Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

7 Important Alcohol Industry Trends (2024 & 2025)

You may also like:

As consumer's tastes rapidly change, the alcohol industry is poised to adapt and launch new products.

One thing remains the same: alcohol producers that can catch trends early will continue to rake in huge profits.

Here’s a list of the top seven trends in the alcohol industry worth keeping an eye on.

1. Non-alcoholic drinks go mainstream

One industry study recently discovered that non-alcoholic beverages are the third fastest growing beverage category in the US.

Searches for “non-alcoholic gin” are up by over 3,400% in 5 years.

This trend is expected to continue. IWSR reports that the total volume of no-alcohol and low-alcohol beverages hitting the global market is expected to grow 31% by 2024.

A recent Gallup survey shows that consumers are supporting this trend.

In 2019, 65% of adults reported drinking alcoholic beverages. That number is now down to 62%.

One survey shows that the highest percentage of individuals drinking alcoholic beverages occurred in 2010, with 67% of adults reporting they drink.

The non-alcoholic beverage trend is especially prevalent among Millennials (people who are 26 to 41 years old right now) and Gen Zers (people who are 10 to 25 years old right now).

Gen Z is drinking more than 20% less than other generations did at their age.

There’s even a movement for people who may have drunk alcohol in the past but don’t anymore: “sober curious”.

Those who are “sober curious” aren’t necessarily addicted to alcohol or feel the need to abstain for the rest of their lives. They are simply experimenting with living without alcohol.

There’s Dry January and Sober October, too, for individuals looking for a defined time to dedicate to non-alcoholic beverages.

Athletic Brewing Co. is one company that’s popularizing the “non-alcoholic alcohol” trend.

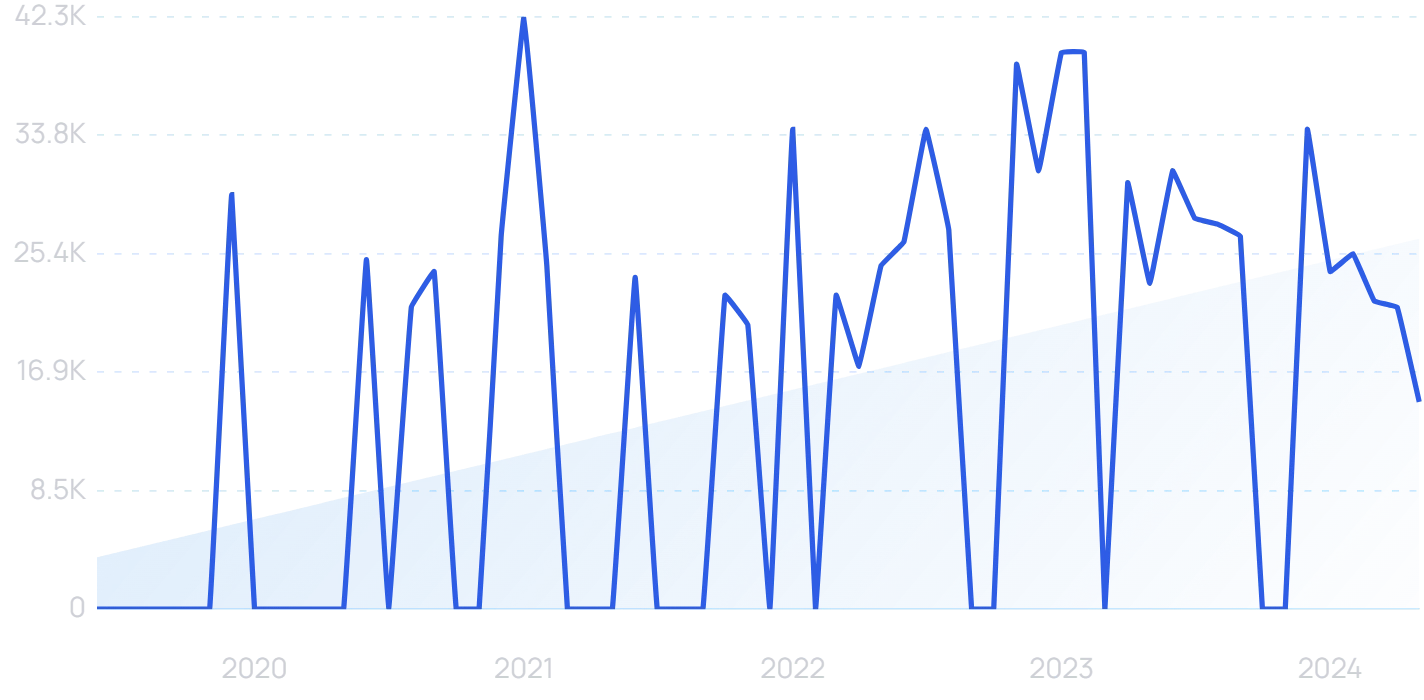

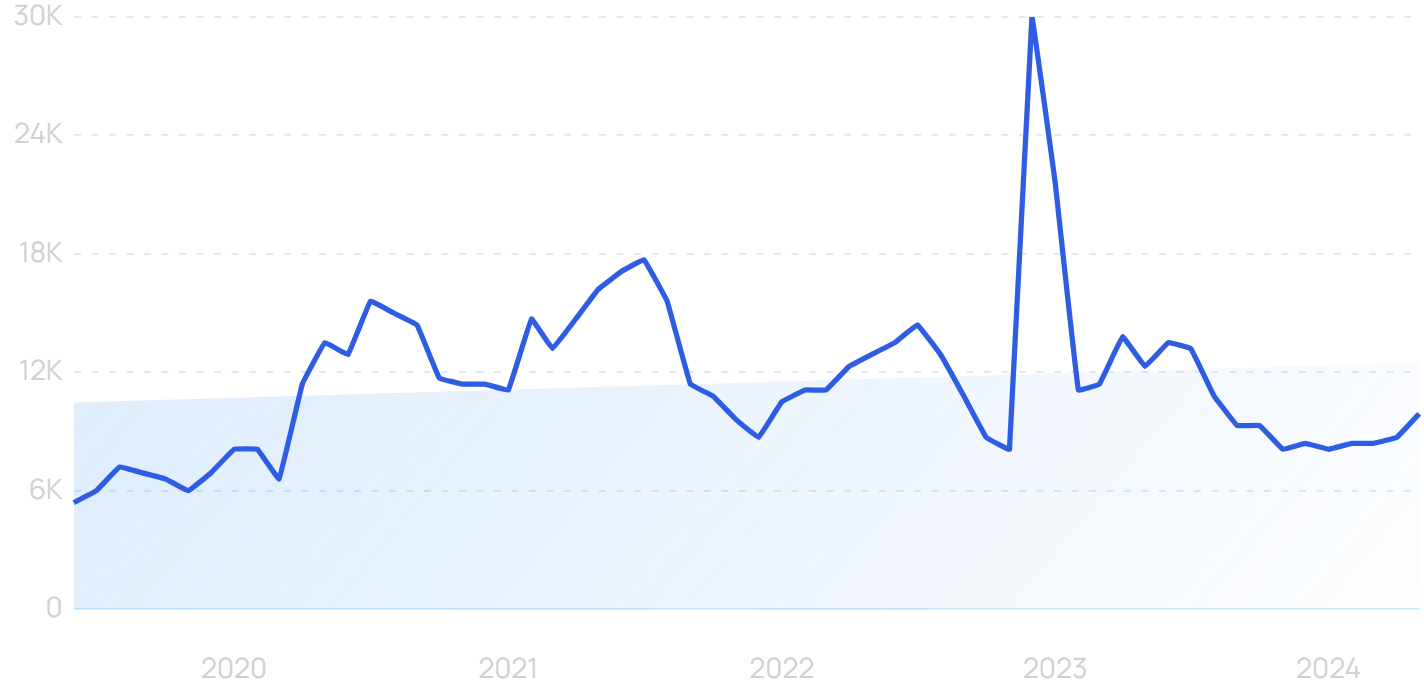

Search growth for “Athletic Brewing Company” have steadily increased since 2019.

The brand now accounts for 19% of the non-alcholic beer market.

2. Mix-ins and enhancements shake up the market

In 2024, an olive in a martini or an orange in a Blue Moon doesn’t cut it anymore.

Consumers are increasingly craving mix-ins, enhancements, and fermented mixers in their drinks.

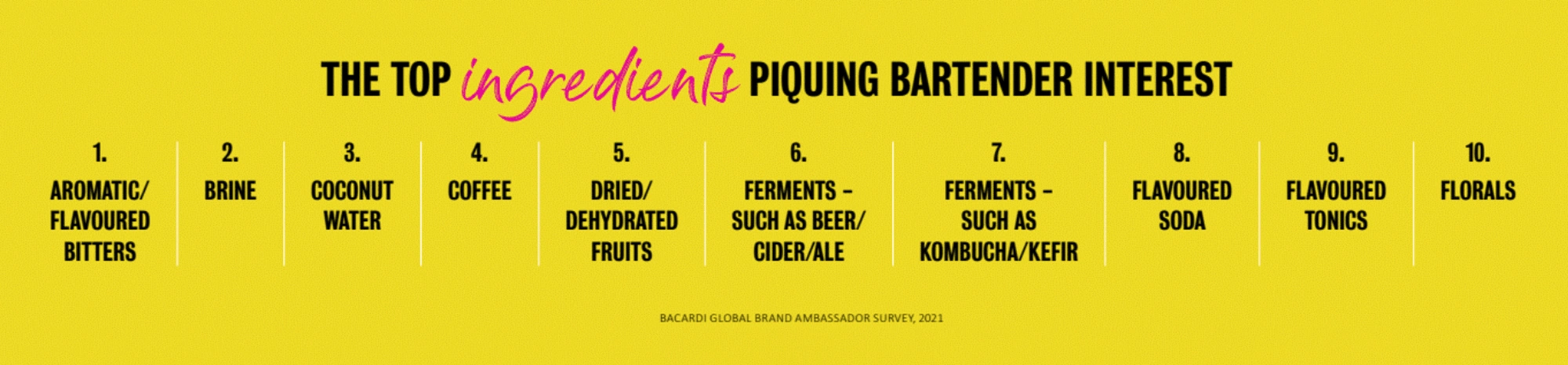

A survey by Bacardi Global ranked flavored bitters, coconut water, coffee, and fermented mixers as the most popular ingredients that are piquing the interest of bartenders.

Bacardi is seeing growth in offbeat mixers.

In the bitters category, Aperol and Campari have specifically soared in popularity.

Bartenders say Aperol paired with Prosecco and club soda (an Aperol Spritz) is one drink of choice.

#aperolspritz has over 2 million posts on Instagram.

Hard coffee was popular in the 90s, and yet, it’s an emerging trend now, too.

The most popular preparation of just two years ago was a mildly sweet, good-for-you cold brew.

Mr. Black Coffee Liquor offers 10 times more coffee concentration than classic brands like Kahlua but packs only half the sugar.

Mr. Black has been called “the leader in a new breed of spirits”.

The fermented drink market (alcoholic and nonalcoholic) is expected to have a CAGR of 6.2% through 2028.

The hard kombucha market (an alcoholic, fermented beverage) is growing much faster with a CAGR of 42.4%.

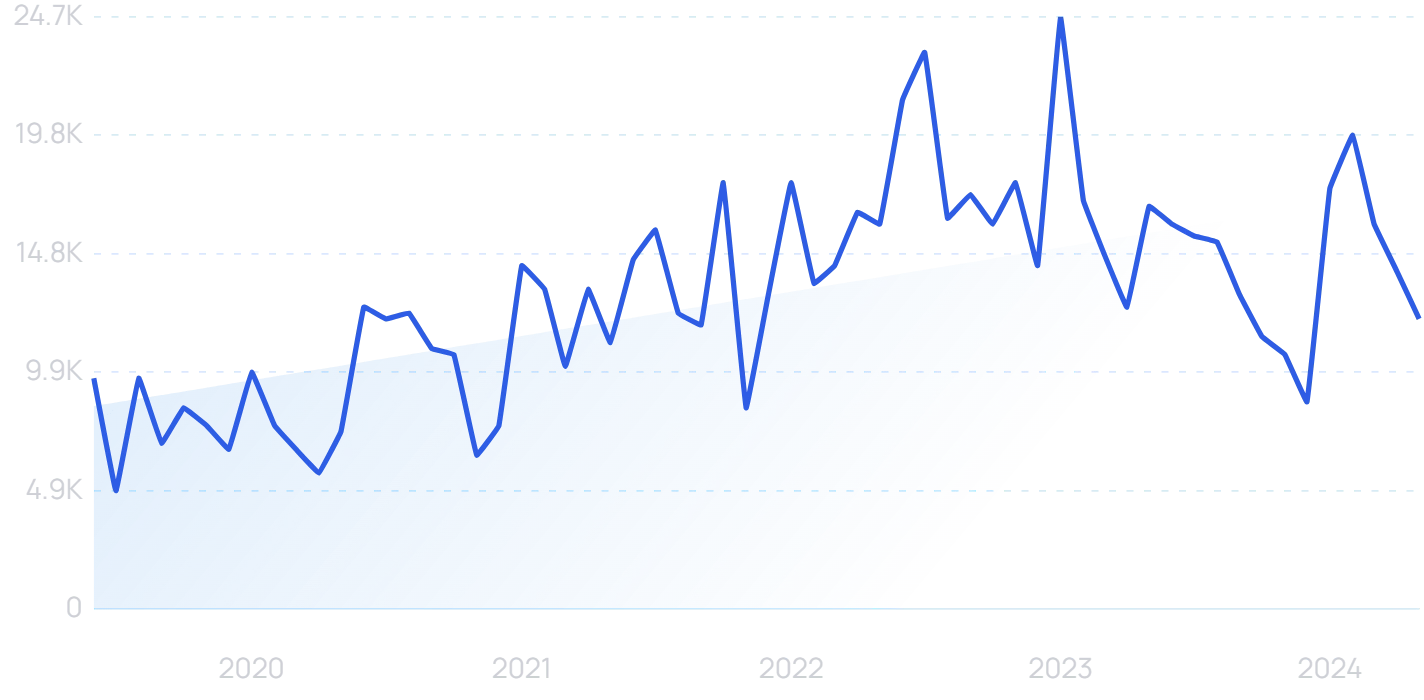

The popularity of hard kombucha continues to grow.

Flying Embers is one of the most successful hard kombucha brewers.

The startup has raised $45 million in VC funding to date. And they’ve reported 93% growth year-over-year.

Flying Embers is one of the top producers of hard kombucha in the US.

3. Alcohol brands are diversifying

In an effort to capture more sales, many beverage brands are diversifying their product offerings.

In recent months we’ve seen non-alcoholic beverage producers enter the alcoholic market. As well as beer brewers launching spirits and hard seltzers.

Ekos, a company that offers business management systems for craft breweries, reports that 31% of their customers say they’ll be launching new types of products in the next two years.

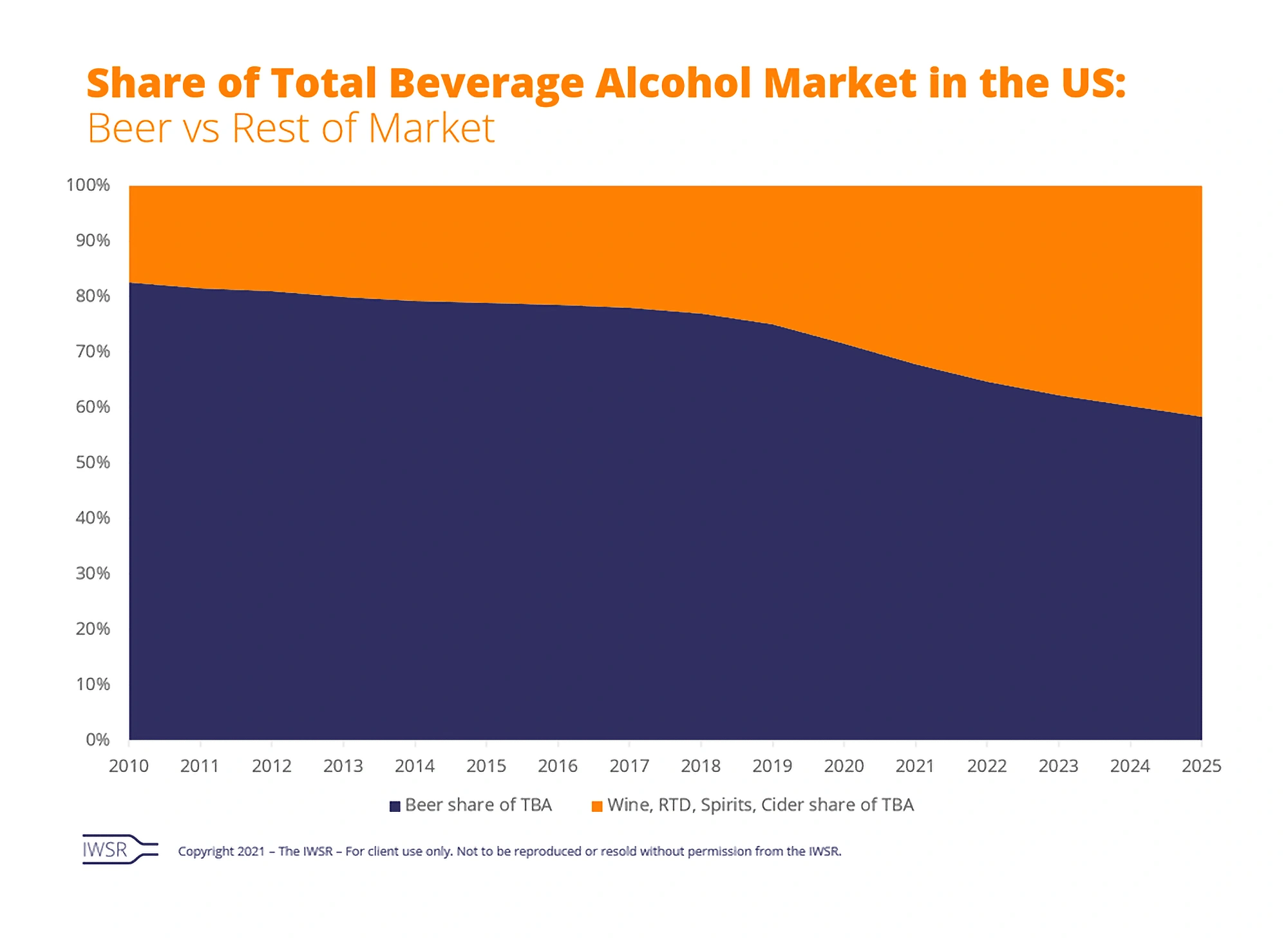

In the midst of this diversification, beer has been losing ground to other beverages in the alcoholic market.

In 1990, beer was responsible for 87% of the volume. According to the latest available data, it was down to 72%.

Beer’s grip on the alcohol market is slipping.

Dutch brewing company Heineken recently acquired Distell for $2.6 million, expanding their business to include wine, brandy, liqueur, and whisky offerings.

Even giant beverage companies like PepsiCo and Coca-Cola are diversifying.

Coca-Cola bought sparkling water company Topo Chico in 2017 and increased its sales by 39% in the following year.

Coca-Cola then launched Topo Chico hard seltzer. It’s Coca-Cola’s first alcoholic beverage in the US since 1980.

Topo Chico hard seltzer capitalizes on the success of its line of sparkling waters.

Craft breweries are diversifying, too.

Making hard seltzer required a few equipment additions in the brewery, but many of the processes were already in place.

The brewer now sells a dozen different flavors of hard seltzer.

As another sign of this trend gaining momentum, Oskar Blues Brewing Co. was acquired by Monster Beverage Corp. (maker of Monster Energy drinks) in early 2022.

Search volume for “Sugar Free Monster” has grown considerably (59%) over the past 5 years.

The $330 million deal brought five craft breweries, a collective known as CANarchy, under Monster’s belt.

CANarchy alone produces 616k barrels of beer and 211k barrels of hard seltzer each year.

Monster is also reportedly in talks to merge with Constellation Brands, which owns brands like Svedka vodka and Meiomi wines.

4. Canned cocktails give consumers a step up from hard seltzer

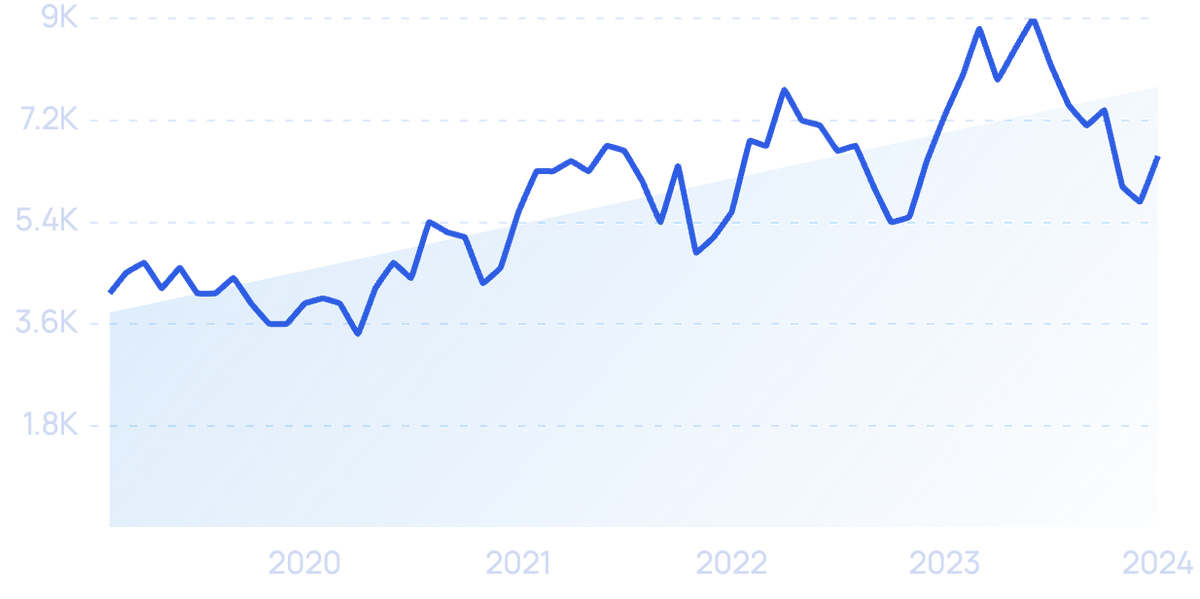

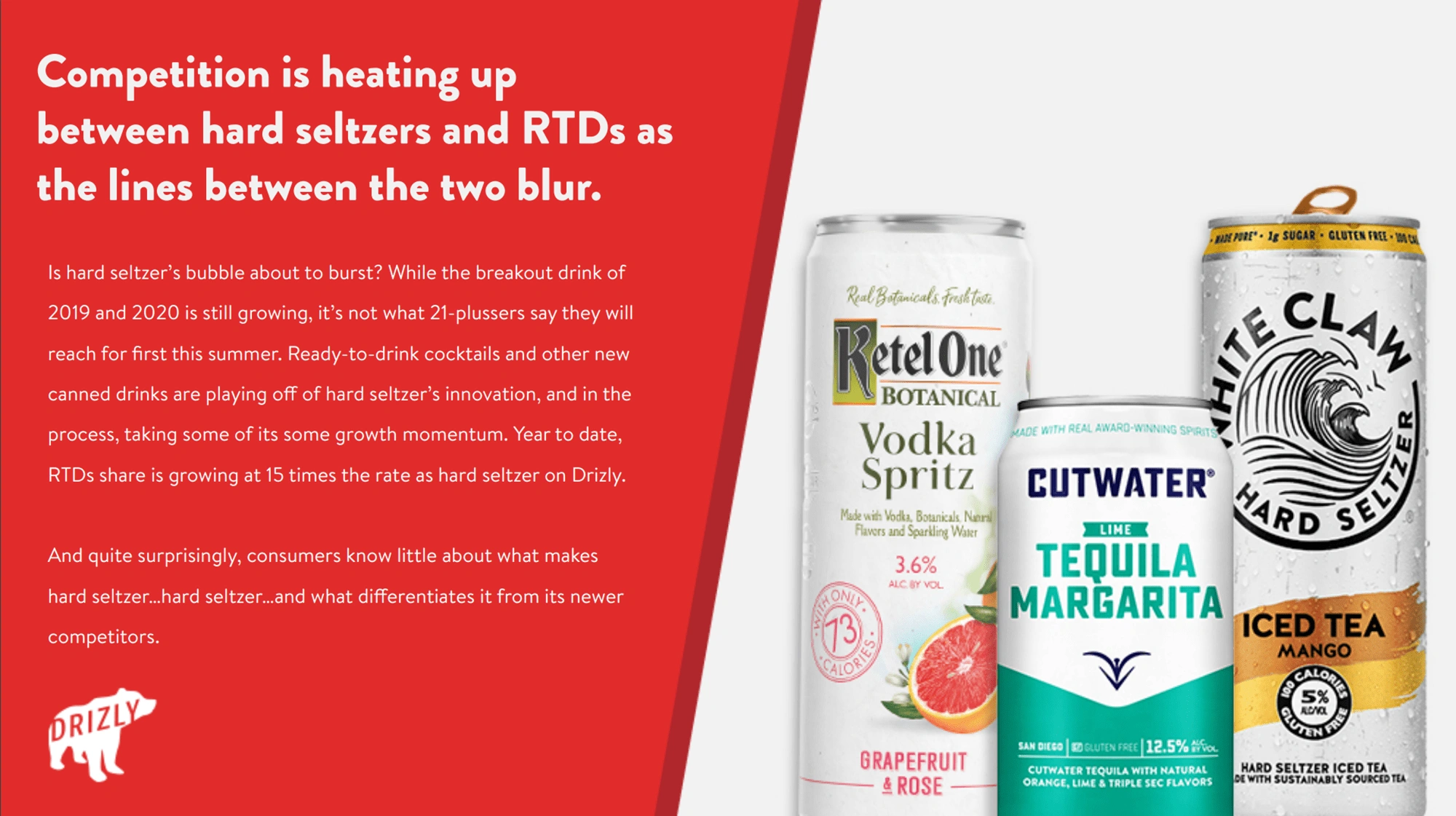

The ready-to-drink (RTD) cocktail market continues to see steady growth.

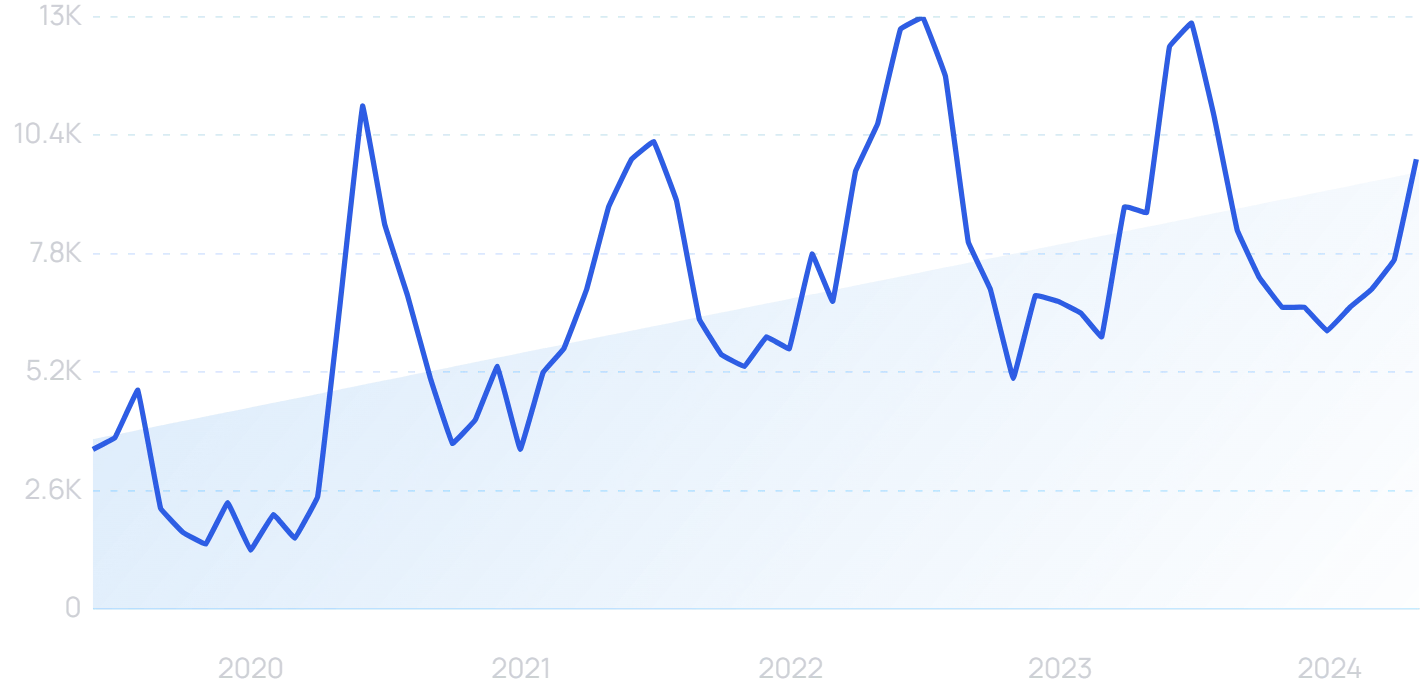

The popularity of canned cocktails is soaring (181% in 5 years).

Data from Nielsen shows that sales of canned cocktails grew 126% in one year.

The Drizly Consumer Report stated the share of sales of RTDs on its alcohol delivery platform was growing 15x faster than that of hard seltzer.

Canned cocktails are capturing a share of the market that hard seltzers used to own.

Experts say the RTD cocktail market will surge through 2030.

Many consumers love RTD cocktails for their simplicity and convenience — there’s no need to haul a dozen ingredients to the beach if you and your friends want cocktails.

Consumers who like to experiment with flavors, especially Millennials, are also leading this trend forward.

From a Manhattan to an Old Fashioned to bourbon whiskey with honey, ginger, lemon, and apple juice, there’s a canned cocktail for everyone’s taste.

5. DTC alcohol sales see significant growth

When pandemic lockdowns went into place, many states loosened their laws regarding alcohol delivery.

Laws vary, but only a few select states specifically outlaw alcohol delivery.

For example, only nine states plus the District of Columbia allow DTC spirit sales. However, 46 states allow DTC wine sales.

The Distilled Spirits Council of the United States is one organization fighting to get the laws surrounding DTC alcohol sales loosened even further.

In fact, they released a survey that found 80% of consumers believe distillers should be able to ship directly to customers.

Their survey also showed that 45% of customers had already bought alcohol online for direct shipment.

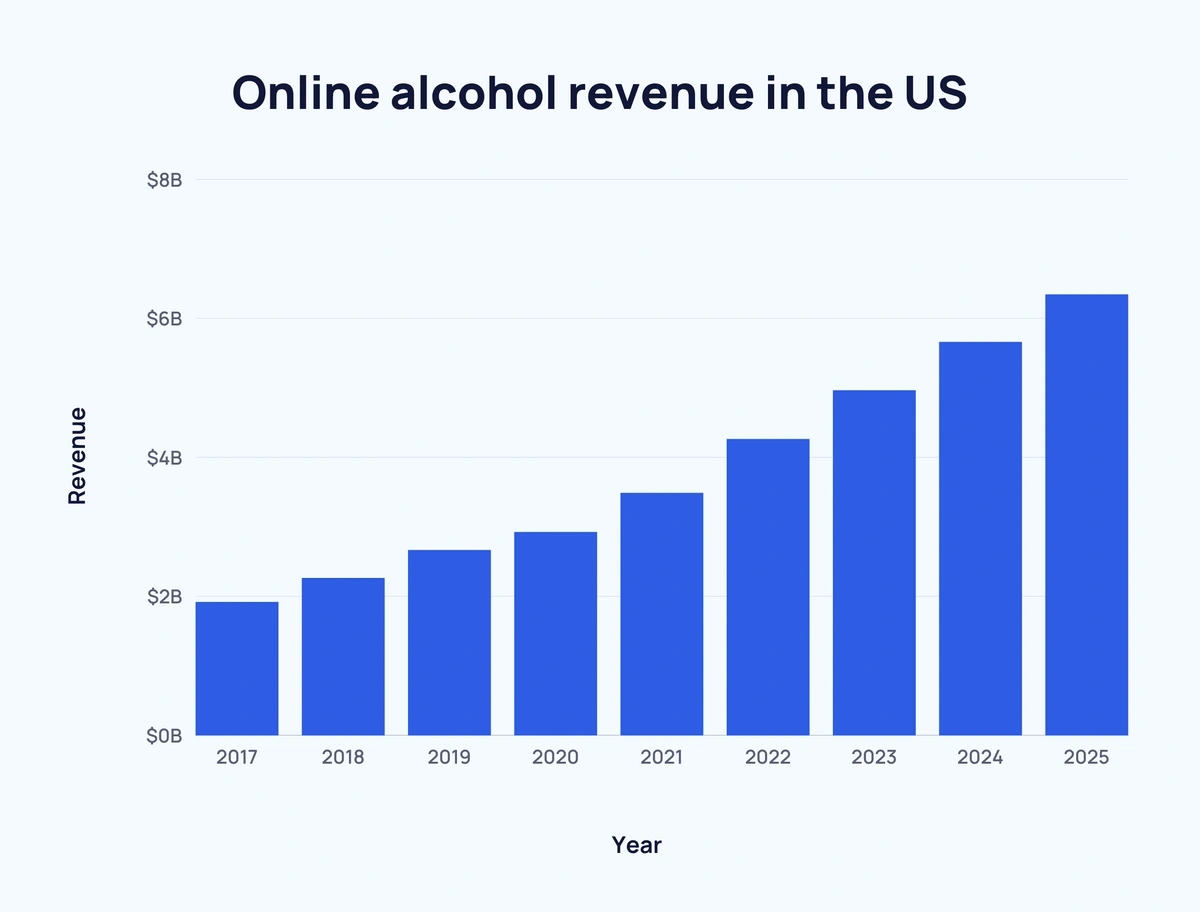

Other estimates for online alcohol sales are a bit more conservative, but still report massive growth through 2025.

Revenue from online alcohol sales continues to grow.

However, there are signs that DTC alcohol growth appears to be slowing down.

Online sales of spirits grew by only 1% last year.

6. Eco-friendly packaging offers benefits to producers and consumers

In the 20th century, packaging alcohol in brown or green bottles was standard because the coating kept the beverage protected from UV rays.

In more modern times, a clear UV coating became available and clear bottles were used.

Now, we are seeing a shift away from glass packaging altogether.

Consumers are demanding more convenient, sustainable, and environmentally friendly ways to carry their alcoholic beverages.

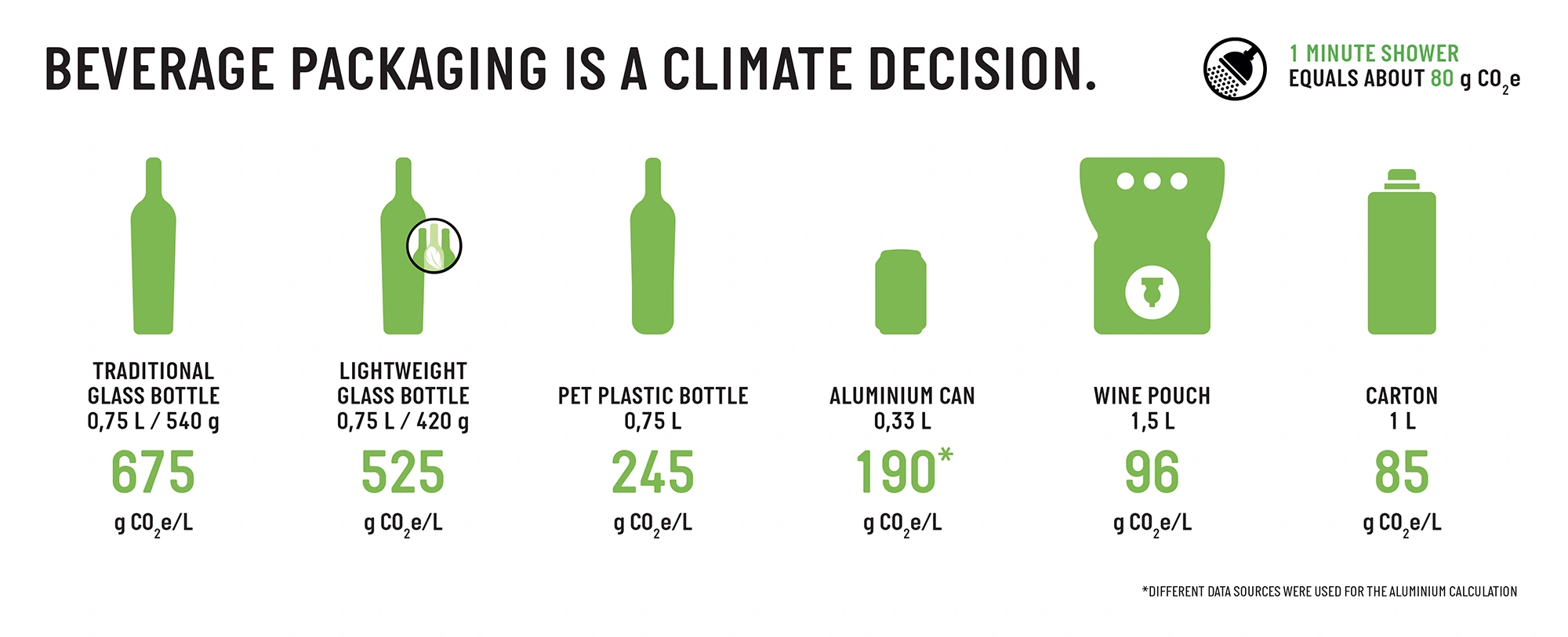

One estimate says a traditional glass bottle has a carbon footprint of 675 g CO2e/l while a wine pouch has a carbon footprint of only 96 g CO2e/l.

Estimated carbon footprints of various packaging options show that pouches and cartons are the most environmentally friendly.

Alcohol pouches are one example of non-glass packaging options. This packaging is lightweight, portable, and resealable. It also has a lower carbon footprint and leaves less waste behind than typical packaging.

Whisky Me is a London-based subscription service that sends customers a monthly sampling from some of the greatest distilleries in the world — all in a pouch.

They’ve got more than 10,000 current members.

Whisky Me’s alcoholic pouches are eco-friendly and easy to ship.

Gone are the days of boxed wine having a stigma attached to it — bag-in-a-box solutions are also becoming popular.

This option offers sustainability and still provides the company with the ability to design attractive packaging via the outer box.

At one UK grocery store, sales of boxed wine were up more than 40% post-pandemic.

MurLarkey Distilled Spirits, a Virginia-based company that was recently ranked among the 25 best distilleries in the US, released their Bootlegged Lemonade Boxed Whiskey Cocktail in 2021.

The distillery uses its lemon whisky and all-natural lemonade to show that consumers don’t have to sacrifice quality when buying a boxed alcoholic beverage.

The first batch sold out through DTC sales in less than three weeks.

The convenience and portability of MurLarkey’s boxed cocktail are a major draw for consumers.

7. Cannabis Drinks Crowd Out Traditional Alcohol

As consumers seek out low-calorie, hangover-free options, THC drinks have the potential to erode significant share of the market from beer, wine, and spirits.

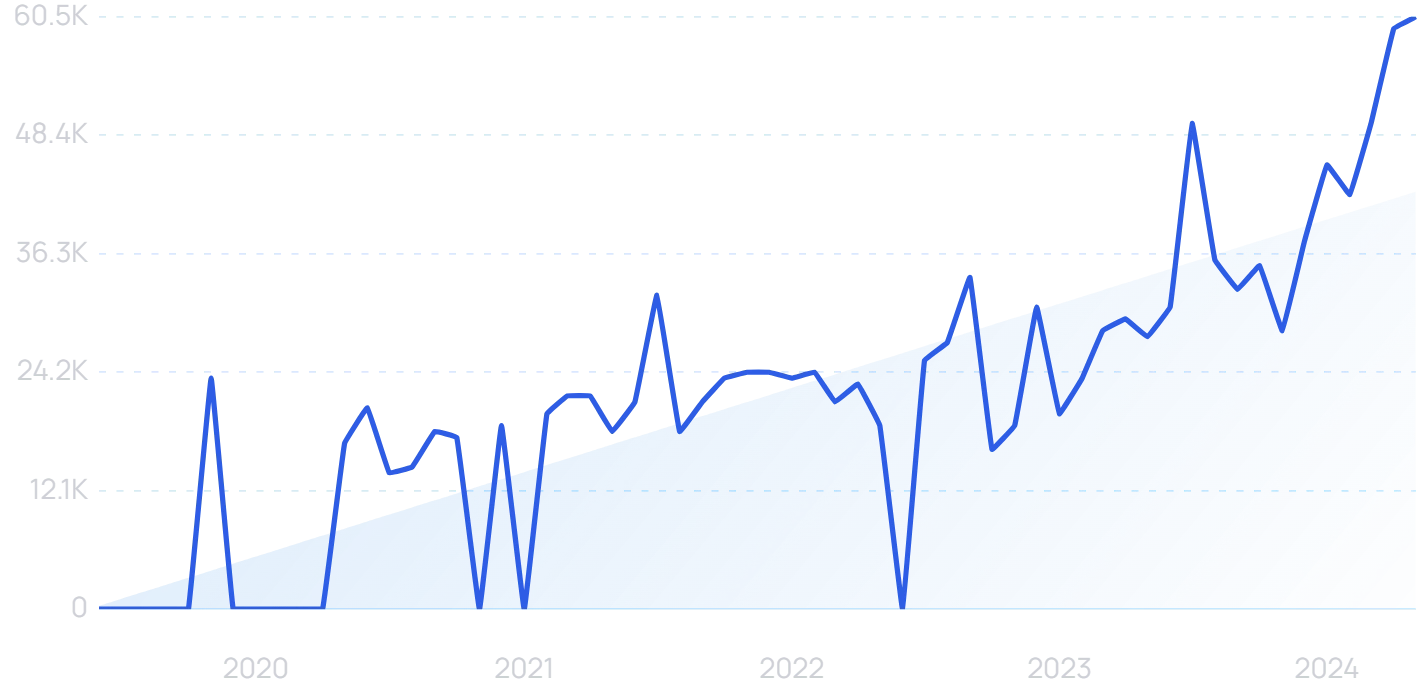

Searches for "THC beverage" are up significantly.

In fact, a BevAlc report showed that more than half of respondents said cannabis-infused drinks have the industry’s highest growth potential.

Overall, the cannabis-infused drinks market is projected to grow at a CAGR of 37.8%, reaching $8.7 billion in annual sales by 2032.

North America is expected to remain the fastest-growing and largest market for cannabis drinks, driven by the legalization of marijuana across several states.

Notably, consumer interest in THC drinks are from members of Gen Z.

Conclusion

That wraps up our list of the most important alcohol industry trends to watch.

From low-alcohol options to canned cocktails, we expect to see producers rapidly adapting to the demands of consumers in the months to come. Those who haven’t already expanded their product offerings will most likely move in that direction soon.

The push for more sustainable packaging and on-demand delivery services may even change the way companies market to consumers. These types of changes aren’t set in stone yet, but local laws and consumer interest will play an important role in the future of the industry.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more