up 1,267% over the last 5 years.

The Benefits of Blockchain-backed Government Currency

As stablecoins like USDT and USDC have proven, there are multiple use cases for a cryptocurrency in which the value is pegged to a country’s currency.

Unlike most cryptocurrencies - where values fluctuate dramatically - crypto that’s pegged to a fiat currency maintains its relative purchasing power (i.e. one crypto dollar is worth one American dollar).

Also, the immutable and transparent nature of blockchains offers a host of benefits not available to central banks in countries where cash circulation is high.

Examples include everything from gaining insight into the actors behind the criminal activity to rapidly distributing austerity payments to citizens.

Expediting Stimulus Payments

As an example, the Economic Impact Payments made to qualifying American citizens were first distributed to taxpayers who already had their direct deposit information on file with the IRS.

However, if someone did not have their information on file, payments were sent via paper check. In some cases, those checks took weeks if not months to arrive.

With a CBDC, however, the government could have made instant payments to all citizens regardless of whether or not they’d signed up for direct deposit with the IRS.

Future Adoption of CBDCs

As of January 2024, only 11 small countries have CBDCs. Specifically, Jamaica, the Bahamas, Nigeria, and seven small countries in the Eastern Caribbean.

With that said, there are some much larger countries on their heels. Specifically, 21 countries are currently testing a pilot version of their CBDC while 33 are in the development phase.

Specifically, the EU, China, South Korea, and Thailand are all in the test pilot phase. Not far behind, we see Canada, Brazil, and Mexico in the development phase.

4. US Regulators Designate Asset Status

It remains unclear if the US government will regulate crypto using existing sector laws (e.g. securities or banking laws) or create a new set of crypto-specific ones.

This, in turn, has limited the degree to which banks, investment firms, and large investors are willing to allocate funds to cryptocurrency.

With that said, after years of uncertainty, progress is being made.

Biden Puts the Wheels in Motion

In November of 2021, sitting President Joe Biden signed a $1.2 trillion infrastructure bill that contained two articles that could have serious implications for the future of crypto.

The first relates to which players in the cryptocurrency industry will be considered “brokers” (with heavy regulation applying to any actor that falls under that designation).

The second relates to the threshold - currently $10,000 - at which actors in the space will have to report transactions to the IRS or the government in general.

With that said, neither of these issues will be defined until 2024, with a variety of pro-crypto advocates in both Congress and the Senate cooperating to introduce amendments surrounding both issues.

The Coming Executive Order

In March of 2022, sitting President Joe Biden signed an executive order calling on the government to report on the “risks and benefits of cryptocurrencies”.

While the order itself does not clarify what asset category crypto will fall into, the reports that come as a result of the order are widely considered to be the first step toward asset class designation.

Submission of those reports, however, is only the first step.

Regulatory Clarity Is On The Horizon

Once the reports have been submitted, legislation will have to pass through Congress, the Senate, and the White House before being finalized.

Because of that, regulatory clarity isn’t expected to happen until late 2024 at the earliest.

In addition, a high-profile lawsuit by the SEC against the top 10 crypto project Ripple could set a legal precedent for how crypto assets are to be regulated before any legislation is signed.

Despite this, legal precedent is not law. And because of that, true clarity regarding how crypto will be designated and regulated is likely a few years away.

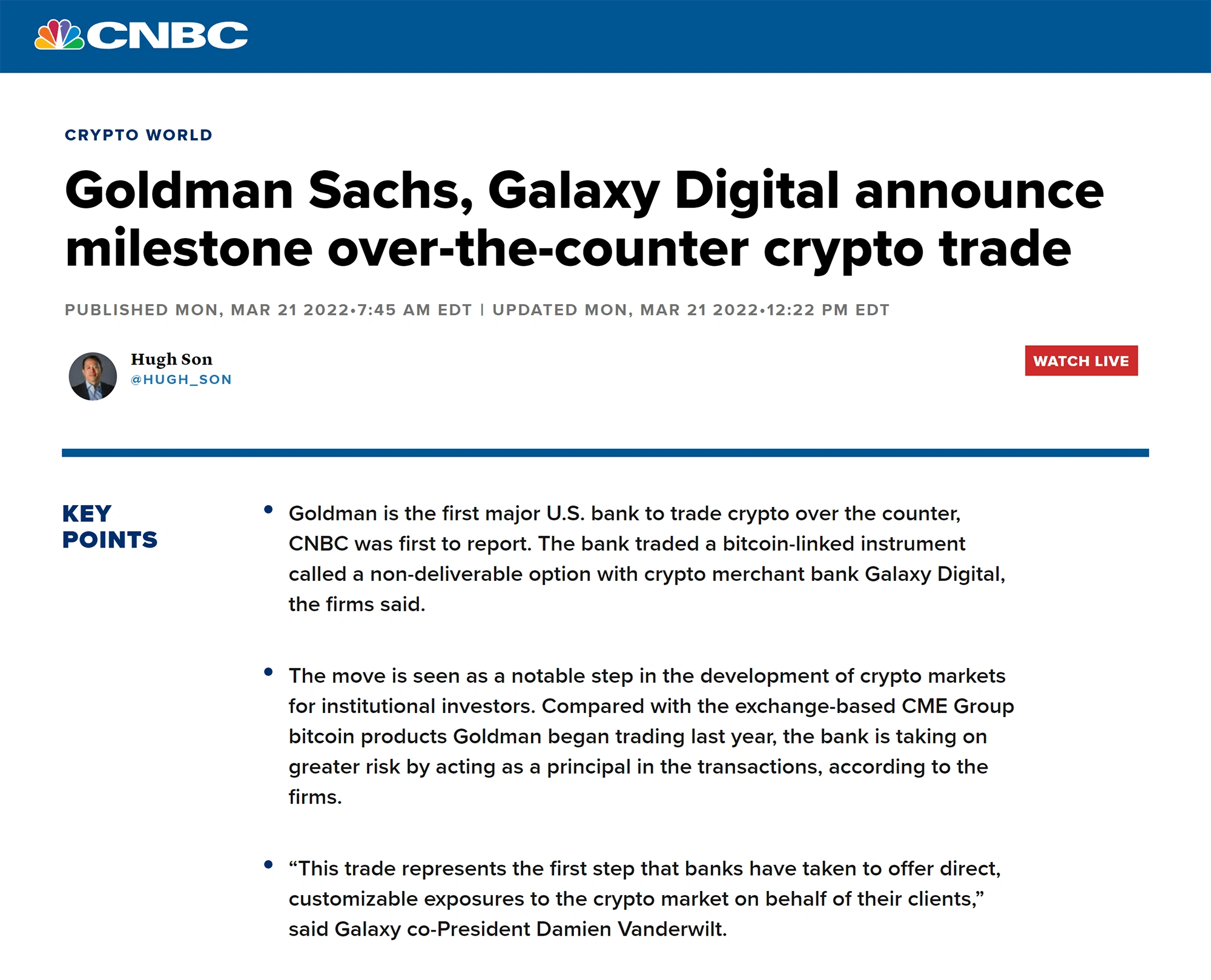

5. Regulation Increases Institutional Crypto Adoption

Over the past year, both hard evidence and a variety of anecdotal reports show institutions are highly interested in crypto.

In March of 2022, Goldman Sachs recently launched Crypto Desk and made its first-ever crypto trade. In May of 2022, Jamie Dimon - an outspoken Bitcoin critic - said the currency was “undervalued” at $28,000.

Despite their interest, the lack of regulatory clarity surrounding crypto - and its highly volatile nature - has prevented most institutions from investing in any kind of substantial way.

Regulations May Lead to Institutional Crypto Investments

Because of this, its widely accepted governmental regulation is necessary before institutions will feel comfortable getting into crypto more aggressively.

For the time being, the small number of firms willing to touch the asset class have limited their investments to only 1-5% of their total assets under management.

Once regulation arrives, however, it's expected a large amount of capital will flow into the asset class. In addition, institutions are turning to crypto for more than just investing and trading.

How Institutions Plan to Use Crypto

For more conservative institutions, who remain nervous regarding crypto’s regulatory status and volatility, one way they plan to get exposure to the asset class is by investing in legitimate crypto companies.

Similar to investing in startups, going this route allows institutions to profit if the companies they invest in become successful (without the regulatory or accounting risks involved in buying and holding tokens).

In addition, Luuk Strijers - chief commercial officer for crypto options exchange Deribit - says some institutions plan to use crypto to hedge their VC investments.

There are a variety of ways they can do this. First, if a firm makes a large bet on a specific ecosystem or blockchain (e.g. Solana), they can hedge that bet by snapping up tokens of a competing chain (e.g. Avalanche).

They can also use crypto to hedge non-crypto VC investments.

Because crypto is considered a “risk on” asset, firms protecting capital during a risk-off environment could hedge their bets by making small investments into crypto (which would likely increase in value if the market turned bullish again).

A Self-Reinforcing Cycle

Both large institutional capital deployments - and the introduction of highly sophisticated traders (who are currently limited to trading futures) - are expected to stabilize the asset class.

And as capital flows in and prices stabilize, it is likely more cautious investors will warm up to the asset class. That, in turn, would result in even more capital flowing into crypto as a whole.

Conclusion

Over the past decade, interest in cryptocurrency was mainly driven by retail traders looking to generate rapid wealth in what is arguably the most volatile asset class on the planet.

However, as markets mature and a growing number of investors suffer the downsides of that volatility, it is possible crypto adoption among mainstream retail traders has peaked (or will grow at slower rates moving forward).

On the flip side, governmental regulation could provide institutions with the clarity they need to finally feel comfortable deploying large amounts of capital to the space.

And that institutional interest - combined with NFTs, blockchain gaming, and the metaverse - is likely to drive the next wave of both capital injections and consumer adoption.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more