Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

AI Bubble Stats (2026)

Sam Altman recently acknowledged that AI could be in a bubble.

He’s the CEO of OpenAI, the maker of ChatGPT. Talks over the next funding round potentially value his company at north of $800 billion.

“ChatGPT” searches are up by 232% in the last 2 years.

So when Altman talks about an AI bubble, it’s worth listening. Few are better placed to diagnose a potentially over-inflated market.

But what would an AI bubble really mean? And how should it influence your attitude toward adopting more AI tools?

The bottom line is that the “bubble” probably doesn’t matter to your business (although it might matter to you as an investor). And getting spooked by it could mean getting left behind.

AI Bubble Top Stats

- Capital expenditure at AI hyperscalers topped $394 billion last year

- 2026 capex is forecast to exceed $500 billion

- One zero-revenue AI startup has raised over $500 million

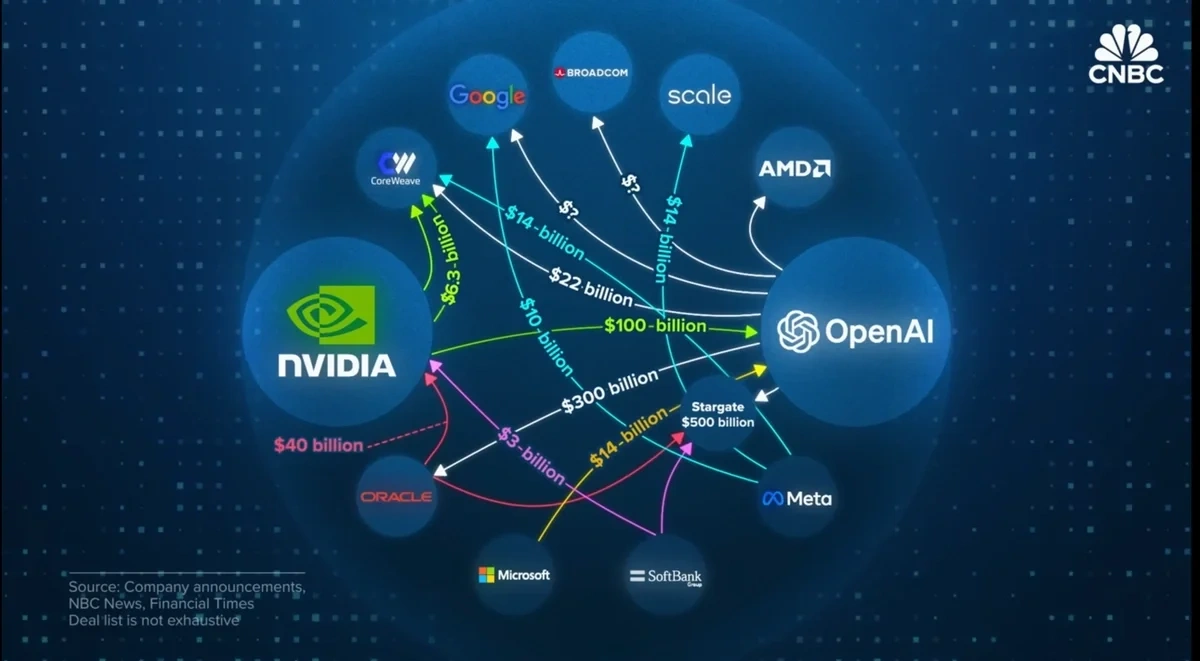

- OpenAI has commitments to Oracle of $300 billion, Oracle is spending $40 billion on Nvidia chips, and Nvidia is (possibly) investing $100 billion in OpenAI

- One analysis found a $600 billion gap between AI revenue expectations and actual revenue

- Amazon stock has increased in value 15.5x since its dot-com bubble “peak”

- 70% of strategy and finance departments have seen revenue increase as a result of using AI

What is the AI Bubble?

Starting with the basics, a bubble in economics is where valuations become artificially inflated. This precedes a sharp loss of value, harming investors who bought into the bubble.

The driving factor of the inflation is speculation. In simple terms, a certain industry or technology becomes the subject of “hype”, driving investments that are no longer tied to the intrinsic value of the product or market in question.

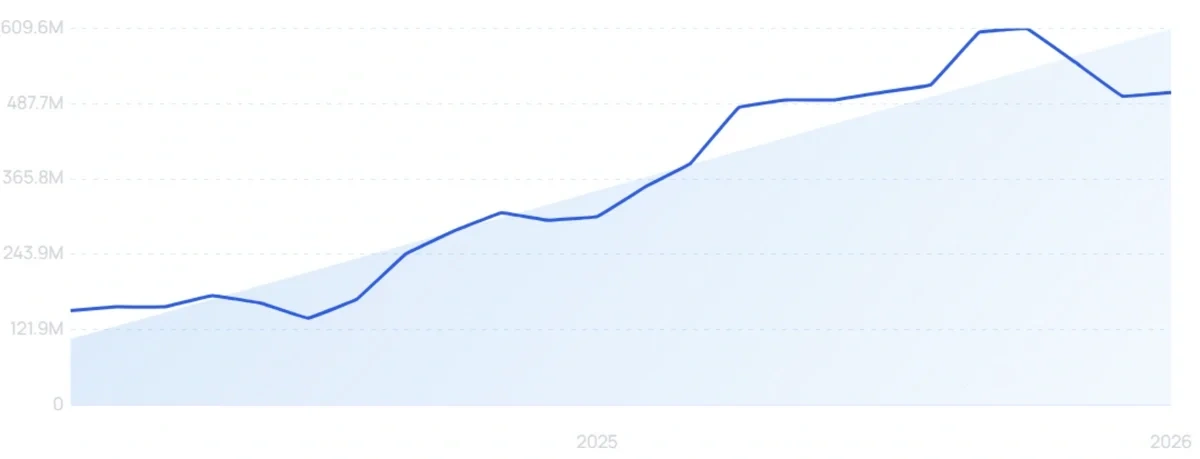

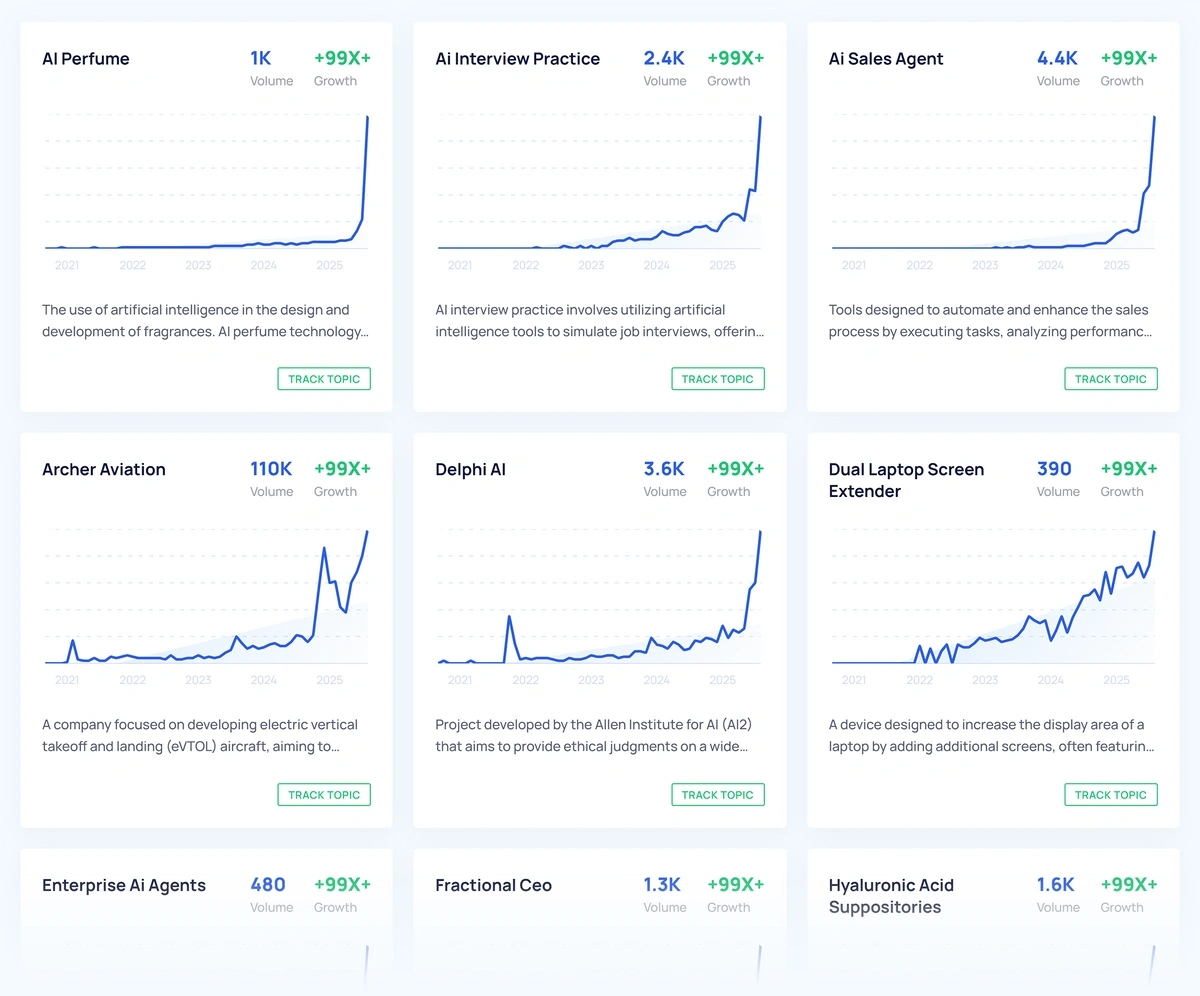

There’s no doubt that AI has been the subject of major hype. This is what the six top non-branded business trends being tracked by Exploding Topics looked like recently:

This surge in interest is coupled with a corresponding spike in investments. By December 2025, AI hyperscalers alone had reached $394 billion in capital expenditure for the year.

Goldman Sachs forecasts that this same group will spend $527 billion in 2026.

But as with any potential bubble, it’s impossible to categorically define it as such until there is a “bursting” event, where AI assets lose vast swathes of their value. Nobody can say with any certainty that this will definitely happen.

What did Sam Altman say about an AI bubble?

While we can’t definitively declare an AI bubble, it is worth listening to the opinions of experts within the field. Sam Altman is certainly one of them, and he thinks the AI market is showing telltale signs of being a bubble.

His own company’s valuation could well be one of the indicators. According to Business Insider, discussions over the latest round of fundraising in early 2026 could value OpenAI at anywhere from $750 billion to $830 billion.

Considering ChatGPT only launched in November 2022, that’s quite the rise.

“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes,” said Altman, via The Verge.

But what he said next is also crucial:

“Is AI the most important thing to happen in a very long time? My opinion is also yes.”

Are We in an AI Bubble?

Of course, we can’t just take Altman’s word for it that we are in an AI bubble. He is well-placed to give an insightful opinion, but he is not the sole authority.

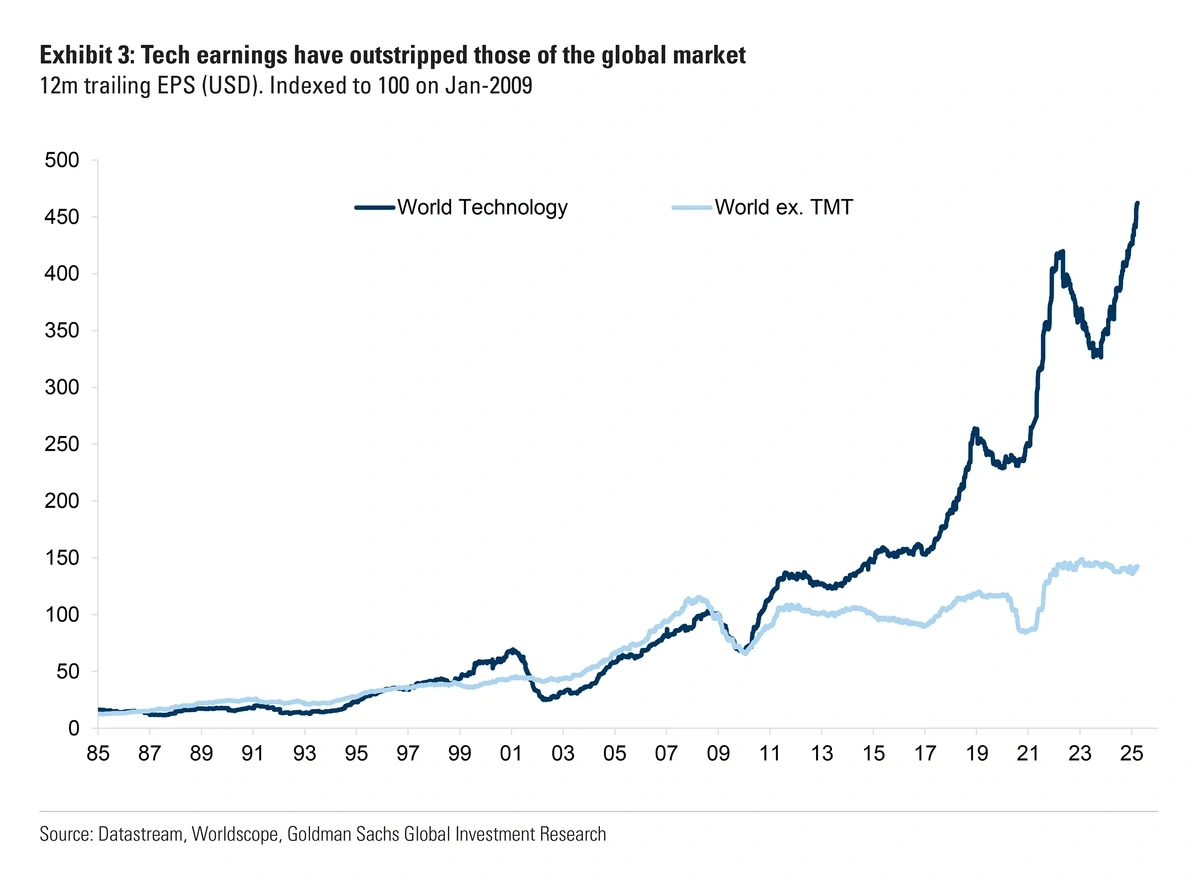

For instance, a Goldman Sachs research paper makes the case that recent enthusiasm for technology stocks, including AI organizations, does not represent a bubble. It argues that unlike prior bubbles, such as the dot-com bubble, the price appreciation is backed up by strong profit fundamentals for tech companies.

But the report evidences that claim primarily by reference to the “magnificent seven”: Alphabet, Amazon, Apple, Broadcom, Meta, Microsoft, and NVIDIA. These behemoths have driven much of the growth in profits.

When it comes to AI startups specifically, investments in many of the market’s newer entrants are not necessarily backed by profits or even revenues.

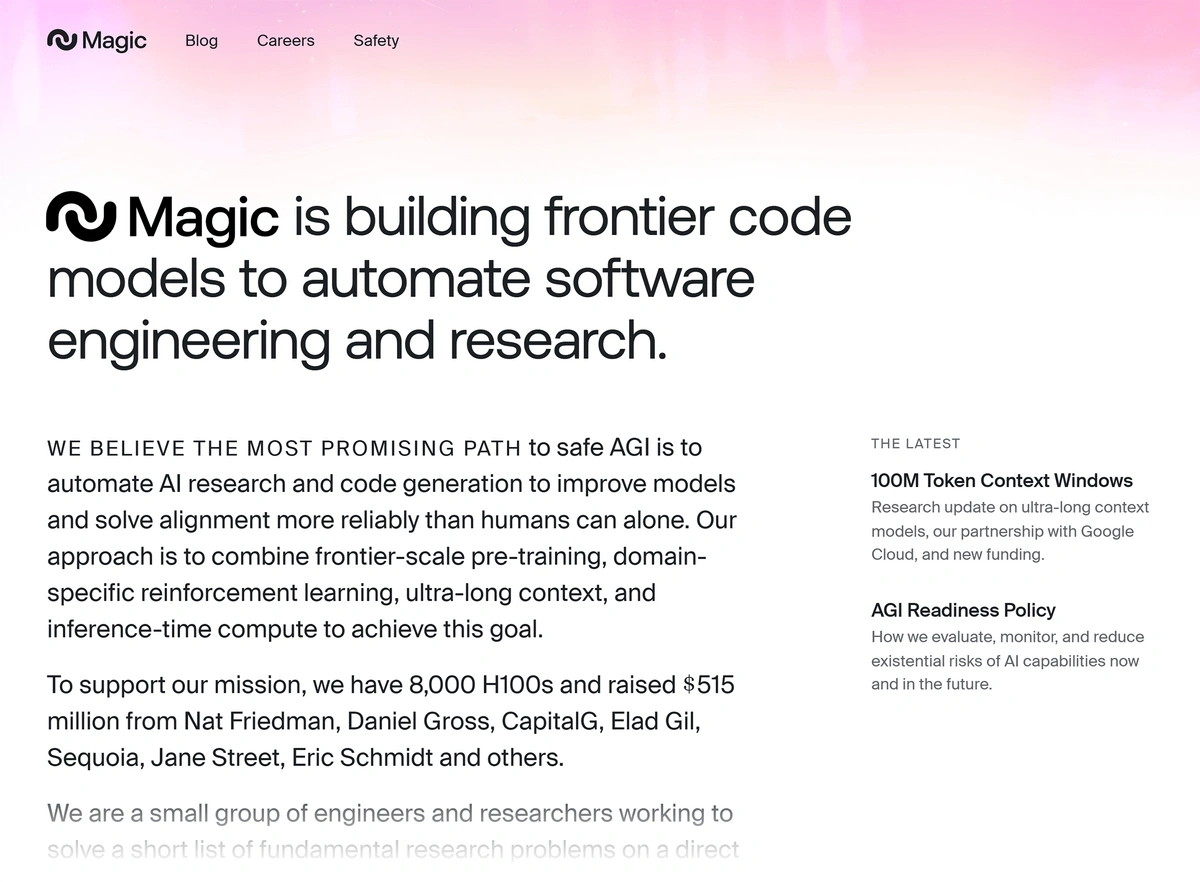

Magic AI is trying to use AI to automate software engineering and research, proposing an eventual road to safe artificial general intelligence (AGI).

Last year, it was reported to be in talks over a $200 million funding round that would have valued the startup at $1.5 billion. That’s despite the company as yet having no revenue and no product.

It ended up raising even more: $320 million. Total funding now exceeds half a billion dollars.

I’m not making any judgment on the specific potential of Magic, nor on the wisdom of the investment that has gone into it. But it’s hard to see how investors could be genuinely assessing the “profit fundamentals” of a zero-revenue company.

There are many such cases, even if Magic is one of the more extreme examples. Last year, Sequoia Capital ran an analysis which found a $600 billion gap between actual AI revenues and the revenue expectations implied by the investment into AI infrastructure.

That doesn’t prove a bubble. But there is an observable decoupling between typical business metrics like revenues and profits, and the amount of money being funnelled into AI ventures — which at the very least increases the risk of a bubble.

The Circular AI Funding Phenomenon

Another potential AI bubble red flag is the extent of circular funding between AI giants. An ever-growing web of deals is sending valuations spiraling, but the same money is seemingly just moving back and forth between the same big players.

In September 2025, Nvidia announced that it would invest up to $100 billion in OpenAI. But directly or indirectly, that money will effectively be committed to purchasing Nvidia's chips to power OpenAI's insatiable need for compute power.

That essentially casts Oracle as the intermediary. OpenAI has committed $300 billion to Oracle to build out its data centers, and Oracle is buying $40 billion worth of Nvidia chips in order to do so.

There's also SoftBank to factor into the equation, which in February 2026 claimed a $4.2 billion gain on its OpenAI investment within the last quarter. But that was based on a revised valuation following an October 2025 secondary share sale, in which SoftBank itself was a major participant.

It's a shaky enough state of affairs when the circle stays complete. But when one element drops out, the whole thing appears prone to come crashing down.

In early 2026, Nvidia took a step back from its $100 billion OpenAI commitment, insisting it had always intended to assess its investment on a rolling basis. That had a ripple effect across the AI ecosystem.

Sam Altman took to X with an "everything is fine" sort of statement, insisting that the relationship with Nvidia remained as good as ever. Oracle, for its part, felt the need to publicly state its confidence in OpenAI's abilities to meet its $300 billion obligations.

Naturally, this had the opposite effect. Oracle stock opened at $170.92 on February 2, the day of its statement, and closed at $160.06. By the end of February 5, it had fallen to $136.48.

Does an AI Bubble Matter?

It seems more likely than not that we are in an AI bubble. However, for the everyday user and indeed the typical business decision-maker, the impact is currently minimal.

Some people have conflated the AI bubble with the idea that the usefulness of AI is also being overhyped and overinflated.

But the two concepts are not necessarily linked at all. That confuses AI valuations with the value of AI.

Even the most pessimistic commentators regarding the possibility of an AI bubble are perfectly happy to accept that the technology is potentially transformative. Here’s an extract from Harris Kupperman:

“At the end of the day, this AI cycle feels less like a revolution and more like a rerun. I’ve seen this story before — fiber in 2000, shale in 2014, cannabis in 2019. Each time, the technology or product was real, even transformative. But the capital cycle was brutal, the math unforgiving, and the equity holders were ultimately incinerated. AI will be no different.”

In other words, while many investors lost out in previous bubbles, the underlying products went from strength to strength. Not only that, but in many cases, early adopters gained a significant first-mover advantage.

The dot-com bubble comparison

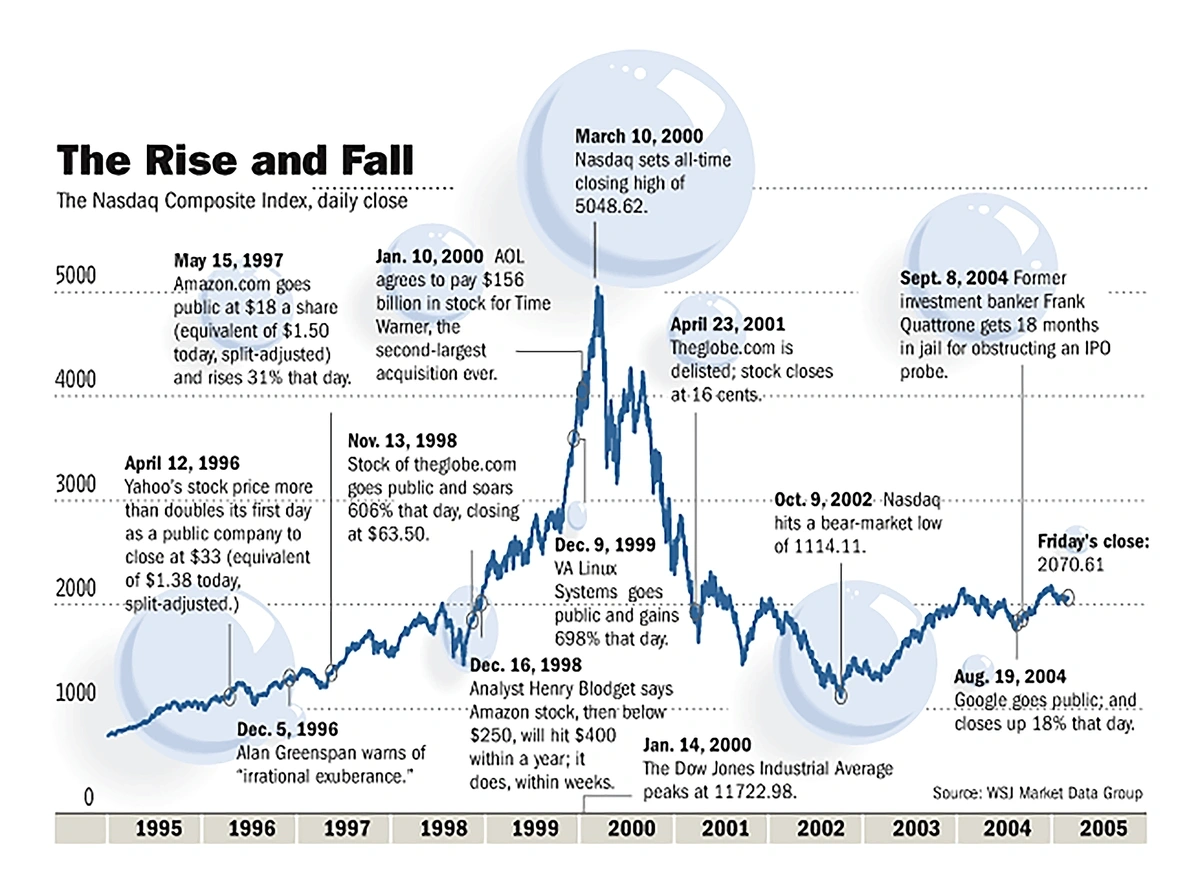

The dot-com bubble is routinely held up as the archetypal example of a bubble. And rightly so: the Nasdaq Composite Index went from a high of 5048.62 in March 2000 to 1114.11 in October 2002.

Clearly, the valuations of numerous specific companies were far too high. Pets.com, Webvan, and Boo.com were all high-profile casualties that attracted vast sums of investor cash before ultimately shutting down.

But the underlying investor excitement in the technology was fundamentally valid. The rise of the internet has been one of the most transformative events in human history.

And some of the companies at the heart of the bubble have even proved investors right over time. Most notably, Amazon has developed into one of the most successful companies in the world.

An investor who bought $1000 of Amazon stock at the peak of the “bubble” would have $15,500 today.

Why Your Business Still Needs to Embrace AI

If your business had correctly diagnosed the dot-com phenomenon as a bubble in the early 2000s, and had subsequently decided to adopt a highly internet-skeptic attitude, you would have been brutally left behind by the competition.

As such, as a business decision maker, the only question you need to be asking yourself is whether AI is genuinely valuable as a business tool, as opposed to whether the valuations being bandied about are strictly accurate.

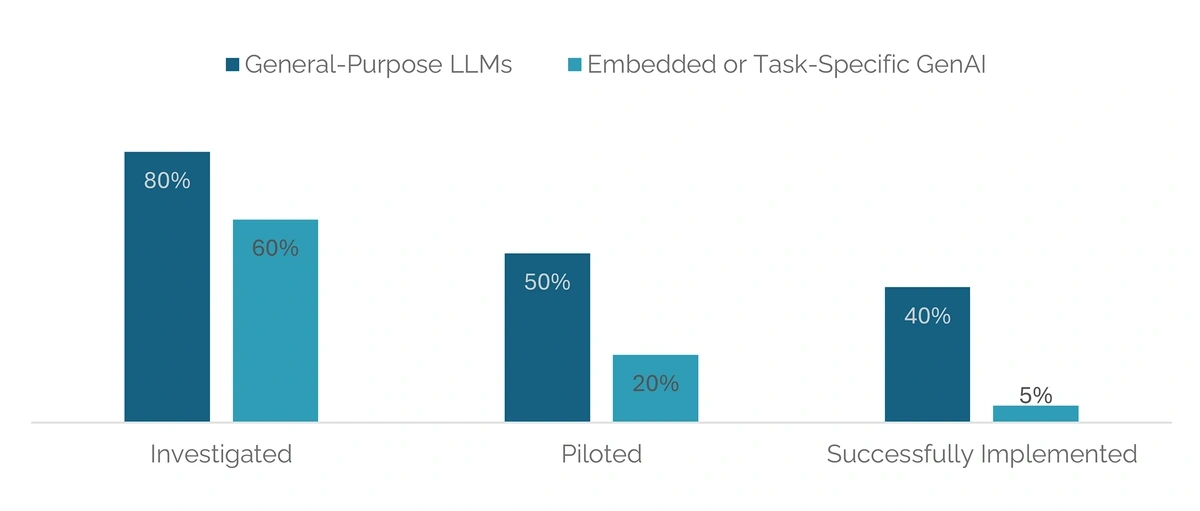

The value of AI as a technology is still something that needs to be tested and probed, rather than taken as read. A handful of studies have cast some doubt on its utility.

Recently, a report from MIT claimed that 95% of generative AI pilots are failing to produce any ROI. That caused lots of media discussion.

But it comes with some major caveats. For one thing, as Marie Haynes points out, the 95% figure comes from just 52 interviews.

Moreover, the report acknowledged that the next evolution of AI tools could fundamentally change business processes. We are dealing with an ever-improving technology.

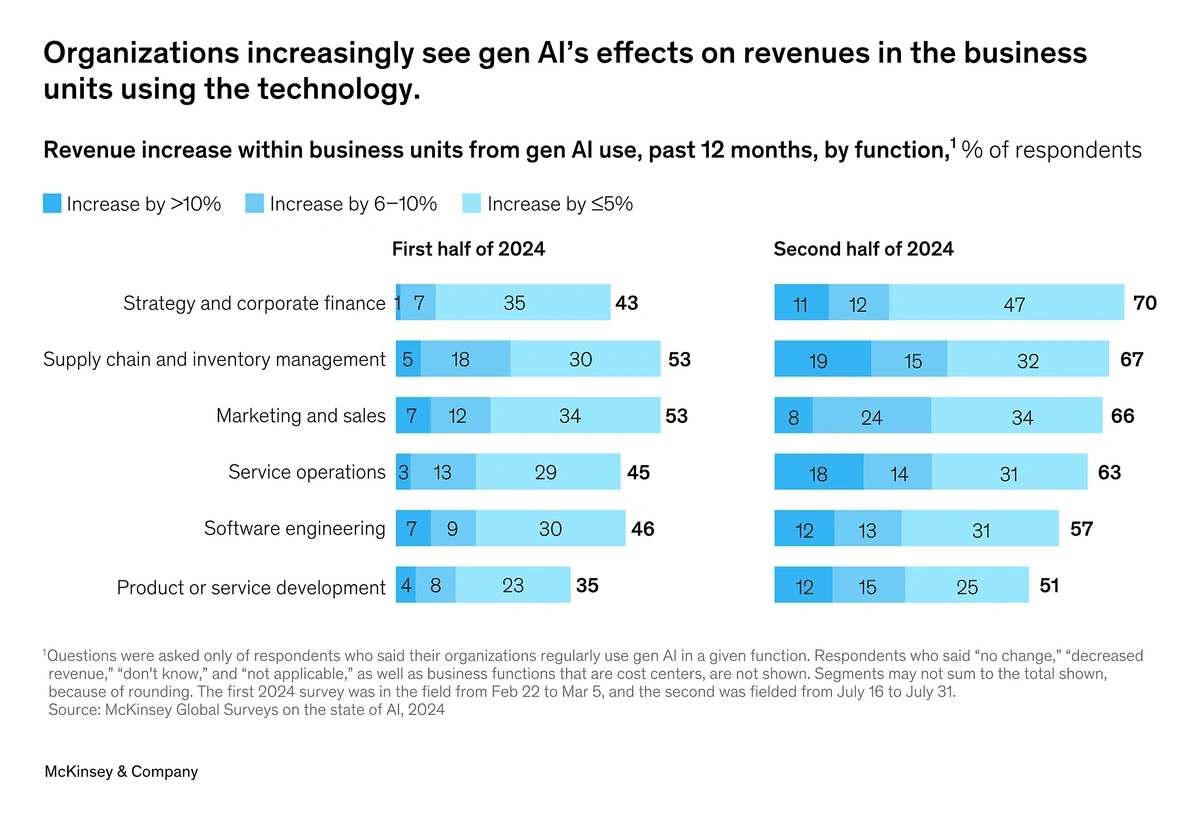

And other studies are clearly showing the real-world value of AI tools right now.

According to McKinsey, 70% of strategy and corporate finance business units have seen some kind of revenue increase over the past 12 months as a direct result of implementing generative AI.

Meanwhile, our own original research has shown that 79.9% of workers believe that AI has increased their productivity. More than 1 in 3 think that their productivity has increased significantly.

While not every AI tool is guaranteed to be a success, investing in the right ones for your company will provide a return on investment.

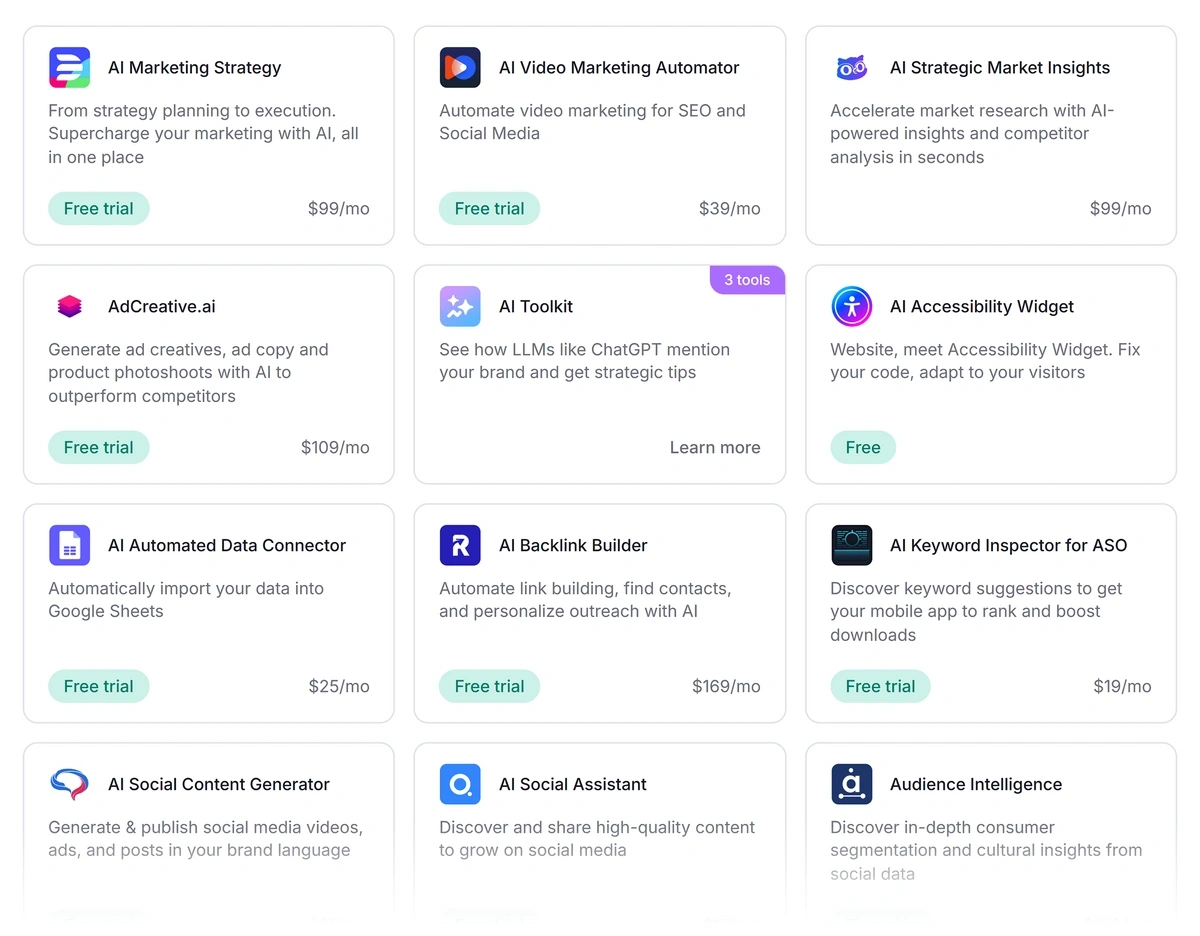

For instance, the Semrush suite of AI tools can massively enhance your business processes. From strategic market insights to ad copy and product photoshoots, there’s an app for you.

And the AI Visibility Toolkit makes sure you won’t get left behind by changing customer behaviors.

Consumers are genuinely using AI as an everyday search tool now, and Semrush’s software lets you track your visibility, share of voice, and growth opportunities within popular tools like ChatGPT and Google AI Mode.

Whether we’re in an AI bubble or not, you cannot afford to ignore the technology — it is there to help you, and your potential customers (and indeed competitors) are already using it.

Why You Might Still Want To Invest (Carefully) in AI Stock

If you’re an investor, then concerns about an AI bubble are more relevant. But they don’t make AI stocks a complete no-go.

Of course, in an ideal world, you would be able to sniff out the AI companies with genuine staying power — discovering the next Amazon and discarding the next Pets.com.

But if it were that simple, everyone would be doing it. Acknowledging that AI is probably in a bubble means accepting that investments in the field involve a potentially higher-than-usual degree of speculation.

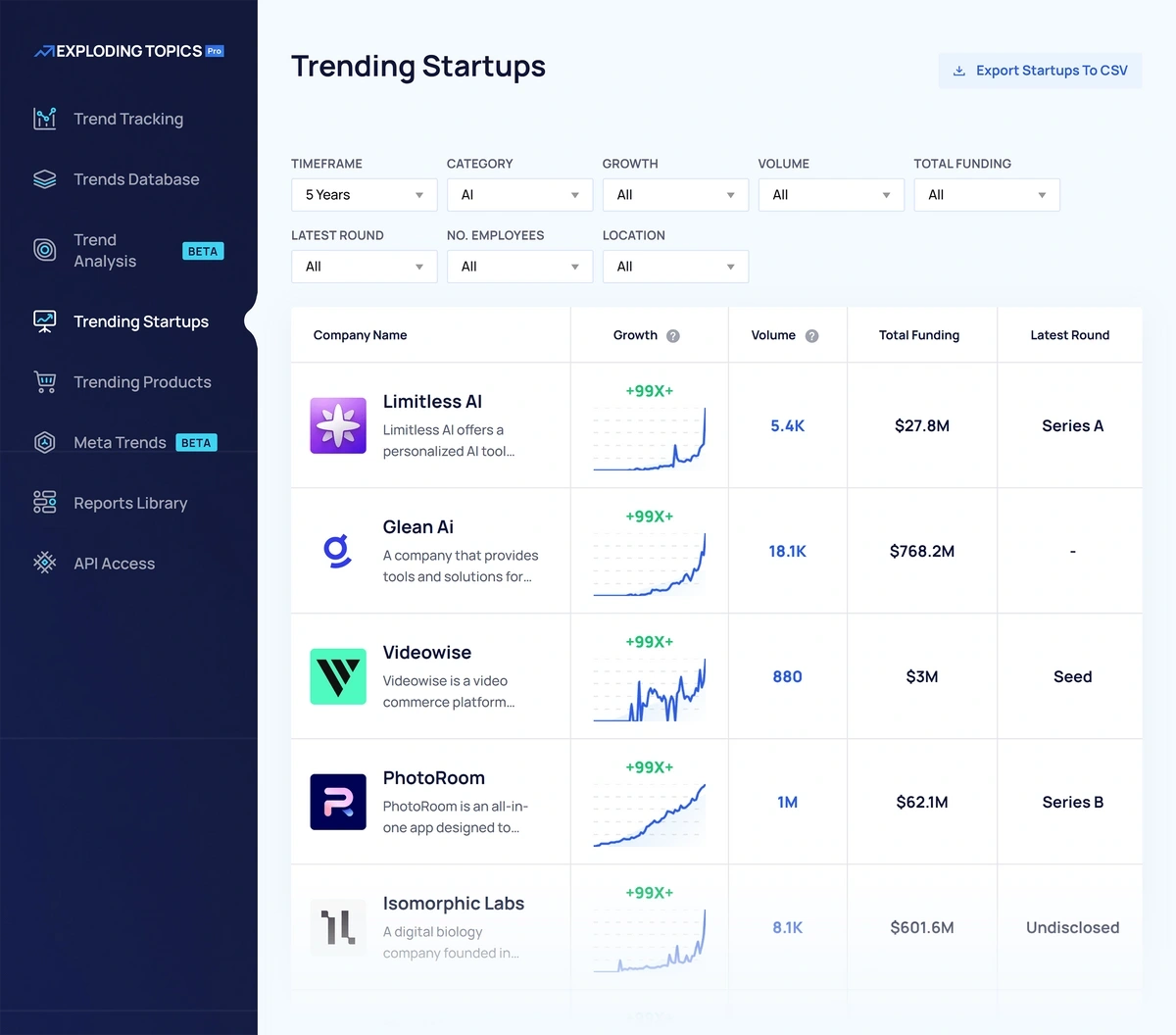

However, there will undoubtedly be winners from the transformative potential of AI, and finding them now promises huge returns for investors. The Exploding Topics Pro database helps you to find early-stage AI startups with encouraging growth.

You can filter by search volume, total funding, funding stage, and the number of employees. This kind of data can give investors an edge.

Meanwhile, tracking down AI startups with strong revenue and profit fundamentals should provide some level of insulation from the effects of the bubble. As long as you’re following more than just hype, there is real value to be found.

Don’t Let The AI Bubble Hold Your Business Back

Sam Altman is right: investors are getting a little bit carried away in some cases when it comes to AI. The money coming in does not match up to the money coming out (and even some of the money coming in relies on volatile circular funding).

But bubbles form around innovations that are genuinely exciting. Money is flooding into AI because it is a transformative technology.

There are already AI tools out there that can markedly improve your bottom line. And these tools are only going to get better.

You have to pick the right tools, both as an investor and as a business decision-maker. But shying away over fears about a bubble will let your competitors move ahead of you. AI is an advancement you simply cannot afford to sit out.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

James is a Journalist at Exploding Topics. After graduating from the University of Oxford with a degree in Law, he completed a... Read more