Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 5 DeFi Trends for 2024-2026

You may also like:

In 2020, the growth of DeFi took the financial world by storm.

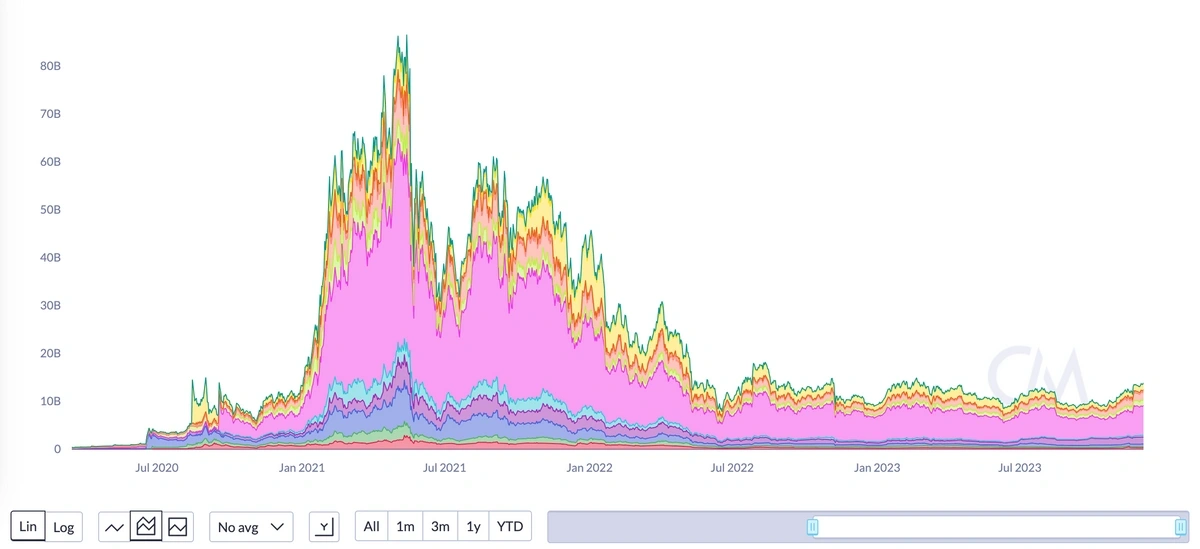

In fact, Total Value Locked (TVL) – a measure of DeFi transaction value – grew by 14x in 2020.

And in 2021, TVL more than quadrupled to a total value of $112.07 billion at its peak.

So if you want to learn about the most important trends in the DeFi space, read on.

1. Traditional Financial Products Enter the DeFi Landscape

In the traditional financial markets, the total value of financial derivatives is estimated by some to be 10x larger than global GDP.

Essentially, derivatives dwarf the value of regular financial markets.

The DeFi derivatives market, on the other hand, is still in its infancy.

The TVL of the DeFi derivatives market is currently $180 billion.

But its recent growth has been very impressive.

The TVL of the DeFi derivatives market was around $25 billion in late 2020.

Maker is the largest player in this market.

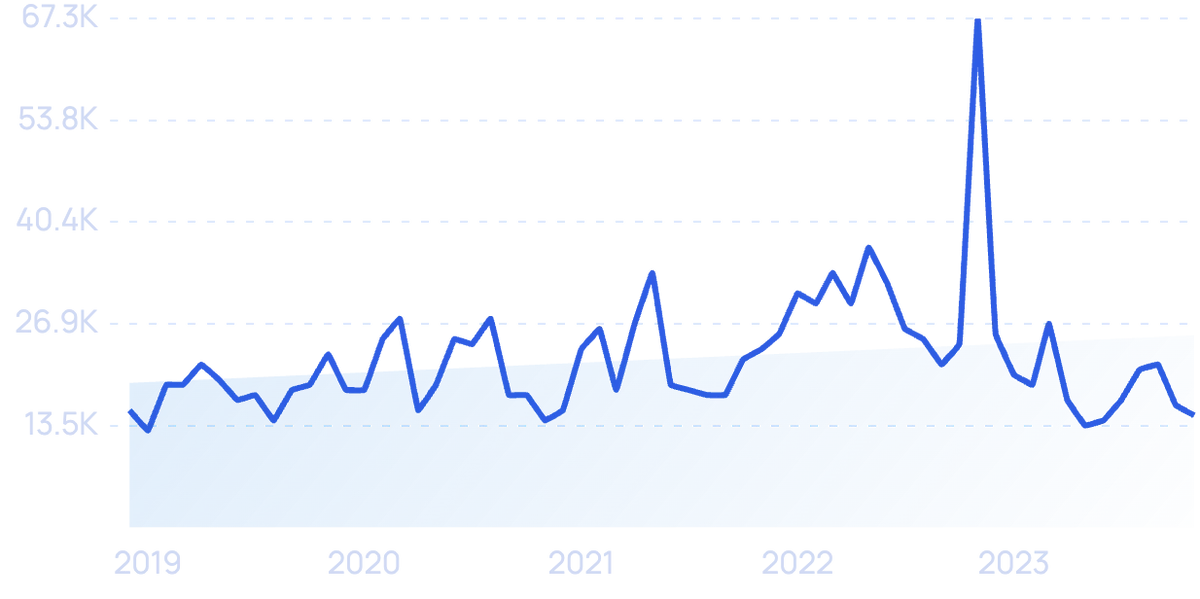

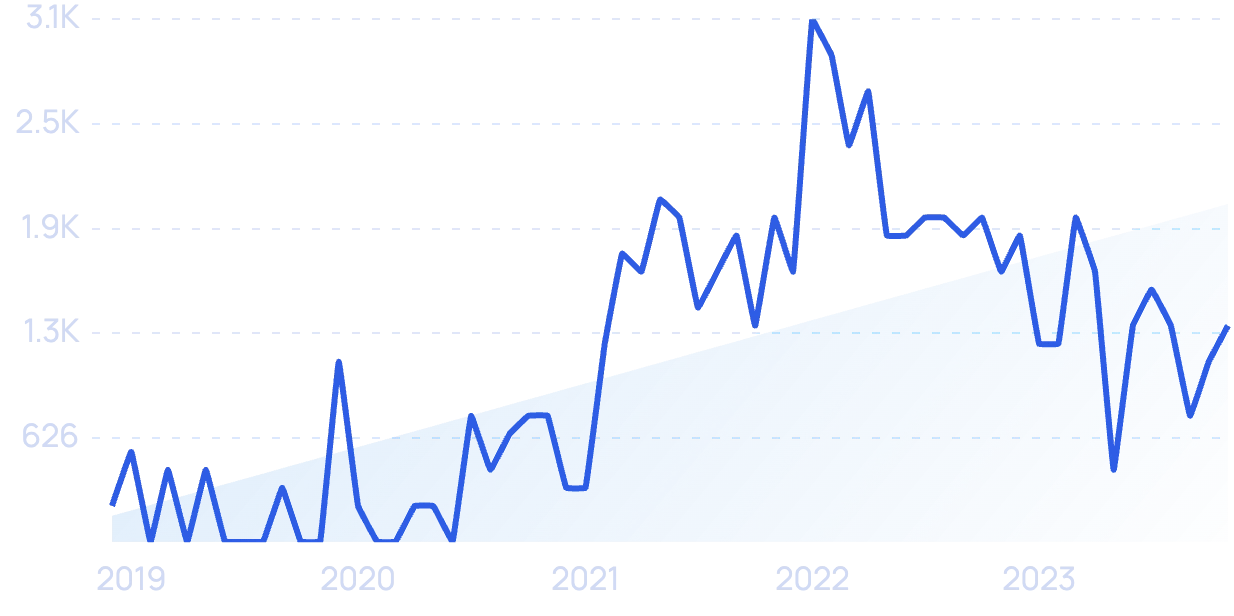

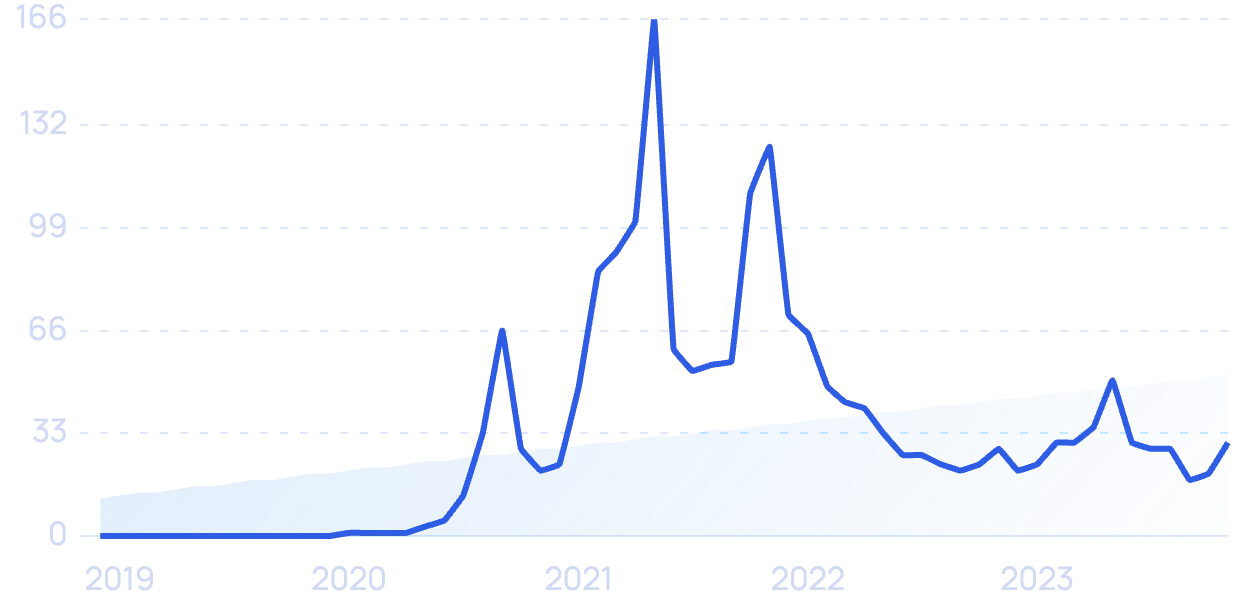

Search interest in "MakerDAO" over the last 5 years.

Another important player is Uniswap.

Uniswap currently sits in second place on the DeFi derivatives market table.

Wrapped Bitcoin (WBTC) is another way the crypto market has managed to use derivatives to increase efficiency.

Search interest in "Wrapped Bitcoin" has grown by 750% over the last 5 years.

WBTC is basically a way to create an Ethereum-based derivative of Bitcoin.

Bitcoin owners can then use the derivative version of the BTC they own to do things like lend, stake, or yield farm on the Ethereum blockchain.

In 2020, the supply of WBTC jumped from representing 600 BTC to 124,000 BTC.

There is even wrapped Ethereum (WETH).

The ERC-20 token standard (the standard now used in most smart contract transactions) was created after the creation of ETH.

Because of this, many ETH holders want to convert their ETH into an ERC-20 token.

WETH allows ETH holders to do this. And it appears to be very popular.

In September 2020, it was reported that over 5% of ETH had been converted into WETH. And by the end of 2020, over 5.5 million WETH had been created.

Tranche lending is a form of financial innovation that is making its way from the world of traditional finance to the crypto ecosystem.

In the financial world, tranche lending products basically allow lenders to fund more volatile and risky loans by taking a pool of loans and segregating the proceeds to groups of investors based on risk appetite.

The asset exposure is diversified. And the owners of the tranche lending product get to choose their risk exposure.

Lower-risk investors get the aggregated interest first, while investors seeking a higher return are paid with riskier income that may or may not actually be paid.

In the crypto world, protocols like BarnBridge and Saffron Finance are pioneering tranche lending.

BarnBridge's main use case is tranche lending.

This is more important than ever to the crypto world. The inherent volatility of crypto assets makes reliable fixed income nearly impossible to attain unless some kind of tranche lending process is created.

Directly related to the growth of DeFi and DeFi derivative products is the rise of DeFi Insurance.

These insurance contracts are similar to traditional insurance in many ways. But in a truly decentralized fashion, DeFi insurance basically matches DeFi users looking to earn income with those looking to reduce risk.

Nexus Mutual, for instance, is a DeFi insurance platform that allows ETH owners to pool their funds in order to provide insurance for other smart contracts. The purchasers of insurance pay a premium to this pool and receive a payout if the covered risk comes to pass.

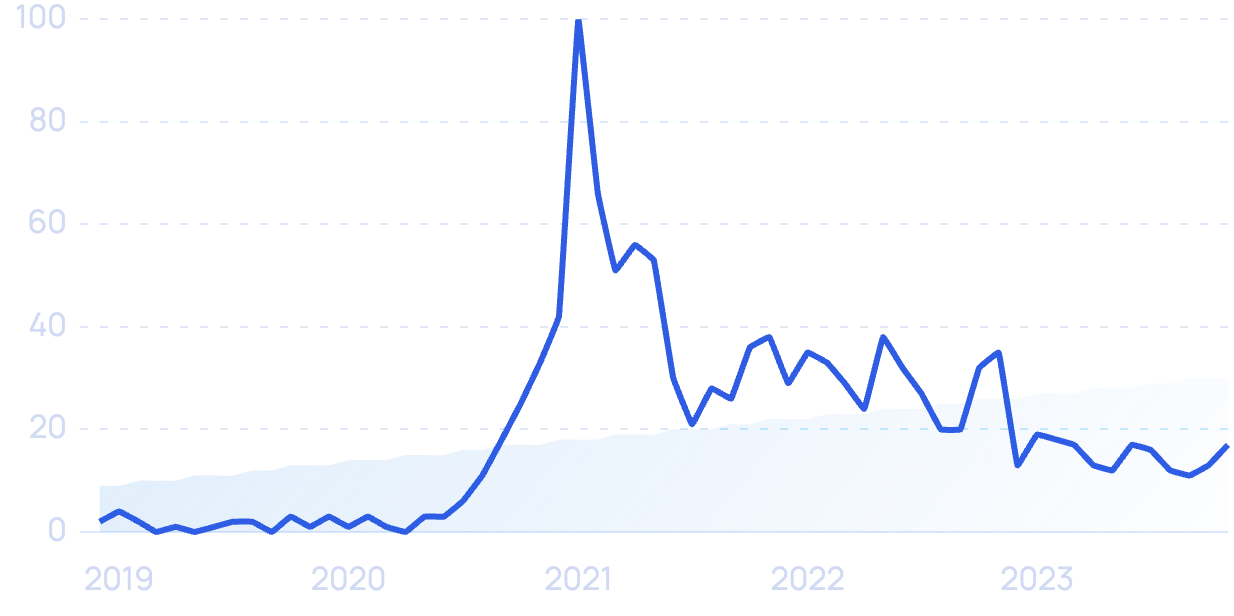

Search interest in "Nexus Mutual" over 10 years.

Nexus Mutual grew from roughly $4 million TVL in July 2020 to around $250 million TVL in February 2021. And doubled in a year to over $500 million in February 2022.

In addition, Bridge Mutual offers an easy way for anyone to generate interest by providing coverage or to protect their assets by purchasing coverage.

Much like Nexus Mutual, Bridge Mutual provides peer-to-peer insurance coverage for stablecoins, crypto exchanges, and smart contracts.

The platform raised $1.6 million in a private offering, which was oversubscribed by $9 million.

As the DeFi industry continues to grow, expect financial products like insurance, derivatives, and tranche or collateralized lending to increase in importance.

2. DeFi Seeks to Monetize Blockchain Gaming

There are well over 3 billion gamers worldwide.

And they spend over $159 billion per year. By 2025, that number is expected to be roughly $256 billion.

With more and more people dedicating hours to this medium of entertainment, both players and creators want to further monetize the industry.

One way that developers are trying to monetize is through blockchain gaming.

Basically, these video games are run on a blockchain, not a central server.

And players “mine” tokens by doing certain tasks in the game.

Popular DeFi protocols will be needed to allow for in-game transferability. And many owners of game-based cryptocurrencies will probably want to earn a return on their assets.

A survey by Toptal showed that 62% of gamers and 82% of developers said they were interested in creating and investing in digital assets that are transferable between games.

Since then, the crypto world has caught up to their desires.

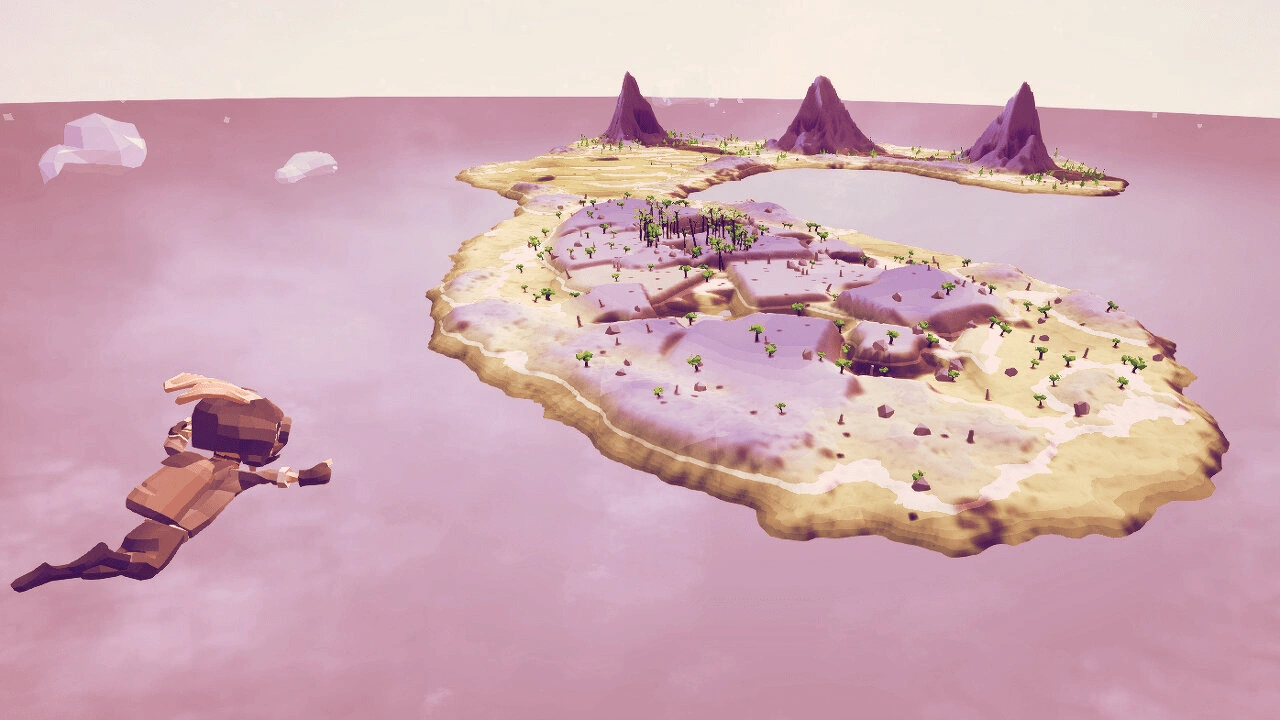

In 2019, Ubisoft created HashCraft, the first blockchain video game.

HashCraft.

And now multiple titles have been released.

In 2020, the crypto gaming platform BitSport announced that it would be creating a way for crypto owners to sponsor professional gamers and stake tournaments.

Basically, through BitSport stablecoin owners can stake their tokens on new tournaments to earn interest.

Or they can back a player and earn a percentage of his or her winnings.

3. Cross-Chain Technology Hopes to Solve Scalability Issues

One of the problems associated with such rapid growth in the DeFi ecosystem is the increasing transaction costs.

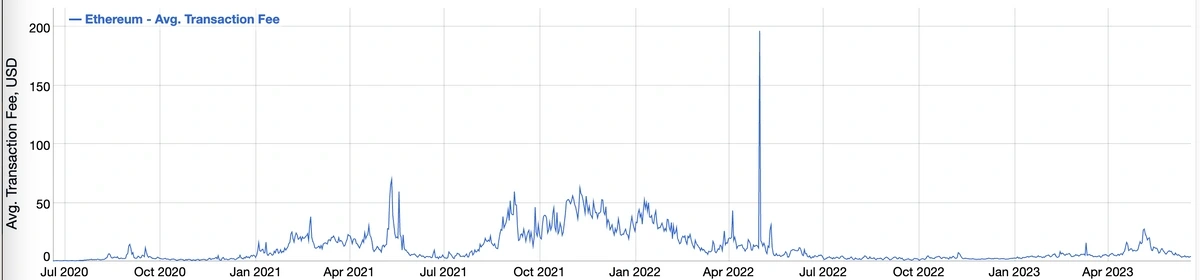

One example of this is the rapidly increasing Ethereum gas fees.

Ethereum gas is basically the price that must be paid to successfully execute a transaction on the Ethereum blockchain.

The price is set based on the supply and demand of computational power needed to process transactions on the network.

The average transaction fee rose sharply at the end of 2020, even reaching over $69 per transaction in May of 2021.

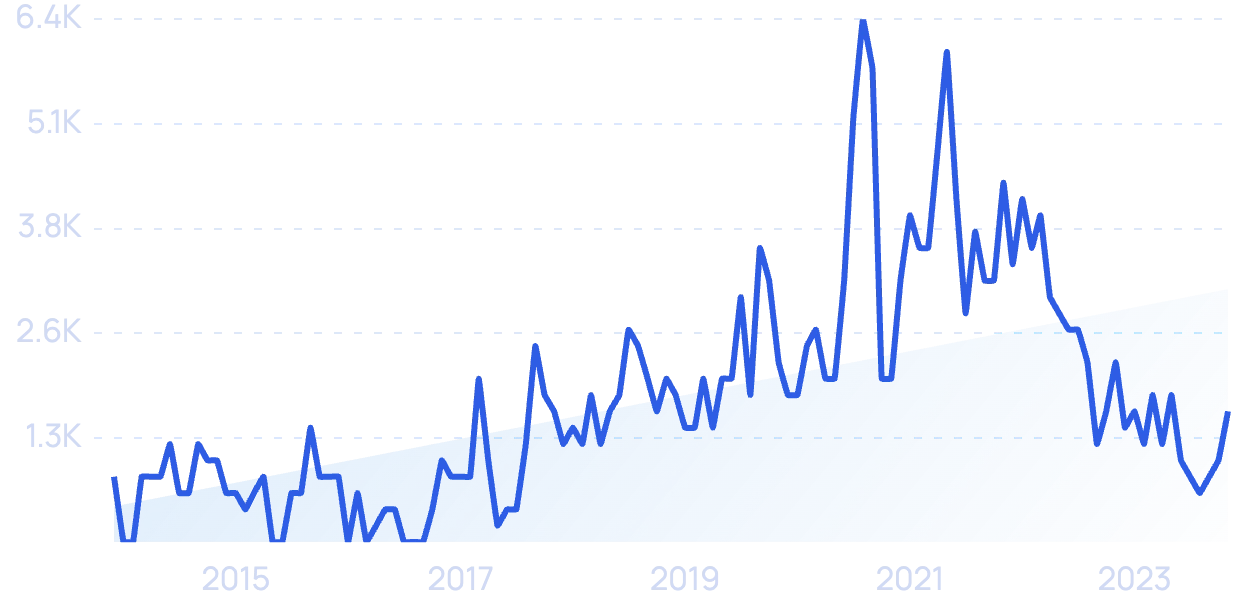

Source: BitInfoCharts

The high gas fees have even been cited as possible reasons for record DeFi liquidations on February 22 and 23, 2021.

In addition to rising transaction costs, the number of new users using DeFi applications on the Ethereum blockchain has made the entire network slower.

To address this issue, many projects in the crypto space are starting to offer cross-chain functionality.

Basically, cross-chain technology hopes to allow transactions and smart contracts to cross over from one chain to the next.

It’s hoped that this interoperability will allow DeFi platforms to scale much easier than they do on the Ethereum network alone.

The most successful innovator in this space has been Polkadot.

Searches for "Polkadot" have grown by 217% in 5 years.

The Polkadot network basically allows for cross-blockchain transfers of tokens, data, and any other assets. It also allows users to create custom blockchains.

And it makes transactions more efficient by spreading them across multiple parallel blockchains.

The price of the Polkadot governance coin (DOT) rose to over $50 at its 2021 peak from under $10 in August 2021.

There have already been a few DeFi applications that have been built on top of Polkadot’s network.

Equilibrium is probably the most popular.

It made the transition to the Polkadot network in 2020. Equilibrium promises to create an interoperable DeFi environment where users can lend, stake, trade assets, and create smart contracts across different blockchains.

And in February of 2021, Equilibrium got one step closer to this goal.

It announced that Curve Finance, the largest crypto-automated market maker (AMM), would be creating an exchange on the Polkadot network.

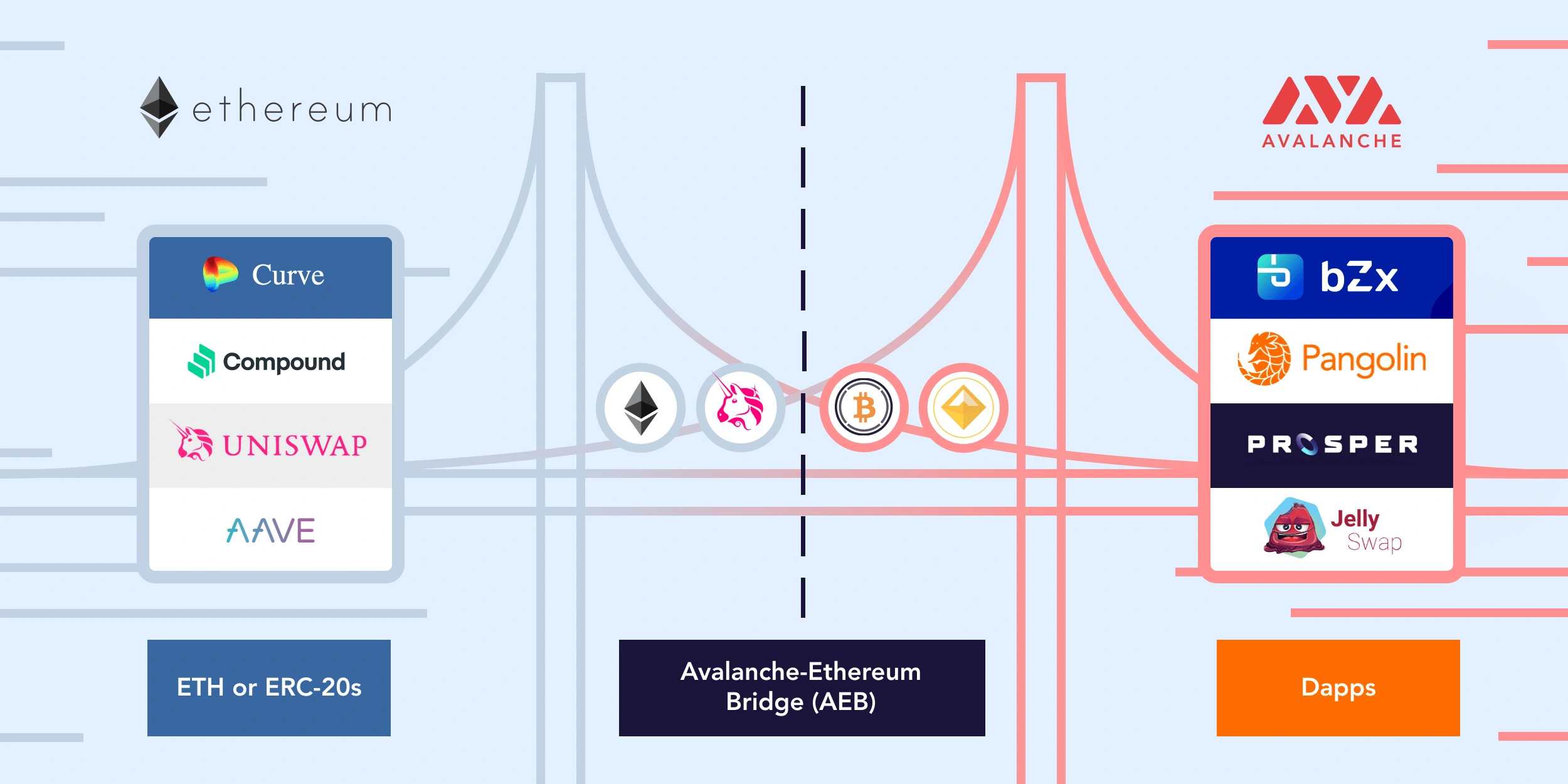

Another network of multiple blockchains, Avalanche, launched its Avalanche-Ethereum Bridge platform in February of 2021.

The platform is basically offering a new DeFi network where transactions will be more efficient and less expensive.

The Avalanche-Ethereum Bridge.

The project hopes to attract its own decentralized applications (Dapps) like Pangolin, a decentralized exchange.

The Poly Network has experienced some success with cross-chain interoperability.

It has teamed up with Binance, the world’s largest crypto exchange, to allow Dapps developed on either the Binance Smart Chain or the Poly Network to be used across both platforms.

(Binance receives 76.7 million visits per month as of May 2025.)

The Poly Network has also been used by the Blockchain Services Network (BSC) to achieve cross-chain interoperability.

The BSC is run by the Chinese government and is being used to create an “internet of blockchains.”

4. DEX’s and AMM’s fuel DeFi Growth

One of the more difficult problems facing the decentralized finance space is balancing decentralization with efficiency.

Centralized cryptocurrency exchanges like Coinbase allow for efficient transactions. But considering that Coinbase is now a public company, they're lacking when it comes to decentralization.

Coinbase is a highly efficient (and popular) exchange. But also highly centralized.

This is where decentralized exchanges (DEXs) come into play.

On DEXs, crypto owners transact with each other directly. There’s no need to go through an intermediary.

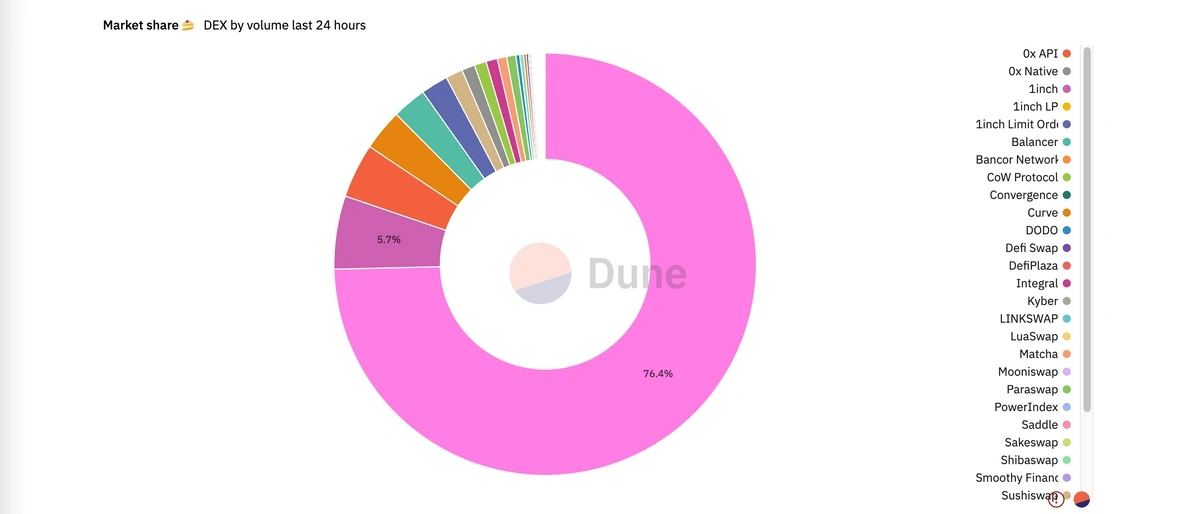

As we’ve covered in our crypto trends post, Uniswap is the largest DEX in this space. Uniswap makes up about 76.4% of all trading volume on DEXs.

Source: defiprime.com

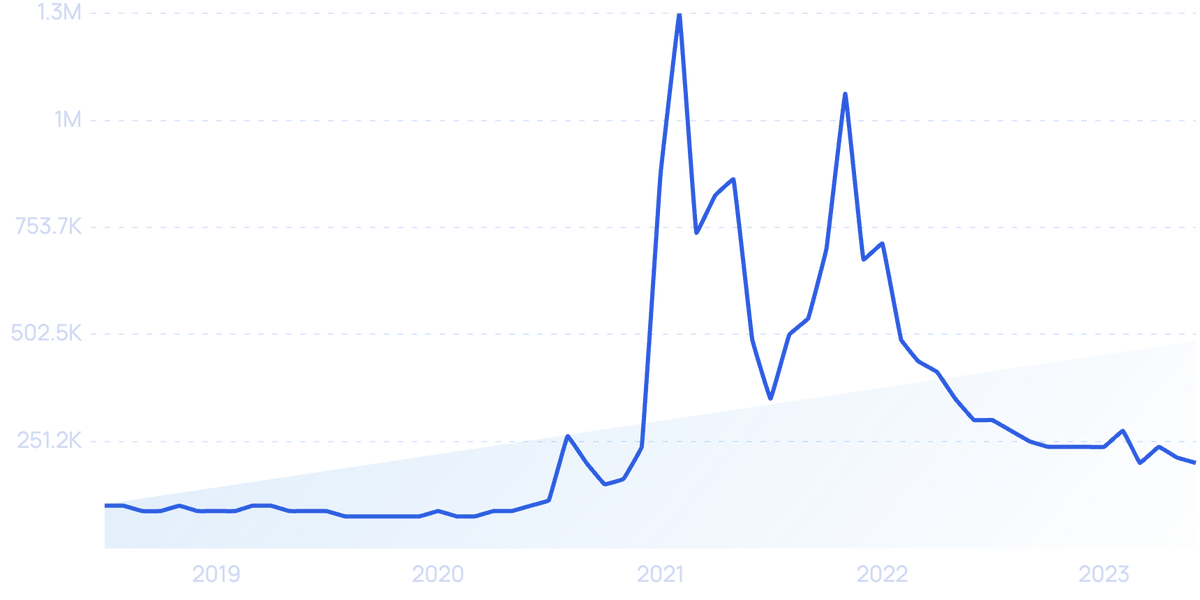

And almost all DEX platforms are experiencing serious growth.

January 2021’s total DEX trading volume was over $60 billion - the highest ever recorded at the time.

In fact, the first two months of 2021 saw more DEX trading volume than all past months combined.

DEX trading volume skyrocketed in early 2021.

As volume has grown, DEXs have had to find ways to make their decentralized exchanges more efficient.

The main way they have accomplished this is through the use of automated market makers (AMMs).

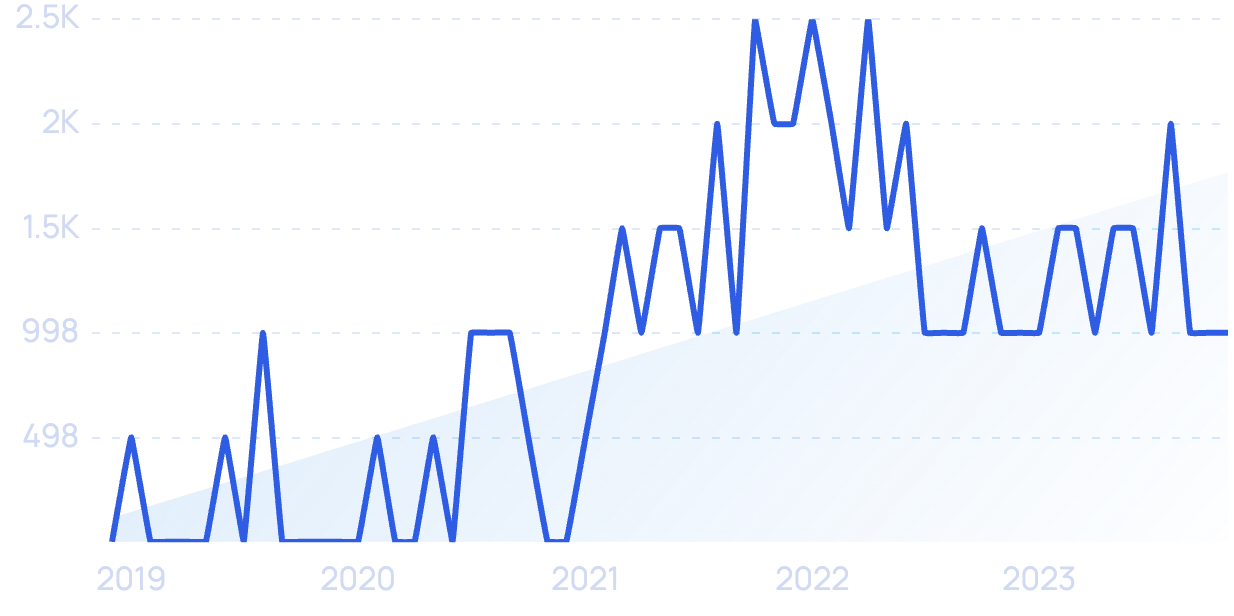

Searches for "Automated Market Maker" have increased by 500% over the last 5 years.

Basically, AMMs are used to provide liquidity on DEXs.

On a traditional exchange, buyers and sellers submit bids and ask prices through an order book. And the exchange clears the trade at the best price.

On a DEX, AMMs provide liquidity pools. Like most of the DeFi ecosystem, this involves staking.

Holders of crypto assets like ETH lend those assets to the liquidity pool in exchange for interest.

The AMM collects transaction fees from the DEX, which are paid by the traders on the exchange.

These fees are then used to pay interest to the true owners of the assets in the liquidity pool.

The AMM determines trading in the pool based on an algorithm.

Some commentators believe that this method of trading has vastly improved DEX liquidity. In fact, Consensys reported in November 2020 that 93% of all DEXs now use AMMs.

Uniswap, as the most successful DEX, is a good example of this. It was the first completely decentralized AMM. And if Uniswap’s size is any indication, the AMM method appears to be working.

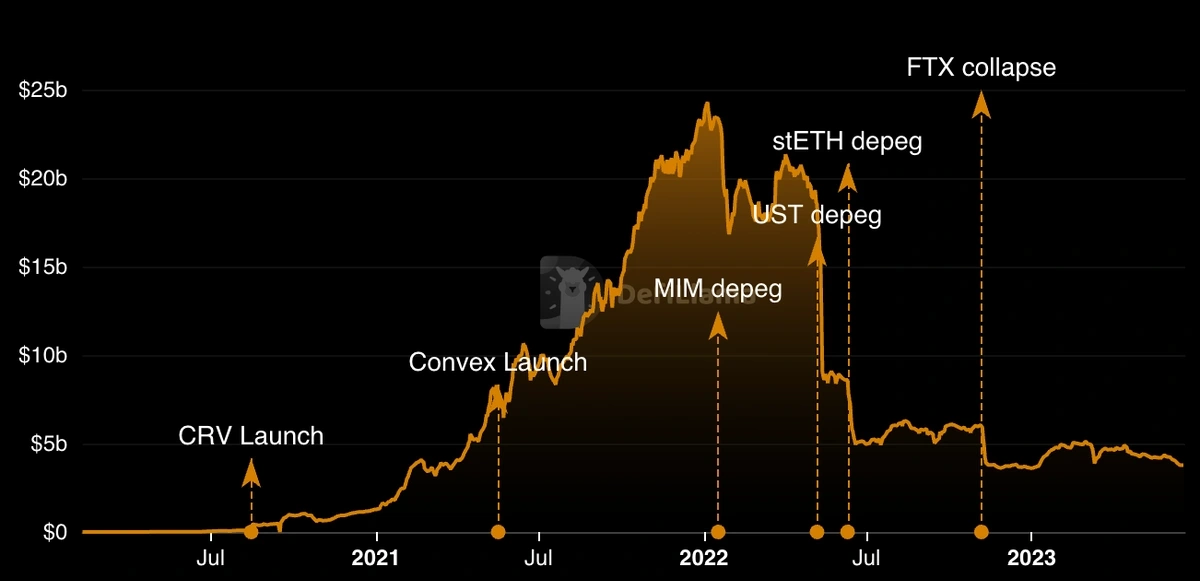

The largest AMM by TVL (basically the amount staked in liquidity pools), however, is Curve Finance.

Curve Finance's retro UI.

Only started in January of 2020, Curve Finance has now seen its total TVL grow to over $3 billion from essentially nothing in little over three years.

Curve is a stablecoin exchange, which may be one reason why crypto asset owners have flocked to the platform. Because of the stability of the assets, stakers may expect to earn a more steady yield.

5. Governance Tokens Become More Important

You may have noticed that all of these growing DeFi platforms also offer their own tokens.

These are known as governance tokens.

Searches for “governance tokens” have increased over 5 years

These tokens are different than typical cryptocurrencies. Their general purpose is to provide the token-holders voting rights with regards to an underlying DeFi protocol.

For instance, a DeFi project like Compound may allow users to do things like yield farm and lend using tokens that are native to another protocol.

Compound, however, has its own token (COMP) as well. And this token governs how the Compound DeFi protocol progresses.

Token holders vote on initiatives, and the value of their tokens generally rises when the DeFi protocol gains more users or increases its TVL.

And if the price is any indication, governance tokens became very popular in 2021.

The collective market cap for the governance tokens of some of the top DeFi platforms (like Curve Finance, Uniswap, Compound, and Yearn Finance) has grown to over $25 billion.

The top three DeFi platforms by TVL have seen their governance tokens experience a massive increase in price since the start of 2021.

The largest, MakerDAO, has seen its token (MKR) rise since the beginning of the 2020.

These tokens are all part of a larger ecosystem, called decentralized autonomous organizations (DAOs).

DAOs are completely decentralized crypto platforms, and governance tokens are central to the system.

Look at Balancer, for example.

It is a decentralized crypto asset exchange (DEX).

However, Balancer also created its own governance token (BAL) that it issues to liquidity providers. The owners of the coin can vote on platform initiatives as well as exchange the token with others.

As the overall platform grows, the token increases in value.

Curve Finance, another DEX, launched its own governance token (CRV) in 2020 as well. Instead of doing some kind of public offering, Curve issued CRV to current liquidity providers on the platform.

Traditional financial institutions are also starting to notice the value of owning governance tokens.

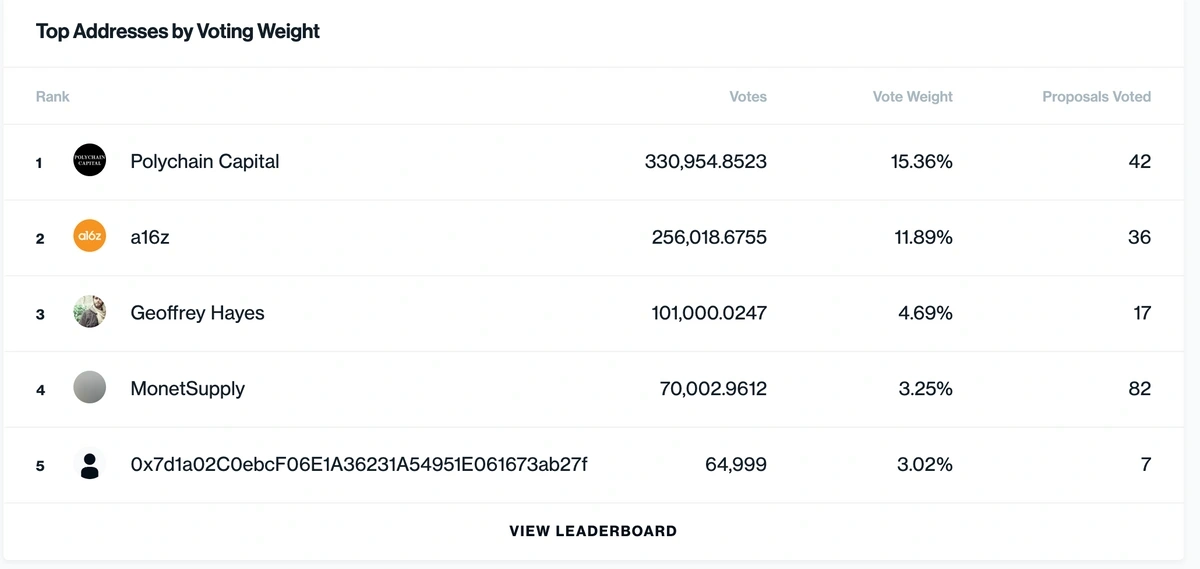

Polychain Capital, Andreeson Horowitz, and Geoffrey Hayes are the three largest holders of Compound’s COMP governance token.

Conclusion

That’s all for the top DeFi trends to watch between 2024 and 2026.

One thing that ties many of these trends together is a focus on increased efficiency. The Ethereum network is sagging under the weight of its popularity. And other technologies (like DOT) are looking to fill in that gap.

Either way, this will be an interesting space to watch.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more