Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Retail Market Research: The Ultimate Guide (2024)

When it comes to retail market research, more data doesn’t mean better decisions.

In fact, excess data can muddle important signals and lead to poor investment decisions.

So to simplify the market research process and make it easy to identify only the important data you need, we'll walk you through a step-by-step guide to market research for retail.

You'll learn which key metrics you need to track, how to find those metrics, and tools you can use to extract the data.

What is Market Research for Retail?

Retail market research is the process of analyzing a retail product or market's potential for future investment opportunities. Market research in a retail setting often aids in launching a new product, expanding your existing products to a new demographic, or improving a company's marketing efforts.

From a tactical standpoint, market research typically involves assessing both quantitative metrics like consumer spend, foot traffic, keyword search volume, and competitor growth rates, as well as qualitative metrics like consumer pain points mentioned in reviews.

Why Is Market Research Important For Retailers?

Here are just a few reasons why market research is especially important for retail businesses.

Identify New Investment Opportunities

Most failed product launches are unsuccessful for one of the following reasons:

- There wasn't enough demand for the product

- The product wasn't profitable

- The competition was too stiff

The good news is that a solid market research process can help you identify all three of these fatal issues and reduce launch risk. In fact, the step-by-step process we'll detail below shows you exactly how to safeguard against these three common challenges.

Set Attainable Goals and Accurate Projections

Market research is a great way to help you set realistic goals and make more accurate projections.

Keep a Pulse on Competitor and Industry Trends

If you don't stay at the forefront of industry trends, your competitors will pounce on new opportunities and quickly take your market share.

So even if you aren't planning to launch a new product or expand to a new demographic, market research is critical to stay up to date with consumer trends and your competitor's movements.

For example, if your competitors are targeting a new demographic or marketing on a new platform, you can quickly jump on that opportunity to stay ahead of the game.

Improve Marketing Messaging and Customer Relationships

Market research also helps you stay up-to-date with consumer behavior so that you can shift your product, messaging, and customer service to better serve them.

For example, if you notice your target market discussing a particular pain point regarding a product category you offer, use that insight to inform your new marketing campaigns or even tweak your product.

Step-by-Step Market Research Process For Retailers

Now let's walk through exactly how to execute a market research process that will help you confidently make data-driven decisions.

Step 1: Identify Industry Trends

One of the hardest aspects of market research is uncovering up-and-coming industry trends that you're not aware of.

If you can identify these trends in their infancy, you'll have the first-mover advantage, which will give you an edge over the competition.

So how can you identify key market trends before your competitors?

While most people rely on their network, social media, and industry publications to identify trends, this manual research is time-consuming and the trends suggested aren't always supported by reliable data.

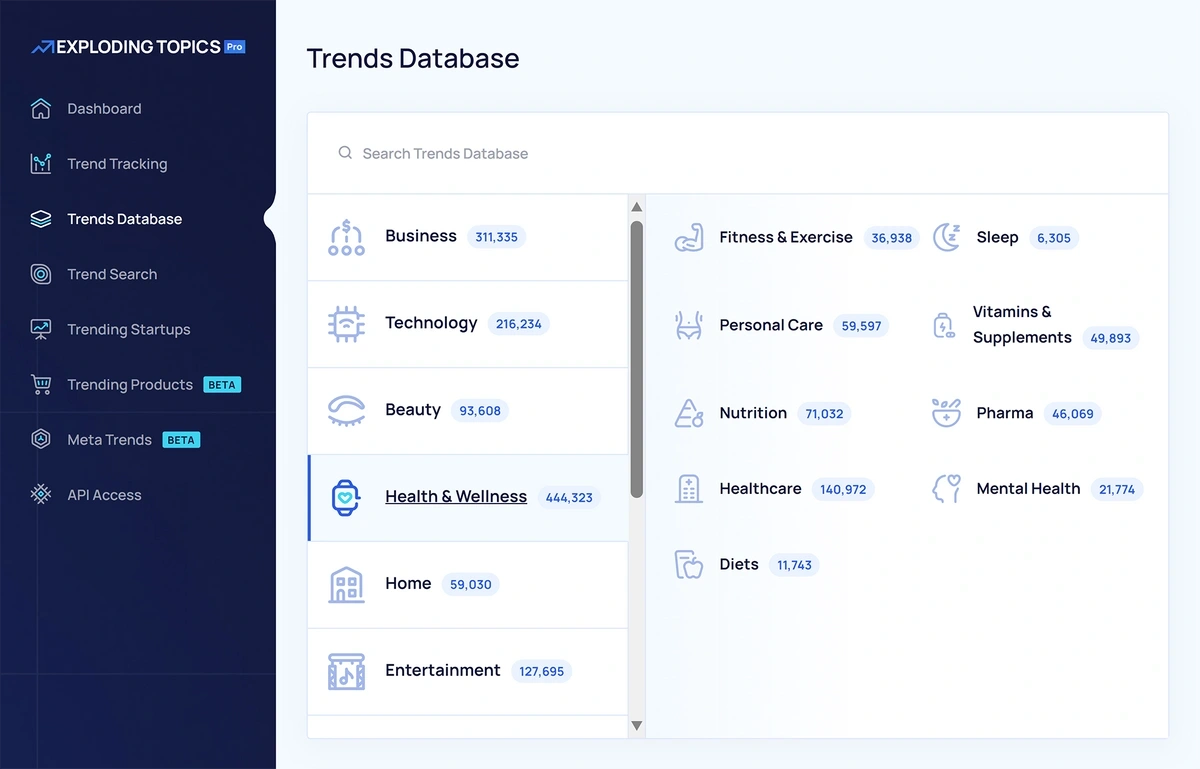

So to solve this problem and make it easy to identify trends based on solid data, we built Exploding Topics. The flagship product is the Trends Database, which offers nearly 1M total trends.

Each trend is a product, company, or industry keyword relevant to business topics. You'll also see a graph that represents its Google searches history over time (the default time frame shown is five years, though you can adjust this to as far back as 15 years or as recent as the past three months).

So to get started with the market research process, you can jump into the free Exploding Topics database and sort by your company's category (e.g., "pets," "fashion," "design," etc.).

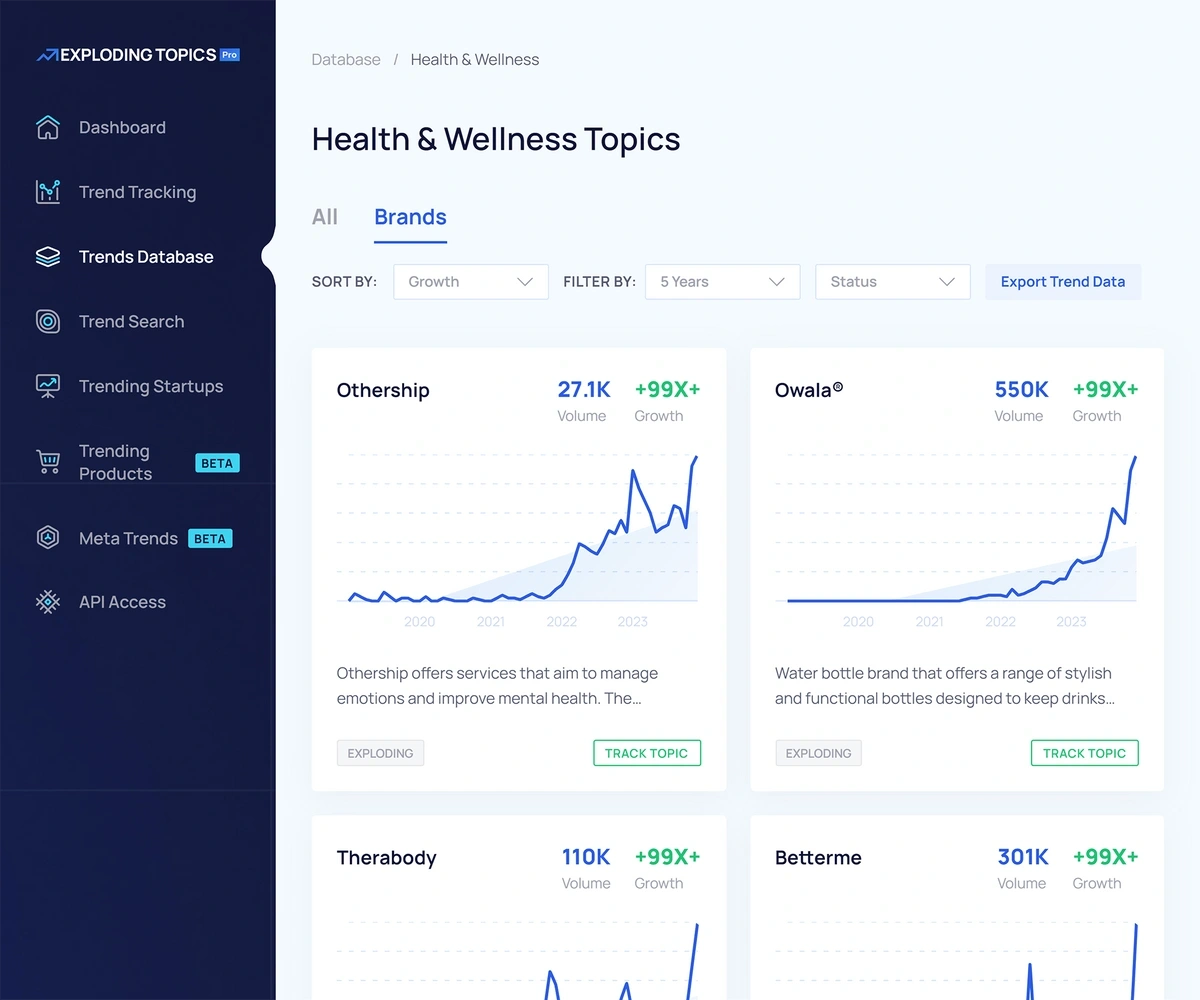

You can also filter just by brands to zero-in on trending companies in that space.

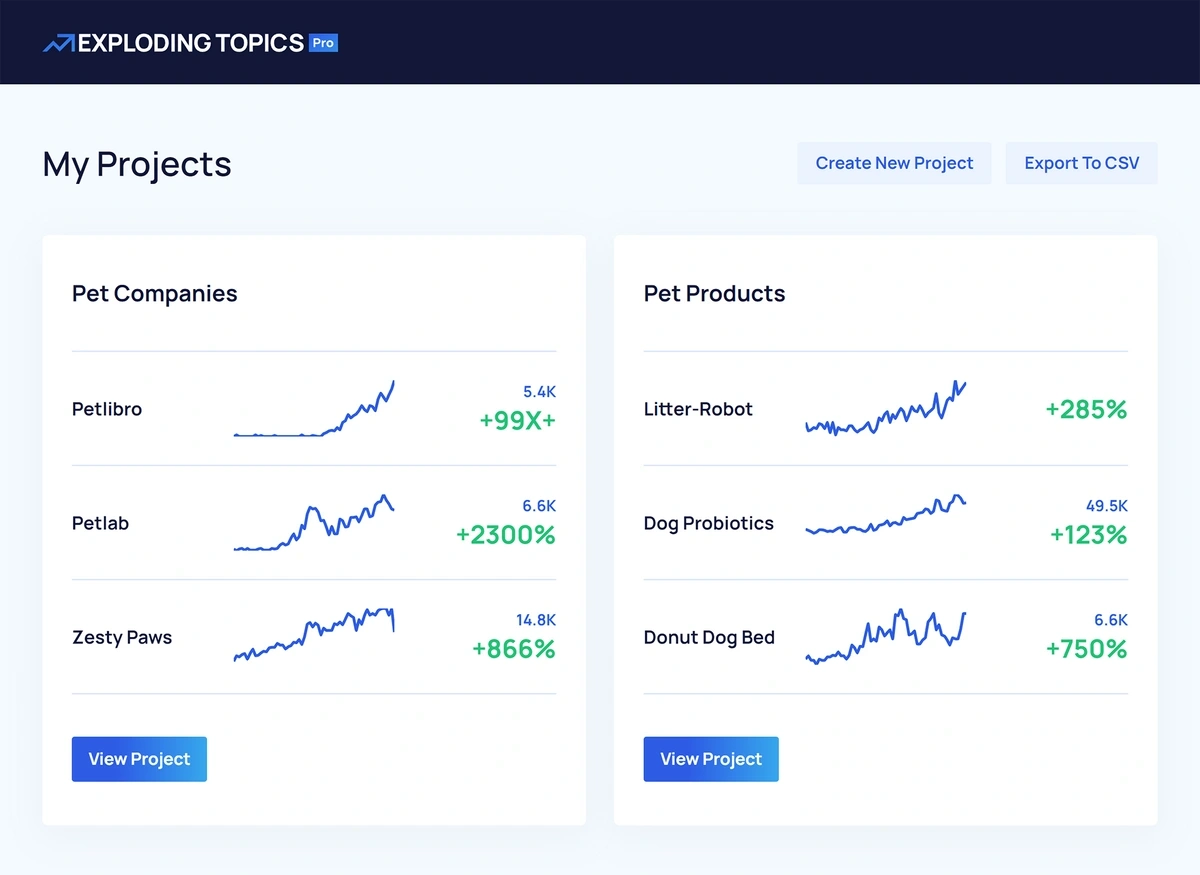

If you're using Exploding Topics Pro, you can easily track any interesting topic by clicking "Track Topic" and creating a project for products, keywords, and companies.

So if you're in the pet space, you might have three Projects that look like this:

By using the Trends Database, you no longer have to spend hours scanning industry publications or scrolling through social media in hopes of finding an occasional promising new trend.

So how do I know that the topics in the Trends Database are reliable trends versus fads that will quickly disappear?

First, Exploding Topics uses Google search volume to determine the status of each trend, as we've found it's the most reliable method to determine interest in a topic over time.

In addition, our trend discovery and vetting process involves both AI and human analysts to ensure each trend in the database is signal – not noise.

Specifically, Exploding Topics uses AI to scrape websites like Reddit, YouTube, Twitter, and even podcasts. Then, a human analyst manually vets each trend to ensure it has business value before adding it to the database.

This strategy ensures every topic inside the Trends Database is a golden nugget – not noise.

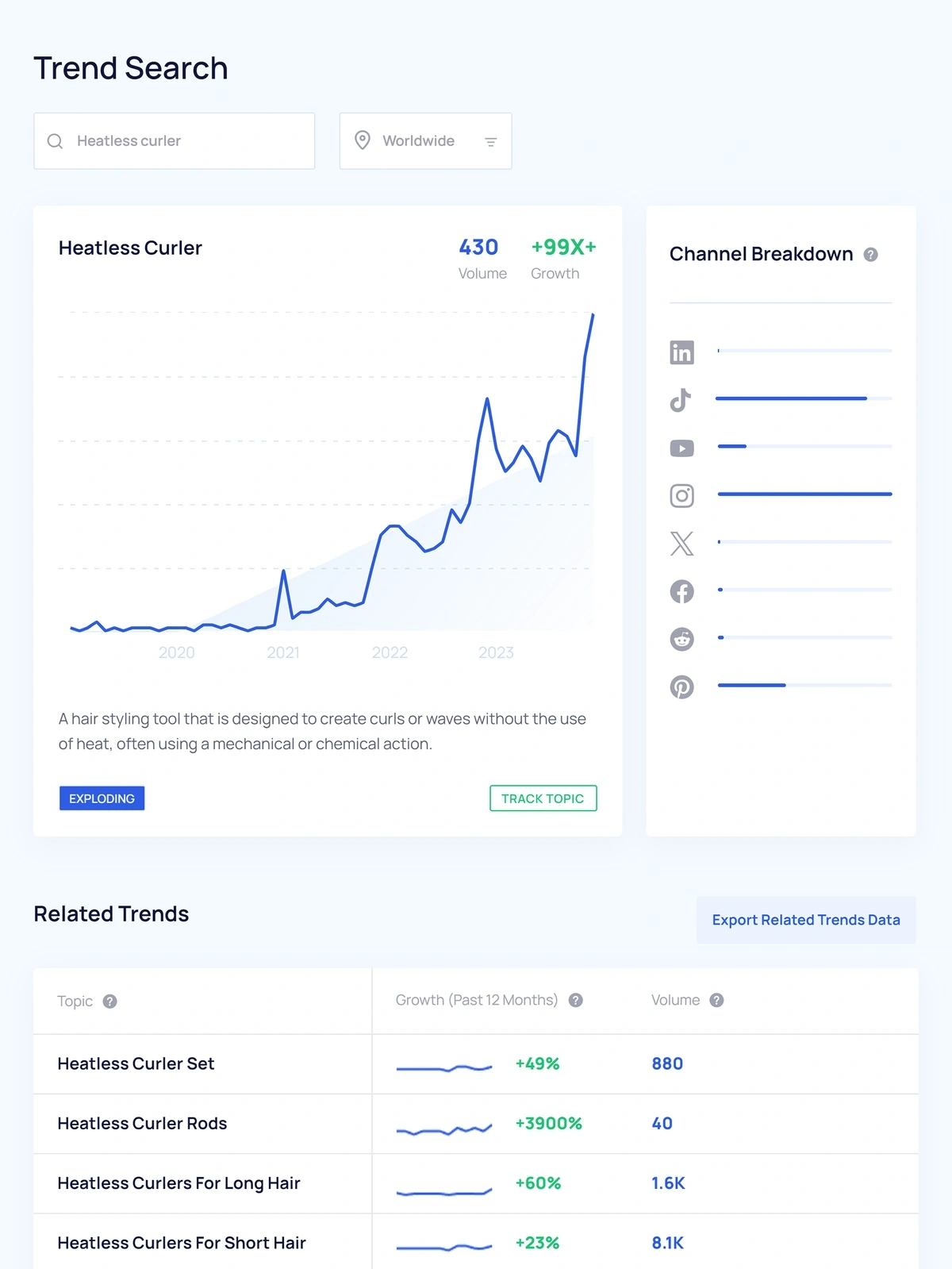

While the Trends Database is excellent for uncovering new trends, we realize you might already have a topic in mind (for example, a product category you're looking to get into) and just want to check its trend status. To do that, you can use the Trend Search feature to generate a trend report for any topic on the fly.

Simply type in the keyword and it automatically creates a report with the keyword’s search volume history and related search terms:

Step 2: Gather Quantitative Data on Trends

Now that you’ve identified a handful of interesting trends, you can collect quantitative data to identify which markets or niches are most promising.

So let’s go through a few quantitative metrics you should find for each of the following categories we identified in the first step.

For Competing Companies:

- Hiring: If a company is actively hiring, there's a good chance that there's substantial demand for that company's products. To see if the company is hiring, you can do a quick Google Search for the brand name and "hiring" as that usually pulls up any listings from Indeed, ZipRecruiter, and other hiring platforms. Alternatively, you can look on the company's LinkedIn page and check the "Jobs" tab to see if there are any open positions.

- Funding: While investors aren't always right, they dedicate all their resources to tracking industry trends. So if you see that a particular company in the niche you're researching has raised a lot of money, that's definitely a good sign. You can use a tool like Crunchbase to identify funding data for most companies.

- Revenue: If the company you're tracking is publicly traded, you should be able to see its revenue. However, try to find the revenue trend, as that is often a better indicator of the market's future than the revenue number itself. To find revenue data, you can just do a Google search for the brand name and revenue, or you can use a tool like Owler to estimate the revenue.

Here’s a quick video of how I’d find the above information for “Hero Cosmetics.”

For Topics/Markets:

- Market spend: Many research companies provide free market reports on various industries with data like estimated market size, compounding annual growth rate (CAGR), and other critical retail market research statistics. A few of the most popular ones include Allied Market Research and Grand View Research, though the easiest ways to uncover these reports is usually a quick Google Search for the retail industry you're searching for and the keyword "market size."

- Related keyword data: While the initial topics you found in Exploding Topics can help you uncover new trends, you can uncover more opportunities by searching for related terms and similar products. For example, if you found that Hero Cosmetics is taking off, you can look at what their top organic keywords are in Ahrefs or Semrush. Alternatively, you can search a product keyword in Google, scroll down to the suggested search results, and then find a list of related keywords.

- Geographic market size: Given that most retail businesses have brick-and-mortar stores, you should also research the market size and consumer spending trends of the geographic region where you're considering opening a retail store. The Census Business Builder is excellent for finding regional consumer insights like detailed consumer spending breakdowns, income, and other helpful data.

To see how to uncover all of this information, here’s a quick screen recording of researching the anti-acne market research.

For Products:

- Profitability: Before launching a new product, it's critical to understand if it will be profitable to sell. To estimate profitability, you can use an ecommerce research tool like Jungle Scout to view an item's approximate wholesale and retail price. While your products might be slightly different, and you'll probably use different manufacturers, it's a great place to start with profitability estimations.

- Demand/sale history: Once you've estimated the profitability of a product, you can estimate the demand for it by looking at Amazon sales with a tool like Jungle Scout or track sales on other ecommerce sites with a tool like Grips.

- SEO difficulty: A company like Nike has significant domain authority in the shoe and athletic wear space, so it will immediately have an advantage in ranking for keywords in that space. However, it might be much more difficult to capture organic SEO traffic if you're a newer brand.

- PPC cost: Another method to estimate the difficulty of attracting traffic is to look up the cost per click for paid keywords. For example, if you want to sell work gloves, you'll see that the CPC for that is about $3.50, so that's useful information to determine whether or not you'll have the budget to be competitive for that product.

Here’s a quick video of how I’d find the above information for the product “Migraine Hat.”

Step 3: Execute Competitive Market Analysis

When you launch your product, don’t try to reinvent the wheel. Instead, look at the top players in the space and duplicate the aspects of their strategies that are working.

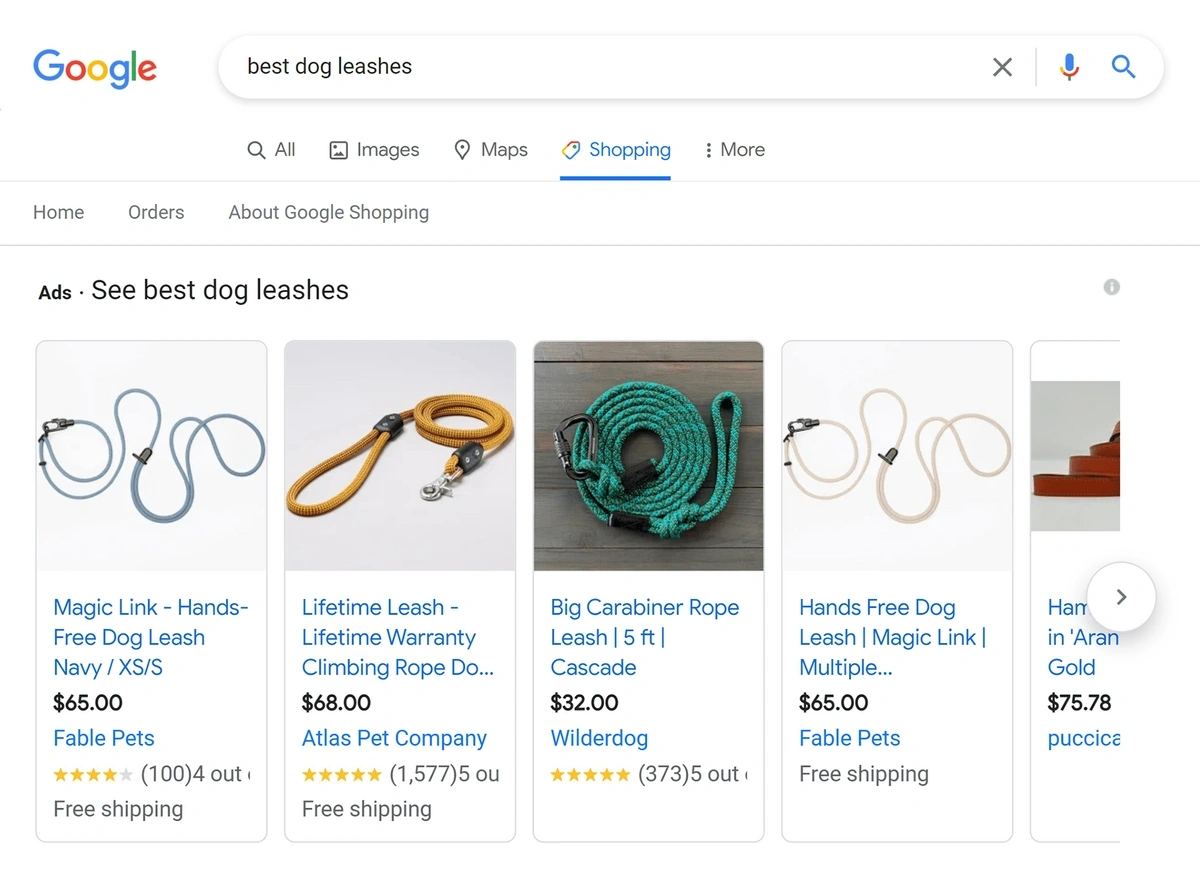

To get started, do a quick Google Search for the core product keyword and create a list of the top competitors. Ideally, find niche brands as it will be easier to copy their marketing strategy than a global conglomerate's marketing strategy.

For example, if you plan to sell dog leashes, write down niche companies like Wilderdog, Fable Pets, and Atlas Pet Company rather than billion-plus dollar retailers like Walmart or PetSmart.

Once you've created a list of these companies, you can use a tool like Similarweb to uncover the following metrics:

- Total traffic and traffic trends: Ideally, see how the traffic has increased or decreased over the past 12 months.

- Traffic region: This will tell you which demographics likely drive the majority of the company's revenue.

- Gender and age distribution: This will help you with marketing messaging and copywriting.

- Top marketing channels: Simiarweb also shows you what percentage of traffic comes from organic search, social media (you can also break this down by social media platform), email, and display advertising. This data makes it easy to identify which marketing channels you should analyze in more detail.

Here’s an example of how I uncovered the above information for Wilderdog:

To help you get started, you can use this free spreadsheet to fill out the metrics above.

Once you have general data on which marketing channels your competitors are using, do a thorough analysis of their strategy for each channel.

- Facebook Ads: You can use the Facebook Ads Library to dive into your competitors' ads and see which ones are running the longest, what aspects they've A/B tested, and more.

- SEO: You can use Ahrefs or SEMrush to identify the top-performing pages, keywords, and approximate difficulty to rank for the same keywords.

- Google Ads: You can use Ahrefs or SEMrush to identify the keywords your competitors are targeting, the exact ad copy they're using, and the approximate traffic to those landing pages.

- Email: Sign up for your competitor's email list and then note how often they send emails, the general messaging, and promotional offers.

- Organic Social: To determine what type of content resonates best with the target persona and which platforms are most effective, just search your competitors' brand name on all popular social media platforms. Then identify the platforms they are most active on and take notes of what kind of content performs the best.

- Influencer Marketing: There are two ways to track your competitors' influencer marketing campaigns. First, you can do a Google Search for the competitor's brand name and "reviews." This will show you approximately what influencer demographics they use to promote their products. Alternatively, you can use a tool like Hype Auditor to give you a more detailed breakdown of all the influencers your competitors are using and even ROI estimations.

Step 4: Qualitative Customer Research

Once you have advanced intel on your competitors and the market, collect qualitative data. This is key to identifying how you'll position your brand and build high-quality products to solve pain points associated with competitors' products.

So here are a few different ways to collect qualitative customer data.

Customer Surveys

If you already have an email list, you can simply survey your existing customers about the new product. Here are some great questions to ask in your survey:

- What other retailers do you shop at?

- What related products do you also purchase?

- What's your biggest pain point with (pain point your new product solves)?

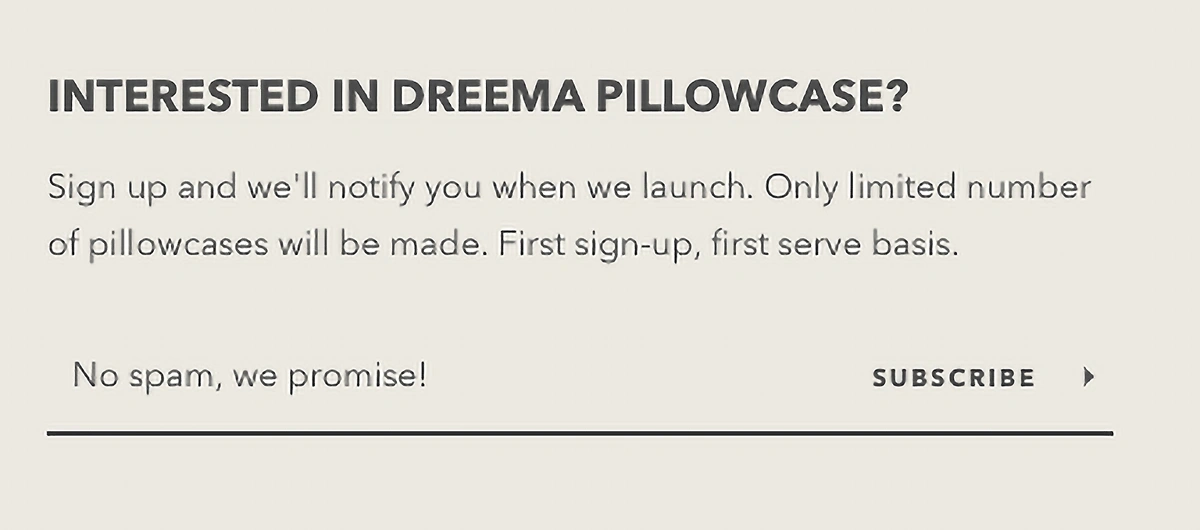

Even if you don't yet have a store or product, start building an email list today. This list will allow you to build your product with your potential customers, and it will give you more momentum when the product is ready to launch.

To see an example of a pre-launch website, check out Dreema’s website from 2022.

However, if you're still not sure you want to launch a new product line or which audience you want to target, here are some other ways to find relevant survey respondents.

First, you can partner with influencers who already have your target audience and pay them to run a survey on your behalf. For example, you could use a platform like Upfluence and hire an influencer to run a survey for you.

Another option is to use a tool like SurveyMonkey or Pollfish which enables you to run surveys to a specific audience.

For example, you can target female consumers between the ages of 25 and 30 in the United States and these survey platforms will run a custom survey to that audience. Pollfish also allows you to include screening questions like, "Did you buy a supplement for your dog in the past 12 months?"

The average cost to run these surveys ranges, though you can typically get started for as low as $1 per response.

If you're running a survey for a retail product that you're about to launch, here are a few different questions you can ask:

- What brands do you currently use?

- What pain point prompted you to purchase this product?

- If you could change something about this product, what would you change?

- What were your top concerns when purchasing this product?

- How did you evaluate different products in this market?

- What made you choose this brand in particular?

- What do you love most about this product?

- What aspects of the purchase experience was excellent?

- What about the purchase experience could have been better?

This makes it easy to collect qualitative data for a reasonable price without owning an audience.

Customer Interviews

While customer surveys make obtaining a high volume of qualitative data easy, you might not uncover the golden nuggets of information that a one-on-one conversation can reveal.

If you already have a target audience, you can simply send an email to your list and offer an Amazon gift card for getting on a call with your team for ten minutes.

If you don't have access to the target audience yet, you can always join groups on social media for that target audience.

For example, if you're planning to launch a baby monitor product, you could join a Facebook group for Moms and ask any of them if they've purchased a baby monitor. For those who respond, you can ask if they'd consider getting on a call with you in exchange for a gift card.

Once you’re on the call, be sure to record it so that you can later analyze all of the recordings for trends.

Once you're on the call, record it so you can later analyze all of the recordings for trends.

You can use a tool like Discuss.io to record the call, as it compiles all of your call recordings and performs sentiment analysis to help you zero in on customer pain points. It also allows you to save key moments, and its theme finder automatically generates video clips based on pre-selected or new keyword tags.

Customer Reviews

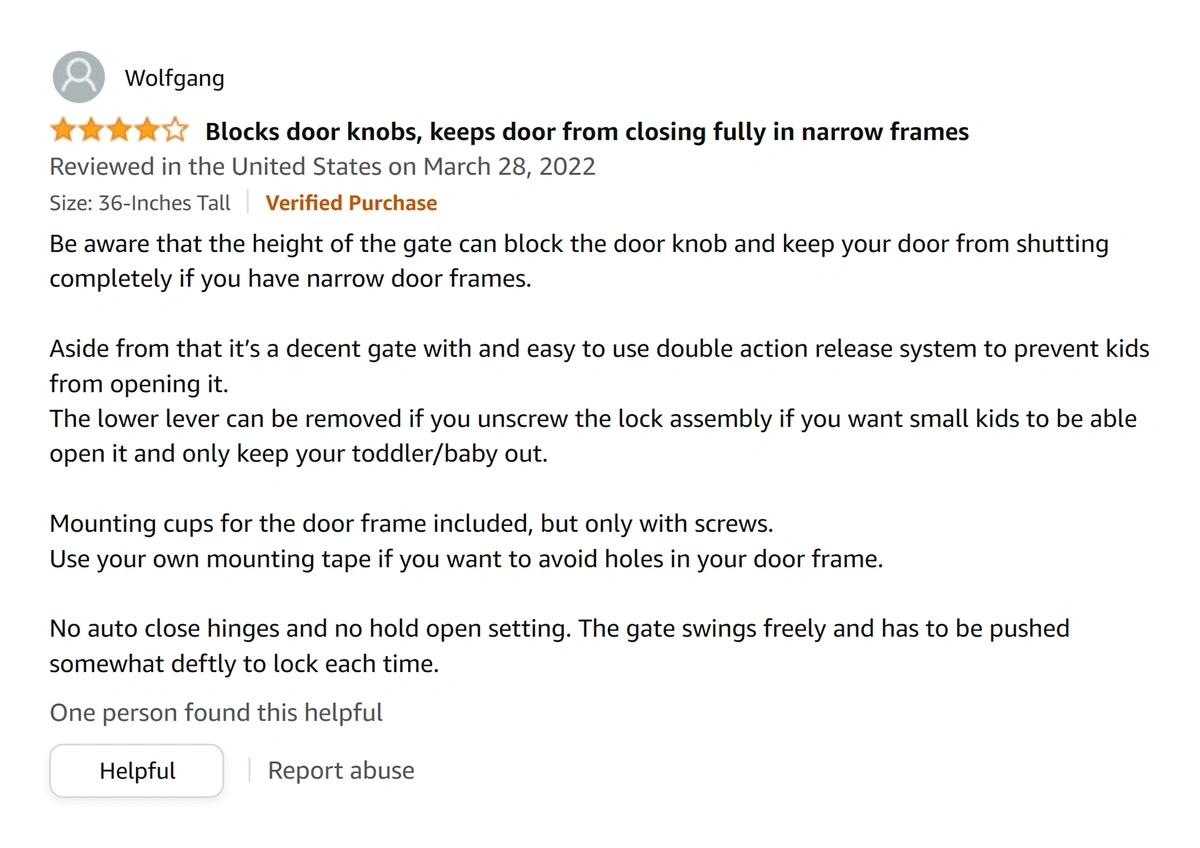

Finally, an easy way to quickly gather qualitative customer data is to read reviews of competing products and identify what people liked and disliked about the product.

You can hire a VA to read through reviews and take notes for you, or you can use a tool like Bright Scraper's Amazon review scraper to find trends in reviews.

As you comb through reviews, look at not only what they liked and disliked about the product, but also details about the customer experience, what caused people to look for the product, and other more detailed aspects of the buyer's journey.

Amazon also shows you a list of other products each reviewer purchased, so use that information to identify parallel products and niches that the target audience uses.

Create a Focus Group

While researching competitive products is a great way to gauge how you can create a better product, the best way to see if your product is actually the best for that customer segment is to test it out.

However, launching a new product to your entire audience is risky as there will inevitably be some trial and error with the first version.

So to improve the quality of your product (before it launches) and generate high-quality customer feedback, create a focus group to test the product for you.

For example, when Nordstrom decided to focus on improving customer satisfaction, they launched Project 18. This project was a focus group of their 800 most engaged customers in Los Angeles to provide feedback on a new shopping app and a new line of clothing they would launch in local department stores.

The focus group helped them identify key customer pain points and fix them before launching to their entire audience.

Step 5: Collect Pre-Sales

Now that you've thoroughly researched the target audience, the only way to tell if the product will actually perform well is to try to sell it.

So rather than developing a product and then hoping you can sell it, consider collecting pre-sales before creating the product.

Then, if you don't receive as many sales as you projected, you can cancel the launch and refund the customers (or only charge their cards when you ship the product). This way, you never waste time and resources manufacturing a product that nobody wants.

Endless Blading is an excellent example of how retailers can leverage pre-sales to validate products.

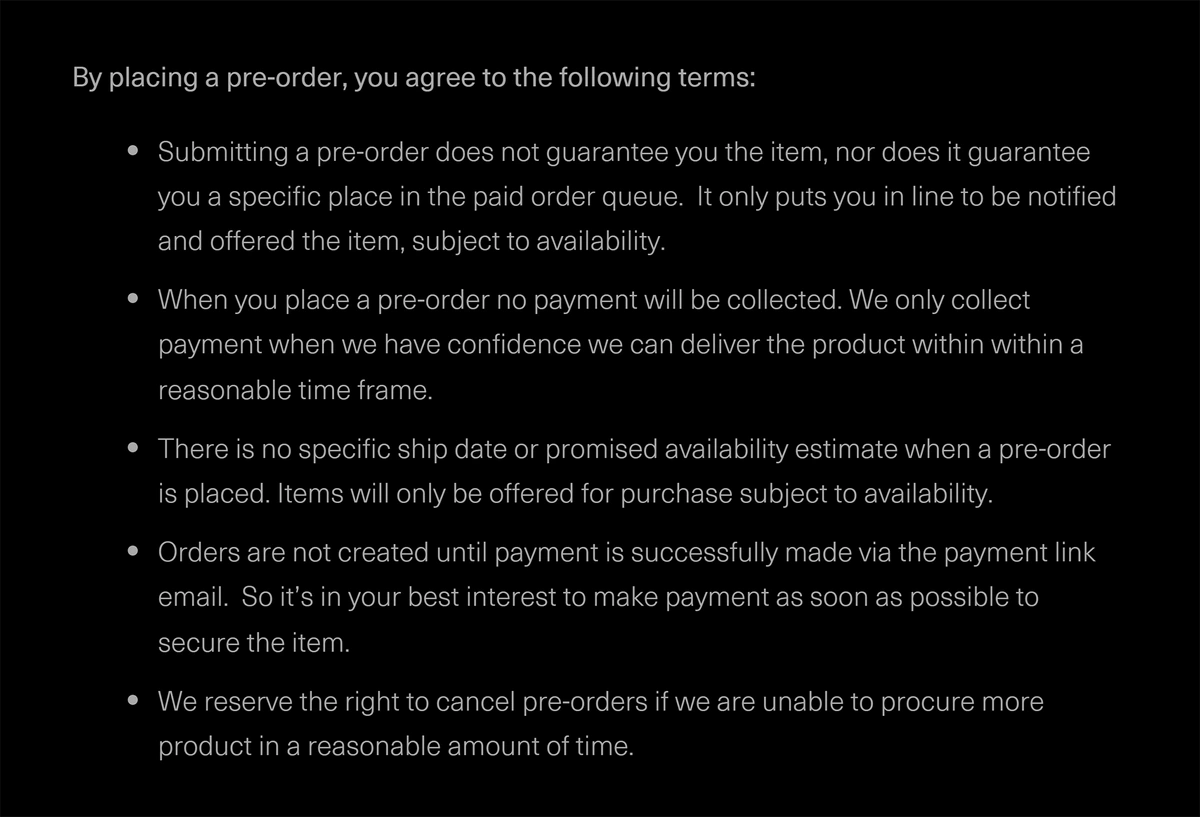

On the website, select products are available for pre-sales, and here's how they've laid out their pre-sale terms:

By collecting pre-sales, you significantly increase the likelihood that your product launch will be a success and add anticipation to the product's release.

Start The Market Research Process Today

There are plenty of different research methods to identify new products and markets, though it’s easy to get lost in a mountain of data and fail to identify key signals to guide your investment and marketing decision-making process.

To get started with the first step, identifying industry trends, you can browse the free Exploding Topics Trends Database, or sign up for Exploding Topics Pro to unlock premium trends, generate trend data for specific topics, create and save projects, and more.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more