Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

11 Top Publishing Trends (2024)

You may also like:

The publishing industry generates around $28 billion in revenue in the United States every year.

Even though that number has been flat for the past four years, the industry has been experiencing some sizable shifts.

(For example, the emergence of ebooks, audiobooks, and generative AI)

With that, here are the top 11 publishing industry trends happening right now.

1. Growing Demand for Audiobooks and Ebooks

During the last 10 years, demand for print books has waned.

However, demand for ebooks and audiobooks has skyrocketed.

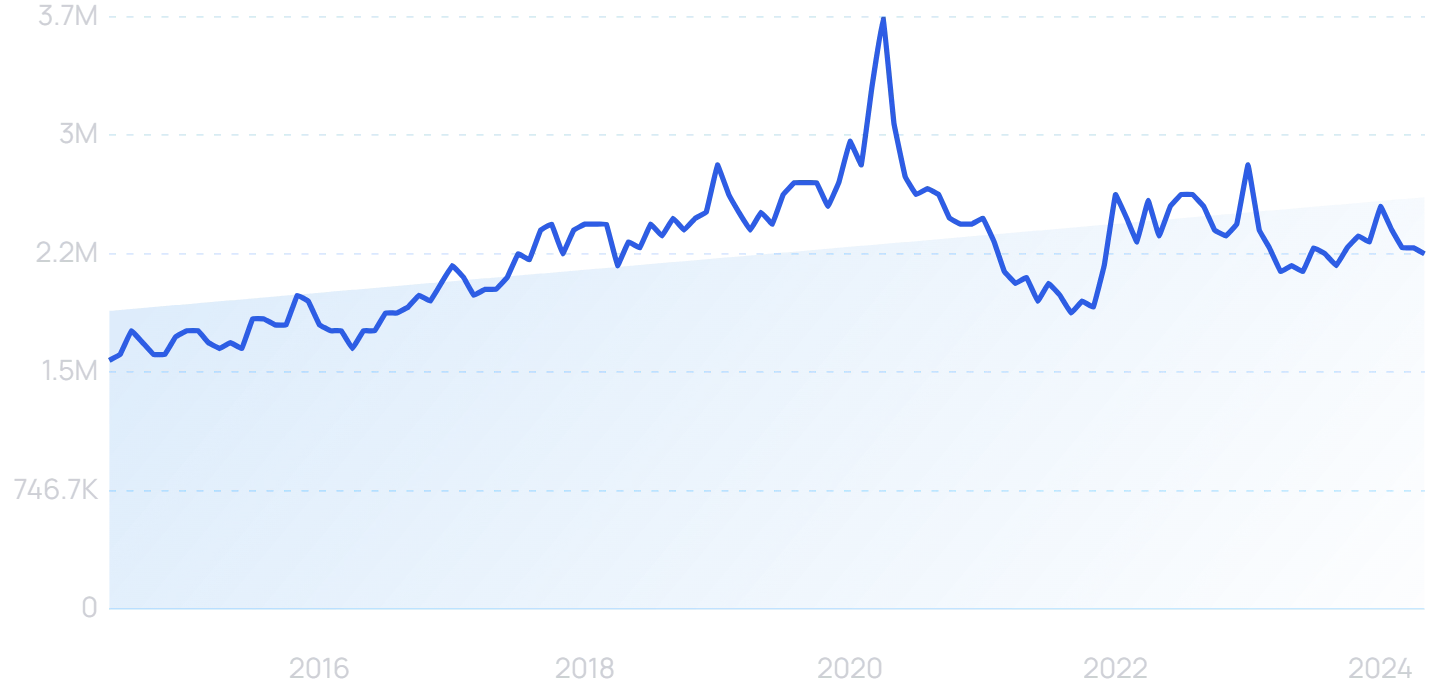

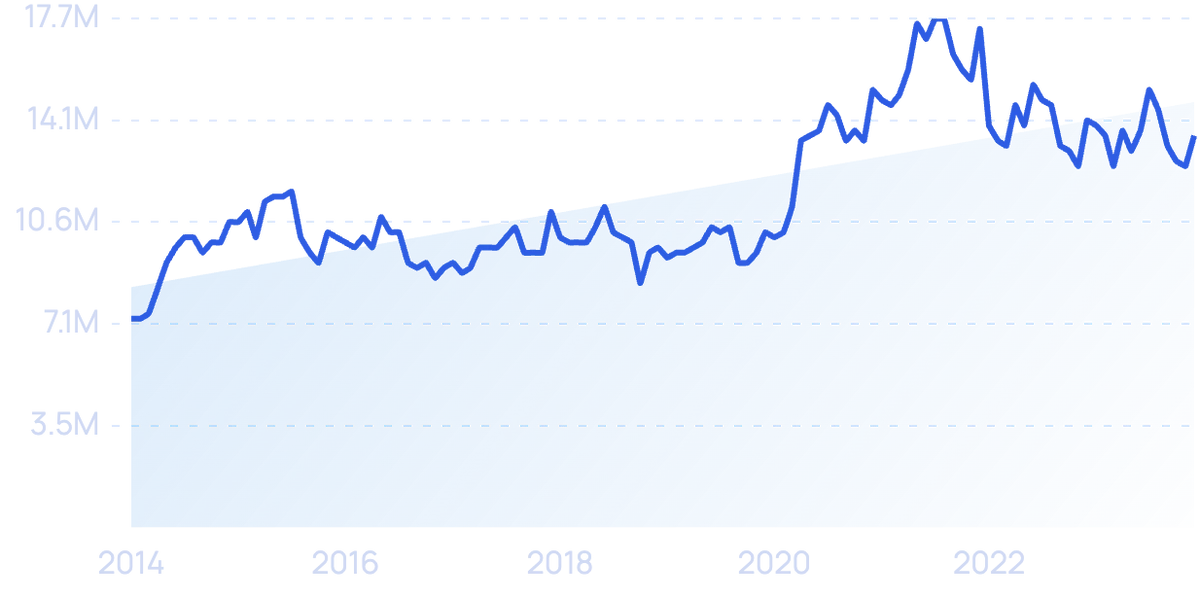

Searches for the audiobook platform “Audible” have risen 47% over the last 10 years.

In fact, 20% of US consumers have listened to an audiobook in the last year.

And a survey out of the UK found that audio book downloads increased 17% last year.

The popularity of audiobooks continue to see steady year-over-year growth.

Industry reports show that sales of audiobooks have seen continuous growth for over a decade.

Interestingly, ebook sales are actually outperforming audiobooks.

Ebook sales total more than $956 million in revenue.

(Driven mostly by Amazon's Kindle.)

For many independent authors, the ebook and audiobook trend is an untapped opportunity.

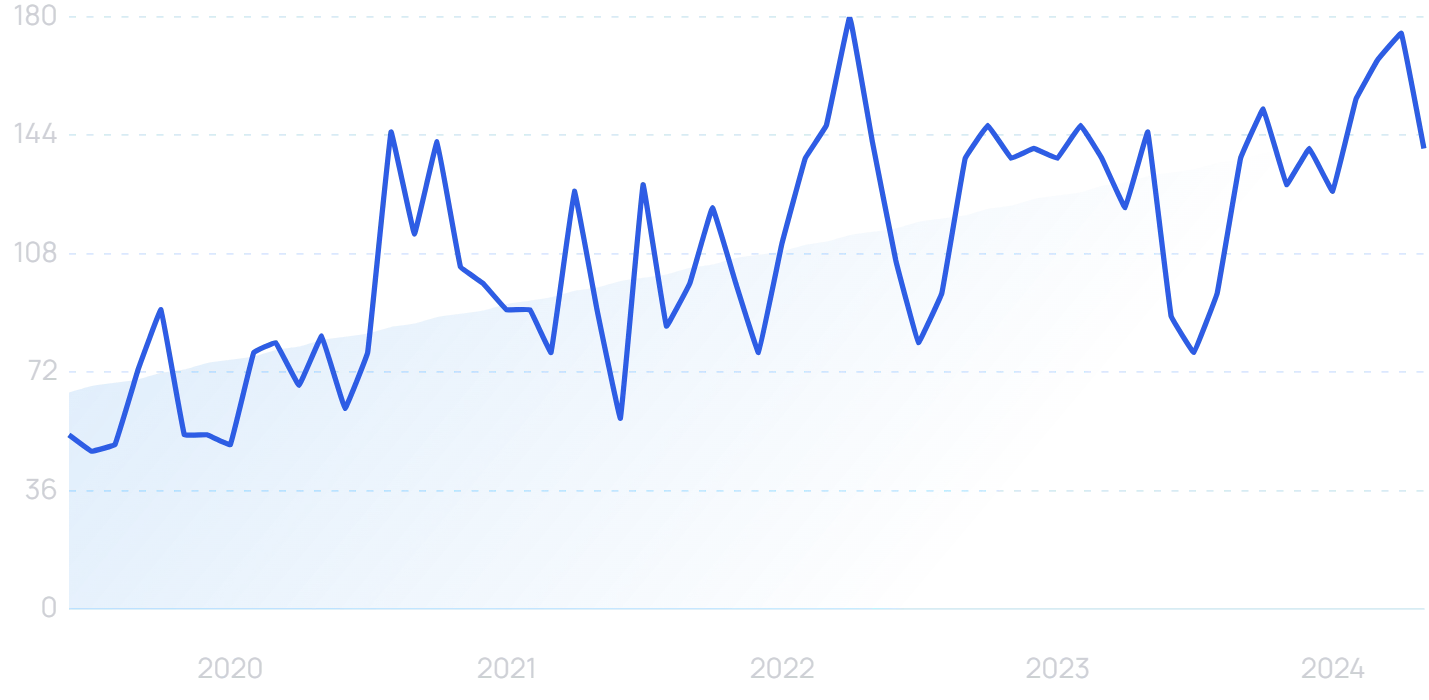

Searches for the keyword “independent author” is up 165% over the last 5 years.

But, with tech developments in the publishing space, it’s getting easier to create and launch digital books.

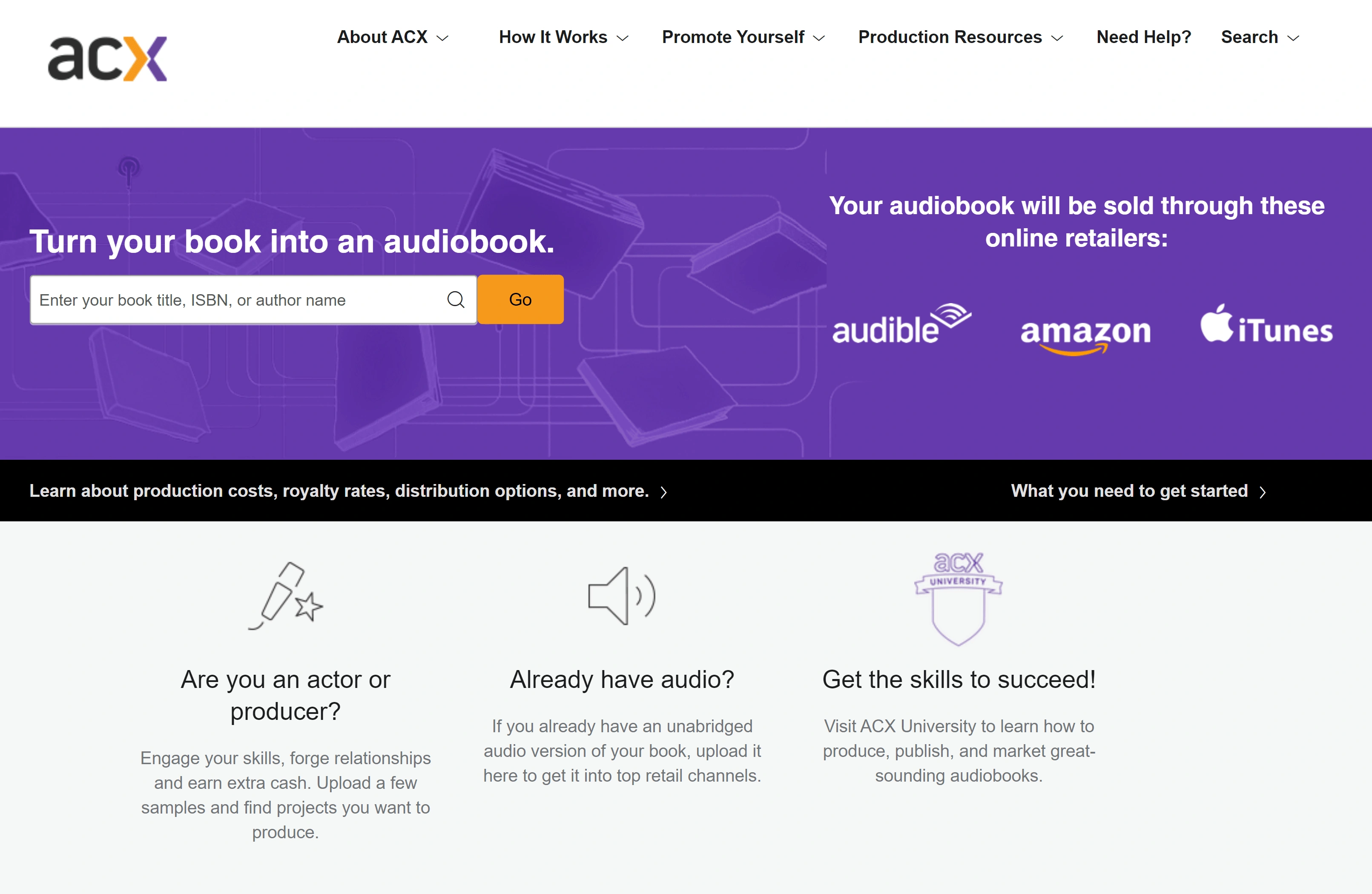

Amazon’s subsidiary ACX will package an author’s audio file and list it on Amazon, Audible, and Apple iBooks.

Self-publishing tool ACX essentially transforms a single book into multiple formats.

Aside from Amazon (which controls nearly 50% of the ebook market and hosts 200,000 audiobooks on Audible) many consumers now get their digital media from public libraries.

Three years ago, the numbers reached record highs: 326 million pieces of digital content were downloaded — that was a 20% increase.

In 2022, ebook checkouts from libraries soared even higher.

An Internet technology company (and TikTok owner) ByteDance sees the future profit available in the digital publishing industry.

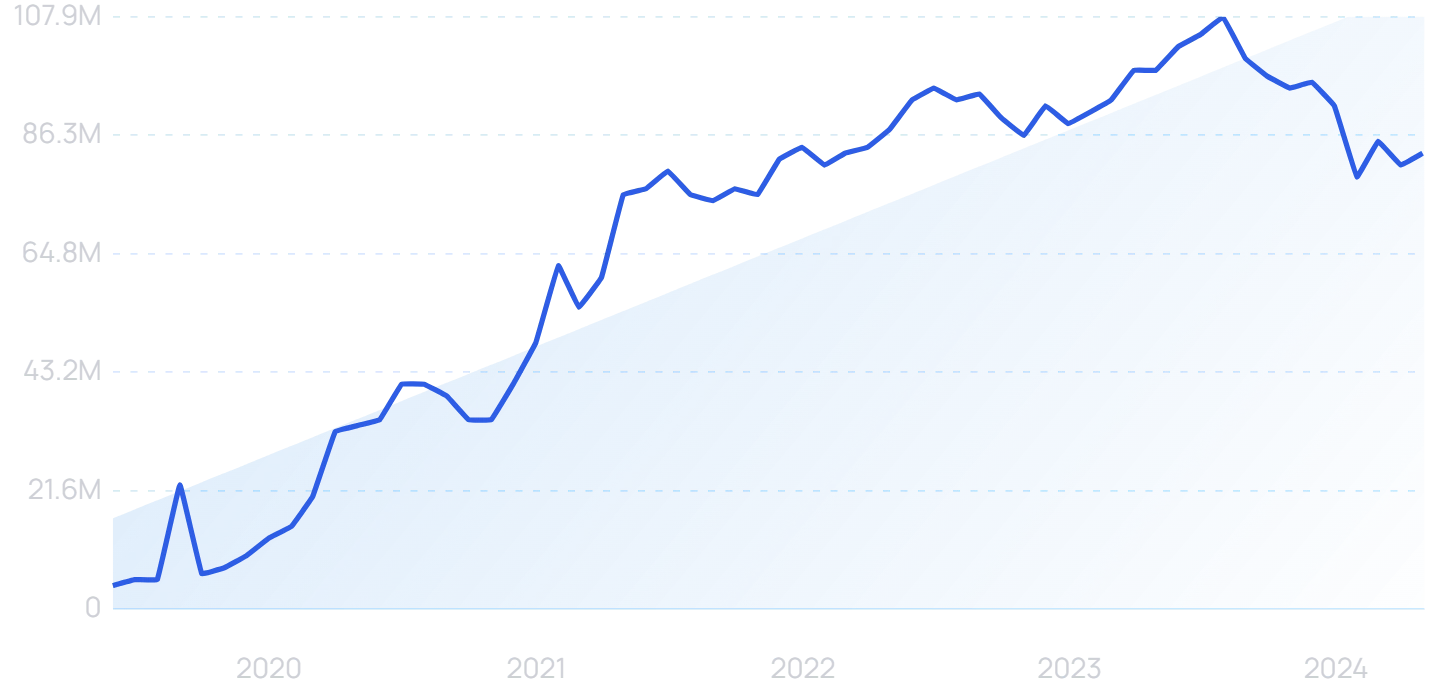

Searches for “TikTok” have seen a 1,900% rise over the last 5 years.

They’ve launched a reading app with AI narrators.

ByteDance's new reading app.

And ByteDance invested $170 million in Zhangyue, one of China’s largest ebook publishers.

2. More Book Summary Platforms Emerge

We’re seeing a growing number of platforms and services designed to summarize nonfiction book content.

Blinkist, a Berlin-based startup with 23 million users, is one of the leaders in this growing space.

Blinkist summarizes books into audio and text summaries that they call “blinks”.

And the startup has raised $34.8 million in VC funding to date.

3. Political Books Remain Popular

In recent years, books in the political genre have been immensely popular.

And, being an election year, this trend is set to continue through 2024.

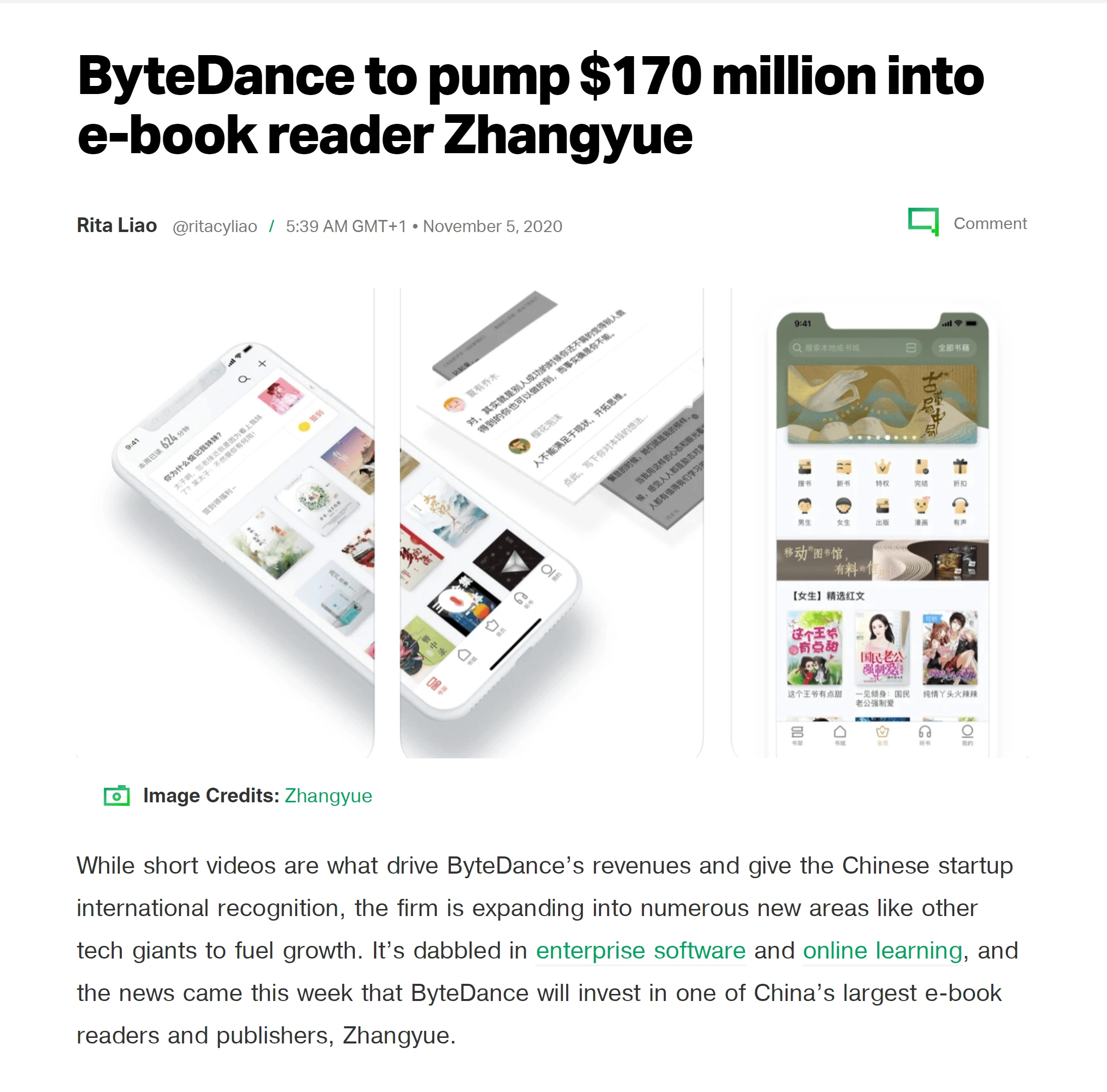

Former President Barack Obama’s third book, A Promised Land, sold 3.3 million copies in the United States in its first month of publication.

President Obama's third book was a bestseller.

Publishing experts expect sales of the book to continue to rise, surpassing the sales of other recent presidential memoirs like Bill Clinton’s My Life and George W. Bush’s Decision Points.

Both of those books sold between 3.5 and 4 million copies in total.

Of course, books about Donald Trump are also insanely popular.

For example, "Fire and Fury: Inside the Trump White House" sold more than 1.7 million copies within weeks of release.

Dozens of books about President Joe Biden were released in the last 3 years, too.

Prior books written by Biden have been popular with consumers.

For example, Promise Me, Dad, was a New York Times bestseller and sold more than 300,000 copies.

Biden also earned $1.8 million from the 30-stop book tour.

4. Small Bookstores Continue to Dwindle

The plight of the small bookstore continues into 2024.

And the overall future for small bookstores looks to be bleak.

Although independent bookstores recently rallied, reporting 49% growth from 2009 to 2018, COVID was be a hurdle many of them simply cannot clear.

Nearly 60 small bookstores closed for good in 2020.

Like many industries, mom-and-pop bookstores simply cannot create the kind of revenue they did before lockdowns went into place.

Publisher’s Weekly reports that bookstore sales continued to fall in 2023.

That’s a drop of more than $2 billion.

Local bookstores, like many small businesses, depend on holiday sales to get them to year-end in the black.

Some bookstores earn up to one-third of their entire annual revenue during the final months of the year.

Many small bookstores say their holiday season has been a bright spot in an otherwise tumultuous year.

With in-store occupancy limits, online sales have become a lifeline for many of these bookstores.

And eCommerce is challenging for bookstore owners who have never sold online and don’t have the logistical power to make it happen.

But bookshop.org is stepping in to simplify things.

Homepage of bookshop.org.

Small bookstores can become affiliates of bookshop.org.

That means that they can create a link to the Bookshop store and they’ll get 30% of the profit from the sales of people using that link.

Bookshop takes care of all the logistics — inventory, packing, shipping, and returns.

This type of profit is similar to what bookstores would make on an in-store purchase.

Local communities are also doing their part to save the small bookstores they love so much.

On GoFundMe, City Lights Bookstore in San Francisco has raised more than $511k, and Seminary Co-op Bookstores in Chicago has raised more than $246k.

5. Libraries At Odds with Publishers

As demand grows for digital media, libraries, and publishers are locked in a duel.

Libraries advocate for the free flow of information.

But many publishing companies are worried about library checkouts cutting into their revenue.

This fight has been brewing for years.

And has only been heightened by the pandemic.

In previous years, book publishers have put limits on how libraries could offer their ebooks to patrons.

Often, they would allow libraries a certain lifetime for an ebook — for example, 2 years or 52 checkouts per ebook license.

But libraries have been paying an average of $45 per ebook, which is nearly 3.5 times more than the consumer price.

Since Macmillan reports that 45% of their ebook reads are coming through libraries, they reportedly wanted to use this policy to see if they could push more sales.

The policy did not last long, though.

Libraries protested and the publisher reversed course when COVID hit.

Macmillan was forced to reverse a policy limiting library access to their ebook titles.

Libraries are concerned with Amazon’s ebook regulations, too.

The internet giant does not allow libraries to purchase any ebooks published under their imprints.

However, they have recently started negotiating a plan for library distribution with the Digital Public Library of America.

The disagreements between the publishers and libraries still remain.

6. Tech Becomes a Competitive Advantage

Technology is going to be a key driver of change in the book publishing industry in 2024 and beyond.

One unexpected way is that publishers are on the brink of using artificial intelligence to write books.

Many online publishers are already using AI to write articles.

Searches for "AI writing" have increased by 9,100% in 5 years.

But as of now, AI struggles to write compelling fiction.

As the USC Annenberg Relevance Report put it, “AI is not ready to write a best-seller yet, [but] it is a powerful tool that can improve stories and increase audience engagement”.

So far, it’s easy for many to tell that a fiction book was written by a non-human.

But, taking into consideration that LLMs (like ChatGPT) have made huge gains in the past few years.

And it may not be long before we see AI write fiction that's much less robotic.

Book publishers have other uses for AI, too.

They are utilizing the technology for content classification, acquisitions, plagiarism checks, and book marketing.

The opportunities associated with digital marketing and promotion in the publishing world are seemingly endless.

First chapters are being read on live social media feeds, virtual literary events are drawing crowds of more than 500k people, and publishers are tracking consumer behavior and data like never before.

“Bookstagrammer” is a real thing on Instagram with more than 15 million posts under the hashtag.

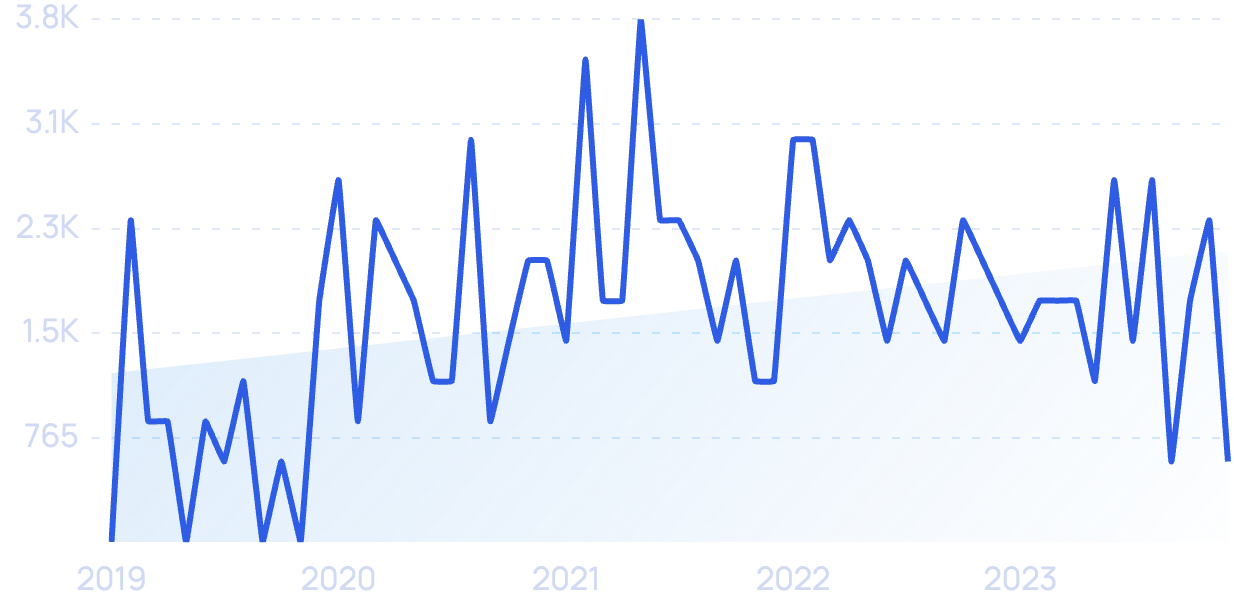

Searches for “Bookstagrammer” in 10 years.

“Booktubers” have created an online community via YouTube and even attracted the attention of Michelle Obama as she marketed her memoir, Becoming.

7. Self-publishing numbers keep climbing

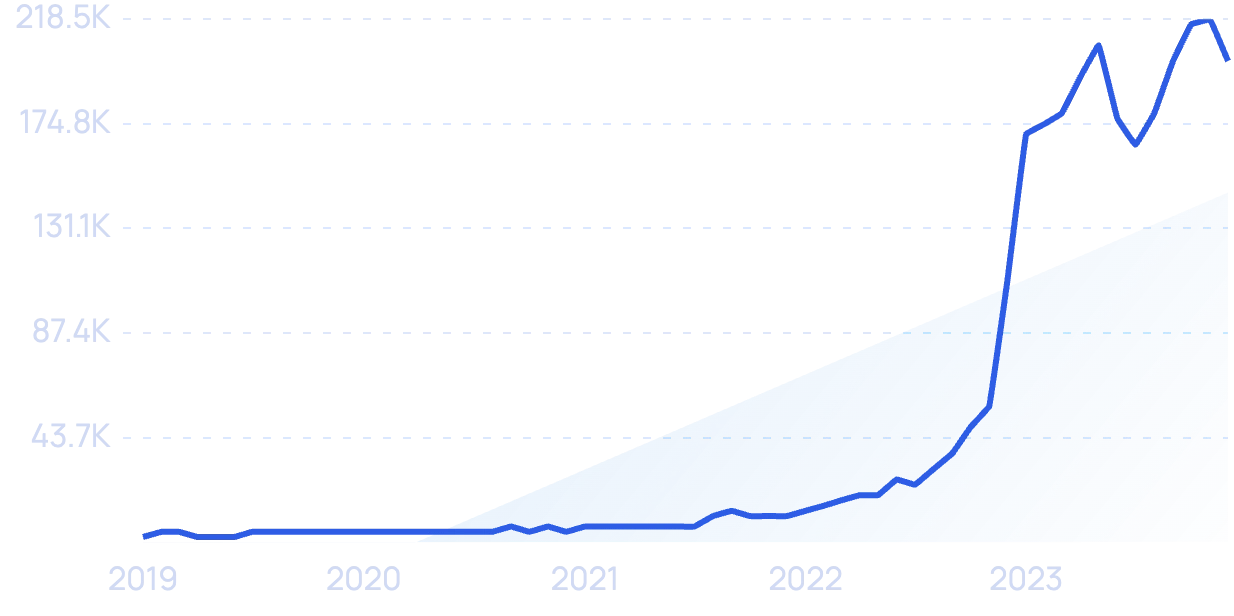

Self-publishing books have been on the rise since 2010.

In that year, there were approximately 153k ISBNs assigned to self-published books. By 2018, that number had climbed to more than 1.6 million books.

Smashwords, the distributor that accounts for nearly half of all self-published e-books, reported a 5.3% increase in authors served and a 5.7% increase in books published last year alone.

Authors, especially new authors, are lured by self-publishing because they get to do exactly what they want with their book.

Instead of a publishing house picking the cover design, managing the editing, and setting the price, the author takes charge.

In recent years, authors who’ve already successfully published with a traditional publishing house have also turned to self-publishing.

Horror author Adam Nevill had already written 19 novels when he self-published his first book in 2019.

His reason? Better pay and more control over the packaging and marketing of the books. His self-published book has even out-sold some of his other novels.

Wattpad is another popular self-publishing avenue. But the premise is a bit different than the usual self-publish process.

"Wattpad" had a surge in 2021 and searches remain relatively high in 2024 (up 88% in 10 years).

Launched in 2006, the website and app are built around a social community of storytelling.

Authors post their stories. Then users read the stories they like and provide feedback.

Most of the stories on Wattpad are free. But they do have a “paid stories” platform, too.

A few of the most popular stories on the site have been turned into printed books through Wattpad Books and movies through Wattpad Studios.

For some authors, Wattpad is a launching pad for working with other publishers.

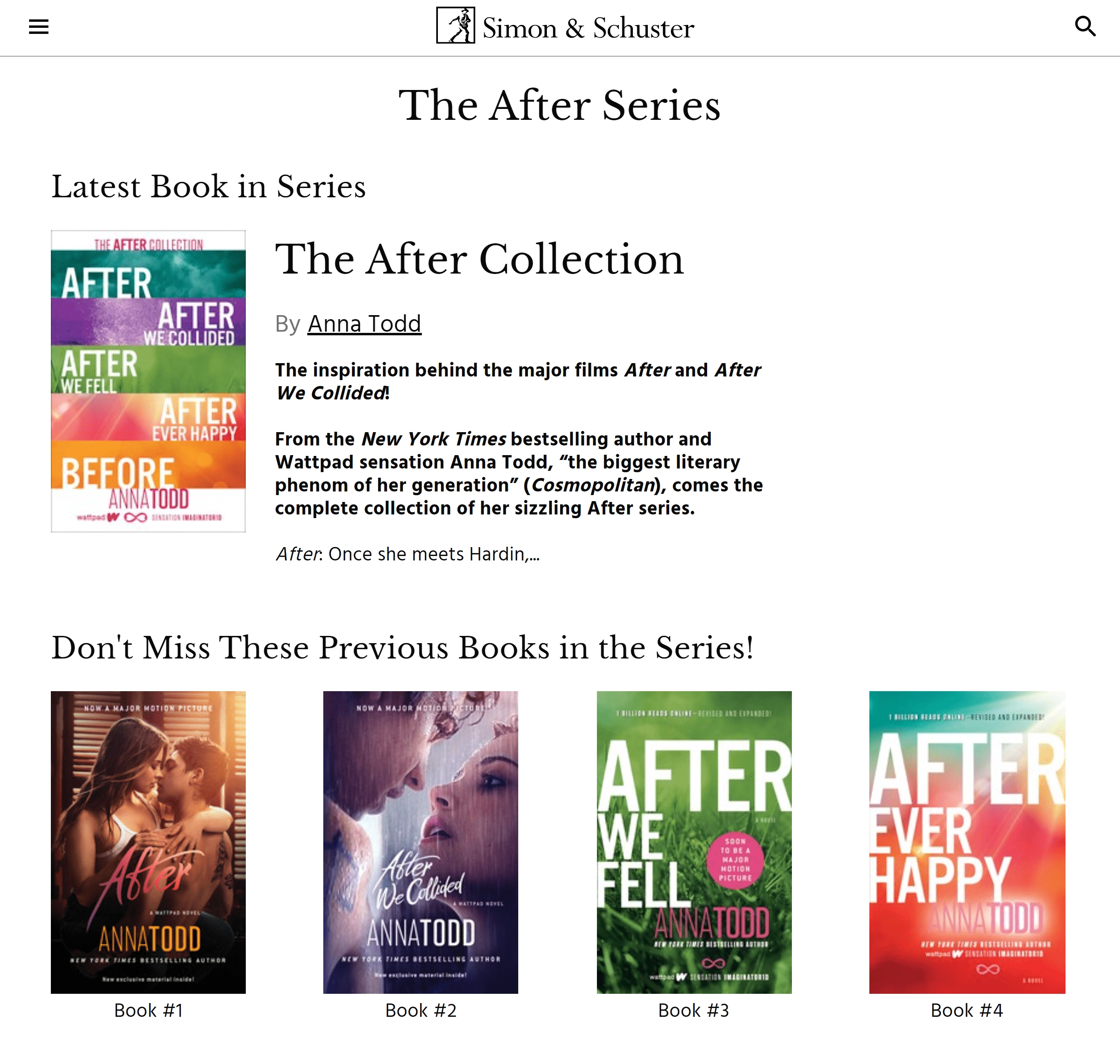

For example, the After series was originally published by author Anna Todd on Wattpad.

After is a book series that was originally self-published.

Her story was noticed by Simon & Schuster, and she’s printed five books through the publisher.

Wattpad was acquired by a South Korean company for more than $600 million.

Before this deal came about, it was reported that other internet giants like Facebook, TikTok, and Netflix were interested in Wattpad.

8. Publishing giants consolidate

In the early 2000s, the publishing industry was dominated by the “big six”.

Hachette, Macmillan, Penguin, HarperCollins, Random House, and Simon & Schuster were the only major players.

These “big six” accounted for 50% of all books sold in the US in 2012.

In 2013, Random House and Penguin merged, leaving the industry in the hands of the “big five”.

Stats show that these five publishers accounted for 80% of all books sold in 2021.

In 2021, Penguin Random House (PRH) announced that it would buy Simon & Schuster for more than $2 billion.

Penguin’s purchase of Simon & Schuster helped consolidate the remaining publishing industry giants.

This means there will only be four major players in the industry, further concentrating publishing power in the hands of a few companies.

Before this merger, Penguin Random House was already the biggest publisher in the US.

Now that the two houses are together, that’s one publisher putting out 34% of the books sold each year.

The Authors Guild is sharply critical of the merger.

They predict that this imbalance in the publishing industry will reduce competition for manuscripts, drive down financial advances, and make it difficult for authors to negotiate contracts.

In late 2020, The Authors Guild released a statement advocating against the merger of Simon & Schuster and Penguin Random House.

Other publishers have also spoken out against the deal.

A HarperCollins spokesperson said that the merged company of PRH and Simon & Schuster would control 70% of the US literary and general fiction market.

Groups in Canada, the UK, and the US are urging government authorities to put a stop to the merger. So far, the merger has cleared all of these hurdles.

9. Independent publishers make gains

As many in the industry view the top publishing houses as turning into behemoths that seek to control the entire book market, indie publishers are seeing a surge.

These smaller publishers are in direct contrast to the big-money operations of the top four publishing houses.

As one author put it “small publishers now provide a far wider variety of literature, politics, history, and journalism, of art-making and truth-to-power-speaking, of actual risk-taking — and from a far more diverse group of authors — than the commercial conglomerate publishers”.

Independent publishers often take risks on books in unusual genres and unknown authors.

Some of their print runs are only 1,000 copies.

Despite the small scale, these indie publishers still find success.

Mango Publishing is a small indie publisher that has seen company revenue growth in recent years.

In 2017, they published 68 titles. In 2019, that number was up to 130 and sales were up 162%.

Mango Publishing prides itself on publishing books from distinct and diverse voices in our culture.

The publisher has only been in business for six years but has made multiple appearances on Publisher Weekly’s fastest-growing small publisher list.

10. Increased calls for diversity

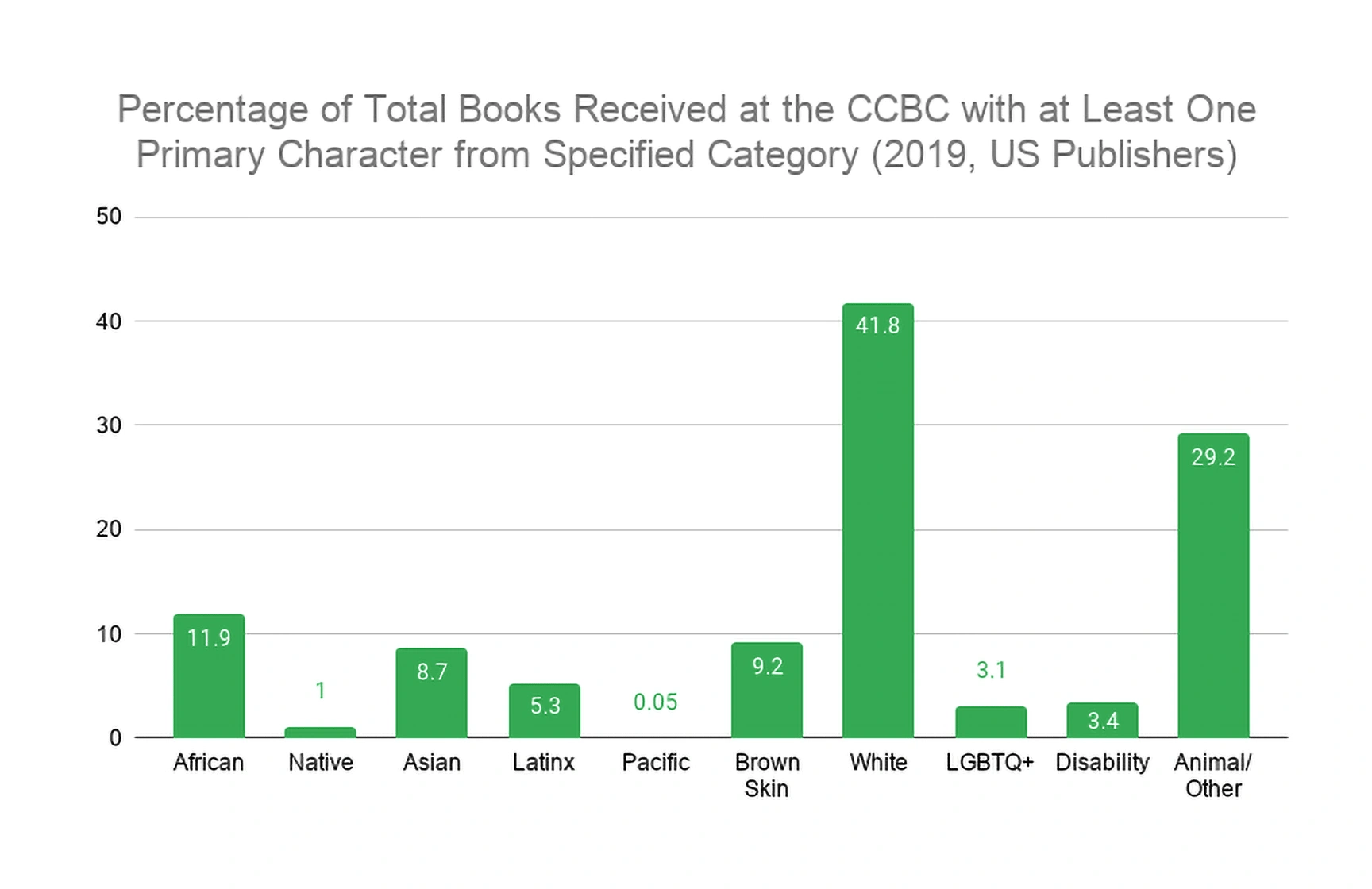

When the Cooperative Children's Book Center (CCBC) analyzed the children’s and YA books they received and reported the diversity statistics of those books.

Out of the 3,700 books they analyzed, nearly 42% had at least one caucasian primary character.

In contrast, 36% of books had a primary character from another race.

Interestingly, 29% had an animal or other type of primary character.

CCBC found that whites and animals starred as the main characters in books far more often than African Americans and brown-skinned people.

Another organization, Diverse BookFinder, has analyzed more than 3,000 children’s books since 2002.

They report that only 29% of books feature a black character and that these books are frequently about oppression and resilience, or they are biographies.

In addition, recent surveys have shown a lack of diversity among those working in the publishing industry.

Lee & Low Books reports that 76% are white and 74% are women.

These stats from 2019 are incredibly similar to the results from their 2015 survey.

The results of Lee & Low Books’ diversity survey found there isn’t really much diversity at all in publishing.

Stats like these have led many in the industry to call for more diversity — in authors, in characters, and in publishing executives.

Many on social media are using #weneeddiversebooks to call attention to the issue.

The hashtag has more than 280,000 posts on Instagram.

On Twitter, authors used the hashtag to share the value of their book advances. It became clear that white authors had more lucrative deals when compared to black authors.

After the hashtag went viral, The New York Times went on to analyze more than 7k books.

They found that 95% of the books were written by white authors.

One way publishing houses have responded to the criticism is by hiring editors specifically focused on acquiring books by Latinx and BIPOC (black, indigenous, and people of color).

The trend of “BIPOC books” popped up in 2020 (700% increase over 5 years).

Some publishers have also created inclusivity plans and donated to anti-racism organizations.

The push for diversity could usher in a new era of publishing or it could fizzle out.

As an author, Dr. Anamik Saha said, “It is too early to say whether this will be a short-lived commercial trend, or whether the profound reckoning with racism that #BLM has provoked is going to lead to radical change. Either way, the publishing industry has to learn that there is more than one audience out there”.

11. Authors go all-in with digital marketing

Authors and publishers want to build long-term, ongoing relationships with their readers.

Customers who are engaged like this are more likely to buy books in the future.

To that end, email marketing is one of the most popular ways to sell books in 2024.

One publishing expert says that email is 100x more effective than social media when it comes to book sales.

Some authors give away free stories to the readers on their email lists.

Some even monetize email subscriptions by offering premium content.

Author Seth Godin has written more than 20 best-selling books. He uses a daily email to market and engage his audience.

Plus, the content of his email is posted every day on his blog — it has more than 7,000 entries.

Even though email is a successful marketing trend that looks to be sticking around for the future, authors are also experimenting with promoting their books on social media.

Posting on TikTok, a relatively new platform has emerged as a genuine marketing strategy for many authors.

The popular #BookTok has over 200 billion video views.

The beauty of #BookTok is that the marketing content is user-generated.

Instead of the authors talking about their own books, it’s actual readers recommending books, giving summaries, or crying after the emotional ending of a book.

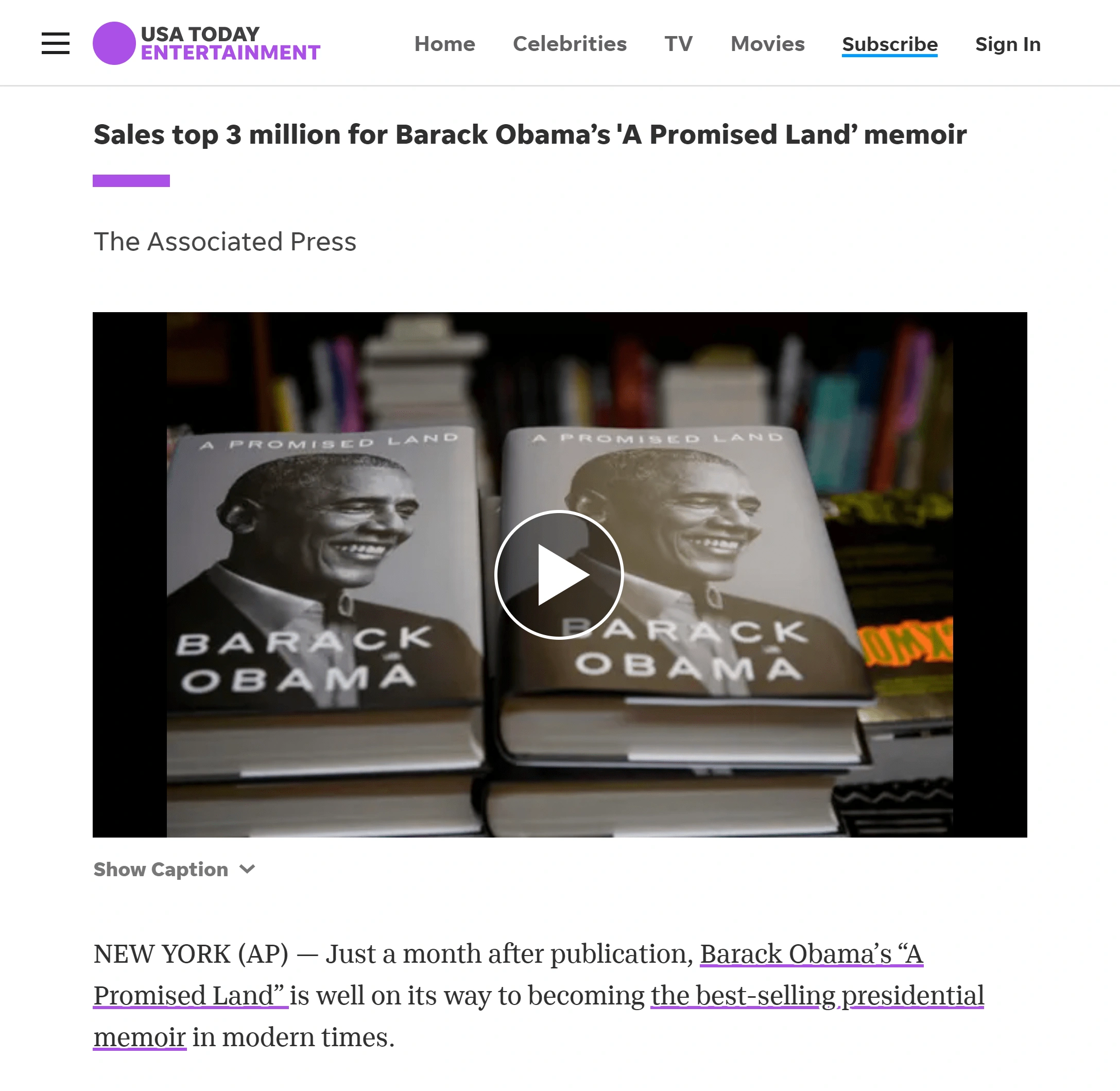

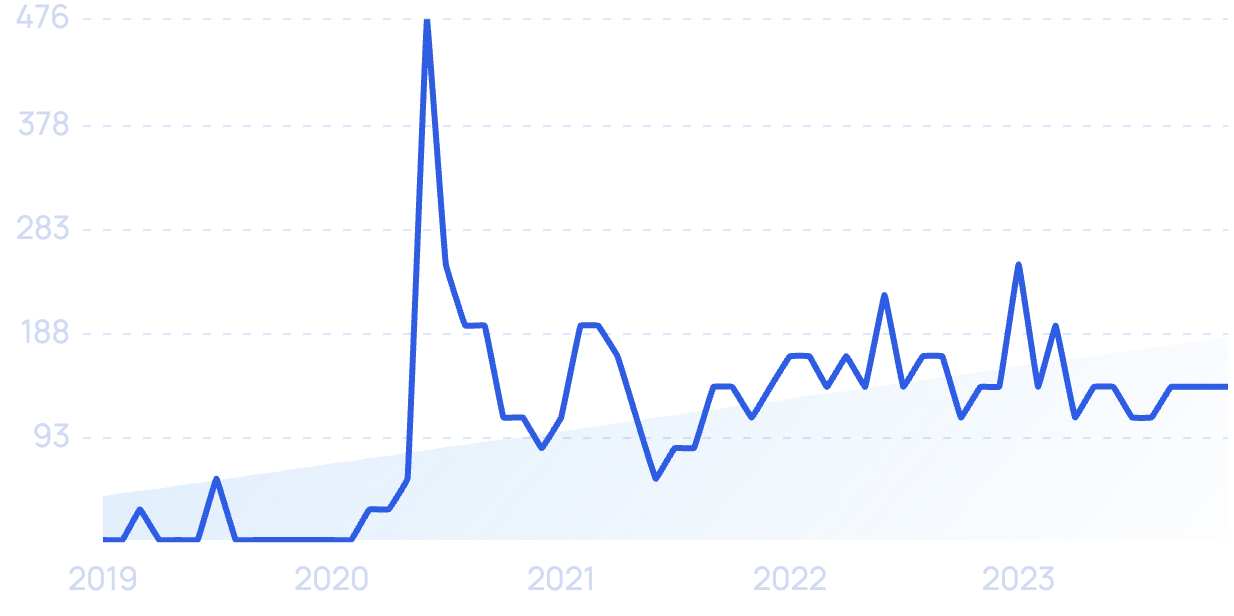

Searches for "BookTok" took off in 2021, up 99x+ in the last 5 years.

The trend is so big that a TikTok video focused on a 2014 book, We Were Liars, was viewed 5.5 million times.

The book even returned to the best-seller list in the summer of 2020.

The head of marketing at Random House Children’s Books says he works with nearly 100 TikTok users to market books.

Hosting virtual author events, which became popular during the pandemic, is another new marketing trend that’s seeing success.

Even though the pandemic is over, the accessibility, low cost, and success of these events have kept them around in 2024.

Conclusion

Publishing is an industry that has always needed to adapt to changing conditions.

However, the last few years have likely seen the fastest (and most disruptive) changes to date.

Including a number of new threats (podcasts) and opportunities (audiobooks).

Either way, it will be fascinating to see how these publishing industry trends play out over the next few years.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more