Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

24 Booming AdTech Companies & Startups (2024)

You may also like:

The advertising technology sector has had an eventful few years. The pandemic caused many advertisers to cut their ad spending. Or temporarily halt ad spending entirely.

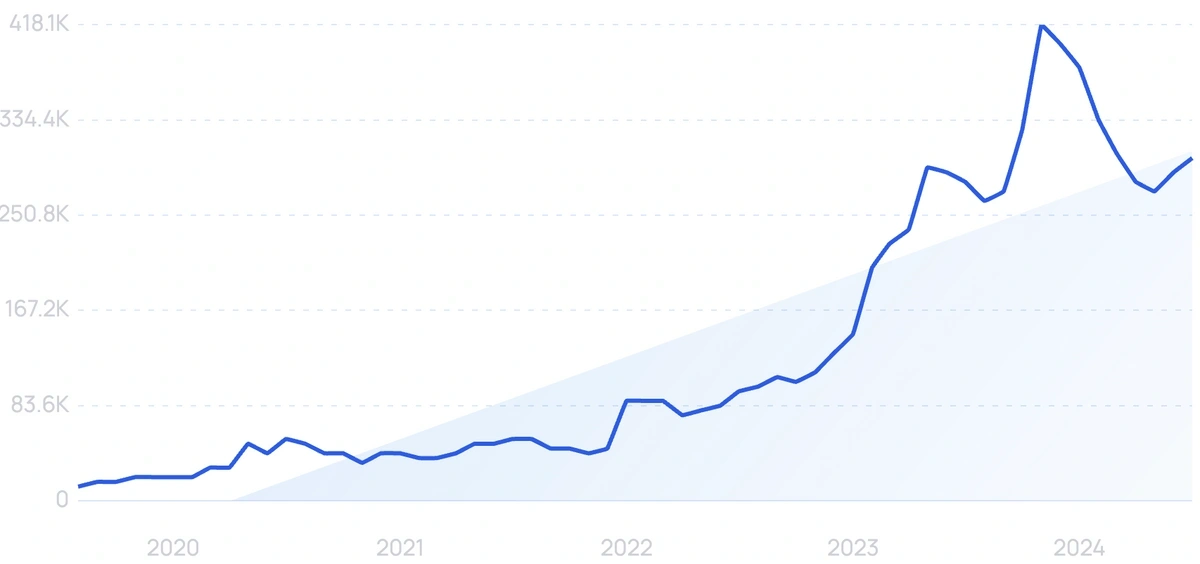

However, in 2024, the online advertising market size is expected to reach $257.9 billion, and by 2029, it's expected to hit $431.7 billion.

Here are fast-growing startups looking to ride this trend.

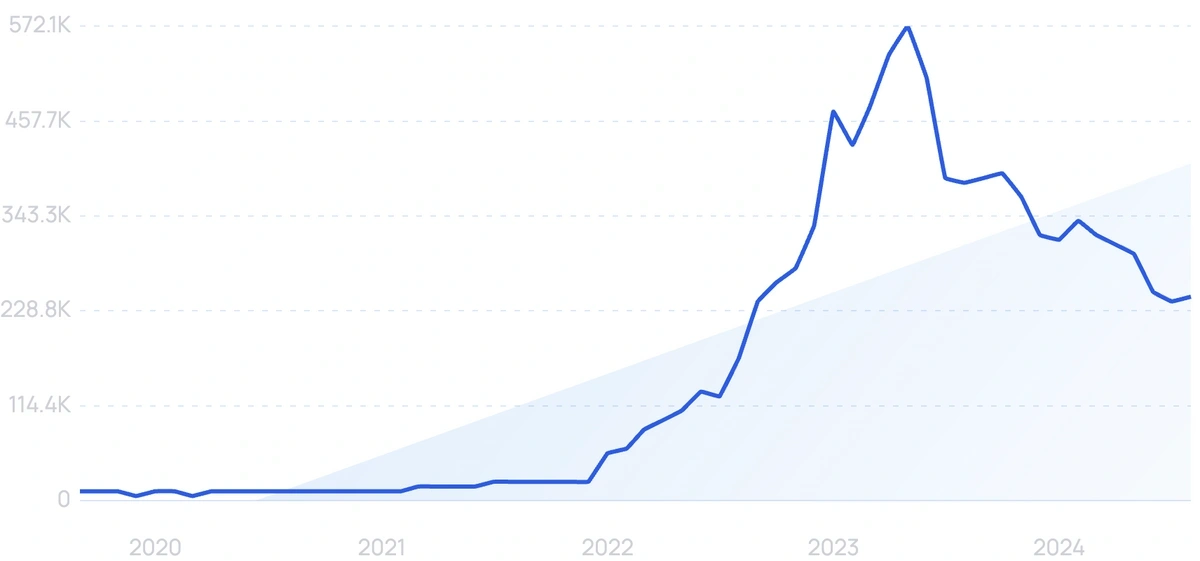

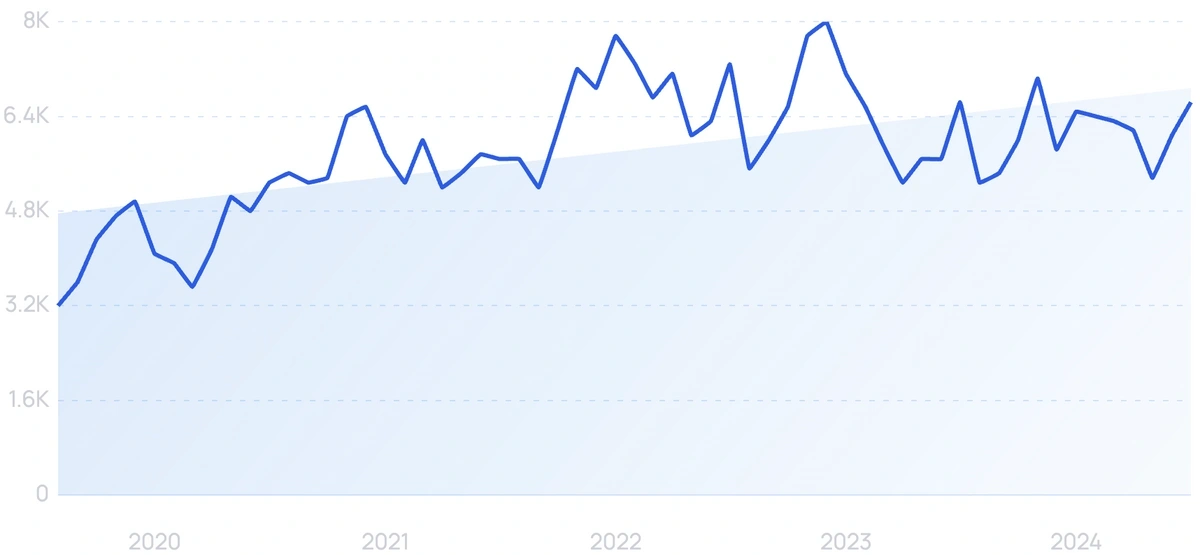

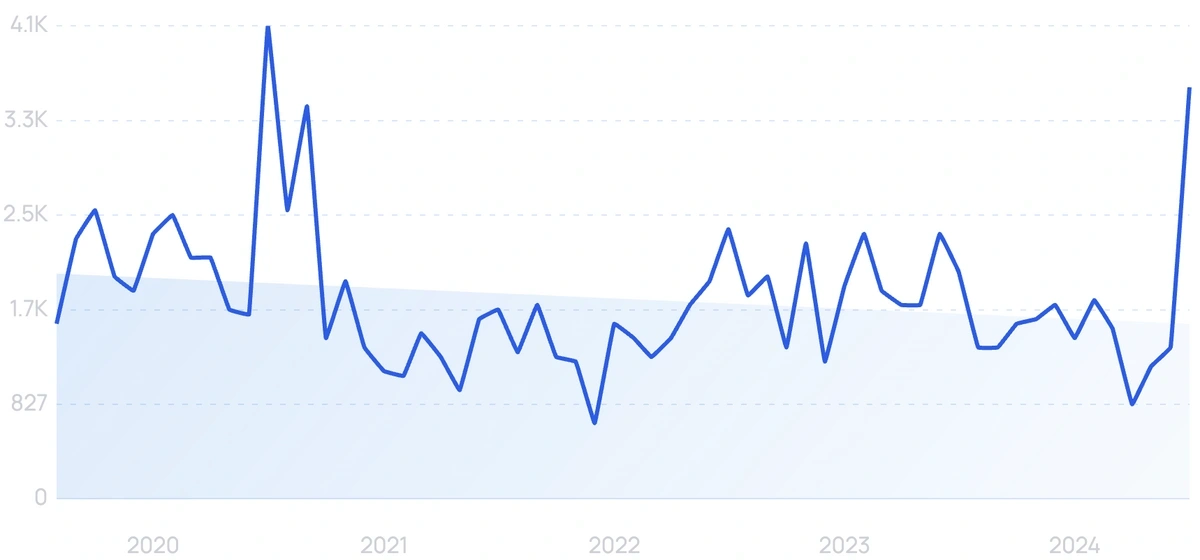

1. Copy.AI

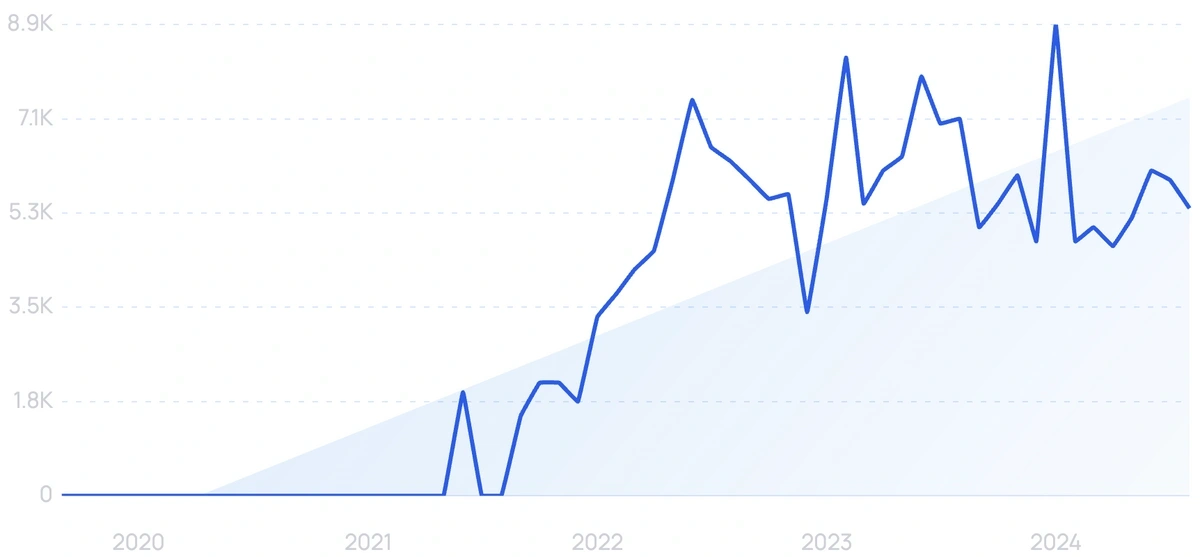

5-year search growth: 2,050%

Search growth status: Exploding

Year founded: 2020

Location: Memphis, Tennessee

Funding: $16.9M (Series Unknown)

What they do: Copy.AI is an AI-powered solution that provides a platform for businesses to generate high-quality and effective marketing content. Copy.AI primarily assists agencies, copywriters, and E-Commerce brands in the social media space, enabling companies to boost conversion rates and engagement.

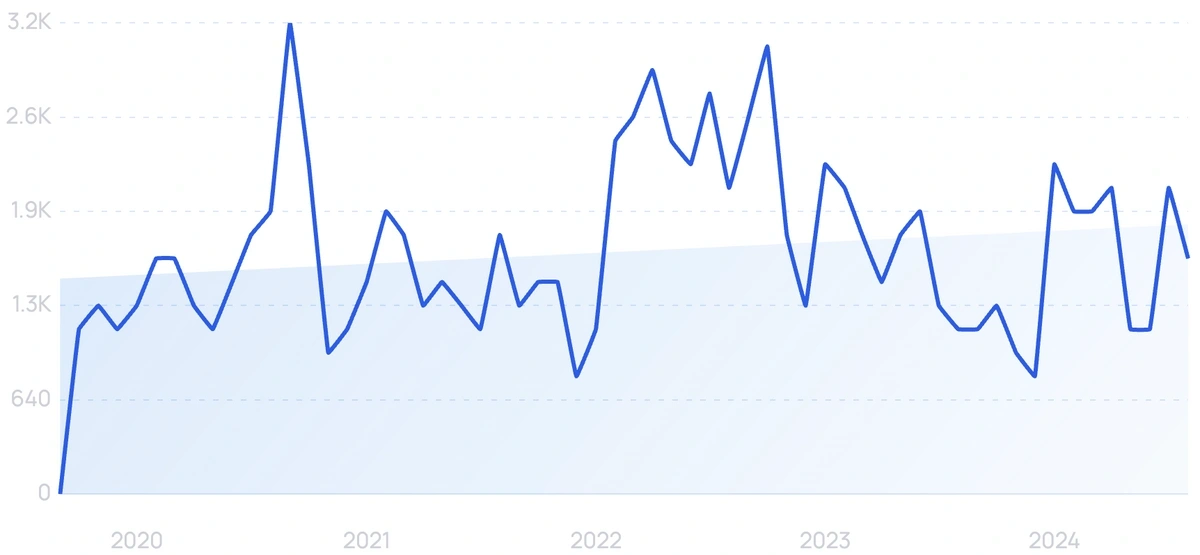

2. Infosum

5-year search growth: 900%

Search growth status: Regular

Year founded: 2016

Location: Basingstoke, United Kingdom

Funding: $88.1M (Series B)

What they do: Infosum is software for creating a “decentralized data ecosystem”. In other words, it allows advertisers to share data securely with vendors and partners. The data collaboration startup has partnered with notable companies, including Experian, DirecTV, and Canvas Worldwide.

3. Prizeout

5-year search growth: 8,500%

Search growth status: Regular

Year founded: 2019

Location: New York, New York

Funding: $37.5M (Corporate Round)

What they do: Prizeout is a digital gift card marketplace. They work with brands looking to grow and offer gift cards on their behalf to push sales. Gift cards are incentivized with exclusive deals to entice consumers.

4. Sourcepoint

5-year search growth: 112%

Search growth status: Regular

Year founded: 2015

Location: New York, New York

Funding: $43M (Series Unknown)

What they do: Sourcepoint offers an arsenal of tools to protect user privacy, manage compliance, and grow revenues. A new “privacy lens” feature will give advertisers more unique and secure data to work with. More recently, the organization acquired The StoneHill Group in hopes to improve their mortgage offering services.

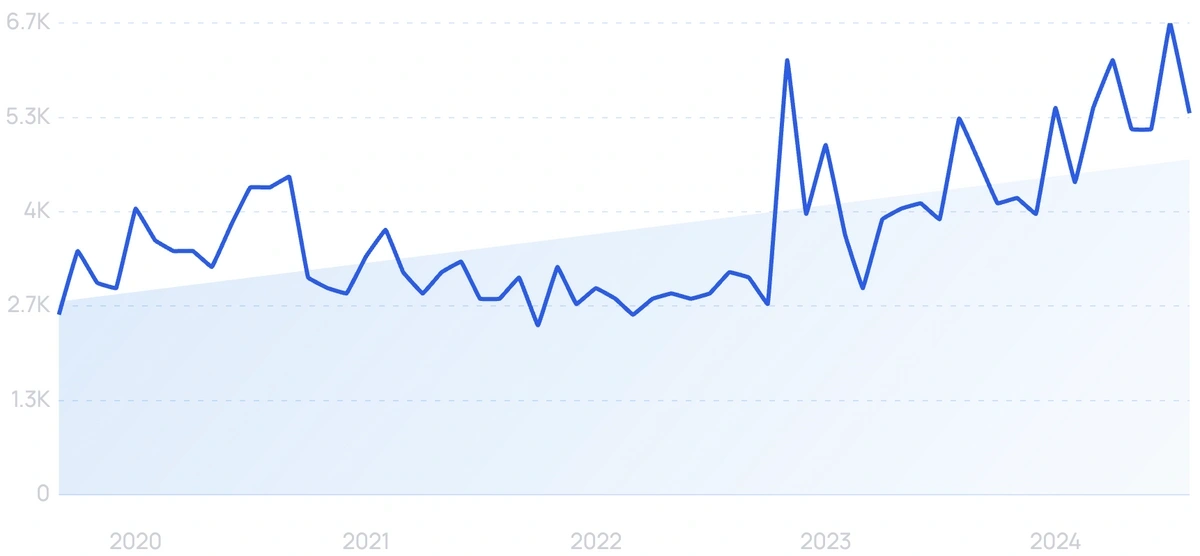

5. GetVantage

5-year search growth: 6,300%

Search growth status: Regular

Year founded: 2019

Location: Mumbai, India

Funding: $41M (Series A)

What they do: GetVantage is a finance company that provides revenue-based financing solutions to small and medium-sized businesses for advertising. Its platform offers businesses access to capital without the need for collateral, based on their revenue projections and business growth potential. GetVantage's financing solutions aim to help businesses overcome cash flow challenges and achieve their growth objectives in marketing.

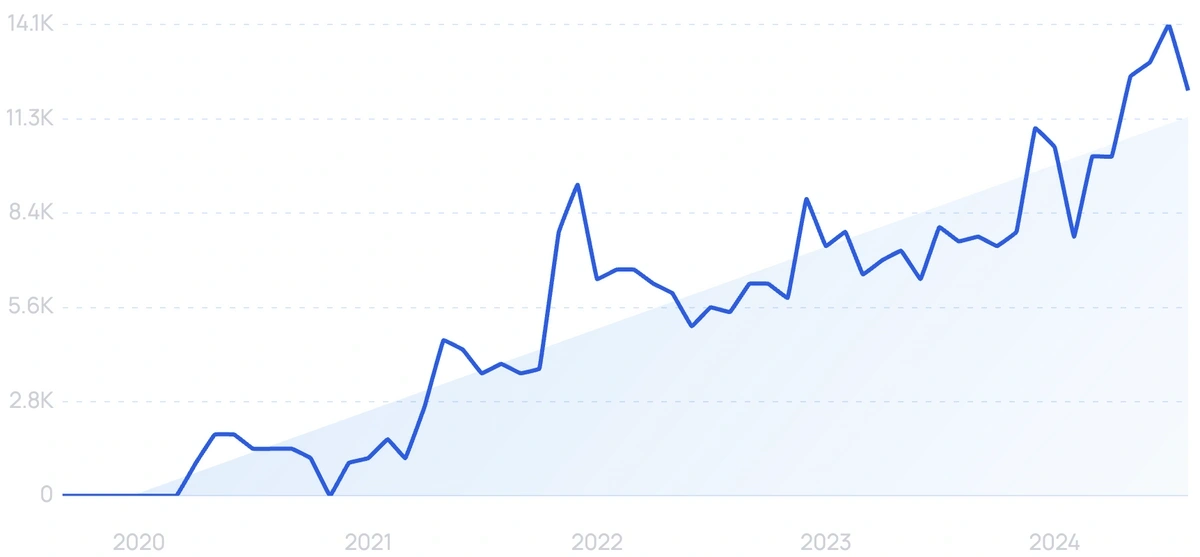

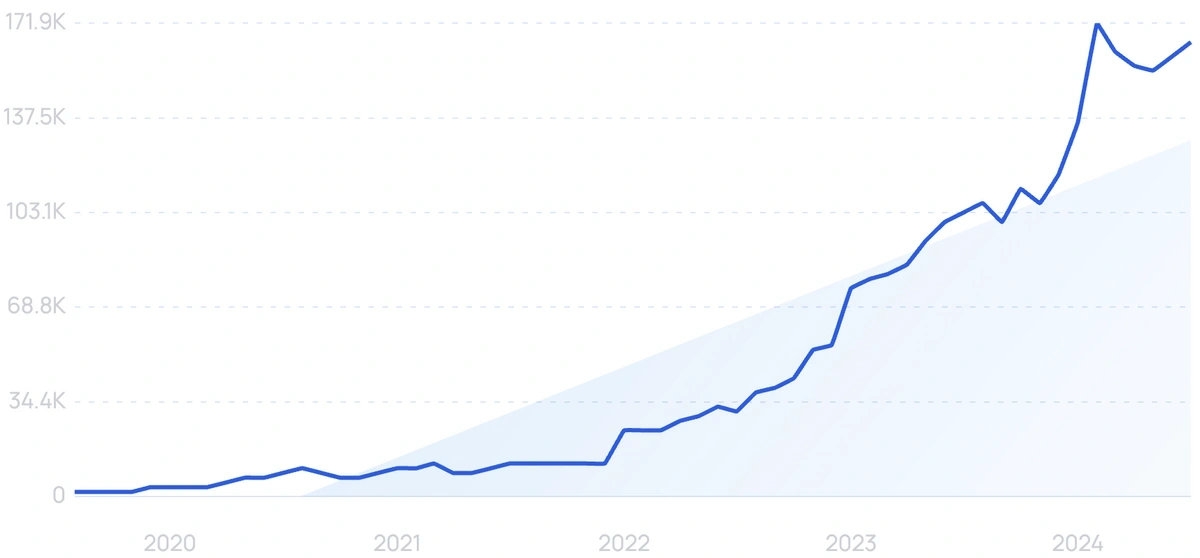

6. GoHighLevel

5-year search growth: 9,500%

Search growth status: Exploding

Year founded: 2018

Location: Dallas, Texas

Funding: $60M (Private Equity)

What they do: GoHighLevel (also known as HighLevel) is an all-in-one marketing, sales, and ad management platform built for marketing agencies, consultants, and businesses. While GoHighLevel's primary function is to provide an operations platform for marketing agencies and businesses, key features include ad tracking, analytics, and detailed reporting.

At the end of 2023, the startup reported over 60,000 customers who earned more than $800,000 in revenue using the platform.

7. Permutive

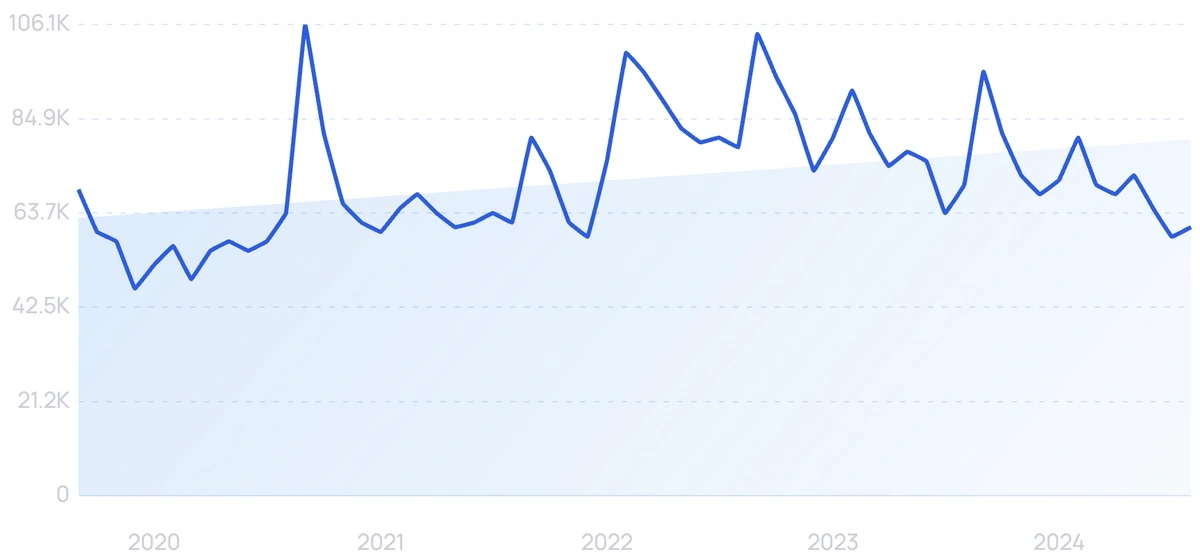

5-year search growth: -52%

Search growth status: Peaked

Year founded: 2013

Location: London, UK

Funding: $105M (Series C)

What they do: Permutive is an advertising data management platform for publishers. It gives users access to secure privacy, scalable analytics, and live targeting features. The goal of Permutive is to enable more intuitive first-party data for publishers. Growing third-party data regulations are making this a growing niche. Permutive's customer list includes The Washington Post, The Economist, Vox, and many more.

8. Kevel

5-year search growth: 75%

Search growth status: Exploding

Year founded: 2010

Location: Durham, North Carolina

Funding: $45.2M (Series C)

What they do: Kevel, formerly known as Adzerk, is a development platform for building custom ad servers. Developers can build these custom APIs to add native ads, sponsored listings, and other promotions directly to their website or app. In their most recent Series C funding round, Kevel managed to raise $23 million.

9. C Wire

5-year search growth: 107%

Search growth status: Regular

Year founded: 2020

Location: Zurich, Switzerland

Funding: Undisclosed (Seed)

What they do: C Wire is an ad-tech company that offers a digital advertising platform for advertisers and publishers. Its platform leverages AI and machine learning to optimize ad performance and provides real-time reporting and analytics. C Wire offers a range of ad formats, including display, native, video, and connected TV, and aims to provide personalized and effective advertising solutions for its clients.

10. Cavai

5-year search growth: -18%

Search growth status: Regular

Year founded: 2018

Location: Oslo, Norway

Funding: $8.2M (Convertible Note)

What they do: Cavai is a conversational advertising platform for brands and publishers. Its platform leverages artificial intelligence (AI) to enable interactive conversations between consumers and brands, providing personalized and engaging ad experiences. Cavai's conversational advertising solutions can be deployed across various channels, including display, video, social, and audio, and aim to help brands deliver more effective and relevant advertising.

11. Minea

5-year search growth: 250%

Search growth status: Exploding

Year founded: 2020

Location: United States

Funding: Undisclosed

What they do: Minea is an ad tracking tool for social media platforms like TikTok, Facebook, and Pinterest. They provide a database of more than 200 million ads while giving users access to competitor stores and product placements. Minea consolidates multiple e-commerce tools into one platform, providing functionalities like ad spy, product research, and supplier analysis.

12. Creatopy

5-year search growth: 7,300%

Search growth status: Regular

Year founded: 2021

Location: San Francisco, California

Funding: $10M (Series A)

What they do: Creatopy is an advertising company that offers a cloud-based design and advertising platform. Its platform provides a range of tools for creating and managing advertising campaigns, including banner ads, social media ads, and email marketing campaigns. Creatopy's features include a drag-and-drop design editor, collaboration tools, and a library of templates and stock images aimed at helping businesses of all sizes create professional-looking ads and marketing materials.

13. LinkBy

5-year search growth: 6,000%

Search growth status: Regular

Year founded: 2020

Location: Sydney, Australia

Funding: $3.3M (Seed)

What they do: LinkBy is a marketing agency that connects advertisers to publishing brands. Its platform provides tools for individuals to find relevant brand partnerships, create sponsored content, and manage their collaborations with brands. LinkBy also offers analytics and reporting tools to help influencers and brands measure the effectiveness of their campaigns.

14. Scalarr

Search growth status: Regular

Year founded: 2016

Location: San Francisco, CA

Funding: $7.5M (Series A)

What they do: Scalarr is a machine learning platform built to detect ad fraud. They offer three core products to integrate with mobile platforms. These products track ad performance, autoblock fraud, and identify opportunities. Scalarr says they detect over 60% more ad fraud than any competitor.

15. Brave

5-year search growth: 68%

Search growth status: Exploding

Year founded: 2015

Location: San Francisco, California

Funding: $42.3M (Series B)

What they do: Brave is a fast, safe online web browser. They plan to provide web users with better privacy features while searching compared to market leaders (like Google Chrome). Brave is also looking to change the ad ecosystem with micropayments and revenue share agreements for publishers. Most recently, they acquired web browser startup Tailcat to expand their reach.

16. AdsPower

5-year search growth: 9,300%

Search growth status: Exploding

Year founded: 2019

Location: Singapore, Singapore

Funding: Undisclosed

What they do: AdsPower is a multi-login anti-detect web browser with VPN-level encryption. Customers rely on this tool to access multiple accounts at once for social media marketing, affiliate marketing, media buying, etc., without getting banned by big tech platforms. According to the company's website, there are over 800,000 customers using the browser today.

17. Vidsy

5-year search growth: 21%

Search growth status: Regular

Year founded: 2014

Location: London, UK

Funding: $24M (Series B)

What they do: Vidsy is software designed to build compelling video-based ads. In addition to their tech, Vidsy also offers help with creative strategy. Vidsy currently works with 5,000 creators in 70 different countries.

18. Zeotap

5-year search growth: 135%

Search growth status: Peaked

Year founded: 2014

Location: Berlin, Germany

Funding: $92.2M (Series C)

What they do: Zeotap is a customer intelligence platform designed to help advertisers predict customer behavior. Zeoptap has experienced over 400% in YoY revenue growth. The startup currently works with 70+ clients, including Audi and McDonalds.

19. Zappi

5-year search growth: 221%

Search growth status: Exploding

Year founded: 2012

Location: London, England

Funding: $192.6M (Private Equity)

What they do: Zappi is a consumer insights platform that gives brands access to various advertising and product development features for market research. By leveraging AI, Zappi can deliver research results faster than its competitors (hours rather than weeks). Today, the startup works with over 1,000 customers in 50+ research markets.

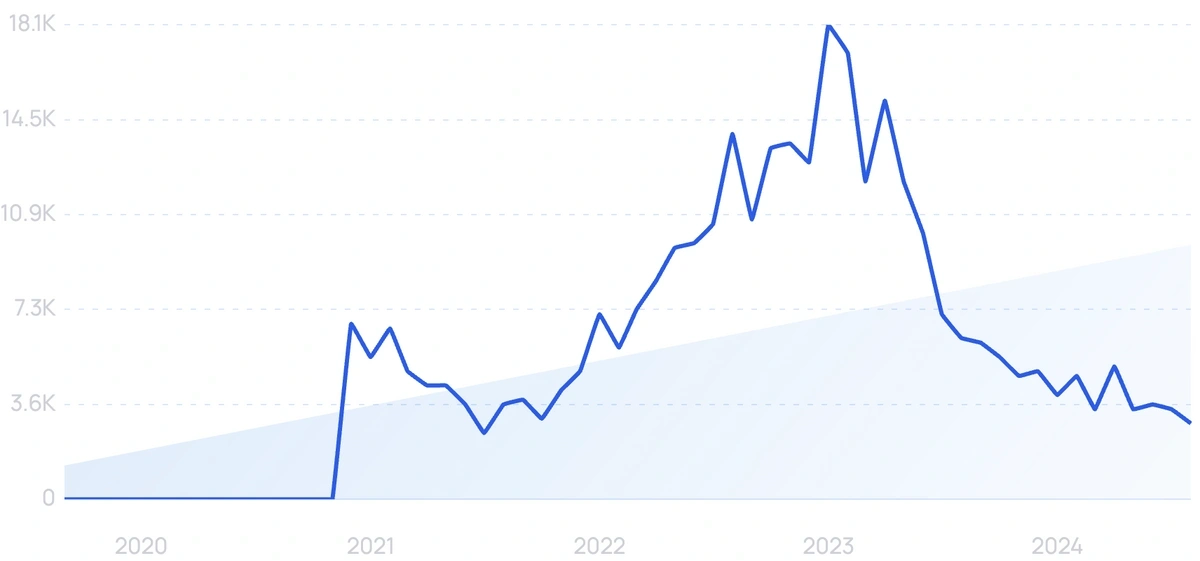

20. Copysmith

5-year search growth: 1,500%

Search growth status: Peaked

Year founded: 2020

Location: San Francisco, California

Funding: $10M (Private Equity)

What they do: Copysmith is a SaaS content creation company that leverages artificial intelligence to provide a platform for businesses to create high-quality and effective ad copy. Its platform offers a range of tools for generating and optimizing ad copy across various formats, including social media, search, and email. Copysmith aims to help businesses save time and resources by automating the process of ad copywriting while improving the quality and effectiveness of their ads.

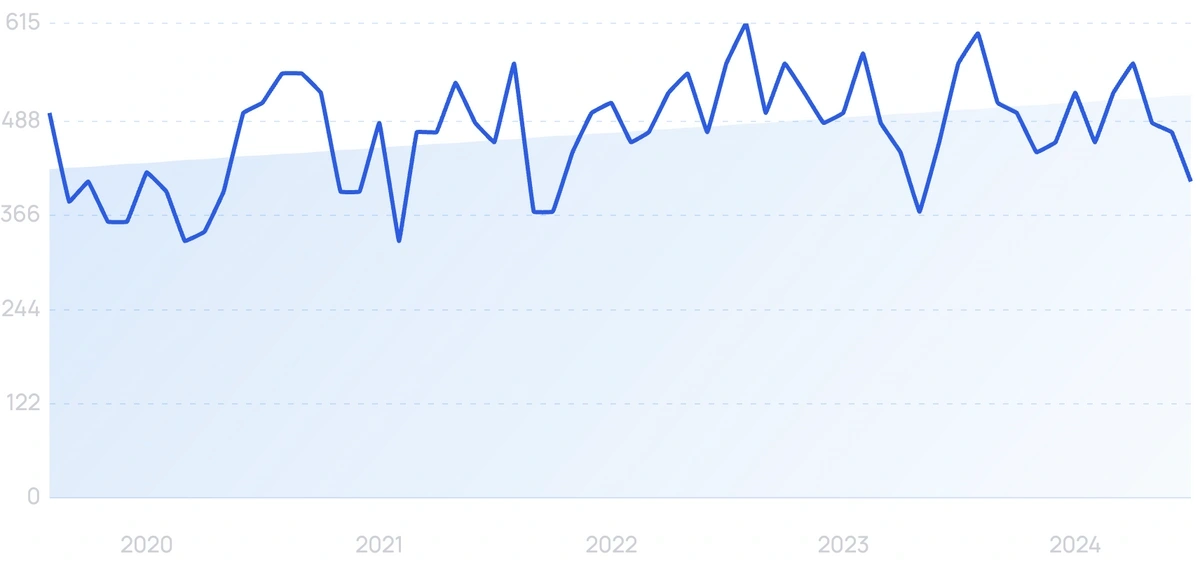

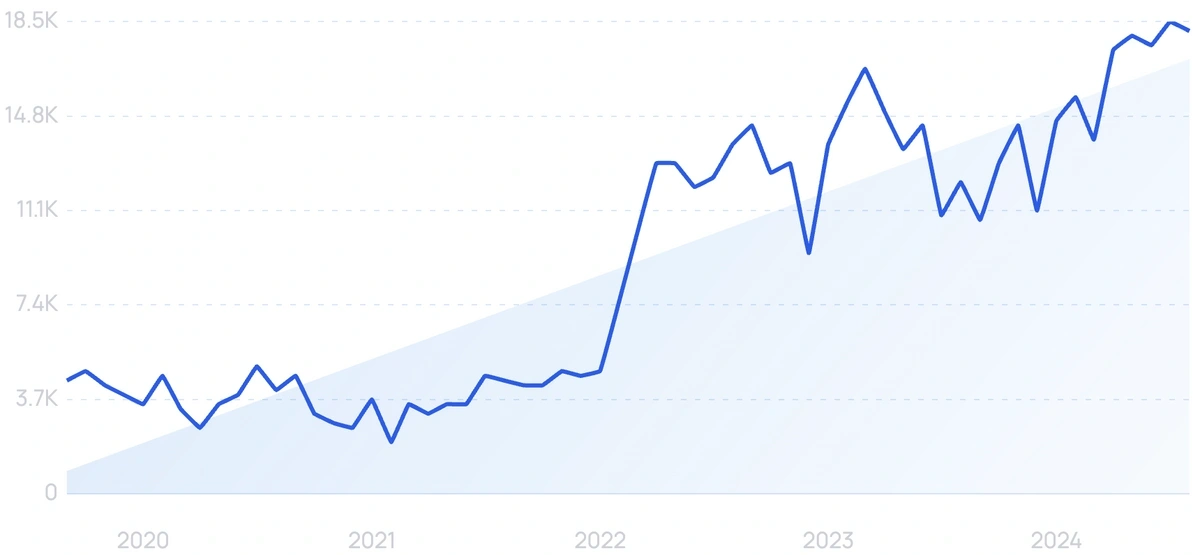

21. StackAdapt

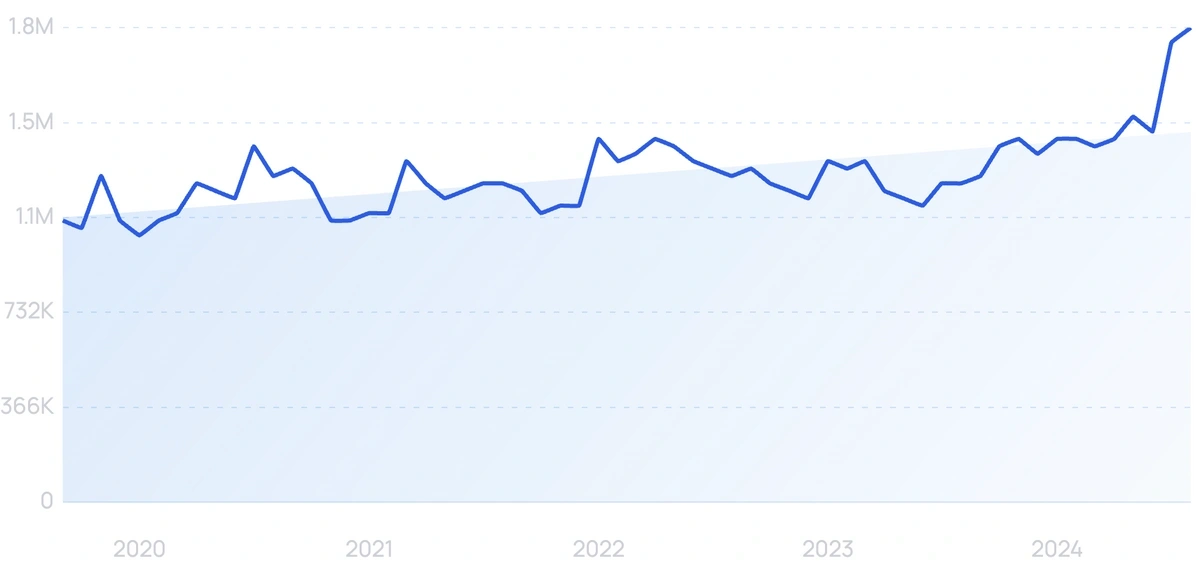

5-year search growth: 308%

Search growth status: Exploding

Year founded: 2013

Location: Toronto, Canada

Funding: $1.6M (Series A)

What they do: StackAdapt is a programmatic advertising platform. In other words, a demand-side platform with a sizable inventory of native ads. In addition to ad inventory, StackAdapt’s customers get access to an array of tools, including ad insights, reporting, and campaign management.

22. VidMod

5-year search growth: 75%

Search growth status: Regular

Year founded: 2014

Location: New York, New York

Funding: $231.6M (Series D)

What they do: VidMob is an online video creation platform specifically geared towards social media ads. Some of Vidmod’s noteworthy clients include Audi, Meta, and Burger King.

23. Titan Digital

5-year search growth: 33%

Search growth status: Regular

Year founded: 2011

Location: Murfreesboro, Tennessee

Funding: Undisclosed

What they do: Titan Digital is an ad tech company that offers a range of digital marketing solutions for businesses of all sizes. Its services include search engine optimization (SEO), pay-per-click (PPC) advertising, social media marketing, and website design and development. Titan Digital aims to help businesses improve their online presence and drive growth through effective digital marketing strategies.

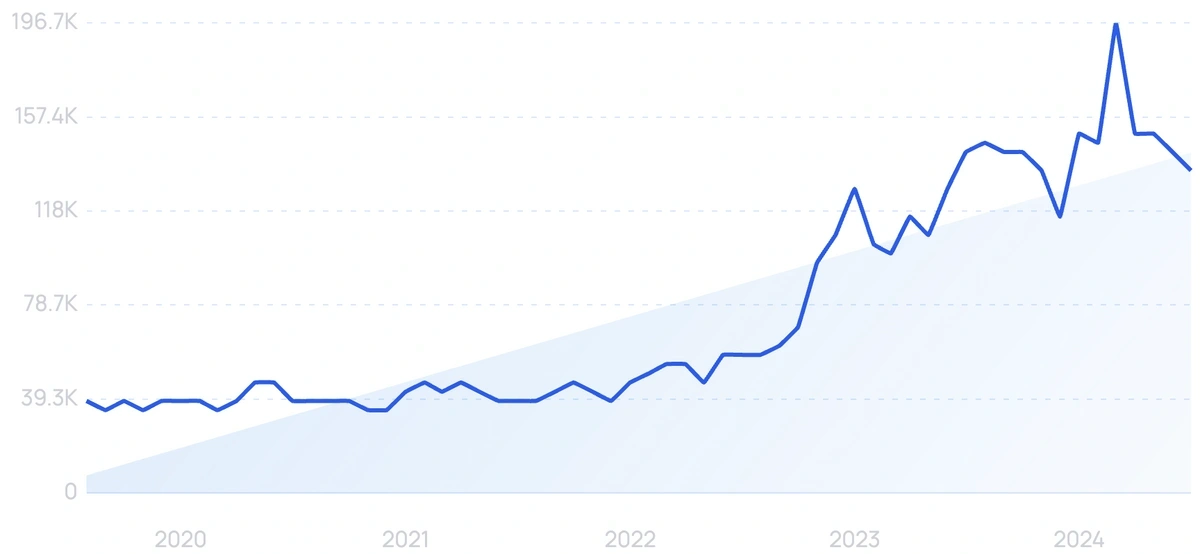

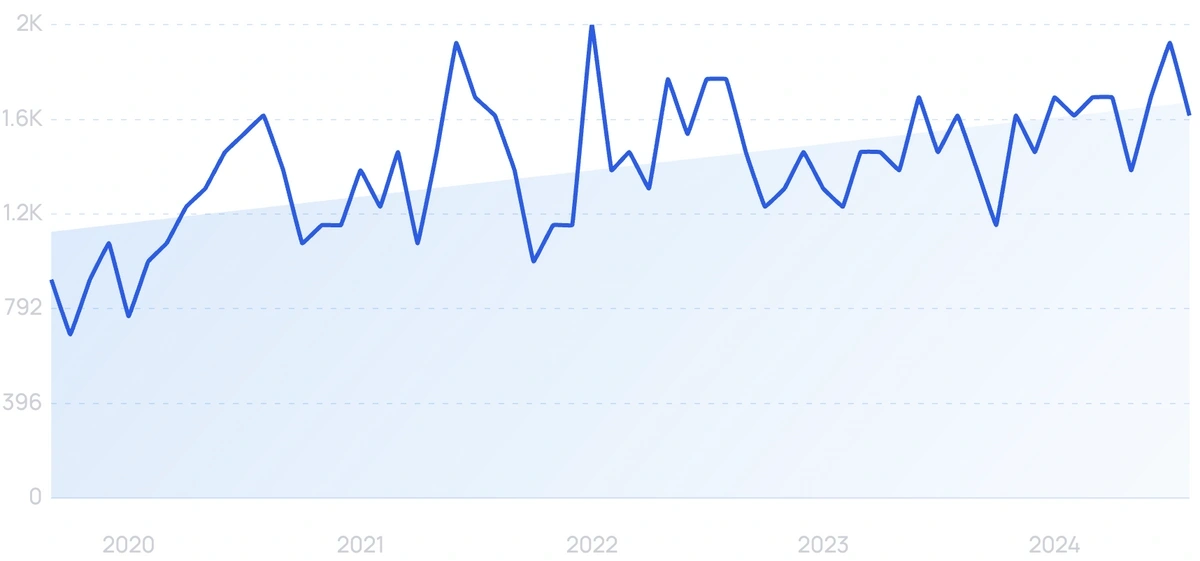

24. Adsterra

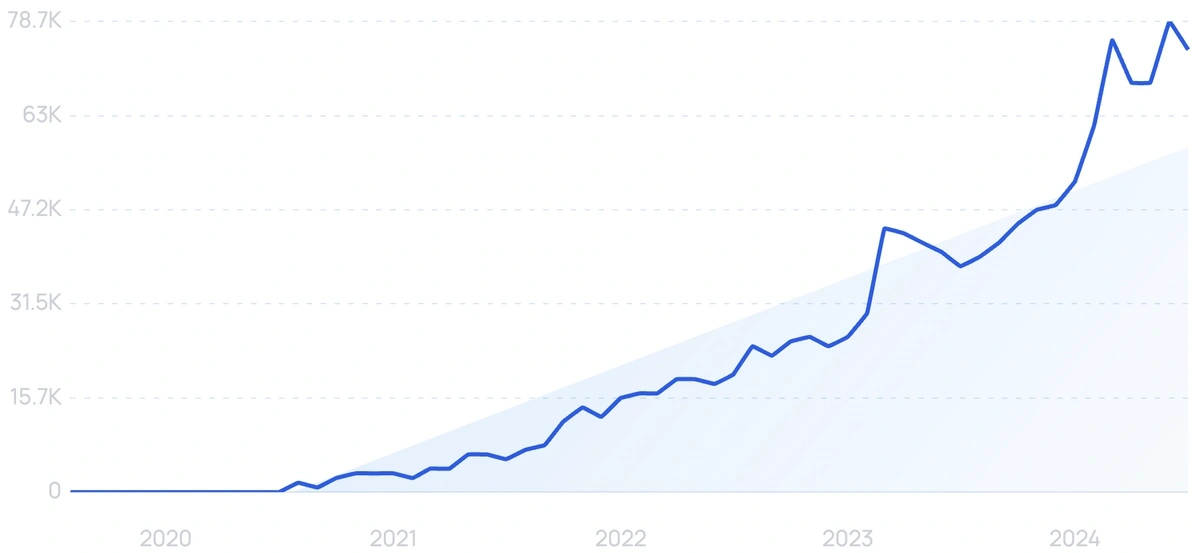

5-year search growth: 2,300%

Search growth status: Exploding

Year founded: 2013

Location: Nicosia, Cyprus

Funding: Undisclosed

What they do: Adsterra is an ad and CPA network that serves over 30 billion ad impressions per month worldwide. The platform connects publishers and advertises with various ad formats, including pop-ups, pop-unders, display banners, etc.

Conclusion

The pandemic caused traditional digital ad spending to decline. However, connected TV (CTV) and mobile advertising saw a large increase in growth.

As you saw, many of the AdTech startups on this list are CTV streaming providers and mobile app advertising platforms.

Another trend we saw was an emphasis on ad fraud and data protection.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more