Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

Top 21 Proptech Companies & Startups In 2024

You may also like:

The Proptech space is changing quickly.

From new technology to changes in how people buy, sell, and rent property, property technology is already disrupting traditional real estate.

In today's post, we'll list the fastest-growing proptech startups in 2024 and provide key data points on each company.

1. Roofr

5-year search growth: 844%

Search growth status: Exploding

Year founded: 2015

Location: San Francisco, CA

Funding: $43.8M (Series A)

What they do: Roofr is a proptech company that provides comprehensive roofing services to residential and commercial property owners. Their services include roof inspections, repairs, replacements, and installations. With a team of experienced experts, advanced technology, and a commitment to customer satisfaction, Roofr strives to deliver the best possible roofing experience to its clients.

2. Pandaloc

5-year search growth: 25%

Search growth status: Regular

Year founded: 2020

Location: Paris, France

Funding: Undisclosed

What they do: Pandaloc is a two-sided marketplace connecting tenants with landlords. The marketplace allows owners to review applications, filter tenants and receive rent payments. In other words, think of Pandaloc as AirBnB for traditional rentals. The startup allows landlords to post and manage one unit for free, but it charges a fixed price for each additional unit. Whereas, tenants are charged a fixed percentage (5%) of their rent payment.

3. Kin Insurance

5-year search growth: 340%

Search growth status: Exploding

Year founded: 2016

Location: Chicago, IL

Funding: $443.2M (Series D)

What they do: Kin offers simplified home insurance plans. Specifically, they focus on providing coverage for properties in regions that are prone to natural disasters. Kin's policies include hurricane, flood, wildfire, and earthquake protection. In February 2024, Kin raised an additional $15 million in Series D funding, giving them Unicorn status and bringing the company's total valuation above $1 billion.

4. Homeday

5-year search growth: -2%

Search growth status: Peaked

Year founded: 2015

Location: Berlin, Germany

Funding: $71.4M (Series Unknown)

What they do: Homeday is a platform for buying and selling real estate (with a focus on houses). However, unlike many FSBO services, Homeday does work with brokers (although their commission of 1.95% is significantly lower than many traditional brokers). The Homeday software also has features for tracking a listing over time.

5. HomeViews

5-year search growth: 111%

Search growth status: Regular

Year founded: 2017

Location: London, UK

Funding: Undisclosed

What they do: HomeViews is a UK-based review site for residential property (specifically, high-end apartment buildings). Reviews typically contain a few paragraphs about the tenant's experience with the property, along with specific ratings for facility quality, location, and overall value. In February 2024, HomeViews was acquired by RightMove for $8M.

6. Acaboom

5-year search growth: 300%

Search growth status: Regular

Year founded: 2014

Location: London, UK

Funding: Undisclosed

What they do: Acaboom is software for real estate agents designed to help them close more deals. Specifically, the software allows agents to create custom presentations for prospective buyers.

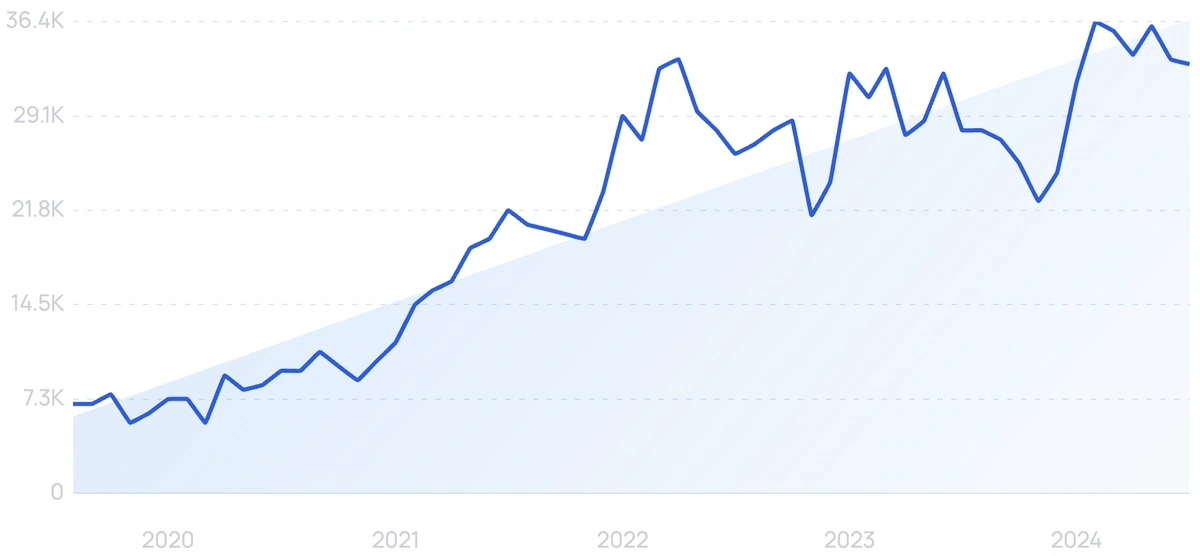

7. Hostify

5-year search growth: 663%

Search growth status: Exploding

Year founded: 2019

Location: Lewes, Delaware

Funding: Undisclosed

What they do: Hostify is a property management and vacation rental platform. The software has a centralized dashboard to help hospitality businesses and property managers handle customer interactions, track bookings, and monitor property performance in one place. Currently, Hostify operates in 43 countries with over 28,000 managed property listings.

8. Briq

5-year search growth: 121%

Search growth status: Regular

Year founded: 2018

Location: Santa Barbara, CA

Funding: $46M (Series B)

What they do: Briq helps real estate and construction professionals manage budgets and investments. The startup's target market includes contractors, construction managers, CFOs and project managers. The Briq platform also has a "predictive analytics" tool designed to test out the impact of changing variables within an active construction project.

9. VergeSense

5-year search growth: 3,100%

Search growth status: Regular

Year founded: 2017

Location: San Francisco, CA

Funding: $82.6M (Series C)

What they do: VergeSense is a data analytics company for work spaces. In other words, the software helps businesses measure and track office space usage. Notable customers include RBC, Quicken Loans, and Cisco.

10. Mynd

Search growth status: Regular

Year founded: 2016

Location: Oakland, CA

Funding: $204.9M (Series Unknown)

What they do: Mynd Property Management is a property management company that provides comprehensive solutions for property owners and investors. They offer a range of services, including property leasing, rent collection, maintenance, and financial reporting to ensure that the properties are managed efficiently and effectively. Their goal is to maximize the ROI from property management expenses while minimizing the stress and hassle.

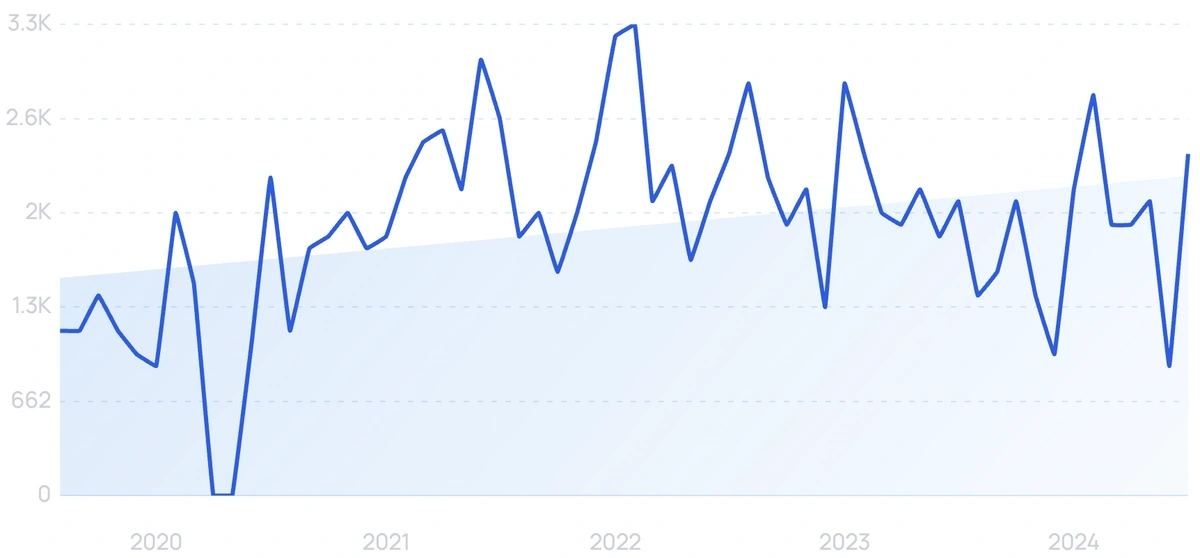

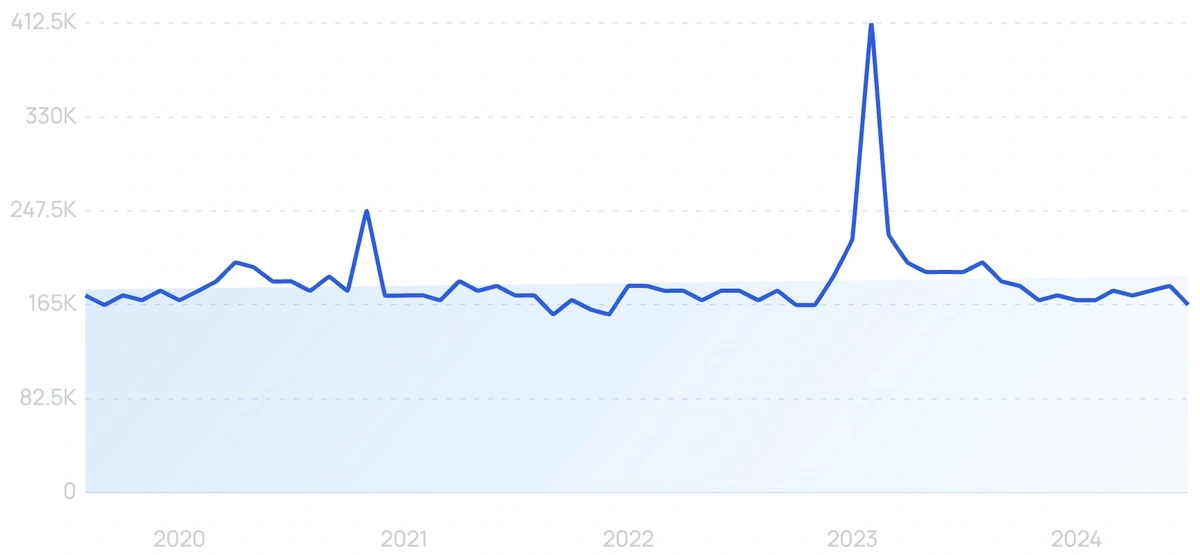

11. Hostaway

5-year search growth: 544%

Search growth status: Exploding

Year founded: 2015

Location: Toronto, Canada

Funding: $178.2M (Private Equity)

What they do: Hostaway is a vacation rental software and Airbnb management platform. Beyond basic short-term rental management, Hostway offers a channel manager that connects to many niche vacation rental sites outside of mainstream sites like Airbnb, Vrbo, Expedia, etc. Currently, Hostaway supports the management of over 100,000 properties in 100+ countries.

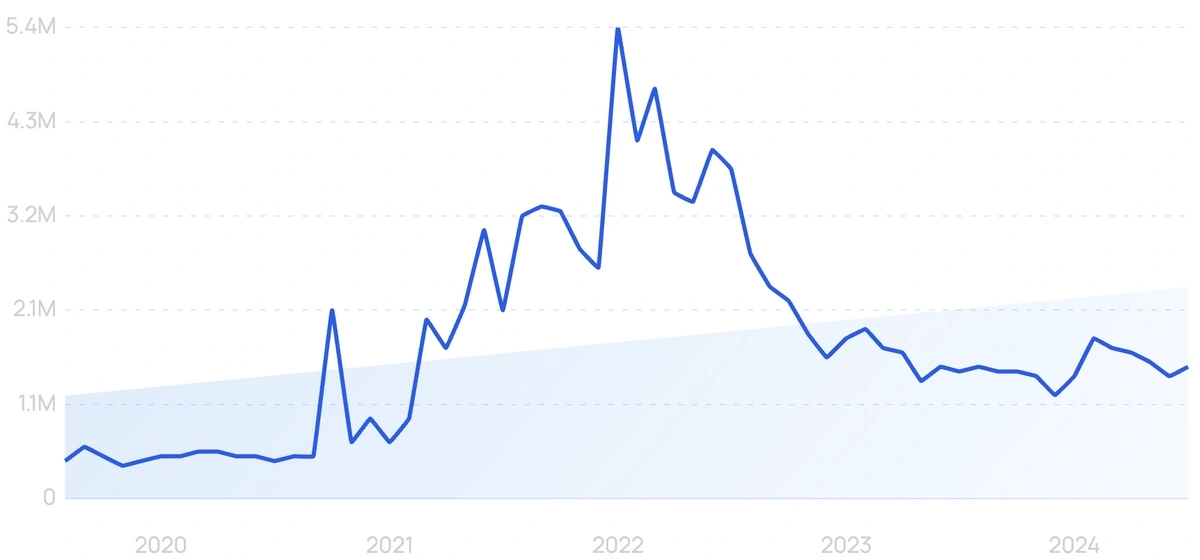

12. eXp Realty

5-year search growth: 87%

Search growth status: Regular

Year founded: 2009

Location: Bellingham, Washington

Funding: $760K (Seed)

What they do: eXp Realty is a cloud-based real estate brokerage firm that offers agents the opportunity to work remotely using cutting-edge technology. The company operates in the United States, Canada, and the United Kingdom, and is known for its unique agent-owned business model and virtual office environment. eXp Realty's technology platform provides agents with the tools and resources they need to facilitate transactions, making the real estate process more efficient and convenient for both agents and clients.

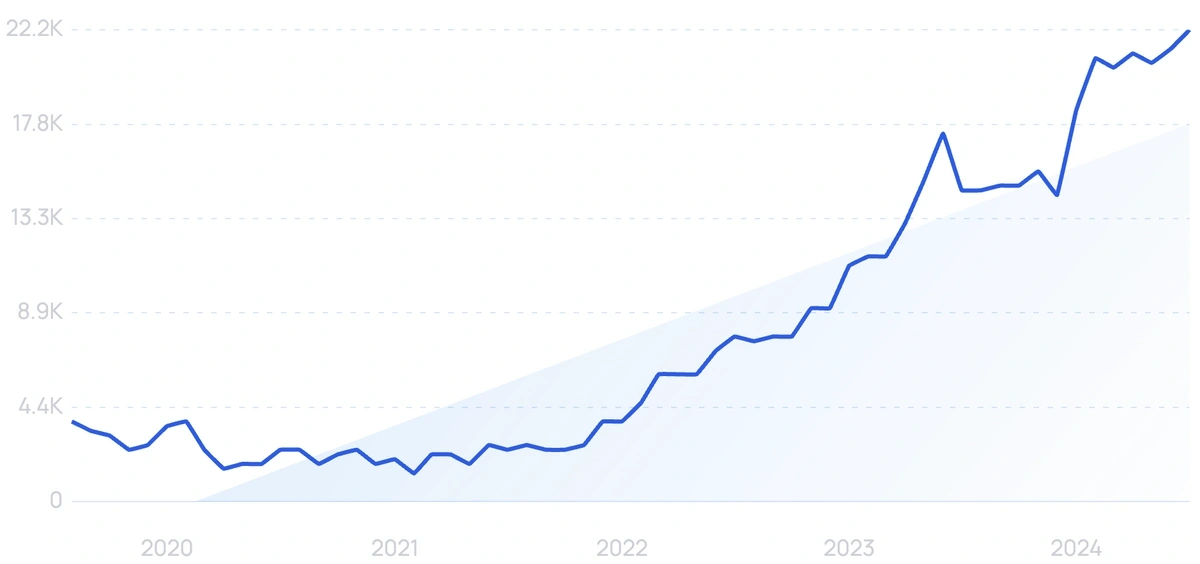

13. EliseAI

5-year search growth: 800%

Search growth status: Exploding

Year founded: 2017

Location: New York City, NY

Funding: $66.9M (Series C)

What they do: Elise is an AI-powered leasing assistant. The tool helps automate lead management (including automatic responses to questions, confirmation of property tours, and follow-ups). The company serves over 1 million units.

14. Knock

5-year search growth: 7%

Search growth status: Regular

Year founded: 2015

Location: San Mateo, CA

Funding: $654.5M (Debt Financing)

What they do: Knock is a technology company that provides home loan products. Its Home Swap offering is basically a car trade-in approach to houses, where home buyers can get approved for a new home before selling their old one.

15. Pacaso

5-year search growth: 150%

Search growth status: Peaked

Year founded: 2020

Location: San Francisco, CA

Funding: $1.5B (Series C)

What they do: Pacaso is a proptech startup that offers an ownership platform for second homes. The service includes an online marketplace with listings to purchase a fraction of the house (via an LLC co-ownership model.) While the company manages the legal processes and property maintenance of the property.

16. DoorLoop

5-year search growth: 669%

Search growth status: Exploding

Year founded: 2018

Location: Miami, Florida

Funding: $30M (Series A)

What they do: DoorLoop is a rental management software that can be used for residential, commercial, student housing, and industrial properties. Some key DoorLoop features include automated rent collection, accounting tools, maintenance request management, and online marketing and listing management. According to the startup, they currently help clients manage "hundreds of thousands of units" in 100+ countries.

17. Casavo

5-year search growth: 3%

Search growth status: Regular

Year founded: 2017

Location: Milan, Italy

Funding: $776.5M (Series Unknown)

What they do: Casavo is an online real estate platform designed to help reduce transaction times. Property sellers are provided with a guaranteed price during the offer stage. Once accepted, the company transfers funds to the property owner and closes the deal within a month.

18. Amenitiz

5-year search growth: 99x+

Search growth status: Exploding

Year founded: 2018

Location: Barcelona, Spain

Funding: $37.2M (Series A)

What they do: Amenitiz is an all-in-one cloud-based hospitality management software. Primarily built for hotels, vacation rentals, and bed and breakfasts, Amenitiz offers a direct booking portal, a drag-and-drop website builder, payment processing, and much more. Over 10,000 properties currently use the startup's software.

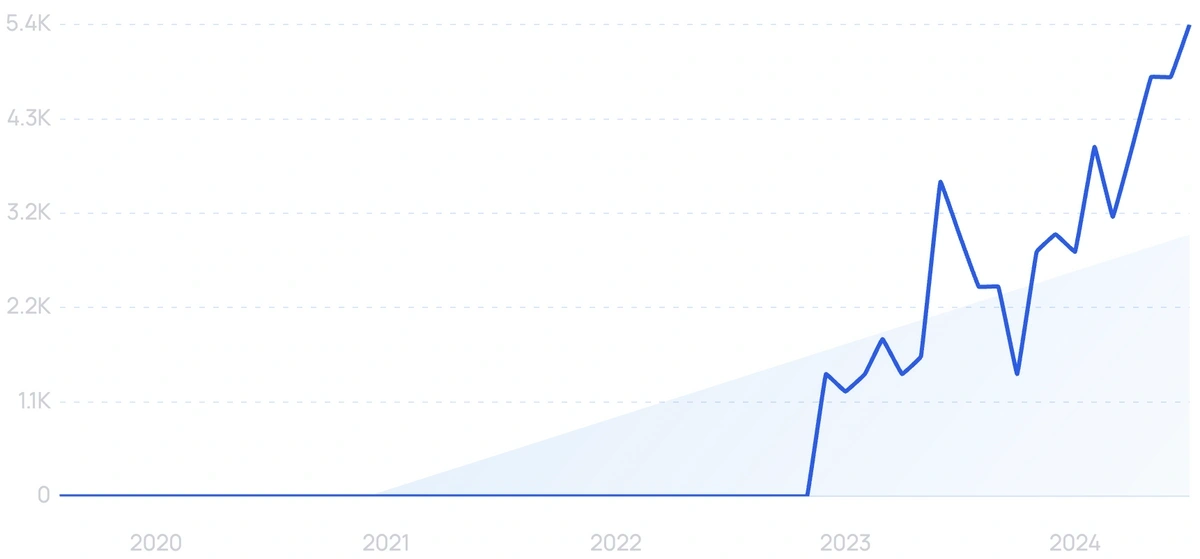

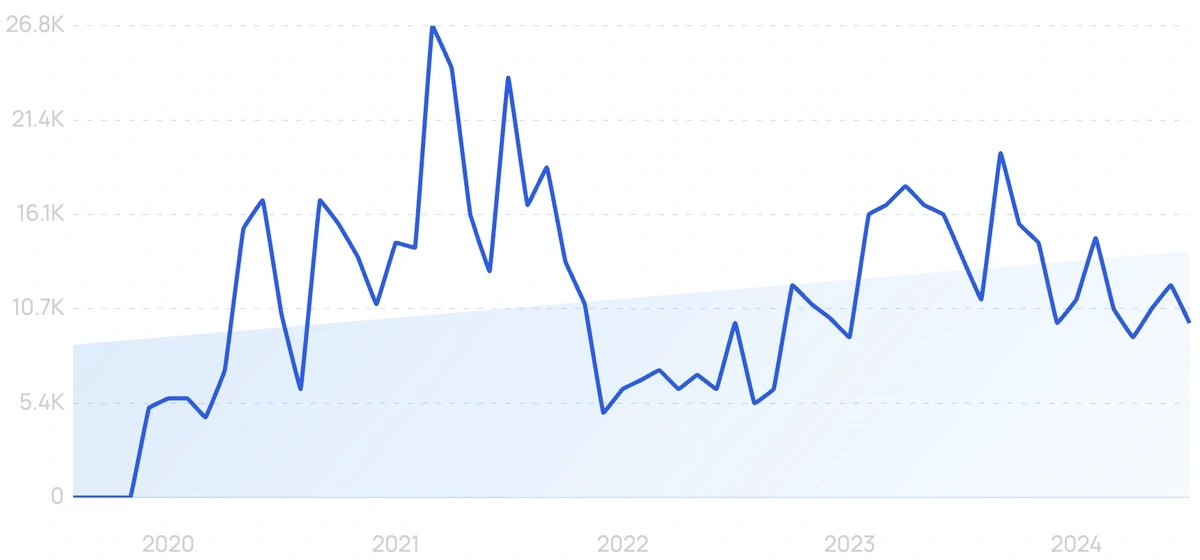

19. InRento

5-year search growth: 5,000%

Search growth status: Regular

Year founded: 2019

Location: Vilnius, Lithuania

Funding: $2.3M (Grant)

What they do: InRento is a real estate P2P lending platform that lets investors participate in buy-to-let property investments. This startup is the first regulated real estate crowdfunding platform, with backing from the Central Bank of Lithuania. InRento has surpassed EUR 21 million in total funded investments and supports over 2,600 active investors.

20. Field Complete

5-year search growth: 117%

Search growth status: Regular

Year founded: 2015

Location: Atlanta, GA

Funding: $3.8M (Seed)

What they do: Field Complete is a cloud-based project management software specifically for field service contractors. For example, the tool has features specifically for remodeling and electrical projects. The startup saw a 38% YoY growth in revenue in 2021 (Pitchbook). Field Complete completed a $1.9M funding round which valued the company at approximately $15M in late 2021.

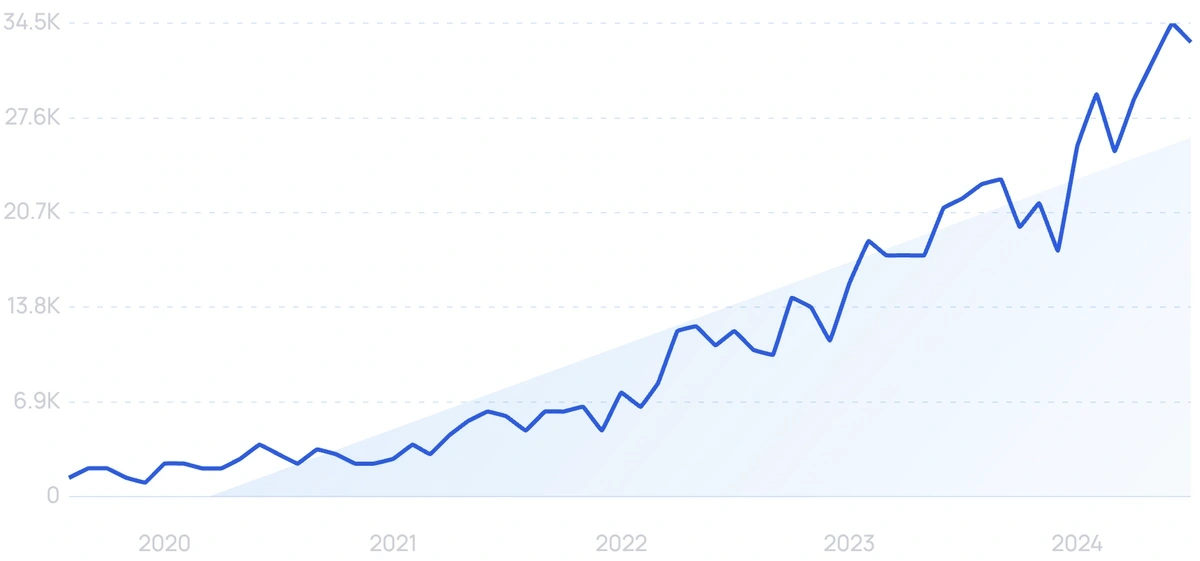

21. TurboTenant

5-year search growth: 186%

Search growth status: Exploding

Year founded: 2015

Location: Fort Collins, CO

Funding: $10.2M (Series A)

What they do: TurboTenant is a property management software platform for landlords. Core features include rental advertising, rental applications, tenant screening, and payment collection. According to TurbeTenant, more than 300,000 property owners currently use the platform.

Wrapping Up

That completes our list of growing startups in the property technology space.

From property management to supporting deals, it's interesting to see how much of this traditional, offline space is being impacted by online technology. And how many of the fastest-growing startups in the proptech world are outside of the US.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more