Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

10 Top Vitamin & Supplement Trends (2024)

You may also like:

Today we’re going to cover 10 important supplement trends for 2024.

From collagen’s continued growth to entirely new categories, this list will help you see what’s coming around the corner in the dietary supplement industry.

1. New Supplement Categories Emerge

Growth in the supplement space will largely come from established supplement categories like multivitamins, Vitamin D, and whey protein powder.

But a good chunk of future growth will come from new, emerging product categories.

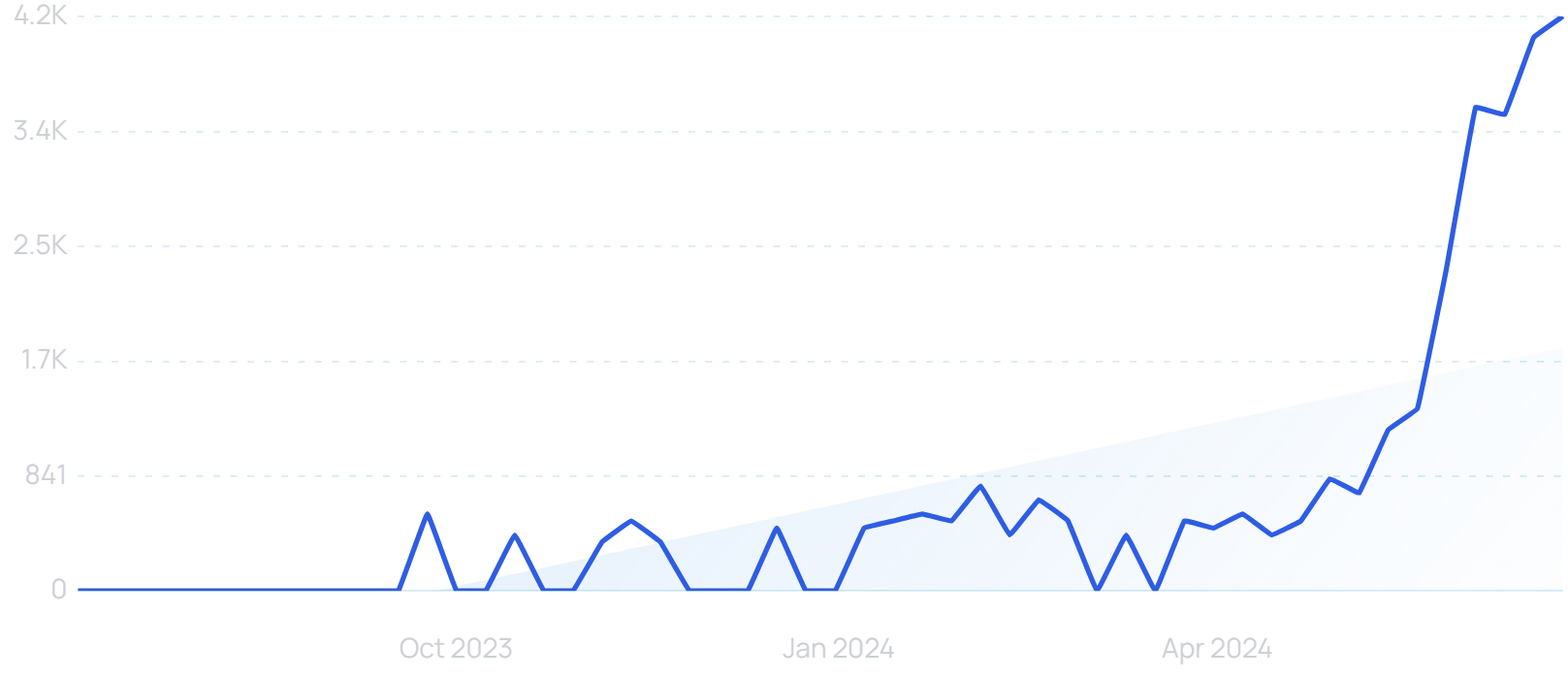

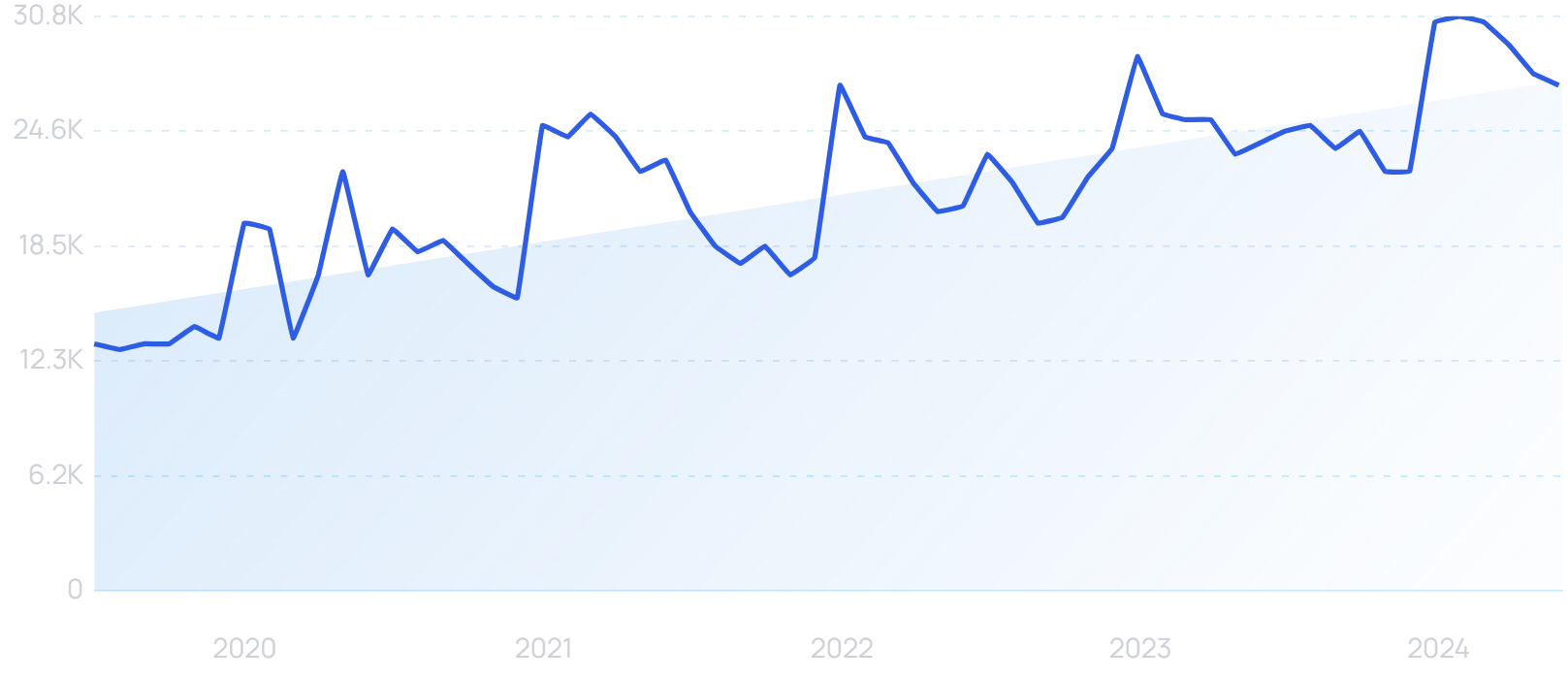

For example, sleep gummies.

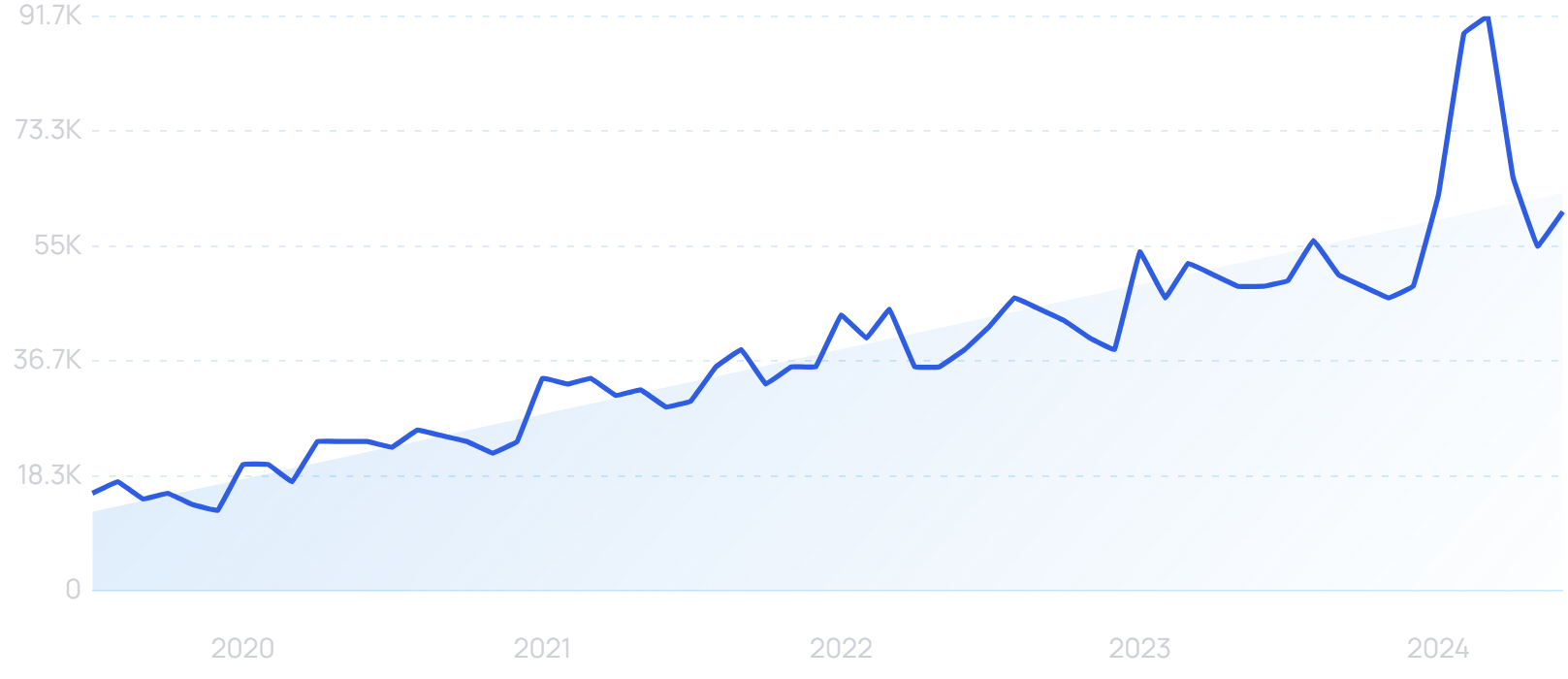

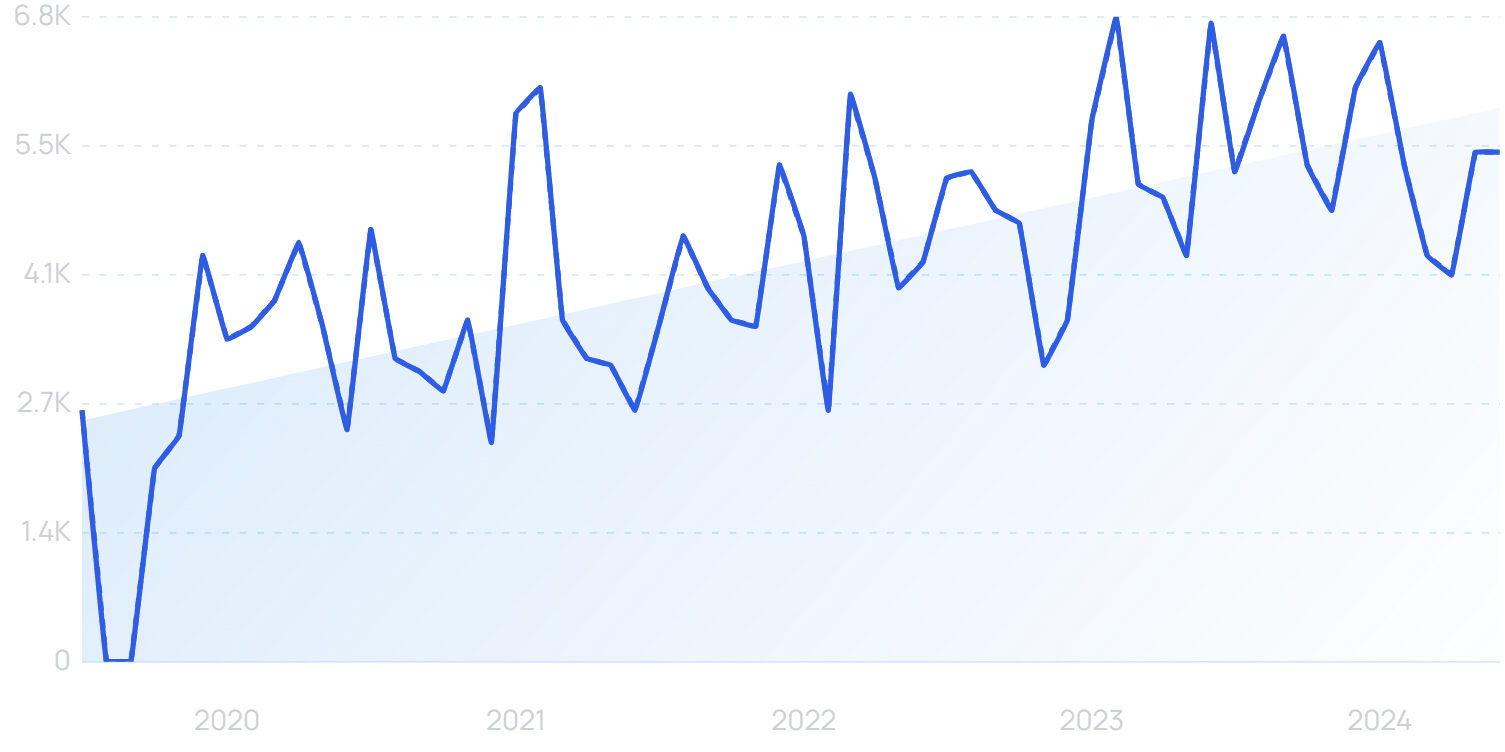

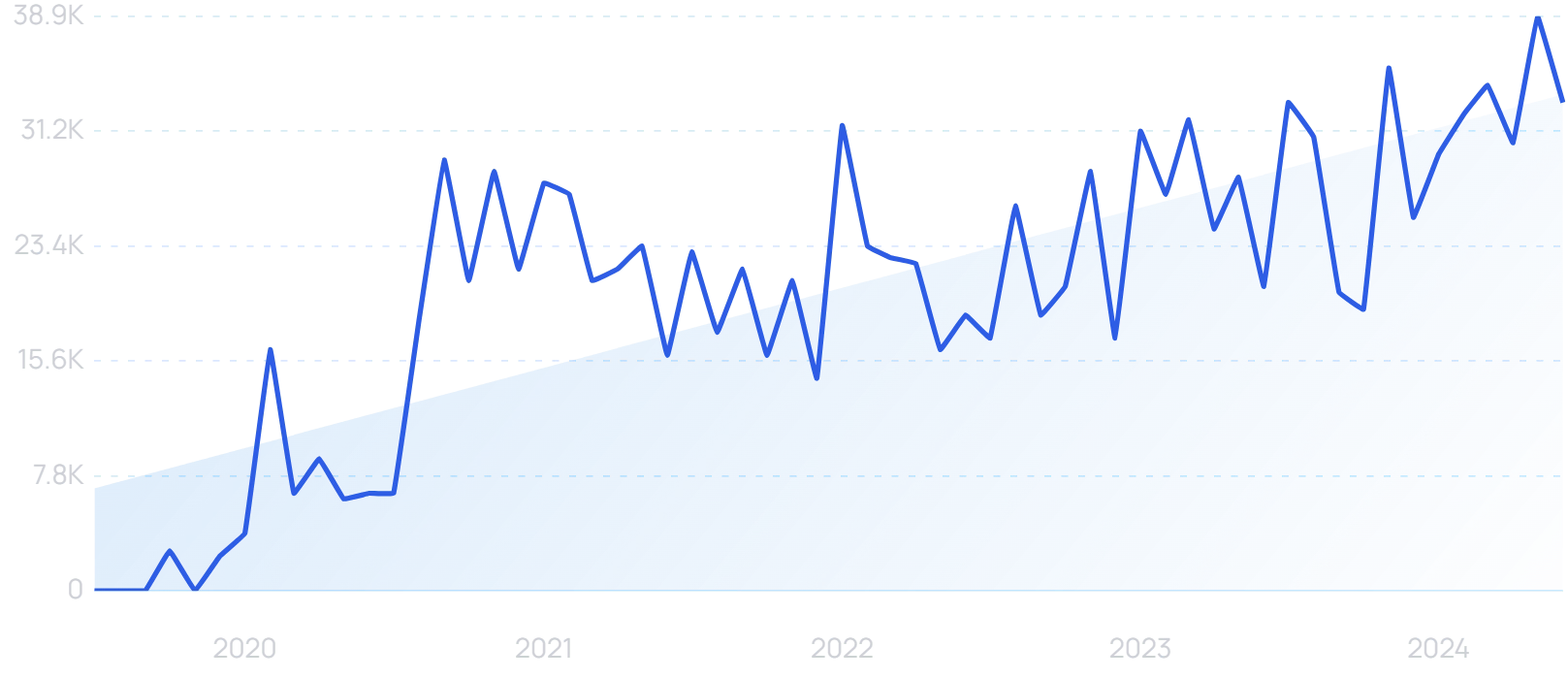

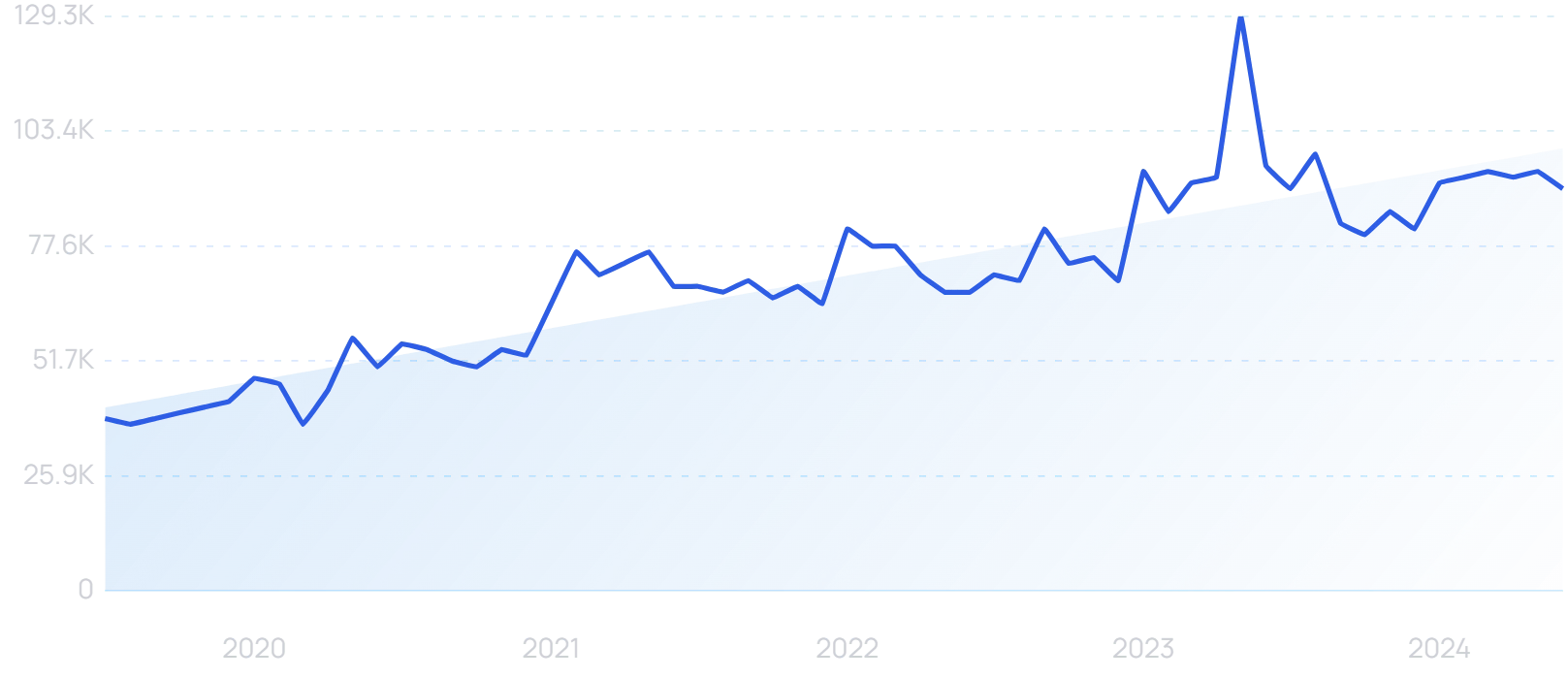

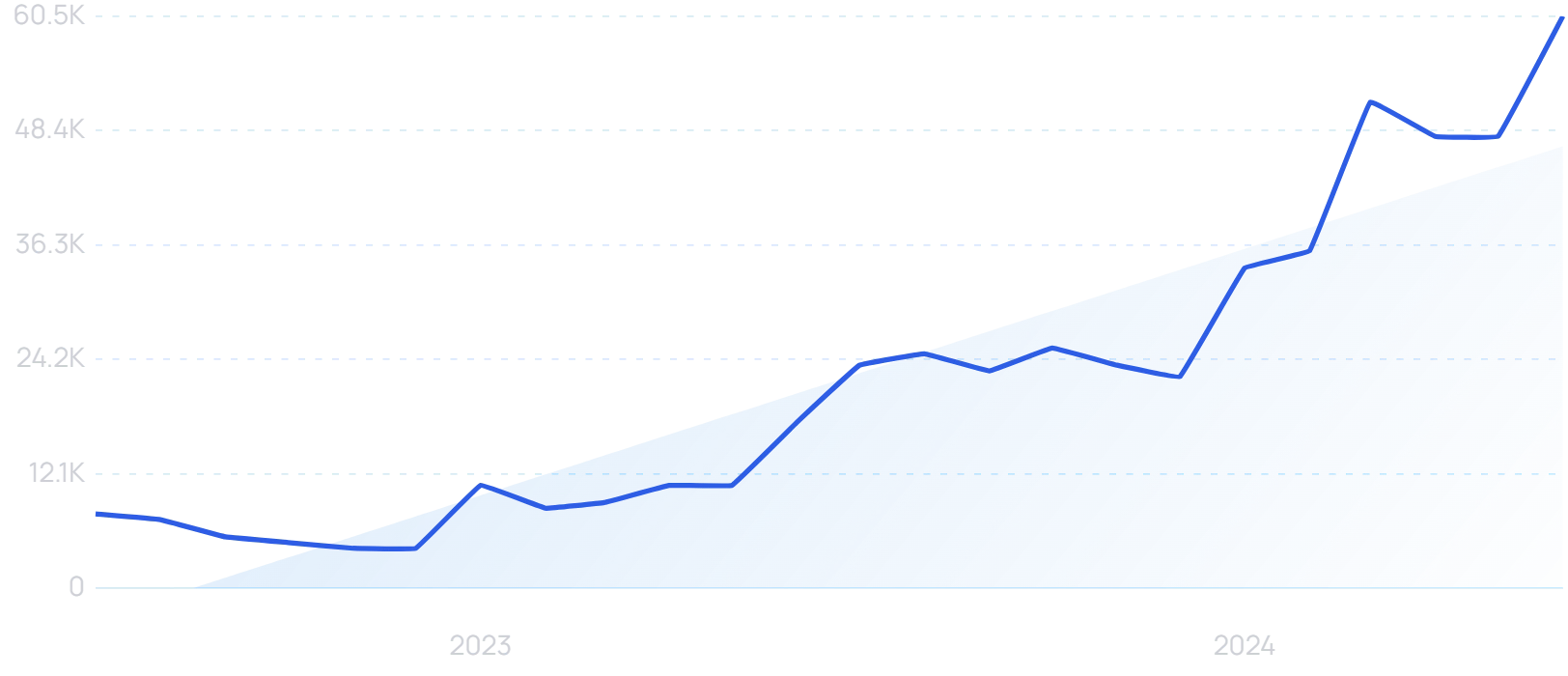

Search growth of “sleep gummies” is up 288% over 5 years.

Sleep gummies are gummy supplements containing compounds and nutrients that aid sleep (including magnesium and melatonin).

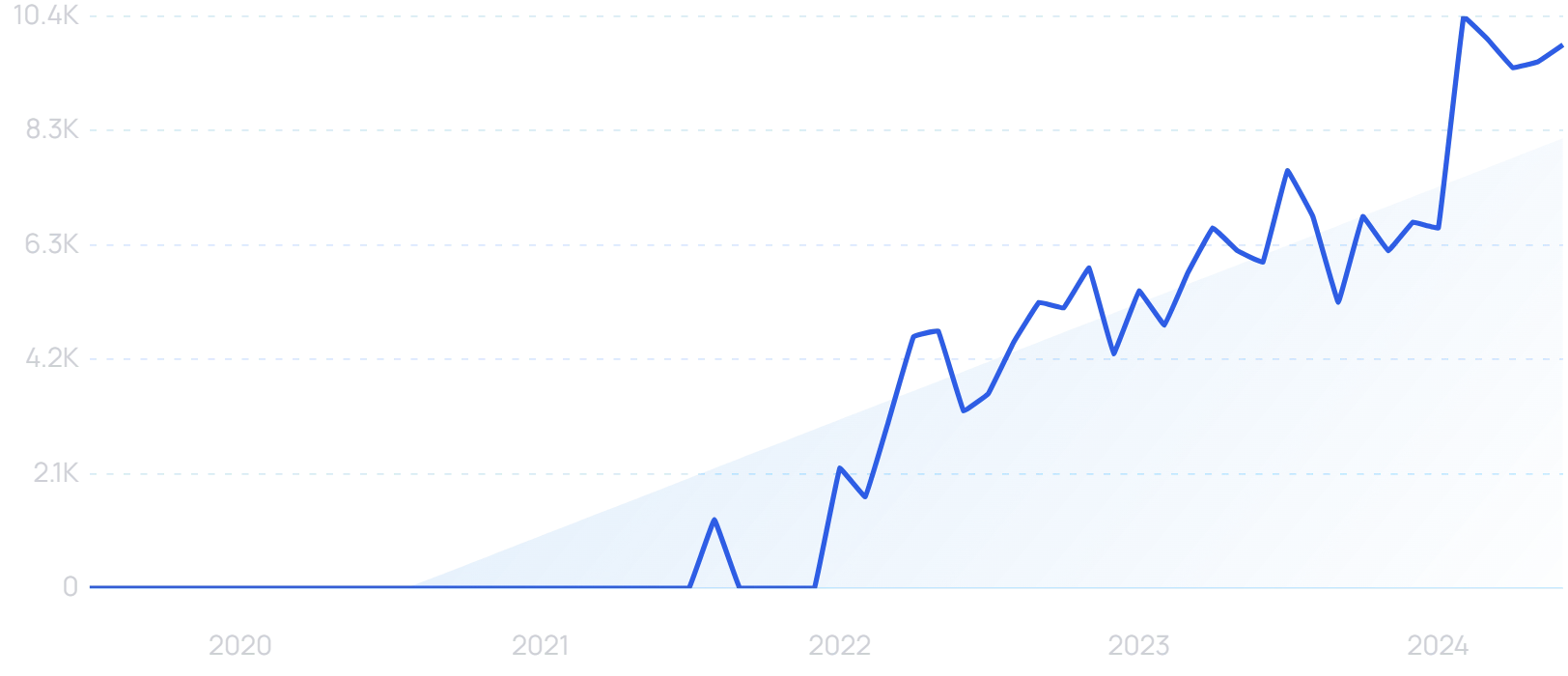

Another new, growing supplement category is Himalayan shilajit resin.

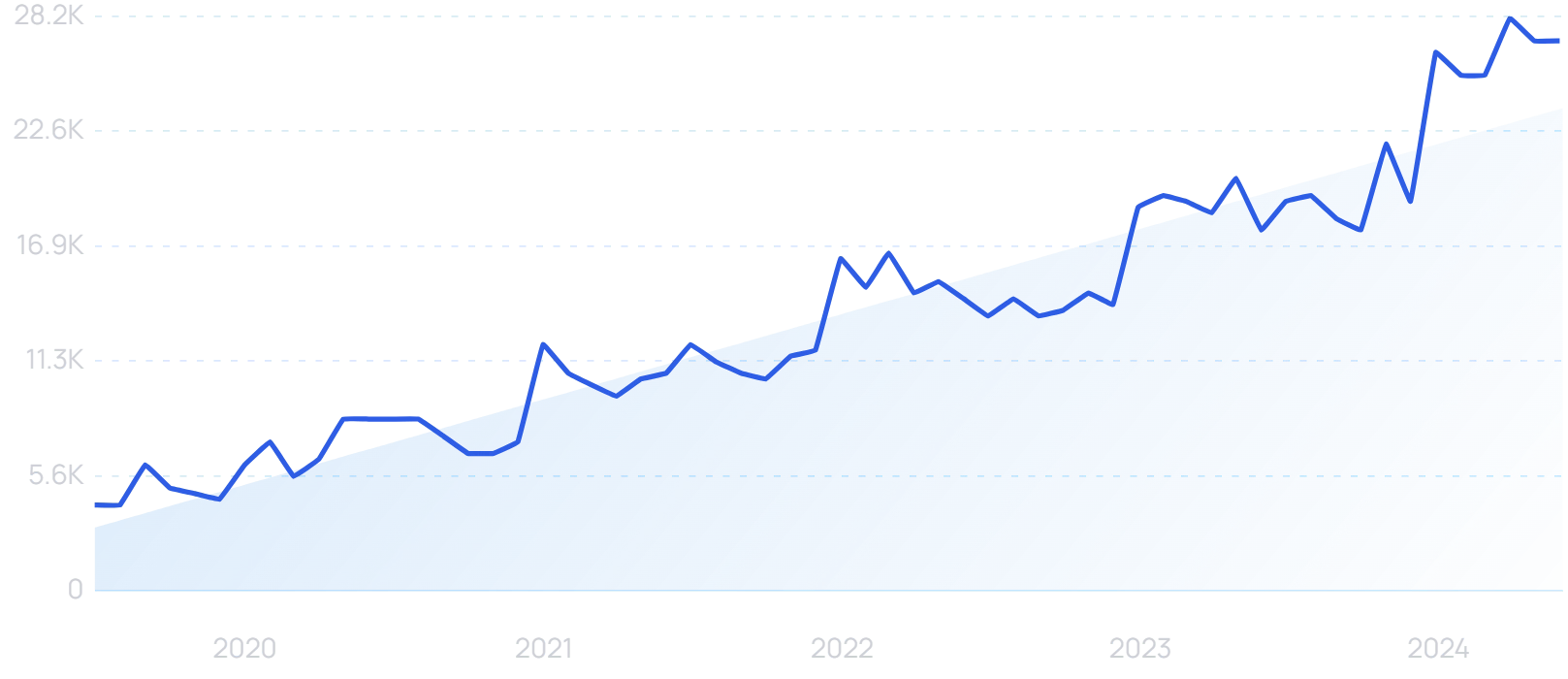

Searches for “Himalayan shilajit resin” have exploded in the last two years, with 99X+ growth.

Shilajit resin is actually a combination of various minerals and substances, with fulvic acid one of the key components. It occurs naturally in certain mountainous regions.

It’s commonly used as a supplement to aid in energy levels and nutrient absorption.

This brand of Shilajit resin has more than 2000 sales on Amazon in the last month.

2. Unnoticeable Supplements Emerge

Prominent among the new wave of supplements is a category of almost “unnoticeable” products that are embedded into consumers’ existing everyday routines.

In particular, supplements are often being combined with coffee.

75% of American adults drank coffee within the past week, so the appeal of adding a health component is clear.

Turmeric coffee is a real leader in this space.

Searches for “turmeric coffee” have grown 78% in the last 2 years.

Turmeric was one of the biggest supplement trends of the last 5 years.

And while turmeric coffee looked as though it might just be one of the quirky products to enjoy a pandemic spike, it’s on the rise again and close to an all-time search peak.

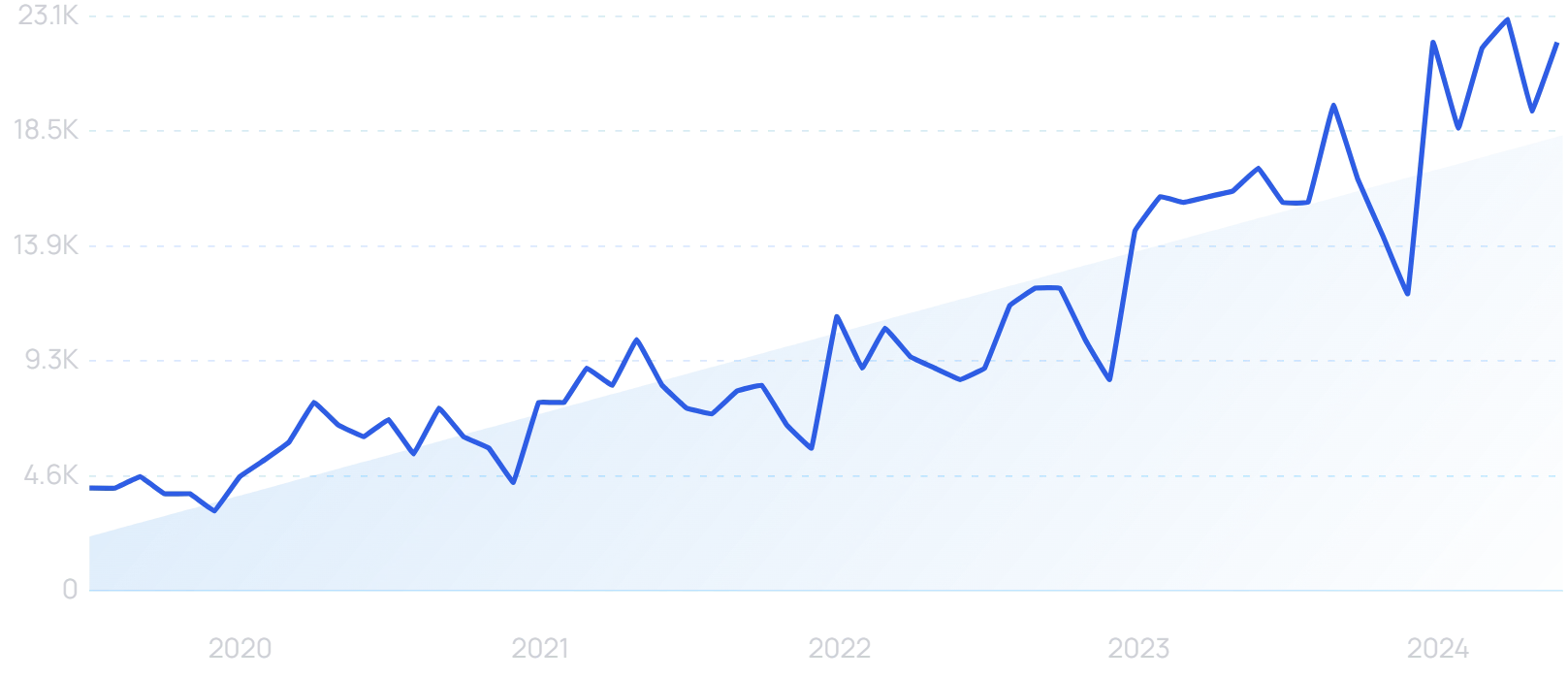

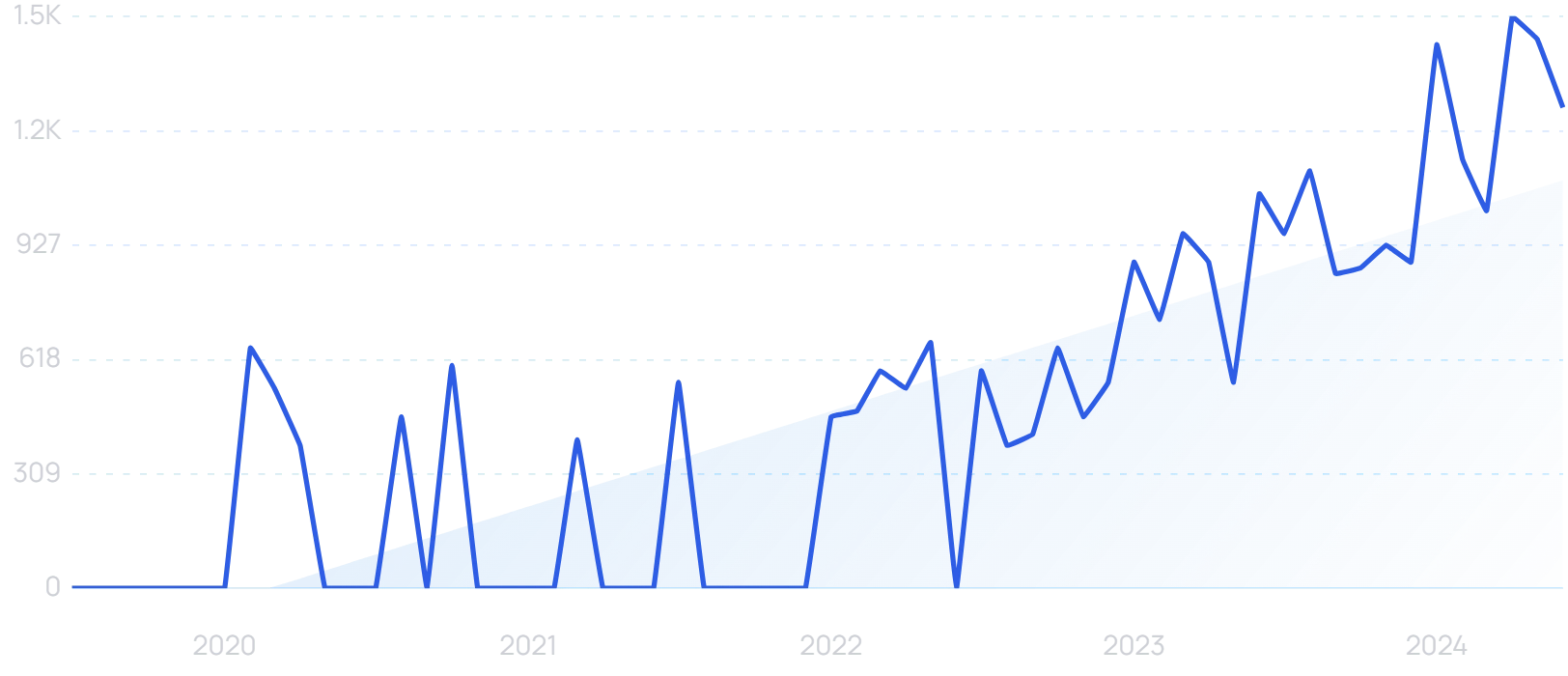

Likewise, mushroom coffee is proving increasingly popular.

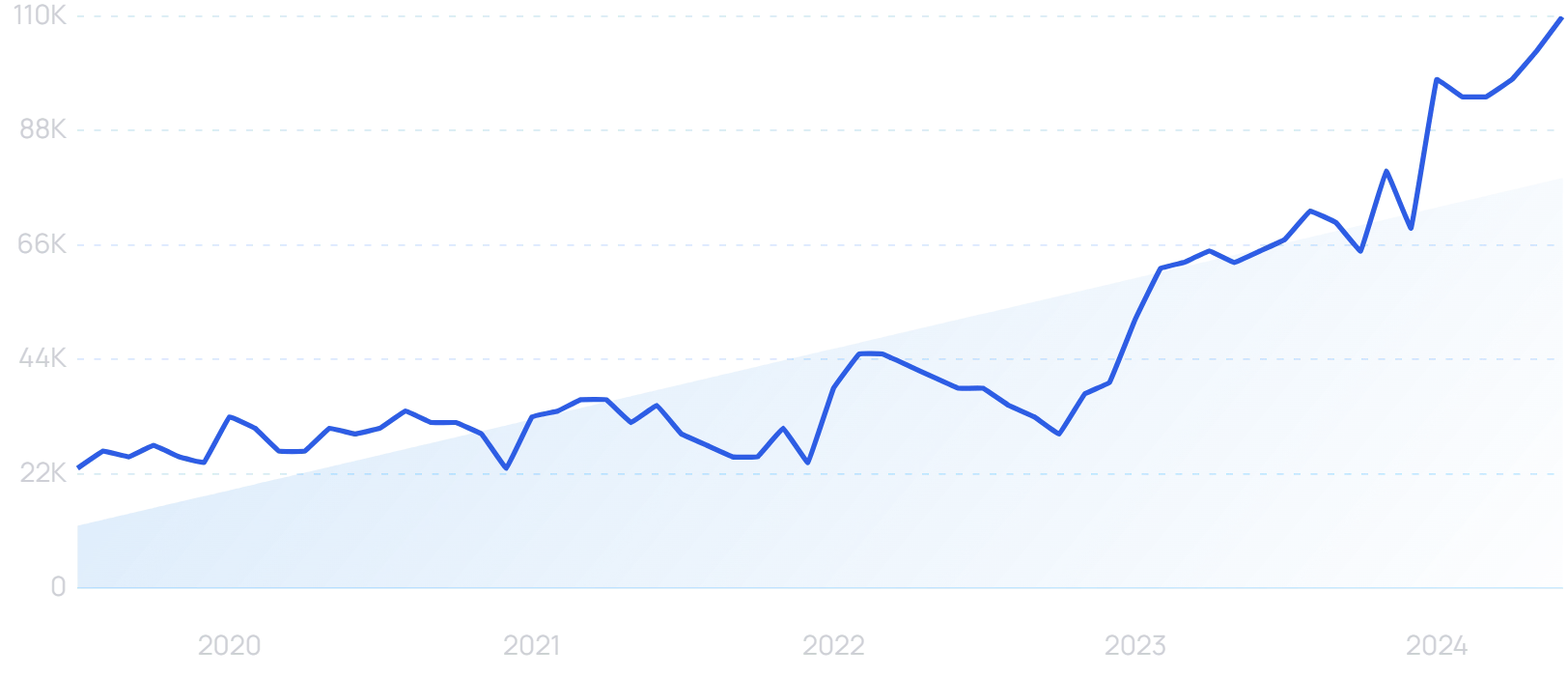

Searches for “mushroom coffee” are up 1143% over a 5-year period.

Mushroom coffee uses powder ground from fungi such as lion’s mane, cordyceps, and chaga.

This is then mixed with regular instant coffee.

Mushroom coffee is designed to taste somewhat similar to regular coffee. But the reduced coffee component means there’s less caffeine.

Other purported health benefits depend on the mushroom blend.

For example, some aim to regulate blood sugar levels or to offer a valuable source of unique minerals and antioxidants.

A growing mushroom brand, Om Mushrooms sells a whole range of mushroom coffee and related products.

Searches for “Om Mushrooms” are up 121% in 5 years.

You can buy coffee, coffee latte, hot chocolate and matcha latte blends. As well as a formulation specially designed for increased energy.

Om Mushrooms offers a range of different mushroom coffee products.

And it’s not just drinks getting the unnoticeable supplement treatment.

Chocolate collagen has seen steep search growth.

Searches for “chocolate collagen” have increased by 135% in 5 years.

3. Demand For Collagen Grows

An analysis by Grand View Research estimates that the collagen market is growing by 9.6% annually.

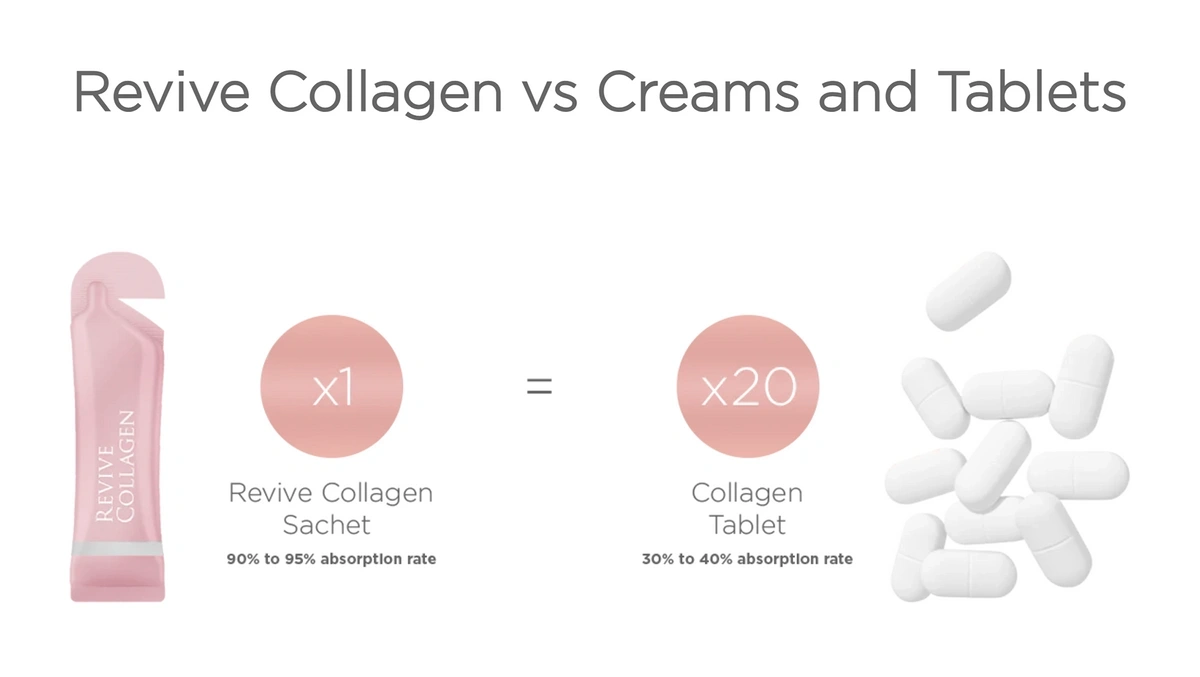

Revive Collagen is a fast-growing brand within this space. Just three years after being founded, it was generating revenue of $16.8 million.

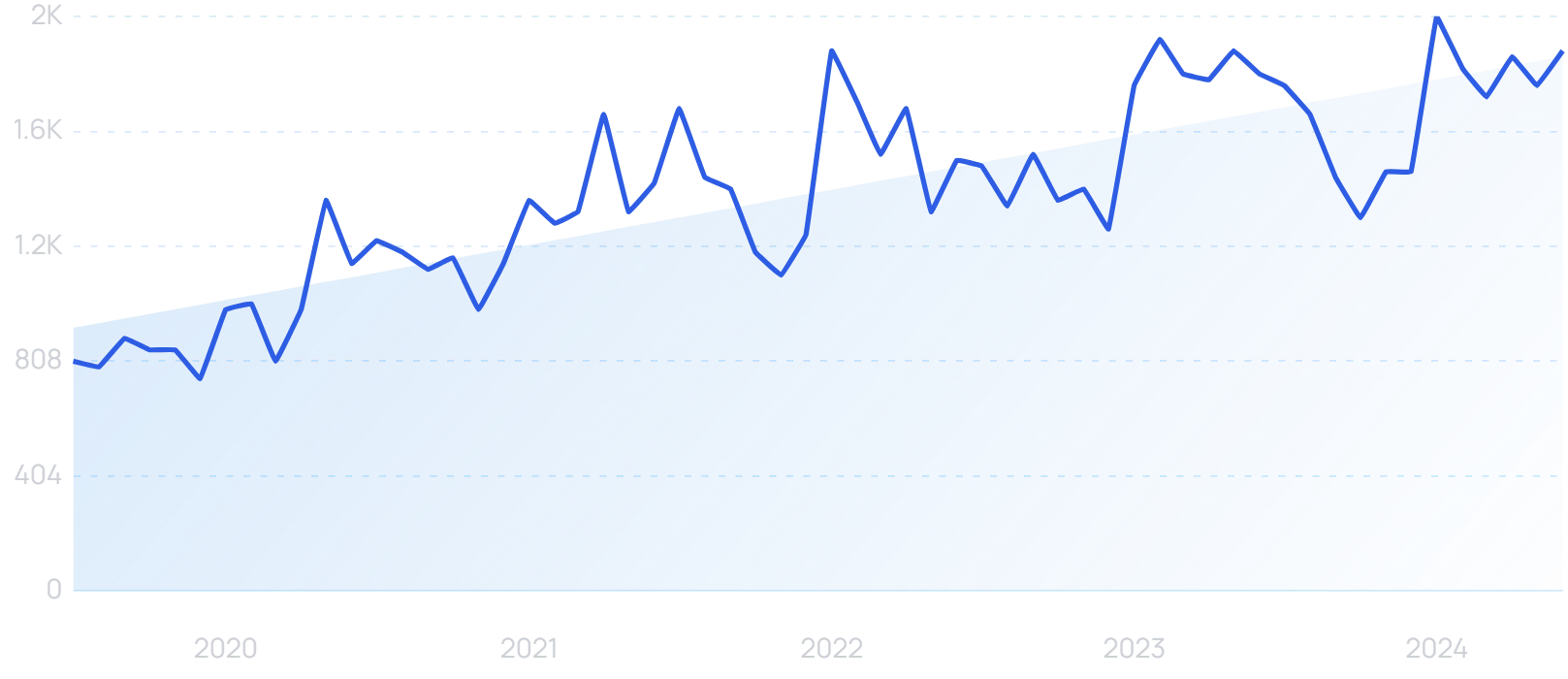

Searches for collagen manufacturer "Revive Collagen" have increased by 93% in 2 years, with strong growth ever since it was founded in August 2020.

The collagen category is growing largely because collagen has a wide range of applications and use cases.

It’s been linked to better hair and joint health.

But skin health is where a lot of the marketing is focused.

And 10-15% of all collagen is used in cosmetics.

This use case blurs the line between supplements and skincare/makeup.

Revive Collagen is primarily designed to target the skin, but it’s taken as a drink.

And we’re also seeing big spikes in demand for niche collagen products.

For example, marine collagen (aka "fish collagen").

Search growth for “marine collagen” is up 133% in the last 5 years.

As the name suggests, marine collagen is collagen derived from fish.

Which makes it an accessible pescatarian alternative to traditional collagen.

And studies suggest that fish collagen supplementation has similar effects to bovine collagen.

Fish collagen may be an effective alternative to bovine collagen for those that follow pescatarian diets.

4. Gummies Become A Mainstream Supplement Form

For many people, CBD gummies helped solidify gummies as a convenient and tasty way to take supplements.

It ties in with the idea of unnoticeable supplements.

And over the last few years, an increasing number of supplements have been “gummified”.

Collagen has been no exception.

“Collagen gummies” searches are up 540% in 5 years.

And just about every category of exploding supplement is also exploding in gummy form.

There are mushroom gummies:

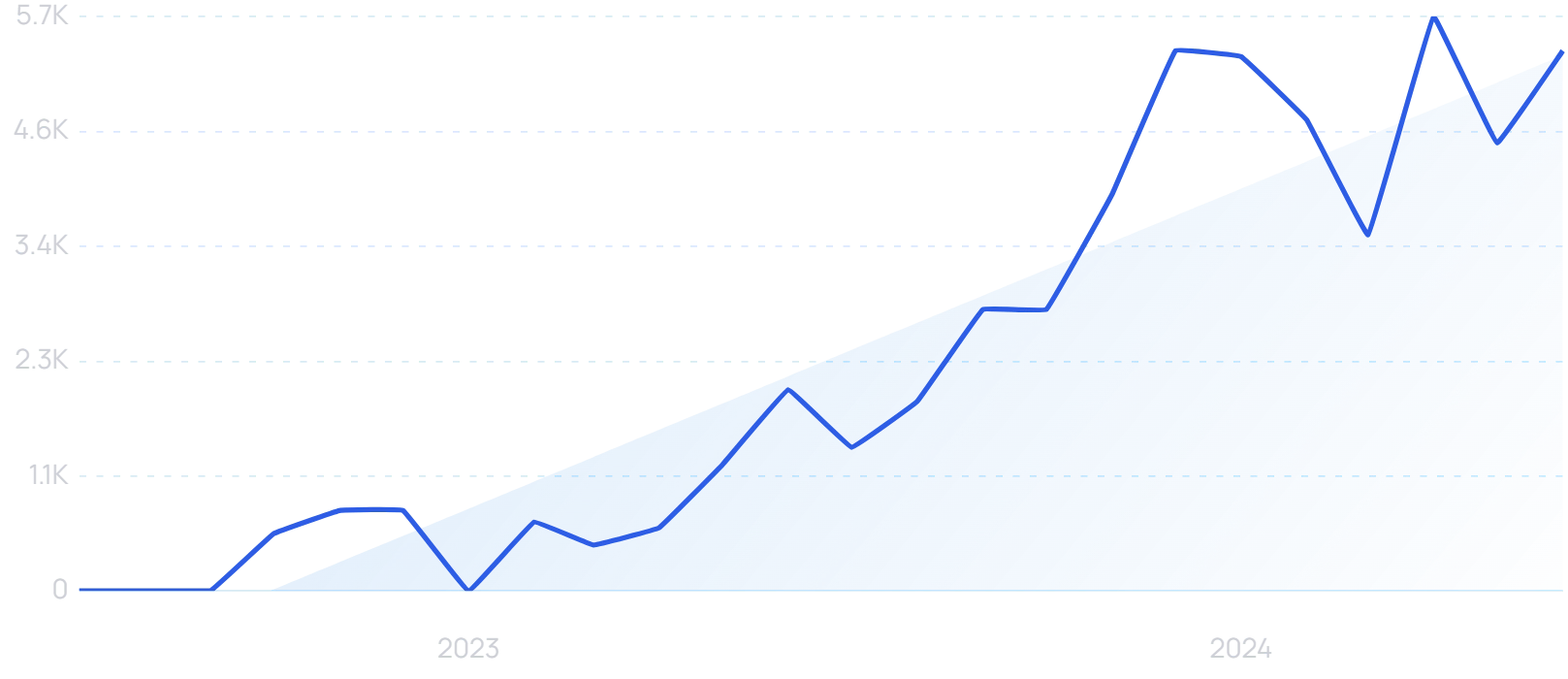

Searches for “mushroom gummies” are up 1011% in 2 years.

And recently, Shilajit gummies:

“Shilajit gummies” have seen 99X+ recent growth.

Other examples of growing gummy supplement categories include magnesium gummies, turmeric gummies and hair gummies.

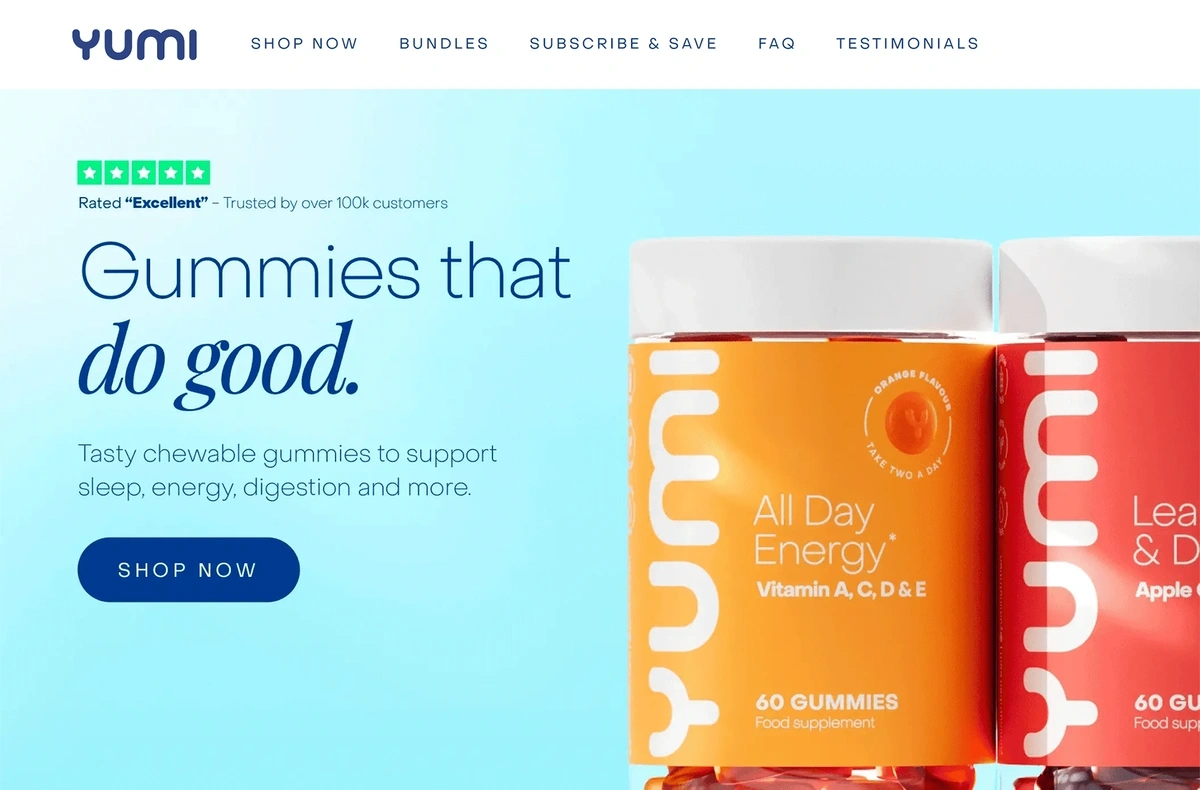

Yumi Nutrition is among the brands to double down on gummy supplements. It saw revenue growth of 216% in the 12 months to March 2021, and the gummy trend has lasted well beyond the depths of the pandemic.

Yumi Nutrition sells a wide range of gummy supplements.

5. Pet Supplements Take Off

36% of dog owners and 28% of cat owners in the US buy pet supplements for joint pain alone.

So it’s no wonder the US pet supplement market is already worth close to $900 million.

And search demand for pet supplements is on the rise.

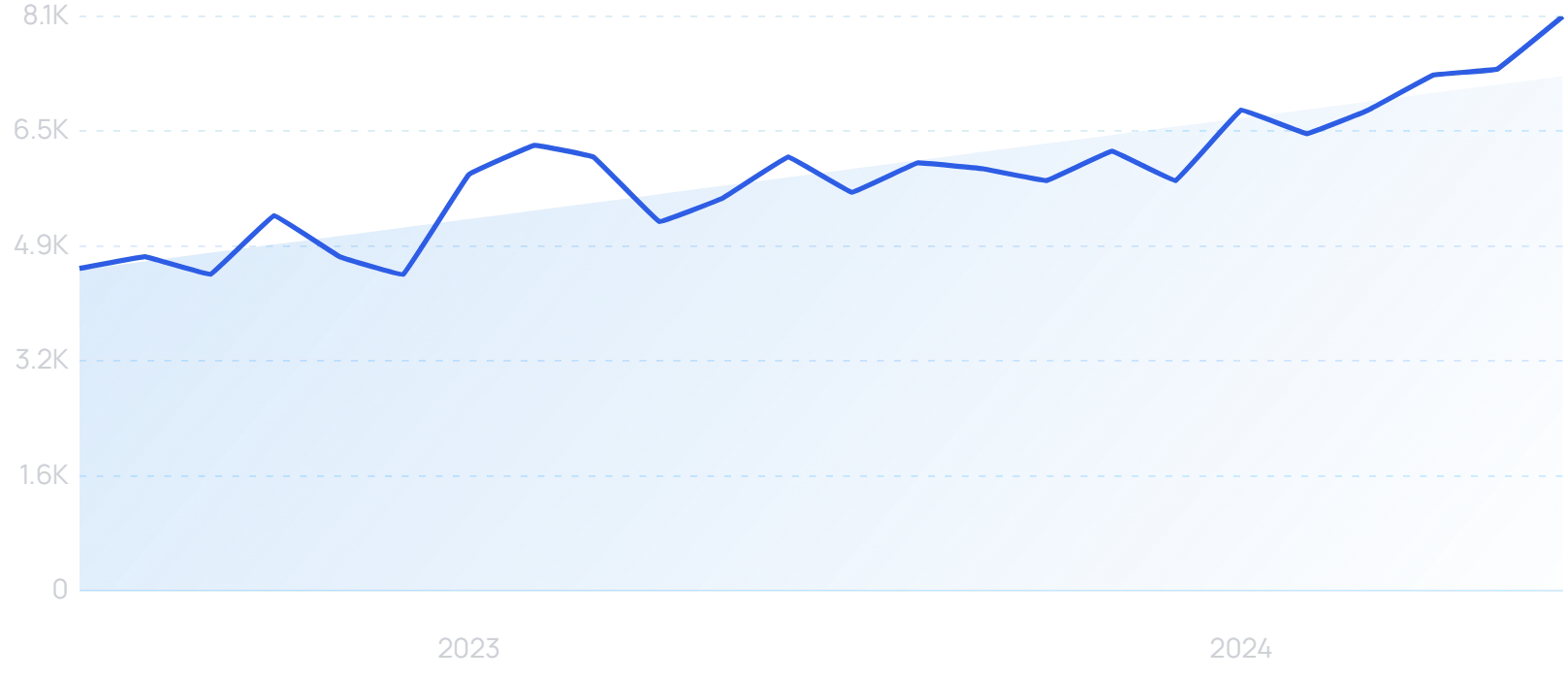

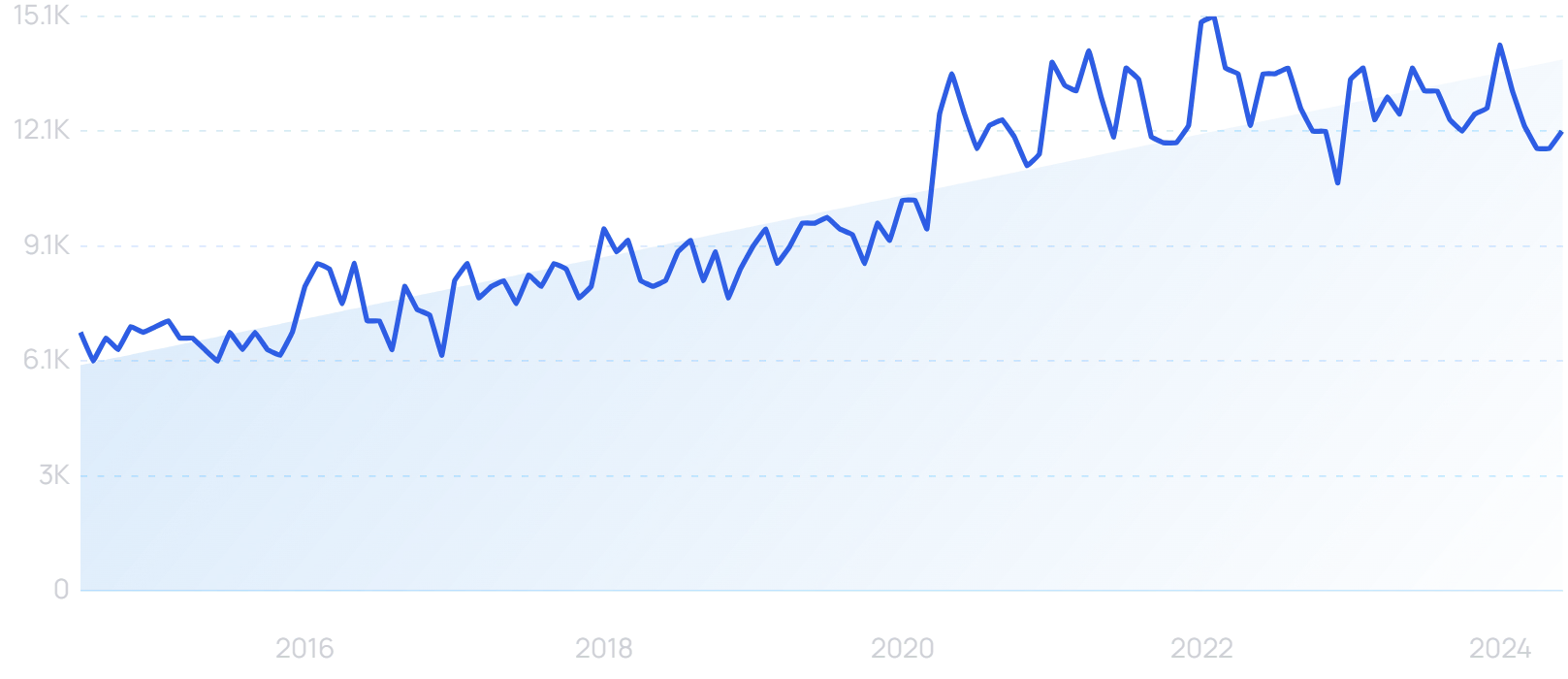

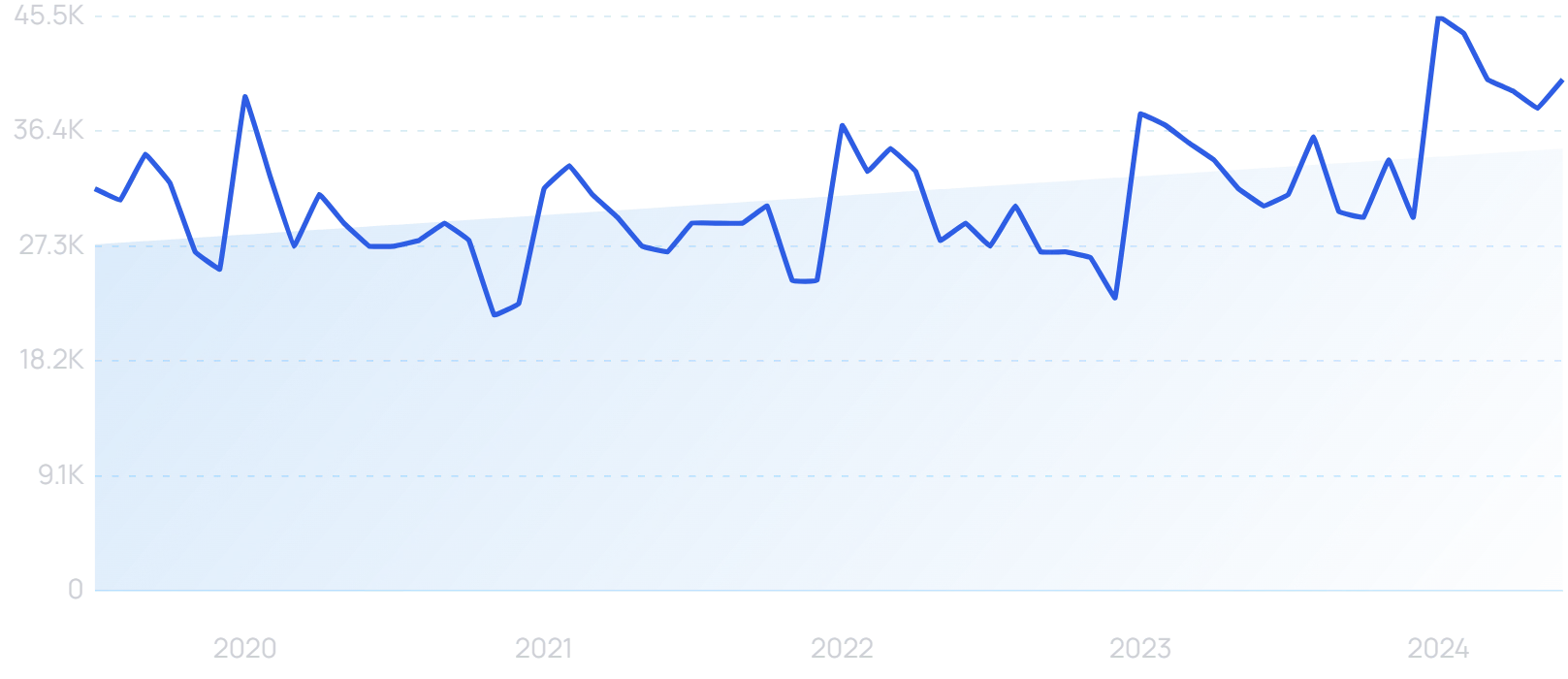

Searches for "dog vitamins" are up 78% over the last 10 years.

Besides improving their pet's joint health, reasons that owners give their pets supplements include boosting overall wellness, improving coat appearance, and optimizing heart health.

Interestingly, many popular pet supplements mirror those that humans take.

One human-inspired pet supplement category is probiotics for pets.

Searches for “dog probiotics” have increased 98% in 5 years.

Like humans, dogs and cats have a microbiome.

And probiotic and prebiotic supplementation may aid in animal gut health as well.

6. Growing Number Of Vegan Supplements

Approximately 5% of Americans follow some form of vegetarian or vegan diet.

Which is why a growing number of Americans are seeking out vegan-friendly supplements.

Especially vegan versions of popular supplements that typically contain animal ingredients.

Or supplements to prevent deficiencies that can occur while following a vegan diet.

One example of a growing vegan supplement is vegan collagen.

Search growth for “vegan collagen” is up 105% over 5 years.

While actual collagen does need to derive from animals, many vegan collagen supplement manufacturers are attempting to recreate collagen from plant-based ingredients.

Or simply marketing nutrients that boost skin and nail health as “vegan collagen”.

Example of a "vegan collagen" product.

Likewise, there’s strong search growth for vegan magnesium, vegan Omega 3 and vegan gummies.

7. DTC Brands Crack Physical Markets

Thanks largely to the pandemic, 2020 was a huge year for the direct-to-consumer space.

Like many industries (including healthcare), the supplement industry was impacted by the rapid growth of the eCommerce sector.

But while there have been DTC opportunities for supplement brands, 81% of supplement sales still happen in stores.

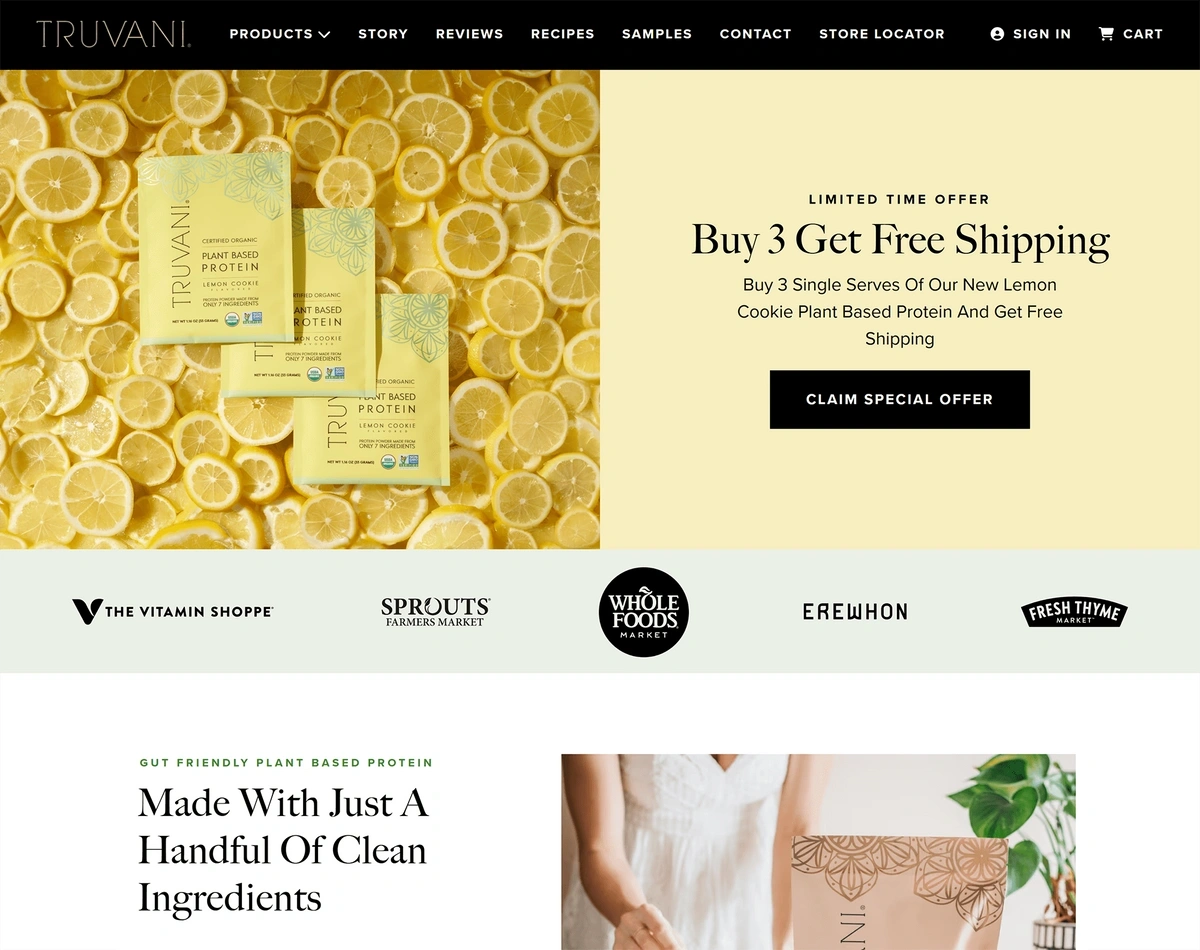

Truvani is an example of a fast-growing supplement brand that’s balanced DTC with brick-and-mortar sales.

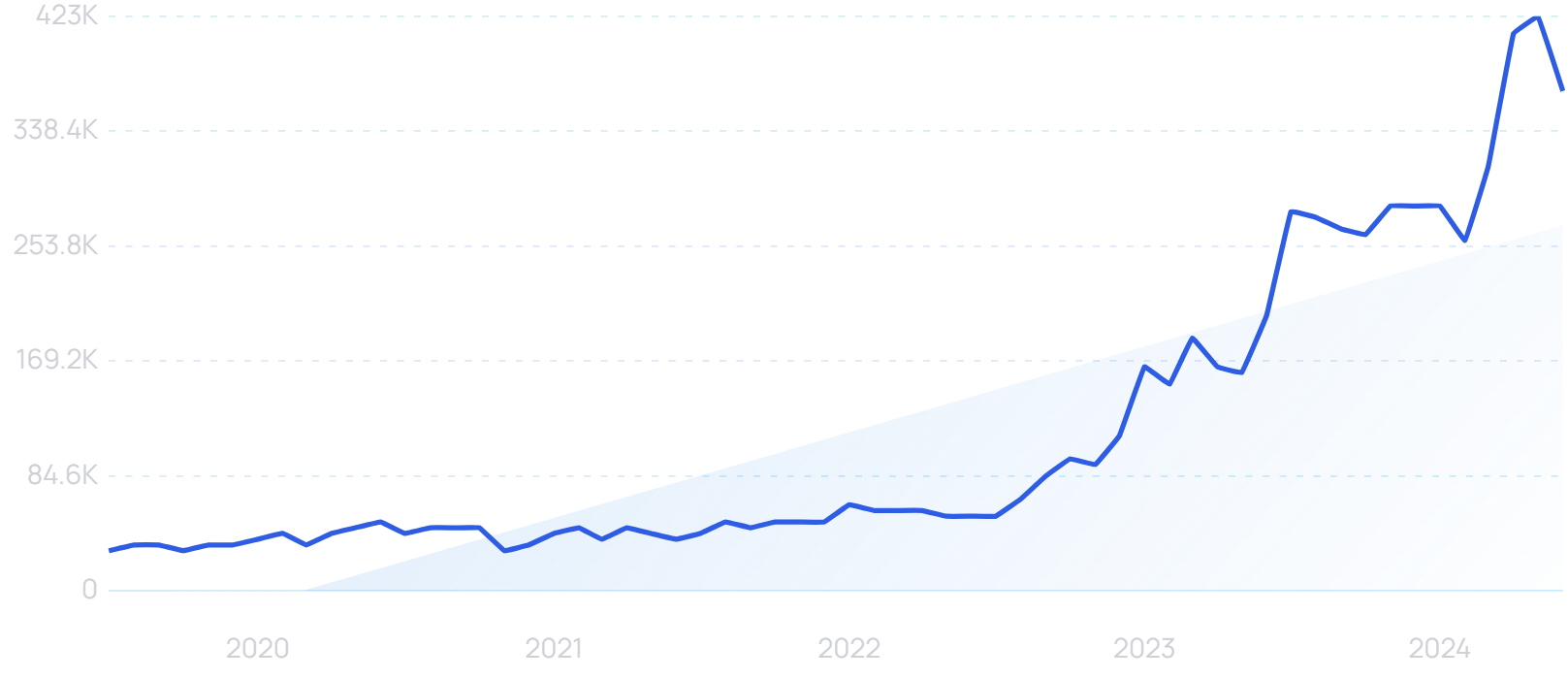

Search growth for “Truvani” is up 433% over the last 5 years.

Truvani has a loyal DTC customer base, and generates around 70% of its Shopify sales from repeat purchasers.

But it’s also in major chains like The Vitamin Shoppe and Whole Foods.

Truvani uses a blended model of ecommerce and physical sales.

Another popular DTC supplement brand is Ancient Nutrition.

Interest in "Ancient Nutrition" has increased 27% over the last 5 years.

It specializes in superfood supplements. And its products can also now be found in Whole Foods.

8. Natural Workout Supplements Hit The Mainstream

Athletes have long been big users of supplements. But they are no longer exclusively the realm of the professionals and the keenest enthusiasts.

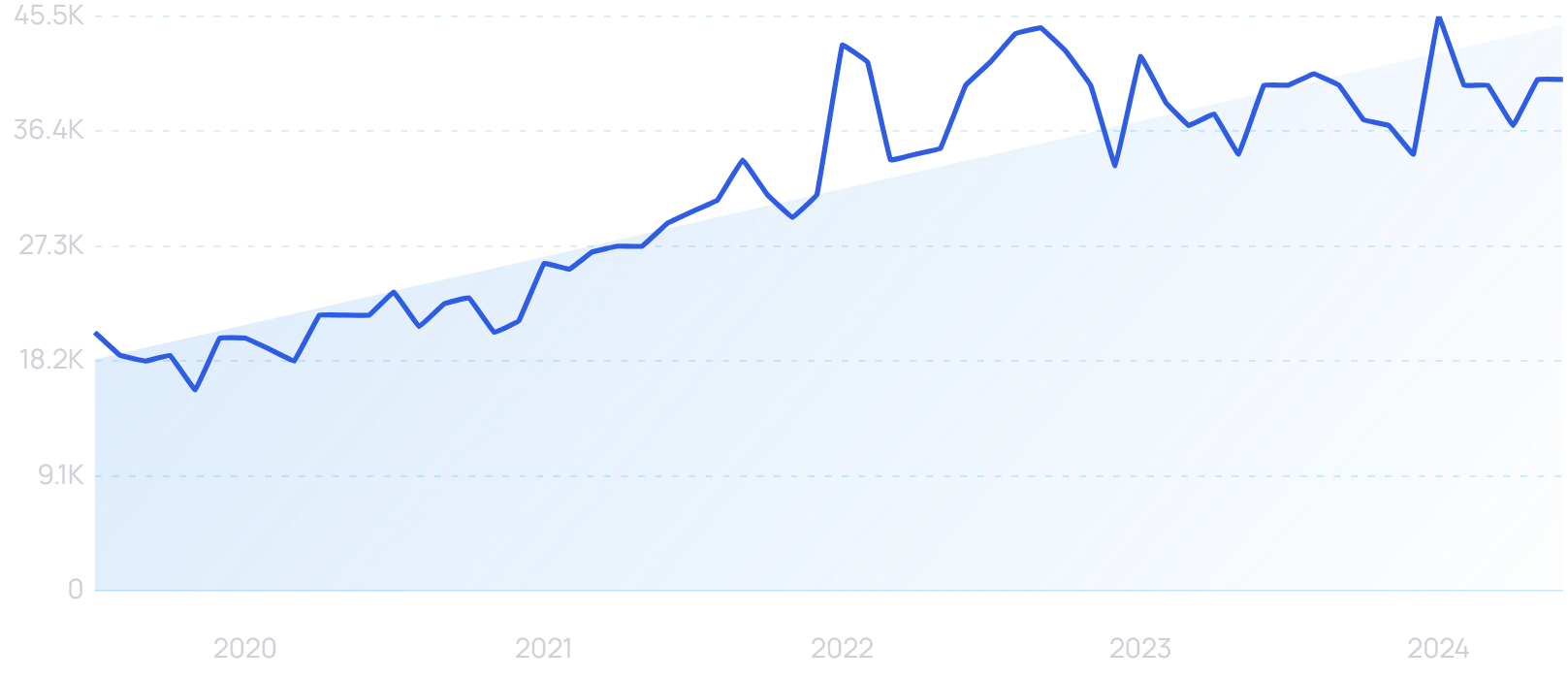

In fact, 43.8% of people who go to the gym use some kind of workout supplement.

The sports nutrition market size has reached $45.2 billion globally. And sports supplements boast the largest revenue share, accounting for 39.4% of the market.

Creatine is naturally occurring in muscle cells. It helps to produce energy during high-intensity exercise and lifting.

And its use as a supplement is rising steeply. Searches for creatine gummies are growing at pace.

Searches for “creatine gummies” are up 669% over the last two years.

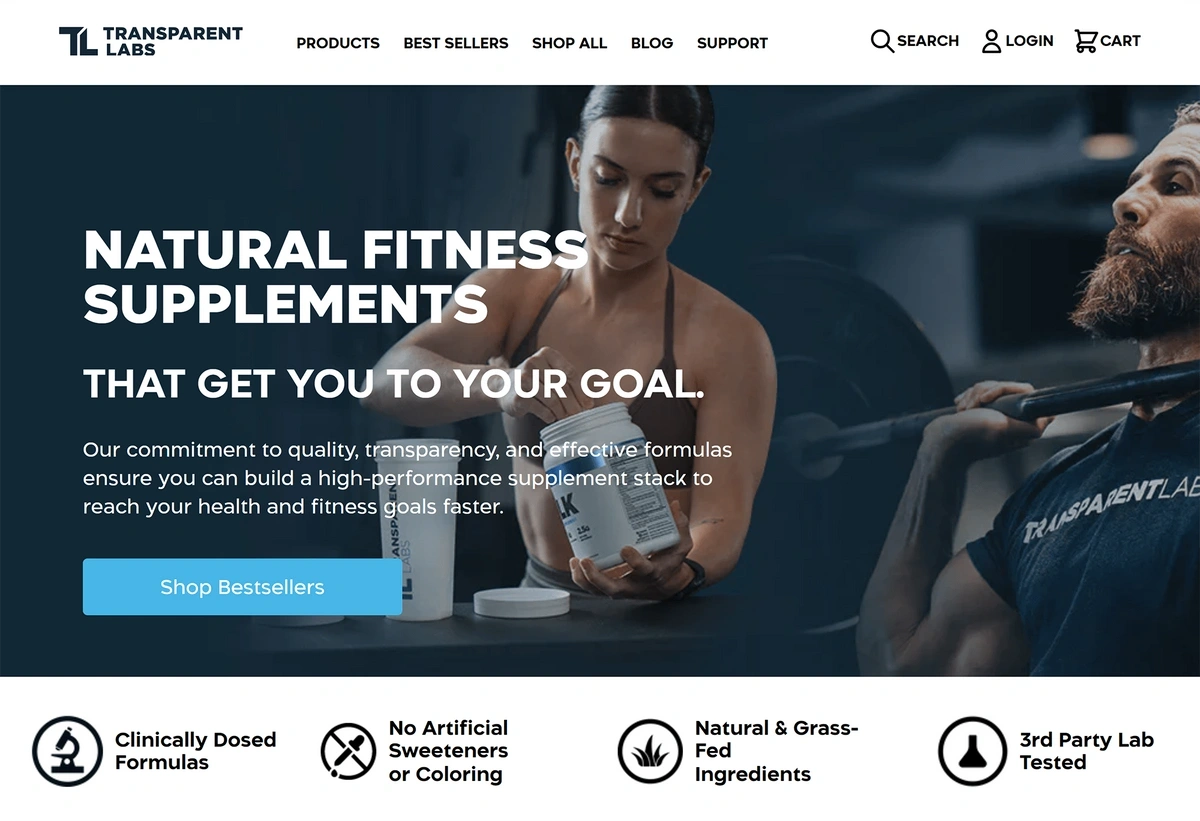

Transparent Labs specializes in all-natural sports supplements.

Transparent Labs avoid artificial sweeteners or coloring in their workout supplements.

Whey protein and creatine products are among the top sellers. And search growth is high.

“Transparent Labs” searches are up by 376% in 5 years.

9. Supplements For Kids

Parents interested in their own health are likely to care at least as much about the health of their children.

Which helps explain why 4.1 million children in the US take supplements.

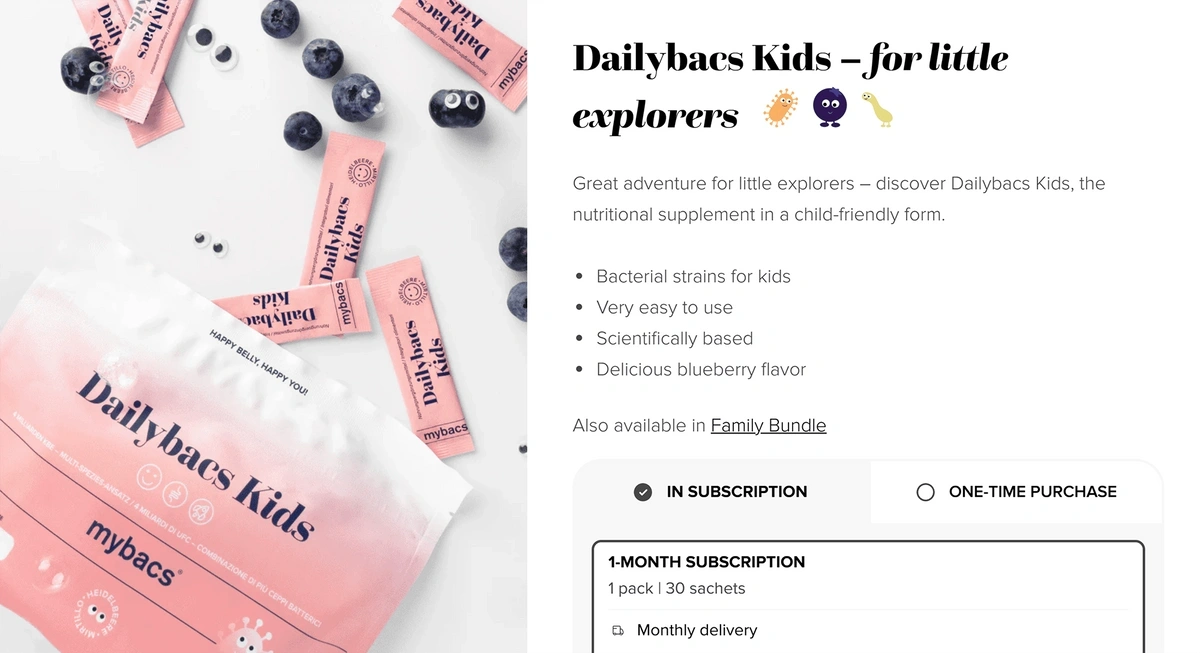

MyBacs is a hugely fast-growing brand that taps into this trend.

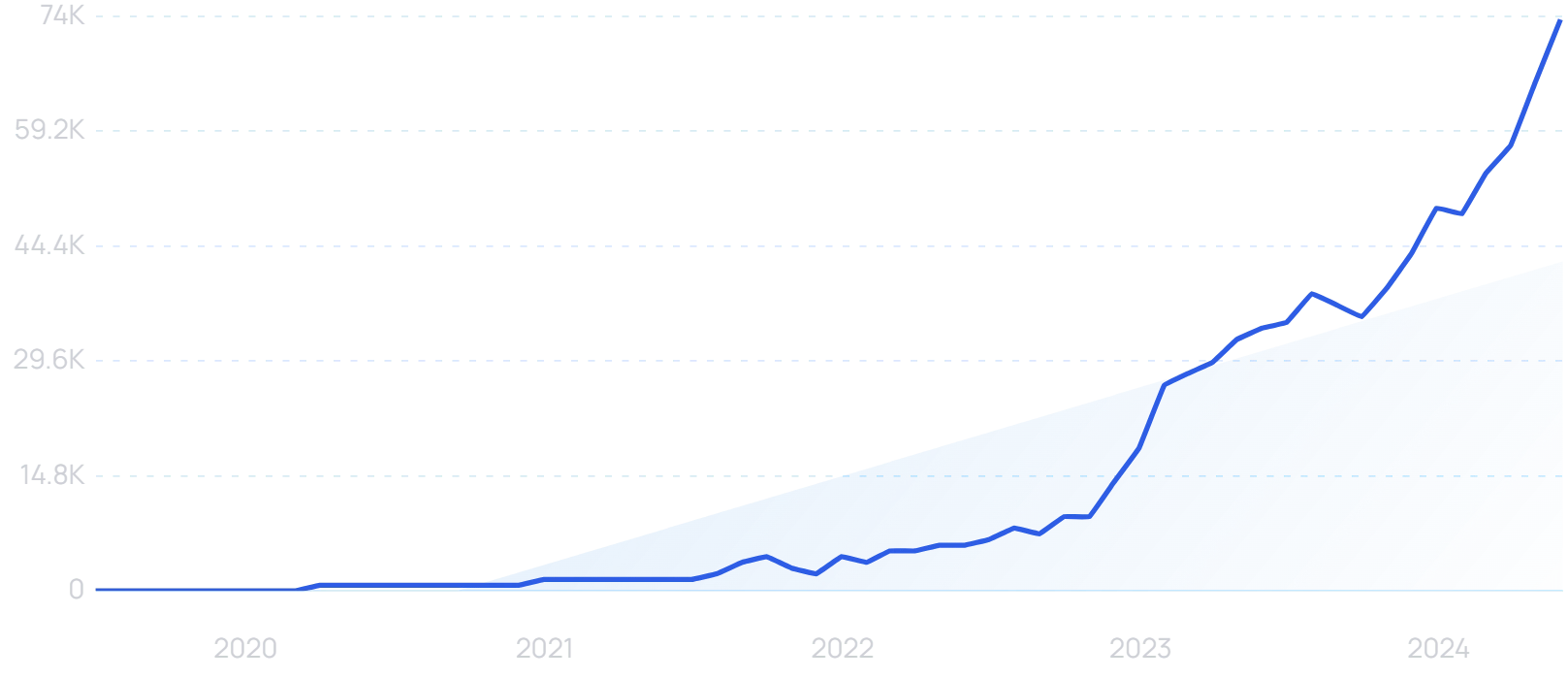

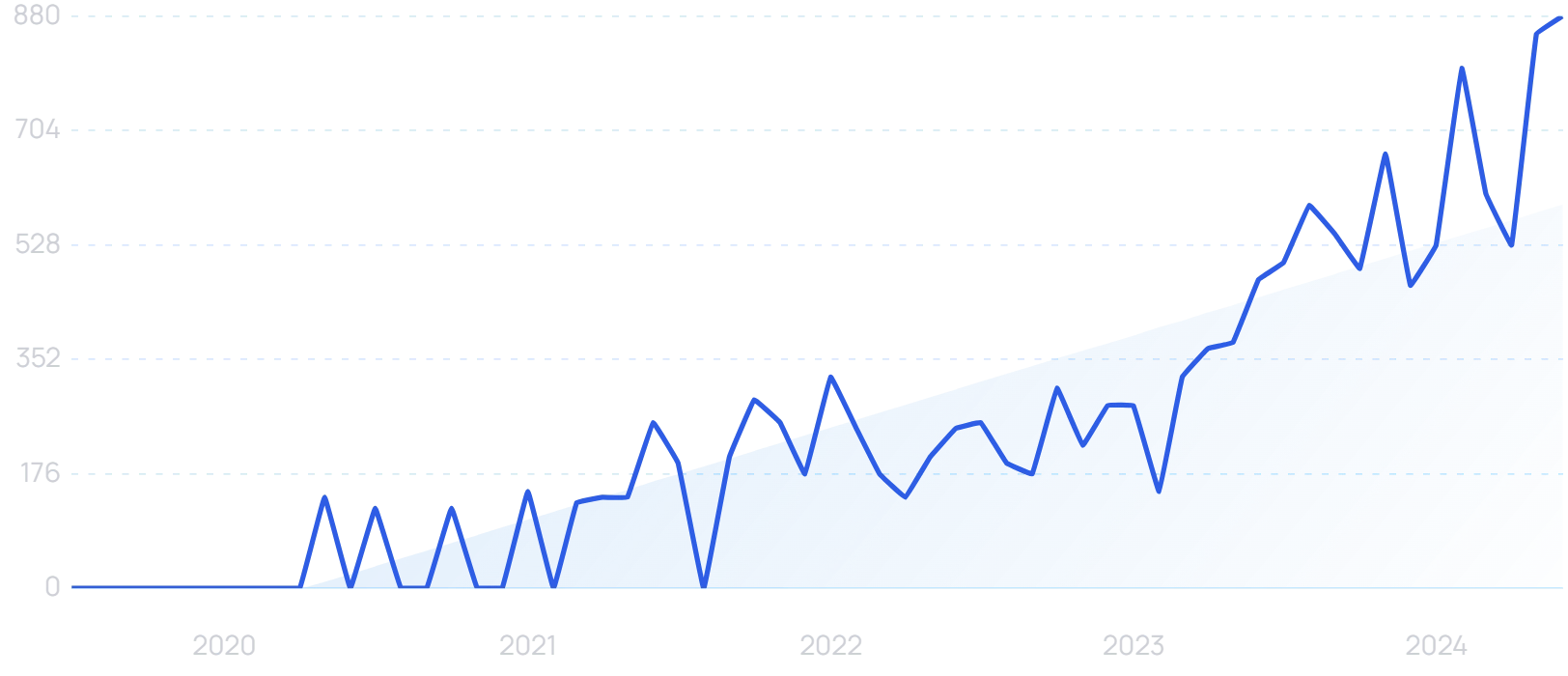

“MyBacs” search growth is 99X+ over the last 5 years.

It sells microbiome supplements for adults too, but has an array of products targeted at children.

MyBacs offers “family bundles” of supplements on a subscription basis.

There’s also a growing niche of supplements designed to stimulate growth in children and teens.

As ever, we can observe the gummy trend. “Height gummies” have seen major search growth.

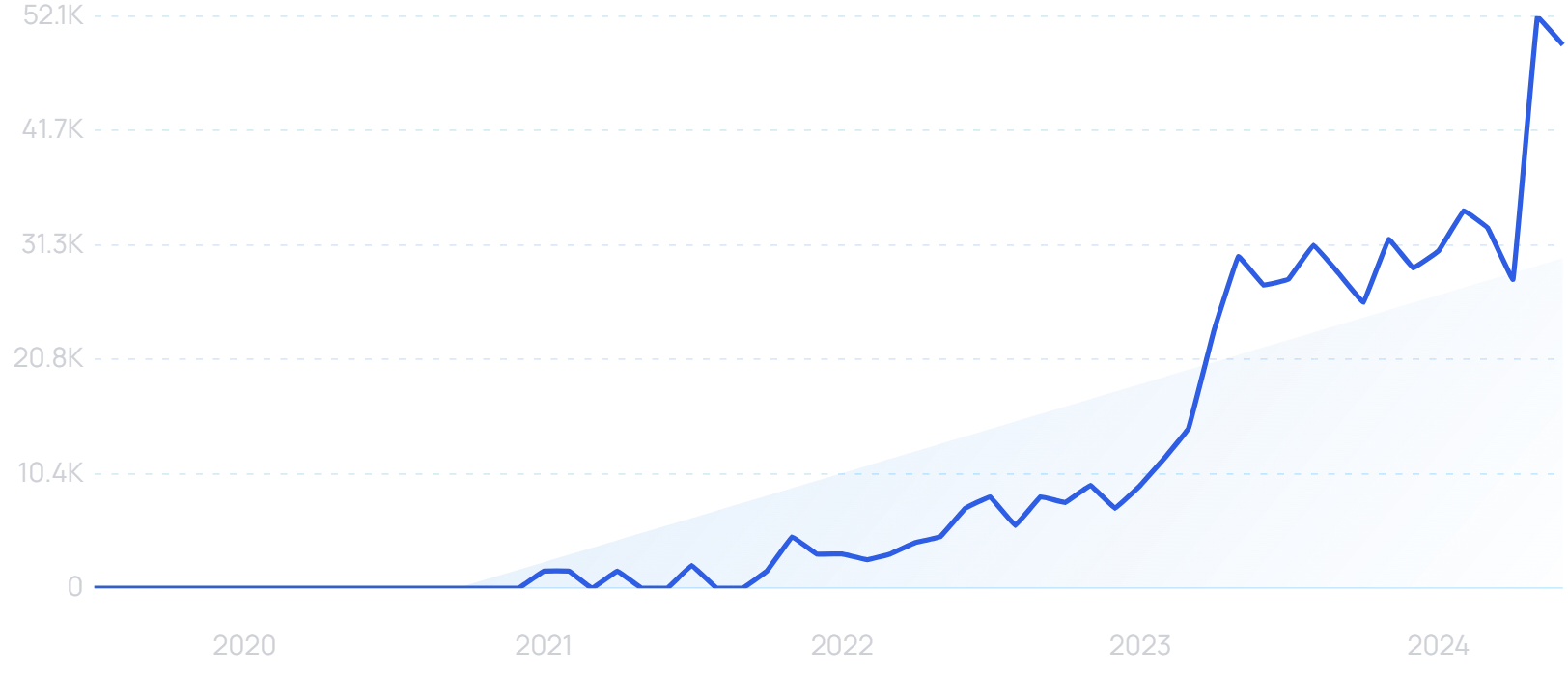

Searches for “height gummies” are up 99X+ in 5 years.

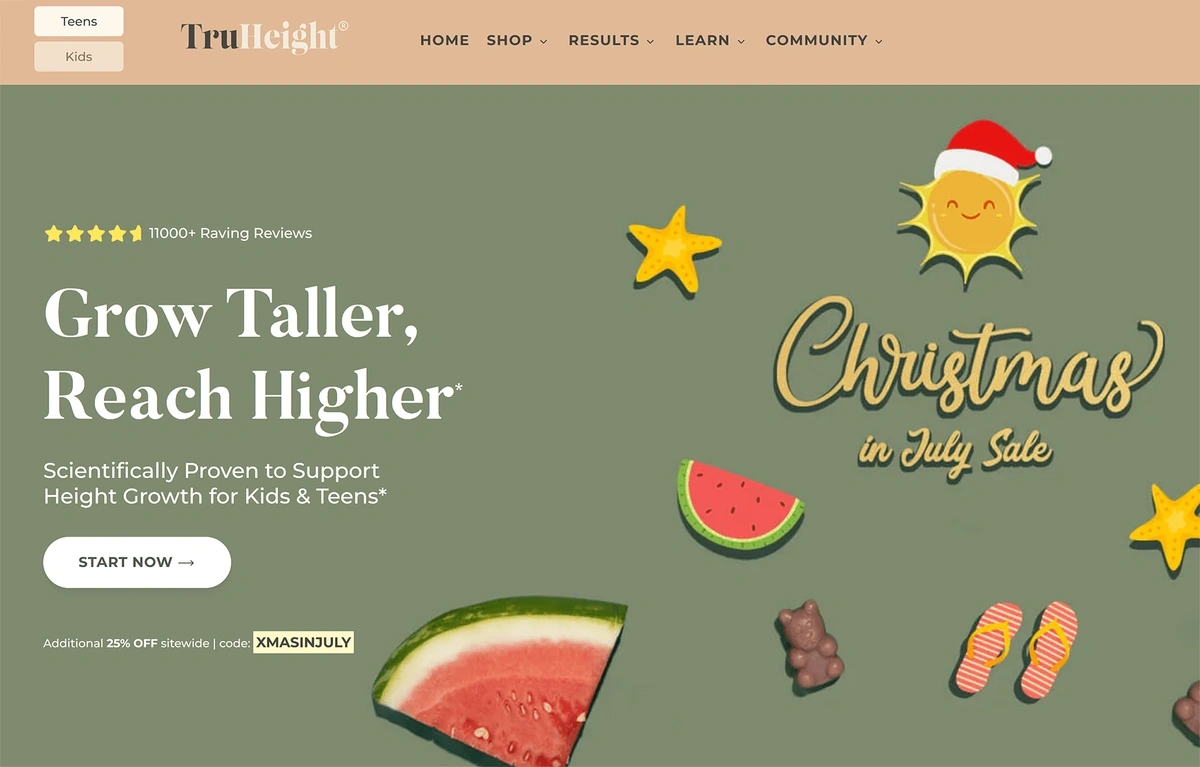

Truheight is one of the top brands in this space.

Truheight makes no secret of its USP: helping kids grow taller.

It has separate ranges for kids and teenagers. And it recently grew its DTC subscriber base by 314% in 12 months.

“Truheight” searches have grown 494% in 2 years.

10. Emerging Diets Supported By Supplements

We’ve already seen that supplements designed to support a vegan diet are growing in popularity. And the same principle applies to a number of emerging new diets.

The low FODMAP diet is an increasingly popular approach designed to tackle irritable bowel syndrome and other gastrointestinal conditions. Certain “risky” foods are removed and then gradually reintroduced with the aim of identifying the problem.

“Fodzyme” is a supplement intended to be taken alongside the diet. It claims to use enzymes specifically designed for FODMAP issues.

“Fodzyme” searches are up by 179% in the last 2 years.

The “carnivore diet” focuses primarily on meat intake, as the name implies. Supplements can help make up for any potential nutritional deficiencies.

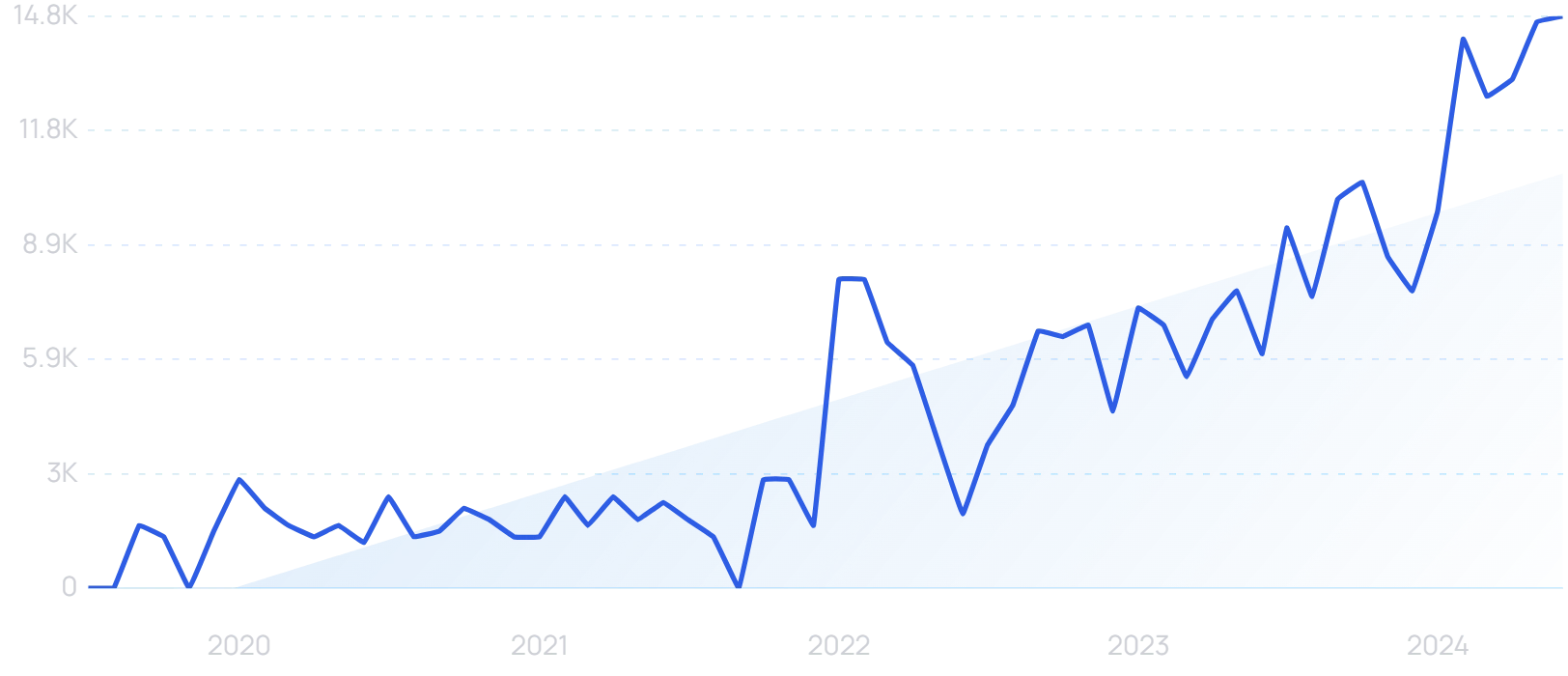

Searches for “carnivore diet supplement” are up 8300% in 5 years (compared to 557% growth for the diet itself).

Conclusion

That wraps up this list of impactful trends in the supplement industry.

The one thread that ties many of these trends together is the fact that many categories of health supplement cater to small, niche audiences.

While mainstream supplements (like calcium and vitamin C) will have their place in the future, we can expect much of the growth in the supplement space to be driven by new products that appeal to smaller groups.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more