Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 High-Growth Architecture Companies & Startups (2024)

You may also like:

The global architectural services market is expected to reach $549.6 billion by 2032 (CAGR of 4.3%).

With new technologies like virtual reality, artificial intelligence, and real-time augmented reality, architecture practices are changing.

This is paving the way for tech companies, architecture firms, and entrepreneurs to launch tech-based architecture startups.

We’ve rounded up some of the fastest-growing and most unique architecture startups to follow in 2024 (and beyond).

1. UpCodes

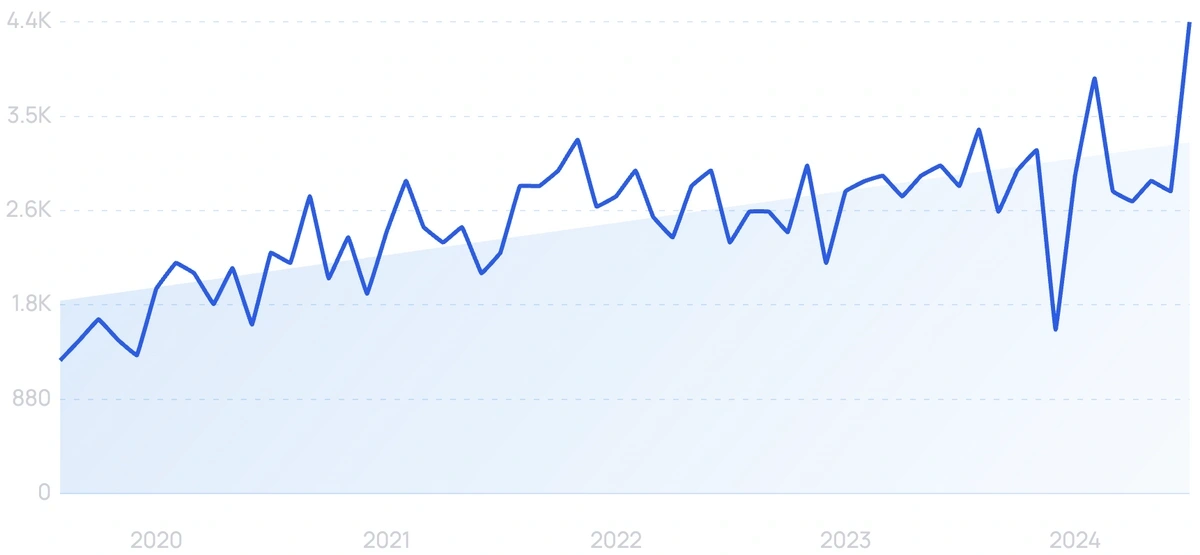

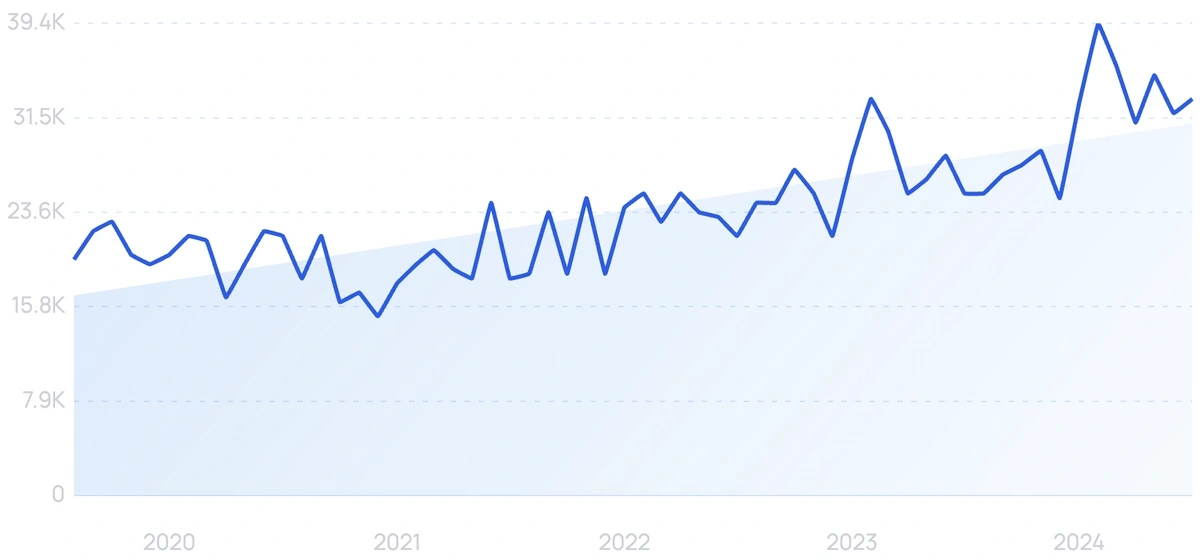

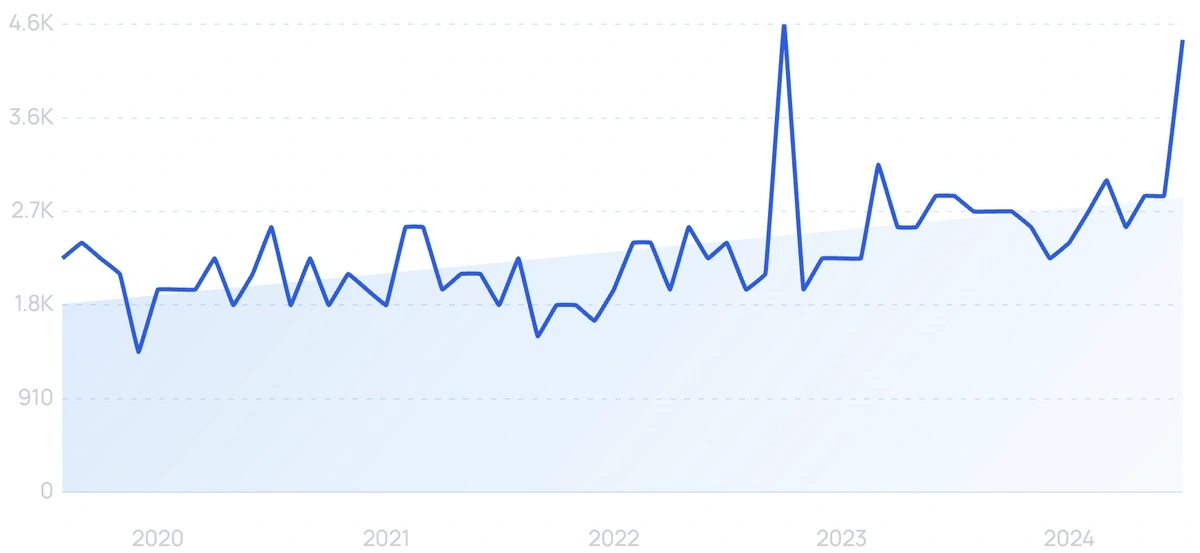

5-year search growth: 290%

Search growth status: Exploding

Year founded: 2016

Location: San Francisco, CA

Funding: $7.6M (Series A)

What they do: UpCodes is a SaaS startup that provides tools for constructing code-compliant buildings for the Architecture, Engineering, and Construction (AEC) industry. With an advanced search engine that’s built for the construction space, users can make systematic searches for building code. It is designed to reduce delays while streamlining requirements for construction projects.

As of August 2024, UpCodes supports over 750,000 monthly active users.

2. Capmo

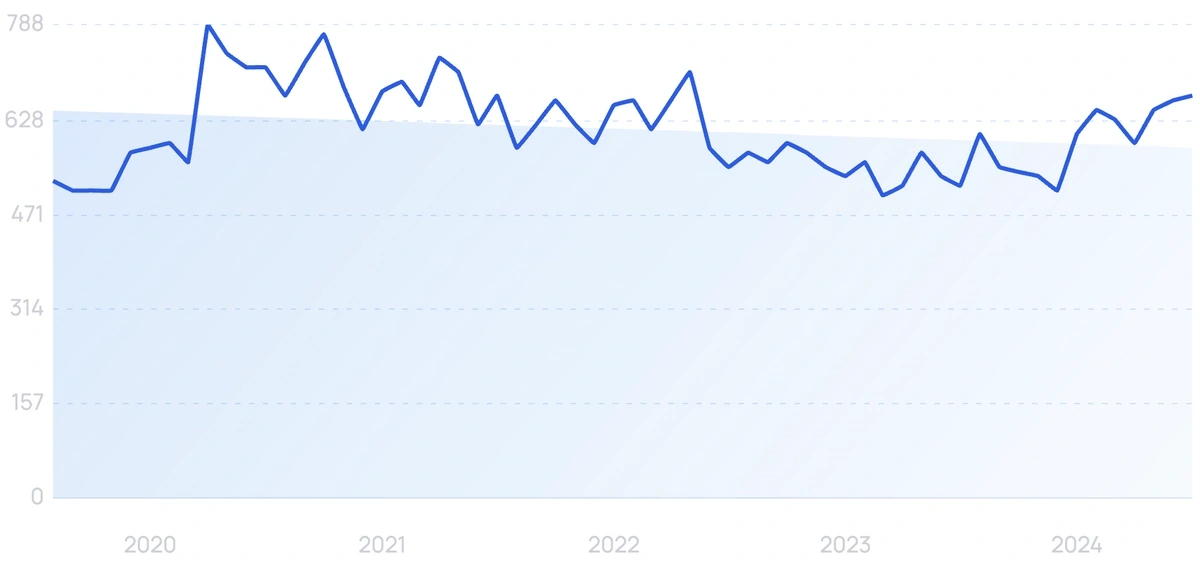

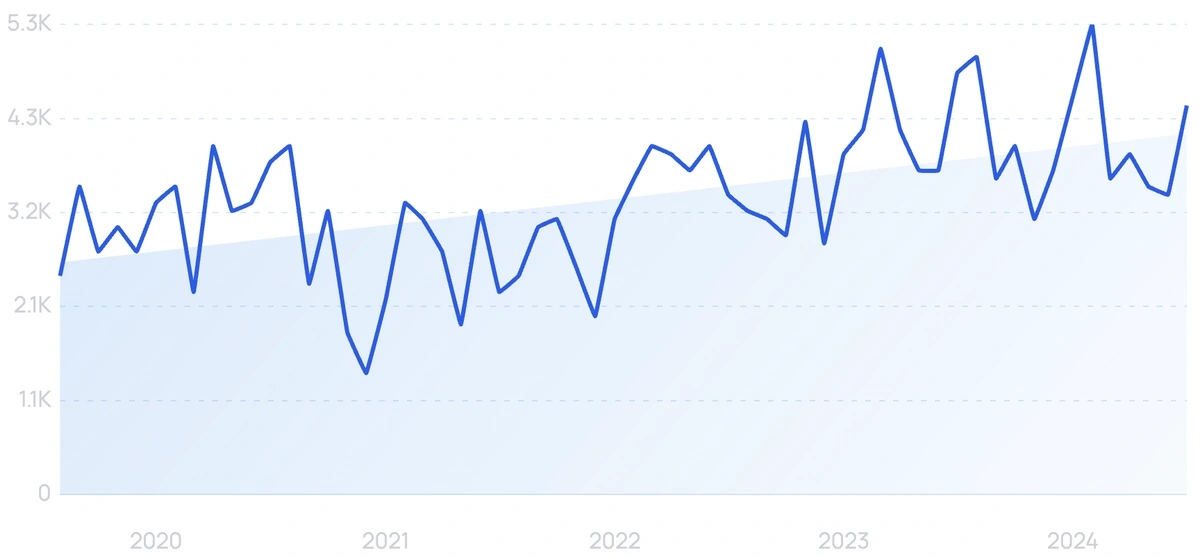

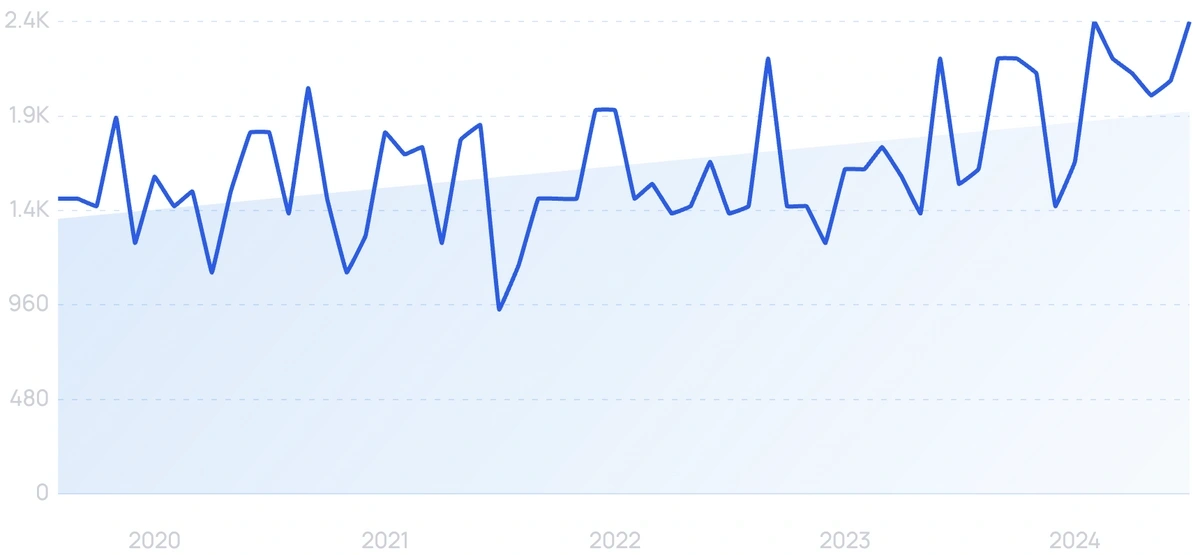

5-year search growth: 211%

Search growth status: Exploding

Year founded: 2018

Location: Munich, Germany

Funding: $34.7M (Series B)

What they do: As a construction management software, Capmo’s primary offering is to smoothen the construction process. They function as an end-to-end partner for the design and construction of any project they work on. The projects can range from homeowners to industrial designs. Currently, Capmo has over 10,000 active projects in Germany.

3. PlanRadar

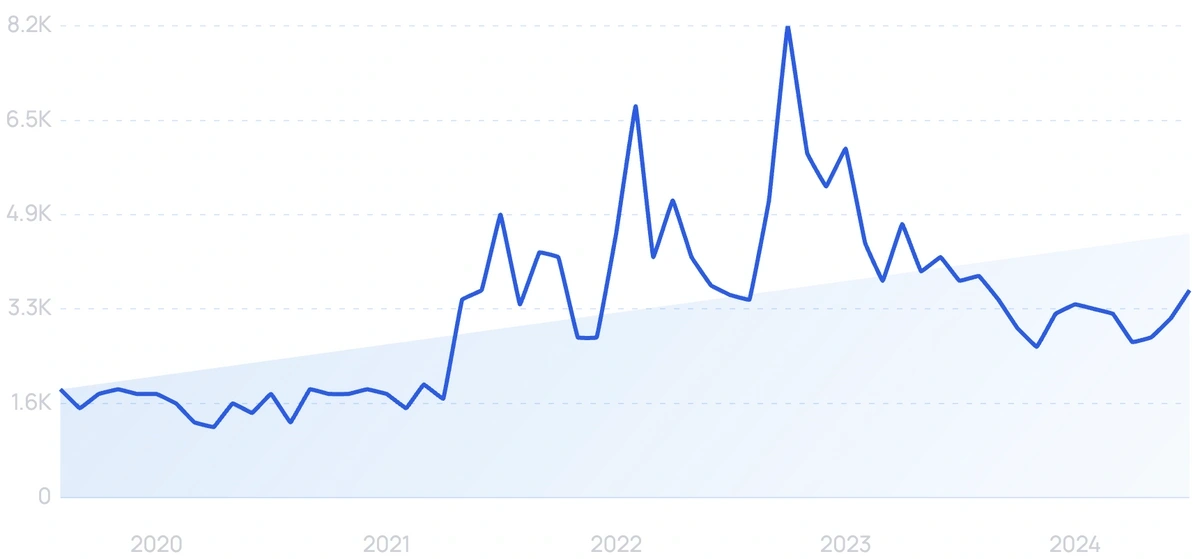

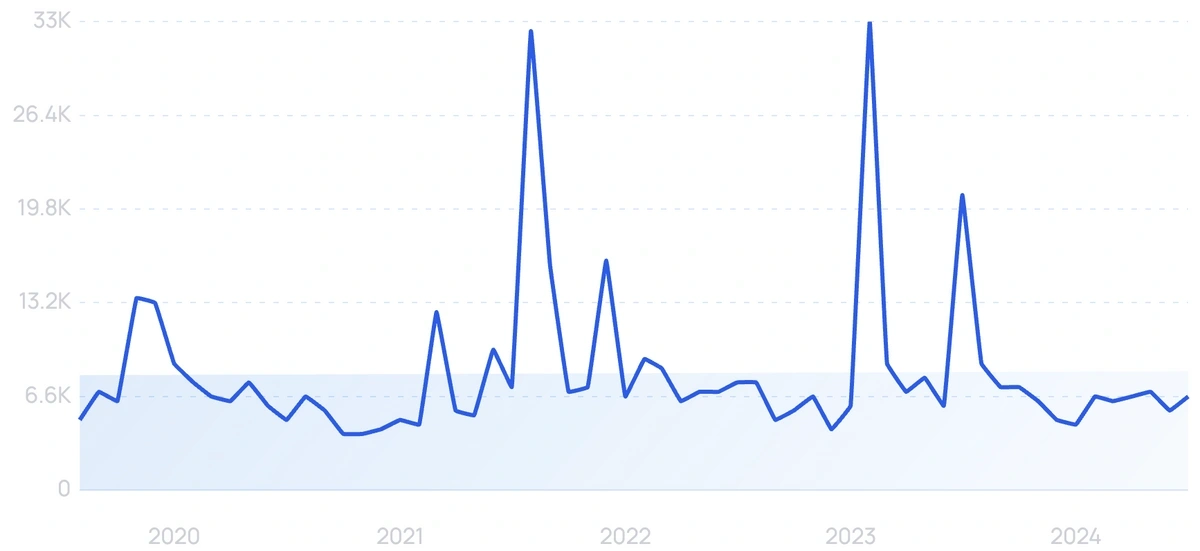

5-year search growth: 142%

Search growth status: Regular

Year founded: 2013

Location: Vienna, Austria

Funding: $96.5M (Series B)

What they do: PlanRadar is a SaaS and project management platform for real estate project documentation and collaboration. With features like direct communication, digital plans, and easy ticketing, PlanRadar aims to make construction more efficient. According to their website, the tool can increase project efficiency by 70%. Currently, the company has over 150,000 customers across 75+ countries.

4. WoHo

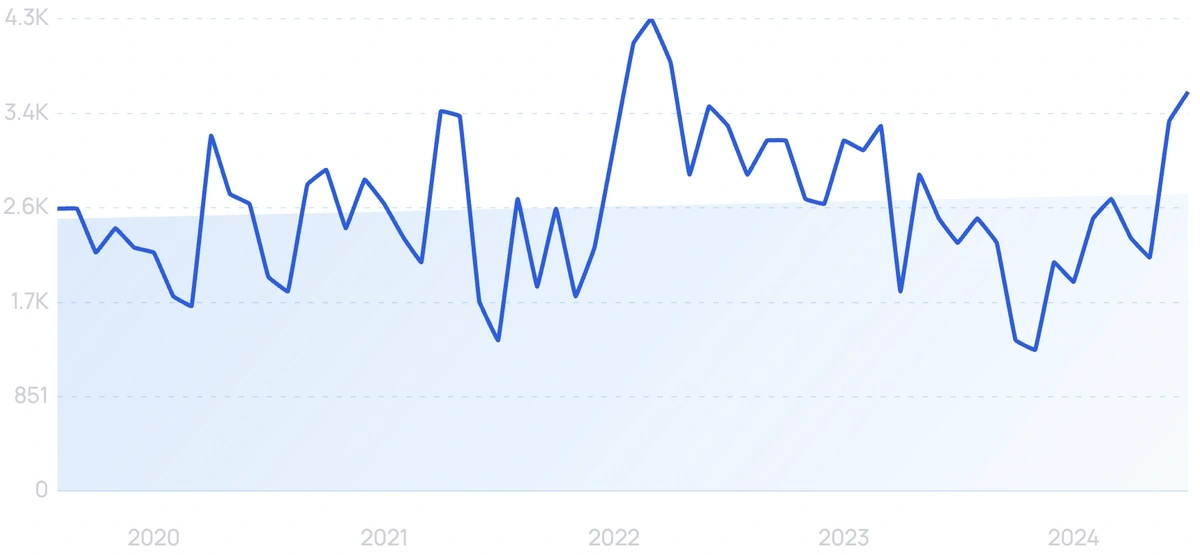

5-year search growth: 29%

Search growth status: Regular

Year founded: 2020

Location: Cambridge, MA

Funding: $4.5M (Seed)

What they do: As an architecture tech startup, WoHo creates “components” that can be pieced together to construct a building. Their tech allows architects and real estate builders to work on small to large-scale projects. WoHo systems manage everything from materials and manufacturing to assembly. Their $4.5 million seed funding was led by The Engine - a venture capital firm that invests in early-stage Touch Tech companies.

5. BRIXEL

5-year search growth: 93%

Search growth status: Peaked

Year founded: 2016

Location: Zurich, Switzerland

Funding: Undisclosed (Non-Equity Assistance)

What they do: BRIXEL is an innovative company that combines cutting-edge robotics, artificial intelligence, and interactive architecture to create intelligent spaces that can be used for a range of applications. The company's goal is to create responsive and adaptive environments that can be customized to meet the needs of any user. BRIXEL's technology has been used in projects such as interactive facades, adaptive architecture, and responsive interiors, among others.

6. Cove.Tool

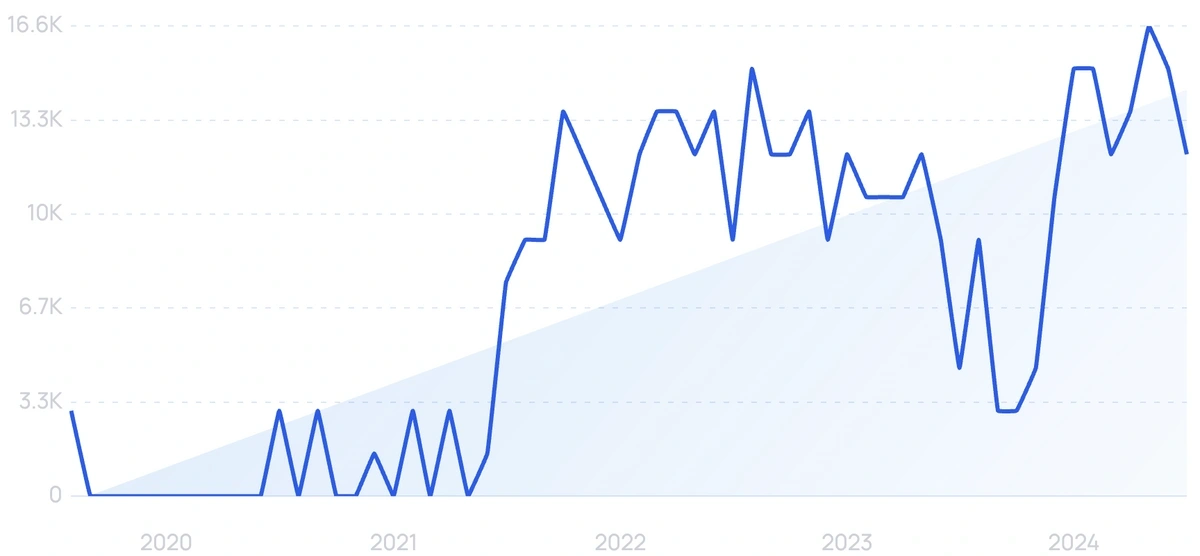

5-year search growth: 1,600%

Search growth status: Regular

Year founded: 2017

Location: Atlanta, GA

Funding: $36.8M (Series B)

What they do: As a web app and tool, CoveTool lets architects and designers assess a building’s impact on sustainability. It provides continuous end-to-end support through automated performance analysis to assist in decision-making. The goal is to find the least costly yet most sustainable design. Most recently, the company launched new features to streamline building models and create design prototypes more quickly.

7. Arcbazar

5-year search growth: 57%

Search growth status: Regular

Year founded: 2010

Location: Cambridge, MA

Funding: $743.3K (Series Unknown)

What they do: Arcbazar is an online architectural competition platform where architects, designers, and interior experts compete. It offers clients access to hundreds of architects and designers, creating a freelance marketplace for them. In 2014, Entrepreneur listed Arcbazar in its 100 Brilliant Companies list. The company has generated over 1 million total views on more than 50,000 projects.

8. Monograph

5-year search growth: 23%

Search growth status: Exploding

Year founded: 2016

Location: San Francisco, CA

Funding: $29.3M (Series B)

What they do: As a project management software for architects, Monograph allows users to track time, invoice clients, and manage tasks. They have a budget-tracking tool that is designed to be used by all forms of AEC firms. Along with that, the MoneyGantt system allows users to manage their budgets and schedules simultaneously. Architects and engineers have used the software to manage $2.8 billion in project fees.

9. Fieldwire

5-year search growth: 59%

Search growth status: Regular

Year founded: 2013

Location: San Francisco, California

Funding: $41.2M (Series C)

What they do: Fieldwire is a construction management platform built specifically for streamlining tasks at the job site. Architects can use Fieldwire to track ongoing projects, discuss designs, and share drawings with engineers and technical consultants. Today, the Fieldwire platform supports more than 1 million projects worldwide.

10. Ecoworks

5-year search growth: 79%

Search growth status: Regular

Year founded: 2018

Location: Berlin, Germany

Funding: $81.4M (Series A)

What they do: Ecoworks is an environment-first renovation company that aims to reshape building designs. Their processes are inspired by the Building Information Modeling (BIM) movement. They use modular construction practices, energy-efficient systems, and industrial prefabrication for sustainability. In December 2023, the startup raised EUR 40 million in Series A funding.

11. Archistar

5-year search growth: 33%

Search growth status: Peaked

Year founded: 2010

Location: Sydney, Australia

Funding: $20.2M (Series A)

What they do: An AI-driven software, Archistar aims to assist architects, property professionals, and individuals in making better decisions. Using machine learning, the software aids in finding profitable sites and helps in designing feasible buildings. In April 2021, it was announced that Archistar raised $6M from Skip Capital and AirTree Ventures. According to their website, the company has over 100,000 users.

12. Material Bank

5-year search growth: 43%

Search growth status: Regular

Year founded: 2018

Location: Boca Raton, Florida

Funding: $323.2M (Series D)

What they do: Material Bank is a digital material platform that enables architecture and design professionals to order physical samples online, providing quick access to materials from a wide range of manufacturers. With over 14,000 materials from over 700 brands, Material Bank streamlines the sample ordering process for designers, making it easy to find, sample, and specify materials for their projects. The platform also provides sustainability information for each material, helping designers make more informed choices.

13. Infurnia

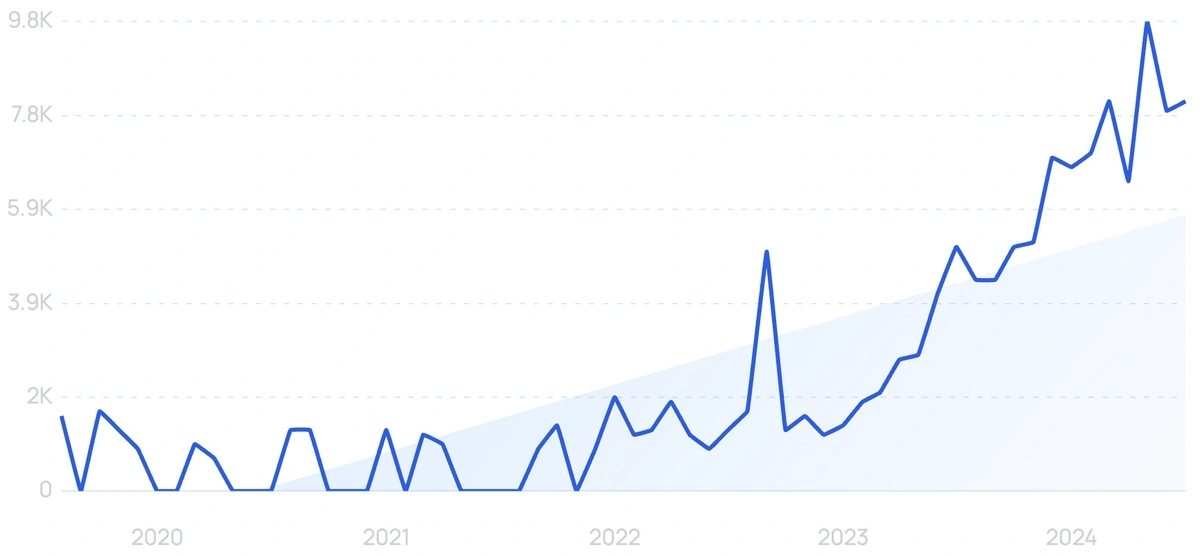

5-year search growth: 9,400%

Search growth status: Regular

Year founded: 2014

Location: Bengaluru, India

Funding: $3.7M (Series Unknown)

What they do: Infurnia is a cloud-based architecture software for implementing BIM in custom-built environments. The software incorporates CAD, computational architecture, data management, product schedules, and collaboration tools. Infurnia’s last funding round was in 2023, when they received $1.2M from a group of angel investors.

14. canibuild

5-year search growth: 1,600%

Search growth status: Regular

Year founded: 2019

Location: Sydney, Australia

Funding: $8.2M (Series A)

What they do: canibuild is a French architecture startup that offers a 3D modeling platform to architects, engineers, and contractors to make the design process more efficient and collaborative. Their software can convert 2D drawings into 3D models and simulate lighting and materials for accurate visualization. canibuild also integrates with other BIM (Building Information Modeling) tools and offers cloud-based storage for easy file sharing.

15. Hypar

Search growth status: Exploding

Year founded: 2018

Location: Culver City, CA

Funding: $8M (Series A)

What they do: Hypar is a cloud-based platform for generating, designing, and sharing building systems. Using BIM and a self-learning AI, the software helps design building models and layout designs. It also features analysis and simulation tools to help predict performance. Hypar closed its third round of funding ($5.5M raised) in 2023 and is currently in the process of scaling.

16. qbiq

5-year search growth: 60%

Search growth status: Exploding

Year founded: New York, New York

Location: 2019

Funding: $10M (Seed)

What they do: Qbiq leverages generative AI to automate and optimize real estate layout planning and visualization. Users can quickly create custom and well-optimized architectural-grade floor plans and 3D virtual tours. Since 2021, Qbig has generated floor plans that span more than 11 billion square feet.

17. Next Sense (Formerly Physee Technologies)

5-year search growth: 170%

Search growth status: Regular

Year founded: 2014

Location: Delft, The Netherlands

Funding: $12.9M (Series A)

What they do: Next Sense's smart building platform creates various solar, coating, and sensor technologies in a bid to make glass more efficient. Their objective is to help establish energy-neutral buildings to maximize sustainability. They are currently dedicated to the UN’s Sustainable Development Goals and the EU Green Deal. In February 2024, EDGE Next and Sense by PHYSEE merged to form Next Sense.

18. Bridgit

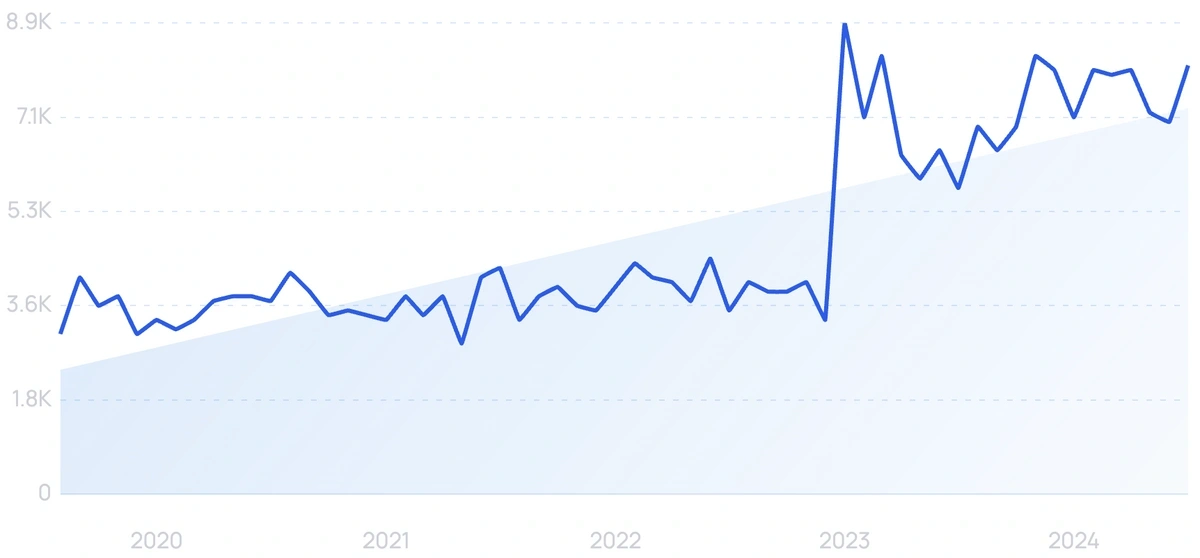

5-year search growth: 303%

Search growth status: Regular

Year founded: 2014

Location: Kitchener, Canada

Funding: $41.9M (Undisclosed)

What they do: Bridgit is a workforce planning software for construction projects. Their primary feature, Bridgit Bench, allows architecture and engineering teams to create blueprints and collaborate in one place. As of today, Bridgit has raised money from key investors, including Autodesk, Salesforce Ventures, Camber Creek, and Storm Ventures.

19. Acelab

5-year search growth: 168%

Search growth status: Exploding

Year founded: 2019

Location: Brooklyn, NY

Funding: $8.8M (Series Unknown)

What they do: Acelab is an architecture-based software company that creates custom web applications, mobile applications, and e-commerce platforms. The company focuses on using modern technologies and agile development methodologies to deliver high-quality solutions that meet the unique needs of each client. Additionally, Acelab provides ongoing support and maintenance services to ensure that its solutions continue to perform optimally.

20. Higharc

5-year search growth: 2,000%

Search growth status: Peaked

Year founded: 2018

Location: Durham, NC

Funding: $80M (Series B)

What they do: Primarily an architectural design software tool, Higharc aims to reduce the time it takes to make a construction-ready design. It incorporates planning phases, material lists, 3D sales tools, and provides access to permit/construction documents. In February 2024, Higharc raised $53M in Series B funding through Spark Capital and Pillar VC.

Conclusion

That concludes our list of the best architecture startups to follow in 2024.

In a spirit of entrepreneurship, each new business in the architecture industry today creates a unique business model. As technology continues to become the foundation of these startups, we’ll continue seeing unique applications in the AEC industry.

As the need for construction and architecture increases globally, we should be seeing more architecture startups popping up in the near future.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more