Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

10 Important Food Trends (2024 & 2025)

You may also like:

When it comes to food and beverages, consumer preferences are always in flux.

Trends that started building momentum a couple of years ago, like non-dairy milk and plant-based foods, are still popular.

But a large portion of consumers are also ready to embrace new flavors and ingredients.

Plus, people are focused on the sustainability and health benefits of food more than ever before.

With that, here are the top 10 food trends for 2024 and 2025.

1. The Alternative Milk Market Evolves

Plant-based milks are no longer just for vegans. A sizable number of consumers are now stocking their refrigerators with everything from oat milk to flax milk to cashew milk.

More than 80% of consumers are at least “a little curious” about plant-based milk.

Right now, more than 40% of households in the US buy plant-based milk.

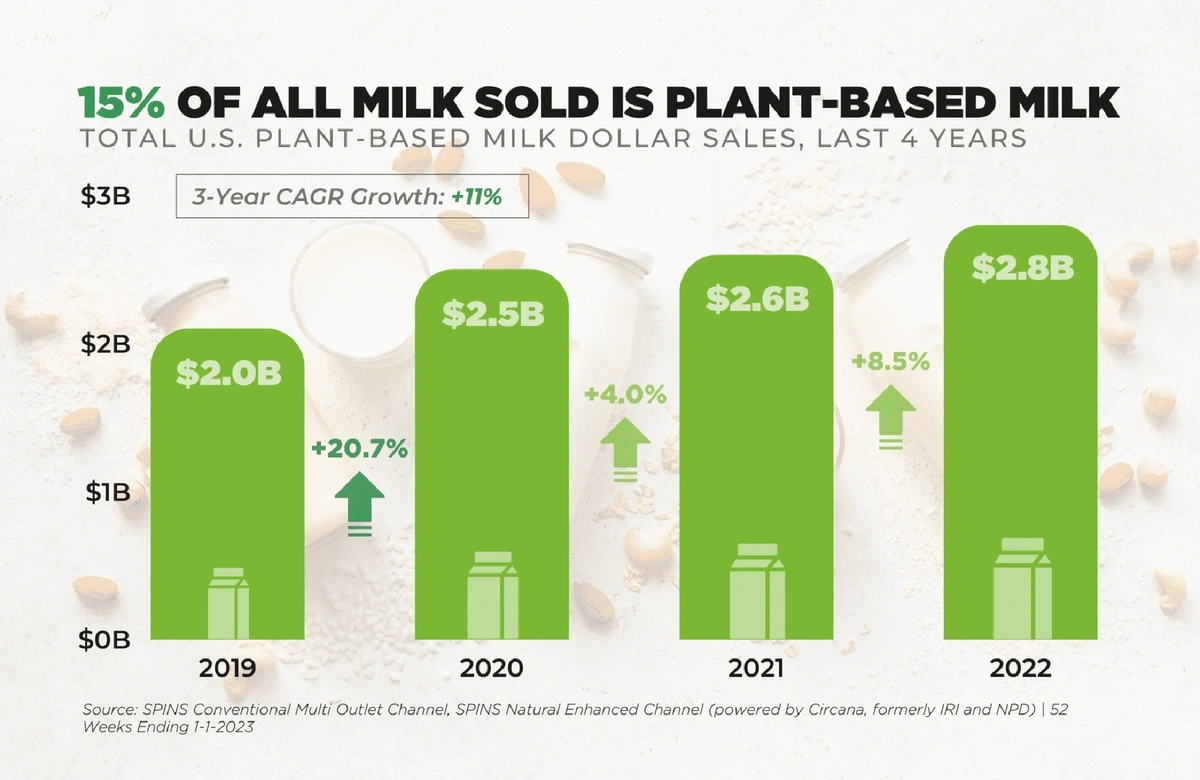

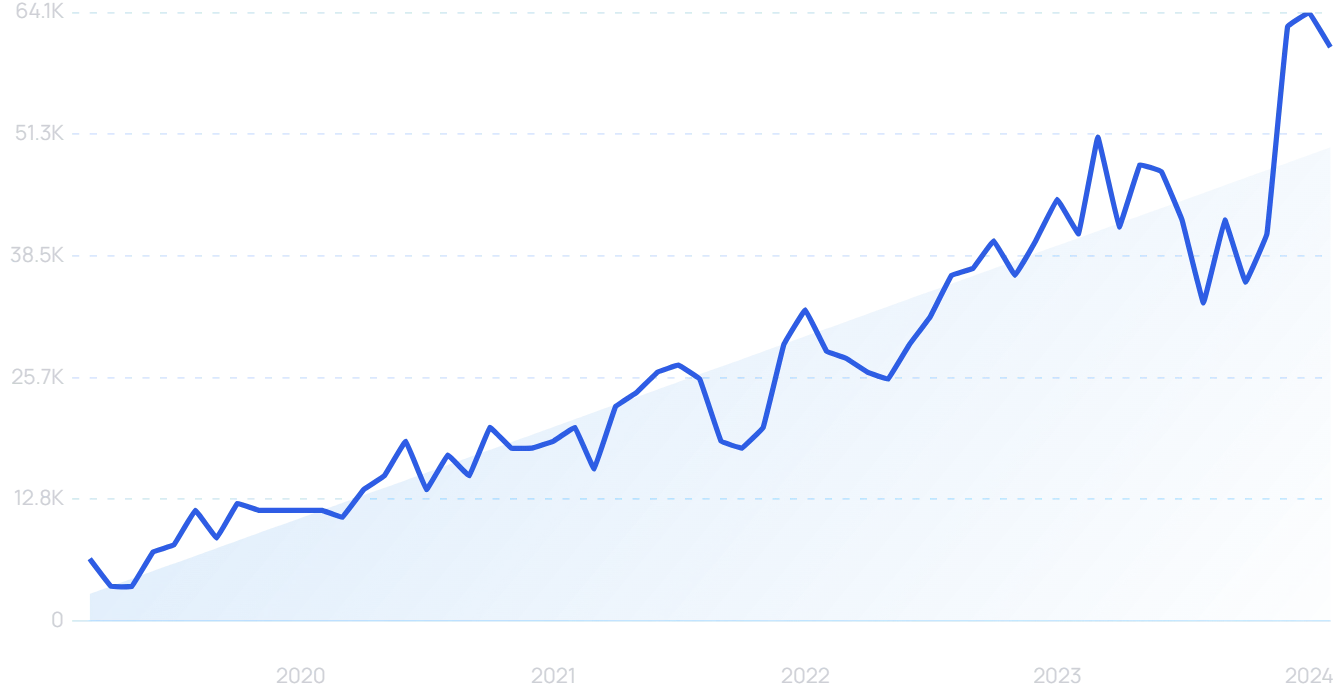

Dollar sales of plant-based milk have been growing since 2019.

Globally, the $29.18-billion milk substitutes market is expected to grow at a CAGR of 12.6% through 2030.

Sales of non-dairy milk in the United States grew more than 11% between 2022 and 2023.

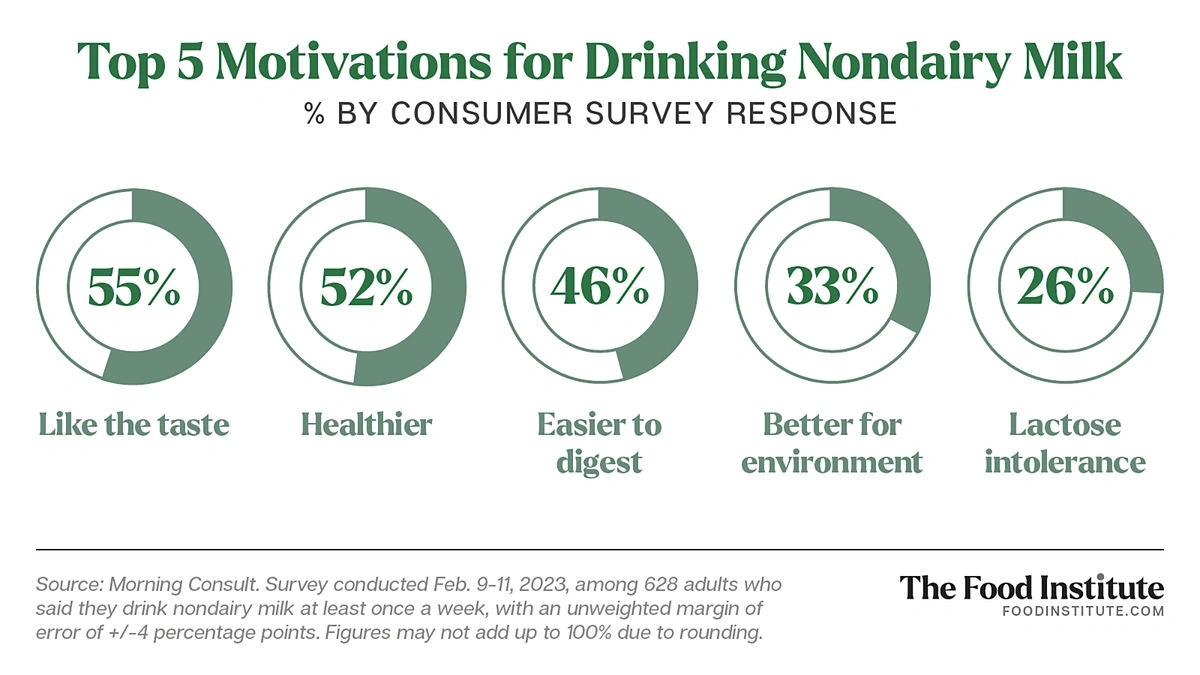

There are a variety of reasons why consumers buy plant-based milk.

Among individuals who drink non-dairy milk at least once per week, more than 55% listed taste as one reason as to why they drink it while 52% say they drink it because it’s healthy.

Taste and health benefits are the top two reasons consumers drink plant-based milk.

Other consumers choose plant-based milk because of sustainability concerns associated with dairy milk.

According to McKinsey, 23% of consumers choose plant-based milk, in part, because they’re better for the environment and 24% do so because it’s better for the animals.

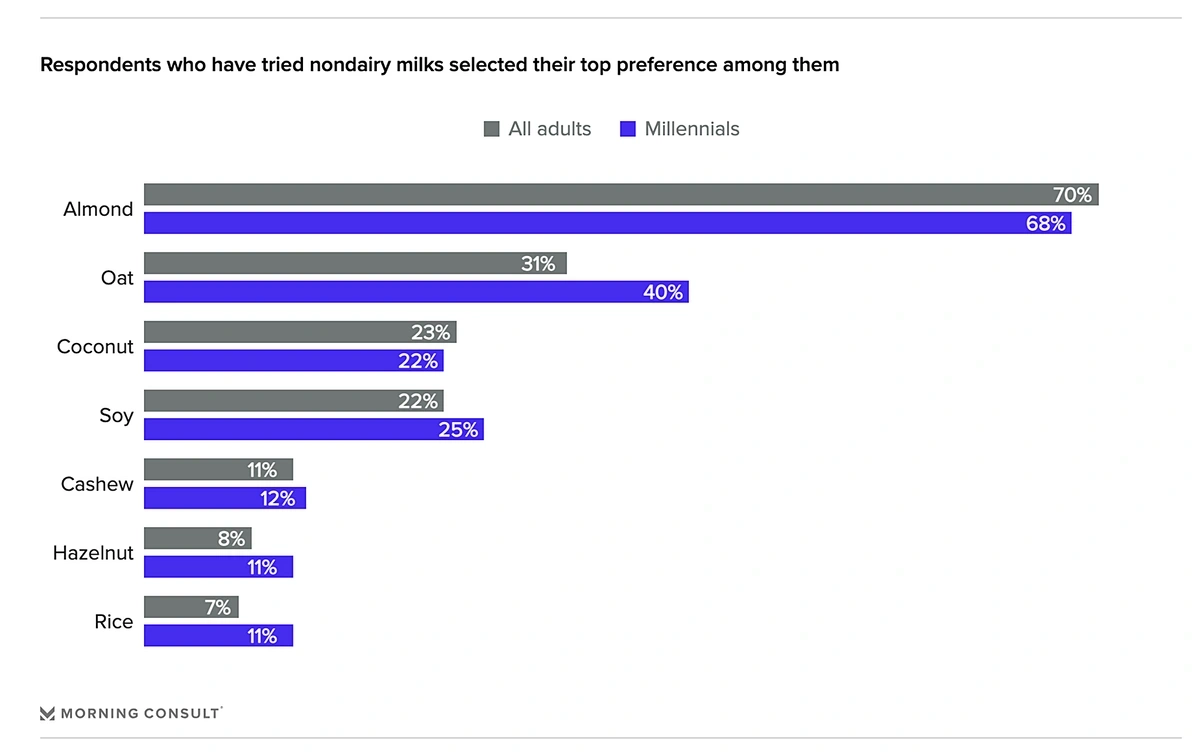

When it comes to specific plant-based milk ingredients, demand for oat milk is really taking off—sales were up 22.6% in 2023.

Year-over-year growth in July 2023 showed a nearly 18% jump.

But almond milk is still the top milk alternative in the United States.

It’s the favorite of 70% of non-dairy milk drinkers.

Almond milk is favored by 70% of plant-based milk drinkers.

But there’s also a totally new type of milk hitting the market: milk made through precision fermentation.

It’s a highly scientific process in which yeast or fungi are encoded with milk protein DNA. Then the yeast or fungi ferment in a process that’s similar to the process of making beer. In the end, the microbes produce proteins that mimic real dairy proteins.

At least 62 companies are already working on creating this animal-free milk.

Bored Cow is one of them.

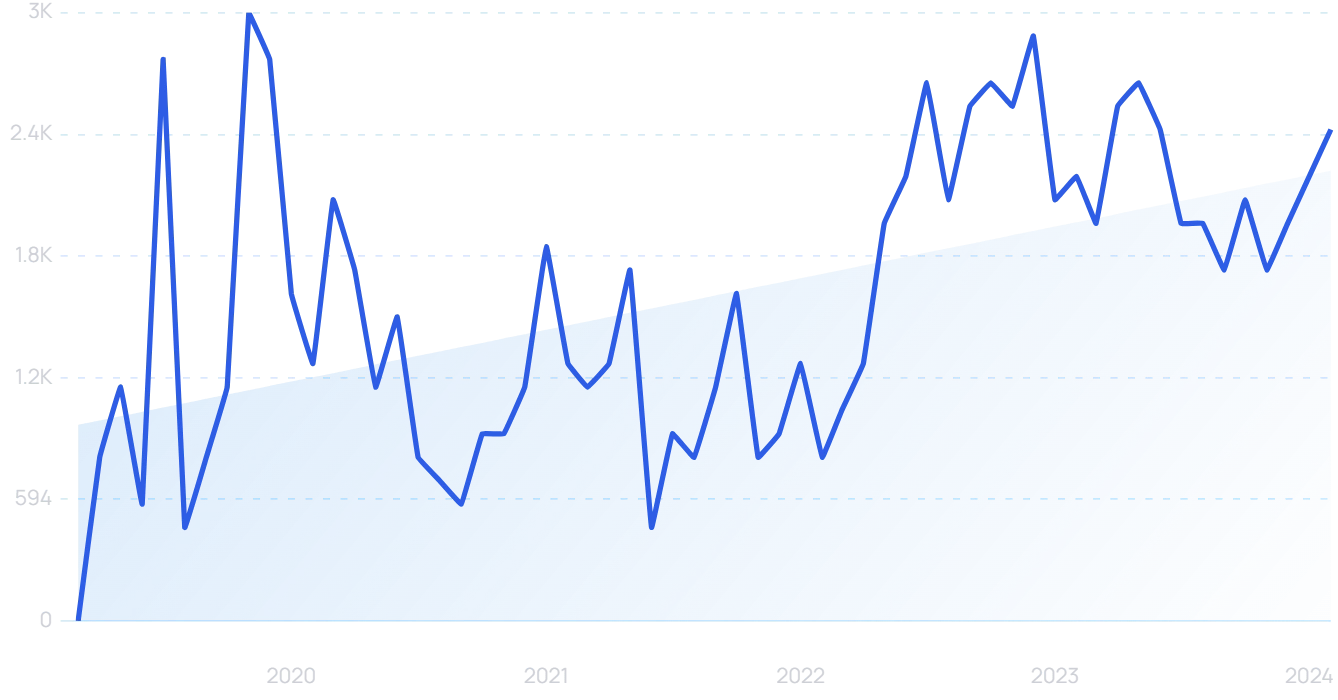

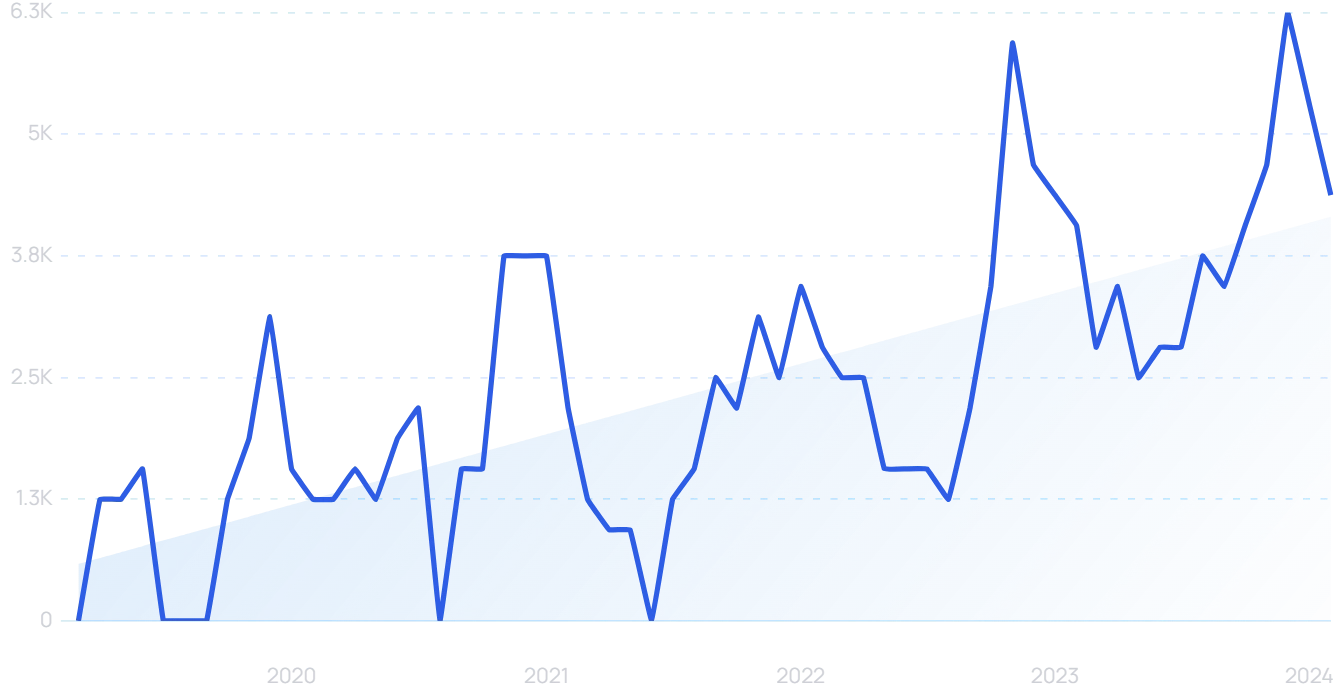

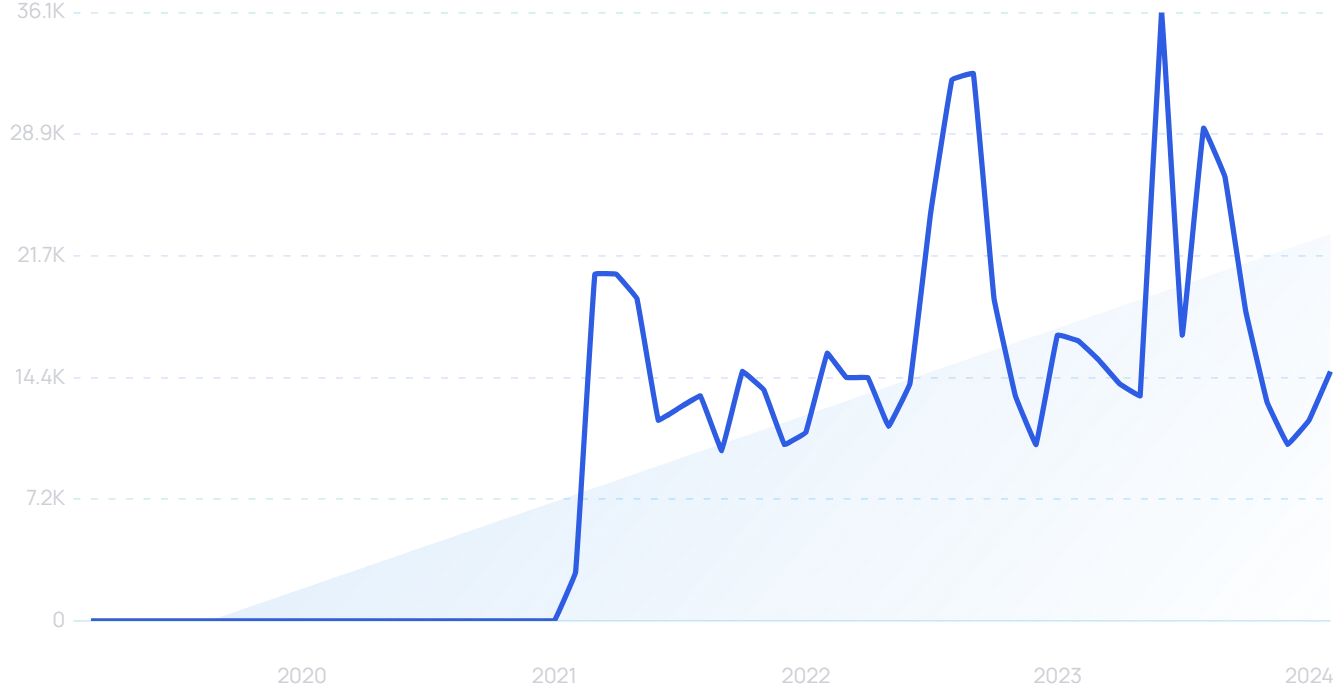

Search interest in “Bored Cow” grew rapidly in 2022 and has remained elevated.

The company fully launched its animal-free milk in mid-2023.

Bored Cow offers three flavors.

2. Natural Sweeteners Appeal to Sugar-Conscious Consumers

America’s overreliance on white sugar has drawn considerable amounts of criticism from health officials in recent years.

Three-quarters of American consumers say they want to limit or avoid sugar in their diet.

To keep a sweet taste in their foods, three in ten Americans regularly consume low or no-calorie sweeteners.

And 44% are drawn to natural, plant-based sweeteners like monk fruit and stevia.

Monk fruit grows on a plant that’s native to southern China. The sweetener is up to 250 times sweeter than sugar and has zero calories.

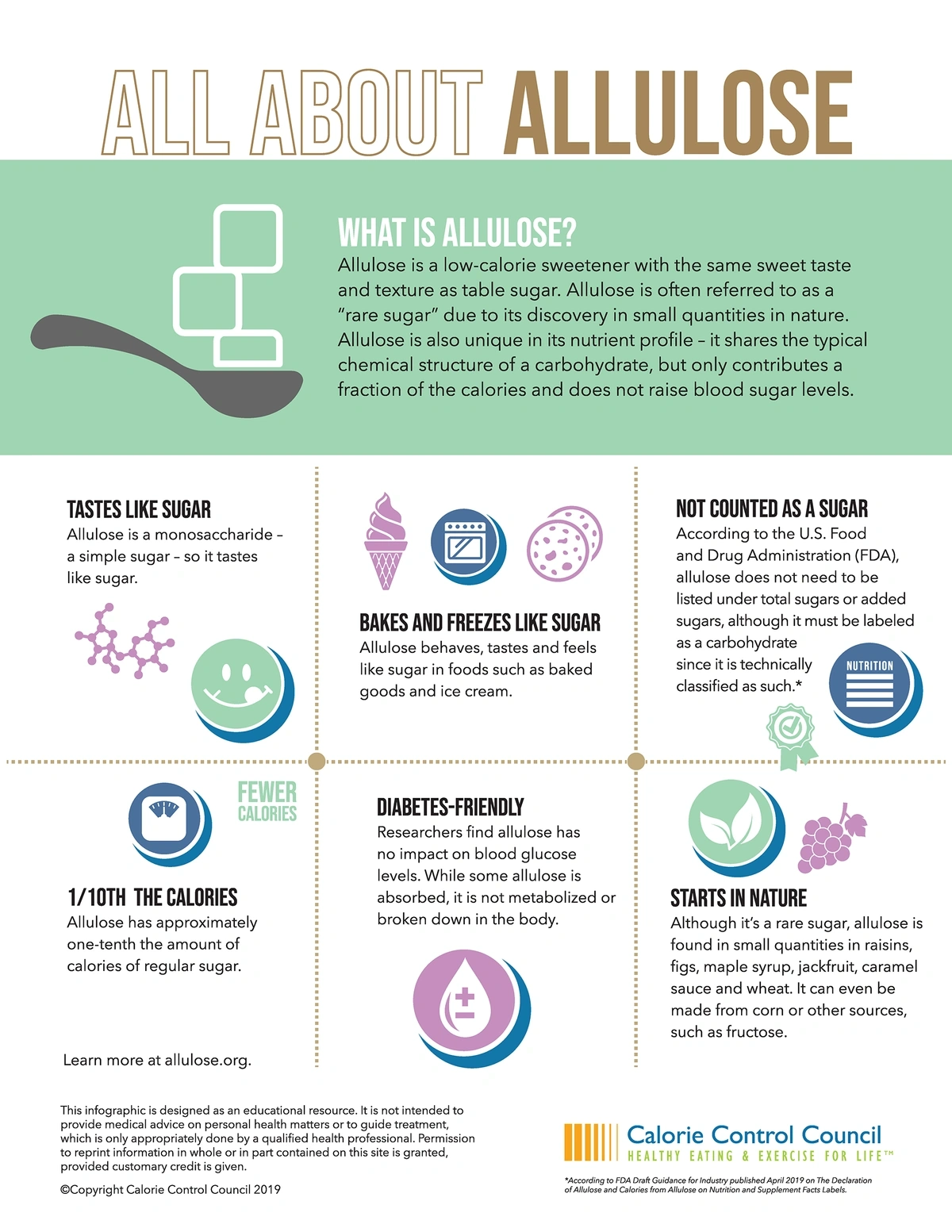

Allulose is another natural sweetener that’s growing in popularity.

Allulose performs like sugar but contains fewer calories.

It’s naturally found in foods like maple sugar, molasses, and figs, but it is synthesized in a lab using corn. It contains less calories than sugar but also less sweetness—only 70%.

Natural sweeteners have been especially evident in packaged beverages lately.

That’s because 83% of consumers have become much more concerned about the sugar content of beverages like teas, juices, and soda.

This has led to new naturally-sweetened beverages on grocery store shelves.

Ocean Spray’s Zero Sugar Juice Drink is one of them.

Ocean Spray recently released two zero-sugar drinks.

Its sole sweetener is stevia leaf extract. The drink contains just five calories per serving.

Then there’s PLEZi, a new good-for-you juice brand that Michelle Obama launched in late 2023.

The brand’s drinks, specially aimed at children, utilize stevia and monk fruit extracts to deliver 75% less sugar than average 100% juice drinks.

PLEZi is a kid-focused alternative to soda and sports drinks.

On the manufacturing end, Elo Life Systems is an ingredient company that’s working to farm monk fruit in a sustainable way.

Elo plans to scale monk fruit production and have a product ready to launch in the next two years.

Its version of monk fruit sweetener, set to be released in 2026, could be as much as 300 times sweeter than sugar.

The company has brought in $45 million in funding so far.

3. Specialty Mushrooms Become a Popular Meat Replacement

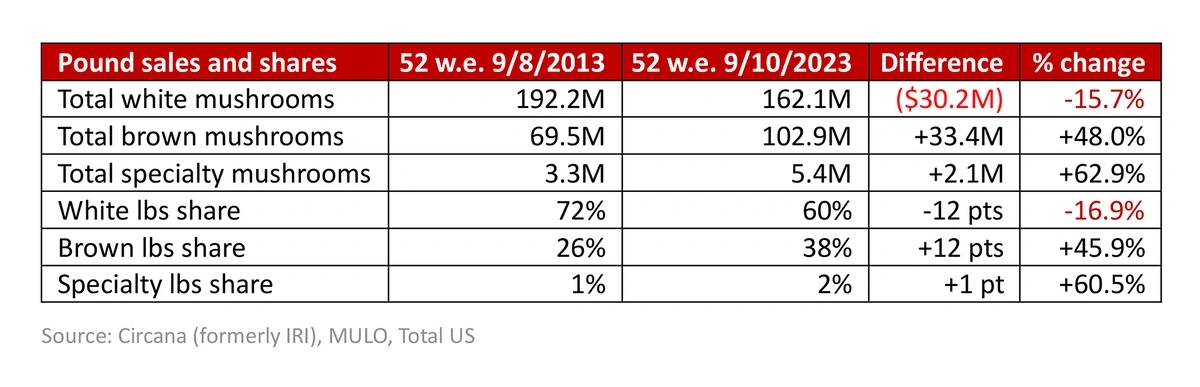

Mushroom sales have jumped nearly 20% in the past 10 years. That’s according to the Mushroom Council’s most recent report.

Their analysis shows that grocery stores sell more than 270 million pounds of mushrooms each year.

And, it’s not just the regular white button mushrooms that consumers are buying.

Individuals are gravitating toward more brown mushrooms and specialty mushrooms, says the Mushroom Council.

Sales of specialty mushrooms were nearly 63% higher in 2023 than in 2012.

Sales of brown mushrooms were up 48% during the same period.

Consumers are buying fewer white mushrooms and more specialty mushrooms.

Other data shows this trend is being driven by individuals who are turning to mushrooms as an alternative to meat. Mushrooms can provide a meaty taste and an umami flavor.

82% of consumers are at least “a little curious” about plant-based proteins and nearly 90% are interested in mushrooms.

Specialty mushrooms like portobellos, shiitake, lion’s mane, and oyster mushrooms are some of the most popular.

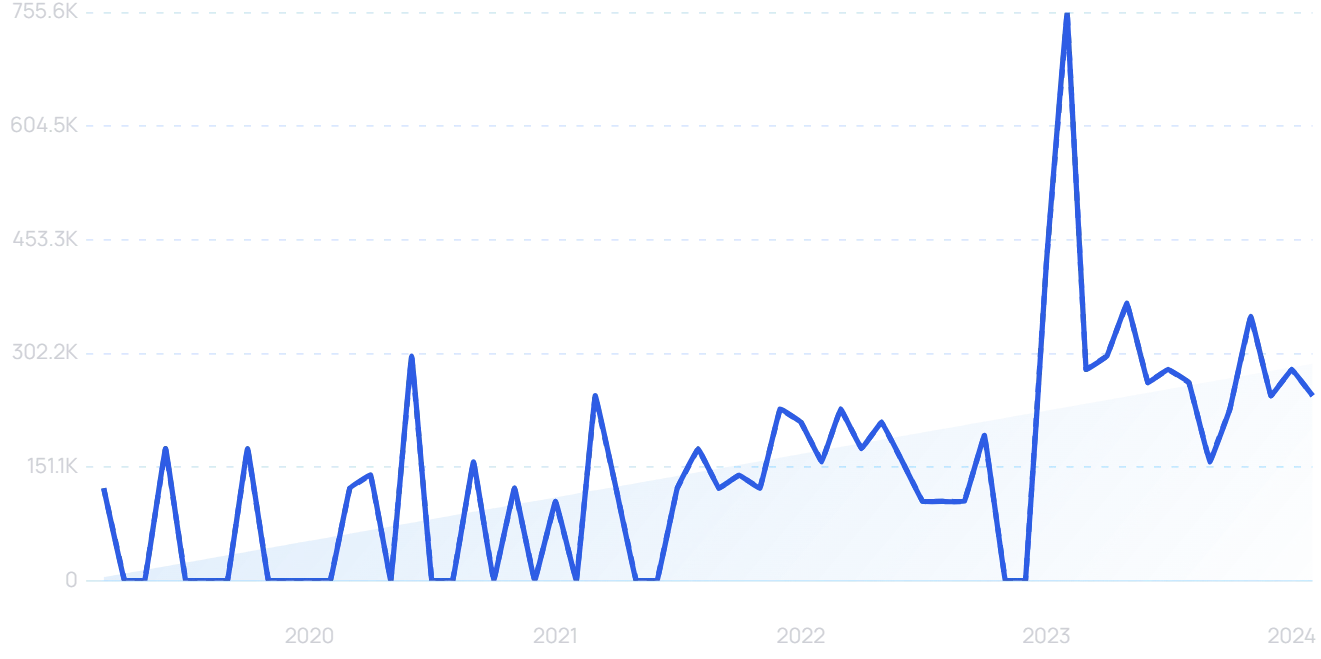

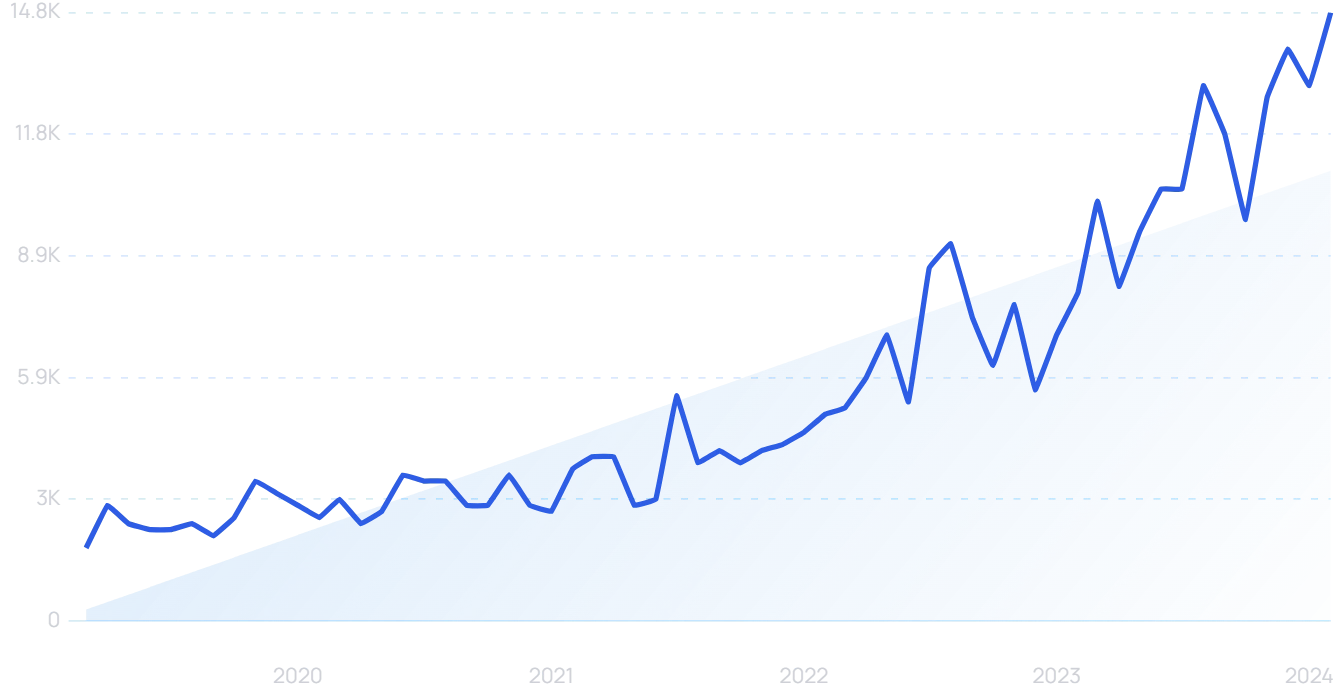

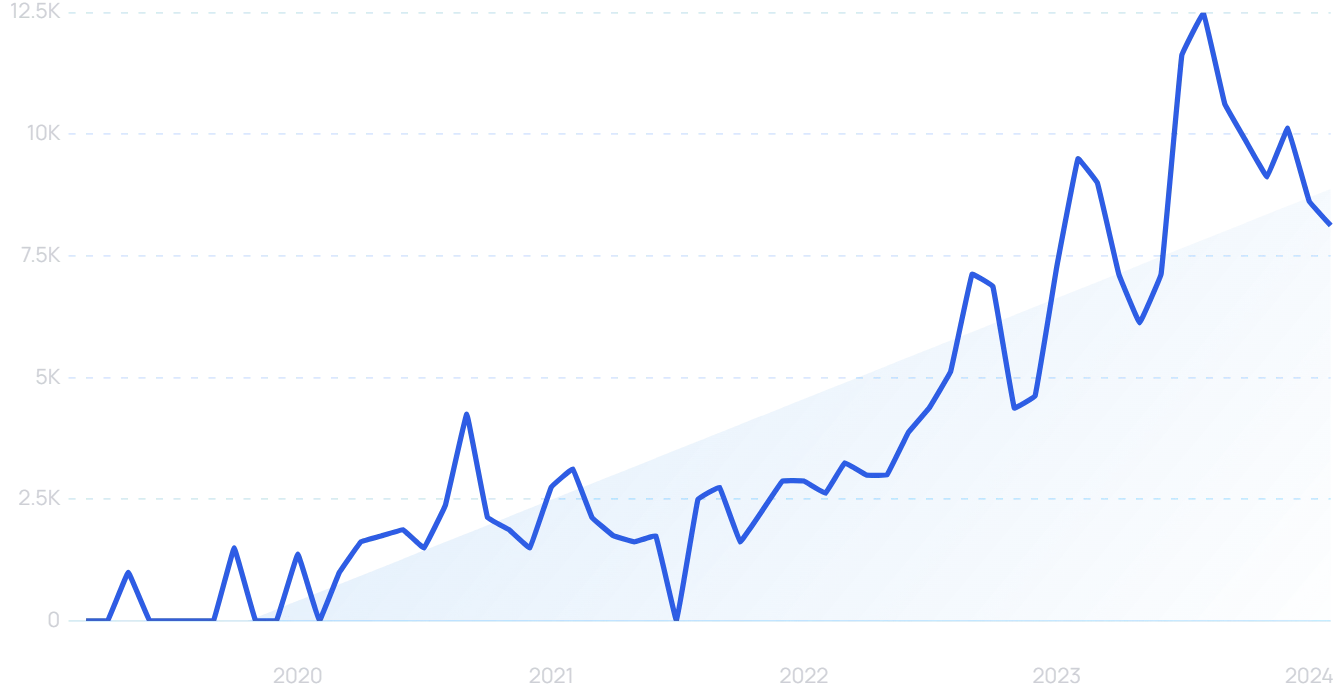

Search interest in “lion’s mane mushroom” has been climbing in recent years.

#lionsmane has more than 40 million views on TikTok.

Many of the videos are recipes for lion’s mane “steak.”

These large mushrooms can be seared like a traditional beef steak.

Several restaurants are jumping on this trend as well.

A New York City restaurant called Third Kingdom has a menu focused entirely on mushrooms.

Third Kingdom serves upscale mushroom dishes.

New mushroom-based products are also hitting grocery store shelves.

Colorado-based Meati sells steaks, cutlets, and jerky made from mushroom root, the part of the fungi that grows underground.

Search interest in “Meati” has jumped 500% in the past five years.

Meati’s products are 95% mushroom root.

4. Cold Brew Coffee at Home and the Grocery Store

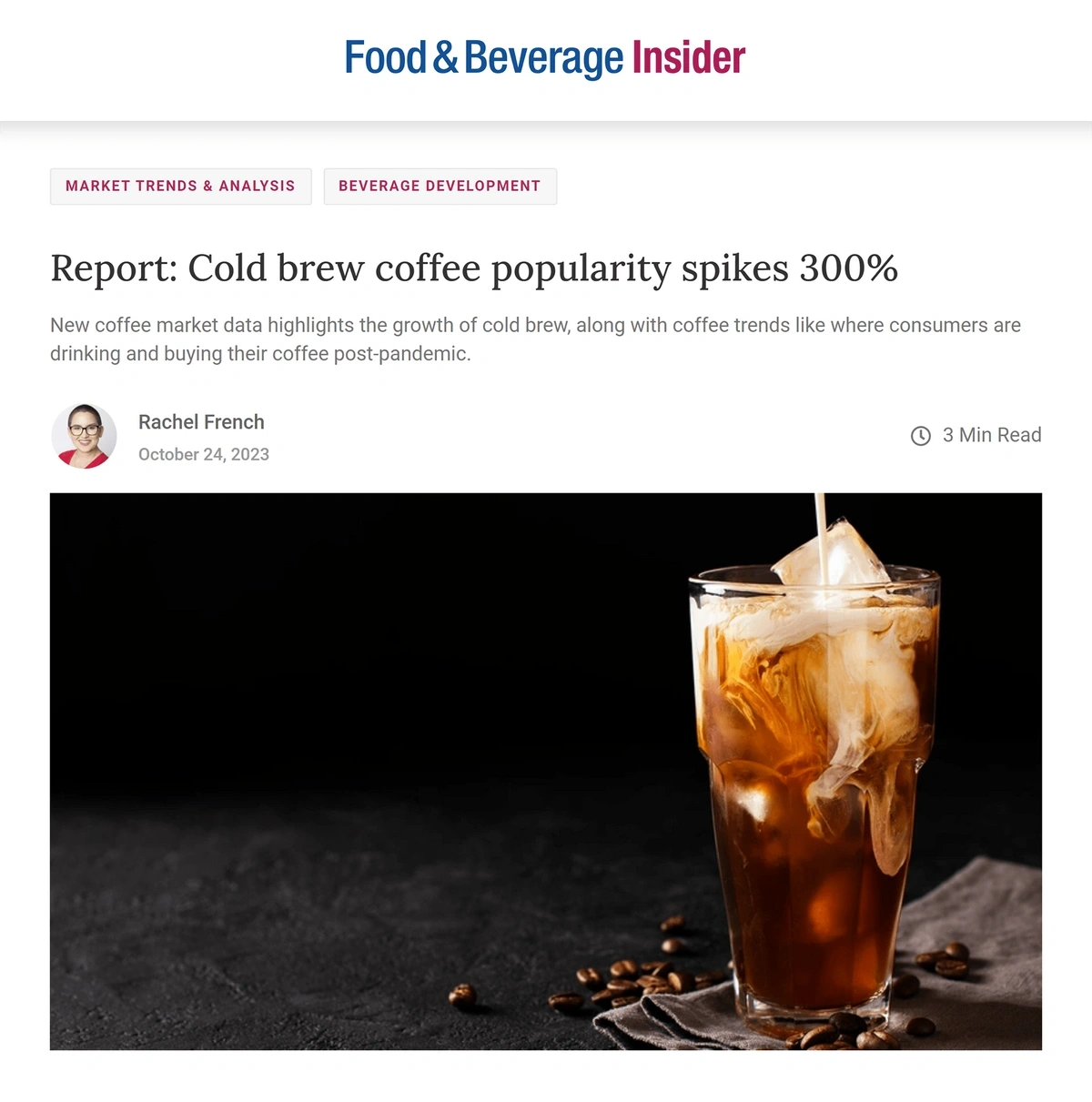

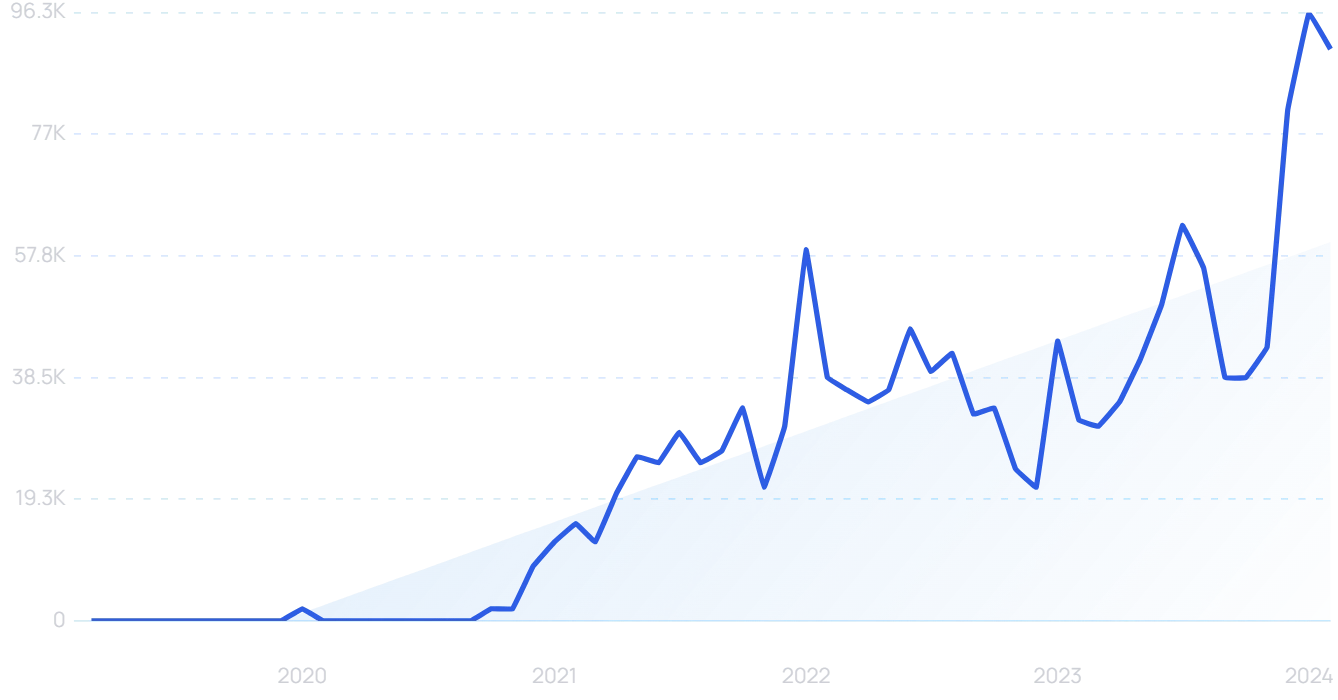

Coffee has always been a popular drink, but in recent months cold brew coffee has been surging in popularity.

This type of coffee is made by steeping coarsely ground coffee in cold water for up to 24 hours.

The value of the cold brew coffee market is set to grow from $650 million in 2022 to $5.48 billion by 2032.

The National Coffee Association reports a 300% increase in the popularity of cold brew since 2016 and a 45% increase since January 2023.

The popularity of cold brew has jumped 300% in recent years.

They say that the number of people who regularly drink cold brew has jumped by 73% since 2019.

In another survey, 47% of respondents say they like to start their day at the office with an iced coffee.

Many cold brew drinkers are brewing their coffee at home.

Prime evidence of this is Keurig’s newest model: K-Iced.

The machine is the first one from Keurig to have a special setting for brewing over ice. It automatically adjusts the temperature throughout the brewing process, starting hot and cooling down near the end of the process.

The K-Iced machine adjusts the brewing process to make iced coffee.

Coffee drinkers who want an even easier solution are turning to ready-to-drink cold brew products.

This is especially true for young consumers like Gen Z.

A recent survey showed that 60% of young coffee drinkers prefer ready-to-drink products compared to traditionally brewed coffee.

One example is Javy Coffee, a cold brew coffee concentrate.

Search interest in “Javy Coffee” has been climbing since 2021.

Javy’s coffee concentrate is packaged in small bottles that contain 35 1-teaspoon servings. Users mix the cold brew with milk or water.

Even traditional coffee brands are following the cold brew trend.

Coffee Mate introduced its first iced coffee product in October 2023.

It’s available in two flavors: french vanilla and caramel.

Consumers can now purchase Coffee Mate iced coffee.

5. Spice Shows Up in Unexpected Foods and Drinks

Spice is no longer reserved for the few consumers brave enough to try it.

A large portion of shoppers, especially millennials and Gen Zers, are showing a growing affinity for spicy foods—50% of people in these generations say they regularly buy hot sauces and want a greater variety of hot sauce options.

In recent months, hot ingredients have been working their way into beverages, snacks, spreads, sweet treats, and more.

Dr. Pepper’s limited-edition spicy soda is one example.

T.Hasegawa’s 2023 Food and Beverage Flavor Trends Report showed a 40% increase in the use of jalapenos as an ingredient in spreads and a 37% increase in the ingredient’s use in dips.

McCormick has reported an increase in their spicy products in recent years, as well.

In 2022, spicy products accounted for at least one-fifth of the company’s total sales, according to company executives.

McCormick owns the popular hot sauce brand Cholula.

But spice is showing up in unexpected places, too.

Frank’s RedHot SpaghettiOs launched in April 2023, and Campbell’s launched ghost pepper chicken noodle soup in January 2023.

With all of this demand, new hot sauce companies are challenging the old favorites.

Melinda’s, a little-known company that launched 34 years ago, has seen a 900% increase in the number of units sold between February 2023 and February 2024.

Search volume for “Melinda’s” has shown steep growth in recent years.

The company ranks among the top 15 fastest-growing condiment brands.

Spice-heavy restaurant dishes are increasing, too.

One market research firm says 71% of food menus and 11% of drink menus feature items labeled as spicy.

6. Plant-Based Chocolates Go Mainstream

Estimates show the vegan chocolate market could grow at a CAGR of more than 10% through 2032.

Its value could hit $2 billion that year.

One recent survey reported the increasing consumer appeal of plant-based chocolates—more than 40% of consumers are interested in this type of treat.

Data shows the top two fastest-growing chocolate ingredients are plant-based: the use of oats is up nearly 80%, and the use of coconut fat is up 74%.

The first vegan chocolates sold nationally in the U.S. came courtesy of Hershey.

Vegan Reese’s peanut butter cups and vegan Hershey’s chocolate bars with almonds launched in March 2023.

Both chocolates are made with oat ingredients.

There’s also growing demand for chocolate that contains another plant-based ingredient: functional mushrooms.

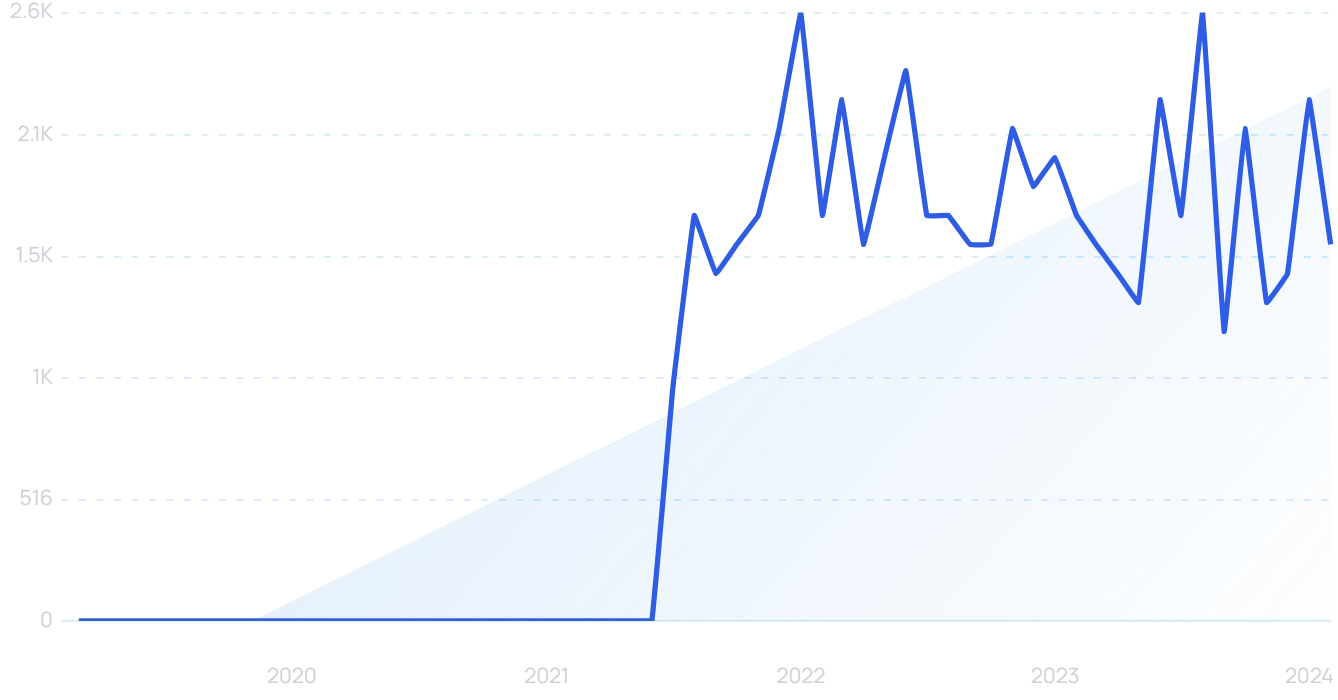

Search interest in “functional mushrooms” has grown 850% over the past five years.

Functional mushrooms have specific nutrients. Some boost energy, some improve gut health, and some help reduce stress.

Mushroom-enhanced chocolate comes in bars and hot chocolate packets.

For example, the brand Alice offers Brainstorm, a tin with 16 squares of chocolate formulated with lion’s mane and cordyceps mushrooms.

This chocolate is said to improve energy levels and focus.

Another example is Shroom Shield from Golde.

This product blends into hot water or milk just like traditional hot chocolate.

The difference is that this powder contains reishi and turkey tail mushrooms to aid in stress management and improve the immune system.

Search volume for “mushroom hot chocolate” has increased nearly 7,000% since 2020.

7. Blending Buckwheat into Bread, Cookies, and Crackers

When it comes to gluten-free grains, oats and quinoa are usually two of the top options.

But buckwheat is becoming more popular.

Buckwheat is a seed from a flowering plant.

Contrary to its name, buckwheat is not wheat; it’s a seed.

It’s usually ground into flour but can also be eaten as kernels. In that form, it’s called “groats.”

According to a survey from the Whole Grains Council, 60% of people have heard of buckwheat as an ingredient. That’s compared to approximately 80% who know about oats and approximately 70% who know about quinoa.

Their survey showed that 27% of respondents have eaten buckwheat. That’s up from 23% in 2021.

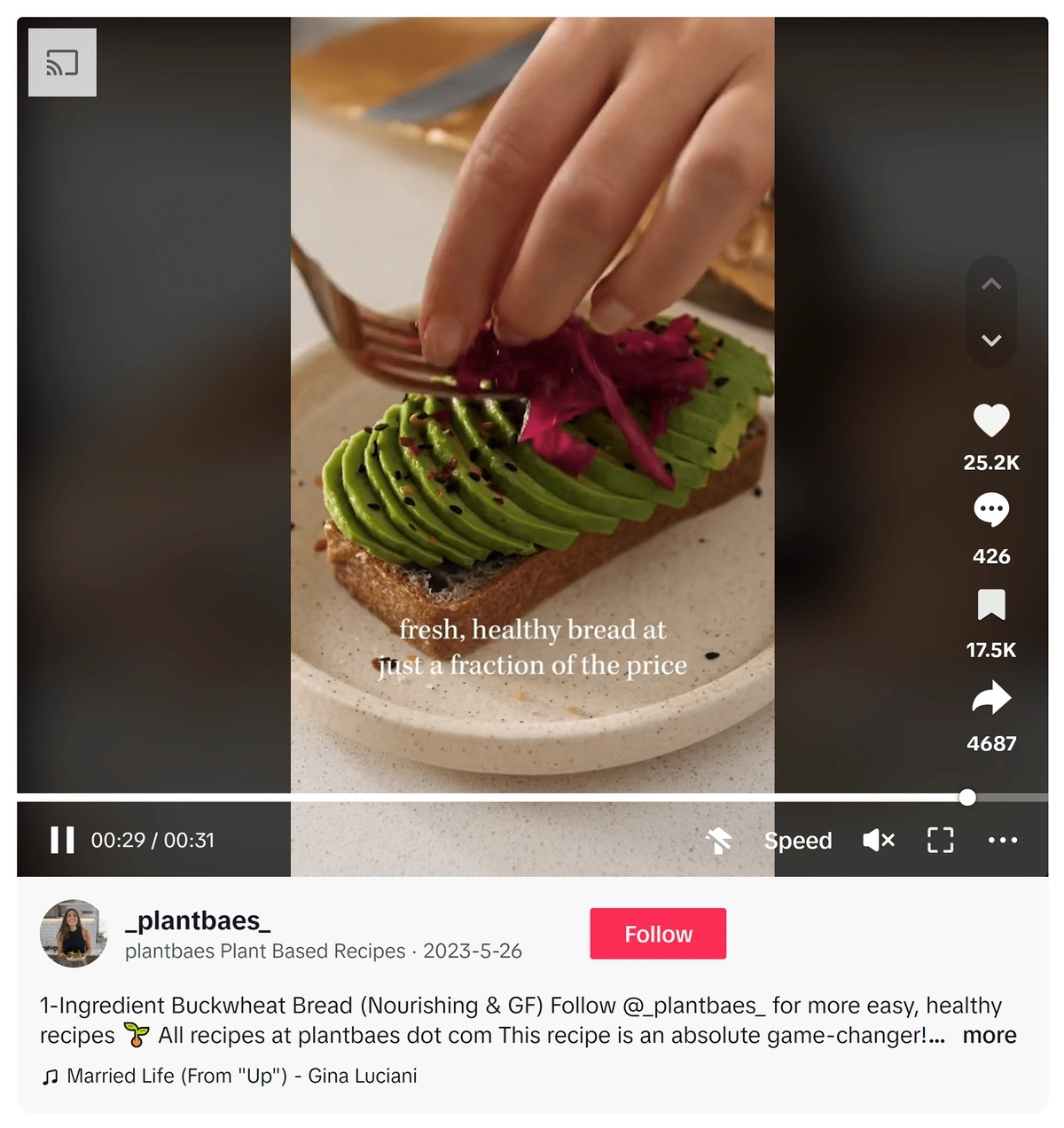

The ingredient is also soaring on TikTok. Buckwheat videos have more than 42 million views.

This TikTok about buckwheat bread has more than 25k likes.

In addition, Whole Foods has called out buckwheat as one of the top food trends of 2024.

On grocery store shelves, buckwheat is showing up in pancake mixes, cookies, and crackers.

Maine Crisp, a snack company founded in 2014, changed its name to Better with Buckwheat in the fall of 2023.

The company sells several flavors of buckwheat crackers.

Better with Buckwheat rebranded in late 2023.

Lil’ Bucks is a buckwheat company that sells groats and buckwheat cookies.

Their products are sold online and in grocery stores like Whole Foods.

Clusterbucks provide ample amounts of fiber and protein.

8. Consumers Put Pickles in Everything

2023 was the year for pickles on GrubHub.

Orders of pickle-focused products saw an 89% increase in 2023. That equaled nearly 7 million pickles!

Yelp also reported an increasing interest in pickles in 2023. Online searches for pickle-focused foods were up 55%, the site reported.

According to Datassential, pickles will continue to trend upward in the coming months.

Sliced pickles are being added to all kinds of food to give consumers the sour taste they crave.

Pickle pizza has been especially popular in recent months.

Search interest in “pickle pizza” jumped in 2021 and remains high.

The trend started online but continued to build momentum with food manufacturers.

DiGiorno released a half pickle and half pineapple pizza in August 2023. Rather than a traditional mass market release, the company gave away the pizzas via their online store.

Pickle-infused sauces are also trending right now.

Shoppers can pick up Frank’s RedHot dill pickle hot sauce, Hidden Valley’s pickle ranch dressing, and pickle ketchup from HEINZ. All of these condiments were released in 2023.

The new sauce was inspired by viral TikTok trends.

There’s even pickle-flavored booze.

Spritz Society teamed up with Claussen to create a sparkling lime cocktail bursting with pickle flavor.

The pickle-flavored cocktail is sold out.

9. Shoppers Choose Good-for-You Beverages

Annual grocery store sales of functional beverages, drinks that contain ingredients with specific health benefits, total $1.2 billion–and that doesn’t include ecommerce purchases.

One analysis found that nearly 40% of consumers actively seek out drinks to improve their overall health or specific body systems.

41% of individuals are willing to pay more for these functional beverages.

Functional beverages often claim to boost energy, improve immunity, promote relaxation, or improve gut health.

A 2023 survey showed that consumers are most interested in foods that could potentially improve gut health and cognitive health.

Nearly three-quarters of consumers are interested in eating foods to improve their gut health.

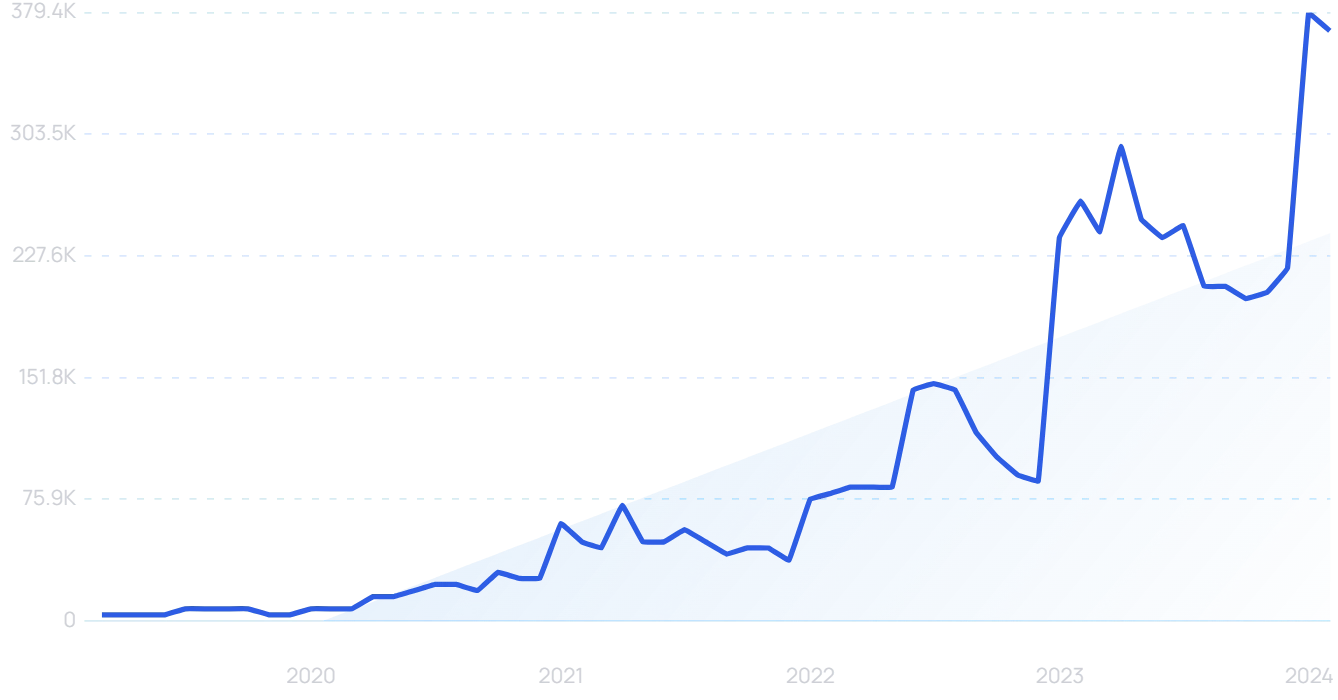

OLIPOP is a functional beverage that promotes gut health. Its popularity has exploded in recent months.

Search volume for “OLIPOP” has increased substantially since 2022.

The brand’s drinks blend plant fiber, prebiotics, and botanicals to create a good-for-you soda.

In 2023, just five years after launching, the brand had amassed more than $200 million in sales–and garnered buy-out offers from Pepsi and Coca-Cola.

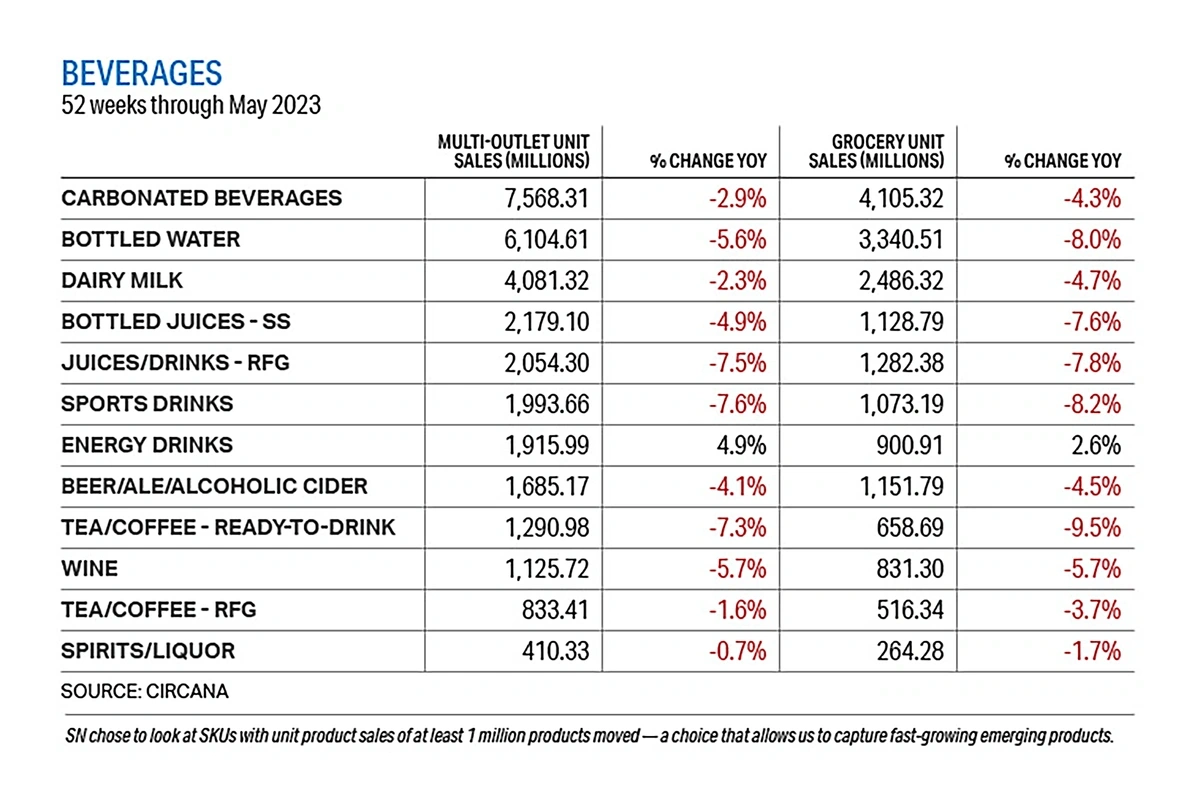

The prevalence of functional energy drinks is growing, as well.

The energy drink category was the only beverage category to see positive growth year-over-year from May 2022 to May 2023.

Unit sales of energy drinks were up nearly 5% in early 2023.

A growing portion of this market are functional beverages that boost energy without excessive sugar or artificial ingredients.

Between 2017 and 2022, the number of energy drinks labeled as “natural” jumped 58%.

Take CLEAN Cause, for example.

Search interest in “CLEAN Cause” increased dramatically in 2022.

The company offers several flavors of an organic energy drink with 160 mg of natural caffeine courtesy of yerba mate extract.

Plus, the company donates a portion of its profits to support addiction recovery.

10. Sustainability Concerns Drive Demand for Alt Seafood

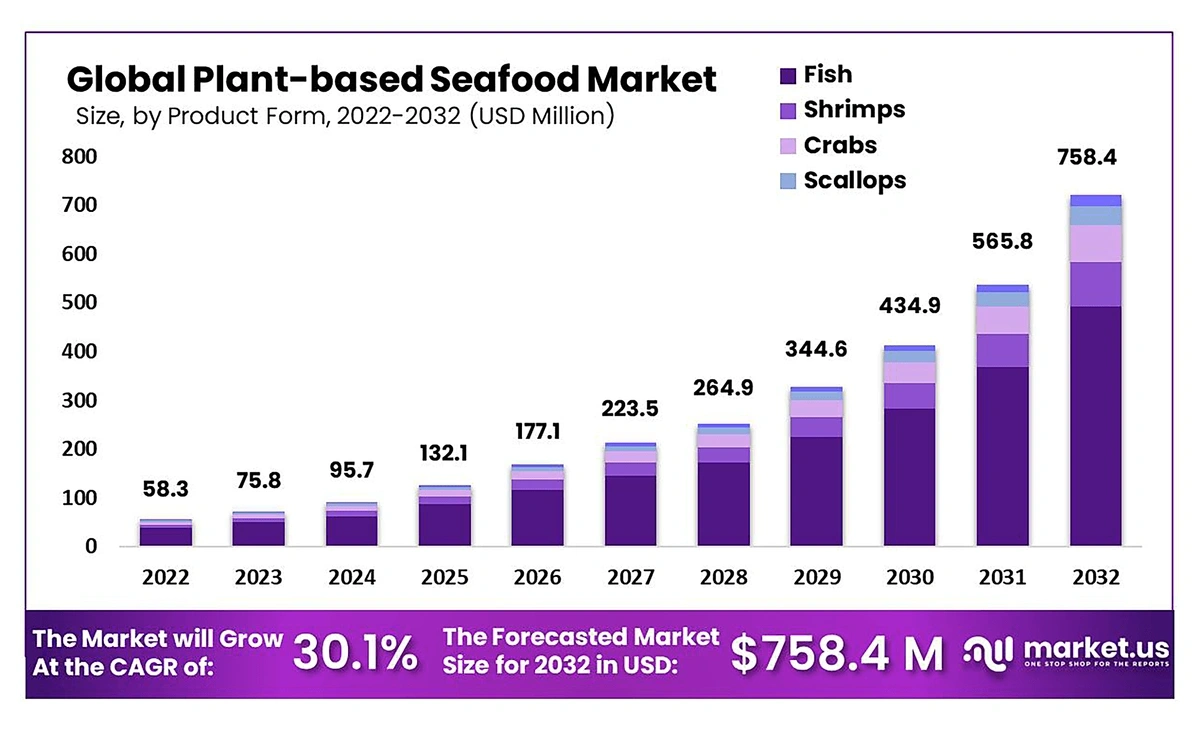

The value of the plant-based seafood market is growing rapidly.

One report from 2023 suggests that the market value could grow at a CAGR of more than 30% through 2032.

The plant-based seafood market could surpass $758 million in value by 2032.

Concerns surrounding the sustainability of seafood have brought about much of the demand behind this trend.

On a global scale, consumption of seafood has doubled since 1998 and is expected to climb another 80% by 2050.

However, somewhere between 70% and 90% of the world’s fish stocks are already either overexploited or depleted.

Further increases in consumption depend heavily on managing the world’s seafood populations in a sustainable way. But most experts say the market is just not there yet.

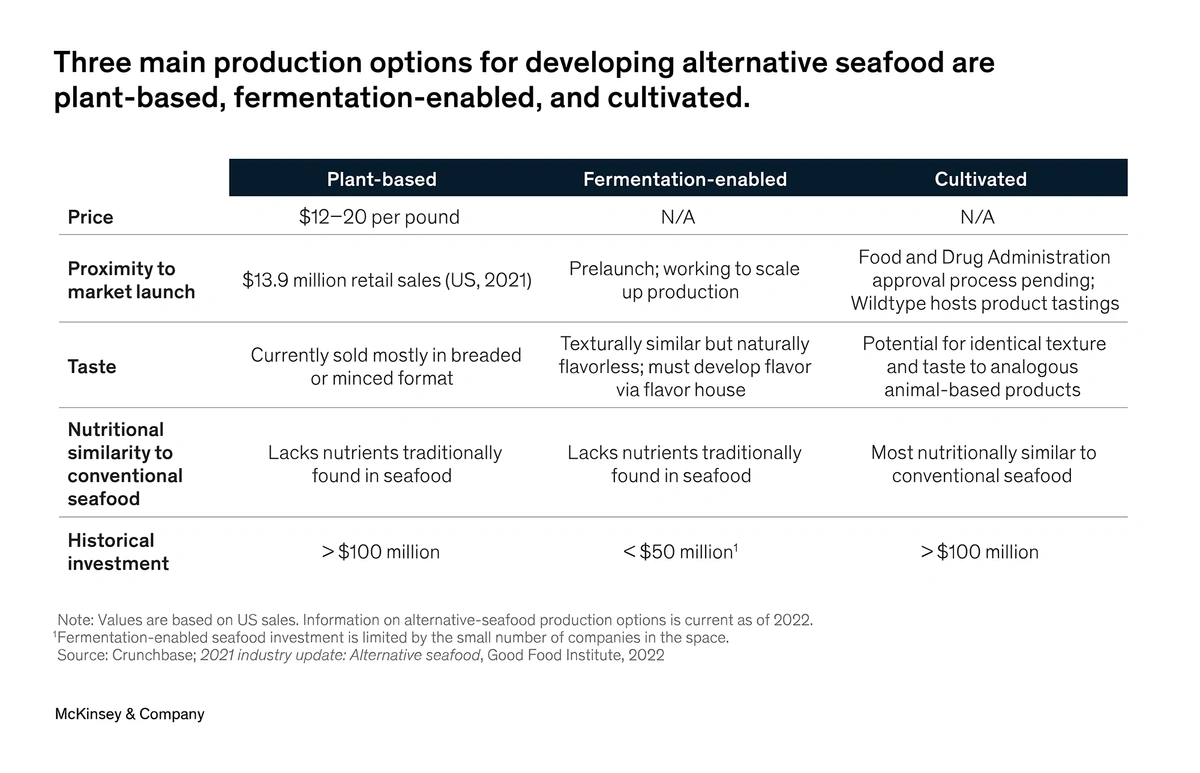

That’s where alternative seafood (plant-based, fermented, and cultivated) comes into play.

Plant-based seafood is currently in production while the other two alt seafood methods are in testing.

The plant-based alternative seafood options on the market today use ingredients like beans, peas, and lentils to try to achieve a texture and flavor that’s similar to traditional fish.

Non-animal seafood is also being produced through a fermentation practice that involves algae or fungi.

There’s also cultivated seafood—it’s produced from fish cells that are grown on alternative tissues.

AQUA Cultured Foods is one of the leading brands of fermentation-enabled seafood.

AQUA Cultured Foods supplies fish-free seafood to Chicago area restaurants.

The company has raised $8 million in funding with high-end restaurants being its prime customers.

For grocery store shoppers, there’s TUN-AH from BettaF!sh.

The brand’s plant-based product comes in more than 10 formulations—in a can, as a spread, in a sandwich, and on a pizza.

The TU-NAH pizza combines plant-based tuna with red onions and tomatoes.

Conclusion

That’s all for our list of the top 10 biggest food trends happening right now.

A large percentage of consumers, especially younger generations, are seeking out food that’s good for them and good for the environment. They’re adventurous enough to try new options, possibly foods and flavor combinations they’ve never considered before.

Also, as consumers become more aware of the health effects of certain foods, they may become even more discerning about the products they buy.

The coming years will likely be filled with a host of new ingredients, new flavors, and new combinations. For food and beverage brands, keeping an eye on consumer tastes will be more important than ever.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Alison is an accomplished copywriter with proven success in editing, marketing, research, and management. Before writing for E... Read more